1e47da2ca3fcb417f2b9b29e8c62bcf2.ppt

- Количество слайдов: 35

Today we’ll be talking about… • … the monetary system. • What is the definition and role of money? Who issues money? How is the money supply controlled? This will be based on Chapter 26 in Mankiw & Taylor.

The Meaning of Money • What is money? £, $. . . – Set of assets in an economy that people regularly use to buy goods and services from other people – Liquid (will get back to this in two slides) • The three functions of money, which distinguish it from other assets (such as bonds or shares) 2

The Meaning of Money • 1. Medium of exchange – Item that buyers give to sellers when they want to purchase goods and services • 2. Unit of account – Yardstick people use to post prices and record debts – Measure of economic value 3

The Meaning of Money • 3. Store of value – Item that people can use to transfer purchasing power from the present to the future • Money is the most liquid of assets – Liquidity: Ease with which an asset can be converted into the economy’s medium of exchange. Money is medium of exchange so most liquid of all assets. – Generally, the more liquid an asset, the lower its return. Not surprisingly, money has the lowest return of any asset (zero or close to zero). 4

The Kinds of Money • Commodity money – Money that takes the form of a commodity with intrinsic value – Intrinsic value: would have value even if it were not used as money • Example: Gold as money (gold standard) – Or paper money that is convertible into gold on demand – Cigarettes or phone cards in a prison 5

The Kinds of Money • Fiat money – Money without intrinsic value that is used as money because of government decree [Fiat, from Latin: “It shall be”] – With fiat money, peoples’ trust is critical. If people lose faith, fiat money will lose its value (e. g. , Russian Ruble in 90 ies). – Conversely, if people have faith, no government is needed (Bit. Coins, Stones on Yap) 6

Money in the Economy • What is the money stock? – Quantity of money circulating in the economy • Includes: currency… – Paper bills and coins in the hands of the public, • … and demand deposits – Balances in bank accounts - depositors can access on demand by writing a cheque, use their debit cards, or go to the bank and take the money out. – What about credit cards? NO! They are a means of deferring not simply transferring payment 7

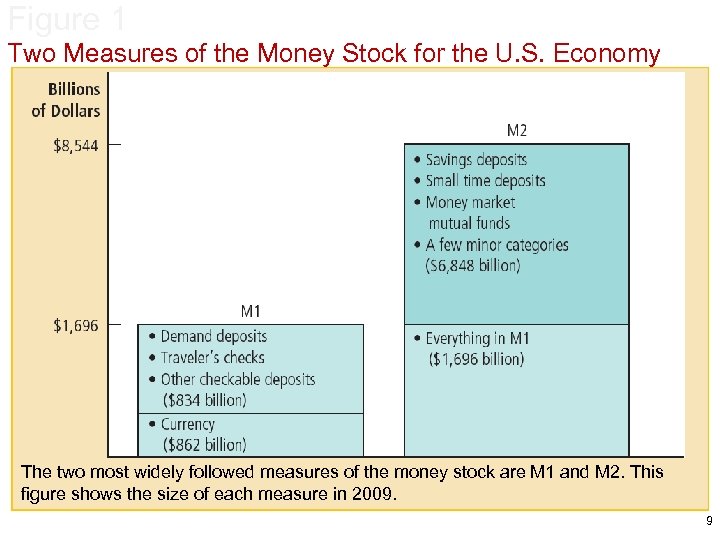

Money in the Economy • There are different measures of the money stock – M 1 (in the US. Definitions vary slightly internationally) • Currency in circulation • Demand deposits, Traveler’s checks (US spelling) • Other checkable deposits – M 2 =everything in M 1 + • Savings deposits (short term) • Money market mutual funds • A few other minor categories 8

Figure 1 Two Measures of the Money Stock for the U. S. Economy The two most widely followed measures of the money stock are M 1 and M 2. This figure shows the size of each measure in 2009. 9

Central Banks • Fiat currencies are regulated by central banks – Bank of England (UK), Federal Reserve (Fed, US) and European Central Bank • What is a central bank (CB)? – It is a legal entity with authority to: • Oversee the banking system • Regulate the quantity of money in the economy 10

Bank of England • Founded in 1694 • Operationally independent since 1997 – Monetary Policy Committee (MPC) – Sets interest rates to achieve 2% CPI inflation rate (“policy goal”) • + New powers for financial regulation, with the abolition of FSA in the aftermath of the global financial crisis 11

The U. S. and Europe • The Federal Reserve – Created in 1913 – After a series of bank failures in 1907 – Policy goal: to ensure the health of the nation’s banking system. • European Central Bank – Created in 1998 – Comprises EMU countries – Aim/policy goal is to achieve price stability • Inflation rates below but close to 2% over the medium run 12

Importance of monetary policy • As we shall see later, prices rise when “too much” money is printed • At the same time, interest rates/money supply affect activity and unemployment • So there is a “trade-off”. Increased money supply leads to: – Inflation (bad!) – Increased production and lower unemployment, at least in the short run (good!). 13

Quantitative Easing (QE) • Way of affecting the money supply • Between March 2009 and January 2010, the MPC authorised the purchase of £ 200 billion worth of assets, mostly gilts • This has since been repeatedly renewed. • This lowers interest rates, boosts activity… and generates inflation. 14

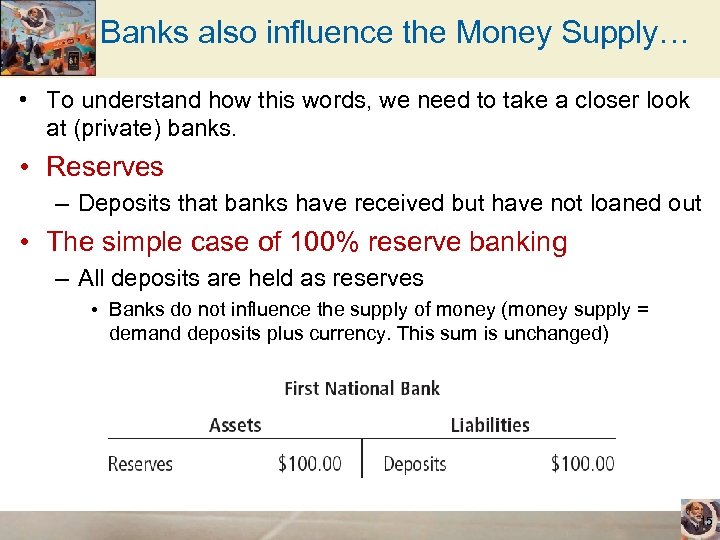

Banks also influence the Money Supply… • To understand how this words, we need to take a closer look at (private) banks. • Reserves – Deposits that banks have received but have not loaned out • The simple case of 100% reserve banking – All deposits are held as reserves • Banks do not influence the supply of money (money supply = demand deposits plus currency. This sum is unchanged) 15

Fractional-Reserve Banking • Fractional-reserve banking – Banks hold only a fraction of their deposits as reserves. Use the remainder to make loans and earn a return on their assets • Reserve ratio – Fraction of deposits that banks hold as reserves • in case depositors wish to withdraw their cash • Reserve requirement – Minimum amount of reserves that banks must hold; set in some countries (by the Fed, ECB). But, unusually, not imposed by law in the UK 16

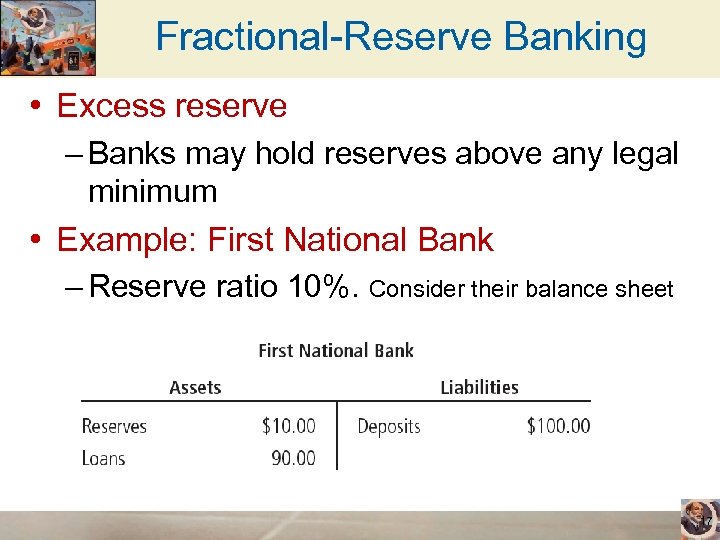

Fractional-Reserve Banking • Excess reserve – Banks may hold reserves above any legal minimum • Example: First National Bank – Reserve ratio 10%. Consider their balance sheet 17

Fractional-Reserve Banking • Banks hold only a fraction of deposits in reserve – First National bank’s $90 loan increases the money supply (puts money in the borrowers pockets). – So FNB has increased the money supply from $100 to $190 – Note that this does not create wealth. Bank loans are debt for the borrowers who are therefore NOT any richer. 18

Money creation • The process of money creation continues… – Suppose the borrower from First National Bank uses the $90 to buy some goods, the proceeds of which are then deposited in Second National Bank – Second National Bank then holds 10% in reserves ($9) and lends out a further $81 – and so on… and on… 19

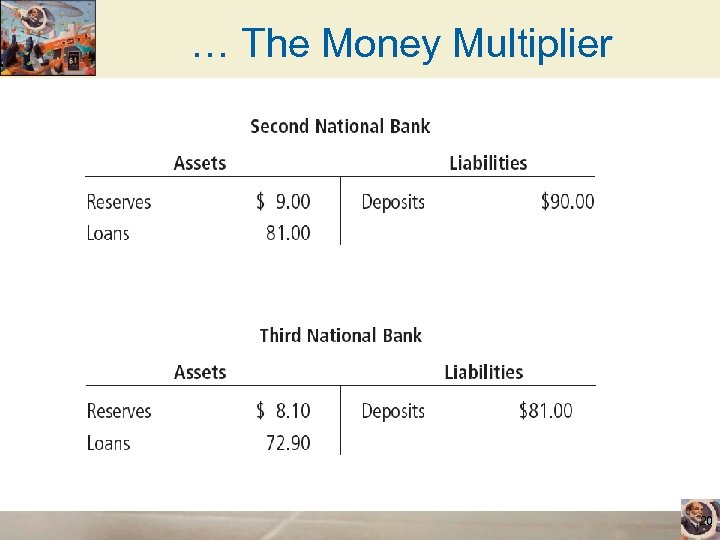

… The Money Multiplier 20

The Money Multiplier • The money multiplier – Original deposit = $100. 00 – First National lending = $ 90. 00 [=. 9 × $100. 00] – Second National lending = $ 81. 00 [=. 9 × $90. 00] – Third National lending = $ 72. 90 [=. 9 × $81. 00] – …Total money supply (sum of the above) = $1, 000. 00 21

The Money Multiplier • The money multiplier – Amount of money the banking system generates with each dollar of reserves – Reciprocal of the reserve ratio = 1/R – Equals 1/0. 1 = 10 in our example (“$100 becomes $1. 000”) • The higher the reserve ratio – The smaller the money multiplier – Money multiplier = 0 when R=1 22

The Central Bank’s Tools of Monetary Control • Three main tools: – Open market operations – The refinancing rate – Reserve requirements Note: Of course there are central banks in less developed economies that use another tool: Running the printing press! The US, UK, and the ECB do not. 23

1. Open-market operations • (Outright) purchase and sale of government bonds by the Central Bank – To increase the money supply • The Central Bank buys government bonds from the public (thus putting additional currency in the hands of the public). E. g. monetary easing example we saw a moment ago. – To reduce the money supply • The Central Bank sells government bonds to the public (and the currency it receives is now out of the hands of the public). 24

2. The Refinancing Rate • The interest rate at which the Central Bank will lend to commercial banks on a short-term basis – Called the refinancing rate in Europe; repo rate in the UK; discount rate in the US – Banks lend money to each other, and borrow from the central bank in the so-called “money market”. The central bank is effectively able to control the going rate of interest in this market. This in turn affects retail interest rates (the interest rate you and I pay to borrow money). 25

2. The Refinancing Rate • The refinancing rate – Higher refinancing rate • Reduces the money supply (borrowing will decrease) – Smaller refinancing rate • Increase the money supply (borrowing will increase) 26

3. Reserve Requirements • Reserve requirements – Regulations on minimum amount of reserves • That banks must hold against deposits – An increase in reserve requirement • Decrease the money supply (multiplier ↓) – A decrease in reserve requirement • Increase the money supply (multiplier ↑) – Rarely used since it greatly upsets banks’ business models. However, it does happen: • Basel III increases reserve ratio 27

Problems… • The Central Banks’s control of the money supply is not precise… – …money multiplier can vary due to fractional reserve banking • The Central Bank – Does not control the amount of money that households choose to hold as deposits in banks – Does not control the amount that bankers choose to lend rather than keep as reserves 28

Summary • So to sum up: Money supply and interest rates controlled by central banks… albeit imperfectly. • OMOs, refinancing rate, reserve requirements are the “monetary policy tools”. • Next: What’s the relationship between prices/inflation and the money supply? 29

• The next slides (on bank runs) are optional extra reading © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 30

Bank runs and the money supply • Bank runs – Depositors suspect that a bank may go bankrupt • “Run” to the bank to withdraw their deposits • Northern Rock bank run in 2007 – Problem for banks under fractionalreserve banking • Cannot satisfy withdrawal requests from all depositors 31

Bank runs and the money supply • When a bank run occurs – The bank is forced to close its doors until some bank loans are repaid – Or until some lender of last resort provides it with the currency it needs to satisfy depositors • In 2008 government took Northern Rock into state ownership 32

Bank runs and the money supply • Great Depression, early 1930 s – Wave of bank runs and bank closings – Households and bankers - more cautious – Households • Withdrew their deposits from banks – Bankers - responded to falling reserves • Reducing bank loans, • Increased their reserve ratios • Smaller money multiplier • Decrease in money supply 33

Bank runs and the money supply • Bank runs today – Not a major problem if the government guarantees the safety of deposits at most banks • Federal Deposit Insurance Corporation (FDIC) in the US • Financial Services Compensation Scheme in the UK guarantees full compensation up to £ 85, 000 per saver, per authorised institution – But only implemented in the aftermath of the Northern Rock bank run/crisis 34

Bank runs and the money supply • No bank runs – Depositors are confident – Government will make good on the deposits • Government deposit insurance – Cost: • Bankers - little incentive to avoid bad risks – Benefit: • A more stable banking system 35

1e47da2ca3fcb417f2b9b29e8c62bcf2.ppt