c2f69f9c8bb2783030fdd485990b8bca.ppt

- Количество слайдов: 41

Title Closing and Escrow Real Estate Leases

Title Closing and Escrow Real Estate Leases

Nightly Trivia Q) Where was the great land boom (1919) in which investors paid up to $25, 000 for lots not yet dredged up from the ocean? A) The great Florida land boom brought hundreds of investors to the state after Carl Fisher founded Miami Beach in 1919

Nightly Trivia Q) Where was the great land boom (1919) in which investors paid up to $25, 000 for lots not yet dredged up from the ocean? A) The great Florida land boom brought hundreds of investors to the state after Carl Fisher founded Miami Beach in 1919

Title Closing and Escrow Buyer’s walk-through Closing meeting Prorations Settlement statement

Title Closing and Escrow Buyer’s walk-through Closing meeting Prorations Settlement statement

Buyer’s Walk-Through Final inspection before the settlement date NOT the time for a FIRST inspection Time to confirm that the property is in the condition previously agreed upon before the exchange is finalized

Buyer’s Walk-Through Final inspection before the settlement date NOT the time for a FIRST inspection Time to confirm that the property is in the condition previously agreed upon before the exchange is finalized

Title Closing The end of the purchase process – the payment and deed are delivered to the appropriate parties Happens on the closing date The process can be called closing, settlement, or escrow

Title Closing The end of the purchase process – the payment and deed are delivered to the appropriate parties Happens on the closing date The process can be called closing, settlement, or escrow

The Meeting The exchange of deed and payment is usually accomplished in person Usually each party is accompanied by their attorney Also attending are real estate agents, and title search agents A party may elect to be represented by his/her attorney

The Meeting The exchange of deed and payment is usually accomplished in person Usually each party is accompanied by their attorney Also attending are real estate agents, and title search agents A party may elect to be represented by his/her attorney

What the Seller Does Offset statement – a document stating the balance due on any existing lien on the property Beneficiary statement – statement of the unpaid balance on a note secured by a trust deed

What the Seller Does Offset statement – a document stating the balance due on any existing lien on the property Beneficiary statement – statement of the unpaid balance on a note secured by a trust deed

What the Buyer Does Have enough money! Have an attorney present Making proper arrangements with the lender

What the Buyer Does Have enough money! Have an attorney present Making proper arrangements with the lender

What the Real Estate Agent Does Make sure everybody else knows what they need The agent responsible for the deal has a responsibility to ensure that all parties are prepared for the closing

What the Real Estate Agent Does Make sure everybody else knows what they need The agent responsible for the deal has a responsibility to ensure that all parties are prepared for the closing

What Actually Happens Names are recorded as witnesses Settlement statement – provides financial details of the transaction Specifies where money went during the transaction Dry closing – a piece of paperwork is missing Everyone signs what they have and delivers documents to the person in charge of the closing Nothing is final until the missing paperwork is found

What Actually Happens Names are recorded as witnesses Settlement statement – provides financial details of the transaction Specifies where money went during the transaction Dry closing – a piece of paperwork is missing Everyone signs what they have and delivers documents to the person in charge of the closing Nothing is final until the missing paperwork is found

Escrow Uses a neutral third party for the transaction – remember deeds of trust? Begins with the buyer and seller signing a sale contract and selecting an escrow agent A broker earning a commission can not be a neutral third party Escrow agents are usually a licensed, bonded profession

Escrow Uses a neutral third party for the transaction – remember deeds of trust? Begins with the buyer and seller signing a sale contract and selecting an escrow agent A broker earning a commission can not be a neutral third party Escrow agents are usually a licensed, bonded profession

What the Escrow Agent Does Prepares escrow instructions based on the sales contract If an existing loan is being paid off, the agent deals with the lender If the loan is being assumed, the agent again deals with the lender

What the Escrow Agent Does Prepares escrow instructions based on the sales contract If an existing loan is being paid off, the agent deals with the lender If the loan is being assumed, the agent again deals with the lender

Reporting Requirements Same exemptions apply when selling a principal residence - $250 K limit if single, $500 K limit if married If the sale is not excluded, the escrow agent needs to report the sale using Form 1099

Reporting Requirements Same exemptions apply when selling a principal residence - $250 K limit if single, $500 K limit if married If the sale is not excluded, the escrow agent needs to report the sale using Form 1099

Closing Using Escrow A final title check is done the day before closing Checks are delivered Documents are delivered Deeds, mortgage releases, and new mortgages are the final items delivered

Closing Using Escrow A final title check is done the day before closing Checks are delivered Documents are delivered Deeds, mortgage releases, and new mortgages are the final items delivered

Delivering the Deed Closing, delivery of title, and recordation are usually simultaneous Deed delivery is fulfilled when the buyer, through an agent, receives the deed The escrow agent does things alone – avoids any personality conflicts Sometimes, only the real estate agent actually meets the escrow agent

Delivering the Deed Closing, delivery of title, and recordation are usually simultaneous Deed delivery is fulfilled when the buyer, through an agent, receives the deed The escrow agent does things alone – avoids any personality conflicts Sometimes, only the real estate agent actually meets the escrow agent

What Happens if Things Slow Down? The closing date is usually 30 -60 days from the contract signing Reasonable delays are ok Unreasonable delays can relieve all parties of obligation Without release papers some obligation may remain Courts rarely enforce cancellation over reasonable delays

What Happens if Things Slow Down? The closing date is usually 30 -60 days from the contract signing Reasonable delays are ok Unreasonable delays can relieve all parties of obligation Without release papers some obligation may remain Courts rarely enforce cancellation over reasonable delays

Other Escrow Details A homeowner refinancing a loan can enter into a loan escrow Reporting requirements remain the same

Other Escrow Details A homeowner refinancing a loan can enter into a loan escrow Reporting requirements remain the same

Prorating Revisited Ongoing expenses and income items are prorated between buyer and seller Insurance is paid in advance and can be transferred at sale as an asset Loan interest is an expense – the seller usually covers accumulated interest to the closing date

Prorating Revisited Ongoing expenses and income items are prorated between buyer and seller Insurance is paid in advance and can be transferred at sale as an asset Loan interest is an expense – the seller usually covers accumulated interest to the closing date

More Prorating Rents are usually prorated on the actual number of days in the month Property tax prorating depends on when property taxes are due, what portion has already been paid, and what period of time they cover Homeowner’s association – fees usually found in condos, planned developments

More Prorating Rents are usually prorated on the actual number of days in the month Property tax prorating depends on when property taxes are due, what portion has already been paid, and what period of time they cover Homeowner’s association – fees usually found in condos, planned developments

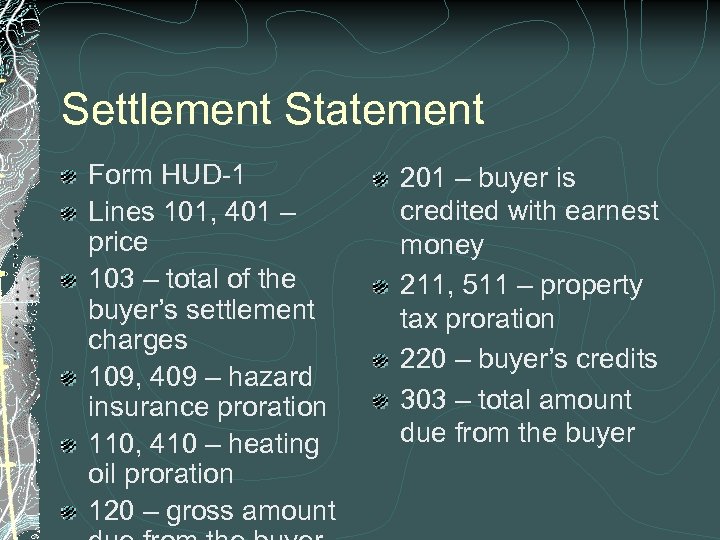

Settlement Statement Form HUD-1 Lines 101, 401 – price 103 – total of the buyer’s settlement charges 109, 409 – hazard insurance proration 110, 410 – heating oil proration 120 – gross amount 201 – buyer is credited with earnest money 211, 511 – property tax proration 220 – buyer’s credits 303 – total amount due from the buyer

Settlement Statement Form HUD-1 Lines 101, 401 – price 103 – total of the buyer’s settlement charges 109, 409 – hazard insurance proration 110, 410 – heating oil proration 120 – gross amount 201 – buyer is credited with earnest money 211, 511 – property tax proration 220 – buyer’s credits 303 – total amount due from the buyer

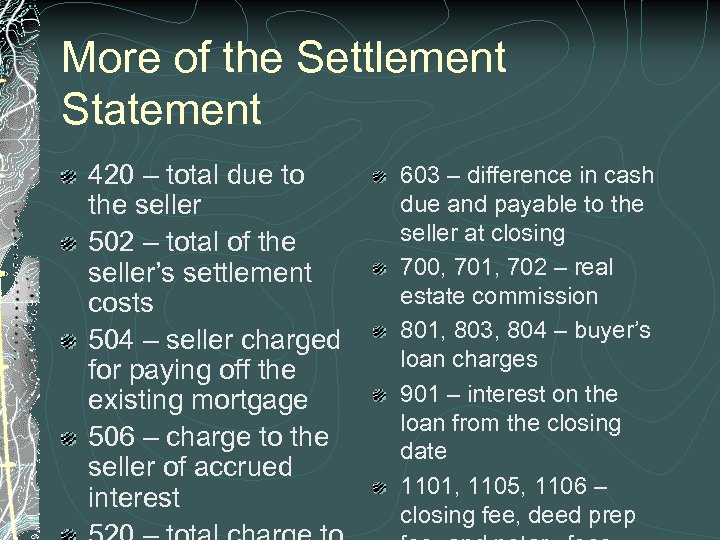

More of the Settlement Statement 420 – total due to the seller 502 – total of the seller’s settlement costs 504 – seller charged for paying off the existing mortgage 506 – charge to the seller of accrued interest 603 – difference in cash due and payable to the seller at closing 700, 701, 702 – real estate commission 801, 803, 804 – buyer’s loan charges 901 – interest on the loan from the closing date 1101, 1105, 1106 – closing fee, deed prep

More of the Settlement Statement 420 – total due to the seller 502 – total of the seller’s settlement costs 504 – seller charged for paying off the existing mortgage 506 – charge to the seller of accrued interest 603 – difference in cash due and payable to the seller at closing 700, 701, 702 – real estate commission 801, 803, 804 – buyer’s loan charges 901 – interest on the loan from the closing date 1101, 1105, 1106 – closing fee, deed prep

The Last of Settlement Paperwork 1108 – title insurance charges 1109, 1110 – coverage of title insurance 1111, 1112 – settlement fees to attorneys 1201, 1203 – recording fees, 1302 – pest inspection fees 1400 – totals for the buyer and seller

The Last of Settlement Paperwork 1108 – title insurance charges 1109, 1110 – coverage of title insurance 1111, 1112 – settlement fees to attorneys 1201, 1203 – recording fees, 1302 – pest inspection fees 1400 – totals for the buyer and seller

Real Estate Settlement Procedures Act Exists to regulate and standardize real estate settlement practices for federally related first mortgage loans Applies to VA, FHA, and other government loans Controls fees and other charges associated with settlement

Real Estate Settlement Procedures Act Exists to regulate and standardize real estate settlement practices for federally related first mortgage loans Applies to VA, FHA, and other government loans Controls fees and other charges associated with settlement

Real Estate Leases Tenant Property owner Property manager

Real Estate Leases Tenant Property owner Property manager

Leasehold Estates The lessee gains rights to possess and use another person’s property The lessor possesses reversion – can take the property back at the end of the agreement Periodic estate – renews itself automatically until termination Estate at will – can be terminated by either party at any time Tenancy at sufferance – tenant stays without permission

Leasehold Estates The lessee gains rights to possess and use another person’s property The lessor possesses reversion – can take the property back at the end of the agreement Periodic estate – renews itself automatically until termination Estate at will – can be terminated by either party at any time Tenancy at sufferance – tenant stays without permission

Elements of a Valid Lease Names of the lessee and lessor Description of the premises Agreement to convey the premises by the lessor and to accept possession by the lessee Provisions for the payment of rent Starting date and duration of the lease Signatures of the parties to the lease

Elements of a Valid Lease Names of the lessee and lessor Description of the premises Agreement to convey the premises by the lessor and to accept possession by the lessee Provisions for the payment of rent Starting date and duration of the lease Signatures of the parties to the lease

Points in the Contract Quiet enjoyment – uninterrupted use of the property without interference from other parties How much, how, and when lease payments will be made Deposits If a lessor or lessee dies, the contract is valid for the survivors unless waived

Points in the Contract Quiet enjoyment – uninterrupted use of the property without interference from other parties How much, how, and when lease payments will be made Deposits If a lessor or lessee dies, the contract is valid for the survivors unless waived

Ways to Set Rent Gross lease – tenant pays a fixed amount, landlord pays operating expenses Graduated rent – increasing fees over a long period of time Escalator or participation clause – over long leases increases in operating expenses can be passed on to tenants

Ways to Set Rent Gross lease – tenant pays a fixed amount, landlord pays operating expenses Graduated rent – increasing fees over a long period of time Escalator or participation clause – over long leases increases in operating expenses can be passed on to tenants

More Ways to Pay Net lease or triple net lease - tenant pays all operating expenses in addition to rent, more common on commercial leases Percentage lease – tenant pays a portion of proceeds from the property Index lease – sets payments to a specific economic index

More Ways to Pay Net lease or triple net lease - tenant pays all operating expenses in addition to rent, more common on commercial leases Percentage lease – tenant pays a portion of proceeds from the property Index lease – sets payments to a specific economic index

Options Again A tenant may have an option clause to be able to renew the lease at a specific rate or to purchase the property at a set price

Options Again A tenant may have an option clause to be able to renew the lease at a specific rate or to purchase the property at a set price

Assignment and Subletting Assignment – a total transfer of rights from the lessor (assignor) to an assignee Sublet – a transfer of only a portion of lease rights Sublease – awards a sublessor partial rights to part of the property or all of the property for a certain period of time

Assignment and Subletting Assignment – a total transfer of rights from the lessor (assignor) to an assignee Sublet – a transfer of only a portion of lease rights Sublease – awards a sublessor partial rights to part of the property or all of the property for a certain period of time

Other Kinds of Leases Ground lease – only the land, usually a 25 -99 year lease The lessee pays for and owns the improvements Vertical lease – can lease rights above or below ground to companies

Other Kinds of Leases Ground lease – only the land, usually a 25 -99 year lease The lessee pays for and owns the improvements Vertical lease – can lease rights above or below ground to companies

Rent Contract rent – the amount of rent that must be paid Economic rent – the market rate Value is determined by the difference between contract and economic rent and the maturity of the lease

Rent Contract rent – the amount of rent that must be paid Economic rent – the market rate Value is determined by the difference between contract and economic rent and the maturity of the lease

Lease Termination/Eviction A lease can be terminated by mutual agreement Actual eviction – for cause, a landlord has a notice served for the tenant to comply with policies or move out Constructive eviction – lease ends due to landlord’s failure to keep property livable Retaliatory eviction – illegal, a landlord evicts someone after they complain

Lease Termination/Eviction A lease can be terminated by mutual agreement Actual eviction – for cause, a landlord has a notice served for the tenant to comply with policies or move out Constructive eviction – lease ends due to landlord’s failure to keep property livable Retaliatory eviction – illegal, a landlord evicts someone after they complain

Rent Control Originated during wartime to control building Rediscovered in the 1970’s as an inflation barrier With controls on rent but not expenses, many residential developments fail and are abandoned Many rent-controlled apartments are converted to condos for sale

Rent Control Originated during wartime to control building Rediscovered in the 1970’s as an inflation barrier With controls on rent but not expenses, many residential developments fail and are abandoned Many rent-controlled apartments are converted to condos for sale

Managing Property Before buying – market research Advertising – better used on signs, etc. in the area of the property Tenant selection – perform credit checks, background checks, interviews

Managing Property Before buying – market research Advertising – better used on signs, etc. in the area of the property Tenant selection – perform credit checks, background checks, interviews

Security Deposit Primarily used to retain against any damage done by the tenant to the property Also serves as a screening device – if the tenant can’t afford the deposit, they may have problems paying the rent

Security Deposit Primarily used to retain against any damage done by the tenant to the property Also serves as a screening device – if the tenant can’t afford the deposit, they may have problems paying the rent

Rent Concessions Often used to attract tenants in during slow rental periods Better than rent reductions because concessions can be removed from new leases when the market improves

Rent Concessions Often used to attract tenants in during slow rental periods Better than rent reductions because concessions can be removed from new leases when the market improves

Keeping a Full House 1/3 of rental units are generally rerented each year Communication helps keep tenants happy Lease periods may help reduce turnover, but may also reduce new tenants

Keeping a Full House 1/3 of rental units are generally rerented each year Communication helps keep tenants happy Lease periods may help reduce turnover, but may also reduce new tenants

Getting Paid Collection policies are important Firm policy is required to keep operating income stable for the property Be careful – overly aggressive or otherwise offensive policies will encourage people to move Eviction for failure to pay rent requires a court order

Getting Paid Collection policies are important Firm policy is required to keep operating income stable for the property Be careful – overly aggressive or otherwise offensive policies will encourage people to move Eviction for failure to pay rent requires a court order

Management It is best to have an on-site manager Allows the manager to walk the property every day One manager can handle 50 -60 units An additional full-time manager is required for each additional 50 -60 units

Management It is best to have an on-site manager Allows the manager to walk the property every day One manager can handle 50 -60 units An additional full-time manager is required for each additional 50 -60 units