637d190a0dfa418cef673df4c27e5569.ppt

- Количество слайдов: 99

Three Lectures on Economic Efficiency and Growth Thorvaldur Gylfason

Three Lectures on Economic Efficiency and Growth Thorvaldur Gylfason

Outline and aims Present a policy-oriented overview of theory and empirical evidence of economic growth Trace linkages between economic growth and its main determinants: saving, investment, and economic efficiency ü ü ü Exogenous vs. endogenous growth Liberalization, stabilization, privatization Education, institutions, natural resources

Outline and aims Present a policy-oriented overview of theory and empirical evidence of economic growth Trace linkages between economic growth and its main determinants: saving, investment, and economic efficiency ü ü ü Exogenous vs. endogenous growth Liberalization, stabilization, privatization Education, institutions, natural resources

Outline and aims Lecture I Saving, efficiency, and economic growth Lecture II Economic policy and growth Lecture III Education, natural resources, institutions, and empirical evidence

Outline and aims Lecture I Saving, efficiency, and economic growth Lecture II Economic policy and growth Lecture III Education, natural resources, institutions, and empirical evidence

1 Introduction Growth theory As old as economics itself Smith, Marshall, Schumpeter, Keynes Explicit growth theory started with Harrod and Domar in 1940 s Why important? Unfashionable in 1960 s and 1970 s Limits to growth, etc. Growth and development

1 Introduction Growth theory As old as economics itself Smith, Marshall, Schumpeter, Keynes Explicit growth theory started with Harrod and Domar in 1940 s Why important? Unfashionable in 1960 s and 1970 s Limits to growth, etc. Growth and development

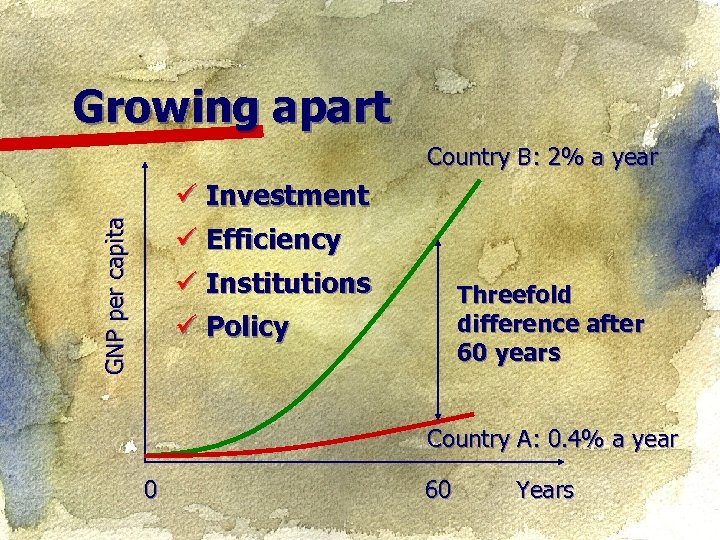

Growing apart Country B: 2% a year GNP per capita ü Investment ü Efficiency ü Institutions ü Policy Threefold difference after 60 years Country A: 0. 4% a year 0 60 Years

Growing apart Country B: 2% a year GNP per capita ü Investment ü Efficiency ü Institutions ü Policy Threefold difference after 60 years Country A: 0. 4% a year 0 60 Years

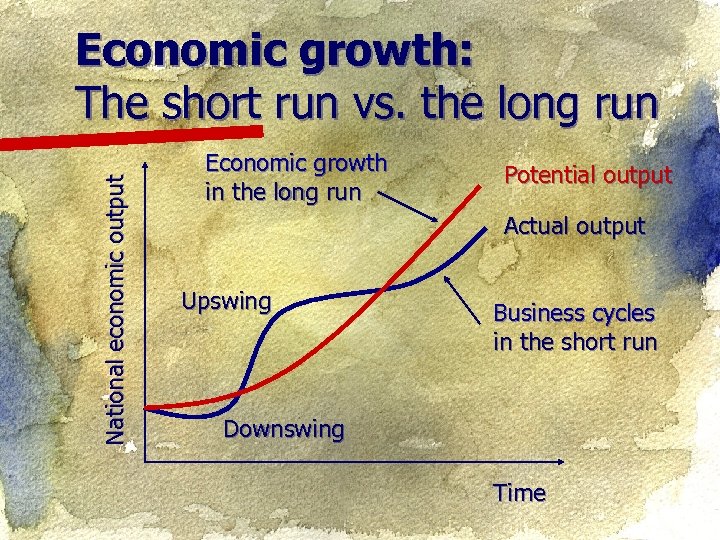

National economic output Economic growth: The short run vs. the long run Economic growth in the long run Potential output Actual output Upswing Business cycles in the short run Downswing Time

National economic output Economic growth: The short run vs. the long run Economic growth in the long run Potential output Actual output Upswing Business cycles in the short run Downswing Time

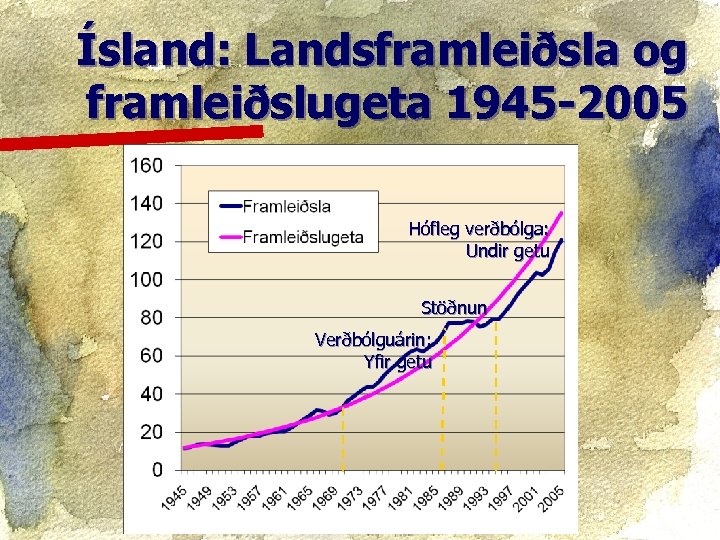

Ísland: Landsframleiðsla og framleiðslugeta 1945 -2005 Hófleg verðbólga: Undir getu Stöðnun Verðbólguárin: Yfir getu

Ísland: Landsframleiðsla og framleiðslugeta 1945 -2005 Hófleg verðbólga: Undir getu Stöðnun Verðbólguárin: Yfir getu

Other comparisons 1) 2) 3) 4) 5) 6) West-Germany vs. East-Germany Austria vs. Czech Republic US vs. USSR South Korea vs. North Korea China vs. Europe: Taiwan vs. China 1: 1 in 1400 Finland vs. Estonia 1: 20 in 1989 ü See my Pictures of Growth ü www. hi. is/~gylfason/pictures 2. htm

Other comparisons 1) 2) 3) 4) 5) 6) West-Germany vs. East-Germany Austria vs. Czech Republic US vs. USSR South Korea vs. North Korea China vs. Europe: Taiwan vs. China 1: 1 in 1400 Finland vs. Estonia 1: 20 in 1989 ü See my Pictures of Growth ü www. hi. is/~gylfason/pictures 2. htm

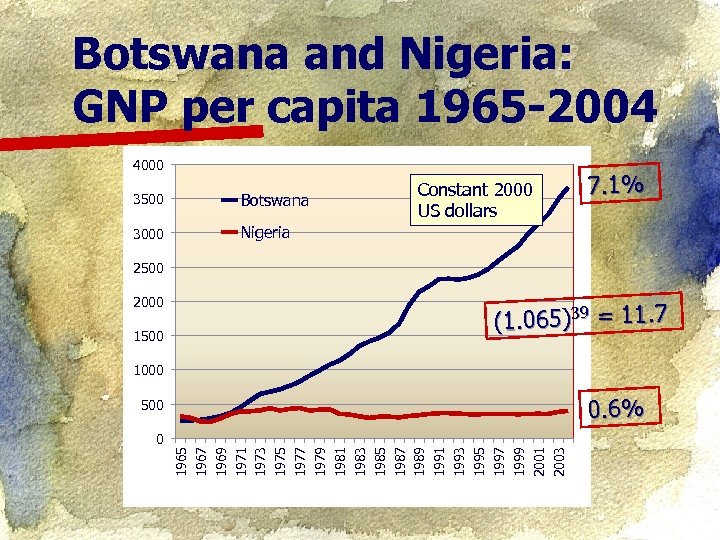

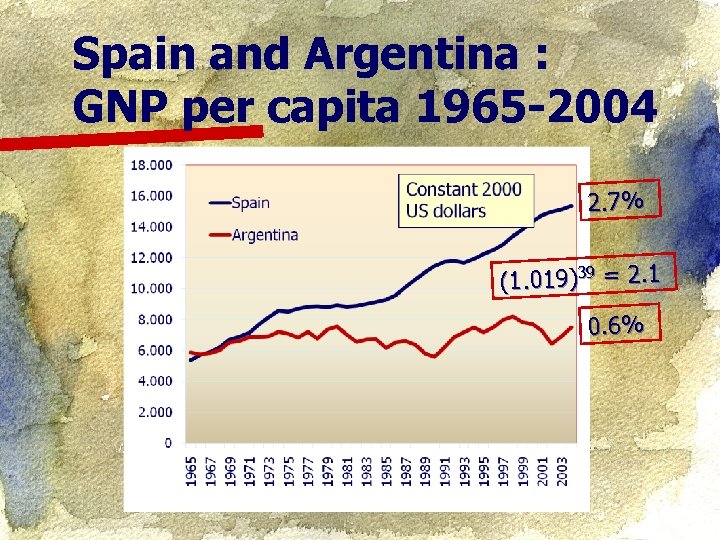

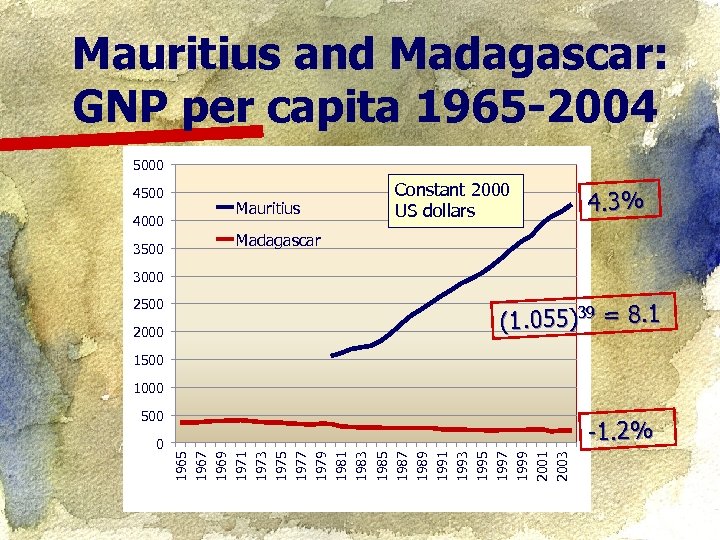

Further comparisons 1) 2) 3) 4) 5) 6) Thailand vs. Burma Mauritius vs. Madagascar Botswana vs. Nigeria Tunisia vs. Morocco Spain vs. Argentina Dominican Republic vs. Haiti

Further comparisons 1) 2) 3) 4) 5) 6) Thailand vs. Burma Mauritius vs. Madagascar Botswana vs. Nigeria Tunisia vs. Morocco Spain vs. Argentina Dominican Republic vs. Haiti

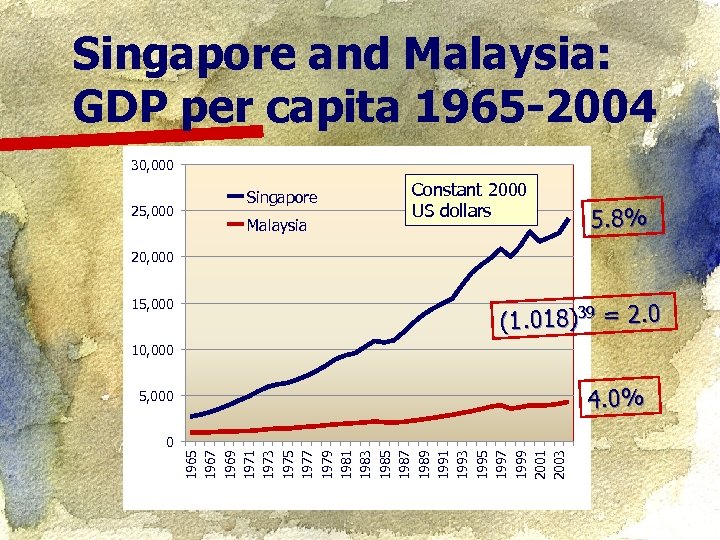

Singapore and Malaysia: GDP per capita 1965 -2004 30, 000 25, 000 Singapore Malaysia Constant 2000 US dollars 5. 8% 20, 000 15, 000 (1. 018)39 = 2. 0 10, 000 4. 0% 5, 000 1965 1967 1969 1971 1973 1975 1977 1979 1981 1983 1985 1987 1989 1991 1993 1995 1997 1999 2001 2003 0

Singapore and Malaysia: GDP per capita 1965 -2004 30, 000 25, 000 Singapore Malaysia Constant 2000 US dollars 5. 8% 20, 000 15, 000 (1. 018)39 = 2. 0 10, 000 4. 0% 5, 000 1965 1967 1969 1971 1973 1975 1977 1979 1981 1983 1985 1987 1989 1991 1993 1995 1997 1999 2001 2003 0

A tale of two countries Growth per capita (%) Malaysia Singapore 4. 1 6. 1

A tale of two countries Growth per capita (%) Malaysia Singapore 4. 1 6. 1

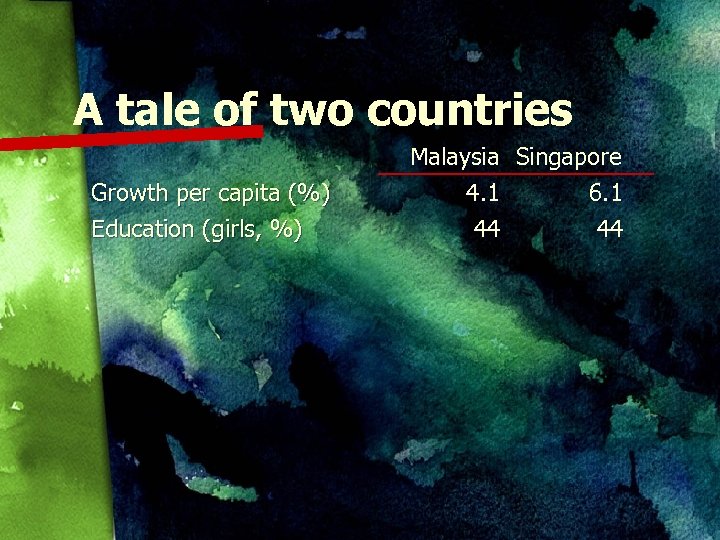

A tale of two countries Growth per capita (%) Education (girls, %) Malaysia Singapore 4. 1 6. 1 44 44

A tale of two countries Growth per capita (%) Education (girls, %) Malaysia Singapore 4. 1 6. 1 44 44

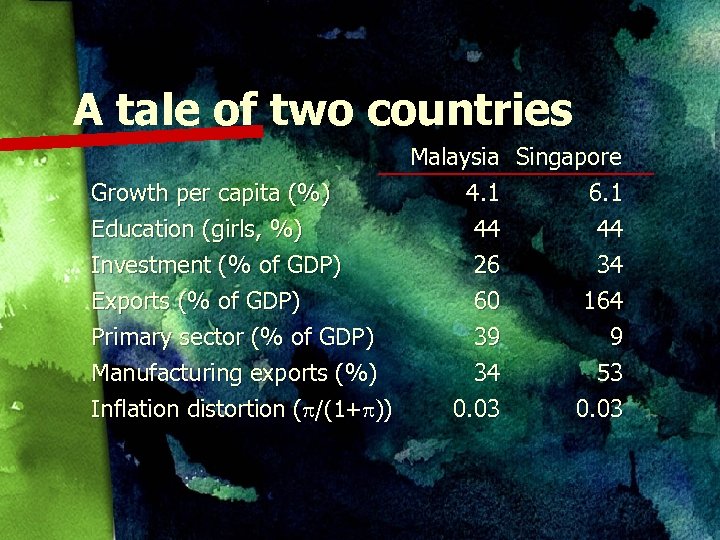

A tale of two countries Growth per capita (%) Education (girls, %) Investment (% of GDP) Malaysia Singapore 4. 1 6. 1 44 44 26 34

A tale of two countries Growth per capita (%) Education (girls, %) Investment (% of GDP) Malaysia Singapore 4. 1 6. 1 44 44 26 34

A tale of two countries Growth per capita (%) Education (girls, %) Investment (% of GDP) Exports (% of GDP) Malaysia Singapore 4. 1 6. 1 44 44 26 34 60 164

A tale of two countries Growth per capita (%) Education (girls, %) Investment (% of GDP) Exports (% of GDP) Malaysia Singapore 4. 1 6. 1 44 44 26 34 60 164

A tale of two countries Growth per capita (%) Education (girls, %) Investment (% of GDP) Exports (% of GDP) Primary sector (% of GDP) Malaysia Singapore 4. 1 6. 1 44 44 26 34 60 164 39 9

A tale of two countries Growth per capita (%) Education (girls, %) Investment (% of GDP) Exports (% of GDP) Primary sector (% of GDP) Malaysia Singapore 4. 1 6. 1 44 44 26 34 60 164 39 9

A tale of two countries Growth per capita (%) Education (girls, %) Investment (% of GDP) Exports (% of GDP) Primary sector (% of GDP) Manufacturing exports (%) Malaysia Singapore 4. 1 6. 1 44 44 26 34 60 164 39 9 34 53

A tale of two countries Growth per capita (%) Education (girls, %) Investment (% of GDP) Exports (% of GDP) Primary sector (% of GDP) Manufacturing exports (%) Malaysia Singapore 4. 1 6. 1 44 44 26 34 60 164 39 9 34 53

A tale of two countries Malaysia Singapore Growth per capita (%) 4. 1 6. 1 Education (girls, %) 44 44 Investment (% of GDP) 26 34 Exports (% of GDP) 60 164 Primary sector (% of GDP) 39 9 Manufacturing exports (%) 34 53 Inflation distortion ( /(1+ )) 0. 03

A tale of two countries Malaysia Singapore Growth per capita (%) 4. 1 6. 1 Education (girls, %) 44 44 Investment (% of GDP) 26 34 Exports (% of GDP) 60 164 Primary sector (% of GDP) 39 9 Manufacturing exports (%) 34 53 Inflation distortion ( /(1+ )) 0. 03

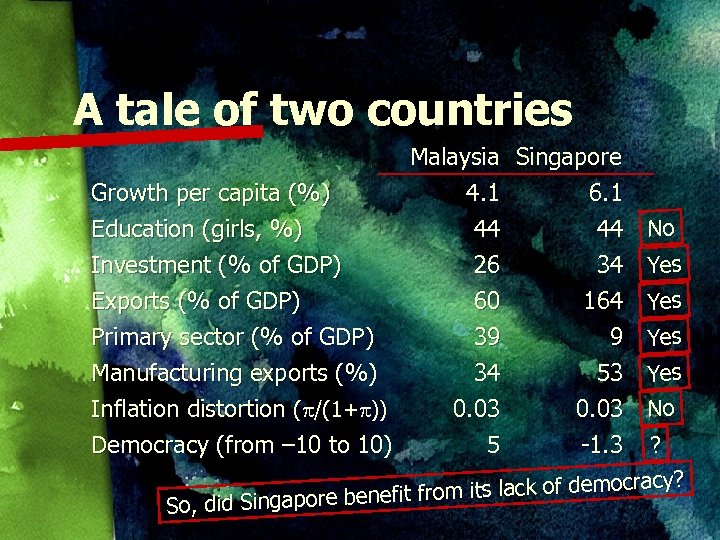

A tale of two countries Malaysia Singapore Growth per capita (%) 4. 1 6. 1 Education (girls, %) 44 44 Investment (% of GDP) 26 34 Exports (% of GDP) 60 164 Primary sector (% of GDP) 39 9 Manufacturing exports (%) 34 53 Inflation distortion ( /(1+ )) 0. 03 Democracy (from – 10 to 10) 5 -1. 3 No Yes Yes No ? cy? om its lack of democra efit fr So, did Singapore ben

A tale of two countries Malaysia Singapore Growth per capita (%) 4. 1 6. 1 Education (girls, %) 44 44 Investment (% of GDP) 26 34 Exports (% of GDP) 60 164 Primary sector (% of GDP) 39 9 Manufacturing exports (%) 34 53 Inflation distortion ( /(1+ )) 0. 03 Democracy (from – 10 to 10) 5 -1. 3 No Yes Yes No ? cy? om its lack of democra efit fr So, did Singapore ben

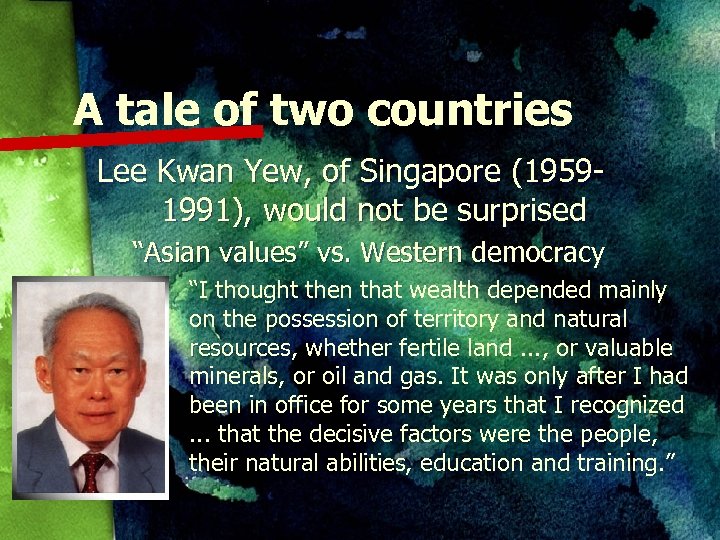

A tale of two countries Lee Kwan Yew, of Singapore (19591991), would not be surprised “Asian values” vs. Western democracy ü “I thought then that wealth depended mainly on the possession of territory and natural resources, whether fertile land. . . , or valuable resources minerals, or oil and gas. It was only after I had been in office for some years that I recognized. . . that the decisive factors were the people, people their natural abilities, education and training. ”

A tale of two countries Lee Kwan Yew, of Singapore (19591991), would not be surprised “Asian values” vs. Western democracy ü “I thought then that wealth depended mainly on the possession of territory and natural resources, whether fertile land. . . , or valuable resources minerals, or oil and gas. It was only after I had been in office for some years that I recognized. . . that the decisive factors were the people, people their natural abilities, education and training. ”

Botswana and Nigeria: GNP per capita 1965 -2004 4000 3500 Botswana 3000 Constant 2000 US dollars 7. 1% Nigeria 2500 2000 1500 (1. 065)39 = 11. 7 1000 0. 6% 500 1965 1967 1969 1971 1973 1975 1977 1979 1981 1983 1985 1987 1989 1991 1993 1995 1997 1999 2001 2003 0

Botswana and Nigeria: GNP per capita 1965 -2004 4000 3500 Botswana 3000 Constant 2000 US dollars 7. 1% Nigeria 2500 2000 1500 (1. 065)39 = 11. 7 1000 0. 6% 500 1965 1967 1969 1971 1973 1975 1977 1979 1981 1983 1985 1987 1989 1991 1993 1995 1997 1999 2001 2003 0

Spain and Argentina : GNP per capita 1965 -2004 2. 7% (1. 019)39 = 2. 1 0. 6%

Spain and Argentina : GNP per capita 1965 -2004 2. 7% (1. 019)39 = 2. 1 0. 6%

Mauritius and Madagascar: GNP per capita 1965 -2004 5000 4500 4000 3500 Mauritius Constant 2000 US dollars 4. 3% Madagascar 3000 2500 2000 (1. 055)39 = 8. 1 1500 1000 500 -1. 2% 1965 1967 1969 1971 1973 1975 1977 1979 1981 1983 1985 1987 1989 1991 1993 1995 1997 1999 2001 2003 0

Mauritius and Madagascar: GNP per capita 1965 -2004 5000 4500 4000 3500 Mauritius Constant 2000 US dollars 4. 3% Madagascar 3000 2500 2000 (1. 055)39 = 8. 1 1500 1000 500 -1. 2% 1965 1967 1969 1971 1973 1975 1977 1979 1981 1983 1985 1987 1989 1991 1993 1995 1997 1999 2001 2003 0

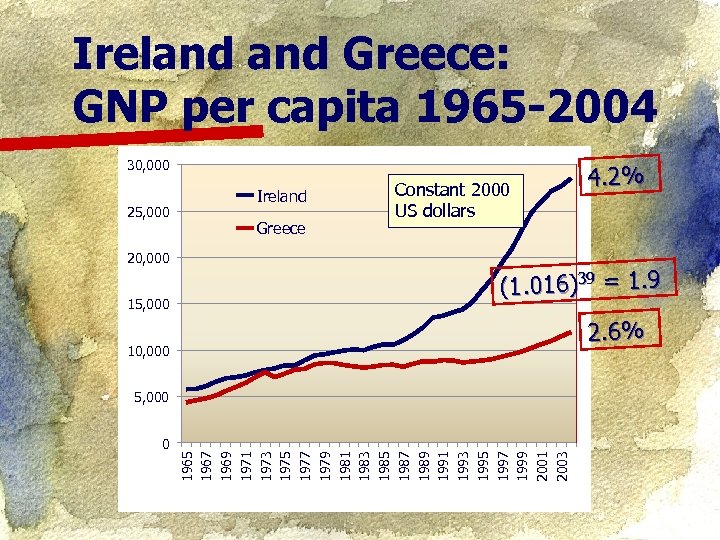

Ireland Greece: GNP per capita 1965 -2004 30, 000 25, 000 20, 000 15, 000 Ireland Greece Constant 2000 US dollars 4. 2% (1. 016)39 = 1. 9 2. 6% 10, 000 5, 000 1965 1967 1969 1971 1973 1975 1977 1979 1981 1983 1985 1987 1989 1991 1993 1995 1997 1999 2001 2003 0

Ireland Greece: GNP per capita 1965 -2004 30, 000 25, 000 20, 000 15, 000 Ireland Greece Constant 2000 US dollars 4. 2% (1. 016)39 = 1. 9 2. 6% 10, 000 5, 000 1965 1967 1969 1971 1973 1975 1977 1979 1981 1983 1985 1987 1989 1991 1993 1995 1997 1999 2001 2003 0

Basic growth theory A. B. C. Harrod-Domar model Solow model Endogenous growth model et’s do the algebra L

Basic growth theory A. B. C. Harrod-Domar model Solow model Endogenous growth model et’s do the algebra L

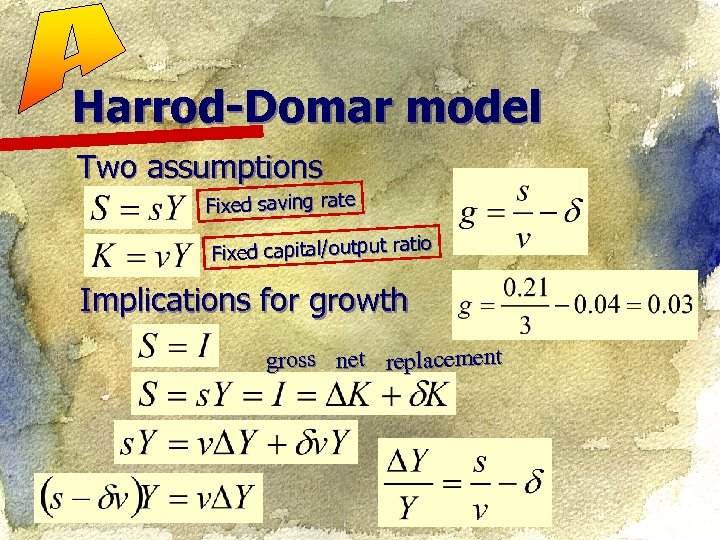

Harrod-Domar model Two assumptions Fixed saving rate tio Fixed capital/output ra Implications for growth gross net replacement

Harrod-Domar model Two assumptions Fixed saving rate tio Fixed capital/output ra Implications for growth gross net replacement

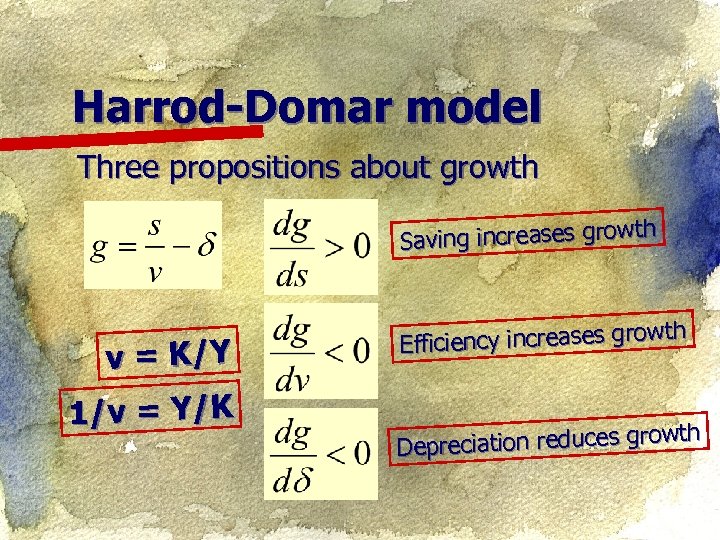

Harrod-Domar model Three propositions about growth th Saving increases grow v = K/Y 1/v = Y/K th iciency increases grow Eff wth epreciation reduces gro D

Harrod-Domar model Three propositions about growth th Saving increases grow v = K/Y 1/v = Y/K th iciency increases grow Eff wth epreciation reduces gro D

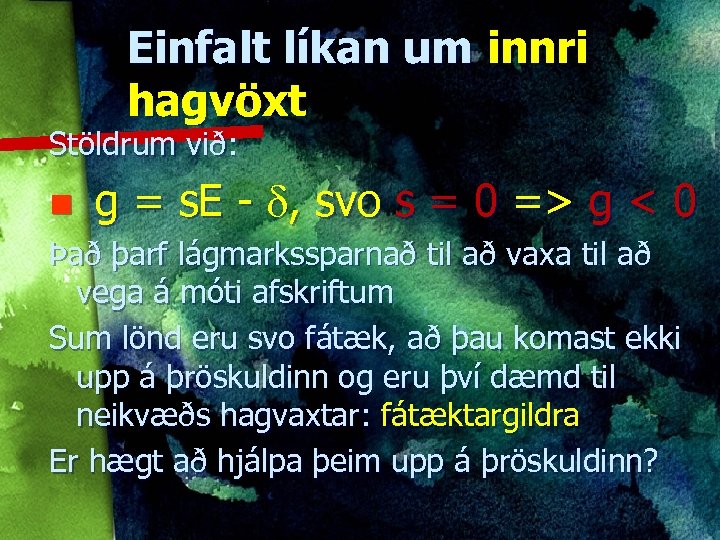

Einfalt líkan um innri hagvöxt Stöldrum við: n g = s. E - , svo s = 0 => g < 0 Það þarf lágmarkssparnað til að vaxa til að vega á móti afskriftum Sum lönd eru svo fátæk, að þau komast ekki upp á þröskuldinn og eru því dæmd til neikvæðs hagvaxtar: fátæktargildra Er hægt að hjálpa þeim upp á þröskuldinn?

Einfalt líkan um innri hagvöxt Stöldrum við: n g = s. E - , svo s = 0 => g < 0 Það þarf lágmarkssparnað til að vaxa til að vega á móti afskriftum Sum lönd eru svo fátæk, að þau komast ekki upp á þröskuldinn og eru því dæmd til neikvæðs hagvaxtar: fátæktargildra Er hægt að hjálpa þeim upp á þröskuldinn?

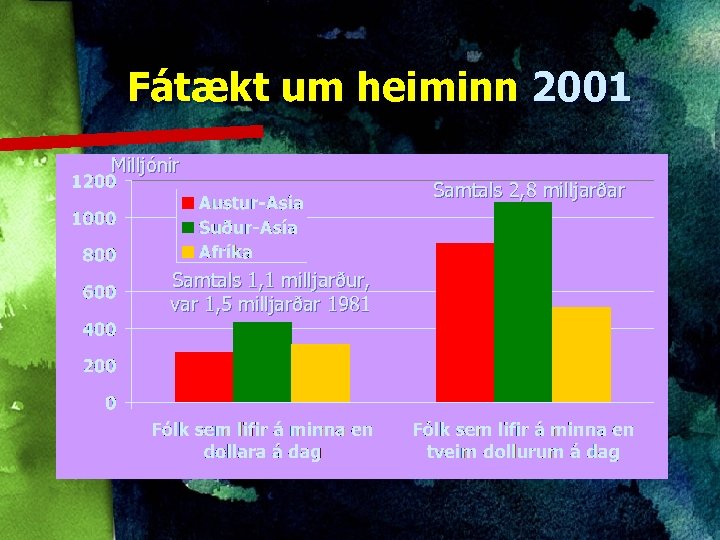

Fátækt um heiminn 2001 Milljónir Samtals 2, 8 milljarðar Samtals 1, 1 milljarður, var 1, 5 milljarðar 1981

Fátækt um heiminn 2001 Milljónir Samtals 2, 8 milljarðar Samtals 1, 1 milljarður, var 1, 5 milljarðar 1981

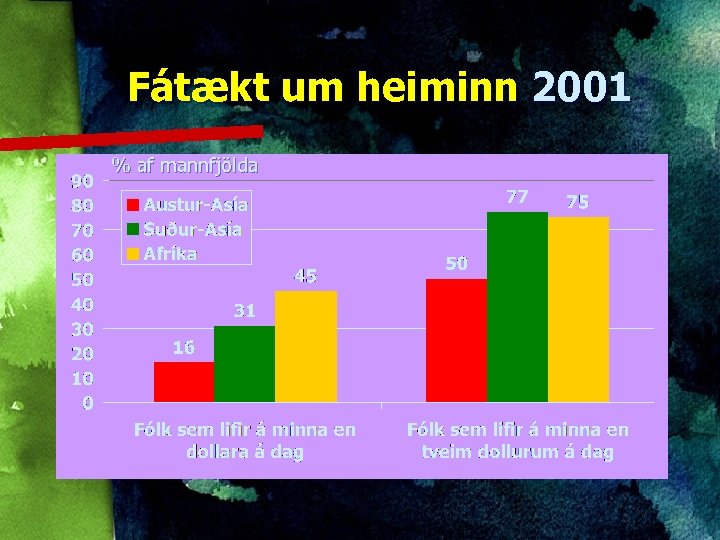

Fátækt um heiminn 2001 % af mannfjölda

Fátækt um heiminn 2001 % af mannfjölda

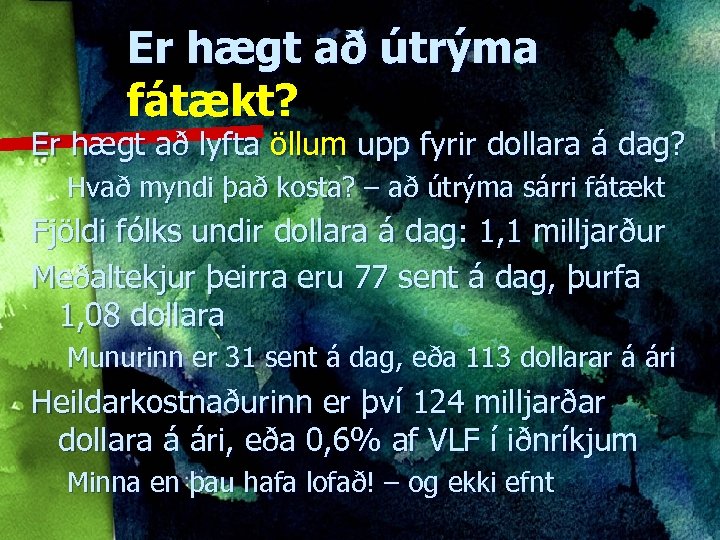

Er hægt að útrýma fátækt? Er hægt að lyfta öllum upp fyrir dollara á dag? Hvað myndi það kosta? – að útrýma sárri fátækt Fjöldi fólks undir dollara á dag: 1, 1 milljarður Meðaltekjur þeirra eru 77 sent á dag, þurfa 1, 08 dollara Munurinn er 31 sent á dag, eða 113 dollarar á ári Heildarkostnaðurinn er því 124 milljarðar dollara á ári, eða 0, 6% af VLF í iðnríkjum Minna en þau hafa lofað! – og ekki efnt

Er hægt að útrýma fátækt? Er hægt að lyfta öllum upp fyrir dollara á dag? Hvað myndi það kosta? – að útrýma sárri fátækt Fjöldi fólks undir dollara á dag: 1, 1 milljarður Meðaltekjur þeirra eru 77 sent á dag, þurfa 1, 08 dollara Munurinn er 31 sent á dag, eða 113 dollarar á ári Heildarkostnaðurinn er því 124 milljarðar dollara á ári, eða 0, 6% af VLF í iðnríkjum Minna en þau hafa lofað! – og ekki efnt

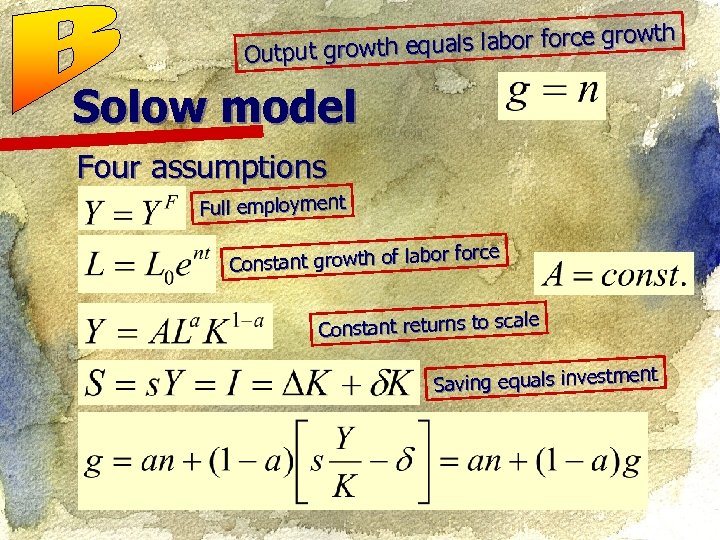

rowth th equals labor force g Output grow Solow model Four assumptions Full employment or force Constant growth of lab ale Constant returns to sc ent Saving equals investm

rowth th equals labor force g Output grow Solow model Four assumptions Full employment or force Constant growth of lab ale Constant returns to sc ent Saving equals investm

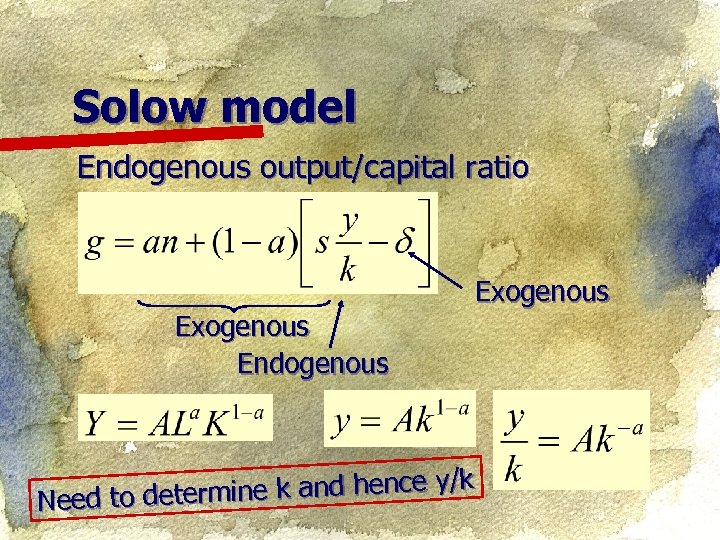

Solow model Endogenous output/capital ratio Exogenous Endogenous Exogenous /k termine k and hence y Need to de

Solow model Endogenous output/capital ratio Exogenous Endogenous Exogenous /k termine k and hence y Need to de

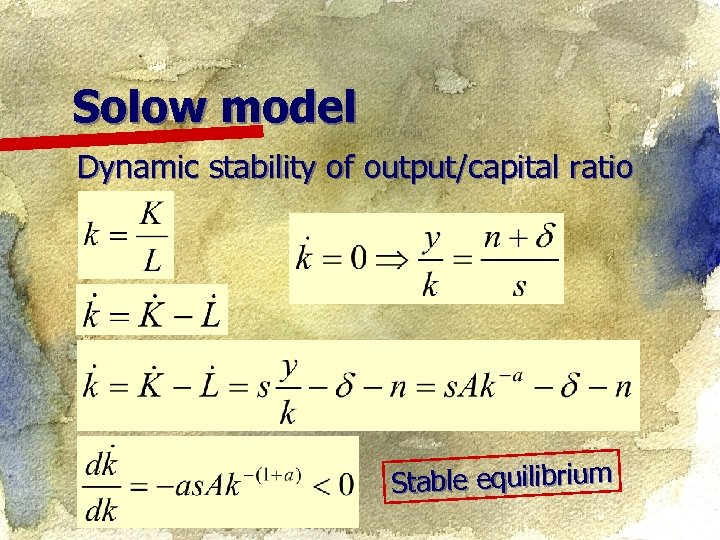

Solow model Dynamic stability of output/capital ratio Stable equilibrium

Solow model Dynamic stability of output/capital ratio Stable equilibrium

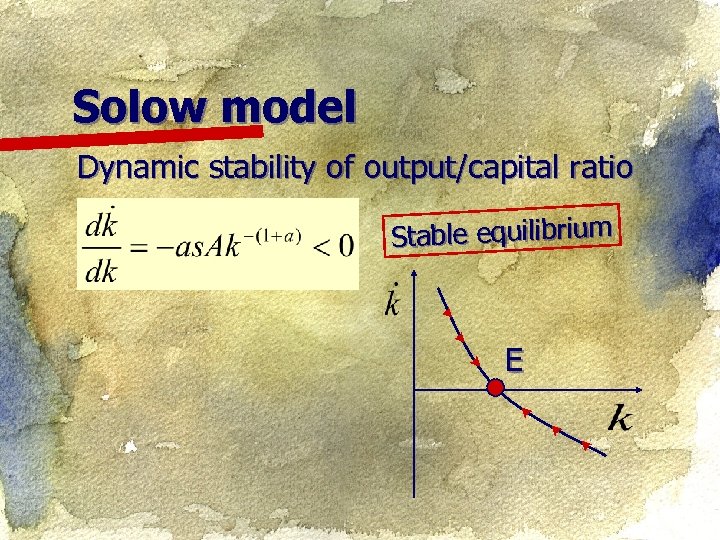

Solow model Dynamic stability of output/capital ratio Stable equilibrium E

Solow model Dynamic stability of output/capital ratio Stable equilibrium E

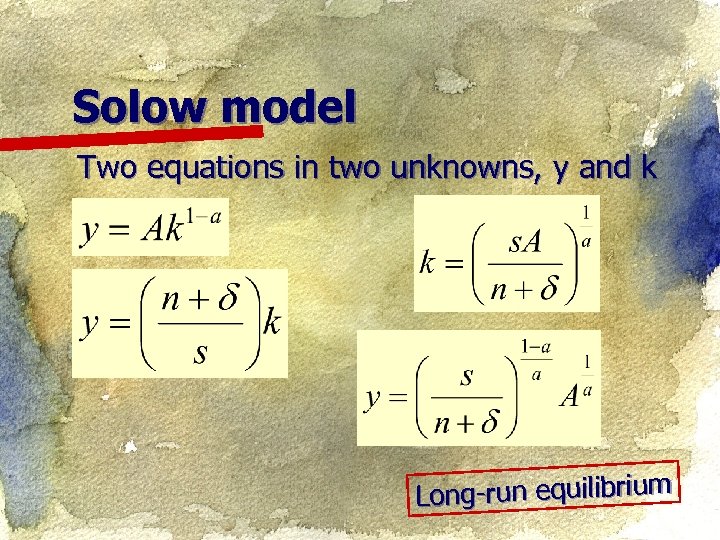

Solow model Two equations in two unknowns, y and k Long-run equilibrium

Solow model Two equations in two unknowns, y and k Long-run equilibrium

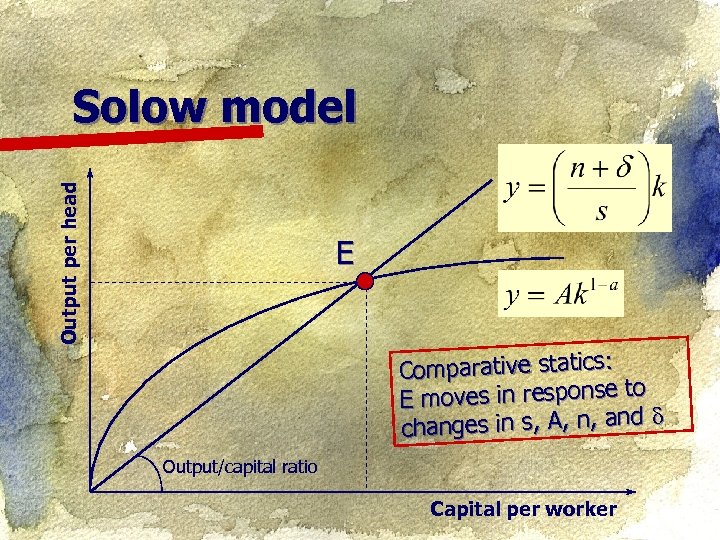

Output per head Solow model E Comparative statics: E moves in response to anges in s, A, n, and ch Output/capital ratio Capital per worker

Output per head Solow model E Comparative statics: E moves in response to anges in s, A, n, and ch Output/capital ratio Capital per worker

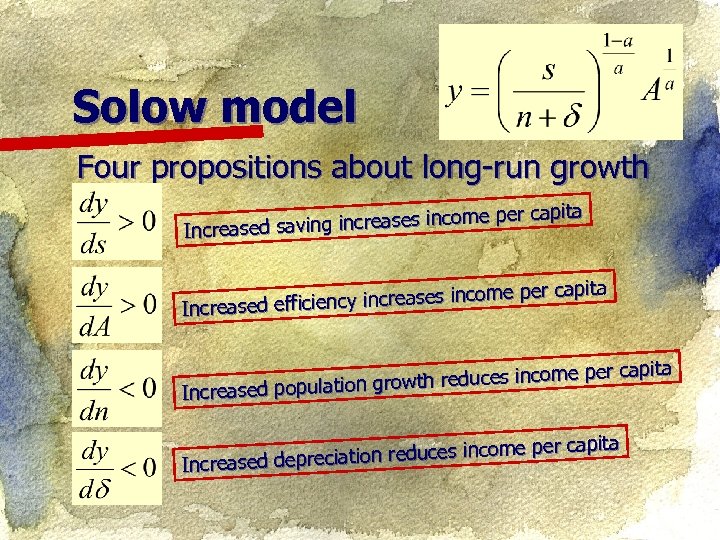

Solow model Four propositions about long-run growth er capita ing increases income p Increased sav capita increases income per Increased efficiency capita th reduces income per grow Increased population per capita ation reduces income Increased depreci

Solow model Four propositions about long-run growth er capita ing increases income p Increased sav capita increases income per Increased efficiency capita th reduces income per grow Increased population per capita ation reduces income Increased depreci

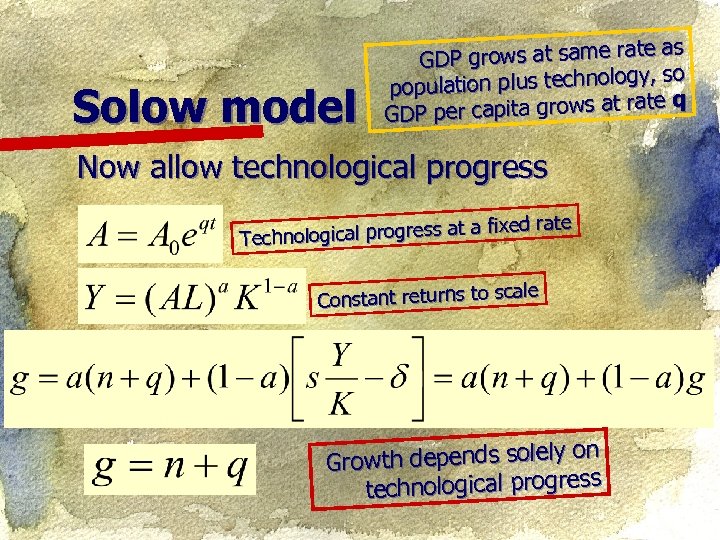

Solow model te as GDP grows at same ra logy, so population plus techno te q per capita grows at ra GDP Now allow technological progress fixed rate nological progress at a Tech ale Constant returns to sc on Growth depends solely technological progress

Solow model te as GDP grows at same ra logy, so population plus techno te q per capita grows at ra GDP Now allow technological progress fixed rate nological progress at a Tech ale Constant returns to sc on Growth depends solely technological progress

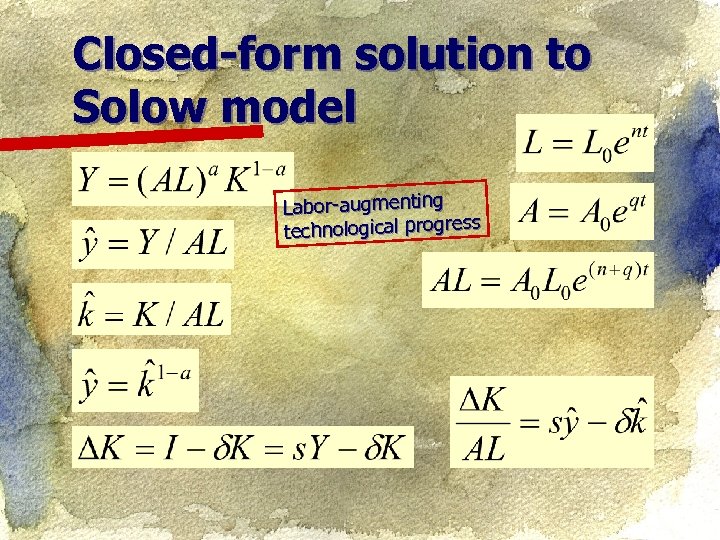

Closed-form solution to Solow model Labor-augmenting technological progress

Closed-form solution to Solow model Labor-augmenting technological progress

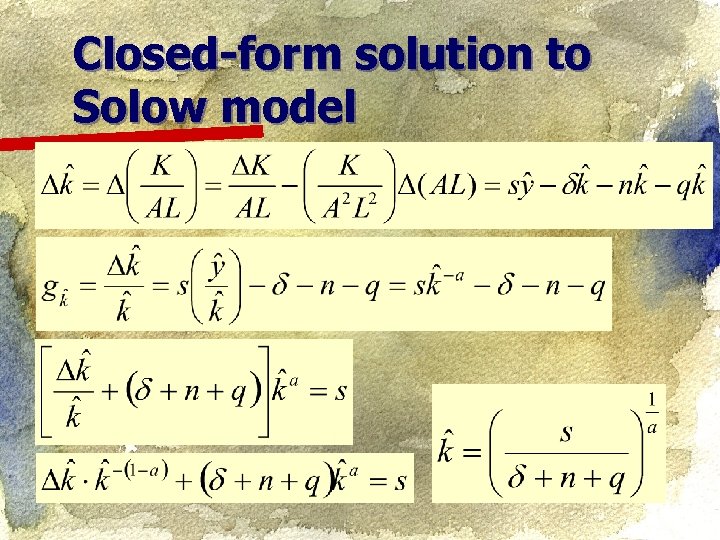

Closed-form solution to Solow model

Closed-form solution to Solow model

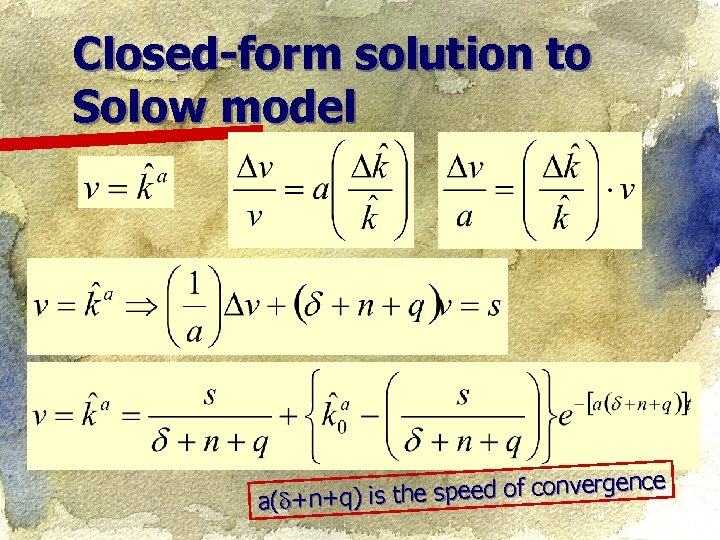

Closed-form solution to Solow model nce the speed of converge a( +n+q) is

Closed-form solution to Solow model nce the speed of converge a( +n+q) is

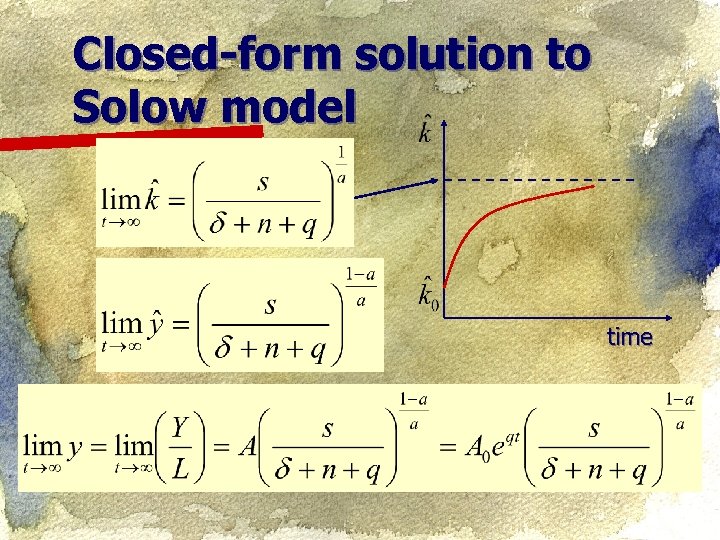

Closed-form solution to Solow model time

Closed-form solution to Solow model time

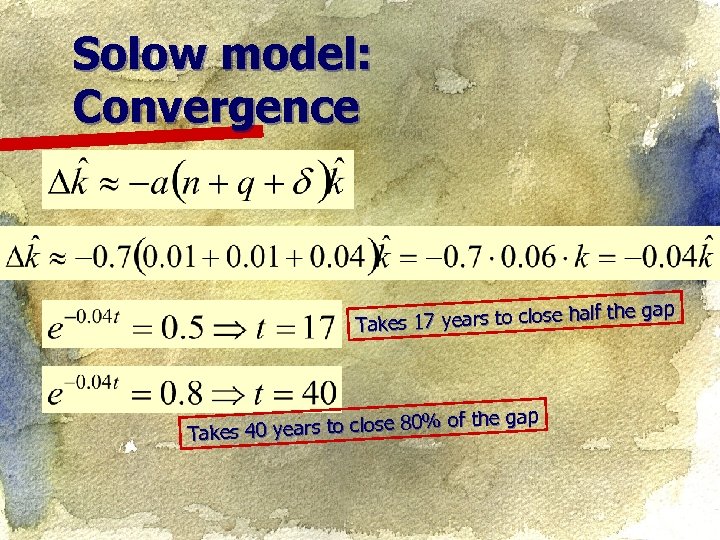

Solow model: Convergence gap years to close half the Takes 17 e gap ears to close 80% of th Takes 40 y

Solow model: Convergence gap years to close half the Takes 17 e gap ears to close 80% of th Takes 40 y

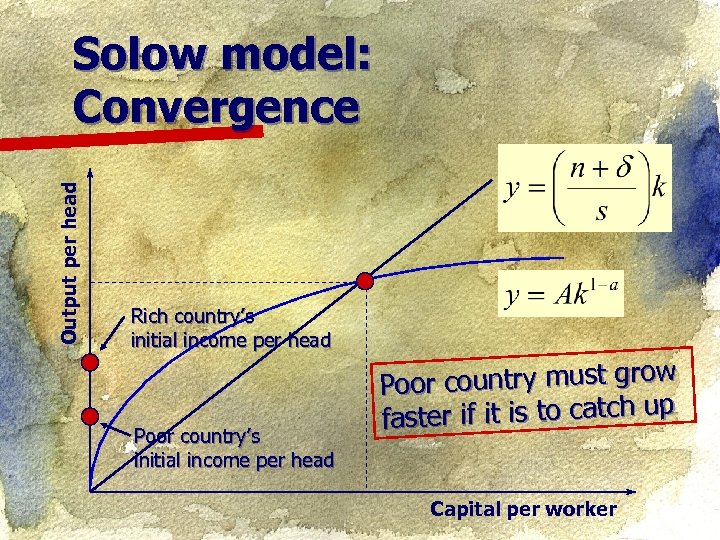

Output per head Solow model: Convergence Rich country’s initial income per head Poor country’s initial income per head w Poor country must gro ster if it is to catch up fa Capital per worker

Output per head Solow model: Convergence Rich country’s initial income per head Poor country’s initial income per head w Poor country must gro ster if it is to catch up fa Capital per worker

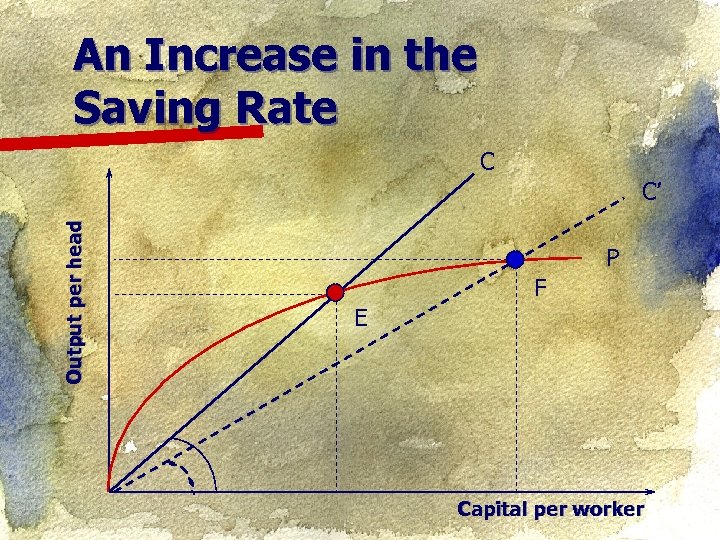

An Increase in the Saving Rate C Output per head C’ P F E Capital per worker

An Increase in the Saving Rate C Output per head C’ P F E Capital per worker

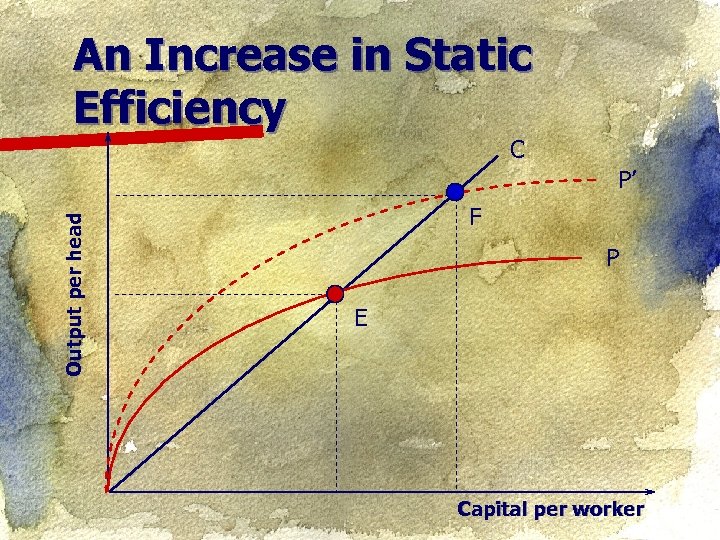

An Increase in Static Efficiency C Output per head P’ F P E Capital per worker

An Increase in Static Efficiency C Output per head P’ F P E Capital per worker

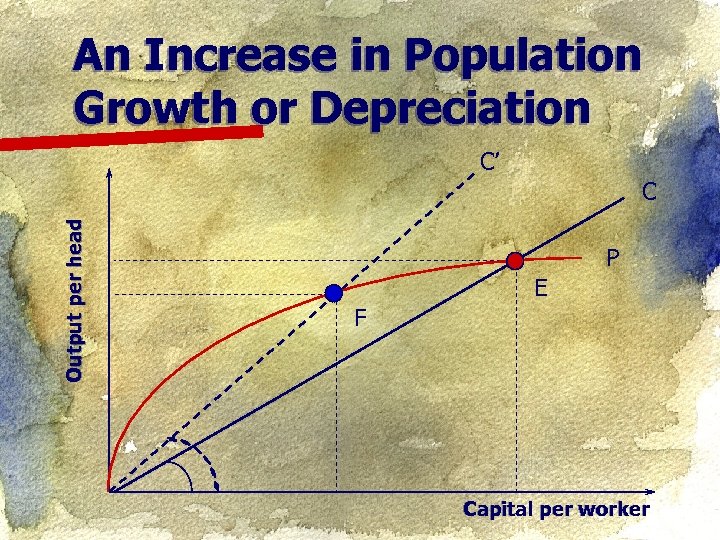

An Increase in Population Growth or Depreciation C’ Output per head C P E F Capital per worker

An Increase in Population Growth or Depreciation C’ Output per head C P E F Capital per worker

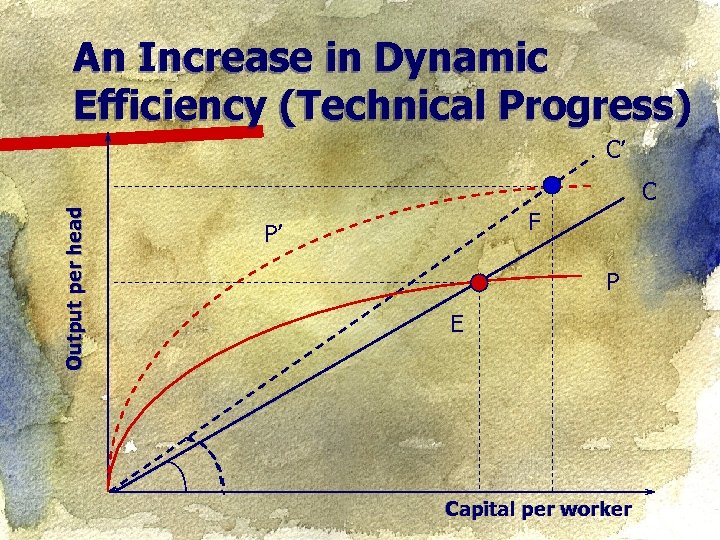

An Increase in Dynamic Efficiency (Technical Progress) C’ Output per head C F P’ P E Capital per worker

An Increase in Dynamic Efficiency (Technical Progress) C’ Output per head C F P’ P E Capital per worker

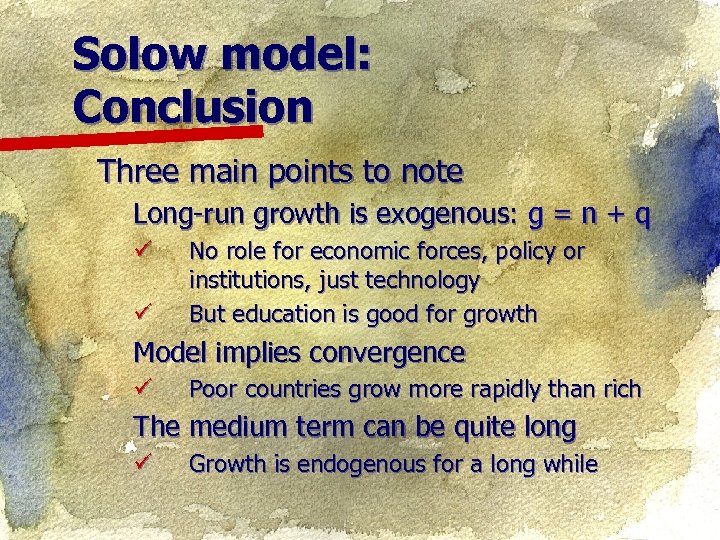

Solow model: Conclusion Three main points to note Long-run growth is exogenous: g = n + q ü ü No role for economic forces, policy or institutions, just technology But education is good for growth Model implies convergence ü Poor countries grow more rapidly than rich The medium term can be quite long ü Growth is endogenous for a long while

Solow model: Conclusion Three main points to note Long-run growth is exogenous: g = n + q ü ü No role for economic forces, policy or institutions, just technology But education is good for growth Model implies convergence ü Poor countries grow more rapidly than rich The medium term can be quite long ü Growth is endogenous for a long while

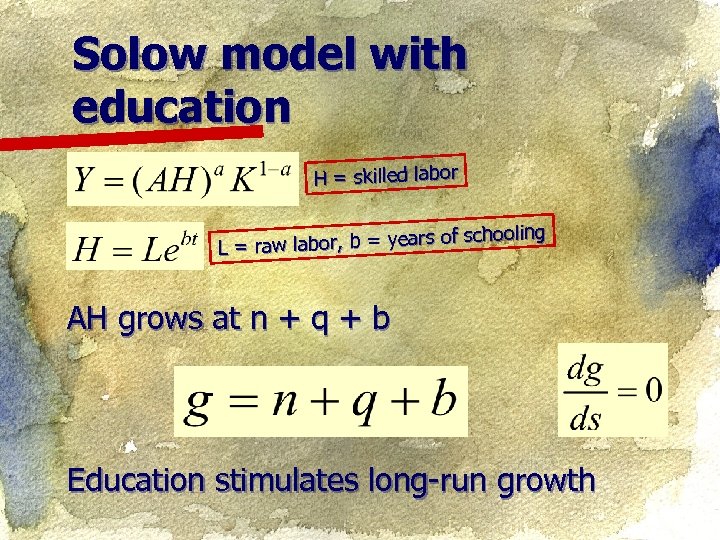

Solow model with education H = skilled labor ooling labor, b = years of sch L = raw AH grows at n + q + b Education stimulates long-run growth

Solow model with education H = skilled labor ooling labor, b = years of sch L = raw AH grows at n + q + b Education stimulates long-run growth

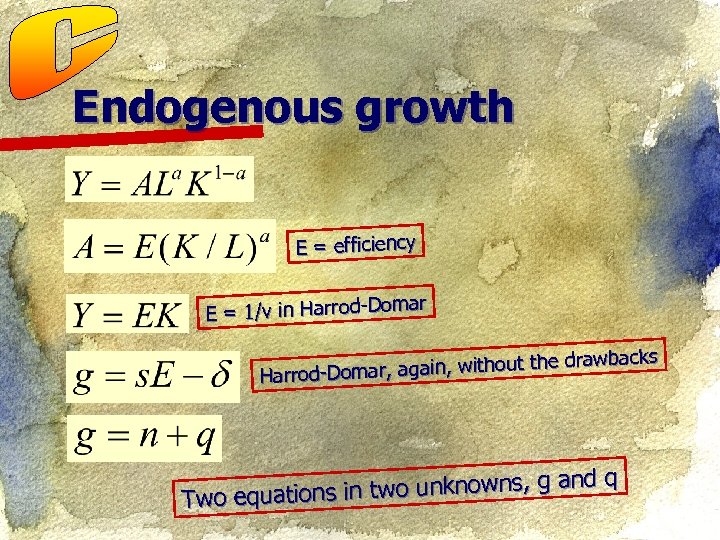

Endogenous growth E = efficiency ar E = 1/v in Harrod-Dom backs gain, without the draw Harrod-Domar, a dq in two unknowns, g an Two equations

Endogenous growth E = efficiency ar E = 1/v in Harrod-Dom backs gain, without the draw Harrod-Domar, a dq in two unknowns, g an Two equations

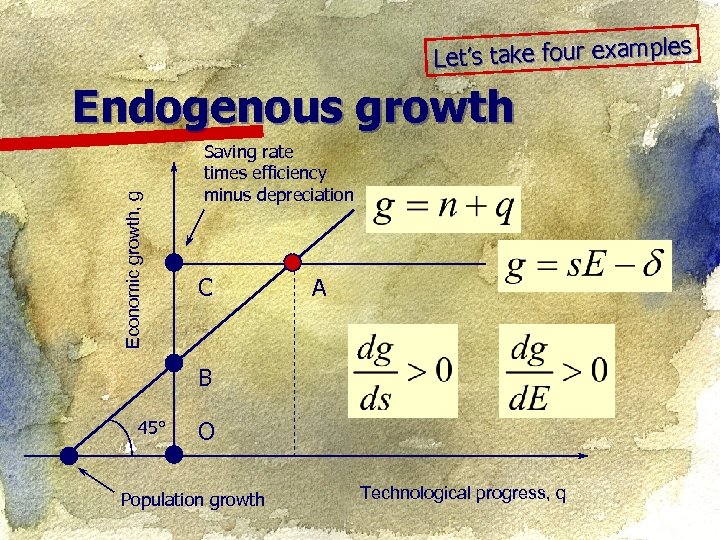

s Let’s take four example Economic growth, g Endogenous growth Saving rate times efficiency minus depreciation C A B 45° O Population growth Technological progress, q

s Let’s take four example Economic growth, g Endogenous growth Saving rate times efficiency minus depreciation C A B 45° O Population growth Technological progress, q

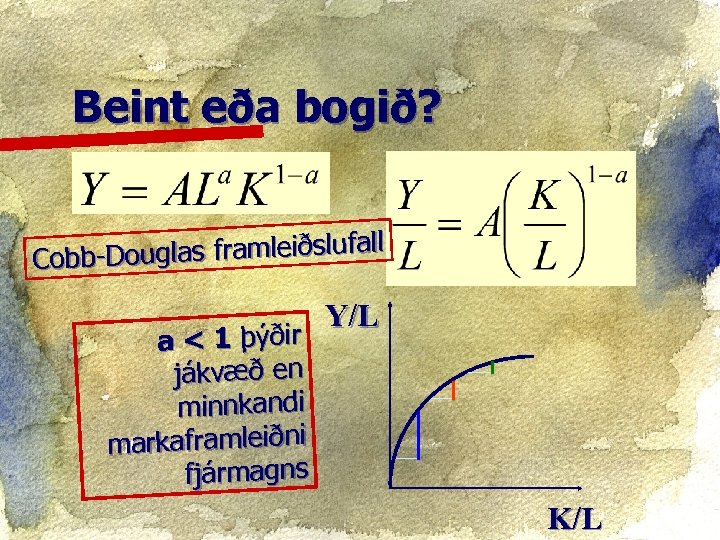

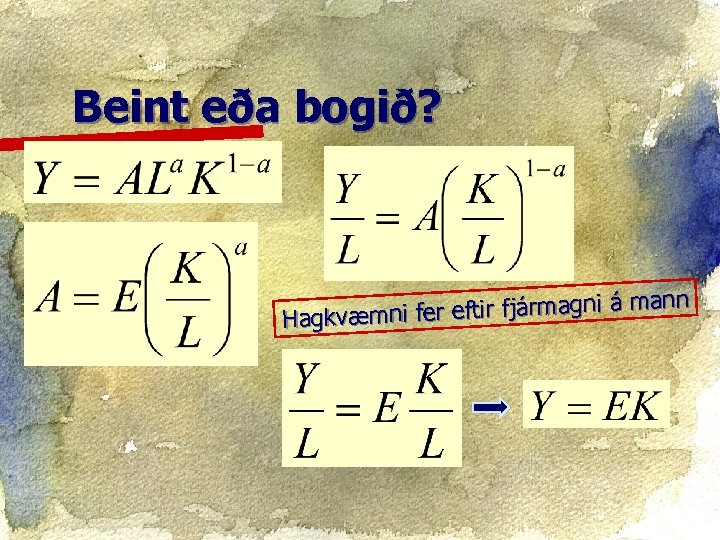

Beint eða bogið? uglas framleiðslufall Cobb-Do a < 1 þýðir jákvæð en minnkandi markaframleiðni fjármagns Y/L K/L

Beint eða bogið? uglas framleiðslufall Cobb-Do a < 1 þýðir jákvæð en minnkandi markaframleiðni fjármagns Y/L K/L

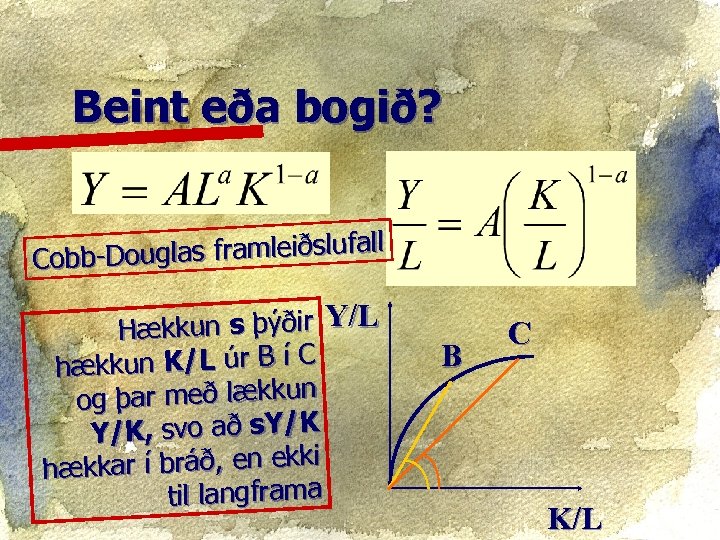

Beint eða bogið? uglas framleiðslufall Cobb-Do ækkun s þýðir Y/L H hækkun K/L úr B í C og þar með lækkun Y/K, svo að s. Y/K i hækkar í bráð, en ekk til langframa B C K/L

Beint eða bogið? uglas framleiðslufall Cobb-Do ækkun s þýðir Y/L H hækkun K/L úr B í C og þar með lækkun Y/K, svo að s. Y/K i hækkar í bráð, en ekk til langframa B C K/L

Beint eða bogið? eftir fjármagni á mann Hagkvæmni fer

Beint eða bogið? eftir fjármagni á mann Hagkvæmni fer

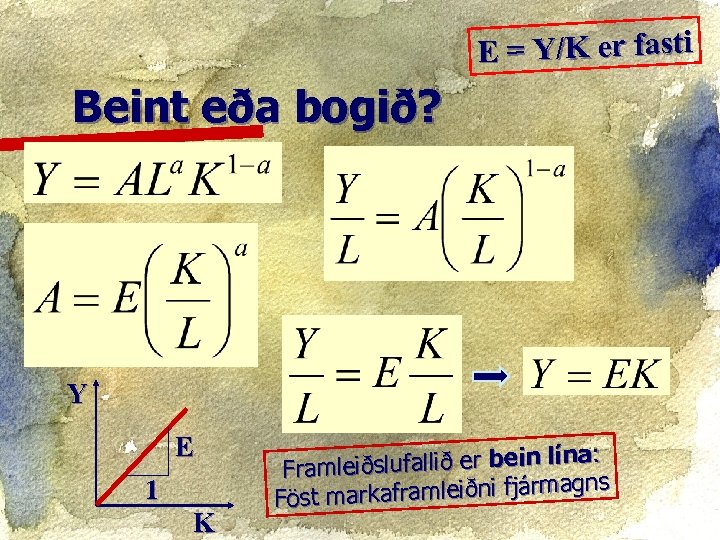

E = Y/K er fasti Beint eða bogið? Y E 1 K : a: leiðslufallið er bein lín a Fram ns arkaframleiðni fjármag Föst m

E = Y/K er fasti Beint eða bogið? Y E 1 K : a: leiðslufallið er bein lín a Fram ns arkaframleiðni fjármag Föst m

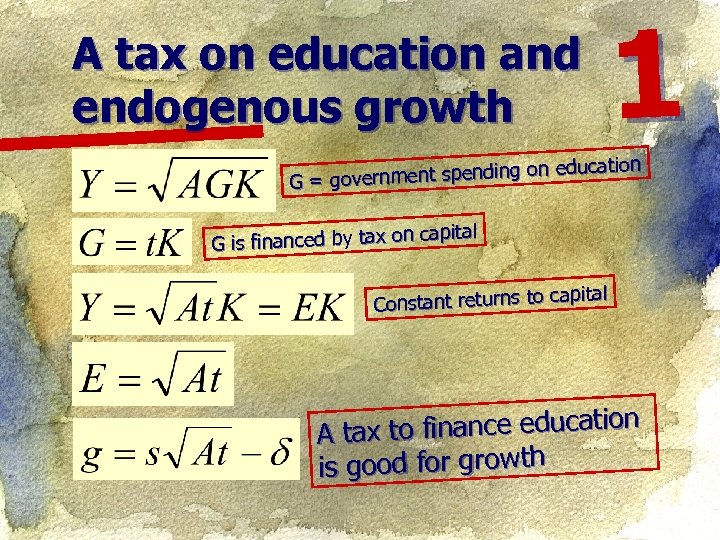

A tax on education and endogenous growth 1 cation ment spending on edu G = govern n capital G is financed by tax o pital Constant returns to ca to finance education A tax is good for growth

A tax on education and endogenous growth 1 cation ment spending on edu G = govern n capital G is financed by tax o pital Constant returns to ca to finance education A tax is good for growth

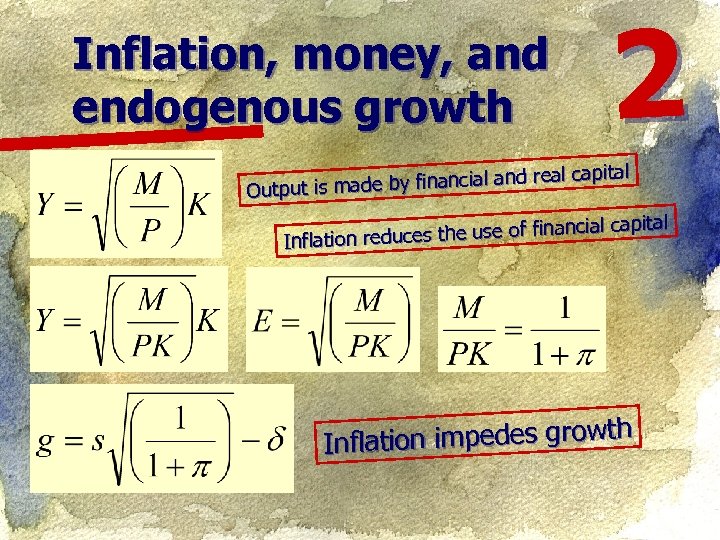

Inflation, money, and endogenous growth 2 l capital de by financial and rea Output is ma cial capital duces the use of finan Inflation re ation impedes growth Infl

Inflation, money, and endogenous growth 2 l capital de by financial and rea Output is ma cial capital duces the use of finan Inflation re ation impedes growth Infl

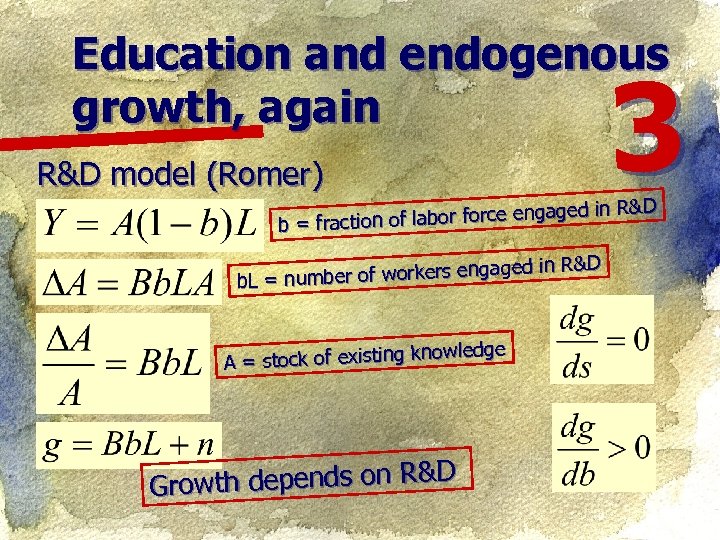

Education and endogenous growth, again R&D model (Romer) 3 ed in R&D n of labor force engag b = fractio d in R&D ber of workers engage b. L = num ledge stock of existing know A= &D Growth depends on R

Education and endogenous growth, again R&D model (Romer) 3 ed in R&D n of labor force engag b = fractio d in R&D ber of workers engage b. L = num ledge stock of existing know A= &D Growth depends on R

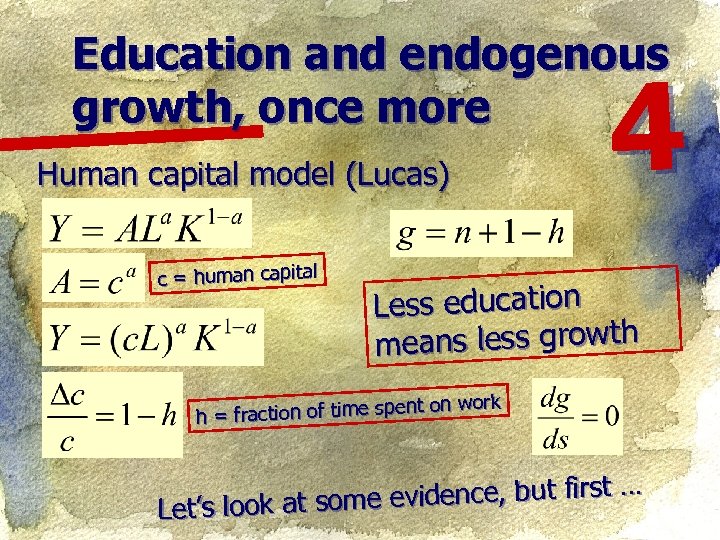

Education and endogenous growth, once more Human capital model (Lucas) c = human capital 4 Less education means less growth ent on work h = fraction of time sp evidence, but first … Let’s look at some

Education and endogenous growth, once more Human capital model (Lucas) c = human capital 4 Less education means less growth ent on work h = fraction of time sp evidence, but first … Let’s look at some

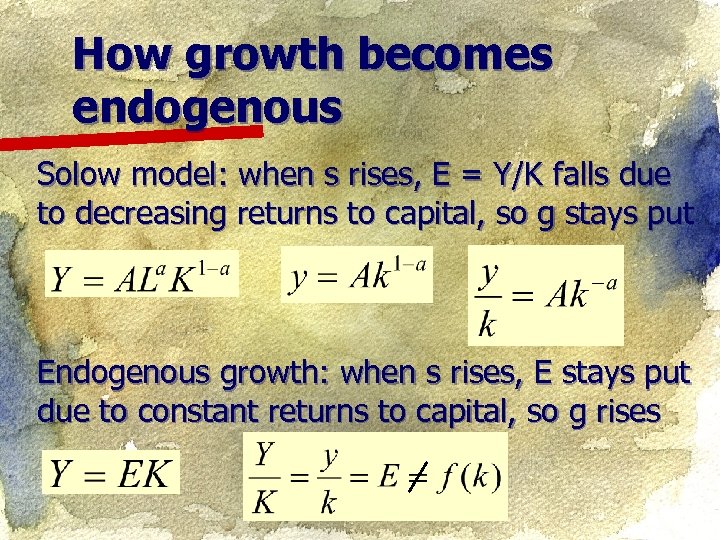

How growth becomes endogenous Solow model: when s rises, E = Y/K falls due to decreasing returns to capital, so g stays put Endogenous growth: when s rises, E stays put due to constant returns to capital, so g rises

How growth becomes endogenous Solow model: when s rises, E = Y/K falls due to decreasing returns to capital, so g stays put Endogenous growth: when s rises, E stays put due to constant returns to capital, so g rises

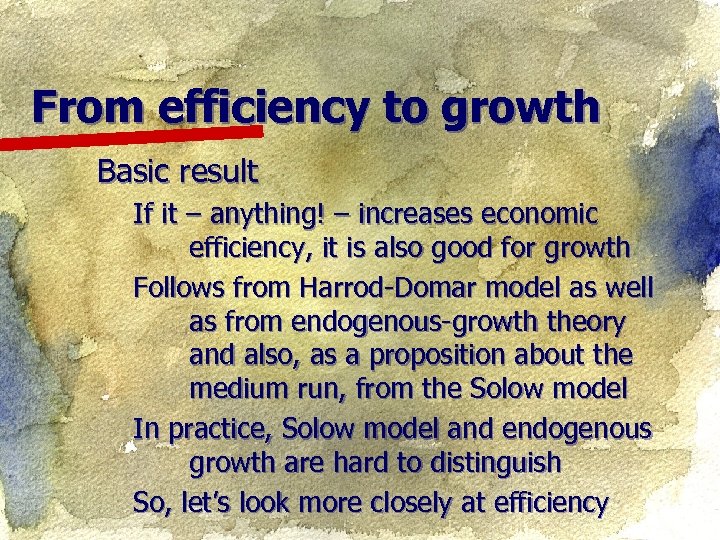

From efficiency to growth Basic result If it – anything! – increases economic efficiency, it is also good for growth Follows from Harrod-Domar model as well as from endogenous-growth theory and also, as a proposition about the medium run, from the Solow model In practice, Solow model and endogenous growth are hard to distinguish So, let’s look more closely at efficiency

From efficiency to growth Basic result If it – anything! – increases economic efficiency, it is also good for growth Follows from Harrod-Domar model as well as from endogenous-growth theory and also, as a proposition about the medium run, from the Solow model In practice, Solow model and endogenous growth are hard to distinguish So, let’s look more closely at efficiency

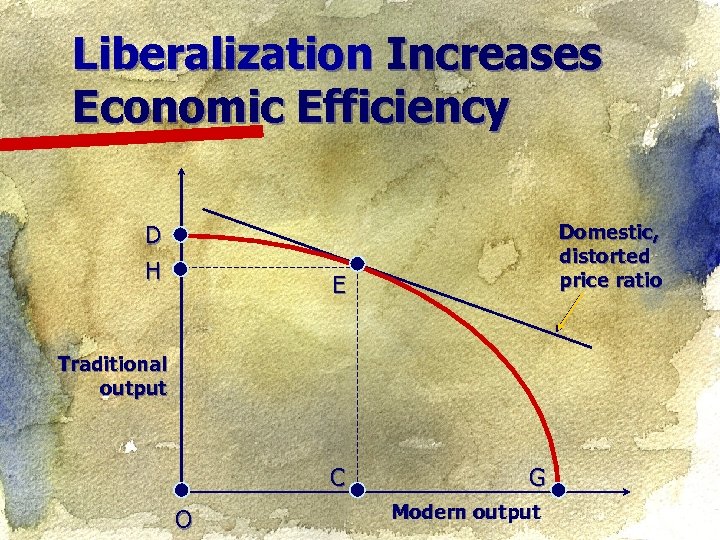

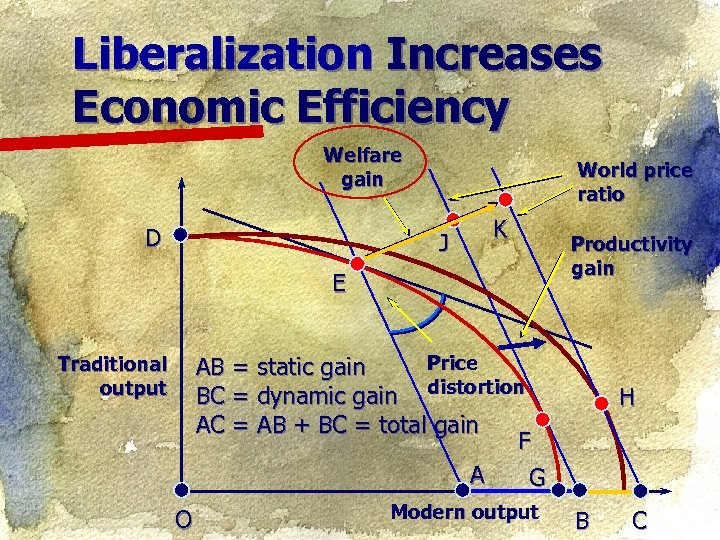

Liberalization Increases Economic Efficiency D H Domestic, distorted price ratio E Traditional output C O G Modern output

Liberalization Increases Economic Efficiency D H Domestic, distorted price ratio E Traditional output C O G Modern output

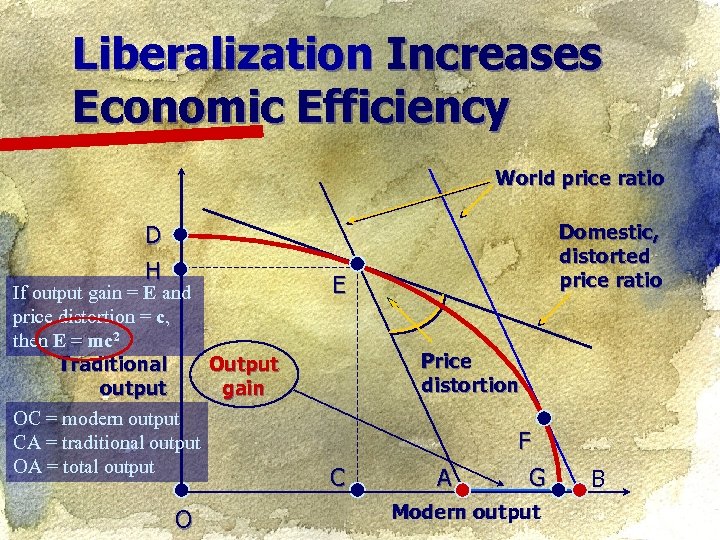

Liberalization Increases Economic Efficiency World price ratio D H If output gain = E and price distortion = c, then E = mc 2 Traditional Output output gain OC = modern output CA = traditional output OA = total output O Domestic, distorted price ratio E Price distortion F C A G Modern output B

Liberalization Increases Economic Efficiency World price ratio D H If output gain = E and price distortion = c, then E = mc 2 Traditional Output output gain OC = modern output CA = traditional output OA = total output O Domestic, distorted price ratio E Price distortion F C A G Modern output B

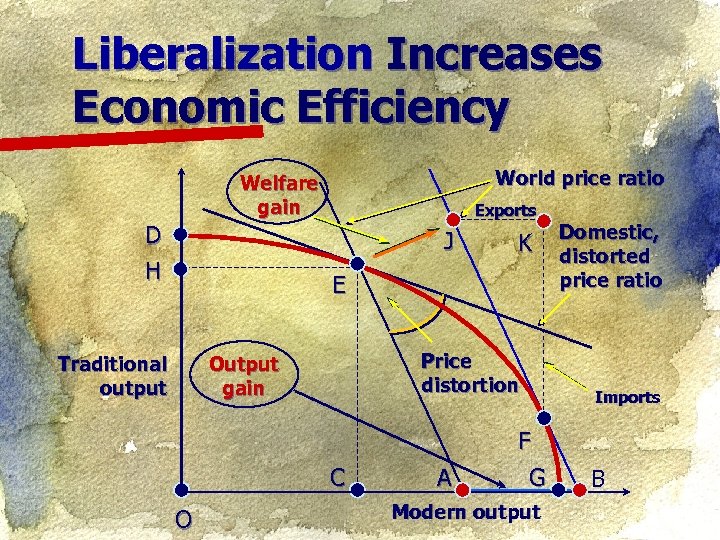

Liberalization Increases Economic Efficiency World price ratio Welfare gain D H Exports J K E Traditional output Price distortion Output gain Domestic, distorted price ratio Imports F C O A G Modern output B

Liberalization Increases Economic Efficiency World price ratio Welfare gain D H Exports J K E Traditional output Price distortion Output gain Domestic, distorted price ratio Imports F C O A G Modern output B

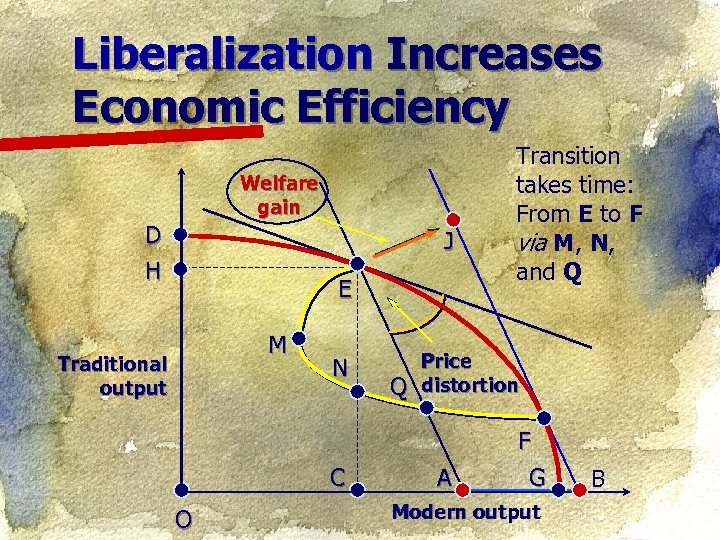

Liberalization Increases Economic Efficiency Welfare gain D H J E M Traditional output N Q Transition takes time: From E to F via M, N, and Q Price distortion F C O A G Modern output B

Liberalization Increases Economic Efficiency Welfare gain D H J E M Traditional output N Q Transition takes time: From E to F via M, N, and Q Price distortion F C O A G Modern output B

Liberalization Increases Economic Efficiency Welfare gain D World price ratio J K E Productivity gain Price AB = static gain BC = dynamic gain distortion AC = AB + BC = total gain F A G Traditional output O Modern output H B C

Liberalization Increases Economic Efficiency Welfare gain D World price ratio J K E Productivity gain Price AB = static gain BC = dynamic gain distortion AC = AB + BC = total gain F A G Traditional output O Modern output H B C

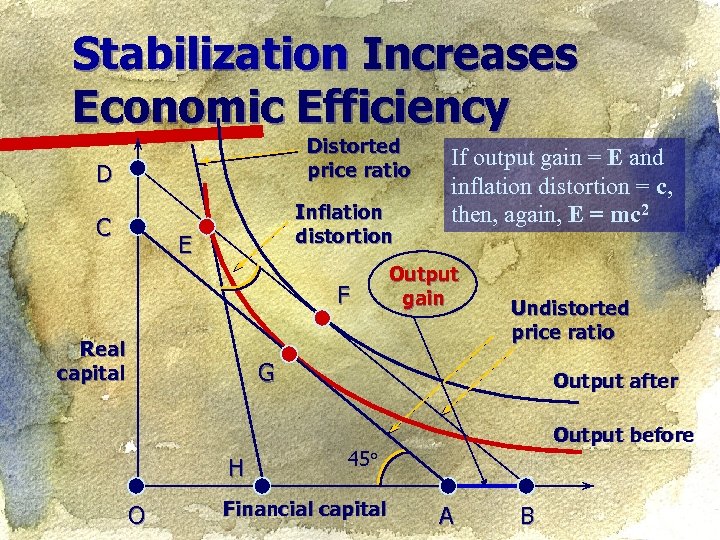

Stabilization Increases Economic Efficiency Distorted price ratio D C Inflation distortion E F Real capital If output gain = E and inflation distortion = c, then, again, E = mc 2 Output gain Undistorted price ratio G H O Output after Output before 45° Financial capital A B

Stabilization Increases Economic Efficiency Distorted price ratio D C Inflation distortion E F Real capital If output gain = E and inflation distortion = c, then, again, E = mc 2 Output gain Undistorted price ratio G H O Output after Output before 45° Financial capital A B

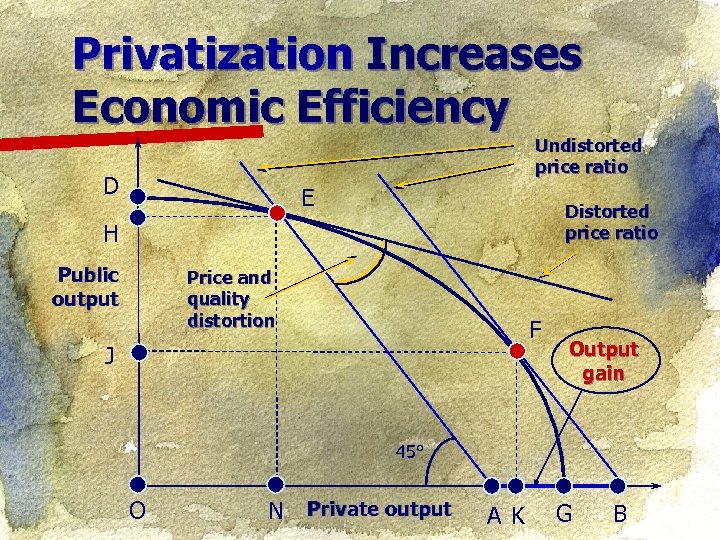

Privatization Increases Economic Efficiency Undistorted price ratio D E Distorted price ratio H Public output Price and quality distortion F J Output gain 45° O N Private output A K G B

Privatization Increases Economic Efficiency Undistorted price ratio D E Distorted price ratio H Public output Price and quality distortion F J Output gain 45° O N Private output A K G B

From efficiency to growth: Same story time and again n Free trade is good for growth – Reduces the inefficiency that results from restrictions on trade n Price stability is good for growth – Reduces inefficiency resulting from inflation n Privatization is good for growth – Reduces inefficiency resulting from SOEs n Education is good for growth – Reduces the inefficiency that results from inadequate education

From efficiency to growth: Same story time and again n Free trade is good for growth – Reduces the inefficiency that results from restrictions on trade n Price stability is good for growth – Reduces inefficiency resulting from inflation n Privatization is good for growth – Reduces inefficiency resulting from SOEs n Education is good for growth – Reduces the inefficiency that results from inadequate education

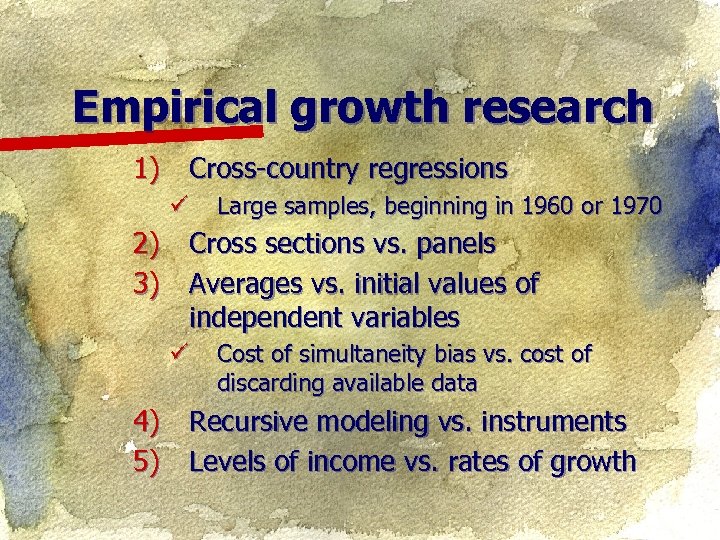

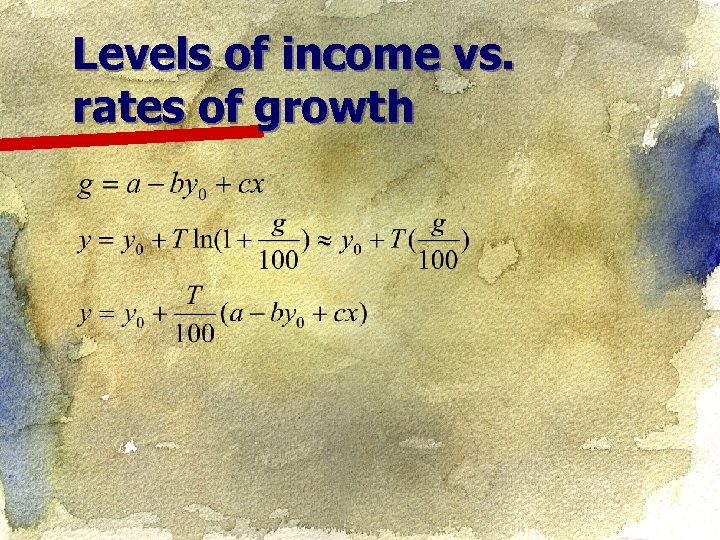

Empirical growth research 1) Cross-country regressions ü Large samples, beginning in 1960 or 1970 2) Cross sections vs. panels 3) Averages vs. initial values of independent variables ü Cost of simultaneity bias vs. cost of discarding available data 4) Recursive modeling vs. instruments 5) Levels of income vs. rates of growth

Empirical growth research 1) Cross-country regressions ü Large samples, beginning in 1960 or 1970 2) Cross sections vs. panels 3) Averages vs. initial values of independent variables ü Cost of simultaneity bias vs. cost of discarding available data 4) Recursive modeling vs. instruments 5) Levels of income vs. rates of growth

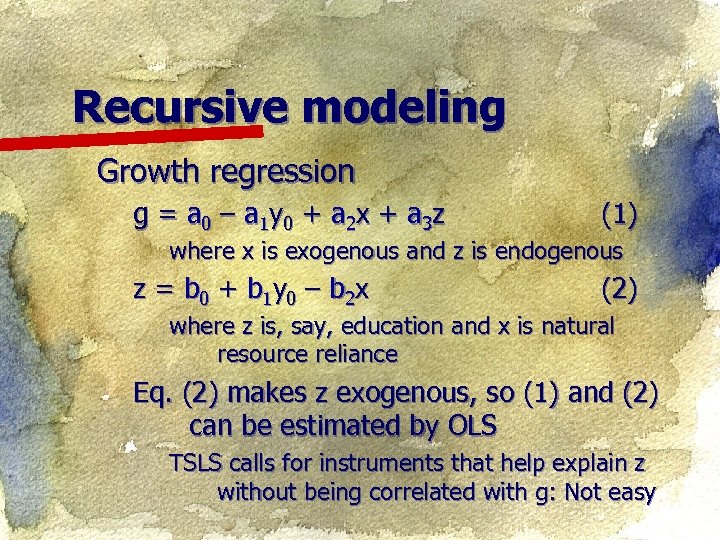

Recursive modeling Growth regression g = a 0 – a 1 y 0 + a 2 x + a 3 z (1) z = b 0 + b 1 y 0 – b 2 x (2) where x is exogenous and z is endogenous where z is, say, education and x is natural resource reliance Eq. (2) makes z exogenous, so (1) and (2) can be estimated by OLS TSLS calls for instruments that help explain z without being correlated with g: Not easy

Recursive modeling Growth regression g = a 0 – a 1 y 0 + a 2 x + a 3 z (1) z = b 0 + b 1 y 0 – b 2 x (2) where x is exogenous and z is endogenous where z is, say, education and x is natural resource reliance Eq. (2) makes z exogenous, so (1) and (2) can be estimated by OLS TSLS calls for instruments that help explain z without being correlated with g: Not easy

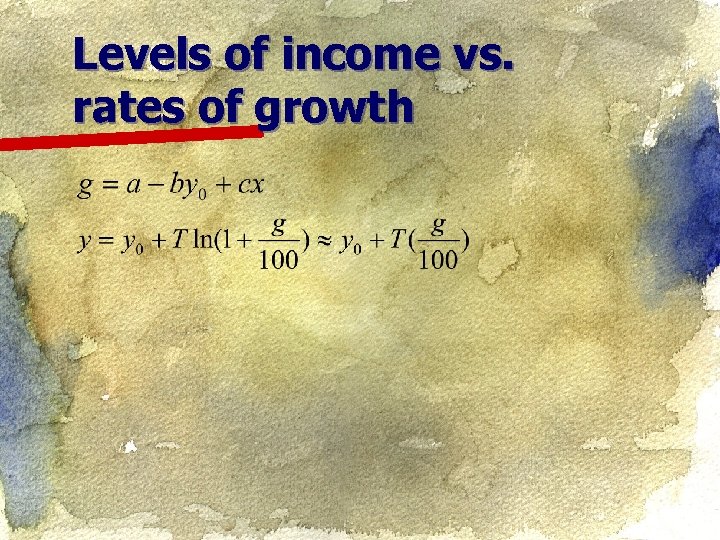

Levels of income vs. rates of growth

Levels of income vs. rates of growth

Levels of income vs. rates of growth

Levels of income vs. rates of growth

Levels of income vs. rates of growth

Levels of income vs. rates of growth

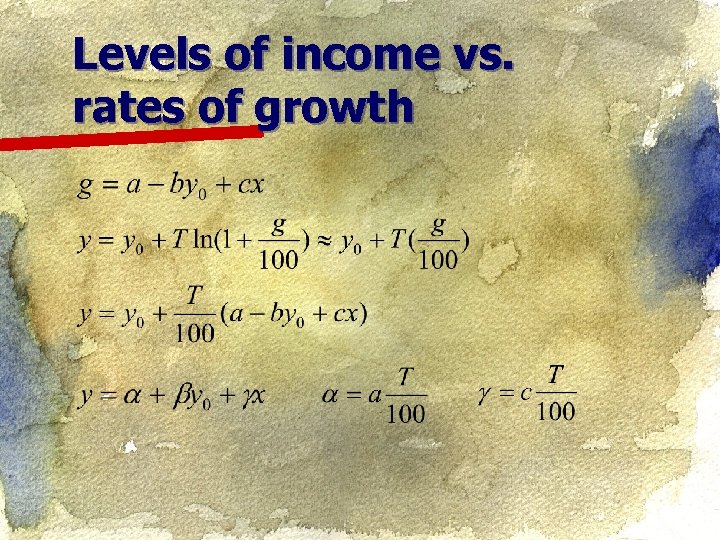

Levels of income vs. rates of growth

Levels of income vs. rates of growth

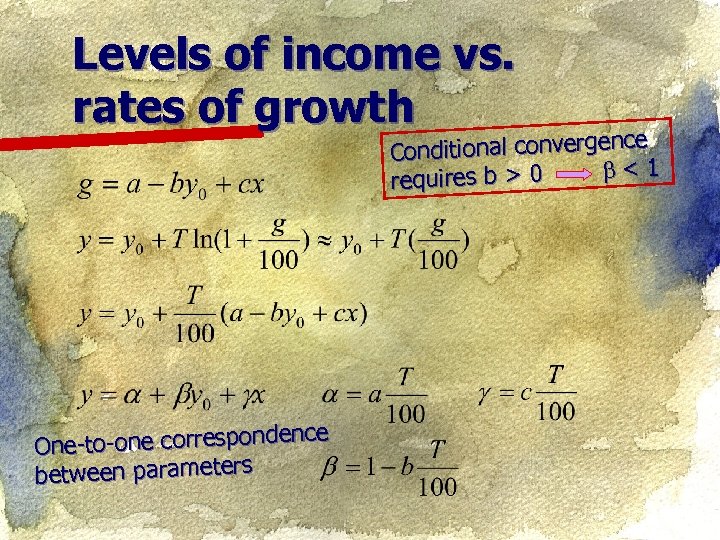

Levels of income vs. rates of growth e onditional convergenc C < 1 uires b > 0 req dence One-to-one correspon between parameters

Levels of income vs. rates of growth e onditional convergenc C < 1 uires b > 0 req dence One-to-one correspon between parameters

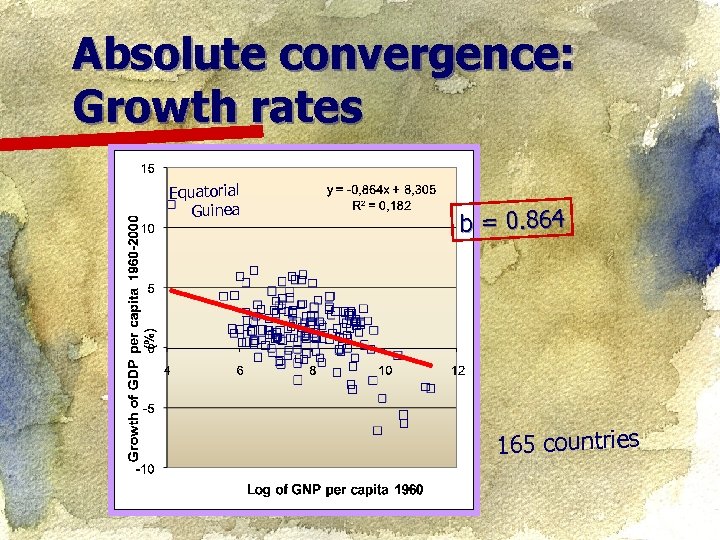

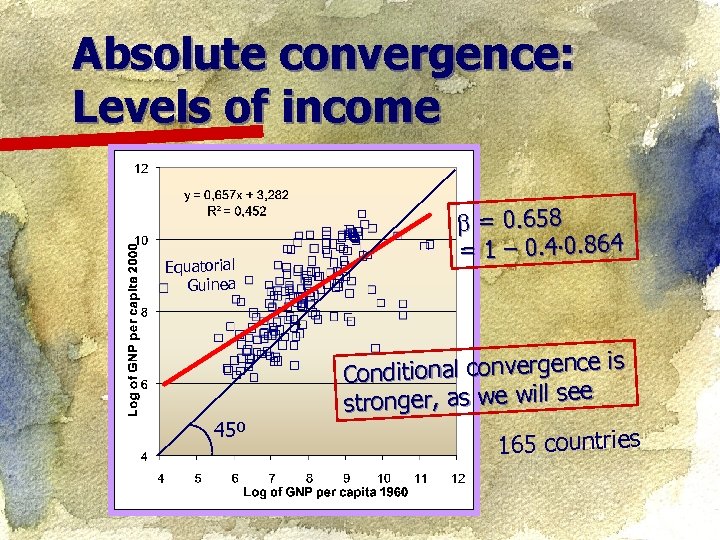

Absolute convergence: Growth rates Equatorial Guinea b = 0. 864 165 countries

Absolute convergence: Growth rates Equatorial Guinea b = 0. 864 165 countries

Absolute convergence: Levels of income Equatorial Guinea 45º = 0. 658. 4 = 1 – 0. 4 0. 864 ce is Conditional convergen e stronger, as we will se 165 countries

Absolute convergence: Levels of income Equatorial Guinea 45º = 0. 658. 4 = 1 – 0. 4 0. 864 ce is Conditional convergen e stronger, as we will se 165 countries

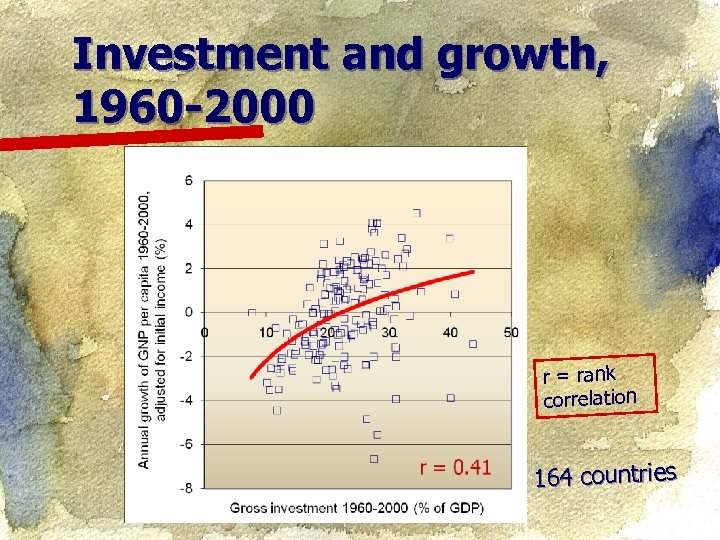

Investment and growth, 1960 -2000 r = rank correlation 164 countries

Investment and growth, 1960 -2000 r = rank correlation 164 countries

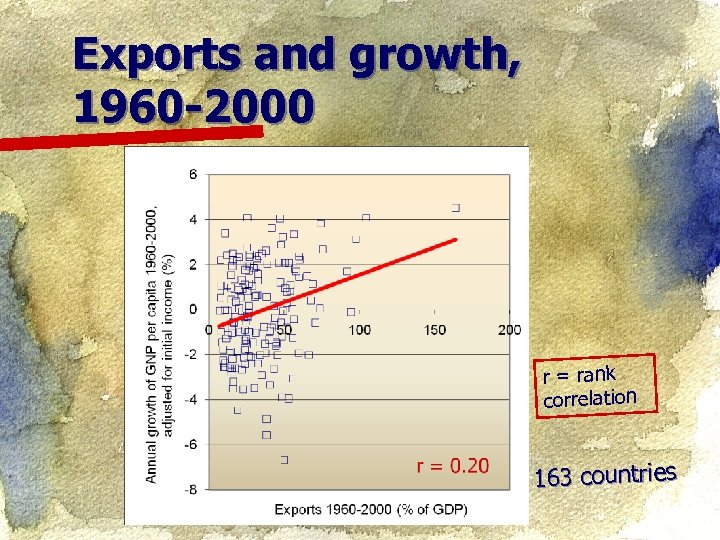

Exports and growth, 1960 -2000 r = rank correlation 163 countries

Exports and growth, 1960 -2000 r = rank correlation 163 countries

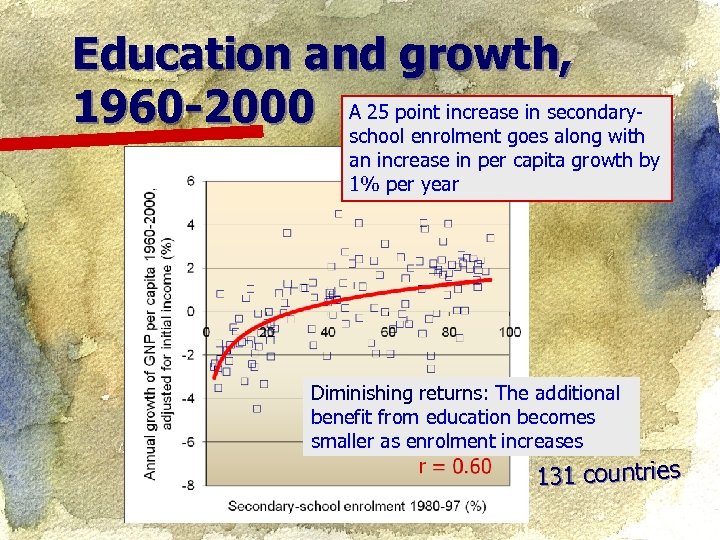

Education and growth, 1960 -2000 A 25 point increase in secondaryschool enrolment goes along with an increase in per capita growth by 1% per year Diminishing returns: The additional benefit from education becomes smaller as enrolment increases 131 countries

Education and growth, 1960 -2000 A 25 point increase in secondaryschool enrolment goes along with an increase in per capita growth by 1% per year Diminishing returns: The additional benefit from education becomes smaller as enrolment increases 131 countries

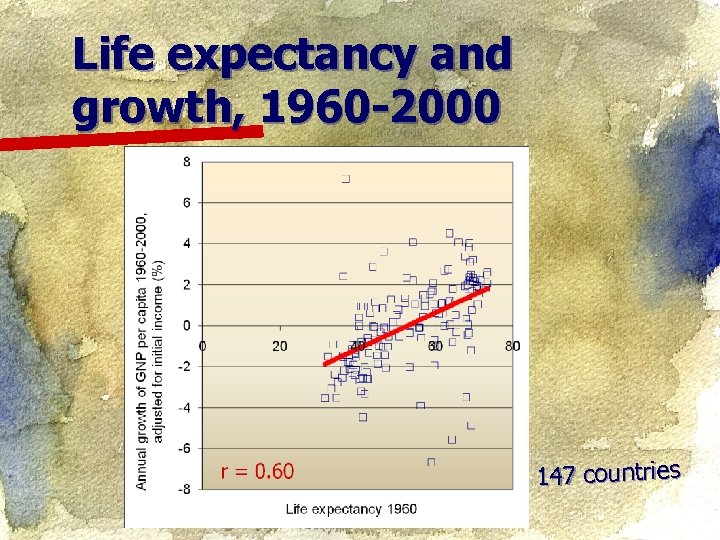

Life expectancy and growth, 1960 -2000 147 countries

Life expectancy and growth, 1960 -2000 147 countries

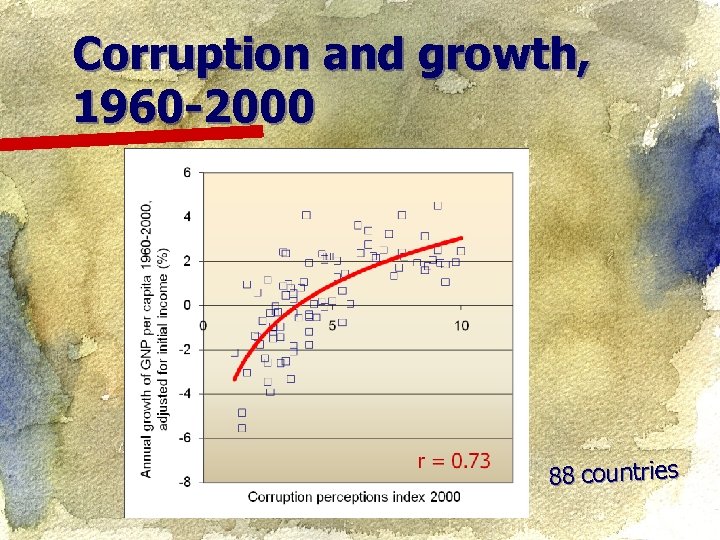

Corruption and growth, 1960 -2000 88 countries

Corruption and growth, 1960 -2000 88 countries

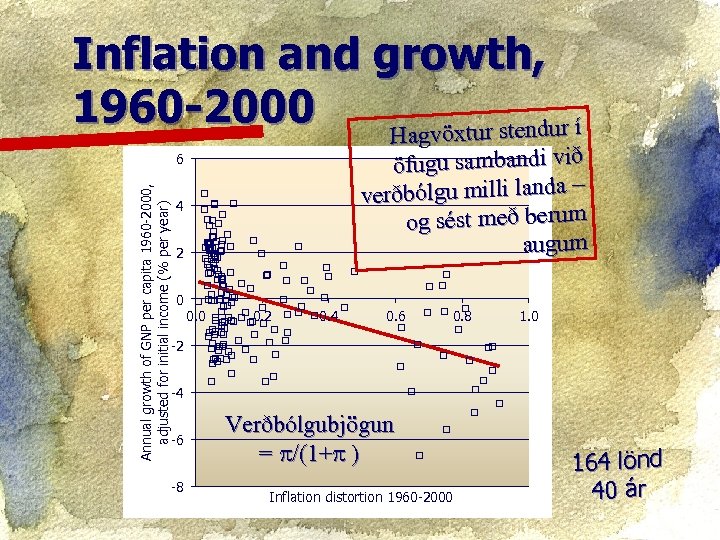

Inflation and growth, 1960 -2000 Hagvöxtur stendur í öfugu sambandi við verðbólgu milli landa – og sést með berum augum Annual growth of GNP per capita 1960 -2000, adjusted for initial income (% per year) 6 4 2 0 0. 2 0. 4 0. 6 0. 8 1. 0 -2 -4 -6 -8 Verðbólgubjögun = /(1+ ) Inflation distortion 1960 -2000 164 lönd 40 ár

Inflation and growth, 1960 -2000 Hagvöxtur stendur í öfugu sambandi við verðbólgu milli landa – og sést með berum augum Annual growth of GNP per capita 1960 -2000, adjusted for initial income (% per year) 6 4 2 0 0. 2 0. 4 0. 6 0. 8 1. 0 -2 -4 -6 -8 Verðbólgubjögun = /(1+ ) Inflation distortion 1960 -2000 164 lönd 40 ár

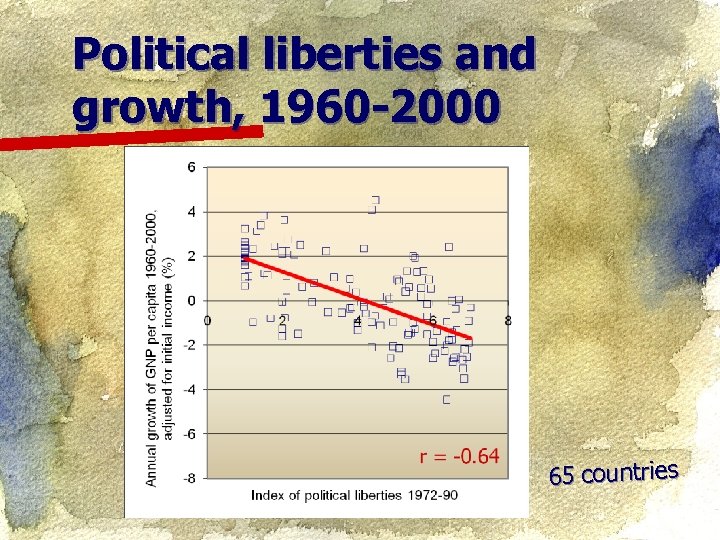

Political liberties and growth, 1960 -2000 65 countries

Political liberties and growth, 1960 -2000 65 countries

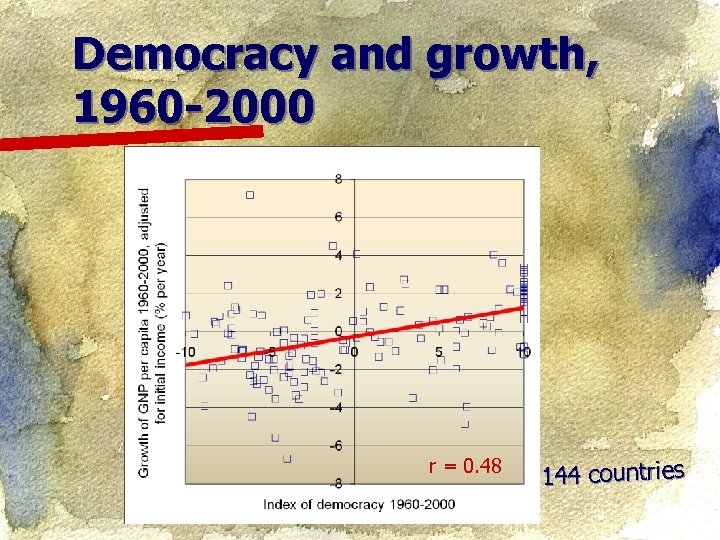

Democracy and growth, 1960 -2000 r = 0. 48 144 countries

Democracy and growth, 1960 -2000 r = 0. 48 144 countries

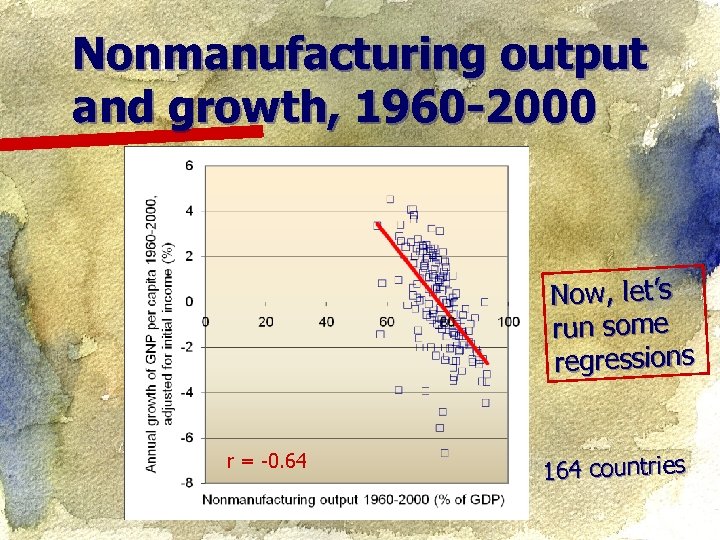

Nonmanufacturing output and growth, 1960 -2000 Now, let’s run some regressions r = -0. 64 164 countries

Nonmanufacturing output and growth, 1960 -2000 Now, let’s run some regressions r = -0. 64 164 countries

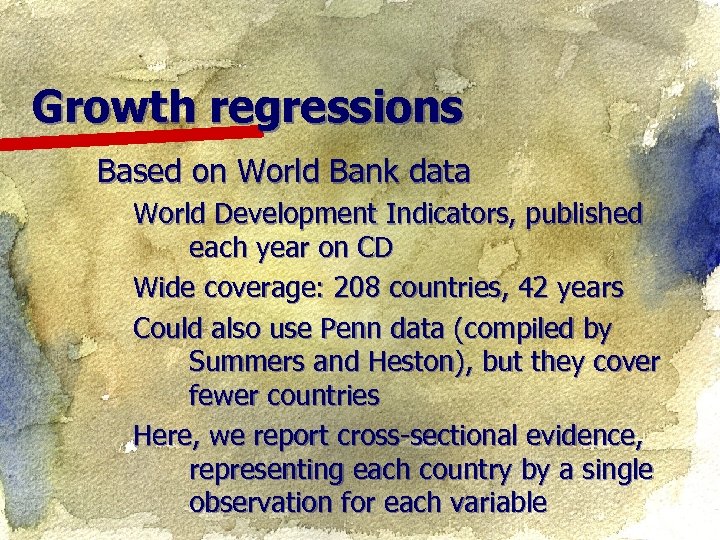

Growth regressions Based on World Bank data World Development Indicators, published each year on CD Wide coverage: 208 countries, 42 years Could also use Penn data (compiled by Summers and Heston), but they cover fewer countries Here, we report cross-sectional evidence, representing each country by a single observation for each variable

Growth regressions Based on World Bank data World Development Indicators, published each year on CD Wide coverage: 208 countries, 42 years Could also use Penn data (compiled by Summers and Heston), but they cover fewer countries Here, we report cross-sectional evidence, representing each country by a single observation for each variable

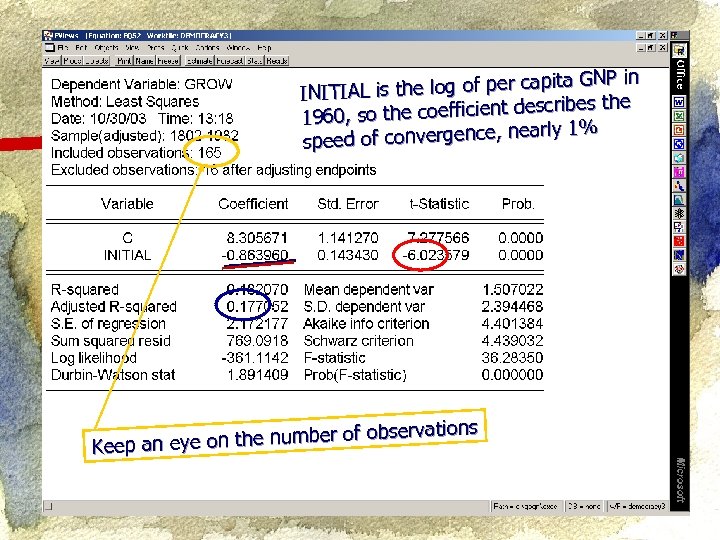

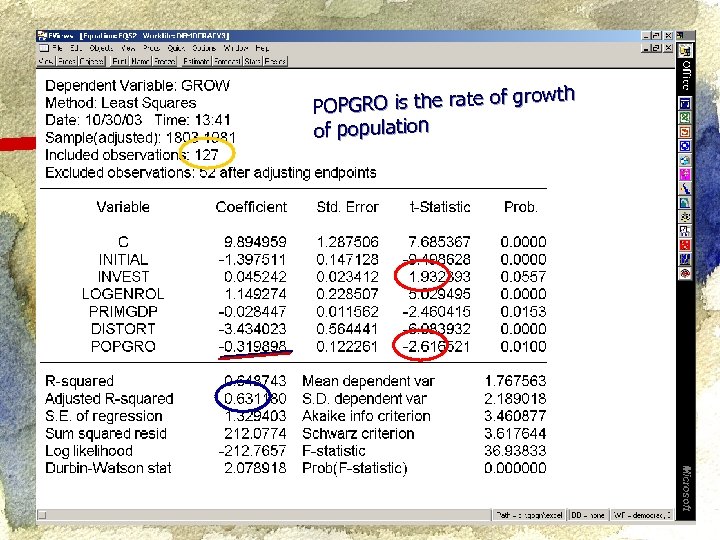

NP in the log of per capita G INITIAL is the e coefficient describes 1960, so th early 1% eed of convergence, n sp rvations on the number of obse Keep an eye

NP in the log of per capita G INITIAL is the e coefficient describes 1960, so th early 1% eed of convergence, n sp rvations on the number of obse Keep an eye

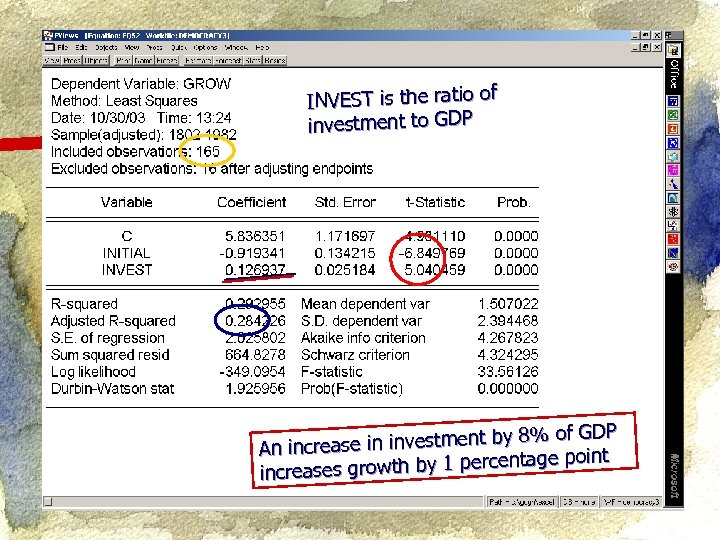

INVEST is the ratio of investment to GDP of GDP se in investment by 8% An increa e point growth by 1 percentag increases

INVEST is the ratio of investment to GDP of GDP se in investment by 8% An increa e point growth by 1 percentag increases

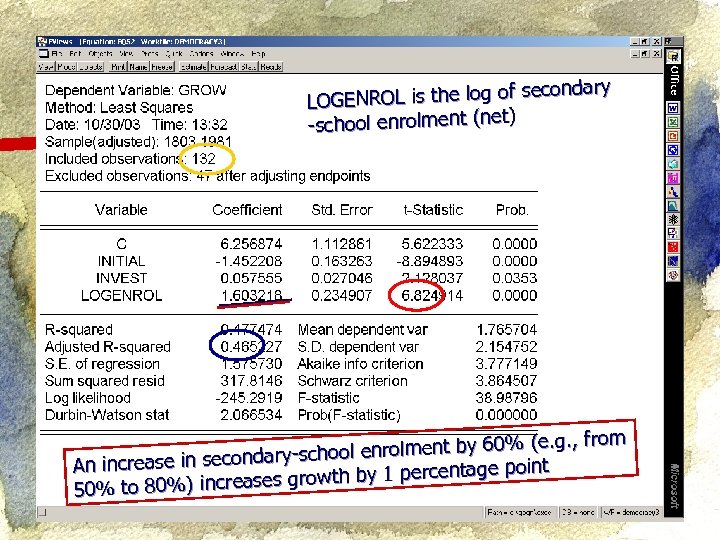

condary GENROL is the log of se LO t) -school enrolment (ne (e. g. , from ool enrolment by 60% ary-sch An increase in second entage point ases growth by 1 perc 50% to 80%) incre

condary GENROL is the log of se LO t) -school enrolment (ne (e. g. , from ool enrolment by 60% ary-sch An increase in second entage point ases growth by 1 perc 50% to 80%) incre

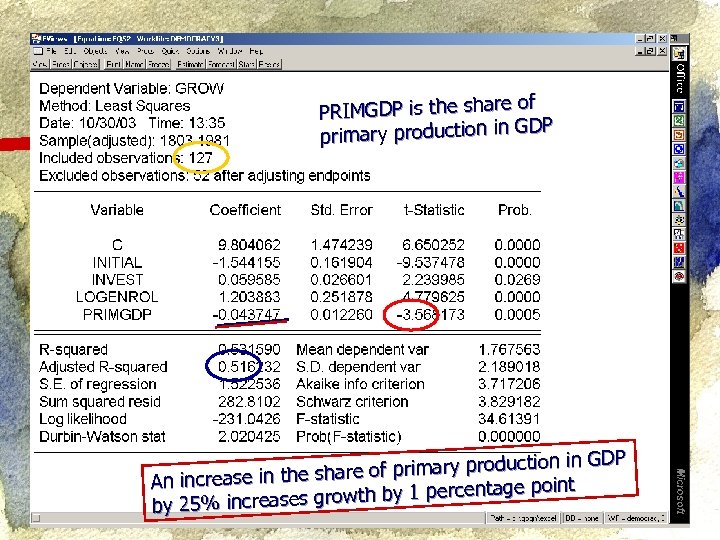

of PRIMGDP is the share GDP primary production in GDP are of primary product An increase in the sh point rowth by 1 percentage by 25% increases g

of PRIMGDP is the share GDP primary production in GDP are of primary product An increase in the sh point rowth by 1 percentage by 25% increases g

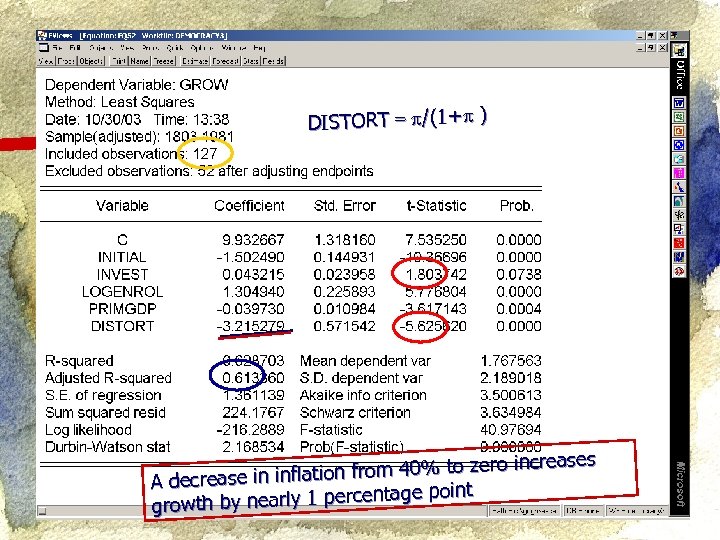

+ T = DISTORT = /(1+ ) increases on from 40% to zero A decrease in inflati ntage point wth by nearly 1 perce gro

+ T = DISTORT = /(1+ ) increases on from 40% to zero A decrease in inflati ntage point wth by nearly 1 perce gro

growth POPGRO is the rate of of population

growth POPGRO is the rate of of population

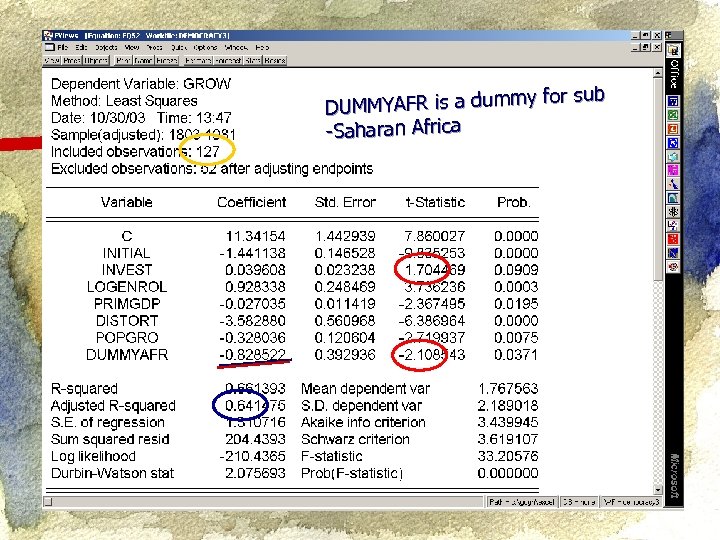

y for sub DUMMYAFR is a dumm -Saharan Africa

y for sub DUMMYAFR is a dumm -Saharan Africa

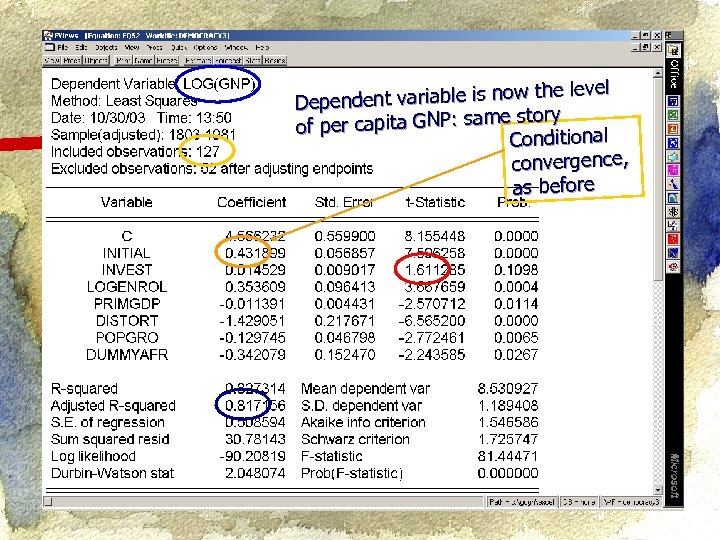

the level ndent variable is now Depe e story of per capita GNP: sam Conditional convergence, as before

the level ndent variable is now Depe e story of per capita GNP: sam Conditional convergence, as before

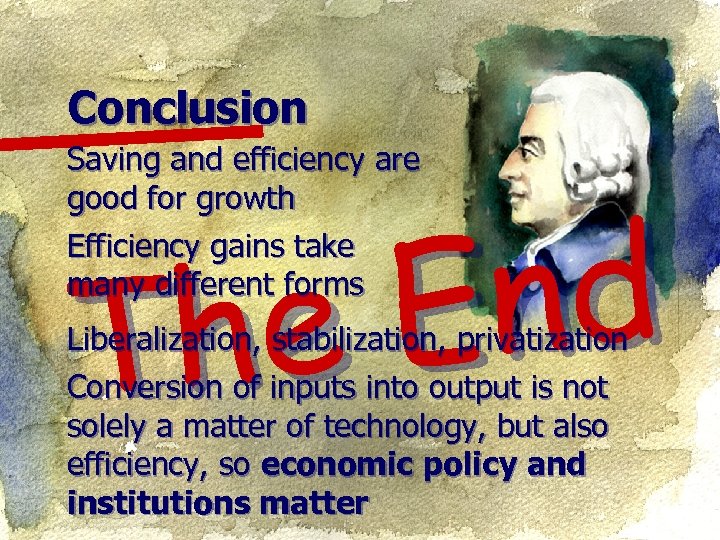

Conclusion Saving and efficiency are good for growth Efficiency gains take many different forms nd E he T Liberalization, stabilization, privatization Conversion of inputs into output is not solely a matter of technology, but also efficiency, so economic policy and institutions matter

Conclusion Saving and efficiency are good for growth Efficiency gains take many different forms nd E he T Liberalization, stabilization, privatization Conversion of inputs into output is not solely a matter of technology, but also efficiency, so economic policy and institutions matter

room discussion Class

room discussion Class