6b6e54366ae9626b4f60558972515e11.ppt

- Количество слайдов: 53

Topic 9: Product Differentiation EC 3322 Semester I – 2008/2009 Yohanes E. Riyanto EC 3322 (Industrial Organization I) 1

Topic 9: Product Differentiation EC 3322 Semester I – 2008/2009 Yohanes E. Riyanto EC 3322 (Industrial Organization I) 1

Introduction n Firms produce similar but not identical products (differentiated) in many different ways. q Horizontally n Goods of similar quality targeted at consumers of different types/ preference/ taste/ location How is variety determined? q How does competition influence the equilibrium variety. q q Vertically n Consumers agree that there are quality differences. n They differ in willingness to pay for quality. q Yohanes E. Riyanto What determine the quality of goods? EC 3322 (Industrial Organization I) 2

Introduction n Firms produce similar but not identical products (differentiated) in many different ways. q Horizontally n Goods of similar quality targeted at consumers of different types/ preference/ taste/ location How is variety determined? q How does competition influence the equilibrium variety. q q Vertically n Consumers agree that there are quality differences. n They differ in willingness to pay for quality. q Yohanes E. Riyanto What determine the quality of goods? EC 3322 (Industrial Organization I) 2

Introduction … n Modeling horizontal product differentiation: q Representative Consumer Model n n q Firms producing differentiated goods compete equally for all consumers. Demand is continuous the usual (inverse) demand function a small change in any one firm’s quantity (or price) a small change in demand. Spatial/ Location/ Address Model n Consumers may prefer products with certain characteristics (taste, location, sugar contents, etc) are willing to pay premium for the preferred products. n Demand maybe independent (not close substitutes) or highly dependent (close substitutes) Yohanes E. Riyanto EC 3322 (Industrial Organization I) 3

Introduction … n Modeling horizontal product differentiation: q Representative Consumer Model n n q Firms producing differentiated goods compete equally for all consumers. Demand is continuous the usual (inverse) demand function a small change in any one firm’s quantity (or price) a small change in demand. Spatial/ Location/ Address Model n Consumers may prefer products with certain characteristics (taste, location, sugar contents, etc) are willing to pay premium for the preferred products. n Demand maybe independent (not close substitutes) or highly dependent (close substitutes) Yohanes E. Riyanto EC 3322 (Industrial Organization I) 3

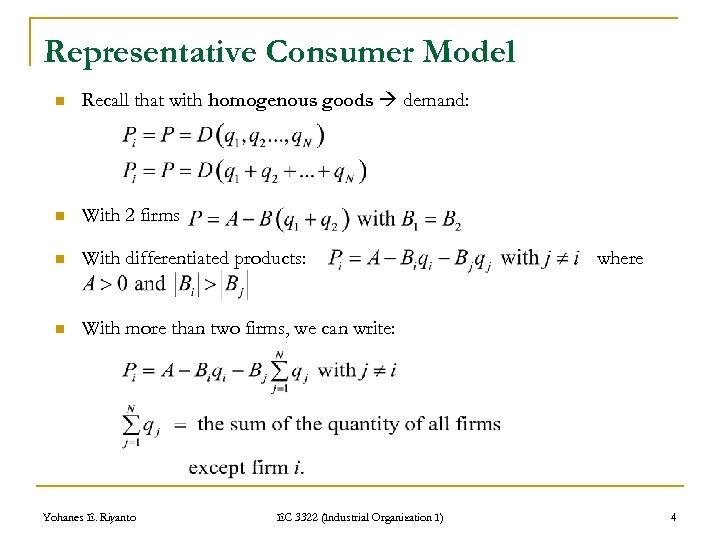

Representative Consumer Model n Recall that with homogenous goods demand: n With 2 firms n With differentiated products: n With more than two firms, we can write: Yohanes E. Riyanto EC 3322 (Industrial Organization I) where 4

Representative Consumer Model n Recall that with homogenous goods demand: n With 2 firms n With differentiated products: n With more than two firms, we can write: Yohanes E. Riyanto EC 3322 (Industrial Organization I) where 4

Representative Consumer Model… Coke and Pepsi are similar but not identical. As a result, the lower priced product does not win the entire market. Suppose that econometric estimation gives: QC = 63. 42 - 3. 98 PC + 2. 25 PP MCC = $4. 96 QP = 49. 52 - 5. 48 PP + 1. 40 PC MCP = $3. 96 There at least two methods for solving this for PC and PP. Assume that we have Bertrand competition. Yohanes E. Riyanto EC 3322 (Industrial Organization I) 5

Representative Consumer Model… Coke and Pepsi are similar but not identical. As a result, the lower priced product does not win the entire market. Suppose that econometric estimation gives: QC = 63. 42 - 3. 98 PC + 2. 25 PP MCC = $4. 96 QP = 49. 52 - 5. 48 PP + 1. 40 PC MCP = $3. 96 There at least two methods for solving this for PC and PP. Assume that we have Bertrand competition. Yohanes E. Riyanto EC 3322 (Industrial Organization I) 5

Representative Consumer Model… Method 1: Calculus Profit of Coke: ΠC = (PC - 4. 96)(63. 42 - 3. 98 PC + 2. 25 PP) Profit of Pepsi: Π P = (PP - 3. 96)(49. 52 - 5. 48 PP + 1. 40 PC) Differentiate with respect to PC and PP respectively first order conditions optimal Pc and Pp. Method 2: MR = MC Reorganize the demand functions PC = (15. 93 + 0. 57 PP) - 0. 25 QC Pc (Qc, Qp) PP = (9. 04 + 0. 26 PC) - 0. 18 QP Pp (Qc, Qp) Calculate marginal revenue, equate to marginal cost, solve for QC and QP and substitute in the demand functions Yohanes E. Riyanto EC 3322 (Industrial Organization I) 6

Representative Consumer Model… Method 1: Calculus Profit of Coke: ΠC = (PC - 4. 96)(63. 42 - 3. 98 PC + 2. 25 PP) Profit of Pepsi: Π P = (PP - 3. 96)(49. 52 - 5. 48 PP + 1. 40 PC) Differentiate with respect to PC and PP respectively first order conditions optimal Pc and Pp. Method 2: MR = MC Reorganize the demand functions PC = (15. 93 + 0. 57 PP) - 0. 25 QC Pc (Qc, Qp) PP = (9. 04 + 0. 26 PC) - 0. 18 QP Pp (Qc, Qp) Calculate marginal revenue, equate to marginal cost, solve for QC and QP and substitute in the demand functions Yohanes E. Riyanto EC 3322 (Industrial Organization I) 6

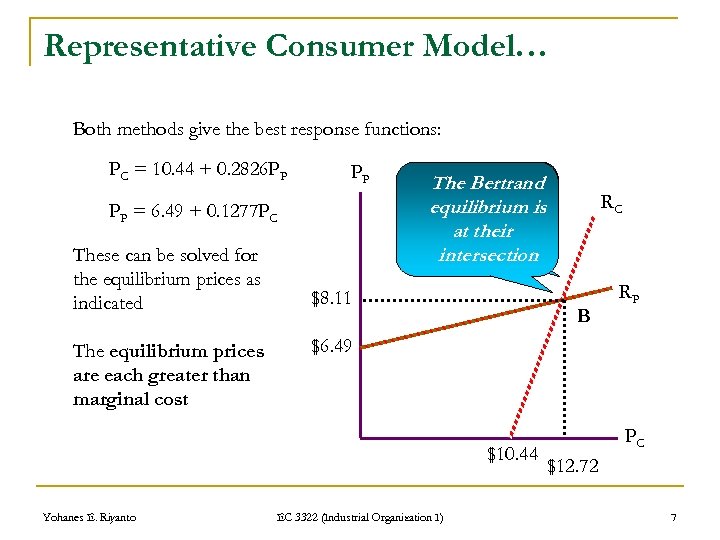

Representative Consumer Model… Both methods give the best response functions: PC = 10. 44 + 0. 2826 PP PP PP = 6. 49 + 0. 1277 PC These can be solved for the equilibrium prices as indicated The equilibrium prices are each greater than marginal cost The Bertrand Note that these equilibrium is are upward at their sloping intersection $8. 11 B RP $6. 49 $10. 44 Yohanes E. Riyanto RC EC 3322 (Industrial Organization I) PC $12. 72 7

Representative Consumer Model… Both methods give the best response functions: PC = 10. 44 + 0. 2826 PP PP PP = 6. 49 + 0. 1277 PC These can be solved for the equilibrium prices as indicated The equilibrium prices are each greater than marginal cost The Bertrand Note that these equilibrium is are upward at their sloping intersection $8. 11 B RP $6. 49 $10. 44 Yohanes E. Riyanto RC EC 3322 (Industrial Organization I) PC $12. 72 7

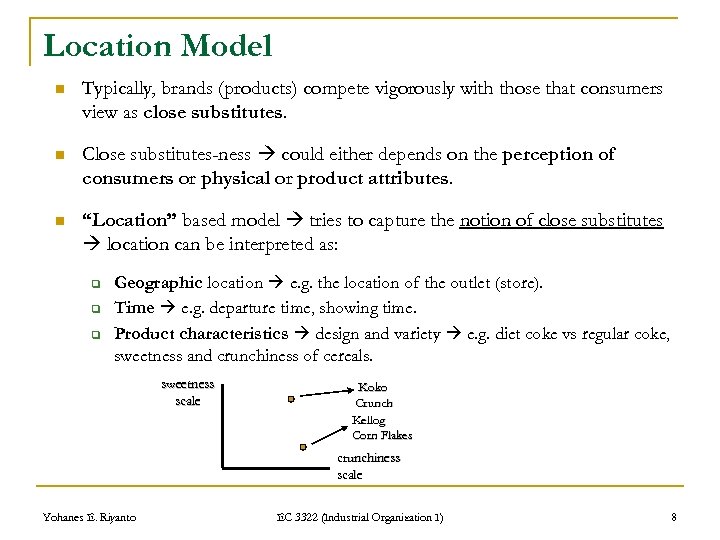

Location Model n Typically, brands (products) compete vigorously with those that consumers view as close substitutes. n Close substitutes-ness could either depends on the perception of consumers or physical or product attributes. n “Location” based model tries to capture the notion of close substitutes location can be interpreted as: q q q Geographic location e. g. the location of the outlet (store). Time e. g. departure time, showing time. Product characteristics design and variety e. g. diet coke vs regular coke, sweetness and crunchiness of cereals. sweetness scale Koko Crunch Kellog Corn Flakes crunchiness scale Yohanes E. Riyanto EC 3322 (Industrial Organization I) 8

Location Model n Typically, brands (products) compete vigorously with those that consumers view as close substitutes. n Close substitutes-ness could either depends on the perception of consumers or physical or product attributes. n “Location” based model tries to capture the notion of close substitutes location can be interpreted as: q q q Geographic location e. g. the location of the outlet (store). Time e. g. departure time, showing time. Product characteristics design and variety e. g. diet coke vs regular coke, sweetness and crunchiness of cereals. sweetness scale Koko Crunch Kellog Corn Flakes crunchiness scale Yohanes E. Riyanto EC 3322 (Industrial Organization I) 8

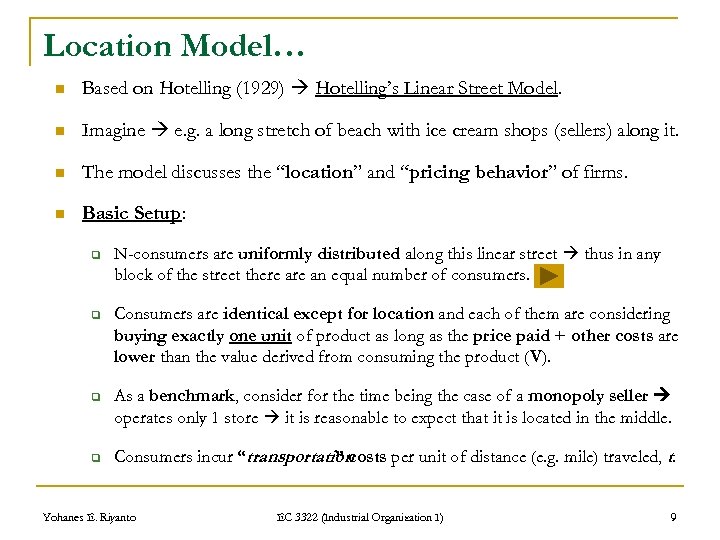

Location Model… n Based on Hotelling (1929) Hotelling’s Linear Street Model. n Imagine e. g. a long stretch of beach with ice cream shops (sellers) along it. n The model discusses the “location” and “pricing behavior” of firms. n Basic Setup: q q N-consumers are uniformly distributed along this linear street thus in any block of the street there an equal number of consumers. Consumers are identical except for location and each of them are considering buying exactly one unit of product as long as the price paid + other costs are lower than the value derived from consuming the product (V). As a benchmark, consider for the time being the case of a monopoly seller operates only 1 store it is reasonable to expect that it is located in the middle. Consumers incur “transportation ” costs per unit of distance (e. g. mile) traveled, t. Yohanes E. Riyanto EC 3322 (Industrial Organization I) 9

Location Model… n Based on Hotelling (1929) Hotelling’s Linear Street Model. n Imagine e. g. a long stretch of beach with ice cream shops (sellers) along it. n The model discusses the “location” and “pricing behavior” of firms. n Basic Setup: q q N-consumers are uniformly distributed along this linear street thus in any block of the street there an equal number of consumers. Consumers are identical except for location and each of them are considering buying exactly one unit of product as long as the price paid + other costs are lower than the value derived from consuming the product (V). As a benchmark, consider for the time being the case of a monopoly seller operates only 1 store it is reasonable to expect that it is located in the middle. Consumers incur “transportation ” costs per unit of distance (e. g. mile) traveled, t. Yohanes E. Riyanto EC 3322 (Industrial Organization I) 9

Location Model… uniform distribution with density N n N street line Yohanes E. Riyanto EC 3322 (Industrial Organization I) 10

Location Model… uniform distribution with density N n N street line Yohanes E. Riyanto EC 3322 (Industrial Organization I) 10

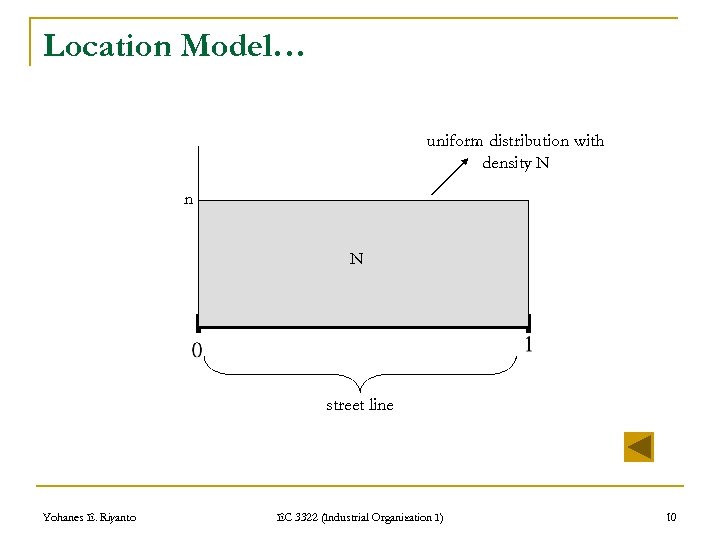

Hotelling Model… Price Suppose that the monopolist Price p 1 p+ t. x sets a price of 1 p 1 + t. x V V All consumers within distance x 1 to the left and right of the shop will by the product z=0 t x 1 t p 1 1/2 Shop 1 What determines x 1 ? x 1 z=1 p 1 + t. x 1 = V, so x 1 = (V – p 1)/t Yohanes E. Riyanto EC 3322 (Industrial Organization I) 11

Hotelling Model… Price Suppose that the monopolist Price p 1 p+ t. x sets a price of 1 p 1 + t. x V V All consumers within distance x 1 to the left and right of the shop will by the product z=0 t x 1 t p 1 1/2 Shop 1 What determines x 1 ? x 1 z=1 p 1 + t. x 1 = V, so x 1 = (V – p 1)/t Yohanes E. Riyanto EC 3322 (Industrial Organization I) 11

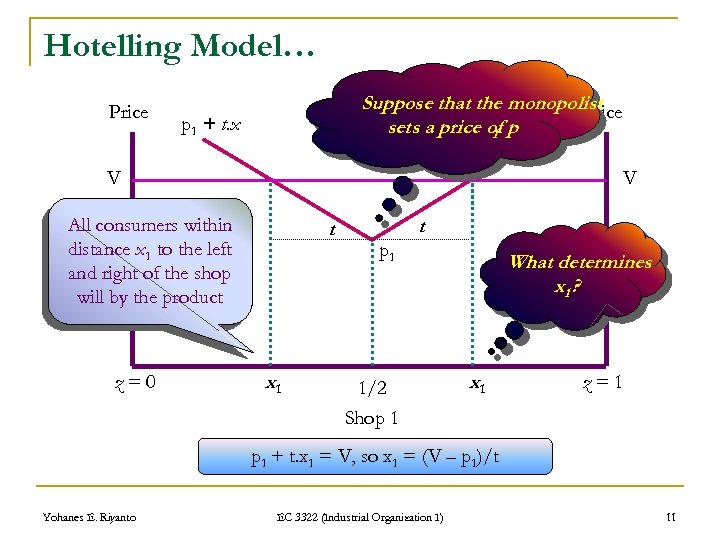

Hotelling Model… Price p 1 + t. x Suppose the firm reduces the price to p 2? V Then all consumers within distance x 2 of the shop will buy from the firm z=0 Price V p 1 p 2 x 1 1/2 x 1 x 2 z=1 Shop 1 Yohanes E. Riyanto EC 3322 (Industrial Organization I) 12

Hotelling Model… Price p 1 + t. x Suppose the firm reduces the price to p 2? V Then all consumers within distance x 2 of the shop will buy from the firm z=0 Price V p 1 p 2 x 1 1/2 x 1 x 2 z=1 Shop 1 Yohanes E. Riyanto EC 3322 (Industrial Organization I) 12

Hotelling Model… n Suppose that all consumers are to be served at price p. q The highest price is that charged to the consumers at the ends of the market. q Their transport costs are t/2 : since they travel ½ mile to the shop q So they pay p + t/2 which must be no greater than V. q So p = V – t/2. n Suppose that marginal costs are c per unit. n Suppose also that a shop has set-up costs of F. n Then profit is Yohanes E. Riyanto EC 3322 (Industrial Organization I) 13

Hotelling Model… n Suppose that all consumers are to be served at price p. q The highest price is that charged to the consumers at the ends of the market. q Their transport costs are t/2 : since they travel ½ mile to the shop q So they pay p + t/2 which must be no greater than V. q So p = V – t/2. n Suppose that marginal costs are c per unit. n Suppose also that a shop has set-up costs of F. n Then profit is Yohanes E. Riyanto EC 3322 (Industrial Organization I) 13

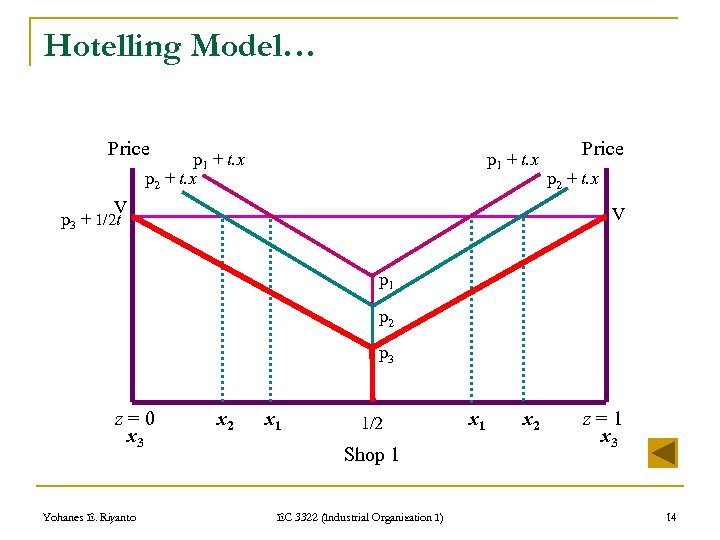

Hotelling Model… Price p 1 + t. x p 2 + t. x p 1 + t. x V p 3 + 1/2 t Price p 2 + t. x V p 1 p 2 p 3 z=0 x 3 Yohanes E. Riyanto x 2 x 1 1/2 Shop 1 EC 3322 (Industrial Organization I) x 1 x 2 z=1 x 3 14

Hotelling Model… Price p 1 + t. x p 2 + t. x p 1 + t. x V p 3 + 1/2 t Price p 2 + t. x V p 1 p 2 p 3 z=0 x 3 Yohanes E. Riyanto x 2 x 1 1/2 Shop 1 EC 3322 (Industrial Organization I) x 1 x 2 z=1 x 3 14

Hotelling Model… n What if there are two shops and these two shops are competitors? n Consumers buy from the shop who can offer the lower full price (product price + transportation cost). n Suppose that location of these two shops are fixed at both ends of the street, and they compete only in price. n How large is the demand obtained by each firm and what prices are they going to charge? Yohanes E. Riyanto EC 3322 (Industrial Organization I) 15

Hotelling Model… n What if there are two shops and these two shops are competitors? n Consumers buy from the shop who can offer the lower full price (product price + transportation cost). n Suppose that location of these two shops are fixed at both ends of the street, and they compete only in price. n How large is the demand obtained by each firm and what prices are they going to charge? Yohanes E. Riyanto EC 3322 (Industrial Organization I) 15

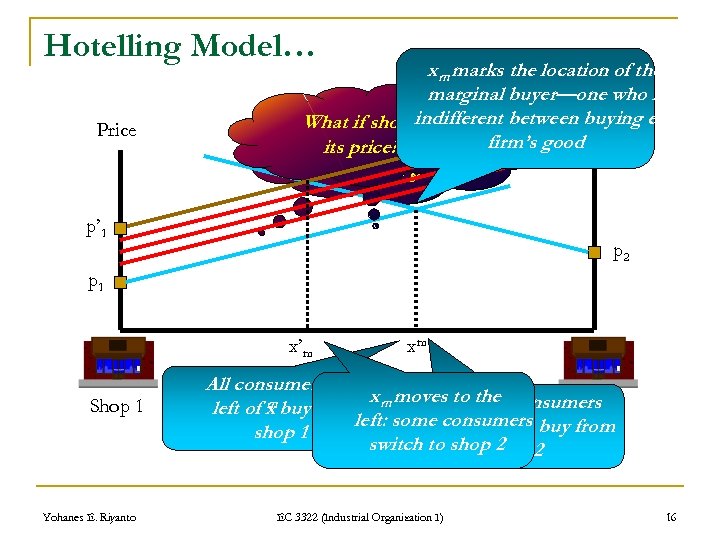

Hotelling Model… Price xm marks the location of the marginal buyer—one who is Assume that shop 1 sets What if shop indifferent between buying either 1 raises Price firm’s good price? shop 2 sets its 1 pand price 2 p p’ 1 p 2 p 1 x’m Shop 1 Yohanes E. Riyanto xm All consumers to the x moves. And all consumers 2 to the m Shop left of x buy from m left: some to the right buy from consumers shop 1 switch to shop 2 2 EC 3322 (Industrial Organization I) 16

Hotelling Model… Price xm marks the location of the marginal buyer—one who is Assume that shop 1 sets What if shop indifferent between buying either 1 raises Price firm’s good price? shop 2 sets its 1 pand price 2 p p’ 1 p 2 p 1 x’m Shop 1 Yohanes E. Riyanto xm All consumers to the x moves. And all consumers 2 to the m Shop left of x buy from m left: some to the right buy from consumers shop 1 switch to shop 2 2 EC 3322 (Industrial Organization I) 16

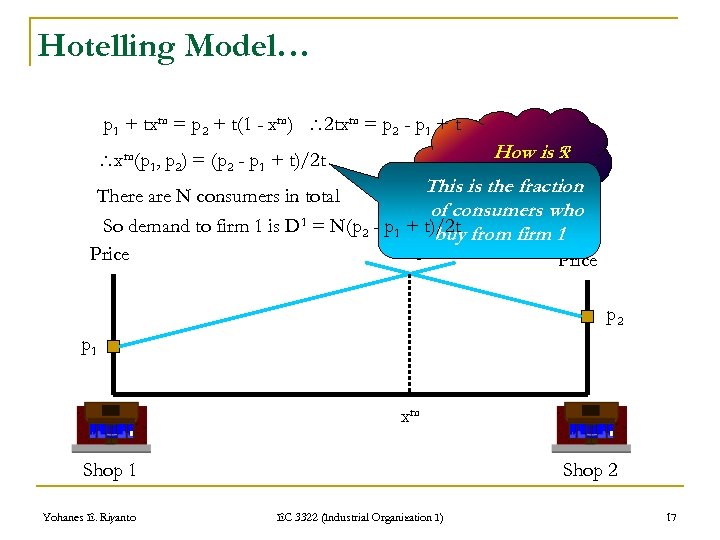

Hotelling Model… p 1 + txm = p 2 + t(1 - xm) 2 txm = p 2 - p 1 + t m How is x This determined? is the fraction xm(p 1, p 2) = (p 2 - p 1 + t)/2 t There are N consumers in total of consumers who So demand to firm 1 is D 1 = N(p 2 - p 1 + t)/2 t from firm 1 buy Price p 2 p 1 xm Shop 1 Yohanes E. Riyanto Shop 2 EC 3322 (Industrial Organization I) 17

Hotelling Model… p 1 + txm = p 2 + t(1 - xm) 2 txm = p 2 - p 1 + t m How is x This determined? is the fraction xm(p 1, p 2) = (p 2 - p 1 + t)/2 t There are N consumers in total of consumers who So demand to firm 1 is D 1 = N(p 2 - p 1 + t)/2 t from firm 1 buy Price p 2 p 1 xm Shop 1 Yohanes E. Riyanto Shop 2 EC 3322 (Industrial Organization I) 17

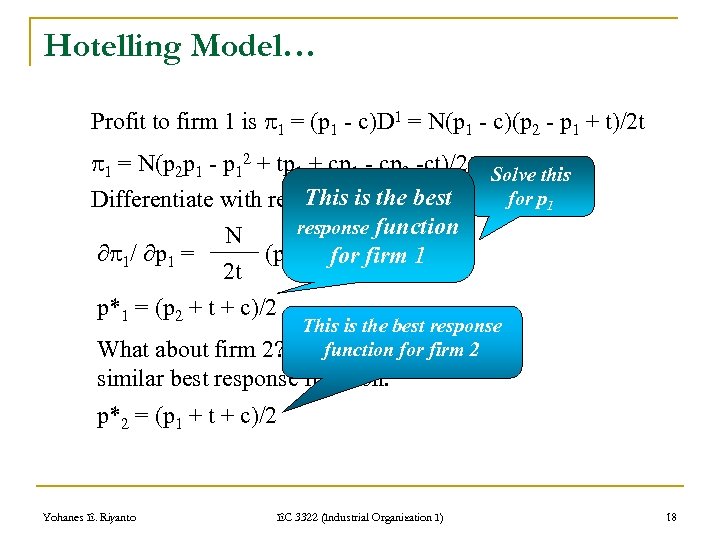

Hotelling Model… Profit to firm 1 is p 1 = (p 1 - c)D 1 = N(p 1 - c)(p 2 - p 1 + t)/2 t p 1 = N(p 2 p 1 - p 12 + tp 1 + cp 1 - cp 2 -ct)/2 t Solve this This is 1 for p 1 Differentiate with respect to pthe best response function N p 1/ p 1 = (p 2 - 2 p 1 + t + c) = 0 for firm 1 2 t p*1 = (p 2 + t + c)/2 This is the best response Byfunction for firm 2 a symmetry, it has What about firm 2? similar best response function. p*2 = (p 1 + t + c)/2 Yohanes E. Riyanto EC 3322 (Industrial Organization I) 18

Hotelling Model… Profit to firm 1 is p 1 = (p 1 - c)D 1 = N(p 1 - c)(p 2 - p 1 + t)/2 t p 1 = N(p 2 p 1 - p 12 + tp 1 + cp 1 - cp 2 -ct)/2 t Solve this This is 1 for p 1 Differentiate with respect to pthe best response function N p 1/ p 1 = (p 2 - 2 p 1 + t + c) = 0 for firm 1 2 t p*1 = (p 2 + t + c)/2 This is the best response Byfunction for firm 2 a symmetry, it has What about firm 2? similar best response function. p*2 = (p 1 + t + c)/2 Yohanes E. Riyanto EC 3322 (Industrial Organization I) 18

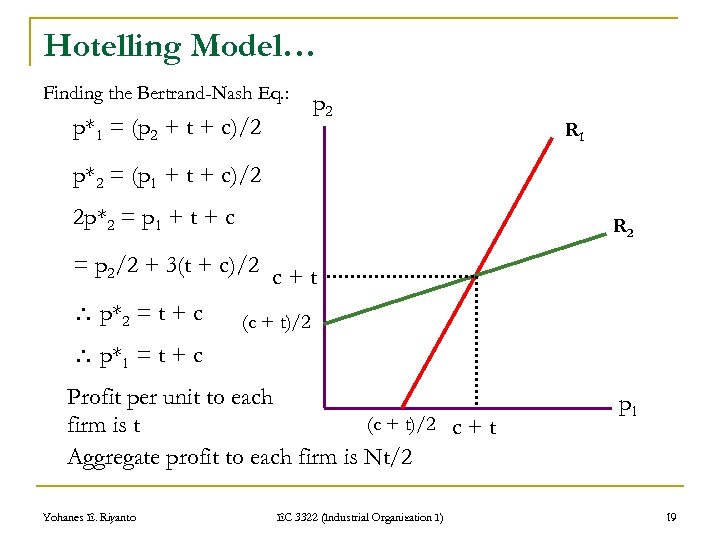

Hotelling Model… Finding the Bertrand-Nash Eq. : p*1 = (p 2 + t + c)/2 p 2 R 1 p*2 = (p 1 + t + c)/2 2 p*2 = p 1 + t + c R 2 = p 2/2 + 3(t + c)/2 p*2 = t + c c+t (c + t)/2 p*1 = t + c Profit per unit to each (c + t)/2 c + t firm is t Aggregate profit to each firm is Nt/2 Yohanes E. Riyanto EC 3322 (Industrial Organization I) p 1 19

Hotelling Model… Finding the Bertrand-Nash Eq. : p*1 = (p 2 + t + c)/2 p 2 R 1 p*2 = (p 1 + t + c)/2 2 p*2 = p 1 + t + c R 2 = p 2/2 + 3(t + c)/2 p*2 = t + c c+t (c + t)/2 p*1 = t + c Profit per unit to each (c + t)/2 c + t firm is t Aggregate profit to each firm is Nt/2 Yohanes E. Riyanto EC 3322 (Industrial Organization I) p 1 19

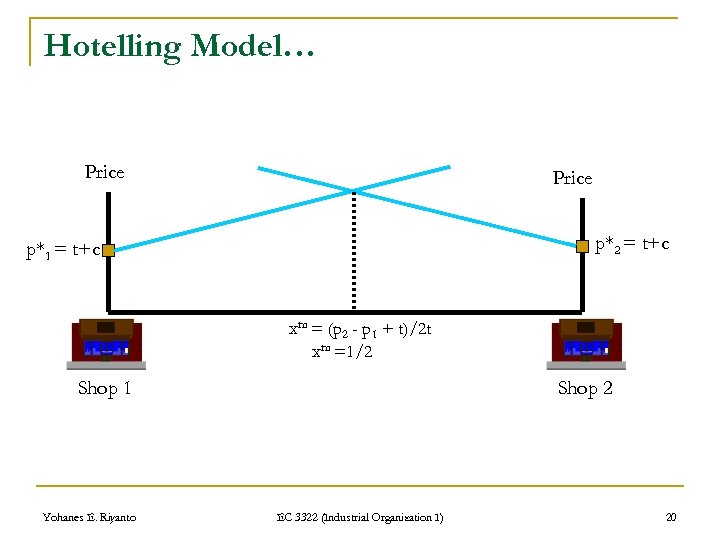

Hotelling Model… Price p*2 = t+c p*1 = t+c xm = (p 2 - p 1 + t)/2 t xm =1/2 Shop 1 Yohanes E. Riyanto Shop 2 EC 3322 (Industrial Organization I) 20

Hotelling Model… Price p*2 = t+c p*1 = t+c xm = (p 2 - p 1 + t)/2 t xm =1/2 Shop 1 Yohanes E. Riyanto Shop 2 EC 3322 (Industrial Organization I) 20

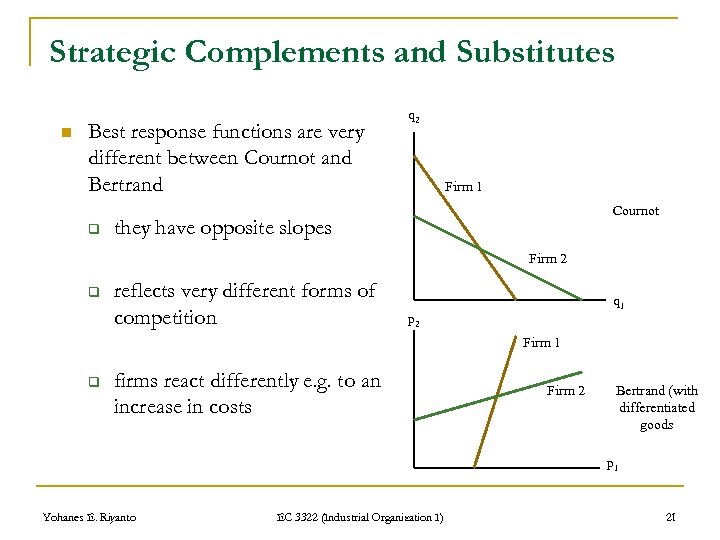

Strategic Complements and Substitutes n Best response functions are very different between Cournot and Bertrand q q 2 Firm 1 Cournot they have opposite slopes Firm 2 q reflects very different forms of competition q 1 p 2 Firm 1 q firms react differently e. g. to an increase in costs Firm 2 Bertrand (with differentiated goods p 1 Yohanes E. Riyanto EC 3322 (Industrial Organization I) 21

Strategic Complements and Substitutes n Best response functions are very different between Cournot and Bertrand q q 2 Firm 1 Cournot they have opposite slopes Firm 2 q reflects very different forms of competition q 1 p 2 Firm 1 q firms react differently e. g. to an increase in costs Firm 2 Bertrand (with differentiated goods p 1 Yohanes E. Riyanto EC 3322 (Industrial Organization I) 21

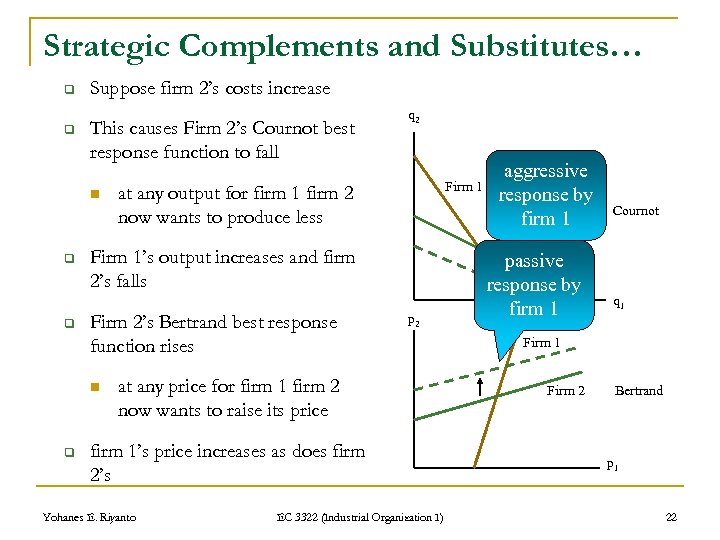

Strategic Complements and Substitutes… q q Suppose firm 2’s costs increase This causes Firm 2’s Cournot best response function to fall n q q Firm 1 at any output for firm 1 firm 2 now wants to produce less Firm 1’s output increases and firm 2’s falls Firm 2’s Bertrand best response function rises n q q 2 p 2 at any price for firm 1 firm 2 now wants to raise its price firm 1’s price increases as does firm 2’s Yohanes E. Riyanto EC 3322 (Industrial Organization I) aggressive response by firm 1 Firm passive 2 response by firm 1 Cournot q 1 Firm 2 Bertrand p 1 22

Strategic Complements and Substitutes… q q Suppose firm 2’s costs increase This causes Firm 2’s Cournot best response function to fall n q q Firm 1 at any output for firm 1 firm 2 now wants to produce less Firm 1’s output increases and firm 2’s falls Firm 2’s Bertrand best response function rises n q q 2 p 2 at any price for firm 1 firm 2 now wants to raise its price firm 1’s price increases as does firm 2’s Yohanes E. Riyanto EC 3322 (Industrial Organization I) aggressive response by firm 1 Firm passive 2 response by firm 1 Cournot q 1 Firm 2 Bertrand p 1 22

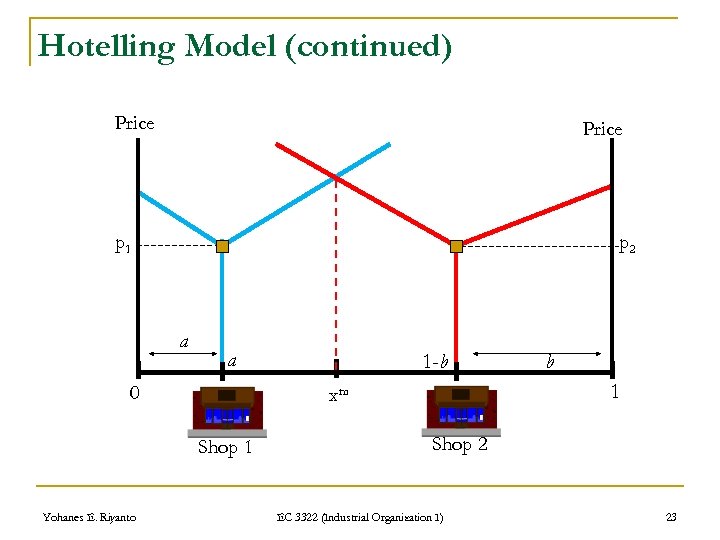

Hotelling Model (continued) Price p 1 p 2 a a 0 b 1 xm Shop 1 Yohanes E. Riyanto 1 -b Shop 2 EC 3322 (Industrial Organization I) 23

Hotelling Model (continued) Price p 1 p 2 a a 0 b 1 xm Shop 1 Yohanes E. Riyanto 1 -b Shop 2 EC 3322 (Industrial Organization I) 23

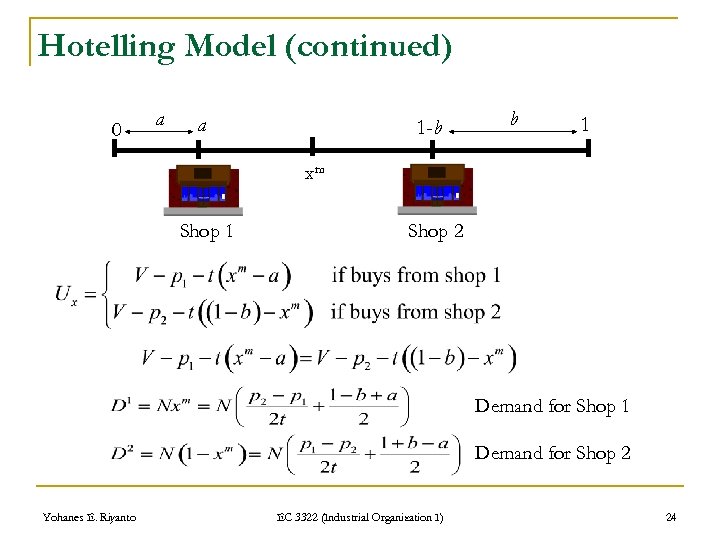

Hotelling Model (continued) 0 a a 1 -b b 1 xm Shop 1 Shop 2 Demand for Shop 1 Demand for Shop 2 Yohanes E. Riyanto EC 3322 (Industrial Organization I) 24

Hotelling Model (continued) 0 a a 1 -b b 1 xm Shop 1 Shop 2 Demand for Shop 1 Demand for Shop 2 Yohanes E. Riyanto EC 3322 (Industrial Organization I) 24

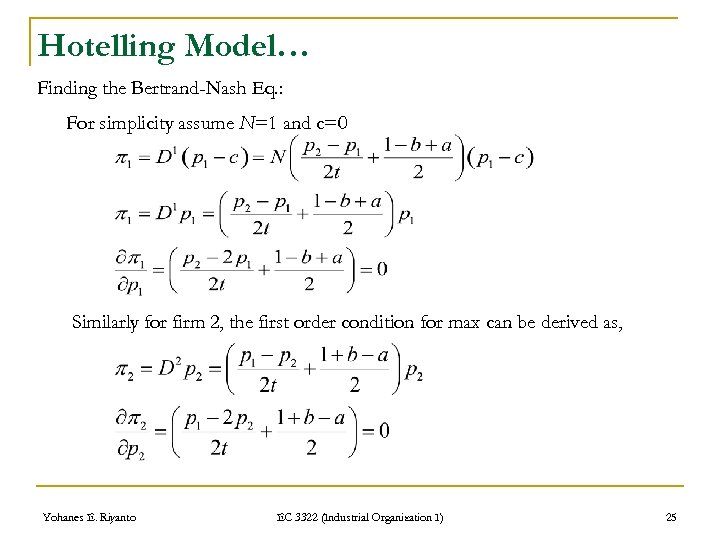

Hotelling Model… Finding the Bertrand-Nash Eq. : For simplicity assume N=1 and c=0 Similarly for firm 2, the first order condition for max can be derived as, Yohanes E. Riyanto EC 3322 (Industrial Organization I) 25

Hotelling Model… Finding the Bertrand-Nash Eq. : For simplicity assume N=1 and c=0 Similarly for firm 2, the first order condition for max can be derived as, Yohanes E. Riyanto EC 3322 (Industrial Organization I) 25

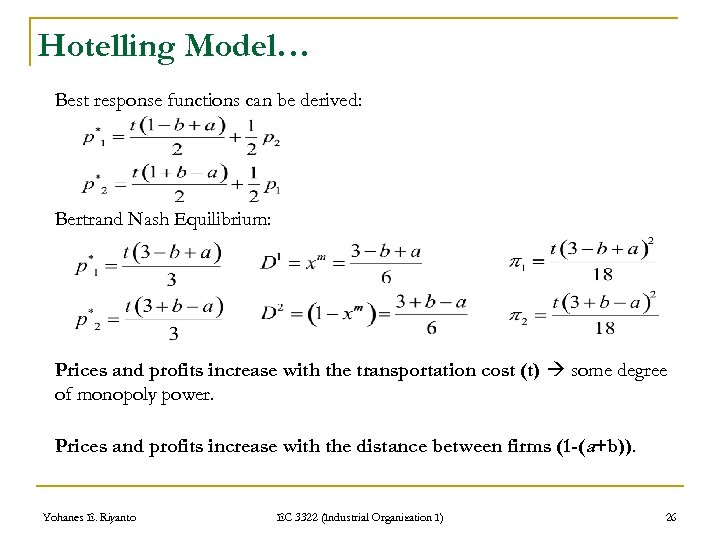

Hotelling Model… Best response functions can be derived: Bertrand Nash Equilibrium: Prices and profits increase with the transportation cost (t) some degree of monopoly power. Prices and profits increase with the distance between firms (1 -(a+b)). Yohanes E. Riyanto EC 3322 (Industrial Organization I) 26

Hotelling Model… Best response functions can be derived: Bertrand Nash Equilibrium: Prices and profits increase with the transportation cost (t) some degree of monopoly power. Prices and profits increase with the distance between firms (1 -(a+b)). Yohanes E. Riyanto EC 3322 (Industrial Organization I) 26

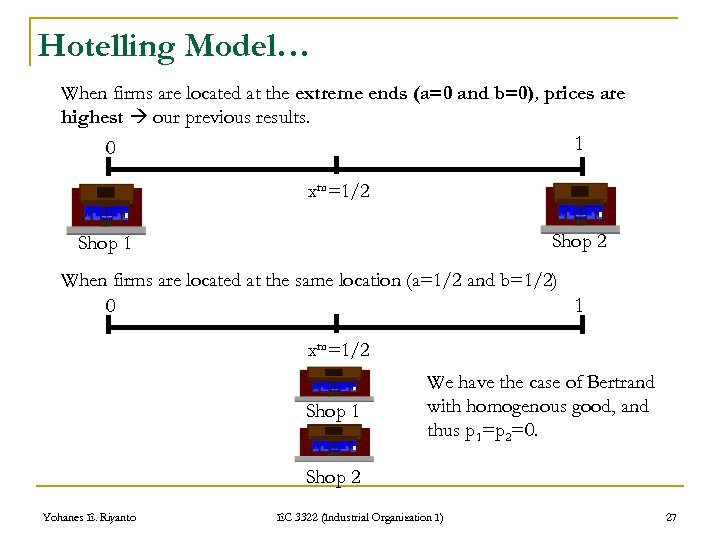

Hotelling Model… When firms are located at the extreme ends (a=0 and b=0), prices are highest our previous results. 1 0 xm=1/2 Shop 1 When firms are located at the same location (a=1/2 and b=1/2) 1 0 xm=1/2 Shop 1 We have the case of Bertrand with homogenous good, and thus p 1=p 2=0. Shop 2 Yohanes E. Riyanto EC 3322 (Industrial Organization I) 27

Hotelling Model… When firms are located at the extreme ends (a=0 and b=0), prices are highest our previous results. 1 0 xm=1/2 Shop 1 When firms are located at the same location (a=1/2 and b=1/2) 1 0 xm=1/2 Shop 1 We have the case of Bertrand with homogenous good, and thus p 1=p 2=0. Shop 2 Yohanes E. Riyanto EC 3322 (Industrial Organization I) 27

Hotelling Model… n Two final points on this analysis n t is a measure of transport costs q it is also a measure of the value consumers place on getting their most preferred variety q when t is large competition is softened n q when t is small competition is tougher n n and profit is increased and profit is decreased Locations have been taken as fixed what happen when firms also choose locations in addition to prices? Yohanes E. Riyanto EC 3322 (Industrial Organization I) 28

Hotelling Model… n Two final points on this analysis n t is a measure of transport costs q it is also a measure of the value consumers place on getting their most preferred variety q when t is large competition is softened n q when t is small competition is tougher n n and profit is increased and profit is decreased Locations have been taken as fixed what happen when firms also choose locations in addition to prices? Yohanes E. Riyanto EC 3322 (Industrial Organization I) 28

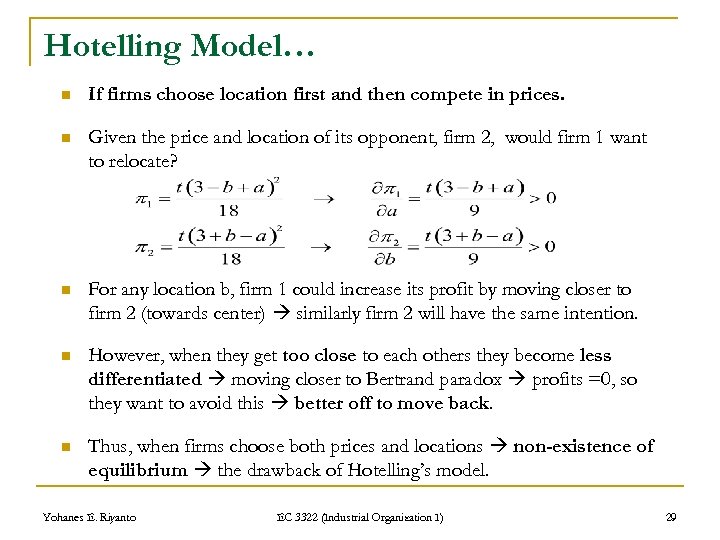

Hotelling Model… n If firms choose location first and then compete in prices. n Given the price and location of its opponent, firm 2, would firm 1 want to relocate? n For any location b, firm 1 could increase its profit by moving closer to firm 2 (towards center) similarly firm 2 will have the same intention. n However, when they get too close to each others they become less differentiated moving closer to Bertrand paradox profits =0, so they want to avoid this better off to move back. n Thus, when firms choose both prices and locations non-existence of equilibrium the drawback of Hotelling’s model. Yohanes E. Riyanto EC 3322 (Industrial Organization I) 29

Hotelling Model… n If firms choose location first and then compete in prices. n Given the price and location of its opponent, firm 2, would firm 1 want to relocate? n For any location b, firm 1 could increase its profit by moving closer to firm 2 (towards center) similarly firm 2 will have the same intention. n However, when they get too close to each others they become less differentiated moving closer to Bertrand paradox profits =0, so they want to avoid this better off to move back. n Thus, when firms choose both prices and locations non-existence of equilibrium the drawback of Hotelling’s model. Yohanes E. Riyanto EC 3322 (Industrial Organization I) 29

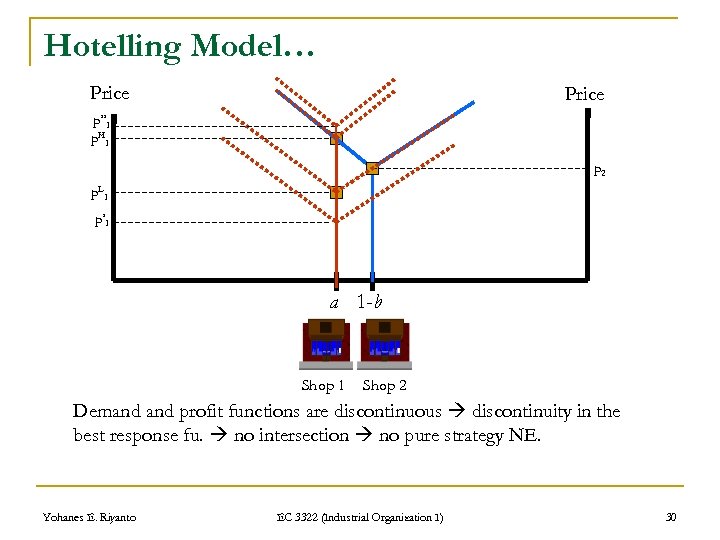

Hotelling Model… Price p’’ 1 p. H 1 p 2 p. L 1 p’ 1 a 1 -b Shop 1 Shop 2 Demand profit functions are discontinuous discontinuity in the best response fu. no intersection no pure strategy NE. Yohanes E. Riyanto EC 3322 (Industrial Organization I) 30

Hotelling Model… Price p’’ 1 p. H 1 p 2 p. L 1 p’ 1 a 1 -b Shop 1 Shop 2 Demand profit functions are discontinuous discontinuity in the best response fu. no intersection no pure strategy NE. Yohanes E. Riyanto EC 3322 (Industrial Organization I) 30

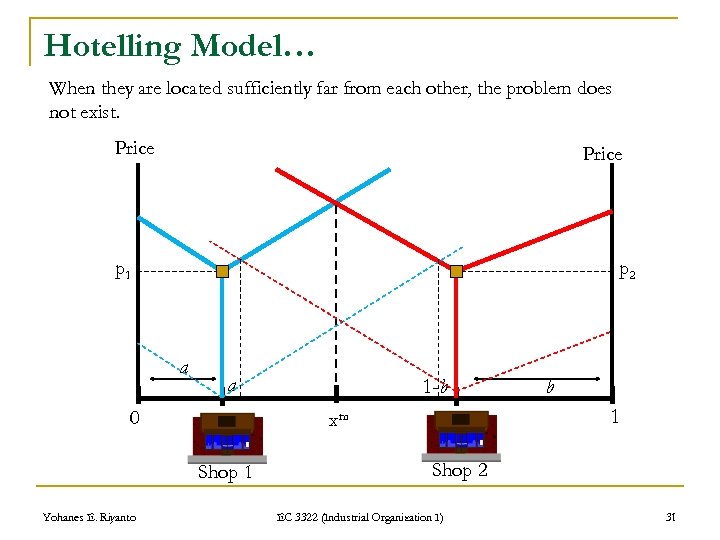

Hotelling Model… When they are located sufficiently far from each other, the problem does not exist. Price p 1 p 2 a a 0 b 1 xm Shop 1 Yohanes E. Riyanto 1 -b Shop 2 EC 3322 (Industrial Organization I) 31

Hotelling Model… When they are located sufficiently far from each other, the problem does not exist. Price p 1 p 2 a a 0 b 1 xm Shop 1 Yohanes E. Riyanto 1 -b Shop 2 EC 3322 (Industrial Organization I) 31

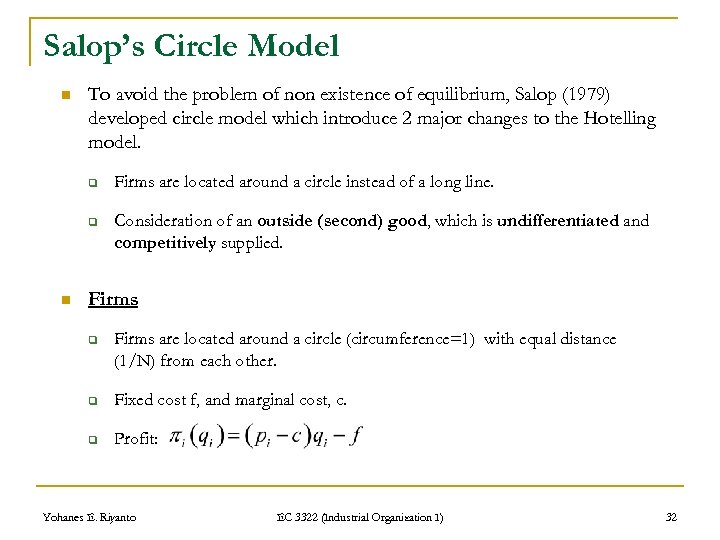

Salop’s Circle Model n To avoid the problem of non existence of equilibrium, Salop (1979) developed circle model which introduce 2 major changes to the Hotelling model. q q n Firms are located around a circle instead of a long line. Consideration of an outside (second) good, which is undifferentiated and competitively supplied. Firms q Firms are located around a circle (circumference=1) with equal distance (1/N) from each other. q Fixed cost f, and marginal cost, c. q Profit: Yohanes E. Riyanto EC 3322 (Industrial Organization I) 32

Salop’s Circle Model n To avoid the problem of non existence of equilibrium, Salop (1979) developed circle model which introduce 2 major changes to the Hotelling model. q q n Firms are located around a circle instead of a long line. Consideration of an outside (second) good, which is undifferentiated and competitively supplied. Firms q Firms are located around a circle (circumference=1) with equal distance (1/N) from each other. q Fixed cost f, and marginal cost, c. q Profit: Yohanes E. Riyanto EC 3322 (Industrial Organization I) 32

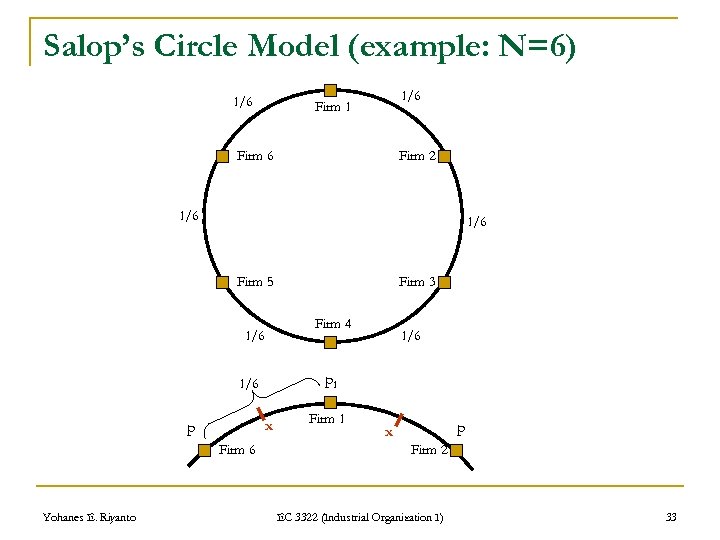

Salop’s Circle Model (example: N=6) 1/6 Firm 1 Firm 6 Firm 2 1/6 Firm 5 Firm 4 1/6 x Firm 6 Yohanes E. Riyanto 1/6 p 1 1/6 p Firm 3 Firm 1 p x Firm 2 EC 3322 (Industrial Organization I) 33

Salop’s Circle Model (example: N=6) 1/6 Firm 1 Firm 6 Firm 2 1/6 Firm 5 Firm 4 1/6 x Firm 6 Yohanes E. Riyanto 1/6 p 1 1/6 p Firm 3 Firm 1 p x Firm 2 EC 3322 (Industrial Organization I) 33

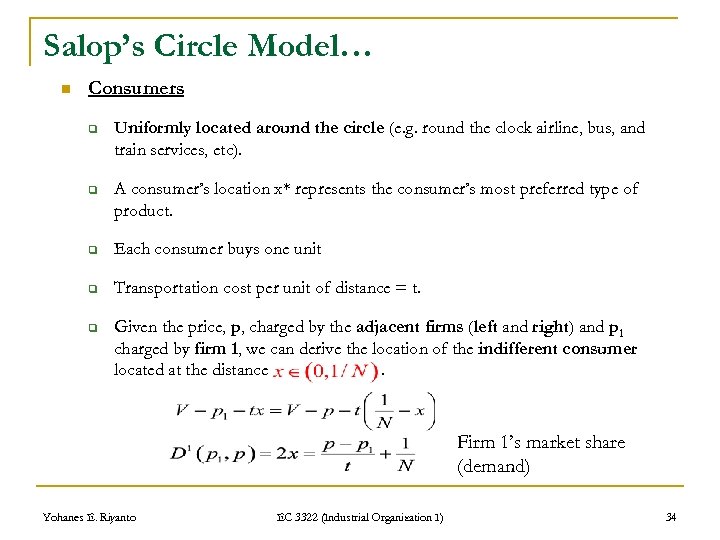

Salop’s Circle Model… n Consumers q Uniformly located around the circle (e. g. round the clock airline, bus, and train services, etc). q A consumer’s location x* represents the consumer’s most preferred type of product. q Each consumer buys one unit q Transportation cost per unit of distance = t. q Given the price, p, charged by the adjacent firms (left and right) and p 1 charged by firm 1, we can derive the location of the indifferent consumer located at the distance. Firm 1’s market share (demand) Yohanes E. Riyanto EC 3322 (Industrial Organization I) 34

Salop’s Circle Model… n Consumers q Uniformly located around the circle (e. g. round the clock airline, bus, and train services, etc). q A consumer’s location x* represents the consumer’s most preferred type of product. q Each consumer buys one unit q Transportation cost per unit of distance = t. q Given the price, p, charged by the adjacent firms (left and right) and p 1 charged by firm 1, we can derive the location of the indifferent consumer located at the distance. Firm 1’s market share (demand) Yohanes E. Riyanto EC 3322 (Industrial Organization I) 34

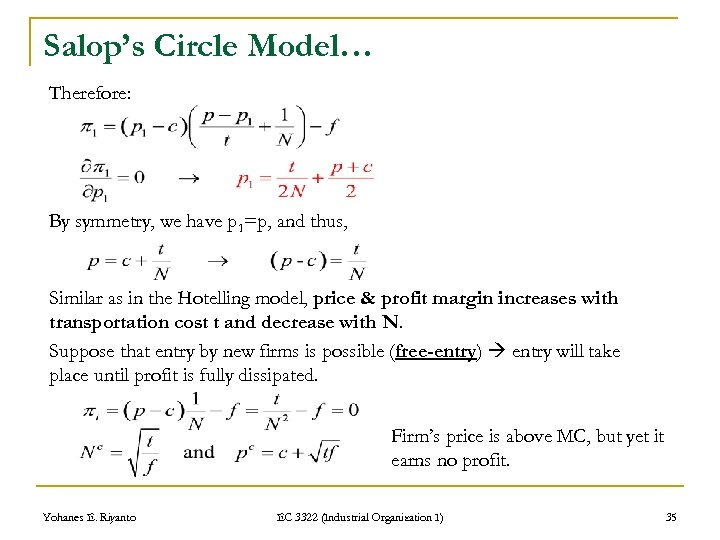

Salop’s Circle Model… Therefore: By symmetry, we have p 1=p, and thus, Similar as in the Hotelling model, price & profit margin increases with transportation cost t and decrease with N. Suppose that entry by new firms is possible (free-entry) entry will take place until profit is fully dissipated. Firm’s price is above MC, but yet it earns no profit. Yohanes E. Riyanto EC 3322 (Industrial Organization I) 35

Salop’s Circle Model… Therefore: By symmetry, we have p 1=p, and thus, Similar as in the Hotelling model, price & profit margin increases with transportation cost t and decrease with N. Suppose that entry by new firms is possible (free-entry) entry will take place until profit is fully dissipated. Firm’s price is above MC, but yet it earns no profit. Yohanes E. Riyanto EC 3322 (Industrial Organization I) 35

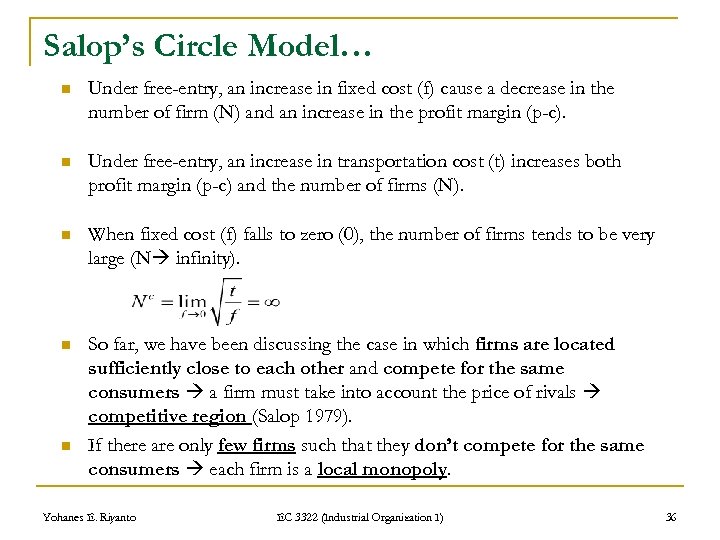

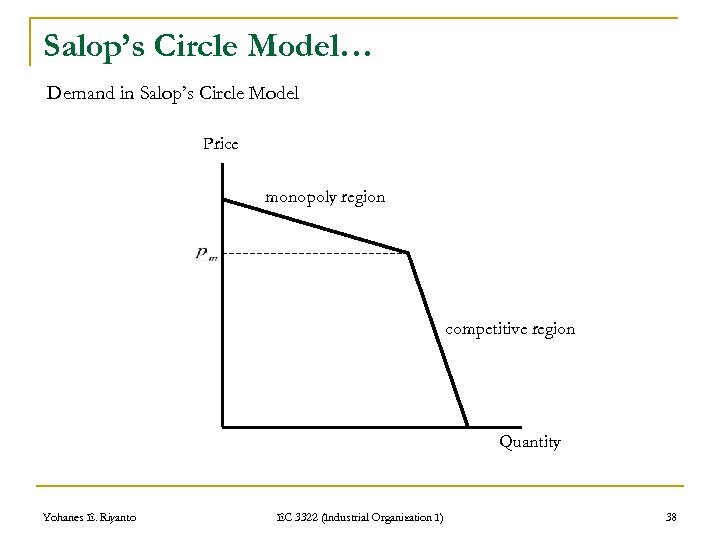

Salop’s Circle Model… n Under free-entry, an increase in fixed cost (f) cause a decrease in the number of firm (N) and an increase in the profit margin (p-c). n Under free-entry, an increase in transportation cost (t) increases both profit margin (p-c) and the number of firms (N). n When fixed cost (f) falls to zero (0), the number of firms tends to be very large (N infinity). n So far, we have been discussing the case in which firms are located sufficiently close to each other and compete for the same consumers a firm must take into account the price of rivals competitive region (Salop 1979). If there are only few firms such that they don’t compete for the same consumers each firm is a local monopoly. n Yohanes E. Riyanto EC 3322 (Industrial Organization I) 36

Salop’s Circle Model… n Under free-entry, an increase in fixed cost (f) cause a decrease in the number of firm (N) and an increase in the profit margin (p-c). n Under free-entry, an increase in transportation cost (t) increases both profit margin (p-c) and the number of firms (N). n When fixed cost (f) falls to zero (0), the number of firms tends to be very large (N infinity). n So far, we have been discussing the case in which firms are located sufficiently close to each other and compete for the same consumers a firm must take into account the price of rivals competitive region (Salop 1979). If there are only few firms such that they don’t compete for the same consumers each firm is a local monopoly. n Yohanes E. Riyanto EC 3322 (Industrial Organization I) 36

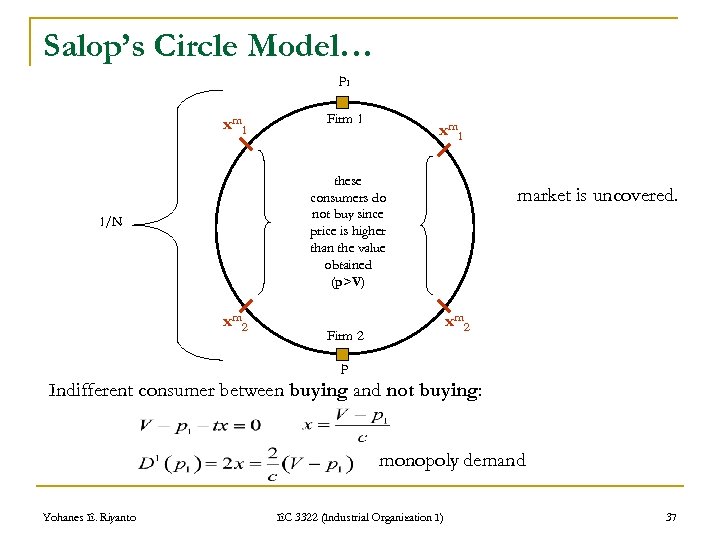

Salop’s Circle Model… p 1 xm 1 Firm 1 xm 1 these consumers do not buy since price is higher than the value obtained (p>V) 1/N xm 2 market is uncovered. xm 2 Firm 2 p Indifferent consumer between buying and not buying: monopoly demand Yohanes E. Riyanto EC 3322 (Industrial Organization I) 37

Salop’s Circle Model… p 1 xm 1 Firm 1 xm 1 these consumers do not buy since price is higher than the value obtained (p>V) 1/N xm 2 market is uncovered. xm 2 Firm 2 p Indifferent consumer between buying and not buying: monopoly demand Yohanes E. Riyanto EC 3322 (Industrial Organization I) 37

Salop’s Circle Model… Demand in Salop’s Circle Model Price monopoly region competitive region Quantity Yohanes E. Riyanto EC 3322 (Industrial Organization I) 38

Salop’s Circle Model… Demand in Salop’s Circle Model Price monopoly region competitive region Quantity Yohanes E. Riyanto EC 3322 (Industrial Organization I) 38

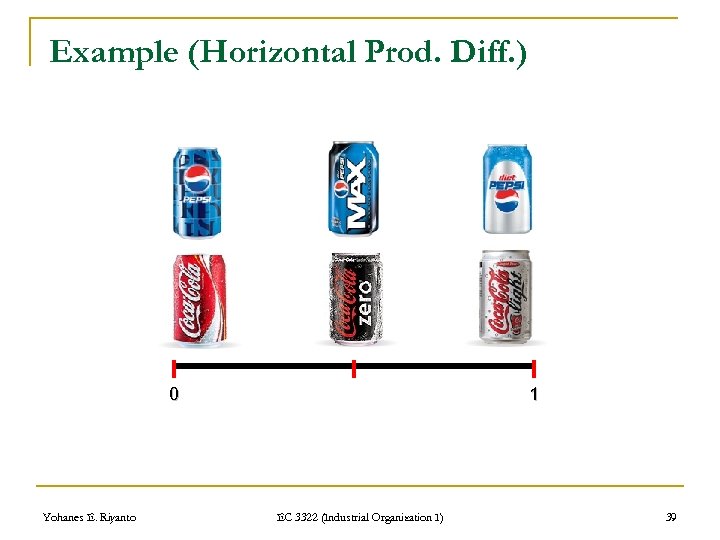

Example (Horizontal Prod. Diff. ) 0 Yohanes E. Riyanto 1 EC 3322 (Industrial Organization I) 39

Example (Horizontal Prod. Diff. ) 0 Yohanes E. Riyanto 1 EC 3322 (Industrial Organization I) 39

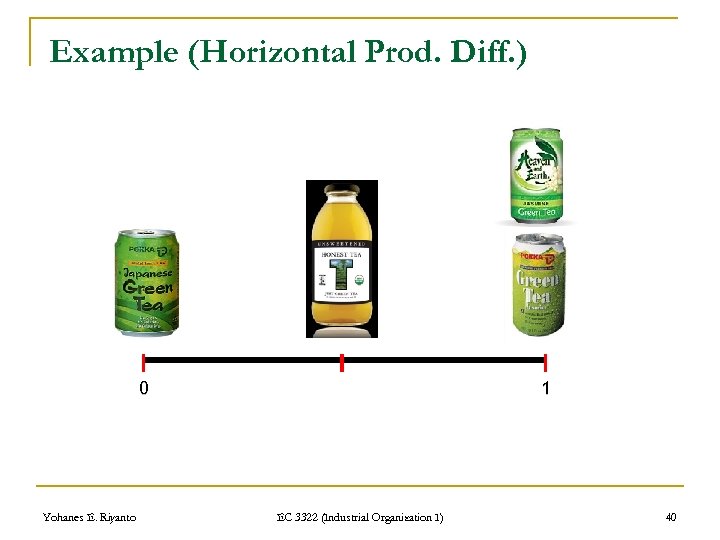

Example (Horizontal Prod. Diff. ) 0 Yohanes E. Riyanto 1 EC 3322 (Industrial Organization I) 40

Example (Horizontal Prod. Diff. ) 0 Yohanes E. Riyanto 1 EC 3322 (Industrial Organization I) 40

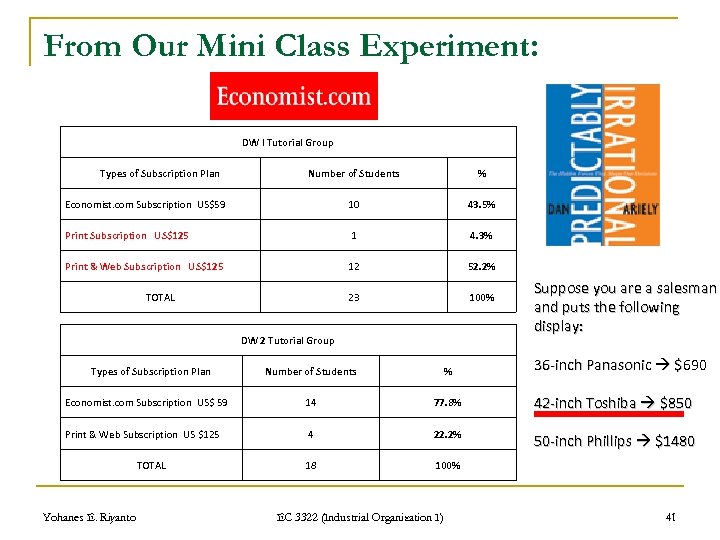

From Our Mini Class Experiment: DW I Tutorial Group Types of Subscription Plan Number of Students % Economist. com Subscription US$59 10 43. 5% Print Subscription US$125 1 4. 3% Print & Web Subscription US$125 12 52. 2% 23 100% TOTAL DW 2 Tutorial Group Types of Subscription Plan Suppose you are a salesman and puts the following display: 36 -inch Panasonic $690 Number of Students % Economist. com Subscription US$ 59 14 77. 8% 42 -inch Toshiba $850 Print & Web Subscription US $125 4 22. 2% 50 -inch Phillips $1480 18 100% TOTAL Yohanes E. Riyanto EC 3322 (Industrial Organization I) 41

From Our Mini Class Experiment: DW I Tutorial Group Types of Subscription Plan Number of Students % Economist. com Subscription US$59 10 43. 5% Print Subscription US$125 1 4. 3% Print & Web Subscription US$125 12 52. 2% 23 100% TOTAL DW 2 Tutorial Group Types of Subscription Plan Suppose you are a salesman and puts the following display: 36 -inch Panasonic $690 Number of Students % Economist. com Subscription US$ 59 14 77. 8% 42 -inch Toshiba $850 Print & Web Subscription US $125 4 22. 2% 50 -inch Phillips $1480 18 100% TOTAL Yohanes E. Riyanto EC 3322 (Industrial Organization I) 41

Example (Vertical Prod. Diff. ) Yohanes E. Riyanto EC 3322 (Industrial Organization I) 42

Example (Vertical Prod. Diff. ) Yohanes E. Riyanto EC 3322 (Industrial Organization I) 42

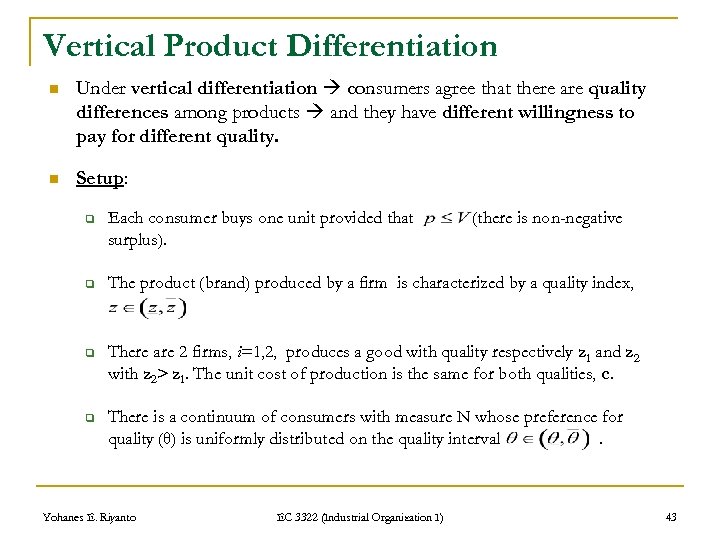

Vertical Product Differentiation n Under vertical differentiation consumers agree that there are quality differences among products and they have different willingness to pay for different quality. n Setup: q Each consumer buys one unit provided that surplus). q The product (brand) produced by a firm is characterized by a quality index, q There are 2 firms, i=1, 2, produces a good with quality respectively z 1 and z 2 with z 2> z 1. The unit cost of production is the same for both qualities, c. q There is a continuum of consumers with measure N whose preference for quality (θ) is uniformly distributed on the quality interval. Yohanes E. Riyanto EC 3322 (Industrial Organization I) (there is non-negative 43

Vertical Product Differentiation n Under vertical differentiation consumers agree that there are quality differences among products and they have different willingness to pay for different quality. n Setup: q Each consumer buys one unit provided that surplus). q The product (brand) produced by a firm is characterized by a quality index, q There are 2 firms, i=1, 2, produces a good with quality respectively z 1 and z 2 with z 2> z 1. The unit cost of production is the same for both qualities, c. q There is a continuum of consumers with measure N whose preference for quality (θ) is uniformly distributed on the quality interval. Yohanes E. Riyanto EC 3322 (Industrial Organization I) (there is non-negative 43

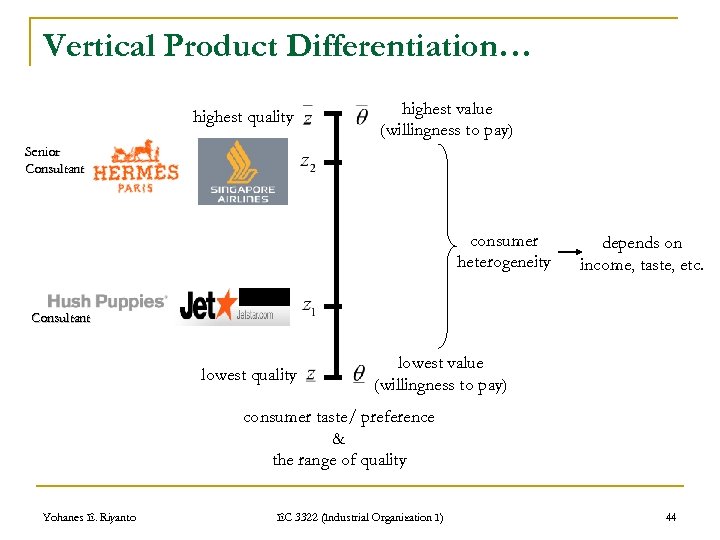

Vertical Product Differentiation… highest quality highest value (willingness to pay) Senior Consultant consumer heterogeneity depends on income, taste, etc. Consultant lowest quality lowest value (willingness to pay) consumer taste/ preference & the range of quality Yohanes E. Riyanto EC 3322 (Industrial Organization I) 44

Vertical Product Differentiation… highest quality highest value (willingness to pay) Senior Consultant consumer heterogeneity depends on income, taste, etc. Consultant lowest quality lowest value (willingness to pay) consumer taste/ preference & the range of quality Yohanes E. Riyanto EC 3322 (Industrial Organization I) 44

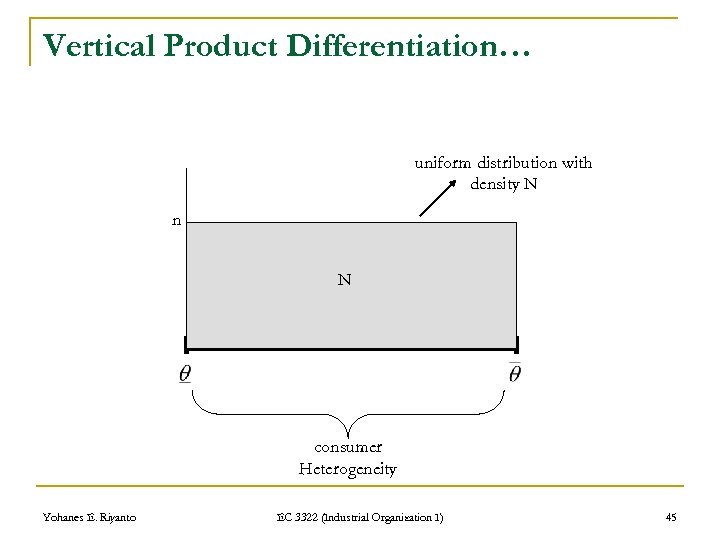

Vertical Product Differentiation… uniform distribution with density N n N consumer Heterogeneity Yohanes E. Riyanto EC 3322 (Industrial Organization I) 45

Vertical Product Differentiation… uniform distribution with density N n N consumer Heterogeneity Yohanes E. Riyanto EC 3322 (Industrial Organization I) 45

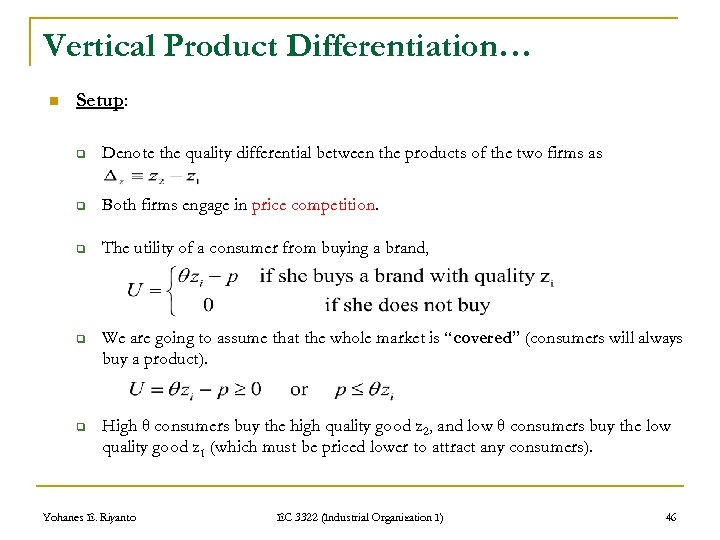

Vertical Product Differentiation… n Setup: q Denote the quality differential between the products of the two firms as q Both firms engage in price competition. q The utility of a consumer from buying a brand, q We are going to assume that the whole market is “covered” (consumers will always buy a product). q High θ consumers buy the high quality good z 2, and low θ consumers buy the low quality good z 1 (which must be priced lower to attract any consumers). Yohanes E. Riyanto EC 3322 (Industrial Organization I) 46

Vertical Product Differentiation… n Setup: q Denote the quality differential between the products of the two firms as q Both firms engage in price competition. q The utility of a consumer from buying a brand, q We are going to assume that the whole market is “covered” (consumers will always buy a product). q High θ consumers buy the high quality good z 2, and low θ consumers buy the low quality good z 1 (which must be priced lower to attract any consumers). Yohanes E. Riyanto EC 3322 (Industrial Organization I) 46

Vertical Product Differentiation… n Setup: q A consumer with taste (preference) θ is indifferent between buying the high quality and the low quality good if: q This implies that all consumers with taste in the interval of will buy the low quality good from firm 1. While consumers with taste in the interval of will buy the high quality good from firm 2. q The demand functions for both firms can be derived: Yohanes E. Riyanto EC 3322 (Industrial Organization I) 47

Vertical Product Differentiation… n Setup: q A consumer with taste (preference) θ is indifferent between buying the high quality and the low quality good if: q This implies that all consumers with taste in the interval of will buy the low quality good from firm 1. While consumers with taste in the interval of will buy the high quality good from firm 2. q The demand functions for both firms can be derived: Yohanes E. Riyanto EC 3322 (Industrial Organization I) 47

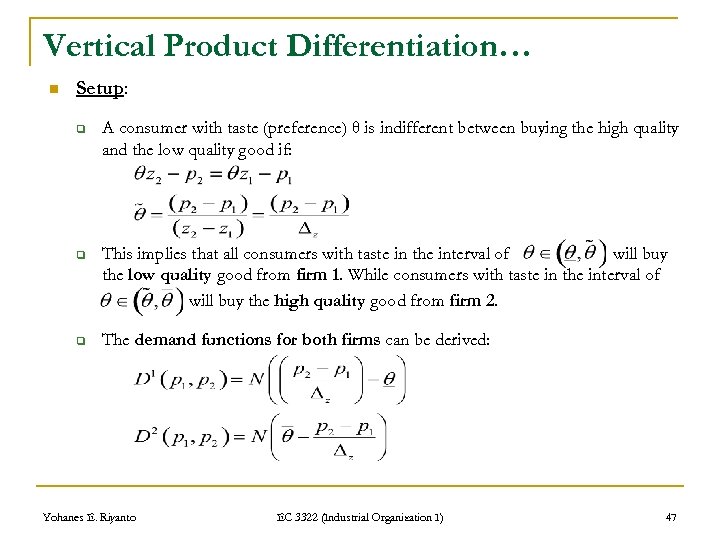

Vertical Product Differentiation… uniform distribution with density N n buy low quality buy high quality consumer heterogeneity Yohanes E. Riyanto EC 3322 (Industrial Organization I) 48

Vertical Product Differentiation… uniform distribution with density N n buy low quality buy high quality consumer heterogeneity Yohanes E. Riyanto EC 3322 (Industrial Organization I) 48

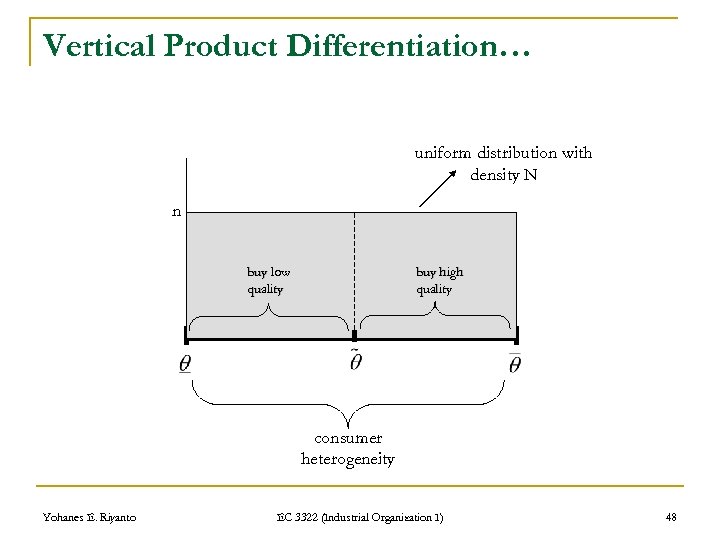

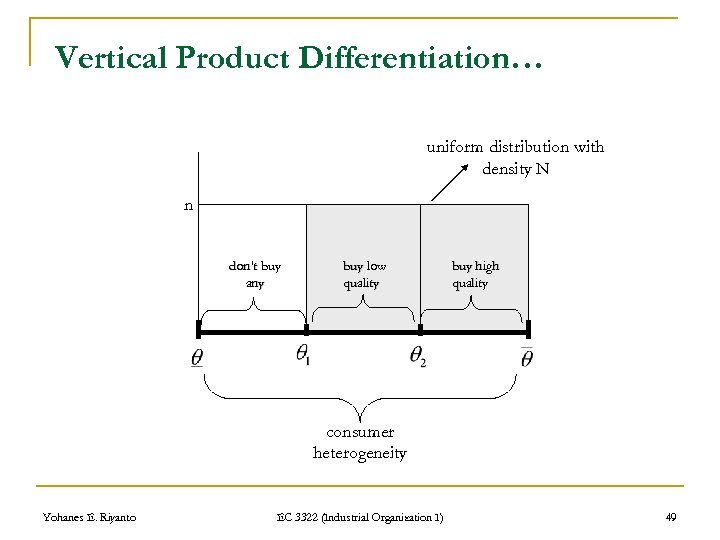

Vertical Product Differentiation… uniform distribution with density N n don't buy any buy low quality buy high quality consumer heterogeneity Yohanes E. Riyanto EC 3322 (Industrial Organization I) 49

Vertical Product Differentiation… uniform distribution with density N n don't buy any buy low quality buy high quality consumer heterogeneity Yohanes E. Riyanto EC 3322 (Industrial Organization I) 49

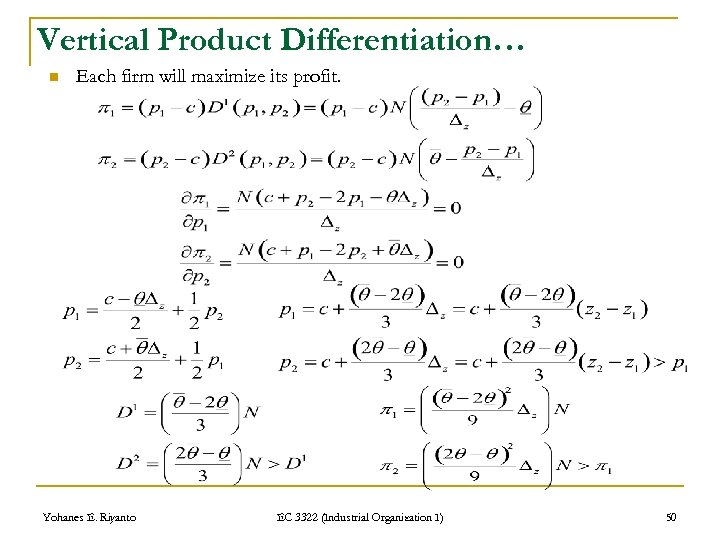

Vertical Product Differentiation… n Each firm will maximize its profit. Yohanes E. Riyanto EC 3322 (Industrial Organization I) 50

Vertical Product Differentiation… n Each firm will maximize its profit. Yohanes E. Riyanto EC 3322 (Industrial Organization I) 50

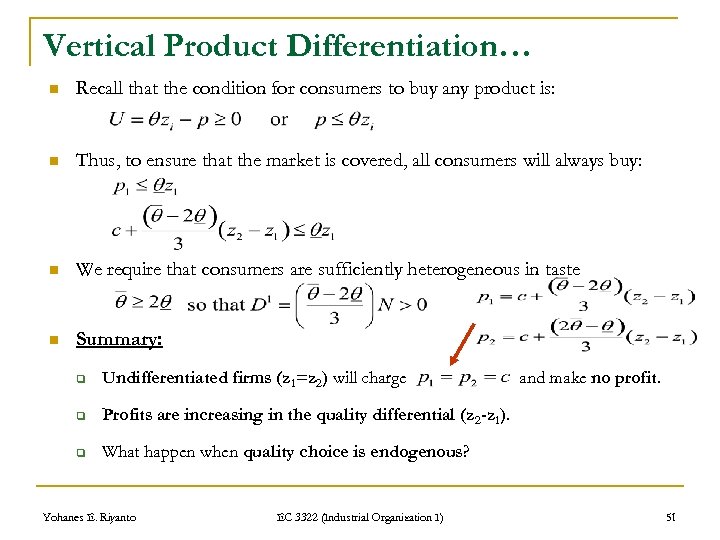

Vertical Product Differentiation… n Recall that the condition for consumers to buy any product is: n Thus, to ensure that the market is covered, all consumers will always buy: n We require that consumers are sufficiently heterogeneous in taste n Summary: q Undifferentiated firms (z 1=z 2) will charge q Profits are increasing in the quality differential (z 2 -z 1). q What happen when quality choice is endogenous? Yohanes E. Riyanto EC 3322 (Industrial Organization I) and make no profit. 51

Vertical Product Differentiation… n Recall that the condition for consumers to buy any product is: n Thus, to ensure that the market is covered, all consumers will always buy: n We require that consumers are sufficiently heterogeneous in taste n Summary: q Undifferentiated firms (z 1=z 2) will charge q Profits are increasing in the quality differential (z 2 -z 1). q What happen when quality choice is endogenous? Yohanes E. Riyanto EC 3322 (Industrial Organization I) and make no profit. 51

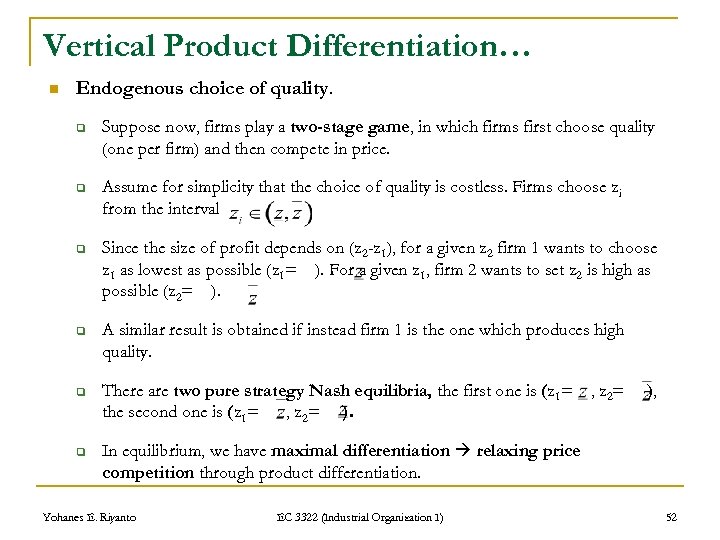

Vertical Product Differentiation… n Endogenous choice of quality. q Suppose now, firms play a two-stage game, in which firms first choose quality (one per firm) and then compete in price. q Assume for simplicity that the choice of quality is costless. Firms choose zi from the interval q Since the size of profit depends on (z 2 -z 1), for a given z 2 firm 1 wants to choose z 1 as lowest as possible (z 1= ). For a given z 1, firm 2 wants to set z 2 is high as possible (z 2= ). q A similar result is obtained if instead firm 1 is the one which produces high quality. q There are two pure strategy Nash equilibria, the first one is (z 1= the second one is (z 1= , z 2= ). q , z 2 = ), In equilibrium, we have maximal differentiation relaxing price competition through product differentiation. Yohanes E. Riyanto EC 3322 (Industrial Organization I) 52

Vertical Product Differentiation… n Endogenous choice of quality. q Suppose now, firms play a two-stage game, in which firms first choose quality (one per firm) and then compete in price. q Assume for simplicity that the choice of quality is costless. Firms choose zi from the interval q Since the size of profit depends on (z 2 -z 1), for a given z 2 firm 1 wants to choose z 1 as lowest as possible (z 1= ). For a given z 1, firm 2 wants to set z 2 is high as possible (z 2= ). q A similar result is obtained if instead firm 1 is the one which produces high quality. q There are two pure strategy Nash equilibria, the first one is (z 1= the second one is (z 1= , z 2= ). q , z 2 = ), In equilibrium, we have maximal differentiation relaxing price competition through product differentiation. Yohanes E. Riyanto EC 3322 (Industrial Organization I) 52

Vertical Product Differentiation… n Endogenous choice of quality. q In a Stackelberg setting, the first mover always wants to enter with high quality, and given this the second mover will choose low quality this gives us a unique equilibrium. We have a setting in which choice of quality is costless and yet, the low quality firm gains from reducing its quality level to the minimum trade-off: demand reduction because of lower quality vs. softer price competition. Yohanes E. Riyanto EC 3322 (Industrial Organization I) 53

Vertical Product Differentiation… n Endogenous choice of quality. q In a Stackelberg setting, the first mover always wants to enter with high quality, and given this the second mover will choose low quality this gives us a unique equilibrium. We have a setting in which choice of quality is costless and yet, the low quality firm gains from reducing its quality level to the minimum trade-off: demand reduction because of lower quality vs. softer price competition. Yohanes E. Riyanto EC 3322 (Industrial Organization I) 53