bfa7ba163b763d008362896c8a52c0ae.ppt

- Количество слайдов: 29

There are two rules for ultimate success in life: (1) Never tell everything you know.

There are two rules for ultimate success in life: (1) Never tell everything you know.

Position Sizing by PJ Scardino

Position Sizing by PJ Scardino

The purpose of any trading system is to: Ø Minimize risk Ø Maximize reward Ø & not let your emotions get in the way

The purpose of any trading system is to: Ø Minimize risk Ø Maximize reward Ø & not let your emotions get in the way

Money Management or how to control risk § Position Sizing determines how much you can win or lose on any given trade. § Use Reward to Risk (RR) ratios to maximize your gains § This is the 1 st step to having a successful trading system!

Money Management or how to control risk § Position Sizing determines how much you can win or lose on any given trade. § Use Reward to Risk (RR) ratios to maximize your gains § This is the 1 st step to having a successful trading system!

RR Example: § Your risk is $1 your expected gain is $3 then Reward vs Risk = 3 to 1 also shown as 3: 1 or just RR=3 § Note: Given RR=3 and if your win 4 out of 10 trades then overall return is 20% It’s also 20% if RR = 2 and wins = 6 out of 10

RR Example: § Your risk is $1 your expected gain is $3 then Reward vs Risk = 3 to 1 also shown as 3: 1 or just RR=3 § Note: Given RR=3 and if your win 4 out of 10 trades then overall return is 20% It’s also 20% if RR = 2 and wins = 6 out of 10

Defining Risk § Know your exit targets before you enter the trade (stop loss & profit objective) § You buy a stock for $20 your stop is $15 Your objective is $30 § Then the potential Reward is $10 & the potential Risk is $5. RR = 2

Defining Risk § Know your exit targets before you enter the trade (stop loss & profit objective) § You buy a stock for $20 your stop is $15 Your objective is $30 § Then the potential Reward is $10 & the potential Risk is $5. RR = 2

How can we do this with options? § You could just set the stop and profit objectives on the option or … § Using your favorite tool (Technical, Fundamental, Sentiment, or Ouigi board) Define stop and profit price points for the stock and calculate the option prices for the stock at those levels. § Then compute RR for each option you are interested in. Here’s an example …

How can we do this with options? § You could just set the stop and profit objectives on the option or … § Using your favorite tool (Technical, Fundamental, Sentiment, or Ouigi board) Define stop and profit price points for the stock and calculate the option prices for the stock at those levels. § Then compute RR for each option you are interested in. Here’s an example …

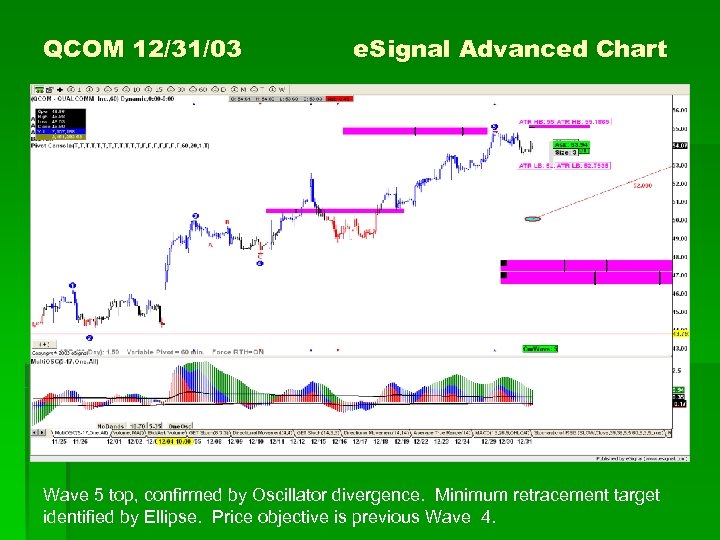

QCOM 12/31/03 e. Signal Advanced Chart Wave 5 top, confirmed by Oscillator divergence. Minimum retracement target identified by Ellipse. Price objective is previous Wave 4.

QCOM 12/31/03 e. Signal Advanced Chart Wave 5 top, confirmed by Oscillator divergence. Minimum retracement target identified by Ellipse. Price objective is previous Wave 4.

QCOM 12/31/03 Option. Vue Chart The blue outline in the upper right corner is the projected price and time.

QCOM 12/31/03 Option. Vue Chart The blue outline in the upper right corner is the projected price and time.

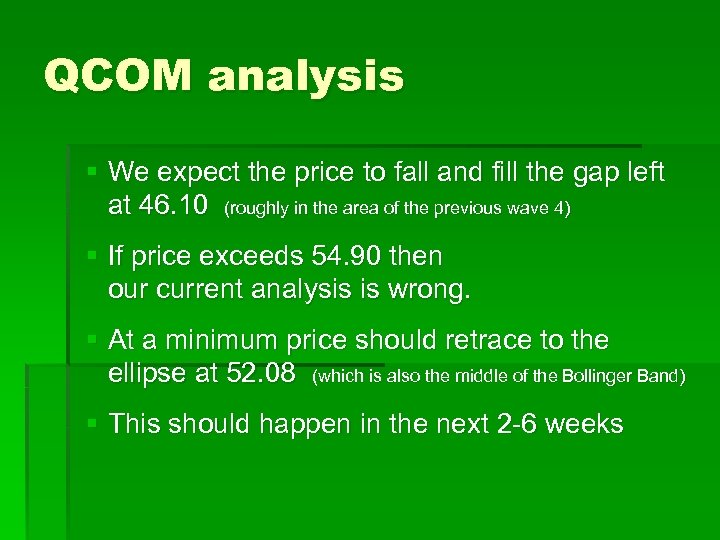

QCOM analysis § We expect the price to fall and fill the gap left at 46. 10 (roughly in the area of the previous wave 4) § If price exceeds 54. 90 then our current analysis is wrong. § At a minimum price should retrace to the ellipse at 52. 08 (which is also the middle of the Bollinger Band) § This should happen in the next 2 -6 weeks

QCOM analysis § We expect the price to fall and fill the gap left at 46. 10 (roughly in the area of the previous wave 4) § If price exceeds 54. 90 then our current analysis is wrong. § At a minimum price should retrace to the ellipse at 52. 08 (which is also the middle of the Bollinger Band) § This should happen in the next 2 -6 weeks

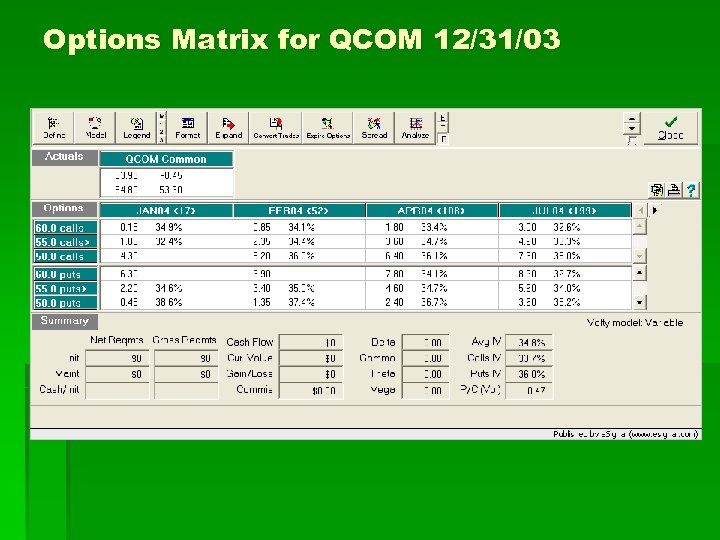

Options Matrix for QCOM 12/31/03

Options Matrix for QCOM 12/31/03

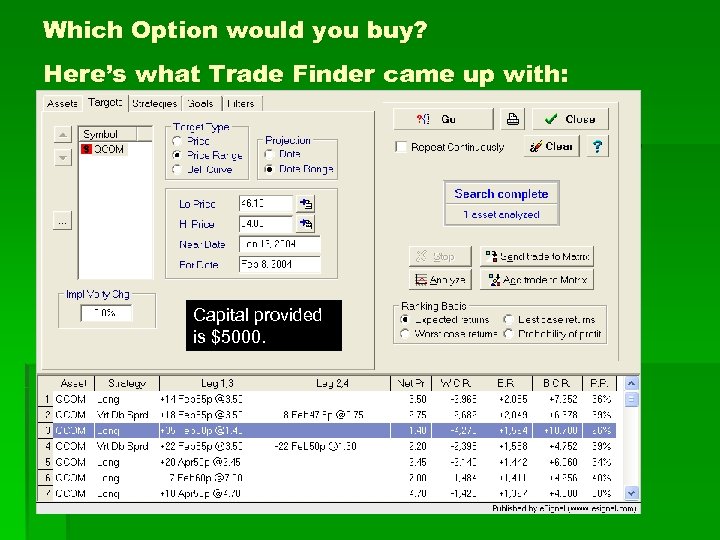

Which Option would you buy? Here’s what Trade Finder came up with: Capital provided is $5000.

Which Option would you buy? Here’s what Trade Finder came up with: Capital provided is $5000.

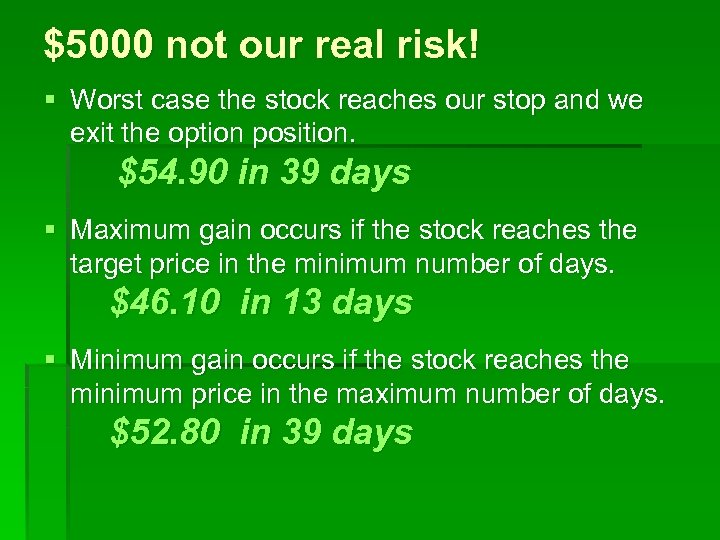

$5000 not our real risk! § Worst case the stock reaches our stop and we exit the option position. $54. 90 in 39 days § Maximum gain occurs if the stock reaches the target price in the minimum number of days. $46. 10 in 13 days § Minimum gain occurs if the stock reaches the minimum price in the maximum number of days. $52. 80 in 39 days

$5000 not our real risk! § Worst case the stock reaches our stop and we exit the option position. $54. 90 in 39 days § Maximum gain occurs if the stock reaches the target price in the minimum number of days. $46. 10 in 13 days § Minimum gain occurs if the stock reaches the minimum price in the maximum number of days. $52. 80 in 39 days

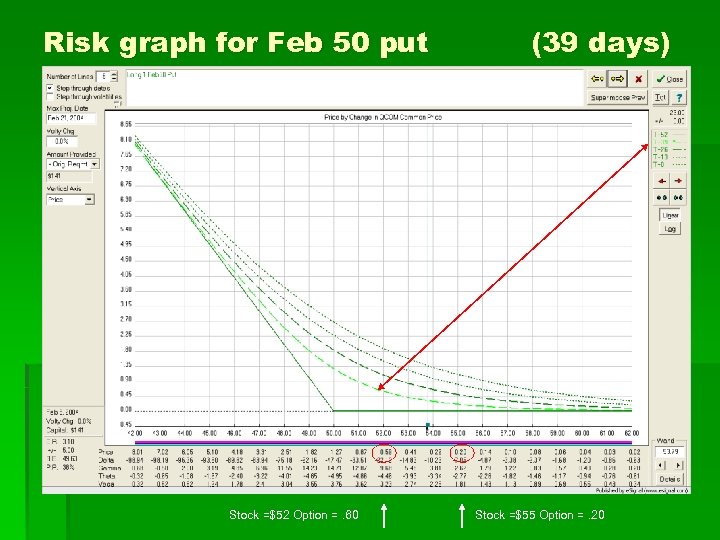

Risk graph for Feb 50 put Stock =$52 Option =. 60 (39 days) Stock =$55 Option =. 20

Risk graph for Feb 50 put Stock =$52 Option =. 60 (39 days) Stock =$55 Option =. 20

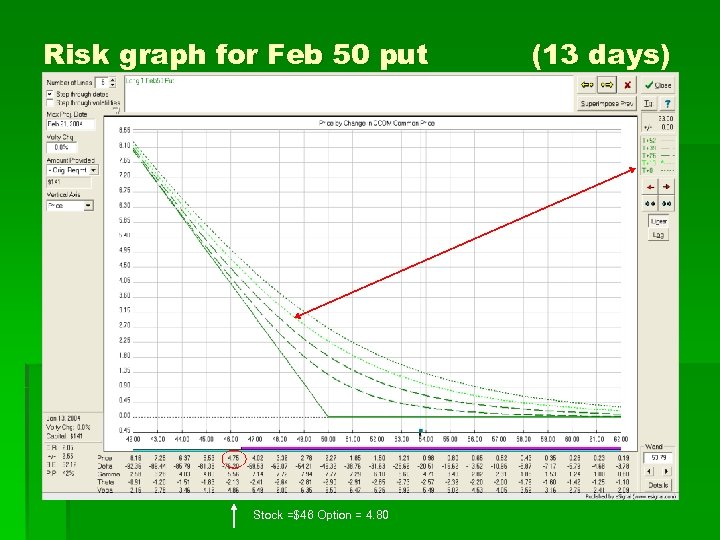

Risk graph for Feb 50 put Stock =$46 Option = 4. 80 (13 days)

Risk graph for Feb 50 put Stock =$46 Option = 4. 80 (13 days)

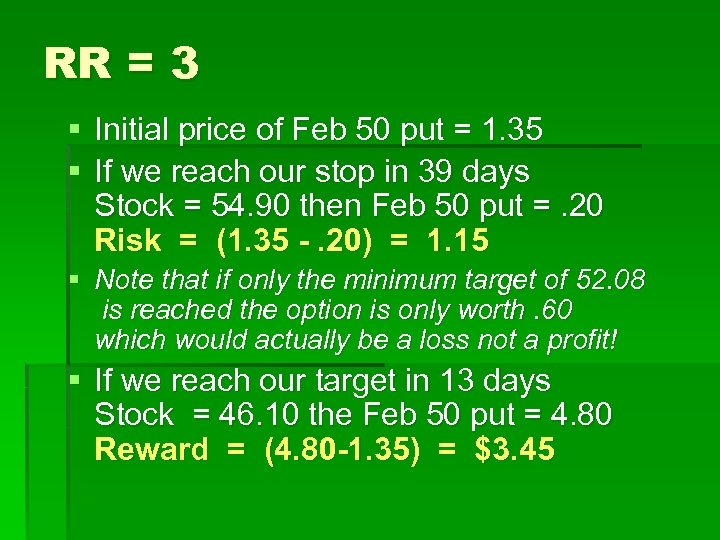

RR = 3 § Initial price of Feb 50 put = 1. 35 § If we reach our stop in 39 days Stock = 54. 90 then Feb 50 put =. 20 Risk = (1. 35 -. 20) = 1. 15 § Note that if only the minimum target of 52. 08 is reached the option is only worth. 60 which would actually be a loss not a profit! § If we reach our target in 13 days Stock = 46. 10 the Feb 50 put = 4. 80 Reward = (4. 80 -1. 35) = $3. 45

RR = 3 § Initial price of Feb 50 put = 1. 35 § If we reach our stop in 39 days Stock = 54. 90 then Feb 50 put =. 20 Risk = (1. 35 -. 20) = 1. 15 § Note that if only the minimum target of 52. 08 is reached the option is only worth. 60 which would actually be a loss not a profit! § If we reach our target in 13 days Stock = 46. 10 the Feb 50 put = 4. 80 Reward = (4. 80 -1. 35) = $3. 45

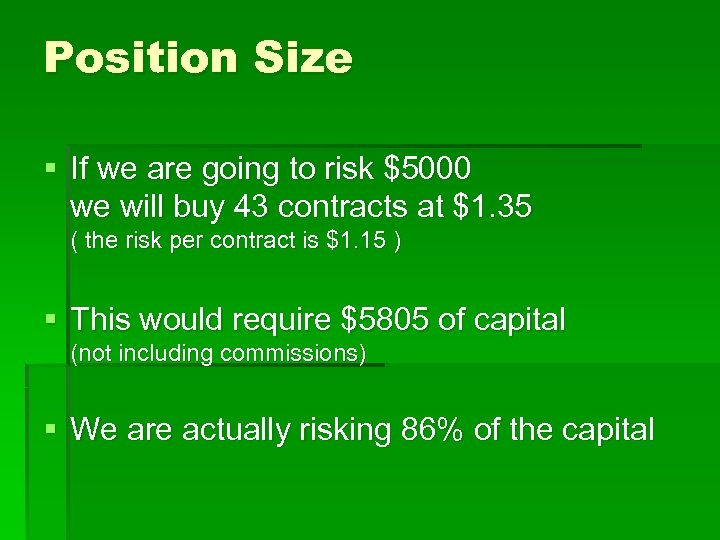

Position Size § If we are going to risk $5000 we will buy 43 contracts at $1. 35 ( the risk per contract is $1. 15 ) § This would require $5805 of capital (not including commissions) § We are actually risking 86% of the capital

Position Size § If we are going to risk $5000 we will buy 43 contracts at $1. 35 ( the risk per contract is $1. 15 ) § This would require $5805 of capital (not including commissions) § We are actually risking 86% of the capital

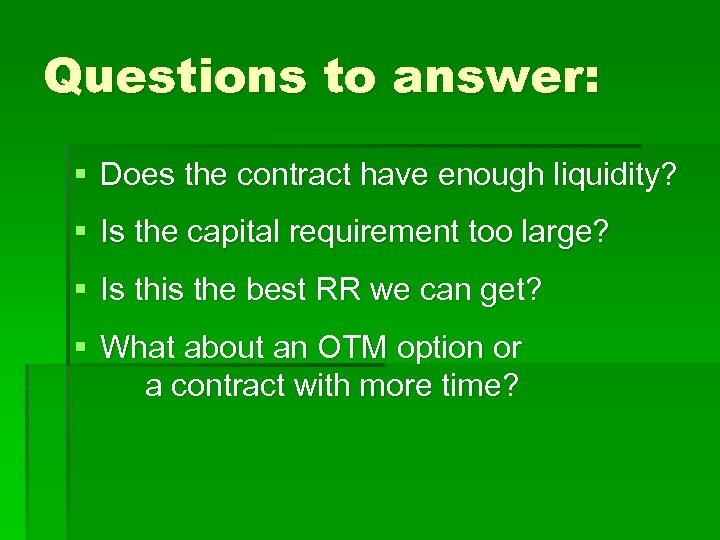

Questions to answer: § Does the contract have enough liquidity? § Is the capital requirement too large? § Is this the best RR we can get? § What about an OTM option or a contract with more time?

Questions to answer: § Does the contract have enough liquidity? § Is the capital requirement too large? § Is this the best RR we can get? § What about an OTM option or a contract with more time?

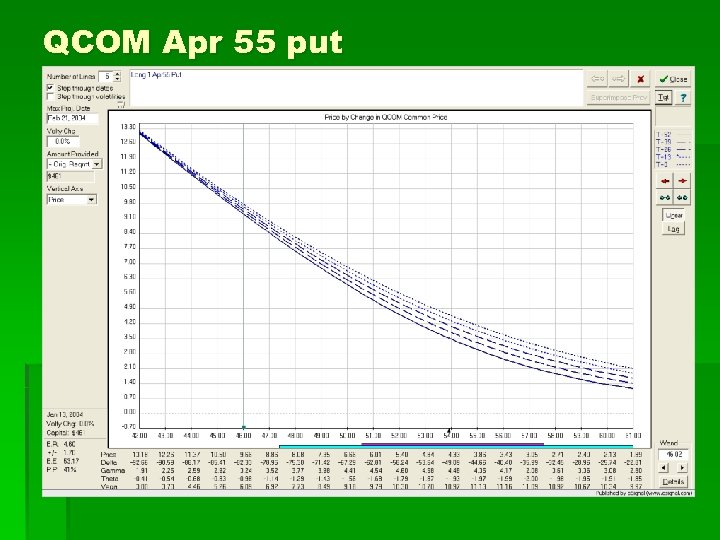

QCOM Apr 55 put

QCOM Apr 55 put

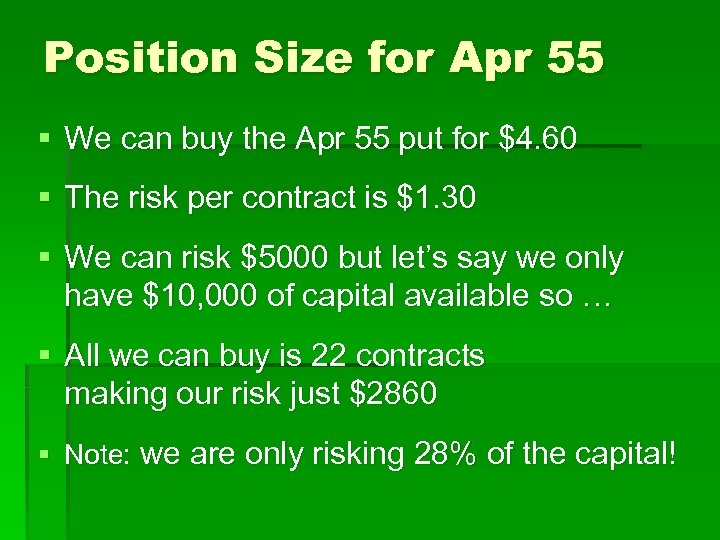

Position Size for Apr 55 § We can buy the Apr 55 put for $4. 60 § The risk per contract is $1. 30 § We can risk $5000 but let’s say we only have $10, 000 of capital available so … § All we can buy is 22 contracts making our risk just $2860 § Note: we are only risking 28% of the capital!

Position Size for Apr 55 § We can buy the Apr 55 put for $4. 60 § The risk per contract is $1. 30 § We can risk $5000 but let’s say we only have $10, 000 of capital available so … § All we can buy is 22 contracts making our risk just $2860 § Note: we are only risking 28% of the capital!

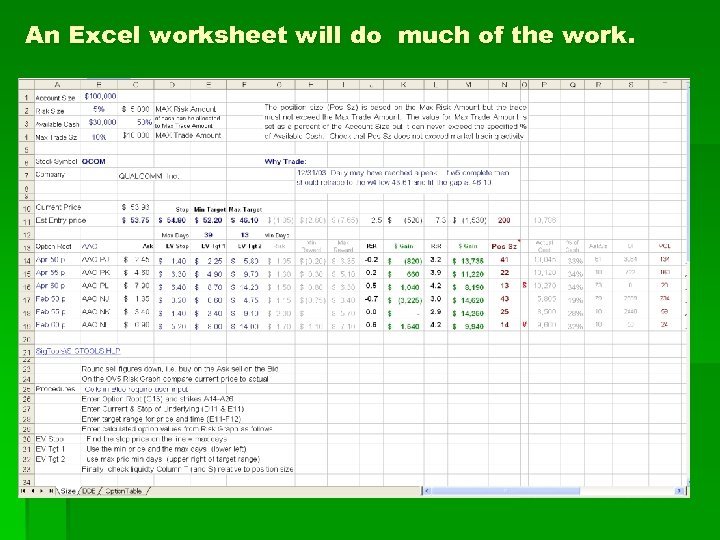

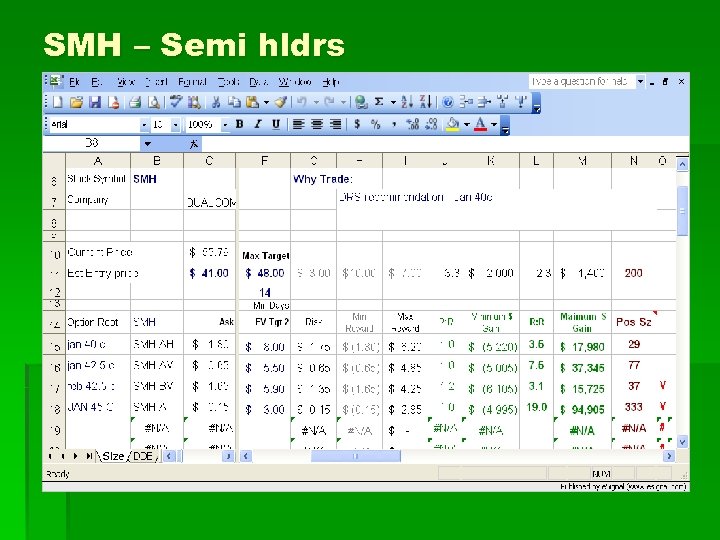

An Excel worksheet will do much of the work.

An Excel worksheet will do much of the work.

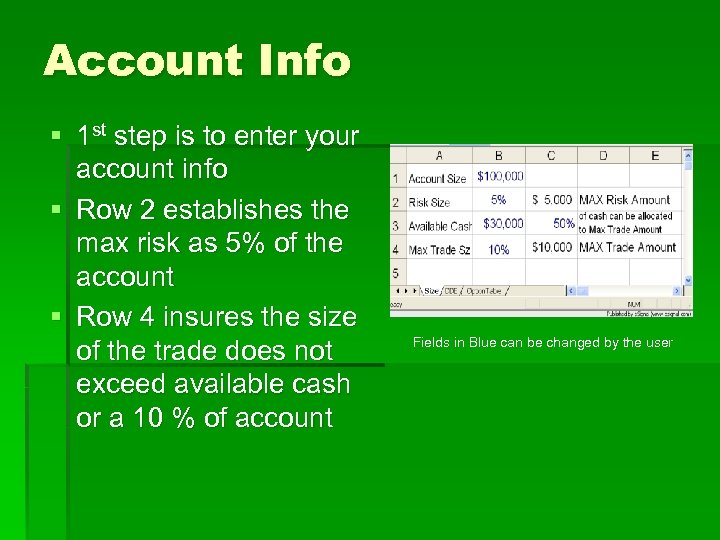

Account Info § 1 st step is to enter your account info § Row 2 establishes the max risk as 5% of the account § Row 4 insures the size of the trade does not exceed available cash or a 10 % of account Fields in Blue can be changed by the user

Account Info § 1 st step is to enter your account info § Row 2 establishes the max risk as 5% of the account § Row 4 insures the size of the trade does not exceed available cash or a 10 % of account Fields in Blue can be changed by the user

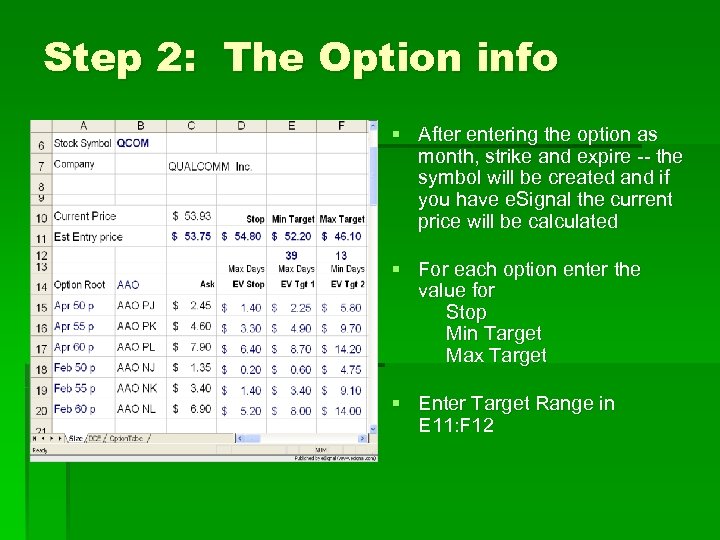

Step 2: The Option info § After entering the option as month, strike and expire -- the symbol will be created and if you have e. Signal the current price will be calculated § For each option enter the value for Stop Min Target Max Target § Enter Target Range in E 11: F 12

Step 2: The Option info § After entering the option as month, strike and expire -- the symbol will be created and if you have e. Signal the current price will be calculated § For each option enter the value for Stop Min Target Max Target § Enter Target Range in E 11: F 12

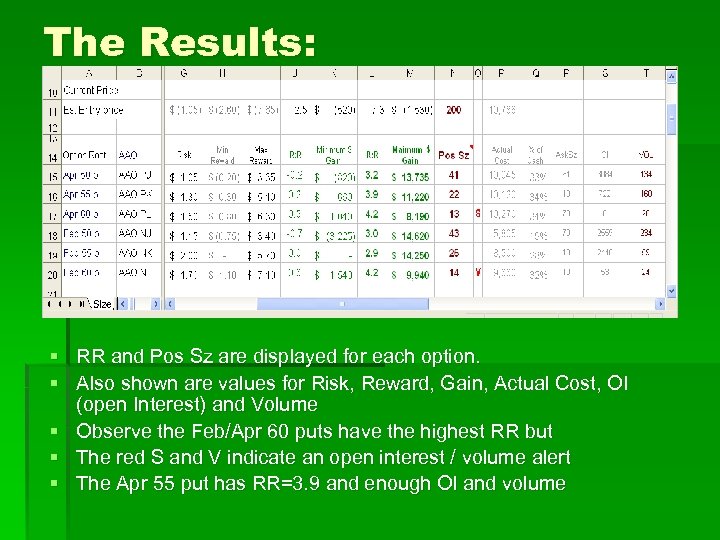

The Results: § RR and Pos Sz are displayed for each option. § Also shown are values for Risk, Reward, Gain, Actual Cost, OI (open Interest) and Volume § Observe the Feb/Apr 60 puts have the highest RR but § The red S and V indicate an open interest / volume alert § The Apr 55 put has RR=3. 9 and enough OI and volume

The Results: § RR and Pos Sz are displayed for each option. § Also shown are values for Risk, Reward, Gain, Actual Cost, OI (open Interest) and Volume § Observe the Feb/Apr 60 puts have the highest RR but § The red S and V indicate an open interest / volume alert § The Apr 55 put has RR=3. 9 and enough OI and volume

Any Questions? If you would like a copy of the presentation or the Excel spreadsheet send an email to: pjscardino@yahoo. com Give me the courage to pull the trigger when the market has changed; Give me the strength to hold my ground when it hasn’t; And give me the wisdom to know the difference!

Any Questions? If you would like a copy of the presentation or the Excel spreadsheet send an email to: pjscardino@yahoo. com Give me the courage to pull the trigger when the market has changed; Give me the strength to hold my ground when it hasn’t; And give me the wisdom to know the difference!

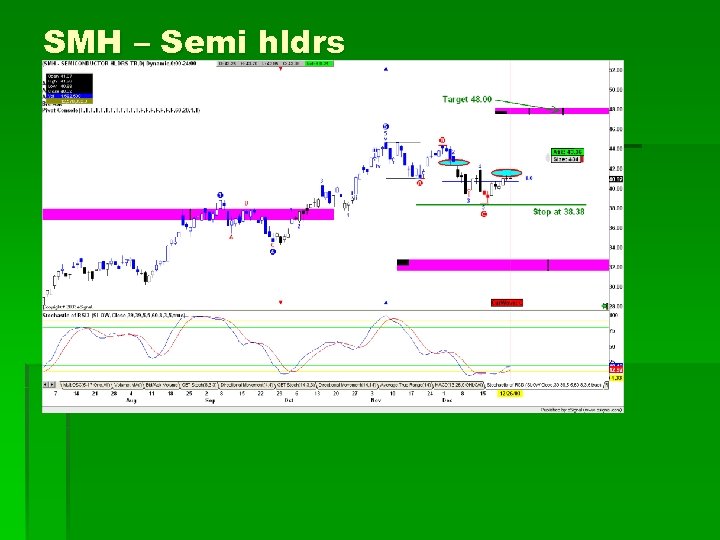

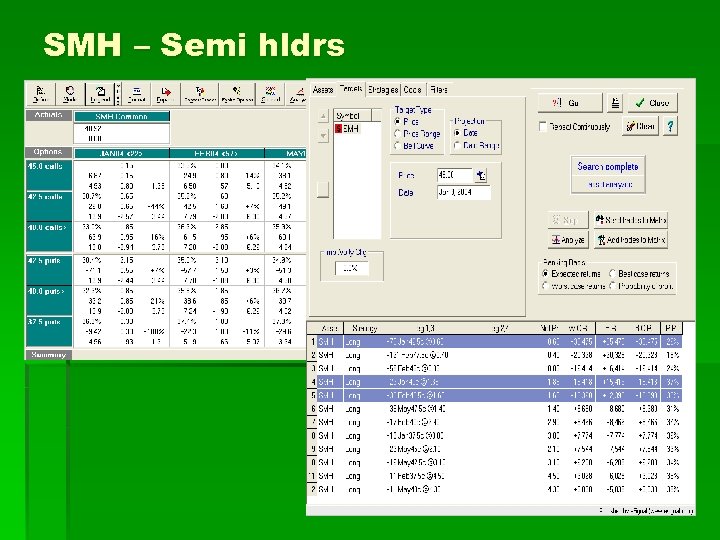

SMH – Semi hldrs

SMH – Semi hldrs

SMH – Semi hldrs

SMH – Semi hldrs

SMH – Semi hldrs

SMH – Semi hldrs

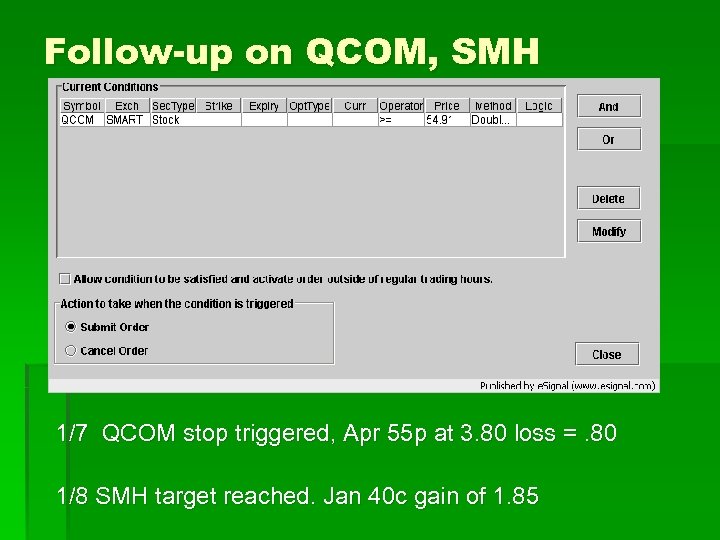

Follow-up on QCOM, SMH 1/7 QCOM stop triggered, Apr 55 p at 3. 80 loss =. 80 1/8 SMH target reached. Jan 40 c gain of 1. 85

Follow-up on QCOM, SMH 1/7 QCOM stop triggered, Apr 55 p at 3. 80 loss =. 80 1/8 SMH target reached. Jan 40 c gain of 1. 85