8c7633a99ce7793cbf6afb1ed10898ef.ppt

- Количество слайдов: 17

To LL. M. (Tax) or not to LL. M (Tax)—That is the question Prof. Mombrun Prof. Branch Assistant Dean Morgan

To LL. M. (Tax) or not to LL. M (Tax)—That is the question Prof. Mombrun Prof. Branch Assistant Dean Morgan

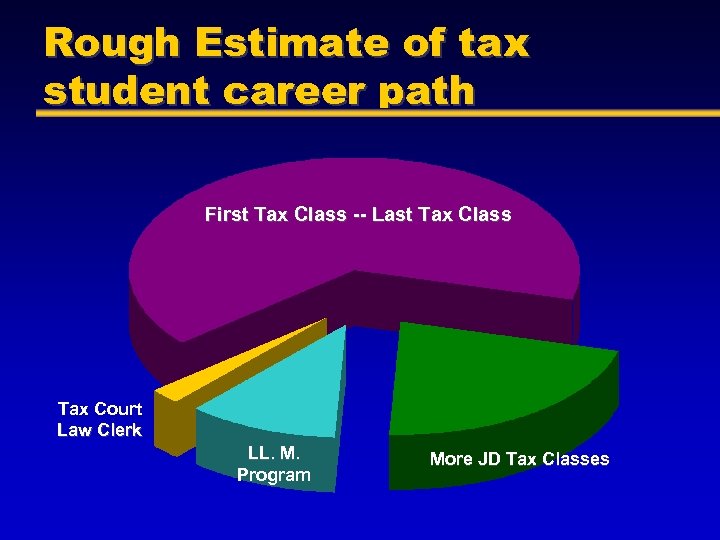

Rough Estimate of tax student career path First Tax Class -- Last Tax Class Tax Court Law Clerk LL. M. Program More JD Tax Classes

Rough Estimate of tax student career path First Tax Class -- Last Tax Class Tax Court Law Clerk LL. M. Program More JD Tax Classes

First & Last Tax Class = No More Steps Congratulations !

First & Last Tax Class = No More Steps Congratulations !

First Tax Class Seriously – an eye opener First time in law school where you get a real answer in class --Not usually—It depends or what do you think? --Normally, either you meet the statutory requirements or you do not --Love at first sight --or you heard that tax lawyers make

First Tax Class Seriously – an eye opener First time in law school where you get a real answer in class --Not usually—It depends or what do you think? --Normally, either you meet the statutory requirements or you do not --Love at first sight --or you heard that tax lawyers make

Benefits of an LL. M. • • • Improve tax job placement significantly Almost a requirement these days Improve substantive tax knowledge—BIG TIME • Improve practical knowledge

Benefits of an LL. M. • • • Improve tax job placement significantly Almost a requirement these days Improve substantive tax knowledge—BIG TIME • Improve practical knowledge

Benefits of LL. M • • Preparation for career at: IRS or Gvt. Agency Law Firm or Accounting Firm Business or Estate Planning Teaching Choosing New Business Entities In-House Counsel Real Estate

Benefits of LL. M • • Preparation for career at: IRS or Gvt. Agency Law Firm or Accounting Firm Business or Estate Planning Teaching Choosing New Business Entities In-House Counsel Real Estate

Benefits of LL. M. • • • Probate Personal Income Tax Local Government

Benefits of LL. M. • • • Probate Personal Income Tax Local Government

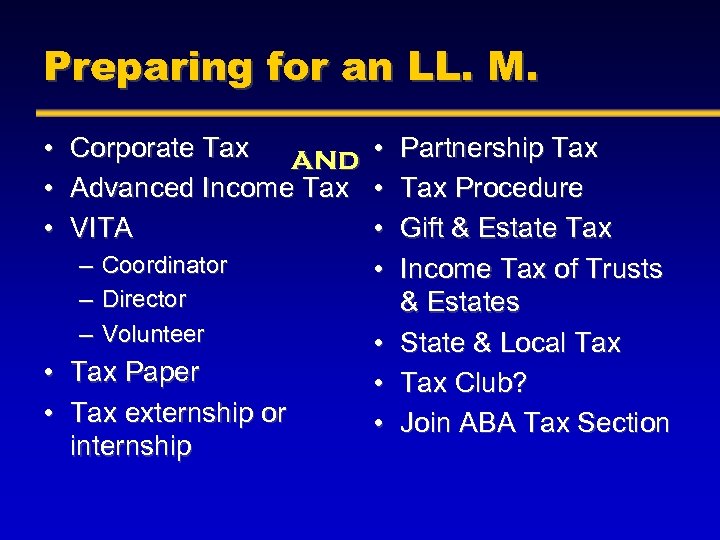

Preparing for an LL. M. • Corporate Tax and • Partnership Tax • Advanced Income Tax • Tax Procedure • VITA • Gift & Estate Tax – Coordinator • Income Tax of Trusts – Director & Estates – Volunteer • State & Local Tax • Tax Paper • Tax Club? • Tax externship or • Join ABA Tax Section internship

Preparing for an LL. M. • Corporate Tax and • Partnership Tax • Advanced Income Tax • Tax Procedure • VITA • Gift & Estate Tax – Coordinator • Income Tax of Trusts – Director & Estates – Volunteer • State & Local Tax • Tax Paper • Tax Club? • Tax externship or • Join ABA Tax Section internship

You are in your third year? • See what you can do from previous slide • Secure really good recommendations from your tax professors • Make sure you get the best possible grades in your tax classes and business classes • Prepare your application carefully and highlight what makes you unique or different

You are in your third year? • See what you can do from previous slide • Secure really good recommendations from your tax professors • Make sure you get the best possible grades in your tax classes and business classes • Prepare your application carefully and highlight what makes you unique or different

You are in your second year! • • • More flexibility! Complete list in slide #8 Do well in your tax and business classes Secure really good recommendations Convince your professors that you really want to get that LL. M.

You are in your second year! • • • More flexibility! Complete list in slide #8 Do well in your tax and business classes Secure really good recommendations Convince your professors that you really want to get that LL. M.

Before the LL. M. Program • Apply in Sept/Oct of 3 L year – Rolling Admissions • • • Make good grades in all your Tax Classes Take as many Tax Classes as Possible Write a Tax Article – Get Published – Enter Competitions!

Before the LL. M. Program • Apply in Sept/Oct of 3 L year – Rolling Admissions • • • Make good grades in all your Tax Classes Take as many Tax Classes as Possible Write a Tax Article – Get Published – Enter Competitions!

Which program to apply to? • Go for the top! • Caveat: Be sure you know what you want and where you want to be! • Above all—APPLY, APPLY • DO NOT TAKE YOURSELF OUT OF THE RUNNING—THIS IS NOT YOUR JOB!!

Which program to apply to? • Go for the top! • Caveat: Be sure you know what you want and where you want to be! • Above all—APPLY, APPLY • DO NOT TAKE YOURSELF OUT OF THE RUNNING—THIS IS NOT YOUR JOB!!

Special Mention—U of Florida • • • Consistently ranked #1 or #2 Rigorous program and very well respected Relatively affordable One year of Florida weather Constantly looking to improve

Special Mention—U of Florida • • • Consistently ranked #1 or #2 Rigorous program and very well respected Relatively affordable One year of Florida weather Constantly looking to improve

Special Mention-Northwestern • Program started in 2002 and they are already ranked #4 by US News • They appear very aggressive and committed to the growth of the program • 94% of graduates employed within 9 months of graduation • TARE—Tax Attorney Recruitment Event – Started recruitment drive 2 years ago with the University of Florida and Boston University

Special Mention-Northwestern • Program started in 2002 and they are already ranked #4 by US News • They appear very aggressive and committed to the growth of the program • 94% of graduates employed within 9 months of graduation • TARE—Tax Attorney Recruitment Event – Started recruitment drive 2 years ago with the University of Florida and Boston University

What’s the LL. M. Program Like? • • • Like your 1 L year … again! Problem-solving based classes Much more reading, researching, & studying Saturation of information Possible thesis paper Makes JD look like kindergarten

What’s the LL. M. Program Like? • • • Like your 1 L year … again! Problem-solving based classes Much more reading, researching, & studying Saturation of information Possible thesis paper Makes JD look like kindergarten

Applying for Jobs in Today’s Market • Résumés vs. Networking • Cover Letter – Don’t start off with Mickey Mouse opening – Sign your name!!! – Proofread and reproof for errors and awkward phrasing • • • Complete application packet Join Tax Section Committees PASS THE BAR

Applying for Jobs in Today’s Market • Résumés vs. Networking • Cover Letter – Don’t start off with Mickey Mouse opening – Sign your name!!! – Proofread and reproof for errors and awkward phrasing • • • Complete application packet Join Tax Section Committees PASS THE BAR

To LL. M (Tax) or not to LL. M. (tax) The End

To LL. M (Tax) or not to LL. M. (tax) The End