015842044d963e299d1a804a6f1a9e68.ppt

- Количество слайдов: 50

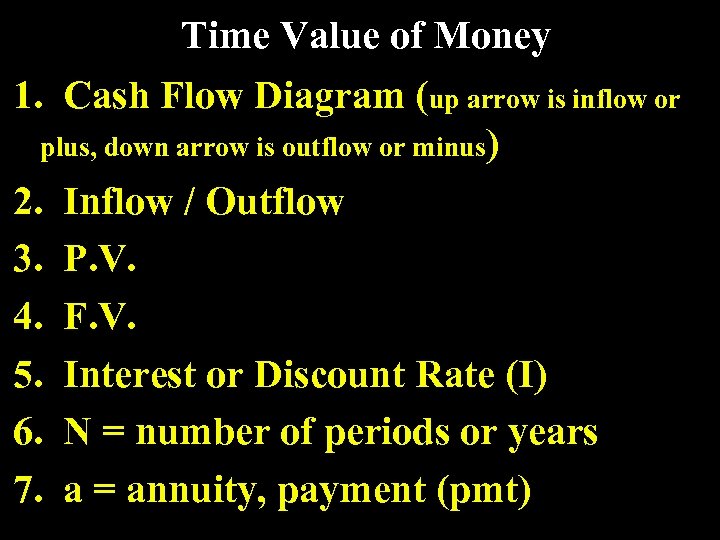

Time Value of Money 1. Cash Flow Diagram (up arrow is inflow or plus, down arrow is outflow or minus) 2. Inflow / Outflow 3. P. V. 4. F. V. 5. Interest or Discount Rate (I) 6. N = number of periods or years 7. a = annuity, payment (pmt)

Time Value of Money 1. Cash Flow Diagram (up arrow is inflow or plus, down arrow is outflow or minus) 2. Inflow / Outflow 3. P. V. 4. F. V. 5. Interest or Discount Rate (I) 6. N = number of periods or years 7. a = annuity, payment (pmt)

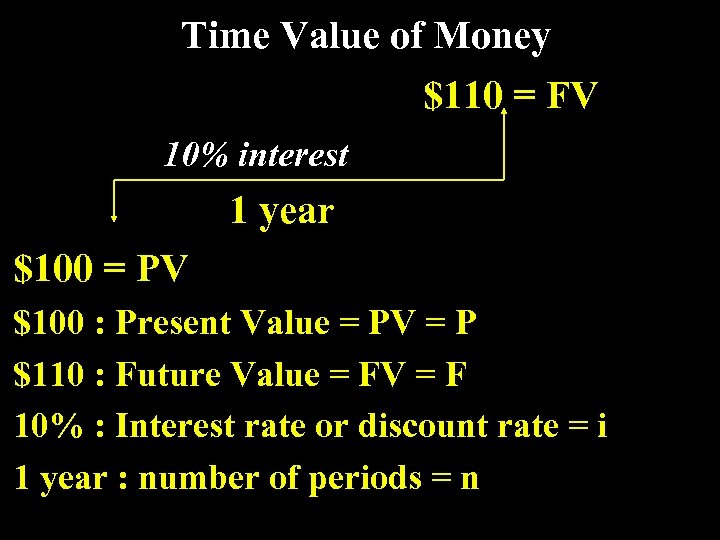

Time Value of Money $110 = FV 10% interest 1 year $100 = PV $100 : Present Value = PV = P $110 : Future Value = FV = F 10% : Interest rate or discount rate = i 1 year : number of periods = n

Time Value of Money $110 = FV 10% interest 1 year $100 = PV $100 : Present Value = PV = P $110 : Future Value = FV = F 10% : Interest rate or discount rate = i 1 year : number of periods = n

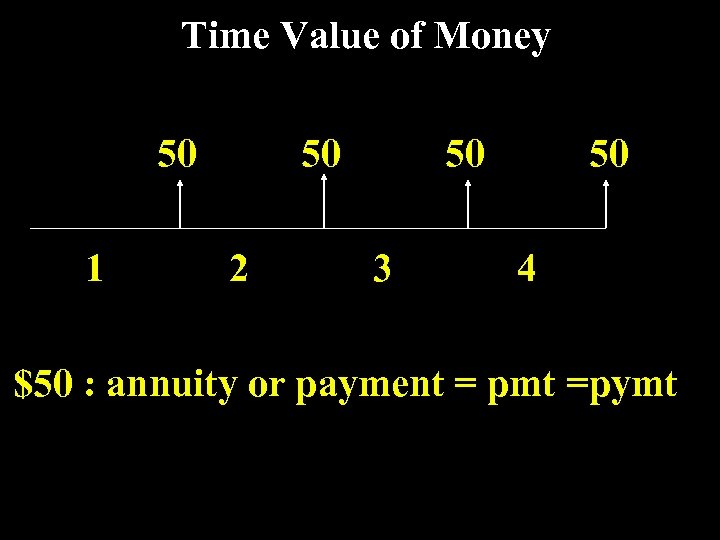

Time Value of Money 50 1 50 2 50 3 50 4 $50 : annuity or payment = pmt =pymt

Time Value of Money 50 1 50 2 50 3 50 4 $50 : annuity or payment = pmt =pymt

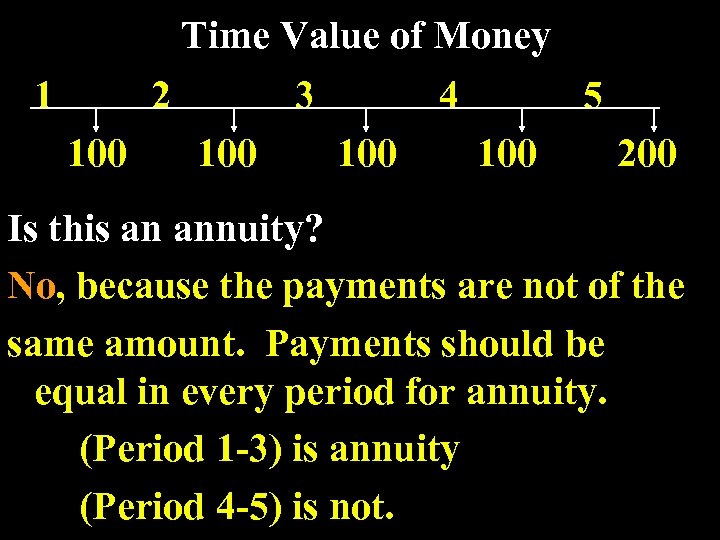

Time Value of Money 1 2 3 4 5 100 100 200 Is this an annuity? No, because the payments are not of the No same amount. Payments should be equal in every period for annuity. (Period 1 -3) is annuity (Period 4 -5) is not.

Time Value of Money 1 2 3 4 5 100 100 200 Is this an annuity? No, because the payments are not of the No same amount. Payments should be equal in every period for annuity. (Period 1 -3) is annuity (Period 4 -5) is not.

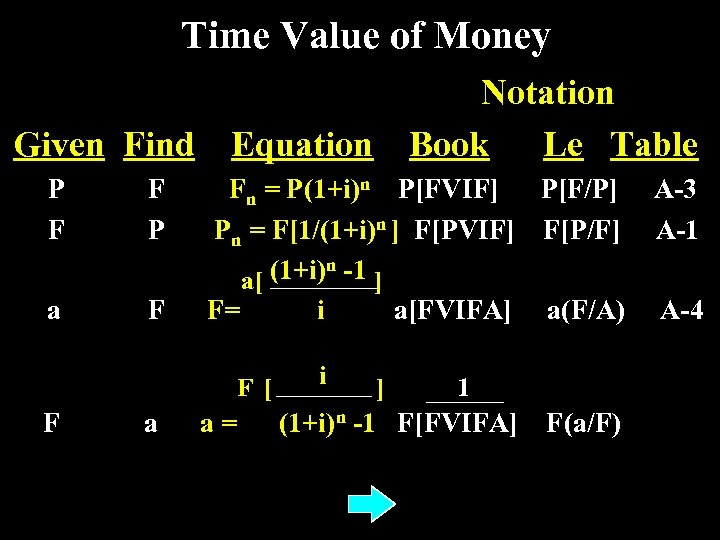

Time Value of Money Given Find P F F P a F Equation Fn = P(1+i)n P[FVIF] P[F/P] Pn = F[1/(1+i)n ] F[PVIF] F[P/F] (1+i)n -1 ] a[ F= i a[FVIFA] a(F/A) F[ F a Notation Book Le Table a= i ] 1 (1+i)n -1 F[FVIFA] F(a/F) A-3 A-1 A-4

Time Value of Money Given Find P F F P a F Equation Fn = P(1+i)n P[FVIF] P[F/P] Pn = F[1/(1+i)n ] F[PVIF] F[P/F] (1+i)n -1 ] a[ F= i a[FVIFA] a(F/A) F[ F a Notation Book Le Table a= i ] 1 (1+i)n -1 F[FVIFA] F(a/F) A-3 A-1 A-4

![Time Value of Money Given Find a P Equation a[1 -1/(1+i)n] i Notation Book Time Value of Money Given Find a P Equation a[1 -1/(1+i)n] i Notation Book](https://present5.com/presentation/015842044d963e299d1a804a6f1a9e68/image-6.jpg) Time Value of Money Given Find a P Equation a[1 -1/(1+i)n] i Notation Book Le Table P P= a[PVIFA] a(P/a) a i 1 a=P[1 -1/(1+i)n] P[PVIFA] A-2 P(a/P)

Time Value of Money Given Find a P Equation a[1 -1/(1+i)n] i Notation Book Le Table P P= a[PVIFA] a(P/a) a i 1 a=P[1 -1/(1+i)n] P[PVIFA] A-2 P(a/P)

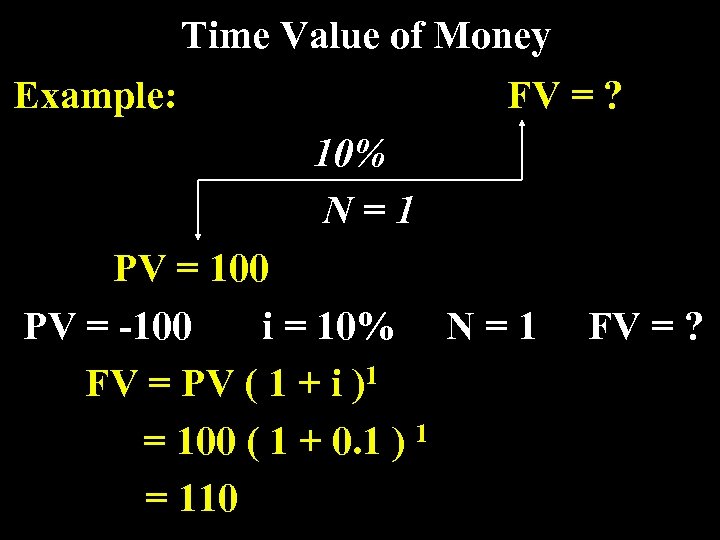

Time Value of Money Example: FV = ? 10% N=1 PV = 100 PV = -100 i = 10% N = 1 FV = ? FV = PV ( 1 + i )1 = 100 ( 1 + 0. 1 ) 1 = 110

Time Value of Money Example: FV = ? 10% N=1 PV = 100 PV = -100 i = 10% N = 1 FV = ? FV = PV ( 1 + i )1 = 100 ( 1 + 0. 1 ) 1 = 110

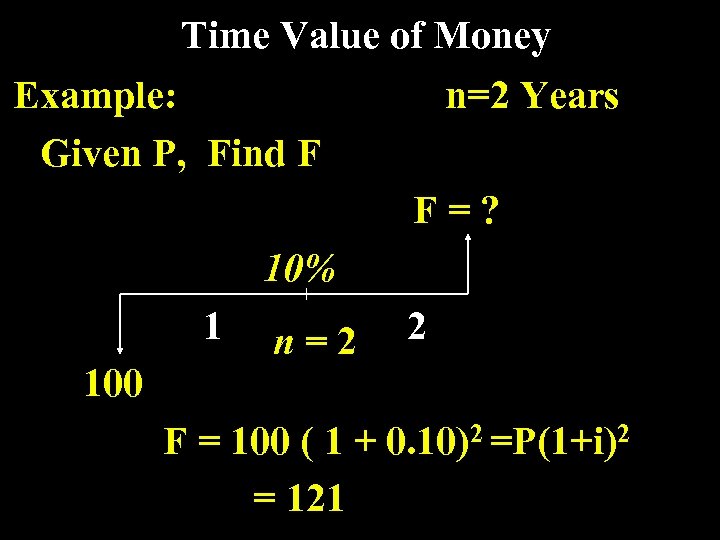

Time Value of Money Example: n=2 Years Given P, Find F F=? 10% 1 n=2 2 100 F = 100 ( 1 + 0. 10)2 =P(1+i)2 = 121

Time Value of Money Example: n=2 Years Given P, Find F F=? 10% 1 n=2 2 100 F = 100 ( 1 + 0. 10)2 =P(1+i)2 = 121

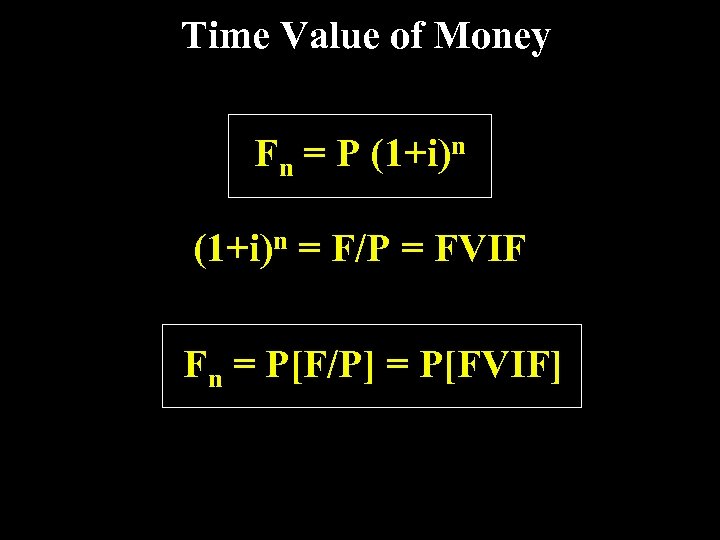

Time Value of Money Fn = P (1+i)n = F/P = FVIF Fn = P[F/P] = P[FVIF]

Time Value of Money Fn = P (1+i)n = F/P = FVIF Fn = P[F/P] = P[FVIF]

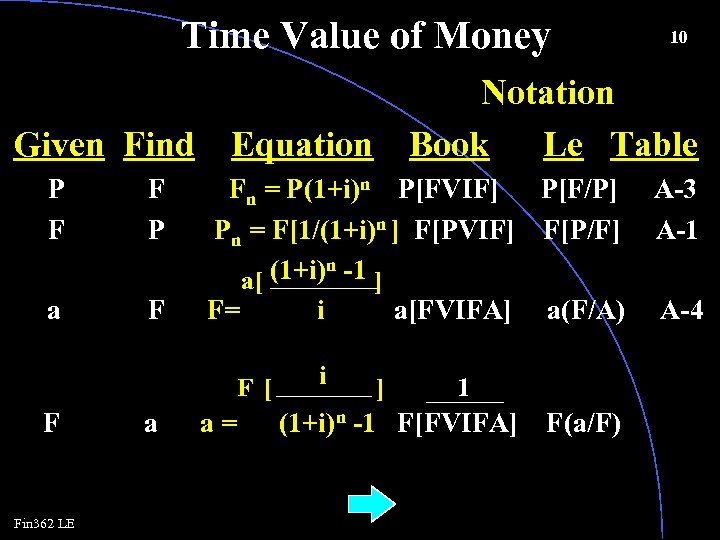

Time Value of Money Given Find P F F P a F F Fin 362 LE a Notation Book Le Table Equation Fn = P(1+i)n P[FVIF] P[F/P] Pn = F[1/(1+i)n ] F[PVIF] F[P/F] (1+i)n -1 ] a[ F= i a[FVIFA] a(F/A) F[ a= i 10 ] 1 (1+i)n -1 F[FVIFA] F(a/F) A-3 A-1 A-4

Time Value of Money Given Find P F F P a F F Fin 362 LE a Notation Book Le Table Equation Fn = P(1+i)n P[FVIF] P[F/P] Pn = F[1/(1+i)n ] F[PVIF] F[P/F] (1+i)n -1 ] a[ F= i a[FVIFA] a(F/A) F[ a= i 10 ] 1 (1+i)n -1 F[FVIFA] F(a/F) A-3 A-1 A-4

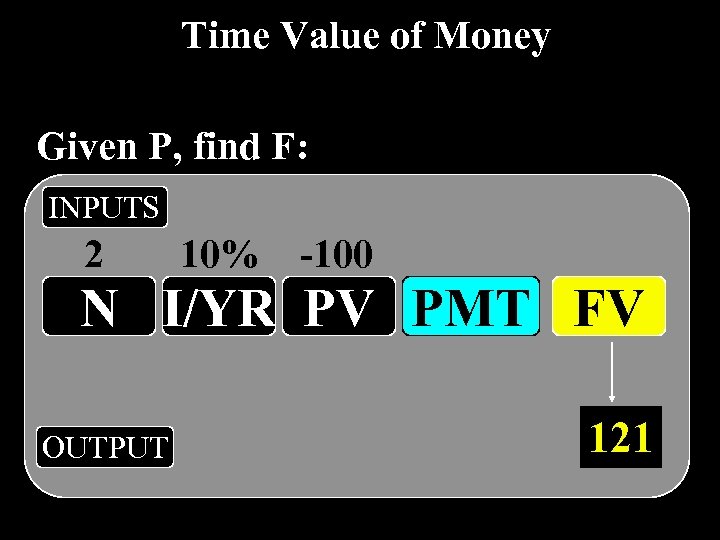

Time Value of Money Given P, find F: INPUTS 2 10% -100 N I/YR PV PMT FV OUTPUT 121

Time Value of Money Given P, find F: INPUTS 2 10% -100 N I/YR PV PMT FV OUTPUT 121

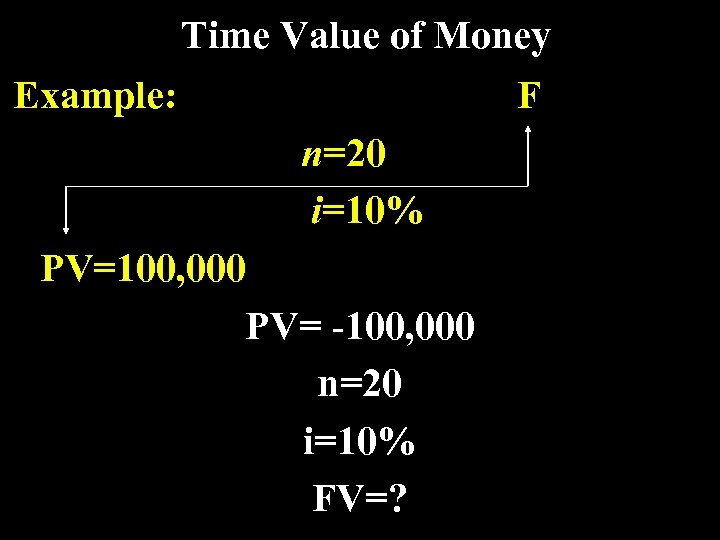

Time Value of Money Example: F n=20 i=10% PV=100, 000 PV= -100, 000 n=20 i=10% FV=?

Time Value of Money Example: F n=20 i=10% PV=100, 000 PV= -100, 000 n=20 i=10% FV=?

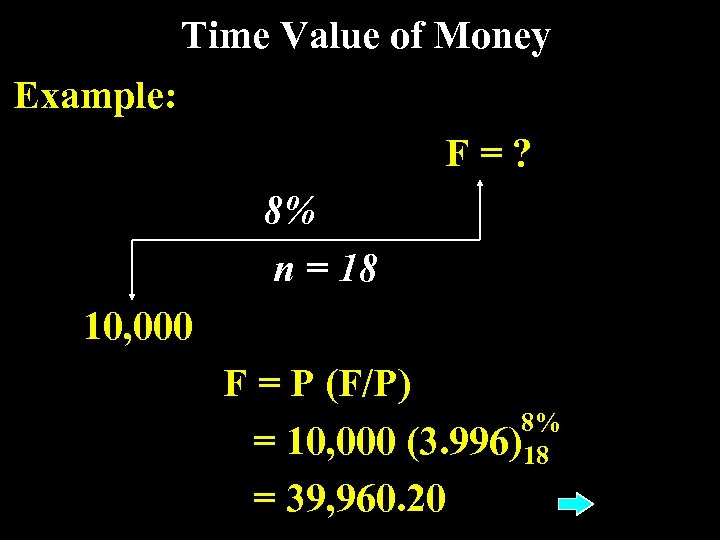

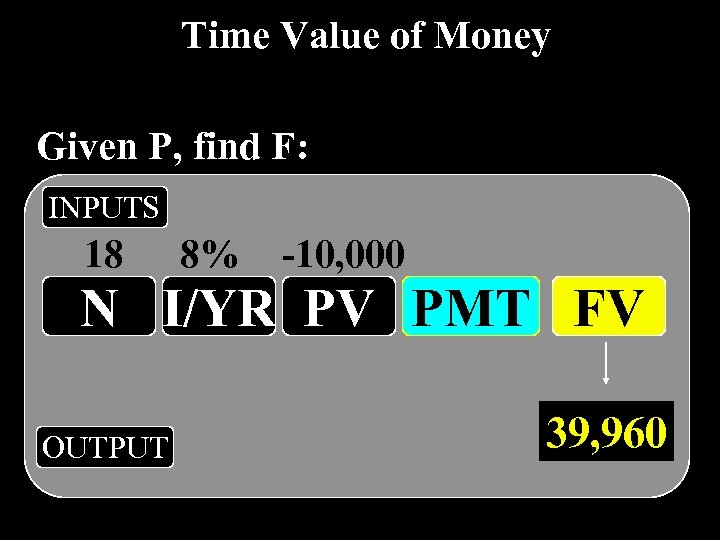

Time Value of Money Example: F=? 8% n = 18 10, 000 F = P (F/P) 8% = 10, 000 (3. 996)18 = 39, 960. 20

Time Value of Money Example: F=? 8% n = 18 10, 000 F = P (F/P) 8% = 10, 000 (3. 996)18 = 39, 960. 20

Time Value of Money Given P, find F: INPUTS 18 8% -10, 000 N I/YR PV PMT FV OUTPUT 39, 960

Time Value of Money Given P, find F: INPUTS 18 8% -10, 000 N I/YR PV PMT FV OUTPUT 39, 960

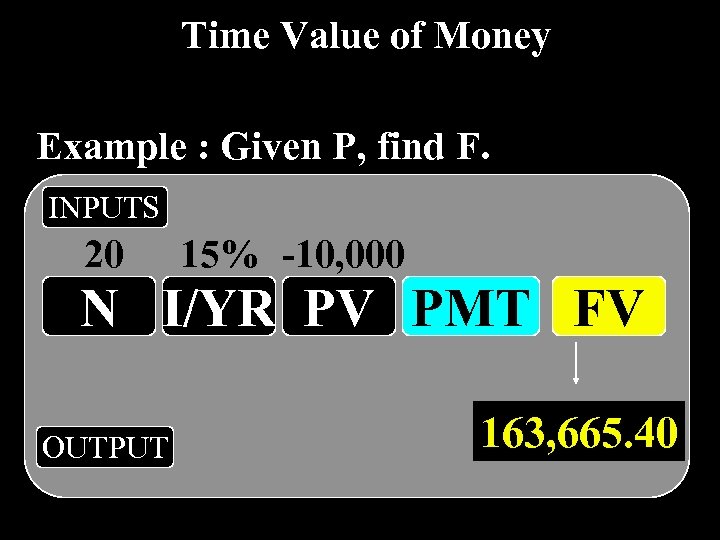

Time Value of Money Example : Given P, find F. INPUTS 20 15% -10, 000 N I/YR PV PMT FV OUTPUT 163, 665. 40

Time Value of Money Example : Given P, find F. INPUTS 20 15% -10, 000 N I/YR PV PMT FV OUTPUT 163, 665. 40

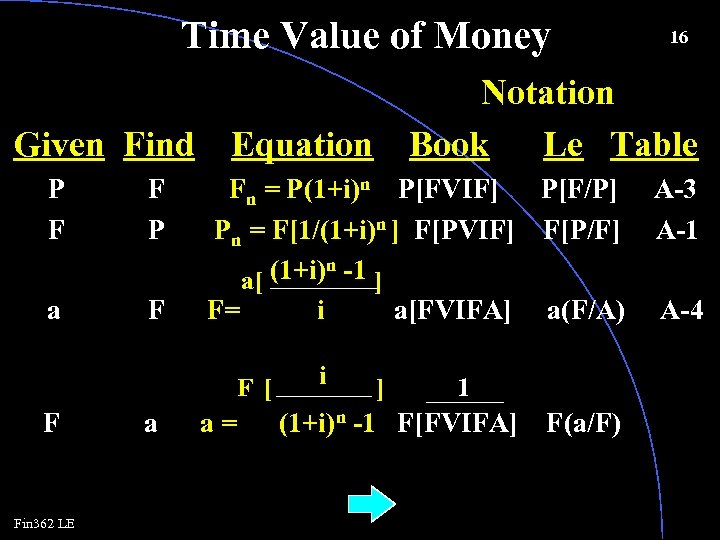

Time Value of Money Given Find P F F P a F F Fin 362 LE a Notation Book Le Table Equation Fn = P(1+i)n P[FVIF] P[F/P] Pn = F[1/(1+i)n ] F[PVIF] F[P/F] (1+i)n -1 ] a[ F= i a[FVIFA] a(F/A) F[ a= i 16 ] 1 (1+i)n -1 F[FVIFA] F(a/F) A-3 A-1 A-4

Time Value of Money Given Find P F F P a F F Fin 362 LE a Notation Book Le Table Equation Fn = P(1+i)n P[FVIF] P[F/P] Pn = F[1/(1+i)n ] F[PVIF] F[P/F] (1+i)n -1 ] a[ F= i a[FVIFA] a(F/A) F[ a= i 16 ] 1 (1+i)n -1 F[FVIFA] F(a/F) A-3 A-1 A-4

![Time Value of Money P = F[1/(1+i)n] = F[P/F] = F [PVIF] Example: F=1, Time Value of Money P = F[1/(1+i)n] = F[P/F] = F [PVIF] Example: F=1,](https://present5.com/presentation/015842044d963e299d1a804a6f1a9e68/image-17.jpg) Time Value of Money P = F[1/(1+i)n] = F[P/F] = F [PVIF] Example: F=1, 000, 000 n=30 i=10% P=?

Time Value of Money P = F[1/(1+i)n] = F[P/F] = F [PVIF] Example: F=1, 000, 000 n=30 i=10% P=?

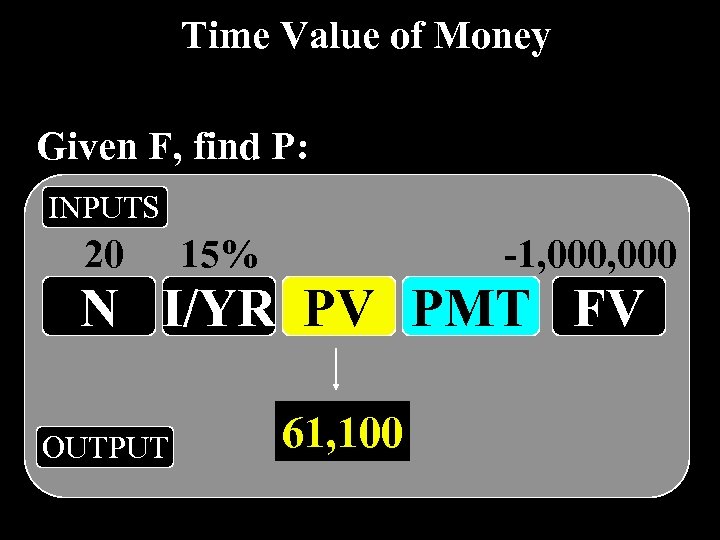

Time Value of Money Given F, find P: INPUTS 20 15% -1, 000 N I/YR PV PMT FV OUTPUT 61, 100

Time Value of Money Given F, find P: INPUTS 20 15% -1, 000 N I/YR PV PMT FV OUTPUT 61, 100

![TVM Given Find F Notation Book Le Table Equation i F[ n -1 ] TVM Given Find F Notation Book Le Table Equation i F[ n -1 ]](https://present5.com/presentation/015842044d963e299d1a804a6f1a9e68/image-19.jpg) TVM Given Find F Notation Book Le Table Equation i F[ n -1 ] A A = (1+i) A/F n A F (1+i) -1] A[ F= i F/A

TVM Given Find F Notation Book Le Table Equation i F[ n -1 ] A A = (1+i) A/F n A F (1+i) -1] A[ F= i F/A

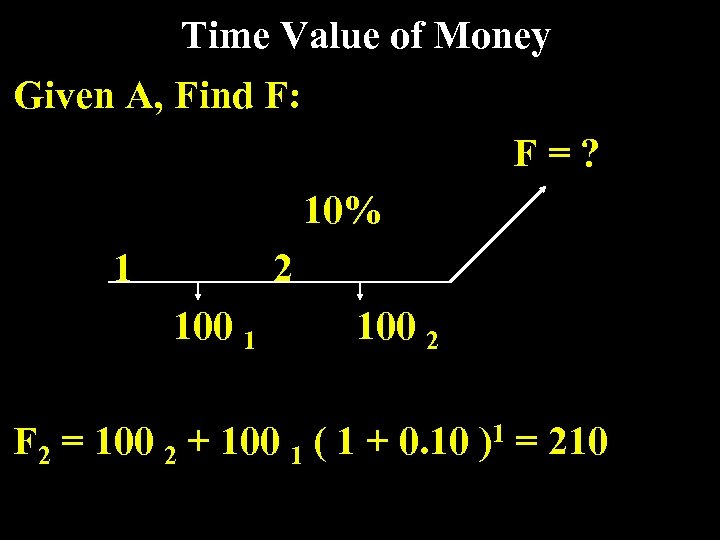

Time Value of Money Given A, Find F: F=? 10% 1 2 100 1 100 2 F 2 = 100 2 + 100 1 ( 1 + 0. 10 )1 = 210

Time Value of Money Given A, Find F: F=? 10% 1 2 100 1 100 2 F 2 = 100 2 + 100 1 ( 1 + 0. 10 )1 = 210

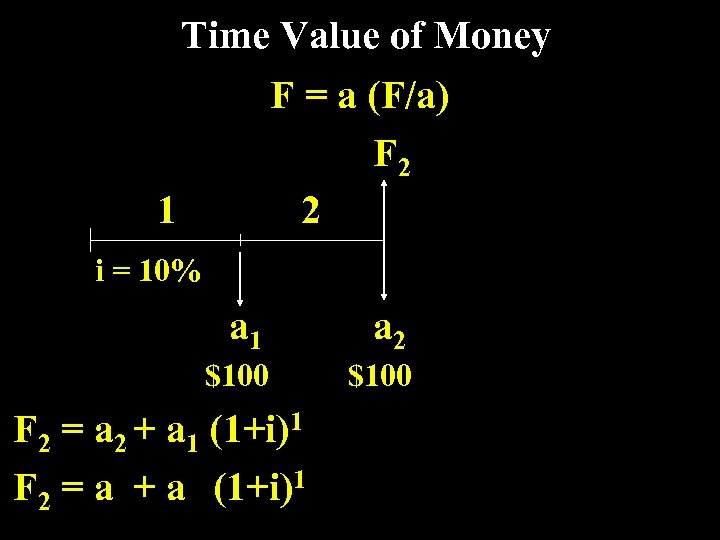

Time Value of Money F = a (F/a) F 2 1 2 i = 10% a 1 a 2 $100 F 2 = a 2 + a 1 (1+i)1 F 2 = a + a (1+i)1

Time Value of Money F = a (F/a) F 2 1 2 i = 10% a 1 a 2 $100 F 2 = a 2 + a 1 (1+i)1 F 2 = a + a (1+i)1

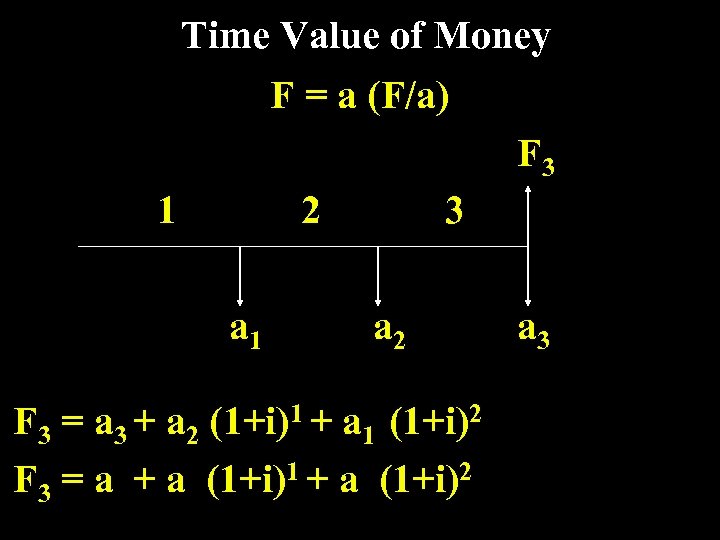

Time Value of Money F = a (F/a) F 3 1 2 3 a 1 a 2 F 3 = a 3 + a 2 (1+i)1 + a 1 (1+i)2 F 3 = a + a (1+i)1 + a (1+i)2 a 3

Time Value of Money F = a (F/a) F 3 1 2 3 a 1 a 2 F 3 = a 3 + a 2 (1+i)1 + a 1 (1+i)2 F 3 = a + a (1+i)1 + a (1+i)2 a 3

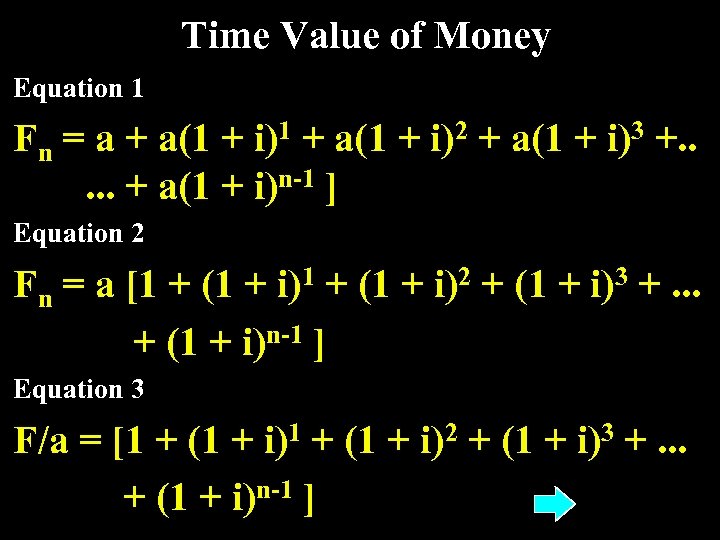

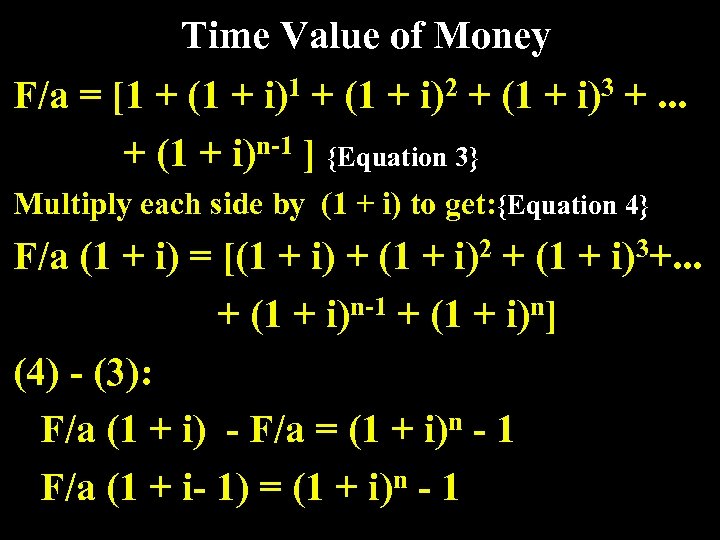

Time Value of Money Equation 1 Fn = a + a(1 + i)1 + a(1 + i)2 + a(1 + i)3 +. . . + a(1 + i)n-1 ] Equation 2 Fn = a [1 + (1 + i)2 + (1 + i)3 +. . . + (1 + i)n-1 ] Equation 3 F/a = [1 + (1 + i)2 + (1 + i)3 +. . . + (1 + i)n-1 ]

Time Value of Money Equation 1 Fn = a + a(1 + i)1 + a(1 + i)2 + a(1 + i)3 +. . . + a(1 + i)n-1 ] Equation 2 Fn = a [1 + (1 + i)2 + (1 + i)3 +. . . + (1 + i)n-1 ] Equation 3 F/a = [1 + (1 + i)2 + (1 + i)3 +. . . + (1 + i)n-1 ]

Time Value of Money F/a = [1 + (1 + i)2 + (1 + i)3 +. . . + (1 + i)n-1 ] {Equation 3} Multiply each side by (1 + i) to get: {Equation 4} F/a (1 + i) = [(1 + i) + (1 + i)2 + (1 + i)3+. . . + (1 + i)n-1 + (1 + i)n] (4) - (3): F/a (1 + i) - F/a = (1 + i)n - 1 F/a (1 + i- 1) = (1 + i)n - 1

Time Value of Money F/a = [1 + (1 + i)2 + (1 + i)3 +. . . + (1 + i)n-1 ] {Equation 3} Multiply each side by (1 + i) to get: {Equation 4} F/a (1 + i) = [(1 + i) + (1 + i)2 + (1 + i)3+. . . + (1 + i)n-1 + (1 + i)n] (4) - (3): F/a (1 + i) - F/a = (1 + i)n - 1 F/a (1 + i- 1) = (1 + i)n - 1

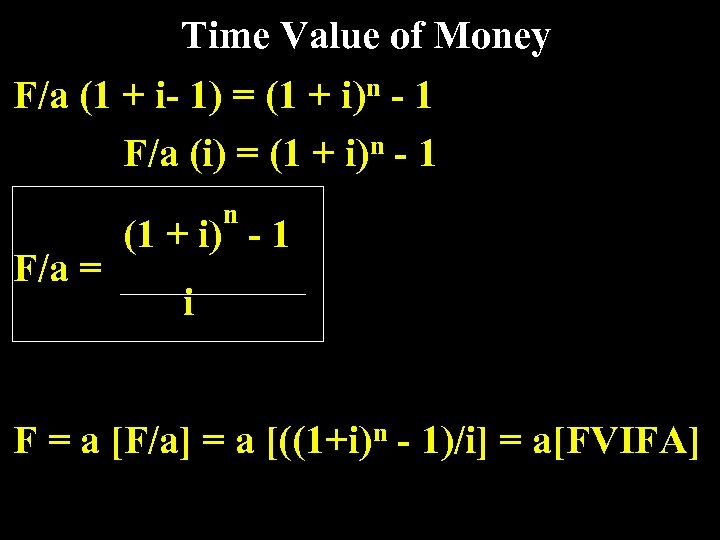

Time Value of Money F/a (1 + i- 1) = (1 + i)n - 1 F/a (i) = (1 + i)n - 1 n F/a = (1 + i) - 1 i F = a [F/a] = a [((1+i)n - 1)/i] = a[FVIFA]

Time Value of Money F/a (1 + i- 1) = (1 + i)n - 1 F/a (i) = (1 + i)n - 1 n F/a = (1 + i) - 1 i F = a [F/a] = a [((1+i)n - 1)/i] = a[FVIFA]

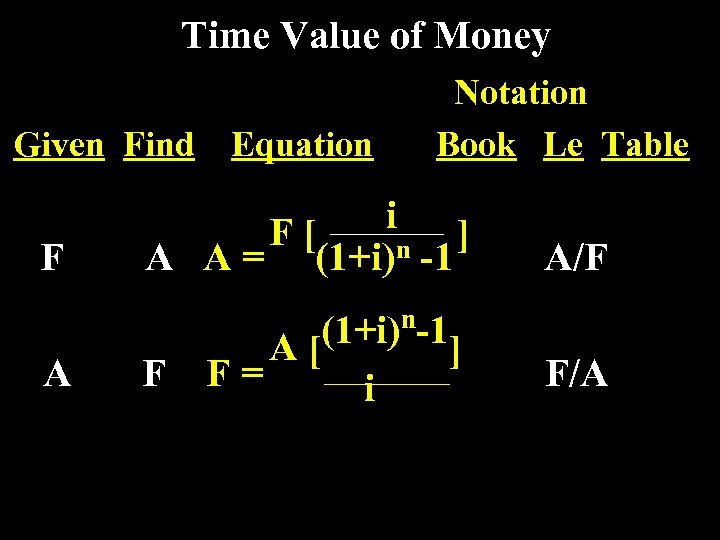

Time Value of Money Given Find F Notation Book Le Table Equation i F[ n -1 ] A A = (1+i) A/F n A F (1+i) -1] A[ F= i F/A

Time Value of Money Given Find F Notation Book Le Table Equation i F[ n -1 ] A A = (1+i) A/F n A F (1+i) -1] A[ F= i F/A

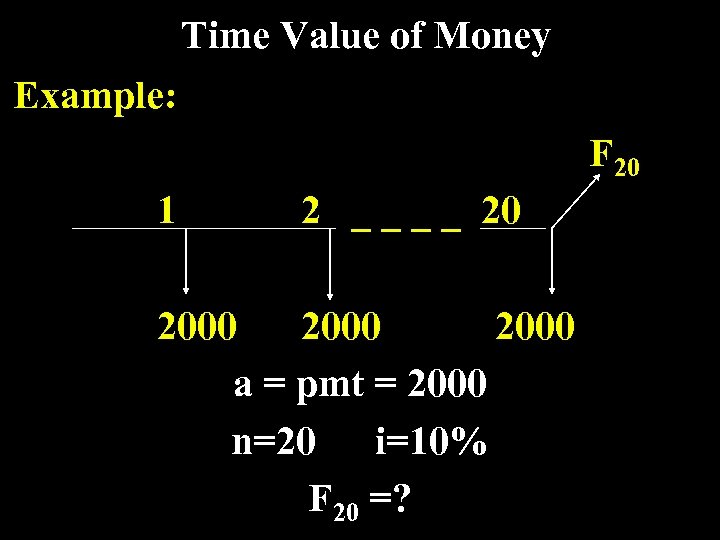

Time Value of Money Example: F 20 1 2 _ _ 20 2000 a = pmt = 2000 n=20 i=10% F 20 =?

Time Value of Money Example: F 20 1 2 _ _ 20 2000 a = pmt = 2000 n=20 i=10% F 20 =?

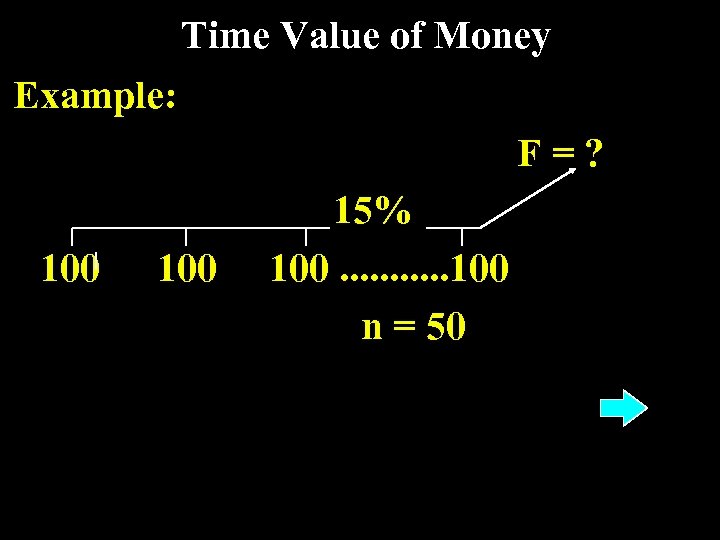

Time Value of Money Example: F=? 100 15% 100. . . 100 n = 50

Time Value of Money Example: F=? 100 15% 100. . . 100 n = 50

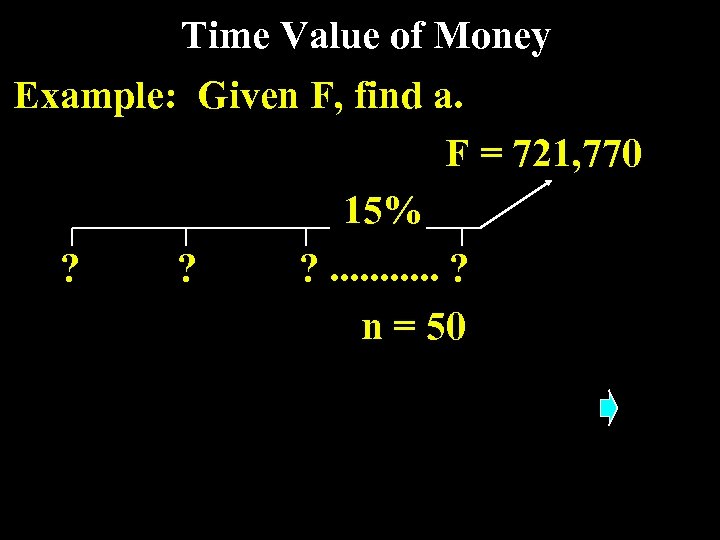

Time Value of Money Example: Given F, find a. F = 721, 770 15% ? ? ? . . . ? n = 50

Time Value of Money Example: Given F, find a. F = 721, 770 15% ? ? ? . . . ? n = 50

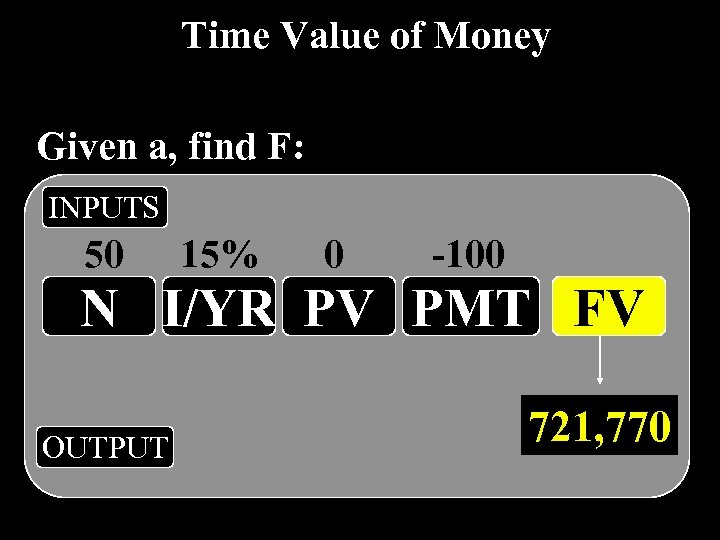

Time Value of Money Given a, find F: INPUTS 50 15% 0 -100 N I/YR PV PMT FV OUTPUT 721, 770

Time Value of Money Given a, find F: INPUTS 50 15% 0 -100 N I/YR PV PMT FV OUTPUT 721, 770

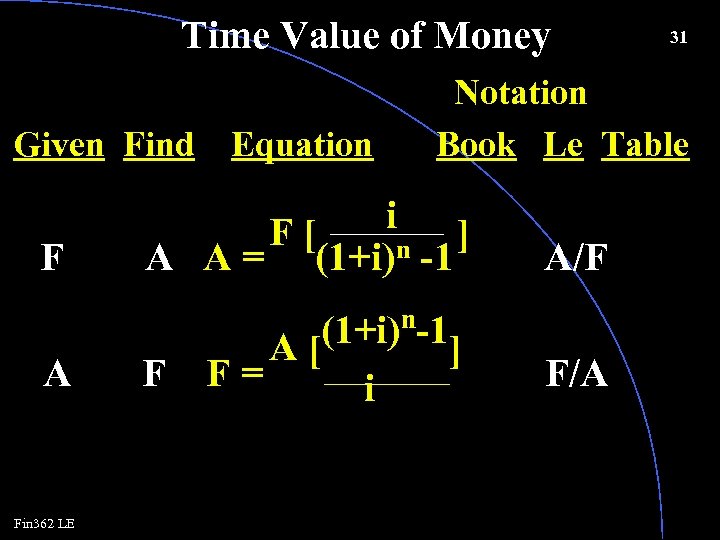

Time Value of Money Given Find F Notation Book Le Table Equation i F[ n -1 ] A A = (1+i) A/F n A Fin 362 LE F 31 (1+i) -1] A[ F= i F/A

Time Value of Money Given Find F Notation Book Le Table Equation i F[ n -1 ] A A = (1+i) A/F n A Fin 362 LE F 31 (1+i) -1] A[ F= i F/A

![Time Value of Money a=F[i/((1+i)n-1)]= F[a/F] = F[1/(FVIFA)] Example: i=10% 1, 000 _ _ Time Value of Money a=F[i/((1+i)n-1)]= F[a/F] = F[1/(FVIFA)] Example: i=10% 1, 000 _ _](https://present5.com/presentation/015842044d963e299d1a804a6f1a9e68/image-32.jpg) Time Value of Money a=F[i/((1+i)n-1)]= F[a/F] = F[1/(FVIFA)] Example: i=10% 1, 000 _ _ 20 a a F = 1, 000 i = 10% n =20 a = pmt = ?

Time Value of Money a=F[i/((1+i)n-1)]= F[a/F] = F[1/(FVIFA)] Example: i=10% 1, 000 _ _ 20 a a F = 1, 000 i = 10% n =20 a = pmt = ?

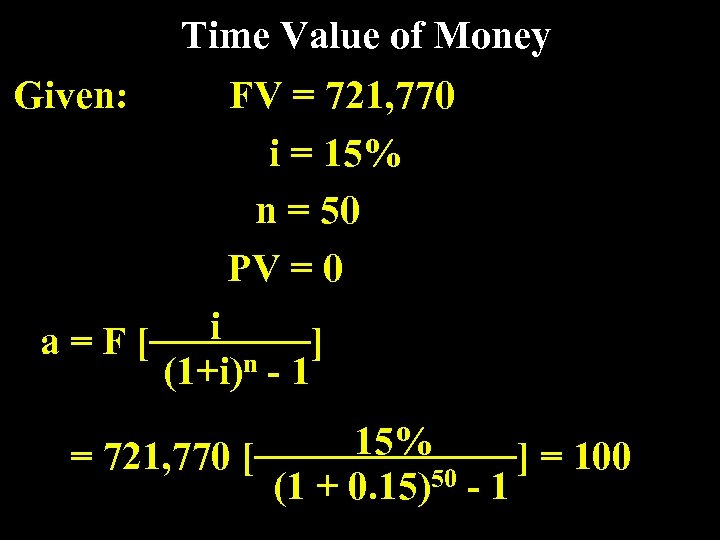

Time Value of Money Given: FV = 721, 770 i = 15% n = 50 PV = 0 i a=F[ ] (1+i)n - 1 15% = 721, 770 [ ] = 100 (1 + 0. 15)50 - 1

Time Value of Money Given: FV = 721, 770 i = 15% n = 50 PV = 0 i a=F[ ] (1+i)n - 1 15% = 721, 770 [ ] = 100 (1 + 0. 15)50 - 1

![Time Value of Money Given Find a P Fin 362 LE Equation a[1 -1/(1+i)n] Time Value of Money Given Find a P Fin 362 LE Equation a[1 -1/(1+i)n]](https://present5.com/presentation/015842044d963e299d1a804a6f1a9e68/image-34.jpg) Time Value of Money Given Find a P Fin 362 LE Equation a[1 -1/(1+i)n] i 34 Notation Book Le Table P P= a[PVIFA] a(P/a) a i 1 a=P[1 -1/(1+i)n] P[PVIFA] A-2 P(a/P)

Time Value of Money Given Find a P Fin 362 LE Equation a[1 -1/(1+i)n] i 34 Notation Book Le Table P P= a[PVIFA] a(P/a) a i 1 a=P[1 -1/(1+i)n] P[PVIFA] A-2 P(a/P)

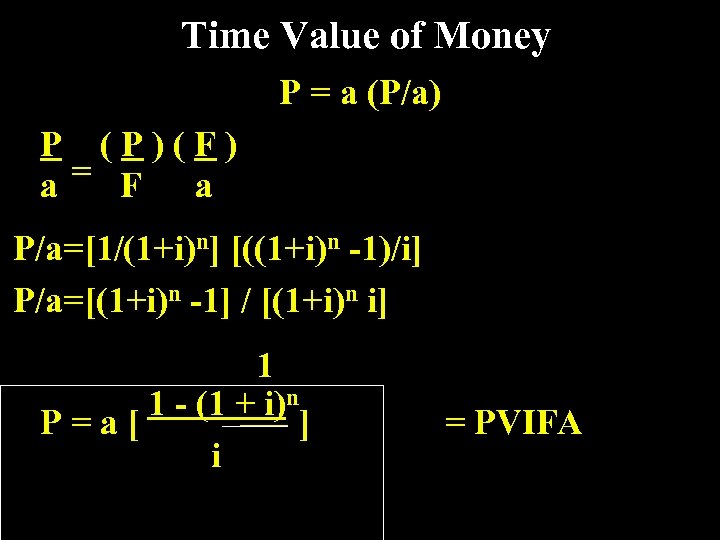

Time Value of Money P = a (P/a) P (P)(F) = F a a P/a=[1/(1+i)n] [((1+i)n -1)/i] P/a=[(1+i)n -1] / [(1+i)n i] 1 1 - (1 + i)n P=a[ ] i = PVIFA

Time Value of Money P = a (P/a) P (P)(F) = F a a P/a=[1/(1+i)n] [((1+i)n -1)/i] P/a=[(1+i)n -1] / [(1+i)n i] 1 1 - (1 + i)n P=a[ ] i = PVIFA

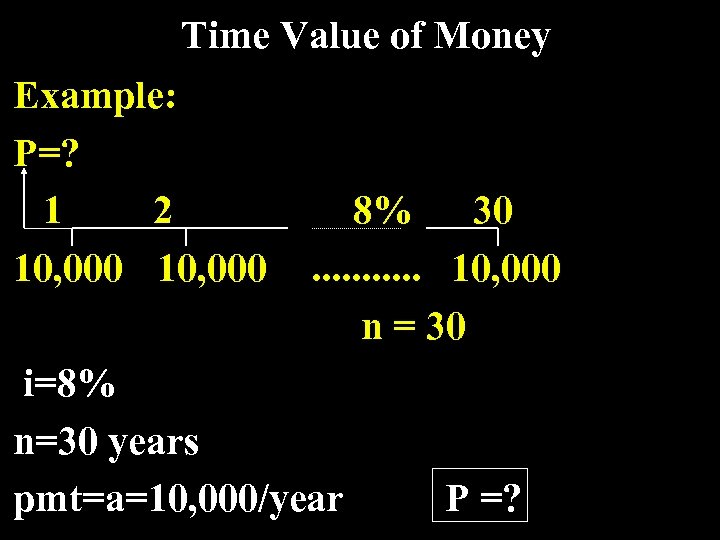

Time Value of Money Example: P=? 1 2 10, 000 8% 30. . . 10, 000 n = 30 i=8% n=30 years pmt=a=10, 000/year P =?

Time Value of Money Example: P=? 1 2 10, 000 8% 30. . . 10, 000 n = 30 i=8% n=30 years pmt=a=10, 000/year P =?

![Time Value of Money Given Find a P Fin 362 LE Equation a[1 -1/(1+i)n] Time Value of Money Given Find a P Fin 362 LE Equation a[1 -1/(1+i)n]](https://present5.com/presentation/015842044d963e299d1a804a6f1a9e68/image-37.jpg) Time Value of Money Given Find a P Fin 362 LE Equation a[1 -1/(1+i)n] i 38 Notation Book Le Table P P= a[PVIFA] a(P/a) a i 1 a=P[1 -1/(1+i)n] P[PVIFA] A-2 P(a/P)

Time Value of Money Given Find a P Fin 362 LE Equation a[1 -1/(1+i)n] i 38 Notation Book Le Table P P= a[PVIFA] a(P/a) a i 1 a=P[1 -1/(1+i)n] P[PVIFA] A-2 P(a/P)

![Time Value of Money a = P[a/P] 1 1 P/a = n = PVIFA Time Value of Money a = P[a/P] 1 1 P/a = n = PVIFA](https://present5.com/presentation/015842044d963e299d1a804a6f1a9e68/image-38.jpg) Time Value of Money a = P[a/P] 1 1 P/a = n = PVIFA (1+i) i a/P = [ i 1 - 1 (1 + i)n ] 1 = PVIFA

Time Value of Money a = P[a/P] 1 1 P/a = n = PVIFA (1+i) i a/P = [ i 1 - 1 (1 + i)n ] 1 = PVIFA

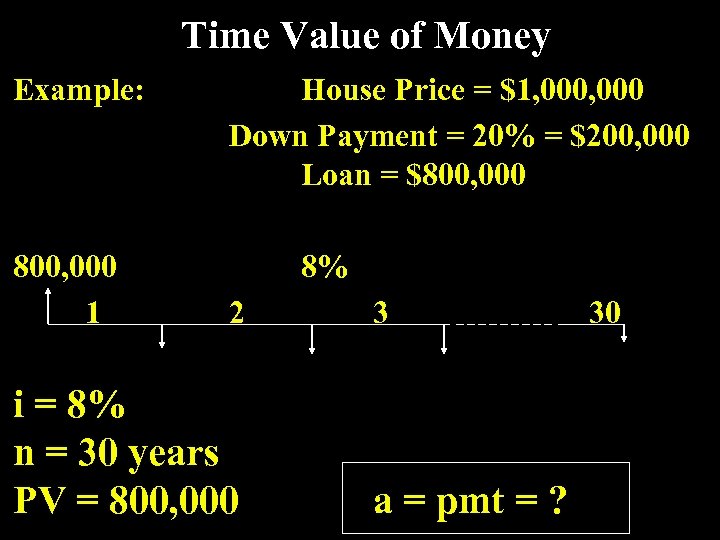

Time Value of Money Example: 800, 000 1 House Price = $1, 000 Down Payment = 20% = $200, 000 Loan = $800, 000 8% 2 i = 8% n = 30 years PV = 800, 000 3 a = pmt = ? 30

Time Value of Money Example: 800, 000 1 House Price = $1, 000 Down Payment = 20% = $200, 000 Loan = $800, 000 8% 2 i = 8% n = 30 years PV = 800, 000 3 a = pmt = ? 30

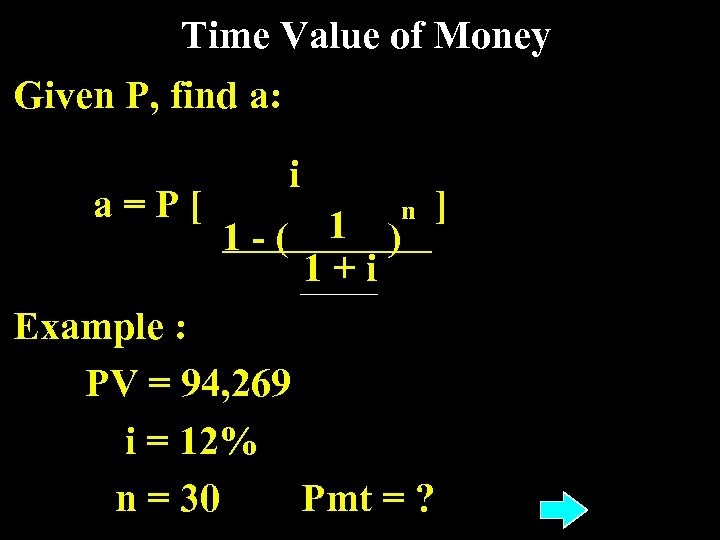

Time Value of Money Given P, find a: a=P[ i 1 -( 1 ) 1+i n Example : PV = 94, 269 i = 12% n = 30 Pmt = ? ]

Time Value of Money Given P, find a: a=P[ i 1 -( 1 ) 1+i n Example : PV = 94, 269 i = 12% n = 30 Pmt = ? ]

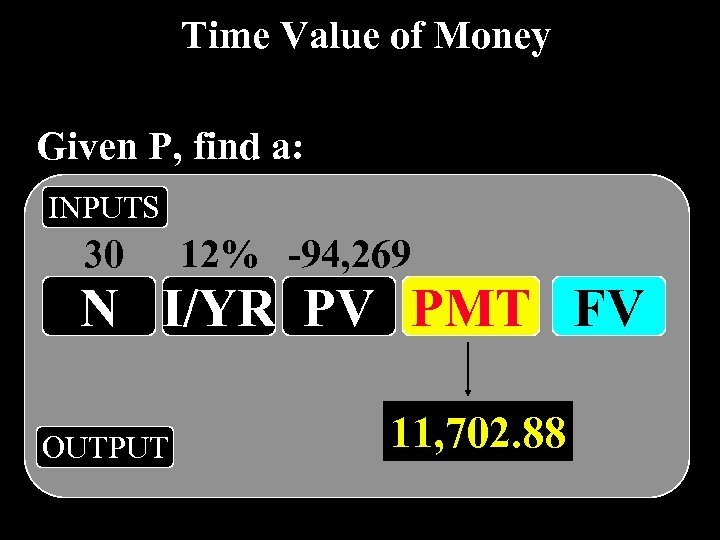

Time Value of Money Given P, find a: INPUTS 30 12% -94, 269 N I/YR PV PMT FV OUTPUT 11, 702. 88

Time Value of Money Given P, find a: INPUTS 30 12% -94, 269 N I/YR PV PMT FV OUTPUT 11, 702. 88

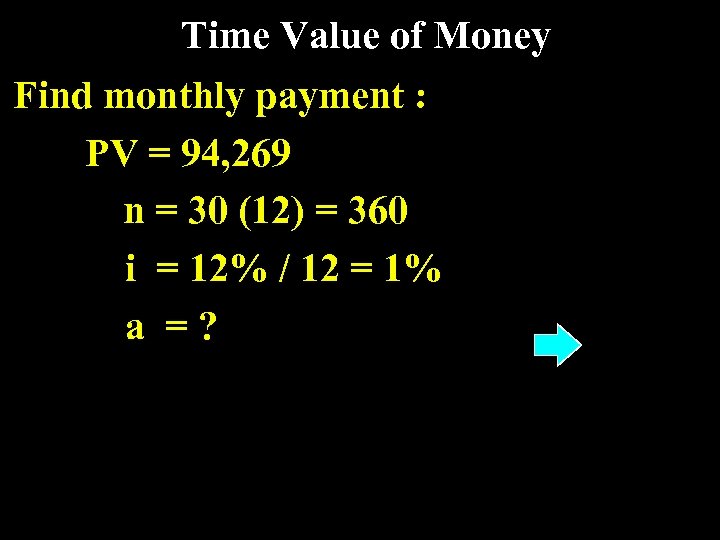

Time Value of Money Find monthly payment : PV = 94, 269 n = 30 (12) = 360 i = 12% / 12 = 1% a =?

Time Value of Money Find monthly payment : PV = 94, 269 n = 30 (12) = 360 i = 12% / 12 = 1% a =?

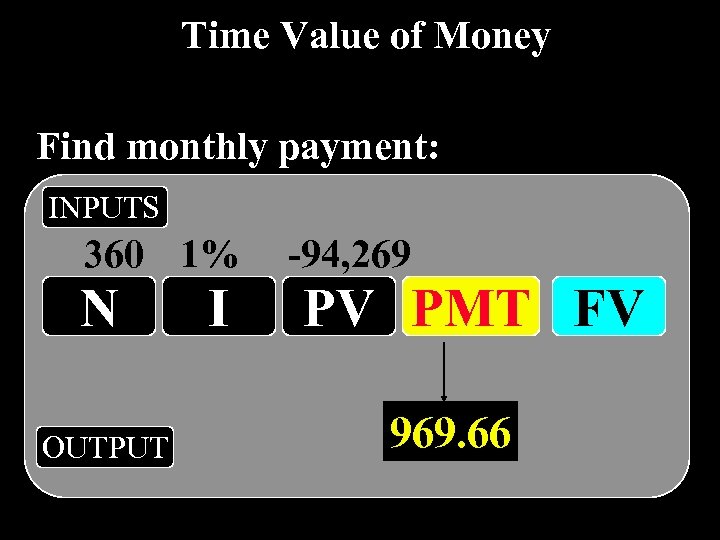

Time Value of Money Find monthly payment: INPUTS 360 1% N OUTPUT I -94, 269 PV PMT FV 969. 66

Time Value of Money Find monthly payment: INPUTS 360 1% N OUTPUT I -94, 269 PV PMT FV 969. 66

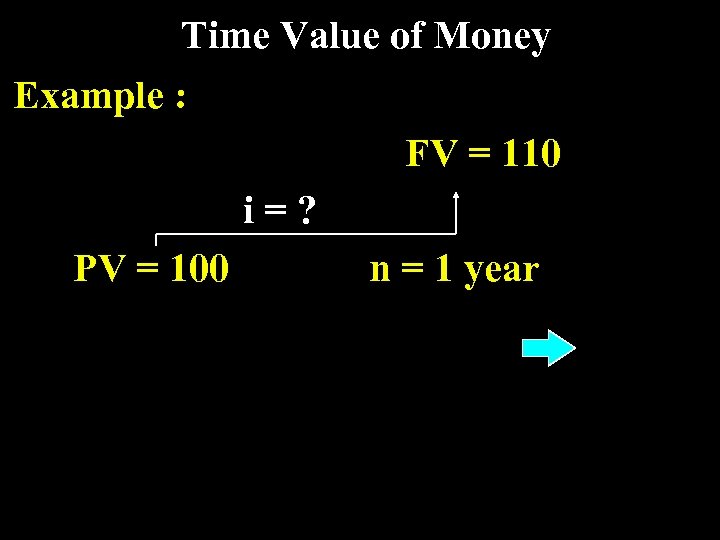

Time Value of Money Example : FV = 110 i=? PV = 100 n = 1 year

Time Value of Money Example : FV = 110 i=? PV = 100 n = 1 year

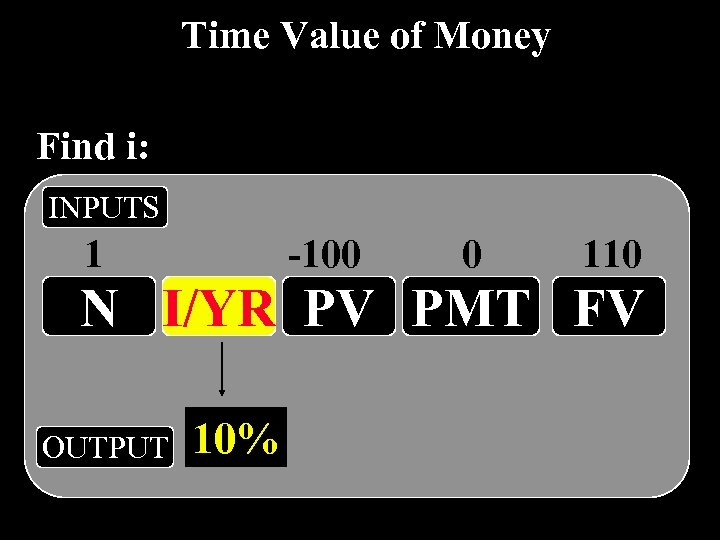

Time Value of Money Find i: INPUTS 1 -100 0 110 N I/YR PV PMT FV OUTPUT 10%

Time Value of Money Find i: INPUTS 1 -100 0 110 N I/YR PV PMT FV OUTPUT 10%

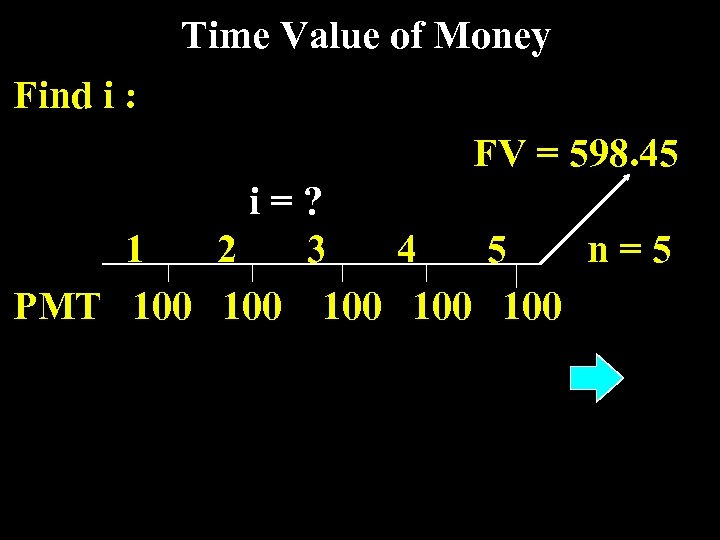

Time Value of Money Find i : FV = 598. 45 i=? 1 2 3 4 5 n=5 PMT 100 100 100

Time Value of Money Find i : FV = 598. 45 i=? 1 2 3 4 5 n=5 PMT 100 100 100

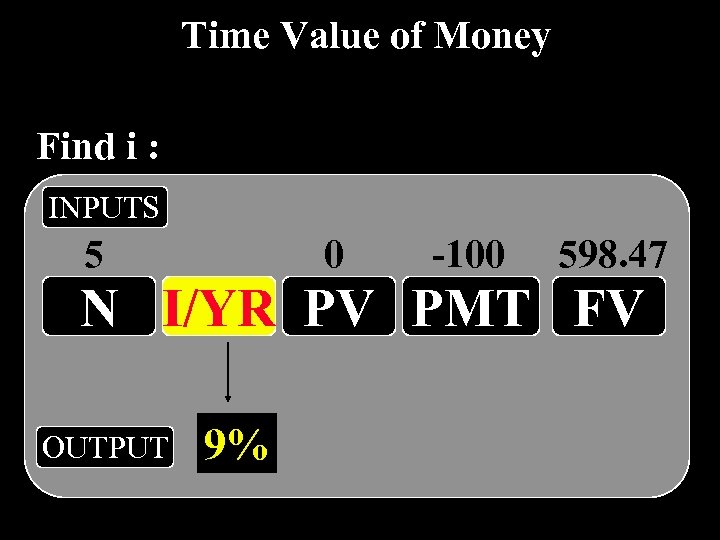

Time Value of Money Find i : INPUTS 5 0 -100 598. 47 N I/YR PV PMT FV OUTPUT 9%

Time Value of Money Find i : INPUTS 5 0 -100 598. 47 N I/YR PV PMT FV OUTPUT 9%

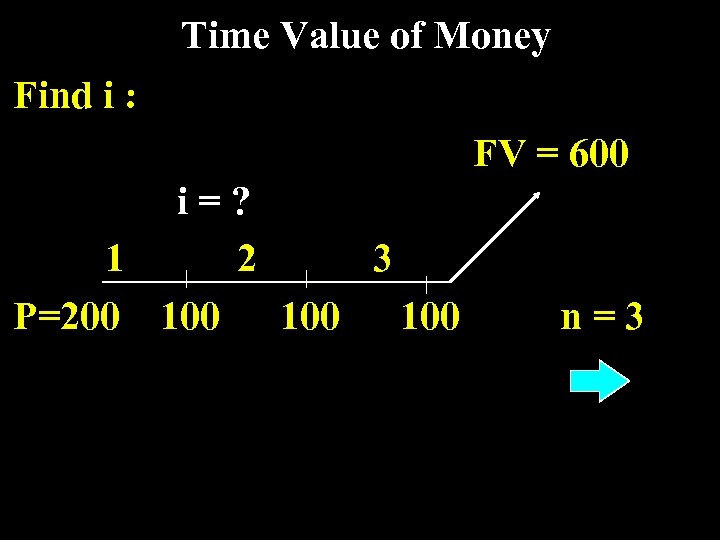

Time Value of Money Find i : FV = 600 i=? 1 2 3 P=200 100 100 n=3

Time Value of Money Find i : FV = 600 i=? 1 2 3 P=200 100 100 n=3

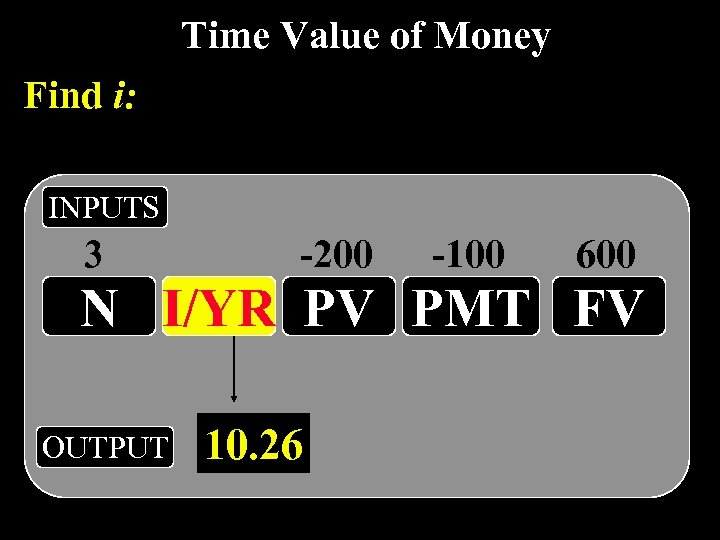

Time Value of Money Find i: INPUTS 3 -200 -100 600 N I/YR PV PMT FV OUTPUT 10. 26

Time Value of Money Find i: INPUTS 3 -200 -100 600 N I/YR PV PMT FV OUTPUT 10. 26

Confused? Then study more--you’ll get it

Confused? Then study more--you’ll get it