2efa42f41c23c17db709ad9de0239404.ppt

- Количество слайдов: 11

This presentation is to attendees at the Mining Conference hosted by the British & Colombian Chamber of Commerce. The contents are for general information only.

This presentation is to attendees at the Mining Conference hosted by the British & Colombian Chamber of Commerce. The contents are for general information only.

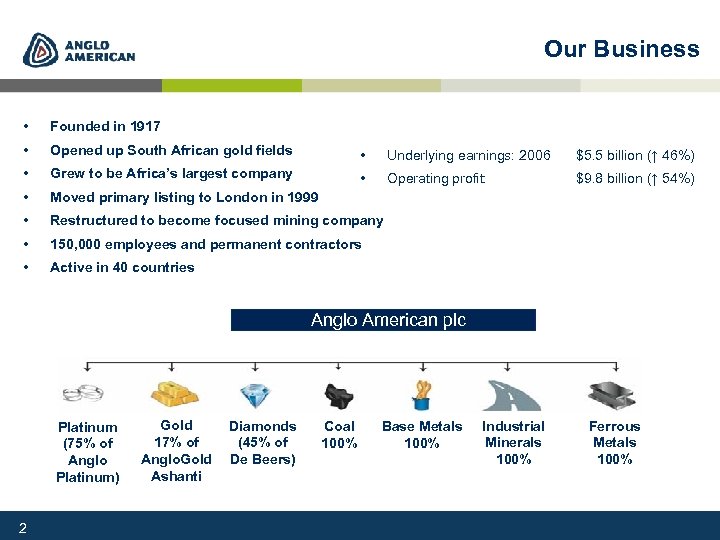

Our Business • Founded in 1917 • Opened up South African gold fields • Underlying earnings: 2006 $5. 5 billion (↑ 46%) • Grew to be Africa’s largest company • Operating profit: $9. 8 billion (↑ 54%) • Moved primary listing to London in 1999 • Restructured to become focused mining company • 150, 000 employees and permanent contractors • Active in 40 countries Anglo American plc Platinum (75% of Anglo Platinum) 2 Gold 17% of Anglo. Gold Ashanti Diamonds (45% of De Beers) Coal 100% Base Metals 100% Industrial Minerals 100% Ferrous Metals 100%

Our Business • Founded in 1917 • Opened up South African gold fields • Underlying earnings: 2006 $5. 5 billion (↑ 46%) • Grew to be Africa’s largest company • Operating profit: $9. 8 billion (↑ 54%) • Moved primary listing to London in 1999 • Restructured to become focused mining company • 150, 000 employees and permanent contractors • Active in 40 countries Anglo American plc Platinum (75% of Anglo Platinum) 2 Gold 17% of Anglo. Gold Ashanti Diamonds (45% of De Beers) Coal 100% Base Metals 100% Industrial Minerals 100% Ferrous Metals 100%

Anglo American in South America Venezuela Carbones del Guasare 25% (Anglo Coal) Colombia Loma de Níquel 91% (Anglo Base Metals) Cerrejón 33% (Anglo Coal) Perú Brasil Quellaveco 80% (Anglo Base Metals) CODEMIN 100% (Anglo Base Metals) Michiquillay Copper project (Anglo Base Metals) Barro Alto 100% (Anglo Base Metals) Chile Catalao 100% (Anglo Base Metals) Serra Grande 50% (Anglo Gold) Collahuasi 44% (Anglo Base Metals) COPEBRAS 73% (Anglo Base Metals) Mantos Blancos 100% (Anglo Base Metals) AGA Brasil Mineracao 100% (Anglo Gold) Mantoverde 100% (Anglo Base Metals) MMX 49% (Anglo Ferrous) Chagres Smelter 100% (Anglo Base Metals) El Soldado 100% (Anglo Base Metals) Los Bronces 100% (Anglo Base Metals) Argentina Cerro Vanguardia 92. 5% (Anglo Gold) 3

Anglo American in South America Venezuela Carbones del Guasare 25% (Anglo Coal) Colombia Loma de Níquel 91% (Anglo Base Metals) Cerrejón 33% (Anglo Coal) Perú Brasil Quellaveco 80% (Anglo Base Metals) CODEMIN 100% (Anglo Base Metals) Michiquillay Copper project (Anglo Base Metals) Barro Alto 100% (Anglo Base Metals) Chile Catalao 100% (Anglo Base Metals) Serra Grande 50% (Anglo Gold) Collahuasi 44% (Anglo Base Metals) COPEBRAS 73% (Anglo Base Metals) Mantos Blancos 100% (Anglo Base Metals) AGA Brasil Mineracao 100% (Anglo Gold) Mantoverde 100% (Anglo Base Metals) MMX 49% (Anglo Ferrous) Chagres Smelter 100% (Anglo Base Metals) El Soldado 100% (Anglo Base Metals) Los Bronces 100% (Anglo Base Metals) Argentina Cerro Vanguardia 92. 5% (Anglo Gold) 3

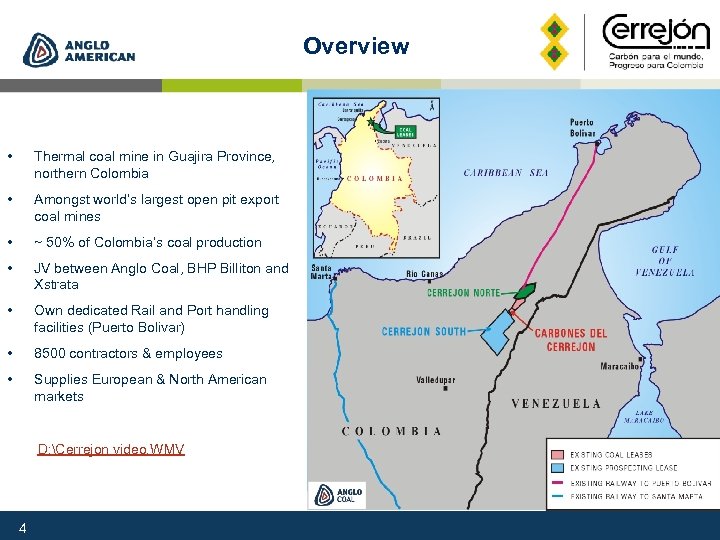

Overview • Thermal coal mine in Guajira Province, northern Colombia • Amongst world’s largest open pit export coal mines • ~ 50% of Colombia’s coal production • JV between Anglo Coal, BHP Billiton and Xstrata • Own dedicated Rail and Port handling facilities (Puerto Bolivar) • 8500 contractors & employees • Supplies European & North American markets D: Cerrejon video. WMV 4

Overview • Thermal coal mine in Guajira Province, northern Colombia • Amongst world’s largest open pit export coal mines • ~ 50% of Colombia’s coal production • JV between Anglo Coal, BHP Billiton and Xstrata • Own dedicated Rail and Port handling facilities (Puerto Bolivar) • 8500 contractors & employees • Supplies European & North American markets D: Cerrejon video. WMV 4

Overview 5

Overview 5

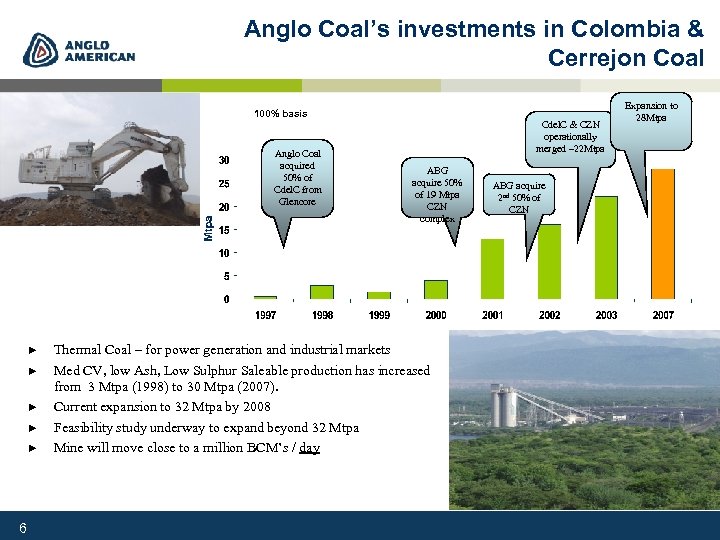

Anglo Coal’s investments in Colombia & Cerrejon Coal 100% basis Anglo Coal acquired 50% of Cdel. C from Glencore ► ► ► 6 Cdel. C & CZN operationally merged – 22 Mtpa ABG acquire 50% of 19 Mtpa CZN complex Thermal Coal – for power generation and industrial markets Med CV, low Ash, Low Sulphur Saleable production has increased from 3 Mtpa (1998) to 30 Mtpa (2007). Current expansion to 32 Mtpa by 2008 Feasibility study underway to expand beyond 32 Mtpa Mine will move close to a million BCM’s / day ABG acquire 2 nd 50% of CZN Expansion to 28 Mtpa

Anglo Coal’s investments in Colombia & Cerrejon Coal 100% basis Anglo Coal acquired 50% of Cdel. C from Glencore ► ► ► 6 Cdel. C & CZN operationally merged – 22 Mtpa ABG acquire 50% of 19 Mtpa CZN complex Thermal Coal – for power generation and industrial markets Med CV, low Ash, Low Sulphur Saleable production has increased from 3 Mtpa (1998) to 30 Mtpa (2007). Current expansion to 32 Mtpa by 2008 Feasibility study underway to expand beyond 32 Mtpa Mine will move close to a million BCM’s / day ABG acquire 2 nd 50% of CZN Expansion to 28 Mtpa

History 1997 - Anglo Coal buys 50% of Carbones del Cerrejon (Cdel. C) from Glencore 1997 - Consortium of Anglo, Glencore and Rio Tinto awarded Cerrejon Sur Mining Contract 1998 - Anglo, Glencore and Rio Tinto form a consortium, each owning one-third of Cdel. C, to exploit the Central and Oreganal Leases, 1999 - Agreement between Cdel. C, Cerrejon Zona Norte (CZN) and government allowing CDC access to rail and port infrastructure of CZN 2000 - Anglo and Glencore buy Rio Tinto’s one-third share of Cdel. C and then on-sell to BHP Billiton 2000 - Consortium buys Carbocol’s 50% interest of CZN 2001 - CZN shareholders win the tender for the Patilla Norte lease 2002 - Consortium buys Exxon. Mobil’s 50% Interest in CZN 2002 - CZN and CDC operationally merged 2002 - CMC Ireland incorporated to sell coal produced by Cdel. C and CZN 2006 - Glencore sells its stake in Cerrejon to Xstrata (US$1, 700 m) 2007/8 – Completion of 32 Mtpa growth project 7

History 1997 - Anglo Coal buys 50% of Carbones del Cerrejon (Cdel. C) from Glencore 1997 - Consortium of Anglo, Glencore and Rio Tinto awarded Cerrejon Sur Mining Contract 1998 - Anglo, Glencore and Rio Tinto form a consortium, each owning one-third of Cdel. C, to exploit the Central and Oreganal Leases, 1999 - Agreement between Cdel. C, Cerrejon Zona Norte (CZN) and government allowing CDC access to rail and port infrastructure of CZN 2000 - Anglo and Glencore buy Rio Tinto’s one-third share of Cdel. C and then on-sell to BHP Billiton 2000 - Consortium buys Carbocol’s 50% interest of CZN 2001 - CZN shareholders win the tender for the Patilla Norte lease 2002 - Consortium buys Exxon. Mobil’s 50% Interest in CZN 2002 - CZN and CDC operationally merged 2002 - CMC Ireland incorporated to sell coal produced by Cdel. C and CZN 2006 - Glencore sells its stake in Cerrejon to Xstrata (US$1, 700 m) 2007/8 – Completion of 32 Mtpa growth project 7

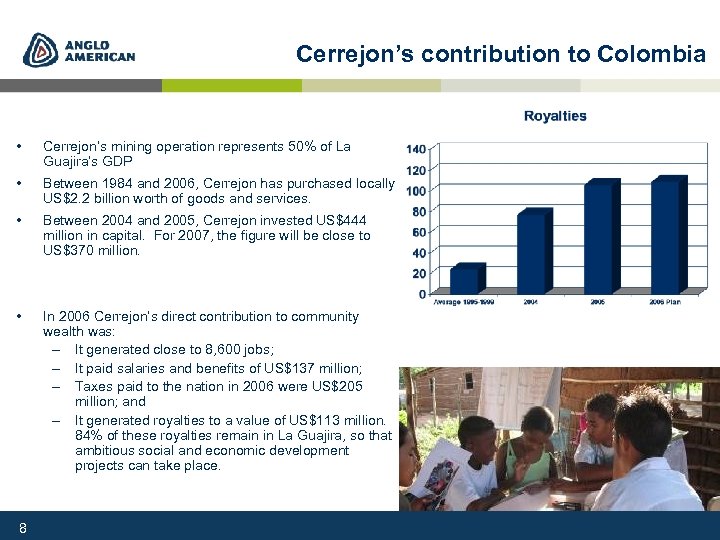

Cerrejon’s contribution to Colombia • Cerrejon’s mining operation represents 50% of La Guajira’s GDP • Between 1984 and 2006, Cerrejon has purchased locally US$2. 2 billion worth of goods and services. • Between 2004 and 2005, Cerrejon invested US$444 million in capital. For 2007, the figure will be close to US$370 million. • In 2006 Cerrejon’s direct contribution to community wealth was: – It generated close to 8, 600 jobs; – It paid salaries and benefits of US$137 million; – Taxes paid to the nation in 2006 were US$205 million; and – It generated royalties to a value of US$113 million. 84% of these royalties remain in La Guajira, so that ambitious social and economic development projects can take place. 8

Cerrejon’s contribution to Colombia • Cerrejon’s mining operation represents 50% of La Guajira’s GDP • Between 1984 and 2006, Cerrejon has purchased locally US$2. 2 billion worth of goods and services. • Between 2004 and 2005, Cerrejon invested US$444 million in capital. For 2007, the figure will be close to US$370 million. • In 2006 Cerrejon’s direct contribution to community wealth was: – It generated close to 8, 600 jobs; – It paid salaries and benefits of US$137 million; – Taxes paid to the nation in 2006 were US$205 million; and – It generated royalties to a value of US$113 million. 84% of these royalties remain in La Guajira, so that ambitious social and economic development projects can take place. 8

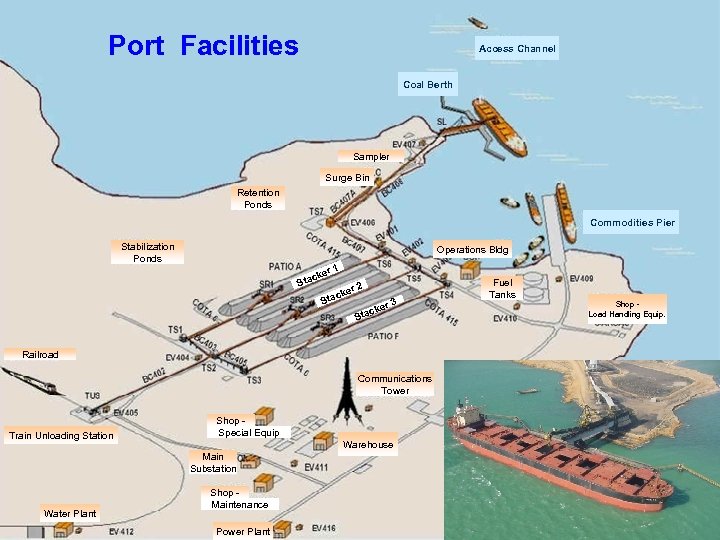

Port Facilities Access Channel Coal Berth Sampler Surge Bin Retention Ponds Commodities Pier Stabilization Ponds Operations Bldg ck Sta er 1 r 2 S ke tac ker c Sta 3 Fuel Tanks Shop Load Handling Equip. Railroad Communications Tower Train Unloading Station Shop Special Equip Warehouse Main Substation Water Plant 11 Shop Maintenance Power Plant Camp

Port Facilities Access Channel Coal Berth Sampler Surge Bin Retention Ponds Commodities Pier Stabilization Ponds Operations Bldg ck Sta er 1 r 2 S ke tac ker c Sta 3 Fuel Tanks Shop Load Handling Equip. Railroad Communications Tower Train Unloading Station Shop Special Equip Warehouse Main Substation Water Plant 11 Shop Maintenance Power Plant Camp