2554b26e830e7d8238e2a4a7d6467b9e.ppt

- Количество слайдов: 53

Topic 8 Competitive Strategy and Strategic Alliances Dr. Songporn Hansanti 1

Topic 8 Competitive Strategy and Strategic Alliances Dr. Songporn Hansanti 1

Competitor Analyses Internal Assessments q External Assessments: Analyzing Competitor Operations q Strategic Alliances q 2

Competitor Analyses Internal Assessments q External Assessments: Analyzing Competitor Operations q Strategic Alliances q 2

Who are they? l Nature of business operation l Direct Competitor l Indirect Competitor 3

Who are they? l Nature of business operation l Direct Competitor l Indirect Competitor 3

Competitor Analyses q Uses of Competitor Analysis q provides insights into rivals’ strategies and enable companies to: Outwit Rivals - detect marketplace changes more quickly than competitors § Outmaneuver Rivals - Being the first to introduce new products and technologies § Outperform Rivals - In terms of new product development, market share, customer satisfaction levels and corporate reputation § 4

Competitor Analyses q Uses of Competitor Analysis q provides insights into rivals’ strategies and enable companies to: Outwit Rivals - detect marketplace changes more quickly than competitors § Outmaneuver Rivals - Being the first to introduce new products and technologies § Outperform Rivals - In terms of new product development, market share, customer satisfaction levels and corporate reputation § 4

Competitor Analysis q Internal Assessments Corporate missions: provide overviews of corporate priorities in terms of products, markets, technology, and corporate culture Ø Strategic intents: relate to long-term competitive aspirations Ø Core competencies: are articulations of what companies do better than others – their acknowledged expertise vis-à-vis the rest of the industry: innovation styling, value Ø 5

Competitor Analysis q Internal Assessments Corporate missions: provide overviews of corporate priorities in terms of products, markets, technology, and corporate culture Ø Strategic intents: relate to long-term competitive aspirations Ø Core competencies: are articulations of what companies do better than others – their acknowledged expertise vis-à-vis the rest of the industry: innovation styling, value Ø 5

Collaborative Strategies 6

Collaborative Strategies 6

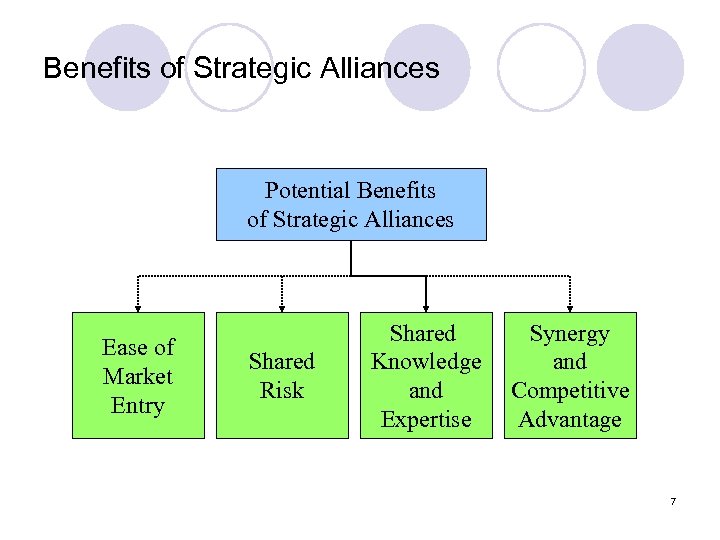

Benefits of Strategic Alliances Potential Benefits of Strategic Alliances Ease of Market Entry Shared Risk Shared Knowledge and Expertise Synergy and Competitive Advantage 7

Benefits of Strategic Alliances Potential Benefits of Strategic Alliances Ease of Market Entry Shared Risk Shared Knowledge and Expertise Synergy and Competitive Advantage 7

Scope of Strategic Alliances l Significant variation ¡ Comprehensive alliance ¡ Narrowly defined alliance l Degree of collaboration depends upon basic goals of each partner 8

Scope of Strategic Alliances l Significant variation ¡ Comprehensive alliance ¡ Narrowly defined alliance l Degree of collaboration depends upon basic goals of each partner 8

Types of Alliances l Comprehensive l Functional ¡ Production ¡ Marketing ¡ Financial ¡ Research and Development 9

Types of Alliances l Comprehensive l Functional ¡ Production ¡ Marketing ¡ Financial ¡ Research and Development 9

Implementation of Strategic Alliances l Selection of partners l Compatibility l Nature of potential partner’s products or services l Relative safeness of the alliance l Learning potential of the alliance 10

Implementation of Strategic Alliances l Selection of partners l Compatibility l Nature of potential partner’s products or services l Relative safeness of the alliance l Learning potential of the alliance 10

Joint Management Considerations l Shared management agreements l Assigned arrangements l Delegated arrangements 11

Joint Management Considerations l Shared management agreements l Assigned arrangements l Delegated arrangements 11

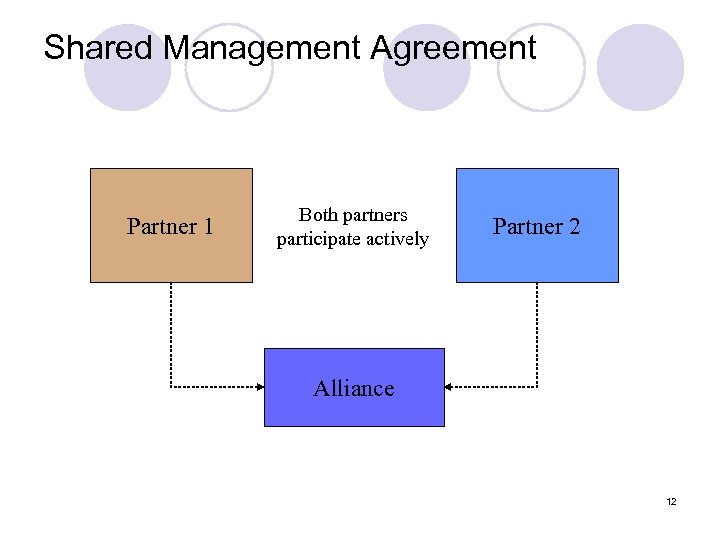

Shared Management Agreement Partner 1 Both partners participate actively Partner 2 Alliance 12

Shared Management Agreement Partner 1 Both partners participate actively Partner 2 Alliance 12

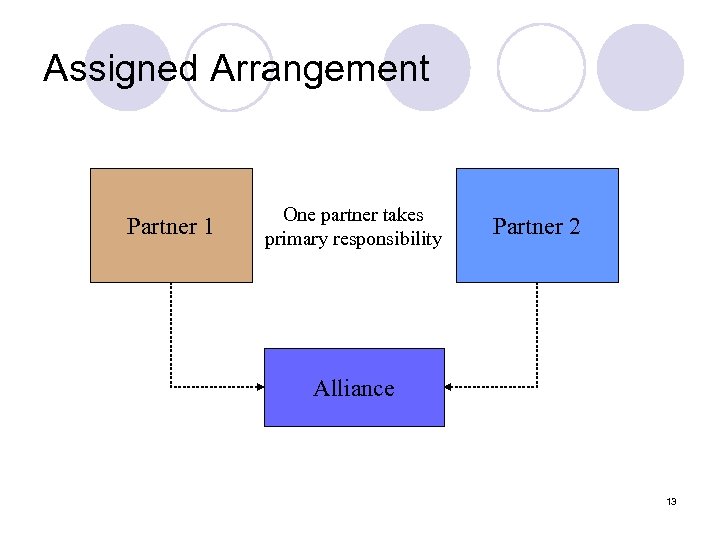

Assigned Arrangement Partner 1 One partner takes primary responsibility Partner 2 Alliance 13

Assigned Arrangement Partner 1 One partner takes primary responsibility Partner 2 Alliance 13

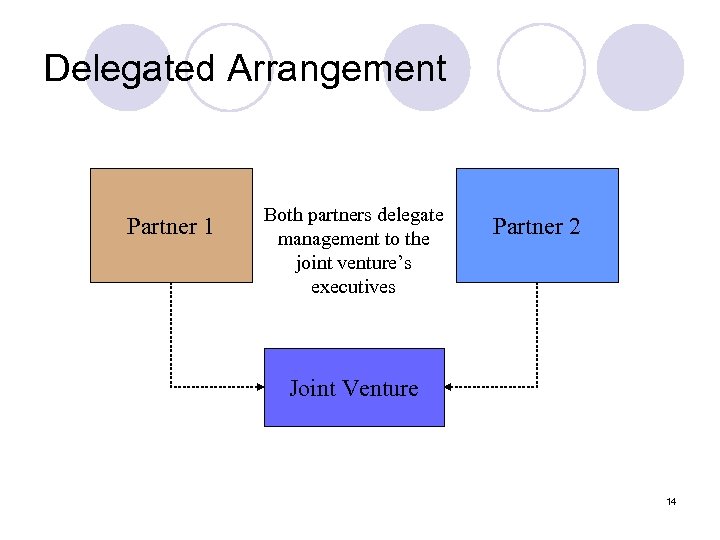

Delegated Arrangement Partner 1 Both partners delegate management to the joint venture’s executives Partner 2 Joint Venture 14

Delegated Arrangement Partner 1 Both partners delegate management to the joint venture’s executives Partner 2 Joint Venture 14

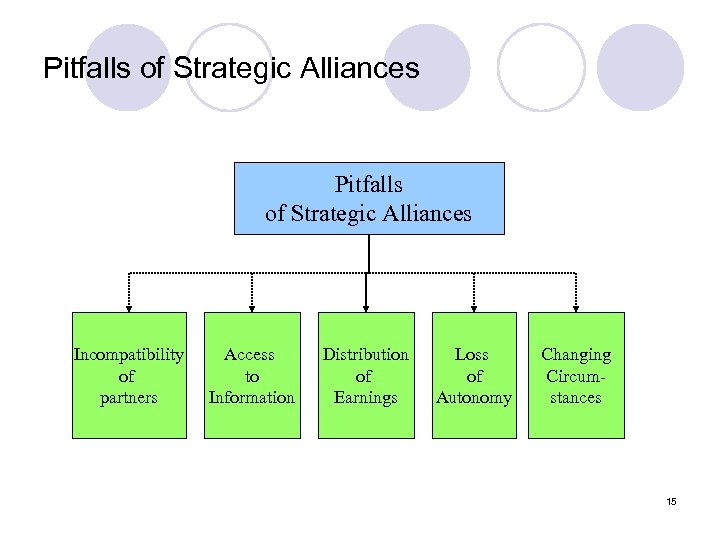

Pitfalls of Strategic Alliances Incompatibility of partners Access to Information Distribution of Earnings Loss of Autonomy Changing Circumstances 15

Pitfalls of Strategic Alliances Incompatibility of partners Access to Information Distribution of Earnings Loss of Autonomy Changing Circumstances 15

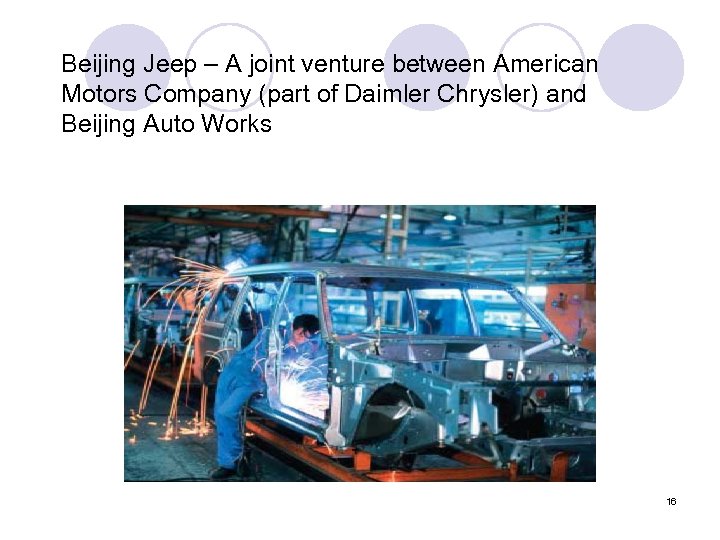

Beijing Jeep – A joint venture between American Motors Company (part of Daimler Chrysler) and Beijing Auto Works 16

Beijing Jeep – A joint venture between American Motors Company (part of Daimler Chrysler) and Beijing Auto Works 16

Merger & Acquisition (M&A) 1. 2. 3. 4. 5. 6. 7. 8. 9. Technological change Efficiency of operations Globalization and freer trade Changes in industry organization New industries Deregulation and regulation Favorable economic and financial conditions Negative trends in industries and economies Widening inequalities in income and wealth 17

Merger & Acquisition (M&A) 1. 2. 3. 4. 5. 6. 7. 8. 9. Technological change Efficiency of operations Globalization and freer trade Changes in industry organization New industries Deregulation and regulation Favorable economic and financial conditions Negative trends in industries and economies Widening inequalities in income and wealth 17

Merger l l l เปนการรวมทไมจำเปนตองตงบรษทใหม ซงการรวมกนจะเปนตกลงกนวาจะเลกบรษท ใด แลวแตจะตกลงกน เชน บรษท สปามหาวนาศ และ บรษท สปาเทวาบรรลย ตางประกอบกจการ ไดรวมกจการเขาดวยกน เหลอเพยง บรษท สปามหาวนาศ เพยงบรษทเดยว ซงการรวมแบบนอาจจะเรยกไดวา Acquisition ซงเปนการซอกจการของบรษทอน อาจซอเพยงทรพยสน หรอทงทรพยสนและหนสน (โอนกจการ ( หรออาจเปนเขาไปซอหนเพอใหเพยงพอ กบการเขาไปไดบรหารกจการ (Take Over) 18

Merger l l l เปนการรวมทไมจำเปนตองตงบรษทใหม ซงการรวมกนจะเปนตกลงกนวาจะเลกบรษท ใด แลวแตจะตกลงกน เชน บรษท สปามหาวนาศ และ บรษท สปาเทวาบรรลย ตางประกอบกจการ ไดรวมกจการเขาดวยกน เหลอเพยง บรษท สปามหาวนาศ เพยงบรษทเดยว ซงการรวมแบบนอาจจะเรยกไดวา Acquisition ซงเปนการซอกจการของบรษทอน อาจซอเพยงทรพยสน หรอทงทรพยสนและหนสน (โอนกจการ ( หรออาจเปนเขาไปซอหนเพอใหเพยงพอ กบการเขาไปไดบรหารกจการ (Take Over) 18

Merger l เปนการรวมทไมจำเปนตองตงบรษ ทใหม ซงการรวมกนจะเปนตกลงกนวาจะเลกบ รษทใด แลวแตจะตกลงกน l เชน บรษท สปามหาวนาศ และ บรษท สปาเทวาบรรลย ตางประกอบกจการ ไดรวมกจการเขาดวยกน เหลอเพยง บรษท สปามหาวนาศ เพยงบรษทเดยว l ซงการรวมแบบนอาจจะเรยกไดวา Acquisition ซงเปนการซอกจการของบรษทอน 19

Merger l เปนการรวมทไมจำเปนตองตงบรษ ทใหม ซงการรวมกนจะเปนตกลงกนวาจะเลกบ รษทใด แลวแตจะตกลงกน l เชน บรษท สปามหาวนาศ และ บรษท สปาเทวาบรรลย ตางประกอบกจการ ไดรวมกจการเขาดวยกน เหลอเพยง บรษท สปามหาวนาศ เพยงบรษทเดยว l ซงการรวมแบบนอาจจะเรยกไดวา Acquisition ซงเปนการซอกจการของบรษทอน 19

Consolidation or Amalgamation l คอการรวมกจการทตงบรษทใหม และยกเลกบรษทเดม l บรษทใหมนตองเปนชอใหม มการออกหนใหม ผถอหนของบรษทเดมจะไดรบห นสามญของบรษทใหมแทนของบรษทเด ม l เชน บรษท สด ดมอ อกซ ไดซ และ บรษท เปาและดม ตางประกอบกจการผลตยาดม 20

Consolidation or Amalgamation l คอการรวมกจการทตงบรษทใหม และยกเลกบรษทเดม l บรษทใหมนตองเปนชอใหม มการออกหนใหม ผถอหนของบรษทเดมจะไดรบห นสามญของบรษทใหมแทนของบรษทเด ม l เชน บรษท สด ดมอ อกซ ไดซ และ บรษท เปาและดม ตางประกอบกจการผลตยาดม 20

M&A Terminology Merger ¡ Negotiated deals ¡ Mutuality of negotiations ¡ Mostly friendly l Restructuring — changes to improve operations, policies, and strategies l 21

M&A Terminology Merger ¡ Negotiated deals ¡ Mutuality of negotiations ¡ Mostly friendly l Restructuring — changes to improve operations, policies, and strategies l 21

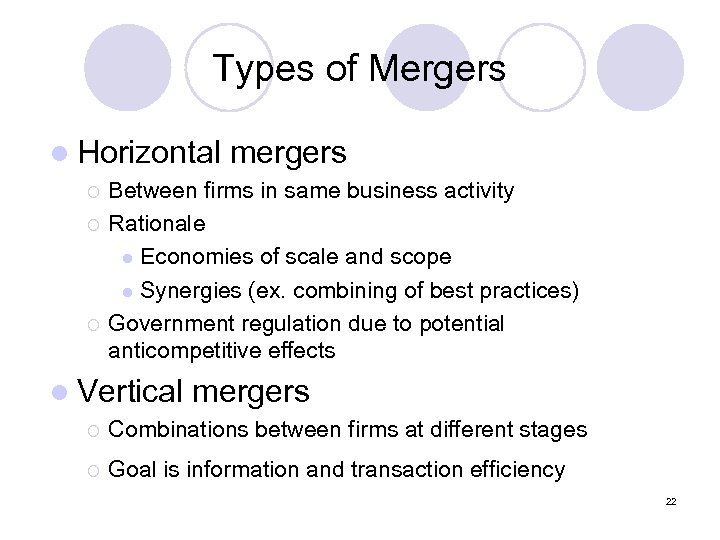

Types of Mergers l Horizontal ¡ ¡ ¡ mergers Between firms in same business activity Rationale l Economies of scale and scope l Synergies (ex. combining of best practices) Government regulation due to potential anticompetitive effects l Vertical mergers ¡ Combinations between firms at different stages ¡ Goal is information and transaction efficiency 22

Types of Mergers l Horizontal ¡ ¡ ¡ mergers Between firms in same business activity Rationale l Economies of scale and scope l Synergies (ex. combining of best practices) Government regulation due to potential anticompetitive effects l Vertical mergers ¡ Combinations between firms at different stages ¡ Goal is information and transaction efficiency 22

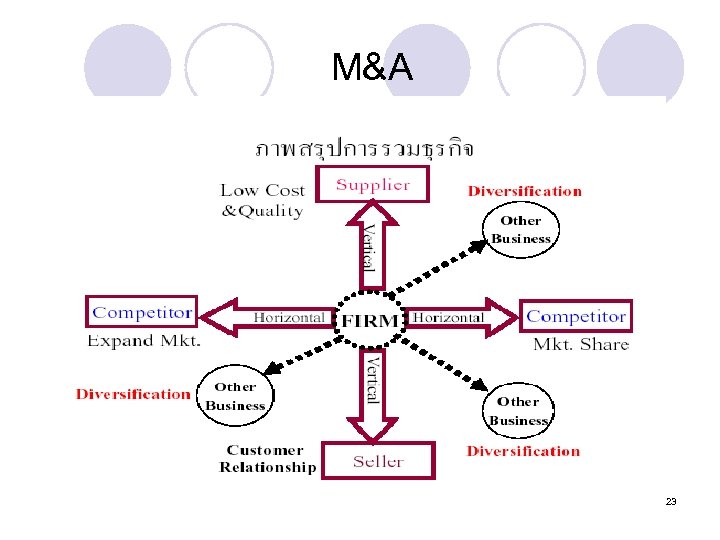

M&A 23

M&A 23

M&A Strategy Defines the long-term plans, policies and culture of an organization l Strategic planning is a dynamic process that requires inputs from all segments of the organization l Acquisition and restructuring policies and decisions should be part of the company's overall strategic plans and processes l Ultimate responsibility for strategic planning resides in the top executive group l 24

M&A Strategy Defines the long-term plans, policies and culture of an organization l Strategic planning is a dynamic process that requires inputs from all segments of the organization l Acquisition and restructuring policies and decisions should be part of the company's overall strategic plans and processes l Ultimate responsibility for strategic planning resides in the top executive group l 24

Strategic Planning Processes in M&A l Essential elements in strategic planning ¡ ¡ ¡ Assessment of changes in the environments Evaluation of company capabilities and limitations Assessment of expectations of stakeholders Analysis of company, competitors, industry, domestic economy and international economies Formulation of the missions, goals and policies for the master strategy Development of sensitivity to critical environmental changes 25

Strategic Planning Processes in M&A l Essential elements in strategic planning ¡ ¡ ¡ Assessment of changes in the environments Evaluation of company capabilities and limitations Assessment of expectations of stakeholders Analysis of company, competitors, industry, domestic economy and international economies Formulation of the missions, goals and policies for the master strategy Development of sensitivity to critical environmental changes 25

Strategic Planning Processes in M&A l Essential elements in strategic planning ¡ ¡ ¡ Formulation of organization performance measurements and benchmarks Formulation of long-range strategy programs Formulation of mid-range programs and short-run plans Organization, funding and other methods to implement all of the preceding elements Information flow and feedback system for continued repetition of above activities and for adjustments and changes at each stage Review and evaluation of above processes 26

Strategic Planning Processes in M&A l Essential elements in strategic planning ¡ ¡ ¡ Formulation of organization performance measurements and benchmarks Formulation of long-range strategy programs Formulation of mid-range programs and short-run plans Organization, funding and other methods to implement all of the preceding elements Information flow and feedback system for continued repetition of above activities and for adjustments and changes at each stage Review and evaluation of above processes 26

Strategic Planning Processes in M&A l Monitoring environments ¡ ¡ Should encompass both domestic and international dimensions Include analysis of economic, social, technological, political, and legal factors Strategy also deals with stakeholders – groups with interests in the firm and its actions l Organization cultures l ¡ ¡ Firm cultures affect strategic thought and plans Failure to combine cultures is a key obstacle to merger integration 27

Strategic Planning Processes in M&A l Monitoring environments ¡ ¡ Should encompass both domestic and international dimensions Include analysis of economic, social, technological, political, and legal factors Strategy also deals with stakeholders – groups with interests in the firm and its actions l Organization cultures l ¡ ¡ Firm cultures affect strategic thought and plans Failure to combine cultures is a key obstacle to merger integration 27

Alternative Strategy Methodologies l l l SWOT or WOTS UP – inventory and analysis of organizational strengths, weaknesses, environmental opportunities and threats Top-down or Bottom-up – relate to company forecasts vs. aggregation segment forecasts Computer models – allow detail and complexity Logical incrementalism – well-supported moves from current bases Comparative histories – learn from the experiences of others 28

Alternative Strategy Methodologies l l l SWOT or WOTS UP – inventory and analysis of organizational strengths, weaknesses, environmental opportunities and threats Top-down or Bottom-up – relate to company forecasts vs. aggregation segment forecasts Computer models – allow detail and complexity Logical incrementalism – well-supported moves from current bases Comparative histories – learn from the experiences of others 28

Alternative Strategy Methodologies l l l Synergy – look for complementarities Adaptive processes – periodic reassessment of environmental opportunities and organization capability adjustments required Environmental scanning – continuous analysis of all relevant environments Intuition – insights of brilliant managers Entrepreneurship – creative leadership 29

Alternative Strategy Methodologies l l l Synergy – look for complementarities Adaptive processes – periodic reassessment of environmental opportunities and organization capability adjustments required Environmental scanning – continuous analysis of all relevant environments Intuition – insights of brilliant managers Entrepreneurship – creative leadership 29

Alternative Analytical Frameworks l l l Product life cycle – introduction, growth, maturity, decline stages with changing opportunities, threats Learning curve – costs decline with cumulative volume experience (first mover advantage) Competitive analysis – industry, suppliers, customers, complemetors, etc. Value chain analysis – seek to add product characteristics valued by customers Cost leadership – low-cost advantages 30

Alternative Analytical Frameworks l l l Product life cycle – introduction, growth, maturity, decline stages with changing opportunities, threats Learning curve – costs decline with cumulative volume experience (first mover advantage) Competitive analysis – industry, suppliers, customers, complemetors, etc. Value chain analysis – seek to add product characteristics valued by customers Cost leadership – low-cost advantages 30

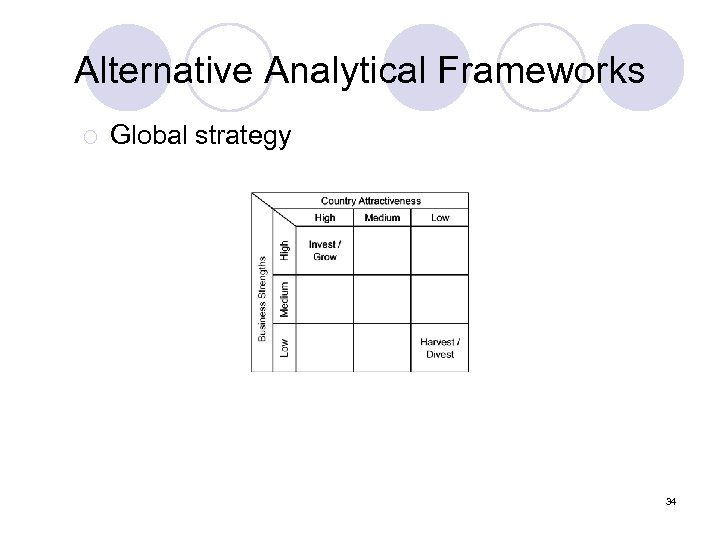

Alternative Analytical Frameworks l l l Resource-based view – capabilities are inimitable Relatedness matrix – unfamiliar markets and products involve greatest risk Focus matrix – narrow versus broad product families Growth/share matrix – aim for high market share in high growth markets Attractiveness matrix – aim to be strong in attractive industries Global matrix – aim for competitive strength in attractive countries 31

Alternative Analytical Frameworks l l l Resource-based view – capabilities are inimitable Relatedness matrix – unfamiliar markets and products involve greatest risk Focus matrix – narrow versus broad product families Growth/share matrix – aim for high market share in high growth markets Attractiveness matrix – aim to be strong in attractive industries Global matrix – aim for competitive strength in attractive countries 31

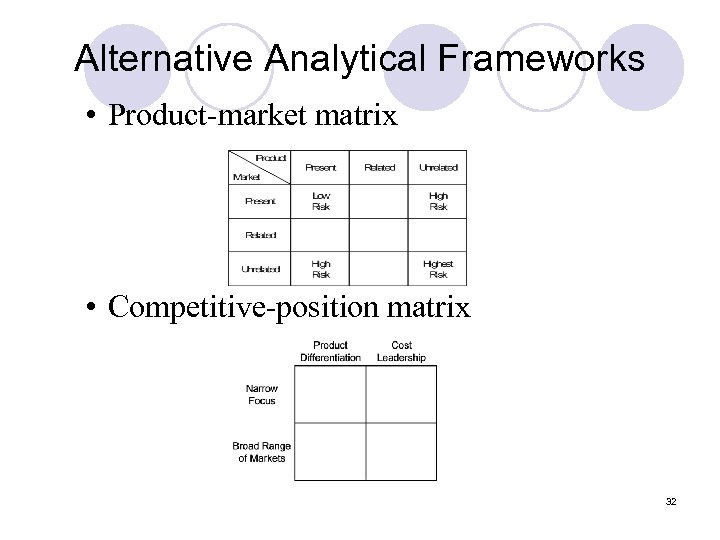

Alternative Analytical Frameworks • Product-market matrix • Competitive-position matrix 32

Alternative Analytical Frameworks • Product-market matrix • Competitive-position matrix 32

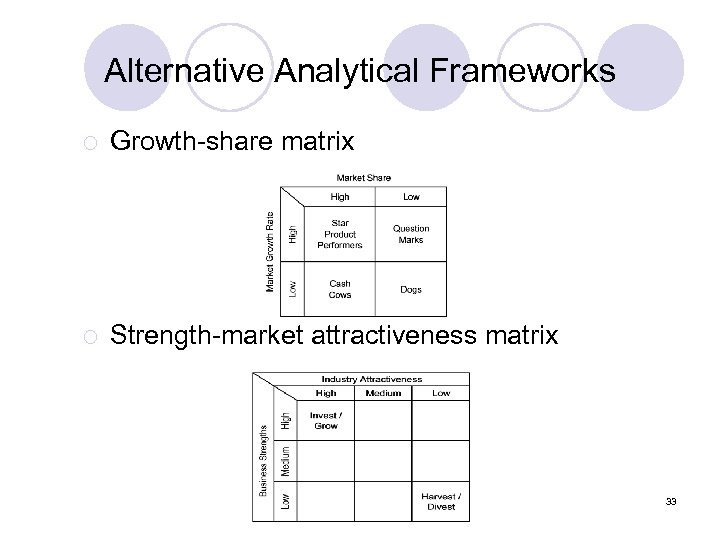

Alternative Analytical Frameworks ¡ Growth-share matrix ¡ Strength-market attractiveness matrix 33

Alternative Analytical Frameworks ¡ Growth-share matrix ¡ Strength-market attractiveness matrix 33

Alternative Analytical Frameworks ¡ Global strategy 34

Alternative Analytical Frameworks ¡ Global strategy 34

Strategy Formulation Approaches l Boston Consulting Group Approach ¡ ¡ l Historical emphasis: experience curve, product life cycle, product portfolio balance Recent approaches l Impact of the Internet and other innovations l Performance measurements - cash flow return on investment (CFROI) Michael Porter Approach (1980, 1985, 1987) ¡ ¡ ¡ Select attractive industry using “Five Forces” Develop competitive advantage through cost leadership, product differentiation, or focus Develop attractive value chains 35

Strategy Formulation Approaches l Boston Consulting Group Approach ¡ ¡ l Historical emphasis: experience curve, product life cycle, product portfolio balance Recent approaches l Impact of the Internet and other innovations l Performance measurements - cash flow return on investment (CFROI) Michael Porter Approach (1980, 1985, 1987) ¡ ¡ ¡ Select attractive industry using “Five Forces” Develop competitive advantage through cost leadership, product differentiation, or focus Develop attractive value chains 35

Evaluation of Strategic Approaches l Steps taken in checklists and iterations: ¡ ¡ ¡ ¡ ¡ State objectives Define environment Analyze strengths/weaknesses relative to environment Assess potential in environment Compare potential to objectives If gap, search for alternative ways to close gap Select alternatives for analysis Cost/benefit analysis of alternatives Tentative selection — formulate plans and actions 36

Evaluation of Strategic Approaches l Steps taken in checklists and iterations: ¡ ¡ ¡ ¡ ¡ State objectives Define environment Analyze strengths/weaknesses relative to environment Assess potential in environment Compare potential to objectives If gap, search for alternative ways to close gap Select alternatives for analysis Cost/benefit analysis of alternatives Tentative selection — formulate plans and actions 36

Formulating a Merger Strategy l Requires ¡ ¡ ¡ ¡ ¡ continuing reassessment Industry analysis Competitor analysis Supplier analysis Customer analysis Substitute products Complementors Technology changes Societal factors Firm's strengths/weaknesses relative to present/future industry conditions 37

Formulating a Merger Strategy l Requires ¡ ¡ ¡ ¡ ¡ continuing reassessment Industry analysis Competitor analysis Supplier analysis Customer analysis Substitute products Complementors Technology changes Societal factors Firm's strengths/weaknesses relative to present/future industry conditions 37

Formulating a Merger Strategy l Goal/capability ¡ ¡ ¡ Are current goals, policies appropriate? Do goals, policies match resources? Does timing of goals/policies reflect ability of firm to change? l Work ¡ ¡ ¡ analysis out strategic alternatives May not include current strategy Choose best Mergers represent one set of alternatives 38

Formulating a Merger Strategy l Goal/capability ¡ ¡ ¡ Are current goals, policies appropriate? Do goals, policies match resources? Does timing of goals/policies reflect ability of firm to change? l Work ¡ ¡ ¡ analysis out strategic alternatives May not include current strategy Choose best Mergers represent one set of alternatives 38

Formulating a Merger Strategy l Grove (1996) ¡ Firm must adjust to six forces l l l ¡ Existing competitors Potential competitors Complementors Customers Suppliers Industry transformation Eclectic adaptive processes approach to strategy 39

Formulating a Merger Strategy l Grove (1996) ¡ Firm must adjust to six forces l l l ¡ Existing competitors Potential competitors Complementors Customers Suppliers Industry transformation Eclectic adaptive processes approach to strategy 39

Formulating a Merger Strategy l Business goals - general or specific, but must be quantifiable to facilitate progress assessment ¡ ¡ Size objectives l Large enough to use fixed factors effectively l Critical mass necessary to attain cost levels for profitable operation at market prices Growth objectives - sales, assets, EPS, values l To get favorable P/E multiple for shares l To increase market to book value of shares 40

Formulating a Merger Strategy l Business goals - general or specific, but must be quantifiable to facilitate progress assessment ¡ ¡ Size objectives l Large enough to use fixed factors effectively l Critical mass necessary to attain cost levels for profitable operation at market prices Growth objectives - sales, assets, EPS, values l To get favorable P/E multiple for shares l To increase market to book value of shares 40

Formulating a Merger Strategy l Business goals ¡ ¡ Stability objectives - two kinds of instability l Large erratic fluctuations in total size and abrupt program shifts (e. g. , defense industry) l Cyclical instability of durable goods industries Flexibility objectives - ability to operate in variety of product markets and responsive to consumers l Breadth of capabilities, e. g. , research, manufacturing, marketing l Technological breadth l Stay close to customers 41

Formulating a Merger Strategy l Business goals ¡ ¡ Stability objectives - two kinds of instability l Large erratic fluctuations in total size and abrupt program shifts (e. g. , defense industry) l Cyclical instability of durable goods industries Flexibility objectives - ability to operate in variety of product markets and responsive to consumers l Breadth of capabilities, e. g. , research, manufacturing, marketing l Technological breadth l Stay close to customers 41

Formulating a Merger Strategy l Aligning firm to changing environments ¡ Gap between objectives and potential based on current capabilities ¡ Various approaches: l l Choose products related to needs of customer that provide large markets Focus on technological bottlenecks Be at frontier of technology and aim for attractive product fallout Emphasize economic criteria – ex. value 42

Formulating a Merger Strategy l Aligning firm to changing environments ¡ Gap between objectives and potential based on current capabilities ¡ Various approaches: l l Choose products related to needs of customer that provide large markets Focus on technological bottlenecks Be at frontier of technology and aim for attractive product fallout Emphasize economic criteria – ex. value 42

Formulating a Merger Strategy l Strategic ¡ ¡ ¡ planning and mergers Diversification strategy may be necessary if firm must alter product-market mix or capabilities to reduce or close strategic gap Both involve evaluation of current capabilities relative to those needed to reach objectives Related diversification involves lower risks 43

Formulating a Merger Strategy l Strategic ¡ ¡ ¡ planning and mergers Diversification strategy may be necessary if firm must alter product-market mix or capabilities to reduce or close strategic gap Both involve evaluation of current capabilities relative to those needed to reach objectives Related diversification involves lower risks 43

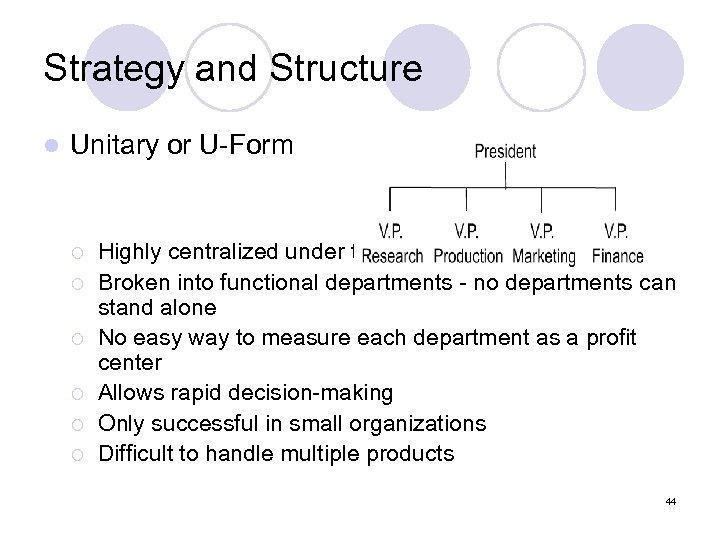

Strategy and Structure l Unitary or U-Form ¡ ¡ ¡ Highly centralized under the president Broken into functional departments - no departments can stand alone No easy way to measure each department as a profit center Allows rapid decision-making Only successful in small organizations Difficult to handle multiple products 44

Strategy and Structure l Unitary or U-Form ¡ ¡ ¡ Highly centralized under the president Broken into functional departments - no departments can stand alone No easy way to measure each department as a profit center Allows rapid decision-making Only successful in small organizations Difficult to handle multiple products 44

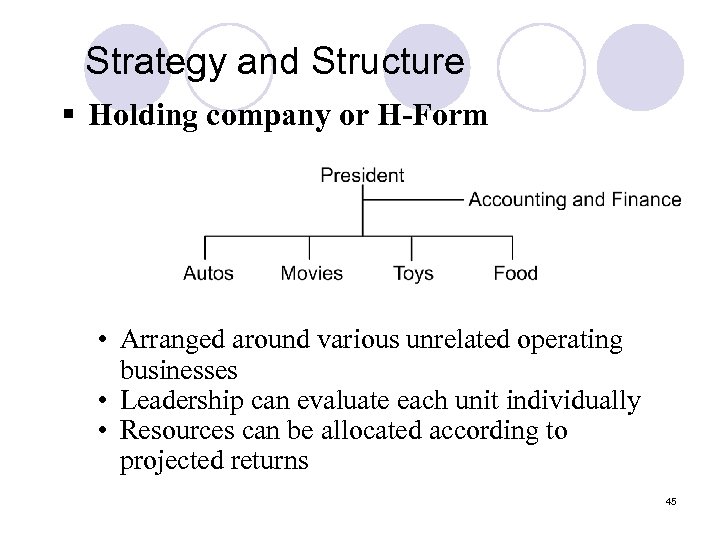

Strategy and Structure § Holding company or H-Form • Arranged around various unrelated operating businesses • Leadership can evaluate each unit individually • Resources can be allocated according to projected returns 45

Strategy and Structure § Holding company or H-Form • Arranged around various unrelated operating businesses • Leadership can evaluate each unit individually • Resources can be allocated according to projected returns 45

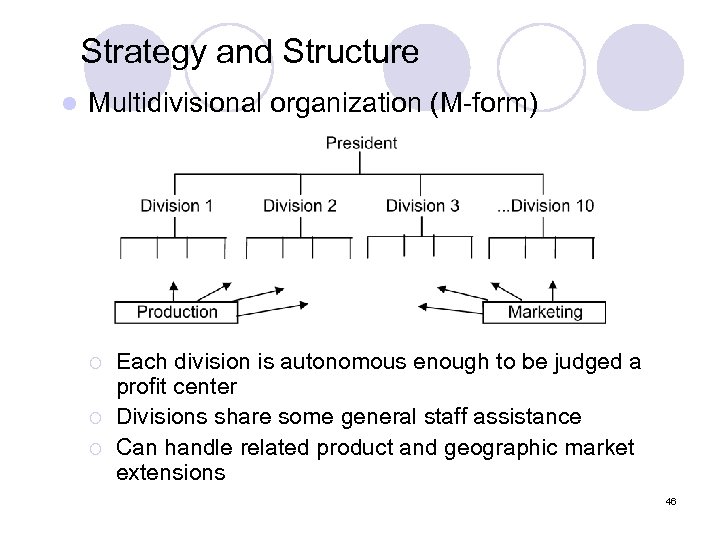

Strategy and Structure l Multidivisional organization (M-form) ¡ ¡ ¡ Each division is autonomous enough to be judged a profit center Divisions share some general staff assistance Can handle related product and geographic market extensions 46

Strategy and Structure l Multidivisional organization (M-form) ¡ ¡ ¡ Each division is autonomous enough to be judged a profit center Divisions share some general staff assistance Can handle related product and geographic market extensions 46

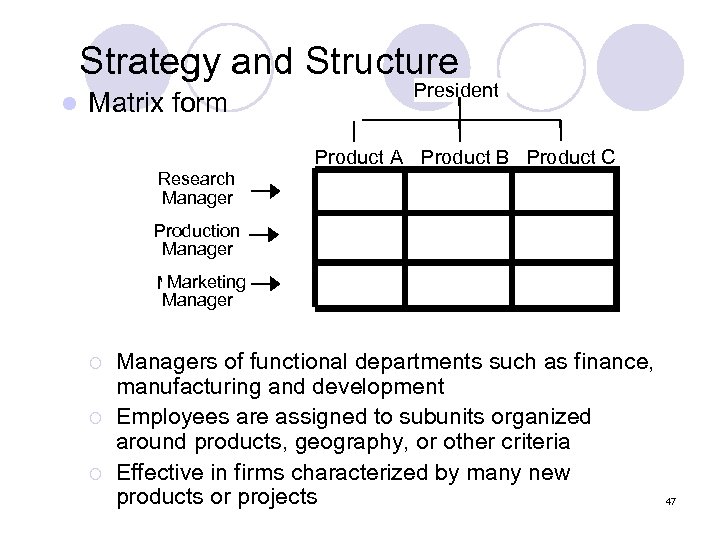

Strategy and Structure l Matrix form President Product A Product B Product C Research Manager Production Manager Marketing Manager ¡ ¡ ¡ Managers of functional departments such as finance, manufacturing and development Employees are assigned to subunits organized around products, geography, or other criteria Effective in firms characterized by many new products or projects 47

Strategy and Structure l Matrix form President Product A Product B Product C Research Manager Production Manager Marketing Manager ¡ ¡ ¡ Managers of functional departments such as finance, manufacturing and development Employees are assigned to subunits organized around products, geography, or other criteria Effective in firms characterized by many new products or projects 47

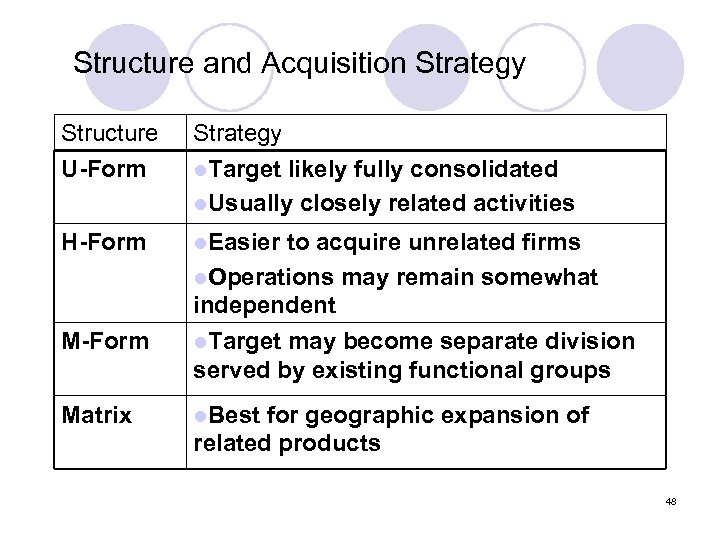

Structure and Acquisition Strategy Structure U-Form Strategy l. Target likely fully consolidated l. Usually closely related activities H-Form l. Easier M-Form l. Target Matrix l. Best to acquire unrelated firms l. Operations may remain somewhat independent may become separate division served by existing functional groups for geographic expansion of related products 48

Structure and Acquisition Strategy Structure U-Form Strategy l. Target likely fully consolidated l. Usually closely related activities H-Form l. Easier M-Form l. Target Matrix l. Best to acquire unrelated firms l. Operations may remain somewhat independent may become separate division served by existing functional groups for geographic expansion of related products 48

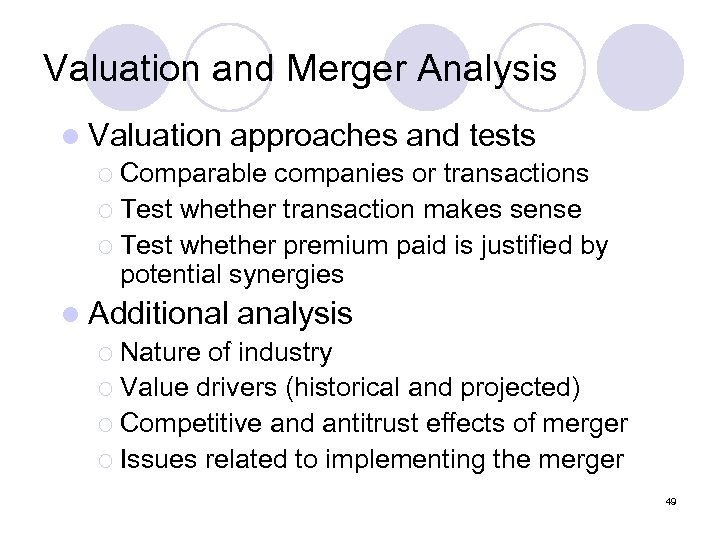

Valuation and Merger Analysis l Valuation approaches and tests ¡ Comparable companies or transactions ¡ Test whether transaction makes sense ¡ Test whether premium paid is justified by potential synergies l Additional analysis ¡ Nature of industry ¡ Value drivers (historical and projected) ¡ Competitive and antitrust effects of merger ¡ Issues related to implementing the merger 49

Valuation and Merger Analysis l Valuation approaches and tests ¡ Comparable companies or transactions ¡ Test whether transaction makes sense ¡ Test whether premium paid is justified by potential synergies l Additional analysis ¡ Nature of industry ¡ Value drivers (historical and projected) ¡ Competitive and antitrust effects of merger ¡ Issues related to implementing the merger 49

Trends of Strategic Alliances in US l l l l Exxon. Mobil = Exxon + Mobil Oil Hewlett-Packard ; with Compaq Procter & Gamble buy Gillette Adidas-Salomon acquire Reebok Siemens; with Nokia The Walt Disney Company acquiring Pixar Google buys Youtube Warner Bros. Entertainment & CBS Corporation = The CW Television Network 50

Trends of Strategic Alliances in US l l l l Exxon. Mobil = Exxon + Mobil Oil Hewlett-Packard ; with Compaq Procter & Gamble buy Gillette Adidas-Salomon acquire Reebok Siemens; with Nokia The Walt Disney Company acquiring Pixar Google buys Youtube Warner Bros. Entertainment & CBS Corporation = The CW Television Network 50

EU l l l Daimler. Chrysler = Daimler Benz + Chrysler BP with Amoco Alcatel + Lucent Technologies = Alcatel-Lucent Air France + KLM Royal Dutch Airlines = Air France-KLM Lufthansa and SWISS 51

EU l l l Daimler. Chrysler = Daimler Benz + Chrysler BP with Amoco Alcatel + Lucent Technologies = Alcatel-Lucent Air France + KLM Royal Dutch Airlines = Air France-KLM Lufthansa and SWISS 51

Japan l Mitsubishi UFJ Financial Group l Konica Minolta = Konica + Minolta l Soft. Bank acquiring Vodafone Japan l Sumitomo Mitsui Banking Corporation = Sumitomo Bank + Sakura Bank 52

Japan l Mitsubishi UFJ Financial Group l Konica Minolta = Konica + Minolta l Soft. Bank acquiring Vodafone Japan l Sumitomo Mitsui Banking Corporation = Sumitomo Bank + Sakura Bank 52

Thailand l EGV + Major = EGV-Major Cineplex l Bilsstel + TG Fone l Lox. Info + CS = CSLox. Info l GMM + True l TMB + IFCT + DTDB 53

Thailand l EGV + Major = EGV-Major Cineplex l Bilsstel + TG Fone l Lox. Info + CS = CSLox. Info l GMM + True l TMB + IFCT + DTDB 53