e8a2f983a52102e8509baf490e8b4e65.ppt

- Количество слайдов: 40

Thoughts on the Current Financial Turmoil presentation by Richard Rosen, Federal Reserve Bank of Chicago April 18, 2008 The views expressed here are those of the author and may not represent those of the Federal Reserve Bank of Chicago or the Federal Reserve System. 1

Outline • What caused the recent financial turmoil? • What do we mean by turmoil? • What does this mean for the broader economy? – What did the Fed do? 2

Causes of the turmoil. • Financial markets seemed strong going into 2007. – Equity markets had at least partially recovered from the 2001 declines. • The IPO market was healthy. • Measures of expected equity market volatility were at historically low levels. – Bond markets were growing, with bond spreads at low levels. • But housing markets were beginning to show signs of weakness. – Home prices had stopped their rapid increase. 3

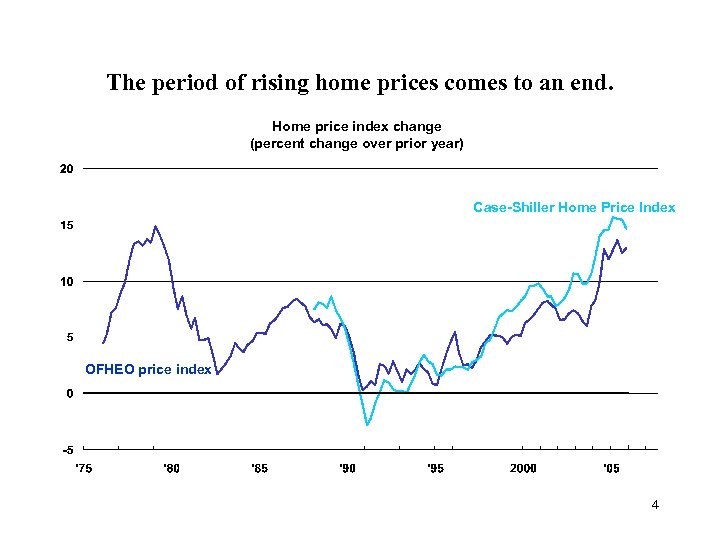

The period of rising home prices comes to an end. Home price index change (percent change over prior year) Case-Shiller Home Price Index OFHEO price index 4

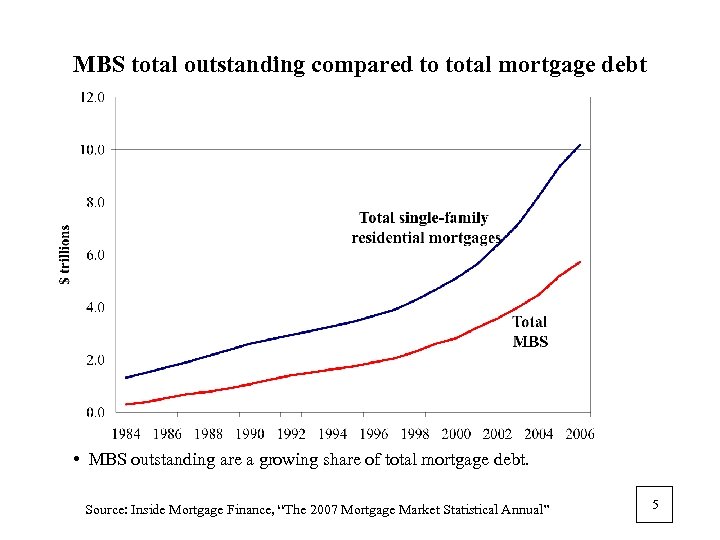

MBS total outstanding compared to total mortgage debt • MBS outstanding are a growing share of total mortgage debt. Source: Inside Mortgage Finance, “The 2007 Mortgage Market Statistical Annual” 5

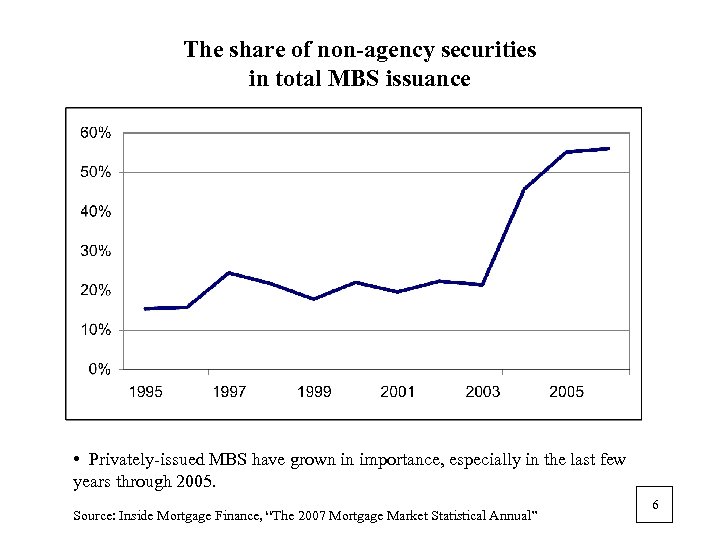

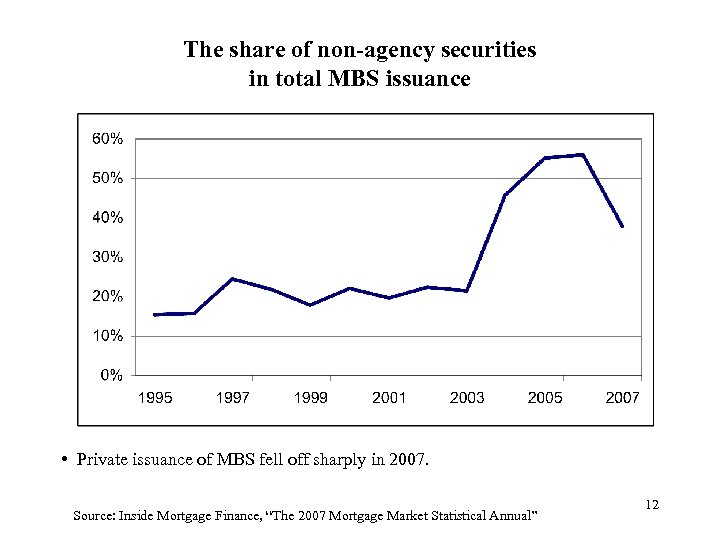

The share of non-agency securities in total MBS issuance • Privately-issued MBS have grown in importance, especially in the last few years through 2005. Source: Inside Mortgage Finance, “The 2007 Mortgage Market Statistical Annual” 6

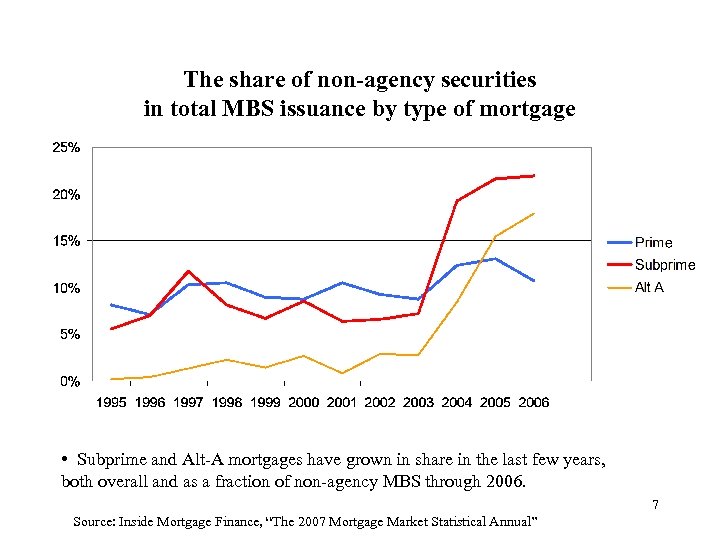

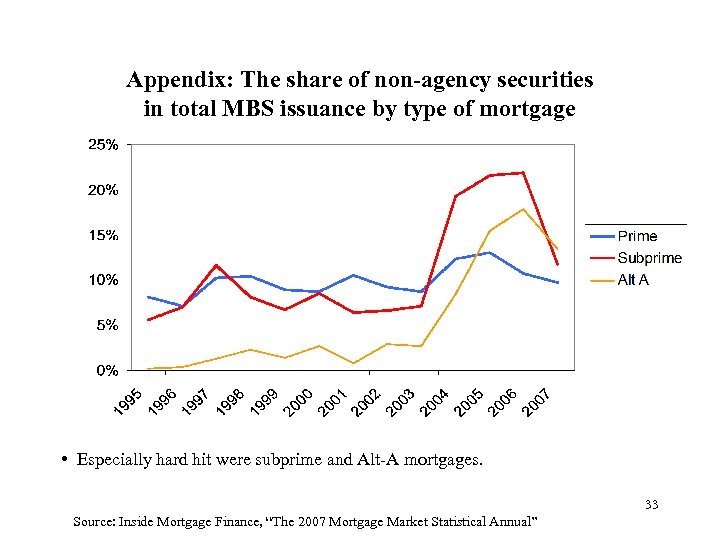

The share of non-agency securities in total MBS issuance by type of mortgage • Subprime and Alt-A mortgages have grown in share in the last few years, both overall and as a fraction of non-agency MBS through 2006. 7 Source: Inside Mortgage Finance, “The 2007 Mortgage Market Statistical Annual”

Causes of the turmoil. • Then, in 2007, there were a series of problems related to subprime mortgage investments that spooked the markets. – In addition, home prices started to decrease in some markets and homes became more difficult to sell. 8

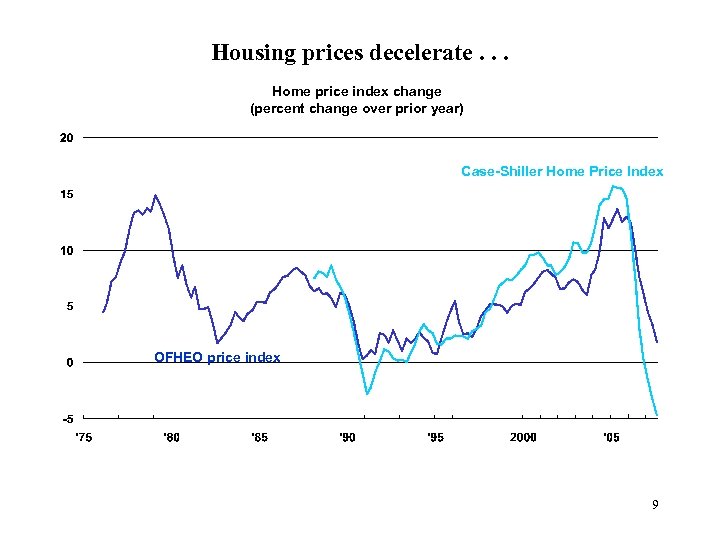

Housing prices decelerate. . . Home price index change (percent change over prior year) Case-Shiller Home Price Index OFHEO price index 9

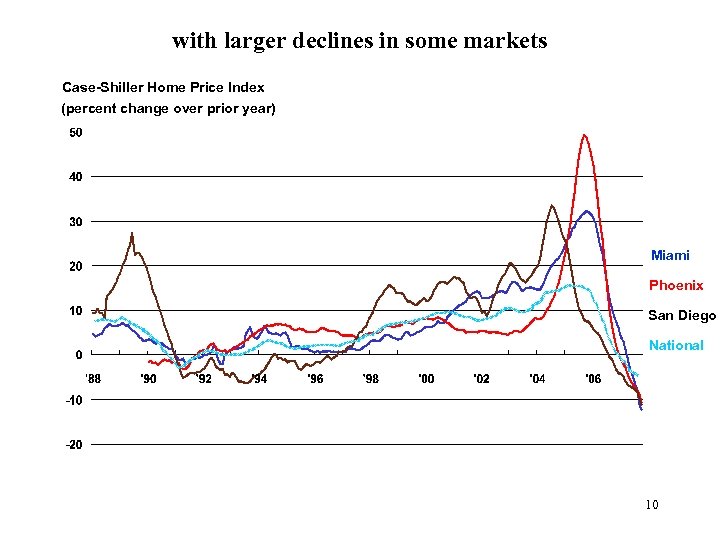

with larger declines in some markets Case-Shiller Home Price Index (percent change over prior year) Miami Phoenix San Diego National 10

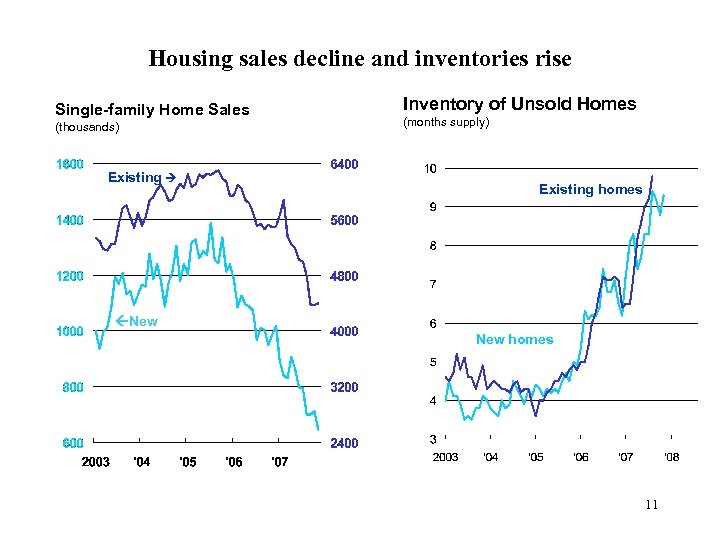

Housing sales decline and inventories rise Single-family Home Sales (thousands) Existing Inventory of Unsold Homes (months supply) Existing homes New homes 11

The share of non-agency securities in total MBS issuance • Private issuance of MBS fell off sharply in 2007. Source: Inside Mortgage Finance, “The 2007 Mortgage Market Statistical Annual” 12

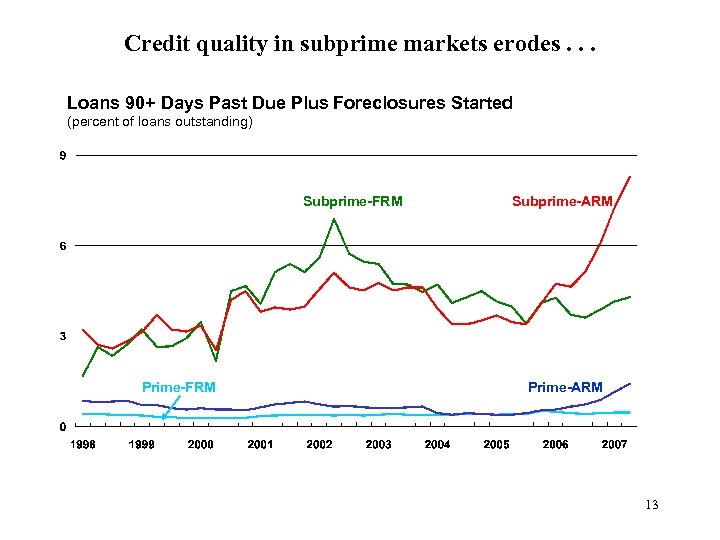

Credit quality in subprime markets erodes. . . Loans 90+ Days Past Due Plus Foreclosures Started (percent of loans outstanding) Subprime-FRM Prime-FRM Subprime-ARM Prime-ARM 13

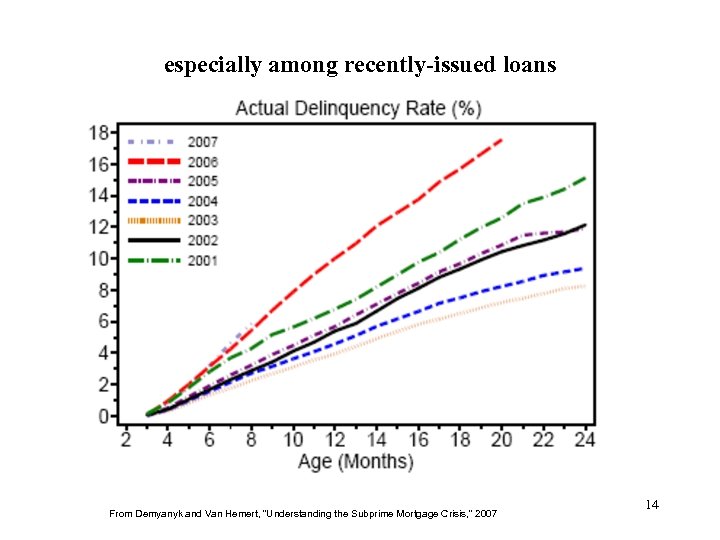

especially among recently-issued loans From Demyanyk and Van Hemert, “Understanding the Subprime Mortgage Crisis, ” 2007 14

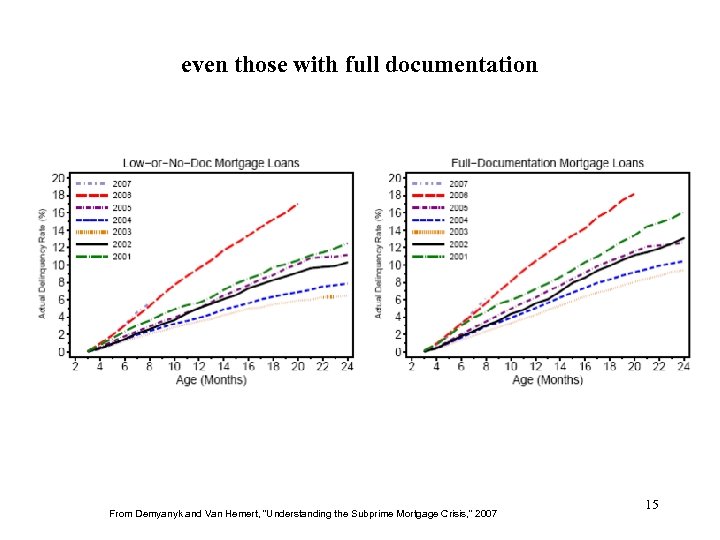

even those with full documentation From Demyanyk and Van Hemert, “Understanding the Subprime Mortgage Crisis, ” 2007 15

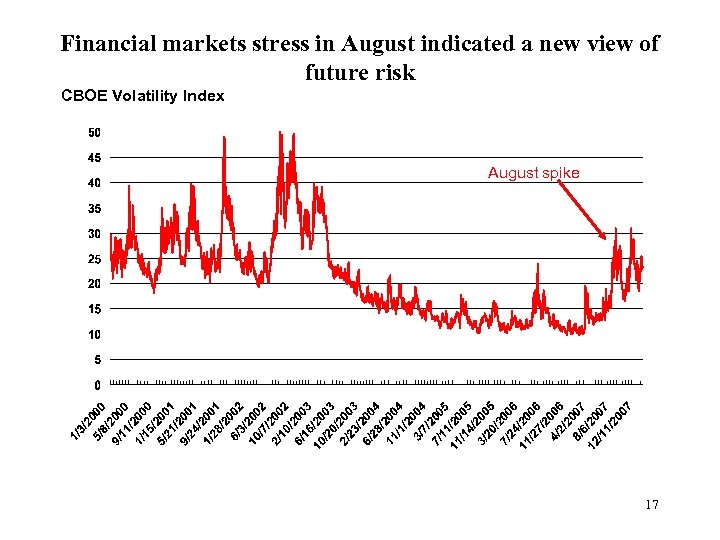

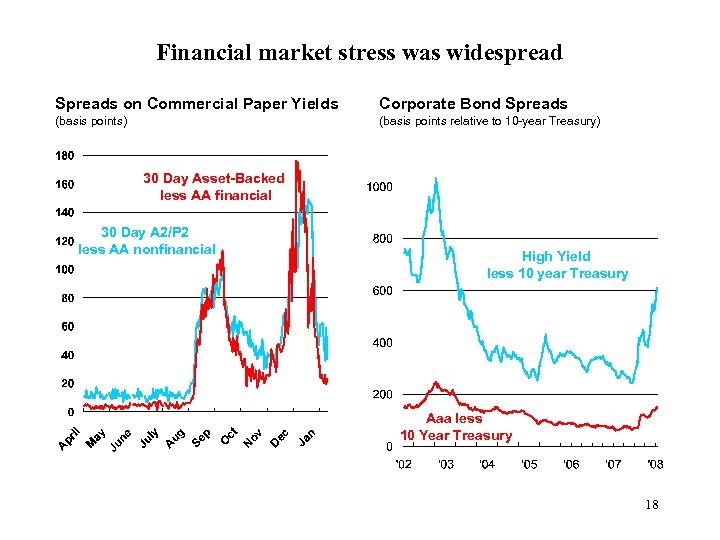

What do we mean by turmoil? • The problems in subprime mortgage markets sparked a general reconsideration of, and repricing of, risk in many markets. 16

Financial markets stress in August indicated a new view of future risk CBOE Volatility Index August spike 17

Financial market stress was widespread Spreads on Commercial Paper Yields Corporate Bond Spreads (basis points) (basis points relative to 10 -year Treasury) 30 Day Asset-Backed less AA financial 30 Day A 2/P 2 less AA nonfinancial High Yield less 10 year Treasury Aaa less 10 Year Treasury 18

There was a flight to quality LIBOR-Overnight Index Swap Spread (basis points; three month maturity) 19

What do we mean by turmoil? • Some markets essentially or largely shut down. – Examples include the asset-backed commercial paper market and auction-rate securities. – The examples may not seem directly related to credit concerns. 20

What happened to the broader economy and financial markets during this time? Heading into the subprime problems: • Economic activity was expanding at a moderate pace. – Unemployment continued to be low. – However, the threat of increased inflation was present. • Financial markets were strong, with market indicators suggesting low risk. • But, . . . 21

Are the changes in credit markets related to the problems in subprime mortgage markets? • The subprime and Alt-A mortgage market is somewhat small. – In total, subprime and Alt-A mortgage debt outstanding is estimated at about $1. 5 trillion, which is 20% of all mortgage debt (Credit Suisse estimates). – This compares to the U. S. GDP of $14 trillion per year and U. S. equity market valuation of about $20 trillion. Ø So, losses of 20% equate to a 1. 5% drop in equity valuations (180 points on the Dow, if the Dow is at 12, 000). 22

Are the changes in credit markets related to the problems in subprime mortgage markets? • But, claims on subprime mortgages are spread more widely. – There are derivative securities such as structured investment vehicles (SIVs) that are based on subprime mortgages. • Perhaps more importantly, the problems in subprime mortgages and derivative products with claims on subprime mortgages may have led the markets to reassess how they calculate risk and risk premia. – This is reflected in the higher risk spreads noted above. 23

What does this mean for the broader economy? The problems in subprime housing can have three types of effects: • Direct effect: Residential construction. • Semi-direct effect: Consumer spending. • Indirect effect: Tightness in credit markets. 24

What does this mean for the broader economy? Where does this leave us? • Overall, economic growth has started to weaken. – There also indications of inflationary pressures. • The weakness in housing continues and there are fears it may negatively affect consumer spending. Ø This led to the decision to cut the federal funds target rate at the recent FOMC meetings (and once between meetings), and to recent statements by senior Fed officials including Chairman Bernanke. 25

What does this mean for the broader economy? What about the financial sector? • The Fed has taken a series of actions designed to add liquidity to credit markets. – Lengthening the maturity of Discount Window loans. – Allowing more collateral for these loans. – Term Auction Facility. – Primary Dealer Credit Facility and Term Securities Lending Facility: loans to investment banks (technically, primary dealers). • And then there was the Bear Stearns situation. . . 26

Bear Stearns and systemic risk • “Our financial system is extremely complex and interconnected, and Bear Stearns participated extensively in a range of critical markets. The sudden failure of Bear Stearns likely would have led to a chaotic unwinding of positions in those markets and could have severely shaken confidence. The company's failure could also have cast doubt on the financial positions of some of Bear Stearns' thousands of counterparties and perhaps of companies with similar businesses. Given the exceptional pressures on the global economy and financial system, the damage caused by a default by Bear Stearns could have been severe and extremely difficult to contain. Moreover, the adverse impact of a default would not have been confined to the financial system but would have been felt broadly in the real economy through its effects on asset values and credit availability. ” Fed Chairman Bernanke before the Senate Banking Committee, April 3, 2008 27

Bear Stearns and systemic risk • The Fed initially agreed to lend money to Bear Stearns through JP Morgan Chase Bank. Then, over the following weekend, JP Morgan Chase agreed to acquire Bear Stearns. – The Bear Stearns resolution immediately preceded the opening of the Term Securities Lending Facility, although the NY Fed president said that Bear Stearns would not have qualified for it. – JP Morgan offered $2 per share, later upped to $10 per share. On the prior Friday, Bear Stearns shares closed at $30 (down from a high of $170). • As the quote on the previous page suggests, the Fed, along with the Treasury Department, felt that it was too dangerous to allow Bear Stearns to fail. – Since the failure of Continental Illinois in 1984, regulators have been reluctant to let large, systemically important banks close. Some have argued that this extends this “too big to fail” policy to investment banks. 28

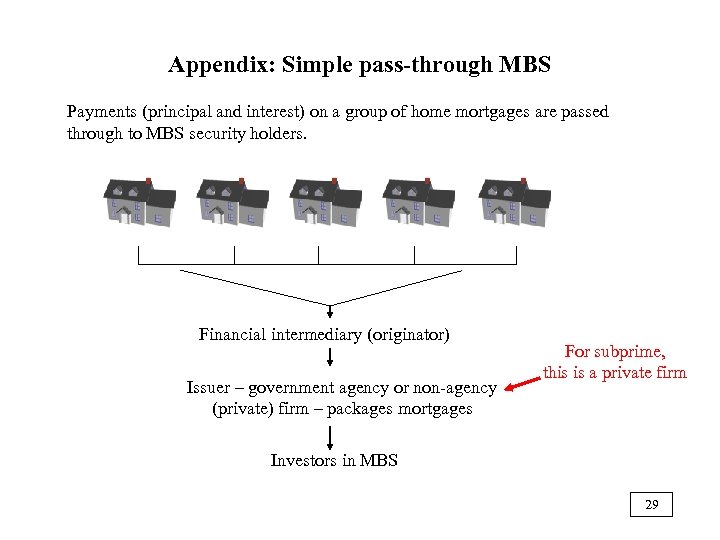

Appendix: Simple pass-through MBS Payments (principal and interest) on a group of home mortgages are passed through to MBS security holders. Financial intermediary (originator) Issuer – government agency or non-agency (private) firm – packages mortgages For subprime, this is a private firm Investors in MBS 29

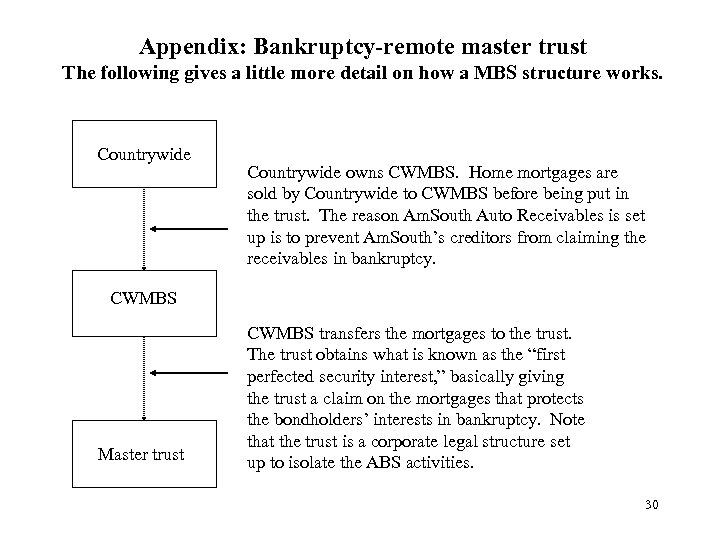

Appendix: Bankruptcy-remote master trust The following gives a little more detail on how a MBS structure works. Countrywide owns CWMBS. Home mortgages are sold by Countrywide to CWMBS before being put in the trust. The reason Am. South Auto Receivables is set up is to prevent Am. South’s creditors from claiming the receivables in bankruptcy. CWMBS Master trust CWMBS transfers the mortgages to the trust. The trust obtains what is known as the “first perfected security interest, ” basically giving the trust a claim on the mortgages that protects the bondholders’ interests in bankruptcy. Note that the trust is a corporate legal structure set up to isolate the ABS activities. 30

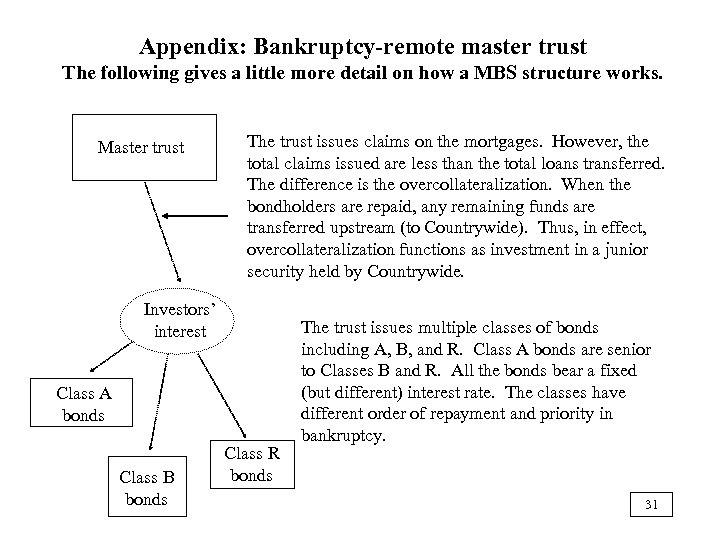

Appendix: Bankruptcy-remote master trust The following gives a little more detail on how a MBS structure works. Master trust The trust issues claims on the mortgages. However, the total claims issued are less than the total loans transferred. The difference is the overcollateralization. When the bondholders are repaid, any remaining funds are transferred upstream (to Countrywide). Thus, in effect, overcollateralization functions as investment in a junior security held by Countrywide. Investors’ interest Class A bonds Class B bonds Class R bonds The trust issues multiple classes of bonds including A, B, and R. Class A bonds are senior to Classes B and R. All the bonds bear a fixed (but different) interest rate. The classes have different order of repayment and priority in bankruptcy. 31

Appendix: Why did subprime mortgages increase? The role of securitization • Somewhat a ‘chicken and egg problem’ – that is, there a number of factors, but it is not clear which came first: – Rising home prices. – “Excess liquidity” – Increases in securitization. • Securitization refers to the packaging and resale of assets as securities. • Mortgage-backed securities (MBS) are bonds with payments based on and backed by the payments on pools of home mortgages. 32

Appendix: The share of non-agency securities in total MBS issuance by type of mortgage • Especially hard hit were subprime and Alt-A mortgages. 33 Source: Inside Mortgage Finance, “The 2007 Mortgage Market Statistical Annual”

Appendix: MBS: Use of Tranches • Issuers structure MBS with multiple tranches (or classes) to allocate prepayment and default risk across different investors. • In the simplest type of tranche structure (referred to as a sequential pay structure), payments are as follows: – Separate bonds are issued for each tranche. – Senior classes have less default risk than junior classes, and generally have less prepayment risk. – Overcollateralization (OC) serves as an equity tranche, absorbing initial default risk. – Payments to the tranches are as follows: • Interest payments: All classes are paid interest if possible. In a shortfall, tranches are paid by seniority. • Principal repayment: The classes are repaid in order of seniority (including cases where there is bankruptcy or prepayment). 34

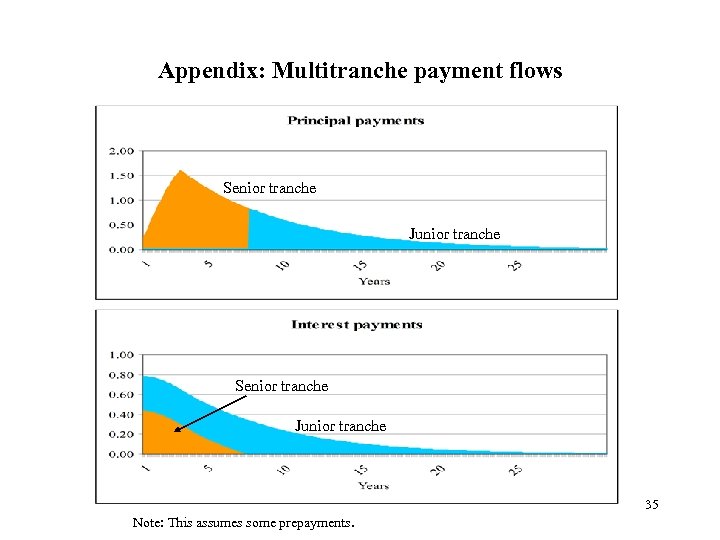

Appendix: Multitranche payment flows Senior tranche Junior tranche 35 Note: This assumes some prepayments.

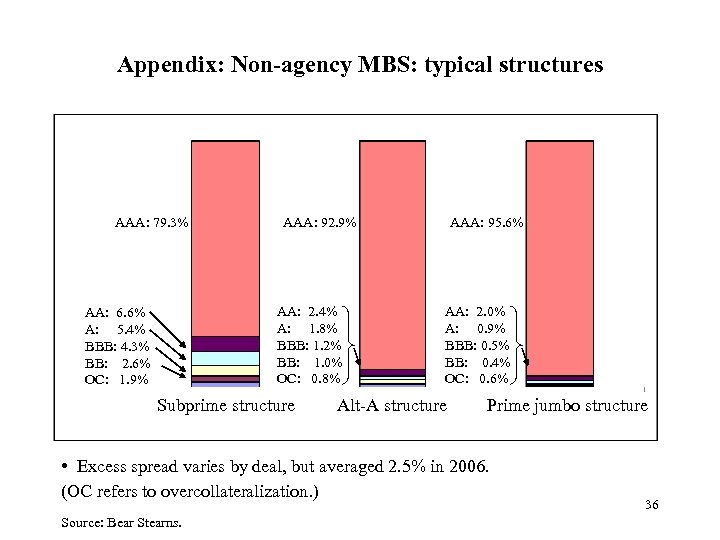

Appendix: Non-agency MBS: typical structures AAA: 79. 3% AAA: 92. 9% AA: 2. 4% A: 1. 8% BBB: 1. 2% BB: 1. 0% OC: 0. 8% AA: 6. 6% A: 5. 4% BBB: 4. 3% BB: 2. 6% OC: 1. 9% Subprime structure AAA: 95. 6% AA: 2. 0% A: 0. 9% BBB: 0. 5% BB: 0. 4% OC: 0. 6% Alt-A structure Prime jumbo structure • Excess spread varies by deal, but averaged 2. 5% in 2006. (OC refers to overcollateralization. ) Source: Bear Stearns. 36

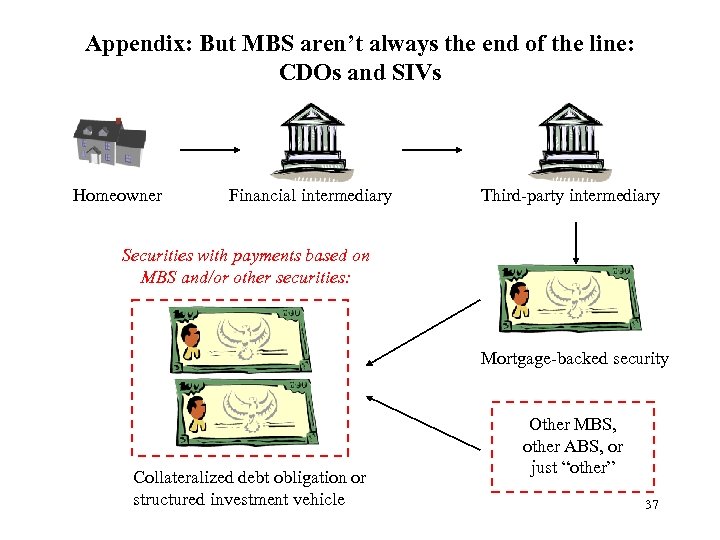

Appendix: But MBS aren’t always the end of the line: CDOs and SIVs Homeowner Financial intermediary Third-party intermediary Securities with payments based on MBS and/or other securities: Mortgage-backed security Collateralized debt obligation or structured investment vehicle Other MBS, other ABS, or just “other” 37

Appendix: Resecuritization: CDOs and SIVs • There also bonds that backed by the payments on mortgage-backed securities rather than the payments on the mortgages themselves. – Collateralized debt obligations (CDOs) are a general class of derivative securities backed by a pool of bonds (or loans). – CDOs backed by bonds issued as part of a mortgage-backed securitization or a derivative MBS security issue are called collateralized mortgage obligations (CMOs). – CMOs typically have complicated tranche structures. • Structured investment vehicles (SIVs) can be considered a type of CDO, but they generally refer to investment vehicles with a specific structure: – SIVs generally issued shorter-term debt than CDOs. – They issue a mix of asset-backed commercial paper (roughly 30% of a typical SIV) and medium-term notes (roughly 70% of a typical SIV). 38

Appendix: MBS: agency and non-agency issuers • Mortgage-backed securities are issued by agency and non-agency issuers. – Agency issuers are the GSEs (Fannie Mae and Freddie Mac) and Ginnie Mae. – Non-agency issuers are private firms. They include depository institutions and other financial intermediaries. 39

Appendix: Non-agency issuers • The largest private issuers include thrifts, investment banks, finance companies, and some commercial banks. Top issuers include (2006 rankings in parentheses): – Thrifts: Countrywide (1), Washington Mutual (2), and Indy. Mac (8) – Investment banks: Lehman (3), Bear Stearns (5), and Goldman Sachs (6). – Finance companies: GMAC (4) and New Century (9) – Commercial banks: Wells Fargo (6) JPMorgan Chase (10), Deustche. Bank (17), and Bank of America (20) • Many of the largest issuers in 2006 were also large issuers in 2000, but: – Investment banks are bigger players today (Lehman and Bear Stearns ranked 12 th and 20 th, respectively, in 2000; and Goldman Sachs was not a major player. ). – The market was more diffuse in 2006 than in 2000 (the market share of the top 10 issuers declined from 93. 6% in 2000 to 56. 0% in 2006. ). Source: Inside Mortgage Finance, “The 2007 Mortgage Market Statistical Annual” 40

e8a2f983a52102e8509baf490e8b4e65.ppt