3b599d525ea48325dcab3de07d9670a5.ppt

- Количество слайдов: 15

This presentation may contain certain "forward-looking statements" with respect to certain of Prudential's plans and its current goals and expectations relating to its future financial condition, performance and results. By their nature, all forward-looking statements involve risk and uncertainty because they relate to future events and circumstances which are beyond Prudential's control including among other things, UK domestic and global economic and business conditions, market related risks such as fluctuations in interest rates and exchange rates, the policies and actions of regulatory authorities, the impact of competition, inflation, deflation, the timing, impact and other uncertainties of future acquisitions or combinations within relevant industries, as well as the impact of tax and other legislation and other regulations in the jurisdictions in which Prudential and its affiliates operate. As a result, Prudential's actual future financial condition, performance and results may differ materially from the plans, goals, and expectations set forth in Prudential's forward-looking statements.

This presentation may contain certain "forward-looking statements" with respect to certain of Prudential's plans and its current goals and expectations relating to its future financial condition, performance and results. By their nature, all forward-looking statements involve risk and uncertainty because they relate to future events and circumstances which are beyond Prudential's control including among other things, UK domestic and global economic and business conditions, market related risks such as fluctuations in interest rates and exchange rates, the policies and actions of regulatory authorities, the impact of competition, inflation, deflation, the timing, impact and other uncertainties of future acquisitions or combinations within relevant industries, as well as the impact of tax and other legislation and other regulations in the jurisdictions in which Prudential and its affiliates operate. As a result, Prudential's actual future financial condition, performance and results may differ materially from the plans, goals, and expectations set forth in Prudential's forward-looking statements.

“CAN EMERGING MARKETS GENERATE SUPERIOR RETURNS? ” Goldman Sachs European Financials Conference, 11 June 2002 JONATHAN BLOOMER GROUP CHIEF EXECUTIVE PRUDENTIAL PLC

“CAN EMERGING MARKETS GENERATE SUPERIOR RETURNS? ” Goldman Sachs European Financials Conference, 11 June 2002 JONATHAN BLOOMER GROUP CHIEF EXECUTIVE PRUDENTIAL PLC

PRUDENTIAL PLC: A STRATEGIC OVERVIEW n A leading international retail financial services player n Focus on medium and long term savings n A market leader in our chosen territories - UK - US - Asia n Diversified products and distribution channels n Scale and resources for future growth, internationally n Balancing short-term and long-term strategies to deliver value to our shareholders

PRUDENTIAL PLC: A STRATEGIC OVERVIEW n A leading international retail financial services player n Focus on medium and long term savings n A market leader in our chosen territories - UK - US - Asia n Diversified products and distribution channels n Scale and resources for future growth, internationally n Balancing short-term and long-term strategies to deliver value to our shareholders

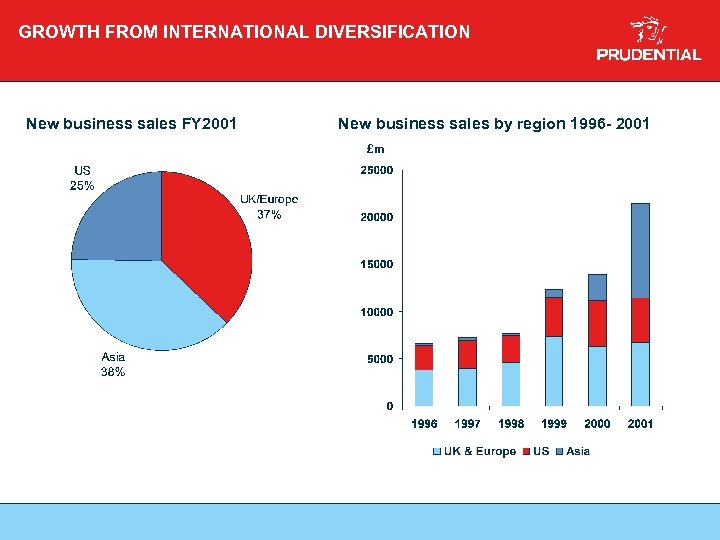

GROWTH FROM INTERNATIONAL DIVERSIFICATION New business sales FY 2001 New business sales by region 1996 - 2001 £m

GROWTH FROM INTERNATIONAL DIVERSIFICATION New business sales FY 2001 New business sales by region 1996 - 2001 £m

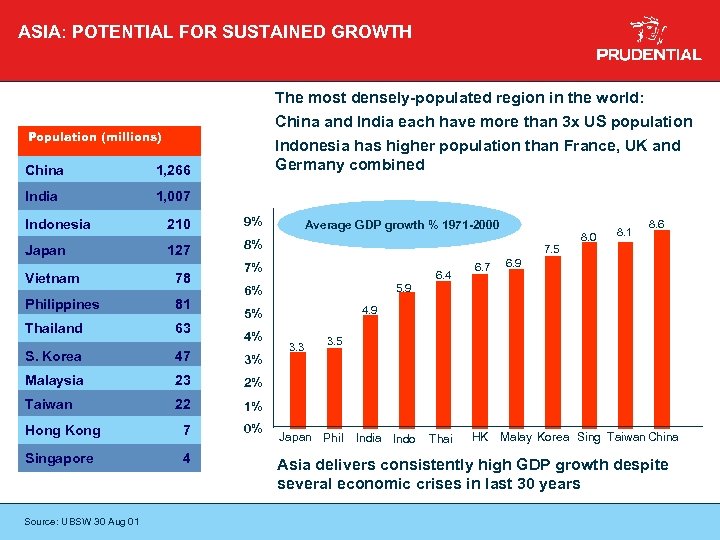

ASIA: POTENTIAL FOR SUSTAINED GROWTH The most densely-populated region in the world: China and India each have more than 3 x US population Indonesia has higher population than France, UK and Germany combined Population (millions) China 1, 266 India 1, 007 Indonesia 210 9% Japan 127 8% Vietnam 78 Philippines 81 Thailand 63 Average GDP growth % 1971 -2000 7. 5 7% 6. 4 47 3% Malaysia 23 22 7 0% Singapore 4 3. 3 3. 5 1% Hong Kong 6. 9 2% Taiwan 8. 6 4. 9 5% S. Korea 8. 1 5. 9 6% 4% 6. 7 8. 0 Source: UBSW 30 Aug 01 Japan Phil India Indo Thai HK Malay Korea Sing Taiwan China Asia delivers consistently high GDP growth despite several economic crises in last 30 years

ASIA: POTENTIAL FOR SUSTAINED GROWTH The most densely-populated region in the world: China and India each have more than 3 x US population Indonesia has higher population than France, UK and Germany combined Population (millions) China 1, 266 India 1, 007 Indonesia 210 9% Japan 127 8% Vietnam 78 Philippines 81 Thailand 63 Average GDP growth % 1971 -2000 7. 5 7% 6. 4 47 3% Malaysia 23 22 7 0% Singapore 4 3. 3 3. 5 1% Hong Kong 6. 9 2% Taiwan 8. 6 4. 9 5% S. Korea 8. 1 5. 9 6% 4% 6. 7 8. 0 Source: UBSW 30 Aug 01 Japan Phil India Indo Thai HK Malay Korea Sing Taiwan China Asia delivers consistently high GDP growth despite several economic crises in last 30 years

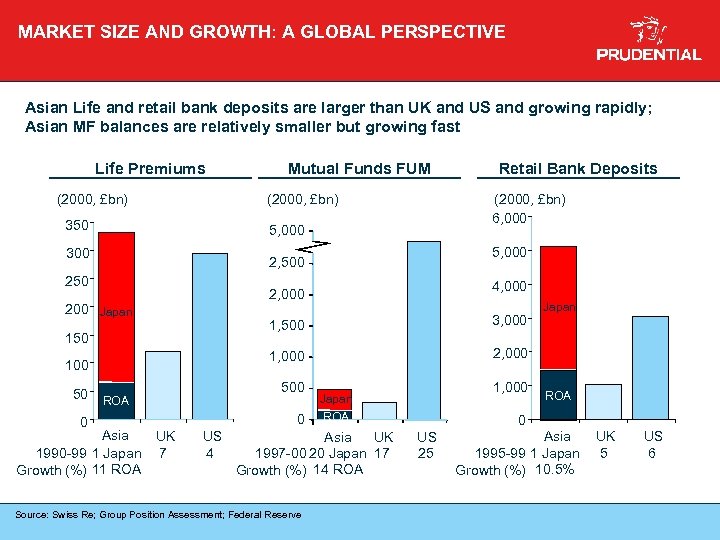

MARKET SIZE AND GROWTH: A GLOBAL PERSPECTIVE Asian Life and retail bank deposits are larger than UK and US and growing rapidly; Asian MF balances are relatively smaller but growing fast Life Premiums (2000, £bn) 350 4, 000 200 Japan 1, 500 100 0 UK 7 US 4 Japan 2, 000 500 ROA Asia 1990 -99 1 Japan Growth (%) 11 ROA 3, 000 150 0 5, 000 2, 500 250 Retail Bank Deposits (2000, £bn) 6, 000 5, 000 300 50 Mutual Funds FUM Asia UK 1997 -00 20 Japan 17 Growth (%) 14 ROA Source: Swiss Re; Group Position Assessment; Federal Reserve 1, 000 Japan ROA 0 US 25 Asia 1995 -99 1 Japan Growth (%) 10. 5% UK 5 US 6

MARKET SIZE AND GROWTH: A GLOBAL PERSPECTIVE Asian Life and retail bank deposits are larger than UK and US and growing rapidly; Asian MF balances are relatively smaller but growing fast Life Premiums (2000, £bn) 350 4, 000 200 Japan 1, 500 100 0 UK 7 US 4 Japan 2, 000 500 ROA Asia 1990 -99 1 Japan Growth (%) 11 ROA 3, 000 150 0 5, 000 2, 500 250 Retail Bank Deposits (2000, £bn) 6, 000 5, 000 300 50 Mutual Funds FUM Asia UK 1997 -00 20 Japan 17 Growth (%) 14 ROA Source: Swiss Re; Group Position Assessment; Federal Reserve 1, 000 Japan ROA 0 US 25 Asia 1995 -99 1 Japan Growth (%) 10. 5% UK 5 US 6

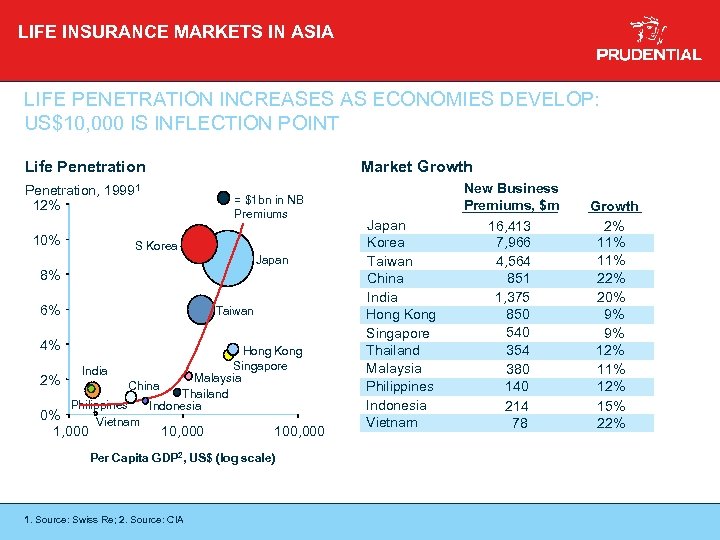

LIFE INSURANCE MARKETS IN ASIA LIFE PENETRATION INCREASES AS ECONOMIES DEVELOP: US$10, 000 IS INFLECTION POINT Life Penetration Market Growth Penetration, 19991 12% 10% = $1 bn in NB Premiums S Korea Japan 8% 6% Taiwan 4% Hong Kong Singapore India Malaysia 2% China Thailand Philippines Indonesia 0% Vietnam 1, 000 100, 000 Per Capita GDP 2, US$ (log scale) 1. Source: Swiss Re; 2. Source: CIA New Business Premiums, $m Japan Korea Taiwan China India Hong Kong Singapore Thailand Malaysia Philippines Indonesia Vietnam 16, 413 7, 966 4, 564 851 1, 375 850 540 354 380 140 214 78 Growth 2% 11% 22% 20% 9% 9% 12% 11% 12% 15% 22%

LIFE INSURANCE MARKETS IN ASIA LIFE PENETRATION INCREASES AS ECONOMIES DEVELOP: US$10, 000 IS INFLECTION POINT Life Penetration Market Growth Penetration, 19991 12% 10% = $1 bn in NB Premiums S Korea Japan 8% 6% Taiwan 4% Hong Kong Singapore India Malaysia 2% China Thailand Philippines Indonesia 0% Vietnam 1, 000 100, 000 Per Capita GDP 2, US$ (log scale) 1. Source: Swiss Re; 2. Source: CIA New Business Premiums, $m Japan Korea Taiwan China India Hong Kong Singapore Thailand Malaysia Philippines Indonesia Vietnam 16, 413 7, 966 4, 564 851 1, 375 850 540 354 380 140 214 78 Growth 2% 11% 22% 20% 9% 9% 12% 11% 12% 15% 22%

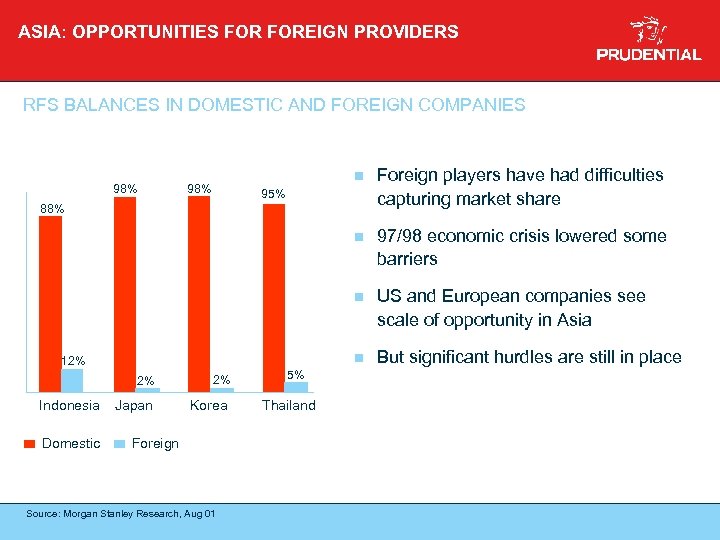

ASIA: OPPORTUNITIES FOREIGN PROVIDERS RFS BALANCES IN DOMESTIC AND FOREIGN COMPANIES n 97/98 economic crisis lowered some barriers n US and European companies see scale of opportunity in Asia n 98% Foreign players have had difficulties capturing market share n 98% But significant hurdles are still in place 95% 88% 12% 2% Indonesia Domestic 2% Japan Korea Foreign Source: Morgan Stanley Research, Aug 01 5% Thailand

ASIA: OPPORTUNITIES FOREIGN PROVIDERS RFS BALANCES IN DOMESTIC AND FOREIGN COMPANIES n 97/98 economic crisis lowered some barriers n US and European companies see scale of opportunity in Asia n 98% Foreign players have had difficulties capturing market share n 98% But significant hurdles are still in place 95% 88% 12% 2% Indonesia Domestic 2% Japan Korea Foreign Source: Morgan Stanley Research, Aug 01 5% Thailand

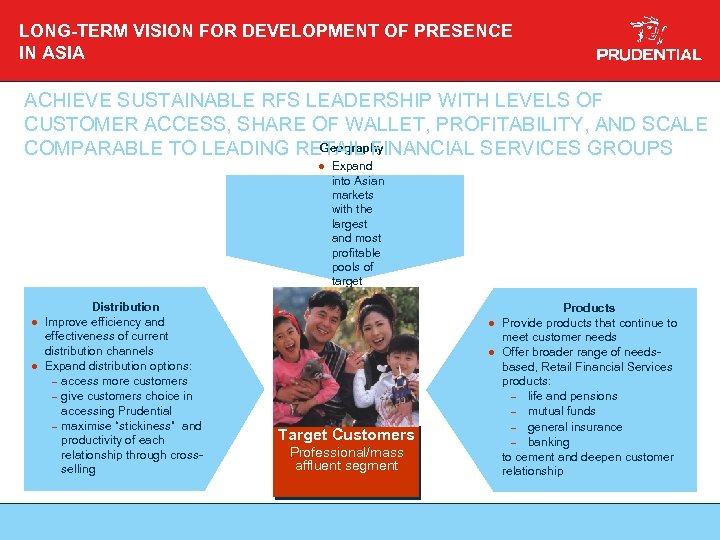

LONG-TERM VISION FOR DEVELOPMENT OF PRESENCE IN ASIA ACHIEVE SUSTAINABLE RFS LEADERSHIP WITH LEVELS OF CUSTOMER ACCESS, SHARE OF WALLET, PROFITABILITY, AND SCALE Geography COMPARABLE TO LEADING RETAIL FINANCIAL SERVICES GROUPS l l l Distribution Improve efficiency and effectiveness of current distribution channels Expand distribution options: – access more customers – give customers choice in accessing Prudential – maximise “stickiness” and productivity of each relationship through crossselling Expand into Asian markets with the largest and most profitable pools of target customer s l l Target Customers Professional/mass affluent segment Products Provide products that continue to meet customer needs Offer broader range of needsbased, Retail Financial Services products: – life and pensions – mutual funds – general insurance – banking to cement and deepen customer relationship

LONG-TERM VISION FOR DEVELOPMENT OF PRESENCE IN ASIA ACHIEVE SUSTAINABLE RFS LEADERSHIP WITH LEVELS OF CUSTOMER ACCESS, SHARE OF WALLET, PROFITABILITY, AND SCALE Geography COMPARABLE TO LEADING RETAIL FINANCIAL SERVICES GROUPS l l l Distribution Improve efficiency and effectiveness of current distribution channels Expand distribution options: – access more customers – give customers choice in accessing Prudential – maximise “stickiness” and productivity of each relationship through crossselling Expand into Asian markets with the largest and most profitable pools of target customer s l l Target Customers Professional/mass affluent segment Products Provide products that continue to meet customer needs Offer broader range of needsbased, Retail Financial Services products: – life and pensions – mutual funds – general insurance – banking to cement and deepen customer relationship

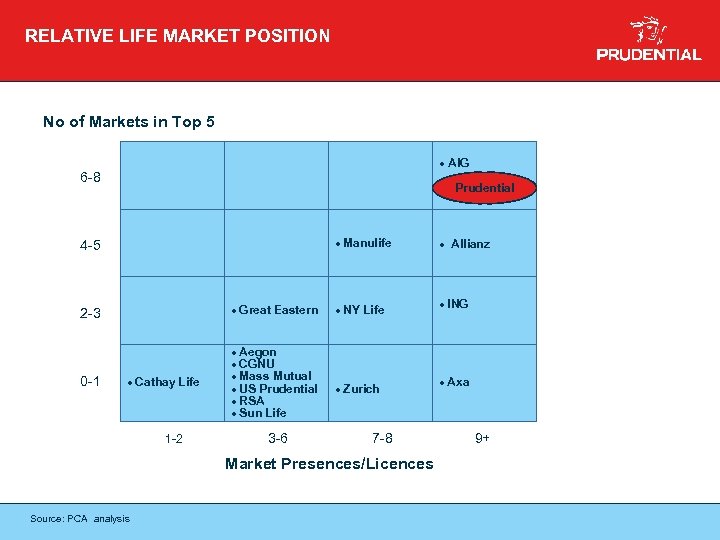

RELATIVE LIFE MARKET POSITION No of Markets in Top 5 · AIG 6 -8 Prudential · Manulife 4 -5 2 -3 · Great Eastern 0 -1 · Aegon · CGNU · Mass Mutual · US Prudential · RSA · Sun Life · Cathay Life 1 -2 3 -6 · NY Life · Zurich 7 -8 Market Presences/Licences Source: PCA analysis · Allianz · ING · Axa 9+

RELATIVE LIFE MARKET POSITION No of Markets in Top 5 · AIG 6 -8 Prudential · Manulife 4 -5 2 -3 · Great Eastern 0 -1 · Aegon · CGNU · Mass Mutual · US Prudential · RSA · Sun Life · Cathay Life 1 -2 3 -6 · NY Life · Zurich 7 -8 Market Presences/Licences Source: PCA analysis · Allianz · ING · Axa 9+

PRUDENTIAL’S STRATEGIC PRIORITIES: CAPITALISE ON THE OPPORTUNITIES n Build a scale presence in North Asia and Greater China - largest profit pools and target customer bases n Grow and strengthen tied agency forces n Continue to evolve towards multi-distribution model - building upon recent successes in bank/direct distribution n Build profitable and material regional Mutual Fund business n Migrate to lower-cost operating configuration with multi-country processing n Continue to develop structure and resource pool

PRUDENTIAL’S STRATEGIC PRIORITIES: CAPITALISE ON THE OPPORTUNITIES n Build a scale presence in North Asia and Greater China - largest profit pools and target customer bases n Grow and strengthen tied agency forces n Continue to evolve towards multi-distribution model - building upon recent successes in bank/direct distribution n Build profitable and material regional Mutual Fund business n Migrate to lower-cost operating configuration with multi-country processing n Continue to develop structure and resource pool

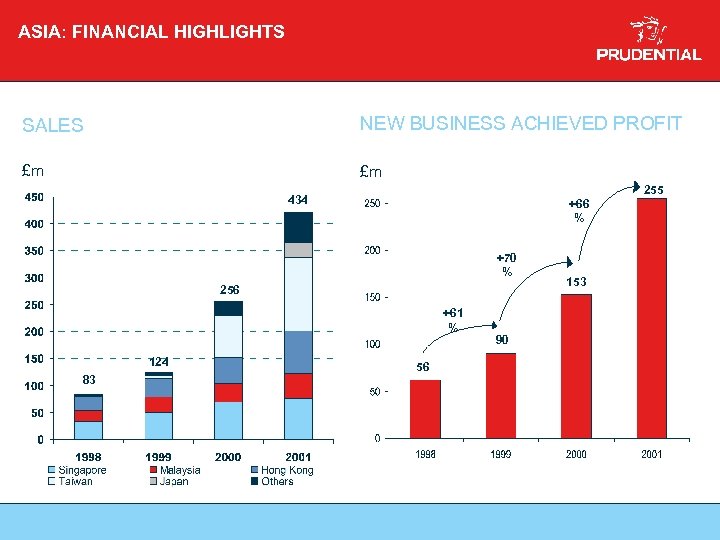

ASIA: FINANCIAL HIGHLIGHTS SALES NEW BUSINESS ACHIEVED PROFIT £m £m 255 434 +66 % +70 % 256 +61 % 124 83 56 90 153

ASIA: FINANCIAL HIGHLIGHTS SALES NEW BUSINESS ACHIEVED PROFIT £m £m 255 434 +66 % +70 % 256 +61 % 124 83 56 90 153

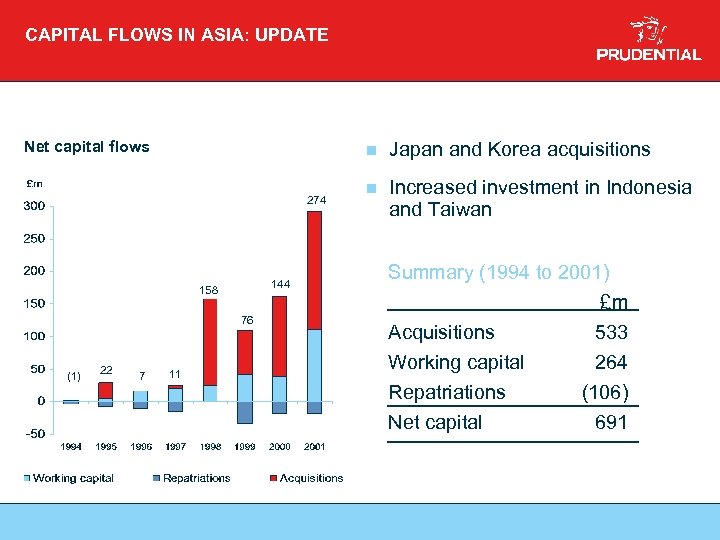

CAPITAL FLOWS IN ASIA: UPDATE Net capital flows n 274 144 158 76 (1) 22 7 11 Japan and Korea acquisitions n Increased investment in Indonesia and Taiwan Summary (1994 to 2001) £m Acquisitions 533 Working capital 264 Repatriations Net capital (106) 691

CAPITAL FLOWS IN ASIA: UPDATE Net capital flows n 274 144 158 76 (1) 22 7 11 Japan and Korea acquisitions n Increased investment in Indonesia and Taiwan Summary (1994 to 2001) £m Acquisitions 533 Working capital 264 Repatriations Net capital (106) 691

CONCLUSION: BENEFITS CAN BE REAPED FROM SUCCESSFUL PARTICIPATION IN EMERGING MARKETS n Markets are attractive and will remain so for the foreseeable future n To succeed a participant needs: - n strong and capable management team strong track record of performance delivery financial strength profitable business model ability to leverage pan-regional presence continued focus on costs clear view of future opportunities and challenges Strategy and capabilities must be designed to deliver profitable growth

CONCLUSION: BENEFITS CAN BE REAPED FROM SUCCESSFUL PARTICIPATION IN EMERGING MARKETS n Markets are attractive and will remain so for the foreseeable future n To succeed a participant needs: - n strong and capable management team strong track record of performance delivery financial strength profitable business model ability to leverage pan-regional presence continued focus on costs clear view of future opportunities and challenges Strategy and capabilities must be designed to deliver profitable growth

PRUDENTIAL PLC

PRUDENTIAL PLC