87c2c522e95d8e201e334c1615e87ee5.ppt

- Количество слайдов: 40

Topic 3: Fiscal Policy Circular Flow Keynesian Economics Taxes and Government Spending 1

Topic 3: Fiscal Policy Circular Flow Keynesian Economics Taxes and Government Spending 1

Economic Output Equation Y = GDP = C + I + G + X – M Y = National Income C = Consumption I = Investment G = Government Spending X – M = Net Exports 2

Economic Output Equation Y = GDP = C + I + G + X – M Y = National Income C = Consumption I = Investment G = Government Spending X – M = Net Exports 2

Focus on National Income Y=C+I+G+X–M In “equilibrium” total national expenditures equal total national income. Both are measures of “Output” 3

Focus on National Income Y=C+I+G+X–M In “equilibrium” total national expenditures equal total national income. Both are measures of “Output” 3

Focus on National Income Y=C+I+G For now, we will also assume that net exports are zero. This is the case when X = M, or if the economy is closed (i. e. , it doesn’t trade with others) We will allow for trade later in the course 4

Focus on National Income Y=C+I+G For now, we will also assume that net exports are zero. This is the case when X = M, or if the economy is closed (i. e. , it doesn’t trade with others) We will allow for trade later in the course 4

Let’s go through these one at a time Y=C+I+G 5

Let’s go through these one at a time Y=C+I+G 5

What is consumption? The amount people (e. g. , households) spend on newly produced goods and services 6 Cars Books Accountants Food Clothes Beer Pets Tuition Nanny Garbage bags Everything

What is consumption? The amount people (e. g. , households) spend on newly produced goods and services 6 Cars Books Accountants Food Clothes Beer Pets Tuition Nanny Garbage bags Everything

How much do people consume? Depends on people’s income C is increasing in “disposable” (after-tax) income Represent this using an equation. For example: C = 100 + 0. 9 ( Y – Tx ) (This means that people consume 100, plus 90% of disposable income) 7

How much do people consume? Depends on people’s income C is increasing in “disposable” (after-tax) income Represent this using an equation. For example: C = 100 + 0. 9 ( Y – Tx ) (This means that people consume 100, plus 90% of disposable income) 7

Consumption Equation A general form of the equation: C = Cmin + MPC ( Y – Tx ) Cmin = spending even when there is no income (must eat to survive) mpc = “Marginal Propensity to Consume” Y – Tx = disposable income (Tx is taxes and Y is income) 8

Consumption Equation A general form of the equation: C = Cmin + MPC ( Y – Tx ) Cmin = spending even when there is no income (must eat to survive) mpc = “Marginal Propensity to Consume” Y – Tx = disposable income (Tx is taxes and Y is income) 8

Marginal Propensity to Consume C = Cmin + MPC ( Y – Tx ) Income can be spent on consumption, saved, or used to pay taxes. MPC is the portion of disposable income that households spend on consumption 1 – MPC is therefore the portion of disposable income households save. It is called the “marginal propensity to save” 9

Marginal Propensity to Consume C = Cmin + MPC ( Y – Tx ) Income can be spent on consumption, saved, or used to pay taxes. MPC is the portion of disposable income that households spend on consumption 1 – MPC is therefore the portion of disposable income households save. It is called the “marginal propensity to save” 9

Consumption Functions If households always spend $750, plus 80% of their disposable income, then C = 750 + 0. 8 ( Y – Tx ) If households always spend $1000, plus 75% of their disposable income, then C = 1000 + 0. 75 ( Y – Tx ) 10

Consumption Functions If households always spend $750, plus 80% of their disposable income, then C = 750 + 0. 8 ( Y – Tx ) If households always spend $1000, plus 75% of their disposable income, then C = 1000 + 0. 75 ( Y – Tx ) 10

What is Investment? Spending by investors (whom may be businesses, financial institutions, governments or households) on: 11

What is Investment? Spending by investors (whom may be businesses, financial institutions, governments or households) on: 11

What is Investment? 1. 12 Plant & Equipment

What is Investment? 1. 12 Plant & Equipment

What is Investment? 2. 13 New Residential Construction

What is Investment? 2. 13 New Residential Construction

What is Investment? 3. 14 Inventories

What is Investment? 3. 14 Inventories

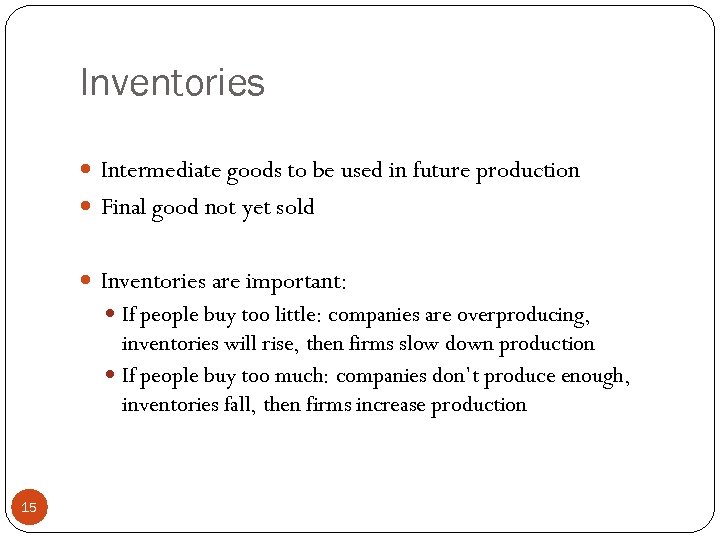

Inventories Intermediate goods to be used in future production Final good not yet sold Inventories are important: If people buy too little: companies are overproducing, inventories will rise, then firms slow down production If people buy too much: companies don’t produce enough, inventories fall, then firms increase production 15

Inventories Intermediate goods to be used in future production Final good not yet sold Inventories are important: If people buy too little: companies are overproducing, inventories will rise, then firms slow down production If people buy too much: companies don’t produce enough, inventories fall, then firms increase production 15

What is Investment? Spending by investors (whom may be businesses, financial institutions, governments or households) on: Plant & Equipment 2. New Residential Construction 3. Inventories 1. 16

What is Investment? Spending by investors (whom may be businesses, financial institutions, governments or households) on: Plant & Equipment 2. New Residential Construction 3. Inventories 1. 16

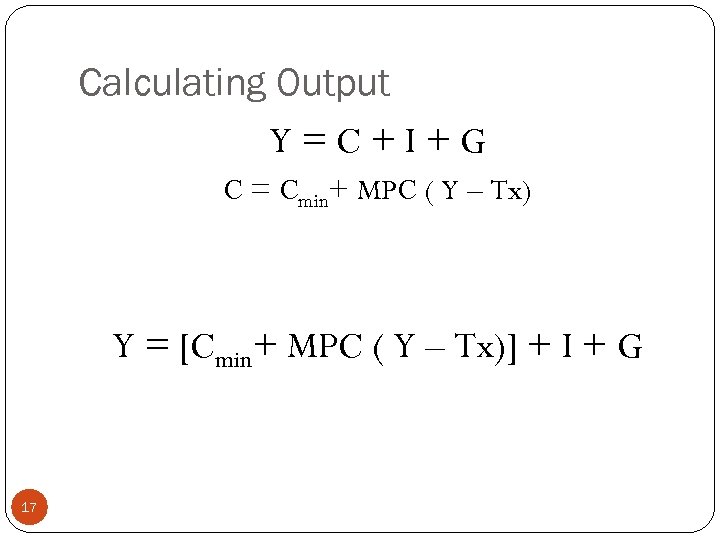

Calculating Output Y=C+I+G C = Cmin+ MPC ( Y – Tx) Y = [Cmin+ MPC ( Y – Tx)] + I + G 17

Calculating Output Y=C+I+G C = Cmin+ MPC ( Y – Tx) Y = [Cmin+ MPC ( Y – Tx)] + I + G 17

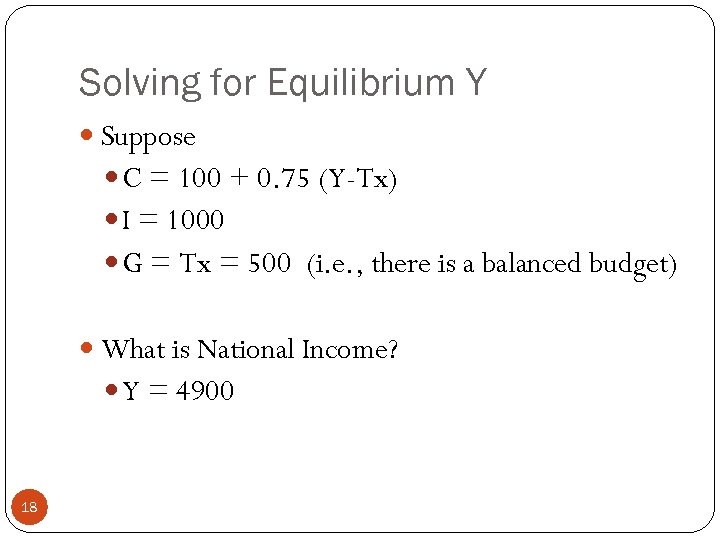

Solving for Equilibrium Y Suppose C = 100 + 0. 75 (Y-Tx) I = 1000 G = Tx = 500 (i. e. , there is a balanced budget) What is National Income? Y = 4900 18

Solving for Equilibrium Y Suppose C = 100 + 0. 75 (Y-Tx) I = 1000 G = Tx = 500 (i. e. , there is a balanced budget) What is National Income? Y = 4900 18

Solving for Equilibrium Y Now, consumers become more optimistic about future income, and in response, they spend an extra 5% of their disposable income. Therefore, MPC goes from 0. 75 to 0. 8. What is National Income? Y = 6000 19

Solving for Equilibrium Y Now, consumers become more optimistic about future income, and in response, they spend an extra 5% of their disposable income. Therefore, MPC goes from 0. 75 to 0. 8. What is National Income? Y = 6000 19

Solving for Equilibrium Y Assume again that MPC = 0. 8. Now the government increases spending by 200 (G increases to 700) while keeping taxes unchanged at 500. What is National Income? Y = 7000 Illustrate this change on the circular flow diagram 20

Solving for Equilibrium Y Assume again that MPC = 0. 8. Now the government increases spending by 200 (G increases to 700) while keeping taxes unchanged at 500. What is National Income? Y = 7000 Illustrate this change on the circular flow diagram 20

Solving for Equilibrium Y Assume again that MPC = 0. 8. G = 700 Now the government cuts taxes by 200 from 500 to 300. What is National Income? Y = 7800 Illustrate this change on the circular flow diagram 21

Solving for Equilibrium Y Assume again that MPC = 0. 8. G = 700 Now the government cuts taxes by 200 from 500 to 300. What is National Income? Y = 7800 Illustrate this change on the circular flow diagram 21

Solving for Equilibrium Y Now, MPC = 0. 8, G = 700, Tx = 300. Investment increases from 1000 to 1200 What is National Income? Y = 8800 Illustrate this change on the circular flow diagram 22

Solving for Equilibrium Y Now, MPC = 0. 8, G = 700, Tx = 300. Investment increases from 1000 to 1200 What is National Income? Y = 8800 Illustrate this change on the circular flow diagram 22

What have we shown? National Income increases when: MPC increases Government spending increases Taxes decrease Investment increases 23

What have we shown? National Income increases when: MPC increases Government spending increases Taxes decrease Investment increases 23

Converse is also true National Income decreases when: MPC decreases Government spending decreases Taxes increase Investment decreases 24

Converse is also true National Income decreases when: MPC decreases Government spending decreases Taxes increase Investment decreases 24

Keynesian Multipliers Tell us how much Y changes given a change in I, or G, or Tx Technically, they equal to: (But, you if you are not comfortable with calculus, don’t worry about these expressions) 25

Keynesian Multipliers Tell us how much Y changes given a change in I, or G, or Tx Technically, they equal to: (But, you if you are not comfortable with calculus, don’t worry about these expressions) 25

Calculating Keynesian Multipliers 26

Calculating Keynesian Multipliers 26

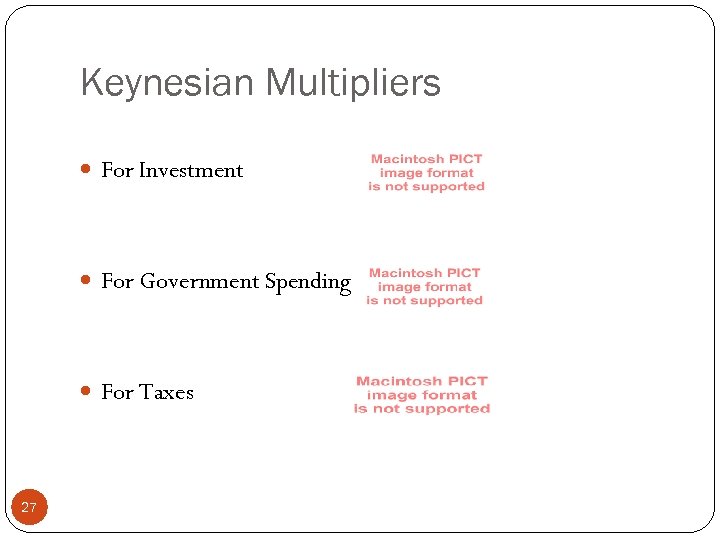

Keynesian Multipliers For Investment For Government Spending For Taxes 27

Keynesian Multipliers For Investment For Government Spending For Taxes 27

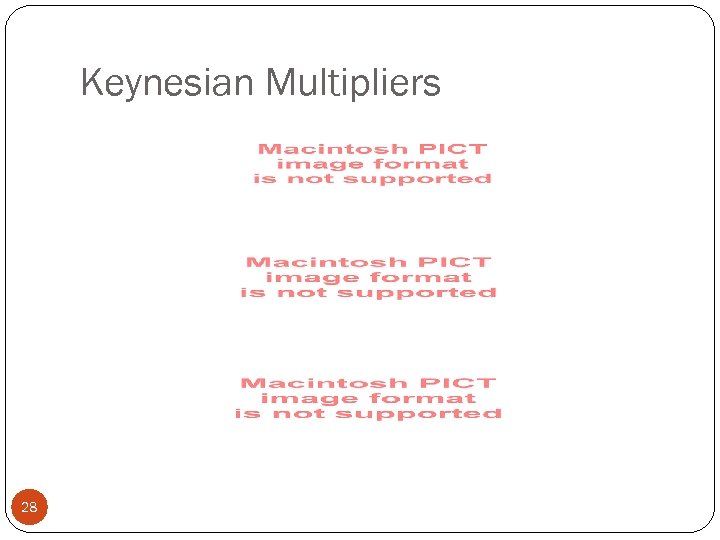

Keynesian Multipliers 28

Keynesian Multipliers 28

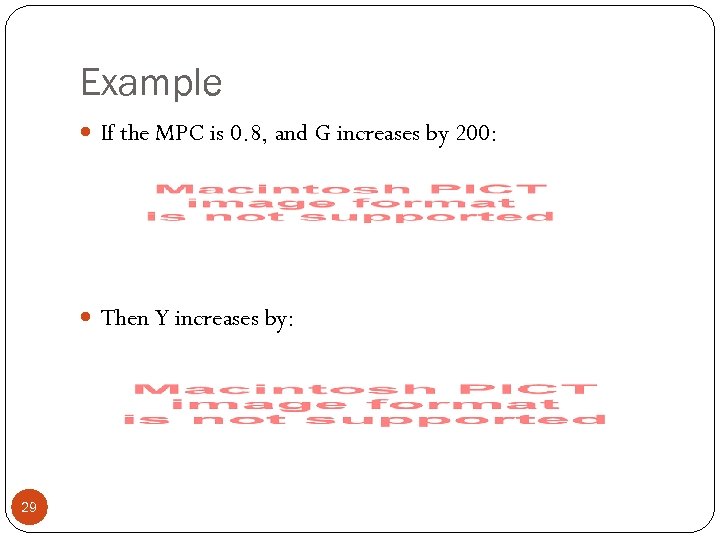

Example If the MPC is 0. 8, and G increases by 200: Then Y increases by: 29

Example If the MPC is 0. 8, and G increases by 200: Then Y increases by: 29

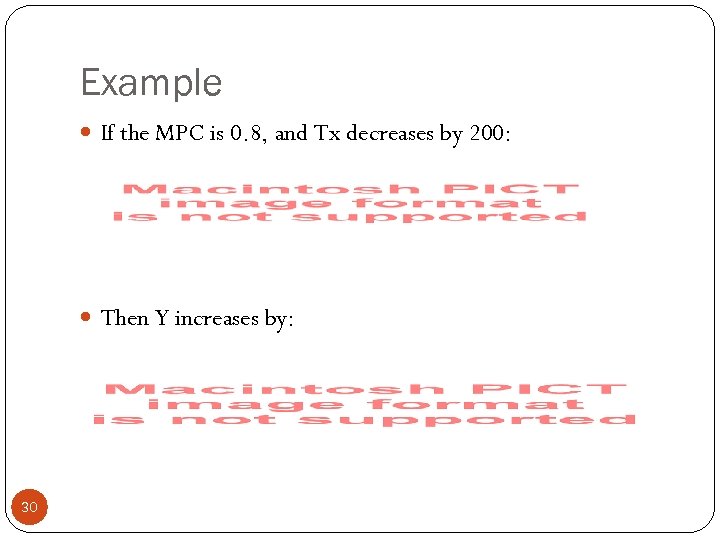

Example If the MPC is 0. 8, and Tx decreases by 200: Then Y increases by: 30

Example If the MPC is 0. 8, and Tx decreases by 200: Then Y increases by: 30

Using Fiscal Policy Fiscal policy: government’s attempt to influence national income by adjusting government spending and taxation G and Tx are determined by government (congress) Fiscal policy provides tools for the government to “slow down” or “speed up” the economy 31

Using Fiscal Policy Fiscal policy: government’s attempt to influence national income by adjusting government spending and taxation G and Tx are determined by government (congress) Fiscal policy provides tools for the government to “slow down” or “speed up” the economy 31

Using Expansionary Fiscal Policy designed to “speed up” the economy, encourage more output Increasing G Decreasing Tx Expansionary policy increases Y If there are unemployed/underutilized resources in the economy, then these resources can be used to increase production… unemployment decreases If the economy is near full employment, then there is no unemployment to decrease… get inflation 32

Using Expansionary Fiscal Policy designed to “speed up” the economy, encourage more output Increasing G Decreasing Tx Expansionary policy increases Y If there are unemployed/underutilized resources in the economy, then these resources can be used to increase production… unemployment decreases If the economy is near full employment, then there is no unemployment to decrease… get inflation 32

Using Contractionary Fiscal Policy designed to “slow down” the economy Decreasing G Increasing Tx Contractionary policy decreases Y Slowing down the economy can decrease inflation But, it also will increase the unemployment 33

Using Contractionary Fiscal Policy designed to “slow down” the economy Decreasing G Increasing Tx Contractionary policy decreases Y Slowing down the economy can decrease inflation But, it also will increase the unemployment 33

Full Employment Level of Income At the “full employment” level of national income, the economy is at full employment, and there isn’t too much inflation If national income exceeds the full employment level, there is too much inflation If national income is below the full employment level, there is too much unemployment 34

Full Employment Level of Income At the “full employment” level of national income, the economy is at full employment, and there isn’t too much inflation If national income exceeds the full employment level, there is too much inflation If national income is below the full employment level, there is too much unemployment 34

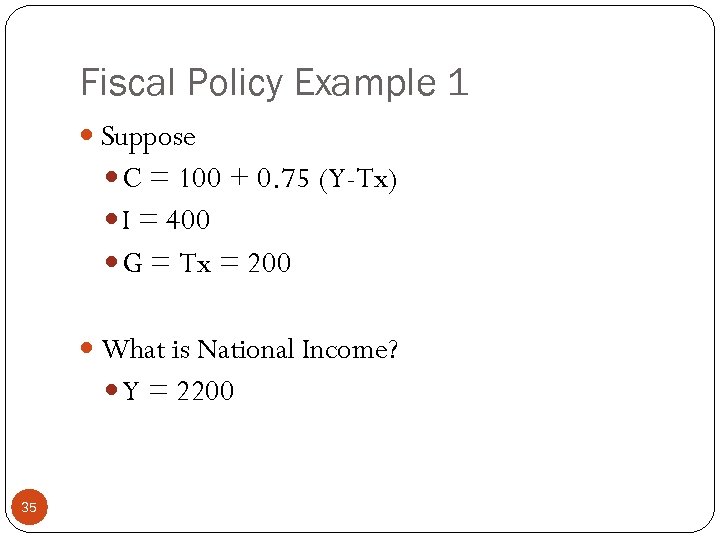

Fiscal Policy Example 1 Suppose C = 100 + 0. 75 (Y-Tx) I = 400 G = Tx = 200 What is National Income? Y = 2200 35

Fiscal Policy Example 1 Suppose C = 100 + 0. 75 (Y-Tx) I = 400 G = Tx = 200 What is National Income? Y = 2200 35

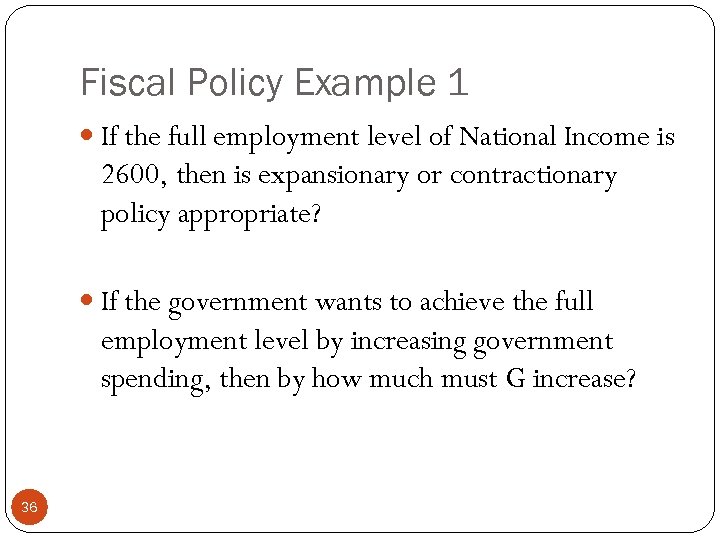

Fiscal Policy Example 1 If the full employment level of National Income is 2600, then is expansionary or contractionary policy appropriate? If the government wants to achieve the full employment level by increasing government spending, then by how much must G increase? 36

Fiscal Policy Example 1 If the full employment level of National Income is 2600, then is expansionary or contractionary policy appropriate? If the government wants to achieve the full employment level by increasing government spending, then by how much must G increase? 36

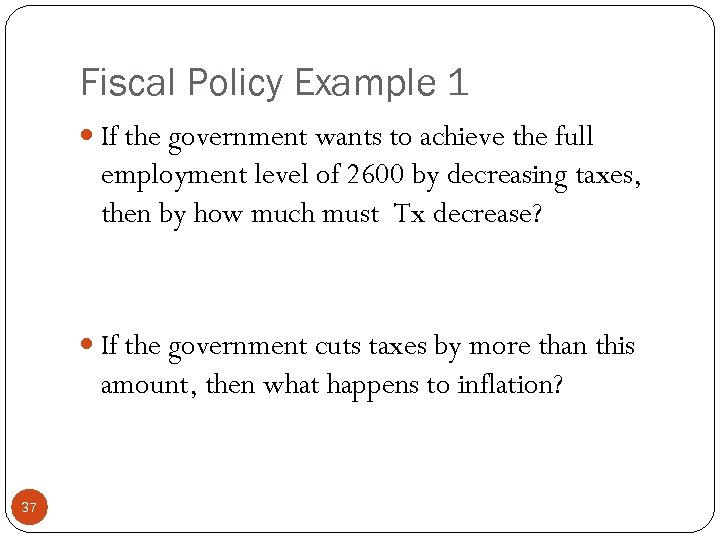

Fiscal Policy Example 1 If the government wants to achieve the full employment level of 2600 by decreasing taxes, then by how much must Tx decrease? If the government cuts taxes by more than this amount, then what happens to inflation? 37

Fiscal Policy Example 1 If the government wants to achieve the full employment level of 2600 by decreasing taxes, then by how much must Tx decrease? If the government cuts taxes by more than this amount, then what happens to inflation? 37

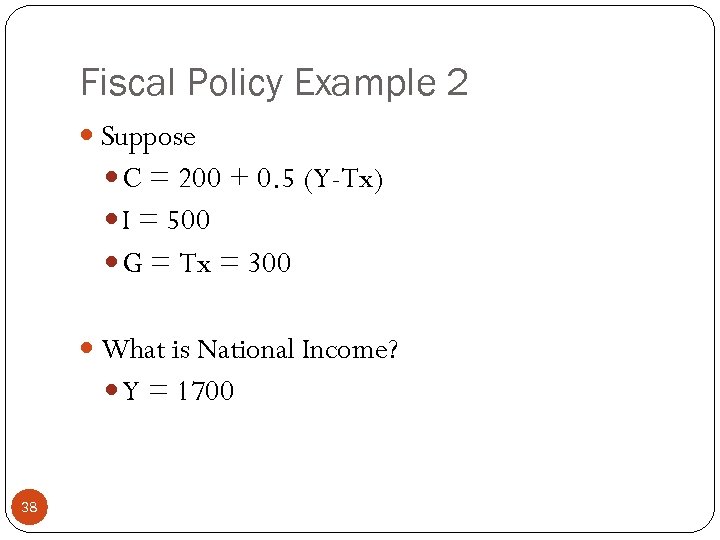

Fiscal Policy Example 2 Suppose C = 200 + 0. 5 (Y-Tx) I = 500 G = Tx = 300 What is National Income? Y = 1700 38

Fiscal Policy Example 2 Suppose C = 200 + 0. 5 (Y-Tx) I = 500 G = Tx = 300 What is National Income? Y = 1700 38

Fiscal Policy Example 2 If the economy is currently experiences high inflation and low unemployment, then is expansionary or contractionary policy appropriate? The government wants to use fiscal policy to achieve the full employment income of 1500 without changing taxes. What should it do? 39

Fiscal Policy Example 2 If the economy is currently experiences high inflation and low unemployment, then is expansionary or contractionary policy appropriate? The government wants to use fiscal policy to achieve the full employment income of 1500 without changing taxes. What should it do? 39

Fiscal Policy Example 2 The government wants to use fiscal policy to achieve the full employment income of 1500 without changing government spending. What should it do? The government wants to use fiscal policy to achieve the full employment income of 1500 while maintaining a balanced budget. What should it do? 40

Fiscal Policy Example 2 The government wants to use fiscal policy to achieve the full employment income of 1500 without changing government spending. What should it do? The government wants to use fiscal policy to achieve the full employment income of 1500 while maintaining a balanced budget. What should it do? 40