0071bc6032dd7b0f0c1ef46a79e35d82.ppt

- Количество слайдов: 67

TOPIC 4 PRODUCTION AND COSTS Slide: 1

TOPIC 4 PRODUCTION AND COSTS Slide: 1

The Firm and Its Economic Problem § Firm § An institution that hires productive resources and that organises those resources to produce and sell goods and services § A firm’s goal is to maximize profit subject to a budget constraint Slide: 2

The Firm and Its Economic Problem § Firm § An institution that hires productive resources and that organises those resources to produce and sell goods and services § A firm’s goal is to maximize profit subject to a budget constraint Slide: 2

Opportunity Cost § Firms incur opportunity costs when they produce goods. § Opportunity cost of producing — the best alternative investment opportunity that the firm foregoes to produce a good or service § Look at it as the opportunity costs of the factors of production the firm employs (labor, capital, entrepreneurs) Slide: 3

Opportunity Cost § Firms incur opportunity costs when they produce goods. § Opportunity cost of producing — the best alternative investment opportunity that the firm foregoes to produce a good or service § Look at it as the opportunity costs of the factors of production the firm employs (labor, capital, entrepreneurs) Slide: 3

Opportunity Cost § Components of a firm’s opportunity cost § Explicit costs (money costs) § The amount paid for factors of production § Implicit costs (non-money costs) § The value of foregone opportunities. § The firm incur implicit costs when it: § uses its own capital § uses its owner’s time or financial resources Slide: 4

Opportunity Cost § Components of a firm’s opportunity cost § Explicit costs (money costs) § The amount paid for factors of production § Implicit costs (non-money costs) § The value of foregone opportunities. § The firm incur implicit costs when it: § uses its own capital § uses its owner’s time or financial resources Slide: 4

Opportunity Cost § Cost of Capital § Economic depreciation is the change in the market price of a durable input over a given time period (not the same as accounting depreciation). § Interest is the funds used to buy capital that could have been used for some other purpose. § Implicit rental rate is the income that the firm forgoes by using the assets itself and not renting them to another firm — the same as economic depreciation and interest costs. Slide: 5

Opportunity Cost § Cost of Capital § Economic depreciation is the change in the market price of a durable input over a given time period (not the same as accounting depreciation). § Interest is the funds used to buy capital that could have been used for some other purpose. § Implicit rental rate is the income that the firm forgoes by using the assets itself and not renting them to another firm — the same as economic depreciation and interest costs. Slide: 5

Opportunity Cost § Cost of Owner’s Resources § The income that the owner could have earned in the best alternative job. § Normal profit is the expected return for supplying entrepreneurial ability. Slide: 6

Opportunity Cost § Cost of Owner’s Resources § The income that the owner could have earned in the best alternative job. § Normal profit is the expected return for supplying entrepreneurial ability. Slide: 6

Economic Profit § A firm’s total revenue minus its opportunity costs. § Not the same as accounting profit. Slide: 7

Economic Profit § A firm’s total revenue minus its opportunity costs. § Not the same as accounting profit. Slide: 7

The Firm and Its Economic Problem The Firm’s Constraints § Three features of its environment limit the maximum profit a firm can make. They are: § Technology § Information § Market Slide: 8

The Firm and Its Economic Problem The Firm’s Constraints § Three features of its environment limit the maximum profit a firm can make. They are: § Technology § Information § Market Slide: 8

The Firm and Its Economic Problem § Technology Constraints § A firm’s resources and the available technology limit its production. § Information Constraints § The cost of coping with limited information itself limits profit. § Market Constraints § Willingness to pay of its customers and by the prices and marketing efforts of rival firms. § Willingness of people to work for and invest in the firm. Slide: 9

The Firm and Its Economic Problem § Technology Constraints § A firm’s resources and the available technology limit its production. § Information Constraints § The cost of coping with limited information itself limits profit. § Market Constraints § Willingness to pay of its customers and by the prices and marketing efforts of rival firms. § Willingness of people to work for and invest in the firm. Slide: 9

Technology and Economic Efficiency § Technological efficiency § Occurs when it is not possible to increase output without increasing inputs § Economic efficiency § Occurs when the cost of producing a given output is as low as possible Slide: 10

Technology and Economic Efficiency § Technological efficiency § Occurs when it is not possible to increase output without increasing inputs § Economic efficiency § Occurs when the cost of producing a given output is as low as possible Slide: 10

Technological and Economic Efficiency § While technological efficiency depends only on what is feasible, economic efficiency depends on the relative cost of resources. § The economically efficient method is the one that uses the smallest amount of a more expensive resource and a larger amount of a less expensive resource. Slide: 11

Technological and Economic Efficiency § While technological efficiency depends only on what is feasible, economic efficiency depends on the relative cost of resources. § The economically efficient method is the one that uses the smallest amount of a more expensive resource and a larger amount of a less expensive resource. Slide: 11

Information and Organisation § Organization of resources within the firm has a direct relation to the ability of the firm to achieve efficient outcomes § Command systems are based upon a managerial hierarchy. § Incentive systems are market-like mechanisms that firms create within their organisations. § These systems are designed to strengthen incentives and raise productivity. Slide: 12

Information and Organisation § Organization of resources within the firm has a direct relation to the ability of the firm to achieve efficient outcomes § Command systems are based upon a managerial hierarchy. § Incentive systems are market-like mechanisms that firms create within their organisations. § These systems are designed to strengthen incentives and raise productivity. Slide: 12

The Principal-Agent Problem § Principal-agent problem § The problem of devising compensation rules that induce an agent to act in the best interest of the principal § Three methods of attenuating the principal-agent problem are: § Ownership § Incentive pay § Well-specified contracts Slide: 13

The Principal-Agent Problem § Principal-agent problem § The problem of devising compensation rules that induce an agent to act in the best interest of the principal § Three methods of attenuating the principal-agent problem are: § Ownership § Incentive pay § Well-specified contracts Slide: 13

The Principal-Agent Problem Ownership By assigning a manager or worker ownership of a business, it is sometimes possible to induce a job performance that increases the firm’s profits. Example: Microsoft Slide: 14

The Principal-Agent Problem Ownership By assigning a manager or worker ownership of a business, it is sometimes possible to induce a job performance that increases the firm’s profits. Example: Microsoft Slide: 14

The Principal-Agent Problem Incentive pay Pay related to performance - are very common. Based on a variety of performance criteria such as profits or production or sales targets. Slide: 15

The Principal-Agent Problem Incentive pay Pay related to performance - are very common. Based on a variety of performance criteria such as profits or production or sales targets. Slide: 15

The Principal-Agent Problem Well-specified contracts Long-term contracts tie the long-term fortunes of managers and workers (agents) to the success of the principle(s) - the owner(s) of the firm, when the contract includes ownership features. Short-term contracts can work as well when the contract is specified on the basis of the completion of specific tasks within specific time-periods Note however, that specific contracts are costly (information, negotiation. Etc) to draw and are often too restrictive. Slide: 16

The Principal-Agent Problem Well-specified contracts Long-term contracts tie the long-term fortunes of managers and workers (agents) to the success of the principle(s) - the owner(s) of the firm, when the contract includes ownership features. Short-term contracts can work as well when the contract is specified on the basis of the completion of specific tasks within specific time-periods Note however, that specific contracts are costly (information, negotiation. Etc) to draw and are often too restrictive. Slide: 16

The Types of Business Organisation § Sole Proprietorship § a firm with a single owner § Partnership § a firm with two or more owners who have unlimited liability § Company § a firm owned by one or more limited liability stockholders Slide: 17

The Types of Business Organisation § Sole Proprietorship § a firm with a single owner § Partnership § a firm with two or more owners who have unlimited liability § Company § a firm owned by one or more limited liability stockholders Slide: 17

The Pros and Cons of the Different Types of Firms § Proprietorship § Pros § Easy to set up § Simple decision making Slide: 18

The Pros and Cons of the Different Types of Firms § Proprietorship § Pros § Easy to set up § Simple decision making Slide: 18

The Pros and Cons of the Different Types of Firms § Proprietorship § Cons § Capital is expensive § Bad decision not checked by need for consensus § Owners entire wealth at risk § Ability to grow is restricted by availability to capital § Firm dies with owner Slide: 19

The Pros and Cons of the Different Types of Firms § Proprietorship § Cons § Capital is expensive § Bad decision not checked by need for consensus § Owners entire wealth at risk § Ability to grow is restricted by availability to capital § Firm dies with owner Slide: 19

The Pros and Cons of the Different Types of Firms § Partnership § Pros § Easy to set up § Diversified decision making § Can survive withdrawal of partner Slide: 20

The Pros and Cons of the Different Types of Firms § Partnership § Pros § Easy to set up § Diversified decision making § Can survive withdrawal of partner Slide: 20

The Pros and Cons of the Different Types of Firms § Partnership § Cons § Achieving consensus may be slow and expensive § Owners entire wealth at risk § Withdrawal of partner may create capital shortage § Capital is expensive Slide: 21

The Pros and Cons of the Different Types of Firms § Partnership § Cons § Achieving consensus may be slow and expensive § Owners entire wealth at risk § Withdrawal of partner may create capital shortage § Capital is expensive Slide: 21

The Pros and Cons of the Different Types of Firms § Company § Pros § Owners have limited liability § Large-scale, low-cost capital available § Professional management not restricted by ability of owners § Perpetual life § Long-term labour contracts cut labour costs Slide: 22

The Pros and Cons of the Different Types of Firms § Company § Pros § Owners have limited liability § Large-scale, low-cost capital available § Professional management not restricted by ability of owners § Perpetual life § Long-term labour contracts cut labour costs Slide: 22

The Pros and Cons of the Different Types of Firms § Company § Cons § Complex management structure can make decision-making slow and expensive § Divorce of ownership and control highlights principal-agent problem Slide: 23

The Pros and Cons of the Different Types of Firms § Company § Cons § Complex management structure can make decision-making slow and expensive § Divorce of ownership and control highlights principal-agent problem Slide: 23

Markets and the Competitive Environment Economists identify four market types: § Perfect competition § Monopolistic competition § Oligopoly § Monopoly Slide: 24

Markets and the Competitive Environment Economists identify four market types: § Perfect competition § Monopolistic competition § Oligopoly § Monopoly Slide: 24

Markets and the Competitive Environment Perfect competition § Arises when there are many firms each selling an identical product, many buyers, and no restrictions on the entry of new firms into the industry. Slide: 25

Markets and the Competitive Environment Perfect competition § Arises when there are many firms each selling an identical product, many buyers, and no restrictions on the entry of new firms into the industry. Slide: 25

Markets and the Competitive Environment Monopolistic competition § A market structure in which a large number of firms compete by making similar buy slightly different products. § Product differentiation gives a monopolistically competitive firm an element of monopoly power. Slide: 26

Markets and the Competitive Environment Monopolistic competition § A market structure in which a large number of firms compete by making similar buy slightly different products. § Product differentiation gives a monopolistically competitive firm an element of monopoly power. Slide: 26

Markets and the Competitive Environment Oligopoly § A market structure in which a small number of firms compete. Slide: 27

Markets and the Competitive Environment Oligopoly § A market structure in which a small number of firms compete. Slide: 27

Markets and the Competitive Environment Monopoly § An industry that produces a good or service for which no close substitutes exists and in which there is one supplier that is protected from competition by a barrier preventing the entry of new firms. Slide: 28

Markets and the Competitive Environment Monopoly § An industry that produces a good or service for which no close substitutes exists and in which there is one supplier that is protected from competition by a barrier preventing the entry of new firms. Slide: 28

Markets and the Competitive Environment § Concentration is an indicator variable for market power, but it is not a sufficient indicator § The Concentration Ratio § Measures the percentage of the value of sales accounted for by the four largest firms § Range from 0 percent to 100 percent § Three-firm concentration ratio: § measures the percentage of the value of sales accounted for by the three largest firms in a market Slide: 29

Markets and the Competitive Environment § Concentration is an indicator variable for market power, but it is not a sufficient indicator § The Concentration Ratio § Measures the percentage of the value of sales accounted for by the four largest firms § Range from 0 percent to 100 percent § Three-firm concentration ratio: § measures the percentage of the value of sales accounted for by the three largest firms in a market Slide: 29

Markets and the Competitive Environment Three problems in the calculation and interpretation of concentration ratios § Market definition § Barriers to entry § Structure versus behaviour Slide: 30

Markets and the Competitive Environment Three problems in the calculation and interpretation of concentration ratios § Market definition § Barriers to entry § Structure versus behaviour Slide: 30

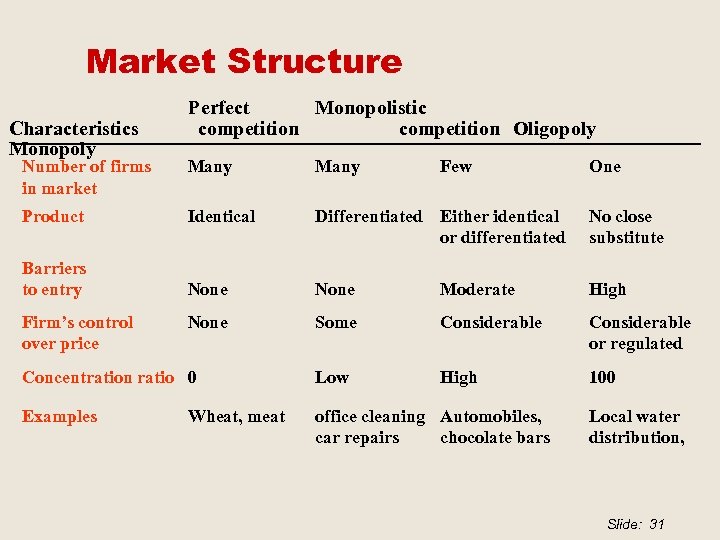

Market Structure Characteristics Monopoly Perfect Monopolistic competition Oligopoly Number of firms in market Many Product Identical Differentiated Either identical or differentiated No close substitute Barriers to entry None Moderate High None Some Considerable or regulated Concentration ratio 0 Low High 100 Examples office cleaning Automobiles, car repairs chocolate bars Firm’s control over price Wheat, meat Few One Local water distribution, Slide: 31

Market Structure Characteristics Monopoly Perfect Monopolistic competition Oligopoly Number of firms in market Many Product Identical Differentiated Either identical or differentiated No close substitute Barriers to entry None Moderate High None Some Considerable or regulated Concentration ratio 0 Low High 100 Examples office cleaning Automobiles, car repairs chocolate bars Firm’s control over price Wheat, meat Few One Local water distribution, Slide: 31

Firms and Markets § What determines whether markets or firms coordinate production? § Answer: § Whichever is the economically efficient method. Slide: 32

Firms and Markets § What determines whether markets or firms coordinate production? § Answer: § Whichever is the economically efficient method. Slide: 32

Why Firms? § Why firms are sometimes more efficient coordinators of economic activity? § Lower transactions costs § Economies of scale § Economies of scope § Economies of team production Slide: 33

Why Firms? § Why firms are sometimes more efficient coordinators of economic activity? § Lower transactions costs § Economies of scale § Economies of scope § Economies of team production Slide: 33

Why Firms? § Transactions costs § The costs arising from finding someone with whom to do business, of reaching an agreement about the price and other aspects of the exchange, and of ensuring that the terms of the agreement are fulfilled. § Coase and The Nature of the Firm Slide: 34

Why Firms? § Transactions costs § The costs arising from finding someone with whom to do business, of reaching an agreement about the price and other aspects of the exchange, and of ensuring that the terms of the agreement are fulfilled. § Coase and The Nature of the Firm Slide: 34

Why Firms? § Economies of scale exist when the cost of producing a unit of a good falls as output increases. § Economies of scope exist when a firm uses specialised resources to produce a range of goods and services. § Team production § A production process in which the individuals in a group specialise in mutually supportive tasks. Slide: 35

Why Firms? § Economies of scale exist when the cost of producing a unit of a good falls as output increases. § Economies of scope exist when a firm uses specialised resources to produce a range of goods and services. § Team production § A production process in which the individuals in a group specialise in mutually supportive tasks. Slide: 35

The Firm’s Time Horizon § The Short Run and the Long Run § The short run is a period of time in which the quantity of at least one input is fixed and the quantities of the other inputs can be varied. § variable inputs and fixed inputs § The long run is a period of time in which the quantities of all inputs can be varied. The firm’s size can be selected Slide: 36

The Firm’s Time Horizon § The Short Run and the Long Run § The short run is a period of time in which the quantity of at least one input is fixed and the quantities of the other inputs can be varied. § variable inputs and fixed inputs § The long run is a period of time in which the quantities of all inputs can be varied. The firm’s size can be selected Slide: 36

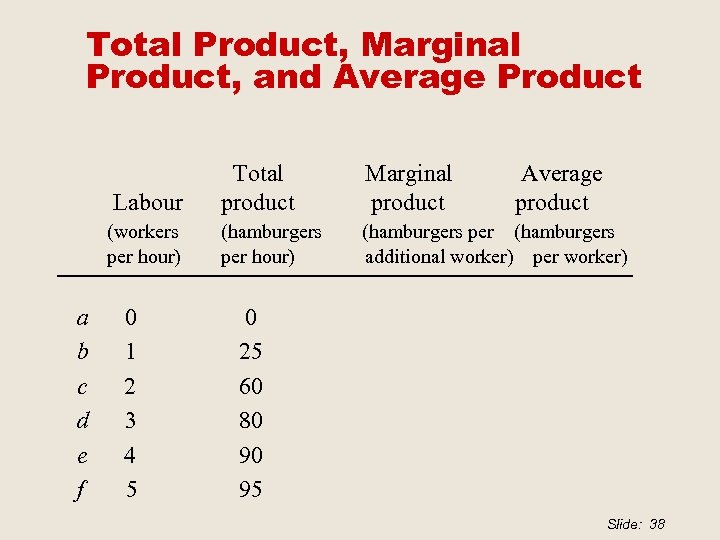

Short-Run Technology Constraint § Increasing output in the short-run § firms must increase the quantity of Labour § Total product is the total output produced. § Marginal product is the increase in total product that result from a one-unit increase in an input. § Average product is the total product divided by the quantity of inputs. Slide: 37

Short-Run Technology Constraint § Increasing output in the short-run § firms must increase the quantity of Labour § Total product is the total output produced. § Marginal product is the increase in total product that result from a one-unit increase in an input. § Average product is the total product divided by the quantity of inputs. Slide: 37

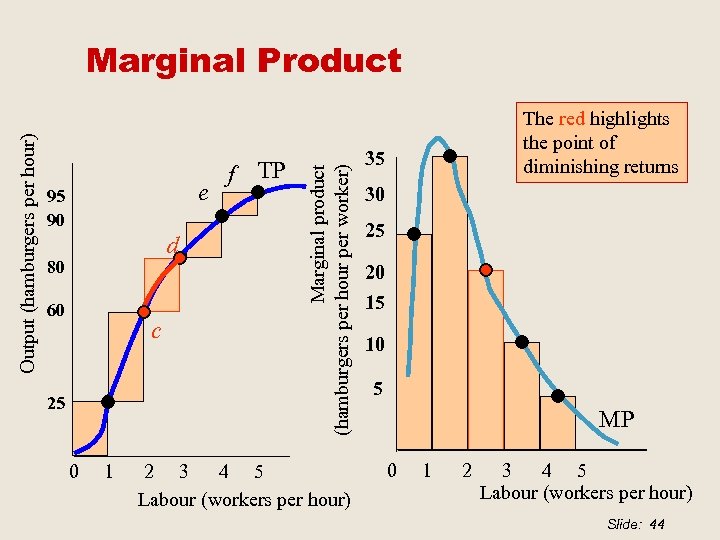

Total Product, Marginal Product, and Average Product Labour (workers per hour) a b c d e f 0 1 2 3 4 5 Total product Marginal product Average product (hamburgers per hour) (hamburgers per (hamburgers additional worker) per worker) 0 25 60 80 90 95 Slide: 38

Total Product, Marginal Product, and Average Product Labour (workers per hour) a b c d e f 0 1 2 3 4 5 Total product Marginal product Average product (hamburgers per hour) (hamburgers per (hamburgers additional worker) per worker) 0 25 60 80 90 95 Slide: 38

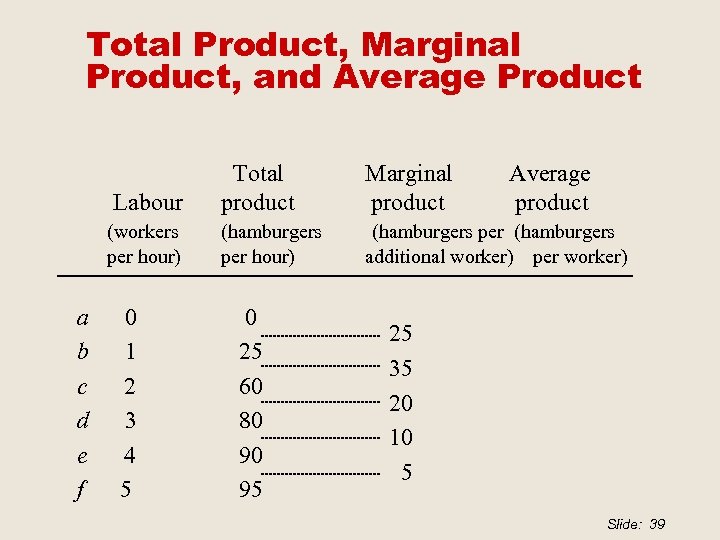

Total Product, Marginal Product, and Average Product Labour (workers per hour) a b c d e f 0 1 2 3 4 5 Total product Marginal product (hamburgers per hour) (hamburgers per (hamburgers additional worker) per worker) 0 25 60 80 90 95 Average product 25 35 20 10 5 Slide: 39

Total Product, Marginal Product, and Average Product Labour (workers per hour) a b c d e f 0 1 2 3 4 5 Total product Marginal product (hamburgers per hour) (hamburgers per (hamburgers additional worker) per worker) 0 25 60 80 90 95 Average product 25 35 20 10 5 Slide: 39

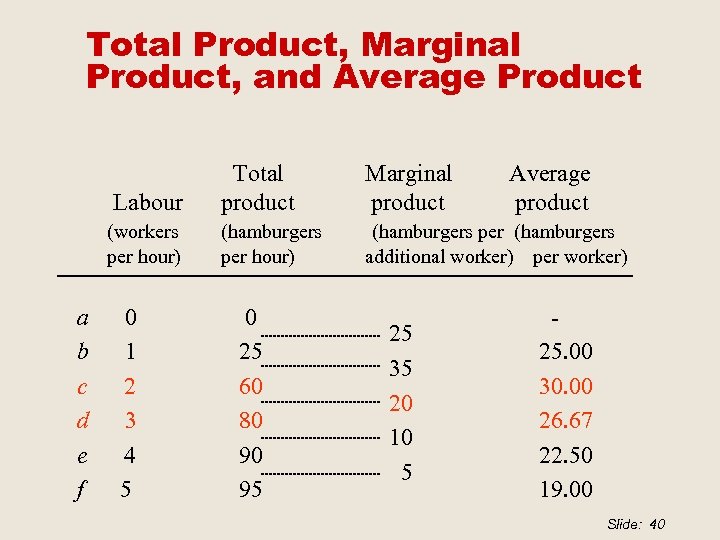

Total Product, Marginal Product, and Average Product Labour (workers per hour) a b c d e f 0 1 2 3 4 5 Total product Marginal product (hamburgers per hour) (hamburgers per (hamburgers additional worker) per worker) 0 25 60 80 90 95 25 35 20 10 5 Average product 25. 00 30. 00 26. 67 22. 50 19. 00 Slide: 40

Total Product, Marginal Product, and Average Product Labour (workers per hour) a b c d e f 0 1 2 3 4 5 Total product Marginal product (hamburgers per hour) (hamburgers per (hamburgers additional worker) per worker) 0 25 60 80 90 95 25 35 20 10 5 Average product 25. 00 30. 00 26. 67 22. 50 19. 00 Slide: 40

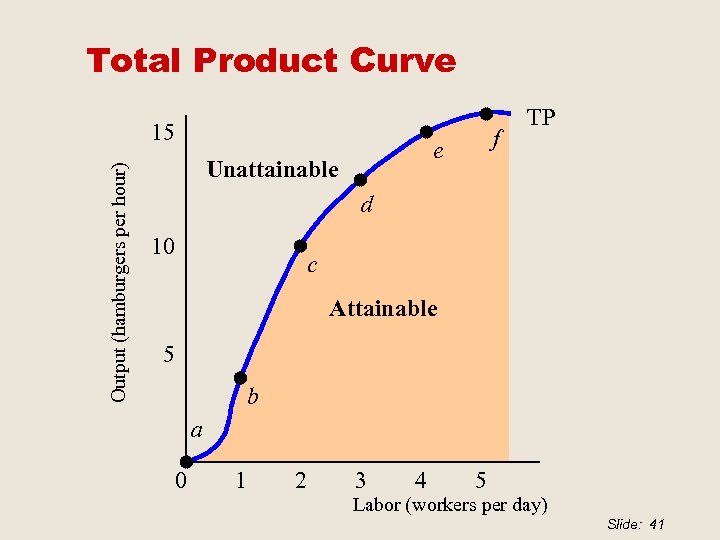

Total Product Curve Output (hamburgers per hour) 15 f e Unattainable TP d 10 c Attainable 5 b a 0 1 2 3 4 5 Labor (workers per day) Slide: 41

Total Product Curve Output (hamburgers per hour) 15 f e Unattainable TP d 10 c Attainable 5 b a 0 1 2 3 4 5 Labor (workers per day) Slide: 41

Marginal Product Curve § Marginal product is also measured by the slope of the total product curve. § Increasing marginal returns occur when the marginal product of an additional worker exceeds the marginal product of the previous worker. Slide: 42

Marginal Product Curve § Marginal product is also measured by the slope of the total product curve. § Increasing marginal returns occur when the marginal product of an additional worker exceeds the marginal product of the previous worker. Slide: 42

Marginal Product Curve § Diminishing marginal returns § Occur when the marginal product of an additional worker is less than the marginal product of the previous worker § Law of diminishing returns § As a firm uses more of a variable input, with a given quantity of fixed inputs, the marginal product of the variable input eventually diminishes Slide: 43

Marginal Product Curve § Diminishing marginal returns § Occur when the marginal product of an additional worker is less than the marginal product of the previous worker § Law of diminishing returns § As a firm uses more of a variable input, with a given quantity of fixed inputs, the marginal product of the variable input eventually diminishes Slide: 43

e 95 90 d 80 60 c 25 0 1 f TP Marginal product (hamburgers per hour per worker) Output (hamburgers per hour) Marginal Product 2 3 4 5 Labour (workers per hour) The red highlights the point of diminishing returns 35 30 25 20 15 10 5 MP 0 1 2 3 4 5 Labour (workers per hour) Slide: 44

e 95 90 d 80 60 c 25 0 1 f TP Marginal product (hamburgers per hour per worker) Output (hamburgers per hour) Marginal Product 2 3 4 5 Labour (workers per hour) The red highlights the point of diminishing returns 35 30 25 20 15 10 5 MP 0 1 2 3 4 5 Labour (workers per hour) Slide: 44

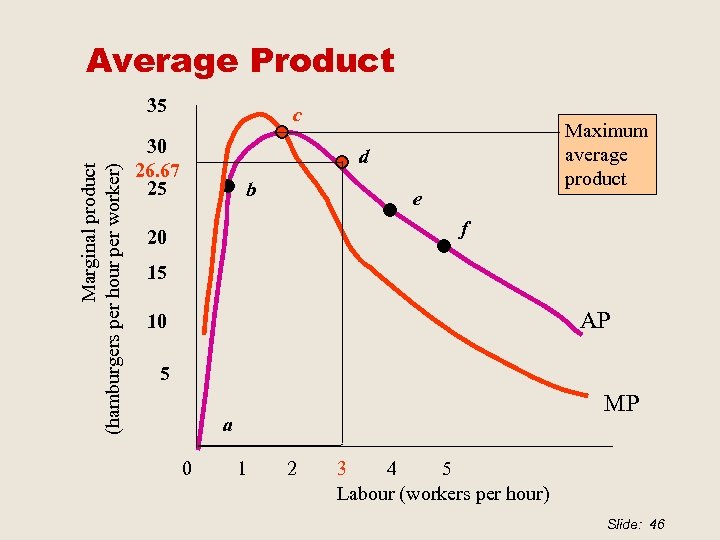

Average Product Curve What does the average product curve look like? Remember that Marginals drag Averages! Marginal grades in this course will influence where your average grade for the course is Slide: 45

Average Product Curve What does the average product curve look like? Remember that Marginals drag Averages! Marginal grades in this course will influence where your average grade for the course is Slide: 45

Average Product Marginal product (hamburgers per hour per worker) 35 c 30 26. 67 25 Maximum average product d b e f 20 15 AP 10 5 MP a 0 1 2 3 4 5 Labour (workers per hour) Slide: 46

Average Product Marginal product (hamburgers per hour per worker) 35 c 30 26. 67 25 Maximum average product d b e f 20 15 AP 10 5 MP a 0 1 2 3 4 5 Labour (workers per hour) Slide: 46

Short-Run Cost § Total cost (TC) is the cost of all productive resources used by a firm. § Total fixed cost (TFC) is the cost of all the firm’s fixed inputs. § Total variable cost (TVC) is the cost of all the firm’s variable inputs. Slide: 47

Short-Run Cost § Total cost (TC) is the cost of all productive resources used by a firm. § Total fixed cost (TFC) is the cost of all the firm’s fixed inputs. § Total variable cost (TVC) is the cost of all the firm’s variable inputs. Slide: 47

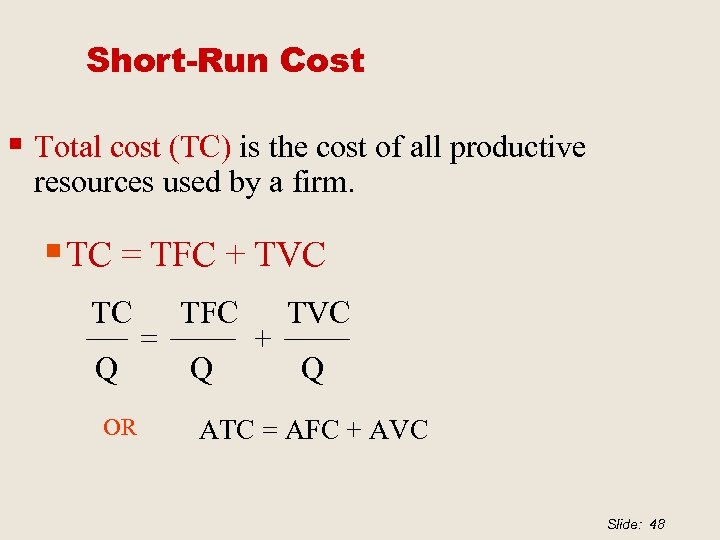

Short-Run Cost § Total cost (TC) is the cost of all productive resources used by a firm. § TC = TFC + TVC TC Q OR = TFC Q + TVC Q ATC = AFC + AVC Slide: 48

Short-Run Cost § Total cost (TC) is the cost of all productive resources used by a firm. § TC = TFC + TVC TC Q OR = TFC Q + TVC Q ATC = AFC + AVC Slide: 48

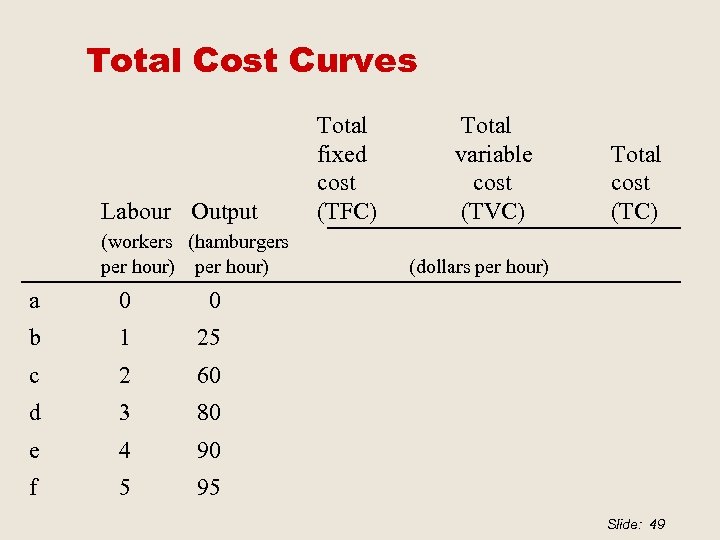

Total Cost Curves Labour Output (workers (hamburgers per hour) a 0 1 2 3 80 e 4 90 f 5 (dollars per hour) 60 d Total cost (TC) 25 c Total variable cost (TVC) 0 b Total fixed cost (TFC) 95 Slide: 49

Total Cost Curves Labour Output (workers (hamburgers per hour) a 0 1 2 3 80 e 4 90 f 5 (dollars per hour) 60 d Total cost (TC) 25 c Total variable cost (TVC) 0 b Total fixed cost (TFC) 95 Slide: 49

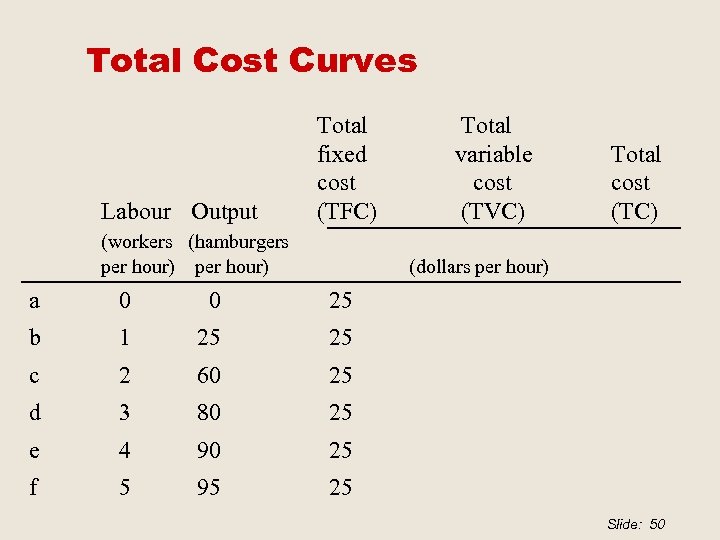

Total Cost Curves Labour Output Total fixed cost (TFC) (workers (hamburgers per hour) Total variable cost (TVC) Total cost (TC) (dollars per hour) a 0 0 25 b 1 25 25 c 2 60 25 d 3 80 25 e 4 90 25 f 5 95 25 Slide: 50

Total Cost Curves Labour Output Total fixed cost (TFC) (workers (hamburgers per hour) Total variable cost (TVC) Total cost (TC) (dollars per hour) a 0 0 25 b 1 25 25 c 2 60 25 d 3 80 25 e 4 90 25 f 5 95 25 Slide: 50

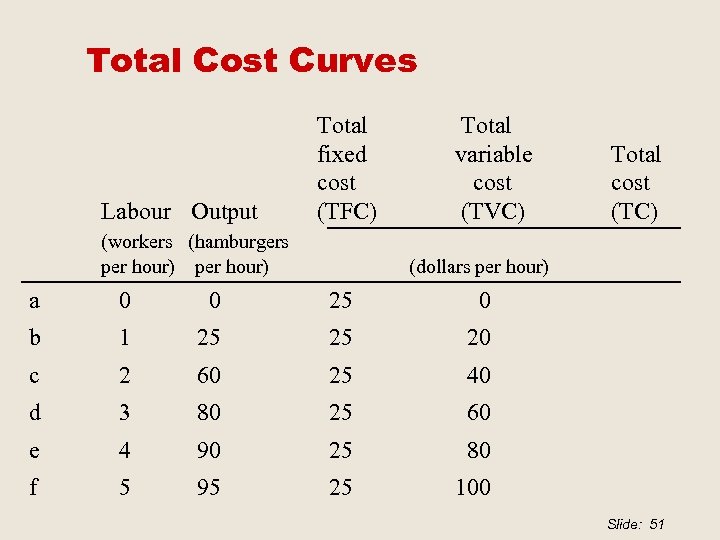

Total Cost Curves Labour Output Total fixed cost (TFC) (workers (hamburgers per hour) Total variable cost (TVC) Total cost (TC) (dollars per hour) a 0 0 25 0 b 1 25 25 20 c 2 60 25 40 d 3 80 25 60 e 4 90 25 80 f 5 95 25 100 Slide: 51

Total Cost Curves Labour Output Total fixed cost (TFC) (workers (hamburgers per hour) Total variable cost (TVC) Total cost (TC) (dollars per hour) a 0 0 25 0 b 1 25 25 20 c 2 60 25 40 d 3 80 25 60 e 4 90 25 80 f 5 95 25 100 Slide: 51

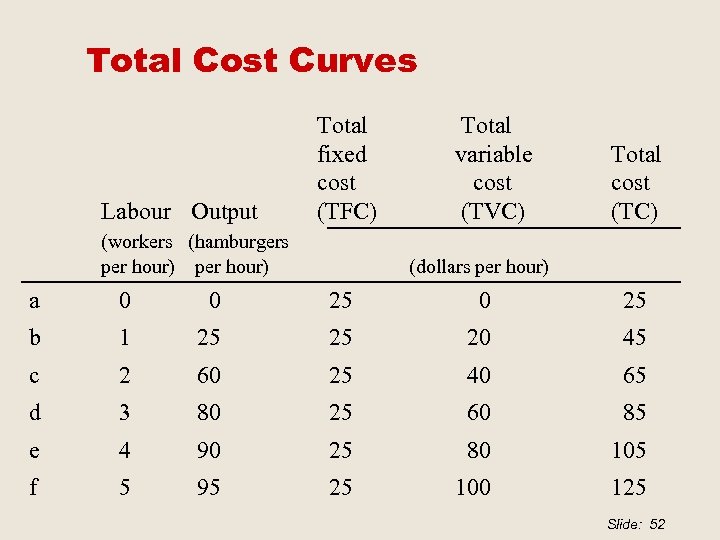

Total Cost Curves Labour Output Total fixed cost (TFC) (workers (hamburgers per hour) Total variable cost (TVC) Total cost (TC) (dollars per hour) a 0 0 25 b 1 25 25 20 45 c 2 60 25 40 65 d 3 80 25 60 85 e 4 90 25 80 105 f 5 95 25 100 125 Slide: 52

Total Cost Curves Labour Output Total fixed cost (TFC) (workers (hamburgers per hour) Total variable cost (TVC) Total cost (TC) (dollars per hour) a 0 0 25 b 1 25 25 20 45 c 2 60 25 40 65 d 3 80 25 60 85 e 4 90 25 80 105 f 5 95 25 100 125 Slide: 52

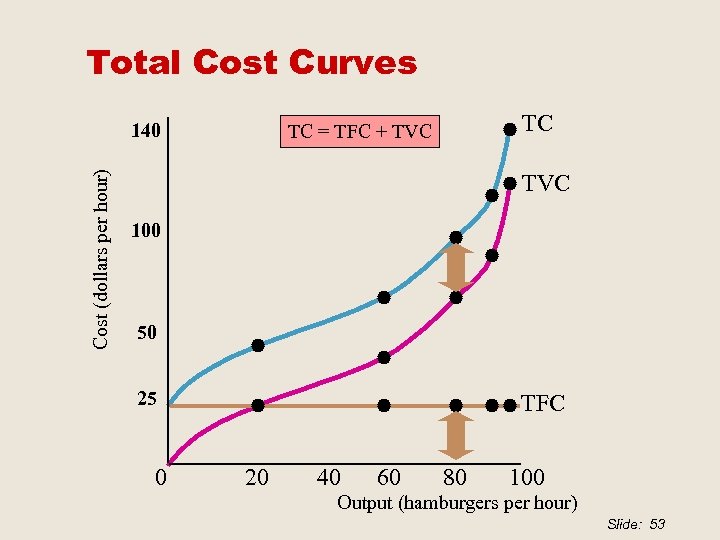

Total Cost Curves Cost (dollars per hour) 140 TC TC = TFC + TVC 100 50 25 0 TFC 20 40 60 80 100 Output (hamburgers per hour) Slide: 53

Total Cost Curves Cost (dollars per hour) 140 TC TC = TFC + TVC 100 50 25 0 TFC 20 40 60 80 100 Output (hamburgers per hour) Slide: 53

Marginal Cost § Marginal cost is the increase in total cost that results from a one-unit increase in output. § It equals the increase in total cost divided by the increase in output. § Marginal costs decrease at low outputs because of the gains from specialisation, but it eventually increases due to the law of diminishing returns. Slide: 54

Marginal Cost § Marginal cost is the increase in total cost that results from a one-unit increase in output. § It equals the increase in total cost divided by the increase in output. § Marginal costs decrease at low outputs because of the gains from specialisation, but it eventually increases due to the law of diminishing returns. Slide: 54

Average Cost § Average fixed cost (AFC) is total fixed cost per unit of output. § Average variable cost (AVC) is total variable cost per unit of output. § Average total cost (ATC) is total cost per unit of output. Slide: 55

Average Cost § Average fixed cost (AFC) is total fixed cost per unit of output. § Average variable cost (AVC) is total variable cost per unit of output. § Average total cost (ATC) is total cost per unit of output. Slide: 55

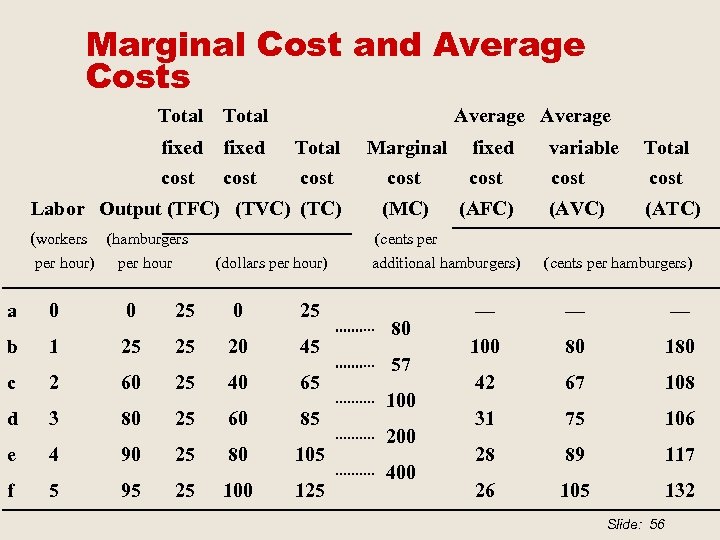

Marginal Cost and Average Costs Total Average fixed Total Marginal cost Labor Output (TFC) (TVC) (TC) (workers per hour) (hamburgers per hour fixed variable Total cost (MC) (AFC) (AVC) (ATC) (cents per (dollars per hour) a 0 0 25 b 1 25 25 20 45 c 2 60 25 40 65 d 3 80 25 60 85 e 4 90 25 80 105 f 5 95 25 100 125 additional hamburgers) 80 57 100 200 400 (cents per hamburgers) — — — 100 80 180 42 67 108 31 75 106 28 89 117 26 105 132 Slide: 56

Marginal Cost and Average Costs Total Average fixed Total Marginal cost Labor Output (TFC) (TVC) (TC) (workers per hour) (hamburgers per hour fixed variable Total cost (MC) (AFC) (AVC) (ATC) (cents per (dollars per hour) a 0 0 25 b 1 25 25 20 45 c 2 60 25 40 65 d 3 80 25 60 85 e 4 90 25 80 105 f 5 95 25 100 125 additional hamburgers) 80 57 100 200 400 (cents per hamburgers) — — — 100 80 180 42 67 108 31 75 106 28 89 117 26 105 132 Slide: 56

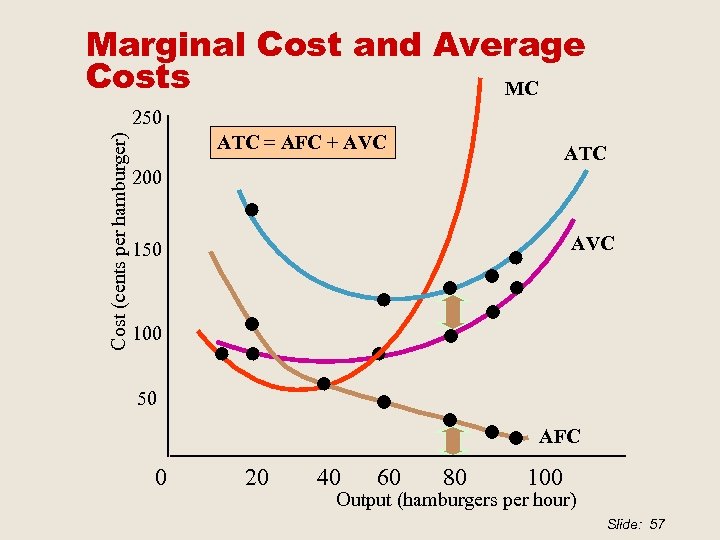

Marginal Cost and Average Costs MC Cost (cents per hamburger) 250 ATC = AFC + AVC ATC 200 AVC 150 100 50 AFC 0 20 40 60 80 100 Output (hamburgers per hour) Slide: 57

Marginal Cost and Average Costs MC Cost (cents per hamburger) 250 ATC = AFC + AVC ATC 200 AVC 150 100 50 AFC 0 20 40 60 80 100 Output (hamburgers per hour) Slide: 57

Long-Run Cost § Long-run cost § The cost of production when a firm uses the economically efficient quantities of labour and capital. § Long-run costs are affected by the production function. § Production function § The relationship between the maximum output attainable and the quantities of both Labour an Capital and the available state of technology. Slide: 58

Long-Run Cost § Long-run cost § The cost of production when a firm uses the economically efficient quantities of labour and capital. § Long-run costs are affected by the production function. § Production function § The relationship between the maximum output attainable and the quantities of both Labour an Capital and the available state of technology. Slide: 58

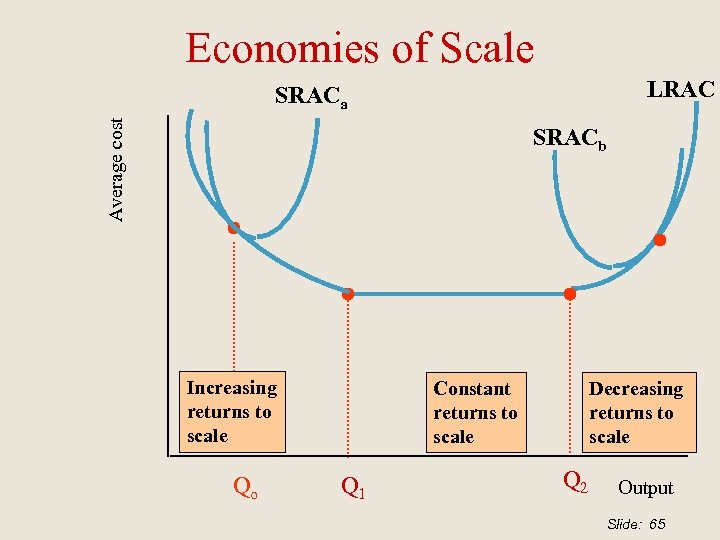

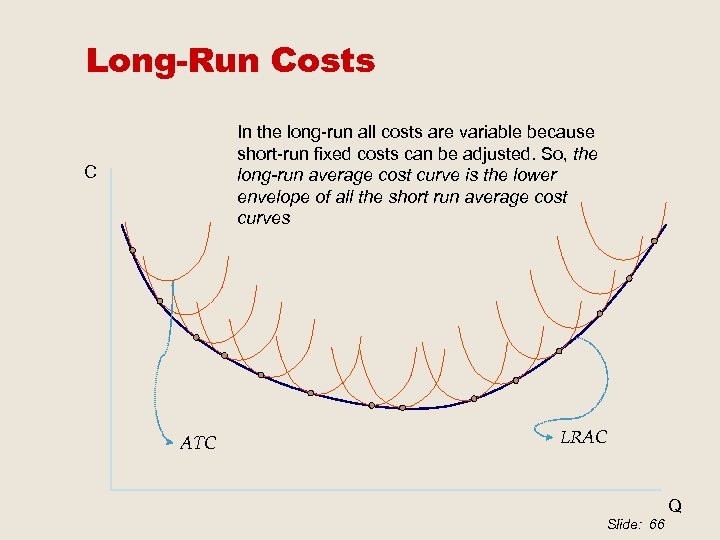

The Long-Run Average Cost Curve § The long run average total cost curve is derived from the short-run average total cost curves. § The segment of the short-run average total cost curves along which average total cost is the lowest make up the long-run average total cost curve. Slide: 59

The Long-Run Average Cost Curve § The long run average total cost curve is derived from the short-run average total cost curves. § The segment of the short-run average total cost curves along which average total cost is the lowest make up the long-run average total cost curve. Slide: 59

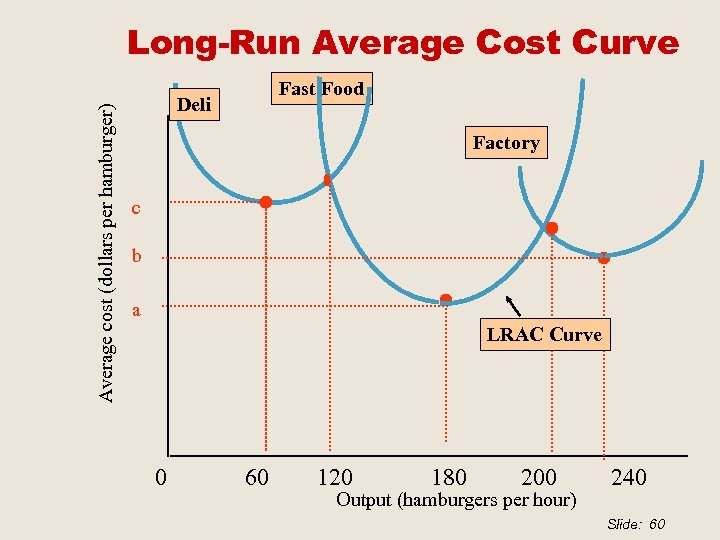

Average cost (dollars per hamburger) Long-Run Average Cost Curve Fast Food Deli Factory c b a LRAC Curve 0 60 120 180 200 Output (hamburgers per hour) 240 Slide: 60

Average cost (dollars per hamburger) Long-Run Average Cost Curve Fast Food Deli Factory c b a LRAC Curve 0 60 120 180 200 Output (hamburgers per hour) 240 Slide: 60

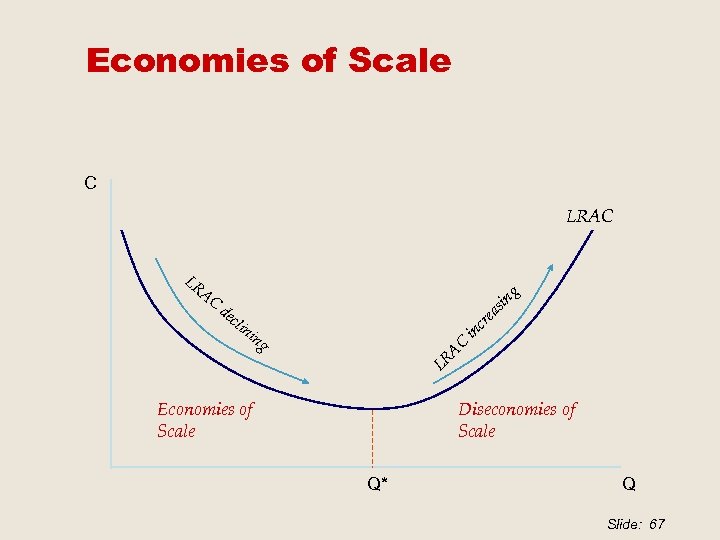

Economies and Diseconomies of Scale § Returns to scale are the increases in output that result from increasing all inputs by the same percentage. § Three possibilities: § Constant returns to scale § Increasing returns to scale § Decreasing returns to scale Slide: 61

Economies and Diseconomies of Scale § Returns to scale are the increases in output that result from increasing all inputs by the same percentage. § Three possibilities: § Constant returns to scale § Increasing returns to scale § Decreasing returns to scale Slide: 61

Returns to Scale § Constant returns to scale § Technological conditions under which a given percentage increase in all the firm’s inputs results in the firm’s output increasing by the same percentage Slide: 62

Returns to Scale § Constant returns to scale § Technological conditions under which a given percentage increase in all the firm’s inputs results in the firm’s output increasing by the same percentage Slide: 62

Returns to Scale § Increasing returns to scale § Technological conditions under which a given percentage increase in all the firm’s inputs results in the firm’s output increasing by a larger percentage Slide: 63

Returns to Scale § Increasing returns to scale § Technological conditions under which a given percentage increase in all the firm’s inputs results in the firm’s output increasing by a larger percentage Slide: 63

Returns to Scale § Decreasing returns to scale § Technological conditions under which a given percentage increase in all the firm’s inputs results in the firm’s output increasing by a smaller percentage Slide: 64

Returns to Scale § Decreasing returns to scale § Technological conditions under which a given percentage increase in all the firm’s inputs results in the firm’s output increasing by a smaller percentage Slide: 64

Economies of Scale LRAC Average cost SRACa SRACb Increasing returns to scale Qo Constant returns to scale Q 1 Decreasing returns to scale Q 2 Output Slide: 65

Economies of Scale LRAC Average cost SRACa SRACb Increasing returns to scale Qo Constant returns to scale Q 1 Decreasing returns to scale Q 2 Output Slide: 65

Long-Run Costs In the long-run all costs are variable because short-run fixed costs can be adjusted. So, the long-run average cost curve is the lower envelope of all the short run average cost curves C ATC LRAC Q Slide: 66

Long-Run Costs In the long-run all costs are variable because short-run fixed costs can be adjusted. So, the long-run average cost curve is the lower envelope of all the short run average cost curves C ATC LRAC Q Slide: 66

Economies of Scale C LRAC sin ea cli cr ni C in ng A de LR AC g LR Diseconomies of Scale Economies of Scale Q* Q Slide: 67

Economies of Scale C LRAC sin ea cli cr ni C in ng A de LR AC g LR Diseconomies of Scale Economies of Scale Q* Q Slide: 67