8181fc5de71a1da0564e375a13344771.ppt

- Количество слайдов: 28

Thermal Mechanics, Inc. Employee Benefits Review July 1, 2015

Benefits Overview United Healthcare • Medical Benefits UMB • H. S. A. Banking Delta Dental • Dental Benefits (4/1 Cycle) Eyemed • 2 Vision Benefits (10/1 Cycle) UNUM • • • Employer Paid Life/AD&D Employer Paid LTD Employer Paid STD Voluntary Life/AD&D Employee Assist Program (EAP)

This is your Open Enrollment. Your benefit elections will remain in effect for the entire plan year. Only Qualified Status Changes allow you to make changes to your benefit elections within 31 days after any one of the following events: • Marriage, Divorce, or Legal Separation • Birth or Adoption of a Child • Death of a Spouse or Child • Loss of Benefits for your Covered Dependents because of a Change in Employment 3 Benefits Overview Eligibility Eligible dependents include your spouse and dependent children under age 26. As in years passed, we are keeping the spousal carve out.

Medical Benefits – as of July 1, 2015 UNITED HEALTHCARE UMB DEDUCTIBLE REIMBURSEMENT 4

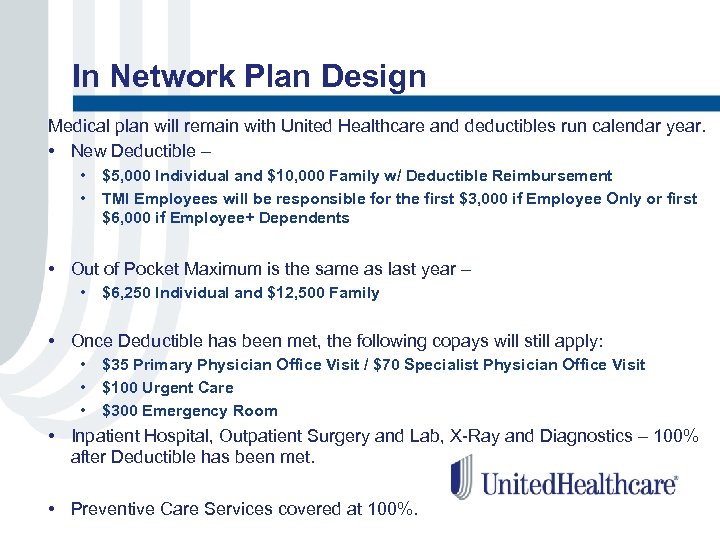

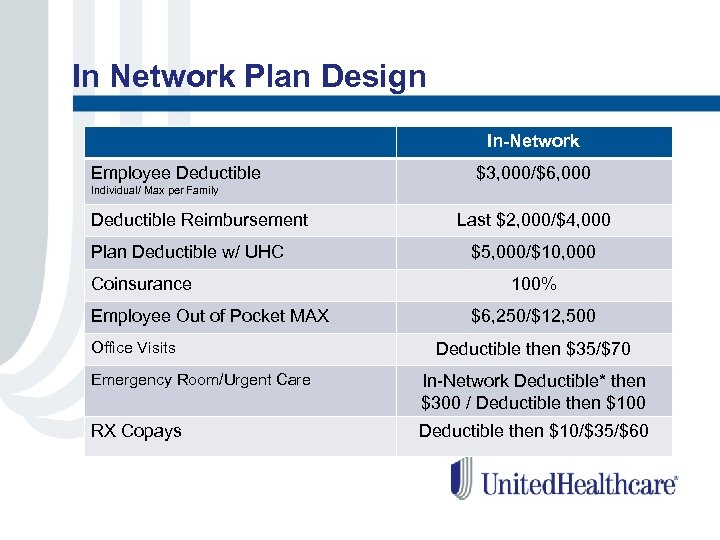

In Network Plan Design Medical plan will remain with United Healthcare and deductibles run calendar year. • New Deductible – • • $5, 000 Individual and $10, 000 Family w/ Deductible Reimbursement TMI Employees will be responsible for the first $3, 000 if Employee Only or first $6, 000 if Employee+ Dependents • Out of Pocket Maximum is the same as last year – • $6, 250 Individual and $12, 500 Family • Once Deductible has been met, the following copays will still apply: • • • $35 Primary Physician Office Visit / $70 Specialist Physician Office Visit $100 Urgent Care $300 Emergency Room • Inpatient Hospital, Outpatient Surgery and Lab, X-Ray and Diagnostics – 100% after Deductible has been met. • Preventive Care Services covered at 100%.

In Network Plan Design In-Network Employee Deductible $3, 000/$6, 000 Individual/ Max per Family Deductible Reimbursement Plan Deductible w/ UHC Coinsurance Employee Out of Pocket MAX Office Visits Last $2, 000/$4, 000 $5, 000/$10, 000 100% $6, 250/$12, 500 Deductible then $35/$70 Emergency Room/Urgent Care In-Network Deductible* then $300 / Deductible then $100 RX Copays Deductible then $10/$35/$60

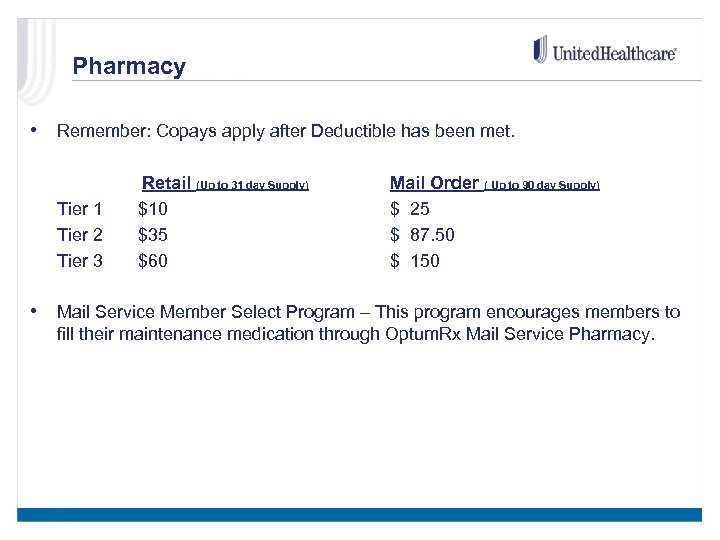

Pharmacy • Remember: Copays apply after Deductible has been met. Tier 1 Tier 2 Tier 3 Retail (Up to 31 day Supply) $10 $35 $60 Mail Order ( Up to 90 day Supply) $ 25 $ 87. 50 $ 150 • Mail Service Member Select Program – This program encourages members to fill their maintenance medication through Optum. Rx Mail Service Pharmacy.

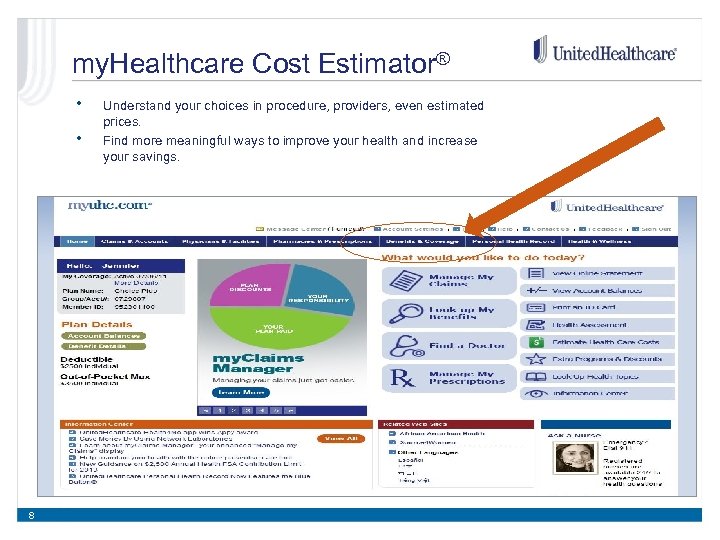

my. Healthcare Cost Estimator® • • 8 Understand your choices in procedure, providers, even estimated prices. Find more meaningful ways to improve your health and increase your savings.

My. UHC. com • Review Claims, Deductibles and Out of Pocket Maximums • Look up In Network Providers • Pull Needed information for the Deductible Reimbursement • Utilize the Treatment Cost Calculator • Download the Health 4 Me App on your smartphone.

Medical Benefits – as of July 1, 2015 UNITED HEALTHCARE UMB DEDUCTIBLE REIMBURSEMENT 10

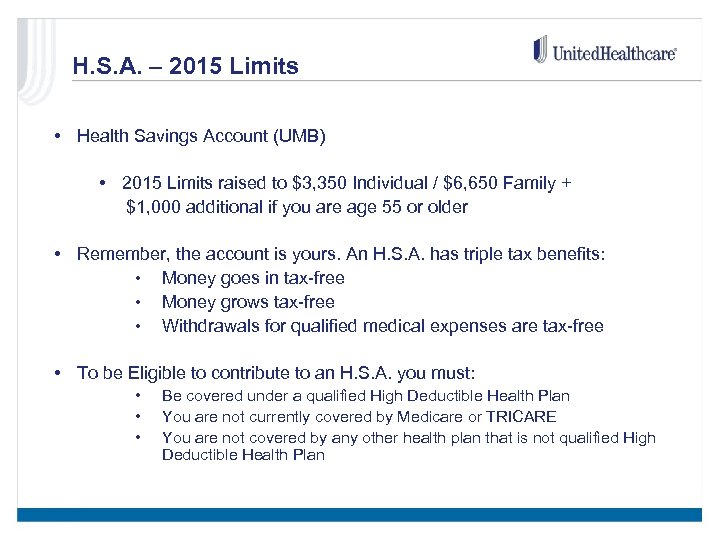

H. S. A. – 2015 Limits • Health Savings Account (UMB) • 2015 Limits raised to $3, 350 Individual / $6, 650 Family + $1, 000 additional if you are age 55 or older • Remember, the account is yours. An H. S. A. has triple tax benefits: • Money goes in tax-free • Money grows tax-free • Withdrawals for qualified medical expenses are tax-free • To be Eligible to contribute to an H. S. A. you must: • • • Be covered under a qualified High Deductible Health Plan You are not currently covered by Medicare or TRICARE You are not covered by any other health plan that is not qualified High Deductible Health Plan

Medical Benefits – as of July 1, 2015 UNITED HEALTHCARE UMB DEDUCTIBLE REIMBURSEMENT 12

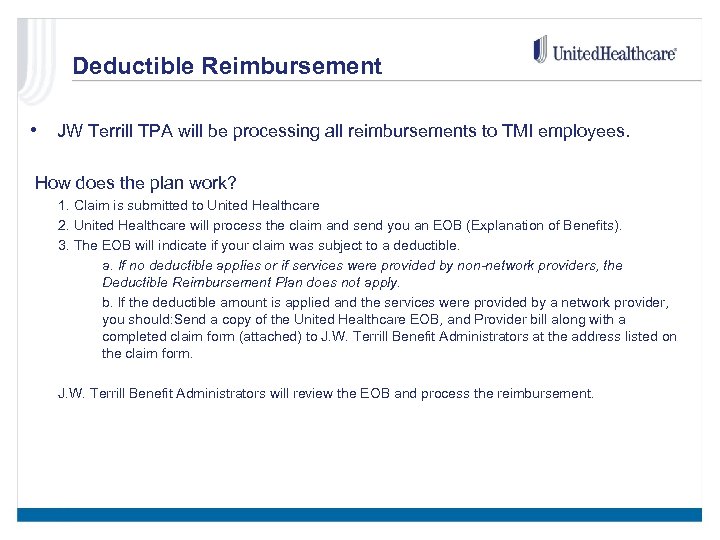

Deductible Reimbursement • JW Terrill TPA will be processing all reimbursements to TMI employees. How does the plan work? 1. Claim is submitted to United Healthcare 2. United Healthcare will process the claim and send you an EOB (Explanation of Benefits). 3. The EOB will indicate if your claim was subject to a deductible. a. If no deductible applies or if services were provided by non-network providers, the Deductible Reimbursement Plan does not apply. b. If the deductible amount is applied and the services were provided by a network provider, you should: Send a copy of the United Healthcare EOB, and Provider bill along with a completed claim form (attached) to J. W. Terrill Benefit Administrators at the address listed on the claim form. J. W. Terrill Benefit Administrators will review the EOB and process the reimbursement.

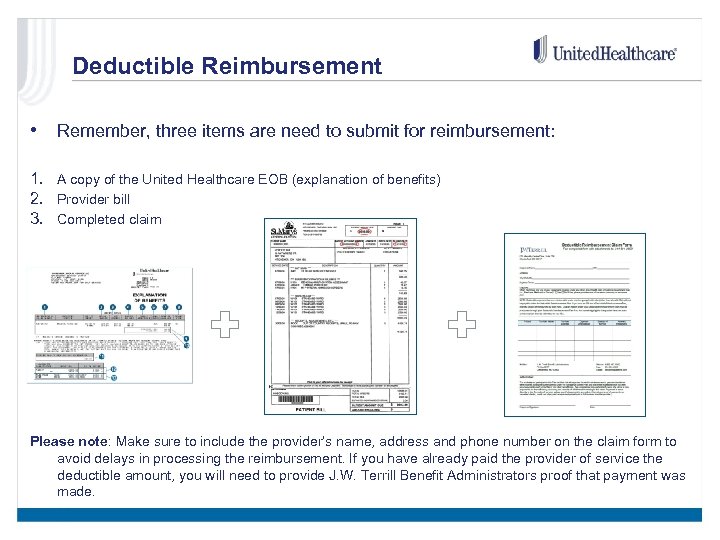

Deductible Reimbursement • Remember, three items are need to submit for reimbursement: 1. A copy of the United Healthcare EOB (explanation of benefits) 2. Provider bill 3. Completed claim Please note: Make sure to include the provider’s name, address and phone number on the claim form to avoid delays in processing the reimbursement. If you have already paid the provider of service the deductible amount, you will need to provide J. W. Terrill Benefit Administrators proof that payment was made.

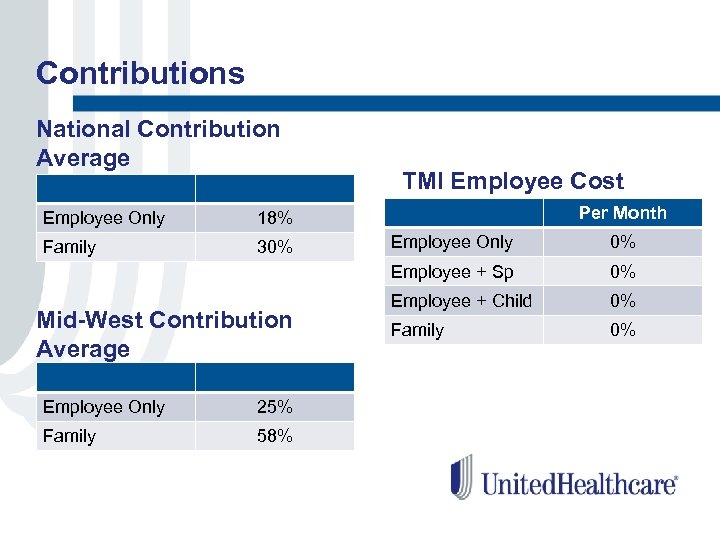

Contributions National Contribution Average Employee Only 30% Per Month 18% Family TMI Employee Cost Employee Only 25% Family 58% 0% Employee + Sp Mid-West Contribution Average Employee Only 0% Employee + Child 0% Family 0%

Short Term Disability, Long Term Disability, and Life insurance UNUM 16

Short Term Disability Coverage Details Your benefit amount ØAll full-time employees working 30+ hours a week Ø 100% employer-funded ØBenefit equal to 60% of basic weekly earnings • Maximum benefit up to $1, 385 per week. ØMaximum Benefit Period: 11 weeks Ø Elimination Period: • 14 Days for disability due to injury • 14 Days for disability due to sickness *Please refer to your policy certificate for the full list of offsets

Long Term Disability Coverage Details Your benefit amount Ø All full-time employees working 30+ hours a week Ø 100% employer funded ØDefinition of Disability • Regular occupation ØElimination ØBenefit Period = 90 days equal to 60% your basic monthly earnings ● Benefit maximum of $6, 000 a month *Please refer to your policy certificate for the full list of offsets 18

Basic Life Insurance Coverage Details Your benefit amount Ø All full-time employees working 30+ hours a week Ø 100% ØFlat employer funded benefit amount = $20, 000 ØAccidental Death & Dismemberment benefit = $20, 000 *Please refer to your policy certificate for the full list of offsets 19

Voluntary Term Life and AD&D Coverage u Employee ● Elect up to 5 x your annual salary ● From $10, 000 up to $500, 000 u Spouse ● Elect up to 100% of employee’s amount u Children ● $10, 000 benefit ● Covers all children *An unmarried handicapped dependent child who becomes handicapped prior to the child's attainment of age 26 may be eligible for benefits. Please see your plan administrator for details on eligibility

Voluntary Term Life and AD&D Coverage Remember, changes above the guarantee issue elections will require medical data. Employees can change election in any increment as long as request is below the following: u $100, 000 guaranteed issue for employees u $25, 000 guaranteed issue for spouses u $10, 000 guaranteed issue coverage for children. If you would like to change your previous election, please complete the Evidence of Insurability form. u Spouse benefits cannot be more than the employee elected benefit. Employees must elect coverage to insure a spouse or dependent.

More services for you and your loved ones Work-life balance employee assistance program Confidential, professional assistance for a wide range of personal and work-related issues for you and your family — by telephone or online. There’s no additional charge and you don’t have to file a disability claim to use it. Limited number of face-to-face counseling Ø Find childcare or learn about adoptions Ø Get help with legal or financial issues Ø Help with finding elder care services Ø Call 1 -800 -854 -1446 Go online at www. lifebalance. net user ID and password: lifebalance Work-life balance employee assistance program services are provided by Ceridian Corporation. These services are available with selected Unum insurance offerings. Exclusions, limitations and prior notice requirements may apply, and service features, terms and eligibility criteria are subject to change. The services are not valid after termination of coverage and may be withdrawn at any time. Please contact your Unum representative for full details.

Questions?

Voluntary Dental Insurance – Reminder DELTA DENTAL 24

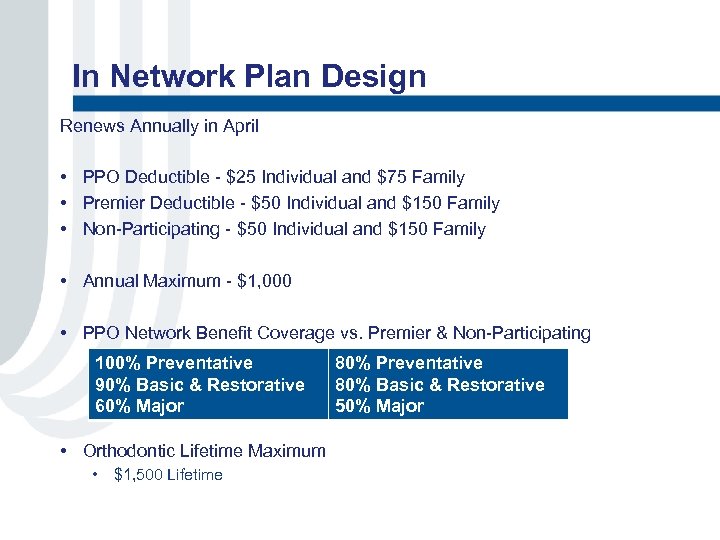

In Network Plan Design Renews Annually in April • PPO Deductible - $25 Individual and $75 Family • Premier Deductible - $50 Individual and $150 Family • Non-Participating - $50 Individual and $150 Family • Annual Maximum - $1, 000 • PPO Network Benefit Coverage vs. Premier & Non-Participating • 100% Preventative • 90% Basic & Restorative • 60% Major • Orthodontic Lifetime Maximum • $1, 500 Lifetime 80% Preventative 80% Basic & Restorative 50% Major

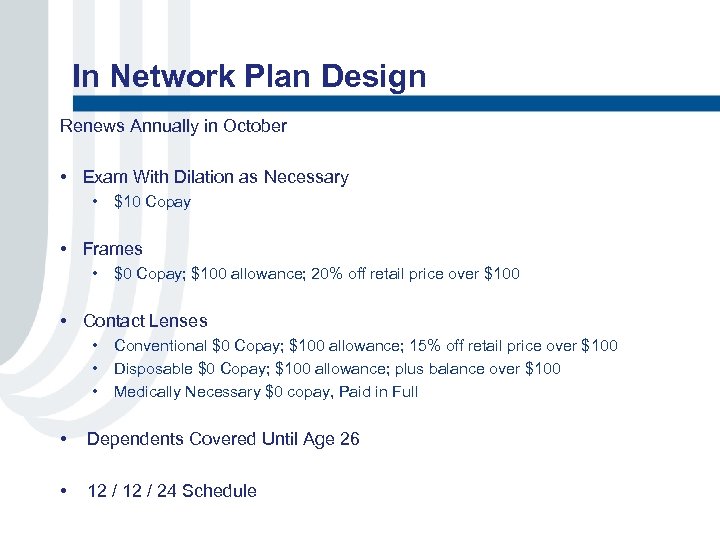

Voluntary Vision - Reminder EYEMED 26

In Network Plan Design Renews Annually in October • Exam With Dilation as Necessary • $10 Copay • Frames • $0 Copay; $100 allowance; 20% off retail price over $100 • Contact Lenses • • • Conventional $0 Copay; $100 allowance; 15% off retail price over $100 Disposable $0 Copay; $100 allowance; plus balance over $100 Medically Necessary $0 copay, Paid in Full • Dependents Covered Until Age 26 • 12 / 24 Schedule

Next Steps • Passive enrollment: No changes? No forms! • Reminder - Spousal Opt Out • Watch mail for new UHC ID Cards • Remember: UHC and JWT TPA do not feed information, we have to keep the TPA informed.

8181fc5de71a1da0564e375a13344771.ppt