f171a763ee7f26a78cd4b0c8d2a9869e.ppt

- Количество слайдов: 60

Tobacco Control Policies: The National Picture and where Virginia stands

Evidence-Based Tobacco Control • Tobacco Taxes • Smoke-free Laws • Comprehensive Prevention & Cessation Programs • Limits on Industry Behavior (e. g. , FDA) TO BRING ABOUT • Social & Environmental Change

THE TRIFECTA Ta Sm x Program Funding ok e- Fr ee

Tobacco Taxes

TOBACCO EXCISE TAXES • A win for public health • A win for state budgets • A win among voters

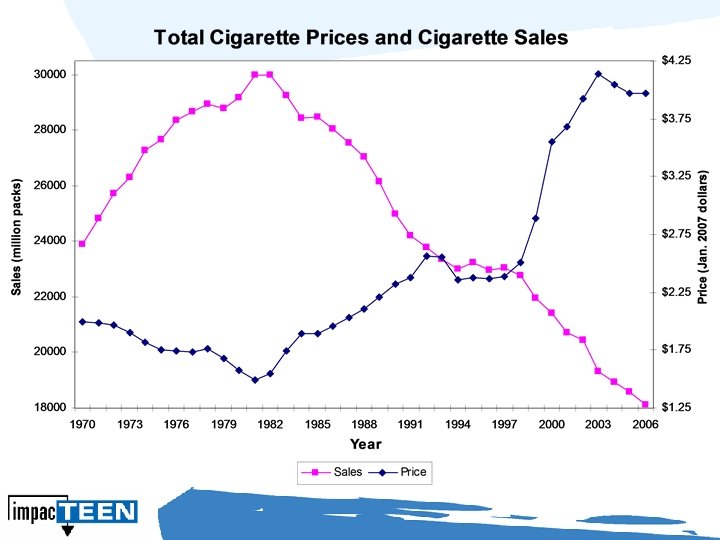

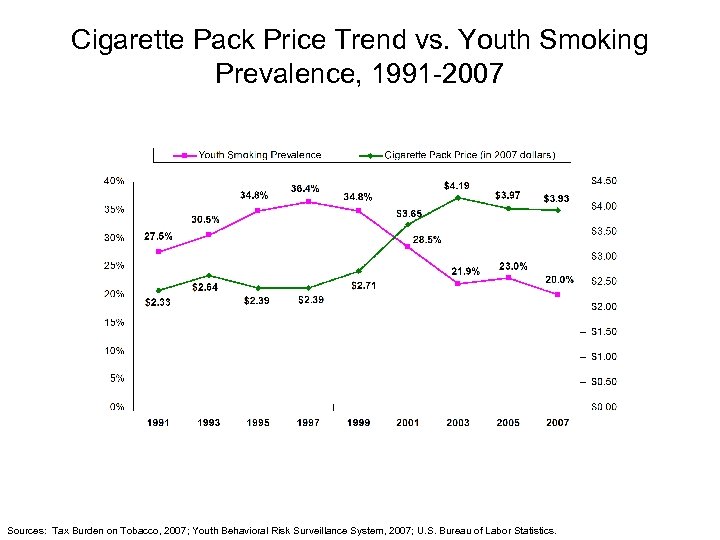

Cigarette Pack Price Trend vs. Youth Smoking Prevalence, 1991 -2007 Sources: Tax Burden on Tobacco, 2007; Youth Behavioral Risk Surveillance System, 2007; U. S. Bureau of Labor Statistics.

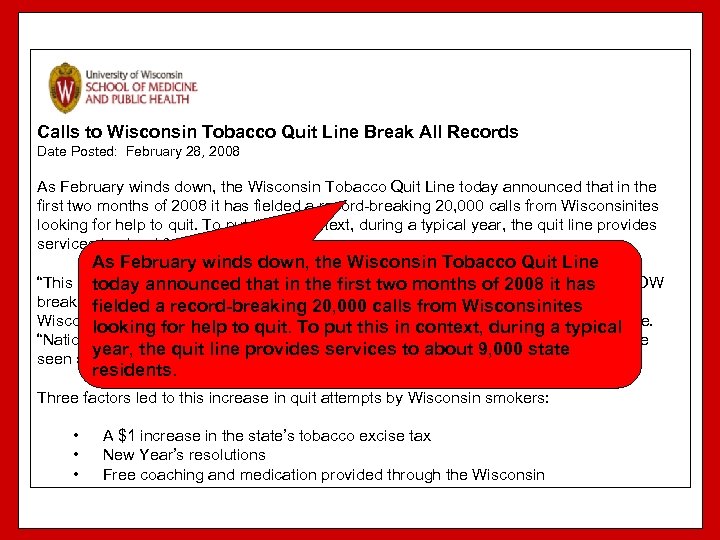

Calls to Wisconsin Tobacco Quit Line Break All Records Date Posted: February 28, 2008 As February winds down, the Wisconsin Tobacco Quit Line today announced that in the first two months of 2008 it has fielded a record-breaking 20, 000 calls from Wisconsinites looking for help to quit. To put this in context, during a typical year, the quit line provides services to about 9, 000 state residents. As February winds down, the Wisconsin Tobacco Quit Line “This unprecedented success in assisting Wisconsin smokers through 1 -800 -QUIT-NOW today announced that in the first two months of 2008 it has breaks all previous state records, ” said Dr. Michael Fiore, director of the University of fielded a record-breaking 20, 000 calls from Wisconsinites Wisconsin Center for Tobacco Research and Intervention, which manages the quit line. looking for help to quit. To put this in context, during a typical “National peers who provide quit services in other states report they have never before year, the quit line provides services to about 9, 000 state seen such a successful state effort to help smokers quit. ” residents. Three factors led to this increase in quit attempts by Wisconsin smokers: • • • A $1 increase in the state’s tobacco excise tax New Year’s resolutions Free coaching and medication provided through the Wisconsin

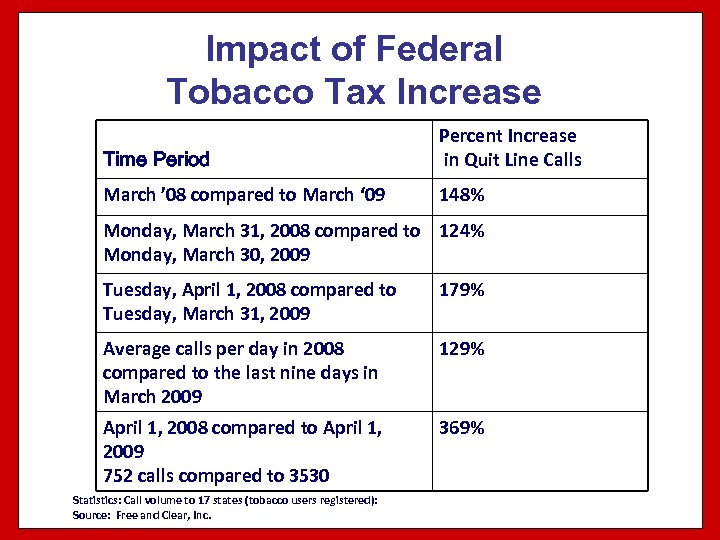

Impact of Federal Tobacco Tax Increase Time Period Percent Increase in Quit Line Calls March ’ 08 compared to March ‘ 09 148% Monday, March 31, 2008 compared to 124% Monday, March 30, 2009 Tuesday, April 1, 2008 compared to Tuesday, March 31, 2009 179% Average calls per day in 2008 compared to the last nine days in March 2009 129% April 1, 2008 compared to April 1, 2009 752 calls compared to 3530 369% Statistics: Call volume to 17 states (tobacco users registered): Source: Free and Clear, Inc.

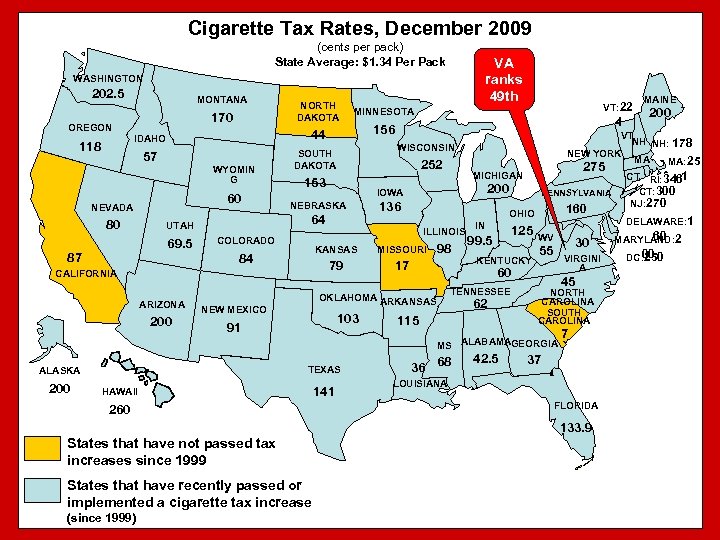

Cigarette Tax Rates, December 2009 (cents per pack) State Average: $1. 34 Per Pack VA ranks 49 th WASHINGTON 202. 5 OREGON 118 MONTANA 170 57 WYOMIN G 60 NEVADA 69. 5 87 COLORADO 84 SOUTH DAKOTA 200 156 252 153 200 136 MISSOURI 79 98 17 103 160 IN 125 99. 5 KENTUCKY WV 55 TENNESSEE 62 115 45 NORTH CAROLINA SOUTH CAROLINA MS ALABAMAGEORGIA TEXAS ALASKA 200 HAWAII 141 260 36 68 42. 5 30 VIRGINI A 60 OKLAHOMA ARKANSAS 91 PENNSYLVANIA OHIO KANSAS NEW MEXICO 275 MICHIGAN ILLINOIS 7 37 LOUISIANA FLORIDA 133. 9 States that have not passed tax increases since 1999 States that have recently passed or implemented a cigarette tax increase (since 1999) MAINE 200 VT NH NH: 178 NEW YORK MA MA: 25 IOWA NEBRASKA CALIFORNIA ARIZONA 4 WISCONSIN 64 UTAH VT: 22 MINNESOTA 44 IDAHO 80 NORTH DAKOTA 1 CT RI: 346 CT: 300 NJ: 270 DELAWARE: 1 60 MARYLAND: 2 00 DC: 250

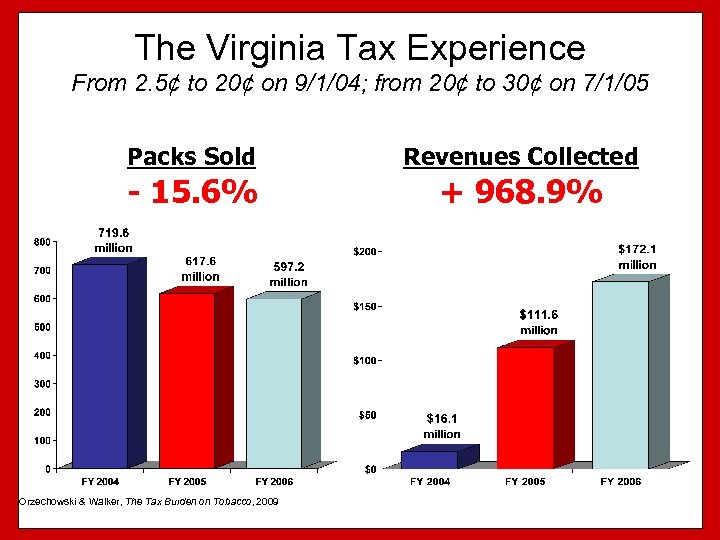

The Virginia Tax Experience From 2. 5¢ to 20¢ on 9/1/04; from 20¢ to 30¢ on 7/1/05 Packs Sold Revenues Collected - 15. 6% + 968. 9% Orzechowski & Walker, The Tax Burden on Tobacco, 2009

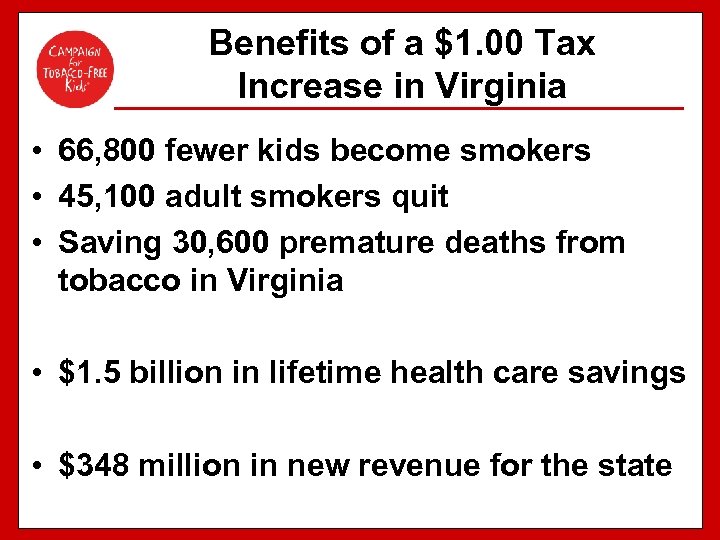

Benefits of a $1. 00 Tax Increase in Virginia • 66, 800 fewer kids become smokers • 45, 100 adult smokers quit • Saving 30, 600 premature deaths from tobacco in Virginia • $1. 5 billion in lifetime health care savings • $348 million in new revenue for the state

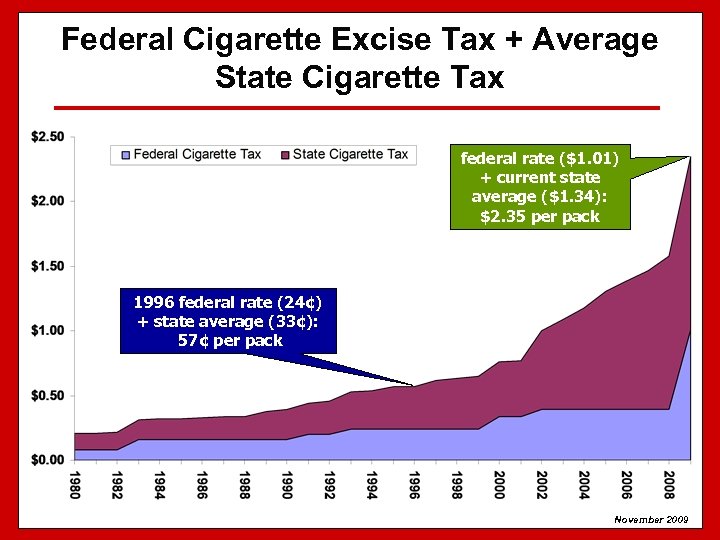

Federal Cigarette Excise Tax + Average State Cigarette Tax federal rate ($1. 01) + current state average ($1. 34): $2. 35 per pack 1996 federal rate (24¢) + state average (33¢): 57¢ per pack November 2009

Despite more states taxing all tobacco products… There is still a big discrepancy between tax rates for OTPs and cigarettes

Smoke-Free

Effects of Smoke-free Laws • Protect everyone from secondhand smoke • Prompt more smokers to try to quit • Increase the number of successful quit attempts • Reduce the number of cigarettes that smokers consume • Discourage kids from starting • Do NOT hurt business

Smoke-Free Restaurant and Bar Laws VA’s smoke-free law does not cover ____. State Smoke-free Laws Including Restaurants & Bars Local Smoke-free Laws Including Restaurants & Bars • MI law effective 5/1/10, WI law effective 7/5/10, KS law effective 7/1/10. March 2010

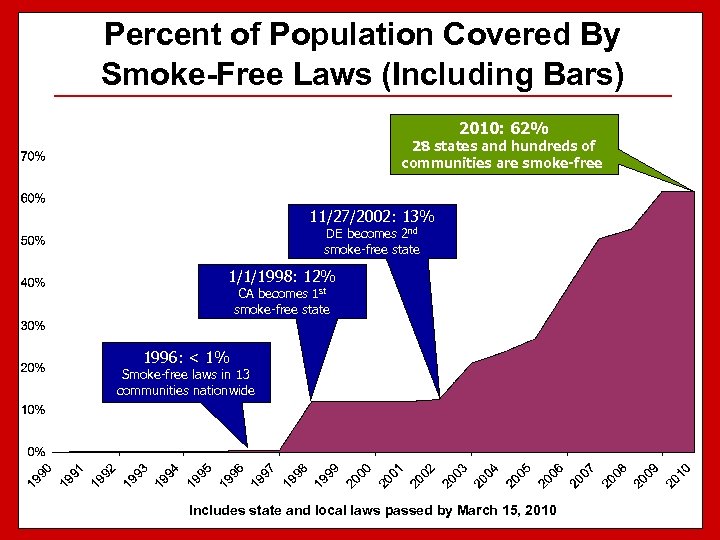

Percent of Population Covered By Smoke-Free Laws (Including Bars) 2010: 62% 28 states and hundreds of communities are smoke-free 11/27/2002: 13% DE becomes 2 nd smoke-free state 1/1/1998: 12% CA becomes 1 st smoke-free state 1996: < 1% Smoke-free laws in 13 communities nationwide Includes state and local laws passed by March 15, 2010

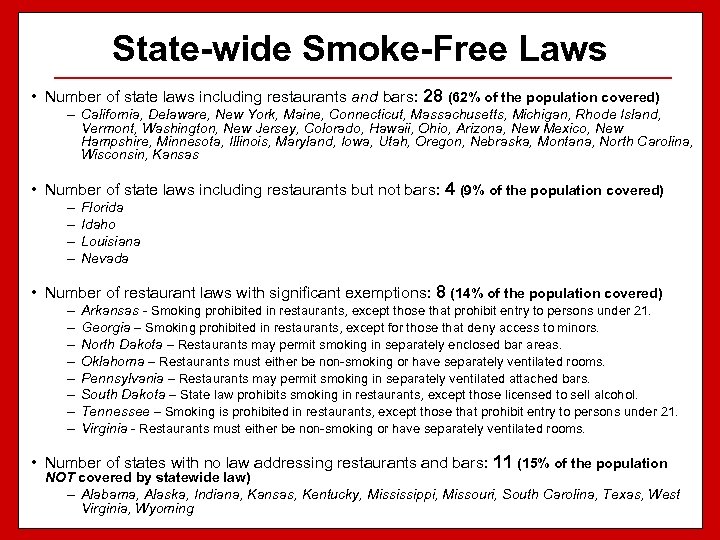

State-wide Smoke-Free Laws • Number of state laws including restaurants and bars: 28 (62% of the population covered) – California, Delaware, New York, Maine, Connecticut, Massachusetts, Michigan, Rhode Island, Vermont, Washington, New Jersey, Colorado, Hawaii, Ohio, Arizona, New Mexico, New Hampshire, Minnesota, Illinois, Maryland, Iowa, Utah, Oregon, Nebraska, Montana, North Carolina, Wisconsin, Kansas • Number of state laws including restaurants but not bars: 4 (9% of the population covered) – – Florida Idaho Louisiana Nevada • Number of restaurant laws with significant exemptions: 8 (14% of the population covered) – – – – Arkansas - Smoking prohibited in restaurants, except those that prohibit entry to persons under 21. Georgia – Smoking prohibited in restaurants, except for those that deny access to minors. North Dakota – Restaurants may permit smoking in separately enclosed bar areas. Oklahoma – Restaurants must either be non-smoking or have separately ventilated rooms. Pennsylvania – Restaurants may permit smoking in separately ventilated attached bars. South Dakota – State law prohibits smoking in restaurants, except those licensed to sell alcohol. Tennessee – Smoking is prohibited in restaurants, except those that prohibit entry to persons under 21. Virginia - Restaurants must either be non-smoking or have separately ventilated rooms. • Number of states with no law addressing restaurants and bars: 11 (15% of the population NOT covered by statewide law) – Alabama, Alaska, Indiana, Kansas, Kentucky, Mississippi, Missouri, South Carolina, Texas, West Virginia, Wyoming

Funding for Tobacco Prevention

Evidence Base .

If every state funded TP at CDC minimum, states would prevent nearly two million kids alive today from becoming smokers, save more than 600, 000 of them from premature, smoking-caused deaths, and save $23. 4 B in smoking-related HC costs.

If every state funded TP at CDC minimum, states would prevent nearly two million kids alive today from becoming smokers, save more than 600, 000 of them from premature, smoking-caused deaths, and save $23. 4 B in smoking-related HC costs.

States with best funded and most sustained tobacco prevention programs during the 1990 s – AZ, CA, MA and OR, reduced cigarette sales more than twice as much as the country as a whole

Best Practices 2007 • State and Community Interventions • Media Interventions • Cessation Interventions • Surveillance/Evaluation • Administration/Management

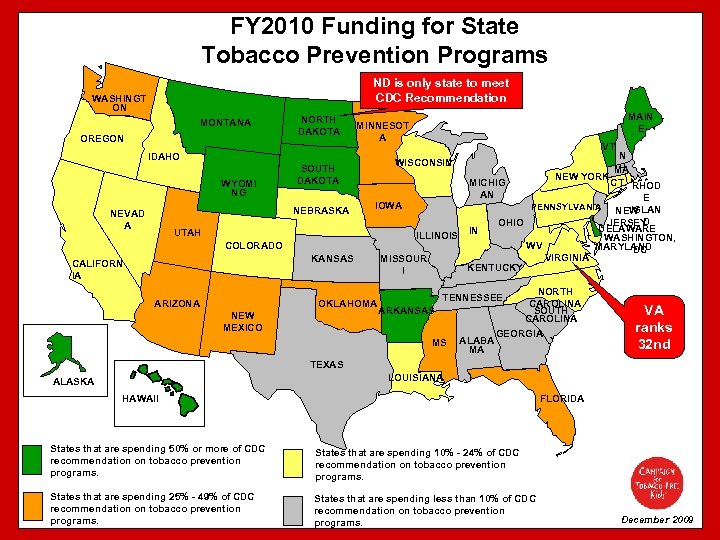

FY 2010 Funding for State Tobacco Prevention Programs ND is only state to meet CDC Recommendation WASHINGT ON MONTANA OREGON NORTH DAKOTA IDAHO WYOMI NG SOUTH DAKOTA NEBRASKA NEVAD A UTAH COLORADO KANSAS CALIFORN IA ARIZONA VT N H MA NEW YORK MICHIG CT RHOD AN E IOWA PENNSYLVANIA ISLAN NEW D OHIO JERSEY DELAWARE IN ILLINOIS WASHINGTON, WV MARYLAND DC VIRGINIA MISSOUR KENTUCKY I OKLAHOMA NEW MEXICO MAIN E MINNESOT A WISCONSIN NORTH CAROLINA SOUTH CAROLINA GEORGIA TENNESSEE ARKANSAS MS ALABA MA VA ranks 32 nd TEXAS LOUISIANA ALASKA HAWAII FLORIDA States that are spending 50% or more of CDC recommendation on tobacco prevention programs. States that are spending 10% - 24% of CDC recommendation on tobacco prevention programs. States that are spending 25% - 49% of CDC recommendation on tobacco prevention programs. States that are spending less than 10% of CDC recommendation on tobacco prevention programs. December 2009

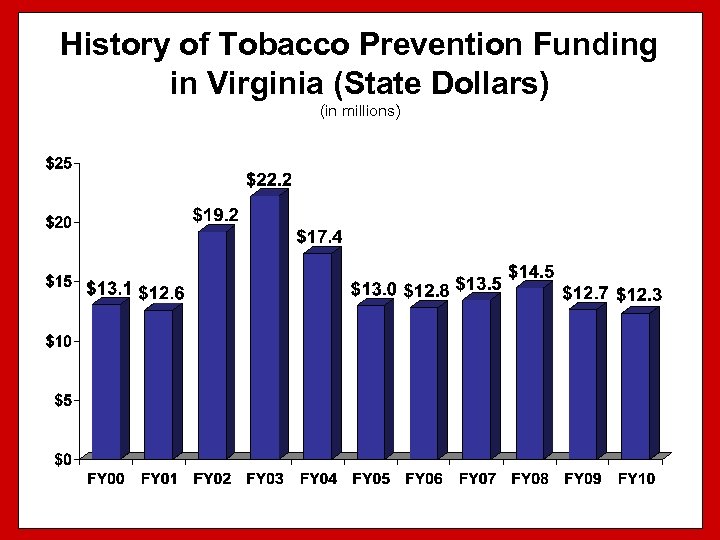

History of Tobacco Prevention Funding in Virginia (State Dollars) (in millions)

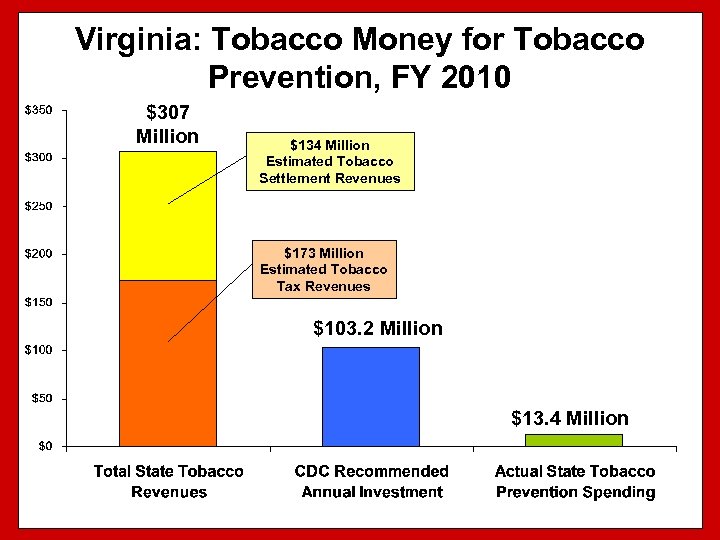

Virginia: Tobacco Money for Tobacco Prevention, FY 2010 $307 Million $134 Million Estimated Tobacco Settlement Revenues $173 Million Estimated Tobacco Tax Revenues $103. 2 Million $13. 4 Million

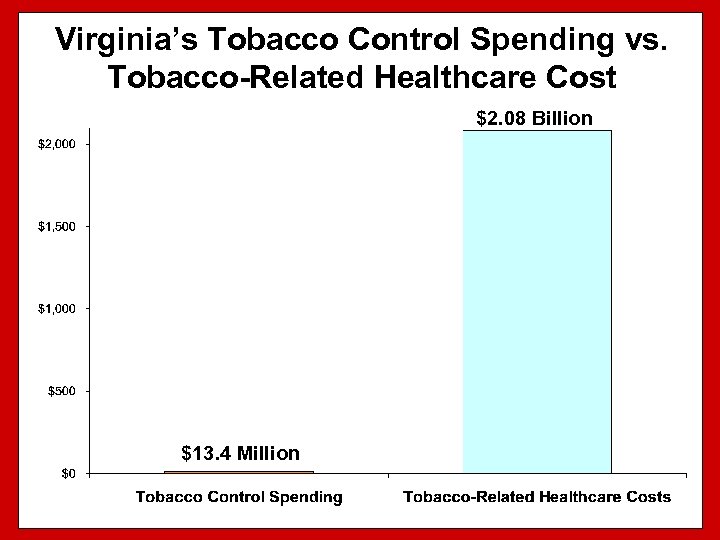

Virginia’s Tobacco Control Spending vs. Tobacco-Related Healthcare Cost $2. 08 Billion $13. 4 Million

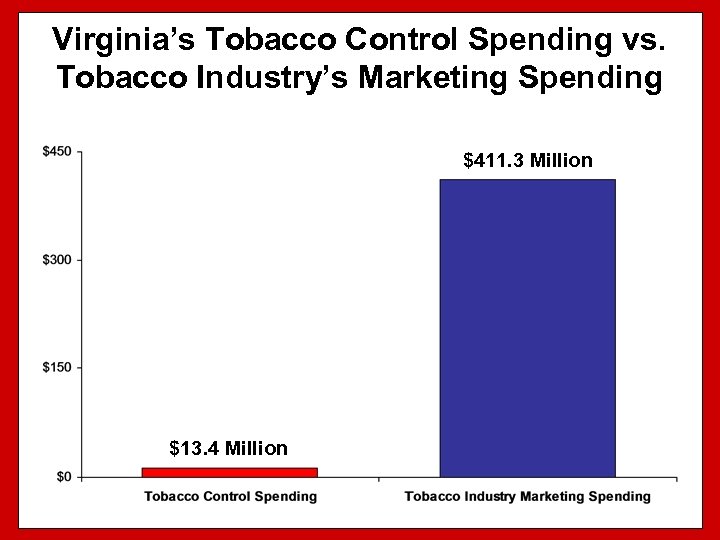

Virginia’s Tobacco Control Spending vs. Tobacco Industry’s Marketing Spending $411. 3 Million $13. 4 Million

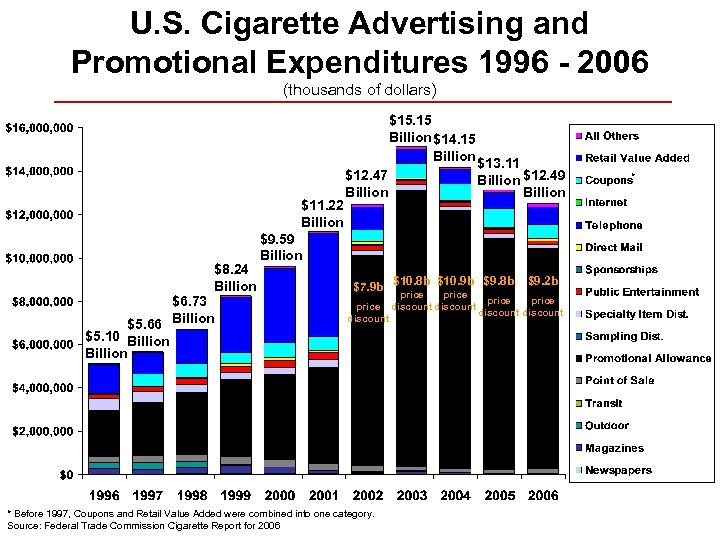

U. S. Cigarette Advertising and Promotional Expenditures 1996 - 2006 (thousands of dollars) $15. 15 Billion $14. 15 Billion $11. 22 Billion $8. 24 Billion $6. 73 $5. 66 Billion $5. 10 Billion $12. 47 Billion $13. 11 Billion $12. 49 Billion $9. 59 Billion $7. 9 b $10. 8 b $10. 9 b $9. 8 b $9. 2 b price price discount discount * Before 1997, Coupons and Retail Value Added were combined into one category. Source: Federal Trade Commission Cigarette Report for 2006 *

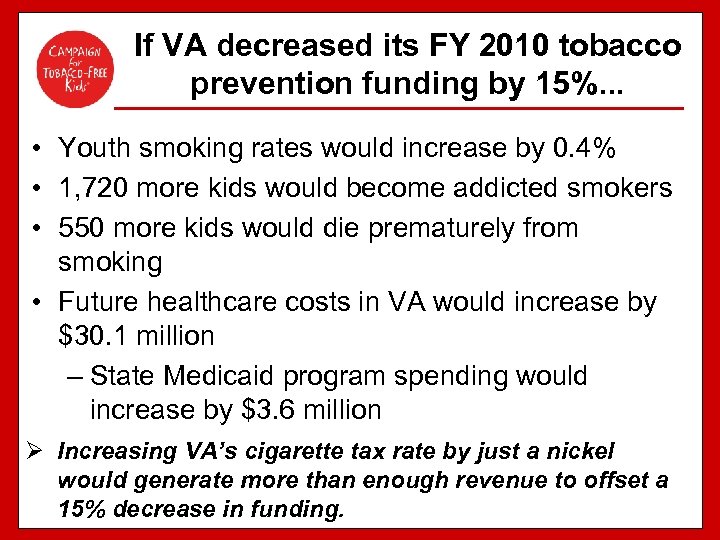

If VA decreased its FY 2010 tobacco prevention funding by 15%. . . • Youth smoking rates would increase by 0. 4% • 1, 720 more kids would become addicted smokers • 550 more kids would die prematurely from smoking • Future healthcare costs in VA would increase by $30. 1 million – State Medicaid program spending would increase by $3. 6 million Ø Increasing VA’s cigarette tax rate by just a nickel would generate more than enough revenue to offset a 15% decrease in funding.

Federal Activities • Stimulus Funds • Health Care Reform • FDA regulation

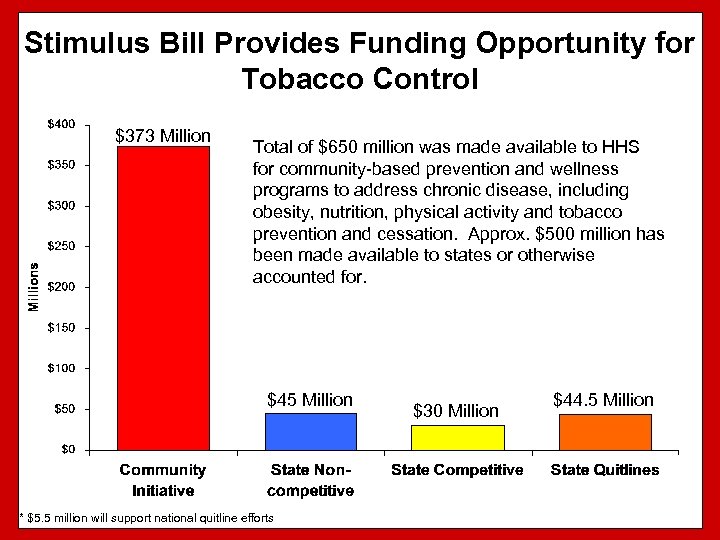

Stimulus Bill Provides Funding Opportunity for Tobacco Control $373 Million Total of $650 million was made available to HHS for community-based prevention and wellness programs to address chronic disease, including obesity, nutrition, physical activity and tobacco prevention and cessation. Approx. $500 million has been made available to states or otherwise accounted for. $45 Million * $5. 5 million will support national quitline efforts $30 Million $44. 5 Million

Health Care Reform

Health Care Reform: Three Key Elements • Private Health Insurance – Both Senate and House bills include coverage for tobacco cessation services with no cost-sharing requirements. – Insurance rating • House bill – insurers not permitted to vary premiums based on tobacco use • Senate bill – premiums could vary based on tobacco use • Medicaid – House bill – States required to cover tobacco cessation services in their Medicaid programs with no cost-sharing requirements – Senate bill – States required to cover tobacco cessation services for pregnant women with no cost-sharing requirements. States are provided a financial incentive to cover all preventive services recommended by USPSTF and immunizations recommended by ACIP, but are not required to do so.

Health Care Reform: Three Key Elements • Prevention Trust Fund – House bill – Public Health Investment Fund: total of $34 billion for FY 2011 –FY 2015 for community health centers, workforce development and prevention; Prevention and Wellness Trust: authorized to receive $15. 4 billion from Public Health Investment Fund for prevention and wellness services and research and to build core public health infrastructure for state, local and tribal health departments and CDC. Community Prevention and Wellness Services grants for community-based prevention and wellness services in HHS priority areas. – Senate bill - Prevention and Public Health Fund: total of $7 billion for FY 2010 –FY 2015 and $2 billion annually thereafter. Funding used for programs authorized by the Public Health Service Act for prevention, wellness and public health activities. New grant programs that could be used to reduce tobacco use include Community Transformation grants and Healthy Aging, Living Well

FDA Regulation of Tobacco: What Does it Mean? What Happens Now?

15 YEARS IN THE MAKING n 79 – 17 Senate Vote (June 11) n 307 -- 97 House Vote (June 12)

June 22, 2009

Key Substantive Elements 1. Require the Industry to provide information to the Gov’t that allows Gov’t to better inform consumers 2. Restrict marketing that appeals to kids, misleads adults, deceptively encourages tobacco use and discourages quitting 3. Strengthen restrictions on sales to youth

Key Substantive Elements 4. More Accurately Inform consumers A. Improved warning Labels B. More accurate testing of tar, nicotine and other harmful substances C. Standards to prohibit unsubstantiated health claims 5. Regulation of the Contents of the Product to protect consumers 6. Protect and Expand State authority

Limitations on FDA Authority • FDA can’t ban all cigarettes, all smokeless tobacco products, … or all roll your own tobacco products; or • Require the reduction of nicotine yields of a tobacco product to zero.

Implementation Milestones Immediate: • States can restrict Time, Place and Manner of tobacco marketing • No health claims without review • Review of new products • Broader advertising restriction authority 44

States may now for the first time, to the extent permitted under the First Amendment, do such things as… • Supplement the new FDA requirement that all retail ads for cigarettes and smokeless consist only of black text on white background by applying the same restrictions to cigar and other tobacco product ads; • Restrict or eliminate “power walls” of cigarettes being offered for sale at retail outlets (which will be the only remaining presentation of cigarette brand logos, labels and colors in retail outlets after the FDA black-text-on-white-background restriction goes into effect);

Continued… • Limit the number or size of tobacco product ads at retail outlets; • Require that all tobacco products or tobacco product ads be kept away from cash registers in order to reduce impulse purchases by smokers trying to quit.

Implementation 3 months: • No candy-flavored cigarettes 47

Implementation 12 months: • No “light, ” “low, ” “mild, ” descriptors • Youth access provisions – contracts with states • Marketing restrictions – magazines, points of sale, sponsorship, etc • New warning labels on smokeless • Scientific Advisory Committee appointed within 15 months 48

Implementation In the slightly longer term…. • Larger, stronger graphic warning labels on cigarettes -- Rule issued within two years -- Implementation – 15 months later 49

Cigarette pack now Front Cigarette pack under FDA Regulation WARNING LABEL Front WARNING LABEL Back

Implementation Menthol Study and Report • 1 Year after Scientific Advisory Committee appointed Dissolvable Tobacco Products Study and Report • 2 Years after Scientific Advisory Committee appointed 51

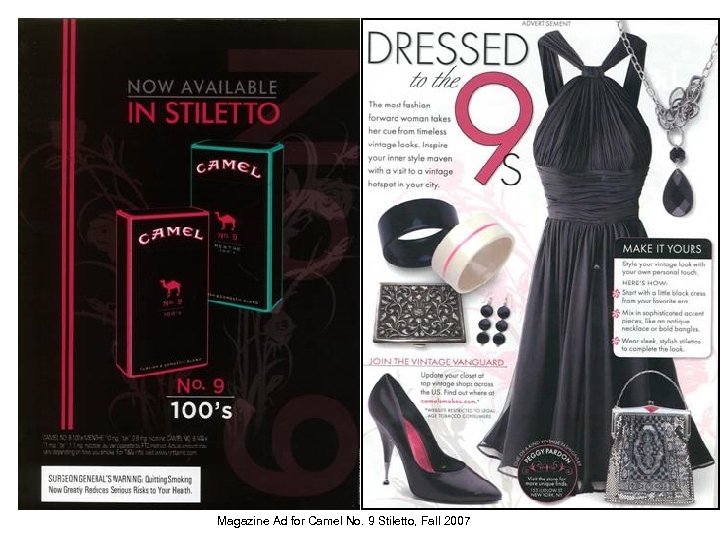

Magazine Ad for Camel No. 9 Stiletto, Fall 2007

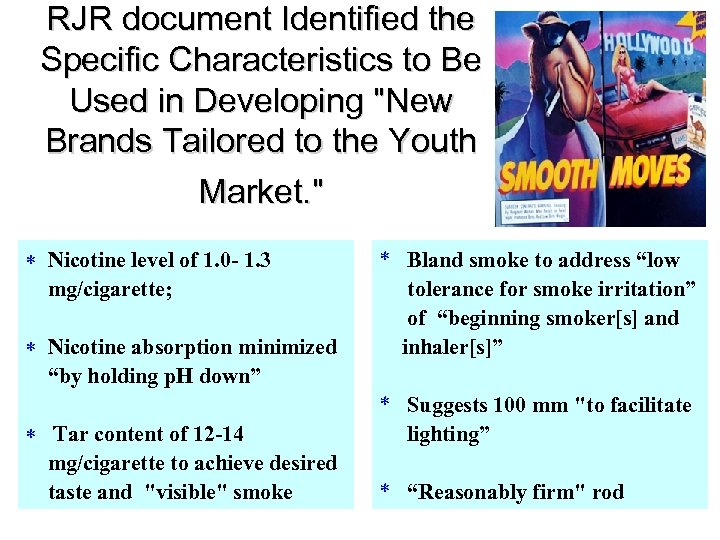

RJR document Identified the Specific Characteristics to Be Used in Developing "New Brands Tailored to the Youth Market. " * Nicotine level of 1. 0 - 1. 3 mg/cigarette; * Nicotine absorption minimized “by holding p. H down” * Tar content of 12 -14 mg/cigarette to achieve desired taste and "visible" smoke * Bland smoke to address “low tolerance for smoke irritation” of “beginning smoker[s] and inhaler[s]” * Suggests 100 mm "to facilitate lighting” * “Reasonably firm" rod

![“[It] will not kill them as quick or as much as other brands, ” “[It] will not kill them as quick or as much as other brands, ”](https://present5.com/presentation/f171a763ee7f26a78cd4b0c8d2a9869e/image-56.jpg)

“[It] will not kill them as quick or as much as other brands, ” Bennett Le. Bow, CEO, Vector, Manufacturer of new Omni cigarettes. -- USA Today 1/11/02

Challenges to the Law: Court Upheld all Except Two • The requirement of large graphic health warnings on cigarette packs; • The prohibition of tobacco companies making health claims about tobacco products without FDA review; • The ban on brand name sponsorships of events like sports and entertainment • The ban on tobacco-branded merchandise like caps and t-shirts • the ban on free samples and free gifts with purchase • the authority of the FDA, as well as state and local governments, to impose additional marketing retrictions on tobacco companies • Restricting tobacco advertising at point of sale and in magazines with high youth readership to black and white/text only format • Prohibition on saying products are FDA approved because Court interpreted it to apply to parties independent of the tobacco companies as well as to tobacco companies

Both Sides Likely to Appeal • We believe all of the marketing restrictions can be upheld • We believe opinion misinterpreted the ban on statements about FDA approval to suggest even non-industry types were banned from talking about this • Even if decision on black and white/text only is upheld, the decision seemed narrowly focused on use of corporate and brand logos – not on banning the colors and images used to attract kids, so rule should be able to be revised if necessary • Because of severability clause, challenges do not stop other provisions of law from going into effect

What is Our Role? • Continue with More of What We Know Works • Tobacco Taxes • Smoke-free Laws • Funding for Tobacco Prevention & Cessation • Coverage for Smoking Cessation Services • FDA is a Complement – not a Substitute

For more information www. tobaccofreekids. org Amy Barkley Director, Tobacco States and Mid-Atlantic abarkley@tobaccofreekids. org 502 -777 -8148

f171a763ee7f26a78cd4b0c8d2a9869e.ppt