Topic2_bonds_valuation_class1_2_students.ppt

- Количество слайдов: 80

Topic 2 Valuing Debt Securities. Bonds Valuation and Interest Rates.

Topic 2 a. Mortgage securitization and financial crisis – discussion b. Bond features, factors that impact bond prices c. Types of bonds. Pure discount bonds. Coupon bonds d. Interest rates and bond valuation. Impact of the discount rate and timing of payments on bond valuation e. Term structure of interest rates f. Bond prices and yields. Current yield and yield to maturity. g. Relationships between coupon rate, required return, and bond price h. Bond valuation and bond yields

Objectives a. Understand what the process of mortgage securitization is and how it triggered the crisis b. Know main types of bonds and their characteristics c. Define bond features and how different factors could affect bond prices and yields d. Understand the term structure of interest rates and the determinants of bond yields e. Apply present value concept to valuation of bonds f. Use different models for bond yields estimation

Mortgage securitization and financial crisis NBC Video: Making Sense of the 2009 Financial Crisis

Financial crisis: lessons NBC Video: Report on the Financial Crisis of 2008 Says it Could Have Been Avoided

Bonds Bond – long-term contract under which a borrower agrees to make payments of interest and principal, on specific dates, to the bondholders.

Types of bonds a. Government bonds b. Municipal bonds c. Corporate bonds Domestic or foreign bonds

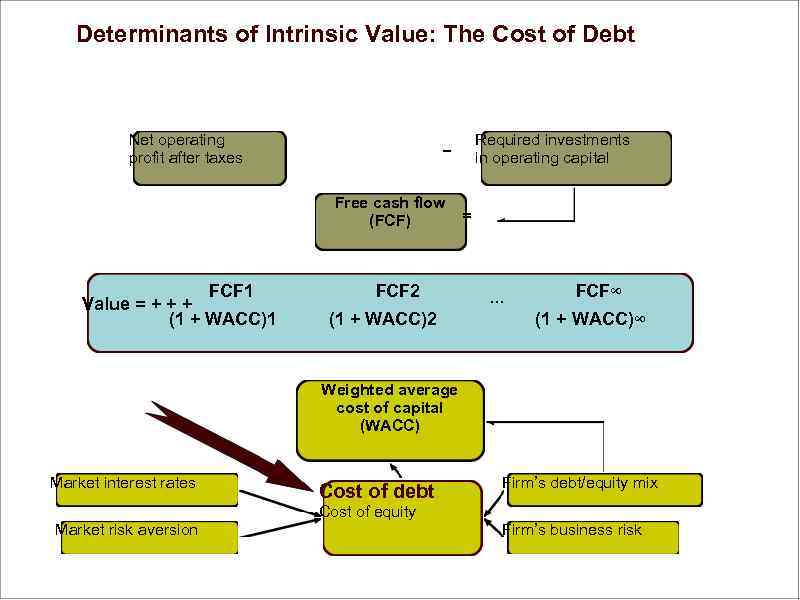

Determinants of Intrinsic Value: The Cost of Debt Net operating profit after taxes Free cash flow (FCF) FCF 1 Value = + + + (1 + WACC)1 Required investments in operating capital − FCF 2 (1 + WACC)2 = . . . FCF∞ (1 + WACC)∞ Weighted average cost of capital (WACC) Market interest rates Market risk aversion Cost of debt Cost of equity Firm’s debt/equity mix Firm’s business risk

Key features of a bond a. Par value: Face amount, paid at maturity (assume $1, 000). b. Coupon interest rate: Stated interest rate. Multiply by par value to get dollars of interest. Generally fixed. c. Maturity: Years until bond must be repaid. Declines. d. Issue date: Date when bond was issued. e. Default risk: Risk that issuer will not make interest or principal payments.

Types of bonds by the payment to investors a. Coupon bonds (fixed coupon and floating rate) b. Zero-coupon bonds c. Payment-in-kind bonds

Differences Between Debt and Equity a. Debt a. Equity a. Not an ownership interest a. Ownership interest b. Creditors do not have voting b. Common stockholders have a rights full range of voting rights c. Interest is considered a cost of according to the legislation doing business and is taxc. Dividends are not considered a deductible cost of doing business and are d. Creditors have legal recourse not tax deductible if interest or principal payments d. Dividends are not a liability of are missed the firm until declared. e. Excess debt can lead to Stockholders have no legal financial distress and recourse if dividends are not bankruptcy declared e. An all-equity firm cannot go bankrupt

Sources of market data http: //finance. yahoo. com/new s/category-bonds http: //www. bondsonline. com/Toda ys_Market/Composite_Bond_Yiel ds_table. php

Bond valuation a. What factors do determine the value of the bond? a. • The discount rate (the yield that could be earned on alternative investments with similar risk and maturity) b. • Coupon rate c. • Timing of payments d. • Maturity of the bond

What the cash flow from the bond is comprised of? How to measure a fundamental bond value? a. Cash flow includes equal regular interest payments and a par value at the maturity. b. Future cash flows should be discounted to the present (to the moment of valuation).

Bond valuation V bond value (should be the present value of its remaining cash flows) C coupon payment provided at each period r required rate of return period used to discount the bond cash flows t period of coupon payment N number of periods to maturity M par value

Valuing bonds with fixed coupon payments a. Example. Consider a bond that has 20 years remaining until maturity. Par value is $1000. Annual coupon rate is 14%, with annual payments period. Assume that the prevailing annualized yield on other bonds with similar characteristics is 14%. What is the bond’s fair value?

V bond value (should be the present value of its remaining cash flows) C coupon payment provided at each period r required rate of return period used to discount the bond cash flows t period of coupon payment N number of periods to maturity M par value

Valuing bonds with fixed coupon payments a. In what case the value of the bond equals to the par value? When coupon rate equals to discount rate

Example. Par value is $1000. Annual coupon rate is 14%, with annual payments period. Assume that the prevailing annualized yield on other bonds with similar characteristics is 14%. What is the bond’s fair value? Assume we make a valuation of the same bond 5 years from now. Required rate of return did not change. Find the present value of all future payments, including par value, that will be paid to the investor 15 years from now.

a. Example. How the value of the bond will change 5 years from now if the required rate of return change to 16%? b. Return on the bond is lower than the market return, so its value should … decline

a. Example. How the value of the bond will change 5 years from now if the required rate of return change to 12%? b. Return on the bond is higher than the market return, so its value should … increase

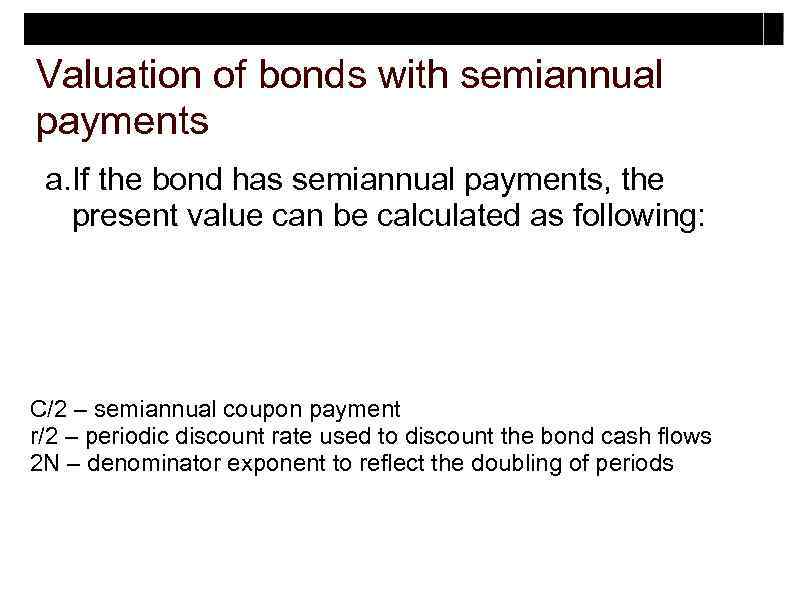

Valuation of bonds with semiannual payments a. If the bond has semiannual payments, the present value can be calculated as following: C/2 – semiannual coupon payment r/2 – periodic discount rate used to discount the bond cash flows 2 N – denominator exponent to reflect the doubling of periods

Valuation of bonds with semiannual payments a. Consider a bond of 15 years before the maturity, 14% coupon rate paid semiannually, 12% required return, $1000 par value. Present value is calculated as following:

a. What is the relationship between coupon rate, required return and bond value?

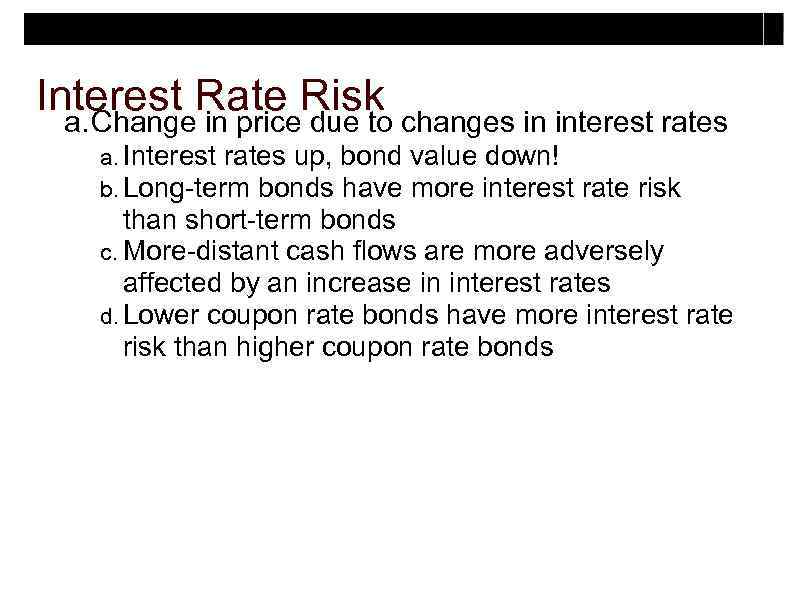

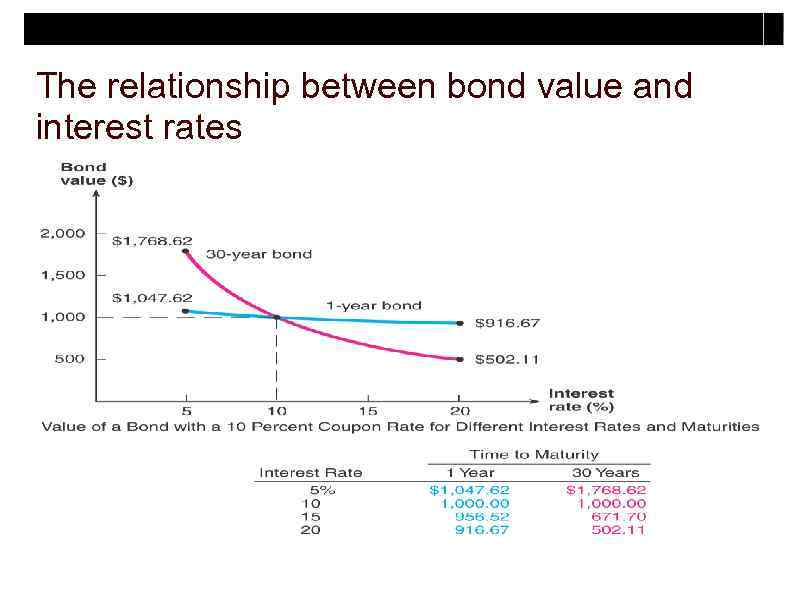

Interest Rate Risk changes in interest rates a. Change in price due to a. Interest rates up, bond b. Long-term bonds have value down! more interest rate risk than short-term bonds c. More-distant cash flows are more adversely affected by an increase in interest rates d. Lower coupon rate bonds have more interest rate risk than higher coupon rate bonds

The relationship between bond value and interest rates

Zero-coupon bonds a. Make no periodic interest payments (coupon rate = 0%) b. The entire yield to maturity comes from the difference between the purchase price and the par value c. Cannot sell for more than par value d. Sometimes called zeroes, or deep discount bonds e. Treasury Bills are examples of zeroes

Valuation of zero-coupon bonds V value of a bond М par value n number of periods to maturity

Example. Zero-coupon bond with a par value of $1000, maturity of 5 years is traded for $630, 12. Is it profitable to invest in this bond, if the investor considers the alternative investment with 12% annual return?

Yield to maturity Example. Suppose we are offered a 10 -year, 11% annual coupon, $1000 face value bond at a price of $1200. What rate of interest would you earn on your investment if you bought the bond and held it to maturity? This rate is yield to maturity. It should be the same as a market interest rate.

Yield to maturity a. Yield to maturity is the calculated return on investment that investors will get if they hold the bond to maturity. It takes into account the present value of all future cash flows, as well as any premium or discount to par that the investor pays. Bonds yields at http: //finance. yahoo. com

Premium and discount Bonds mature at a par value, which is almost always $1, 000. A premium bond is any bond that is currently trading at a price above par. A discount bond is a bond trading at a price lower than par. Bonds yields at http: //finance. yahoo. com

Yield to maturity Example. Suppose we are offered a 10 -year, 11% annual coupon, $1000 face value bond at a price of $1200. What rate of interest would you earn on your investment if you bought the bond and held it to maturity?

a. V current price of a bond b. C coupon payments c. YTM yield to maturity d. t period of coupon payment e. N number of periods of payment f. M par value

Yield to maturity Example. Suppose we are offered a 10 -year, 11% annual coupon, $1000 face value bond at a price of $1200. What rate of interest would you earn on your investment if you bought the bond and held it to maturity? YTM = 8, 02% Yield-2

Current yield a. Current yield is the rate of return an investor will get, without taking into account the value of the premium or discount of the purchase price. b. It is calculated by dividing the coupon by the price. c. The current yield is not a good indication of your return on investment. d. Yield to maturity and yield to call take into account the value of the discount or premium paid for the bond, and as such they offer a much better indication of the value of the bond.

Current yield a. Example. Suppose we are offered a 10 year, 11% annual coupon, $1000 face value bond at a price of $1200. What is the current yield? 9, 17% Yield-2

Call provisions a. Some bonds can be called (redeemed) by the issuer on specified dates throughout the life of the bond. b. Issuer can refund (repurchase the issue) if interest rates decline. That helps the issuer to manage its debt, but hurts the investor. c. Therefore, coupon rates on callable bonds are higher. Most bonds assume a call premium. Usually they have a deferred call provision.

Yield to call a. Based on the current price of a bond, the yield to all calls should be calculated, and the investor should note the lowest yield to call and the yield to maturity.

Yield to call Example. Suppose we are offered a 10 -year, 11% annual coupon, $1000 face value bond at a price of $1200. What rate of interest would you earn on your investment if you bought the bond and held it to maturity? The bonds may be called in 5 years at 109% of face value (call price $1090). What is the yield to call? The previous example:

Yield to call we are offered a 10 -year, 11% annual Example. Suppose coupon, $1000 face value bond at a price of $1200. What rate of interest would you earn on your investment if you bought the bond and held it to maturity? The bonds may be called in 5 years at 109% of face value (call price $1090). What is the yield to call? Yield-2 7, 59%

Graphical Relationship Between Price and YTM

Bond Prices: Relationship Between Coupon and Yield If YTM = coupon rate, then par value = bond price

a. If YTM > coupon rate, then par value > bond price • Price below par = “discount” bond • If YTM < coupon rate, then par value < bond price • Price above par = “premium” bond Bond screener at http: //finance. yahoo. co m

YTM: rate of return? Will the investor receive the YTM if interest rates will change over time until maturity? Yes, the rate of return on the bond investment equals to the YTM Will the rate of return on the investment in the bond be equal to the YTM in case of reinvestment of coupon payments? No. There are two different strategies – investment in the bond and reinvestment.

Challenging question a. In case of semiannual payments: what will be the effective annual rate? The effective annual rate will be higher than in case of annual payments at the same coupon rate.

a. What will be the EAR in the example? Consider a bond of 15 years before the maturity, 14% coupon rate paid semiannually, 12% required return, $1000 par value. Is this a rate of return on the investment in the bond?

Challenging question Assume, you buy a bond between interest payment dates, how much should you pay? How the valuation model for the bond will change? No change in the valuation. The buyer should pay the price plus accrued interest.

a. Example. Consider a bond of 15 years before the maturity, 14% annual coupon rate paid semiannually, 12% required return, $1000 par value. Assume you buy a bond 3 months before it’s semiannual payment. How much should you pay? Basic price (see previous examples) plus accrued interest that equals to

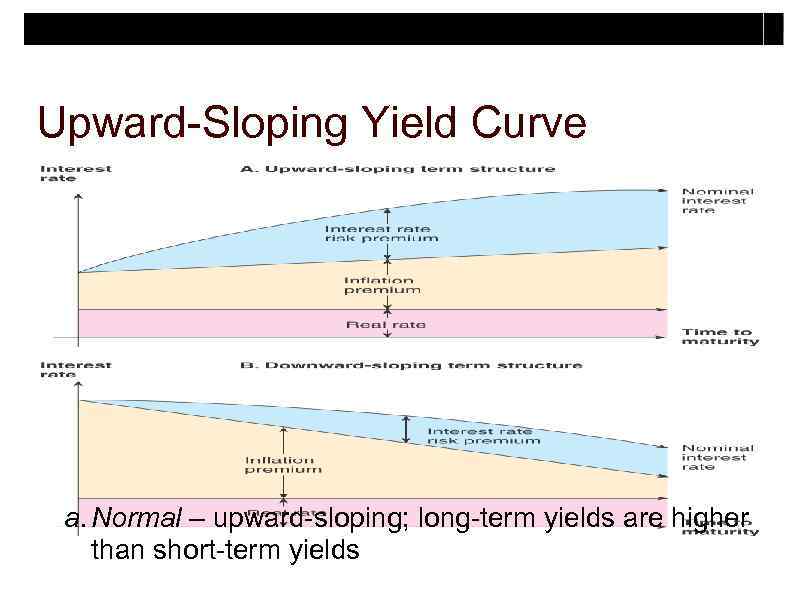

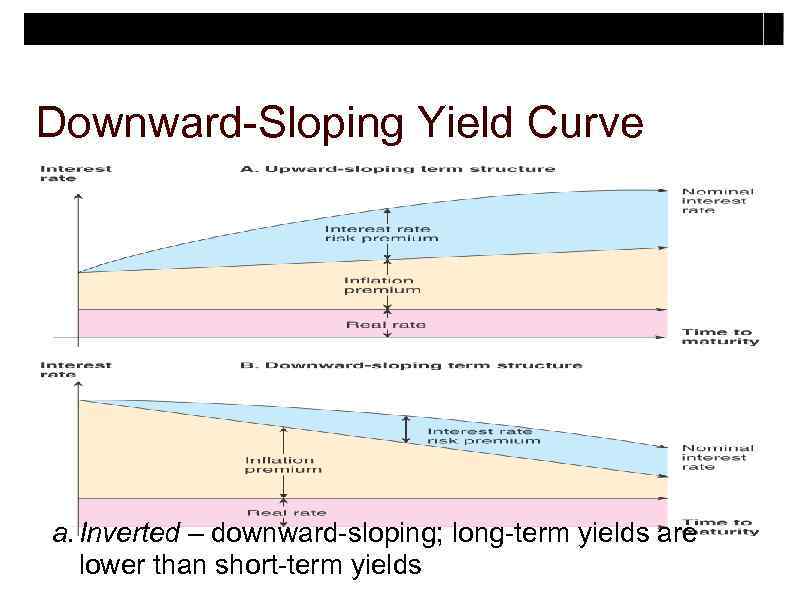

Term Structure of Interest Rates a. Term structure is the relationship between time to maturity and yields, all else equal b. Yield curve – graphical representation of the term structure and describes YTM (yield to maturity) for different maturities of debt instruments. It reflects risk and expectations regarding future interest rates.

Upward-Sloping Yield Curve a. Normal – upward-sloping; long-term yields are higher than short-term yields

Downward-Sloping Yield Curve a. Inverted – downward-sloping; long-term yields are lower than short-term yields

a. http: //www. bloomberg. com/markets/rates/index. html b. stockcharts. com/charts/yieldcurve. html Long-term rates should raise because of expectations of higher interest rates reflecting inflation and risk. Inverted yield curve could be a signal of recession.

Bond yields http: //finance. yahoo. com/bonds /composite_bond_rates

U. S. Treasury bonds interest rates on different dates Yield Curve for March 1980 Yield Curve for February 2000 Yield Curve for March 2009

Bond yields a. What moves the yield curve (bond prices)? Expectations regarding the benchmark interest rate (risk-free rate) - Federal Funds Rate, Refinancing rate • The benchmark rate responds to changes in inflation and real GDP growth

Changes in bond values over time and total return a. Current yield = coupon rate/current price b. Capital gains yield = c. YTM = current yield + capital gains yield Change in price Beginning price Tool kits-bonds. Chapter. Section 5. 4

Changes to a bond pricevalues over time and in bond over time? What happens To set return totalup this problem, we will enter the different interest rates, and use the array of cash flows (see tool kits). The following example operates under the precept that the bond is issued at par ($1, 000) in year 0. From this point, the example sets three conditions for interest rates to follow: interest rates stay constant at 10%, interest rates fall to 5%, or interest rates rise to 15%. Then the price of the bond over the fifteen years of its life is determined for each of the scenarios. Tool kits-bonds. Chapter. Section 5. 4

Changes in bond values over time

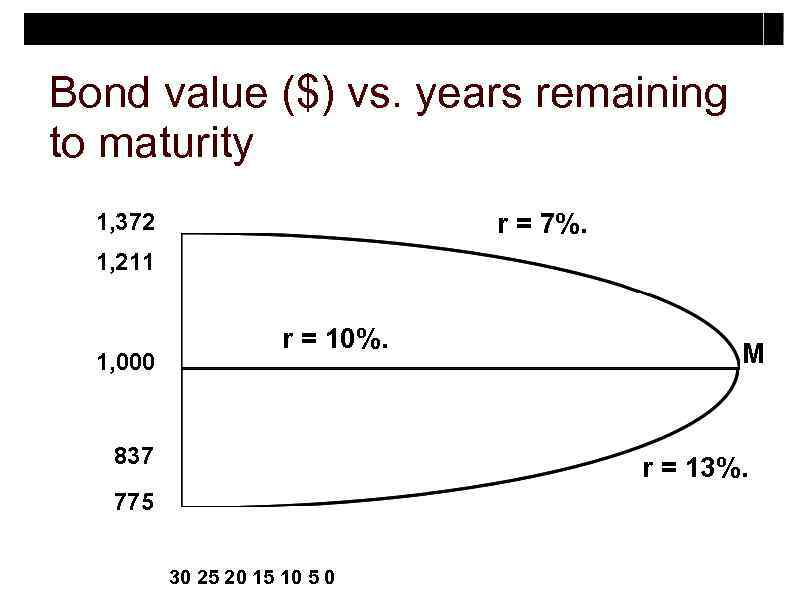

Example a. Suppose the bond was issued 20 years ago and now has 10 years to maturity. What would happen to its value over time if the required rate of return remained at 10%, or at 13%, or at 7%? b. See next slide.

Bond value ($) vs. years remaining to maturity r = 7%. 1, 372 1, 211 1, 000 r = 10%. 837 M r = 13%. 775 30 25 20 15 10 5 0

a. At maturity, the value of any bond must equal its par value. b. The value of a premium bond would decrease to $1, 000. c. The value of a discount bond would increase to $1, 000. d. A par bond stays at $1, 000 if r remains constant.

What Drives Yields? Expectations about the Future a. The pure expectations theory provides a relationship between short-term interest and long term yields. b. The expectations theory says that long term yields are averages of expected one period (e. g. , one year) yields.

The Pure Expectations Theory a. Yield on an n period bond at time t is equal to the average of the expected one period interest rates between t and t+n b. The above statement is called the expectations theory of term structure of interest rates

The Pure Expectations Theory The expectations theory implies: Case 1: If investors expect the future one period interest rates to rise then the current yield curve upward sloping Case 2: If investors expect no change in the future one period interest then the current yield is flat Case 3: If investors expect the future one period interest rates to fall then the current yield curve downward sloping

The Central Bank and the Term. Structure a. The Fed manages the one period interest rate (fed funds rate) b. Expectations theory today’s yield curve reflects the markets expectations of future Fed actions regarding the Fed Funds rate c. There is an important link between the yield curve and Federal Reserve’s monetary policy d. If the economy is likely to go into a recession then investors expect the Federal Funds interest rate to fall, hence current yield curve is downward sloping

a. If you receive news that real GDP growth will decline (i. e. , a recession) then the yields will fall (bond prices rise) in anticipation of a Fed funds interest rate cut b. If you receive news about higher future inflation then current yields will rise (bond prices fall) in anticipation of higher future Fed funds rate

r = r* + IP + DRP + LP + MRP. Here: r = Required rate of return on a debt security. r* = Real risk-free rate. IP = Inflation premium. DRP = Default risk premium. LP = Liquidity premium. MRP = Maturity risk premium.

What is the nominal risk-free rate? Here: rrf = Nominal risk-free rate r* = Real risk-free rate IP = Inflation premium

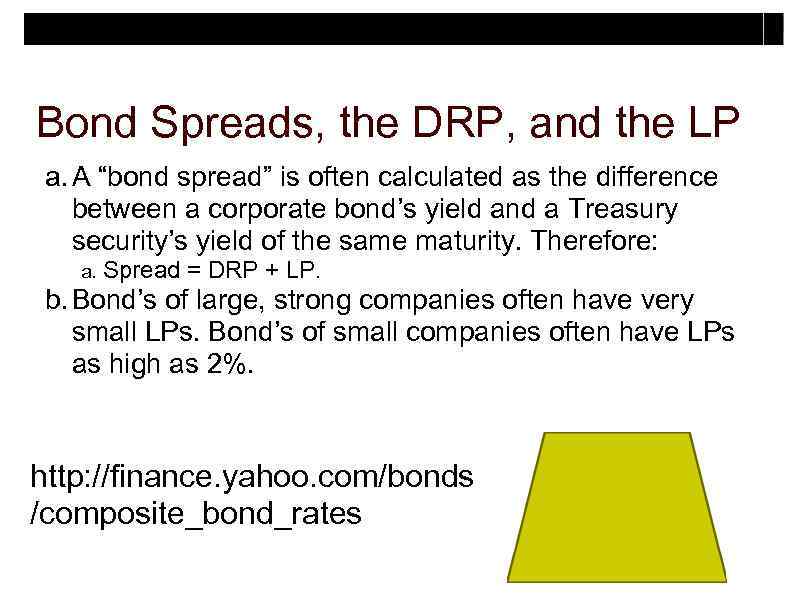

Bond Spreads, the DRP, and the LP a. A “bond spread” is often calculated as the difference between a corporate bond’s yield and a Treasury security’s yield of the same maturity. Therefore: a. Spread = DRP + LP. b. Bond’s of large, strong companies often have very small LPs. Bond’s of small companies often have LPs as high as 2%. http: //finance. yahoo. com/bonds /composite_bond_rates

Bond spreads

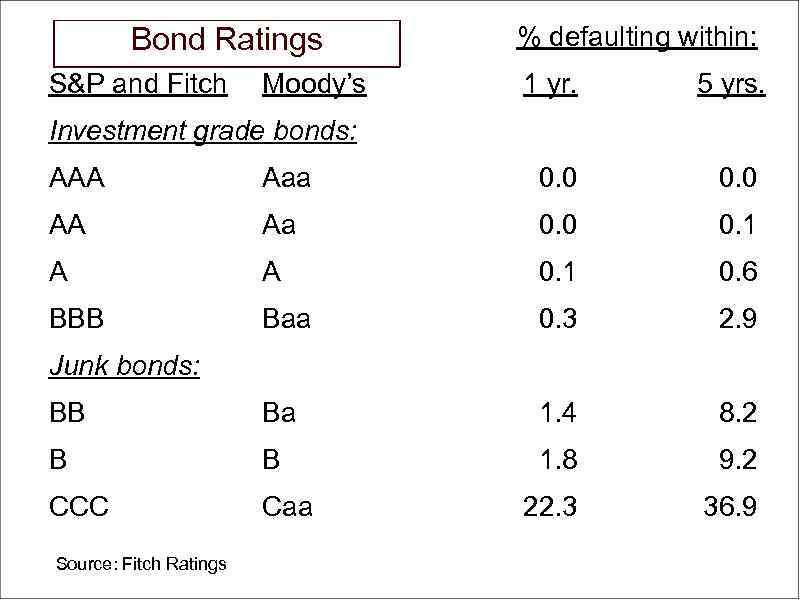

Bond Ratings S&P and Fitch Moody’s % defaulting within: 1 yr. 5 yrs. Investment grade bonds: AAA Aaa 0. 0 AA Aa 0. 0 0. 1 A A 0. 1 0. 6 BBB Baa 0. 3 2. 9 BB Ba 1. 4 8. 2 B B 1. 8 9. 2 CCC Caa 22. 3 36. 9 Junk bonds: Source: Fitch Ratings

Bond Ratings and Bond Spreads Long-term Bonds 10 -Year T-bond AAA AA A BBB BB B CCC Yield (%) Spread (%) 2. 68 5. 50 5. 62 5. 79 7. 53 11. 62 13. 70 26. 30 2. 82 2. 94 3. 11 4. 85 8. 94 11. 02 23. 62

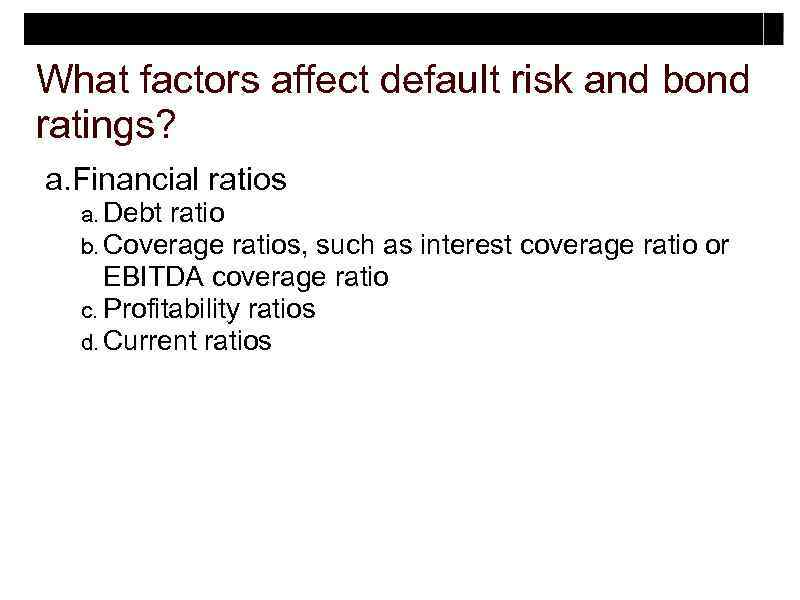

What factors affect default risk and bond ratings? a. Financial ratios a. Debt ratio b. Coverage ratios, such as interest coverage ratio or EBITDA coverage ratio c. Profitability ratios d. Current ratios

When the bond market is called to be efficient? Bond prices fully reflect all the information that is publicly available How would bond prices adjust given the fact that company experienced very weak sales the last quarter?

Return and risk on international bonds a. An additional factor that affects the return to investors from another country is exchange rate risk Foreign interest rates movements Exchange rate fluctuations

Using Spreadsheets a. PRICE(Settlement, Maturity, Rate, Yld, Redemptio n, Frequency, Basis) a. YIELD(Settlement, Maturity, Rate, Pr, Redemption, Frequency, Basis) b. Settlement and maturity need to be actual dates c. The redemption and Pr need to be given as % of par value b. Click on the Excel icon for an example

Exercise (home) and required reading a. Use the file: in-class and home exercise 2. 1 Reading: 1. 1. Determinants of market interest rates: BE, Chapter 5, sections 5. 7 -5. 15. • 2. High Corporate Profits May Reduce Risk in High-Yield Bonds: http: //www. nytimes. com/2011/10/09/business/mutfund/highcorporate-profits-could-reduce-risk-in-junkbonds. html? partner=yahoofinance

Work the Web a. Bond yield information is available online b. One good site is Bonds Online c. Click on the Web surfer to go to the site a. Follow the “bond search, ” “search/quote center, ” “corporate/agency bonds, ” and “composite bond yields” links b. Observe the yields for various bond types, and the shape of the yield curve

Work the Web a. http: //finance. yahoo. com b. Search for: investing/bonds screener c. Find quotes and yields for US corporate and government bonds

Topic2_bonds_valuation_class1_2_students.ppt