24c6154cf2ef08d7feab2606dbab87db.ppt

- Количество слайдов: 63

This Employer Webinar Series program is presented by Spencer Fane Britt & Browne LLP in conjunction with United Benefit Advisors Kansas City = Omaha = Overland Park St. Louis = Jefferson City www. spencerfane. com www. UBAbenefits. com

2009 Form 5500: Are You Ready? Robert A. Browning, Esq. Melissa Hinkle, CEBS, RPA, GBA Copyright 2010 2

Meet the Presenters Rob Browning 913 -327 -5192 rbrowning@spencerfane. com Melissa Hinkle 913 -327 -5139 mhinkle@spencerfane. com Copyright 2010 3

Form 5500 – What’s New? u u u Copyright 2010 Key changes to the 2009 Form 5500 Series Annual Report Electronic Filing via EFAST 2 Schedule C: Disclosing Compensation Paid to Service Providers 4

Form 5500 Revisions - Overview u u u Copyright 2010 Facilitate fully electronic filing (required for all 2009 returns) Simplify filing for small plans Expand disclosure of fees, expenses Incorporate Pension Protection Act changes first effective in 2008 Put 403(b) plans on par with 401(k)s 5

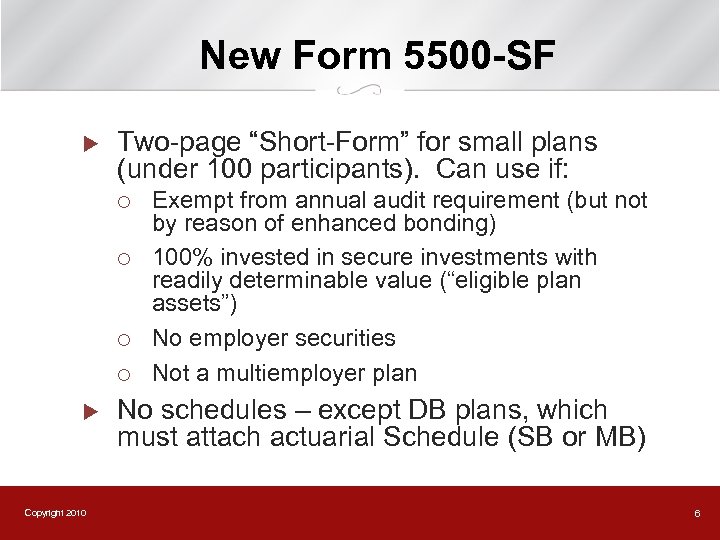

New Form 5500 -SF u Two-page “Short-Form” for small plans (under 100 participants). Can use if: ¡ ¡ u Copyright 2010 Exempt from annual audit requirement (but not by reason of enhanced bonding) 100% invested in secure investments with readily determinable value (“eligible plan assets”) No employer securities Not a multiemployer plan No schedules – except DB plans, which must attach actuarial Schedule (SB or MB) 6

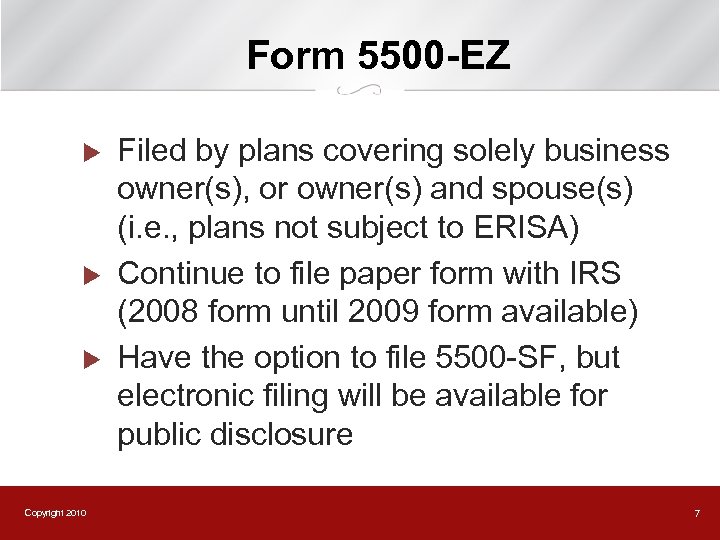

Form 5500 -EZ u u u Copyright 2010 Filed by plans covering solely business owner(s), or owner(s) and spouse(s) (i. e. , plans not subject to ERISA) Continue to file paper form with IRS (2008 form until 2009 form available) Have the option to file 5500 -SF, but electronic filing will be available for public disclosure 7

Form 5500 Changes u IRS-only Schedules (E, SSA) removed to enable mandatory electronic filing ¡ ¡ u u u Copyright 2010 File SSA info with IRS (when form available) ESOP questions now on Schedule R New Schedule C – more fee disclosure More info on DB plan funding and multiemployer plans 403(b) plans must file entire report 8

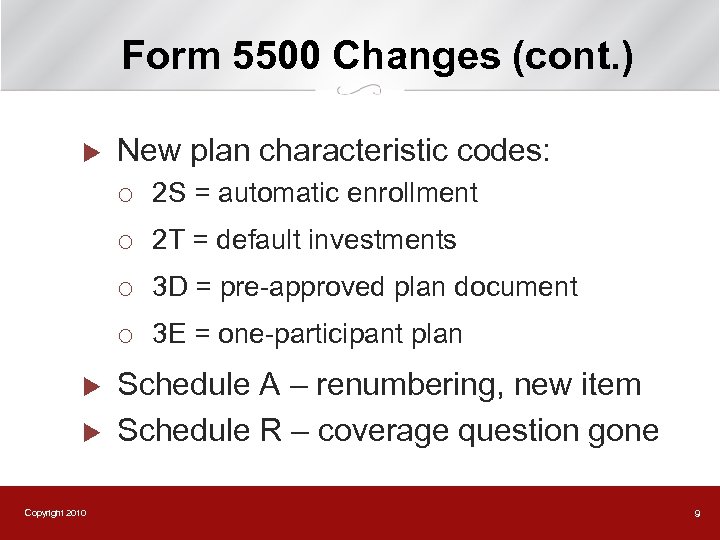

Form 5500 Changes (cont. ) u New plan characteristic codes: ¡ ¡ Copyright 2010 3 D = pre-approved plan document ¡ u 2 T = default investments ¡ u 2 S = automatic enrollment 3 E = one-participant plan Schedule A – renumbering, new item Schedule R – coverage question gone 9

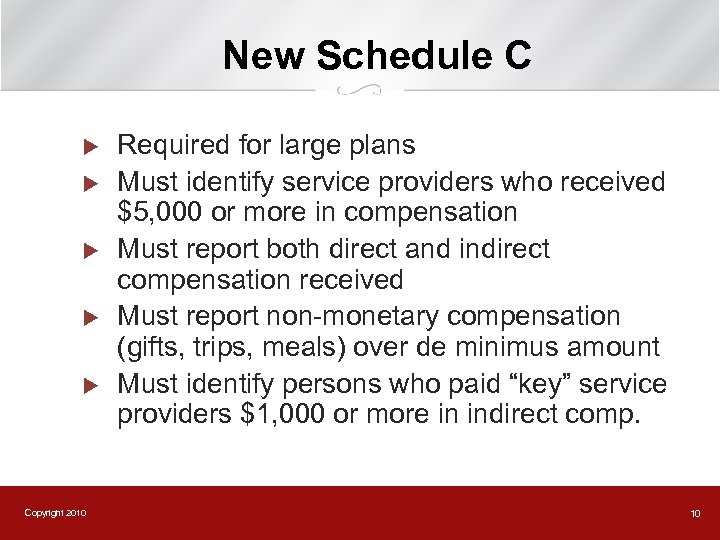

New Schedule C u u u Copyright 2010 Required for large plans Must identify service providers who received $5, 000 or more in compensation Must report both direct and indirect compensation received Must report non-monetary compensation (gifts, trips, meals) over de minimus amount Must identify persons who paid “key” service providers $1, 000 or more in indirect comp. 10

Fees and Expenses – Small Plans u u Copyright 2010 Schedule I filers not required to report indirect compensation (like Schedule C) Must report (on Schedule I) fees paid directly by plan to administrative service provider Schedule A still reports insurance fees and commissions SF has questions re: direct compensation paid by plan, insurance fees & commissions 11

Reporting by 403(b) Plans u u u 403(b)s now treated same as 401(k)s Must complete entire form (rather than just a few lines) and all applicable Schedules Large plans must have an audit Many small plans will qualify for 5500 -SF Applies only to ERISA-covered plans ¡ Copyright 2010 “Safe” harbor for voluntary salary-deferral-only plans with limited employer involvement still available (but more difficult to satisfy) 12

PPA-Related Changes u u Generally effective for 2008 plan year Replace Schedule B with: ¡ ¡ u Copyright 2010 Schedule SB (for single employer and multiple-employer plans); and Schedule MB (for multiemployer plans and certain money purchase plans) New Schedule R questions for DB plans and multiemployer plans 13

New Compliance and Technical Questions u u Copyright 2010 Did plan pay benefits when due? Did plan comply with blackout notice requirements? New feature codes for plans with auto enrollment, QDIAs Standard supplemental schedule to report delinquent contributions on Schedule H 14

Delinquent Filer Program u u DFVCP still available with move to electronic filing under EFAST 2 Still a two-step process: ¡ ¡ Copyright 2010 Calculate and pay DFVCP fee online at www. efast. dol. gov ¡ u File Form 5500 (electronically) – EFAST 2 Nothing to send to North Carolina No change in DFVCP fees 15

What is EFAST 2? u u EFAST 2 is the Employee Benefit Security Administration’s (EBSA) new web-based system designed to electronically receive, process, store, publicly disclose, distribute, and archive Form 5500 series filings EFAST 2 data will be furnished to: ¡ ¡ u Copyright 2010 the Internal Revenue Service (IRS) the Pension Benefit Guaranty Corporation (PBGC) EFAST 2 replaces the EFAST system previously in effect 16

EFAST 2: 2009 and Subsequent Plan Years u u Beginning January 2010, plan sponsors must file Form 5500 or Form 5500 -SF for plan/reporting year 2009 and for all subsequent plan/reporting years using EFAST 2 Form 5500 -EZ may not be filed electronically ¡ ¡ Copyright 2010 A one-participant plan that is eligible to file Form 5500 -EZ and is not required to file under Title I of ERISA may elect to file Form 5500 -SF electronically with EFAST 2 instead of filing a paper Form 5500 -EZ with the IRS A one-participant plan that is not eligible to file Form 5500 SF must file Form 5500 -EZ on paper with the IRS 17

EFAST 2: 2008 Plan Year u A plan sponsor can timely file a 2008 annual return/report that is due after January 1, 2010 in any of the following ways: ¡ ¡ Electronically file using EFAST-approved thirdparty software until June 30, 2010 ¡ Copyright 2010 Electronically file using EFAST 2 File on paper through the EFAST filing system using EFAST-approved software or governmentissued hand print forms until October 15, 2010 18

Delinquent or Amended Returns u u Copyright 2010 Generally, beginning January 1, 2010, delinquent and amended Form 5500 series filings must be submitted through EFAST 2 Exception: Delinquent or amended 2008 plan year filings may be submitted through EFAST either electronically until June 30, 2010, or on paper until October 15, 2010 19

Special Rules for Delinquent or Amended Returns u For plan years prior to 2009, delinquent or amended returns must be submitted using current filing year Form 5500, schedules, and instructions except the following correct-year schedules must be used: ¡ ¡ Schedule E (ESOP Annual Information) ¡ Schedule P (Annual Return of Fiduciary of Employee Benefit Trust) ¡ Schedule R (Retirement Information) ¡ Copyright 2010 Schedule B, SB, or MB (Actuarial Information) Schedule T (Qualified Pension Plan Coverage Information) 20

Special Rules for Delinquent or Amended Returns u Attach the correct-year schedules as PDF files to the current year Form 5500 ¡ ¡ u u Copyright 2010 2009 or 2010 forms can be used as current filing year forms as of January 1, 2010 Form 5500 -SF may not be filed for 2008 or any prior plan year Label the correct-year schedules as “other attachments” Do not send any penalty payments associated with a delinquent filing to EFAST 2 21

Short Plan Year Returns u Form 5500 must be filed through EFAST 2 for short plan years beginning on or after January 1, 2009 ¡ Filers had until December 31, 2009 to file 2009 short year paper returns with a plan year end on or before May 31, 2009 ¡ The DOL will now reject any 2009 short year paper return that is postmarked after December 31, 2009 ¡ The deadline to refile a rejected 2009 short year return (with a plan year end on or before May 31, 2009) is the latest of: n n n Copyright 2010 45 days after the date of the rejection letter, March 31, 2010 (90 days after the start of EFAST 2), or The due date of the return with any other available extension 22

EFAST 2: The Mechanics of Filing u There are two options for preparing and submitting annual returns/reports under EFAST 2 ¡ ¡ Copyright 2010 Filing directly with the DOL using “IFILE” Using commercial software approved by the DOL, or using third party preparers who use the approved software 23

IFILE u IFILE is a free, no “frills” web-based filing system that allows for preparation and submission of filings to EFAST 2 ¡ ¡ Transmits single filings only - cannot be used to transmit batches of filings ¡ Does not integrate with other systems to automatically populate required fields ¡ Copyright 2010 Does not include filing assistance or integrated instructions Does not allow for file sharing 24

EFAST 2 -Approved Software u The DOL has two types of software certification in EFAST 2 – ¡ ¡ u Copyright 2010 certification of software for use in preparing filings, and certification of software for use in submitting filings A list of EFAST 2 -approved third-party software is posted on www. efast. dol. gov 25

Features of Third-Party Software u EFAST 2 -approved software may include one or more of the following features not available with IFILE ¡ ¡ Auto fill features that integrate with filer’s system ¡ File sharing features ¡ Batch filing capability ¡ Copyright 2010 Filing assistance and integrated instructions Automated client communications 26

Obtaining Electronic Credentials u u Copyright 2010 Register for electronic credentials for IFILE at www. efast. dol. gov May register for more than one type of credentials Check e-mail to complete registration EFAST registered filers must register for and obtain new credentials under EFAST 2 27

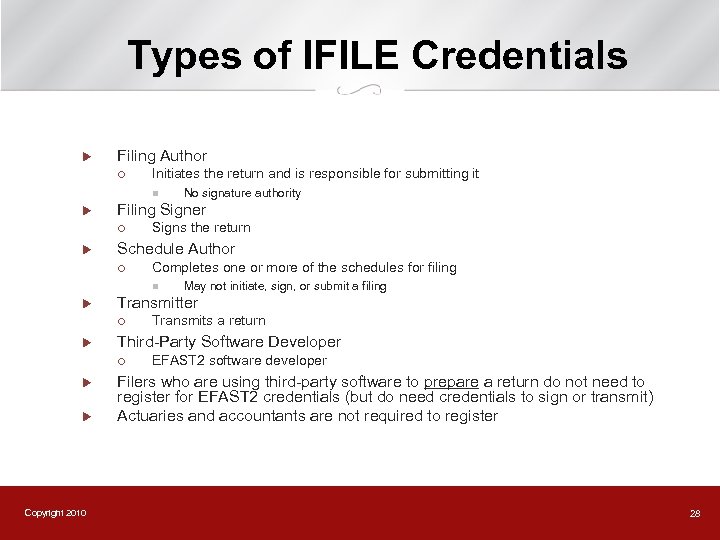

Types of IFILE Credentials u Filing Author ¡ Initiates the return and is responsible for submitting it n u Filing Signer ¡ u Signs the return Schedule Author ¡ Completes one or more of the schedules for filing n u u Copyright 2010 Transmits a return Third-Party Software Developer ¡ u May not initiate, sign, or submit a filing Transmitter ¡ u No signature authority EFAST 2 software developer Filers who are using third-party software to prepare a return do not need to register for EFAST 2 credentials (but do need credentials to sign or transmit) Actuaries and accountants are not required to register 28

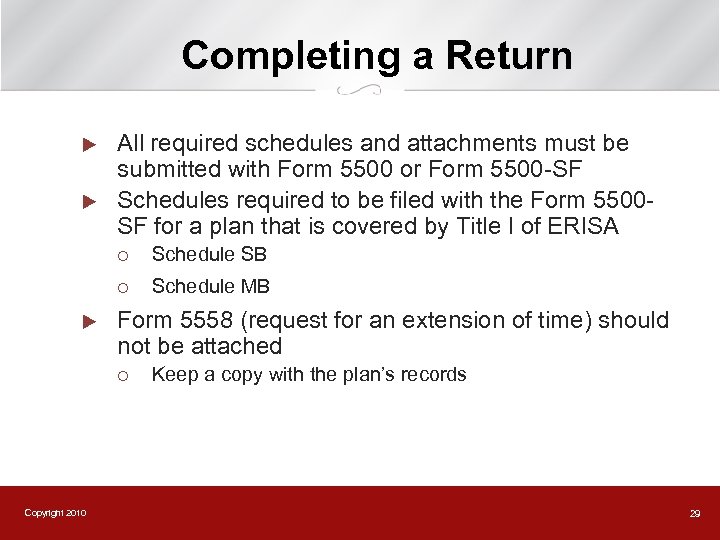

Completing a Return u u All required schedules and attachments must be submitted with Form 5500 or Form 5500 -SF Schedules required to be filed with the Form 5500 SF for a plan that is covered by Title I of ERISA ¡ ¡ u Schedule SB Schedule MB Form 5558 (request for an extension of time) should not be attached ¡ Copyright 2010 Keep a copy with the plan’s records 29

Attachments to Returns u u Copyright 2010 The accountant opinion and signed Schedule MB or Schedule SB must be in PDF format with signatures Other attachments types can be TXT or PDF formats IFILE has a 10 MB limit per attachment Filings that include SSNs are subject to rejection 30

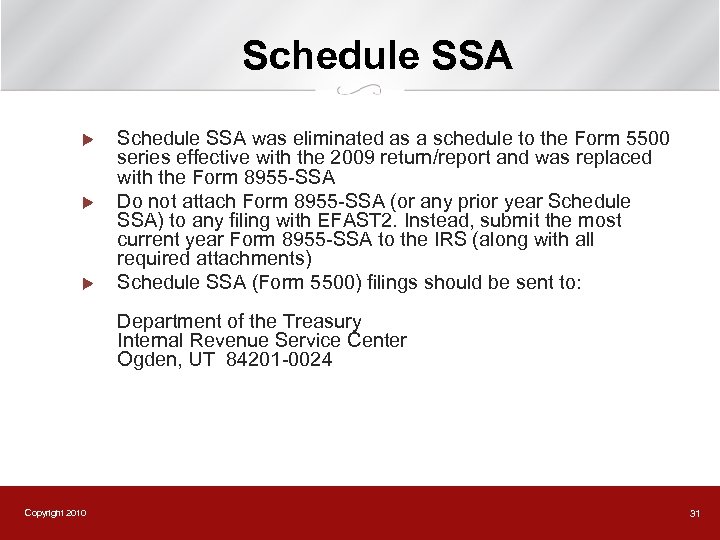

Schedule SSA u u u Schedule SSA was eliminated as a schedule to the Form 5500 series effective with the 2009 return/report and was replaced with the Form 8955 -SSA Do not attach Form 8955 -SSA (or any prior year Schedule SSA) to any filing with EFAST 2. Instead, submit the most current year Form 8955 -SSA to the IRS (along with all required attachments) Schedule SSA (Form 5500) filings should be sent to: Department of the Treasury Internal Revenue Service Center Ogden, UT 84201 -0024 Copyright 2010 31

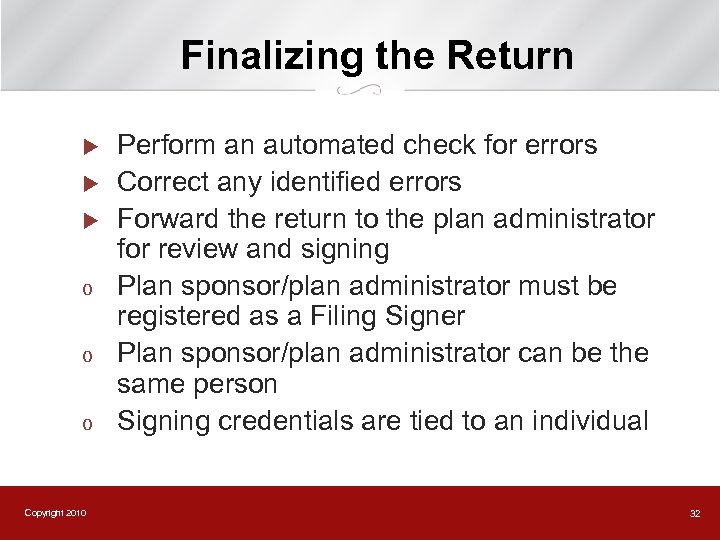

Finalizing the Return u u u o o o Copyright 2010 Perform an automated check for errors Correct any identified errors Forward the return to the plan administrator for review and signing Plan sponsor/plan administrator must be registered as a Filing Signer Plan sponsor/plan administrator can be the same person Signing credentials are tied to an individual 32

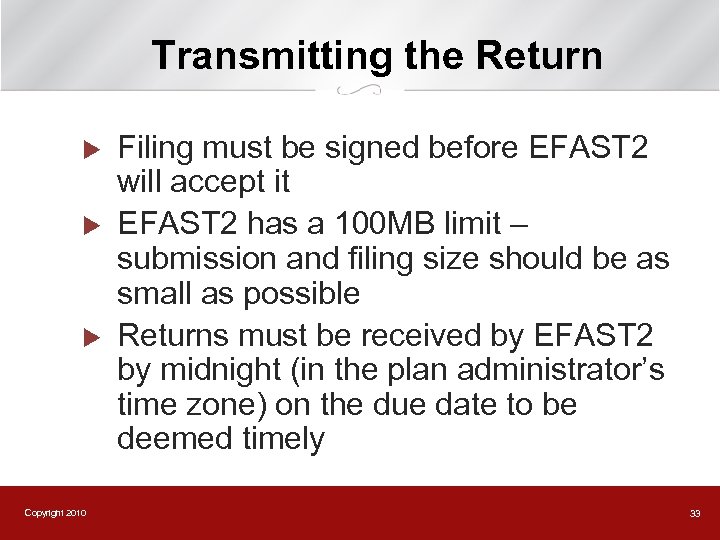

Transmitting the Return u u u Copyright 2010 Filing must be signed before EFAST 2 will accept it EFAST 2 has a 100 MB limit – submission and filing size should be as small as possible Returns must be received by EFAST 2 by midnight (in the plan administrator’s time zone) on the due date to be deemed timely 33

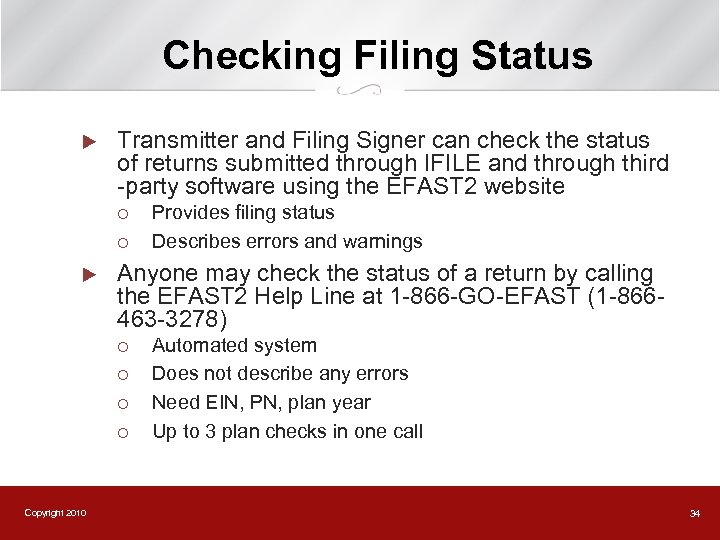

Checking Filing Status u Transmitter and Filing Signer can check the status of returns submitted through IFILE and through third -party software using the EFAST 2 website ¡ ¡ u Anyone may check the status of a return by calling the EFAST 2 Help Line at 1 -866 -GO-EFAST (1 -866463 -3278) ¡ ¡ Copyright 2010 Provides filing status Describes errors and warnings Automated system Does not describe any errors Need EIN, PN, plan year Up to 3 plan checks in one call 34

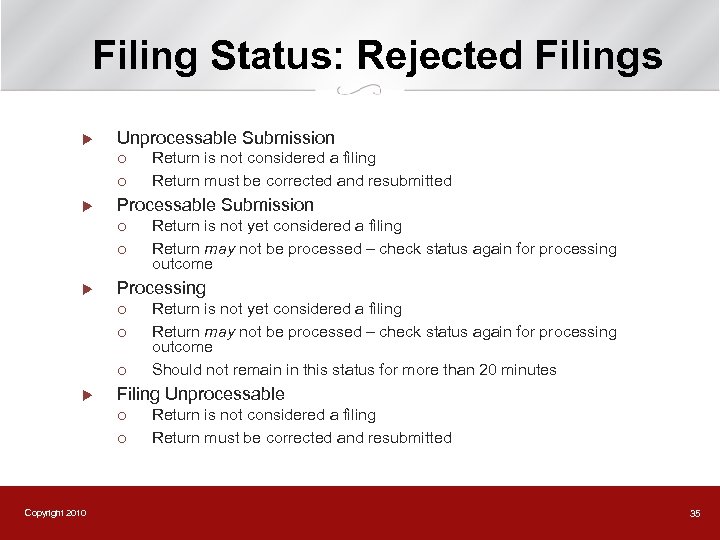

Filing Status: Rejected Filings u Unprocessable Submission ¡ ¡ u Processable Submission ¡ ¡ u ¡ ¡ Return is not yet considered a filing Return may not be processed – check status again for processing outcome Should not remain in this status for more than 20 minutes Filing Unprocessable ¡ ¡ Copyright 2010 Return is not yet considered a filing Return may not be processed – check status again for processing outcome Processing ¡ u Return is not considered a filing Return must be corrected and resubmitted 35

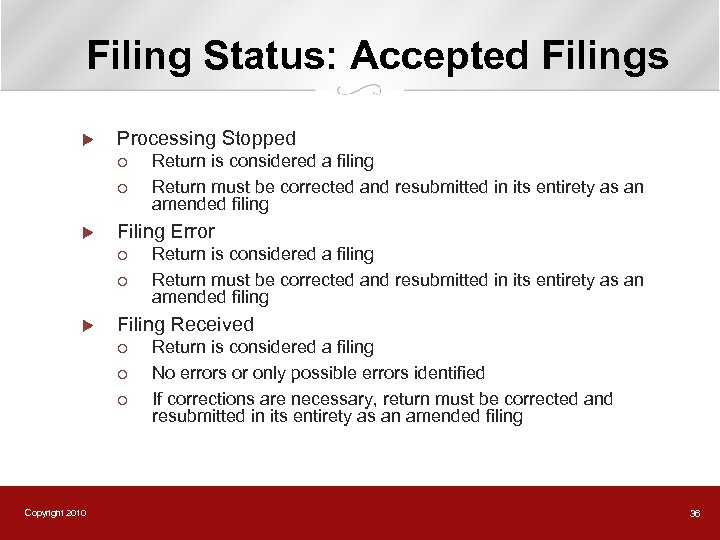

Filing Status: Accepted Filings u Processing Stopped ¡ ¡ u Filing Error ¡ ¡ u Return is considered a filing Return must be corrected and resubmitted in its entirety as an amended filing Filing Received ¡ ¡ ¡ Copyright 2010 Return is considered a filing Return must be corrected and resubmitted in its entirety as an amended filing Return is considered a filing No errors or only possible errors identified If corrections are necessary, return must be corrected and resubmitted in its entirety as an amended filing 36

Public Disclosure u u Copyright 2010 Received filings will be posted on the EFAST 2 website (www. efast. dol. gov) Generally posted within 24 hours of receipt Electronic credentials not required to view filings posted on the EFAST 2 website Filings not available on the EFAST 2 website will be available through the public disclosure room 37

Troubleshooting u u u Copyright 2010 Turn off pop-up blockers when using the EFAST 2 website Scanning attachments at 300 x 300 resolution and using True Gray, Grayscale, or Black and White color depth may help minimize file size Call the EFAST 2 Help Line at 1 -866 GO-EFAST (1 -866 -463 -3278) 38

New Schedule C - Overview Disclose fees that impact the amount of plan assets available to participants (the account balance in DC plans) More info re: the reasonableness of fees, conflicts of interest and revenue sharing arrangements Payments made directly by the plan sponsor that aren’t reimbursed by the plan are NOT reported on Schedule C Copyright 2010 39

Schedule C – Service Provider Information Which plans will need to file? ¡ Large retirement and welfare plans ¡ Master Trusts ¡ Direct Filer Entities (“DFEs”) Which plans do not need to file? ¡ ¡ Large unfunded welfare plans ¡ Common/collective trusts ¡ Copyright 2010 Small retirement and welfare plans Pooled separate accounts 40

Three Parts to Schedule C 1. 2. 3. Copyright 2010 Persons or firms who received, directly or indirectly, $5, 000 or more in connection with services to the plan or the person’s position with the plan Fiduciaries or key service providers who failed to provide information for Part I Terminated accountants/actuaries 41

Part 1 - $5, 000 Threshold u Disclose those service providers whose total compensation is $5, 000 or more ¡ ¡ Consider compensation on Schedule A (but do not disclose on Schedule C) ¡ Copyright 2010 Count direct and indirect compensation If given a formula or schedule to compute Schedule C compensation – assume at least $5, 000 42

Non-Monetary items u Plan must report gifts and other nonmonetary compensation (dinners, conference fees, coffee mugs, etc) ¡ ¡ u Copyright 2010 <$10 – can ignore, regardless of total $10 -50 – ignore, but only if total from single source is less than $100 See DOL’s FAQ’s (and Schedule C instructions) at www. dol. gov/ebsa/faqs 43

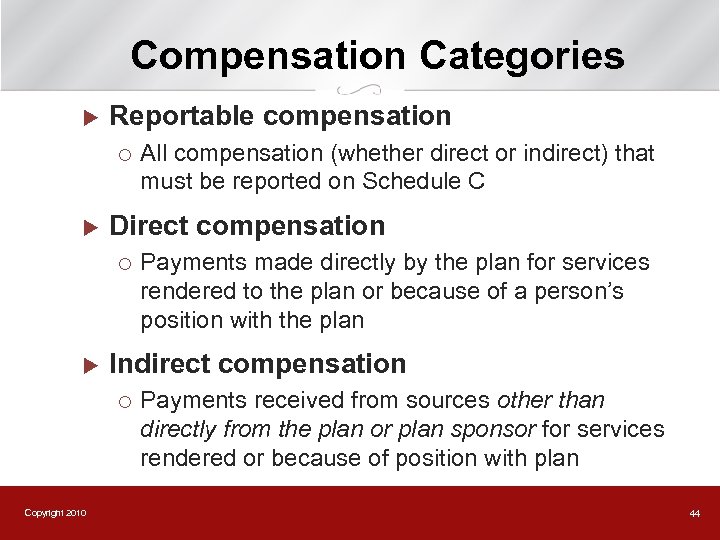

Compensation Categories u Reportable compensation ¡ u Direct compensation ¡ u Payments made directly by the plan for services rendered to the plan or because of a person’s position with the plan Indirect compensation ¡ Copyright 2010 All compensation (whether direct or indirect) that must be reported on Schedule C Payments received from sources other than directly from the plan or plan sponsor for services rendered or because of position with plan 44

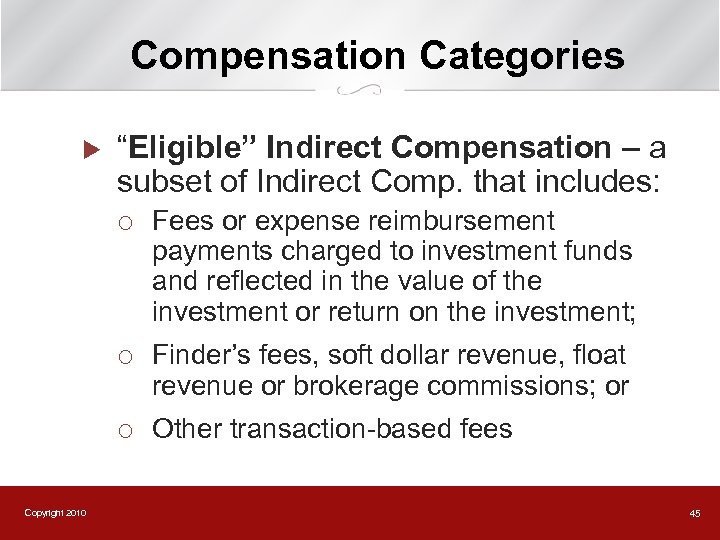

Compensation Categories u “Eligible” Indirect Compensation – a subset of Indirect Comp. that includes: ¡ ¡ Finder’s fees, soft dollar revenue, float revenue or brokerage commissions; or ¡ Copyright 2010 Fees or expense reimbursement payments charged to investment funds and reflected in the value of the investment or return on the investment; Other transaction-based fees 45

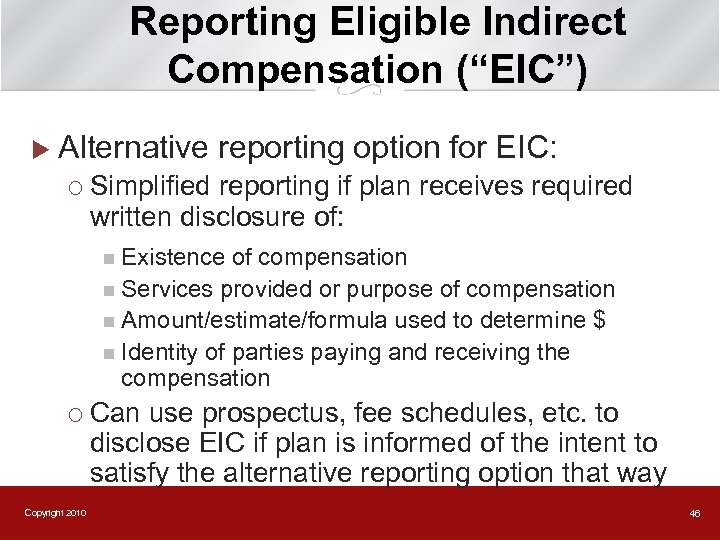

Reporting Eligible Indirect Compensation (“EIC”) u Alternative reporting option for EIC: ¡ Simplified reporting if plan receives required written disclosure of: n Existence of compensation n Services provided or purpose of compensation n Amount/estimate/formula used to determine $ n Identity of parties paying and receiving the compensation ¡ Copyright 2010 Can use prospectus, fee schedules, etc. to disclose EIC if plan is informed of the intent to satisfy the alternative reporting option that way 46

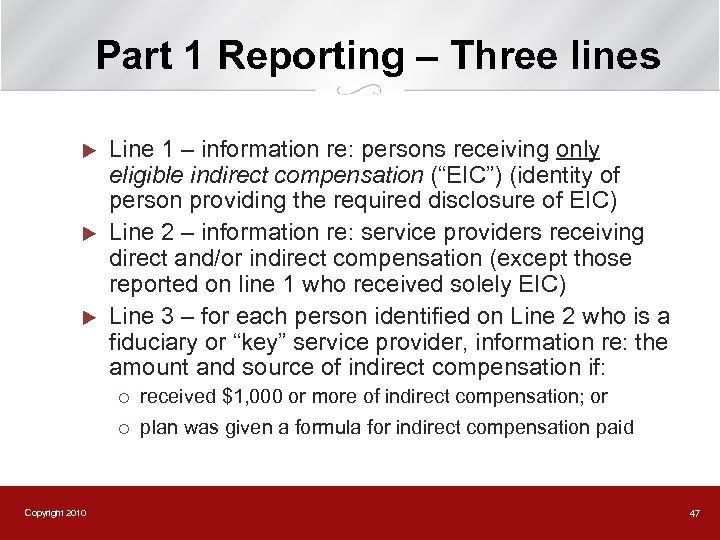

Part 1 Reporting – Three lines u u u Line 1 – information re: persons receiving only eligible indirect compensation (“EIC”) (identity of person providing the required disclosure of EIC) Line 2 – information re: service providers receiving direct and/or indirect compensation (except those reported on line 1 who received solely EIC) Line 3 – for each person identified on Line 2 who is a fiduciary or “key” service provider, information re: the amount and source of indirect compensation if: ¡ ¡ Copyright 2010 received $1, 000 or more of indirect compensation; or plan was given a formula for indirect compensation paid 47

Part 1 Reporting – Line 1 ¡ Information on Persons Receiving only Eligible Indirect Compensation ¡ Limited to those who satisfy the “Alternative Reporting” option for EIC by providing the plan with the required disclosure of EIC ¡ Line a. - Check yes or no as to whethere any such persons ¡ Line b. – Provide name and EIN or address of the person who provided the disclosure Copyright 2010 48

Part 1 Reporting - Line 2 ¡ Report persons/entities receiving direct and/or indirect compensation (including EIC) n Element (a) – name and EIN or address (no SSNs) n Element (b) – Service codes (55 available) – use all that apply (see instructions) n Element (c) – relationship of person/entity in (a) to the plan sponsor or party-in-interest (union officer, affiliate of plan record keeper, vice president of employer) n Element (d) – amount of direct compensation Copyright 2010 49

Line 2(d) - Direct Compensation u Payments made directly by the plan – ¡ Reported on Schedule H and plan’s financial statements n Audit fees (if paid by plan) n Loan and distribution processing fees n TPA fees n Amounts reimbursed by the plan n Charges to forfeiture account (i. e. , expenses) ¡ If fees are offset, disclose only amount paid ¡ Do no leave (d) blank – enter “ 0” Copyright 2010 50

Lines 2 (e) – (g): Indirect Compensation u Compensation from sources other than directly from the plan or plan sponsor for services rendered to, or position with, the Plan ¡ Fees or expense reimbursements paid by investment funds in which plan invests n Sub-transfer agency fees n Shareholder servicing fees n Account maintenance fees n 12 b-1 fees ¡ Copyright 2010 Finder’s fees 51

Lines 2 (e) – (g): Indirect Compensation ¡ ¡ Gifts, meals and entertainment ¡ Brokerage commissions ¡ Copyright 2010 Soft dollars (sales trips, incentives, etc) ¡ u Float revenue Transaction based fees received in connection with transactions or services involving the plan Do not leave (g) blank – enter “ 0” 52

Line 2(h) u Copyright 2010 Indicate if any of the indirect compensation was provided in the form of a formula or a description instead of an amount or an estimated amount 53

Part 1 – Line 3 u More information (service codes, source of payment and amounts) re: fiduciaries and “key” service providers listed in line 2 who either: ¡ Received more than $1, 000 of indirect compensation; ¡ Received indirect compensation according to a formula (rather than an amount or estimate) Copyright 2010 54

“Key” Service Providers u Plan fiduciary or someone who provides one or more of the following services to the plan: n Contract administrator/Claims processing n Participant communication n Consulting n Investment advice (to plan or participants) n Investment management n Securities brokerage n Recordkeeping Copyright 2010 55

Bundled Service Arrangements u Arrangement where Plan hires one company to provide a range of services as a single package ¡ ¡ Copyright 2010 Payments made by the Plan to bundled service provider are reported as direct compensation to the service provider Payments generally do not need to be allocated among affiliates, subcontractors 56

Bundled Service - Exceptions u Must separately report compensation received by affiliates, subs if amount is: ¡ ¡ Charged to the plan’s investment and is reflected in the net value of the investment (i. e. , fees paid to M/F invest. advisor, 12 b-1 fees, shareholder servicing or acct. maint. fees ) ¡ Copyright 2010 Determined on a per-transaction basis One of several specific types of fees paid to a fiduciary, contract administrator, investment advisor or manager, broker or recordkeeper 57

Allocating Compensation among Multiple Plans u Person receives compensation in connection with several plans (or DFEs) ¡ ¡ Copyright 2010 Any reasonable method of allocation is accepted as long as the method is disclosed to the plan administrator Consider the amount received by the person/entity that is attributable to the plan for the $5, 000 threshold 58

Schedule C – Part II u Identify service providers who fail or refuse to provide information required for Part 1 ¡ ¡ Nature of services (service code) ¡ u Name and EIN or address Description of information not provided Relief for 2009 (transition) FAQ 40 ¡ Copyright 2010 If Plan relies on service provider for compensation and provider made good faith attempt but couldn’t gather info. 59

Schedule C – Part III u Identification of any Accountants or Actuaries terminated during the plan year ¡ Name/address/telephone ¡ EIN (of employer, if applicable, no SSN) ¡ Position ¡ Explanation of termination n u Copyright 2010 Material disputes or matters of disagreement Notification of termination must be provided to the accountant or actuary 60

DOL Frequently Asked Questions (“FAQs”) u Two sets of FAQs re: Schedule C ¡ ¡ u July, 2008 – 40 Q & A’s October, 2009 – 27 Q & A’s FAQs re: EFAST 2 ¡ March, 2010 - 46 questions www. dol. gov/ebsa/faqs Copyright 2010 61

Meet the Presenters Rob Browning 913 -327 -5192 rbrowning@spencerfane. com Melissa Hinkle 913 -327 -5139 mhinkle@spencerfane. com Copyright 2010 62

Thank you for your participation in the Employer Webinar Series. To obtain a recording of this presentation, or to register for future presentations, contact your local UBA Member Firm. Thank You For Your Participation Kansas City = Omaha = Overland Park St. Louis = Jefferson City www. spencerfane. com www. UBAbenefits. com

24c6154cf2ef08d7feab2606dbab87db.ppt