4f92d4fd547e23b473a7f2e73b831231.ppt

- Количество слайдов: 17

THOMSON REUTERS PRESENTATION TEMPLATE INVESTOR TARGETING: TOOLS OF THE TRADE JOHN T. Mc. NAMARA, CFA NIRI CT/WESCHESTER CHAPTER MARCH 9, 2011

THOMSON REUTERS PRESENTATION TEMPLATE INVESTOR TARGETING: TOOLS OF THE TRADE JOHN T. Mc. NAMARA, CFA NIRI CT/WESCHESTER CHAPTER MARCH 9, 2011

AGENDA • NEW TRENDS IN INVESTOR TARGETING METHODS • UNDERSTANDING INVESTOR BEHAVIOR • IDENTIFYING THE RIGHT PROSPECTS • HOW TO MAKE AN ACTIONABLE PLAN • DIFFICULTIES FACED BY MID AND SMALL-CAP STOCKS • CONCLUDING REMARKS • DISCUSION 2

AGENDA • NEW TRENDS IN INVESTOR TARGETING METHODS • UNDERSTANDING INVESTOR BEHAVIOR • IDENTIFYING THE RIGHT PROSPECTS • HOW TO MAKE AN ACTIONABLE PLAN • DIFFICULTIES FACED BY MID AND SMALL-CAP STOCKS • CONCLUDING REMARKS • DISCUSION 2

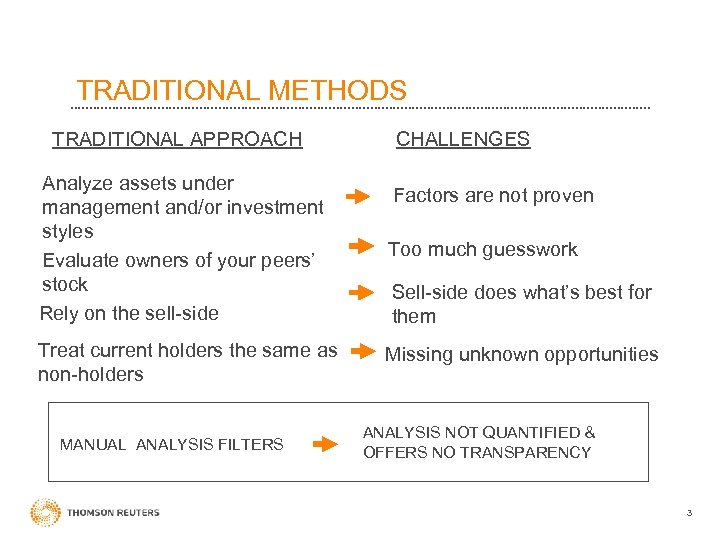

TRADITIONAL METHODS TRADITIONAL APPROACH CHALLENGES Analyze assets under management and/or investment styles Evaluate owners of your peers’ stock Rely on the sell-side Too much guesswork Treat current holders the same as non-holders Missing unknown opportunities MANUAL ANALYSIS FILTERS Factors are not proven Sell-side does what’s best for them ANALYSIS NOT QUANTIFIED & OFFERS NO TRANSPARENCY 3

TRADITIONAL METHODS TRADITIONAL APPROACH CHALLENGES Analyze assets under management and/or investment styles Evaluate owners of your peers’ stock Rely on the sell-side Too much guesswork Treat current holders the same as non-holders Missing unknown opportunities MANUAL ANALYSIS FILTERS Factors are not proven Sell-side does what’s best for them ANALYSIS NOT QUANTIFIED & OFFERS NO TRANSPARENCY 3

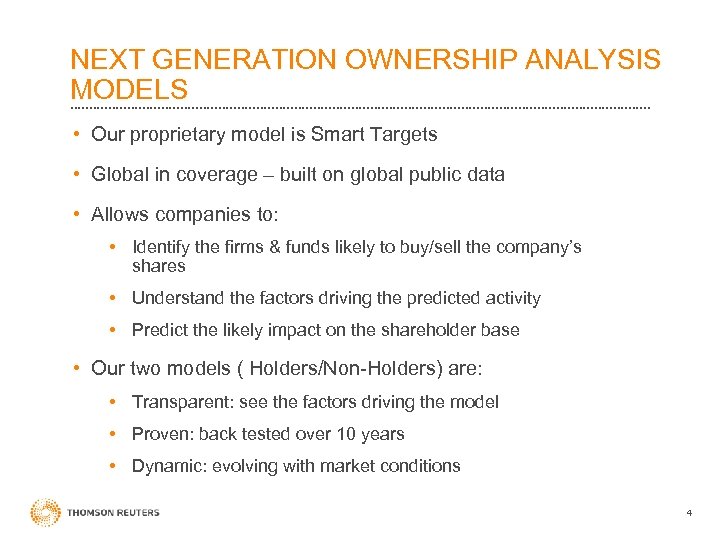

NEXT GENERATION OWNERSHIP ANALYSIS MODELS • Our proprietary model is Smart Targets • Global in coverage – built on global public data • Allows companies to: • Identify the firms & funds likely to buy/sell the company’s shares • Understand the factors driving the predicted activity • Predict the likely impact on the shareholder base • Our two models ( Holders/Non-Holders) are: • Transparent: see the factors driving the model • Proven: back tested over 10 years • Dynamic: evolving with market conditions 4

NEXT GENERATION OWNERSHIP ANALYSIS MODELS • Our proprietary model is Smart Targets • Global in coverage – built on global public data • Allows companies to: • Identify the firms & funds likely to buy/sell the company’s shares • Understand the factors driving the predicted activity • Predict the likely impact on the shareholder base • Our two models ( Holders/Non-Holders) are: • Transparent: see the factors driving the model • Proven: back tested over 10 years • Dynamic: evolving with market conditions 4

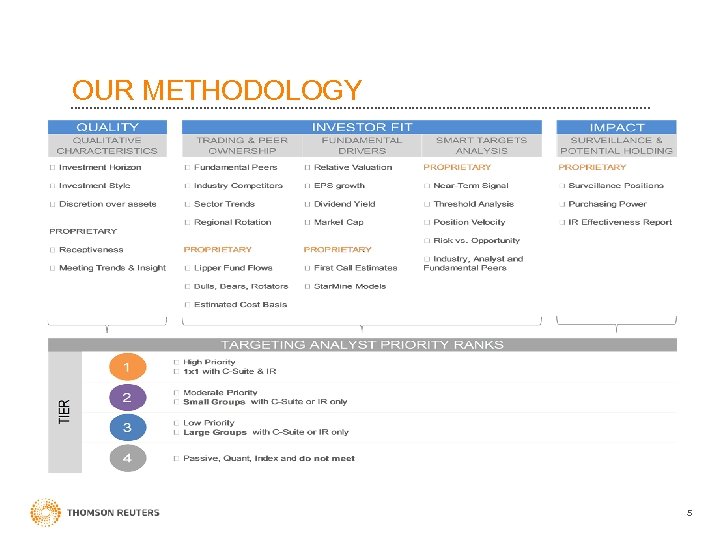

OUR METHODOLOGY 5

OUR METHODOLOGY 5

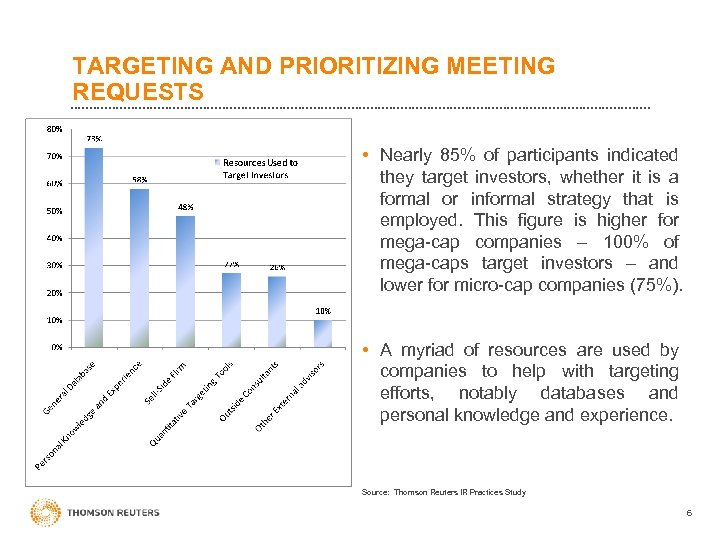

TARGETING AND PRIORITIZING MEETING REQUESTS • Nearly 85% of participants indicated they target investors, whether it is a formal or informal strategy that is employed. This figure is higher for mega-cap companies – 100% of mega-caps target investors – and lower for micro-cap companies (75%). • A myriad of resources are used by companies to help with targeting efforts, notably databases and personal knowledge and experience. Source: Thomson Reuters IR Practices Study 6

TARGETING AND PRIORITIZING MEETING REQUESTS • Nearly 85% of participants indicated they target investors, whether it is a formal or informal strategy that is employed. This figure is higher for mega-cap companies – 100% of mega-caps target investors – and lower for micro-cap companies (75%). • A myriad of resources are used by companies to help with targeting efforts, notably databases and personal knowledge and experience. Source: Thomson Reuters IR Practices Study 6

UNDERSTANDING THE BUY-SIDE The North American Institutional Market for Equities • 2, 511 actively managed firms have over $9. 8 trillion in EAUM, with $8. 1 trillion invested in NA Equities • However, the “relevant” institutional market , those that meet with management, consists of 880+ firms with approximately $8 trillion in EAUM and $6. 4 trillion in NA Equities • The largest 50 firms manage $5 trillion with the remainder managing $3 trillion between them • 2, 932 actively managed mutual funds with $4. 3 trillion in EAUM • The largest 100 funds manage $2. 5 trillion in EA 7

UNDERSTANDING THE BUY-SIDE The North American Institutional Market for Equities • 2, 511 actively managed firms have over $9. 8 trillion in EAUM, with $8. 1 trillion invested in NA Equities • However, the “relevant” institutional market , those that meet with management, consists of 880+ firms with approximately $8 trillion in EAUM and $6. 4 trillion in NA Equities • The largest 50 firms manage $5 trillion with the remainder managing $3 trillion between them • 2, 932 actively managed mutual funds with $4. 3 trillion in EAUM • The largest 100 funds manage $2. 5 trillion in EA 7

UNDERSTANDING INVESTOR BEHAVIOR • Analyzing investor behavior is a key step of any successful targeting program • Understanding what drives the decision making process helps with message development, managing risk, preparation, etc. • Traditional approaches to targeting are lacking and create a distinct set of challenges • New quantitative methodologies combined with experienced analysis provide valuable insights above and beyond the traditional approach • Essential in preparing for investor roadshows 8

UNDERSTANDING INVESTOR BEHAVIOR • Analyzing investor behavior is a key step of any successful targeting program • Understanding what drives the decision making process helps with message development, managing risk, preparation, etc. • Traditional approaches to targeting are lacking and create a distinct set of challenges • New quantitative methodologies combined with experienced analysis provide valuable insights above and beyond the traditional approach • Essential in preparing for investor roadshows 8

KEY POINTS TO CONSIDER WHEN TARGETING • Understand the financial community • Sell-side is organized by industry, buy-side is not • Investment banks serve multiple constituencies • Money managers’ reliance on the sell-side has decreased • Valuation drives investment • Strategic targeting begins with a company’s financial profile • Valuation relative to market, fundamental peers and industry • Institutional knowledge is powerful • • Investors have particular preferences for growth/value/income Investment style labels are insufficient Be aware of any non-financial drivers and activist tendencies Not all firms are receptive to contact 9

KEY POINTS TO CONSIDER WHEN TARGETING • Understand the financial community • Sell-side is organized by industry, buy-side is not • Investment banks serve multiple constituencies • Money managers’ reliance on the sell-side has decreased • Valuation drives investment • Strategic targeting begins with a company’s financial profile • Valuation relative to market, fundamental peers and industry • Institutional knowledge is powerful • • Investors have particular preferences for growth/value/income Investment style labels are insufficient Be aware of any non-financial drivers and activist tendencies Not all firms are receptive to contact 9

COMPETITION FOR CAPITAL • “XYZ competes with every single stock globally. We do not allocate a certain percentage to any one sector or any one industry. XYZ is competing for capital across the board, in every single industry across the world. ” • “XYZ competes with any company that has a market capitalization above $5 billion. ” • “XYZ competes with everything and anything. Any company that is undervalued and is a good business is a competitor. ” • “XYZ competes with the entire market. We look at high quality companies defined by the S&P quality ranking of B+ or better. ” 10

COMPETITION FOR CAPITAL • “XYZ competes with every single stock globally. We do not allocate a certain percentage to any one sector or any one industry. XYZ is competing for capital across the board, in every single industry across the world. ” • “XYZ competes with any company that has a market capitalization above $5 billion. ” • “XYZ competes with everything and anything. Any company that is undervalued and is a good business is a competitor. ” • “XYZ competes with the entire market. We look at high quality companies defined by the S&P quality ranking of B+ or better. ” 10

IDENTIFYING PROSPECTS • Do not fall into the “who owns my peers that does not own me” trap • Understand your company’s investment profile • Determine if you have the time, skills and information to properly segment investors or if you need outside tools or services • Filter investors and utilize management when the best opportunities to interact with long-term, partnershiporiented, current or prospective investors are possible • Utilize the sell-side but control the overall process 11

IDENTIFYING PROSPECTS • Do not fall into the “who owns my peers that does not own me” trap • Understand your company’s investment profile • Determine if you have the time, skills and information to properly segment investors or if you need outside tools or services • Filter investors and utilize management when the best opportunities to interact with long-term, partnershiporiented, current or prospective investors are possible • Utilize the sell-side but control the overall process 11

CURRENT SHAREHOLDERS • The best prospects are often current shareholders with a solid fundamental fit and more purchasing power • Know their preferences and remember that cultivating existing is as important as targeting new • Recognize when conditions are changing as they are likely to cause turnover in the base to varying degrees • Not all turnover is bad – It poses risk and also opens up new opportunities 12

CURRENT SHAREHOLDERS • The best prospects are often current shareholders with a solid fundamental fit and more purchasing power • Know their preferences and remember that cultivating existing is as important as targeting new • Recognize when conditions are changing as they are likely to cause turnover in the base to varying degrees • Not all turnover is bad – It poses risk and also opens up new opportunities 12

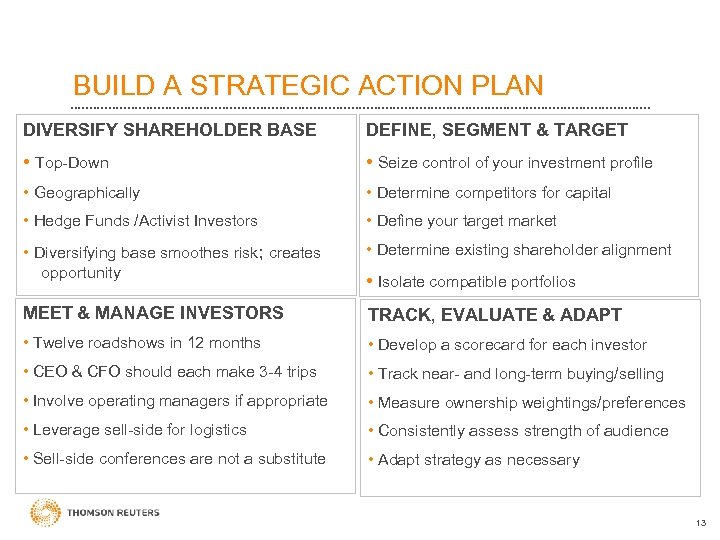

BUILD A STRATEGIC ACTION PLAN DIVERSIFY SHAREHOLDER BASE DEFINE, SEGMENT & TARGET • Top-Down • Seize control of your investment profile • Geographically • Determine competitors for capital • Hedge Funds /Activist Investors • Define your target market • Diversifying base smoothes risk; creates opportunity • Determine existing shareholder alignment MEET & MANAGE INVESTORS TRACK, EVALUATE & ADAPT • Twelve roadshows in 12 months • Develop a scorecard for each investor • CEO & CFO should each make 3 -4 trips • Track near- and long-term buying/selling • Involve operating managers if appropriate • Measure ownership weightings/preferences • Leverage sell-side for logistics • Consistently assess strength of audience • Sell-side conferences are not a substitute • Adapt strategy as necessary • Isolate compatible portfolios 13

BUILD A STRATEGIC ACTION PLAN DIVERSIFY SHAREHOLDER BASE DEFINE, SEGMENT & TARGET • Top-Down • Seize control of your investment profile • Geographically • Determine competitors for capital • Hedge Funds /Activist Investors • Define your target market • Diversifying base smoothes risk; creates opportunity • Determine existing shareholder alignment MEET & MANAGE INVESTORS TRACK, EVALUATE & ADAPT • Twelve roadshows in 12 months • Develop a scorecard for each investor • CEO & CFO should each make 3 -4 trips • Track near- and long-term buying/selling • Involve operating managers if appropriate • Measure ownership weightings/preferences • Leverage sell-side for logistics • Consistently assess strength of audience • Sell-side conferences are not a substitute • Adapt strategy as necessary • Isolate compatible portfolios 13

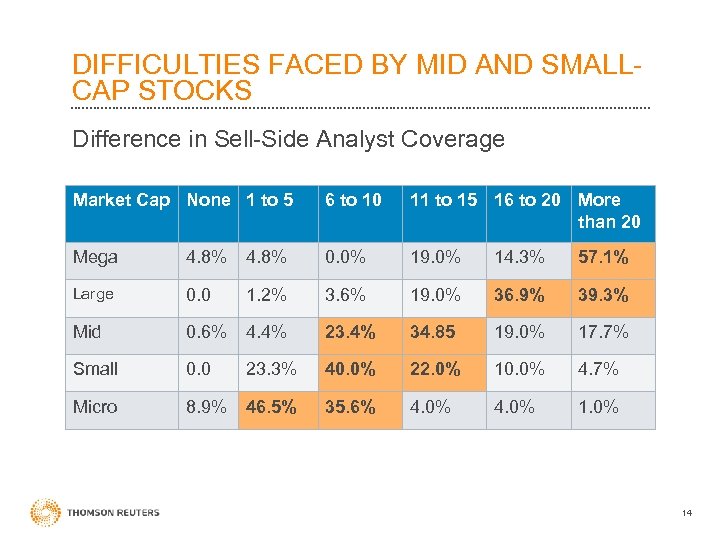

DIFFICULTIES FACED BY MID AND SMALLCAP STOCKS Difference in Sell-Side Analyst Coverage Market Cap None 1 to 5 6 to 10 11 to 15 16 to 20 More than 20 Mega 4. 8% 0. 0% 19. 0% 14. 3% 57. 1% Large 0. 0 1. 2% 3. 6% 19. 0% 36. 9% 39. 3% Mid 0. 6% 4. 4% 23. 4% 34. 85 19. 0% 17. 7% Small 0. 0 23. 3% 40. 0% 22. 0% 10. 0% 4. 7% Micro 8. 9% 46. 5% 35. 6% 4. 0% 14

DIFFICULTIES FACED BY MID AND SMALLCAP STOCKS Difference in Sell-Side Analyst Coverage Market Cap None 1 to 5 6 to 10 11 to 15 16 to 20 More than 20 Mega 4. 8% 0. 0% 19. 0% 14. 3% 57. 1% Large 0. 0 1. 2% 3. 6% 19. 0% 36. 9% 39. 3% Mid 0. 6% 4. 4% 23. 4% 34. 85 19. 0% 17. 7% Small 0. 0 23. 3% 40. 0% 22. 0% 10. 0% 4. 7% Micro 8. 9% 46. 5% 35. 6% 4. 0% 14

DIFFICULTIES FACED BY MID AND SMALLCAP STOCKS • Are you a market leader? • How do you plan to grow market share? • Do you have the cash to grow? • What is your debt profile? • Not a market leader? § Institutions don’t want to talk to you • Liquidity concerns • Lower volume keeps some larger investors on the sidelines § When they do buy or sell they can wreak havoc on share price § Target smaller investors as well as the big guns 15

DIFFICULTIES FACED BY MID AND SMALLCAP STOCKS • Are you a market leader? • How do you plan to grow market share? • Do you have the cash to grow? • What is your debt profile? • Not a market leader? § Institutions don’t want to talk to you • Liquidity concerns • Lower volume keeps some larger investors on the sidelines § When they do buy or sell they can wreak havoc on share price § Target smaller investors as well as the big guns 15

ADDITIONAL STEPS YOU CAN TAKE • Direct e-mail outreach • • Focus on a manageable number prospects Personalize rather than blast e-mail Offer Management time, site visits, product experts Add value to the Investor • Sell-Side analyst and conference targeting • If analyst loves the story they can bring corporate access team in early • Can yield conference invites ahead of coverage • Target conferences that might be appropriate § Sector or market cap § Paid conference appearances § Trade organizations 16

ADDITIONAL STEPS YOU CAN TAKE • Direct e-mail outreach • • Focus on a manageable number prospects Personalize rather than blast e-mail Offer Management time, site visits, product experts Add value to the Investor • Sell-Side analyst and conference targeting • If analyst loves the story they can bring corporate access team in early • Can yield conference invites ahead of coverage • Target conferences that might be appropriate § Sector or market cap § Paid conference appearances § Trade organizations 16

KEY TAKEAWAYS • IR and senior management messaging creates value • Think market cap, fundamentals, benchmarks and then sector…not the other way around • Understand your investment profile and how/when it might change • Analyze preferences for both halves of the buy-side audience, current shareholders and prospects • Develop a strategic investor management plan • Market the company utilizing management’s time logically and efficiently 17

KEY TAKEAWAYS • IR and senior management messaging creates value • Think market cap, fundamentals, benchmarks and then sector…not the other way around • Understand your investment profile and how/when it might change • Analyze preferences for both halves of the buy-side audience, current shareholders and prospects • Develop a strategic investor management plan • Market the company utilizing management’s time logically and efficiently 17