51d64763627665405cbc51a097e1a562.ppt

- Количество слайдов: 27

Tom Johnstone, President and CEO CMD 2013

Tom Johnstone, President and CEO CMD 2013

Key items • H 1 summary and outlook • SKF priorities • Specific focus - IT investment (UNITE) - Cost reduction and Purchasing © SKF Group CMD 2013

Key items • H 1 summary and outlook • SKF priorities • Specific focus - IT investment (UNITE) - Cost reduction and Purchasing © SKF Group CMD 2013

Highlights H 1 2013 Acquisitions and divestments • SKF completed the acquisition of German-based ship components provider Blohm + Voss Industries (BVI) • SKF divested the aerospace metallic rods business New facilities in India • a new lubrication systems laboratory in SKF Global Technical Centre • a new manufacturing unit in Pune for producing housings for bearings Two new SKF Solution Factories Inaugurated in Madrid, Spain and Katowice, Poland Programme to improve efficiency, reduce cost and strengthen profitable growth continues • one-off costs of around SEK 440 million • annual savings of around SEK 180 million © SKF Group CMD 2013 Madrid, Spain

Highlights H 1 2013 Acquisitions and divestments • SKF completed the acquisition of German-based ship components provider Blohm + Voss Industries (BVI) • SKF divested the aerospace metallic rods business New facilities in India • a new lubrication systems laboratory in SKF Global Technical Centre • a new manufacturing unit in Pune for producing housings for bearings Two new SKF Solution Factories Inaugurated in Madrid, Spain and Katowice, Poland Programme to improve efficiency, reduce cost and strengthen profitable growth continues • one-off costs of around SEK 440 million • annual savings of around SEK 180 million © SKF Group CMD 2013 Madrid, Spain

Highlights H 1 2013 Some examples of new business • with Pratt & Whitney, to supply engine main shaft bearings • with Nordex for delivery of mainshaft bearings and lubrication systems • for automated lubrication systems installed in the MSC Home Terminal cranes in Belgium’s Port of Antwerp • with a steel and mining company for industrial bearings and units, seals, mechatronics, and services • with Öhlins Racing AB for SKF’s integrated monotube seal • with the Chinese customer Great Wall for hub bearing units • 10 -year contract worth SEK 900 million with Turbomeca • service contracts worth SEK 200 million in Latin America • contract for wheel hub bearing units (HBU 3) to Volvo Car Corporation Thrust main shaft bearing, one of the bearings for the ARRANO Engine of TURBOMECA © SKF Group CMD 2013

Highlights H 1 2013 Some examples of new business • with Pratt & Whitney, to supply engine main shaft bearings • with Nordex for delivery of mainshaft bearings and lubrication systems • for automated lubrication systems installed in the MSC Home Terminal cranes in Belgium’s Port of Antwerp • with a steel and mining company for industrial bearings and units, seals, mechatronics, and services • with Öhlins Racing AB for SKF’s integrated monotube seal • with the Chinese customer Great Wall for hub bearing units • 10 -year contract worth SEK 900 million with Turbomeca • service contracts worth SEK 200 million in Latin America • contract for wheel hub bearing units (HBU 3) to Volvo Car Corporation Thrust main shaft bearing, one of the bearings for the ARRANO Engine of TURBOMECA © SKF Group CMD 2013

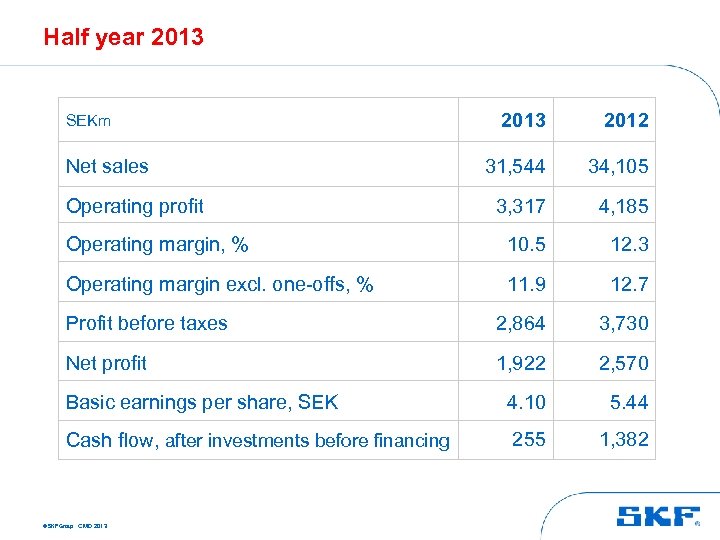

Half year 2013 2012 31, 544 34, 105 3, 317 4, 185 Operating margin, % 10. 5 12. 3 Operating margin excl. one-offs, % 11. 9 12. 7 Profit before taxes 2, 864 3, 730 Net profit 1, 922 2, 570 Basic earnings per share, SEK 4. 10 5. 44 Cash flow, after investments before financing 255 1, 382 SEKm Net sales Operating profit © SKF Group CMD 2013

Half year 2013 2012 31, 544 34, 105 3, 317 4, 185 Operating margin, % 10. 5 12. 3 Operating margin excl. one-offs, % 11. 9 12. 7 Profit before taxes 2, 864 3, 730 Net profit 1, 922 2, 570 Basic earnings per share, SEK 4. 10 5. 44 Cash flow, after investments before financing 255 1, 382 SEKm Net sales Operating profit © SKF Group CMD 2013

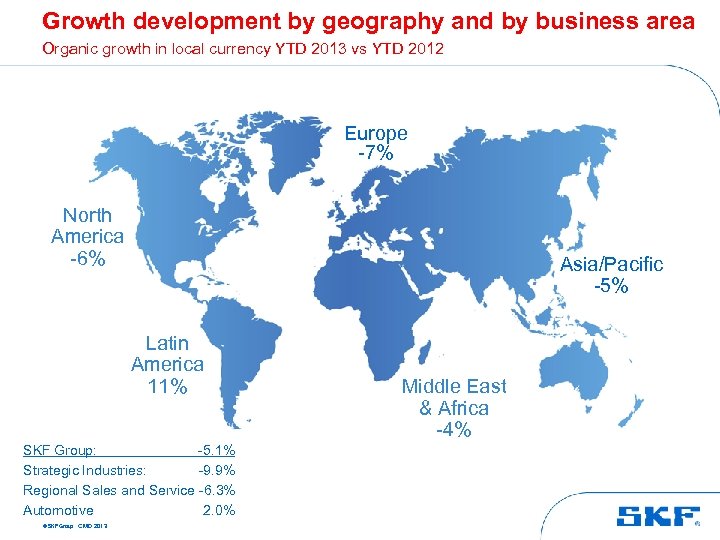

Growth development by geography and by business area Organic growth in local currency YTD 2013 vs YTD 2012 Europe -7% North America -6% Asia/Pacific -5% Latin America 11% SKF Group: -5. 1% Strategic Industries: -9. 9% Regional Sales and Service -6. 3% Automotive 2. 0% © SKF Group CMD 2013 Middle East & Africa -4%

Growth development by geography and by business area Organic growth in local currency YTD 2013 vs YTD 2012 Europe -7% North America -6% Asia/Pacific -5% Latin America 11% SKF Group: -5. 1% Strategic Industries: -9. 9% Regional Sales and Service -6. 3% Automotive 2. 0% © SKF Group CMD 2013 Middle East & Africa -4%

SKF demand outlook Q 3 2013, regions Share of net sales 2012 Sequential trend for Q 3 2013 vs Q 3 2012 Europe 43% +/- Asia Pacific 24% + North America 23% + Latin America 7% ++ Total © SKF Group CMD 2013 +

SKF demand outlook Q 3 2013, regions Share of net sales 2012 Sequential trend for Q 3 2013 vs Q 3 2012 Europe 43% +/- Asia Pacific 24% + North America 23% + Latin America 7% ++ Total © SKF Group CMD 2013 +

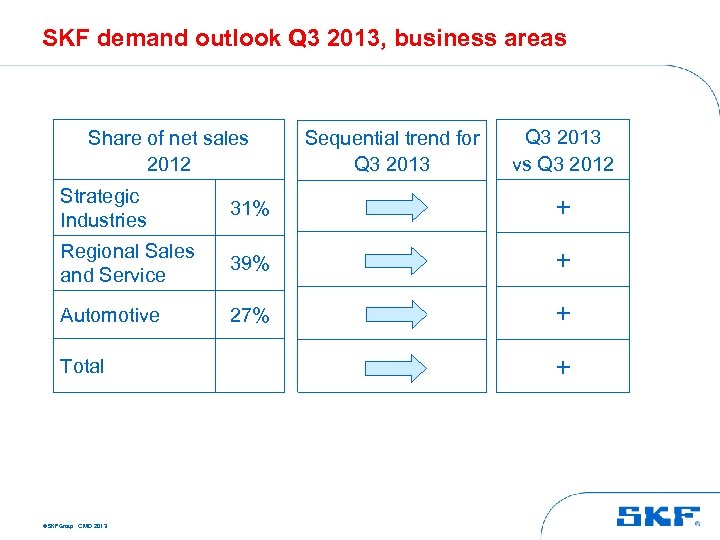

SKF demand outlook Q 3 2013, business areas Share of net sales 2012 Sequential trend for Q 3 2013 vs Q 3 2012 Strategic Industries 31% + Regional Sales and Service 39% + Automotive 27% + Total © SKF Group CMD 2013 +

SKF demand outlook Q 3 2013, business areas Share of net sales 2012 Sequential trend for Q 3 2013 vs Q 3 2012 Strategic Industries 31% + Regional Sales and Service 39% + Automotive 27% + Total © SKF Group CMD 2013 +

Key items • H 1 summary and outlook • SKF priorities • Specific focus - IT investment (UNITE) - Cost reduction and Purchasing © SKF Group CMD 2013

Key items • H 1 summary and outlook • SKF priorities • Specific focus - IT investment (UNITE) - Cost reduction and Purchasing © SKF Group CMD 2013

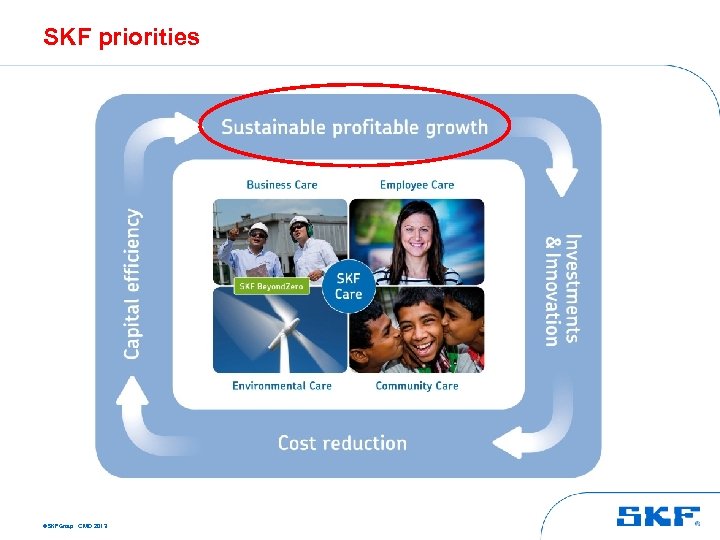

SKF priorities © SKF Group CMD 2013

SKF priorities © SKF Group CMD 2013

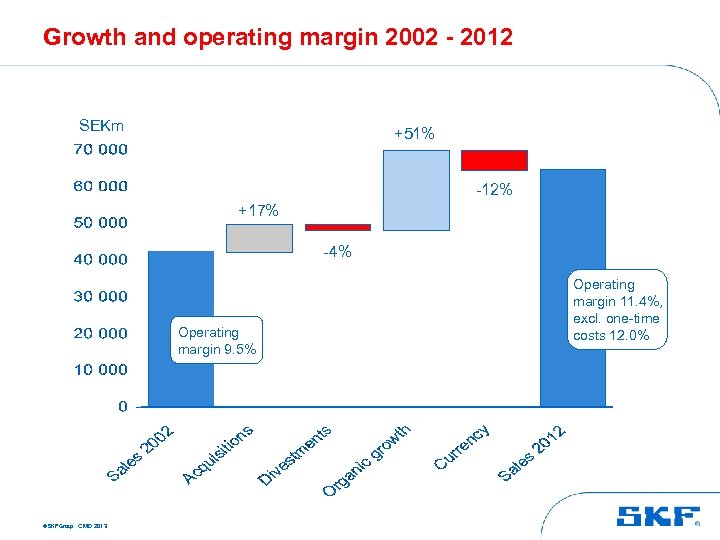

Growth and operating margin 2002 - 2012 SEKm +51% -12% +17% -4% Operating margin 9. 5% © SKF Group CMD 2013 Operating margin 11. 4%, excl. one-time costs 12. 0%

Growth and operating margin 2002 - 2012 SEKm +51% -12% +17% -4% Operating margin 9. 5% © SKF Group CMD 2013 Operating margin 11. 4%, excl. one-time costs 12. 0%

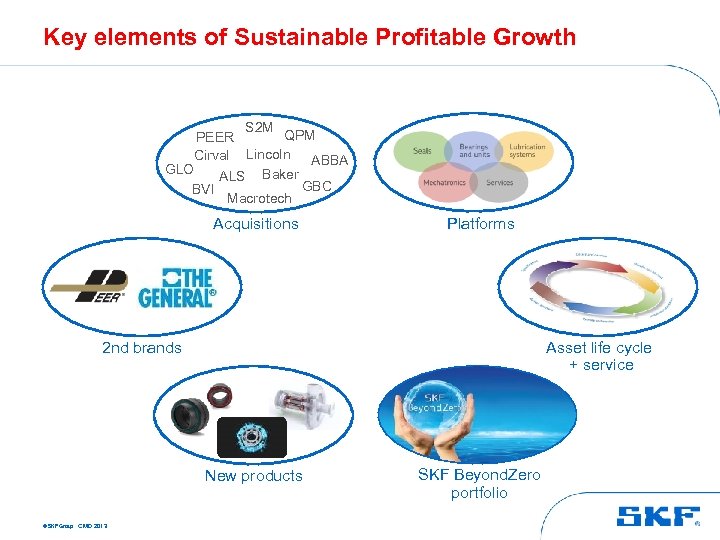

Key elements of Sustainable Profitable Growth S 2 M QPM PEER Cirval Lincoln ABBA GLO ALS Baker GBC BVI Macrotech Acquisitions Platforms 2 nd brands Asset life cycle + service New products © SKF Group CMD 2013 SKF Beyond. Zero portfolio

Key elements of Sustainable Profitable Growth S 2 M QPM PEER Cirval Lincoln ABBA GLO ALS Baker GBC BVI Macrotech Acquisitions Platforms 2 nd brands Asset life cycle + service New products © SKF Group CMD 2013 SKF Beyond. Zero portfolio

Key items • H 1 summary and outlook • SKF priorities • Specific focus - IT investment (UNITE) - Cost reduction and Purchasing © SKF Group CMD 2013

Key items • H 1 summary and outlook • SKF priorities • Specific focus - IT investment (UNITE) - Cost reduction and Purchasing © SKF Group CMD 2013

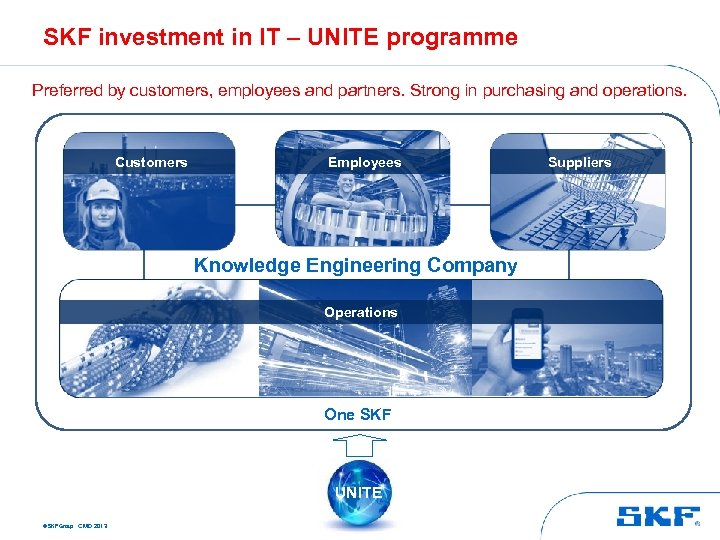

SKF investment in IT – UNITE programme Preferred by customers, employees and partners. Strong in purchasing and operations. Customers Employees Knowledge Engineering Company Operations One SKF UNITE © SKF Group CMD 2013 Suppliers

SKF investment in IT – UNITE programme Preferred by customers, employees and partners. Strong in purchasing and operations. Customers Employees Knowledge Engineering Company Operations One SKF UNITE © SKF Group CMD 2013 Suppliers

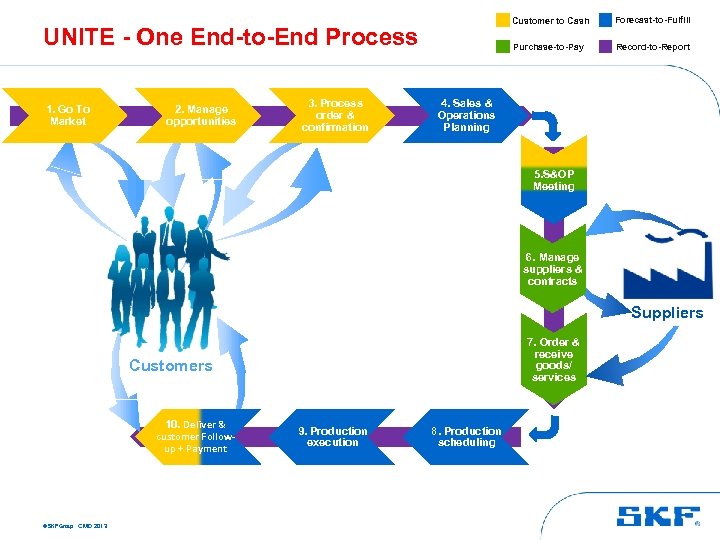

Customer to Cash Purchase-to-Pay UNITE - One End-to-End Process 1. Go To Market 2. Manage opportunities 3. Process order & confirmation Forecast-to-Fulfill Record-to-Report 4. Sales & Operations Planning 5. S&OP Meeting 6. Manage suppliers & contracts Suppliers 7. Order & receive goods/ services Customers 10. Deliver & customer Followup + Payment © SKF Group CMD 2013 9. Production execution 8. Production scheduling

Customer to Cash Purchase-to-Pay UNITE - One End-to-End Process 1. Go To Market 2. Manage opportunities 3. Process order & confirmation Forecast-to-Fulfill Record-to-Report 4. Sales & Operations Planning 5. S&OP Meeting 6. Manage suppliers & contracts Suppliers 7. Order & receive goods/ services Customers 10. Deliver & customer Followup + Payment © SKF Group CMD 2013 9. Production execution 8. Production scheduling

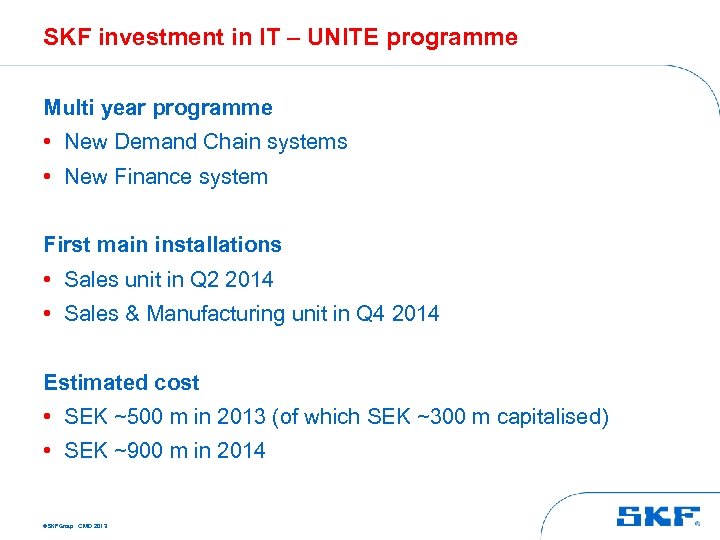

SKF investment in IT – UNITE programme Multi year programme • New Demand Chain systems • New Finance system First main installations • Sales unit in Q 2 2014 • Sales & Manufacturing unit in Q 4 2014 Estimated cost • SEK ~500 m in 2013 (of which SEK ~300 m capitalised) • SEK ~900 m in 2014 © SKF Group CMD 2013

SKF investment in IT – UNITE programme Multi year programme • New Demand Chain systems • New Finance system First main installations • Sales unit in Q 2 2014 • Sales & Manufacturing unit in Q 4 2014 Estimated cost • SEK ~500 m in 2013 (of which SEK ~300 m capitalised) • SEK ~900 m in 2014 © SKF Group CMD 2013

Key items • H 1 summary and outlook • SKF priorities • Specific focus - IT investment - Cost reduction and Purchasing © SKF Group CMD 2013

Key items • H 1 summary and outlook • SKF priorities • Specific focus - IT investment - Cost reduction and Purchasing © SKF Group CMD 2013

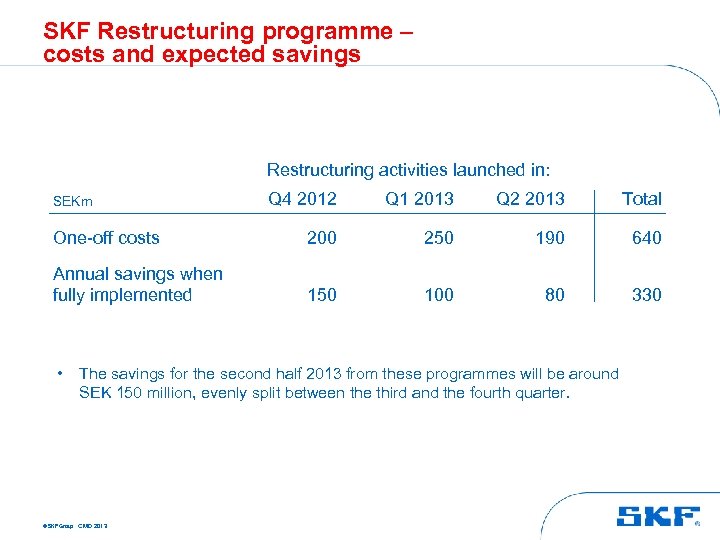

SKF Restructuring programme – costs and expected savings Restructuring activities launched in: Q 4 2012 Q 1 2013 Q 2 2013 Total One-off costs 200 250 190 640 Annual savings when fully implemented 150 100 80 330 SEKm • The savings for the second half 2013 from these programmes will be around SEK 150 million, evenly split between the third and the fourth quarter. © SKF Group CMD 2013

SKF Restructuring programme – costs and expected savings Restructuring activities launched in: Q 4 2012 Q 1 2013 Q 2 2013 Total One-off costs 200 250 190 640 Annual savings when fully implemented 150 100 80 330 SEKm • The savings for the second half 2013 from these programmes will be around SEK 150 million, evenly split between the third and the fourth quarter. © SKF Group CMD 2013

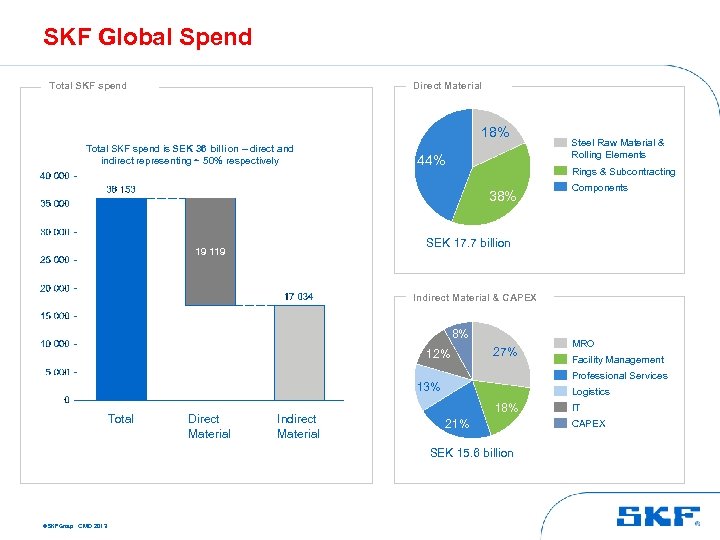

SKF Global Spend Total SKF spend Direct Material 18% Total SKF spend is SEK 36 billion – direct and indirect representing ~ 50% respectively 44% Steel Raw Material & Rolling Elements Rings & Subcontracting 38% Components SEK 17. 7 billion 19 119 Indirect Material & CAPEX 8% 12% 27% Direct Material Indirect Material Logistics 18% 21% SEK 15. 6 billion © SKF Group CMD 2013 Facility Management Professional Services 13% Total MRO IT CAPEX

SKF Global Spend Total SKF spend Direct Material 18% Total SKF spend is SEK 36 billion – direct and indirect representing ~ 50% respectively 44% Steel Raw Material & Rolling Elements Rings & Subcontracting 38% Components SEK 17. 7 billion 19 119 Indirect Material & CAPEX 8% 12% 27% Direct Material Indirect Material Logistics 18% 21% SEK 15. 6 billion © SKF Group CMD 2013 Facility Management Professional Services 13% Total MRO IT CAPEX

Challenges in the global supply chain – many factors Natural disasters Geopolitical Risk Supply Chain Disruptions Market demand variations and volatility Price and currency volatility Effective sourcing strategy Global & Local Supplier Relationships © SKF Group CMD 2013 Supplier Innovations Sustainable and Responsible Sourcing

Challenges in the global supply chain – many factors Natural disasters Geopolitical Risk Supply Chain Disruptions Market demand variations and volatility Price and currency volatility Effective sourcing strategy Global & Local Supplier Relationships © SKF Group CMD 2013 Supplier Innovations Sustainable and Responsible Sourcing

Key initiatives to achieve savings • Category and business driven purchasing • Supplier consolidation and localization • Leverage of all purchasing power across all businesses • Product, process & system standardization • Total cost approach and leading purchasing practices applied © SKF Group CMD 2013

Key initiatives to achieve savings • Category and business driven purchasing • Supplier consolidation and localization • Leverage of all purchasing power across all businesses • Product, process & system standardization • Total cost approach and leading purchasing practices applied © SKF Group CMD 2013

Success Story – localization of cages in China Target: • China supplier development to secure capacity and Q C D I M targets SKF benefits: • Access to a supplier base in China close to Dalian • 100% localization • 2 suppliers fully approved in China • Worldwide supplier market base fitting with new SKF manufacturing footprint • Development of a Chinese suppliers base with export capacity © SKF Group CMD 2013 Contract Status: 2012/2013 Savings: -40/50% vs Import in China

Success Story – localization of cages in China Target: • China supplier development to secure capacity and Q C D I M targets SKF benefits: • Access to a supplier base in China close to Dalian • 100% localization • 2 suppliers fully approved in China • Worldwide supplier market base fitting with new SKF manufacturing footprint • Development of a Chinese suppliers base with export capacity © SKF Group CMD 2013 Contract Status: 2012/2013 Savings: -40/50% vs Import in China

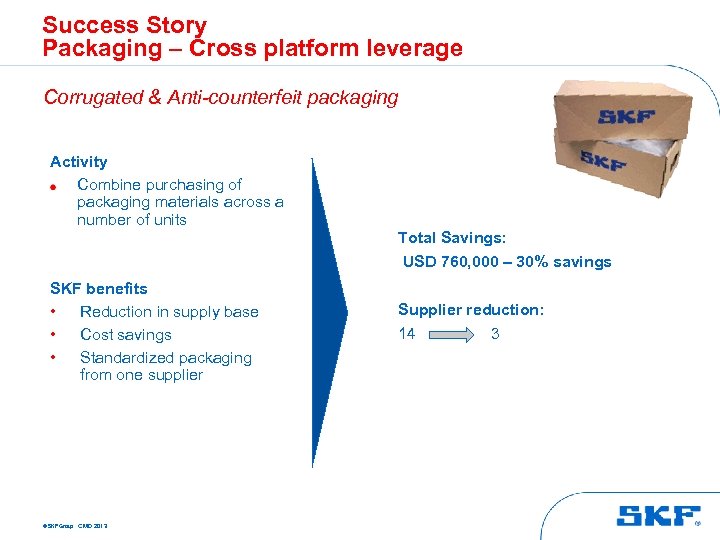

Success Story Packaging – Cross platform leverage Corrugated & Anti-counterfeit packaging Activity Combine purchasing of packaging materials across a number of units Total Savings: USD 760, 000 – 30% savings SKF benefits • Reduction in supply base • Cost savings • Standardized packaging from one supplier © SKF Group CMD 2013 Supplier reduction: 14 3

Success Story Packaging – Cross platform leverage Corrugated & Anti-counterfeit packaging Activity Combine purchasing of packaging materials across a number of units Total Savings: USD 760, 000 – 30% savings SKF benefits • Reduction in supply base • Cost savings • Standardized packaging from one supplier © SKF Group CMD 2013 Supplier reduction: 14 3

Success Story Standardization of capital equipment • Equipment for Grinding, Honing, Laser marking and Assembly • HBU 3 channel standardization SEK 280 million of total cost savings • Clear business requirements • Improved sourcing process • Standardization of equipment • Cross business leverage • Regional Asian supplier base developed with global capabilities © SKF Group CMD 2013

Success Story Standardization of capital equipment • Equipment for Grinding, Honing, Laser marking and Assembly • HBU 3 channel standardization SEK 280 million of total cost savings • Clear business requirements • Improved sourcing process • Standardization of equipment • Cross business leverage • Regional Asian supplier base developed with global capabilities © SKF Group CMD 2013

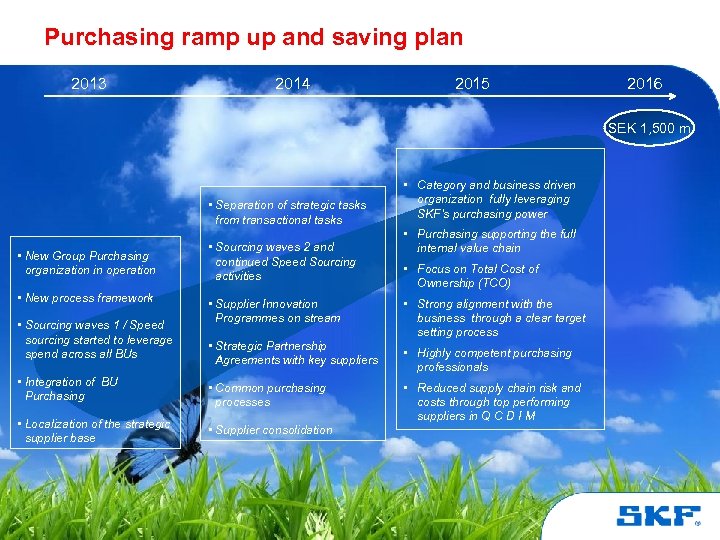

Purchasing ramp up and saving plan 2013 2014 2015 2016 SEK 1, 500 m • Separation of strategic tasks from transactional tasks • New Group Purchasing organization in operation • New process framework • Sourcing waves 1 / Speed sourcing started to leverage spend across all BUs • Sourcing waves 2 and continued Speed Sourcing activities • Supplier Innovation Programmes on stream • Strategic Partnership Agreements with key suppliers • Integration of BU Purchasing • Common purchasing processes • Localization of the strategic supplier base • Supplier consolidation © SKF Group CMD 2013 • Category and business driven organization fully leveraging SKF’s purchasing power • Purchasing supporting the full internal value chain • Focus on Total Cost of Ownership (TCO) • Strong alignment with the business through a clear target setting process • Highly competent purchasing professionals • Reduced supply chain risk and costs through top performing suppliers in Q C D I M

Purchasing ramp up and saving plan 2013 2014 2015 2016 SEK 1, 500 m • Separation of strategic tasks from transactional tasks • New Group Purchasing organization in operation • New process framework • Sourcing waves 1 / Speed sourcing started to leverage spend across all BUs • Sourcing waves 2 and continued Speed Sourcing activities • Supplier Innovation Programmes on stream • Strategic Partnership Agreements with key suppliers • Integration of BU Purchasing • Common purchasing processes • Localization of the strategic supplier base • Supplier consolidation © SKF Group CMD 2013 • Category and business driven organization fully leveraging SKF’s purchasing power • Purchasing supporting the full internal value chain • Focus on Total Cost of Ownership (TCO) • Strong alignment with the business through a clear target setting process • Highly competent purchasing professionals • Reduced supply chain risk and costs through top performing suppliers in Q C D I M

SKF priorities © SKF Group CMD 2013

SKF priorities © SKF Group CMD 2013

Key business message • No change in demand outlook for Q 3 • SKF priorities in focus – good progress in H 1 • New IT investment (UNITE) and purchasing programmes going according to plan © SKF Group CMD 2013

Key business message • No change in demand outlook for Q 3 • SKF priorities in focus – good progress in H 1 • New IT investment (UNITE) and purchasing programmes going according to plan © SKF Group CMD 2013