73f943772d9decd3625c2d799220de32.ppt

- Количество слайдов: 36

This webinar is brought to you by CLEONet www. cleonet. ca CLEONet is a web site of legal information for community workers and advocates who work with low-income and disadvantaged communities in Ontario. 2010, Community Law School (Sarnia-Lambton) Inc.

Please note … The content of this webinar is based on law that was current on the date the webinar was recorded. CLEONet webinars contain general legal information. They are not intended to be used as legal advice for a specific legal problem. For more information on how to find a lawyer or to contact your local community legal clinic visit www. cleonet. ca/need_legal_help 2010, Community Law School (Sarnia-Lambton) Inc.

The Disability Tax Credit Certificate & Related Benefits under the Income Tax Act ARCH DISABILITY LAW CENTRE May 4 th, 2011 Brendon D. Pooran 416 -617 -6805 bpooran@pooranlaw. com www. pooranlaw. com

About our presenter… Brendon Pooran has been involved with disability organizations as a member, volunteer, employee or director for most of his life. His practice, which is primarily built around disability issues, is inspired by the challenges people with disabilities face throughout their lives. He created Pooranlaw to provide a voice for this community and to serve as a resource for accessibility issues throughout Ontario. Brendon teaches Critical Disability Law at York University, is a lawyer member on the Consent and Capacity Board and sits on the Board of Directors at the Canadian Abilities Foundation, Community Living York South, Muki. Baum Treatment Centres and PLAN Toronto.

DISCLAIMER The information provided in this presentation is not legal advice and does not create a solicitor-client relationship. Pooranlaw provides such information for general information purposes only. While we attempt to convey current and accurate information, we make no representations or warranties of any kind, express or implied, about the completeness, currency, accuracy, reliability, suitability or availability of the information. Any reliance you place on such information is therefore strictly at your own risk. 5

1. What is the Disability Tax Credit Certificate? (Form T 2201)? 2. Who can complete the DTCC? 3. Who qualifies for the DTCC? AGENDA 4. Can I appeal CRA’s decision? 5. What benefits are available with an approved DTCC? a. The Disability Amount b. Transferring the Disability Amount to a Dependant c. Child Disability Benefit d. Working Income Tax Benefit Disability Supplement e. Disability Supports Deduction f. Eligible Medical Expenses g. Registered Disability Savings Plan 6. What other benefits are available under the Income Tax Act? a. Caregiver Amount b. Amount for Infirm Dependants c. Homebuyer’s Amount d. HST Information 7. Can I File Adjustments to Prior Years’ Tax Returns? 6

What is the DTCC? • Disability Tax Credit Certificate • Canada Revenue Agency - Form T 2201 http: //www. cra-arc. gc. ca/E/pbg/tf/t 2201/README. html • Qualifies individuals for benefits under the Income Tax Act • Confirms that individual has “severe or prolonged impairment in physical or mental functions” • See self-assessment form 7

Who Can Complete the DTCC? Part A • completed by person with disability or representative • Authorize representative by completing Form T 1013 Authorizing or Cancelling a Representative Part B • Completed by a qualified practitioner • Medical doctor, optometrist, occupational therapist, audiologist, physiotherapist, psychologist, speech-language pathologist 8

Who Qualifies for the DTCC? 1. The individual has: • an impairment in physical or mental functions • lasting, or expecting to last, at least 12 months and • is blind 9

Who Qualifies for the DTCC? 2. The individual has: • an impairment in physical or mental functions • lasting, or expecting to last, at least 12 months and • is receiving life-sustaining therapy 10

Who Qualifies for the DTCC? Life-sustaining therapy • Supports vital function • May alleviate symptoms • At least 3 times per week / avg 14 hours per week • Yes chest physiotherapy, dialysis, adjustment of medication on daily basis • No implanted devices (pacemaker), special programs of diet, exercise, hygiene 11

Who Qualifies for the DTCC? 3. The individual has: • an impairment in physical or mental functions • lasting, or expecting to last, at least 12 months and • the effect of the impairment causes the individual to be markedly restricted in one of the activities of daily living 12

Who Qualifies for the DTCC? Activities of Daily Living • Speaking • Feeding • Dressing • Walking • Mental functions necessary for everyday life • Elimination (bowel or bladder functions) 13

Who Qualifies for the DTCC? Markedly Restricted • All or substantially all of the time • unable or takes an inordinate amount of time • to perform one or more of the ADLs • even with therapy (other than lifesustaining) and • use of appropriate devices & medication 14

Who Qualifies for the DTCC? 4. In 2005 or later, the individual has: • an impairment in physical or mental functions • lasting, or expecting to last, at least 12 months • because of the impairment, the individual is significantly restricted in two or more of the ADLs • Significant restrictions exist together all or substantially all of the time • Cumulative effect = markedly restricted in single ADL 15

Who Qualifies for the DTCC? 5. In 2005 or later, the individual has: • an impairment in physical or mental functions • lasting, or expecting to last, at least 12 months • because of the impairment, is significantly restricted in vision and at least one ADL • Significant restrictions exist together all or substantially all of the time • Cumulative effect = markedly restricted in single ADL 16

Who Qualifies for the DTCC? Significantly Restricted • Do not quite meet criteria for markedly restricted • Ability to perform ADL is substantially restricted 17

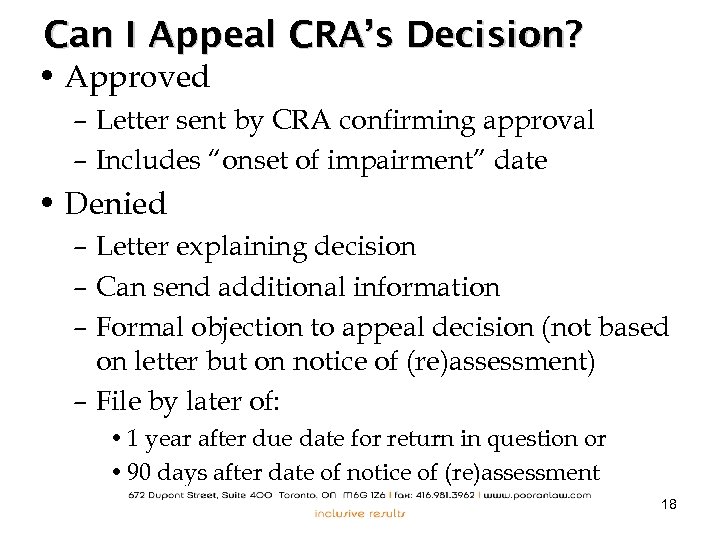

Can I Appeal CRA’s Decision? • Approved – Letter sent by CRA confirming approval – Includes “onset of impairment” date • Denied – Letter explaining decision – Can send additional information – Formal objection to appeal decision (not based on letter but on notice of (re)assessment) – File by later of: • 1 year after due date for return in question or • 90 days after date of notice of (re)assessment 18

Benefits Associated with the Disability Tax Credit Certificate 19

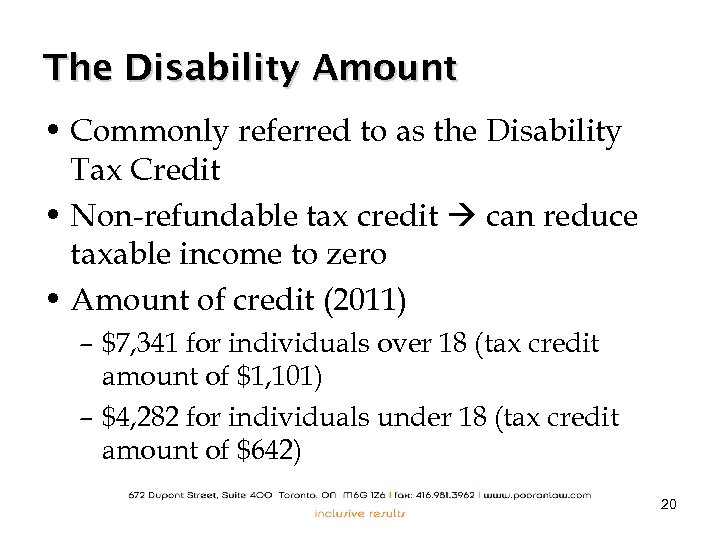

The Disability Amount • Commonly referred to as the Disability Tax Credit • Non-refundable tax credit can reduce taxable income to zero • Amount of credit (2011) – $7, 341 for individuals over 18 (tax credit amount of $1, 101) – $4, 282 for individuals under 18 (tax credit amount of $642) 20

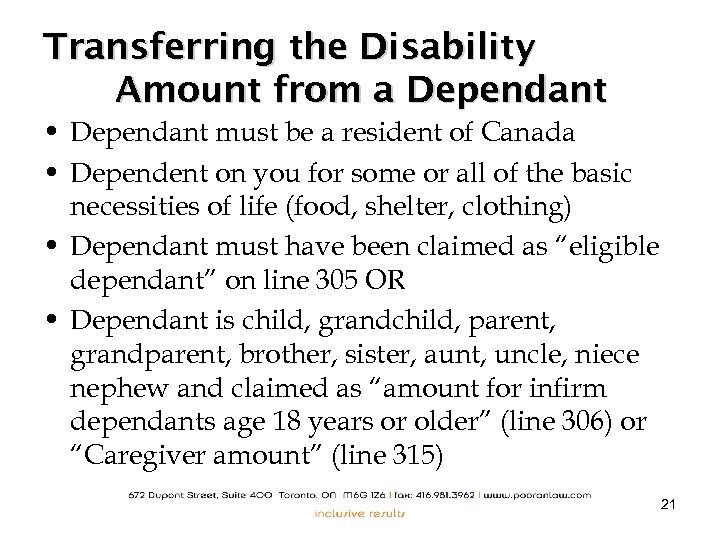

Transferring the Disability Amount from a Dependant • Dependant must be a resident of Canada • Dependent on you for some or all of the basic necessities of life (food, shelter, clothing) • Dependant must have been claimed as “eligible dependant” on line 305 OR • Dependant is child, grandchild, parent, grandparent, brother, sister, aunt, uncle, niece nephew and claimed as “amount for infirm dependants age 18 years or older” (line 306) or “Caregiver amount” (line 315) 21

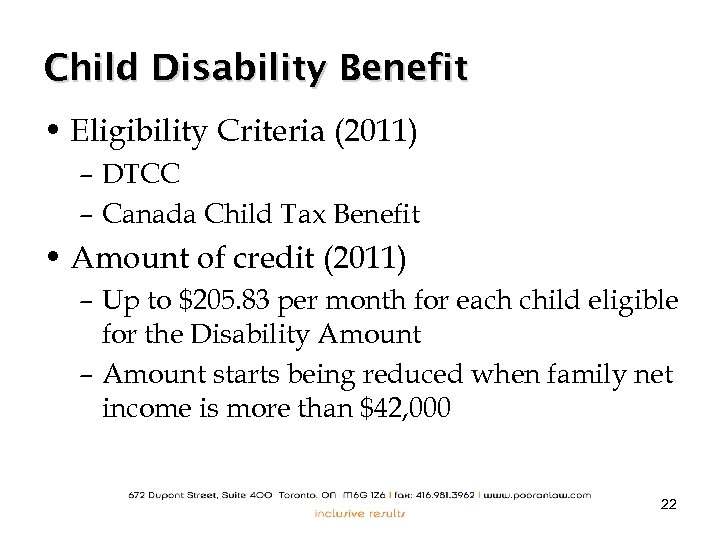

Child Disability Benefit • Eligibility Criteria (2011) – DTCC – Canada Child Tax Benefit • Amount of credit (2011) – Up to $205. 83 per month for each child eligible for the Disability Amount – Amount starts being reduced when family net income is more than $42, 000 22

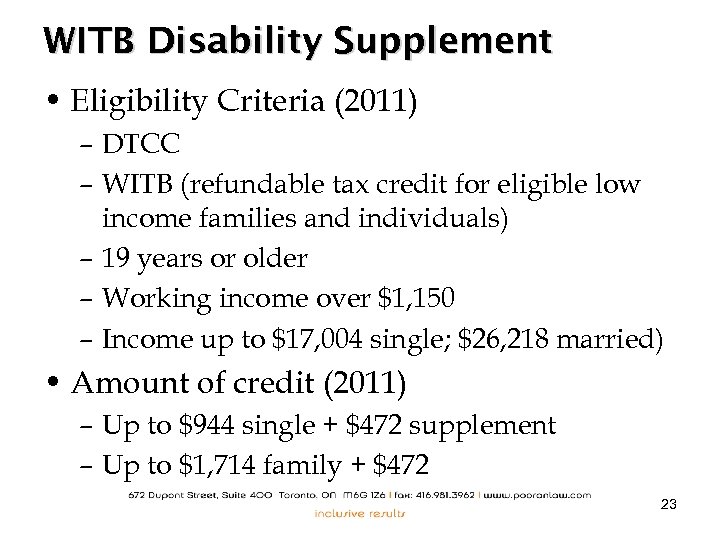

WITB Disability Supplement • Eligibility Criteria (2011) – DTCC – WITB (refundable tax credit for eligible low income families and individuals) – 19 years or older – Working income over $1, 150 – Income up to $17, 004 single; $26, 218 married) • Amount of credit (2011) – Up to $944 single + $472 supplement – Up to $1, 714 family + $472 supplement 23

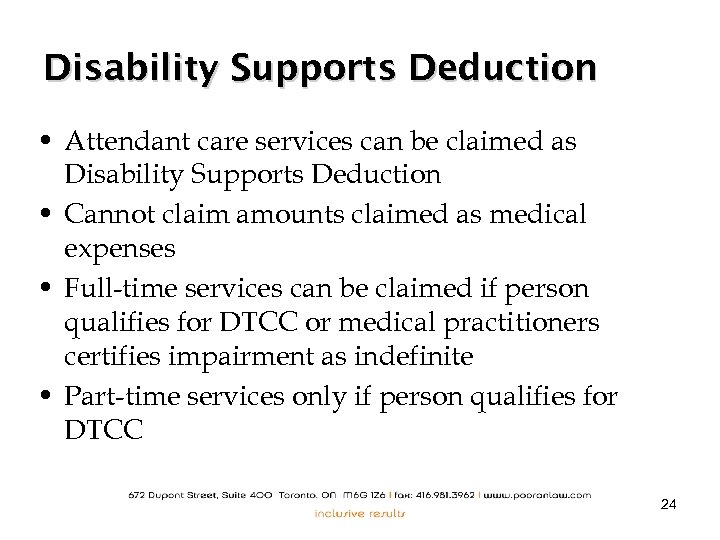

Disability Supports Deduction • Attendant care services can be claimed as Disability Supports Deduction • Cannot claim amounts claimed as medical expenses • Full-time services can be claimed if person qualifies for DTCC or medical practitioners certifies impairment as indefinite • Part-time services only if person qualifies for DTCC 24

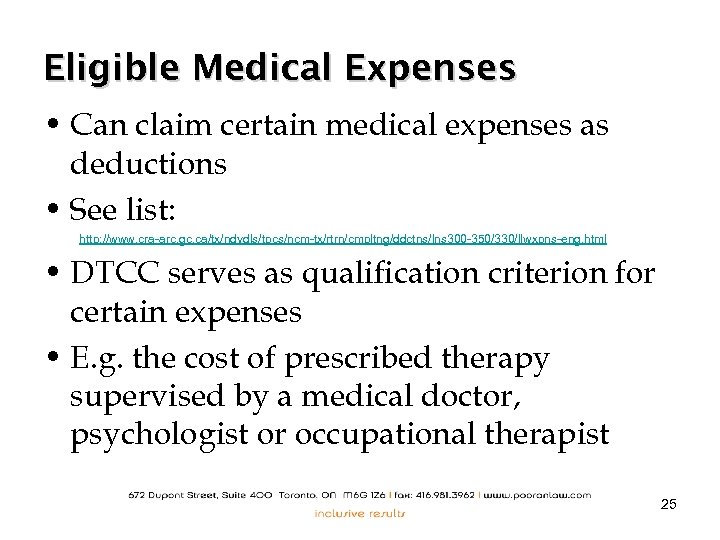

Eligible Medical Expenses • Can claim certain medical expenses as deductions • See list: http: //www. cra-arc. gc. ca/tx/ndvdls/tpcs/ncm-tx/rtrn/cmpltng/ddctns/lns 300 -350/330/llwxpns-eng. html • DTCC serves as qualification criterion for certain expenses • E. g. the cost of prescribed therapy supervised by a medical doctor, psychologist or occupational therapist 25

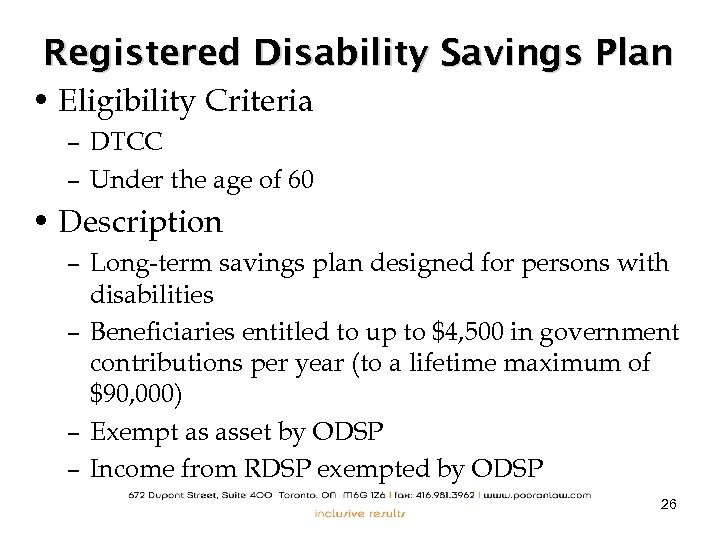

Registered Disability Savings Plan • Eligibility Criteria – DTCC – Under the age of 60 • Description – Long-term savings plan designed for persons with disabilities – Beneficiaries entitled to up to $4, 500 in government contributions per year (to a lifetime maximum of $90, 000) – Exempt as asset by ODSP – Income from RDSP exempted by ODSP 26

Other Benefits Available Under the Income Tax Act 27

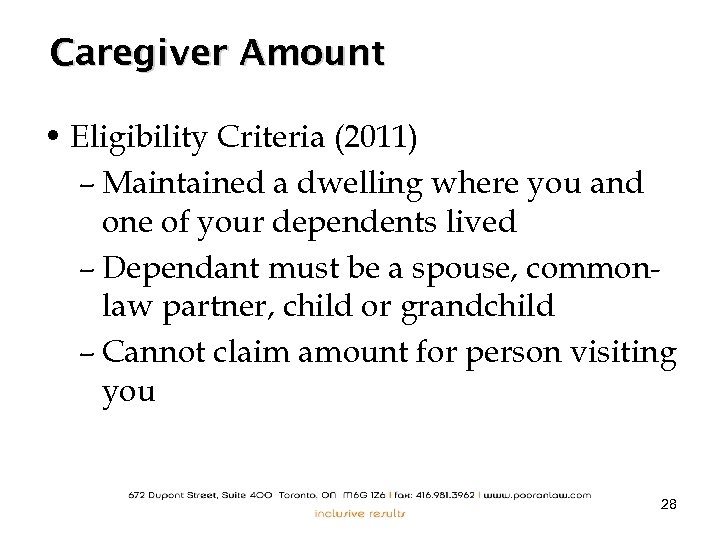

Caregiver Amount • Eligibility Criteria (2011) – Maintained a dwelling where you and one of your dependents lived – Dependant must be a spouse, commonlaw partner, child or grandchild – Cannot claim amount for person visiting you 28

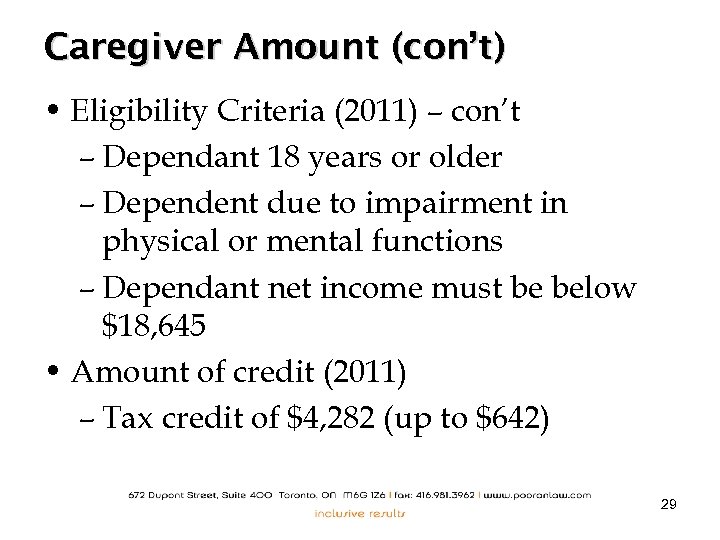

Caregiver Amount (con’t) • Eligibility Criteria (2011) – con’t – Dependant 18 years or older – Dependent due to impairment in physical or mental functions – Dependant net income must be below $18, 645 • Amount of credit (2011) – Tax credit of $4, 282 (up to $642) 29

Amount for Infirm Dependants • Eligibility Criteria (2011) – Dependant child/grandchild 18 years or older – Dependent due to impairment in physical or mental functions • Amount of credit (2011) – Tax credit of $4, 282 (up to $642) 30

Homebuyer’s Amount • Eligibility Criteria – DTCC (if not a first-time buyer) – Can buy for related person who qualifies for DTCC (to allow person to live in more accessible home) – Purchase of qualifying home closing after January 27, 2009 • Amount of credit (2011) – Up to $5, 000 31

HST Information • Some goods and services used by persons with disabilities are exempt • E. g. – Most health-care services – Personal care and supervision programs – Medical devices and supplies – Specially equipped motor vehicles 32

Can I Adjust Prior Years’ Returns? • Yes • Up to 10 years prior to current year • Disability Amount • Caregiver Amount • Complete T 1 Adjustment Request Form http: //www. cra-arc. gc. ca/E/pbg/tf/t 1 -adj/ • Submit separate form for each year 33

Can I Adjust Prior Years’ Returns? Pooranlaw www. pooranlaw. com CRA Guide (RC 4064) – Medical & Disability-Related Information http: //www. cra-arc. gc. ca/E/pub/tg/rc 4064/README. html Disability Tax Credit Certificate (T 2201) http: //www. cra-arc. gc. ca/E/pbg/tf/t 2201/README. html Caregiver Tax Credit http: //www. cra-arc. gc. ca/tx/ndvdls/tpcs/ncmtx/rtrn/cmpltng/ddctns/lns 300 -350/315/menu-eng. html 34

QUESTIONS Brendon D. Pooran 416 -617 -6805 bpooran@pooranlaw. com www. pooranlaw. com 35

This webinar was brought to you by CLEONet For more information visit the Health and Disability Law section of CLEONet at www. cleonet. ca For more public legal information webinars visit: http: //www. cleonet. ca/training 2010, Community Law School (Sarnia-Lambton) Inc.

73f943772d9decd3625c2d799220de32.ppt