73dce5f25923d36f53ac2b80e9cda2a1.ppt

- Количество слайдов: 25

Tier Pricing By T. Y. Lee

Table of Contents • • • Background Framework Process Power of Separation Adverse Selection Conclusion

Background (1/2) • Dual Card Crisis in 2005 • Financial Authority order banks to do Tier Pricing (or Risk Based Pricing) to manage risk

Background (2/2) • Common response in Taiwan: – separate risk into tiers according to rough definition of revolvers vs. transactors • Pros: can be easily done and implemented • Cons: loss of opportunities because of low power of separation – there are other factors determining risk

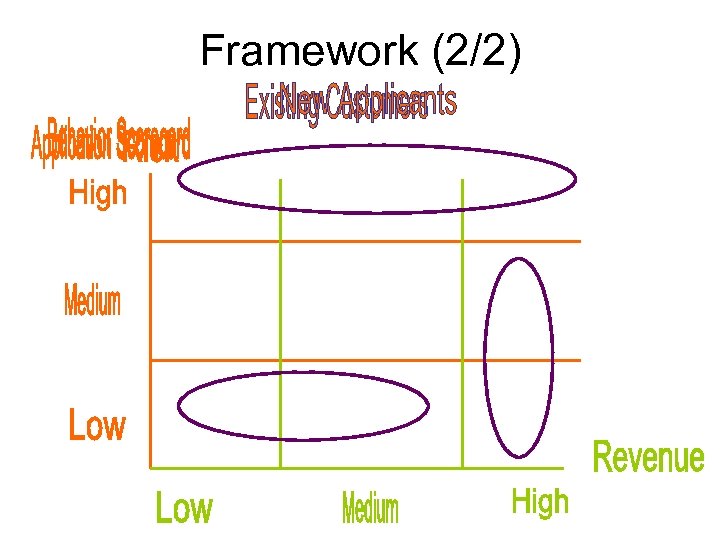

Framework (1/2) • What I Did: – – – In addition to looking at risk, I also looked at potential revenue (or profit) Set up a two-dimension framework and developed a scorecard for each dimension Risk Scorecard on vertical axis Revenue (or Profit) Scorecard on horizontal axis There are 2 phases: 1. Existing Customers 2. New Applicants

Framework (2/2)

Process (1/2) • For existing customers: – We have their information in-house – Both scorecards are updated monthly with latest customer information on consumption and payment – Set different strategies for customers in different cells – Movements between cells must be monitored

Process (2/2) • For New Applicants: – We do not have their information in-house, need to check Joint Credit Information Center (JCIC) for information – Usually on first come first serve basis – There are 2 stages: 1. To decide whether to approve or decline 2. If approved, one should determine the interest rate and the credit limit

Power of Separation (1/7) • Key to the success of this framework is the “Power of Separation” of scorecards, especially Risk scorecards – – assuming other things equal

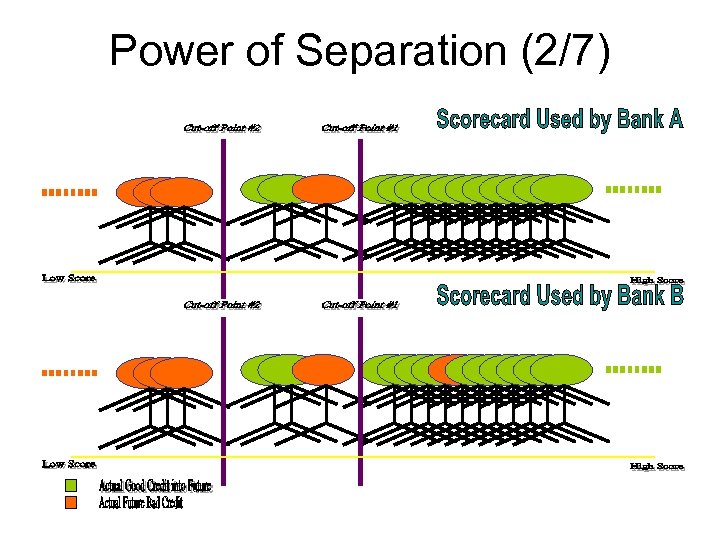

Power of Separation (2/7)

Power of Separation (3/7) • How to Measure Power of Separation: – KS (Kolmogorov–Smirnov) • Advantage: easily understood and practical • Disadvantage: not good with small BAD sample and not statistically intuitive – ROC (Receiver Operating Characteristics) • Advantage: statistically intuitive and deals with small BAD sample well • Disadvantage: difficult to determine rank order – Gini – • similar to ROC

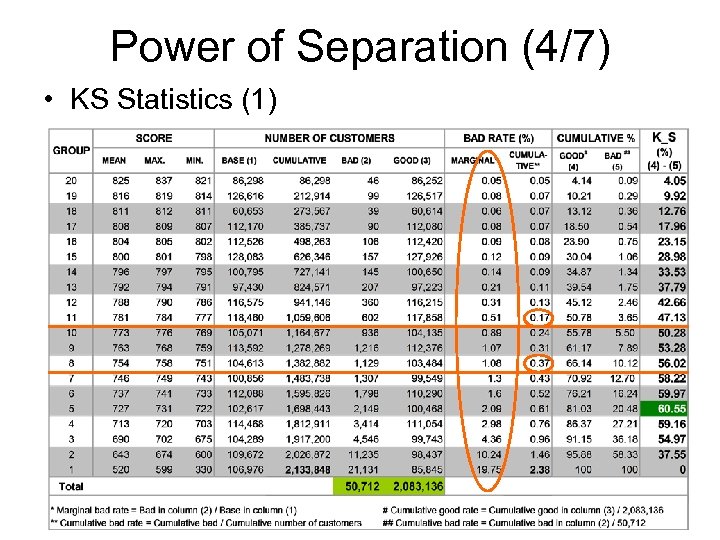

Power of Separation (4/7) • KS Statistics (1)

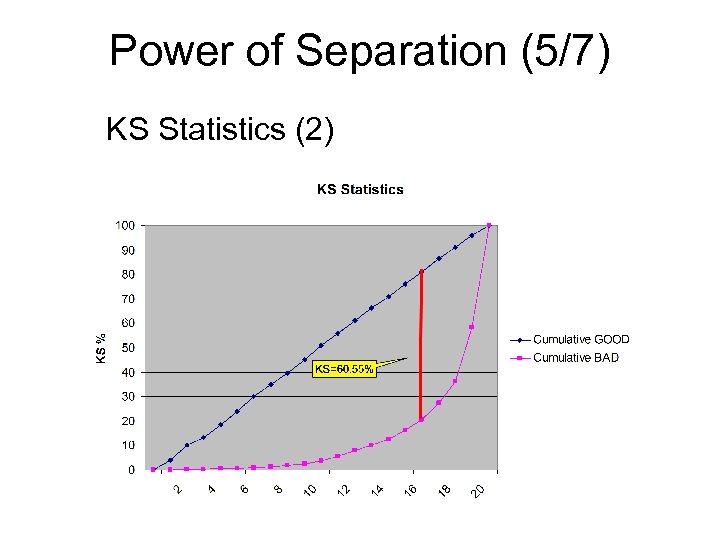

Power of Separation (5/7) KS Statistics (2)

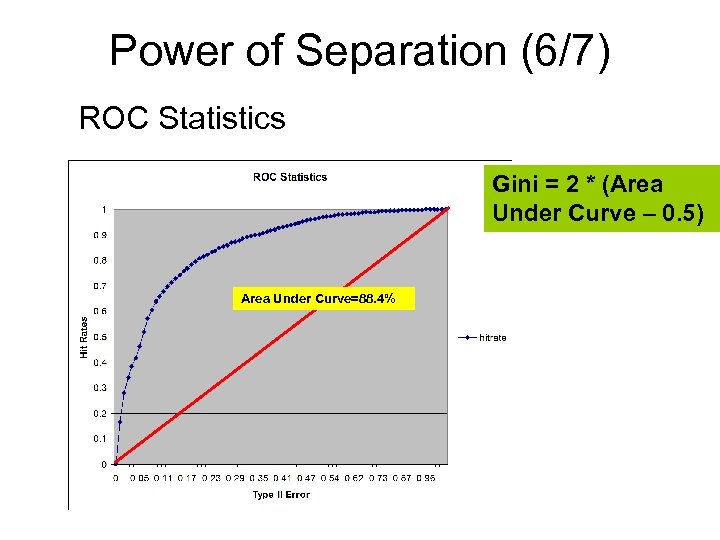

Power of Separation (6/7) ROC Statistics Gini = 2 * (Area Under Curve – 0. 5) Area Under Curve=88. 4%

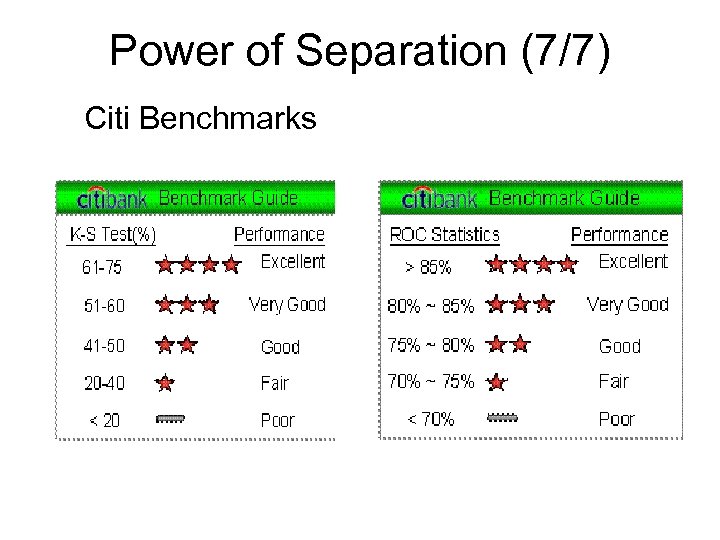

Power of Separation (7/7) Citi Benchmarks

Adverse Selection (1/5) • An Example: – Banks A & B are targeting potential customers 1&2 – Both banks use scorecards, but the one used in Bank A is more accurate than the one used in Bank B – Customer 1 is actually riskier than customer 2 – Customer 1 eventually defaults in the future but customer 2 remains in good standing

Adverse Selection (2/5) – Bank A correctly identifies that customer 1 is riskier because its model is more accurate – Unfortunately Bank B did not because its model is inferior

Adverse Selection (3/5) – Scenario 1: • Bank B approves customer 1’s application but reject customer 2’s • Bank A approves customer 2’s application but reject customer 1’s • Bank A makes profits on customer 2 and avoids default loss on customer 1 • While Bank B suffers default loss on customer 1 and misses opportunity of doing business with customer 2 • Scenario 1 is called adverse selection

Adverse Selection (4/5) – Scenario 2: • Both banks approve both customers’ application • Due to Risk Based Pricing Bank A charges customer 2 a lower interest rate and higher rate for customer 1 • Bank B charges customer 2 a higher rate than Bank A and customer 1 a lower rate than Bank A • Customer 2 does business with Bank A only because of lower interest rate; while customer 1 does business with Bank B only because of lower interest rate as well

Adverse Selection (5/5) – Scenario 2 (cont’d): • Customer 1 eventually defaults • Bank B suffers loss from customer 1 while Bank A make profits from customer 2 • Scenario 2 is also called adverse selection

Conclusion • One should look at both risk and reward at the same time to have the whole picture • Scorecards are powerful tools, if one knows how to use it

Q&A

Appendix • Revolvers • Transactors

Revolvers • Different banks may have different definitions, such as: – Ever have balance greater than 0 after payment in the past 3 month – Ever have balance greater than 0 after payment in the past 6 month – Ever have balance greater than 1, 000 after payment in the past 3 month – Etc.

Transactors • Different banks may have different definitions, such as: – Never have balance greater than 0 after payment in the past 3 month – Never have balance greater than 0 after payment in the past 6 month – Never have balance greater than 1, 000 after payment in the past 3 month – Etc.

73dce5f25923d36f53ac2b80e9cda2a1.ppt