cf6ccdc257553cbffa94b7451b755c39.ppt

- Количество слайдов: 168

Tier 1 Training Annual Updates 2010 -2011 School Year School Management Issues & Updates School Finance Issues & Updates 1

Tier 1 Training Annual Updates 2010 -2011 School Year School Management Issues & Updates School Finance Issues & Updates 1

Required Training ACA Section 6 -20 -2204 • Tier 1 & Tier 2 apply to school districts, open-enrollment charter schools and education service cooperatives. • Tier 1 required for: – Superintendents – Cooperative Directors – Charter Schools Directors – Person responsible for preparing budget or overall accounting responsibility (GBM) 2

Required Training ACA Section 6 -20 -2204 • Tier 1 & Tier 2 apply to school districts, open-enrollment charter schools and education service cooperatives. • Tier 1 required for: – Superintendents – Cooperative Directors – Charter Schools Directors – Person responsible for preparing budget or overall accounting responsibility (GBM) 2

General Business Manager ACA Section 6 -15 -2302 • A chief financial officer or business manager, however the position is titled, who: – Is responsible for fiscal operations – Under direction of superintendent – Meets minimum qualifications specified by ADE Rule 3

General Business Manager ACA Section 6 -15 -2302 • A chief financial officer or business manager, however the position is titled, who: – Is responsible for fiscal operations – Under direction of superintendent – Meets minimum qualifications specified by ADE Rule 3

Required Tier 1 - Content ACA Section 6 -20 -2204 • School laws of Arkansas; • Laws and rules governing the expenditure of public education funds, fiscal accountability, and school finance; • Ethics; and • Financial accounting and reporting of schools, school districts, open-enrollment public charter schools, and cooperatives. 4

Required Tier 1 - Content ACA Section 6 -20 -2204 • School laws of Arkansas; • Laws and rules governing the expenditure of public education funds, fiscal accountability, and school finance; • Ethics; and • Financial accounting and reporting of schools, school districts, open-enrollment public charter schools, and cooperatives. 4

Tier 1 Initial Training-12 Hours ACA Section 6 -20 -2204 • • • School Revenues – 2 hrs School Expenditures – 2 hrs School Ethics & Audit Compliance – 2 hrs School Purchasing – 2 hrs School Finance Issues & Updates – 2 hrs School Management Issues & Updates 2 hrs 5

Tier 1 Initial Training-12 Hours ACA Section 6 -20 -2204 • • • School Revenues – 2 hrs School Expenditures – 2 hrs School Ethics & Audit Compliance – 2 hrs School Purchasing – 2 hrs School Finance Issues & Updates – 2 hrs School Management Issues & Updates 2 hrs 5

Tier 1 Annual Training ACA Section 6 -20 -2204 • 4 hours of annual training and instruction in order to maintain basic proficiency in the topics required in the initial 12 hours of Tier 1 training. – Must receive training by December 31 st for the current school year. • Accreditation citation for failure to meet December 31 st deadline. • Unable to continue in position if training not received by March 1 st of following calendar year. 6

Tier 1 Annual Training ACA Section 6 -20 -2204 • 4 hours of annual training and instruction in order to maintain basic proficiency in the topics required in the initial 12 hours of Tier 1 training. – Must receive training by December 31 st for the current school year. • Accreditation citation for failure to meet December 31 st deadline. • Unable to continue in position if training not received by March 1 st of following calendar year. 6

Tier 2 Annual Training ACA Section 6 -20 -2204 • For employees who do not make decisions about selecting codes or who have a limited number of codes that they can use. – Principals – Assistant Principals – School Secretaries – Program Directors 7

Tier 2 Annual Training ACA Section 6 -20 -2204 • For employees who do not make decisions about selecting codes or who have a limited number of codes that they can use. – Principals – Assistant Principals – School Secretaries – Program Directors 7

Tier 2 Annual Training ACA Section 6 -20 -2204 • 4 hours per year • School district, charter school or cooperative responsible for providing the training • Trainers required to attend Tier 1 training • Maintain records of all employees required to have Tier 2 training and who have completed Tier 2 training. 8

Tier 2 Annual Training ACA Section 6 -20 -2204 • 4 hours per year • School district, charter school or cooperative responsible for providing the training • Trainers required to attend Tier 1 training • Maintain records of all employees required to have Tier 2 training and who have completed Tier 2 training. 8

School Finance Issues & Updates 9

School Finance Issues & Updates 9

Educational Financial Accounting and Reporting Act of 2004 (6 -20 -2201) • Budget report (6 -20 -2202) – Submitted to ADE through APSCN with cycle 1 due September 30 th. – To be approved by board in a legally held meeting and signed by president and ex- officio financial secretary. – If budget not submitted by September 30 th: – Warrants and checks issued after September 30 not valid – Ex officio financial secretary or surety liable for checks/warrants issued after September 30 th – State funding suspended until budget submitted 10

Educational Financial Accounting and Reporting Act of 2004 (6 -20 -2201) • Budget report (6 -20 -2202) – Submitted to ADE through APSCN with cycle 1 due September 30 th. – To be approved by board in a legally held meeting and signed by president and ex- officio financial secretary. – If budget not submitted by September 30 th: – Warrants and checks issued after September 30 not valid – Ex officio financial secretary or surety liable for checks/warrants issued after September 30 th – State funding suspended until budget submitted 10

Educational Financial Accounting and Reporting Act of 2004 (6 -20 -2201) • Annual financial report (6 -20 -2202) – Submitted to ADE through APSCN with cycle 9 due August 31 st. – Information required: • Daily expenditures and receipts • Fund balances • Reasons for maintaining rather than spending fund balances • Transfers between funds 11

Educational Financial Accounting and Reporting Act of 2004 (6 -20 -2201) • Annual financial report (6 -20 -2202) – Submitted to ADE through APSCN with cycle 9 due August 31 st. – Information required: • Daily expenditures and receipts • Fund balances • Reasons for maintaining rather than spending fund balances • Transfers between funds 11

Educational Financial Accounting and Reporting Act of 2004 (6 -20 -2201) • Final Close of General Ledger – Required by September 15 th for year ended the previous June 30 th. – No changes can be made to the prior year financial data after September 15 th. • If changes are made after submitting cycle 9, cycle 9 must be re-submitted by September 15 th. • If a change is needed after final close but before September 15 th, APSCN can assist. 12

Educational Financial Accounting and Reporting Act of 2004 (6 -20 -2201) • Final Close of General Ledger – Required by September 15 th for year ended the previous June 30 th. – No changes can be made to the prior year financial data after September 15 th. • If changes are made after submitting cycle 9, cycle 9 must be re-submitted by September 15 th. • If a change is needed after final close but before September 15 th, APSCN can assist. 12

Educational Financial Accounting and Reporting Act of 2004 (6 -20 -2201) • Uniform budget and accounting system – Arkansas Educational Financial Accounting and Reporting System • Establish and implement process and procedures for financial reporting. • Uniform chart of accounts-Arkansas Financial Accounting Handbook (Arkansas Handbook). – To comply with federal reporting requirements – Provide valid comparisons of expenditures of schools, school districts, charter schools and cooperatives. 13

Educational Financial Accounting and Reporting Act of 2004 (6 -20 -2201) • Uniform budget and accounting system – Arkansas Educational Financial Accounting and Reporting System • Establish and implement process and procedures for financial reporting. • Uniform chart of accounts-Arkansas Financial Accounting Handbook (Arkansas Handbook). – To comply with federal reporting requirements – Provide valid comparisons of expenditures of schools, school districts, charter schools and cooperatives. 13

Educational Financial Accounting and Reporting Act of 2004 (6 -20 -2201) • Arkansas Handbook shall include, but not be limited to: – Categories to allow for the gathering of data on separate functions and programs; – Categories and descriptions of expenditures to be reported on the annual school performance report; and – Categories and descriptions of expenditures that allow for the gathering of data required by law. 14

Educational Financial Accounting and Reporting Act of 2004 (6 -20 -2201) • Arkansas Handbook shall include, but not be limited to: – Categories to allow for the gathering of data on separate functions and programs; – Categories and descriptions of expenditures to be reported on the annual school performance report; and – Categories and descriptions of expenditures that allow for the gathering of data required by law. 14

Educational Financial Accounting and Reporting Act of 2004 (6 -20 -2201) • Examples of categories of expenditures required to be reported: – Annual School Performance Report: • • • Total expenditures Instructional expenditures Administrative expenditures Extracurricular expenditures Capital expenditures Debt Service expenditures 15

Educational Financial Accounting and Reporting Act of 2004 (6 -20 -2201) • Examples of categories of expenditures required to be reported: – Annual School Performance Report: • • • Total expenditures Instructional expenditures Administrative expenditures Extracurricular expenditures Capital expenditures Debt Service expenditures 15

Educational Financial Accounting and Reporting Act of 2004 (6 -20 -2201) • Examples of categories of expenditures required to be reported-Continued: – Functions and programs provided by law: • • • Athletic expenditures Student transportation expenditures School district level administrative costs School level administrative costs Instructional facilitators Supervisory aides 16

Educational Financial Accounting and Reporting Act of 2004 (6 -20 -2201) • Examples of categories of expenditures required to be reported-Continued: – Functions and programs provided by law: • • • Athletic expenditures Student transportation expenditures School district level administrative costs School level administrative costs Instructional facilitators Supervisory aides 16

Educational Financial Accounting and Reporting Act of 2004 (6 -20 -2201) • Functions and programs provided by law. Continued: – Substitutes – Property Insurance 17

Educational Financial Accounting and Reporting Act of 2004 (6 -20 -2201) • Functions and programs provided by law. Continued: – Substitutes – Property Insurance 17

Educational Financial Accounting and Reporting Act of 2004 (6 -20 -2201) • Examples of categories of expenditures required to be reported-Continued: – From following sources of revenue: • • • Student growth Declining enrollment Special education catastrophic occurrences Special education services Technology grants Debt service funding supplement 18

Educational Financial Accounting and Reporting Act of 2004 (6 -20 -2201) • Examples of categories of expenditures required to be reported-Continued: – From following sources of revenue: • • • Student growth Declining enrollment Special education catastrophic occurrences Special education services Technology grants Debt service funding supplement 18

Educational Financial Accounting and Reporting Act of 2004 (6 -20 -2201) • From following sources of revenue. Continued: • General facilities funding • Distance learning • Gifted and talented 19

Educational Financial Accounting and Reporting Act of 2004 (6 -20 -2201) • From following sources of revenue. Continued: • General facilities funding • Distance learning • Gifted and talented 19

Educational Financial Accounting and Reporting Act of 2004 (6 -20 -2201) • Examples of categories of expenditures required to be reported-Continued: – Categories and descriptions of restricted fund balances. – Categories and descriptions of expenditures that each education service cooperative shall report on its annual report authorized by law. 20

Educational Financial Accounting and Reporting Act of 2004 (6 -20 -2201) • Examples of categories of expenditures required to be reported-Continued: – Categories and descriptions of restricted fund balances. – Categories and descriptions of expenditures that each education service cooperative shall report on its annual report authorized by law. 20

Educational Financial Accounting and Reporting Act of 2004 (6 -20 -2201) • Arkansas Financial Accounting Handbook and APSCN – Web site location of Handbook is http: //www. apscn. org/ • FMS>Financial Management System-Training Documentation – Arkansas Financial Accounting Handbook 2009/2010 – Commissioner’s Memos on Coding – Frequently asked questions 21

Educational Financial Accounting and Reporting Act of 2004 (6 -20 -2201) • Arkansas Financial Accounting Handbook and APSCN – Web site location of Handbook is http: //www. apscn. org/ • FMS>Financial Management System-Training Documentation – Arkansas Financial Accounting Handbook 2009/2010 – Commissioner’s Memos on Coding – Frequently asked questions 21

Educational Financial Accounting and Reporting Act of 2004 (6 -20 -2201) • Arkansas Handbook modeled after the Financial Accounting for Local and State School Systems, 2003 Edition (National Center for Education Statistics, U. S. Department of Education-Institute of Education Sciences, NCES-2004 -318) • A new NCES edition was published June, 2009. Online version can be found at: http: //nces. ed. gov/pubsearch/pubsinfo. asp? pubid=2009325 22

Educational Financial Accounting and Reporting Act of 2004 (6 -20 -2201) • Arkansas Handbook modeled after the Financial Accounting for Local and State School Systems, 2003 Edition (National Center for Education Statistics, U. S. Department of Education-Institute of Education Sciences, NCES-2004 -318) • A new NCES edition was published June, 2009. Online version can be found at: http: //nces. ed. gov/pubsearch/pubsinfo. asp? pubid=2009325 22

Arkansas Financial Accounting Handbook • ADE’s Arkansas Public School Computer Network (APSCN) is responsible for maintaining the Arkansas Handbook and implementing revisions necessary to gather and report financial data required by state and federal law. 23

Arkansas Financial Accounting Handbook • ADE’s Arkansas Public School Computer Network (APSCN) is responsible for maintaining the Arkansas Handbook and implementing revisions necessary to gather and report financial data required by state and federal law. 23

Arkansas Financial Accounting Handbook • Financial coding structure (chart of accounts) within Arkansas Handbook – Fund – Source of Fund – Function – Location – Program – Subject Area – Object 24

Arkansas Financial Accounting Handbook • Financial coding structure (chart of accounts) within Arkansas Handbook – Fund – Source of Fund – Function – Location – Program – Subject Area – Object 24

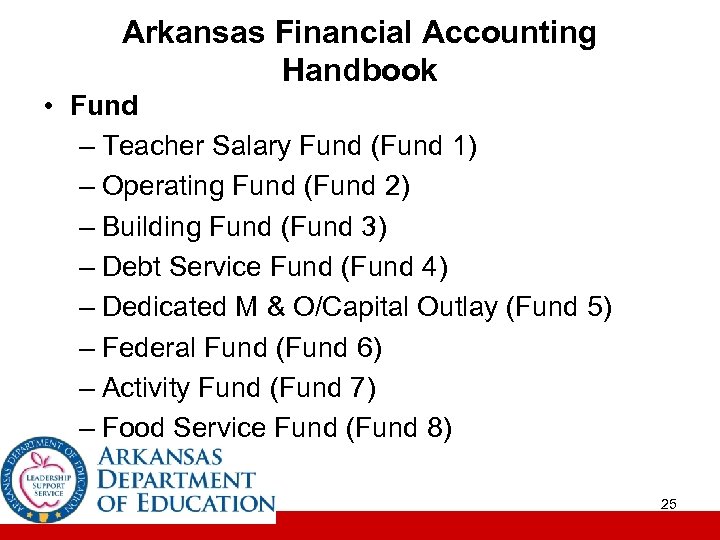

Arkansas Financial Accounting Handbook • Fund – Teacher Salary Fund (Fund 1) – Operating Fund (Fund 2) – Building Fund (Fund 3) – Debt Service Fund (Fund 4) – Dedicated M & O/Capital Outlay (Fund 5) – Federal Fund (Fund 6) – Activity Fund (Fund 7) – Food Service Fund (Fund 8) 25

Arkansas Financial Accounting Handbook • Fund – Teacher Salary Fund (Fund 1) – Operating Fund (Fund 2) – Building Fund (Fund 3) – Debt Service Fund (Fund 4) – Dedicated M & O/Capital Outlay (Fund 5) – Federal Fund (Fund 6) – Activity Fund (Fund 7) – Food Service Fund (Fund 8) 25

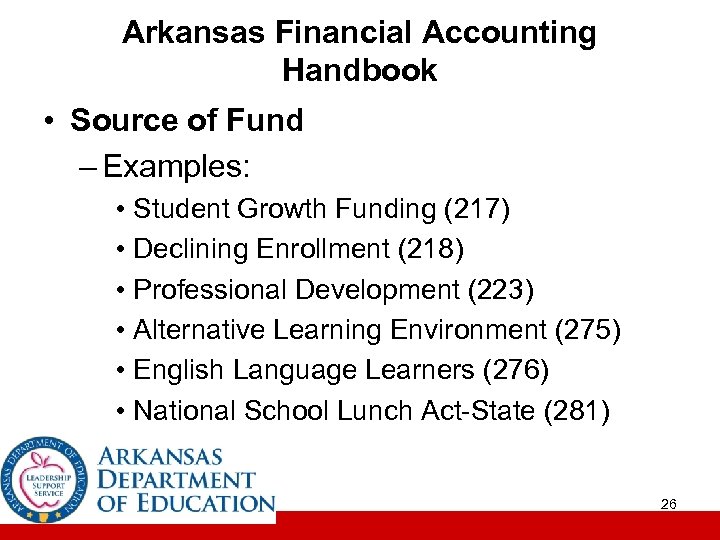

Arkansas Financial Accounting Handbook • Source of Fund – Examples: • Student Growth Funding (217) • Declining Enrollment (218) • Professional Development (223) • Alternative Learning Environment (275) • English Language Learners (276) • National School Lunch Act-State (281) 26

Arkansas Financial Accounting Handbook • Source of Fund – Examples: • Student Growth Funding (217) • Declining Enrollment (218) • Professional Development (223) • Alternative Learning Environment (275) • English Language Learners (276) • National School Lunch Act-State (281) 26

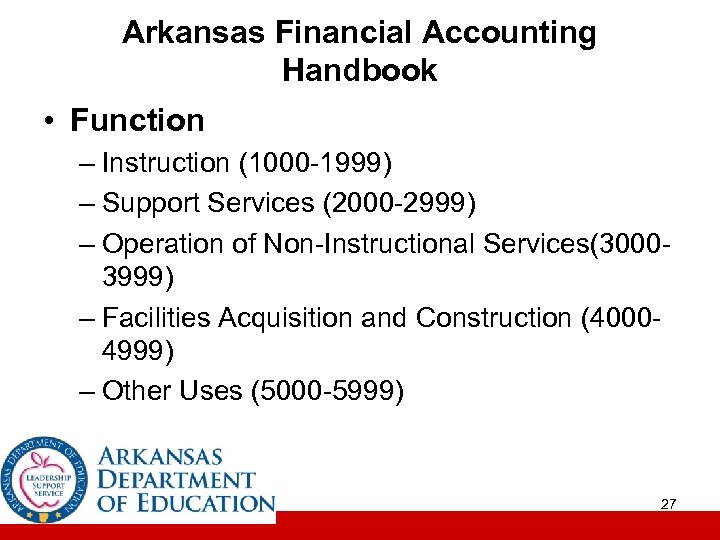

Arkansas Financial Accounting Handbook • Function – Instruction (1000 -1999) – Support Services (2000 -2999) – Operation of Non-Instructional Services(30003999) – Facilities Acquisition and Construction (40004999) – Other Uses (5000 -5999) 27

Arkansas Financial Accounting Handbook • Function – Instruction (1000 -1999) – Support Services (2000 -2999) – Operation of Non-Instructional Services(30003999) – Facilities Acquisition and Construction (40004999) – Other Uses (5000 -5999) 27

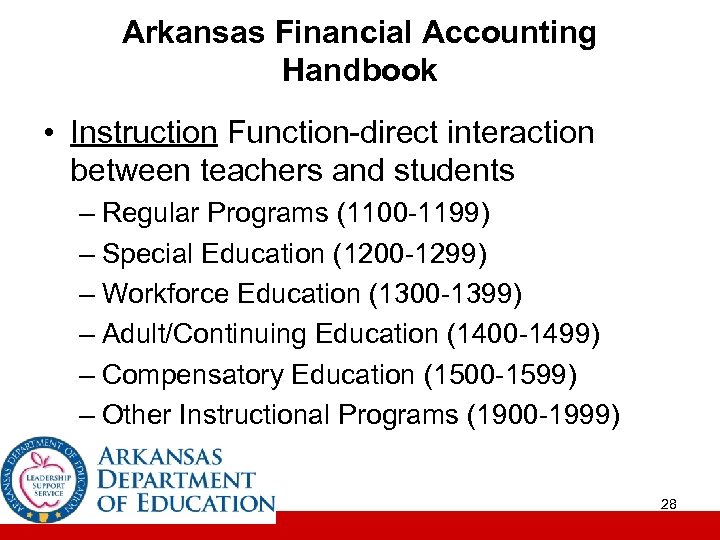

Arkansas Financial Accounting Handbook • Instruction Function-direct interaction between teachers and students – Regular Programs (1100 -1199) – Special Education (1200 -1299) – Workforce Education (1300 -1399) – Adult/Continuing Education (1400 -1499) – Compensatory Education (1500 -1599) – Other Instructional Programs (1900 -1999) 28

Arkansas Financial Accounting Handbook • Instruction Function-direct interaction between teachers and students – Regular Programs (1100 -1199) – Special Education (1200 -1299) – Workforce Education (1300 -1399) – Adult/Continuing Education (1400 -1499) – Compensatory Education (1500 -1599) – Other Instructional Programs (1900 -1999) 28

Arkansas Financial Accounting Handbook • Support Services Function-provide administrative, technical and logistical support to facilitate and enhance instruction. – Includes: • • Student Support (2100 -2199) Instructional Staff Support (2200 -2299) General Administration (2300 -2399) School Administration (2400 -2499) 29

Arkansas Financial Accounting Handbook • Support Services Function-provide administrative, technical and logistical support to facilitate and enhance instruction. – Includes: • • Student Support (2100 -2199) Instructional Staff Support (2200 -2299) General Administration (2300 -2399) School Administration (2400 -2499) 29

Arkansas Financial Accounting Handbook • Support Services Function-provide administrative, technical and logistical support to facilitate and enhance instruction-Continued: – Includes: • Central Services (2500 -2599) • Operation & Maintenance of Plant (2600 -2699) • Student Transportation (2700 -2799) 30

Arkansas Financial Accounting Handbook • Support Services Function-provide administrative, technical and logistical support to facilitate and enhance instruction-Continued: – Includes: • Central Services (2500 -2599) • Operation & Maintenance of Plant (2600 -2699) • Student Transportation (2700 -2799) 30

Arkansas Financial Accounting Handbook • Operation of Non-instructional Services Function – Food Service Operations – Other Enterprise Operations – Community Services Operations 31

Arkansas Financial Accounting Handbook • Operation of Non-instructional Services Function – Food Service Operations – Other Enterprise Operations – Community Services Operations 31

Arkansas Financial Accounting Handbook • Facilities Acquisition and Construction Services Function – Land Acquisition – Land Improvement – Architectural & Engineering Services – Building Acquisition and Construction – Site Improvement – Building Improvements 32

Arkansas Financial Accounting Handbook • Facilities Acquisition and Construction Services Function – Land Acquisition – Land Improvement – Architectural & Engineering Services – Building Acquisition and Construction – Site Improvement – Building Improvements 32

Arkansas Financial Accounting Handbook • Other Uses Function – Debt payments (principal & interest) – Transfers to other district funds – Indirect costs – Payments to state for prior year overpayment – 98% URT collection rate exceeded per 6 -202305 33

Arkansas Financial Accounting Handbook • Other Uses Function – Debt payments (principal & interest) – Transfers to other district funds – Indirect costs – Payments to state for prior year overpayment – 98% URT collection rate exceeded per 6 -202305 33

Arkansas Financial Accounting Handbook • Location Code – The three-digit ADE assigned LEA number for schools that identifies the campus where funds are expended. 34

Arkansas Financial Accounting Handbook • Location Code – The three-digit ADE assigned LEA number for schools that identifies the campus where funds are expended. 34

Arkansas Financial Accounting Handbook • Program Code – a program is a plan of activities and procedures designed to accomplish a predetermined objective or set of objectives. This code will enable all expenditures pertaining to a particular program to be tracked across funds, sources of funds, functions and locations. 35

Arkansas Financial Accounting Handbook • Program Code – a program is a plan of activities and procedures designed to accomplish a predetermined objective or set of objectives. This code will enable all expenditures pertaining to a particular program to be tracked across funds, sources of funds, functions and locations. 35

Arkansas Financial Accounting Handbook • Program Code Examples: – NSLA Supplementing Salaries of Teachers (015) – State Academic Facilities Funded (070 -099) – Athletics (115) – Non-athletic extracurricular activities (116) – Special Education (200) – Gifted & Talented (270) – Alternative Education (438) 36

Arkansas Financial Accounting Handbook • Program Code Examples: – NSLA Supplementing Salaries of Teachers (015) – State Academic Facilities Funded (070 -099) – Athletics (115) – Non-athletic extracurricular activities (116) – Special Education (200) – Gifted & Talented (270) – Alternative Education (438) 36

Arkansas Financial Accounting Handbook • Subject Area – Use of this code is not currently required by ADE. School districts use this code for a variety of purposes pertaining to their own needs. State or federal reporting requirements could require designated subject area codes at some point in the future. 37

Arkansas Financial Accounting Handbook • Subject Area – Use of this code is not currently required by ADE. School districts use this code for a variety of purposes pertaining to their own needs. State or federal reporting requirements could require designated subject area codes at some point in the future. 37

Arkansas Financial Accounting Handbook • Expenditure Budget Unit – The sixteendigit number entered for all expenditures that includes the fund, source of fund, function, location, program, and subject area codes. • Revenue Budget Unit – The four-digit number entered for all revenue that includes the fund and source of fund codes. 38

Arkansas Financial Accounting Handbook • Expenditure Budget Unit – The sixteendigit number entered for all expenditures that includes the fund, source of fund, function, location, program, and subject area codes. • Revenue Budget Unit – The four-digit number entered for all revenue that includes the fund and source of fund codes. 38

Arkansas Financial Accounting Handbook • Revenue Object /Account – A five digit number that describes the revenue. • Expenditure Object – A five digit number that describes the type of expenditure: – – – Salary (61000 -61999) Employee Benefit (62000 -62999) Purchased Services (63000 -65999) Supplies and Materials (66000 -66999) Capital Outlay (67000 -67999) Other (68000 -68999) 39

Arkansas Financial Accounting Handbook • Revenue Object /Account – A five digit number that describes the revenue. • Expenditure Object – A five digit number that describes the type of expenditure: – – – Salary (61000 -61999) Employee Benefit (62000 -62999) Purchased Services (63000 -65999) Supplies and Materials (66000 -66999) Capital Outlay (67000 -67999) Other (68000 -68999) 39

Coding Changes for 2009 -2010 • Expenditures from Foundation & Enhanced Funding (FIN-09 -047, 1/29/09) • Fund/Source of Fund Codes Required for all expenditures paid with Foundation and Enhanced Educational Funding: – Fund 1 -Teacher Salary Fund – Fund 2 -Operating Fund – Source of Fund 000 – Source of Fund 100 -199 See Appendix A-1 for Adequacy Funding Matrix 40

Coding Changes for 2009 -2010 • Expenditures from Foundation & Enhanced Funding (FIN-09 -047, 1/29/09) • Fund/Source of Fund Codes Required for all expenditures paid with Foundation and Enhanced Educational Funding: – Fund 1 -Teacher Salary Fund – Fund 2 -Operating Fund – Source of Fund 000 – Source of Fund 100 -199 See Appendix A-1 for Adequacy Funding Matrix 40

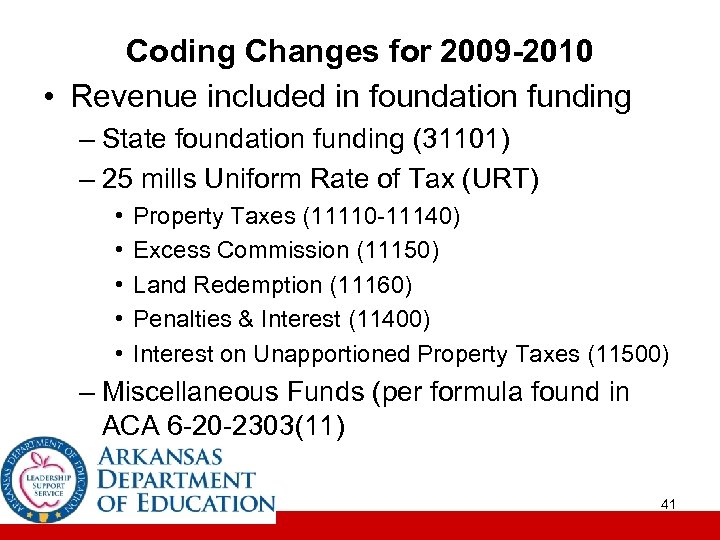

Coding Changes for 2009 -2010 • Revenue included in foundation funding – State foundation funding (31101) – 25 mills Uniform Rate of Tax (URT) • • • Property Taxes (11110 -11140) Excess Commission (11150) Land Redemption (11160) Penalties & Interest (11400) Interest on Unapportioned Property Taxes (11500) – Miscellaneous Funds (per formula found in ACA 6 -20 -2303(11) 41

Coding Changes for 2009 -2010 • Revenue included in foundation funding – State foundation funding (31101) – 25 mills Uniform Rate of Tax (URT) • • • Property Taxes (11110 -11140) Excess Commission (11150) Land Redemption (11160) Penalties & Interest (11400) Interest on Unapportioned Property Taxes (11500) – Miscellaneous Funds (per formula found in ACA 6 -20 -2303(11) 41

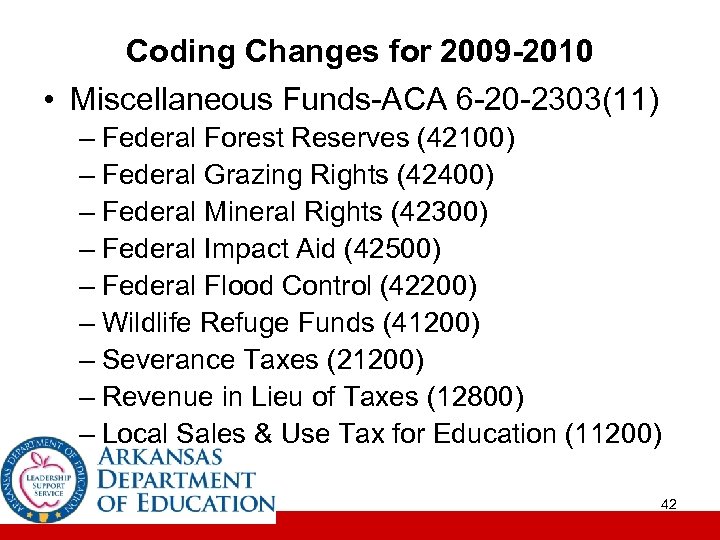

Coding Changes for 2009 -2010 • Miscellaneous Funds-ACA 6 -20 -2303(11) – Federal Forest Reserves (42100) – Federal Grazing Rights (42400) – Federal Mineral Rights (42300) – Federal Impact Aid (42500) – Federal Flood Control (42200) – Wildlife Refuge Funds (41200) – Severance Taxes (21200) – Revenue in Lieu of Taxes (12800) – Local Sales & Use Tax for Education (11200) 42

Coding Changes for 2009 -2010 • Miscellaneous Funds-ACA 6 -20 -2303(11) – Federal Forest Reserves (42100) – Federal Grazing Rights (42400) – Federal Mineral Rights (42300) – Federal Impact Aid (42500) – Federal Flood Control (42200) – Wildlife Refuge Funds (41200) – Severance Taxes (21200) – Revenue in Lieu of Taxes (12800) – Local Sales & Use Tax for Education (11200) 42

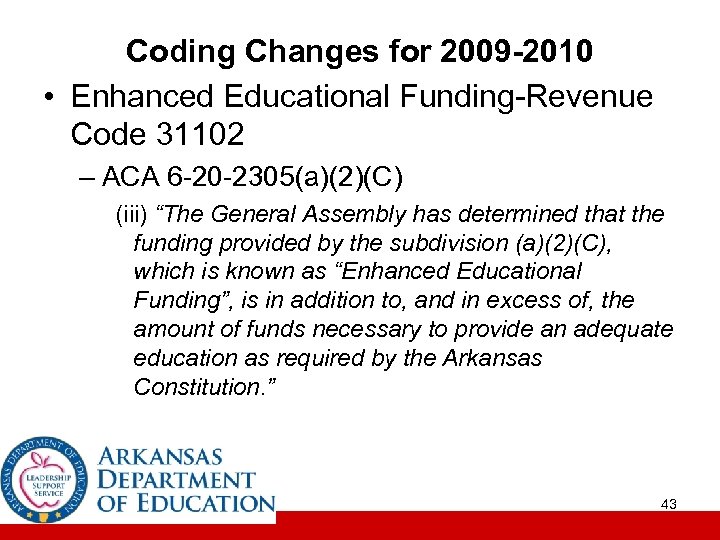

Coding Changes for 2009 -2010 • Enhanced Educational Funding-Revenue Code 31102 – ACA 6 -20 -2305(a)(2)(C) (iii) “The General Assembly has determined that the funding provided by the subdivision (a)(2)(C), which is known as “Enhanced Educational Funding”, is in addition to, and in excess of, the amount of funds necessary to provide an adequate education as required by the Arkansas Constitution. ” 43

Coding Changes for 2009 -2010 • Enhanced Educational Funding-Revenue Code 31102 – ACA 6 -20 -2305(a)(2)(C) (iii) “The General Assembly has determined that the funding provided by the subdivision (a)(2)(C), which is known as “Enhanced Educational Funding”, is in addition to, and in excess of, the amount of funds necessary to provide an adequate education as required by the Arkansas Constitution. ” 43

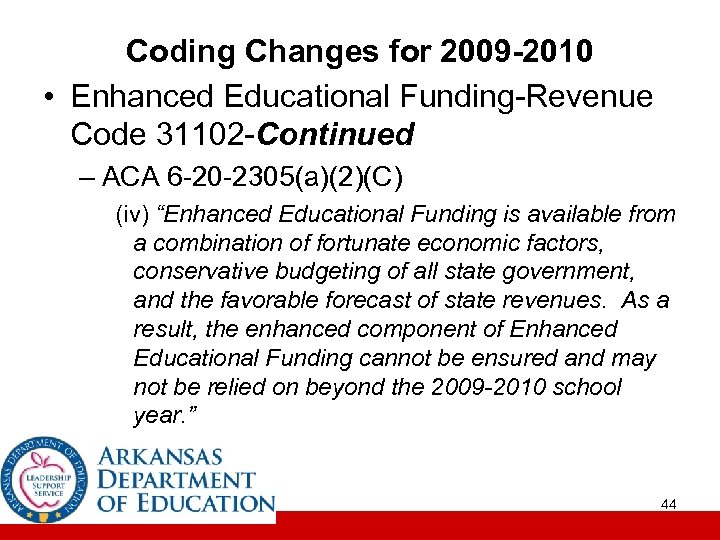

Coding Changes for 2009 -2010 • Enhanced Educational Funding-Revenue Code 31102 -Continued – ACA 6 -20 -2305(a)(2)(C) (iv) “Enhanced Educational Funding is available from a combination of fortunate economic factors, conservative budgeting of all state government, and the favorable forecast of state revenues. As a result, the enhanced component of Enhanced Educational Funding cannot be ensured and may not be relied on beyond the 2009 -2010 school year. ” 44

Coding Changes for 2009 -2010 • Enhanced Educational Funding-Revenue Code 31102 -Continued – ACA 6 -20 -2305(a)(2)(C) (iv) “Enhanced Educational Funding is available from a combination of fortunate economic factors, conservative budgeting of all state government, and the favorable forecast of state revenues. As a result, the enhanced component of Enhanced Educational Funding cannot be ensured and may not be relied on beyond the 2009 -2010 school year. ” 44

Athletic Expenditures Coding • Tracking and accounting for the amount of state funds that are used to support interschool athletic programs in public schools. (ACA 6 -202001 – 6 -20 -2004) – State funds-All money derived from state revenues, specifically including, but not limited to, distributions from the Department of Education Public School Fund Account and ad valorem property taxes distributed to a public school or school district. – Athletic expenditures-All direct and indirect expenses related to interschool athletic programs, prorated if necessary. 45

Athletic Expenditures Coding • Tracking and accounting for the amount of state funds that are used to support interschool athletic programs in public schools. (ACA 6 -202001 – 6 -20 -2004) – State funds-All money derived from state revenues, specifically including, but not limited to, distributions from the Department of Education Public School Fund Account and ad valorem property taxes distributed to a public school or school district. – Athletic expenditures-All direct and indirect expenses related to interschool athletic programs, prorated if necessary. 45

Athletic Expenditures Coding – Interschool athletic program: • Any athletic program that is organized primarily for the purpose of competing with other schools, public or private; or • Any athletic program that is subject to regulation by the Arkansas Activities Association. 46

Athletic Expenditures Coding – Interschool athletic program: • Any athletic program that is organized primarily for the purpose of competing with other schools, public or private; or • Any athletic program that is subject to regulation by the Arkansas Activities Association. 46

Athletic Expenditures Coding • Athletic expenditures to include but not be limited to: – Salaries and fringe benefits related to athletic programs. – Travel, including bus-related operation and maintenance, to and from any interschool athletic program event for students, faculty, spirit groups, band, or patrons of the school district. 47

Athletic Expenditures Coding • Athletic expenditures to include but not be limited to: – Salaries and fringe benefits related to athletic programs. – Travel, including bus-related operation and maintenance, to and from any interschool athletic program event for students, faculty, spirit groups, band, or patrons of the school district. 47

Athletic Expenditures Coding • Athletic expenditures to include but not be limited to: Continued – Equipment – Meals – Supplies – Property and medical insurance – Medical expenses – Utilities – Maintenance of facilities 48

Athletic Expenditures Coding • Athletic expenditures to include but not be limited to: Continued – Equipment – Meals – Supplies – Property and medical insurance – Medical expenses – Utilities – Maintenance of facilities 48

Athletic Expenditures Coding • Rules Governing Athletic Expenditures for Public School Districts-September 2007 (See Appendix B-1) • Commissioner’s Memo COM-08 -156, 6/06/2008 Athletic Expenditures and Allocations (See Appendix B-2) • Commissioner’s Memo FIN-10 -049, 12/30/2009 – Athletic Expenditure Audits (See Appendix B-3) • Commissioner’s Memo FIN-10 -051, 1/14/2010 – FY 10 Transportation Rates (See Appendix B-4) 49

Athletic Expenditures Coding • Rules Governing Athletic Expenditures for Public School Districts-September 2007 (See Appendix B-1) • Commissioner’s Memo COM-08 -156, 6/06/2008 Athletic Expenditures and Allocations (See Appendix B-2) • Commissioner’s Memo FIN-10 -049, 12/30/2009 – Athletic Expenditure Audits (See Appendix B-3) • Commissioner’s Memo FIN-10 -051, 1/14/2010 – FY 10 Transportation Rates (See Appendix B-4) 49

Athletic Expenditures Coding • Problems reported by Arkansas Division of Legislative Audit in Special Report on Athletic Expenditures. – For 2008 -2009 (48 SE Arkansas districts reviewed) • Review adjustments totaled $3. 4 M (14. 7%) • Athletic expenditures for 23 districts adjusted in excess of 10%, ranging from $7, 759 to $2. 0 M. • 27 districts improperly allocated coaches’ salaries • 9 districts improperly allocated construction costs 50

Athletic Expenditures Coding • Problems reported by Arkansas Division of Legislative Audit in Special Report on Athletic Expenditures. – For 2008 -2009 (48 SE Arkansas districts reviewed) • Review adjustments totaled $3. 4 M (14. 7%) • Athletic expenditures for 23 districts adjusted in excess of 10%, ranging from $7, 759 to $2. 0 M. • 27 districts improperly allocated coaches’ salaries • 9 districts improperly allocated construction costs 50

Athletic Expenditures Coding – For 2007 -2008 (51 NW Arkansas districts reviewed) • Review adjustments totaled $3. 3 M (6. 8%) • Athletic expenditures for 14 districts adjusted in excess of 10%, ranging from $11, 694 to $457, 191. • 4 districts did not properly code athletic related construction costs. • 18 districts did not code the salaries of spirit group sponsors and athletic directors as athletic expenditure. • Program code 115 not used in the budget unit of all athletic expenditures. 51

Athletic Expenditures Coding – For 2007 -2008 (51 NW Arkansas districts reviewed) • Review adjustments totaled $3. 3 M (6. 8%) • Athletic expenditures for 14 districts adjusted in excess of 10%, ranging from $11, 694 to $457, 191. • 4 districts did not properly code athletic related construction costs. • 18 districts did not code the salaries of spirit group sponsors and athletic directors as athletic expenditure. • Program code 115 not used in the budget unit of all athletic expenditures. 51

Athletic Expenditures Coding – For 2007 -2008 (51 NW Arkansas districts reviewed)-Continued • 17 districts coded positions such as gatekeepers and bus drivers to “direct instruction-function 1150”. • 16 districts improperly allocated coaches’ salaries. 52

Athletic Expenditures Coding – For 2007 -2008 (51 NW Arkansas districts reviewed)-Continued • 17 districts coded positions such as gatekeepers and bus drivers to “direct instruction-function 1150”. • 16 districts improperly allocated coaches’ salaries. 52

Athletic Expenditures Coding – For 2006 -2007 (50 Central Arkansas districts reviewed) • Review adjustments totaled $4. 3 M (18. 9%) • Athletic expenditures for 19 districts adjusted in excess of 10%, ranging from $7, 518 to $1. 1 M. • 9 districts failed to properly code athletic related construction costs. • Salaries of spirit group sponsors and athletic directors not coded to athletics. • Function code 1150 for “direct instruction” used for all athletic expenditures. 53

Athletic Expenditures Coding – For 2006 -2007 (50 Central Arkansas districts reviewed) • Review adjustments totaled $4. 3 M (18. 9%) • Athletic expenditures for 19 districts adjusted in excess of 10%, ranging from $7, 518 to $1. 1 M. • 9 districts failed to properly code athletic related construction costs. • Salaries of spirit group sponsors and athletic directors not coded to athletics. • Function code 1150 for “direct instruction” used for all athletic expenditures. 53

Athletic Expenditures Coding – For 2006 -2007 (50 Central Arkansas districts reviewed)-Continued • 20 districts improperly allocated coaches’ base contract amounts between athletics and instruction. • www. arklegaudit. gov Select “Special Reports” – on the next screen type “Athletic Expenditures” in the search box. 54

Athletic Expenditures Coding – For 2006 -2007 (50 Central Arkansas districts reviewed)-Continued • 20 districts improperly allocated coaches’ base contract amounts between athletics and instruction. • www. arklegaudit. gov Select “Special Reports” – on the next screen type “Athletic Expenditures” in the search box. 54

Athletic Expenditures Coding • Sanctions for improper coding of Athletic expenditures (or other material misstatements in reported data): – Section 8. 00 of ADE Rule-Arkansas Financial Accounting and Reporting System and Annual Training Requirements: (See Appendix B-5) • Fiscal Distress (Also in Rule Governing Athletic Expenditures for Public School Districts-9. 00) • Probation, suspension or revocation of professional license. • Accreditation citation/probation. 55

Athletic Expenditures Coding • Sanctions for improper coding of Athletic expenditures (or other material misstatements in reported data): – Section 8. 00 of ADE Rule-Arkansas Financial Accounting and Reporting System and Annual Training Requirements: (See Appendix B-5) • Fiscal Distress (Also in Rule Governing Athletic Expenditures for Public School Districts-9. 00) • Probation, suspension or revocation of professional license. • Accreditation citation/probation. 55

Chapter 4 of Arkansas Financial Accounting Handbook- “A Guide for a Minimum Property Accounting System” • Expenditures for acquiring capital assets, including land, buildings, equipment, vehicles, furniture, technology related hardware and software, and infrastructure are coded to object codes in the 6710067499 range if the unit cost is $1, 000 or more. 56

Chapter 4 of Arkansas Financial Accounting Handbook- “A Guide for a Minimum Property Accounting System” • Expenditures for acquiring capital assets, including land, buildings, equipment, vehicles, furniture, technology related hardware and software, and infrastructure are coded to object codes in the 6710067499 range if the unit cost is $1, 000 or more. 56

Chapter 4 of Arkansas Financial Accounting Handbook- “A Guide for a Minimum Property Accounting System” • Capital Outlay must meet all of the following criteria: – Retains original shape, appearance and/or character with use. – Does not lose its identity through fabrication or incorporation into a different or more complex unit or substance. 57

Chapter 4 of Arkansas Financial Accounting Handbook- “A Guide for a Minimum Property Accounting System” • Capital Outlay must meet all of the following criteria: – Retains original shape, appearance and/or character with use. – Does not lose its identity through fabrication or incorporation into a different or more complex unit or substance. 57

Chapter 4 of Arkansas Financial Accounting Handbook- “A Guide for a Minimum Property Accounting System” – It is non-expendable; that is, if the item is damaged or some of its parts are lost or worn out, it is more feasible to repair the item than to replace it with an entirely new unit. – Under normal conditions of use, including reasonable care and maintenance, it can be expected to serve its principal purpose for at least two years. – Unit cost of at least $1, 000. 58

Chapter 4 of Arkansas Financial Accounting Handbook- “A Guide for a Minimum Property Accounting System” – It is non-expendable; that is, if the item is damaged or some of its parts are lost or worn out, it is more feasible to repair the item than to replace it with an entirely new unit. – Under normal conditions of use, including reasonable care and maintenance, it can be expected to serve its principal purpose for at least two years. – Unit cost of at least $1, 000. 58

Coding ARRA Revenue & Expenditures • Commissioner’s Memo FIN-09 -077, 5/07/2009, provides the following for American Recovery and Reinvestment Act (ARRA) funds: – Fund/Source of Fund Codes – Revenue Codes – CFDA# – Program Code for Expenditures 59

Coding ARRA Revenue & Expenditures • Commissioner’s Memo FIN-09 -077, 5/07/2009, provides the following for American Recovery and Reinvestment Act (ARRA) funds: – Fund/Source of Fund Codes – Revenue Codes – CFDA# – Program Code for Expenditures 59

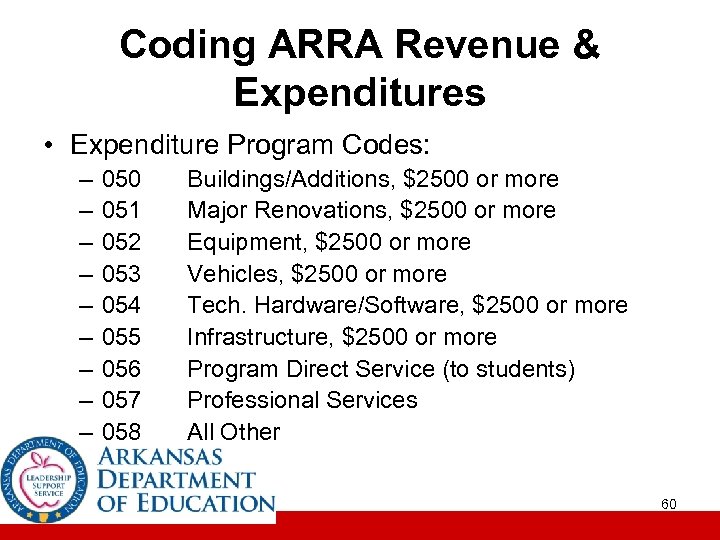

Coding ARRA Revenue & Expenditures • Expenditure Program Codes: – – – – – 050 051 052 053 054 055 056 057 058 Buildings/Additions, $2500 or more Major Renovations, $2500 or more Equipment, $2500 or more Vehicles, $2500 or more Tech. Hardware/Software, $2500 or more Infrastructure, $2500 or more Program Direct Service (to students) Professional Services All Other 60

Coding ARRA Revenue & Expenditures • Expenditure Program Codes: – – – – – 050 051 052 053 054 055 056 057 058 Buildings/Additions, $2500 or more Major Renovations, $2500 or more Equipment, $2500 or more Vehicles, $2500 or more Tech. Hardware/Software, $2500 or more Infrastructure, $2500 or more Program Direct Service (to students) Professional Services All Other 60

Fiscal Assessment and Accountability Program • Indicators of fiscal distress (ACA 6 -20 -1904): – Declining balance determined to jeopardize the fiscal integrity of a school district or education service cooperative. – An act or violation determined to jeopardize the fiscal integrity of a school district or cooperative. – Any other fiscal condition of a school district or cooperative deemed to have a detrimental negative impact on the continuation of educational services by that district or cooperative. 61

Fiscal Assessment and Accountability Program • Indicators of fiscal distress (ACA 6 -20 -1904): – Declining balance determined to jeopardize the fiscal integrity of a school district or education service cooperative. – An act or violation determined to jeopardize the fiscal integrity of a school district or cooperative. – Any other fiscal condition of a school district or cooperative deemed to have a detrimental negative impact on the continuation of educational services by that district or cooperative. 61

Fiscal Assessment and Accountability Program • Fiscal Integrity – To comply completely and accurately with financial management, accounting, auditing, and reporting procedures and facilities management procedures as required by state or federal laws and regulations in a forthright and timely manner. 62

Fiscal Assessment and Accountability Program • Fiscal Integrity – To comply completely and accurately with financial management, accounting, auditing, and reporting procedures and facilities management procedures as required by state or federal laws and regulations in a forthright and timely manner. 62

Fiscal Assessment and Accountability Program • Examples of acts or violations: – Failing to properly maintain facilities – Violation of fire, health or safety codes – Violation of construction codes – State or federal audit exceptions or violations – Failure to provide timely and accurate required financial reports – Insufficient funds to cover legal obligations – Failure to meet state expenditure requirements – Failure to comply with purchasing or bid requirements – Default on debt obligations – Material variances between budget and actual – Failure to comply with audit requirements 63

Fiscal Assessment and Accountability Program • Examples of acts or violations: – Failing to properly maintain facilities – Violation of fire, health or safety codes – Violation of construction codes – State or federal audit exceptions or violations – Failure to provide timely and accurate required financial reports – Insufficient funds to cover legal obligations – Failure to meet state expenditure requirements – Failure to comply with purchasing or bid requirements – Default on debt obligations – Material variances between budget and actual – Failure to comply with audit requirements 63

Fiscal Assessment and Accountability Program • Fiscal Distress Early Intervention (Act 798 of 2009) – Commissioner’s Memo FIN-10 -018 provides a checklist superintendents can use to determine if early intervention should be considered. – Early intervention is provided by ADE if it is determined that a school district has experienced two or more indicators at a “nonmaterial” level —but without intervention could place the district in fiscal distress. – Communication requirement is a two-way street: • By August 31 ADE notifies superintendent if it is aware of two or more nonmaterial indicators having occurred in the prior school year. • By August 31 the superintendent notifies ADE if he or she is aware of two or more nonmaterial indicators having occurred in the prior school year. • ADE and superintendent to review all data and make a determination regarding the need for early intervention. 64

Fiscal Assessment and Accountability Program • Fiscal Distress Early Intervention (Act 798 of 2009) – Commissioner’s Memo FIN-10 -018 provides a checklist superintendents can use to determine if early intervention should be considered. – Early intervention is provided by ADE if it is determined that a school district has experienced two or more indicators at a “nonmaterial” level —but without intervention could place the district in fiscal distress. – Communication requirement is a two-way street: • By August 31 ADE notifies superintendent if it is aware of two or more nonmaterial indicators having occurred in the prior school year. • By August 31 the superintendent notifies ADE if he or she is aware of two or more nonmaterial indicators having occurred in the prior school year. • ADE and superintendent to review all data and make a determination regarding the need for early intervention. 64

Fiscal Assessment and Accountability Program • Fiscal Distress Early Intervention (Act 798 of 2009)-Continued – Within 30 days of determination ADE shall: • Provides notice to the school district’s superintendent and board of directors that: – Describes the nonmaterial indicators – Identifies the support available from ADE – The board of directors shall place on the agenda for its next regularly scheduled meeting a discussion of the notice of nonmaterial indicators of fiscal distress. 65

Fiscal Assessment and Accountability Program • Fiscal Distress Early Intervention (Act 798 of 2009)-Continued – Within 30 days of determination ADE shall: • Provides notice to the school district’s superintendent and board of directors that: – Describes the nonmaterial indicators – Identifies the support available from ADE – The board of directors shall place on the agenda for its next regularly scheduled meeting a discussion of the notice of nonmaterial indicators of fiscal distress. 65

School Management Issues and Updates 66

School Management Issues and Updates 66

Frequent Audit Findings 2008 -2009 • Review of 237 Audits (85% of total) – 462 Audit Findings • 201 findings related to failure to maintain time certification records for federally funded personnel. • 185 findings related to internal control and lack of segregation of duties. (See Appendix C-1) 67

Frequent Audit Findings 2008 -2009 • Review of 237 Audits (85% of total) – 462 Audit Findings • 201 findings related to failure to maintain time certification records for federally funded personnel. • 185 findings related to internal control and lack of segregation of duties. (See Appendix C-1) 67

Time Distribution • Federal law requires for all employees paid with federal funds. This includes Child Nutrition and Special Education. • Time distribution records are also called PARs (personnel activity reports). • “Time distribution” refers to the requirement that an employee paid from federal funds “allocate” his time among the funding sources that pay his salary. • Records must be maintained that reflect this distribution of effort, or time distribution records. • Rules for Time Distribution are found in OMB Circular A-87. • Federal funds can pay for goods or services to the extent that there is a benefit to the federal program. • This benefit must be documented. 68

Time Distribution • Federal law requires for all employees paid with federal funds. This includes Child Nutrition and Special Education. • Time distribution records are also called PARs (personnel activity reports). • “Time distribution” refers to the requirement that an employee paid from federal funds “allocate” his time among the funding sources that pay his salary. • Records must be maintained that reflect this distribution of effort, or time distribution records. • Rules for Time Distribution are found in OMB Circular A-87. • Federal funds can pay for goods or services to the extent that there is a benefit to the federal program. • This benefit must be documented. 68

Time Distribution Records Frequency: – Does the employee work on one federal program or multiple programs? Examples: – An employee working 50% of time for Title I and 50% for district would have two programs. – An employee working 50% for Title I and 50% for Title V would also have two programs. – An employee working 100% of his time on Title I would have a single program. 69

Time Distribution Records Frequency: – Does the employee work on one federal program or multiple programs? Examples: – An employee working 50% of time for Title I and 50% for district would have two programs. – An employee working 50% for Title I and 50% for Title V would also have two programs. – An employee working 100% of his time on Title I would have a single program. 69

Time Distribution Records (Continued) • Example: – Targeted Assisted school wants to set up a computer lab. An aide works in the lab. The lab is used for Title I - 50% of the time. District uses the lab 50% of the time. Time Distribution Records would indicate the aide time for federal funds Title I – 50% of time and district funds 50% of time. – If appropriate time distribution records are maintained to document services, then Title I can pay for half the aide’s salary and benefits. 70

Time Distribution Records (Continued) • Example: – Targeted Assisted school wants to set up a computer lab. An aide works in the lab. The lab is used for Title I - 50% of the time. District uses the lab 50% of the time. Time Distribution Records would indicate the aide time for federal funds Title I – 50% of time and district funds 50% of time. – If appropriate time distribution records are maintained to document services, then Title I can pay for half the aide’s salary and benefits. 70

Time Distribution Record Keeping • Time distribution records are above and beyond the normal payroll records used by an organization to document time and attendance. • If an employee works for one federal program, then time distribution records are simple. Periodic, semi-annual certifications signed and dated by employee or supervisor with firsthand knowledge of the work performed are required – twice a year. • Federally-funded employees working for multiple programs must keep monthly Personnel Activity Reports (PARs). Must be signed and dated by the employee, detailing the actual time spent engaged in the various programs. 71

Time Distribution Record Keeping • Time distribution records are above and beyond the normal payroll records used by an organization to document time and attendance. • If an employee works for one federal program, then time distribution records are simple. Periodic, semi-annual certifications signed and dated by employee or supervisor with firsthand knowledge of the work performed are required – twice a year. • Federally-funded employees working for multiple programs must keep monthly Personnel Activity Reports (PARs). Must be signed and dated by the employee, detailing the actual time spent engaged in the various programs. 71

Time Distribution Record Keeping (Continued) • Maintain PARS in central audit file by fiscal year. • Time Distribution rules apply to teachers paid with federal funds. This includes Special Education. • Can I use lesson plans as the required time record? • Yes: – – If written schedules were followed. If notes are made after the fact to indicate completion of each activity. If lesson plans account for the total time compensated for. If lesson plans are prepared at least monthly and coincide with pay periods. – If completed lesson plan is signed by the employee. – If lesson plans are retained and maintained as time and attendance. 72

Time Distribution Record Keeping (Continued) • Maintain PARS in central audit file by fiscal year. • Time Distribution rules apply to teachers paid with federal funds. This includes Special Education. • Can I use lesson plans as the required time record? • Yes: – – If written schedules were followed. If notes are made after the fact to indicate completion of each activity. If lesson plans account for the total time compensated for. If lesson plans are prepared at least monthly and coincide with pay periods. – If completed lesson plan is signed by the employee. – If lesson plans are retained and maintained as time and attendance. 72

Blanket PARS Certification • If several employees work full time on the same program, then blanket semiannual certification can be filed. • The supervisor filing the blanket certification must have actual, firsthand knowledge of the work that the employees perform. • Required once every six months. 73

Blanket PARS Certification • If several employees work full time on the same program, then blanket semiannual certification can be filed. • The supervisor filing the blanket certification must have actual, firsthand knowledge of the work that the employees perform. • Required once every six months. 73

Sample Personnel Activity Reports/Time Certification Forms Commissioner’s Memo FIN-10 -041 dated 11/06/2009 includes Sample PAR and Time Certification forms. 74

Sample Personnel Activity Reports/Time Certification Forms Commissioner’s Memo FIN-10 -041 dated 11/06/2009 includes Sample PAR and Time Certification forms. 74

Solving Internal Control Audit Findings 75 75

Solving Internal Control Audit Findings 75 75

Internal Control A process to: • Create reliability of financial reporting • Assess risk • Control preventable loss • Promote efficiency and effectiveness of operations • Ensure compliance with applicable law/rules • Promote public trust 76 76

Internal Control A process to: • Create reliability of financial reporting • Assess risk • Control preventable loss • Promote efficiency and effectiveness of operations • Ensure compliance with applicable law/rules • Promote public trust 76 76

Purpose of Internal Control Policy Internal control gives the school board and administration reasonable assurance that the district/charter will: • Achieve its goals • Operate effectively and efficiently • Provide accurate and reliable financial data • Operate in compliance with current federal and state laws and rules 77 77

Purpose of Internal Control Policy Internal control gives the school board and administration reasonable assurance that the district/charter will: • Achieve its goals • Operate effectively and efficiently • Provide accurate and reliable financial data • Operate in compliance with current federal and state laws and rules 77 77

What are the Goals of Internal Control? • • Limit opportunity for theft or unauthorized use Ensure proper and legal expenditure/disbursement Detect errors and fraud in a timely manner Alert management of relevant required courses of action Provide accurate financial information Provide documentation of proper accounting Provides reasonable assurance that misstatements, losses, noncompliance with laws/rules would be prevented Promote public trust and confidence 78 78

What are the Goals of Internal Control? • • Limit opportunity for theft or unauthorized use Ensure proper and legal expenditure/disbursement Detect errors and fraud in a timely manner Alert management of relevant required courses of action Provide accurate financial information Provide documentation of proper accounting Provides reasonable assurance that misstatements, losses, noncompliance with laws/rules would be prevented Promote public trust and confidence 78 78

Five Components of Internal Control 1. Control Environment 2. Risk Assessment 3. Control Activities 4. Information and Communication 5. Monitoring See Appendix D-1 for Discussion of Each Component 79 79

Five Components of Internal Control 1. Control Environment 2. Risk Assessment 3. Control Activities 4. Information and Communication 5. Monitoring See Appendix D-1 for Discussion of Each Component 79 79

Key Control Activity • Segregation of Duties – Lack of segregation of duties is one of the most frequent audit findings. – Idea is for individuals responsible for making entries to the general ledger, to not have access to subsidiary records that support entries to the general ledger. – Districts with one person accounting offices often have inadequate segregation of duties. 80 80

Key Control Activity • Segregation of Duties – Lack of segregation of duties is one of the most frequent audit findings. – Idea is for individuals responsible for making entries to the general ledger, to not have access to subsidiary records that support entries to the general ledger. – Districts with one person accounting offices often have inadequate segregation of duties. 80 80

Control Activities (Continued) • Examples of Needed Duty Segregation: – Authorization and maintenance of approved vendor files and entry of accounts payable. – Set up new employee records and issue payroll checks. – Fixed asset physical inventory and maintain fixed asset inventory in computer system. – Process checks or bank deposits and reconcile bank account. 81 81

Control Activities (Continued) • Examples of Needed Duty Segregation: – Authorization and maintenance of approved vendor files and entry of accounts payable. – Set up new employee records and issue payroll checks. – Fixed asset physical inventory and maintain fixed asset inventory in computer system. – Process checks or bank deposits and reconcile bank account. 81 81

Control Activities (Continued) • Cost/Benefit analysis for having adequate segregation of duties: – The cost of adding personnel can be easily measured. – The benefit of having adequate segregation of duties is not as easily measured. – The superintendent and the board should carefully assess the risk of having too much control in the hands of one person. 82 82

Control Activities (Continued) • Cost/Benefit analysis for having adequate segregation of duties: – The cost of adding personnel can be easily measured. – The benefit of having adequate segregation of duties is not as easily measured. – The superintendent and the board should carefully assess the risk of having too much control in the hands of one person. 82 82

How will you know Internal Controls are working? 1. Risks are appropriately identified and managed; 2. Interaction of the various governance groups occurs; 3. Significant financial, managerial, and operating information is accurate, reliable, and timely; 4. Employees’ conduct and actions are in compliance with policies, applicable laws and regulations; 5. Employees are trained to be responsible for notifying the superintendent/director of irregular circumstances; 6. Resources are acquired economically, used efficiently, and adequately safeguarded; 7. Quality and continuous improvement are encouraged; 8. Significant regulatory issues are recognized and addressed appropriately. 83 83

How will you know Internal Controls are working? 1. Risks are appropriately identified and managed; 2. Interaction of the various governance groups occurs; 3. Significant financial, managerial, and operating information is accurate, reliable, and timely; 4. Employees’ conduct and actions are in compliance with policies, applicable laws and regulations; 5. Employees are trained to be responsible for notifying the superintendent/director of irregular circumstances; 6. Resources are acquired economically, used efficiently, and adequately safeguarded; 7. Quality and continuous improvement are encouraged; 8. Significant regulatory issues are recognized and addressed appropriately. 83 83

Other School Management Issues and Updates 84

Other School Management Issues and Updates 84

Federal Contracts Concerns: 1. Davis-Bacon Act (DBA) 2. Debarment (EDGAR, 34 CFR Part 85 covers debarment for contracts which include federal funds. ) Legislative Audit and the U. S. Department of Labor are monitoring school districts’ compliance on these issues. 85 85

Federal Contracts Concerns: 1. Davis-Bacon Act (DBA) 2. Debarment (EDGAR, 34 CFR Part 85 covers debarment for contracts which include federal funds. ) Legislative Audit and the U. S. Department of Labor are monitoring school districts’ compliance on these issues. 85 85

Davis-Bacon Act (DBA) 1. Applies to federal contracts of $2, 000 or more. 2. Applies to federal contracts for construction, renovation, and/or repair. This would include painting, running conduit, and installing white boards. 3. Applies to the entire project if any part of the project is paid with federal funds. 86 86

Davis-Bacon Act (DBA) 1. Applies to federal contracts of $2, 000 or more. 2. Applies to federal contracts for construction, renovation, and/or repair. This would include painting, running conduit, and installing white boards. 3. Applies to the entire project if any part of the project is paid with federal funds. 86 86

Davis-Bacon Act (DBA) 4. District is responsible for ensuring that contractors comply with DBA. 5. Monitoring Requirements include: * Requiring contractors to provide weekly copies of certified payroll with original signature and maintain for audit purposes. * Verifying rates in all classes of workers. 87 87

Davis-Bacon Act (DBA) 4. District is responsible for ensuring that contractors comply with DBA. 5. Monitoring Requirements include: * Requiring contractors to provide weekly copies of certified payroll with original signature and maintain for audit purposes. * Verifying rates in all classes of workers. 87 87

Davis-Bacon Act (DBA) * Conducting interviews to verify pay received and hours worked per week. (Prevailing rate is the rate of pay established in approved contract. Rate may change in market, but not for the approved contract. ) 88 88

Davis-Bacon Act (DBA) * Conducting interviews to verify pay received and hours worked per week. (Prevailing rate is the rate of pay established in approved contract. Rate may change in market, but not for the approved contract. ) 88 88

Davis-Bacon Act (DBA) 6. Legislative Audit and the U. S. Department of Labor are monitoring to determine district compliance. 7. Required to keep all records and documentation for three (3) years under federal law. 89 89

Davis-Bacon Act (DBA) 6. Legislative Audit and the U. S. Department of Labor are monitoring to determine district compliance. 7. Required to keep all records and documentation for three (3) years under federal law. 89 89

Davis-Bacon Act (DBA) 8. It is the Department of Labor’s interpretation that any school district, charter school, or educational cooperative that accepts funds for construction purposes assumes the role of the federal government becoming the “Contracting Officer” referred to in the wage law. 90

Davis-Bacon Act (DBA) 8. It is the Department of Labor’s interpretation that any school district, charter school, or educational cooperative that accepts funds for construction purposes assumes the role of the federal government becoming the “Contracting Officer” referred to in the wage law. 90

Debarment The Education Department General Administrative Regulations (EDGAR)34 CFR Part 85 contains the requirements for entities receiving contracts paid with federal funds. Part 85 covers all federal education programs including ARRA. 91 91

Debarment The Education Department General Administrative Regulations (EDGAR)34 CFR Part 85 contains the requirements for entities receiving contracts paid with federal funds. Part 85 covers all federal education programs including ARRA. 91 91

Debarment The Excluded Parties List System (EPLS) identifies parties excluded from receiving federal contracts. EPLS includes the names and other valid information for all contractors debarred, suspended, excluded, or disqualified for procurement contracts. This list can be found at https: //www. epls. gov Commissioners Memo FIN-10 -047 found at http: //arkedu. state. ar. us/commemos/customer. cgi contains the Arkansas Department of Education guidance on debarment. 92 92

Debarment The Excluded Parties List System (EPLS) identifies parties excluded from receiving federal contracts. EPLS includes the names and other valid information for all contractors debarred, suspended, excluded, or disqualified for procurement contracts. This list can be found at https: //www. epls. gov Commissioners Memo FIN-10 -047 found at http: //arkedu. state. ar. us/commemos/customer. cgi contains the Arkansas Department of Education guidance on debarment. 92 92

Debarment Contractors debarred are excluded from receiving contracts, and districts shall not award contracts to these contractors. After receiving bids or proposals, the district shall review the EPLS. Keep a printout from EPLS to document the district verified the contractor’s status and complied with the requirements. 93 93

Debarment Contractors debarred are excluded from receiving contracts, and districts shall not award contracts to these contractors. After receiving bids or proposals, the district shall review the EPLS. Keep a printout from EPLS to document the district verified the contractor’s status and complied with the requirements. 93 93

Debarment Bids received from debarred contractors shall be entered on the list of bids and rejected. Prior to the awarding of the contract, the district shall again review EPLS to ensure that no contract is made with a debarred contractor. 94 94

Debarment Bids received from debarred contractors shall be entered on the list of bids and rejected. Prior to the awarding of the contract, the district shall again review EPLS to ensure that no contract is made with a debarred contractor. 94 94

Debarment applies when federal contract is expected to equal or exceed $25, 000. Debarment shall not exceed three (3) years. Districts need to verify status before awarding a federal contract equal to or exceeding $25, 000. 95 95

Debarment applies when federal contract is expected to equal or exceed $25, 000. Debarment shall not exceed three (3) years. Districts need to verify status before awarding a federal contract equal to or exceeding $25, 000. 95 95

Debarment Three methods to comply with debarment requirements as per Legislative Audit: 1. Verify status of contractor by accessing the EPLS system. Print report to verify for audit. 2. Vendor could provide certification that they have not been debarred and are not currently on the excluded parties list. 96 96

Debarment Three methods to comply with debarment requirements as per Legislative Audit: 1. Verify status of contractor by accessing the EPLS system. Print report to verify for audit. 2. Vendor could provide certification that they have not been debarred and are not currently on the excluded parties list. 96 96

Debarment 3. District can make it a requirement of the contract that in order to contract with any vendor where the cost of the contract exceeds $25, 000 that the contract must include a statement that the vendor is not currently on the federal government excluded parties list (EPLS). 97 97

Debarment 3. District can make it a requirement of the contract that in order to contract with any vendor where the cost of the contract exceeds $25, 000 that the contract must include a statement that the vendor is not currently on the federal government excluded parties list (EPLS). 97 97

Homeless Expenditure Requirements Districts and Charter Schools are required to serve Homeless children. Districts are required to reserve Title I, Part A funds as “may be necessary” to serve Homeless students attending both Title I and non-Title I schools. 98

Homeless Expenditure Requirements Districts and Charter Schools are required to serve Homeless children. Districts are required to reserve Title I, Part A funds as “may be necessary” to serve Homeless students attending both Title I and non-Title I schools. 98

Homeless Expenditure Requirements Services provided to Homeless students must be comparable to services provided to students attending Title I schools. Districts may provide Homeless students with educationally-related support services such as tutoring, an item of clothing to meet a school’s dress or uniform requirements, summer school, medical, dental, eyeglasses, immunization, and/or school supplies. (Must document not readily available from other sources. ) 99

Homeless Expenditure Requirements Services provided to Homeless students must be comparable to services provided to students attending Title I schools. Districts may provide Homeless students with educationally-related support services such as tutoring, an item of clothing to meet a school’s dress or uniform requirements, summer school, medical, dental, eyeglasses, immunization, and/or school supplies. (Must document not readily available from other sources. ) 99

Homeless Expenditure Requirements Title I funds may not be used to pay for a Homeless student’s living expenses, driver’s license fees, extracurricular activities, or transportation to and from their school of origin. Homeless students may receive services not offered to other Title I students. 100

Homeless Expenditure Requirements Title I funds may not be used to pay for a Homeless student’s living expenses, driver’s license fees, extracurricular activities, or transportation to and from their school of origin. Homeless students may receive services not offered to other Title I students. 100

Homeless Student Definition: Children who lack a fixed, regular, and adequate nighttime residence including: • Students who are sharing housing with friends or relatives because of a loss or hardship. • Families living in transitional housing that is designed to move people from homelessness to a housed state. • Children who are abandoned in hospitals or are awaiting foster care. 101

Homeless Student Definition: Children who lack a fixed, regular, and adequate nighttime residence including: • Students who are sharing housing with friends or relatives because of a loss or hardship. • Families living in transitional housing that is designed to move people from homelessness to a housed state. • Children who are abandoned in hospitals or are awaiting foster care. 101

Homeless Student Definition: • Children living in hotels and motels that are designed for low-income residents. • Students living in inadequate housing or housing not appropriate for habitation, such as campgrounds, cars, parks, public spaces, abandoned buildings, bus or train stations, or other inadequate facilities like garages or sheds. 102

Homeless Student Definition: • Children living in hotels and motels that are designed for low-income residents. • Students living in inadequate housing or housing not appropriate for habitation, such as campgrounds, cars, parks, public spaces, abandoned buildings, bus or train stations, or other inadequate facilities like garages or sheds. 102

Homeless Student Definition: • Unaccompanied youth who have run away or been “pushed out” by parents and are living in shelters or with friends or relatives. • Migrant students who qualify as homeless because of their living situation. All Homeless students are eligible for Title I regardless of whether they are enrolled in a Title I school or are struggling academically. 103

Homeless Student Definition: • Unaccompanied youth who have run away or been “pushed out” by parents and are living in shelters or with friends or relatives. • Migrant students who qualify as homeless because of their living situation. All Homeless students are eligible for Title I regardless of whether they are enrolled in a Title I school or are struggling academically. 103

Required Set Aside Homeless Students • Federal law requires that districts set aside funds to serve Homeless students. • Statute does not define a formula for determining the appropriate amount to set aside. 104

Required Set Aside Homeless Students • Federal law requires that districts set aside funds to serve Homeless students. • Statute does not define a formula for determining the appropriate amount to set aside. 104

Required Set Aside Homeless Students Suggested method: Obtain estimated count of Homeless students in district and multiply the number by the district’s Title I, Part A per pupil allocation. Set that amount aside in the ACSIP budget. Currently, Homeless is budgeted under “ 3351 Welfare. ” 105

Required Set Aside Homeless Students Suggested method: Obtain estimated count of Homeless students in district and multiply the number by the district’s Title I, Part A per pupil allocation. Set that amount aside in the ACSIP budget. Currently, Homeless is budgeted under “ 3351 Welfare. ” 105

Homeless Caution Recent states monitoring has cited districts for under-identifying homeless students. 106

Homeless Caution Recent states monitoring has cited districts for under-identifying homeless students. 106

Identifying Homeless Students Use the comprehensive Homeless definitions in estimating Homeless students. Do not pick out one or two of the Homeless definitions, use all seven! 107

Identifying Homeless Students Use the comprehensive Homeless definitions in estimating Homeless students. Do not pick out one or two of the Homeless definitions, use all seven! 107

Homeless Resource U. S. Department of Education Non. Regulatory Guidance for Education for Homeless Children and Youth Program can be found at the website below: http: //www. ed. gov/programs/homeless/guida nce. doc 3/15/2018 108

Homeless Resource U. S. Department of Education Non. Regulatory Guidance for Education for Homeless Children and Youth Program can be found at the website below: http: //www. ed. gov/programs/homeless/guida nce. doc 3/15/2018 108

ESEA MAINTENANCE OF EFFORT Section 1120 A(a) of Title I Section 9521 of ESEA 34 CFR 299. 5 • Maintenance of Effort (MOE) is required by federal law to ensure that federal funds are not used to replace state and local funds. • Maintenance of Effort (MOE) is a district-level test that measures whether a district is providing a consistent level of local and state support from year to year. 109

ESEA MAINTENANCE OF EFFORT Section 1120 A(a) of Title I Section 9521 of ESEA 34 CFR 299. 5 • Maintenance of Effort (MOE) is required by federal law to ensure that federal funds are not used to replace state and local funds. • Maintenance of Effort (MOE) is a district-level test that measures whether a district is providing a consistent level of local and state support from year to year. 109

MAINTENANCE OF EFFORT WAIVER Districts may seek a waiver of MOE by demonstrating that the decline in MOE was the result of an exceptional or uncontrollable event or a drastic decline in financial resources. (Section 9521(c)) 110

MAINTENANCE OF EFFORT WAIVER Districts may seek a waiver of MOE by demonstrating that the decline in MOE was the result of an exceptional or uncontrollable event or a drastic decline in financial resources. (Section 9521(c)) 110

MAINTENANCE OF EFFORT The following ESEA programs are subject to the maintenance of effort requirement: • Title I, Part A, ARRA • Title I, Part D, Neglected/Delinquent Programs • Title II, Part A Improving Teacher Quality • Title II, Part D Educational Technology • Title III, Part A English Language Learners • Title IV, Part B 21 st Century Community Learning • Title VI, Part B, Subpart 2 Rural Education 111

MAINTENANCE OF EFFORT The following ESEA programs are subject to the maintenance of effort requirement: • Title I, Part A, ARRA • Title I, Part D, Neglected/Delinquent Programs • Title II, Part A Improving Teacher Quality • Title II, Part D Educational Technology • Title III, Part A English Language Learners • Title IV, Part B 21 st Century Community Learning • Title VI, Part B, Subpart 2 Rural Education 111

MAINTENANCE OF EFFORT • The MOE provision requires that LEA’s maintain at least 90% of their level of expenditures for programs from state and local funds from one year to the next. • The LEA cannot reduce the amount it spends for educational programs from state and local funds and just pay for those programs from federal funds. 112

MAINTENANCE OF EFFORT • The MOE provision requires that LEA’s maintain at least 90% of their level of expenditures for programs from state and local funds from one year to the next. • The LEA cannot reduce the amount it spends for educational programs from state and local funds and just pay for those programs from federal funds. 112

MAINTENANCE OF EFFORT • A district may receive its full allocations of ESEA funds only if it has met the MOE requirement. • If a district’s expenditures from state and local funds fall below the 90% threshold, the state must reduce the district’s ESEA allocations by the percentage below the minimum that expenditures fell short. 113

MAINTENANCE OF EFFORT • A district may receive its full allocations of ESEA funds only if it has met the MOE requirement. • If a district’s expenditures from state and local funds fall below the 90% threshold, the state must reduce the district’s ESEA allocations by the percentage below the minimum that expenditures fell short. 113

What expenditures are included in the MOE calculation? • • State and local funds for education Administration Instruction Attendance and Health Services Transportation Operation and Maintenance of Facilities Fixed Charges Net expenditures to cover deficits for food services and student activities 114

What expenditures are included in the MOE calculation? • • State and local funds for education Administration Instruction Attendance and Health Services Transportation Operation and Maintenance of Facilities Fixed Charges Net expenditures to cover deficits for food services and student activities 114

MOE calculations should not include: • • Community services Capital outlay Debt services Expenses incurred as a result of a presidentially declared disaster • Expenditures from funds provided by federal government 115

MOE calculations should not include: • • Community services Capital outlay Debt services Expenses incurred as a result of a presidentially declared disaster • Expenditures from funds provided by federal government 115

Maintenance of Effort CAUTION: • If a district is using ARRA funds as local funds for purposes of meeting the MOE provision, districts must remember that in FY 2011 when the ARRA funds expire, the district will have to maintain the MOE obligation from regular local and state funds. 116

Maintenance of Effort CAUTION: • If a district is using ARRA funds as local funds for purposes of meeting the MOE provision, districts must remember that in FY 2011 when the ARRA funds expire, the district will have to maintain the MOE obligation from regular local and state funds. 116

Maintenance of Effort For the latest ADE guidance, see FIN -10 -040 issued November 17, 2009. 117

Maintenance of Effort For the latest ADE guidance, see FIN -10 -040 issued November 17, 2009. 117

Special Education Maintenance of Effort Reminder Special Education has a 100% requirement on Maintenance of Effort. 118

Special Education Maintenance of Effort Reminder Special Education has a 100% requirement on Maintenance of Effort. 118