4db852b127053622f6858e542dcb7bb5.ppt

- Количество слайдов: 57

This document is intended for investment professionals only and must not be relied on by anyone else A Standard Life Investments presentation on Asset Allocation Seminar PFS – May and June 2011

This document is intended for investment professionals only and must not be relied on by anyone else A Standard Life Investments presentation on Asset Allocation Seminar PFS – May and June 2011

Standard Life Investments Agenda § Basic Modern Portfolio Theory and The Efficient Frontier § Strategic Asset Allocation § Coffee Break § Stochastic Modelling § Tactical Asset Allocation § Passive vs. Active 2

Standard Life Investments Agenda § Basic Modern Portfolio Theory and The Efficient Frontier § Strategic Asset Allocation § Coffee Break § Stochastic Modelling § Tactical Asset Allocation § Passive vs. Active 2

Standard Life Investments FSA’s approach to assessing suitability • COBS 92. 2 R requires that firms must: § Take into account the customer’s preferences regarding risk taking § Take into account the customer’s risk profile § Ensure that customers are able financially to bear risks Source: http: //www. fsa. gov. uk/pubs/guidance/gc 11_01. pdf 3

Standard Life Investments FSA’s approach to assessing suitability • COBS 92. 2 R requires that firms must: § Take into account the customer’s preferences regarding risk taking § Take into account the customer’s risk profile § Ensure that customers are able financially to bear risks Source: http: //www. fsa. gov. uk/pubs/guidance/gc 11_01. pdf 3

Standard Life Investments FSA’s approach to assessing suitability • However, the FSA finds that firms: § Over-rely on risk profiling and asset allocation tools § Poorly describe customer risk attitudes § Poorly understand tools Source: http: //www. fsa. gov. uk/pubs/guidance/gc 11_01. pdf 4

Standard Life Investments FSA’s approach to assessing suitability • However, the FSA finds that firms: § Over-rely on risk profiling and asset allocation tools § Poorly describe customer risk attitudes § Poorly understand tools Source: http: //www. fsa. gov. uk/pubs/guidance/gc 11_01. pdf 4

Standard Life Investments FSA’s approach to assessing suitability • FSA’s recommendations: § Firms should have a robust processing for assessing a customer’s willingness and ability to take risk § Tools should be appropriate and limitations should be recognised § All aspects of a customer’s objectives and situation should be considered when making investment selections – not just risk Source: http: //www. fsa. gov. uk/pubs/guidance/gc 11_01. pdf 5

Standard Life Investments FSA’s approach to assessing suitability • FSA’s recommendations: § Firms should have a robust processing for assessing a customer’s willingness and ability to take risk § Tools should be appropriate and limitations should be recognised § All aspects of a customer’s objectives and situation should be considered when making investment selections – not just risk Source: http: //www. fsa. gov. uk/pubs/guidance/gc 11_01. pdf 5

Standard Life Investments Today’s key issues and objectives Key Issues • FSA’s view on lack of attention to asset allocation • FSA’s concerns over superficial treatment of risk Objectives of today’s seminar You will be in a better position to: • • Recommend a suitable investment strategy for clients Understand forecast returns on different portfolios Analyse the risk and return trade off Set more informed client expectations 6

Standard Life Investments Today’s key issues and objectives Key Issues • FSA’s view on lack of attention to asset allocation • FSA’s concerns over superficial treatment of risk Objectives of today’s seminar You will be in a better position to: • • Recommend a suitable investment strategy for clients Understand forecast returns on different portfolios Analyse the risk and return trade off Set more informed client expectations 6

Standard Life Investments Fundamental meaning of Asset Allocation Blending underlying characteristics of various asset classes to Focused on delivering superior performance produce a stronger composite than any single element Recognising and balancing tradeoffs including time horizon, Capital preservation goals, and expected sources of return Setting minimum and maximum constraints to ensure sufficient representation, but not overconcentration Diversifying asset classes to align portfolio and individual risk/reward profiles and to be compensated for bearing non diversifiable volatility 7

Standard Life Investments Fundamental meaning of Asset Allocation Blending underlying characteristics of various asset classes to Focused on delivering superior performance produce a stronger composite than any single element Recognising and balancing tradeoffs including time horizon, Capital preservation goals, and expected sources of return Setting minimum and maximum constraints to ensure sufficient representation, but not overconcentration Diversifying asset classes to align portfolio and individual risk/reward profiles and to be compensated for bearing non diversifiable volatility 7

Standard Life Investments Basic Modern Portfolio Theory and Efficient Frontiers 8

Standard Life Investments Basic Modern Portfolio Theory and Efficient Frontiers 8

Standard Life Investments Modern portfolio theory • Maximise expected return for a given amount of risk • Or maximise risk for a given level of expected return • Mathematical formulation of the concept of diversification in investing • Aim is to select investment assets that collectively lower risk than any individual asset class • Stock markets moving independently to bond markets • By combining assets that are not perfectly correlated MPT seeks to reduce the total volatility of portfolio returns • Assumes investors are rational and marks are efficient 9

Standard Life Investments Modern portfolio theory • Maximise expected return for a given amount of risk • Or maximise risk for a given level of expected return • Mathematical formulation of the concept of diversification in investing • Aim is to select investment assets that collectively lower risk than any individual asset class • Stock markets moving independently to bond markets • By combining assets that are not perfectly correlated MPT seeks to reduce the total volatility of portfolio returns • Assumes investors are rational and marks are efficient 9

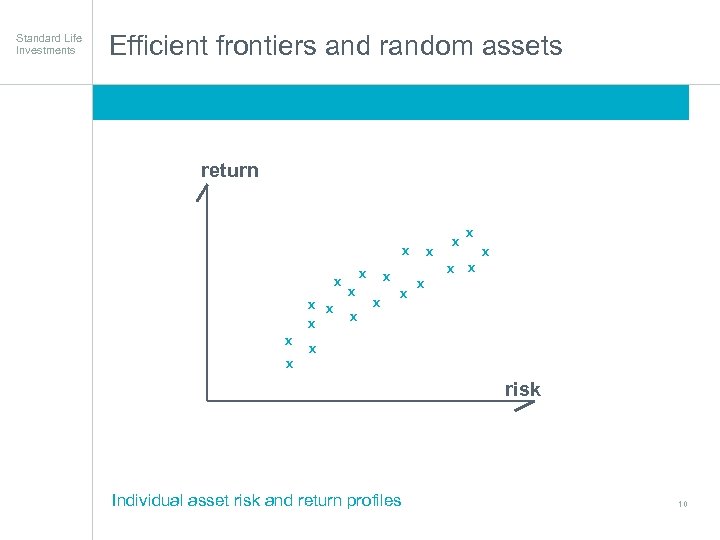

Standard Life Investments Efficient frontiers and random assets Focused on delivering superior performance return x x x x x x risk Individual asset risk and return profiles 10

Standard Life Investments Efficient frontiers and random assets Focused on delivering superior performance return x x x x x x risk Individual asset risk and return profiles 10

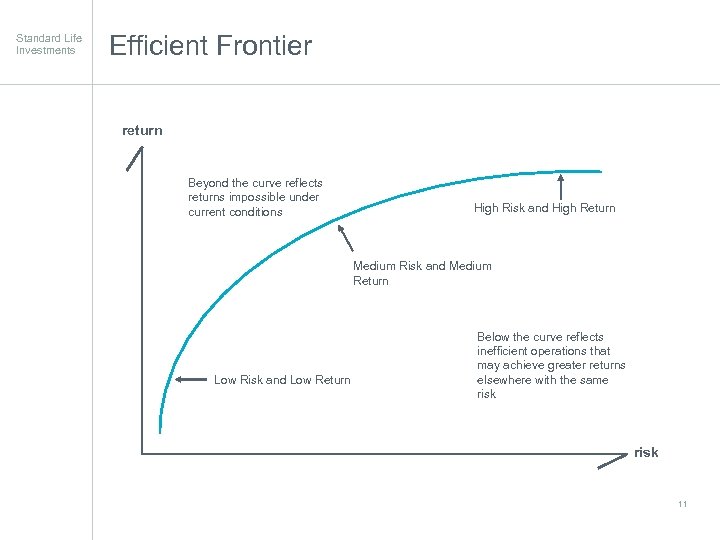

Standard Life Investments Efficient Frontier return Beyond the curve reflects returns impossible under current conditions High Risk and High Return Medium Risk and Medium Return Low Risk and Low Return Below the curve reflects inefficient operations that may achieve greater returns elsewhere with the same risk 11

Standard Life Investments Efficient Frontier return Beyond the curve reflects returns impossible under current conditions High Risk and High Return Medium Risk and Medium Return Low Risk and Low Return Below the curve reflects inefficient operations that may achieve greater returns elsewhere with the same risk 11

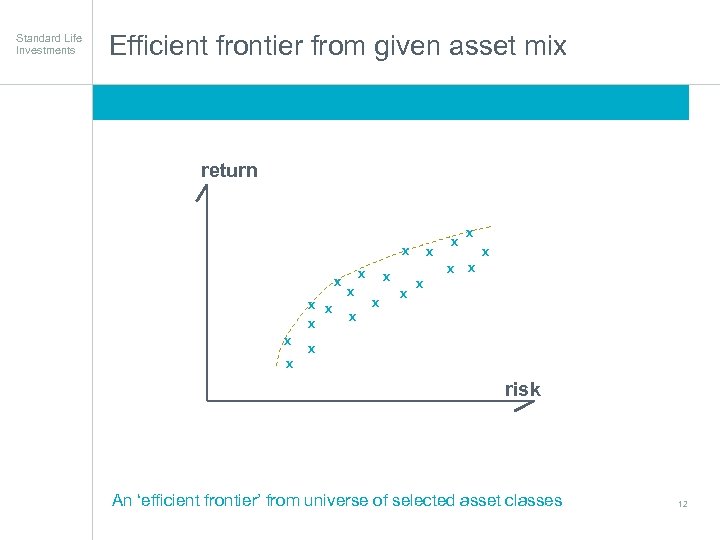

Standard Life Investments Efficient frontier from given asset mix Focused on delivering superior performance return x x x x x x risk An ‘efficient frontier’ from universe of selected asset classes 12

Standard Life Investments Efficient frontier from given asset mix Focused on delivering superior performance return x x x x x x risk An ‘efficient frontier’ from universe of selected asset classes 12

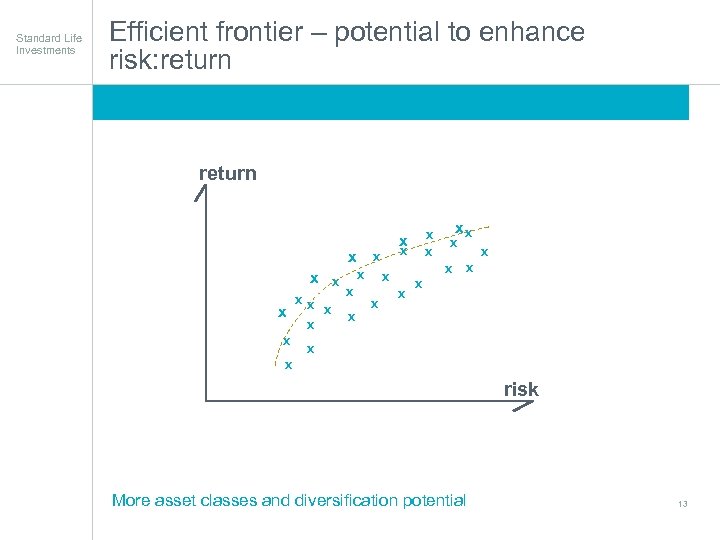

Standard Life Investments Efficient frontier – potential to enhance risk: return Focused on delivering superior performance return x x x xx x x x x x risk More asset classes and diversification potential 13

Standard Life Investments Efficient frontier – potential to enhance risk: return Focused on delivering superior performance return x x x xx x x x x x risk More asset classes and diversification potential 13

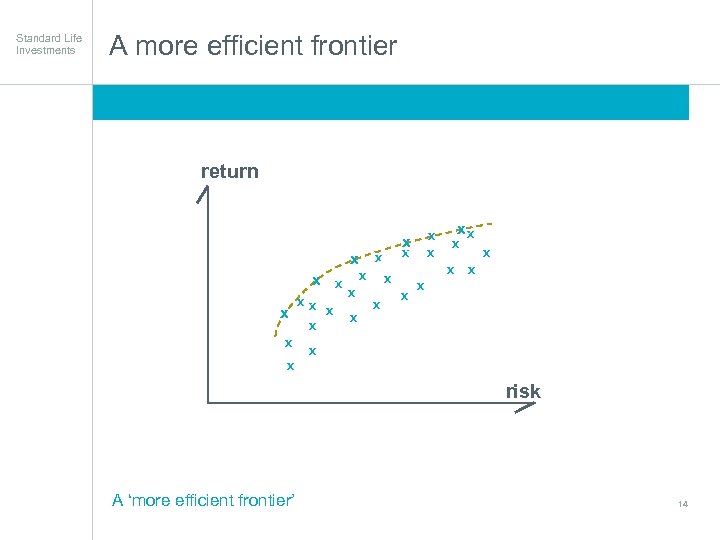

Standard Life Investments A more efficient frontier Focused on delivering superior performance return x x x xx x x x x x risk A ‘more efficient frontier’ 14

Standard Life Investments A more efficient frontier Focused on delivering superior performance return x x x xx x x x x x risk A ‘more efficient frontier’ 14

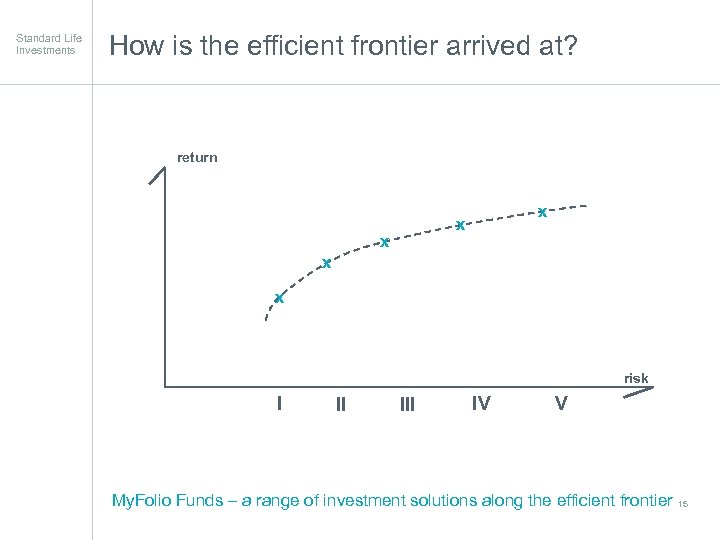

Standard Life Investments How is the efficient frontier arrived at? Focused on delivering superior performance return x x x risk I II IV V My. Folio Funds – a range of investment solutions along the efficient frontier 15

Standard Life Investments How is the efficient frontier arrived at? Focused on delivering superior performance return x x x risk I II IV V My. Folio Funds – a range of investment solutions along the efficient frontier 15

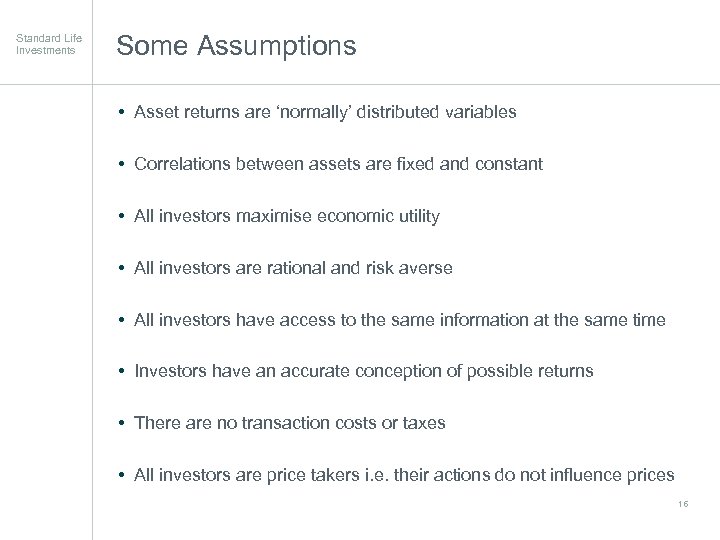

Standard Life Investments Some Assumptions • Asset returns are ‘normally’ distributed variables • Correlations between assets are fixed and constant • All investors maximise economic utility • All investors are rational and risk averse • All investors have access to the same information at the same time • Investors have an accurate conception of possible returns • There are no transaction costs or taxes • All investors are price takers i. e. their actions do not influence prices 16

Standard Life Investments Some Assumptions • Asset returns are ‘normally’ distributed variables • Correlations between assets are fixed and constant • All investors maximise economic utility • All investors are rational and risk averse • All investors have access to the same information at the same time • Investors have an accurate conception of possible returns • There are no transaction costs or taxes • All investors are price takers i. e. their actions do not influence prices 16

Standard Life Investments Q - What is the efficient frontier A. A set of portfolios that offer the maximum rate of return for any given level of risk B. A set of portfolios that offer the minimum rate of return for any given level of risk C. A set of portfolios that provide 90% returns from AA D. A set of randomly selected portfolios 17

Standard Life Investments Q - What is the efficient frontier A. A set of portfolios that offer the maximum rate of return for any given level of risk B. A set of portfolios that offer the minimum rate of return for any given level of risk C. A set of portfolios that provide 90% returns from AA D. A set of randomly selected portfolios 17

Standard Life Investments Strategic Asset Allocation 18

Standard Life Investments Strategic Asset Allocation 18

Standard Life Investments What is Strategic Asset Allocation? • Strategic asset allocation refers to the long-term allocation of an investment portfolio to various asset classes based on an investor's goals and tolerance for risk • A portfolio's strategic asset allocation incorporates a base policy mix that should remain unchanged even when the market moves up or down • Investments are chosen so as to: w Maximize w Minimize expected return risk 19

Standard Life Investments What is Strategic Asset Allocation? • Strategic asset allocation refers to the long-term allocation of an investment portfolio to various asset classes based on an investor's goals and tolerance for risk • A portfolio's strategic asset allocation incorporates a base policy mix that should remain unchanged even when the market moves up or down • Investments are chosen so as to: w Maximize w Minimize expected return risk 19

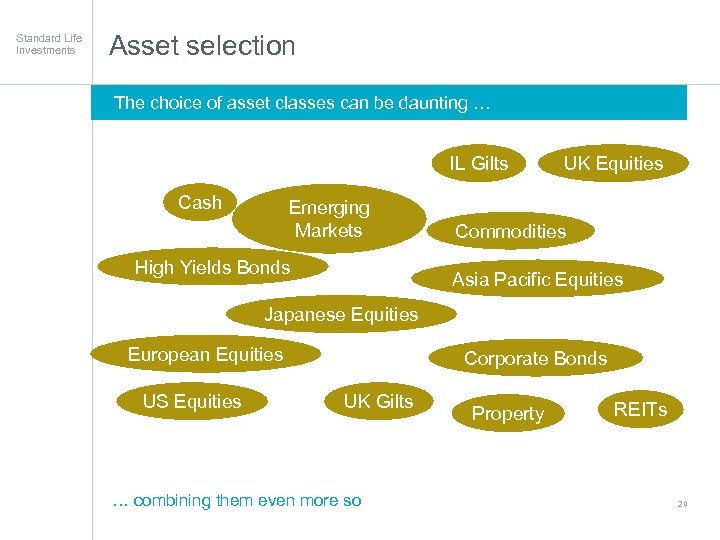

Standard Life Investments Asset selection The choice of asset classes can be daunting … IL Gilts Cash Emerging Markets High Yields Bonds UK Equities Commodities Asia Pacific Equities Japanese Equities European Equities US Equities Corporate Bonds UK Gilts … combining them even more so Property REITs 20

Standard Life Investments Asset selection The choice of asset classes can be daunting … IL Gilts Cash Emerging Markets High Yields Bonds UK Equities Commodities Asia Pacific Equities Japanese Equities European Equities US Equities Corporate Bonds UK Gilts … combining them even more so Property REITs 20

Standard Life Investments Q - Explain how diversification can reduce risk within an investment portfolio A. Diversification reduces risk by combining assets to reduce the overall risk to less than average risk of a single holding B. The downside risk of an investment can be offset by the upside of another C. Diversification is most effective where stocks move in opposite directions / are negatively correlated D. Diversification can remove non-market risk E. All of the above 21

Standard Life Investments Q - Explain how diversification can reduce risk within an investment portfolio A. Diversification reduces risk by combining assets to reduce the overall risk to less than average risk of a single holding B. The downside risk of an investment can be offset by the upside of another C. Diversification is most effective where stocks move in opposite directions / are negatively correlated D. Diversification can remove non-market risk E. All of the above 21

Standard Life Investments What is Strategic Asset Allocation? • Strategic asset allocation will depend on the risk profile of the investor • Strategic asset allocation can be influenced by investor goals • The vast majority of investors can be categorised as risk averse • But some investors are more risk averse than others, based on characteristics such as: § Wealth § Gender § Age § Education 22

Standard Life Investments What is Strategic Asset Allocation? • Strategic asset allocation will depend on the risk profile of the investor • Strategic asset allocation can be influenced by investor goals • The vast majority of investors can be categorised as risk averse • But some investors are more risk averse than others, based on characteristics such as: § Wealth § Gender § Age § Education 22

Standard Life Investments What is Strategic Asset Allocation? • Strategic asset allocation will also depend on the investor’s time horizon § The longer the time horizon, the greater an investor’s ability to assume more risk § Long time horizons provide more time for periods with strong performance to offset periods with poor performance § Over a long-term investment horizon, inflation can pose a greater threat than market volatility § The longer an investor’s time horizon, the more they will be willing to invest in illiquid investments 23

Standard Life Investments What is Strategic Asset Allocation? • Strategic asset allocation will also depend on the investor’s time horizon § The longer the time horizon, the greater an investor’s ability to assume more risk § Long time horizons provide more time for periods with strong performance to offset periods with poor performance § Over a long-term investment horizon, inflation can pose a greater threat than market volatility § The longer an investor’s time horizon, the more they will be willing to invest in illiquid investments 23

Standard Life Investments What is Strategic Asset Allocation? • Strategic asset allocation is founded on the following beliefs: § The advisor has accurately identified the client’s characteristics, hence an ideal asset allocation should be identifiable § Market timing is impossible, hence only a long term approach is prudent Source: The Chartered Insurance Institute, July 2010 24

Standard Life Investments What is Strategic Asset Allocation? • Strategic asset allocation is founded on the following beliefs: § The advisor has accurately identified the client’s characteristics, hence an ideal asset allocation should be identifiable § Market timing is impossible, hence only a long term approach is prudent Source: The Chartered Insurance Institute, July 2010 24

Standard Life Investments Q – Which of the following is a characteristic of strategic asset allocation? A. SAA attempts to time the market B. SAA is a long term approach C. The investor’s risk profile is irrelevant to SAA D. The investor’s time horizon is irrelevant to SAA 25

Standard Life Investments Q – Which of the following is a characteristic of strategic asset allocation? A. SAA attempts to time the market B. SAA is a long term approach C. The investor’s risk profile is irrelevant to SAA D. The investor’s time horizon is irrelevant to SAA 25

Standard Life Investments Q - What percentage of the variation in a portfolio’s return is explained by it’s long term target asset allocation policy? A. 87. 5% based on latest studies from B. More than 100% and frequently stock (fund) selection and market timing / can destroy value C. At least 75% D. About 90% 26

Standard Life Investments Q - What percentage of the variation in a portfolio’s return is explained by it’s long term target asset allocation policy? A. 87. 5% based on latest studies from B. More than 100% and frequently stock (fund) selection and market timing / can destroy value C. At least 75% D. About 90% 26

Standard Life Investments What are the compromises in the client design of asset allocation Driven by the level of return needed by the client and then limited by the tolerance for declines. The client has several choices: • Adjust the goals downward until the required return has a volatility that is acceptable • Work longer or save more so that the need for returns can be lowered • Die sooner! • Learn more about investment history and concepts so their tolerance for volatility / risk increases Source: Creating a IPS, Boone and Lubitz Asset allocation is probably the single most important issue to be addressed by an investor and the adviser 27

Standard Life Investments What are the compromises in the client design of asset allocation Driven by the level of return needed by the client and then limited by the tolerance for declines. The client has several choices: • Adjust the goals downward until the required return has a volatility that is acceptable • Work longer or save more so that the need for returns can be lowered • Die sooner! • Learn more about investment history and concepts so their tolerance for volatility / risk increases Source: Creating a IPS, Boone and Lubitz Asset allocation is probably the single most important issue to be addressed by an investor and the adviser 27

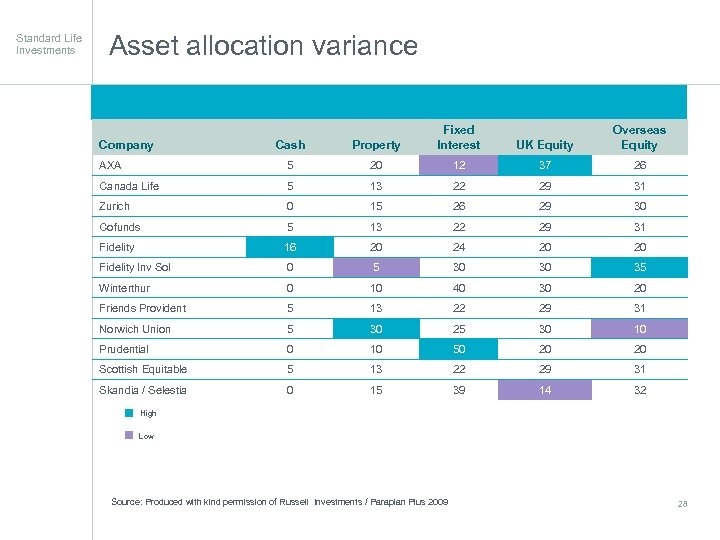

Standard Life Investments Asset allocation variance Cash Property Fixed Interest AXA 5 20 12 37 26 Canada Life 5 13 22 29 31 Zurich 0 15 26 29 30 Cofunds 5 13 22 29 31 Fidelity 16 20 24 20 20 Fidelity Inv Sol 0 5 30 30 35 Winterthur 0 10 40 30 20 Friends Provident 5 13 22 29 31 Norwich Union 5 30 25 30 10 Prudential 0 10 50 20 20 Scottish Equitable 5 13 22 29 31 Skandia / Selestia 0 15 39 14 32 Company UK Equity Overseas Equity High Low Source: Produced with kind permission of Russell Investments / Paraplan Plus 2009 28

Standard Life Investments Asset allocation variance Cash Property Fixed Interest AXA 5 20 12 37 26 Canada Life 5 13 22 29 31 Zurich 0 15 26 29 30 Cofunds 5 13 22 29 31 Fidelity 16 20 24 20 20 Fidelity Inv Sol 0 5 30 30 35 Winterthur 0 10 40 30 20 Friends Provident 5 13 22 29 31 Norwich Union 5 30 25 30 10 Prudential 0 10 50 20 20 Scottish Equitable 5 13 22 29 31 Skandia / Selestia 0 15 39 14 32 Company UK Equity Overseas Equity High Low Source: Produced with kind permission of Russell Investments / Paraplan Plus 2009 28

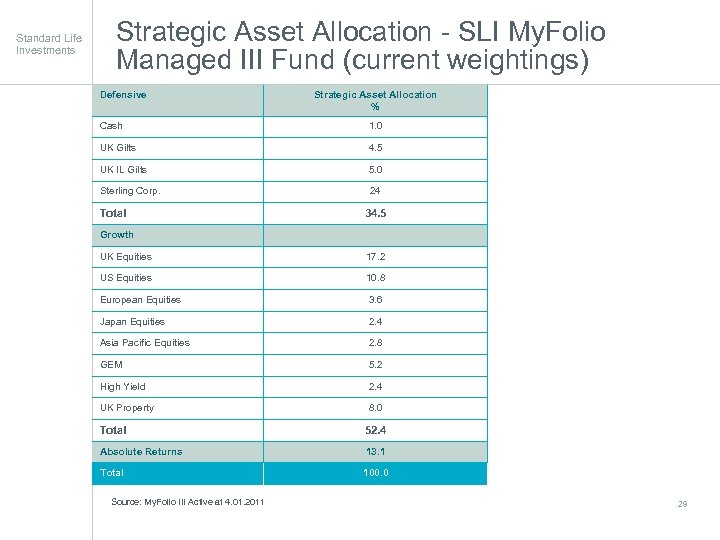

Standard Life Investments Strategic Asset Allocation - SLI My. Folio Managed III Fund (current weightings) Defensive Strategic Asset Allocation % Cash 1. 0 UK Gilts 4. 5 UK IL Gilts 5. 0 Sterling Corp. 24 Total 34. 5 Growth UK Equities 17. 2 US Equities 10. 8 European Equities 3. 6 Japan Equities 2. 4 Asia Pacific Equities 2. 8 GEM 5. 2 High Yield 2. 4 UK Property 8. 0 Total 52. 4 Absolute Returns 13. 1 Total 100. 0 Source: My. Folio III Active at 4. 01. 2011 29

Standard Life Investments Strategic Asset Allocation - SLI My. Folio Managed III Fund (current weightings) Defensive Strategic Asset Allocation % Cash 1. 0 UK Gilts 4. 5 UK IL Gilts 5. 0 Sterling Corp. 24 Total 34. 5 Growth UK Equities 17. 2 US Equities 10. 8 European Equities 3. 6 Japan Equities 2. 4 Asia Pacific Equities 2. 8 GEM 5. 2 High Yield 2. 4 UK Property 8. 0 Total 52. 4 Absolute Returns 13. 1 Total 100. 0 Source: My. Folio III Active at 4. 01. 2011 29

Standard Life Investments Coffee Break 30

Standard Life Investments Coffee Break 30

Standard Life Investments Stochastic Modeling 31

Standard Life Investments Stochastic Modeling 31

Standard Life Investments Stochastic Investment Model • Initial set of assets and relevant variables selected • Long term outcomes from different investment strategies • Assumptions are based on historic data, current market data and expert forecasts • Sets up a projection model which looks at an entire portfolio • Rather than setting investment returns according to their most likely estimate, it uses random variation to look at what investment conditions might be like • Based on random outcomes, the experience of the portfolio is projected. This is repeated with new random variable thousands of times 32

Standard Life Investments Stochastic Investment Model • Initial set of assets and relevant variables selected • Long term outcomes from different investment strategies • Assumptions are based on historic data, current market data and expert forecasts • Sets up a projection model which looks at an entire portfolio • Rather than setting investment returns according to their most likely estimate, it uses random variation to look at what investment conditions might be like • Based on random outcomes, the experience of the portfolio is projected. This is repeated with new random variable thousands of times 32

Standard Life Investments Stochastic modelling variables • Barrie & Hibbert Economic Scenario Generator (ESG) stochastically models for optimum portfolios • Interest Rates • Risk Premium for asset classes • Volatility (short and long term) • Exchange Rate Fluctuations • Correlation • Short Term market features that may impact long term risk/reward Stable Portfolios – Reviewed Quarterly 33

Standard Life Investments Stochastic modelling variables • Barrie & Hibbert Economic Scenario Generator (ESG) stochastically models for optimum portfolios • Interest Rates • Risk Premium for asset classes • Volatility (short and long term) • Exchange Rate Fluctuations • Correlation • Short Term market features that may impact long term risk/reward Stable Portfolios – Reviewed Quarterly 33

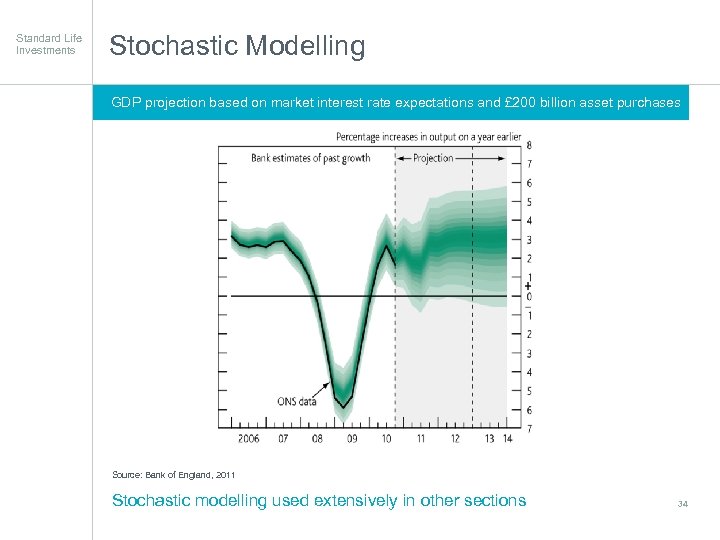

Standard Life Investments Stochastic Modelling GDP projection based on market interest rate expectations and £ 200 billion asset purchases Focused on delivering superior performance Source: Bank of England, 2011 Stochastic modelling used extensively in other sections 34

Standard Life Investments Stochastic Modelling GDP projection based on market interest rate expectations and £ 200 billion asset purchases Focused on delivering superior performance Source: Bank of England, 2011 Stochastic modelling used extensively in other sections 34

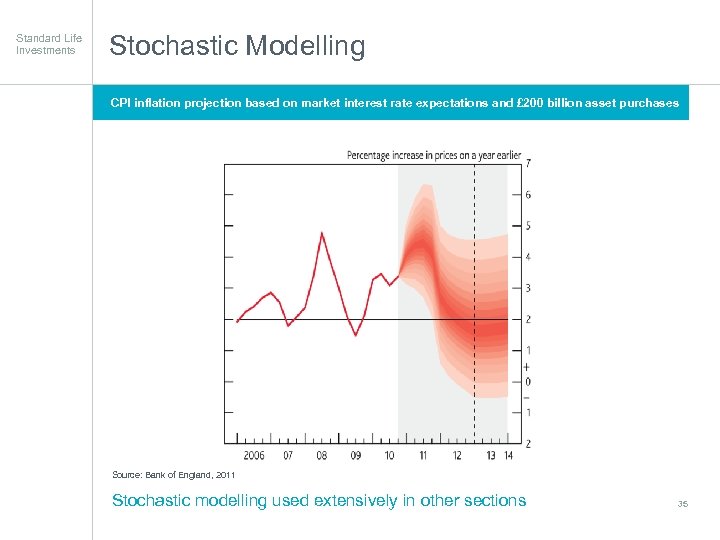

Standard Life Investments Stochastic Modelling CPI inflation projection based on market interest rate expectations and £ 200 billion asset purchases Focused on delivering superior performance Source: Bank of England, 2011 Stochastic modelling used extensively in other sections 35

Standard Life Investments Stochastic Modelling CPI inflation projection based on market interest rate expectations and £ 200 billion asset purchases Focused on delivering superior performance Source: Bank of England, 2011 Stochastic modelling used extensively in other sections 35

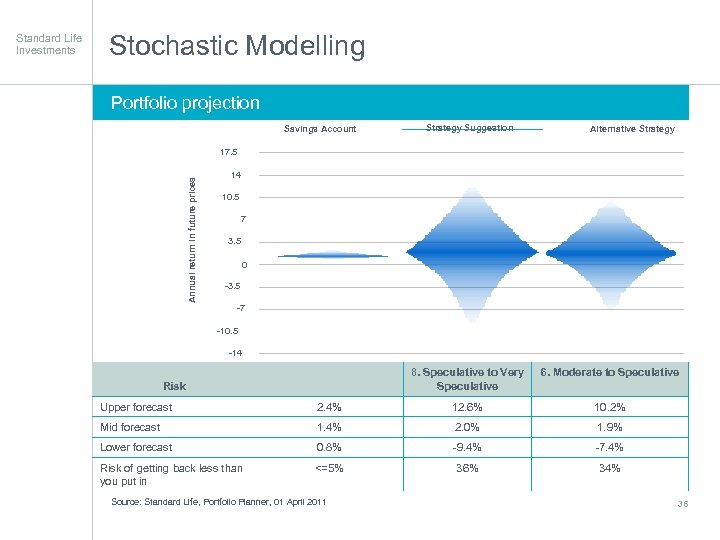

Stochastic Modelling Portfolio projection Savings Account Strategy Suggestion Alternative Strategy 17. 5 Annual return in future prices Standard Life Investments 14 10. 5 7 3. 5 0 -3. 5 -7 -10. 5 -14 8. Speculative to Very Speculative Risk 6. Moderate to Speculative Upper forecast 2. 4% 12. 6% 10. 2% Mid forecast 1. 4% 2. 0% 1. 9% Lower forecast 0. 8% -9. 4% -7. 4% Risk of getting back less than you put in <=5% 36% 34% Source: Standard Life, Portfolio Planner, 01 April 2011 36

Stochastic Modelling Portfolio projection Savings Account Strategy Suggestion Alternative Strategy 17. 5 Annual return in future prices Standard Life Investments 14 10. 5 7 3. 5 0 -3. 5 -7 -10. 5 -14 8. Speculative to Very Speculative Risk 6. Moderate to Speculative Upper forecast 2. 4% 12. 6% 10. 2% Mid forecast 1. 4% 2. 0% 1. 9% Lower forecast 0. 8% -9. 4% -7. 4% Risk of getting back less than you put in <=5% 36% 34% Source: Standard Life, Portfolio Planner, 01 April 2011 36

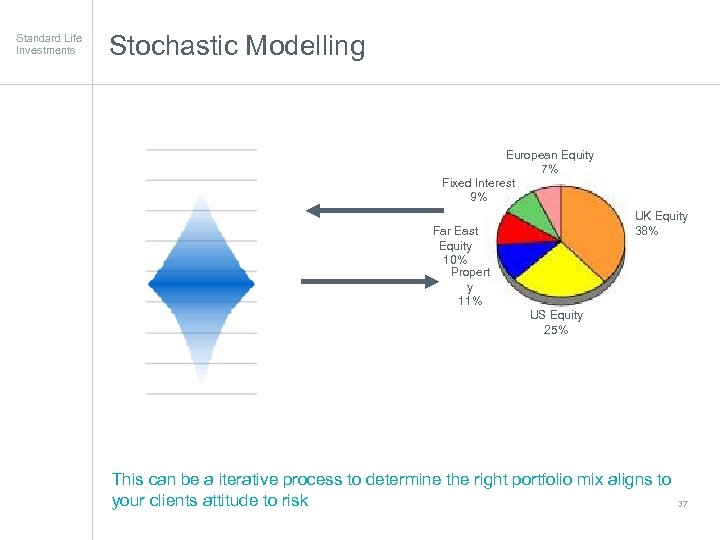

Standard Life Investments Stochastic Modelling European Equity 7% Fixed Interest 9% UK Equity 38% Far East Equity 10% Propert y 11% US Equity 25% This can be a iterative process to determine the right portfolio mix aligns to your clients attitude to risk 37

Standard Life Investments Stochastic Modelling European Equity 7% Fixed Interest 9% UK Equity 38% Far East Equity 10% Propert y 11% US Equity 25% This can be a iterative process to determine the right portfolio mix aligns to your clients attitude to risk 37

Standard Life Investments Stochastic Modeling • What is stochastic modeling? § An initial set of assets is identified § Identify relevant variables § Assumptions are made regarding the return behaviour of the assets, allowing for random changes in factors § A wide range of scenarios is run in which the assets follow the assumed behaviour § Results of these scenarios are used to determine the probability of various outcomes 38

Standard Life Investments Stochastic Modeling • What is stochastic modeling? § An initial set of assets is identified § Identify relevant variables § Assumptions are made regarding the return behaviour of the assets, allowing for random changes in factors § A wide range of scenarios is run in which the assets follow the assumed behaviour § Results of these scenarios are used to determine the probability of various outcomes 38

Standard Life Investments Stochastic Modelling Advantages Disadvantages • Brings rigour, logic, discipline and organisation to the investment process • Over dependence can lead to poor decisions Focused on delivering superior performance • Significant research, historic and future analysis provides deeper understanding of range of outcomes • Output dependant on assumptions made in any forecasting, interest rates, inflation, correlations, GDP etc. These can vary significantly • Provides risk control framework, by setting minimum and maximums per asset class • Computer driven allocation programmes can lead to extreme allocations to certain asset classes, particular those with low or negative • Quantitative process can help reduce correlations with other asset classes any subjectivity and inconsistent approaches • Costs are frequently not factored into the model and these can eat into returns 39

Standard Life Investments Stochastic Modelling Advantages Disadvantages • Brings rigour, logic, discipline and organisation to the investment process • Over dependence can lead to poor decisions Focused on delivering superior performance • Significant research, historic and future analysis provides deeper understanding of range of outcomes • Output dependant on assumptions made in any forecasting, interest rates, inflation, correlations, GDP etc. These can vary significantly • Provides risk control framework, by setting minimum and maximums per asset class • Computer driven allocation programmes can lead to extreme allocations to certain asset classes, particular those with low or negative • Quantitative process can help reduce correlations with other asset classes any subjectivity and inconsistent approaches • Costs are frequently not factored into the model and these can eat into returns 39

Standard Life Investments Q - What will stochastic modelling provide? A. A clear understanding of the expected return a client is likely to receive B. A range of indicative returns based on past, present and future assumptions covering a number of economic and market factors C. The model portfolios suggestions based on your clients attitude to risk D. A optimised portfolio likely to deliver above median returns 40

Standard Life Investments Q - What will stochastic modelling provide? A. A clear understanding of the expected return a client is likely to receive B. A range of indicative returns based on past, present and future assumptions covering a number of economic and market factors C. The model portfolios suggestions based on your clients attitude to risk D. A optimised portfolio likely to deliver above median returns 40

Standard Life Investments Tactical Asset Allocation 41

Standard Life Investments Tactical Asset Allocation 41

Standard Life Investments What is Tactical Asset Allocation? Tactical Asset Allocation (TAA) deviates from strategic asset allocation in response to short-term expected return opportunities § Once the opportunity is exploited, the investor returns to the original allocation § TAA assumes that relative returns among different asset classes can diverge from equilibrium levels, but are ultimately mean reverting § TAA enables investors to respond to significant shifts in asset price, while strategic asset allocation helps them set a long-term plan to achieve their long-term goals 42

Standard Life Investments What is Tactical Asset Allocation? Tactical Asset Allocation (TAA) deviates from strategic asset allocation in response to short-term expected return opportunities § Once the opportunity is exploited, the investor returns to the original allocation § TAA assumes that relative returns among different asset classes can diverge from equilibrium levels, but are ultimately mean reverting § TAA enables investors to respond to significant shifts in asset price, while strategic asset allocation helps them set a long-term plan to achieve their long-term goals 42

Standard Life Investments 43

Standard Life Investments 43

Standard Life Investments TAA vs. Market Timing TAA differs from market timing techniques § Tactical allocation adjustments are a form of fine-tuning to the strategic asset mix, often done in response to broader market trends § Such deviations may be left in place for lengthy periods of time as economic or market conditions warrant § Market timing, on the other hand, is akin to betting – its success depends on profitably gauging the size and scope of random market spikes while avoiding the equally prevalent random market troughs 44

Standard Life Investments TAA vs. Market Timing TAA differs from market timing techniques § Tactical allocation adjustments are a form of fine-tuning to the strategic asset mix, often done in response to broader market trends § Such deviations may be left in place for lengthy periods of time as economic or market conditions warrant § Market timing, on the other hand, is akin to betting – its success depends on profitably gauging the size and scope of random market spikes while avoiding the equally prevalent random market troughs 44

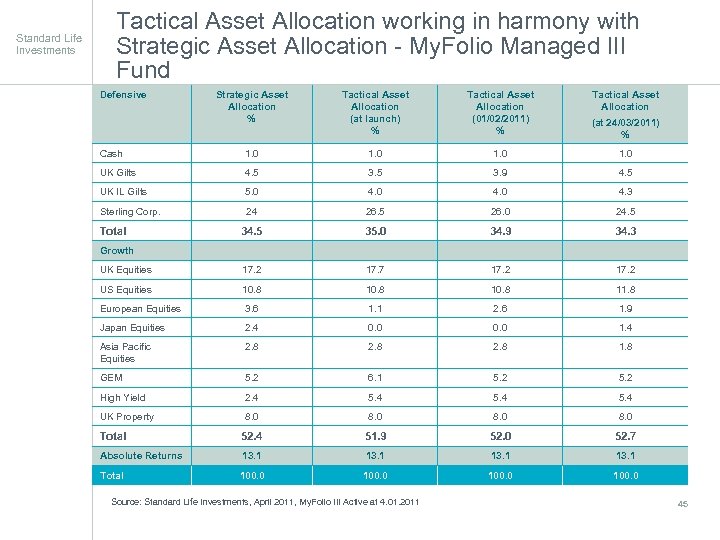

Standard Life Investments Tactical Asset Allocation working in harmony with Strategic Asset Allocation - My. Folio Managed III Fund Defensive Strategic Asset Allocation % Tactical Asset Allocation (at launch) % Tactical Asset Allocation (01/02/2011) % (at 24/03/2011) % Cash 1. 0 UK Gilts 4. 5 3. 9 4. 5 UK IL Gilts 5. 0 4. 3 Sterling Corp. 24 26. 5 26. 0 24. 5 35. 0 34. 9 34. 3 UK Equities 17. 2 17. 7 17. 2 US Equities 10. 8 11. 8 European Equities 3. 6 1. 1 2. 6 1. 9 Japan Equities 2. 4 0. 0 1. 4 Asia Pacific Equities 2. 8 1. 8 GEM 5. 2 6. 1 5. 2 High Yield 2. 4 5. 4 UK Property 8. 0 Total 52. 4 51. 9 52. 0 52. 7 Absolute Returns 13. 1 Total 100. 0 Total Tactical Asset Allocation Growth Source: Standard Life Investments, April 2011, My. Folio III Active at 4. 01. 2011 45

Standard Life Investments Tactical Asset Allocation working in harmony with Strategic Asset Allocation - My. Folio Managed III Fund Defensive Strategic Asset Allocation % Tactical Asset Allocation (at launch) % Tactical Asset Allocation (01/02/2011) % (at 24/03/2011) % Cash 1. 0 UK Gilts 4. 5 3. 9 4. 5 UK IL Gilts 5. 0 4. 3 Sterling Corp. 24 26. 5 26. 0 24. 5 35. 0 34. 9 34. 3 UK Equities 17. 2 17. 7 17. 2 US Equities 10. 8 11. 8 European Equities 3. 6 1. 1 2. 6 1. 9 Japan Equities 2. 4 0. 0 1. 4 Asia Pacific Equities 2. 8 1. 8 GEM 5. 2 6. 1 5. 2 High Yield 2. 4 5. 4 UK Property 8. 0 Total 52. 4 51. 9 52. 0 52. 7 Absolute Returns 13. 1 Total 100. 0 Total Tactical Asset Allocation Growth Source: Standard Life Investments, April 2011, My. Folio III Active at 4. 01. 2011 45

Standard Life Investments Q- Which of the following is required to implement Tactical Asset Allocation? A. The availability of passive index funds B. A long term investment objective C. The ability and conviction to forecast performance D. All of the above 46

Standard Life Investments Q- Which of the following is required to implement Tactical Asset Allocation? A. The availability of passive index funds B. A long term investment objective C. The ability and conviction to forecast performance D. All of the above 46

Standard Life Investments Q - Which of the following best characterises Tactical Asset Allocation? A. TAA focuses on long-term market trends B. TAA is a view on market beta C. TAA is a core strategy D. TAA is a passive investing strategy 47

Standard Life Investments Q - Which of the following best characterises Tactical Asset Allocation? A. TAA focuses on long-term market trends B. TAA is a view on market beta C. TAA is a core strategy D. TAA is a passive investing strategy 47

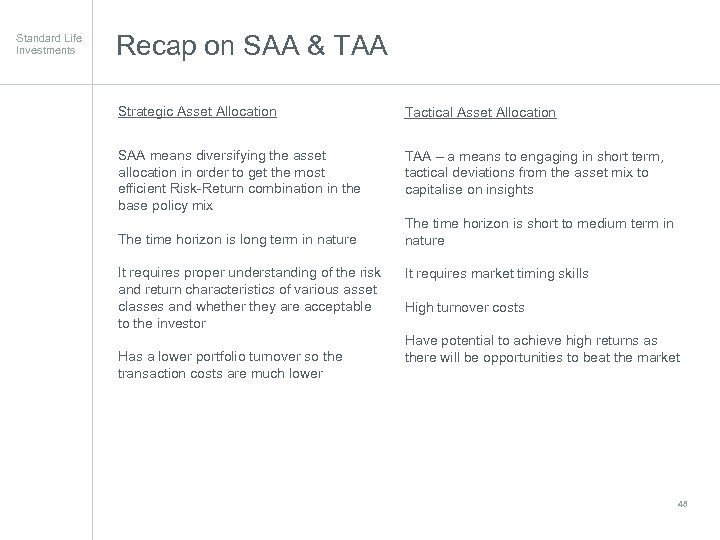

Standard Life Investments Recap on SAA & TAA Strategic Asset Allocation Tactical Asset Allocation SAA means diversifying the asset allocation in order to get the most efficient Risk-Return combination in the base policy mix TAA – a means to engaging in short term, tactical deviations from the asset mix to capitalise on insights The time horizon is long term in nature It requires proper understanding of the risk and return characteristics of various asset classes and whether they are acceptable to the investor Has a lower portfolio turnover so the transaction costs are much lower The time horizon is short to medium term in nature It requires market timing skills High turnover costs Have potential to achieve high returns as there will be opportunities to beat the market 48

Standard Life Investments Recap on SAA & TAA Strategic Asset Allocation Tactical Asset Allocation SAA means diversifying the asset allocation in order to get the most efficient Risk-Return combination in the base policy mix TAA – a means to engaging in short term, tactical deviations from the asset mix to capitalise on insights The time horizon is long term in nature It requires proper understanding of the risk and return characteristics of various asset classes and whether they are acceptable to the investor Has a lower portfolio turnover so the transaction costs are much lower The time horizon is short to medium term in nature It requires market timing skills High turnover costs Have potential to achieve high returns as there will be opportunities to beat the market 48

Standard Life Investments Active & Passive Portfolio Management 49

Standard Life Investments Active & Passive Portfolio Management 49

Standard Life Investments Active vs. Passive the great debate Active vs. Passive • Active managers primarily target a return in excess of a benchmark (alpha) • Passive managers seek to replicate the return of a market Passive Management Assumptions • Based on principle that stock markets rise more often than they fall • Market exposure alone will generate positive returns • Markets are totally efficient Methods of delivery • Full replication • Sampling or optimisation techniques • ETF’s 50

Standard Life Investments Active vs. Passive the great debate Active vs. Passive • Active managers primarily target a return in excess of a benchmark (alpha) • Passive managers seek to replicate the return of a market Passive Management Assumptions • Based on principle that stock markets rise more often than they fall • Market exposure alone will generate positive returns • Markets are totally efficient Methods of delivery • Full replication • Sampling or optimisation techniques • ETF’s 50

Standard Life Investments Active Management Assumptions Believe in their ability to deliver Alpha consistently The concept of the efficient market hypothesis is flawed and that there Are nearly always mispricing opportunities in the markets Allows risk to be managed appropriately to investors Method of delivery Normally expressed in the asset managers investment philosophy and processes 51

Standard Life Investments Active Management Assumptions Believe in their ability to deliver Alpha consistently The concept of the efficient market hypothesis is flawed and that there Are nearly always mispricing opportunities in the markets Allows risk to be managed appropriately to investors Method of delivery Normally expressed in the asset managers investment philosophy and processes 51

Standard Life Investments Active Portfolio Management Techniques of active portfolio management include: § Technical analysis: Identifies price trends in a market in order to forecast price movements § Fundamental analysis: Identifies value of an asset as the present value of future cash flows that the asset will generate § Quantitative analysis: Uses mathematical and statistical models in order to predict price changes 52

Standard Life Investments Active Portfolio Management Techniques of active portfolio management include: § Technical analysis: Identifies price trends in a market in order to forecast price movements § Fundamental analysis: Identifies value of an asset as the present value of future cash flows that the asset will generate § Quantitative analysis: Uses mathematical and statistical models in order to predict price changes 52

Standard Life Investments 53

Standard Life Investments 53

Standard Life Investments Q – Passive Investing Which of the following is more likely to describe a passive investor? A. Believes that markets are efficient B. Believes that markets are inefficient 54

Standard Life Investments Q – Passive Investing Which of the following is more likely to describe a passive investor? A. Believes that markets are efficient B. Believes that markets are inefficient 54

Standard Life Investments Q. Which investment technique is being used by an active portfolio manager in a company research visit? A. Technical analysis B. Passive investing C. Fundamental analysis D. Earnings momentum 55

Standard Life Investments Q. Which investment technique is being used by an active portfolio manager in a company research visit? A. Technical analysis B. Passive investing C. Fundamental analysis D. Earnings momentum 55

Standard Life Investments Topics Covered § Basic Modern Portfolio Theory and The Efficient Frontier § Strategic Asset Allocation § Stochastic Modelling § Tactical Asset Allocation § Passive vs. Active 56

Standard Life Investments Topics Covered § Basic Modern Portfolio Theory and The Efficient Frontier § Strategic Asset Allocation § Stochastic Modelling § Tactical Asset Allocation § Passive vs. Active 56

Standard Life Investments The information shown relates to the past. Past performance is not a guide to the future. The value of investment can go down as well as up. For full details of the fund's objective, policy, investment and borrowing powers and details of the risks investors need to be aware of please refer to the full prospectus which can be found on www. standardlifeinvestments. com Any data contained herein which is attributed to a third party ("Third Party Data") is the property of (a) third party supplier(s) (the “Owner”) and is licensed for use by Standard Life**. Third Party Data may not be copied or distributed. Third Party Data is provided “as is” and is not warranted to be accurate, complete or timely. To the extent permitted by applicable law, none of the Owner, Standard Life** or any other third party (including any third party involved in providing and/or compiling Third Party Data) shall have any liability for Third Party Data or for any use made of Third Party Data. Past performance is no guarantee of future results. Neither the Owner nor any other third party sponsors, endorses or promotes the fund or product to which Third Party Data relates. **Standard Life means the relevant member of the Standard Life group, being Standard Life plc together with its subsidiaries, subsidiary undertakings and associated companies (whether direct or indirect) from time to time. " Standard Life Investments Limited is registered in Scotland (SC 123321) at 1 George Street, Edinburgh EH 2 2 LL. The Standard Life Investments group includes Standard Life Investments (Mutual Funds) Limited, SLTM Limited, Standard Life Investments (Corporate Funds) Limited, SL Capital Partners LLP and AIDA Capital Limited. Standard Life Investments Limited is authorised and regulated by the Financial Services Authority. Calls may be monitored and/or recorded to protect both you and us and help with our training. www. standardlifeinvestments. com © 2011 Standard Life, images reproduced under licence 57

Standard Life Investments The information shown relates to the past. Past performance is not a guide to the future. The value of investment can go down as well as up. For full details of the fund's objective, policy, investment and borrowing powers and details of the risks investors need to be aware of please refer to the full prospectus which can be found on www. standardlifeinvestments. com Any data contained herein which is attributed to a third party ("Third Party Data") is the property of (a) third party supplier(s) (the “Owner”) and is licensed for use by Standard Life**. Third Party Data may not be copied or distributed. Third Party Data is provided “as is” and is not warranted to be accurate, complete or timely. To the extent permitted by applicable law, none of the Owner, Standard Life** or any other third party (including any third party involved in providing and/or compiling Third Party Data) shall have any liability for Third Party Data or for any use made of Third Party Data. Past performance is no guarantee of future results. Neither the Owner nor any other third party sponsors, endorses or promotes the fund or product to which Third Party Data relates. **Standard Life means the relevant member of the Standard Life group, being Standard Life plc together with its subsidiaries, subsidiary undertakings and associated companies (whether direct or indirect) from time to time. " Standard Life Investments Limited is registered in Scotland (SC 123321) at 1 George Street, Edinburgh EH 2 2 LL. The Standard Life Investments group includes Standard Life Investments (Mutual Funds) Limited, SLTM Limited, Standard Life Investments (Corporate Funds) Limited, SL Capital Partners LLP and AIDA Capital Limited. Standard Life Investments Limited is authorised and regulated by the Financial Services Authority. Calls may be monitored and/or recorded to protect both you and us and help with our training. www. standardlifeinvestments. com © 2011 Standard Life, images reproduced under licence 57