Topic 5. Structuring the Deal.ppt

- Количество слайдов: 33

Topic 5. Structuring the Deal 1. M&A Deal Structuring Process 2. Payment & Legal Considerations 3. Tax and Accounting Considerations

Topic 5. Structuring the Deal 1. M&A Deal Structuring Process 2. Payment & Legal Considerations 3. Tax and Accounting Considerations

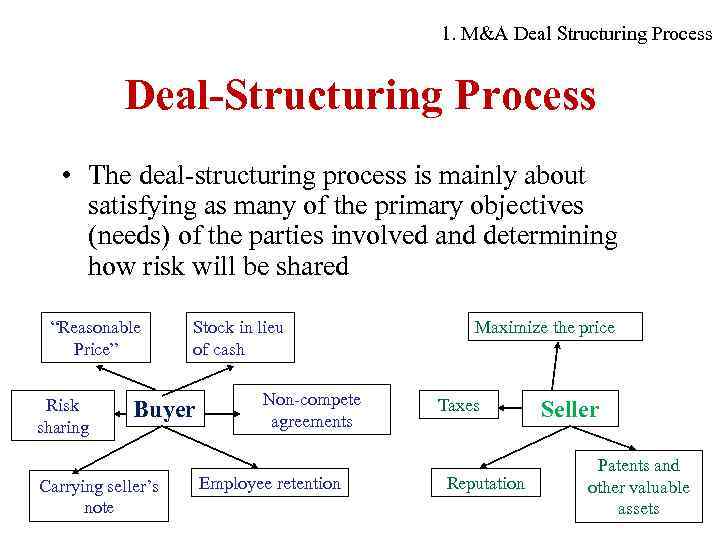

1. M&A Deal Structuring Process Deal-Structuring Process • The deal-structuring process is mainly about satisfying as many of the primary objectives (needs) of the parties involved and determining how risk will be shared “Reasonable Price” Risk sharing Stock in lieu of cash Buyer Carrying seller’s note Non-compete agreements Employee retention Maximize the price Taxes Reputation Seller Patents and other valuable assets

1. M&A Deal Structuring Process Deal-Structuring Process • The deal-structuring process is mainly about satisfying as many of the primary objectives (needs) of the parties involved and determining how risk will be shared “Reasonable Price” Risk sharing Stock in lieu of cash Buyer Carrying seller’s note Non-compete agreements Employee retention Maximize the price Taxes Reputation Seller Patents and other valuable assets

1. M&A Deal Structuring Process • Deal structuring involves identifying – The primary goals of the parties involved in the transaction; – Alternatives to achieve these goals; and – How to share risks. • The appropriate deal structure is that which – Satisfies as many of the primary objectives of the parties involved as necessary to reach agreement – Subject to an acceptable level of risk

1. M&A Deal Structuring Process • Deal structuring involves identifying – The primary goals of the parties involved in the transaction; – Alternatives to achieve these goals; and – How to share risks. • The appropriate deal structure is that which – Satisfies as many of the primary objectives of the parties involved as necessary to reach agreement – Subject to an acceptable level of risk

1. M&A Deal Structuring Process Key components of the Dealstructuring Process (fig. 1) 1. 2. 3. 4. 5. 6. 7. Acquisition vehicle Post-closing organization Form of payment Form of acquisition Legal form of selling entity Accounting Considerations Tax considerations

1. M&A Deal Structuring Process Key components of the Dealstructuring Process (fig. 1) 1. 2. 3. 4. 5. 6. 7. Acquisition vehicle Post-closing organization Form of payment Form of acquisition Legal form of selling entity Accounting Considerations Tax considerations

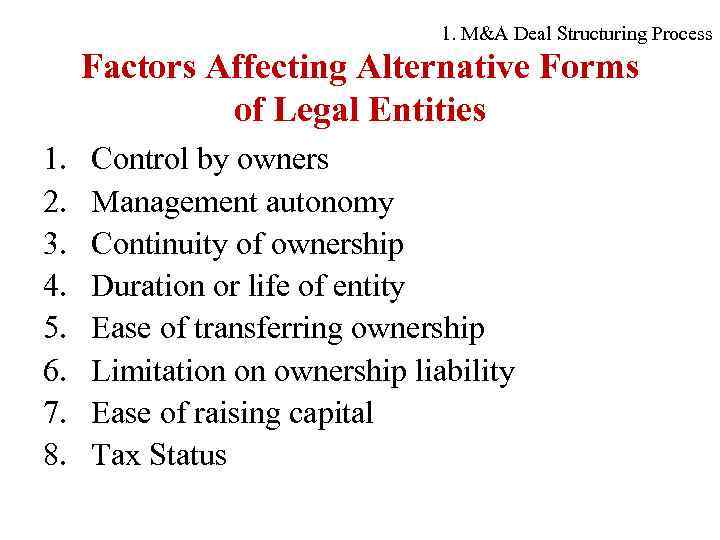

1. M&A Deal Structuring Process Factors Affecting Alternative Forms of Legal Entities 1. 2. 3. 4. 5. 6. 7. 8. Control by owners Management autonomy Continuity of ownership Duration or life of entity Ease of transferring ownership Limitation on ownership liability Ease of raising capital Tax Status

1. M&A Deal Structuring Process Factors Affecting Alternative Forms of Legal Entities 1. 2. 3. 4. 5. 6. 7. 8. Control by owners Management autonomy Continuity of ownership Duration or life of entity Ease of transferring ownership Limitation on ownership liability Ease of raising capital Tax Status

1. M&A Deal Structuring Process Acquisition Vehicle The legal entity used to acquire the target and generally to continue to own and operate the acquired company after closing Acquirer’s Objective (s) Maximizing control Facilitating postclosing integration Minimizing or sharing risk Potential Organization Corporate or divisional structure Partnership/joint venture Holding company Gaining control while limiting Holding company investment Transferring ownership Employee stock ownership interest to employees plan (ESOP)

1. M&A Deal Structuring Process Acquisition Vehicle The legal entity used to acquire the target and generally to continue to own and operate the acquired company after closing Acquirer’s Objective (s) Maximizing control Facilitating postclosing integration Minimizing or sharing risk Potential Organization Corporate or divisional structure Partnership/joint venture Holding company Gaining control while limiting Holding company investment Transferring ownership Employee stock ownership interest to employees plan (ESOP)

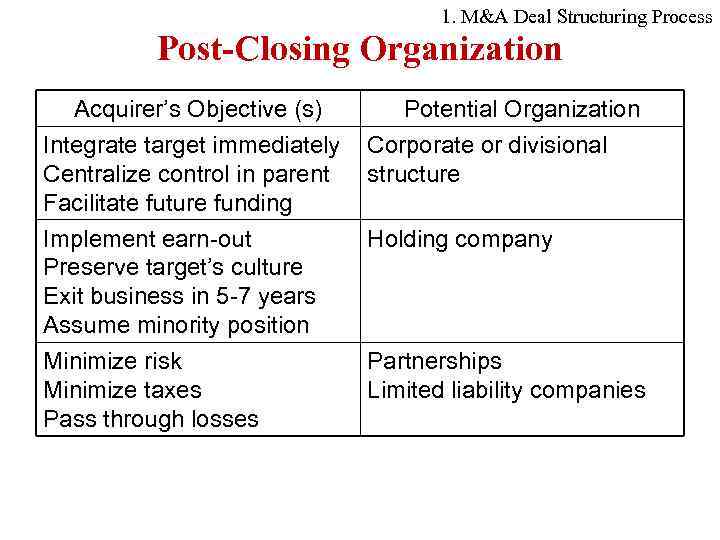

1. M&A Deal Structuring Process Post-Closing Organization Acquirer’s Objective (s) Integrate target immediately Centralize control in parent Facilitate future funding Potential Organization Corporate or divisional structure Implement earn-out Preserve target’s culture Exit business in 5 -7 years Assume minority position Minimize risk Minimize taxes Pass through losses Holding company Partnerships Limited liability companies

1. M&A Deal Structuring Process Post-Closing Organization Acquirer’s Objective (s) Integrate target immediately Centralize control in parent Facilitate future funding Potential Organization Corporate or divisional structure Implement earn-out Preserve target’s culture Exit business in 5 -7 years Assume minority position Minimize risk Minimize taxes Pass through losses Holding company Partnerships Limited liability companies

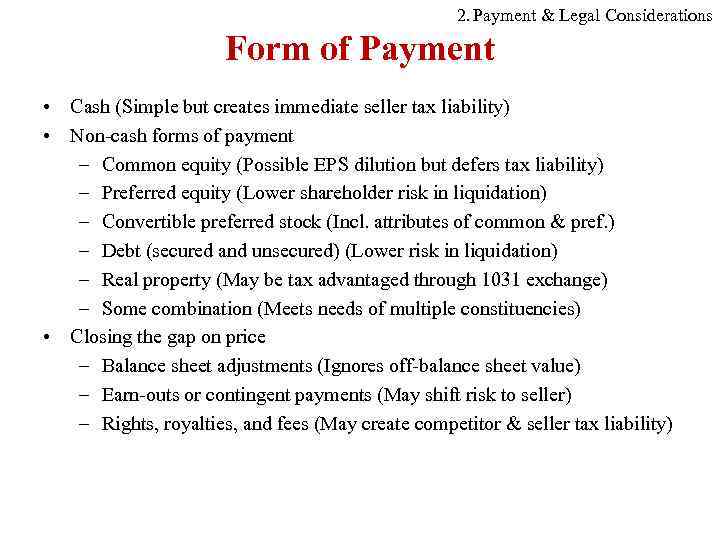

2. Payment & Legal Considerations Form of Payment • Cash (Simple but creates immediate seller tax liability) • Non-cash forms of payment – Common equity (Possible EPS dilution but defers tax liability) – Preferred equity (Lower shareholder risk in liquidation) – Convertible preferred stock (Incl. attributes of common & pref. ) – Debt (secured and unsecured) (Lower risk in liquidation) – Real property (May be tax advantaged through 1031 exchange) – Some combination (Meets needs of multiple constituencies) • Closing the gap on price – Balance sheet adjustments (Ignores off-balance sheet value) – Earn-outs or contingent payments (May shift risk to seller) – Rights, royalties, and fees (May create competitor & seller tax liability)

2. Payment & Legal Considerations Form of Payment • Cash (Simple but creates immediate seller tax liability) • Non-cash forms of payment – Common equity (Possible EPS dilution but defers tax liability) – Preferred equity (Lower shareholder risk in liquidation) – Convertible preferred stock (Incl. attributes of common & pref. ) – Debt (secured and unsecured) (Lower risk in liquidation) – Real property (May be tax advantaged through 1031 exchange) – Some combination (Meets needs of multiple constituencies) • Closing the gap on price – Balance sheet adjustments (Ignores off-balance sheet value) – Earn-outs or contingent payments (May shift risk to seller) – Rights, royalties, and fees (May create competitor & seller tax liability)

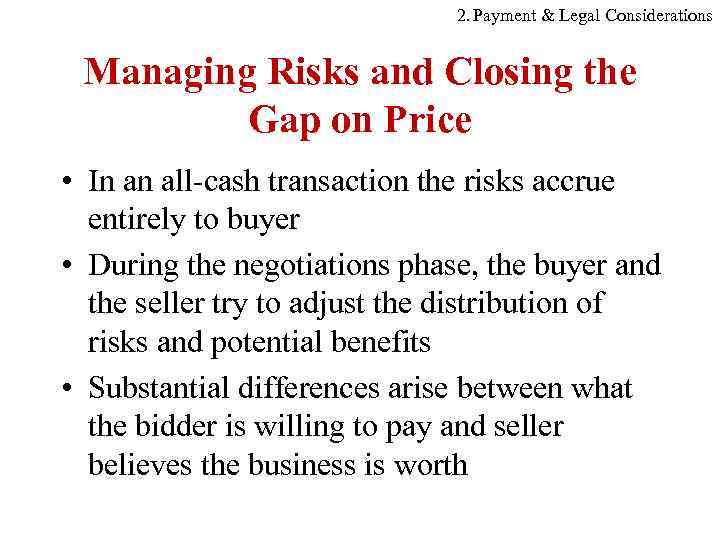

2. Payment & Legal Considerations Managing Risks and Closing the Gap on Price • In an all-cash transaction the risks accrue entirely to buyer • During the negotiations phase, the buyer and the seller try to adjust the distribution of risks and potential benefits • Substantial differences arise between what the bidder is willing to pay and seller believes the business is worth

2. Payment & Legal Considerations Managing Risks and Closing the Gap on Price • In an all-cash transaction the risks accrue entirely to buyer • During the negotiations phase, the buyer and the seller try to adjust the distribution of risks and potential benefits • Substantial differences arise between what the bidder is willing to pay and seller believes the business is worth

2. Payment & Legal Considerations Post-closing Price Adjustments • Mechanisms rely on an audit of the target company to determinr its “true” value • Usually involve escrow accounts • With escrow accounts, the buyer retains the portion of the purchase price until the postclosing audit is being finished

2. Payment & Legal Considerations Post-closing Price Adjustments • Mechanisms rely on an audit of the target company to determinr its “true” value • Usually involve escrow accounts • With escrow accounts, the buyer retains the portion of the purchase price until the postclosing audit is being finished

2. Payment & Legal Considerations Earn-Outs and Other Contingent Payments • An earn-out agreement is a financial contract in which the portion of the purchase price of a company is to be paid in the future, contingent on the realisation of a previously agreed-on future earnings or other performance indicator • It generally means that after the deal-closing the acquired company would operate for a while as a wholly-owned subsidiary of a buyer under the management of former owners or executives • Usually warrants are used

2. Payment & Legal Considerations Earn-Outs and Other Contingent Payments • An earn-out agreement is a financial contract in which the portion of the purchase price of a company is to be paid in the future, contingent on the realisation of a previously agreed-on future earnings or other performance indicator • It generally means that after the deal-closing the acquired company would operate for a while as a wholly-owned subsidiary of a buyer under the management of former owners or executives • Usually warrants are used

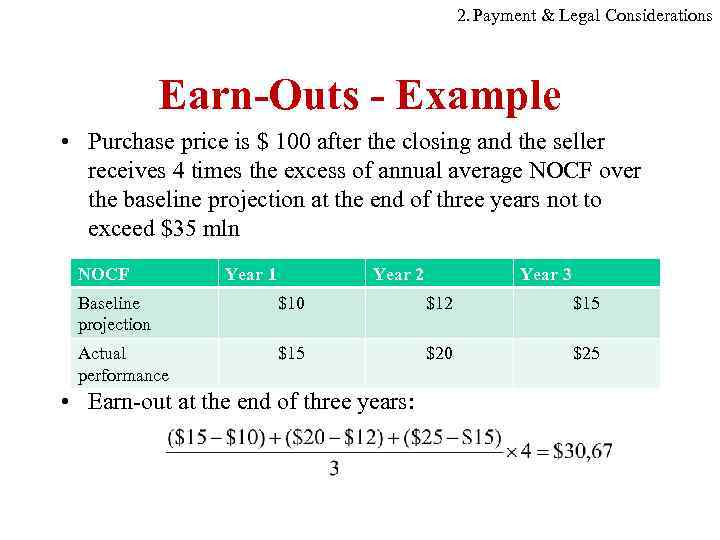

2. Payment & Legal Considerations Earn-Outs - Example • Purchase price is $ 100 after the closing and the seller receives 4 times the excess of annual average NOCF over the baseline projection at the end of three years not to exceed $35 mln NOCF Year 1 Year 2 Year 3 Baseline projection $10 $12 $15 Actual performance $15 $20 $25 • Earn-out at the end of three years:

2. Payment & Legal Considerations Earn-Outs - Example • Purchase price is $ 100 after the closing and the seller receives 4 times the excess of annual average NOCF over the baseline projection at the end of three years not to exceed $35 mln NOCF Year 1 Year 2 Year 3 Baseline projection $10 $12 $15 Actual performance $15 $20 $25 • Earn-out at the end of three years:

2. Payment & Legal Considerations Other forms of adjustments • Contingent value rights – commitments by the buyer to pay additional cash to the seller if the share price of the buyer falls below a specified level at some date in the future • Distributed or Staged Payouts • Rights, royalties and fees

2. Payment & Legal Considerations Other forms of adjustments • Contingent value rights – commitments by the buyer to pay additional cash to the seller if the share price of the buyer falls below a specified level at some date in the future • Distributed or Staged Payouts • Rights, royalties and fees

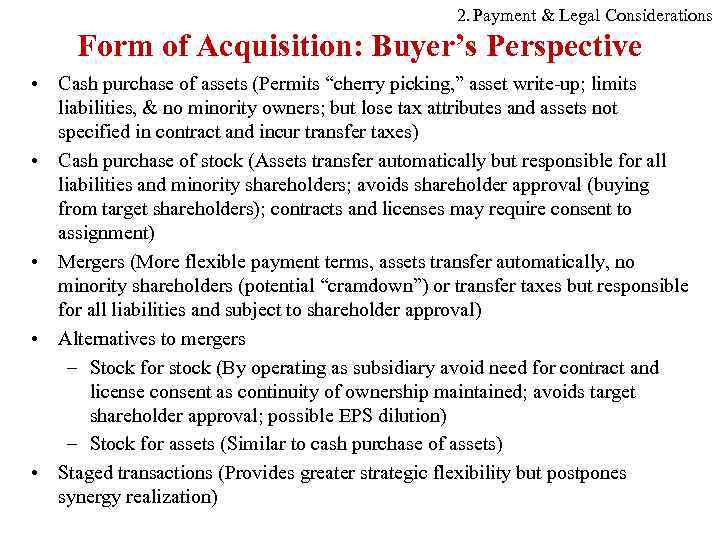

2. Payment & Legal Considerations Form of Acquisition: Buyer’s Perspective • Cash purchase of assets (Permits “cherry picking, ” asset write-up; limits liabilities, & no minority owners; but lose tax attributes and assets not specified in contract and incur transfer taxes) • Cash purchase of stock (Assets transfer automatically but responsible for all liabilities and minority shareholders; avoids shareholder approval (buying from target shareholders); contracts and licenses may require consent to assignment) • Mergers (More flexible payment terms, assets transfer automatically, no minority shareholders (potential “cramdown”) or transfer taxes but responsible for all liabilities and subject to shareholder approval) • Alternatives to mergers – Stock for stock (By operating as subsidiary avoid need for contract and license consent as continuity of ownership maintained; avoids target shareholder approval; possible EPS dilution) – Stock for assets (Similar to cash purchase of assets) • Staged transactions (Provides greater strategic flexibility but postpones synergy realization)

2. Payment & Legal Considerations Form of Acquisition: Buyer’s Perspective • Cash purchase of assets (Permits “cherry picking, ” asset write-up; limits liabilities, & no minority owners; but lose tax attributes and assets not specified in contract and incur transfer taxes) • Cash purchase of stock (Assets transfer automatically but responsible for all liabilities and minority shareholders; avoids shareholder approval (buying from target shareholders); contracts and licenses may require consent to assignment) • Mergers (More flexible payment terms, assets transfer automatically, no minority shareholders (potential “cramdown”) or transfer taxes but responsible for all liabilities and subject to shareholder approval) • Alternatives to mergers – Stock for stock (By operating as subsidiary avoid need for contract and license consent as continuity of ownership maintained; avoids target shareholder approval; possible EPS dilution) – Stock for assets (Similar to cash purchase of assets) • Staged transactions (Provides greater strategic flexibility but postpones synergy realization)

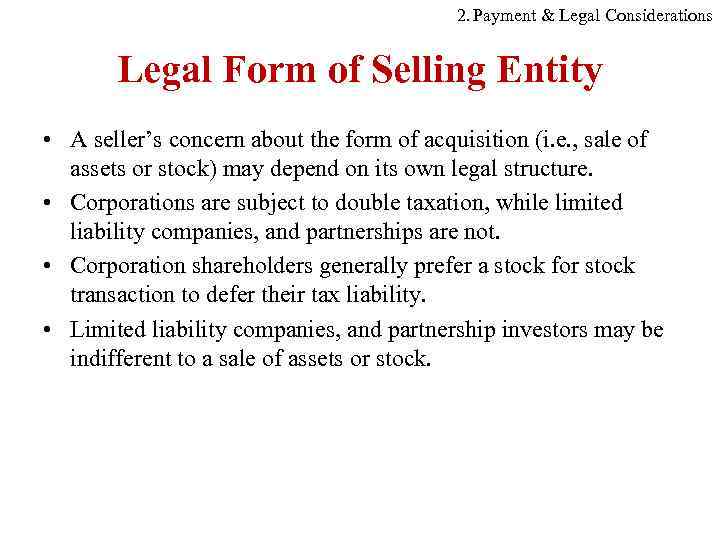

2. Payment & Legal Considerations Legal Form of Selling Entity • A seller’s concern about the form of acquisition (i. e. , sale of assets or stock) may depend on its own legal structure. • Corporations are subject to double taxation, while limited liability companies, and partnerships are not. • Corporation shareholders generally prefer a stock for stock transaction to defer their tax liability. • Limited liability companies, and partnership investors may be indifferent to a sale of assets or stock.

2. Payment & Legal Considerations Legal Form of Selling Entity • A seller’s concern about the form of acquisition (i. e. , sale of assets or stock) may depend on its own legal structure. • Corporations are subject to double taxation, while limited liability companies, and partnerships are not. • Corporation shareholders generally prefer a stock for stock transaction to defer their tax liability. • Limited liability companies, and partnership investors may be indifferent to a sale of assets or stock.

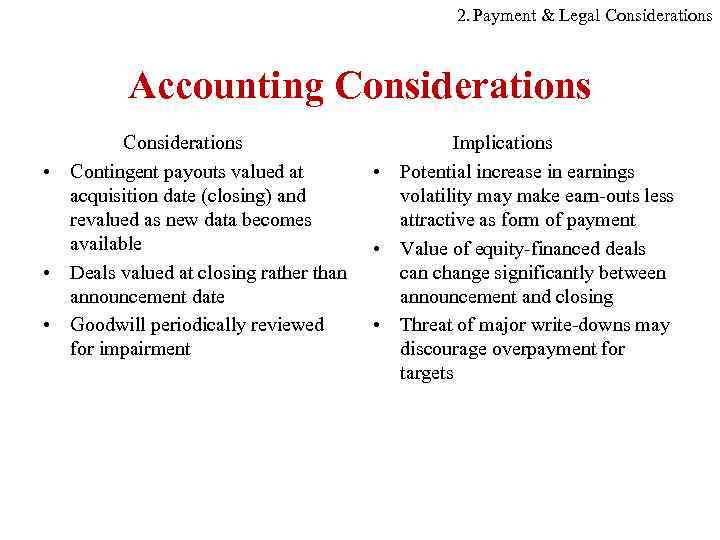

2. Payment & Legal Considerations Accounting Considerations • Contingent payouts valued at acquisition date (closing) and revalued as new data becomes available • Deals valued at closing rather than announcement date • Goodwill periodically reviewed for impairment Implications • Potential increase in earnings volatility make earn-outs less attractive as form of payment • Value of equity-financed deals can change significantly between announcement and closing • Threat of major write-downs may discourage overpayment for targets

2. Payment & Legal Considerations Accounting Considerations • Contingent payouts valued at acquisition date (closing) and revalued as new data becomes available • Deals valued at closing rather than announcement date • Goodwill periodically reviewed for impairment Implications • Potential increase in earnings volatility make earn-outs less attractive as form of payment • Value of equity-financed deals can change significantly between announcement and closing • Threat of major write-downs may discourage overpayment for targets

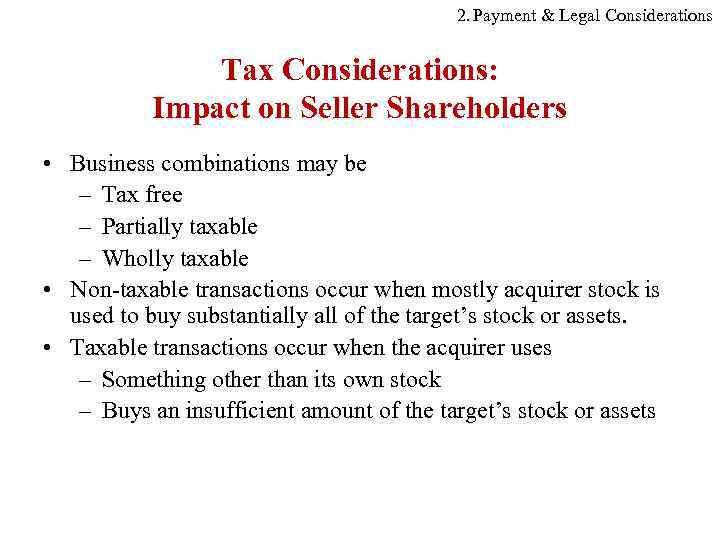

2. Payment & Legal Considerations Tax Considerations: Impact on Seller Shareholders • Business combinations may be – Tax free – Partially taxable – Wholly taxable • Non-taxable transactions occur when mostly acquirer stock is used to buy substantially all of the target’s stock or assets. • Taxable transactions occur when the acquirer uses – Something other than its own stock – Buys an insufficient amount of the target’s stock or assets

2. Payment & Legal Considerations Tax Considerations: Impact on Seller Shareholders • Business combinations may be – Tax free – Partially taxable – Wholly taxable • Non-taxable transactions occur when mostly acquirer stock is used to buy substantially all of the target’s stock or assets. • Taxable transactions occur when the acquirer uses – Something other than its own stock – Buys an insufficient amount of the target’s stock or assets

2. Payment & Legal Considerations Tax Considerations: Impact on Combined Businesses’ Shareholders • Avoiding double (i. e. , by firm and shareholder) or triple taxation (i. e. , by firm; shareholder on sale proceeds & possible liquidating dividend) • Allocating losses to owners

2. Payment & Legal Considerations Tax Considerations: Impact on Combined Businesses’ Shareholders • Avoiding double (i. e. , by firm and shareholder) or triple taxation (i. e. , by firm; shareholder on sale proceeds & possible liquidating dividend) • Allocating losses to owners

2. Payment & Legal Considerations Things to Remember… • Deal structuring addresses identifying and satisfying as many of the primary objectives of the parties involved and determining how risk will be shared. • Deal structuring consists of determining the acquisition vehicle, post-closing organization, the form of payment, the form of acquisition, legal form of selling entity, and accounting and tax considerations. • Choices made in one area of the “deal” are likely to impact other aspects of the transaction.

2. Payment & Legal Considerations Things to Remember… • Deal structuring addresses identifying and satisfying as many of the primary objectives of the parties involved and determining how risk will be shared. • Deal structuring consists of determining the acquisition vehicle, post-closing organization, the form of payment, the form of acquisition, legal form of selling entity, and accounting and tax considerations. • Choices made in one area of the “deal” are likely to impact other aspects of the transaction.

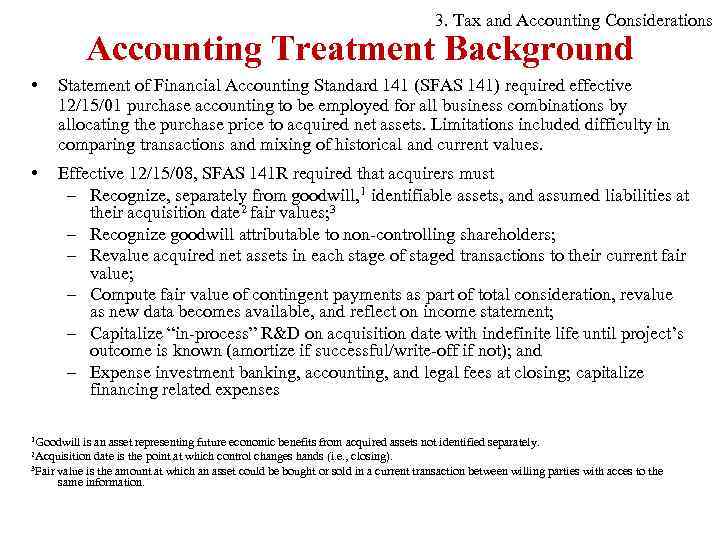

3. Tax and Accounting Considerations Accounting Treatment Background • Statement of Financial Accounting Standard 141 (SFAS 141) required effective 12/15/01 purchase accounting to be employed for all business combinations by allocating the purchase price to acquired net assets. Limitations included difficulty in comparing transactions and mixing of historical and current values. • Effective 12/15/08, SFAS 141 R required that acquirers must – Recognize, separately from goodwill, 1 identifiable assets, and assumed liabilities at their acquisition date 2 fair values; 3 – Recognize goodwill attributable to non-controlling shareholders; – Revalue acquired net assets in each stage of staged transactions to their current fair value; – Compute fair value of contingent payments as part of total consideration, revalue as new data becomes available, and reflect on income statement; – Capitalize “in-process” R&D on acquisition date with indefinite life until project’s outcome is known (amortize if successful/write-off if not); and – Expense investment banking, accounting, and legal fees at closing; capitalize financing related expenses 1 Goodwill is an asset representing future economic benefits from acquired assets not identified separately. date is the point at which control changes hands (i. e. , closing). 3 Fair value is the amount at which an asset could be bought or sold in a current transaction between willing parties with acces to the same information. 2 Acquisition

3. Tax and Accounting Considerations Accounting Treatment Background • Statement of Financial Accounting Standard 141 (SFAS 141) required effective 12/15/01 purchase accounting to be employed for all business combinations by allocating the purchase price to acquired net assets. Limitations included difficulty in comparing transactions and mixing of historical and current values. • Effective 12/15/08, SFAS 141 R required that acquirers must – Recognize, separately from goodwill, 1 identifiable assets, and assumed liabilities at their acquisition date 2 fair values; 3 – Recognize goodwill attributable to non-controlling shareholders; – Revalue acquired net assets in each stage of staged transactions to their current fair value; – Compute fair value of contingent payments as part of total consideration, revalue as new data becomes available, and reflect on income statement; – Capitalize “in-process” R&D on acquisition date with indefinite life until project’s outcome is known (amortize if successful/write-off if not); and – Expense investment banking, accounting, and legal fees at closing; capitalize financing related expenses 1 Goodwill is an asset representing future economic benefits from acquired assets not identified separately. date is the point at which control changes hands (i. e. , closing). 3 Fair value is the amount at which an asset could be bought or sold in a current transaction between willing parties with acces to the same information. 2 Acquisition

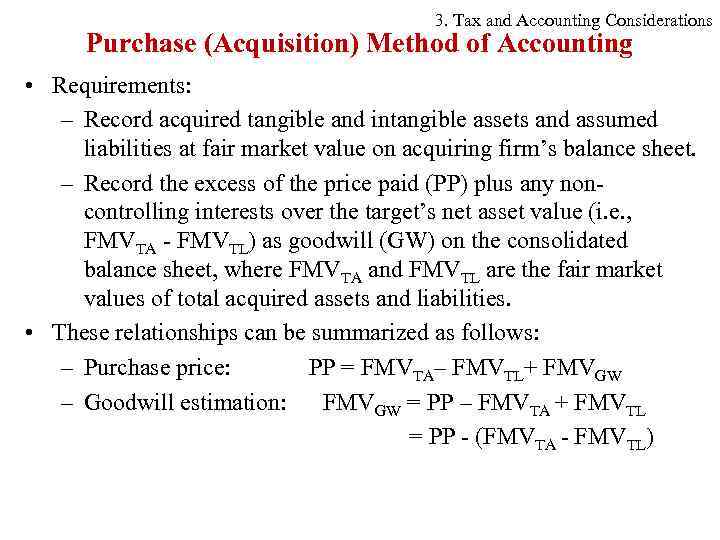

3. Tax and Accounting Considerations Purchase (Acquisition) Method of Accounting • Requirements: – Record acquired tangible and intangible assets and assumed liabilities at fair market value on acquiring firm’s balance sheet. – Record the excess of the price paid (PP) plus any noncontrolling interests over the target’s net asset value (i. e. , FMVTA - FMVTL) as goodwill (GW) on the consolidated balance sheet, where FMVTA and FMVTL are the fair market values of total acquired assets and liabilities. • These relationships can be summarized as follows: – Purchase price: PP = FMVTA– FMVTL+ FMVGW – Goodwill estimation: FMVGW = PP – FMVTA + FMVTL = PP - (FMVTA - FMVTL)

3. Tax and Accounting Considerations Purchase (Acquisition) Method of Accounting • Requirements: – Record acquired tangible and intangible assets and assumed liabilities at fair market value on acquiring firm’s balance sheet. – Record the excess of the price paid (PP) plus any noncontrolling interests over the target’s net asset value (i. e. , FMVTA - FMVTL) as goodwill (GW) on the consolidated balance sheet, where FMVTA and FMVTL are the fair market values of total acquired assets and liabilities. • These relationships can be summarized as follows: – Purchase price: PP = FMVTA– FMVTL+ FMVGW – Goodwill estimation: FMVGW = PP – FMVTA + FMVTL = PP - (FMVTA - FMVTL)

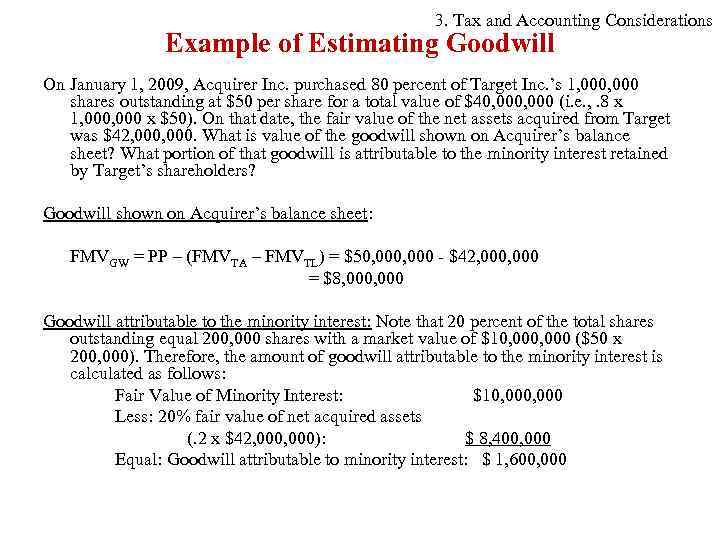

3. Tax and Accounting Considerations Example of Estimating Goodwill On January 1, 2009, Acquirer Inc. purchased 80 percent of Target Inc. ’s 1, 000 shares outstanding at $50 per share for a total value of $40, 000 (i. e. , . 8 x 1, 000 x $50). On that date, the fair value of the net assets acquired from Target was $42, 000. What is value of the goodwill shown on Acquirer’s balance sheet? What portion of that goodwill is attributable to the minority interest retained by Target’s shareholders? Goodwill shown on Acquirer’s balance sheet: FMVGW = PP – (FMVTA – FMVTL) = $50, 000 - $42, 000 = $8, 000 Goodwill attributable to the minority interest: Note that 20 percent of the total shares outstanding equal 200, 000 shares with a market value of $10, 000 ($50 x 200, 000). Therefore, the amount of goodwill attributable to the minority interest is calculated as follows: Fair Value of Minority Interest: $10, 000 Less: 20% fair value of net acquired assets (. 2 x $42, 000): $ 8, 400, 000 Equal: Goodwill attributable to minority interest: $ 1, 600, 000

3. Tax and Accounting Considerations Example of Estimating Goodwill On January 1, 2009, Acquirer Inc. purchased 80 percent of Target Inc. ’s 1, 000 shares outstanding at $50 per share for a total value of $40, 000 (i. e. , . 8 x 1, 000 x $50). On that date, the fair value of the net assets acquired from Target was $42, 000. What is value of the goodwill shown on Acquirer’s balance sheet? What portion of that goodwill is attributable to the minority interest retained by Target’s shareholders? Goodwill shown on Acquirer’s balance sheet: FMVGW = PP – (FMVTA – FMVTL) = $50, 000 - $42, 000 = $8, 000 Goodwill attributable to the minority interest: Note that 20 percent of the total shares outstanding equal 200, 000 shares with a market value of $10, 000 ($50 x 200, 000). Therefore, the amount of goodwill attributable to the minority interest is calculated as follows: Fair Value of Minority Interest: $10, 000 Less: 20% fair value of net acquired assets (. 2 x $42, 000): $ 8, 400, 000 Equal: Goodwill attributable to minority interest: $ 1, 600, 000

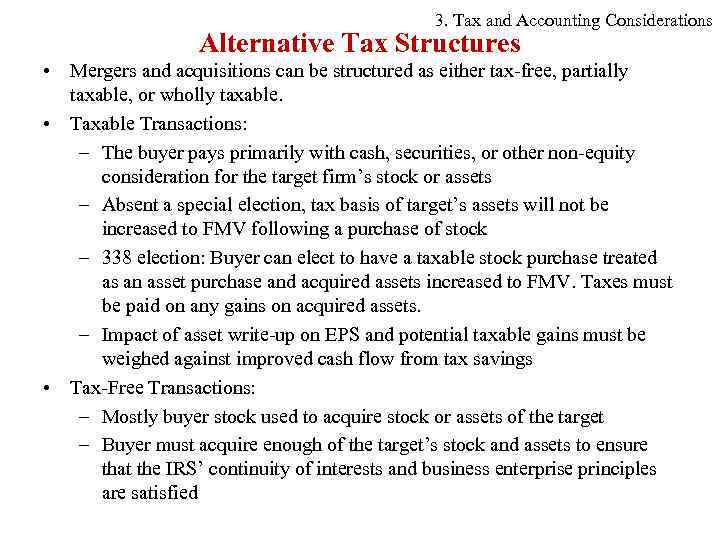

3. Tax and Accounting Considerations Alternative Tax Structures • Mergers and acquisitions can be structured as either tax-free, partially taxable, or wholly taxable. • Taxable Transactions: – The buyer pays primarily with cash, securities, or other non-equity consideration for the target firm’s stock or assets – Absent a special election, tax basis of target’s assets will not be increased to FMV following a purchase of stock – 338 election: Buyer can elect to have a taxable stock purchase treated as an asset purchase and acquired assets increased to FMV. Taxes must be paid on any gains on acquired assets. – Impact of asset write-up on EPS and potential taxable gains must be weighed against improved cash flow from tax savings • Tax-Free Transactions: – Mostly buyer stock used to acquire stock or assets of the target – Buyer must acquire enough of the target’s stock and assets to ensure that the IRS’ continuity of interests and business enterprise principles are satisfied

3. Tax and Accounting Considerations Alternative Tax Structures • Mergers and acquisitions can be structured as either tax-free, partially taxable, or wholly taxable. • Taxable Transactions: – The buyer pays primarily with cash, securities, or other non-equity consideration for the target firm’s stock or assets – Absent a special election, tax basis of target’s assets will not be increased to FMV following a purchase of stock – 338 election: Buyer can elect to have a taxable stock purchase treated as an asset purchase and acquired assets increased to FMV. Taxes must be paid on any gains on acquired assets. – Impact of asset write-up on EPS and potential taxable gains must be weighed against improved cash flow from tax savings • Tax-Free Transactions: – Mostly buyer stock used to acquire stock or assets of the target – Buyer must acquire enough of the target’s stock and assets to ensure that the IRS’ continuity of interests and business enterprise principles are satisfied

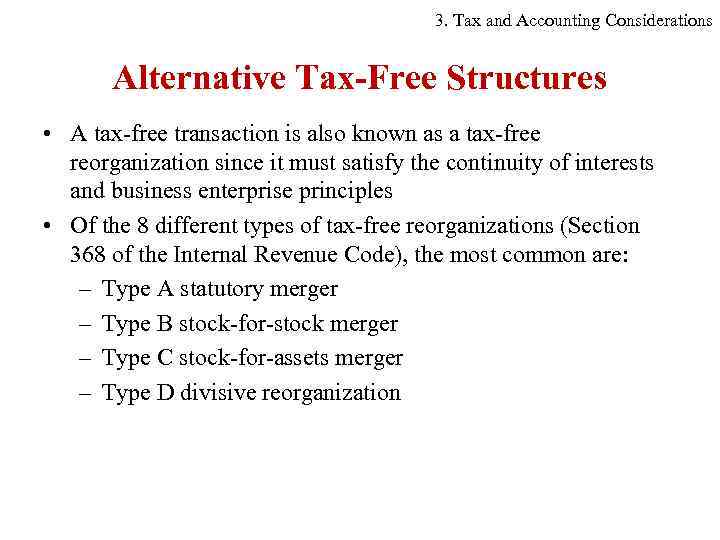

3. Tax and Accounting Considerations Alternative Tax-Free Structures • A tax-free transaction is also known as a tax-free reorganization since it must satisfy the continuity of interests and business enterprise principles • Of the 8 different types of tax-free reorganizations (Section 368 of the Internal Revenue Code), the most common are: – Type A statutory merger – Type B stock-for-stock merger – Type C stock-for-assets merger – Type D divisive reorganization

3. Tax and Accounting Considerations Alternative Tax-Free Structures • A tax-free transaction is also known as a tax-free reorganization since it must satisfy the continuity of interests and business enterprise principles • Of the 8 different types of tax-free reorganizations (Section 368 of the Internal Revenue Code), the most common are: – Type A statutory merger – Type B stock-for-stock merger – Type C stock-for-assets merger – Type D divisive reorganization

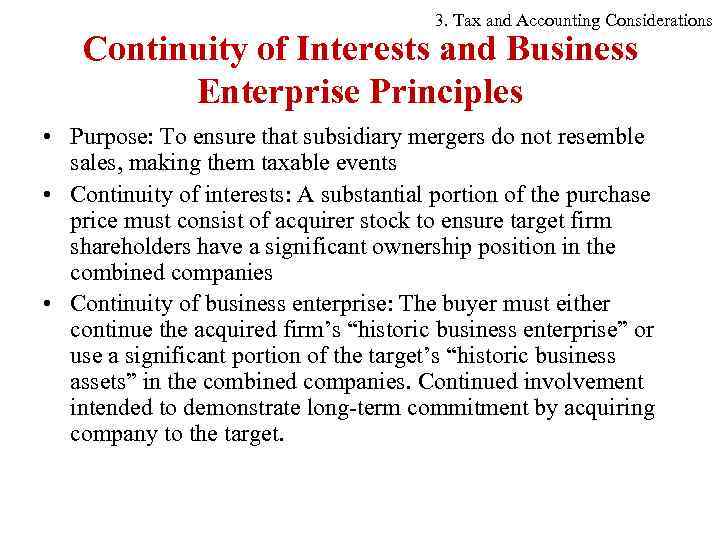

3. Tax and Accounting Considerations Continuity of Interests and Business Enterprise Principles • Purpose: To ensure that subsidiary mergers do not resemble sales, making them taxable events • Continuity of interests: A substantial portion of the purchase price must consist of acquirer stock to ensure target firm shareholders have a significant ownership position in the combined companies • Continuity of business enterprise: The buyer must either continue the acquired firm’s “historic business enterprise” or use a significant portion of the target’s “historic business assets” in the combined companies. Continued involvement intended to demonstrate long-term commitment by acquiring company to the target.

3. Tax and Accounting Considerations Continuity of Interests and Business Enterprise Principles • Purpose: To ensure that subsidiary mergers do not resemble sales, making them taxable events • Continuity of interests: A substantial portion of the purchase price must consist of acquirer stock to ensure target firm shareholders have a significant ownership position in the combined companies • Continuity of business enterprise: The buyer must either continue the acquired firm’s “historic business enterprise” or use a significant portion of the target’s “historic business assets” in the combined companies. Continued involvement intended to demonstrate long-term commitment by acquiring company to the target.

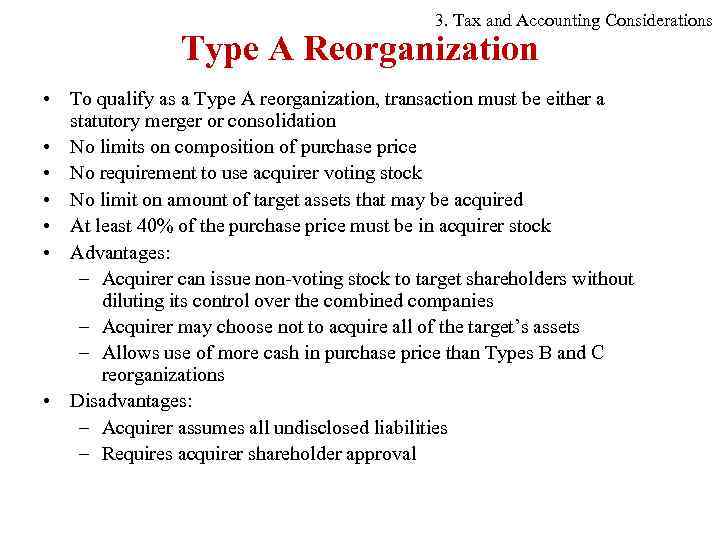

3. Tax and Accounting Considerations Type A Reorganization • To qualify as a Type A reorganization, transaction must be either a statutory merger or consolidation • No limits on composition of purchase price • No requirement to use acquirer voting stock • No limit on amount of target assets that may be acquired • At least 40% of the purchase price must be in acquirer stock • Advantages: – Acquirer can issue non-voting stock to target shareholders without diluting its control over the combined companies – Acquirer may choose not to acquire all of the target’s assets – Allows use of more cash in purchase price than Types B and C reorganizations • Disadvantages: – Acquirer assumes all undisclosed liabilities – Requires acquirer shareholder approval

3. Tax and Accounting Considerations Type A Reorganization • To qualify as a Type A reorganization, transaction must be either a statutory merger or consolidation • No limits on composition of purchase price • No requirement to use acquirer voting stock • No limit on amount of target assets that may be acquired • At least 40% of the purchase price must be in acquirer stock • Advantages: – Acquirer can issue non-voting stock to target shareholders without diluting its control over the combined companies – Acquirer may choose not to acquire all of the target’s assets – Allows use of more cash in purchase price than Types B and C reorganizations • Disadvantages: – Acquirer assumes all undisclosed liabilities – Requires acquirer shareholder approval

3. Tax and Accounting Considerations Type B Stock for Stock Reorganization • To qualify as a Type B Reorganization, acquirer must use only voting stock to purchase at least 80% of the target’s voting stock and at least 80% of the target’s non-voting stock • Cash may be used only to acquire fractional shares • Used mainly as an alternative to a merger or consolidation • Advantages: – Target may be maintained as an independent operating subsidiary or merged into the parent – Stock may be purchased over a 12 month period allowing for a phasing of the transaction • Disadvantages: – Lack of flexibility in determining composition of purchase price – Potential dilution of combined company EPS

3. Tax and Accounting Considerations Type B Stock for Stock Reorganization • To qualify as a Type B Reorganization, acquirer must use only voting stock to purchase at least 80% of the target’s voting stock and at least 80% of the target’s non-voting stock • Cash may be used only to acquire fractional shares • Used mainly as an alternative to a merger or consolidation • Advantages: – Target may be maintained as an independent operating subsidiary or merged into the parent – Stock may be purchased over a 12 month period allowing for a phasing of the transaction • Disadvantages: – Lack of flexibility in determining composition of purchase price – Potential dilution of combined company EPS

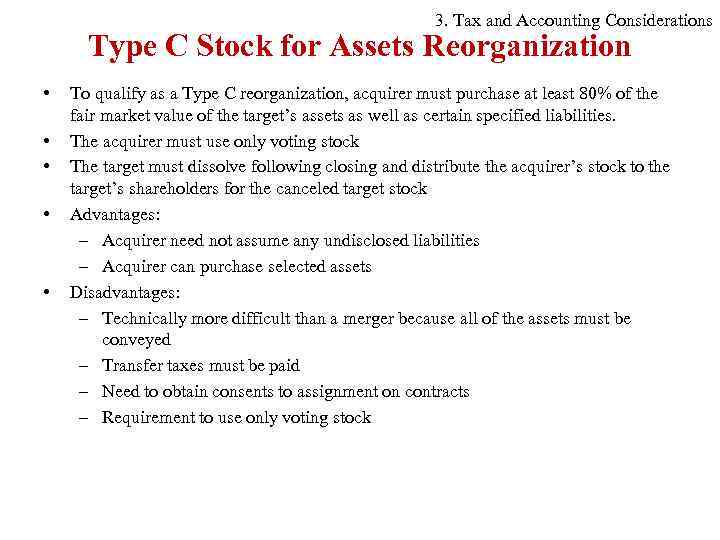

3. Tax and Accounting Considerations Type C Stock for Assets Reorganization • • • To qualify as a Type C reorganization, acquirer must purchase at least 80% of the fair market value of the target’s assets as well as certain specified liabilities. The acquirer must use only voting stock The target must dissolve following closing and distribute the acquirer’s stock to the target’s shareholders for the canceled target stock Advantages: – Acquirer need not assume any undisclosed liabilities – Acquirer can purchase selected assets Disadvantages: – Technically more difficult than a merger because all of the assets must be conveyed – Transfer taxes must be paid – Need to obtain consents to assignment on contracts – Requirement to use only voting stock

3. Tax and Accounting Considerations Type C Stock for Assets Reorganization • • • To qualify as a Type C reorganization, acquirer must purchase at least 80% of the fair market value of the target’s assets as well as certain specified liabilities. The acquirer must use only voting stock The target must dissolve following closing and distribute the acquirer’s stock to the target’s shareholders for the canceled target stock Advantages: – Acquirer need not assume any undisclosed liabilities – Acquirer can purchase selected assets Disadvantages: – Technically more difficult than a merger because all of the assets must be conveyed – Transfer taxes must be paid – Need to obtain consents to assignment on contracts – Requirement to use only voting stock

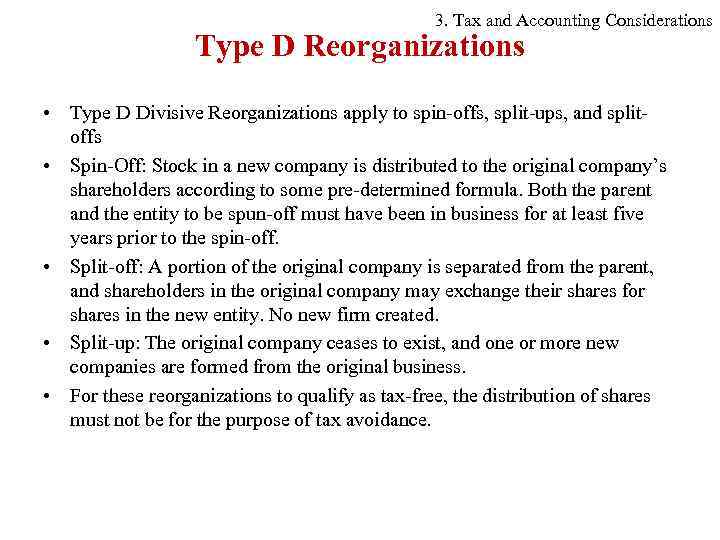

3. Tax and Accounting Considerations Type D Reorganizations • Type D Divisive Reorganizations apply to spin-offs, split-ups, and splitoffs • Spin-Off: Stock in a new company is distributed to the original company’s shareholders according to some pre-determined formula. Both the parent and the entity to be spun-off must have been in business for at least five years prior to the spin-off. • Split-off: A portion of the original company is separated from the parent, and shareholders in the original company may exchange their shares for shares in the new entity. No new firm created. • Split-up: The original company ceases to exist, and one or more new companies are formed from the original business. • For these reorganizations to qualify as tax-free, the distribution of shares must not be for the purpose of tax avoidance.

3. Tax and Accounting Considerations Type D Reorganizations • Type D Divisive Reorganizations apply to spin-offs, split-ups, and splitoffs • Spin-Off: Stock in a new company is distributed to the original company’s shareholders according to some pre-determined formula. Both the parent and the entity to be spun-off must have been in business for at least five years prior to the spin-off. • Split-off: A portion of the original company is separated from the parent, and shareholders in the original company may exchange their shares for shares in the new entity. No new firm created. • Split-up: The original company ceases to exist, and one or more new companies are formed from the original business. • For these reorganizations to qualify as tax-free, the distribution of shares must not be for the purpose of tax avoidance.

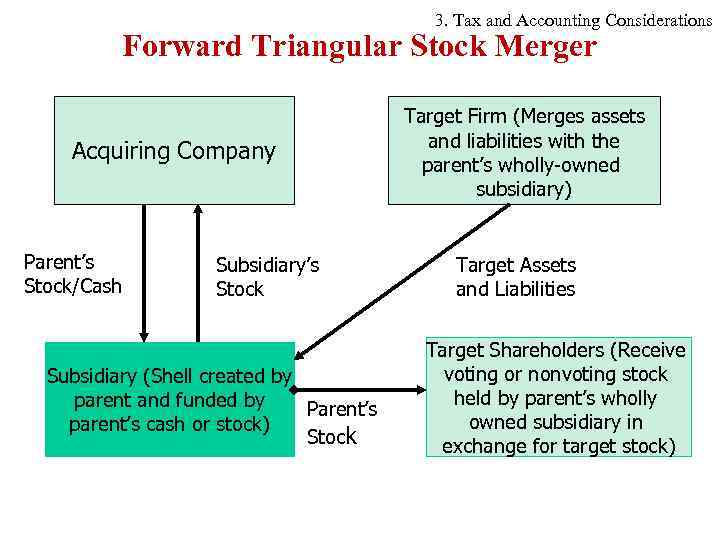

3. Tax and Accounting Considerations Forward Triangular Stock Merger Acquiring Company Parent’s Stock/Cash Subsidiary’s Stock Subsidiary (Shell created by parent and funded by Parent’s parent’s cash or stock) Stock Target Firm (Merges assets and liabilities with the parent’s wholly-owned subsidiary) Target Assets and Liabilities Target Shareholders (Receive voting or nonvoting stock held by parent’s wholly owned subsidiary in exchange for target stock)

3. Tax and Accounting Considerations Forward Triangular Stock Merger Acquiring Company Parent’s Stock/Cash Subsidiary’s Stock Subsidiary (Shell created by parent and funded by Parent’s parent’s cash or stock) Stock Target Firm (Merges assets and liabilities with the parent’s wholly-owned subsidiary) Target Assets and Liabilities Target Shareholders (Receive voting or nonvoting stock held by parent’s wholly owned subsidiary in exchange for target stock)

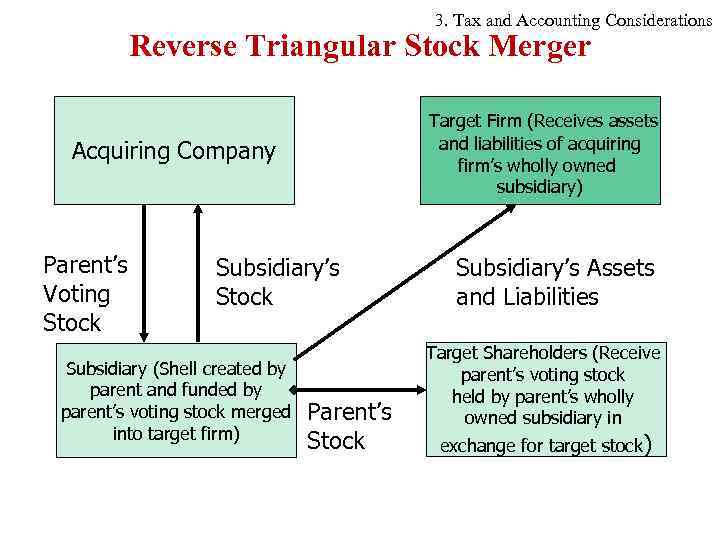

3. Tax and Accounting Considerations Reverse Triangular Stock Merger Target Firm (Receives assets and liabilities of acquiring firm’s wholly owned subsidiary) Acquiring Company Parent’s Voting Stock Subsidiary’s Stock Subsidiary (Shell created by parent and funded by parent’s voting stock merged into target firm) Parent’s Stock Subsidiary’s Assets and Liabilities Target Shareholders (Receive parent’s voting stock held by parent’s wholly owned subsidiary in exchange for target stock)

3. Tax and Accounting Considerations Reverse Triangular Stock Merger Target Firm (Receives assets and liabilities of acquiring firm’s wholly owned subsidiary) Acquiring Company Parent’s Voting Stock Subsidiary’s Stock Subsidiary (Shell created by parent and funded by parent’s voting stock merged into target firm) Parent’s Stock Subsidiary’s Assets and Liabilities Target Shareholders (Receive parent’s voting stock held by parent’s wholly owned subsidiary in exchange for target stock)

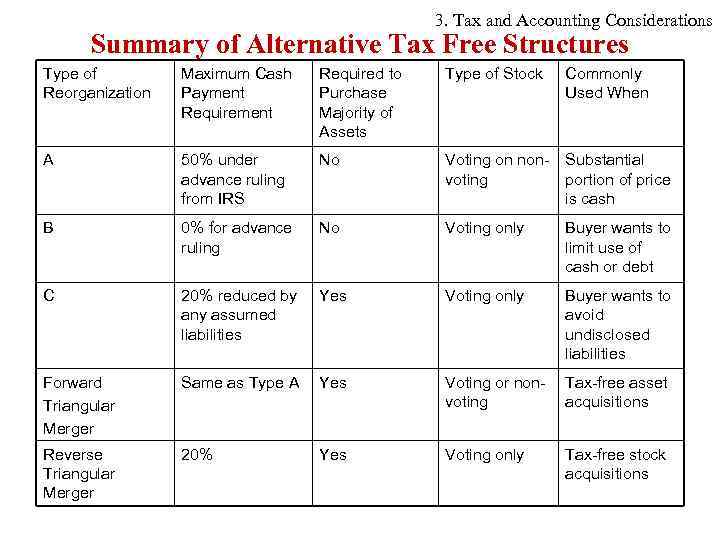

3. Tax and Accounting Considerations Summary of Alternative Tax Free Structures Type of Reorganization Maximum Cash Payment Required to Purchase Majority of Assets Type of Stock Commonly Used When A 50% under advance ruling from IRS No Voting on nonvoting Substantial portion of price is cash B 0% for advance ruling No Voting only Buyer wants to limit use of cash or debt C 20% reduced by any assumed liabilities Yes Voting only Buyer wants to avoid undisclosed liabilities Forward Triangular Merger Same as Type A Yes Voting or nonvoting Tax-free asset acquisitions Reverse Triangular Merger 20% Yes Voting only Tax-free stock acquisitions

3. Tax and Accounting Considerations Summary of Alternative Tax Free Structures Type of Reorganization Maximum Cash Payment Required to Purchase Majority of Assets Type of Stock Commonly Used When A 50% under advance ruling from IRS No Voting on nonvoting Substantial portion of price is cash B 0% for advance ruling No Voting only Buyer wants to limit use of cash or debt C 20% reduced by any assumed liabilities Yes Voting only Buyer wants to avoid undisclosed liabilities Forward Triangular Merger Same as Type A Yes Voting or nonvoting Tax-free asset acquisitions Reverse Triangular Merger 20% Yes Voting only Tax-free stock acquisitions

3. Tax and Accounting Considerations Implications of Tax Considerations for Deal Structuring • If a transaction is taxable, it is likely that the target firm will demand an increase in purchase price to compensate shareholders for their tax liability. • The increase in the purchase price may impact form of payment since buyer may maintain PV of transaction’s total cost by deferring some portion of purchase price. • If buyer wants to avoid EPS dilution by issuing stock, the buyer will desire to structure the transaction as taxable by buying stock or assets for cash, notes, or some other form of payment • If buyer concerned about preserving cash and target’s favorable tax attributes, buyer may want to structure the transaction as non-taxable by acquiring stock or assets for stock. – Buyer may be willing to pay a somewhat higher price if the target has net operating loss and tax credits carryovers.

3. Tax and Accounting Considerations Implications of Tax Considerations for Deal Structuring • If a transaction is taxable, it is likely that the target firm will demand an increase in purchase price to compensate shareholders for their tax liability. • The increase in the purchase price may impact form of payment since buyer may maintain PV of transaction’s total cost by deferring some portion of purchase price. • If buyer wants to avoid EPS dilution by issuing stock, the buyer will desire to structure the transaction as taxable by buying stock or assets for cash, notes, or some other form of payment • If buyer concerned about preserving cash and target’s favorable tax attributes, buyer may want to structure the transaction as non-taxable by acquiring stock or assets for stock. – Buyer may be willing to pay a somewhat higher price if the target has net operating loss and tax credits carryovers.