1e7234e10145fe628bcbb083180b2b76.ppt

- Количество слайдов: 137

TK 1003: Wealth Planning and Management Pre-examination Seminar By Dr Shaikh Hamzah 1

TK 1003: Wealth Planning and Management Pre-examination Seminar By Dr Shaikh Hamzah 1

What’s On Our Menu 9: 00 - 10: 30 a. m. -- All About CIFP Part I Assessment Methods 10: 30 - 10: 45 a. m. -- Break 10: 45 - 12: 00 noon -- Review of TK 1001(Session I) 12: 00 -- 1: 00 p. m. -- Break 1: 00 -- 3: 30 p. m. -- Review of TK 1001 (Session II)

What’s On Our Menu 9: 00 - 10: 30 a. m. -- All About CIFP Part I Assessment Methods 10: 30 - 10: 45 a. m. -- Break 10: 45 - 12: 00 noon -- Review of TK 1001(Session I) 12: 00 -- 1: 00 p. m. -- Break 1: 00 -- 3: 30 p. m. -- Review of TK 1001 (Session II)

Learning Outcomes At the end of the PES, candidates should be able to: comprehend the assessment methods for the CIFP Part I program have a clear idea of the final examination format and procedures, NOT the questions understand the Do’s & Don’ts in the final exams 3

Learning Outcomes At the end of the PES, candidates should be able to: comprehend the assessment methods for the CIFP Part I program have a clear idea of the final examination format and procedures, NOT the questions understand the Do’s & Don’ts in the final exams 3

Learning Outcomes At the end of the PES, candidates should be able to: have a better idea on how to maximize your scores/marks for each question in the exams avoid common pitfalls and/or mistakes in the final exam Reviews of the Module Q&A

Learning Outcomes At the end of the PES, candidates should be able to: have a better idea on how to maximize your scores/marks for each question in the exams avoid common pitfalls and/or mistakes in the final exam Reviews of the Module Q&A

Assessment Methods The Assessment of the CIFP Part I Comprises of the followings: One Project Paper - 20% (Due on 17 th July 2009) Final Examination 2009) - 80% (Aug 4 th,

Assessment Methods The Assessment of the CIFP Part I Comprises of the followings: One Project Paper - 20% (Due on 17 th July 2009) Final Examination 2009) - 80% (Aug 4 th,

Format of the Final Exam Duration: 3 Hours (excluding 15 minutes reading time) The Final Examination Consists of the Followings: Twenty MCQs : 20 points Five short essay questions : 20 points Choose three out five long questions: 60 points

Format of the Final Exam Duration: 3 Hours (excluding 15 minutes reading time) The Final Examination Consists of the Followings: Twenty MCQs : 20 points Five short essay questions : 20 points Choose three out five long questions: 60 points

Assessment Methods Distribution of Grades: 80 to 100 : A 60 to 79 : B < 60 : F

Assessment Methods Distribution of Grades: 80 to 100 : A 60 to 79 : B < 60 : F

Do’s and Don’ts Do’s Read and follow the instructions carefully (write legibly, read all of the questions, begin your answers for each question on a fresh page, etc. ) Observe your time management Lead a healthy lifesyle few days before the exam

Do’s and Don’ts Do’s Read and follow the instructions carefully (write legibly, read all of the questions, begin your answers for each question on a fresh page, etc. ) Observe your time management Lead a healthy lifesyle few days before the exam

Do’s and Don’ts Leave any questions unanswered -- this you will surely get. . . Leave the examination hall before the time is up, i. e. never give-up Make any Pleas or Confessions

Do’s and Don’ts Leave any questions unanswered -- this you will surely get. . . Leave the examination hall before the time is up, i. e. never give-up Make any Pleas or Confessions

Maximizing Your Marks Analyze the framing of the question and response appropriately e. g. : Critically analyze, critical assessment, discuss, soliciting for opinions, understand, compare and contrast, analysis of statements, current issues, etc. Answer what you are asked for, NOT what you know Plan your answer

Maximizing Your Marks Analyze the framing of the question and response appropriately e. g. : Critically analyze, critical assessment, discuss, soliciting for opinions, understand, compare and contrast, analysis of statements, current issues, etc. Answer what you are asked for, NOT what you know Plan your answer

Maximizing Your Marks Each question comes with the distribution of marks Read and go through all questions and jot down your first thoughts on each question Answer questions that will give you the most marks first Write in full & complete sentences Write legibly

Maximizing Your Marks Each question comes with the distribution of marks Read and go through all questions and jot down your first thoughts on each question Answer questions that will give you the most marks first Write in full & complete sentences Write legibly

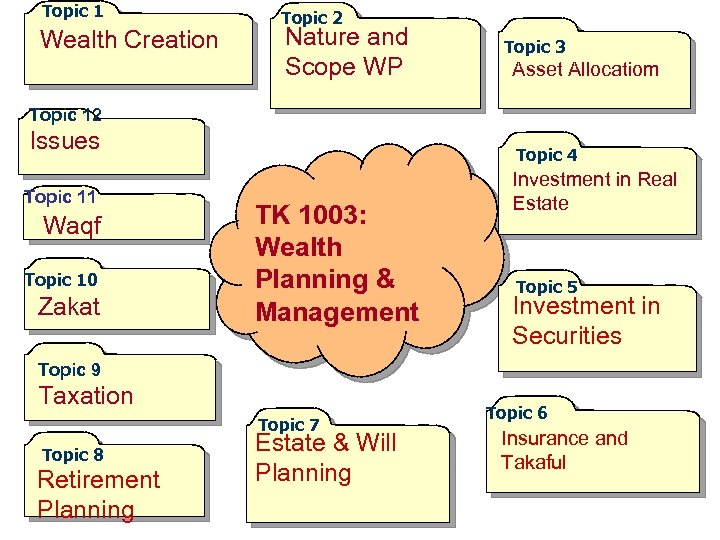

Topic 1 Wealth Creation Topic 2 Nature and Scope WP Topic 3 Asset Allocatiom Topic 12 Issues Topic 11 Waqf Topic 10 Zakat Topic 4 TK 1003: Wealth Planning & Management Investment in Real Estate Topic 5 Investment in Securities Topic 9 Taxation Topic 7 Topic 8 Retirement Planning Estate & Will Planning Topic 6 Insurance and Takaful

Topic 1 Wealth Creation Topic 2 Nature and Scope WP Topic 3 Asset Allocatiom Topic 12 Issues Topic 11 Waqf Topic 10 Zakat Topic 4 TK 1003: Wealth Planning & Management Investment in Real Estate Topic 5 Investment in Securities Topic 9 Taxation Topic 7 Topic 8 Retirement Planning Estate & Will Planning Topic 6 Insurance and Takaful

Common Pitfalls/Mistakes To write what you know, NOT what is being asked To leave questions unanswered To write about the sad stories of your life To write uneven answers according to marks distribution To sit for the exam with insufficient stationaries required To study until the last minutes, thus coming in late

Common Pitfalls/Mistakes To write what you know, NOT what is being asked To leave questions unanswered To write about the sad stories of your life To write uneven answers according to marks distribution To sit for the exam with insufficient stationaries required To study until the last minutes, thus coming in late

Topic One: Wealth Creation And Mobilisation From Conventional And Islamic Perspectives 14

Topic One: Wealth Creation And Mobilisation From Conventional And Islamic Perspectives 14

Review Questions & Answers • Differentiate the concepts of wealth between the Islamic and conventional perspectives. Are there any points of similarities? How do you reconcile the two concepts in reality? – In Islam • • All wealth belongs to Allah. Man is a trustee and needs to use it in accordance with Islamic teachings Wealth is in abundance Everyone has been allocated what is due to him. It is up to him to work on it. – From conventional perspective • • Wealth is generated by individual and hence he is the rightful owner Wealth is scarce It is man who generates wealth and not apportioned to him. He has complete freedom to use it – Efforts are needed to generate wealth under both perspectives – To reconcile: Man’s effort can only be successful with the permission of Allah 15

Review Questions & Answers • Differentiate the concepts of wealth between the Islamic and conventional perspectives. Are there any points of similarities? How do you reconcile the two concepts in reality? – In Islam • • All wealth belongs to Allah. Man is a trustee and needs to use it in accordance with Islamic teachings Wealth is in abundance Everyone has been allocated what is due to him. It is up to him to work on it. – From conventional perspective • • Wealth is generated by individual and hence he is the rightful owner Wealth is scarce It is man who generates wealth and not apportioned to him. He has complete freedom to use it – Efforts are needed to generate wealth under both perspectives – To reconcile: Man’s effort can only be successful with the permission of Allah 15

Review Questions & Answers • Describe the nature of goods that Islam distinguishes for public consumption. Why do you think Islam distinguishes them from those that could rightfully be privately owned? – Two kinds of assets for public consumption: • First is public utilities such as large streams, bridges, land for common use and river banks. • Second, natural resources: water, herbage fire and salt – However, jurists are of the opinion that those goods with the same attributes should be included as well 16

Review Questions & Answers • Describe the nature of goods that Islam distinguishes for public consumption. Why do you think Islam distinguishes them from those that could rightfully be privately owned? – Two kinds of assets for public consumption: • First is public utilities such as large streams, bridges, land for common use and river banks. • Second, natural resources: water, herbage fire and salt – However, jurists are of the opinion that those goods with the same attributes should be included as well 16

Review Questions & Answers • The rationale is that those goods whose production are too costly and burdensome to individuals yet are very much needed by the public at large should belong to public. Otherwise the good can be privately owned 17

Review Questions & Answers • The rationale is that those goods whose production are too costly and burdensome to individuals yet are very much needed by the public at large should belong to public. Otherwise the good can be privately owned 17

Review Questions & Answers • Explain why wealth is considered as a two-edged sword? How could one protect oneself from going beyond the bounds permitted by the Shariah and why? – It is useful when one uses it in accordance with Shariah. It helps man to perform his obligations and he should get the blessings of Allah – On the other hand he will suffer in the hereafter especially when asked to account how he has attained and spent it. – If he has used them for things forbidden it will be worst for him – Some examples? 18

Review Questions & Answers • Explain why wealth is considered as a two-edged sword? How could one protect oneself from going beyond the bounds permitted by the Shariah and why? – It is useful when one uses it in accordance with Shariah. It helps man to perform his obligations and he should get the blessings of Allah – On the other hand he will suffer in the hereafter especially when asked to account how he has attained and spent it. – If he has used them for things forbidden it will be worst for him – Some examples? 18

Review Questions & Answers • Is wealth planning permissible in Islam? How much different will it be done from the conventional approach? – Define wealth planning – What are the components of wealth planning in Islam and in conventional practice – Why is it permissible in Islam? Wealth planning is permissible in Islam in order to ensure that man is able to live comfortably in his old age. Islam does not want Muslims to suffer in this world – It will be very different because • a Muslim needs to cleanse (pay zakat, voluntary sadaqah and spending on others) his property. • He must not indulge in un. Islamic activities while generating, accumulating, preserving, protecting and spending his wealth. 19

Review Questions & Answers • Is wealth planning permissible in Islam? How much different will it be done from the conventional approach? – Define wealth planning – What are the components of wealth planning in Islam and in conventional practice – Why is it permissible in Islam? Wealth planning is permissible in Islam in order to ensure that man is able to live comfortably in his old age. Islam does not want Muslims to suffer in this world – It will be very different because • a Muslim needs to cleanse (pay zakat, voluntary sadaqah and spending on others) his property. • He must not indulge in un. Islamic activities while generating, accumulating, preserving, protecting and spending his wealth. 19

Review Questions & Answers • The three prohibitive elements that would make a commercial transaction non-shariah compliant are riba (usury), maisir (gambling) and gharar (uncertainty; ambiguity). Why are they considered prohibitive to Shariah? – They obstruct justice and equity – The players are not in the same playing fields – Information is incomplete (gharar) 20

Review Questions & Answers • The three prohibitive elements that would make a commercial transaction non-shariah compliant are riba (usury), maisir (gambling) and gharar (uncertainty; ambiguity). Why are they considered prohibitive to Shariah? – They obstruct justice and equity – The players are not in the same playing fields – Information is incomplete (gharar) 20

Review Questions & Answers • “They ask you what they should spend (in charity). Say: Whatever you spend that is good, is for parents and relatives and orphans and those in want and for wayfarers. And whatever ye do that is good, -(Allah) knows it well” [Quran: Chapter 2 (Al-Baqarah): Verse 215] Spending one’s wealth on others is strongly encouraged by Islam as is mentioned in the above verse of the Holy Quran. Briefly explain the importance of spending in the context of wealth purification in Islamic wealth planning. 21

Review Questions & Answers • “They ask you what they should spend (in charity). Say: Whatever you spend that is good, is for parents and relatives and orphans and those in want and for wayfarers. And whatever ye do that is good, -(Allah) knows it well” [Quran: Chapter 2 (Al-Baqarah): Verse 215] Spending one’s wealth on others is strongly encouraged by Islam as is mentioned in the above verse of the Holy Quran. Briefly explain the importance of spending in the context of wealth purification in Islamic wealth planning. 21

Review Questions & Answers • Purification is of two kinds, the physical and the spiritual • Wealth purification is manifested by sharing with others what we have and better still what we love most (physical, purifying from non-Shariah compliant income that may be earned unknowingly or within tolerable limits) • It is in the spirit of searching for the blessings of Allah that we give away what we have (spiritual) 22

Review Questions & Answers • Purification is of two kinds, the physical and the spiritual • Wealth purification is manifested by sharing with others what we have and better still what we love most (physical, purifying from non-Shariah compliant income that may be earned unknowingly or within tolerable limits) • It is in the spirit of searching for the blessings of Allah that we give away what we have (spiritual) 22

Review Questions & Answers • The main distinction between the conventional and Islamic wealth planning is the Shariah requirement of wealth purification. Briefly explain each of the different Islamic wealth purification processes. – Spending (infaq) – Voluntary charity (sadaqah) – Compulsory wealth tax (Zakat) – Endowment (Waqf) 23

Review Questions & Answers • The main distinction between the conventional and Islamic wealth planning is the Shariah requirement of wealth purification. Briefly explain each of the different Islamic wealth purification processes. – Spending (infaq) – Voluntary charity (sadaqah) – Compulsory wealth tax (Zakat) – Endowment (Waqf) 23

Topic Two: Nature and scope of wealth planning 24

Topic Two: Nature and scope of wealth planning 24

Review Questions & Answers • Describe the differences and similarities between wealth planning and financial planning – Similarities: • Both aim at enhancing the value of wealth or resources • Both use similar methods to enhance or preserve value • Both have specific objectives when formulating plans – Differences: • FP is for specific projects or periods. WP is for the end of the period • FP is for relatively shorter term but WP is for long term • FP is meant to have enough for all periods but WP is for future 25

Review Questions & Answers • Describe the differences and similarities between wealth planning and financial planning – Similarities: • Both aim at enhancing the value of wealth or resources • Both use similar methods to enhance or preserve value • Both have specific objectives when formulating plans – Differences: • FP is for specific projects or periods. WP is for the end of the period • FP is for relatively shorter term but WP is for long term • FP is meant to have enough for all periods but WP is for future 25

Review Questions & Answers • Explain the differences and similarities between the objectives of conventional and Islamic wealth planning – Similarities: • Both contain functions of generation, accumulation, protection or preservation, enhancement and distribution • Both aim to have a good life during retirement – Differences: • Islamic: need to do cleansing (zakat, etc) • Islamic: cannot contravene Shariah 26

Review Questions & Answers • Explain the differences and similarities between the objectives of conventional and Islamic wealth planning – Similarities: • Both contain functions of generation, accumulation, protection or preservation, enhancement and distribution • Both aim to have a good life during retirement – Differences: • Islamic: need to do cleansing (zakat, etc) • Islamic: cannot contravene Shariah 26

Review Questions & Answers • Describe the significance of the different stages in wealth planning process – Inventory taking – Analysis & Evaluation – Plan Designing – Implementation – Monitoring and Reviewing 27

Review Questions & Answers • Describe the significance of the different stages in wealth planning process – Inventory taking – Analysis & Evaluation – Plan Designing – Implementation – Monitoring and Reviewing 27

Review Questions & Answers • Explain the trade-off concept and its relevance in the preparation of a comprehensive wealth management plan. – Trade-off between risk and return • • May not get the rate of return expected Client may have different risk appetite Risk-free concept means return is very low Consistency of performance Asset allocation can improve or worsen return Trade-off between service and return Trade-off between this world and the next 28

Review Questions & Answers • Explain the trade-off concept and its relevance in the preparation of a comprehensive wealth management plan. – Trade-off between risk and return • • May not get the rate of return expected Client may have different risk appetite Risk-free concept means return is very low Consistency of performance Asset allocation can improve or worsen return Trade-off between service and return Trade-off between this world and the next 28

Review Questions & Answers • How different is the conventional trade-off concept from the Islamic concept? – Trade-off between this world and the next – A Muslim believes in fate and destiny (qadha’ and qadar) – There is effort (ikhtiar) and leaving it to Allah (Tawakkul) 29

Review Questions & Answers • How different is the conventional trade-off concept from the Islamic concept? – Trade-off between this world and the next – A Muslim believes in fate and destiny (qadha’ and qadar) – There is effort (ikhtiar) and leaving it to Allah (Tawakkul) 29

Review Questions & Answers • Explain the similarities and differences between the conventional and Islamic “Tradeoff Concept” in relation to wealth planning. – Similar answer to the previous question 30

Review Questions & Answers • Explain the similarities and differences between the conventional and Islamic “Tradeoff Concept” in relation to wealth planning. – Similar answer to the previous question 30

Review Questions & Answers • “To Allah belongs all that is in the heavens and on earth: To Him do all questions go back (for decision)” [Quran: Chapter 3 (Ali ‘Imran): Verse 109] Based on the above verse from the Holy Quran: – can you explain the concept of wealth ownership in Islam; – what implications do you think the second part of the verse has on the generation and utilization of wealth in Islam? – what should the objectives of wealth planning in Islam be and relate its importance especially in the modern world. 31

Review Questions & Answers • “To Allah belongs all that is in the heavens and on earth: To Him do all questions go back (for decision)” [Quran: Chapter 3 (Ali ‘Imran): Verse 109] Based on the above verse from the Holy Quran: – can you explain the concept of wealth ownership in Islam; – what implications do you think the second part of the verse has on the generation and utilization of wealth in Islam? – what should the objectives of wealth planning in Islam be and relate its importance especially in the modern world. 31

Review Questions & Answers – To Allah belongs all creations and hence all resources and wealth and man is just the trustee who has the right to use in accordance with His Will – We are accountable for all our actions – To generate and accumulate wealth in order to be closer to Him in whatever way. E. g. spend in His way, sharing with others, etc. 32

Review Questions & Answers – To Allah belongs all creations and hence all resources and wealth and man is just the trustee who has the right to use in accordance with His Will – We are accountable for all our actions – To generate and accumulate wealth in order to be closer to Him in whatever way. E. g. spend in His way, sharing with others, etc. 32

Topic Three: Wealth (asset) allocation process 33

Topic Three: Wealth (asset) allocation process 33

Review Questions & Answers • One of the most important aspects of successful wealth planning is the process of wealth allocation. Describe the main components of wealth allocation process and explain the significance of each to the success of wealth planning. – – Establishment of objectives Identifying potential opportunities Determining risks and constraints Potential investment channels 34

Review Questions & Answers • One of the most important aspects of successful wealth planning is the process of wealth allocation. Describe the main components of wealth allocation process and explain the significance of each to the success of wealth planning. – – Establishment of objectives Identifying potential opportunities Determining risks and constraints Potential investment channels 34

Review Questions & Answers • One of the important processes in wealth planning is the wealth allocation. In order to ensure that the wealth allocation process is carried out properly, one needs to formulate the investment policy statement. List four important elements that should be included in the investment policy statement for wealth allocation process and briefly explain what each entails. 35

Review Questions & Answers • One of the important processes in wealth planning is the wealth allocation. In order to ensure that the wealth allocation process is carried out properly, one needs to formulate the investment policy statement. List four important elements that should be included in the investment policy statement for wealth allocation process and briefly explain what each entails. 35

Review Questions & Answers – Brief client description – Purpose of establishing policies and guidelines regarding objectives, goals, restrictions and responsibilities – Identification of duties – Statement of investment goals, objectives and constraints – Schedule of review of investment performance, Shariah compliance, etc. – Asset allocation considerations – Rebalancing guidelines for portfolio adjustments based on feedback 36

Review Questions & Answers – Brief client description – Purpose of establishing policies and guidelines regarding objectives, goals, restrictions and responsibilities – Identification of duties – Statement of investment goals, objectives and constraints – Schedule of review of investment performance, Shariah compliance, etc. – Asset allocation considerations – Rebalancing guidelines for portfolio adjustments based on feedback 36

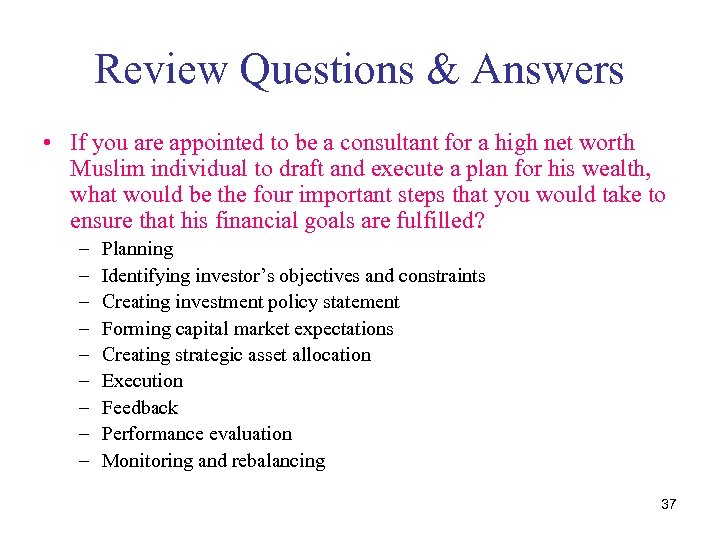

Review Questions & Answers • If you are appointed to be a consultant for a high net worth Muslim individual to draft and execute a plan for his wealth, what would be the four important steps that you would take to ensure that his financial goals are fulfilled? – – – – – Planning Identifying investor’s objectives and constraints Creating investment policy statement Forming capital market expectations Creating strategic asset allocation Execution Feedback Performance evaluation Monitoring and rebalancing 37

Review Questions & Answers • If you are appointed to be a consultant for a high net worth Muslim individual to draft and execute a plan for his wealth, what would be the four important steps that you would take to ensure that his financial goals are fulfilled? – – – – – Planning Identifying investor’s objectives and constraints Creating investment policy statement Forming capital market expectations Creating strategic asset allocation Execution Feedback Performance evaluation Monitoring and rebalancing 37

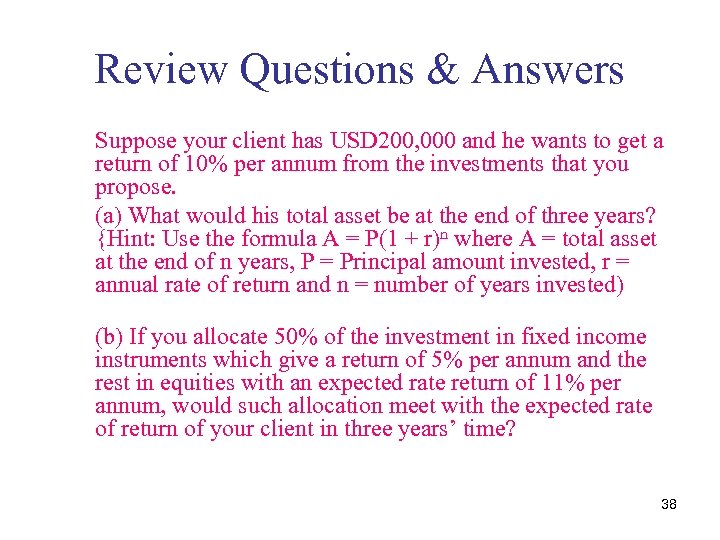

Review Questions & Answers Suppose your client has USD 200, 000 and he wants to get a return of 10% per annum from the investments that you propose. (a) What would his total asset be at the end of three years? {Hint: Use the formula A = P(1 + r)n where A = total asset at the end of n years, P = Principal amount invested, r = annual rate of return and n = number of years invested) (b) If you allocate 50% of the investment in fixed income instruments which give a return of 5% per annum and the rest in equities with an expected rate return of 11% per annum, would such allocation meet with the expected rate of return of your client in three years’ time? 38

Review Questions & Answers Suppose your client has USD 200, 000 and he wants to get a return of 10% per annum from the investments that you propose. (a) What would his total asset be at the end of three years? {Hint: Use the formula A = P(1 + r)n where A = total asset at the end of n years, P = Principal amount invested, r = annual rate of return and n = number of years invested) (b) If you allocate 50% of the investment in fixed income instruments which give a return of 5% per annum and the rest in equities with an expected rate return of 11% per annum, would such allocation meet with the expected rate of return of your client in three years’ time? 38

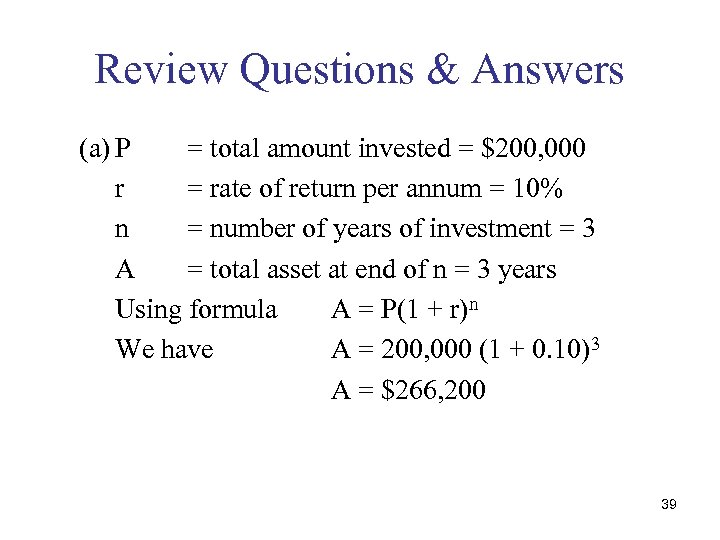

Review Questions & Answers (a) P = total amount invested = $200, 000 r = rate of return per annum = 10% n = number of years of investment = 3 A = total asset at end of n = 3 years Using formula A = P(1 + r)n We have A = 200, 000 (1 + 0. 10)3 A = $266, 200 39

Review Questions & Answers (a) P = total amount invested = $200, 000 r = rate of return per annum = 10% n = number of years of investment = 3 A = total asset at end of n = 3 years Using formula A = P(1 + r)n We have A = 200, 000 (1 + 0. 10)3 A = $266, 200 39

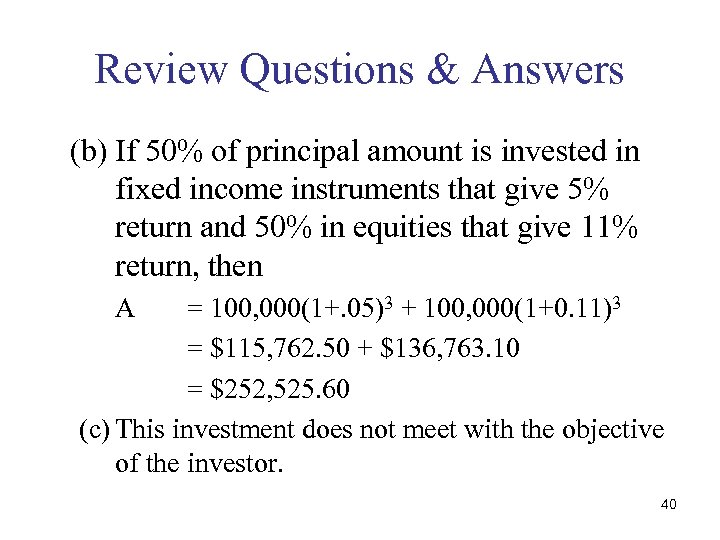

Review Questions & Answers (b) If 50% of principal amount is invested in fixed income instruments that give 5% return and 50% in equities that give 11% return, then A = 100, 000(1+. 05)3 + 100, 000(1+0. 11)3 = $115, 762. 50 + $136, 763. 10 = $252, 525. 60 (c) This investment does not meet with the objective of the investor. 40

Review Questions & Answers (b) If 50% of principal amount is invested in fixed income instruments that give 5% return and 50% in equities that give 11% return, then A = 100, 000(1+. 05)3 + 100, 000(1+0. 11)3 = $115, 762. 50 + $136, 763. 10 = $252, 525. 60 (c) This investment does not meet with the objective of the investor. 40

Topic 4: Investment In Real Estates 41

Topic 4: Investment In Real Estates 41

Review Questions & Answers • Real estate is one investment that seems to appreciate in value more than depreciate. Explain. – Real estate refers to land anything affixed to it – It has special features: • Durable/ Perpetual • Over time the property will be surrounded by development • More facilities become available • Scarcity and immobility 42

Review Questions & Answers • Real estate is one investment that seems to appreciate in value more than depreciate. Explain. – Real estate refers to land anything affixed to it – It has special features: • Durable/ Perpetual • Over time the property will be surrounded by development • More facilities become available • Scarcity and immobility 42

Review Questions & Answers • What are the common factors that determine the value of real estate? Give reasons why. – – – – High demand Short supply Development surrounding it Shape and size Accessibility No encumbrances Scenic view Location 43

Review Questions & Answers • What are the common factors that determine the value of real estate? Give reasons why. – – – – High demand Short supply Development surrounding it Shape and size Accessibility No encumbrances Scenic view Location 43

Review Questions & Answers • Why does locality of a real estate play such an important role in determining the value of a real estate? – It is immovable and hence depends on where it is located, near the town, country side, – Accessibility – Access to facilities (market, shops, school, hospital) – Landscape 44

Review Questions & Answers • Why does locality of a real estate play such an important role in determining the value of a real estate? – It is immovable and hence depends on where it is located, near the town, country side, – Accessibility – Access to facilities (market, shops, school, hospital) – Landscape 44

Review Questions & Answers • Describe and explain the various methods of valuation of real estate – Comparison method • Compare like for like and adjust the differences – Investment method • Comparing the returns to investment on the property – Cost method • Normally applied to public properties such as schools, hospitals, etc. Comparison is made between the cost of building and the replacement cost giving allowance to depreciation – Profit Method • It is based on the kind of profit that could be earned from the property – The Residual method • It is used to evaluate the development sites and properties suitable for redevelopment. It compares value of proceeds (after development) with development cost 45

Review Questions & Answers • Describe and explain the various methods of valuation of real estate – Comparison method • Compare like for like and adjust the differences – Investment method • Comparing the returns to investment on the property – Cost method • Normally applied to public properties such as schools, hospitals, etc. Comparison is made between the cost of building and the replacement cost giving allowance to depreciation – Profit Method • It is based on the kind of profit that could be earned from the property – The Residual method • It is used to evaluate the development sites and properties suitable for redevelopment. It compares value of proceeds (after development) with development cost 45

Review Questions & Answers • Explain the economics of real estate cycles – Increase in demand due to population growth, industrial development, public works and government services – Time is required to supply and construct properties which gives rise to rents and land value – Peak – high volume of real estate transfers. By that time, S>D. Rentals fail to readjust. This causes the break of building boom 46

Review Questions & Answers • Explain the economics of real estate cycles – Increase in demand due to population growth, industrial development, public works and government services – Time is required to supply and construct properties which gives rise to rents and land value – Peak – high volume of real estate transfers. By that time, S>D. Rentals fail to readjust. This causes the break of building boom 46

Review Questions & Answers • Mr. Ali bought a house for investment. He paid a total of RM 200, 000 for it which includes the legal and agency fees and all other miscellaneous expenses. He took a 90% financing based on Bay’ Bithaman Ajil (BBA) for 20 years at 4. 0% per annum. He managed to get a tenant who pays a rental of RM 1, 500. 00 per month. (a) How much will Mr. Ali pay for the house in 20 years? (b) What is the rate of return on his investment? (c) Is this a good investment? Why? 47

Review Questions & Answers • Mr. Ali bought a house for investment. He paid a total of RM 200, 000 for it which includes the legal and agency fees and all other miscellaneous expenses. He took a 90% financing based on Bay’ Bithaman Ajil (BBA) for 20 years at 4. 0% per annum. He managed to get a tenant who pays a rental of RM 1, 500. 00 per month. (a) How much will Mr. Ali pay for the house in 20 years? (b) What is the rate of return on his investment? (c) Is this a good investment? Why? 47

Review Questions & Answers (a) 90% financing at 4% per annum for 20 years will yield a total financing cost of (90/100) x 200, 000 x (4/100) x 20 = $144, 000 Therefore the total amount paid by Ali in 20 years is $200, 000 + $144, 000 = $344, 000 (b) The rate of return on his investment is $1, 500 x 12 ÷ $200, 000 x 100% = 9% p. a. (c) Since the rental is $1, 500 per month and the monthly instalment is $344, 000 ÷ 240 = $1433 per month, it is not a bad investment at all. 48

Review Questions & Answers (a) 90% financing at 4% per annum for 20 years will yield a total financing cost of (90/100) x 200, 000 x (4/100) x 20 = $144, 000 Therefore the total amount paid by Ali in 20 years is $200, 000 + $144, 000 = $344, 000 (b) The rate of return on his investment is $1, 500 x 12 ÷ $200, 000 x 100% = 9% p. a. (c) Since the rental is $1, 500 per month and the monthly instalment is $344, 000 ÷ 240 = $1433 per month, it is not a bad investment at all. 48

Topic 5: Investment In Securities 49

Topic 5: Investment In Securities 49

Review Questions & Answers • Briefly explain the following terminologies as used in the securities market: – Authorised Capital – Market Value of Firm – Bonus Issue – Earnings per Share or EPS 50

Review Questions & Answers • Briefly explain the following terminologies as used in the securities market: – Authorised Capital – Market Value of Firm – Bonus Issue – Earnings per Share or EPS 50

Review Questions & Answers • Compare and contrast the debt and equity instruments – Debt and equity instruments are differentiated by claim and time. – Debt or borrowing is fixed in time and fixed in claim. i. e. they are terminal and have fixed maturity period. They must be paid in full or within the stipulated time. Once it is paid, creditors have no links with them 51

Review Questions & Answers • Compare and contrast the debt and equity instruments – Debt and equity instruments are differentiated by claim and time. – Debt or borrowing is fixed in time and fixed in claim. i. e. they are terminal and have fixed maturity period. They must be paid in full or within the stipulated time. Once it is paid, creditors have no links with them 51

Review Questions & Answers – Claim on debt is fixed (principal + interest). – Equity provides ownership, is residual in claim and perpetual in time. Equity owners own the firm net of the firm’s obligations. The net residual portion belongs to equity holders. All values created beyond the firm’s obligations belong to the equity holders. – Equity being ownership is not terminal and does not have fixed maturity. Hence equity instruments are perpetuities. – Most common equity instruments is the common stock. 52

Review Questions & Answers – Claim on debt is fixed (principal + interest). – Equity provides ownership, is residual in claim and perpetual in time. Equity owners own the firm net of the firm’s obligations. The net residual portion belongs to equity holders. All values created beyond the firm’s obligations belong to the equity holders. – Equity being ownership is not terminal and does not have fixed maturity. Hence equity instruments are perpetuities. – Most common equity instruments is the common stock. 52

Review Questions & Answers • What makes securities so attractive that shareholders are willing to part with their ownership when they go public? – The capital gain is normally very high when the company goes public (IPO price is much higher) – It provides instant cash – It is too long to wait for dividends to recover the capital gains – Shareholders can easily repurchase the securities if they want to – “It is better to have cash now than to keep papers” which may bring in losses too 53

Review Questions & Answers • What makes securities so attractive that shareholders are willing to part with their ownership when they go public? – The capital gain is normally very high when the company goes public (IPO price is much higher) – It provides instant cash – It is too long to wait for dividends to recover the capital gains – Shareholders can easily repurchase the securities if they want to – “It is better to have cash now than to keep papers” which may bring in losses too 53

Review Questions & Answers • Identify risk elements inherent in the investment in securities – Business risk – refers to uncertainty of income flows caused by firm’s business performance – Financial risk – refers to uncertainty originating from the way the financing is done (equity- debt combinations; etc) – Liquidity risk – refers to un certainty introduced by the secondary market for investment – Currency risk – exchange rate risks due to the fluctuations in exchange rates 54

Review Questions & Answers • Identify risk elements inherent in the investment in securities – Business risk – refers to uncertainty of income flows caused by firm’s business performance – Financial risk – refers to uncertainty originating from the way the financing is done (equity- debt combinations; etc) – Liquidity risk – refers to un certainty introduced by the secondary market for investment – Currency risk – exchange rate risks due to the fluctuations in exchange rates 54

Review Questions & Answers – Country Risk – also called political risk arising out of sudden change in policies or government – Bond risks and rating – can be categorised as follows: • • Default risk Interest rate risk Liquidity risk Inflation risk 55

Review Questions & Answers – Country Risk – also called political risk arising out of sudden change in policies or government – Bond risks and rating – can be categorised as follows: • • Default risk Interest rate risk Liquidity risk Inflation risk 55

Review Questions & Answers • Explain the stock screening process adopted by the Shariah Advisory Council of the Securities Commission – Step 1: Identify the universe based on core business. SC has also listed activities that are non-Shariah compliant – Step 2: Takes into account the level of contribution of interest income from conventional fixed deposits or other interest bearing financial instruments. Dividends from investment in Shariah non-compliant securities are also considered. 56

Review Questions & Answers • Explain the stock screening process adopted by the Shariah Advisory Council of the Securities Commission – Step 1: Identify the universe based on core business. SC has also listed activities that are non-Shariah compliant – Step 2: Takes into account the level of contribution of interest income from conventional fixed deposits or other interest bearing financial instruments. Dividends from investment in Shariah non-compliant securities are also considered. 56

Review Questions & Answers – For companies with activities comprising both permissible and non-permissible elements the SAC considers two additional criteria: • Public perception of the company must be good • The core activities of the company are important and considered maslahah (“benefit” in general) to the Muslim ummah and the non-permissible element is very small and involves matters such as umum balwah (common plight and difficult to avoid) ‘uruf (custom) and the rights of the non-Muslim community which are accepted by Islam. 57

Review Questions & Answers – For companies with activities comprising both permissible and non-permissible elements the SAC considers two additional criteria: • Public perception of the company must be good • The core activities of the company are important and considered maslahah (“benefit” in general) to the Muslim ummah and the non-permissible element is very small and involves matters such as umum balwah (common plight and difficult to avoid) ‘uruf (custom) and the rights of the non-Muslim community which are accepted by Islam. 57

Review Questions & Answers – To determine the tolerable level of mixed contributions from permissible and nonpermissible activities towards turnover and profit before tax of a company the SAC has established the following benchmarks • a. The 5% benchmark – is used for activities that are clearly prohibited such as riba; gambling; liquor and pork • b. The 10% benchmark – is used for activities considered as umum balwah. E. g. interest from fixed deposit 58

Review Questions & Answers – To determine the tolerable level of mixed contributions from permissible and nonpermissible activities towards turnover and profit before tax of a company the SAC has established the following benchmarks • a. The 5% benchmark – is used for activities that are clearly prohibited such as riba; gambling; liquor and pork • b. The 10% benchmark – is used for activities considered as umum balwah. E. g. interest from fixed deposit 58

Review Questions & Answers – c. The 20% benchmark – is used to assess the level of contribution of mixed rental payment from shariah noncompliant activities such as rental payments from premises used in gambling; sale of liquor etc. – d. The 25% benchmark – is used to assess the level of contribution from activities that are generally permissible and have an element of maslahah to the public but there are other elements that may affect the Shariah status of these activities such as hotel and resort operations; share trading; stockbroking and others because these activities may involve non-permissible activities 59

Review Questions & Answers – c. The 20% benchmark – is used to assess the level of contribution of mixed rental payment from shariah noncompliant activities such as rental payments from premises used in gambling; sale of liquor etc. – d. The 25% benchmark – is used to assess the level of contribution from activities that are generally permissible and have an element of maslahah to the public but there are other elements that may affect the Shariah status of these activities such as hotel and resort operations; share trading; stockbroking and others because these activities may involve non-permissible activities 59

Review Questions & Answers – When there is a change of status from Shariahcompliant to Shariah non-compliant • Sell the securities immediately if it is profitable to do so and take the profits • Wait until the price of security equals cost if at the time of change of status the market price is less than purchase price. • While waiting if there is dividend received the company may take it. • If the company delays selling any profit made must be cleansed. 60

Review Questions & Answers – When there is a change of status from Shariahcompliant to Shariah non-compliant • Sell the securities immediately if it is profitable to do so and take the profits • Wait until the price of security equals cost if at the time of change of status the market price is less than purchase price. • While waiting if there is dividend received the company may take it. • If the company delays selling any profit made must be cleansed. 60

Review Questions & Answers • Explain how an ijarah sukuk is structured – Refer to notes 61

Review Questions & Answers • Explain how an ijarah sukuk is structured – Refer to notes 61

Review Questions & Answers • What are the main differences in the nature of real estate and securities? Real estate: physical properties; not liquid; no structured market; information not readily available; not easily transferable; requires third party or real estate agents; immobile; huge in size; value depends on state of development in the surroundings; location; view; size and shape; long term; appreciating in value 62

Review Questions & Answers • What are the main differences in the nature of real estate and securities? Real estate: physical properties; not liquid; no structured market; information not readily available; not easily transferable; requires third party or real estate agents; immobile; huge in size; value depends on state of development in the surroundings; location; view; size and shape; long term; appreciating in value 62

Review Questions & Answers • Securities: two types of securities- equity and debt; structured markets; complete information available; prices fluctuate wildly; price is known; lots of players; easy transfer; easy entry and exit; small investment; volatile; risky but high returns; short term; 63

Review Questions & Answers • Securities: two types of securities- equity and debt; structured markets; complete information available; prices fluctuate wildly; price is known; lots of players; easy transfer; easy entry and exit; small investment; volatile; risky but high returns; short term; 63

Review Questions & Answers • What are the differences between investing in real estate and investing in stock market? – Refer to previous answer 64

Review Questions & Answers • What are the differences between investing in real estate and investing in stock market? – Refer to previous answer 64

Review Questions & Answers • Investing in debt instruments is different from investing in equity instruments. What are the main differences in the nature of debt and equity instruments? – Refer to previous answer 65

Review Questions & Answers • Investing in debt instruments is different from investing in equity instruments. What are the main differences in the nature of debt and equity instruments? – Refer to previous answer 65

Review Questions & Answers • Explain the difference between equity and debt instruments • Refer to previous answer 66

Review Questions & Answers • Explain the difference between equity and debt instruments • Refer to previous answer 66

Review Questions & Answers • What are the features of sukuk that are globally acceptable? – Should be asset backed – Should not be based on debt 67

Review Questions & Answers • What are the features of sukuk that are globally acceptable? – Should be asset backed – Should not be based on debt 67

Review Questions & Answers • Do you think harmonization of global Shariah opinions would enhance further development of Islamic finance industry? – Open question 68

Review Questions & Answers • Do you think harmonization of global Shariah opinions would enhance further development of Islamic finance industry? – Open question 68

Review Questions & Answers • When the core business of a company is Shariah compliant, it may still have income from non-Shariah compliant sources. For such companies, the Shariah Advisory Council of the Securities Commission, Malaysia has issued four benchmarks that set the maximum level of non-Shariah income that could be tolerated for such companies to be considered as Shariah-compliant stock. Briefly explain each of the four benchmarks. – Refer to previous answer 69

Review Questions & Answers • When the core business of a company is Shariah compliant, it may still have income from non-Shariah compliant sources. For such companies, the Shariah Advisory Council of the Securities Commission, Malaysia has issued four benchmarks that set the maximum level of non-Shariah income that could be tolerated for such companies to be considered as Shariah-compliant stock. Briefly explain each of the four benchmarks. – Refer to previous answer 69

Review Questions & Answers What are the main features of investments in – Real estate; and – Securities? Discuss their differences Real estate: physical properties; not liquid; no structured market; information not readily available; not easily transferable; requires third party or real estate agents; immobile; huge in size; value depends on state of development in the surroundings; location; view; size and shape; long term; appreciating in value 70

Review Questions & Answers What are the main features of investments in – Real estate; and – Securities? Discuss their differences Real estate: physical properties; not liquid; no structured market; information not readily available; not easily transferable; requires third party or real estate agents; immobile; huge in size; value depends on state of development in the surroundings; location; view; size and shape; long term; appreciating in value 70

Review Questions & Answers • Securities: two types of securities- equity and debt; structured markets; complete information available; prices fluctuate wildly; price is known; lots of players; easy transfer; easy entry and exit; small investment; volatile; risky but high returns; short term; 71

Review Questions & Answers • Securities: two types of securities- equity and debt; structured markets; complete information available; prices fluctuate wildly; price is known; lots of players; easy transfer; easy entry and exit; small investment; volatile; risky but high returns; short term; 71

Topic 6: Insurance And Takaful Schemes 72

Topic 6: Insurance And Takaful Schemes 72

Review Questions & Answers • Describe the roles of insurance and takaful in wealth planning – Insurance and takaful are very important for wealth preservation and distribution as they create an instant estate with a small premium – It helps in case of sudden death; temporary or permanent disability in providing • • Income replacement needs Funeral expense needs Debt repayment needs Education needs 73

Review Questions & Answers • Describe the roles of insurance and takaful in wealth planning – Insurance and takaful are very important for wealth preservation and distribution as they create an instant estate with a small premium – It helps in case of sudden death; temporary or permanent disability in providing • • Income replacement needs Funeral expense needs Debt repayment needs Education needs 73

Review Questions & Answers • Explain the differences between the underlying principles of insurance and takaful contracts – Insurance contract between the company and the client is one of indemnity – Takaful contract is one among the participants who are willing to donate part of their contributions to compensate losses incurred by any participant. This donation is called tabarru’. The company is only the manager or operator. 74

Review Questions & Answers • Explain the differences between the underlying principles of insurance and takaful contracts – Insurance contract between the company and the client is one of indemnity – Takaful contract is one among the participants who are willing to donate part of their contributions to compensate losses incurred by any participant. This donation is called tabarru’. The company is only the manager or operator. 74

Review Questions & Answers • Briefly compare the differences in the takaful models – Mudharabah model where the company is the operator (mudharrib) and the group of participants is the provider of capital (rabbul mal). The company shares the underwriting surplus and the investment profits with the participants – Wakalah model – company takes an upfront fee for managing the takaful business (underwriting and investment plus the operations). The company may share the profits from investment if it only takes fee for underwriting and operations. – Wakalah-waqf model – similar to wakalah model but the donation portion is used to create waqf fund which is used to pay off losses incurred by participants. 75

Review Questions & Answers • Briefly compare the differences in the takaful models – Mudharabah model where the company is the operator (mudharrib) and the group of participants is the provider of capital (rabbul mal). The company shares the underwriting surplus and the investment profits with the participants – Wakalah model – company takes an upfront fee for managing the takaful business (underwriting and investment plus the operations). The company may share the profits from investment if it only takes fee for underwriting and operations. – Wakalah-waqf model – similar to wakalah model but the donation portion is used to create waqf fund which is used to pay off losses incurred by participants. 75

Review Questions & Answers • Explain the main differences in the life insurance contracts – Term life – • • For a specific period. It is least expensive. Can terminate and renewed at a higher premium Could be until age 65 or 75 or 100 with no renewal guarantees • To remain insured the insurer issues renewable term insurance which will be converted to permanent coverage 76

Review Questions & Answers • Explain the main differences in the life insurance contracts – Term life – • • For a specific period. It is least expensive. Can terminate and renewed at a higher premium Could be until age 65 or 75 or 100 with no renewal guarantees • To remain insured the insurer issues renewable term insurance which will be converted to permanent coverage 76

Review Questions & Answers – Whole life – is for insured’s whole life time • • • Very long period such as 88 or 90 or 100 years Is a form of permanent insurance It has element of savings called cash value Straight life – premium payable as long as insured lives Limited-pay life policy – premium payable for specific period say 20 years or until 65 • After that no payment needed but insured is covered until death 77

Review Questions & Answers – Whole life – is for insured’s whole life time • • • Very long period such as 88 or 90 or 100 years Is a form of permanent insurance It has element of savings called cash value Straight life – premium payable as long as insured lives Limited-pay life policy – premium payable for specific period say 20 years or until 65 • After that no payment needed but insured is covered until death 77

Review Questions & Answers • Endowment is another form of permanent insurance similar to whole life. – The only difference is that the contracts provide death benefits for a specified period of time. – It has cash value and insured is paid face amount at the end of the period if insured is still alive. 78

Review Questions & Answers • Endowment is another form of permanent insurance similar to whole life. – The only difference is that the contracts provide death benefits for a specified period of time. – It has cash value and insured is paid face amount at the end of the period if insured is still alive. 78

Review Questions & Answers • Investment-life insurance contracts is different from any other life insurance contracts – The premium is divided into two accounts – investment account and risk account – Investment account belongs to insured – Risk account belongs to company who will conduct operations and pay off compensations. – At death the insured party will get the investment account plus the face value of the risk account – The same as investment link insurance 79

Review Questions & Answers • Investment-life insurance contracts is different from any other life insurance contracts – The premium is divided into two accounts – investment account and risk account – Investment account belongs to insured – Risk account belongs to company who will conduct operations and pay off compensations. – At death the insured party will get the investment account plus the face value of the risk account – The same as investment link insurance 79

Review Questions & Answers • List the main differences between the conventional insurance operations and those of takaful (Islamic insurance). – Insurance is a contract of indemnifying the policy holders from the risks related to the policy. Takaful is the mutual sharing of risks and compensating those that face any hazards – Insurance involves ambiguity (al-gharar), gambling (al-maisir) and interest bearing investments (riba). Takaful avoids all three 80

Review Questions & Answers • List the main differences between the conventional insurance operations and those of takaful (Islamic insurance). – Insurance is a contract of indemnifying the policy holders from the risks related to the policy. Takaful is the mutual sharing of risks and compensating those that face any hazards – Insurance involves ambiguity (al-gharar), gambling (al-maisir) and interest bearing investments (riba). Takaful avoids all three 80

Review Questions & Answers • Explain the concept of tabarru’ as is used in takaful. – Tabarru’ comes from the Arabic root word “albirr” which means “righteousness”. Tabarru’ is a sincere or voluntary donation by takaful participants from part of the contribution for a policy. The participants have no right to the amount donated and will not receive any benefit out of it because he has “given up his right on it” This is the part that is managed by the takaful operator to pay out claims. 81

Review Questions & Answers • Explain the concept of tabarru’ as is used in takaful. – Tabarru’ comes from the Arabic root word “albirr” which means “righteousness”. Tabarru’ is a sincere or voluntary donation by takaful participants from part of the contribution for a policy. The participants have no right to the amount donated and will not receive any benefit out of it because he has “given up his right on it” This is the part that is managed by the takaful operator to pay out claims. 81

Review Questions & Answers • What are the means available today that can help us protect our wealth? – Insurance and takaful – There available takaful products that are meant to compensate losses on property due to fire, theft, and where a piece of property is being purchased under some financing arrangement, the purchaser can have a policy that would pay out the total financing in case of death or incapacitation of the purchaser 82

Review Questions & Answers • What are the means available today that can help us protect our wealth? – Insurance and takaful – There available takaful products that are meant to compensate losses on property due to fire, theft, and where a piece of property is being purchased under some financing arrangement, the purchaser can have a policy that would pay out the total financing in case of death or incapacitation of the purchaser 82

Review Questions & Answers • There are three main models of takaful in operation today. Describe the basic Quranic principle that underlies all the different takaful models. – The basic Quranic principle of “Ta’awun” or helping one another in righteousness and piety is the underlying principle that is being employed in formulating takaful models. [Surah Al-Maidah (5): verse 3)] which means, “Help ye one another in righteousness and piety, but help ye not one another in sin and rancour” 83

Review Questions & Answers • There are three main models of takaful in operation today. Describe the basic Quranic principle that underlies all the different takaful models. – The basic Quranic principle of “Ta’awun” or helping one another in righteousness and piety is the underlying principle that is being employed in formulating takaful models. [Surah Al-Maidah (5): verse 3)] which means, “Help ye one another in righteousness and piety, but help ye not one another in sin and rancour” 83

Review Questions & Answers • Explain in some detail the operations of one of the models. – Refer to the previous answer 84

Review Questions & Answers • Explain in some detail the operations of one of the models. – Refer to the previous answer 84

Topic 7: Estate Planning 85

Topic 7: Estate Planning 85

Review Questions & Answers o What is the purpose of estate planning and why is it important to have a plan? o Estate here means all the movable and immovable properties of an individual o Estate planning therefore concerns the various steps to be taken in order to accumulate, conserve, enhance and distribute the estate of the individual. In Islam, it also includes cleansing or purifying the estate which involves voluntary and compulsory distribution and after death, the implementation of the law of inheritance. o It is very important to have a plan so that the wishes of the individual can be fulfilled and his dependents are well taken care of. 86

Review Questions & Answers o What is the purpose of estate planning and why is it important to have a plan? o Estate here means all the movable and immovable properties of an individual o Estate planning therefore concerns the various steps to be taken in order to accumulate, conserve, enhance and distribute the estate of the individual. In Islam, it also includes cleansing or purifying the estate which involves voluntary and compulsory distribution and after death, the implementation of the law of inheritance. o It is very important to have a plan so that the wishes of the individual can be fulfilled and his dependents are well taken care of. 86

Review Questions & Answers o What are the most important components of a Will? Briefly explain the purpose of each component. o A will is a declaration of the intentions of a testator (owner of an estate) with respect to his property which he desires to be distributed upon his death. o. It should include o. The list of his properties ( to know what he has as property) o. The list of beneficiaries and the proportions of the property he allocated (to whom should be given) o. The administrator or executor of the will (to execute his will) 87

Review Questions & Answers o What are the most important components of a Will? Briefly explain the purpose of each component. o A will is a declaration of the intentions of a testator (owner of an estate) with respect to his property which he desires to be distributed upon his death. o. It should include o. The list of his properties ( to know what he has as property) o. The list of beneficiaries and the proportions of the property he allocated (to whom should be given) o. The administrator or executor of the will (to execute his will) 87

Review Questions & Answers o. When does a Will take effect and can one change his Will? If so, how many times? o. A will takes effect only after the death of the testator o. One can change his will any number of times until his death 88

Review Questions & Answers o. When does a Will take effect and can one change his Will? If so, how many times? o. A will takes effect only after the death of the testator o. One can change his will any number of times until his death 88

Review Questions & Answers • What is the “Power of Attorney”? When does it become necessary? Who can get it? – It is an instrument created by the person granting the power of attorney (Donor) in favour of a person or persons named by the Donor in the power of attorney instrument (Donee) – It becomes necessary when the Donor may not be available to execute his plan or transaction – The person named by the Donor in the instrument of the Power of Attorney 89

Review Questions & Answers • What is the “Power of Attorney”? When does it become necessary? Who can get it? – It is an instrument created by the person granting the power of attorney (Donor) in favour of a person or persons named by the Donor in the power of attorney instrument (Donee) – It becomes necessary when the Donor may not be available to execute his plan or transaction – The person named by the Donor in the instrument of the Power of Attorney 89

Review Questions & Answers • Differentiate between a contentious and noncontentious Probate. – Non-contentious Probate is when the deceased has left a Will and named an executor, or if all the beneficiaries have consented to a particular executor, even if his name is not mentioned in the Will – Contentious Probate is when the executor is not named in the Will or when the beneficiaries do not give consent to the executor. 90

Review Questions & Answers • Differentiate between a contentious and noncontentious Probate. – Non-contentious Probate is when the deceased has left a Will and named an executor, or if all the beneficiaries have consented to a particular executor, even if his name is not mentioned in the Will – Contentious Probate is when the executor is not named in the Will or when the beneficiaries do not give consent to the executor. 90

Review Questions & Answers • Differentiate between a Trust and Will – Will is a declaration of the intentions of an estate owner on how his estate is to be executed when he dies. – Trust is the right given to a person or persons to manage or handle an interest (could be a property or anything of value) on behalf of another person 91

Review Questions & Answers • Differentiate between a Trust and Will – Will is a declaration of the intentions of an estate owner on how his estate is to be executed when he dies. – Trust is the right given to a person or persons to manage or handle an interest (could be a property or anything of value) on behalf of another person 91

Review Questions & Answers • What are the roles of a Representative in the administration of an estate? – He has to fulfil all the intentions of the testator according to the Will – Essentially, he has to ensure that the estate is well managed, transacted and distributed to the rightful beneficiaries 92

Review Questions & Answers • What are the roles of a Representative in the administration of an estate? – He has to fulfil all the intentions of the testator according to the Will – Essentially, he has to ensure that the estate is well managed, transacted and distributed to the rightful beneficiaries 92

Review Questions & Answers • Explain the differences between the Contested and the Non-Contested Beneficiaries – Non-contested beneficiaries are those whose names have been listed and their proportions of estate have been allocated – Contested beneficiaries are those whose names are not listed, these may come from spouses, unmarried daughters, infant sons and/or mentally or physically disabled minors who are incapable of looking after themselves 93

Review Questions & Answers • Explain the differences between the Contested and the Non-Contested Beneficiaries – Non-contested beneficiaries are those whose names have been listed and their proportions of estate have been allocated – Contested beneficiaries are those whose names are not listed, these may come from spouses, unmarried daughters, infant sons and/or mentally or physically disabled minors who are incapable of looking after themselves 93

Review Questions & Answers o Islamic Law of inheritance seems to give favour to males than females. What seems to be the rationale? o Islamic law of inheritance is based upon the responsibilities of the males over the females. This is clear from the Quranic injunctions o The husband for instance are to provide everything for the wife even if the wife has her own income and the wife does not have to share her income if she does not want to. The husband can only use her income if she consents 94

Review Questions & Answers o Islamic Law of inheritance seems to give favour to males than females. What seems to be the rationale? o Islamic law of inheritance is based upon the responsibilities of the males over the females. This is clear from the Quranic injunctions o The husband for instance are to provide everything for the wife even if the wife has her own income and the wife does not have to share her income if she does not want to. The husband can only use her income if she consents 94

Review Questions & Answers o. Can somewhat give away his property according to his own personal preference? o. He can do so while he is still alive and not on his death bed 95

Review Questions & Answers o. Can somewhat give away his property according to his own personal preference? o. He can do so while he is still alive and not on his death bed 95

Review Questions & Answers o. A man dies leaving a wife and a son. What are the proportions of the estate that the wife and the son should get? o. The wife should get 1/8, and the rest goes to the son 96

Review Questions & Answers o. A man dies leaving a wife and a son. What are the proportions of the estate that the wife and the son should get? o. The wife should get 1/8, and the rest goes to the son 96

Review Questions & Answers o. A lady leaves her husband, her father and two daughters. What proportions of her property will each get? o husband gets ¼ or (3/12) two daughters get 2/3 or (4/12 each) and father will get the residue which is 1/12. This is the case where the father will not get his fixed share of 1/6. 97

Review Questions & Answers o. A lady leaves her husband, her father and two daughters. What proportions of her property will each get? o husband gets ¼ or (3/12) two daughters get 2/3 or (4/12 each) and father will get the residue which is 1/12. This is the case where the father will not get his fixed share of 1/6. 97

Review Questions & Answers • List the main features of the Islamic law of inheritance (faraid). – Distributed based on responsibilities, need and nearness or closeness to the deceased 98

Review Questions & Answers • List the main features of the Islamic law of inheritance (faraid). – Distributed based on responsibilities, need and nearness or closeness to the deceased 98

Review Questions & Answers • Explain why it forms the basis of estate distribution in Islam. – Because it is comprehensive, covers all the heirs and is essentially Quranic 99

Review Questions & Answers • Explain why it forms the basis of estate distribution in Islam. – Because it is comprehensive, covers all the heirs and is essentially Quranic 99

Review Questions & Answers • A man dies and leaves behind two wives, a son, two daughters and a brother from the same parent. If his total estate is worth USD 100, 000 how much will each of the beneficiaries get? – The two wives will share 1/8 or 1/16 each or 2/32 each – The two daughters and the son will share 7/8 in the proportion that the son will get two portions and the daughters one each. So, 7/8 to be divided by 4 which is 7/32 each. So the son gets 14/32 ($43, 750), the daughters 7/32 ($21875) each and the wives 2/32 ($6250) each – The brother does not get anything as he has been blocked by the son 100

Review Questions & Answers • A man dies and leaves behind two wives, a son, two daughters and a brother from the same parent. If his total estate is worth USD 100, 000 how much will each of the beneficiaries get? – The two wives will share 1/8 or 1/16 each or 2/32 each – The two daughters and the son will share 7/8 in the proportion that the son will get two portions and the daughters one each. So, 7/8 to be divided by 4 which is 7/32 each. So the son gets 14/32 ($43, 750), the daughters 7/32 ($21875) each and the wives 2/32 ($6250) each – The brother does not get anything as he has been blocked by the son 100

Review Questions & Answers • The Islamic law of inheritance is derived mainly from the Qur’an. List down the main principles of the law – See the previous answer 101

Review Questions & Answers • The Islamic law of inheritance is derived mainly from the Qur’an. List down the main principles of the law – See the previous answer 101

Review Questions & Answers • A woman dies and leaves behind a daughter, a brother from the same parents, two granddaughters and a grandson who are the children of her late son. If his total estate is worth USD 100, 000 how much will each of the beneficiaries get? – – Daughter will get ½ = $50, 000 Grandson and 2 granddaughters will share the other half with the grandson getting 2 portions and granddaughters get one portion each. The brother gets nothing. So the grandson gets ¼ = $25, 000 The granddaughters get 1/8 each or $12, 500 102

Review Questions & Answers • A woman dies and leaves behind a daughter, a brother from the same parents, two granddaughters and a grandson who are the children of her late son. If his total estate is worth USD 100, 000 how much will each of the beneficiaries get? – – Daughter will get ½ = $50, 000 Grandson and 2 granddaughters will share the other half with the grandson getting 2 portions and granddaughters get one portion each. The brother gets nothing. So the grandson gets ¼ = $25, 000 The granddaughters get 1/8 each or $12, 500 102

Topic Eight: Retirement planning 103

Topic Eight: Retirement planning 103

Review Questions & Answers • What do you understand by retirement planning? – Retirement planning is a comprehensive process of reviewing and analysing our assets, liabilities, saving and investment strategies to ensure there is sufficient income for all our needs when we retire. – In other words, based on the wealth that we have we would like to make a comprehensive plan to ensure we have enough during our retirement. 104

Review Questions & Answers • What do you understand by retirement planning? – Retirement planning is a comprehensive process of reviewing and analysing our assets, liabilities, saving and investment strategies to ensure there is sufficient income for all our needs when we retire. – In other words, based on the wealth that we have we would like to make a comprehensive plan to ensure we have enough during our retirement. 104

Review Questions & Answers • Why is retirement planning becoming more important now? – In the past, the average income level of individuals were not high enough to warrant a comprehensive plan. – Secondly, the average life expectancy has significantly increased due to advancement of medicine and improvement in quality of life. – Thirdly, there is also an increase in the cost of living especially medical, which requires proper plan for healthy life. – Fourthly, there is significant increase in the average income level of society that warrants a comprehensive plan to meet all the needs of modern living. 105

Review Questions & Answers • Why is retirement planning becoming more important now? – In the past, the average income level of individuals were not high enough to warrant a comprehensive plan. – Secondly, the average life expectancy has significantly increased due to advancement of medicine and improvement in quality of life. – Thirdly, there is also an increase in the cost of living especially medical, which requires proper plan for healthy life. – Fourthly, there is significant increase in the average income level of society that warrants a comprehensive plan to meet all the needs of modern living. 105

Review Questions & Answers • There are many factors that lead to the need for retirement planning. List four of them. – Refer to previous answer 106

Review Questions & Answers • There are many factors that lead to the need for retirement planning. List four of them. – Refer to previous answer 106

Review Questions & Answers • Explain the six stages of retirement planning process. – The six stages of retirement planning process are: • Setting retirement plan goals (setting retirement goals and the desired life style – they must be specific, realistic and measurable) • Obtain necessary information to determine retirement needs (information pertaining to financial statement, required retirement income, resources available, interest and inflation rate, investment opportunities – will help achieve the goals set above) These information will be necessary to calculate the future income needs using the Replacement income method or the Expense method 107

Review Questions & Answers • Explain the six stages of retirement planning process. – The six stages of retirement planning process are: • Setting retirement plan goals (setting retirement goals and the desired life style – they must be specific, realistic and measurable) • Obtain necessary information to determine retirement needs (information pertaining to financial statement, required retirement income, resources available, interest and inflation rate, investment opportunities – will help achieve the goals set above) These information will be necessary to calculate the future income needs using the Replacement income method or the Expense method 107

Review Questions & Answers • Analyse information and calculate saving needed to meet the objectives (we need the cash flow statement showing client’s current annual sources of income and uses of cash, annual budget listing of present and future income, review of all available assets that will be utilized to meet retirement needs) • Plan the distribution of the income (must take into consideration the risk appetite, the inflation rates, etc) • Implementation of the plan • Reviewing the plan (to revisit and rebalance the strategies) 108

Review Questions & Answers • Analyse information and calculate saving needed to meet the objectives (we need the cash flow statement showing client’s current annual sources of income and uses of cash, annual budget listing of present and future income, review of all available assets that will be utilized to meet retirement needs) • Plan the distribution of the income (must take into consideration the risk appetite, the inflation rates, etc) • Implementation of the plan • Reviewing the plan (to revisit and rebalance the strategies) 108

Topic Nine: Tax Planning and Management 109

Topic Nine: Tax Planning and Management 109

Review Questions & Answers • What are the criteria used to evaluate a tax system? – Certainty – All tax liabilities should be certain and not arbitrary – Fair – All transactions should be treated fairly for tax purposes – Efficiency – The tax system should be able to generate the amount of revenue required by the Government – Low compliance cost – Tax laws should be simple so that compliance costs can be kept to a minimum – Flexibility – Aspects of the tax system can be varied quickly to have an immediate impact and to achieve other economic objectives 110

Review Questions & Answers • What are the criteria used to evaluate a tax system? – Certainty – All tax liabilities should be certain and not arbitrary – Fair – All transactions should be treated fairly for tax purposes – Efficiency – The tax system should be able to generate the amount of revenue required by the Government – Low compliance cost – Tax laws should be simple so that compliance costs can be kept to a minimum – Flexibility – Aspects of the tax system can be varied quickly to have an immediate impact and to achieve other economic objectives 110

Review Questions & Answers • Define the following terms – – – Chargeable income Scope of taxation Tax rebates Tax exemptions Chargeable income = income that is taxable which is gross income less all relief allowed – Scope of taxation = the definition of income that is taxable. It depends on whether the person is a resident of the country or not and that his income is earned from activities conducted in the country or remitted from outside. If a person is a resident then all income he drives from the country or remitted from abroad will be taxable. 111