c9f97438dfe0fe5c6822cf2fe7283d12.ppt

- Количество слайдов: 65

Topic 6 – Introduction To Macroeconomics 19. a Introduction to Macroeconomics 19. b Output 19. c Macroeconomic Variables 20. a Value Added 20. b GDP 20. c GDP Issues

Topic 6 – Introduction To Macroeconomics 19. a Introduction to Macroeconomics 19. b Output 19. c Macroeconomic Variables 20. a Value Added 20. b GDP 20. c GDP Issues

19. a Macroeconomics The study of economic aggregates or averages; the study of how the broad economy behaves. Ø Includes variables such as total output, total investment, total exports, price level, and the effect of government policy MICROECONOMICS = The study of individual (consumer, firm, etc) decisions MACROECONOMICS = The study of group (industry, country, etc) results

19. a Macroeconomics The study of economic aggregates or averages; the study of how the broad economy behaves. Ø Includes variables such as total output, total investment, total exports, price level, and the effect of government policy MICROECONOMICS = The study of individual (consumer, firm, etc) decisions MACROECONOMICS = The study of group (industry, country, etc) results

Short Run vs. Long Run Short Run – study of macroeconomic variables in the short run (when some decisions are fixed) and how the government impacts these variables Ø Involves analysis of business cycles Long Run - study of macroeconomic variables in the long run (when no decision is fixed) Ø Involves analysis of growth and the impact of investment and technological change

Short Run vs. Long Run Short Run – study of macroeconomic variables in the short run (when some decisions are fixed) and how the government impacts these variables Ø Involves analysis of business cycles Long Run - study of macroeconomic variables in the long run (when no decision is fixed) Ø Involves analysis of growth and the impact of investment and technological change

19. b Output Ø National Economic Activity is often summarized by National Product or simply Output Ø Since wages come from production, National Product = National Income Ø The are a variety of ways to calculate output, and short-run vs. long-run output reveals different things about the economy

19. b Output Ø National Economic Activity is often summarized by National Product or simply Output Ø Since wages come from production, National Product = National Income Ø The are a variety of ways to calculate output, and short-run vs. long-run output reveals different things about the economy

19. b National Income Ø The current dollar values of all goods produced in an economy is nominal national income: ∑PQ ØThis is also called current-dollar national income ØThis changes when prices or production changes Ø To ignore the effects of price fluctuations, economics calculate real national income based on prices in a base year: ∑Pbase. Q ØThis is also called constant-dollar national income ØThis changes when production changes

19. b National Income Ø The current dollar values of all goods produced in an economy is nominal national income: ∑PQ ØThis is also called current-dollar national income ØThis changes when prices or production changes Ø To ignore the effects of price fluctuations, economics calculate real national income based on prices in a base year: ∑Pbase. Q ØThis is also called constant-dollar national income ØThis changes when production changes

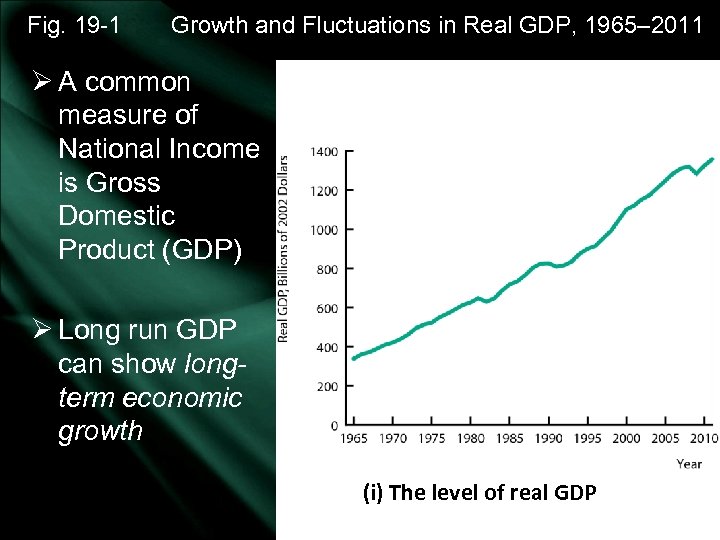

Fig. 19 -1 Growth and Fluctuations in Real GDP, 1965– 2011 Ø A common measure of National Income is Gross Domestic Product (GDP) Ø Long run GDP can show longterm economic growth (i) The level of real GDP

Fig. 19 -1 Growth and Fluctuations in Real GDP, 1965– 2011 Ø A common measure of National Income is Gross Domestic Product (GDP) Ø Long run GDP can show longterm economic growth (i) The level of real GDP

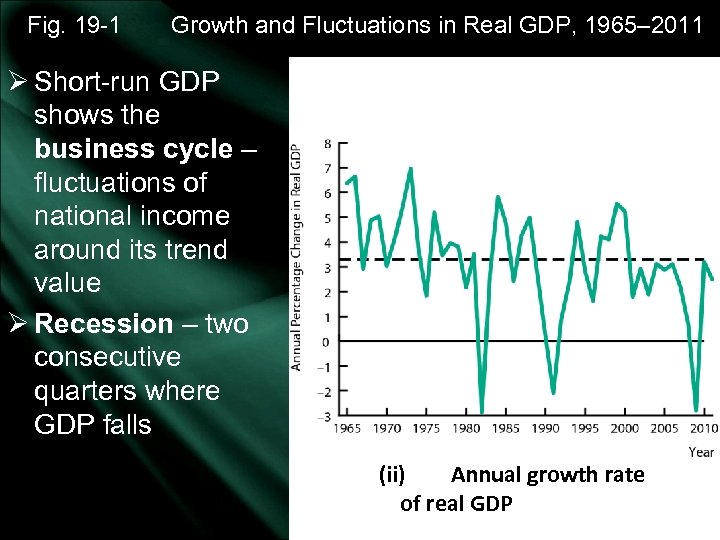

Fig. 19 -1 Growth and Fluctuations in Real GDP, 1965– 2011 Ø Short-run GDP shows the business cycle – fluctuations of national income around its trend value Ø Recession – two consecutive quarters where GDP falls (ii) Annual growth rate of real GDP

Fig. 19 -1 Growth and Fluctuations in Real GDP, 1965– 2011 Ø Short-run GDP shows the business cycle – fluctuations of national income around its trend value Ø Recession – two consecutive quarters where GDP falls (ii) Annual growth rate of real GDP

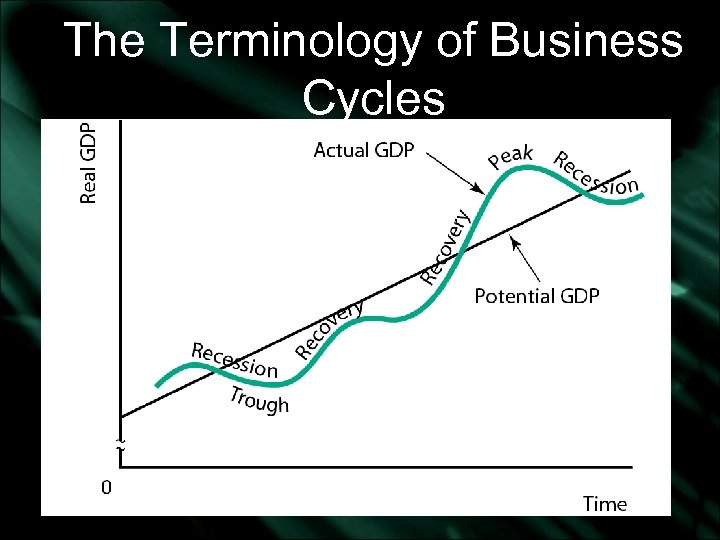

19. b National Income Ø Real GDP fluctuates around a rising trend: Øthe trend shows long-run economic growth Øthe short-run fluctuations show the business cycle Ø Potential output is what the economy could produce if all resources were employed at their normal levels of utilization. Ø often called full-employment output

19. b National Income Ø Real GDP fluctuates around a rising trend: Øthe trend shows long-run economic growth Øthe short-run fluctuations show the business cycle Ø Potential output is what the economy could produce if all resources were employed at their normal levels of utilization. Ø often called full-employment output

The Terminology of Business Cycles

The Terminology of Business Cycles

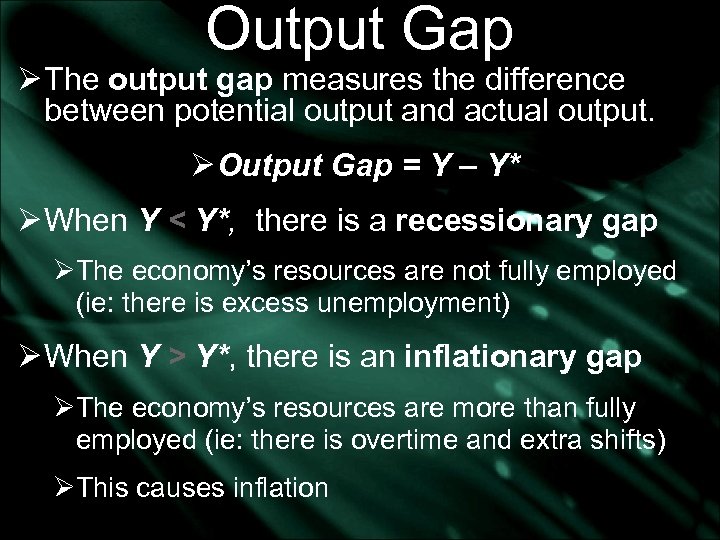

Output Gap Ø The output gap measures the difference between potential output and actual output. Ø Output Gap = Y – Y* Ø When Y < Y*, there is a recessionary gap ØThe economy’s resources are not fully employed (ie: there is excess unemployment) Ø When Y > Y*, there is an inflationary gap ØThe economy’s resources are more than fully employed (ie: there is overtime and extra shifts) ØThis causes inflation

Output Gap Ø The output gap measures the difference between potential output and actual output. Ø Output Gap = Y – Y* Ø When Y < Y*, there is a recessionary gap ØThe economy’s resources are not fully employed (ie: there is excess unemployment) Ø When Y > Y*, there is an inflationary gap ØThe economy’s resources are more than fully employed (ie: there is overtime and extra shifts) ØThis causes inflation

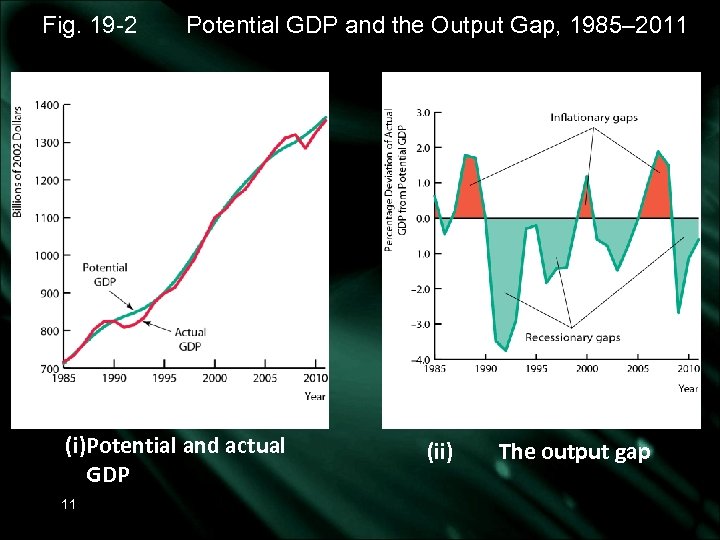

Fig. 19 -2 Potential GDP and the Output Gap, 1985– 2011 (i)Potential and actual GDP 11 (ii) The output gap

Fig. 19 -2 Potential GDP and the Output Gap, 1985– 2011 (i)Potential and actual GDP 11 (ii) The output gap

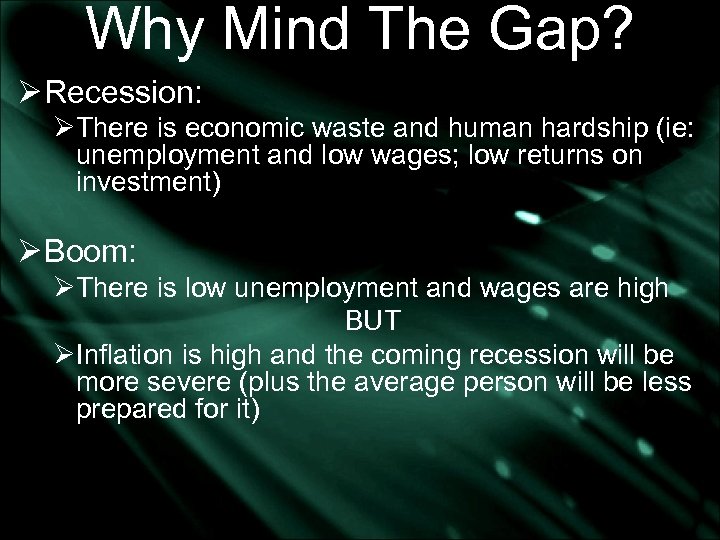

Why Mind The Gap? Ø Recession: ØThere is economic waste and human hardship (ie: unemployment and low wages; low returns on investment) Ø Boom: ØThere is low unemployment and wages are high BUT ØInflation is high and the coming recession will be more severe (plus the average person will be less prepared for it)

Why Mind The Gap? Ø Recession: ØThere is economic waste and human hardship (ie: unemployment and low wages; low returns on investment) Ø Boom: ØThere is low unemployment and wages are high BUT ØInflation is high and the coming recession will be more severe (plus the average person will be less prepared for it)

19. b – Macro Variables Unemployment Ø 14. 5 Million Canadians covered by Unemployment Insurance in 2008 -09 Ø$9. 5 billion on regular benefits Ø$2. 9 billion on family benefits (maternity and parental leave) Ø$1 billion on sickness Ø$246 million on fishing benefits Ø$1. 6 billion on training, job creation, selfemployment assistance, wage subsidies, and labor market agreements

19. b – Macro Variables Unemployment Ø 14. 5 Million Canadians covered by Unemployment Insurance in 2008 -09 Ø$9. 5 billion on regular benefits Ø$2. 9 billion on family benefits (maternity and parental leave) Ø$1 billion on sickness Ø$246 million on fishing benefits Ø$1. 6 billion on training, job creation, selfemployment assistance, wage subsidies, and labor market agreements

Unemployment Definitions Ø There are 3 key categories needed to understand unemployment in Canada: Employed – adult workers (over 15) who have a job (regardless of hours), are off work due to illness, vacation, or industrial dispute Unemployed – workers who were available for work and made an effort to find a job during the previous 4 weeks, or who were available for work and waiting to be recalled from a layoff within 26 weeks, or reporting to a new job within 4 weeks

Unemployment Definitions Ø There are 3 key categories needed to understand unemployment in Canada: Employed – adult workers (over 15) who have a job (regardless of hours), are off work due to illness, vacation, or industrial dispute Unemployed – workers who were available for work and made an effort to find a job during the previous 4 weeks, or who were available for work and waiting to be recalled from a layoff within 26 weeks, or reporting to a new job within 4 weeks

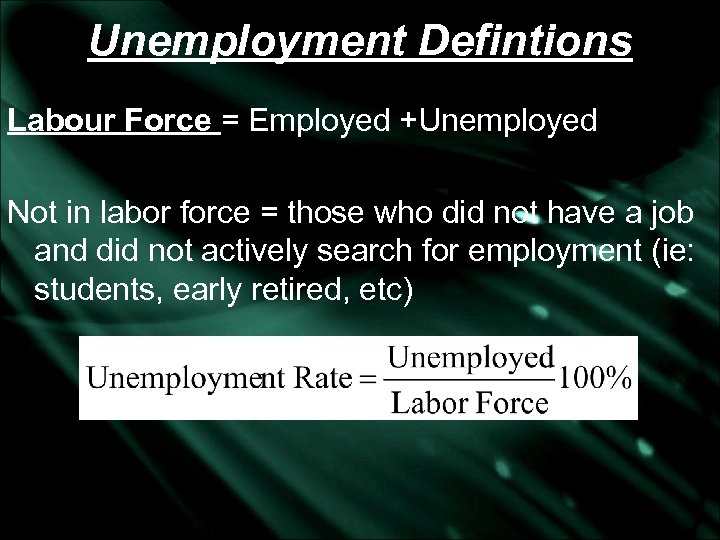

Unemployment Defintions Labour Force = Employed +Unemployed Not in labor force = those who did not have a job and did not actively search for employment (ie: students, early retired, etc)

Unemployment Defintions Labour Force = Employed +Unemployed Not in labor force = those who did not have a job and did not actively search for employment (ie: students, early retired, etc)

Unemployment in Canada Ø When Y = Y*, the economy is at FULL EMPLOYMENT Ø BUT some unemployment exists: Ø frictional unemployment (natural turnover) Ø structural unemployment (mismatch between jobs and workers) Ø Therefore @ full employment, unemployment ≠ 0

Unemployment in Canada Ø When Y = Y*, the economy is at FULL EMPLOYMENT Ø BUT some unemployment exists: Ø frictional unemployment (natural turnover) Ø structural unemployment (mismatch between jobs and workers) Ø Therefore @ full employment, unemployment ≠ 0

Unemployment in Canada Ø When Y < Y*, there is cyclical unemployment ØThis is caused by the business cycle Ø Industries with seasonal business cycles (fisheries, parks and recreation, ice cream sales, retailers at Christmas, etc) may have seasonal unemployment ØTherefore Statistics Canada publishes seasonally adjusted unemployment values

Unemployment in Canada Ø When Y < Y*, there is cyclical unemployment ØThis is caused by the business cycle Ø Industries with seasonal business cycles (fisheries, parks and recreation, ice cream sales, retailers at Christmas, etc) may have seasonal unemployment ØTherefore Statistics Canada publishes seasonally adjusted unemployment values

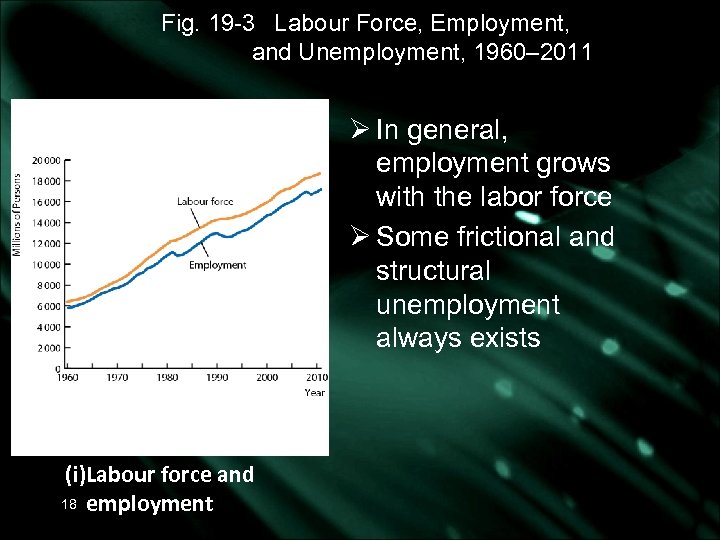

Fig. 19 -3 Labour Force, Employment, and Unemployment, 1960– 2011 Ø In general, employment grows with the labor force Ø Some frictional and structural unemployment always exists (i)Labour force and 18 employment

Fig. 19 -3 Labour Force, Employment, and Unemployment, 1960– 2011 Ø In general, employment grows with the labor force Ø Some frictional and structural unemployment always exists (i)Labour force and 18 employment

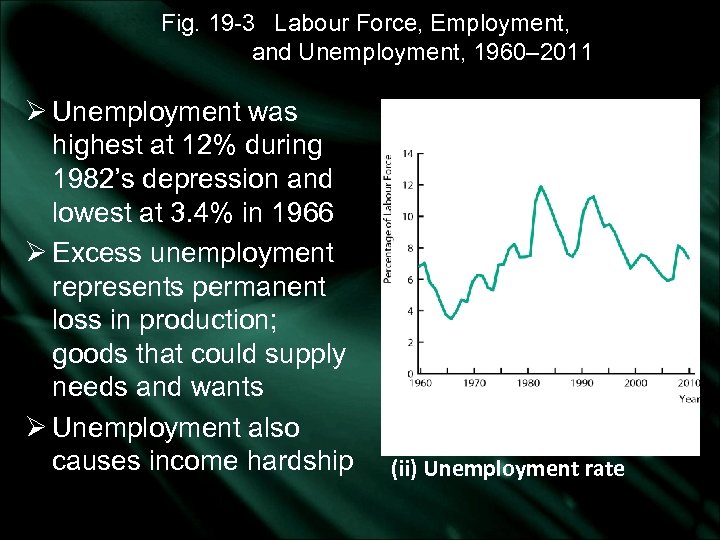

Fig. 19 -3 Labour Force, Employment, and Unemployment, 1960– 2011 Ø Unemployment was highest at 12% during 1982’s depression and lowest at 3. 4% in 1966 Ø Excess unemployment represents permanent loss in production; goods that could supply needs and wants Ø Unemployment also causes income hardship (ii) Unemployment rate

Fig. 19 -3 Labour Force, Employment, and Unemployment, 1960– 2011 Ø Unemployment was highest at 12% during 1982’s depression and lowest at 3. 4% in 1966 Ø Excess unemployment represents permanent loss in production; goods that could supply needs and wants Ø Unemployment also causes income hardship (ii) Unemployment rate

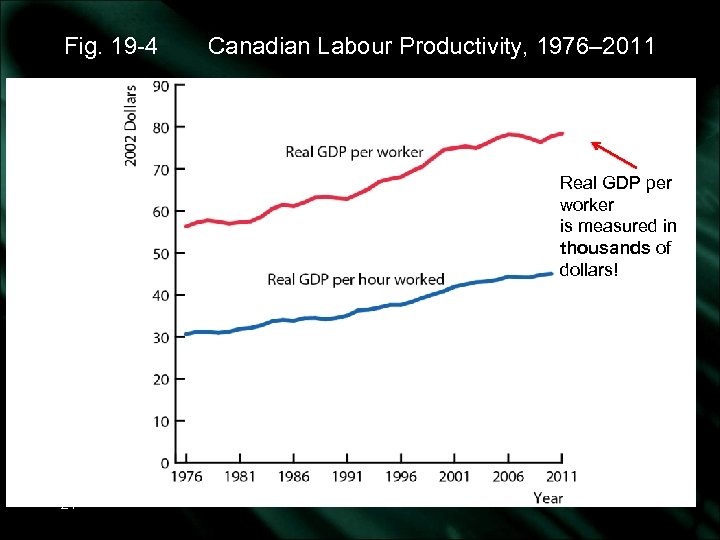

Macro Variables - Productivity Ø Productivity: a measure of output per unit of input Ø Increases in productivity are probably the single largest determinant of long-run increases in material living standards Ø Higher Productivity => Higher Real wages

Macro Variables - Productivity Ø Productivity: a measure of output per unit of input Ø Increases in productivity are probably the single largest determinant of long-run increases in material living standards Ø Higher Productivity => Higher Real wages

Fig. 19 -4 Canadian Labour Productivity, 1976– 2011 Real GDP per worker is measured in thousands of dollars! 21

Fig. 19 -4 Canadian Labour Productivity, 1976– 2011 Real GDP per worker is measured in thousands of dollars! 21

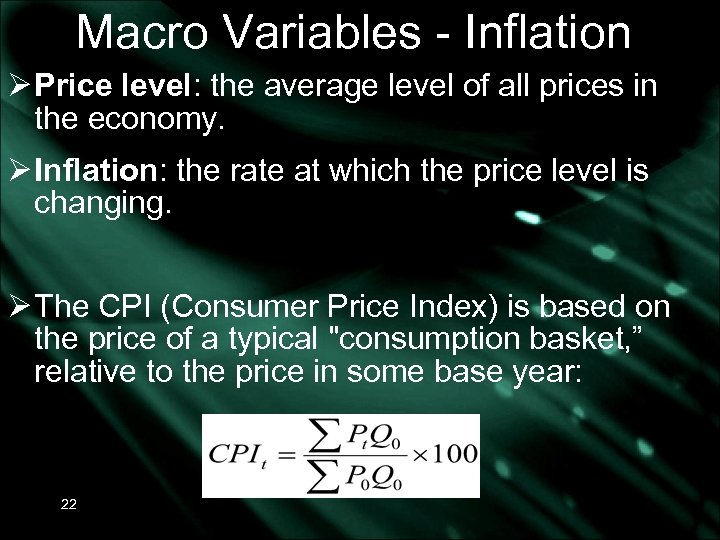

Macro Variables - Inflation Ø Price level: the average level of all prices in the economy. Ø Inflation: the rate at which the price level is changing. Ø The CPI (Consumer Price Index) is based on the price of a typical "consumption basket, ” relative to the price in some base year: 22

Macro Variables - Inflation Ø Price level: the average level of all prices in the economy. Ø Inflation: the rate at which the price level is changing. Ø The CPI (Consumer Price Index) is based on the price of a typical "consumption basket, ” relative to the price in some base year: 22

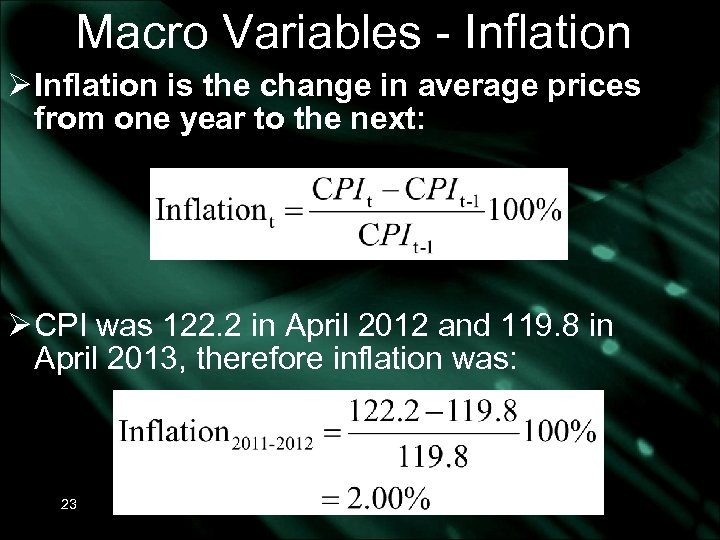

Macro Variables - Inflation Ø Inflation is the change in average prices from one year to the next: Ø CPI was 122. 2 in April 2012 and 119. 8 in April 2013, therefore inflation was: 23

Macro Variables - Inflation Ø Inflation is the change in average prices from one year to the next: Ø CPI was 122. 2 in April 2012 and 119. 8 in April 2013, therefore inflation was: 23

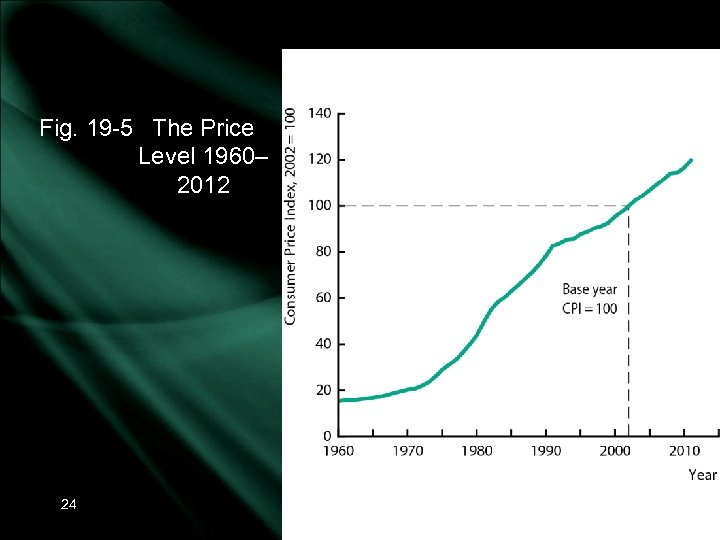

Fig. 19 -5 The Price Level 1960– 2012 24

Fig. 19 -5 The Price Level 1960– 2012 24

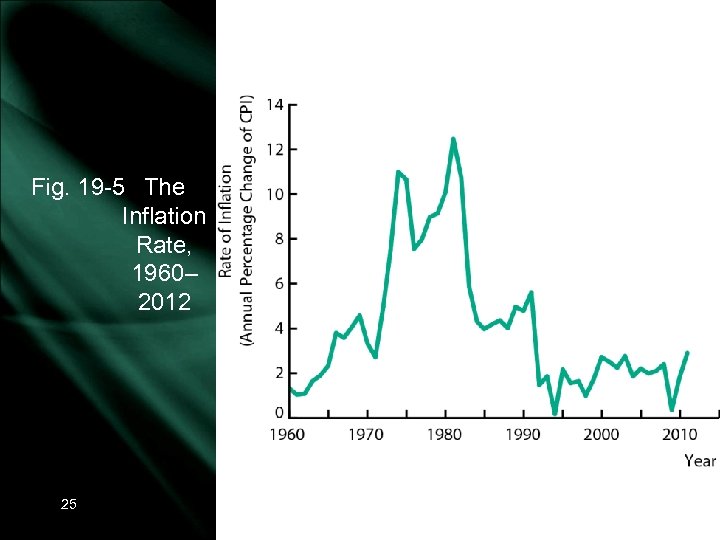

Fig. 19 -5 The Inflation Rate, 1960– 2012 25 Copyright © 2014 Pearson Canada Inc. Chapter 19, Slide

Fig. 19 -5 The Inflation Rate, 1960– 2012 25 Copyright © 2014 Pearson Canada Inc. Chapter 19, Slide

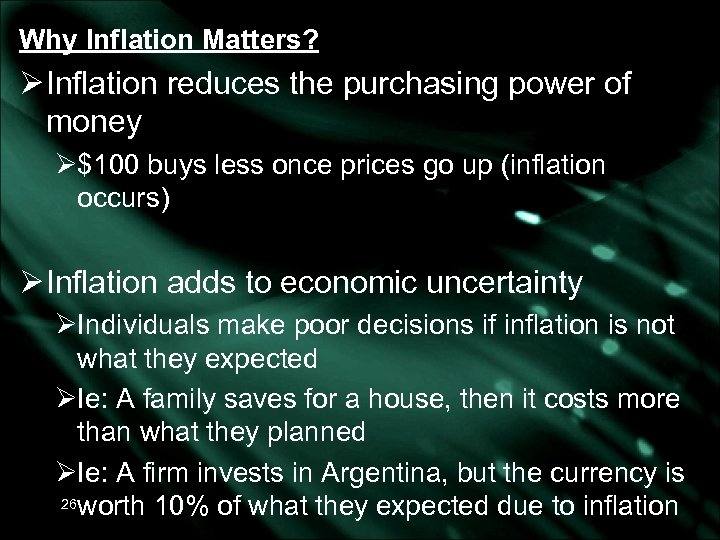

Why Inflation Matters? Ø Inflation reduces the purchasing power of money Ø$100 buys less once prices go up (inflation occurs) Ø Inflation adds to economic uncertainty ØIndividuals make poor decisions if inflation is not what they expected ØIe: A family saves for a house, then it costs more than what they planned ØIe: A firm invests in Argentina, but the currency is 26 worth 10% of what they expected due to inflation

Why Inflation Matters? Ø Inflation reduces the purchasing power of money Ø$100 buys less once prices go up (inflation occurs) Ø Inflation adds to economic uncertainty ØIndividuals make poor decisions if inflation is not what they expected ØIe: A family saves for a house, then it costs more than what they planned ØIe: A firm invests in Argentina, but the currency is 26 worth 10% of what they expected due to inflation

Inflation Example Super Savings Bank Account: 2% interest Cash on hand: $100 2 DVD players: Basic: $100 DVD Playback Deluxe: $102 DVD/VCD/SVCD/AVI/DVD±R/CD/CD±R 3 D Blu-Ray, Wi-Fi, Memory Card Slot, Picture Viewer, Stop Memory, Shiny Red Colour

Inflation Example Super Savings Bank Account: 2% interest Cash on hand: $100 2 DVD players: Basic: $100 DVD Playback Deluxe: $102 DVD/VCD/SVCD/AVI/DVD±R/CD/CD±R 3 D Blu-Ray, Wi-Fi, Memory Card Slot, Picture Viewer, Stop Memory, Shiny Red Colour

Inflation Example You want the deluxe, so you invest for a year, cash on hand in a year: $102 But, due to 3% inflation, the DVD players now cost: $103 (basic) $105. 06 (deluxe) Now you can’t afford either You’ve LOST buying power

Inflation Example You want the deluxe, so you invest for a year, cash on hand in a year: $102 But, due to 3% inflation, the DVD players now cost: $103 (basic) $105. 06 (deluxe) Now you can’t afford either You’ve LOST buying power

Macro Variables- Interest Rates Interest rates – percentage price paid to borrow money over a period of time Ø$100 borrowed at 8% interest will cost $8 a year Øthey show the opportunity cost of a project Different interest rates apply to different situations Different interest rates are available to different people

Macro Variables- Interest Rates Interest rates – percentage price paid to borrow money over a period of time Ø$100 borrowed at 8% interest will cost $8 a year Øthey show the opportunity cost of a project Different interest rates apply to different situations Different interest rates are available to different people

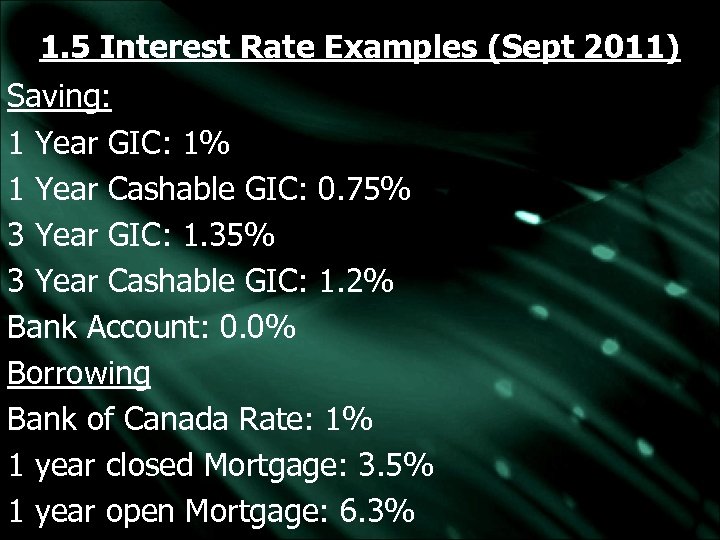

1. 5 Interest Rate Examples (Sept 2011) Saving: 1 Year GIC: 1% 1 Year Cashable GIC: 0. 75% 3 Year GIC: 1. 35% 3 Year Cashable GIC: 1. 2% Bank Account: 0. 0% Borrowing Bank of Canada Rate: 1% 1 year closed Mortgage: 3. 5% 1 year open Mortgage: 6. 3%

1. 5 Interest Rate Examples (Sept 2011) Saving: 1 Year GIC: 1% 1 Year Cashable GIC: 0. 75% 3 Year GIC: 1. 35% 3 Year Cashable GIC: 1. 2% Bank Account: 0. 0% Borrowing Bank of Canada Rate: 1% 1 year closed Mortgage: 3. 5% 1 year open Mortgage: 6. 3%

Interest Rate Rules Bank of Canada rate for banks (bank rate) Is less than Banks’ rates for best customers (prime rate) Is less than Typical Bank Rate More risk = higher rate

Interest Rate Rules Bank of Canada rate for banks (bank rate) Is less than Banks’ rates for best customers (prime rate) Is less than Typical Bank Rate More risk = higher rate

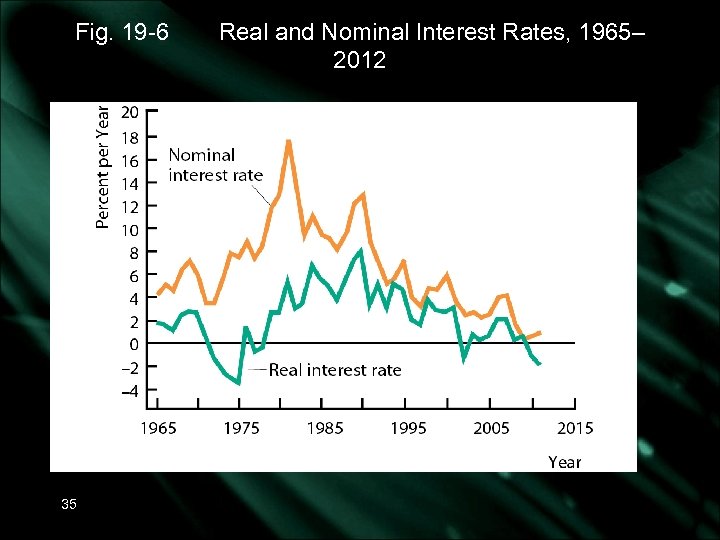

Real vs. Nominal Interest Rate: – Price Paid per dollar borrowed period of time Real Interest Rate: – Nominal Interest Rate adjusted for change in purchasing power; adjusted for inflation

Real vs. Nominal Interest Rate: – Price Paid per dollar borrowed period of time Real Interest Rate: – Nominal Interest Rate adjusted for change in purchasing power; adjusted for inflation

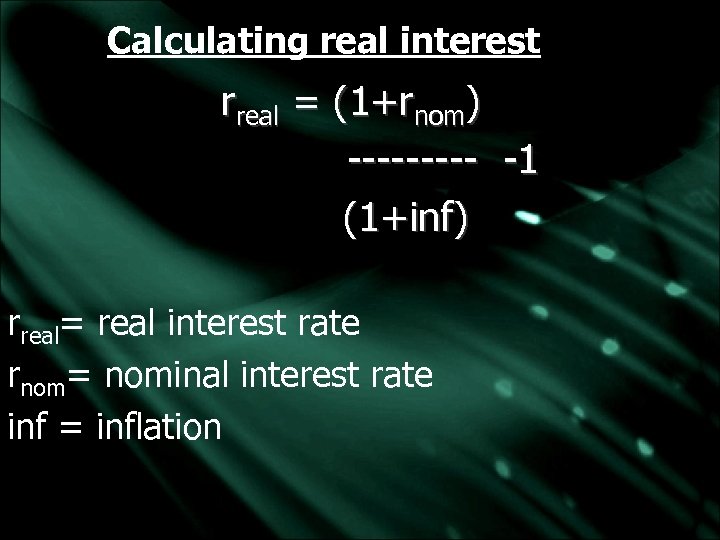

Calculating real interest rreal = (1+rnom) ----- -1 (1+inf) rreal= real interest rate rnom= nominal interest rate inf = inflation

Calculating real interest rreal = (1+rnom) ----- -1 (1+inf) rreal= real interest rate rnom= nominal interest rate inf = inflation

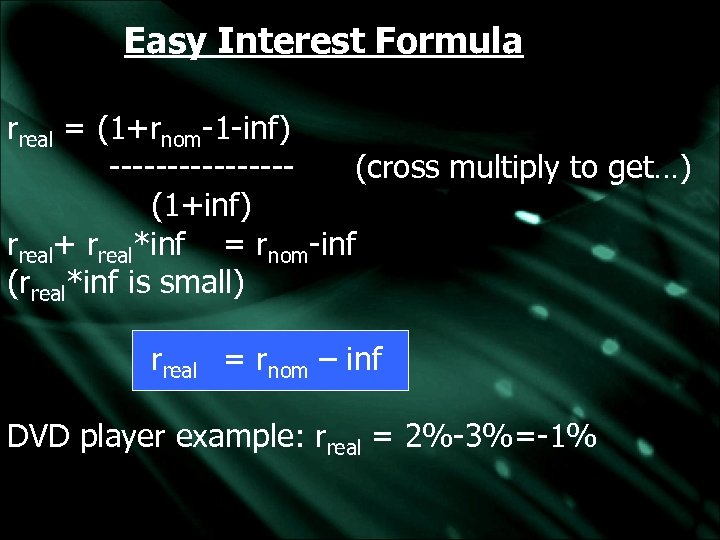

Easy Interest Formula rreal = (1+rnom-1 -inf) --------(cross multiply to get…) (1+inf) rreal+ rreal*inf = rnom-inf (rreal*inf is small) rreal = rnom – inf DVD player example: rreal = 2%-3%=-1%

Easy Interest Formula rreal = (1+rnom-1 -inf) --------(cross multiply to get…) (1+inf) rreal+ rreal*inf = rnom-inf (rreal*inf is small) rreal = rnom – inf DVD player example: rreal = 2%-3%=-1%

Fig. 19 -6 35 Real and Nominal Interest Rates, 1965– 2012

Fig. 19 -6 35 Real and Nominal Interest Rates, 1965– 2012

Interest Rate Importance ØLow real interest rates are good for borrowers (ie: entrepreneurs) ØHigh real interest rates are good for savers (ie: retirees) ØInterest rates affect the level of investing ØTopic 7 will investigate how the Bank of Canada influences interest rates

Interest Rate Importance ØLow real interest rates are good for borrowers (ie: entrepreneurs) ØHigh real interest rates are good for savers (ie: retirees) ØInterest rates affect the level of investing ØTopic 7 will investigate how the Bank of Canada influences interest rates

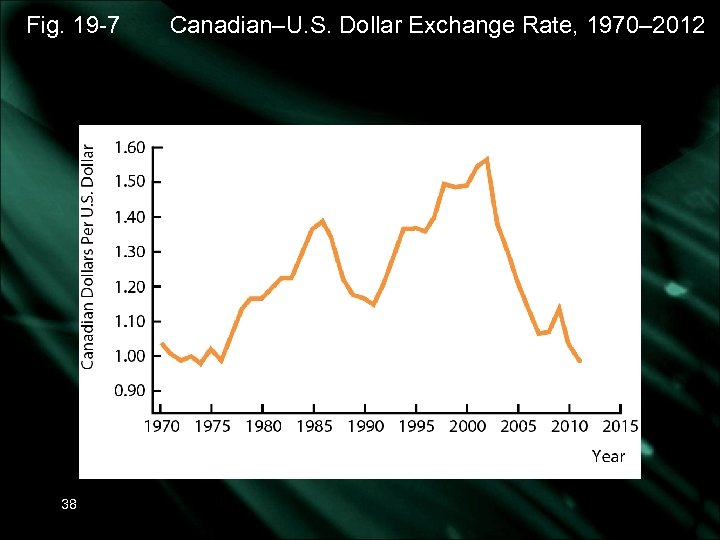

Macro Variables – Exchange Rate Ø Exchange rate: the number of Canadian dollars required to purchase one unit of foreign currency. Ø Depreciation of the Canadian dollar means that it is worth less on the foreign-exchange market (more $Can for $Other) Ø Appreciation of the Canadian dollar means that it is worth more on the foreign-exchange market (less $Can for $Other) 37

Macro Variables – Exchange Rate Ø Exchange rate: the number of Canadian dollars required to purchase one unit of foreign currency. Ø Depreciation of the Canadian dollar means that it is worth less on the foreign-exchange market (more $Can for $Other) Ø Appreciation of the Canadian dollar means that it is worth more on the foreign-exchange market (less $Can for $Other) 37

Fig. 19 -7 38 Canadian–U. S. Dollar Exchange Rate, 1970– 2012

Fig. 19 -7 38 Canadian–U. S. Dollar Exchange Rate, 1970– 2012

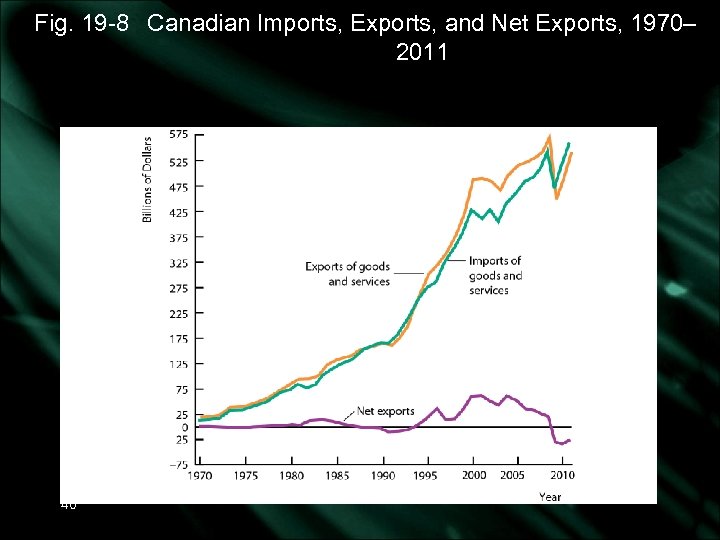

Macro Variables – Export and Imports Ø Export – Good/service sold to another country Ø Import – Good/service bought from another country Ø For Canada, exports and imports are both very large—roughly 35% of GDP—but the trade balance is usually small.

Macro Variables – Export and Imports Ø Export – Good/service sold to another country Ø Import – Good/service bought from another country Ø For Canada, exports and imports are both very large—roughly 35% of GDP—but the trade balance is usually small.

Fig. 19 -8 Canadian Imports, Exports, and Net Exports, 1970– 2011 40

Fig. 19 -8 Canadian Imports, Exports, and Net Exports, 1970– 2011 40

Long Run Growth ØGrowth is generally positive in the long run ØThis causes an increase in living standards ØTypically gets little media attention ØHow should the government treat the long-run? ØCAN the government affect growth? ØDoes controlling inflation affect growth? ØDoes running a deficit cause borrowing and reduce growth? ØShould government innovate or allow the private sector to innovate?

Long Run Growth ØGrowth is generally positive in the long run ØThis causes an increase in living standards ØTypically gets little media attention ØHow should the government treat the long-run? ØCAN the government affect growth? ØDoes controlling inflation affect growth? ØDoes running a deficit cause borrowing and reduce growth? ØShould government innovate or allow the private sector to innovate?

Short Run Fluctuations ØWhat causes the business cycle? ØWhy did the recession hit in 2008? ØWhy was unemployment so low in 2007? ØHow much does the Canadian business cycle depend on the US? On Europe? On Asia? ØCan the government influence the business cycle? ØIf so, how much?

Short Run Fluctuations ØWhat causes the business cycle? ØWhy did the recession hit in 2008? ØWhy was unemployment so low in 2007? ØHow much does the Canadian business cycle depend on the US? On Europe? On Asia? ØCan the government influence the business cycle? ØIf so, how much?

20. a Value Added Ø Production occurs in stages—most firms produce outputs that are other firms' inputs Øintermediate goods are used to produce Øfinal goods Ø Each firm’s contribution to total output (final goods) is its value added Ø Sum of value added is an economy’s output

20. a Value Added Ø Production occurs in stages—most firms produce outputs that are other firms' inputs Øintermediate goods are used to produce Øfinal goods Ø Each firm’s contribution to total output (final goods) is its value added Ø Sum of value added is an economy’s output

20. b GDP Ø Three methods for measuring national income (output): a) total value added from domestic production (good theory, unrealistic in practice) b) total expenditures on domestic output c) total income generated by domestic production Ø Because of the circular flow of income, these three measures yield the same total – GDP ØGross Domestic Product – total value of goods and services produced in the economy during a given period

20. b GDP Ø Three methods for measuring national income (output): a) total value added from domestic production (good theory, unrealistic in practice) b) total expenditures on domestic output c) total income generated by domestic production Ø Because of the circular flow of income, these three measures yield the same total – GDP ØGross Domestic Product – total value of goods and services produced in the economy during a given period

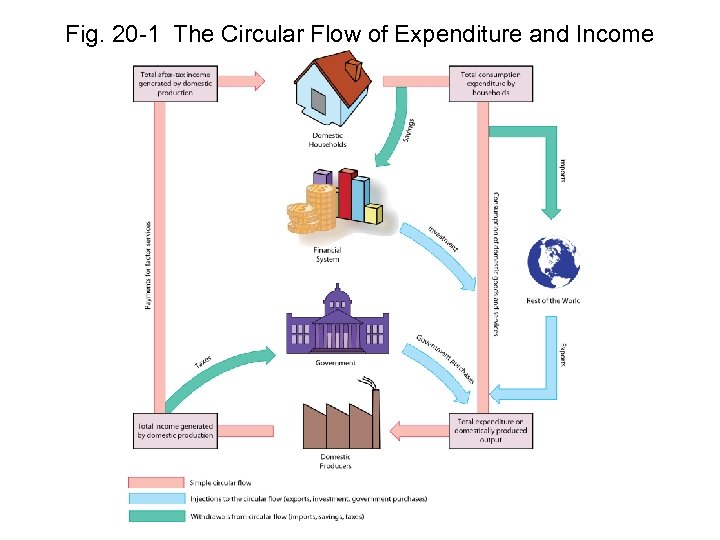

Fig. 20 -1 The Circular Flow of Expenditure and Income 45

Fig. 20 -1 The Circular Flow of Expenditure and Income 45

b) GDP -Expenditure Side Ø Consider adding up the expenditures needed to purchase the final output produced in any given year. Ø There are four broad expenditure categories: Ø consumption Ø investment Ø government purchases Ø net exports

b) GDP -Expenditure Side Ø Consider adding up the expenditures needed to purchase the final output produced in any given year. Ø There are four broad expenditure categories: Ø consumption Ø investment Ø government purchases Ø net exports

GDP -Expenditure Side Ø Consumption expenditure (C) includes household expenditure on all final goods during the year ØHaircuts, Xbox’s, chicken, legal advice, etc. Ø Investment expenditure (I) is expenditure on the production of goods not for present consumption, including: Øinventories Øplant and equipment (capital stock) Øresidential housing

GDP -Expenditure Side Ø Consumption expenditure (C) includes household expenditure on all final goods during the year ØHaircuts, Xbox’s, chicken, legal advice, etc. Ø Investment expenditure (I) is expenditure on the production of goods not for present consumption, including: Øinventories Øplant and equipment (capital stock) Øresidential housing

ØGovernment purchases (G) is the purchase of currently produced goods and services by government Øexcluding transfer payments (unemployment insurance, Canada Pension Plan, etc. ) Ø Net exports (X – IM) is the difference between exports and imports Ø Exports are purchases of Canadian-produced goods and services by foreigners. We subtract imports because they are not produced in Canada.

ØGovernment purchases (G) is the purchase of currently produced goods and services by government Øexcluding transfer payments (unemployment insurance, Canada Pension Plan, etc. ) Ø Net exports (X – IM) is the difference between exports and imports Ø Exports are purchases of Canadian-produced goods and services by foreigners. We subtract imports because they are not produced in Canada.

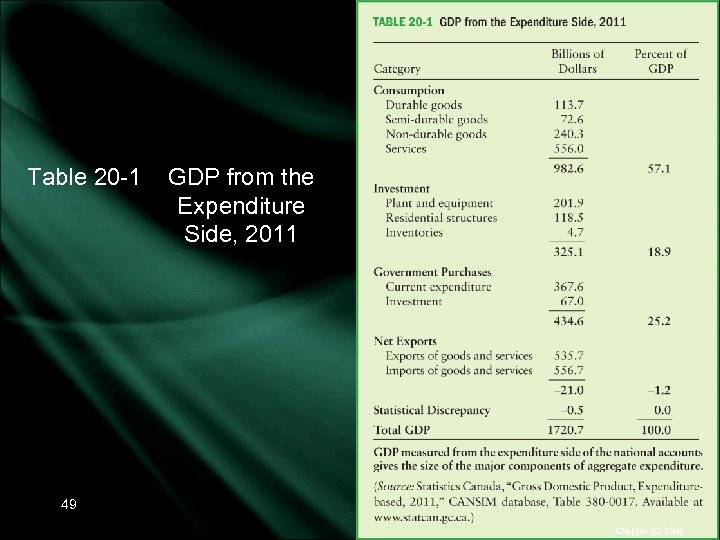

Table 20 -1 GDP from the Expenditure Side, 2011 49 Chapter 20, Slide

Table 20 -1 GDP from the Expenditure Side, 2011 49 Chapter 20, Slide

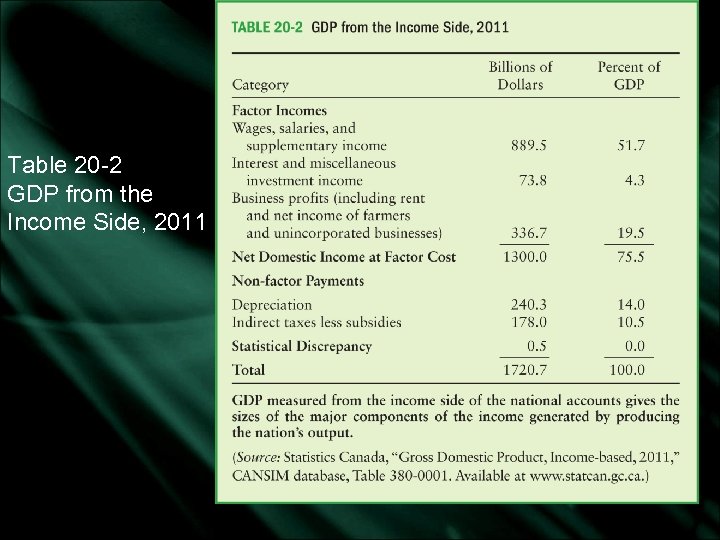

c) GDP from the Income Side Ø GDP is also the sum of factor incomes and other claims on the value of output. 1) Factor incomes: Øwages net domestic income Ørent, interest, and profits 2) Non-factor payments: Øindirect taxes (ie GST; income collected but not received) ØSubsidies (ie: furnace subsidy; negative tax) 50 Ødepreciation of existing physical capital

c) GDP from the Income Side Ø GDP is also the sum of factor incomes and other claims on the value of output. 1) Factor incomes: Øwages net domestic income Ørent, interest, and profits 2) Non-factor payments: Øindirect taxes (ie GST; income collected but not received) ØSubsidies (ie: furnace subsidy; negative tax) 50 Ødepreciation of existing physical capital

GDP from the income side is therefore equal to: GDP = Net domestic income + Indirect taxes (less subsidies) + Depreciation

GDP from the income side is therefore equal to: GDP = Net domestic income + Indirect taxes (less subsidies) + Depreciation

Table 20 -2 GDP from the Income Side, 2011

Table 20 -2 GDP from the Income Side, 2011

20. c GDP Issues 1) GDP and GNP Ø A measure of national output closely related to GDP is Gross National Product (GNP). Ø GDP measures production in Canada (even if some of the profits leave the country) ØMeasure of domestic production Ø GNP measures income of Canadians (even if they earn income outside of Canada) ØMeasure of domestic income Ø GNP is typically 3%-4% less than GDP

20. c GDP Issues 1) GDP and GNP Ø A measure of national output closely related to GDP is Gross National Product (GNP). Ø GDP measures production in Canada (even if some of the profits leave the country) ØMeasure of domestic production Ø GNP measures income of Canadians (even if they earn income outside of Canada) ØMeasure of domestic income Ø GNP is typically 3%-4% less than GDP

20. c GDP Issues 2) Disposable Personal Income Ø A more important measure for households is disposable personal income – the part of GNP that households can spend or save Ø It equals GNP minus: Øany part not actually paid to households Ø Taxes, depreciation, retained earnings, and interest paid to institutions Øplus transfer payments received by households Ø Child Tax Credit, Unemployment Insurance, GST rebate, etc.

20. c GDP Issues 2) Disposable Personal Income Ø A more important measure for households is disposable personal income – the part of GNP that households can spend or save Ø It equals GNP minus: Øany part not actually paid to households Ø Taxes, depreciation, retained earnings, and interest paid to institutions Øplus transfer payments received by households Ø Child Tax Credit, Unemployment Insurance, GST rebate, etc.

3) The Problem with Nominal GDP Assume: prices quadruple (x 4) production is cut in half (x 1/2) Nominal GDP (year 1) = 1 X 1 = 1 Nominal GDP (year 2) = 0. 5 X 4 = 2 Øalthough production has been devastated, GDP reflects extreme growth

3) The Problem with Nominal GDP Assume: prices quadruple (x 4) production is cut in half (x 1/2) Nominal GDP (year 1) = 1 X 1 = 1 Nominal GDP (year 2) = 0. 5 X 4 = 2 Øalthough production has been devastated, GDP reflects extreme growth

Real GDP -Base year value of all goods currently produced: ∑ quantities X prices base year -doesn’t change when prices change -changes when quantities change

Real GDP -Base year value of all goods currently produced: ∑ quantities X prices base year -doesn’t change when prices change -changes when quantities change

The Solution of Real GDP Assume: prices quadruple (x 4) production is cut in half (x 1/2) Real GDP (year 1) = 1 X 1 = 1 Real GDP (year 2) = 0. 5 X 1 = 0. 5 -real GDP accurately reflects the economy

The Solution of Real GDP Assume: prices quadruple (x 4) production is cut in half (x 1/2) Real GDP (year 1) = 1 X 1 = 1 Real GDP (year 2) = 0. 5 X 1 = 0. 5 -real GDP accurately reflects the economy

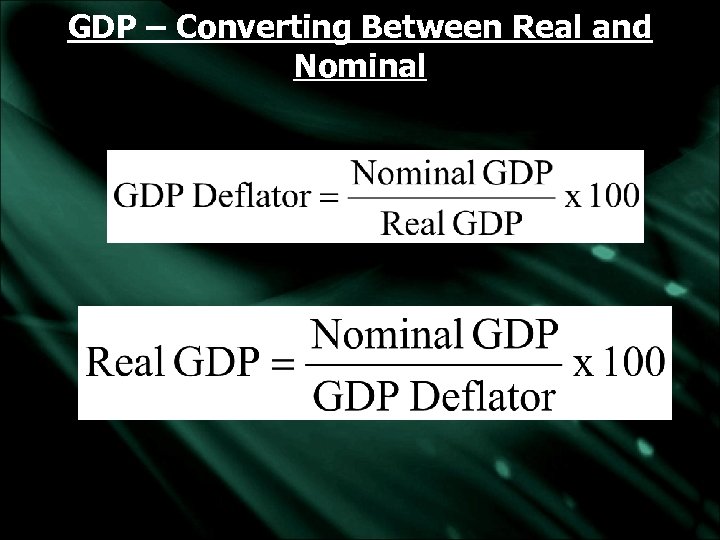

GDP – Converting Between Real and Nominal

GDP – Converting Between Real and Nominal

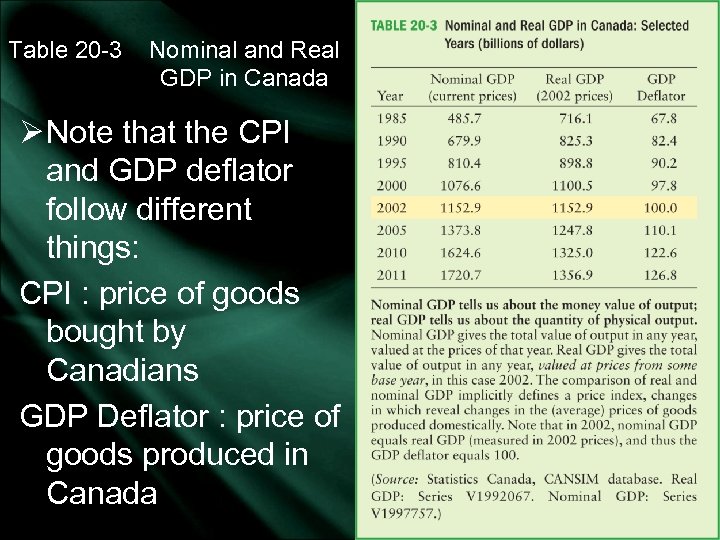

Table 20 -3 Nominal and Real GDP in Canada Ø Note that the CPI and GDP deflator follow different things: CPI : price of goods bought by Canadians GDP Deflator : price of goods produced in Canada

Table 20 -3 Nominal and Real GDP in Canada Ø Note that the CPI and GDP deflator follow different things: CPI : price of goods bought by Canadians GDP Deflator : price of goods produced in Canada

4) Omissions from the GDP Ø National income accountants cannot measure economic activity that takes place outside of regular, legal markets: Øillegal activities ØLeisure (people work less because they derive a benefit from it) Øthe underground economy (unreported income, trading, etc) Øhome production (ie: stay at home parents) Øeconomic "bads“ (ie: pollution)

4) Omissions from the GDP Ø National income accountants cannot measure economic activity that takes place outside of regular, legal markets: Øillegal activities ØLeisure (people work less because they derive a benefit from it) Øthe underground economy (unreported income, trading, etc) Øhome production (ie: stay at home parents) Øeconomic "bads“ (ie: pollution)

Do These Issues Matter? Ø The current calculations is used because: ØIt would be difficult to correct the major omissions. ØThe level of GDP may be inaccurate but the change in GDP is a good indication of the changes in economic activity. ØTo design policies to control inflation it is necessary to know the ACTUAL, LEGAL flow of money payments made to produce and purchase Canadian output.

Do These Issues Matter? Ø The current calculations is used because: ØIt would be difficult to correct the major omissions. ØThe level of GDP may be inaccurate but the change in GDP is a good indication of the changes in economic activity. ØTo design policies to control inflation it is necessary to know the ACTUAL, LEGAL flow of money payments made to produce and purchase Canadian output.

GDP and Living Standards Ø "Well-being" is a broader concept than material living standards: ØGDP is not a complete measure of economic well -being Ø Equity, environment, freedom of religion/expression, unemployment, weather, etc are all factors Øbut income is a very important part of well-being and GDP is a good measure of income.

GDP and Living Standards Ø "Well-being" is a broader concept than material living standards: ØGDP is not a complete measure of economic well -being Ø Equity, environment, freedom of religion/expression, unemployment, weather, etc are all factors Øbut income is a very important part of well-being and GDP is a good measure of income.

Topic 6 Summary Ø Macroeconomics is the study of how the broad economy behaves Ø Long-Run output examines economic growth Ø Short-Run output gives us the business cycle Ø The government’s control over each is debatable Ø Key Macroeconomic Variables include unemployment, productivity, inflation, interest rates, exports and imports Ø The difference between real and nominal variables is key to macroeconomics 63

Topic 6 Summary Ø Macroeconomics is the study of how the broad economy behaves Ø Long-Run output examines economic growth Ø Short-Run output gives us the business cycle Ø The government’s control over each is debatable Ø Key Macroeconomic Variables include unemployment, productivity, inflation, interest rates, exports and imports Ø The difference between real and nominal variables is key to macroeconomics 63

Topic 6 Summary Ø Only final goods should be considered when calculating a country’s production Ø Thus every stage of production adds a “value added” Ø GDP can be calculated from its Expenditure or Income side Ø GDP is production inside Canada; whereas GNP is income made by Canadians Ø GDP issues include GNP, disposable income, nominal GDP problems, and GDP omissions 64

Topic 6 Summary Ø Only final goods should be considered when calculating a country’s production Ø Thus every stage of production adds a “value added” Ø GDP can be calculated from its Expenditure or Income side Ø GDP is production inside Canada; whereas GNP is income made by Canadians Ø GDP issues include GNP, disposable income, nominal GDP problems, and GDP omissions 64

Topic 6 Summary Ø Despite GDP difficulties, GDP is still useful in analyzing the economy and making decisions Ø Factors other than GDP influence quality of life Ø But GDP is still a good measure Ø You should buy that DVD player before it goes up in price 65

Topic 6 Summary Ø Despite GDP difficulties, GDP is still useful in analyzing the economy and making decisions Ø Factors other than GDP influence quality of life Ø But GDP is still a good measure Ø You should buy that DVD player before it goes up in price 65