Topic 2. The value of M&A deals 1. 2. 3. 4. The synergy concept The synergy assessment Valuing the merger SME M&A valuation

Topic 2. The value of M&A deals 1. 2. 3. 4. The synergy concept The synergy assessment Valuing the merger SME M&A valuation

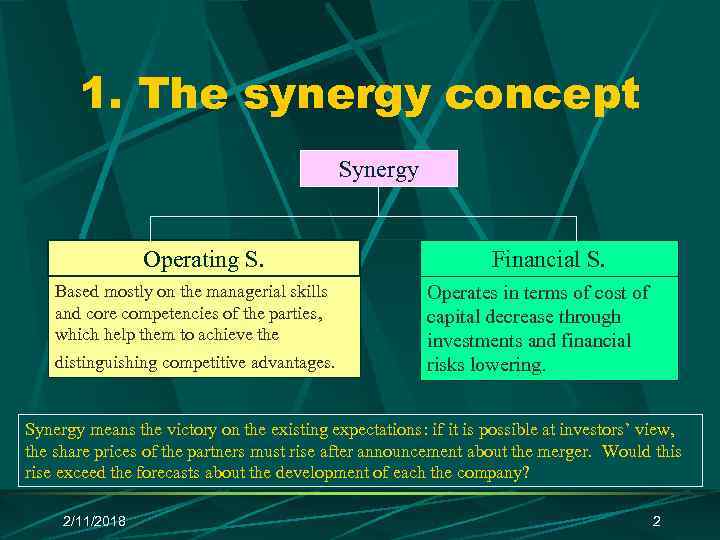

1. The synergy concept Synergy Operating S. Based mostly on the managerial skills and core competencies of the parties, which help them to achieve the distinguishing competitive advantages. Financial S. Operates in terms of cost of capital decrease through investments and financial risks lowering. Synergy means the victory on the existing expectations: if it is possible at investors’ view, the share prices of the partners must rise after announcement about the merger. Would this rise exceed the forecasts about the development of each the company? 2/11/2018 2

1. The synergy concept Synergy Operating S. Based mostly on the managerial skills and core competencies of the parties, which help them to achieve the distinguishing competitive advantages. Financial S. Operates in terms of cost of capital decrease through investments and financial risks lowering. Synergy means the victory on the existing expectations: if it is possible at investors’ view, the share prices of the partners must rise after announcement about the merger. Would this rise exceed the forecasts about the development of each the company? 2/11/2018 2

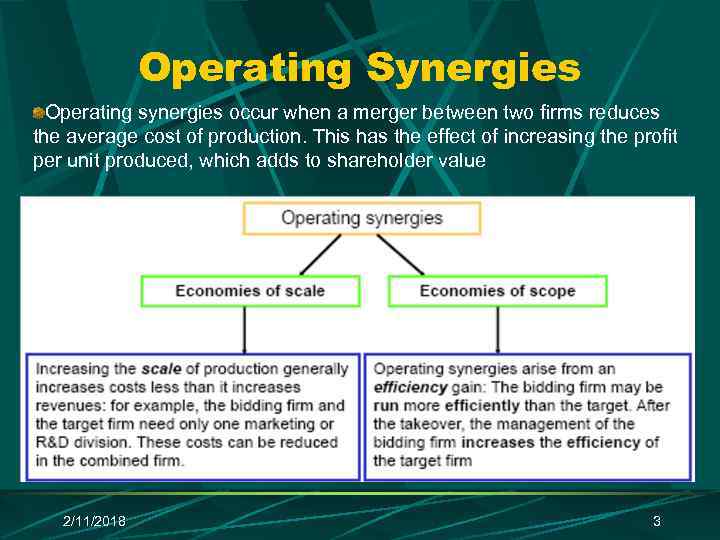

Operating Synergies Operating synergies occur when a merger between two firms reduces the average cost of production. This has the effect of increasing the profit per unit produced, which adds to shareholder value 2/11/2018 3

Operating Synergies Operating synergies occur when a merger between two firms reduces the average cost of production. This has the effect of increasing the profit per unit produced, which adds to shareholder value 2/11/2018 3

Economies of scope are related to the efficiency of the firm in terms of its management effectiveness. The efficiency of a firm can be measured by its q-ratio or Tobin’s q, which is defined as follows: q-ratio = market value of the firm / replacement value of the firm’s assets ¨ ¨ The q-ratio therefore measures how much more a firm’s assets are worth when they are part of the productive process of that firm. A q-ratio higher than one its assets are worth more when used in the firm’s production than as stand-alone assets. A bidding firm may acquire a low q-ratio firm because it will be cheaper than expanding through the acquisition of the individual assets However, this a firm may also acquire also a high q-ratio firm in order to improve its efficiency. 2/11/2018 4

Economies of scope are related to the efficiency of the firm in terms of its management effectiveness. The efficiency of a firm can be measured by its q-ratio or Tobin’s q, which is defined as follows: q-ratio = market value of the firm / replacement value of the firm’s assets ¨ ¨ The q-ratio therefore measures how much more a firm’s assets are worth when they are part of the productive process of that firm. A q-ratio higher than one its assets are worth more when used in the firm’s production than as stand-alone assets. A bidding firm may acquire a low q-ratio firm because it will be cheaper than expanding through the acquisition of the individual assets However, this a firm may also acquire also a high q-ratio firm in order to improve its efficiency. 2/11/2018 4

Financial synergies occur when a merger between two companies reduces the average cost of financing the firms’ activities. These could arise as a result of: Tax Gains: If the bidding firm is profitable but the target firm is making a loss then the total tax bill of the two firms can be reduced by combining. Financing Opportunities: One firm may be generating lots of cash that must be returned to investors, while the other firm may need a lot cash for investment. Enhanced debt capacity: The debt capacity of the combined firm may be greater than the sum of the debt capacities of the individual firms, leading to greater tax benefits. 2/11/2018 5

Financial synergies occur when a merger between two companies reduces the average cost of financing the firms’ activities. These could arise as a result of: Tax Gains: If the bidding firm is profitable but the target firm is making a loss then the total tax bill of the two firms can be reduced by combining. Financing Opportunities: One firm may be generating lots of cash that must be returned to investors, while the other firm may need a lot cash for investment. Enhanced debt capacity: The debt capacity of the combined firm may be greater than the sum of the debt capacities of the individual firms, leading to greater tax benefits. 2/11/2018 5

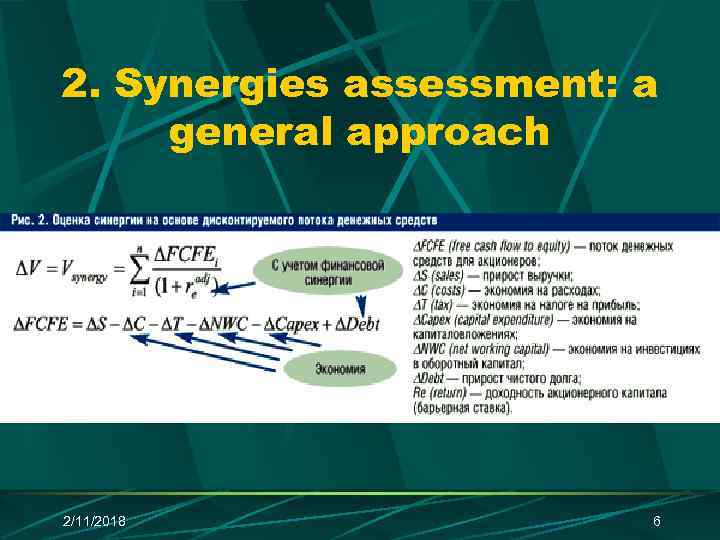

2. Synergies assessment: a general approach 2/11/2018 6

2. Synergies assessment: a general approach 2/11/2018 6

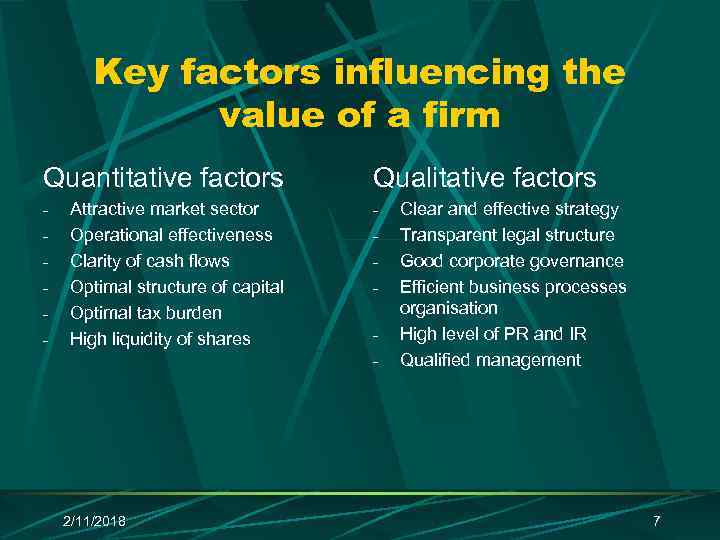

Key factors influencing the value of a firm Quantitative factors - Attractive market sector Operational effectiveness Clarity of cash flows Optimal structure of capital Optimal tax burden High liquidity of shares Qualitative factors - 2/11/2018 Clear and effective strategy Transparent legal structure Good corporate governance Efficient business processes organisation High level of PR and IR Qualified management 7

Key factors influencing the value of a firm Quantitative factors - Attractive market sector Operational effectiveness Clarity of cash flows Optimal structure of capital Optimal tax burden High liquidity of shares Qualitative factors - 2/11/2018 Clear and effective strategy Transparent legal structure Good corporate governance Efficient business processes organisation High level of PR and IR Qualified management 7

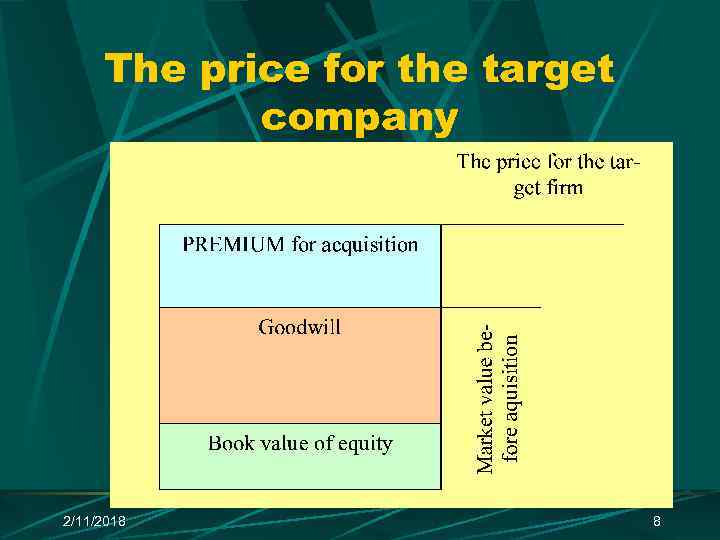

The price for the target company 2/11/2018 8

The price for the target company 2/11/2018 8

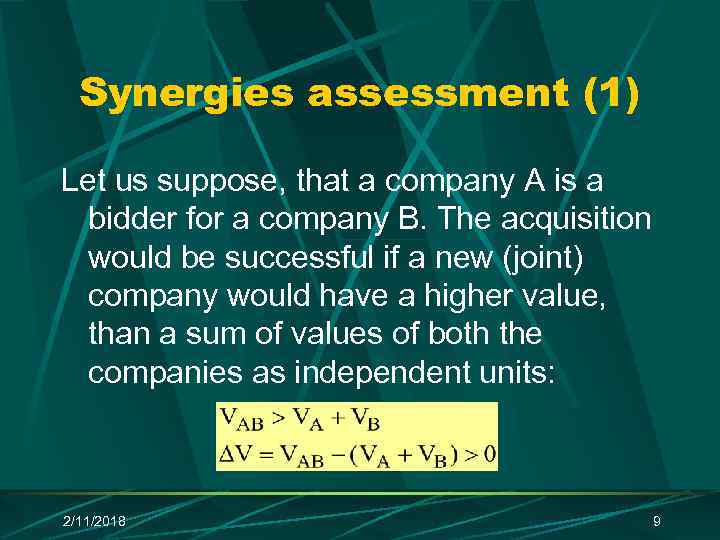

Synergies assessment (1) Let us suppose, that a company А is a bidder for a company В. The acquisition would be successful if a new (joint) company would have a higher value, than a sum of values of both the companies as independent units: 2/11/2018 9

Synergies assessment (1) Let us suppose, that a company А is a bidder for a company В. The acquisition would be successful if a new (joint) company would have a higher value, than a sum of values of both the companies as independent units: 2/11/2018 9

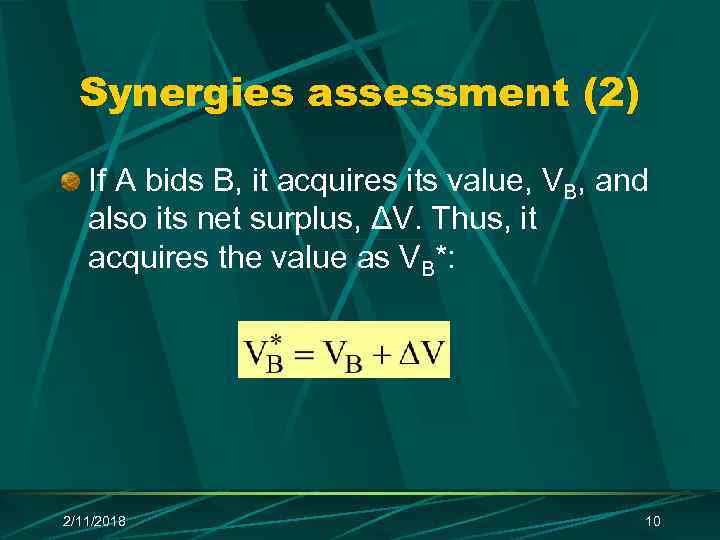

Synergies assessment (2) If А bids В, it acquires its value, VB, and also its net surplus, ΔV. Thus, it acquires the value as VB*: 2/11/2018 10

Synergies assessment (2) If А bids В, it acquires its value, VB, and also its net surplus, ΔV. Thus, it acquires the value as VB*: 2/11/2018 10

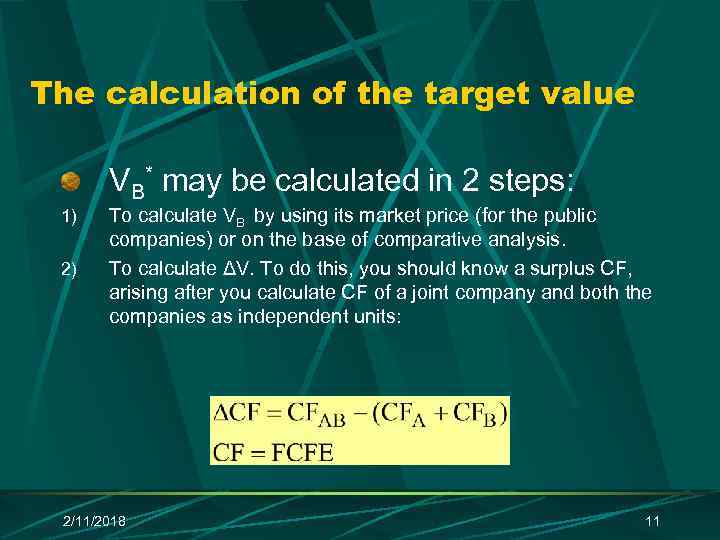

The calculation of the target value VB* may be calculated in 2 steps: 1) 2) To calculate VB by using its market price (for the public companies) or on the base of comparative analysis. To calculate ΔV. To do this, you should know a surplus CF, arising after you calculate CF of a joint company and both the companies as independent units: 2/11/2018 11

The calculation of the target value VB* may be calculated in 2 steps: 1) 2) To calculate VB by using its market price (for the public companies) or on the base of comparative analysis. To calculate ΔV. To do this, you should know a surplus CF, arising after you calculate CF of a joint company and both the companies as independent units: 2/11/2018 11

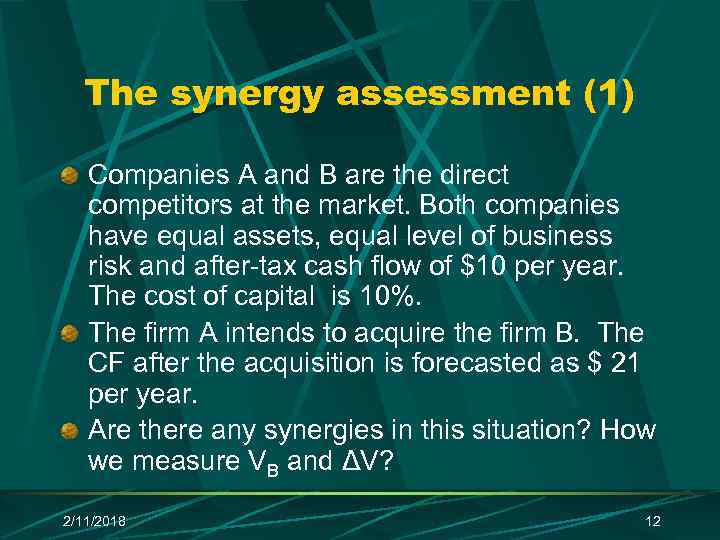

The synergy assessment (1) Companies А and В are the direct competitors at the market. Both companies have equal assets, equal level of business risk and after-tax cash flow of $10 per year. The cost of capital is 10%. The firm А intends to acquire the firm B. The CF after the acquisition is forecasted as $ 21 per year. Are there any synergies in this situation? How we measure VB and ΔV? 2/11/2018 12

The synergy assessment (1) Companies А and В are the direct competitors at the market. Both companies have equal assets, equal level of business risk and after-tax cash flow of $10 per year. The cost of capital is 10%. The firm А intends to acquire the firm B. The CF after the acquisition is forecasted as $ 21 per year. Are there any synergies in this situation? How we measure VB and ΔV? 2/11/2018 12

The synergy assessment (2) ΔCF=$21 – ($10+$10) = $1 – synergy. Taking into account the equal level of risk of both the companies, we may count the value of the new company AB: VAB = $21/0. 10 = $210. If we measure values of A&B as single units, we have for each of them: $10/0. 10 = $100, and for the sum of them $200. Then ΔV = $210 - $ 200 = $ 10. The value of the target company В for its bidder А is: VB* = $100 + $ 10 = $ 110. 2/11/2018 13

The synergy assessment (2) ΔCF=$21 – ($10+$10) = $1 – synergy. Taking into account the equal level of risk of both the companies, we may count the value of the new company AB: VAB = $21/0. 10 = $210. If we measure values of A&B as single units, we have for each of them: $10/0. 10 = $100, and for the sum of them $200. Then ΔV = $210 - $ 200 = $ 10. The value of the target company В for its bidder А is: VB* = $100 + $ 10 = $ 110. 2/11/2018 13

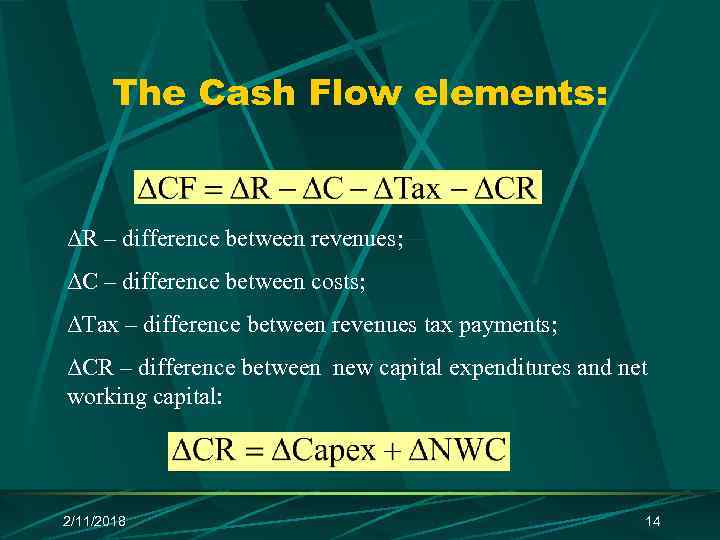

The Cash Flow elements: ΔR – difference between revenues; ΔС – difference between costs; ΔTax – difference between revenues tax payments; ΔCR – difference between new capital expenditures and net working capital: 2/11/2018 14

The Cash Flow elements: ΔR – difference between revenues; ΔС – difference between costs; ΔTax – difference between revenues tax payments; ΔCR – difference between new capital expenditures and net working capital: 2/11/2018 14

The possible positive effects of M&A deals: The growth of revenues (ΔR); The decrease of costs (-ΔC); The taxes economy (-ΔTax); The economy on capital expenditures (-ΔCR). The merger is reasonable if we identify minimum one positive result. 2/11/2018 15

The possible positive effects of M&A deals: The growth of revenues (ΔR); The decrease of costs (-ΔC); The taxes economy (-ΔTax); The economy on capital expenditures (-ΔCR). The merger is reasonable if we identify minimum one positive result. 2/11/2018 15

The revenues’ growth 1. Improvement in marketing, advertises, distribution, product range changes. 2. The strengthening of competitive advantages through the strategic flexibility. For example, the acquisition of Charmin Paper Co by Procter&Gamble had helped P&G to develop the production of tissue-based products for their operations – beachhead (entry to new business on the base of old competencies). The growth of market share due to the rise of prices and reshaping of agreements. 2/11/2018 16

The revenues’ growth 1. Improvement in marketing, advertises, distribution, product range changes. 2. The strengthening of competitive advantages through the strategic flexibility. For example, the acquisition of Charmin Paper Co by Procter&Gamble had helped P&G to develop the production of tissue-based products for their operations – beachhead (entry to new business on the base of old competencies). The growth of market share due to the rise of prices and reshaping of agreements. 2/11/2018 16

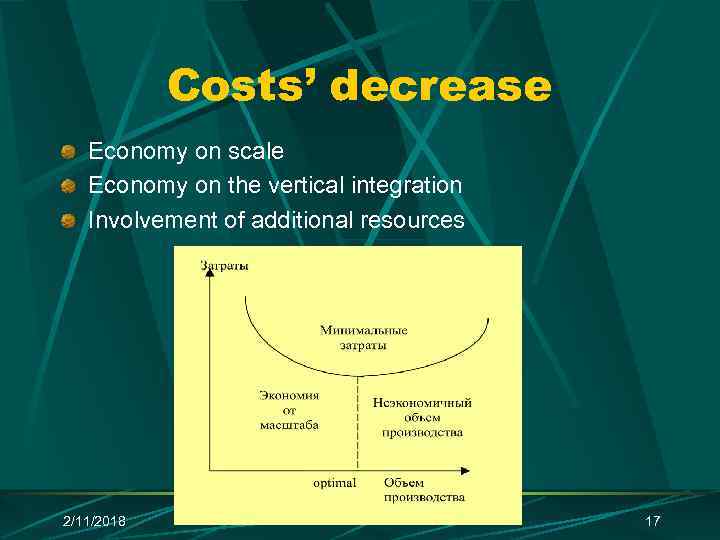

Costs’ decrease Economy on scale Economy on the vertical integration Involvement of additional resources 2/11/2018 17

Costs’ decrease Economy on scale Economy on the vertical integration Involvement of additional resources 2/11/2018 17

Economy on tax payments Tax losses use Loans use Depreciation and amortization use Dividends payment, shares’ buy-back and other opportunities for financial engineering 2/11/2018 18

Economy on tax payments Tax losses use Loans use Depreciation and amortization use Dividends payment, shares’ buy-back and other opportunities for financial engineering 2/11/2018 18

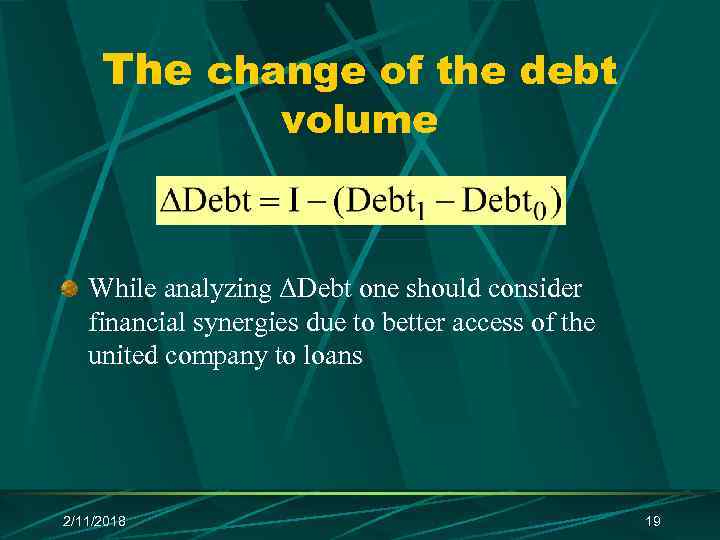

The change of the debt volume While analyzing ΔDebt one should consider financial synergies due to better access of the united company to loans 2/11/2018 19

The change of the debt volume While analyzing ΔDebt one should consider financial synergies due to better access of the united company to loans 2/11/2018 19

Additional financial effects of M&A deals EPS growth – the illusion of performance increase Diversification – means diminishing of unsystematic risk but not the value creation (shareholders may do it theirselves, without paying additional cash for an acquisition). 2/11/2018 20

Additional financial effects of M&A deals EPS growth – the illusion of performance increase Diversification – means diminishing of unsystematic risk but not the value creation (shareholders may do it theirselves, without paying additional cash for an acquisition). 2/11/2018 20

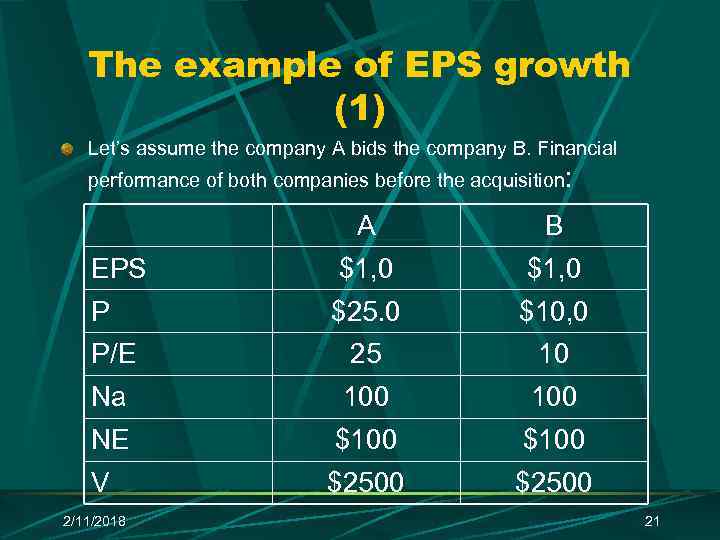

The example of EPS growth (1) Let’s assume the company А bids the company В. Financial performance of both companies before the acquisition: A B EPS $1, 0 P $25. 0 $10, 0 P/E 25 10 Na 100 NE $100 V $2500 2/11/2018 21

The example of EPS growth (1) Let’s assume the company А bids the company В. Financial performance of both companies before the acquisition: A B EPS $1, 0 P $25. 0 $10, 0 P/E 25 10 Na 100 NE $100 V $2500 2/11/2018 21

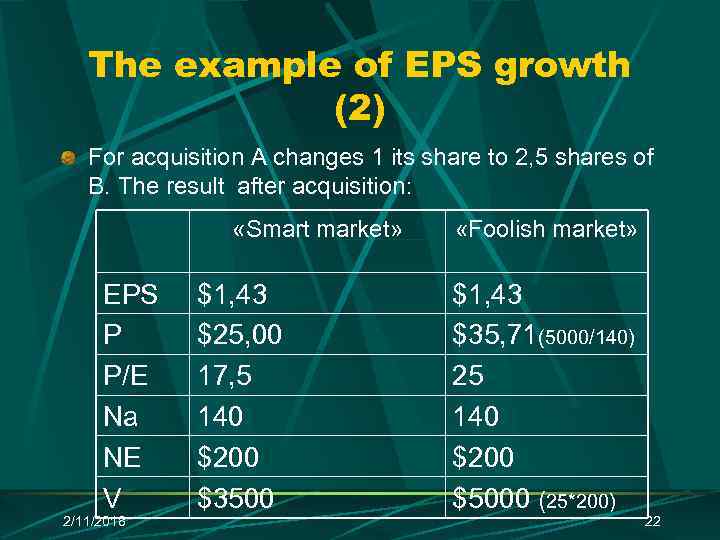

The example of EPS growth (2) For acquisition A changes 1 its share to 2, 5 shares of В. The result after acquisition: «Smart market» EPS P P/E Na NE V 2/11/2018 $1, 43 $25, 00 17, 5 140 $200 $3500 «Foolish market» $1, 43 $35, 71(5000/140) 25 140 $200 $5000 (25*200) 22

The example of EPS growth (2) For acquisition A changes 1 its share to 2, 5 shares of В. The result after acquisition: «Smart market» EPS P P/E Na NE V 2/11/2018 $1, 43 $25, 00 17, 5 140 $200 $3500 «Foolish market» $1, 43 $35, 71(5000/140) 25 140 $200 $5000 (25*200) 22

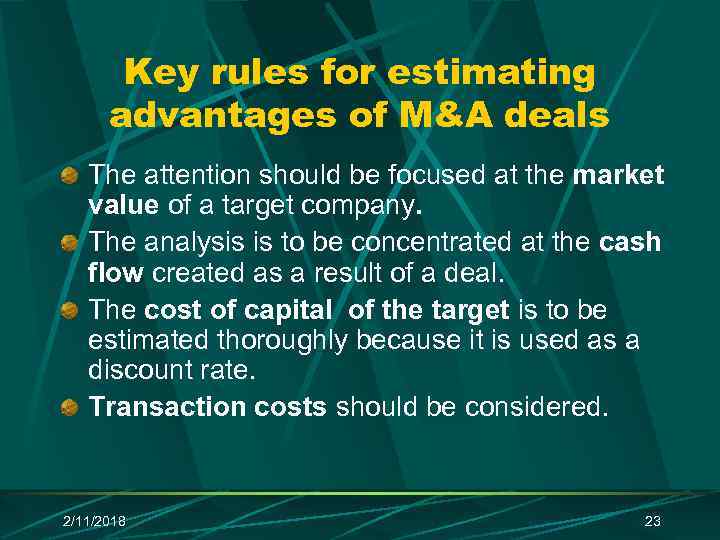

Key rules for estimating advantages of M&A deals The attention should be focused at the market value of a target company. The analysis is to be concentrated at the cash flow created as a result of a deal. The cost of capital of the target is to be estimated thoroughly because it is used as a discount rate. Transaction costs should be considered. 2/11/2018 23

Key rules for estimating advantages of M&A deals The attention should be focused at the market value of a target company. The analysis is to be concentrated at the cash flow created as a result of a deal. The cost of capital of the target is to be estimated thoroughly because it is used as a discount rate. Transaction costs should be considered. 2/11/2018 23

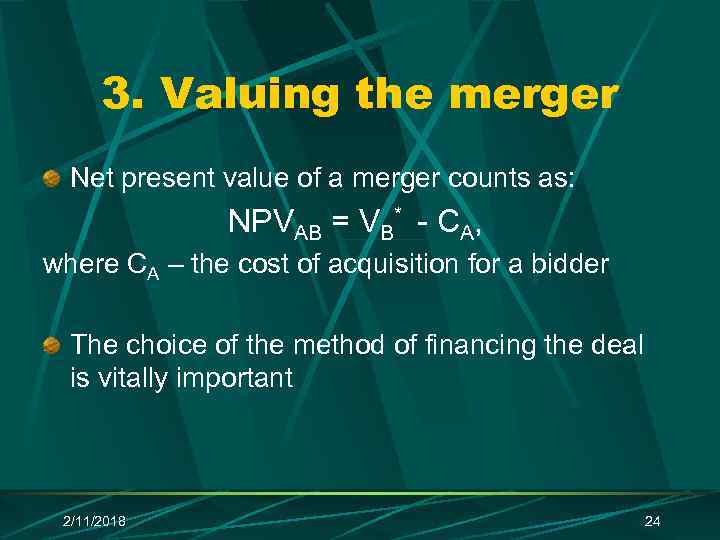

3. Valuing the merger Net present value of a merger counts as: NPVAB = VB* - CA, where CA – the cost of acquisition for a bidder The choice of the method of financing the deal is vitally important 2/11/2018 24

3. Valuing the merger Net present value of a merger counts as: NPVAB = VB* - CA, where CA – the cost of acquisition for a bidder The choice of the method of financing the deal is vitally important 2/11/2018 24

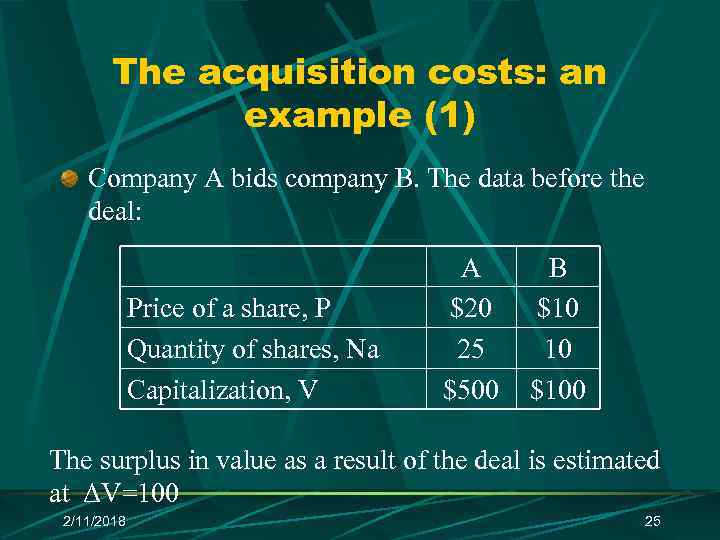

The acquisition costs: an example (1) Company А bids company В. The data before the deal: Price of a share, P Quantity of shares, Na Capitalization, V А $20 25 $500 В $10 10 $100 The surplus in value as a result of the deal is estimated at ΔV=100 2/11/2018 25

The acquisition costs: an example (1) Company А bids company В. The data before the deal: Price of a share, P Quantity of shares, Na Capitalization, V А $20 25 $500 В $10 10 $100 The surplus in value as a result of the deal is estimated at ΔV=100 2/11/2018 25

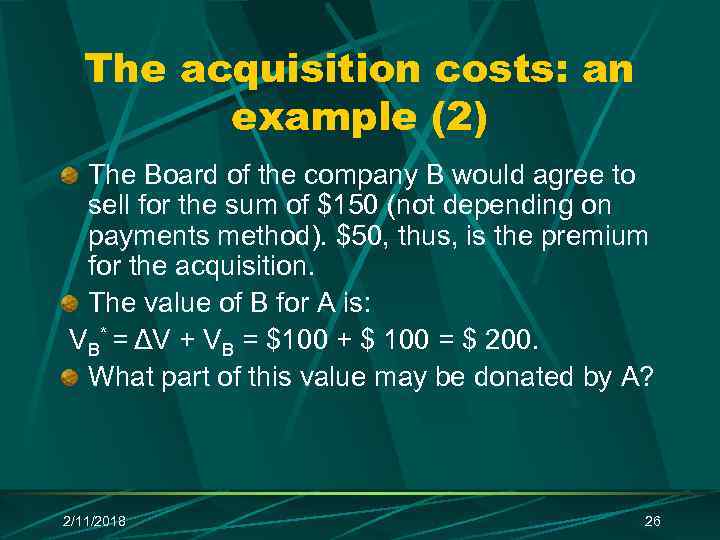

The acquisition costs: an example (2) The Board of the company B would agree to sell for the sum of $150 (not depending on payments method). $50, thus, is the premium for the acquisition. The value of B for A is: VB* = ΔV + VB = $100 + $ 100 = $ 200. What part of this value may be donated by А? 2/11/2018 26

The acquisition costs: an example (2) The Board of the company B would agree to sell for the sum of $150 (not depending on payments method). $50, thus, is the premium for the acquisition. The value of B for A is: VB* = ΔV + VB = $100 + $ 100 = $ 200. What part of this value may be donated by А? 2/11/2018 26

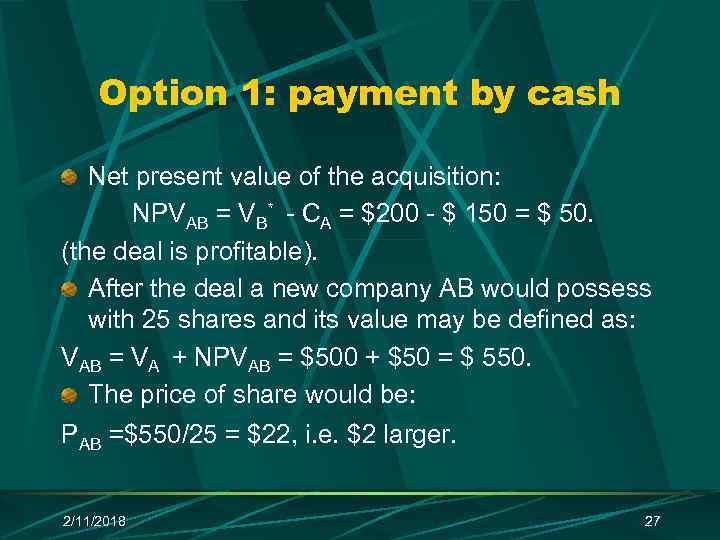

Option 1: payment by cash Net present value of the acquisition: NPVAB = VB* - CA = $200 - $ 150 = $ 50. (the deal is profitable). After the deal a new company АВ would possess with 25 shares and its value may be defined as: VAB = VA + NPVAB = $500 + $50 = $ 550. The price of share would be: РАВ =$550/25 = $22, i. e. $2 larger. 2/11/2018 27

Option 1: payment by cash Net present value of the acquisition: NPVAB = VB* - CA = $200 - $ 150 = $ 50. (the deal is profitable). After the deal a new company АВ would possess with 25 shares and its value may be defined as: VAB = VA + NPVAB = $500 + $50 = $ 550. The price of share would be: РАВ =$550/25 = $22, i. e. $2 larger. 2/11/2018 27

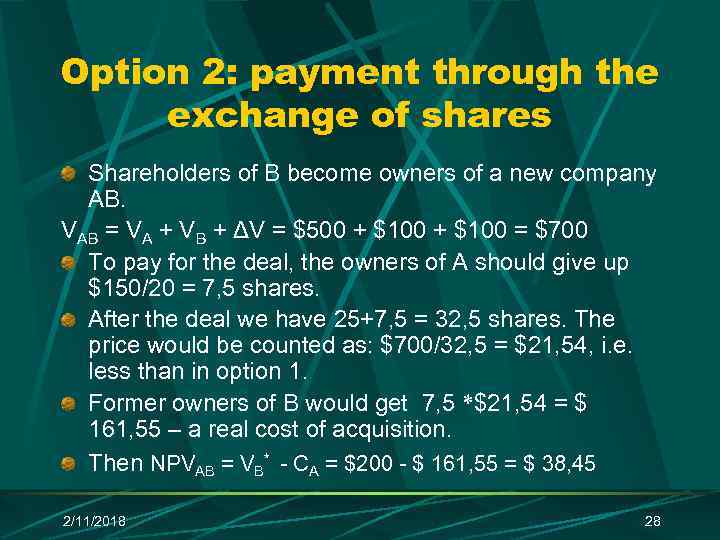

Option 2: payment through the exchange of shares Shareholders of B become owners of a new company АВ. VAB = VA + VB + ΔV = $500 + $100 = $700 To pay for the deal, the owners of A should give up $150/20 = 7, 5 shares. After the deal we have 25+7, 5 = 32, 5 shares. The price would be counted as: $700/32, 5 = $21, 54, i. е. less than in option 1. Former owners of B would get 7, 5 *$21, 54 = $ 161, 55 – a real cost of acquisition. Then NPVAB = VB* - CA = $200 - $ 161, 55 = $ 38, 45 2/11/2018 28

Option 2: payment through the exchange of shares Shareholders of B become owners of a new company АВ. VAB = VA + VB + ΔV = $500 + $100 = $700 To pay for the deal, the owners of A should give up $150/20 = 7, 5 shares. After the deal we have 25+7, 5 = 32, 5 shares. The price would be counted as: $700/32, 5 = $21, 54, i. е. less than in option 1. Former owners of B would get 7, 5 *$21, 54 = $ 161, 55 – a real cost of acquisition. Then NPVAB = VB* - CA = $200 - $ 161, 55 = $ 38, 45 2/11/2018 28

The choice of funding way If we use cash, the cost of acquisition doesn’t depend on growth of the value as a result of a deal. In the most of cases, if the bidder pays by shares, the cost of acquisition for him is larger, because the owners of a target participate in the results of the acquisition. Yet, if the NPV of an acquisition is negative, new owners shares the risk of losses. 2/11/2018 29

The choice of funding way If we use cash, the cost of acquisition doesn’t depend on growth of the value as a result of a deal. In the most of cases, if the bidder pays by shares, the cost of acquisition for him is larger, because the owners of a target participate in the results of the acquisition. Yet, if the NPV of an acquisition is negative, new owners shares the risk of losses. 2/11/2018 29

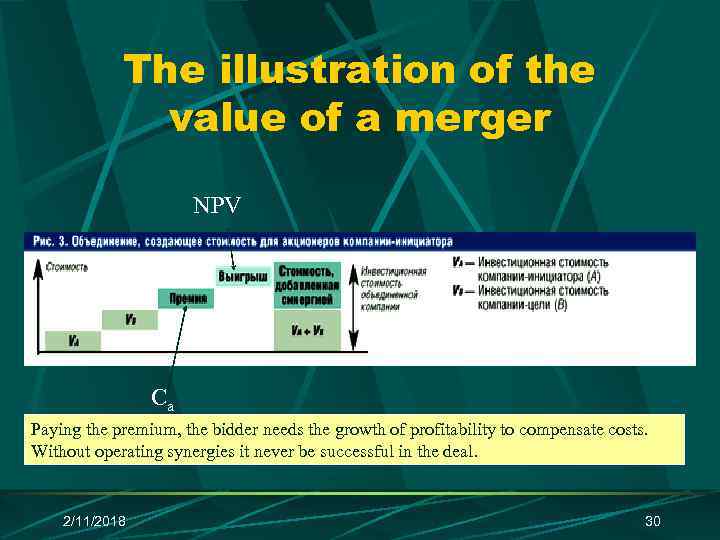

The illustration of the value of a merger NPV Ca Paying the premium, the bidder needs the growth of profitability to compensate costs. Without operating synergies it never be successful in the deal. 2/11/2018 30

The illustration of the value of a merger NPV Ca Paying the premium, the bidder needs the growth of profitability to compensate costs. Without operating synergies it never be successful in the deal. 2/11/2018 30

Valuing a Merger Firms decide to acquire other firms because they believe that it will increase shareholder value. This is occurs if the gain from the merger > the cost of the merger. To calculate the NPV of the merger to Firm A VA = value of firm A VB = value of firm B Value of the merged firm = VAB The gain from the merger is G=VAB - (VA+VB) The price paid for B = PB. The cost of the merger is C = PB - VB The overall value of the merger to the shareholders of firm A is the difference between the gain and the cost NPV = gain - cost 2/11/2018 31

Valuing a Merger Firms decide to acquire other firms because they believe that it will increase shareholder value. This is occurs if the gain from the merger > the cost of the merger. To calculate the NPV of the merger to Firm A VA = value of firm A VB = value of firm B Value of the merged firm = VAB The gain from the merger is G=VAB - (VA+VB) The price paid for B = PB. The cost of the merger is C = PB - VB The overall value of the merger to the shareholders of firm A is the difference between the gain and the cost NPV = gain - cost 2/11/2018 31

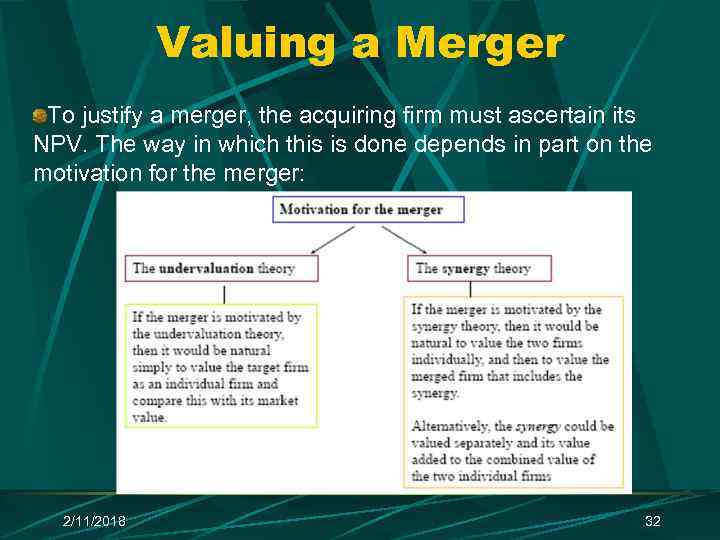

Valuing a Merger To justify a merger, the acquiring firm must ascertain its NPV. The way in which this is done depends in part on the motivation for the merger: 2/11/2018 32

Valuing a Merger To justify a merger, the acquiring firm must ascertain its NPV. The way in which this is done depends in part on the motivation for the merger: 2/11/2018 32

Valuing a Merger The undervaluation theory rests on the assumption that markets are not efficient. In an efficient market, the fair value of a firm should be its market value. ¨ ¨ However, the market value of a firm may already reflect the anticipated merger premium. Also, the target firm may not be publicly traded and so its market value would not be available. It is therefore likely that we will need to ascertain the value of the target firm ourselves. Another approach, however, is to use comparative firms or comparative transactions in order to ascertain the ‘fair’ value of a 2/11/2018 33 firm.

Valuing a Merger The undervaluation theory rests on the assumption that markets are not efficient. In an efficient market, the fair value of a firm should be its market value. ¨ ¨ However, the market value of a firm may already reflect the anticipated merger premium. Also, the target firm may not be publicly traded and so its market value would not be available. It is therefore likely that we will need to ascertain the value of the target firm ourselves. Another approach, however, is to use comparative firms or comparative transactions in order to ascertain the ‘fair’ value of a 2/11/2018 33 firm.

Valuing a merger: Comparative Firms Approach One way to value a firm is to see how ‘similar’ firms are valued by the market. We could find comparative firms that have similar characteristics, such as: ¨ ¨ ¨ Size Industry Age Having chosen a group of firms that approximately match these characteristics, we could compare their fundamentals, such as: ¨ ¨ ¨ Book value of equity Sales Earnings We could then apply the same valuation to the target firm to approximate the ‘fair’ market value of the firm. This approach is widely used by investment analysts in M&A departments 2/11/2018 34

Valuing a merger: Comparative Firms Approach One way to value a firm is to see how ‘similar’ firms are valued by the market. We could find comparative firms that have similar characteristics, such as: ¨ ¨ ¨ Size Industry Age Having chosen a group of firms that approximately match these characteristics, we could compare their fundamentals, such as: ¨ ¨ ¨ Book value of equity Sales Earnings We could then apply the same valuation to the target firm to approximate the ‘fair’ market value of the firm. This approach is widely used by investment analysts in M&A departments 2/11/2018 34

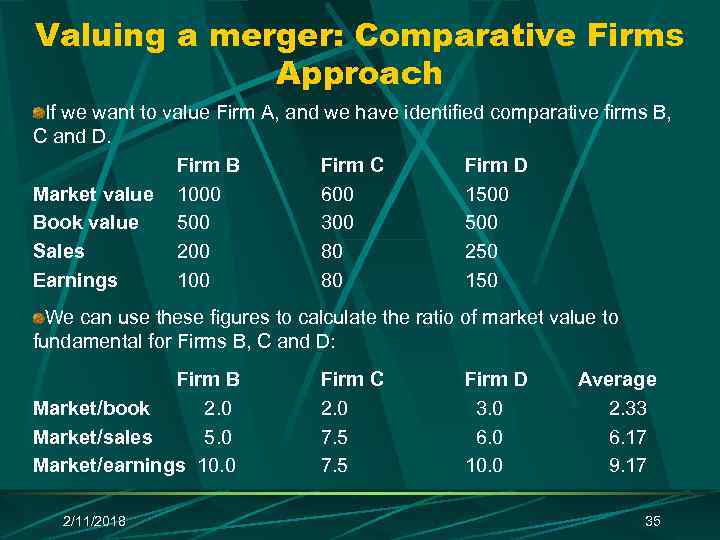

Valuing a merger: Comparative Firms Approach If we want to value Firm A, and we have identified comparative firms B, C and D. Firm B Firm C Firm D Market value 1000 600 1500 Book value 500 300 500 Sales 200 80 250 Earnings 100 80 150 We can use these figures to calculate the ratio of market value to fundamental for Firms B, C and D: Firm B Market/book 2. 0 Market/sales 5. 0 Market/earnings 10. 0 2/11/2018 Firm C 2. 0 7. 5 Firm D 3. 0 6. 0 10. 0 Average 2. 33 6. 17 9. 17 35

Valuing a merger: Comparative Firms Approach If we want to value Firm A, and we have identified comparative firms B, C and D. Firm B Firm C Firm D Market value 1000 600 1500 Book value 500 300 500 Sales 200 80 250 Earnings 100 80 150 We can use these figures to calculate the ratio of market value to fundamental for Firms B, C and D: Firm B Market/book 2. 0 Market/sales 5. 0 Market/earnings 10. 0 2/11/2018 Firm C 2. 0 7. 5 Firm D 3. 0 6. 0 10. 0 Average 2. 33 6. 17 9. 17 35

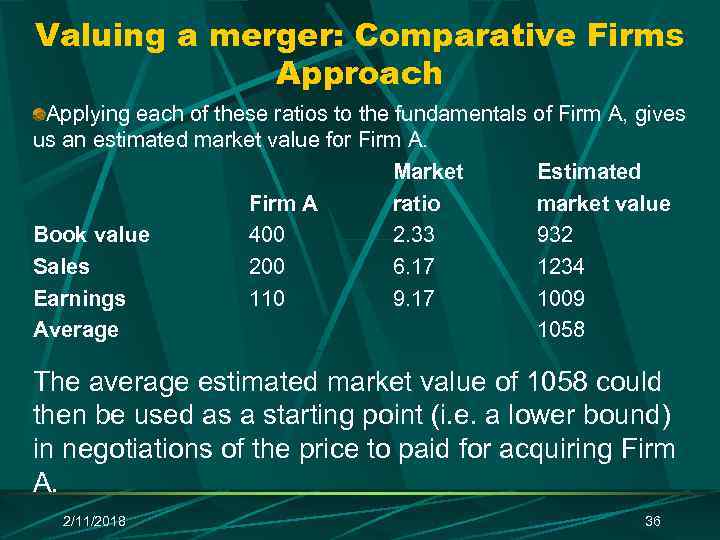

Valuing a merger: Comparative Firms Approach Applying each of these ratios to the fundamentals of Firm A, gives us an estimated market value for Firm A. Market Estimated Firm A ratio market value Book value 400 2. 33 932 Sales 200 6. 17 1234 Earnings 110 9. 17 1009 Average 1058 The average estimated market value of 1058 could then be used as a starting point (i. e. a lower bound) in negotiations of the price to paid for acquiring Firm A. 2/11/2018 36

Valuing a merger: Comparative Firms Approach Applying each of these ratios to the fundamentals of Firm A, gives us an estimated market value for Firm A. Market Estimated Firm A ratio market value Book value 400 2. 33 932 Sales 200 6. 17 1234 Earnings 110 9. 17 1009 Average 1058 The average estimated market value of 1058 could then be used as a starting point (i. e. a lower bound) in negotiations of the price to paid for acquiring Firm A. 2/11/2018 36

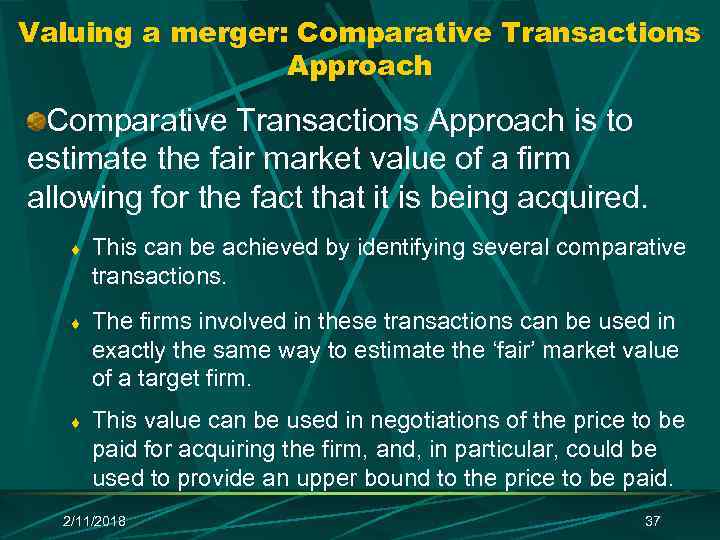

Valuing a merger: Comparative Transactions Approach is to estimate the fair market value of a firm allowing for the fact that it is being acquired. ¨ This can be achieved by identifying several comparative transactions. ¨ The firms involved in these transactions can be used in exactly the same way to estimate the ‘fair’ market value of a target firm. ¨ This value can be used in negotiations of the price to be paid for acquiring the firm, and, in particular, could be used to provide an upper bound to the price to be paid. 2/11/2018 37

Valuing a merger: Comparative Transactions Approach is to estimate the fair market value of a firm allowing for the fact that it is being acquired. ¨ This can be achieved by identifying several comparative transactions. ¨ The firms involved in these transactions can be used in exactly the same way to estimate the ‘fair’ market value of a target firm. ¨ This value can be used in negotiations of the price to be paid for acquiring the firm, and, in particular, could be used to provide an upper bound to the price to be paid. 2/11/2018 37

Mergers and asymmetric information A bidding firm can offer cash or shares in return for the equity of the target firm and in an efficient market, it should not matter how the transaction is financed. This is not true if there is asymmetric information. Suppose that the managers of Firm A are more optimistic than outside investors about the value of their firm. ¨ They would prefer to finance the merger with cash since this will be cheaper than financing it using undervalued shares in their own company. ¨ Conversely, if the managers of Firm A believe their firm to be overvalued, they would prefer to finance a merger with shares. 2/11/2018 38

Mergers and asymmetric information A bidding firm can offer cash or shares in return for the equity of the target firm and in an efficient market, it should not matter how the transaction is financed. This is not true if there is asymmetric information. Suppose that the managers of Firm A are more optimistic than outside investors about the value of their firm. ¨ They would prefer to finance the merger with cash since this will be cheaper than financing it using undervalued shares in their own company. ¨ Conversely, if the managers of Firm A believe their firm to be overvalued, they would prefer to finance a merger with shares. 2/11/2018 38

Empirical evidence: Do mergers they create value? The total gain to mergers is, on average, positive. ¨ The total increase in shareholder value of the bidding & target firm is positive. Shareholders of the bidding firm tend to be no better off. ¨ However, the shareholders of the bidding firm are no better off as a result of a merger, particularly when the merger is financed with shares rather than cash The shareholders of target firms are, on average, better off. ¨ Shareholders of the target firms gain most of the value of the merger The return to the bidding firms’ shareholders is about zero; the return to target firm shareholders is typically substantial. ¨ The return to bidding companies is about zero, while the return to the target company is typically between 20% and 40% The gains from a merger tend to be persistent. 2/11/2018 39

Empirical evidence: Do mergers they create value? The total gain to mergers is, on average, positive. ¨ The total increase in shareholder value of the bidding & target firm is positive. Shareholders of the bidding firm tend to be no better off. ¨ However, the shareholders of the bidding firm are no better off as a result of a merger, particularly when the merger is financed with shares rather than cash The shareholders of target firms are, on average, better off. ¨ Shareholders of the target firms gain most of the value of the merger The return to the bidding firms’ shareholders is about zero; the return to target firm shareholders is typically substantial. ¨ The return to bidding companies is about zero, while the return to the target company is typically between 20% and 40% The gains from a merger tend to be persistent. 2/11/2018 39

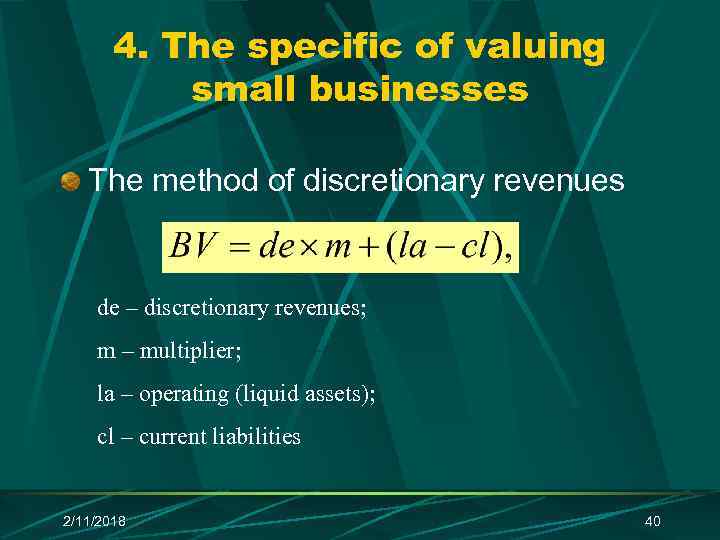

4. The specific of valuing small businesses The method of discretionary revenues de – discretionary revenues; m – multiplier; la – operating (liquid assets); cl – current liabilities 2/11/2018 40

4. The specific of valuing small businesses The method of discretionary revenues de – discretionary revenues; m – multiplier; la – operating (liquid assets); cl – current liabilities 2/11/2018 40

SDC – sellers discretionary cash Enterprise earnings before diminishing at: tax; Non-period revenues and costs; Non-operating R&C; Depreciation and amortization; Interest payments Wages and compensation to a single owner (general manager) after payments to all other owners 2/11/2018 41

SDC – sellers discretionary cash Enterprise earnings before diminishing at: tax; Non-period revenues and costs; Non-operating R&C; Depreciation and amortization; Interest payments Wages and compensation to a single owner (general manager) after payments to all other owners 2/11/2018 41

When the method is appropriate: Wages and compensations contribute significantly in a company revenues; The company belongs to a single owner (general manager); For defining the value corridor When we face the lack of information concerning deals with comparable companies 2/11/2018 42

When the method is appropriate: Wages and compensations contribute significantly in a company revenues; The company belongs to a single owner (general manager); For defining the value corridor When we face the lack of information concerning deals with comparable companies 2/11/2018 42

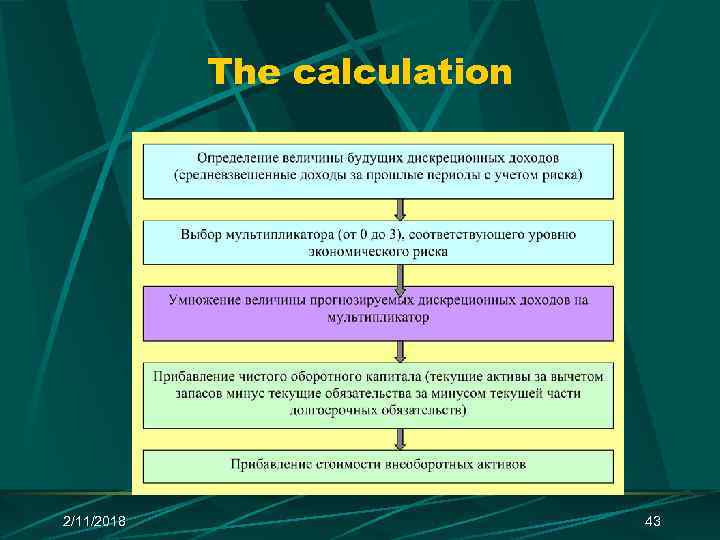

The calculation 2/11/2018 43

The calculation 2/11/2018 43

Risks Stability of sales Company and market growth Management Location and infrastructure Staff Competition Diversification Access to capital and investments appeal 2/11/2018 44

Risks Stability of sales Company and market growth Management Location and infrastructure Staff Competition Diversification Access to capital and investments appeal 2/11/2018 44

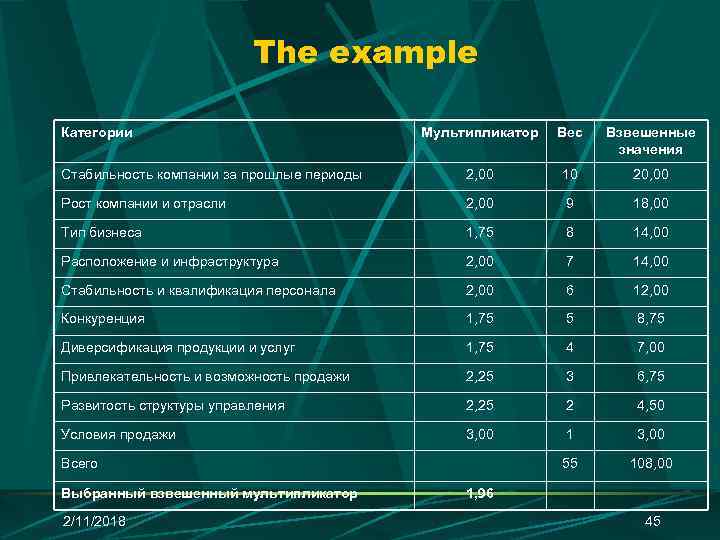

The example Категории Мультипликатор Вес Взвешенные значения Стабильность компании за прошлые периоды 2, 00 10 20, 00 Рост компании и отрасли 2, 00 9 18, 00 Тип бизнеса 1, 75 8 14, 00 Расположение и инфраструктура 2, 00 7 14, 00 Стабильность и квалификация персонала 2, 00 6 12, 00 Конкуренция 1, 75 5 8, 75 Диверсификация продукции и услуг 1, 75 4 7, 00 Привлекательность и возможность продажи 2, 25 3 6, 75 Развитость структуры управления 2, 25 2 4, 50 Условия продажи 3, 00 1 3, 00 55 108, 00 Всего Выбранный взвешенный мультипликатор 2/11/2018 1, 96 45

The example Категории Мультипликатор Вес Взвешенные значения Стабильность компании за прошлые периоды 2, 00 10 20, 00 Рост компании и отрасли 2, 00 9 18, 00 Тип бизнеса 1, 75 8 14, 00 Расположение и инфраструктура 2, 00 7 14, 00 Стабильность и квалификация персонала 2, 00 6 12, 00 Конкуренция 1, 75 5 8, 75 Диверсификация продукции и услуг 1, 75 4 7, 00 Привлекательность и возможность продажи 2, 25 3 6, 75 Развитость структуры управления 2, 25 2 4, 50 Условия продажи 3, 00 1 3, 00 55 108, 00 Всего Выбранный взвешенный мультипликатор 2/11/2018 1, 96 45

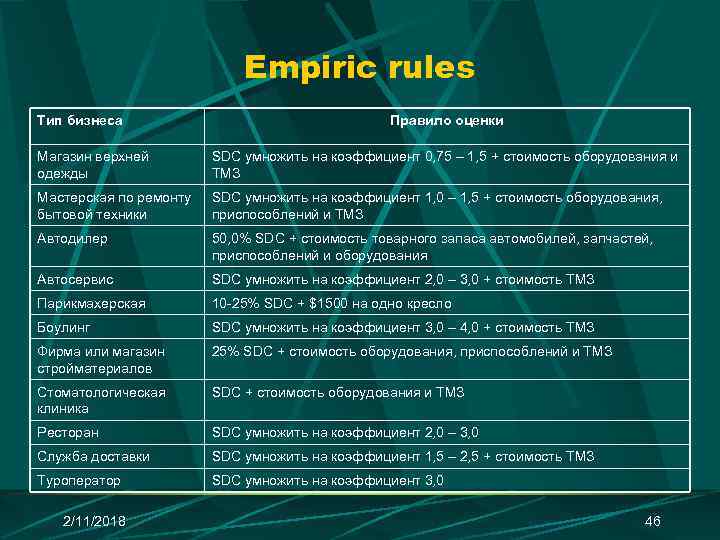

Empiric rules Тип бизнеса Правило оценки Магазин верхней одежды SDC умножить на коэффициент 0, 75 – 1, 5 + стоимость оборудования и ТМЗ Мастерская по ремонту бытовой техники SDC умножить на коэффициент 1, 0 – 1, 5 + стоимость оборудования, приспособлений и ТМЗ Автодилер 50, 0% SDC + стоимость товарного запаса автомобилей, запчастей, приспособлений и оборудования Автосервис SDC умножить на коэффициент 2, 0 – 3, 0 + стоимость ТМЗ Парикмахерская 10 -25% SDC + $1500 на одно кресло Боулинг SDC умножить на коэффициент 3, 0 – 4, 0 + стоимость ТМЗ Фирма или магазин стройматериалов 25% SDC + стоимость оборудования, приспособлений и ТМЗ Стоматологическая клиника SDC + стоимость оборудования и ТМЗ Ресторан SDC умножить на коэффициент 2, 0 – 3, 0 Служба доставки SDC умножить на коэффициент 1, 5 – 2, 5 + стоимость ТМЗ Туроператор SDC умножить на коэффициент 3, 0 2/11/2018 46

Empiric rules Тип бизнеса Правило оценки Магазин верхней одежды SDC умножить на коэффициент 0, 75 – 1, 5 + стоимость оборудования и ТМЗ Мастерская по ремонту бытовой техники SDC умножить на коэффициент 1, 0 – 1, 5 + стоимость оборудования, приспособлений и ТМЗ Автодилер 50, 0% SDC + стоимость товарного запаса автомобилей, запчастей, приспособлений и оборудования Автосервис SDC умножить на коэффициент 2, 0 – 3, 0 + стоимость ТМЗ Парикмахерская 10 -25% SDC + $1500 на одно кресло Боулинг SDC умножить на коэффициент 3, 0 – 4, 0 + стоимость ТМЗ Фирма или магазин стройматериалов 25% SDC + стоимость оборудования, приспособлений и ТМЗ Стоматологическая клиника SDC + стоимость оборудования и ТМЗ Ресторан SDC умножить на коэффициент 2, 0 – 3, 0 Служба доставки SDC умножить на коэффициент 1, 5 – 2, 5 + стоимость ТМЗ Туроператор SDC умножить на коэффициент 3, 0 2/11/2018 46