3d844c90302f564f82e2fcce0b517e2d.ppt

- Количество слайдов: 46

Topic 7 Money and Banking 27. a Money 27. b Banking in Canada 27. c Money Creation 27. d Money Supply 28. a Compound Interest and PV 28. b Money Demand 28. c Money Equilibrium 29 Canadian Monetary Policy

27. a Money’s Role Money fulfills three roles: 1) Medium of Exchange Ø Money is accepted in return for goods and services Ø Without money, exchanges would be made with trades and barter, which requires 2 agents wanting each other’s goods Ø A dentist would have to find an Apple employee that needs a filling Ø Money makes the economy more efficient 2

27. a Money’s Role 2) Store of Value Ø Goods and services can be sold for money today, and then that money can be traded for goods and services in the future Ø Inflation weakens money’s role as a store of value 3) Unit of Account Ø Money can be used for accounting (sales, expenses, allocations, etc) Ø Physical money doesn’t need to even exist for 3 this purpose

27. a History of Money 1) Metallic Money Ø Gold and other precious metals were rare and divisible, and originally used as money Ø Metals could be shaved down to cheat Ø Coins could be re-minted less pure and cause inflation 2) Paper Money Ø Based on gold held by a private or central bank Ø Banks could “create” money by printing more 4 notes than they had gold

27. a History of Money 3) Fiat Money Ø After WWI and WWII, money was controlled by central banks an no longer tradable for gold Ø Government establishes the money as legal tender 4) Deposit Money Ø Entries in bank accounts are money without physical form Ø These entries are transferred between bank accounts through transactions 5

27. a Money Now Ø Deposit Money far exceeds physical coin and paper (fiat) money Ø Banks can still create money by issuing more deposit money than they have reserves to pay out 6

27. b Bank of Canada – Canada’s CENTRAL BANK – A bank that acts as banker to commercial banks and the governments. Ø Government owned, run by a Governor Ø Sole money-issuing authority Ø Works with the government, but is separate from the government (free of politics) Ø In THEORY, the Minister of Finance could issue a directive to the bank, forcing the bank to follow it or the Governor to resign 7 Ø This has NEVER happened

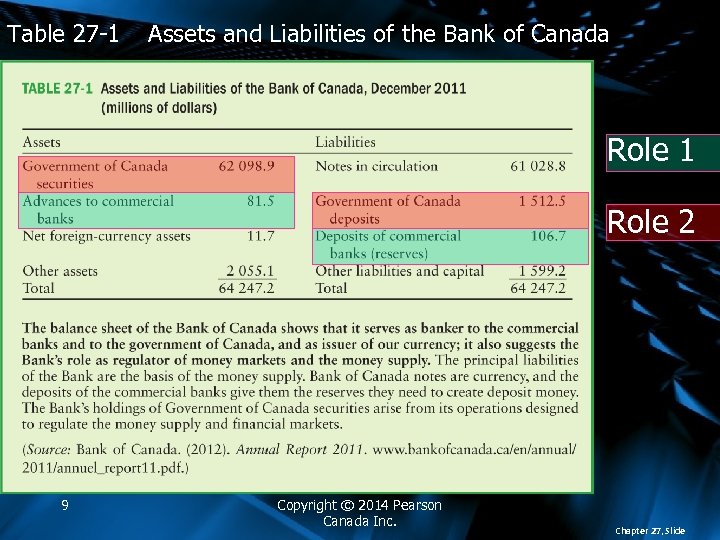

27. b Bank of Canada The Bank of Canada has 4 roles: 1) Banker to Commercial Banks Ø Commercial banks have accounts and loans with Bank of Canada Ø Funds are moved between these accounts as people make payments between banks 2) Banker to the Federal Government Ø Federal Government has an account with the Bank of Canada Ø Bank of Canada buys government bonds when 8 the government requires money

Table 27 -1 Assets and Liabilities of the Bank of Canada Role 1 Role 2 9 Copyright © 2014 Pearson Canada Inc. Chapter 27, Slide

27. b Bank of Canada 3) Regulator of Money Supply ØBank of Canada can change its assets and liabilities to affect the Money Supply (chapter 29) 4) Supporter of Financial Markets ØKeeps financial institutions stable by: ØControlling the interest rate (chapter 29) ØMaking sure credit is available ØMaintaining citizen confidence 10

27. b Commercial Banks Commercial banks (banks owned by the private sector), as well as other financial institutions (such as trust companies and credit unions) have 3 features: 1) Providers of Credit Ø Banks act as a FINANCIAL INTERMEDIARY, borrowing from individuals who have extra money and lending to individuals who need credit Ø This allows businesses to operate day-to-day and households to make big purchases 11

27. b Commercial Banks 2) Interbank Activities ØBanks work together for “pool loans” and credit cards ØBanks allow for cheque and electronic transfer clearing between institutions (through the Bank of Canada accounts when needed) 3) Banks are Profit Seekers ØBanks compete for investments, and make profits by lending these investments ØAlso make profits from bank fees for a range 12 of financial services

27. c Creation of Money To see how banking activities create money, we need the following definitions: Reserves – money a commercial bank keeps on hand (or at the central bank) to pay out to investors if required (banks can always take a loan from the central bank if more money is required – hence consumer confidence remains) Reserve ratio – fraction of its deposits that a 13 commercial bank holds as reserves

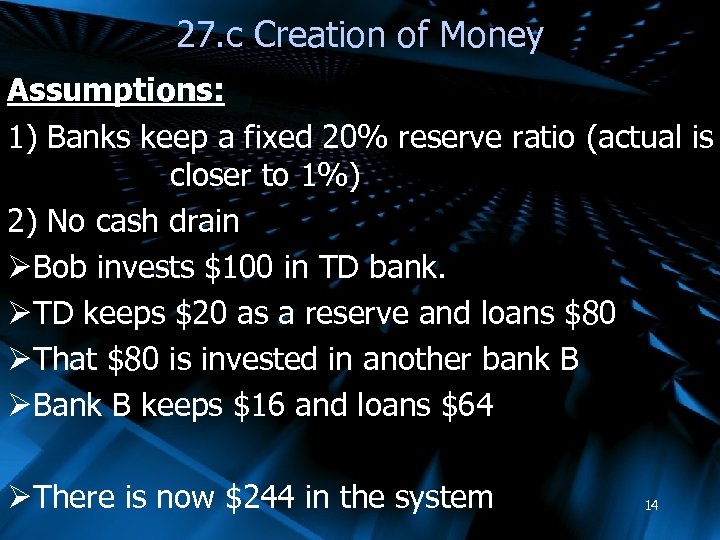

27. c Creation of Money Assumptions: 1) Banks keep a fixed 20% reserve ratio (actual is closer to 1%) 2) No cash drain ØBob invests $100 in TD bank. ØTD keeps $20 as a reserve and loans $80 ØThat $80 is invested in another bank B ØBank B keeps $16 and loans $64 ØThere is now $244 in the system 14

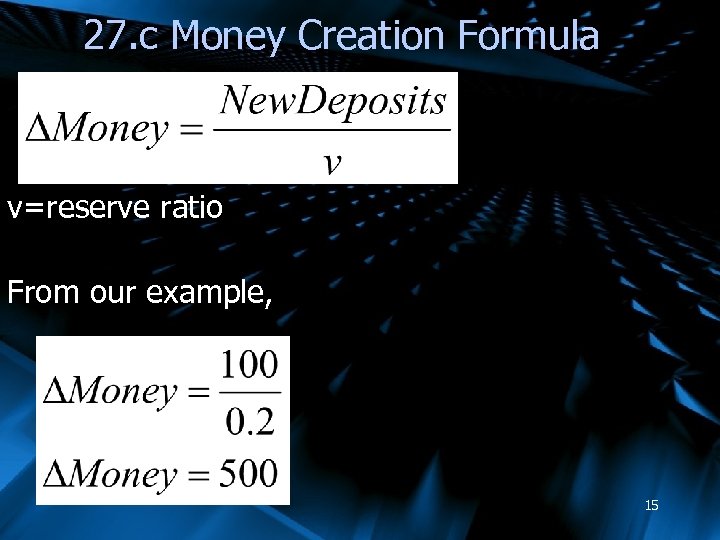

27. c Money Creation Formula v=reserve ratio From our example, 15

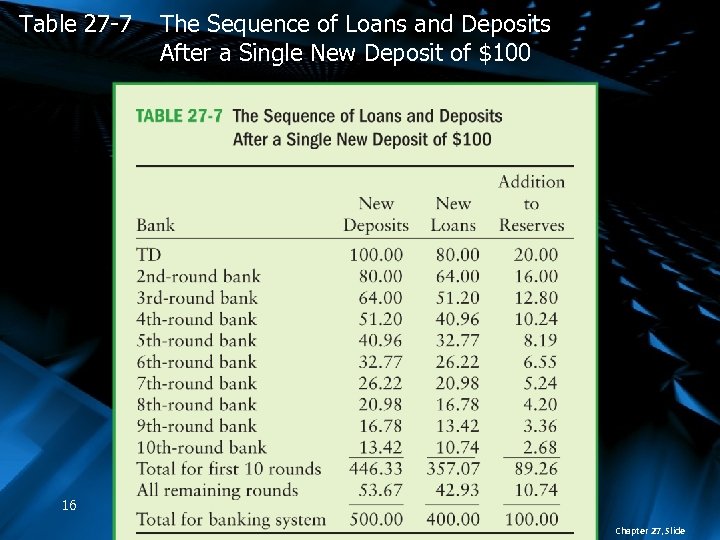

Table 27 -7 The Sequence of Loans and Deposits After a Single New Deposit of $100 16 Chapter 27, Slide

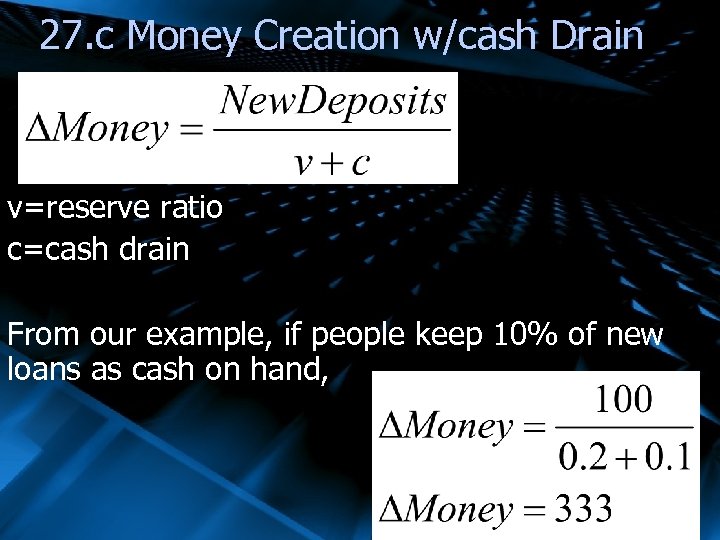

27. c Money Creation w/cash Drain v=reserve ratio c=cash drain From our example, if people keep 10% of new loans as cash on hand, 17

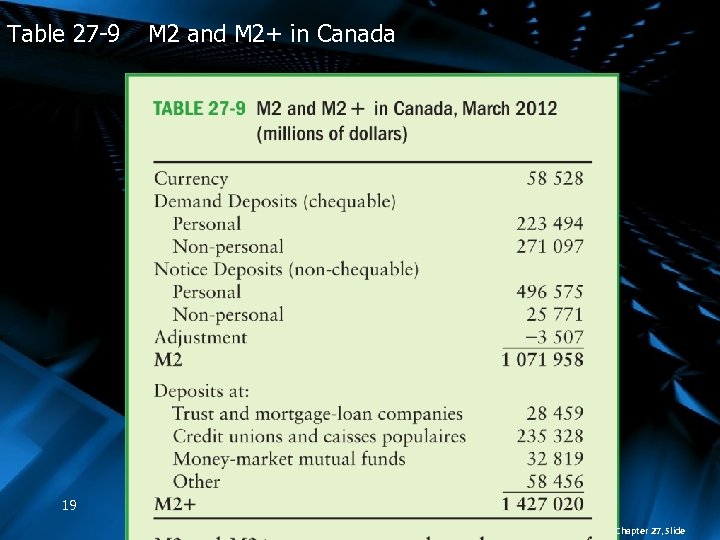

27. d Money Supply Two calculations of Money Supply are M 2 and M 2+: M 2: Currency, plus demand notice deposits at chartered banks M 2+: M 2, plus demand notice deposits at other financial institutions 18

Table 27 -9 M 2 and M 2+ in Canada 19 Chapter 27, Slide

28. a PV Calculations Ø Given a choice between 2 investments, you need to be able to compare them Ø 2 investment’s can’t be compared if they come due at different times Ø ie: $120, 000 next year or $155, 000 in 3 years Ø We need to be able to examine the PRESENT VALUE (value today) of a future amount of money

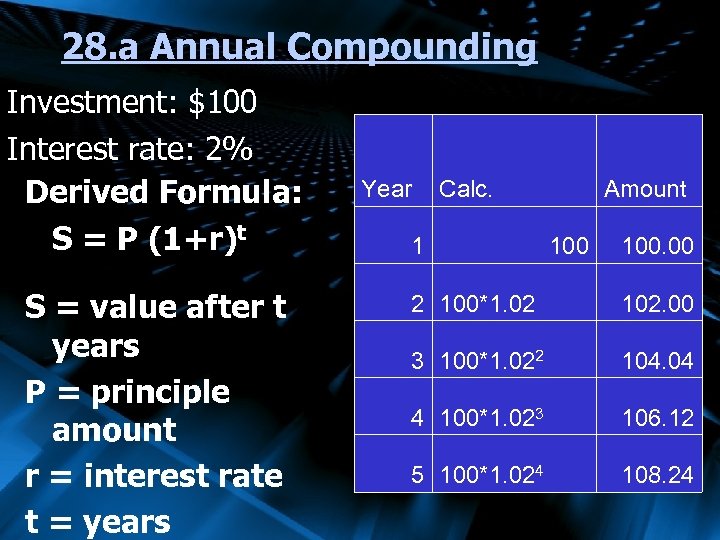

28. a Annual Compounding Investment: $100 Interest rate: 2% Derived Formula: S = P (1+r)t S = value after t years P = principle amount r = interest rate t = years Year Calc. 1 Amount 100. 00 2 100*1. 02 102. 00 3 100*1. 022 104. 04 4 100*1. 023 106. 12 5 100*1. 024 108. 24

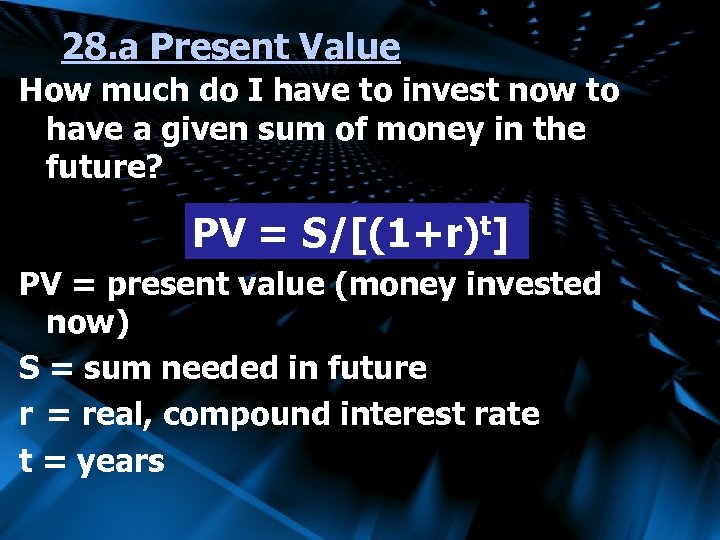

28. a Present Value How much do I have to invest now to have a given sum of money in the future? PV = S/[(1+r)t] PV = present value (money invested now) S = sum needed in future r = real, compound interest rate t = years

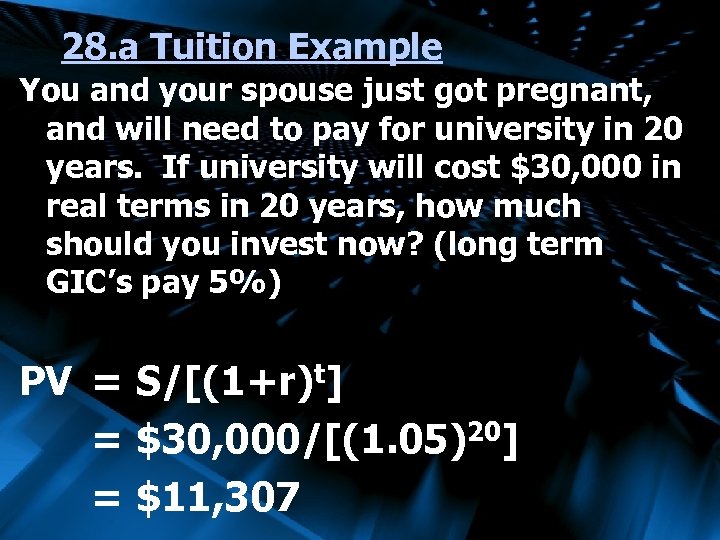

28. a Tuition Example You and your spouse just got pregnant, and will need to pay for university in 20 years. If university will cost $30, 000 in real terms in 20 years, how much should you invest now? (long term GIC’s pay 5%) PV = S/[(1+r)t] = $30, 000/[(1. 05)20] = $11, 307

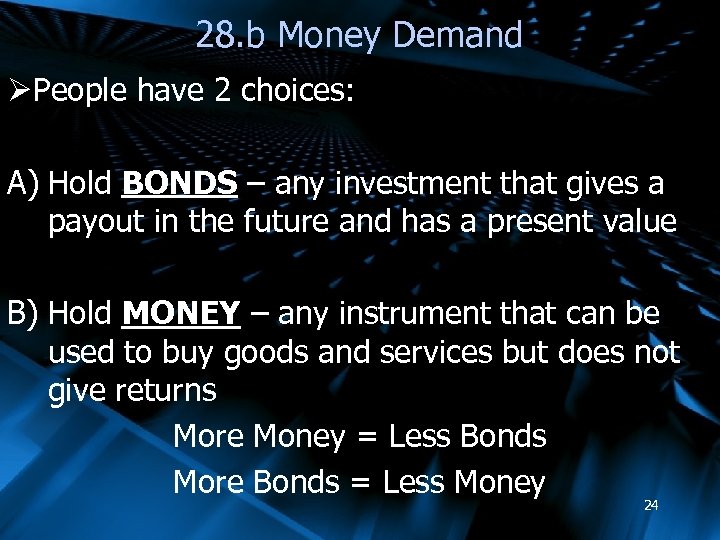

28. b Money Demand ØPeople have 2 choices: A) Hold BONDS – any investment that gives a payout in the future and has a present value B) Hold MONEY – any instrument that can be used to buy goods and services but does not give returns More Money = Less Bonds More Bonds = Less Money 24

28. b Money Demand ØPeople and firms hold money for 3 reasons A) Transaction Demand – people and firms need money to buy things B) Precautionary Demand – people and firms hold money in case they need to buy things C) Speculative Demand – firms (mostly) hold money if they think interest rates will increase in the future, making bonds more profitable Ø Uncertainty is part of money demand 25

28. b Money Demand ØMoney Demand Depends on 3 Variables: 1) the interest rate (-) ØHigher interest rates mean more bonds are bought (therefore less money) 2) real GDP (+) ØHigher output means higher wages, meaning more money is needed 3) the price level (+) Ø Higher prices means more money is needed to buy the same amount 26

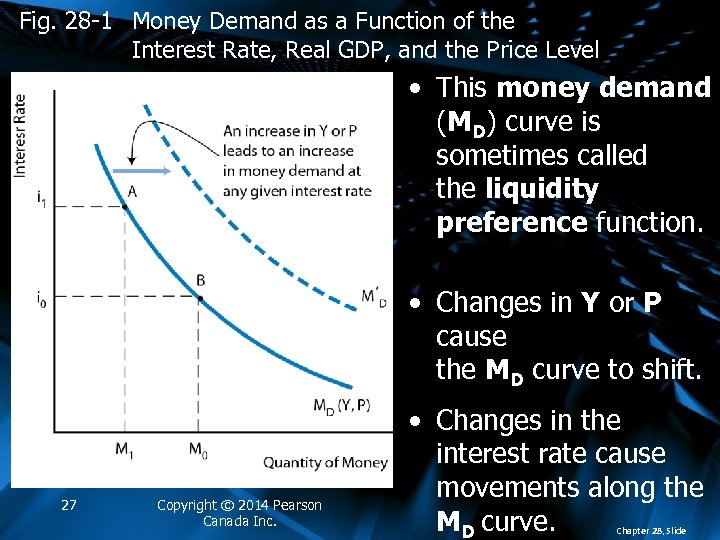

Fig. 28 -1 Money Demand as a Function of the Interest Rate, Real GDP, and the Price Level • This money demand (MD) curve is sometimes called the liquidity preference function. • Changes in Y or P cause the MD curve to shift. 27 Copyright © 2014 Pearson Canada Inc. • Changes in the interest rate cause movements along the MD curve. Chapter 28, Slide

Money Demand—Summing Up - + + MD = MD (i, Y, P)P) • Remember there are two assets—bonds and money. • The decision to hold money is the same as the decision not to hold bonds.

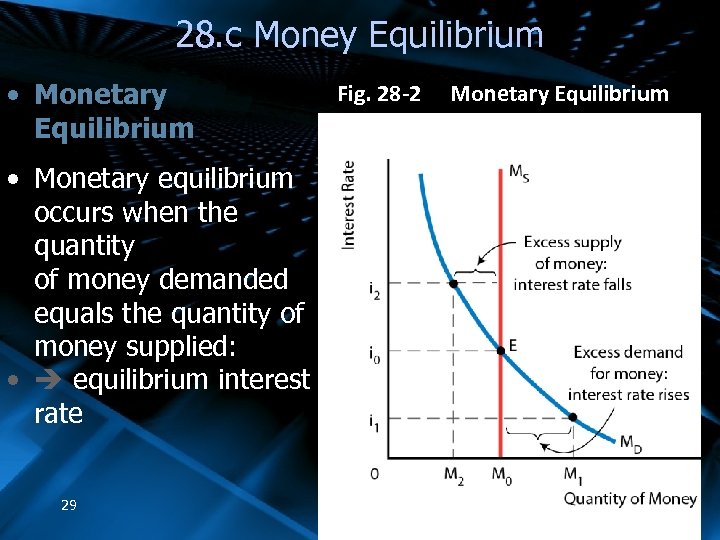

28. c Money Equilibrium • Monetary Equilibrium Fig. 28 -2 Monetary Equilibrium • Monetary equilibrium occurs when the quantity of money demanded equals the quantity of money supplied: • equilibrium interest rate 29 Chapter 28, Slide

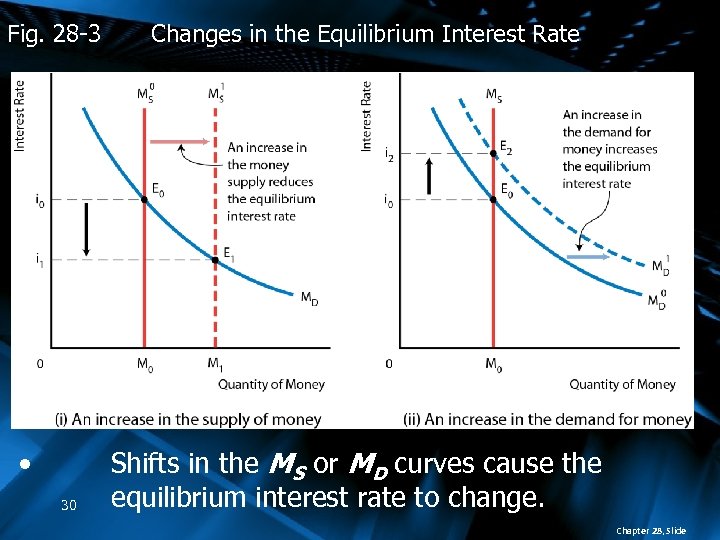

Fig. 28 -3 • 30 Changes in the Equilibrium Interest Rate Shifts in the MS or MD curves cause the equilibrium interest rate to change. Chapter 28, Slide

Money Neutrality v. Hysteresis Ø Money neutrality is the idea that changes in the money supply do not have real LONGRUN effects on the economy. ØTechnology and preferences affect GDP, relative prices, employment etc. in the long run ØMoney Supply only affects absolute price levels

Money Neutrality v. Hysteresis Ø Hysteresis: the growth rate of Y* may be affected by the short run path of real GDP. ØMoney Supply affects interest rates ØInterest rates MAY affect aggregate investment rates ØInvestment rates affect growth ØMonetary shifts can accompany unemployment, which deteriorates skills (human capital) therefore reduces growth

Keynes v. Friedman Ø John Maynard Keynes: 1) Money Supply Changes have little effect on the interest rate (Money Demand is relatively flat) 2) Interest rates have little effect on investment Therefore fiscal policy is a better tool than monetary policy

Friedman (Monetarist) Ø Milton Friedman: 1) Money Supply Changes have large effects on the interest rate (Money Demand is relatively steep) 2) Interest rates have big effects on investment Therefore monetary policy is a great tool.

Keynes v. Friedman Results Studies show: 1) Money Demand is relatively steep (Friedman/Monetarists were right) BUT 2) The AGGREGATE impact of interest rates on investment is unknown Ø Investors may expect the interest rate to go higher Ø Investment may be in different areas

Monetary Policy Debate Economists debate the following: 1) Monetary policy can only affect the price level OR 2) Monetary policy can lessen the effect of shocks OR 3) Monetary policy can influence long-run growth

29 Canadian Monetary Policy – How? ØThe Bank of Canada’s Monetary policy consists of INTEREST RATE TARGETTING Where the Bank of Canada 1) Announces a desired interest rate, 2) Money demand of banks and individuals change 3) The Bank of Canada allows Money Supply to change as needed 4) The new equilibrium gives the target rate 37

29 Canadian Monetary Policy – How? A) Bank of Canada announces its TARGET RATE, and the BANK RATE 0. 25% above its target Bank Rate = Target Rate +0. 25% B) The Bank of Canada will lend to banks at the BANK RATE and borrow from banks at 0. 5% below the BANK RATE 38

29 Canadian Monetary Policy – How? C) Since Banks compete, no bank can offer a sure loan or borrow at a rate not within 0. 25% of the target rate D) All bank loans (mortgages, etc) proceed from this Bank Rate, increased slightly for bank profit, and to different degrees according to uncertainty. 39

29 Canadian Monetary Policy – How? ØThe Bank of Canada’s Monetary policy targets interest rates to MAINTAIN A TARGET INFLATION RATE ØIn an inflationary gap, inflation is too high and needs to be decreased ØIncreasing interest rates slows the economy and reduces inflation ØIn a recessionary gap, low inflation accompanies unemployment and low wages 40 ØDecreasing interest rates boosts the economy

29 Canadian Monetary Policy – WHY? High inflation is costly: ØPeople with fixed income (ie: Seniors) are unable to meet their current needs ØPeople with investments have lower real returns ØPrices become poor signals to producers and consumers ØUncertainty increases, making firms less willing to innovate 41

29 Canadian Monetary Policy Complications 1) Core Inflation Ø Some sources of inflation (ie: international gas prices) are unaffected by Canadian targetting Ø Therefore Canada targets CORE INFLATION (with food, energy, and indirect tax effects removed) 42

29 Canadian Monetary Policy Complications 2) Time Lag Ø Changing interest rates will affect GDP (through investment) in 9 to 12 months Ø Affecting prices and inflation can take a further 9 to 12 months Ø The BANK has to react to output gaps BEFORE they occur Ø They therefore only react to large, foreseeable changes 43 Ø Sometimes there is error and destabilization

Topic 7 Summary Ø The role of money has evolved over the years Ø There is currently much more deposit (virtual) money that fiat (actual) money Ø The Bank of Canada has accounts for the big banks and the government of Canada Ø The Bank of Canada has control over the money supply and supports the Canadian financial system Ø Charter banks provide credit (together and separate) 44

Topic 7 Summary Ø Charter banks can create money, depending on their reserve Ø Money supply is currency plus deposits Ø Money demand is based on the decision to hold cash or hold bonds (investment), which depends on the interest rate Ø Equilibrium in money demand supply determines the interest rate Ø The Bank of Canada targets the interest rate through an announced Bank Rate 45

Topic 7 Summary Ø The Bank of Canada’s monetary policy serves to target inflation Ø Slowing down the economy in an inflationary gap Ø Helping spur the economy in a recessionary gap Ø The Bank of Canada can only target Core Interest Rates Ø This adjustment takes time, and errors can lead to destabilization 46

3d844c90302f564f82e2fcce0b517e2d.ppt