f1f2a2baaccf6fe6018541a76fc12b96.ppt

- Количество слайдов: 44

Thomas Murray Risk Developments for CSDs John Woodhouse AMEDA Conference Tripoli 29 November 2010 Page 1 © 2008 Thomas Murray Ltd.

Thomas Murray Risk Developments for CSDs John Woodhouse AMEDA Conference Tripoli 29 November 2010 Page 1 © 2008 Thomas Murray Ltd.

Thomas Murray Agenda I. Global Trends A) CSD Consolidation B) Evolving Roles of CSD 1) Utility vs Commercial Motivation 2) Investor CSDs and Issuer CSDs II. Recent Developments A) New CCPs B) Regulation C) Taxation Page 2 © 2008 Thomas Murray Ltd.

Thomas Murray Agenda I. Global Trends A) CSD Consolidation B) Evolving Roles of CSD 1) Utility vs Commercial Motivation 2) Investor CSDs and Issuer CSDs II. Recent Developments A) New CCPs B) Regulation C) Taxation Page 2 © 2008 Thomas Murray Ltd.

Thomas Murray Agenda III. Risk Rating Methodology IV. Africa and Middle East Countries Market Comparisons V. Regional Developments A) Changes in Regulation B) Taxation C) Liquidity Settlement Improvements D) Technological Developments E) Linking markets Page 3 © 2008 Thomas Murray Ltd.

Thomas Murray Agenda III. Risk Rating Methodology IV. Africa and Middle East Countries Market Comparisons V. Regional Developments A) Changes in Regulation B) Taxation C) Liquidity Settlement Improvements D) Technological Developments E) Linking markets Page 3 © 2008 Thomas Murray Ltd.

Thomas Murray I. Global Trends Page 4 © 2008 Thomas Murray Ltd.

Thomas Murray I. Global Trends Page 4 © 2008 Thomas Murray Ltd.

Thomas Murray I. Global Trends A) CSD Consolidation The trend of consolidation amongst CSDs has continued since 2006: • In 2006 there were 31 countries with at least 2 domestic CSDs, in 2010 this figure is 27. Bank Indonesia is considering exiting the business. • 24 of these are Central Banks, down from 27 in 2006 (Latvia, Slovakia, Ukraine exited). Trend has been for central banks to exit the business but will this continue? • Consolidations include NCSD (Sweden and Finland) into Euroclear, UNIVYC/SCP into CDCP (Czech Rep), TSCD and DIDC into TDCC (Taiwan). • Exchange consolidations do not necessarily pre-empt CSD consolidations. In Australia and Spain, the CSDs are under the same holding company but are still operationally and systemically separate. • In the UAE, NASDAQ Dubai and DFM began a consolidation process in December 2009. Effective from 11 July 2010, all of NASADQ Dubai’s equities started to settle through DFM. • In October of this year, Singapore Exchange (SGX) entered into a consolidation process with the Australian Securities Exchange (ASX). The combined group will operate under the name “ASX-SGX Limited”. • However, in some markets new CSDs are being created e. g. New Zealand with NZCDC. © 2008 Thomas Murray Ltd. Page 5

Thomas Murray I. Global Trends A) CSD Consolidation The trend of consolidation amongst CSDs has continued since 2006: • In 2006 there were 31 countries with at least 2 domestic CSDs, in 2010 this figure is 27. Bank Indonesia is considering exiting the business. • 24 of these are Central Banks, down from 27 in 2006 (Latvia, Slovakia, Ukraine exited). Trend has been for central banks to exit the business but will this continue? • Consolidations include NCSD (Sweden and Finland) into Euroclear, UNIVYC/SCP into CDCP (Czech Rep), TSCD and DIDC into TDCC (Taiwan). • Exchange consolidations do not necessarily pre-empt CSD consolidations. In Australia and Spain, the CSDs are under the same holding company but are still operationally and systemically separate. • In the UAE, NASDAQ Dubai and DFM began a consolidation process in December 2009. Effective from 11 July 2010, all of NASADQ Dubai’s equities started to settle through DFM. • In October of this year, Singapore Exchange (SGX) entered into a consolidation process with the Australian Securities Exchange (ASX). The combined group will operate under the name “ASX-SGX Limited”. • However, in some markets new CSDs are being created e. g. New Zealand with NZCDC. © 2008 Thomas Murray Ltd. Page 5

Thomas Murray I. Global Trends B) The Evolving Roles of CSDs 1) Utility vs. Commercial Motivations • In recent years, CSDs around the world have been moving into value added services and ‘non-traditional’ revenue streams, such as: - Courier services (i. e. delivery of physical documentation, including certificates) e. g. CREST Counter Service - Ownership record keeping for other real-estate property (e. g. Denmark and Mexico) - Consulting services (e. g. Euroclear, BME Consulting (Spain)) - Outsourcing • In 2005, CDS in Canada realised in excess of 33% of its total revenue (in excess of CAD 33 Million) from non-core/non-traditional (clearing, settlement and depository) activities Page 6 © 2008 Thomas Murray Ltd.

Thomas Murray I. Global Trends B) The Evolving Roles of CSDs 1) Utility vs. Commercial Motivations • In recent years, CSDs around the world have been moving into value added services and ‘non-traditional’ revenue streams, such as: - Courier services (i. e. delivery of physical documentation, including certificates) e. g. CREST Counter Service - Ownership record keeping for other real-estate property (e. g. Denmark and Mexico) - Consulting services (e. g. Euroclear, BME Consulting (Spain)) - Outsourcing • In 2005, CDS in Canada realised in excess of 33% of its total revenue (in excess of CAD 33 Million) from non-core/non-traditional (clearing, settlement and depository) activities Page 6 © 2008 Thomas Murray Ltd.

Thomas Murray I. Global Trends 1) Utility vs. Commercial Motivations With increasing frequency, CSDs are providing: • OTC Pre-Matching services to their markets. • a range of Outsourcing services including back office services, corporate actions processing as well as systems management and operations, e. g. Euroclear Finland, CDS (Canada) and TSD (Thailand). • an expanded range of Information Services including; corporate events, proxy services, reference data and even pricing information, e. g. VP (Denmark), CDS (Canada), DTCC (USA). • Securities Lending services ranging from lending securities as principal, to matching up borrowers and lenders, to the provision of transaction and loan management services, e. g. KSD (Korea), SIX SIS (Switzerland). Page 7 © 2008 Thomas Murray Ltd.

Thomas Murray I. Global Trends 1) Utility vs. Commercial Motivations With increasing frequency, CSDs are providing: • OTC Pre-Matching services to their markets. • a range of Outsourcing services including back office services, corporate actions processing as well as systems management and operations, e. g. Euroclear Finland, CDS (Canada) and TSD (Thailand). • an expanded range of Information Services including; corporate events, proxy services, reference data and even pricing information, e. g. VP (Denmark), CDS (Canada), DTCC (USA). • Securities Lending services ranging from lending securities as principal, to matching up borrowers and lenders, to the provision of transaction and loan management services, e. g. KSD (Korea), SIX SIS (Switzerland). Page 7 © 2008 Thomas Murray Ltd.

Thomas Murray I. Global Trends 1) Utility vs. Commercial Motivations With increasing frequency, CSDs are providing: • expanded Corporate Actions Processing for their markets, thus allowing their participants to capitalise on economy of scale opportunities and focus on more commercially oriented activities. (Many CSDs around the world) • Responsibility for Securities Numbering has increasingly come under the purview of CSDs. A significant number of the recognised national numbering agencies are now CSDs. Among the CSDs performing this function are DECEVAL (Colombia), CDS (Canada), Indeval (Mexico), NDC (Russia), TSD (Thailand), and MCDR (Egypt). • Mutual Fund Services including account maintenance and transaction processing, e. g. VPS (Norway), Midclear (Lebanon), SIX SIS (Switzerland). • Page 8 © 2008 Thomas Murray Ltd.

Thomas Murray I. Global Trends 1) Utility vs. Commercial Motivations With increasing frequency, CSDs are providing: • expanded Corporate Actions Processing for their markets, thus allowing their participants to capitalise on economy of scale opportunities and focus on more commercially oriented activities. (Many CSDs around the world) • Responsibility for Securities Numbering has increasingly come under the purview of CSDs. A significant number of the recognised national numbering agencies are now CSDs. Among the CSDs performing this function are DECEVAL (Colombia), CDS (Canada), Indeval (Mexico), NDC (Russia), TSD (Thailand), and MCDR (Egypt). • Mutual Fund Services including account maintenance and transaction processing, e. g. VPS (Norway), Midclear (Lebanon), SIX SIS (Switzerland). • Page 8 © 2008 Thomas Murray Ltd.

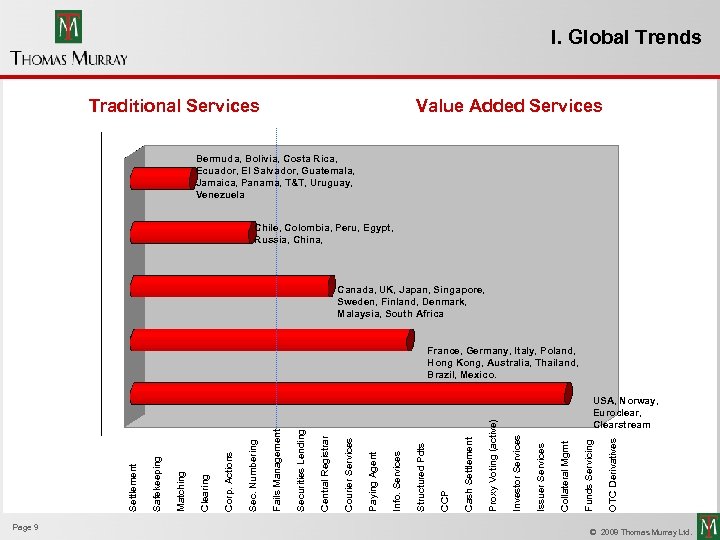

Thomas Murray I. Global Trends Value Added Services Traditional Services Bermuda, Bolivia, Costa Rica, Ecuador, El Salvador, Guatemala, Jamaica, Panama, T&T, Uruguay, Venezuela Chile, Colombia, Peru, Egypt, Russia, China, Canada, UK, Japan, Singapore, Sweden, Finland, Denmark, Malaysia, South Africa Page 9 OTC Derivatives Funds Servicing Collateral Mgmt Issuer Services USA, Norway, Euroclear, Clearstream Investor Services Proxy Voting (active) Cash Settlement CCP Structured Pdts Info. Services Paying Agent Courier Services Central Registrar Securities Lending Fails Management Sec. Numbering Corp. Actions Clearing Matching Safekeeping Settlement France, Germany, Italy, Poland, Hong Kong, Australia, Thailand, Brazil, Mexico. Page 9 © 2008 Thomas Murray Ltd.

Thomas Murray I. Global Trends Value Added Services Traditional Services Bermuda, Bolivia, Costa Rica, Ecuador, El Salvador, Guatemala, Jamaica, Panama, T&T, Uruguay, Venezuela Chile, Colombia, Peru, Egypt, Russia, China, Canada, UK, Japan, Singapore, Sweden, Finland, Denmark, Malaysia, South Africa Page 9 OTC Derivatives Funds Servicing Collateral Mgmt Issuer Services USA, Norway, Euroclear, Clearstream Investor Services Proxy Voting (active) Cash Settlement CCP Structured Pdts Info. Services Paying Agent Courier Services Central Registrar Securities Lending Fails Management Sec. Numbering Corp. Actions Clearing Matching Safekeeping Settlement France, Germany, Italy, Poland, Hong Kong, Australia, Thailand, Brazil, Mexico. Page 9 © 2008 Thomas Murray Ltd.

Thomas Murray I. Global Trends B) The Evolving Roles of CSDs 2) Issuer CSDs and Investor CSDs (post T 2 S competitive scenarios) • Two new roles have been prescribed for CSDs in a post T 2 S environment: Issuer CSDs and Investor CSDs. Most European CSDs are preparing to adopt both roles. • Issuer CSDs will compete to safekeep and service issues from different countries. Under the terms of T 2 S membership, CSDs will have to make securities they hold available to other CSDs. • Investor CSDs will support local market participants’ cross-border investment needs by holding accounts in other CSDs (i. e. become custodians for them). • Successful adopters will become something akin to a custodian/ICSD. Consequently, CSDs are being encouraged by the ECB to compete with custodians in these areas as well as other added value services. Page 10 © 2008 Thomas Murray Ltd.

Thomas Murray I. Global Trends B) The Evolving Roles of CSDs 2) Issuer CSDs and Investor CSDs (post T 2 S competitive scenarios) • Two new roles have been prescribed for CSDs in a post T 2 S environment: Issuer CSDs and Investor CSDs. Most European CSDs are preparing to adopt both roles. • Issuer CSDs will compete to safekeep and service issues from different countries. Under the terms of T 2 S membership, CSDs will have to make securities they hold available to other CSDs. • Investor CSDs will support local market participants’ cross-border investment needs by holding accounts in other CSDs (i. e. become custodians for them). • Successful adopters will become something akin to a custodian/ICSD. Consequently, CSDs are being encouraged by the ECB to compete with custodians in these areas as well as other added value services. Page 10 © 2008 Thomas Murray Ltd.

Thomas Murray II. Recent Developments Page 11 © 2008 Thomas Murray Ltd.

Thomas Murray II. Recent Developments Page 11 © 2008 Thomas Murray Ltd.

Thomas Murray II. Recent Developments A) New CCPs • • • Explosion of MTFs has resulted in a growth in diversity of CCPs. There are currently about 10 operational [cash-market] CCPs in Europe. Of these, around 5 are actively competing with each other (LCH. Clearnet, Eurex, EMCF, Euro. CCP, x-clear). Competition has been fierce with clearing fees declining by over 50% in the last 2 years. The fear is that with very little profit or cost margins left to cut, CCPs will compete on risk (i. e. cutting margins). From anecdotal evidence, this ‘race to the bottom’ may already have started. The European Code of Conduct on Clearing and Settlement prescribed a mode of ‘interoperability’ between market infrastructure entities which would allow CCPs to enter new markets. Of the nearly 50 interoperability requests, only a handful have come to fruition (London, Germany , Switzerland, Sweden/Finland). However, several markets have (or are planning to have) multiple, competing CCP including UK, Italy, Switzerland NASDAQ OMX Nordic (Sweden, Finland, Denmark, Iceland). © 2008 Thomas Murray Ltd. Page 12

Thomas Murray II. Recent Developments A) New CCPs • • • Explosion of MTFs has resulted in a growth in diversity of CCPs. There are currently about 10 operational [cash-market] CCPs in Europe. Of these, around 5 are actively competing with each other (LCH. Clearnet, Eurex, EMCF, Euro. CCP, x-clear). Competition has been fierce with clearing fees declining by over 50% in the last 2 years. The fear is that with very little profit or cost margins left to cut, CCPs will compete on risk (i. e. cutting margins). From anecdotal evidence, this ‘race to the bottom’ may already have started. The European Code of Conduct on Clearing and Settlement prescribed a mode of ‘interoperability’ between market infrastructure entities which would allow CCPs to enter new markets. Of the nearly 50 interoperability requests, only a handful have come to fruition (London, Germany , Switzerland, Sweden/Finland). However, several markets have (or are planning to have) multiple, competing CCP including UK, Italy, Switzerland NASDAQ OMX Nordic (Sweden, Finland, Denmark, Iceland). © 2008 Thomas Murray Ltd. Page 12

Thomas Murray II. Recent Developments A) New CCPs • Since the Lehmans default, there has been widespread governmental pressure to increase the influence of CCPs to centralise and manage counterparty risk. • NYSE Euronext announced it will end its contracts with LCH. Clearnet and create its own CCPs in London and Paris to clear its tradeflow by late 2012. • Poland: The CSD is to create a new subsidiary which will assume the role of CCP in 2011. • Chile: CCLV to be introduced as a CCP for on-exchange transactions. • Spain: The market regulator issued a clearing, settlement and registry system reform which includes the future introduction of a CCP in the market. Furthermore, LCH. Clearnet started operating as a CCP for government debt and repos in August 2010 with settlement taking place at Euroclear Bank or Clearstream. • Thailand: CCP functions for the equities cash-market moved from the TSD (the depository) to Thailand Clearing House (TCH) in February 2010, although both are under the Stock Exchange of Thailand (SET) holding company • Sri Lanka: The Colombo Stock Exchange is considering the development of a CCP for equities and corporate debt. Page 13 • New Zealand: The NZX launched a CCP for on-exchange trades in September Page 13 © 2008 Thomas Murray Ltd.

Thomas Murray II. Recent Developments A) New CCPs • Since the Lehmans default, there has been widespread governmental pressure to increase the influence of CCPs to centralise and manage counterparty risk. • NYSE Euronext announced it will end its contracts with LCH. Clearnet and create its own CCPs in London and Paris to clear its tradeflow by late 2012. • Poland: The CSD is to create a new subsidiary which will assume the role of CCP in 2011. • Chile: CCLV to be introduced as a CCP for on-exchange transactions. • Spain: The market regulator issued a clearing, settlement and registry system reform which includes the future introduction of a CCP in the market. Furthermore, LCH. Clearnet started operating as a CCP for government debt and repos in August 2010 with settlement taking place at Euroclear Bank or Clearstream. • Thailand: CCP functions for the equities cash-market moved from the TSD (the depository) to Thailand Clearing House (TCH) in February 2010, although both are under the Stock Exchange of Thailand (SET) holding company • Sri Lanka: The Colombo Stock Exchange is considering the development of a CCP for equities and corporate debt. Page 13 • New Zealand: The NZX launched a CCP for on-exchange trades in September Page 13 © 2008 Thomas Murray Ltd.

Thomas Murray II. Recent Developments B) Regulation • Prior to the global financial crisis, regulation on the financial markets was reasonably light. Now there is a move to re-regulate the market, particularly to control the investment banks and bring riskier products and markets under the rule of CCPs. • The risk is that regulators will be over-zealous (e. g. US) and inconsistent in their new regulatory structures, producing conflicting regulatory environments in what is a global financial system. • In the US under the Volcker rule, banks will have two years to wind down proprietary trading after regulators write detailed rules on what constitutes proprietary trading (possibly this year). But some banks have already begun to take action with JP Morgan Chase closing its commodity trading unit in London/New York. • The OTC Derivatives Market Act of 2009 in the US mandates that certain swaps must be centrally cleared and the US Congress wants to move all OTC Derivatives onto formalised trading platforms and clearing houses. In Europe, CESR is currently in consultation with the market over similar moves which may be included in a CCP Directive. Page 14 © 2008 Thomas Murray Ltd.

Thomas Murray II. Recent Developments B) Regulation • Prior to the global financial crisis, regulation on the financial markets was reasonably light. Now there is a move to re-regulate the market, particularly to control the investment banks and bring riskier products and markets under the rule of CCPs. • The risk is that regulators will be over-zealous (e. g. US) and inconsistent in their new regulatory structures, producing conflicting regulatory environments in what is a global financial system. • In the US under the Volcker rule, banks will have two years to wind down proprietary trading after regulators write detailed rules on what constitutes proprietary trading (possibly this year). But some banks have already begun to take action with JP Morgan Chase closing its commodity trading unit in London/New York. • The OTC Derivatives Market Act of 2009 in the US mandates that certain swaps must be centrally cleared and the US Congress wants to move all OTC Derivatives onto formalised trading platforms and clearing houses. In Europe, CESR is currently in consultation with the market over similar moves which may be included in a CCP Directive. Page 14 © 2008 Thomas Murray Ltd.

Thomas Murray II. Recent Developments B) Regulation • Prior to the global financial crisis, the major ‘regulation’ (although it was technically a voluntary code) affecting CSDs in Europe, was the EU Code of Conduct on Clearing and Settlement. This set standards for CSDs for price transparency, access and interoperability, and unbundling and accounting separation. The first and third provisions have been successful in promoting fair pricing, but the interoperabililty standard has failed to facilitate greater competition in the clearing and settlement landscape. • Although short-selling bans have been widely imposed globally (and CESR is formulating uniform short-selling rules for Europe), we have recently seen bans in Italy, India and Greece. • Basel III regulation seeks to avoid systemic failures in the banking system by increasing capital ratios (although these will not kick in until 2019). C) Taxation • Government have made changes to taxation regimes to rein in fiscal deficits. • There has been a significant number of DTT and TIEAs signed in recent months in order to boost cooperation, curb tax evasion and increase fiscal revenue. Page 15 © 2008 Thomas Murray Ltd.

Thomas Murray II. Recent Developments B) Regulation • Prior to the global financial crisis, the major ‘regulation’ (although it was technically a voluntary code) affecting CSDs in Europe, was the EU Code of Conduct on Clearing and Settlement. This set standards for CSDs for price transparency, access and interoperability, and unbundling and accounting separation. The first and third provisions have been successful in promoting fair pricing, but the interoperabililty standard has failed to facilitate greater competition in the clearing and settlement landscape. • Although short-selling bans have been widely imposed globally (and CESR is formulating uniform short-selling rules for Europe), we have recently seen bans in Italy, India and Greece. • Basel III regulation seeks to avoid systemic failures in the banking system by increasing capital ratios (although these will not kick in until 2019). C) Taxation • Government have made changes to taxation regimes to rein in fiscal deficits. • There has been a significant number of DTT and TIEAs signed in recent months in order to boost cooperation, curb tax evasion and increase fiscal revenue. Page 15 © 2008 Thomas Murray Ltd.

Thomas Murray III. Risk Rating Methodology Page 16 © 2008 Thomas Murray Ltd.

Thomas Murray III. Risk Rating Methodology Page 16 © 2008 Thomas Murray Ltd.

Thomas Murray III. Risk Rating Methodology The core principles behind the Thomas Murray CSD Ratings are: they are calculated from domestic and foreign investors’ perspectives (i. e. the risks that the investor incurs when using the depository). • they take account of the general infrastructure in the market that the CSD has a direct interaction with, such as stock exchanges, trading platforms, CCPs/Clearing Houses, payments systems and the general regulatory environment. • they are a benchmark against best market practice globally, not against regional or local market practice. • they are a point-in-time rating. Planned or developing services, systems, procedures or any other changes do not affect the Rating, but may influence the Outlook. • the Ratings rely on accurate, measurable and verifiable information from the CSD and their participants. • Page 17 © 2008 Thomas Murray Ltd.

Thomas Murray III. Risk Rating Methodology The core principles behind the Thomas Murray CSD Ratings are: they are calculated from domestic and foreign investors’ perspectives (i. e. the risks that the investor incurs when using the depository). • they take account of the general infrastructure in the market that the CSD has a direct interaction with, such as stock exchanges, trading platforms, CCPs/Clearing Houses, payments systems and the general regulatory environment. • they are a benchmark against best market practice globally, not against regional or local market practice. • they are a point-in-time rating. Planned or developing services, systems, procedures or any other changes do not affect the Rating, but may influence the Outlook. • the Ratings rely on accurate, measurable and verifiable information from the CSD and their participants. • Page 17 © 2008 Thomas Murray Ltd.

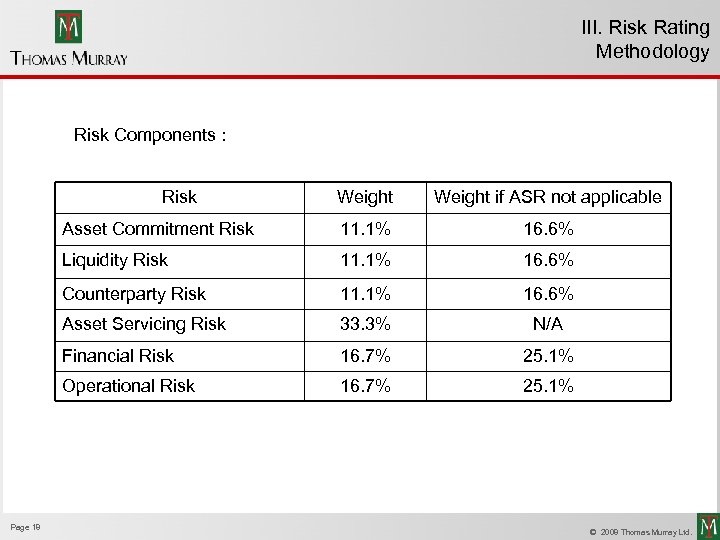

Thomas Murray III. Risk Rating Methodology Risk Components : Risk Weight if ASR not applicable Asset Commitment Risk 11. 1% 16. 6% Liquidity Risk 11. 1% 16. 6% Counterparty Risk 11. 1% 16. 6% Asset Servicing Risk 33. 3% N/A Financial Risk 16. 7% 25. 1% Operational Risk 16. 7% 25. 1% Page 18 © 2008 Thomas Murray Ltd.

Thomas Murray III. Risk Rating Methodology Risk Components : Risk Weight if ASR not applicable Asset Commitment Risk 11. 1% 16. 6% Liquidity Risk 11. 1% 16. 6% Counterparty Risk 11. 1% 16. 6% Asset Servicing Risk 33. 3% N/A Financial Risk 16. 7% 25. 1% Operational Risk 16. 7% 25. 1% Page 18 © 2008 Thomas Murray Ltd.

Thomas Murray III. Risk Rating Methodology Asset Commitment Risk - The period of time from when control of securities or cash is given up until receipt of countervalue. This risk concerns the time period during which a participant’s assets, either cash or stock, are committed within the CSD and payment system pending final settlement of the underlying transaction(s). Following settlement, the risk period is extended until the transfer of funds and stock becomes irrevocable. It excludes any periods when assets, cash or stock, are committed to a market participant including brokers, banks and custodians, not caused by CSD processing. Page 19 © 2008 Thomas Murray Ltd.

Thomas Murray III. Risk Rating Methodology Asset Commitment Risk - The period of time from when control of securities or cash is given up until receipt of countervalue. This risk concerns the time period during which a participant’s assets, either cash or stock, are committed within the CSD and payment system pending final settlement of the underlying transaction(s). Following settlement, the risk period is extended until the transfer of funds and stock becomes irrevocable. It excludes any periods when assets, cash or stock, are committed to a market participant including brokers, banks and custodians, not caused by CSD processing. Page 19 © 2008 Thomas Murray Ltd.

Thomas Murray III. Risk Rating Methodology Asset Commitment Risk - Criteria • Minimising processing times maximises the availability of assets, particularly for transfer of assets off-shore (e. g. cross-border collateral movement, repatriation of funds) • Processing speed (real-time, intraday batches, overnight batches) • Market deadline for securities / funds positioning • Finality in settlement system (with legal basis) • Pre-funding markets (e. g. Russia), or long blocking periods • Same day fund provision Page 20 © 2008 Thomas Murray Ltd.

Thomas Murray III. Risk Rating Methodology Asset Commitment Risk - Criteria • Minimising processing times maximises the availability of assets, particularly for transfer of assets off-shore (e. g. cross-border collateral movement, repatriation of funds) • Processing speed (real-time, intraday batches, overnight batches) • Market deadline for securities / funds positioning • Finality in settlement system (with legal basis) • Pre-funding markets (e. g. Russia), or long blocking periods • Same day fund provision Page 20 © 2008 Thomas Murray Ltd.

Thomas Murray III. Risk Rating Methodology Liquidity Risk - The risk that insufficient securities and or funds are available to meet commitments; the obligation will be covered some time later. This is where for certain technical reasons (e. g. , stock out on loan, stock in course of registration, turn round of recently deposited stock is not possible) one or both parties to the trade has a shortfall in the amount of funds (credit line) or unencumbered stock available to meet settlement obligations when due. These shortfalls may lead to settlement ‘fails’ but do not normally lead to a default. Page 21 © 2008 Thomas Murray Ltd.

Thomas Murray III. Risk Rating Methodology Liquidity Risk - The risk that insufficient securities and or funds are available to meet commitments; the obligation will be covered some time later. This is where for certain technical reasons (e. g. , stock out on loan, stock in course of registration, turn round of recently deposited stock is not possible) one or both parties to the trade has a shortfall in the amount of funds (credit line) or unencumbered stock available to meet settlement obligations when due. These shortfalls may lead to settlement ‘fails’ but do not normally lead to a default. Page 21 © 2008 Thomas Murray Ltd.

Thomas Murray III. Risk Rating Methodology Liquidity Risk - Criteria • • • Optimising asset liquidity now paramount in large markets. Managing late settlements effectively and quickly reduces ‘indirect’ losses Netting (with legal basis) / optimisation Multiple processing cycles Stock lending Credit facilities Fails management (fines, buy-ins) High levels of immobilisation / dematerialisation Fast registration / central registrar Proportion of securities held within the depository Matching arrangements Page 22 © 2008 Thomas Murray Ltd.

Thomas Murray III. Risk Rating Methodology Liquidity Risk - Criteria • • • Optimising asset liquidity now paramount in large markets. Managing late settlements effectively and quickly reduces ‘indirect’ losses Netting (with legal basis) / optimisation Multiple processing cycles Stock lending Credit facilities Fails management (fines, buy-ins) High levels of immobilisation / dematerialisation Fast registration / central registrar Proportion of securities held within the depository Matching arrangements Page 22 © 2008 Thomas Murray Ltd.

Thomas Murray III. Risk Rating Methodology Counterparty Risk - The risk that a counterparty (i. e. , a participant) will not settle its obligations for full value at any time. This is simply the total default of a direct participant of the CSD. This is the event when a participant is unable to meet its financial liability to the CSD and possibly other creditors. This risk only goes as far as direct participants of the CSD and excludes clients of direct participants that default on liabilities to such participants, even if such a default should systemically cause the direct participant to subsequently default. Page 23 © 2008 Thomas Murray Ltd.

Thomas Murray III. Risk Rating Methodology Counterparty Risk - The risk that a counterparty (i. e. , a participant) will not settle its obligations for full value at any time. This is simply the total default of a direct participant of the CSD. This is the event when a participant is unable to meet its financial liability to the CSD and possibly other creditors. This risk only goes as far as direct participants of the CSD and excludes clients of direct participants that default on liabilities to such participants, even if such a default should systemically cause the direct participant to subsequently default. Page 23 © 2008 Thomas Murray Ltd.

Thomas Murray III. Risk Rating Methodology Counterparty Risk - Criteria • • Managing defaults is critical to reducing direct loss of Principal and Systemic risks through participant interdependence. DVP (market AND client-side) Central Bank, same-day funds Settlement assurance (CCP, collateral, guarantee fund) Strict participation criteria Participant concentration Surveillance of participant volumes / risk modelling Page 24 © 2008 Thomas Murray Ltd.

Thomas Murray III. Risk Rating Methodology Counterparty Risk - Criteria • • Managing defaults is critical to reducing direct loss of Principal and Systemic risks through participant interdependence. DVP (market AND client-side) Central Bank, same-day funds Settlement assurance (CCP, collateral, guarantee fund) Strict participation criteria Participant concentration Surveillance of participant volumes / risk modelling Page 24 © 2008 Thomas Murray Ltd.

Thomas Murray III. Risk Rating Methodology Asset Servicing Risk - The risk that a participant may incur a loss arising from missed or inaccurate information provided by the depository, or from incorrectly executed instructions, in respect of corporate actions and proxy voting. Page 25 This risk arises when a participant places reliance on the information a depository provides or when the participant instructs the depository to carry out an economic transaction on its behalf. If the depository fails either to provide the information or to carry out the instruction correctly then the participant may suffer a loss for which the depository may not accept liability. The depository may provide these services on a commercial basis, without statutory immunity, or it may provide the service as part of its statutory role, possibly with some level of protection from liability. This risk is likely to become much higher when international securities are included in the service. Page 25 © 2008 Thomas Murray Ltd.

Thomas Murray III. Risk Rating Methodology Asset Servicing Risk - The risk that a participant may incur a loss arising from missed or inaccurate information provided by the depository, or from incorrectly executed instructions, in respect of corporate actions and proxy voting. Page 25 This risk arises when a participant places reliance on the information a depository provides or when the participant instructs the depository to carry out an economic transaction on its behalf. If the depository fails either to provide the information or to carry out the instruction correctly then the participant may suffer a loss for which the depository may not accept liability. The depository may provide these services on a commercial basis, without statutory immunity, or it may provide the service as part of its statutory role, possibly with some level of protection from liability. This risk is likely to become much higher when international securities are included in the service. Page 25 © 2008 Thomas Murray Ltd.

Thomas Murray III. Risk Rating Methodology Asset Servicing Risk - Criteria • • Managing corporate actions effectively perhaps the biggest potential risk exposure. Reliable ‘official’ source Multiple information sources allowing for verification/’data scrubbing’ Timely, accurate and comprehensive event notification Timely, accurate and comprehensive event processing Pro-active client servicing Straight-Through-Processing Clear statement of liability Page 26 © 2008 Thomas Murray Ltd.

Thomas Murray III. Risk Rating Methodology Asset Servicing Risk - Criteria • • Managing corporate actions effectively perhaps the biggest potential risk exposure. Reliable ‘official’ source Multiple information sources allowing for verification/’data scrubbing’ Timely, accurate and comprehensive event notification Timely, accurate and comprehensive event processing Pro-active client servicing Straight-Through-Processing Clear statement of liability Page 26 © 2008 Thomas Murray Ltd.

Thomas Murray III. Risk Rating Methodology Financial Risk - The ability of the CSD to operate as a financially viable company. This risk concerns the financial strength of the depository and if its capital is sufficient to meet the on-going operation of the organisation. Page 27 © 2008 Thomas Murray Ltd.

Thomas Murray III. Risk Rating Methodology Financial Risk - The ability of the CSD to operate as a financially viable company. This risk concerns the financial strength of the depository and if its capital is sufficient to meet the on-going operation of the organisation. Page 27 © 2008 Thomas Murray Ltd.

Thomas Murray III. Risk Rating Methodology Financial Risk - Criteria • • • Ongoing financial stability of the CSD as a business. Net capital Operationally profitable Financial flexibility – fee setting Comprehensive insurance Any principal activity fully collateralised/ managed Limited commercial activity Limited liability (exclude indirect losses) Ability to borrow or attain financial resources Page 28 © 2008 Thomas Murray Ltd.

Thomas Murray III. Risk Rating Methodology Financial Risk - Criteria • • • Ongoing financial stability of the CSD as a business. Net capital Operationally profitable Financial flexibility – fee setting Comprehensive insurance Any principal activity fully collateralised/ managed Limited commercial activity Limited liability (exclude indirect losses) Ability to borrow or attain financial resources Page 28 © 2008 Thomas Murray Ltd.

Thomas Murray III. Risk Rating Methodology Operational Risk - The risk that deficiencies in information systems or internal controls, human errors or management failures will result in losses. The risk of loss due to breakdowns or weaknesses in internal controls and procedures. Internal factors to be considered in the assessment include ensuring the CSD has formalised procedures established for its main services. The CSD should have identified control objectives and related key controls to ensure operation and proper control of established procedures. Systems and procedures should be tested periodically. There should be external audit processes in place to provide third-party audit evidence of the adequacy of the controls. Page 29 © 2008 Thomas Murray Ltd.

Thomas Murray III. Risk Rating Methodology Operational Risk - The risk that deficiencies in information systems or internal controls, human errors or management failures will result in losses. The risk of loss due to breakdowns or weaknesses in internal controls and procedures. Internal factors to be considered in the assessment include ensuring the CSD has formalised procedures established for its main services. The CSD should have identified control objectives and related key controls to ensure operation and proper control of established procedures. Systems and procedures should be tested periodically. There should be external audit processes in place to provide third-party audit evidence of the adequacy of the controls. Page 29 © 2008 Thomas Murray Ltd.

Thomas Murray III. Risk Rating Methodology Operational Risk - Criteria • • Internal controls and procedures should be adequate to control operational risk exposures Comprehensive controls and procedures Extent of Internal and External operational audits Limit manual processing / internal STP Secure and efficient interfaces – external STP DRP/BCP procedures Automated and comprehensive reporting Ongoing staff training Page 30 © 2008 Thomas Murray Ltd.

Thomas Murray III. Risk Rating Methodology Operational Risk - Criteria • • Internal controls and procedures should be adequate to control operational risk exposures Comprehensive controls and procedures Extent of Internal and External operational audits Limit manual processing / internal STP Secure and efficient interfaces – external STP DRP/BCP procedures Automated and comprehensive reporting Ongoing staff training Page 30 © 2008 Thomas Murray Ltd.

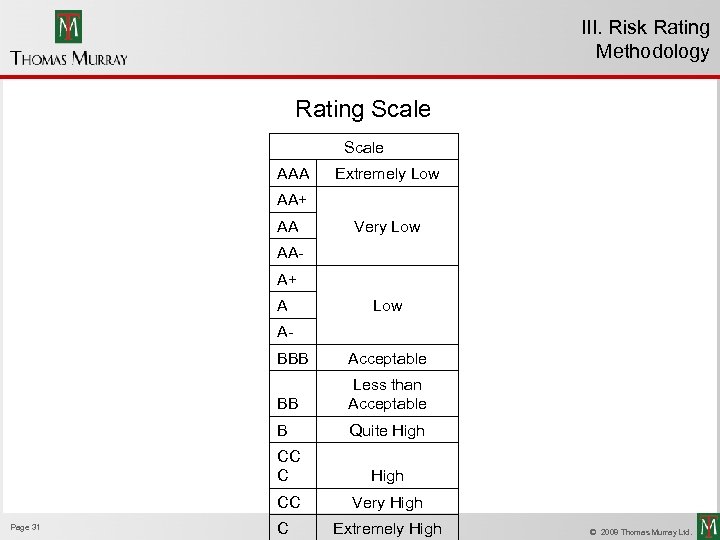

Thomas Murray III. Risk Rating Methodology Rating Scale AAA Extremely Low AA+ AA Very Low AAA+ A Low ABBB Acceptable BB Less than Acceptable B Quite High CC C CC Page 31 High Very High C Extremely High Page 31 © 2008 Thomas Murray Ltd.

Thomas Murray III. Risk Rating Methodology Rating Scale AAA Extremely Low AA+ AA Very Low AAA+ A Low ABBB Acceptable BB Less than Acceptable B Quite High CC C CC Page 31 High Very High C Extremely High Page 31 © 2008 Thomas Murray Ltd.

Thomas Murray III. Risk Rating Methodology Publicly Rated CSDs Seven CSDs have been publicly rated: • NDC (Russia) • DCC (Russia) • Monte Titoli (Italy) • CDS (Canada) • MCDR (Egypt) • DCV (Chile) • TASECH (Israel) Page 32 © 2008 Thomas Murray Ltd.

Thomas Murray III. Risk Rating Methodology Publicly Rated CSDs Seven CSDs have been publicly rated: • NDC (Russia) • DCC (Russia) • Monte Titoli (Italy) • CDS (Canada) • MCDR (Egypt) • DCV (Chile) • TASECH (Israel) Page 32 © 2008 Thomas Murray Ltd.

Thomas Murray IV. Africa and Middle East Countries Market Comparisons Page 33 © 2008 Thomas Murray Ltd.

Thomas Murray IV. Africa and Middle East Countries Market Comparisons Page 33 © 2008 Thomas Murray Ltd.

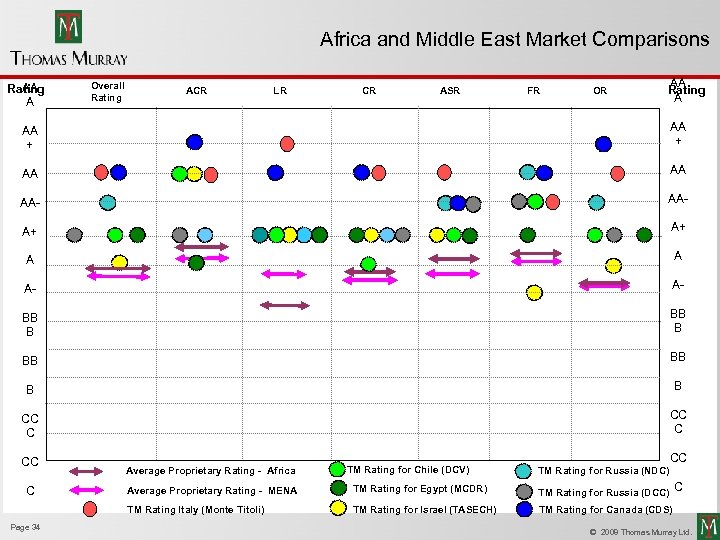

Thomas Murray AA Rating A Overall Rating Africa and Middle East Market Comparisons ACR LR CR ASR FR OR AA Rating A AA + AA AA AA- A+ A+ A A A- A- BB BB B B CC C CC Average Proprietary Rating - Africa TM Rating for Chile (DCV) CC TM Rating for Russia (NDC) C Page 34 Average Proprietary Rating - MENA TM Rating for Egypt (MCDR) TM Rating for Russia (DCC) TM Rating Italy (Monte Titoli) C TM Rating for Israel (TASECH) TM Rating for Canada (CDS) Page 34 © 2008 Thomas Murray Ltd.

Thomas Murray AA Rating A Overall Rating Africa and Middle East Market Comparisons ACR LR CR ASR FR OR AA Rating A AA + AA AA AA- A+ A+ A A A- A- BB BB B B CC C CC Average Proprietary Rating - Africa TM Rating for Chile (DCV) CC TM Rating for Russia (NDC) C Page 34 Average Proprietary Rating - MENA TM Rating for Egypt (MCDR) TM Rating for Russia (DCC) TM Rating Italy (Monte Titoli) C TM Rating for Israel (TASECH) TM Rating for Canada (CDS) Page 34 © 2008 Thomas Murray Ltd.

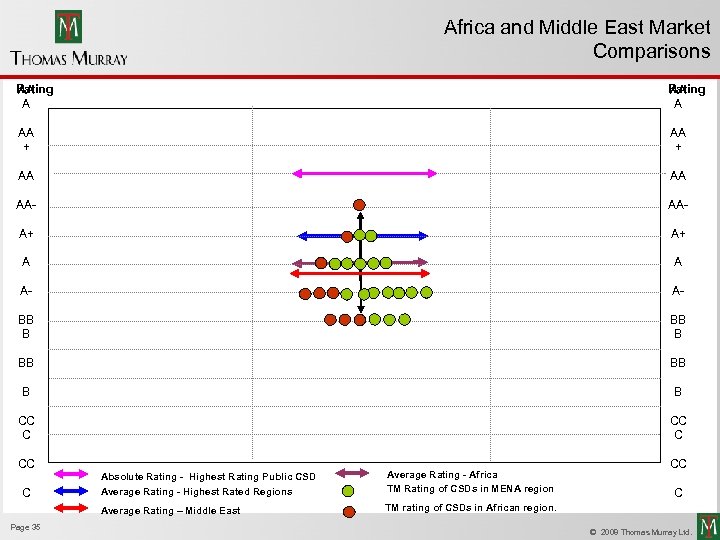

Thomas Murray Africa and Middle East Market Comparisons Rating AA A AA + AA AA AA- A+ A+ A A A- A- BB BB B B CC C CC Page 35 Average Rating - Africa TM Rating of CSDs in MENA region Average Rating – Middle East C Absolute Rating - Highest Rating Public CSD Average Rating - Highest Rated Regions TM rating of CSDs in African region. CC C Page 35 © 2008 Thomas Murray Ltd.

Thomas Murray Africa and Middle East Market Comparisons Rating AA A AA + AA AA AA- A+ A+ A A A- A- BB BB B B CC C CC Page 35 Average Rating - Africa TM Rating of CSDs in MENA region Average Rating – Middle East C Absolute Rating - Highest Rating Public CSD Average Rating - Highest Rated Regions TM rating of CSDs in African region. CC C Page 35 © 2008 Thomas Murray Ltd.

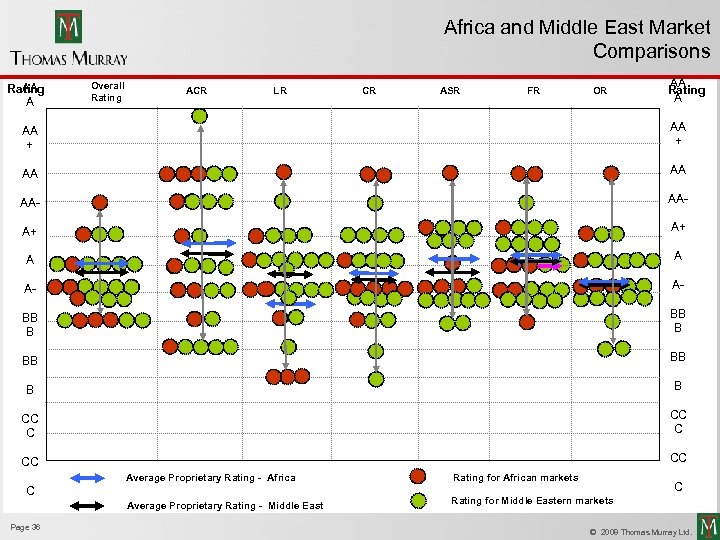

Thomas Murray AA Rating A Overall Rating Africa and Middle East Market Comparisons ACR LR CR ASR FR OR AA Rating A AA + AA AA AA- A+ A+ A A A- A- BB BB B B CC CC Average Proprietary Rating - Africa C Average Proprietary Rating - Middle East Page 36 Rating for African markets C Rating for Middle Eastern markets Page 36 © 2008 Thomas Murray Ltd.

Thomas Murray AA Rating A Overall Rating Africa and Middle East Market Comparisons ACR LR CR ASR FR OR AA Rating A AA + AA AA AA- A+ A+ A A A- A- BB BB B B CC CC Average Proprietary Rating - Africa C Average Proprietary Rating - Middle East Page 36 Rating for African markets C Rating for Middle Eastern markets Page 36 © 2008 Thomas Murray Ltd.

Thomas Murray V. Regional Developments Page 37 © 2008 Thomas Murray Ltd.

Thomas Murray V. Regional Developments Page 37 © 2008 Thomas Murray Ltd.

Thomas Murray V. Regional Developments A. Changes in Regulation • Kenya’s Capital Markets Authority “”has in the pipeline new regulations for an over-the-counter (OTC) bond trading model, which would allow investors to trade without intermediaries. • Also, the Kenyan parliament has passed tough anti-money laundering legislation including provisions to identify, trace, freeze, seize and confiscate the proceeds of crime. The Financial Reporting Centre and the Assets Recovery Agency were created. • The Egyptian Financial Supervisory Authority (EFSA) approved new regulations aimed at improving market liquidity. The package of measures included: *New rules for Exchange Traded Funds (ETF); *Reviewing the process of calculation of capital adequacy of the companies in intra-day trading, *New rules for approving the agendas of shareholder meetings *Setting new rules for OTC trading Page 38 • © 2008 Thomas Murray Ltd. EFSA also announced its plans to introduce sukuk (Islamic bonds) in the

Thomas Murray V. Regional Developments A. Changes in Regulation • Kenya’s Capital Markets Authority “”has in the pipeline new regulations for an over-the-counter (OTC) bond trading model, which would allow investors to trade without intermediaries. • Also, the Kenyan parliament has passed tough anti-money laundering legislation including provisions to identify, trace, freeze, seize and confiscate the proceeds of crime. The Financial Reporting Centre and the Assets Recovery Agency were created. • The Egyptian Financial Supervisory Authority (EFSA) approved new regulations aimed at improving market liquidity. The package of measures included: *New rules for Exchange Traded Funds (ETF); *Reviewing the process of calculation of capital adequacy of the companies in intra-day trading, *New rules for approving the agendas of shareholder meetings *Setting new rules for OTC trading Page 38 • © 2008 Thomas Murray Ltd. EFSA also announced its plans to introduce sukuk (Islamic bonds) in the

Thomas Murray V. Regional Developments B) Taxation • There have been a series of tax reforms across the world. In Africa, Botswana, Nigeria and Zimbabwe have introduced or are planning to implement changes to their local tax structures. • Following the G-20 meeting in London, there has been a surge in double taxation treaties across the world. More than 30 DTTs have been signed, ratified, entered into force or become effective in the last year, involving a member of the region. Page 39 © 2008 Thomas Murray Ltd.

Thomas Murray V. Regional Developments B) Taxation • There have been a series of tax reforms across the world. In Africa, Botswana, Nigeria and Zimbabwe have introduced or are planning to implement changes to their local tax structures. • Following the G-20 meeting in London, there has been a surge in double taxation treaties across the world. More than 30 DTTs have been signed, ratified, entered into force or become effective in the last year, involving a member of the region. Page 39 © 2008 Thomas Murray Ltd.

Thomas Murray V. Regional Developments C) Liquidity Settlement Improvements Changes included: • In Zambia the central bank permitted the extension of intra-day overdrafts issued by custodian banks to non-resident investors. • In South Africa, STRATE made adjustments to the SBL regulations to introduce more flexibility in the market and increase settlement liquidity. • The Moroccan authorities approved draft legislation for the implementation of SBL. The securities eligible for lending and borrowing include listed equities, commercial paper and treasury bills. • The Casablanca Stock Exchange (CSE) also made adjustments to the management of fails. The CSE toughened the rules on sanctions to defaulting participants. Changes included adjustments to the pricing mechanism for buy-ins and to the recycling of suspended trades. Page 40 © 2008 Thomas Murray Ltd.

Thomas Murray V. Regional Developments C) Liquidity Settlement Improvements Changes included: • In Zambia the central bank permitted the extension of intra-day overdrafts issued by custodian banks to non-resident investors. • In South Africa, STRATE made adjustments to the SBL regulations to introduce more flexibility in the market and increase settlement liquidity. • The Moroccan authorities approved draft legislation for the implementation of SBL. The securities eligible for lending and borrowing include listed equities, commercial paper and treasury bills. • The Casablanca Stock Exchange (CSE) also made adjustments to the management of fails. The CSE toughened the rules on sanctions to defaulting participants. Changes included adjustments to the pricing mechanism for buy-ins and to the recycling of suspended trades. Page 40 © 2008 Thomas Murray Ltd.

Thomas Murray V. Regional Developments D) Technological Developments • Bahrain Stock Exchange (BFX) announced the creation of an Islamic Finance division, Bait Al Bursa, from 19 October 2010. The new division will be managed electronically via E-Tayseer for automating Murabaha transactions. The new platform will be compliant with Shariah rules. • The Egyptian Exchange (EGX) will use a Trading Surveillance System (TSS). This new technology will facilitate an effective maintenance of an orderly market. • In late 2009 the Nairobi Stock Exchange (NSE) introduced an electronic Automated Trading System (ATS) for the trading of debt securities. The system is linked with the depository system of the Central Bank of Kenya and (CDSC). • STRATE implemented a new centralised communication hub facilitating the sending and receiving of messages between several clients in May of this year. Page 41 © 2008 Thomas Murray Ltd.

Thomas Murray V. Regional Developments D) Technological Developments • Bahrain Stock Exchange (BFX) announced the creation of an Islamic Finance division, Bait Al Bursa, from 19 October 2010. The new division will be managed electronically via E-Tayseer for automating Murabaha transactions. The new platform will be compliant with Shariah rules. • The Egyptian Exchange (EGX) will use a Trading Surveillance System (TSS). This new technology will facilitate an effective maintenance of an orderly market. • In late 2009 the Nairobi Stock Exchange (NSE) introduced an electronic Automated Trading System (ATS) for the trading of debt securities. The system is linked with the depository system of the Central Bank of Kenya and (CDSC). • STRATE implemented a new centralised communication hub facilitating the sending and receiving of messages between several clients in May of this year. Page 41 © 2008 Thomas Murray Ltd.

Thomas Murray V. Regional Developments D) Technological Developments • Maroclear implemented a new IT platform in September 2010 with the following features: * Same-day turnaround for external trades, subject to the completion of settlement from the buy side; * Real-time settlement for over the counter (OTC) trading; * Separation of the on-exchange and OTC platforms; * Gross settlement for broker-to-broker trading; * Automation of processes including registration; * A dedicated platform for Repo transaction management; * A real-time tool to check balances and trade status; * Segregation of accounts by client at CSD level; * Future implementation of SWIFT. Page 42 © 2008 Thomas Murray Ltd.

Thomas Murray V. Regional Developments D) Technological Developments • Maroclear implemented a new IT platform in September 2010 with the following features: * Same-day turnaround for external trades, subject to the completion of settlement from the buy side; * Real-time settlement for over the counter (OTC) trading; * Separation of the on-exchange and OTC platforms; * Gross settlement for broker-to-broker trading; * Automation of processes including registration; * A dedicated platform for Repo transaction management; * A real-time tool to check balances and trade status; * Segregation of accounts by client at CSD level; * Future implementation of SWIFT. Page 42 © 2008 Thomas Murray Ltd.

Thomas Murray V. Regional Developments D) Technological Developments • The Qatar Exchange adopted the Universal Trading Platform (UPT), which includes: * Continuous trading phase, including an opening and closing auction; * Inductive Matching Opening Price (IMP); * Algorithmic auction closing for orders (Closing Price depends on the Closing Auction); * Trading-At-Last (TAL) phase after the closing auction; * “Stop” orders at the call phase to act as market stabilisers; * “Market to Limit and Stop” order in the Auction phase and the continuous phase. * New validity parameters and conditions; * Safeguards, including dynamic thresholds, reference price and price range • Page 43 The Bank of Zambia implemented the Zambian Inter-Bank Payment and © 2008 Thomas Murray Ltd. Settlement System (ZIPSS) for the cash settlement of on-exchange trades Page 43

Thomas Murray V. Regional Developments D) Technological Developments • The Qatar Exchange adopted the Universal Trading Platform (UPT), which includes: * Continuous trading phase, including an opening and closing auction; * Inductive Matching Opening Price (IMP); * Algorithmic auction closing for orders (Closing Price depends on the Closing Auction); * Trading-At-Last (TAL) phase after the closing auction; * “Stop” orders at the call phase to act as market stabilisers; * “Market to Limit and Stop” order in the Auction phase and the continuous phase. * New validity parameters and conditions; * Safeguards, including dynamic thresholds, reference price and price range • Page 43 The Bank of Zambia implemented the Zambian Inter-Bank Payment and © 2008 Thomas Murray Ltd. Settlement System (ZIPSS) for the cash settlement of on-exchange trades Page 43

Thomas Murray V. Regional Developments E) Linking markets • The Capital Markets Authority (CMA) in Kenya announced its plan to make it possible for publically issued securities to be traded on platforms other than the approved Securities Exchanges. • The Egyptian Stock Exchange (EGX) and the London Stock Exchange (LSE) have plans to allow their customers to access both trading systems via the Financial Information Exchange (FIX). • Egypt’s Central Securities Depository (MCDR) joined the Link Up Markets as the second non-European member in March 2010. Page 44 © 2008 Thomas Murray Ltd.

Thomas Murray V. Regional Developments E) Linking markets • The Capital Markets Authority (CMA) in Kenya announced its plan to make it possible for publically issued securities to be traded on platforms other than the approved Securities Exchanges. • The Egyptian Stock Exchange (EGX) and the London Stock Exchange (LSE) have plans to allow their customers to access both trading systems via the Financial Information Exchange (FIX). • Egypt’s Central Securities Depository (MCDR) joined the Link Up Markets as the second non-European member in March 2010. Page 44 © 2008 Thomas Murray Ltd.