6 loans Legal basis of borrowings and government credits.pptx

- Количество слайдов: 10

Theme 6: Legal basis of borrowings and government credits

Questions: 1. The notion of public credits 2. Concept of public borrowings 3. Types and forms of government borrowings

The notion of public credits 1. State credit is a set of credit relationships, in which one of the parties is a state, and other individuals and entities. In the field of international credit, states can act both as lenders and borrowers. Usually, the state is the borrower of money, and creditors are banks, government agencies, corporations, insurance companies, the government acts in the role of the lender and the borrower are local governments, state enterprises, etc.

Concept of public borrowings Public borrowings of the RK executed by the Government of the Republic of Kazakhstan, the National Bank of Kazakhstan and local executive bodies. Borrowings by the Government of the Republic of Kazakhstan is provided in order to finance the national budget deficit. Borrowings of the National Bank RK are aimed to support the balance of payments of the Republic of Kazakhstan and the replenishment of gold reserves of the National Bank of RK, as well as other objectives defined in the Republic of Kazakhstan held monetary policy. Government borrowings by local authorities act in order to finance local investment projects, as well as for other purposes, provided the budget legislation of Kazakhstan.

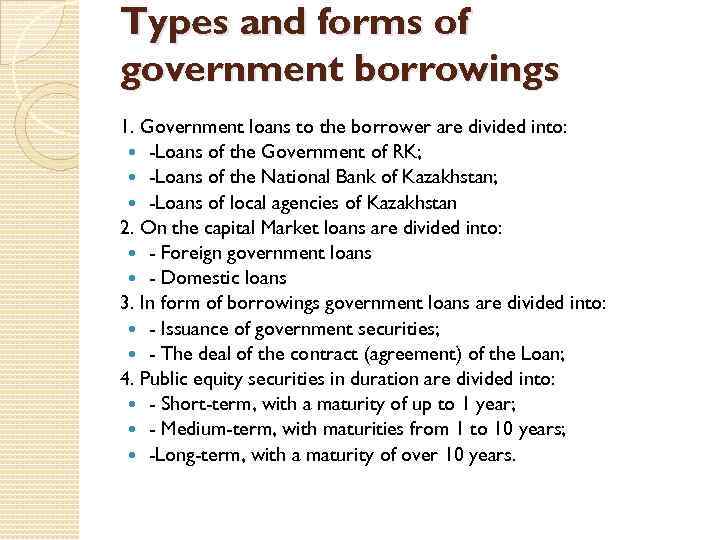

Types and forms of government borrowings 1. Government loans to the borrower are divided into: -Loans of the Government of RK; -Loans of the National Bank of Kazakhstan; -Loans of local agencies of Kazakhstan 2. On the capital Market loans are divided into: - Foreign government loans - Domestic loans 3. In form of borrowings government loans are divided into: - Issuance of government securities; - The deal of the contract (agreement) of the Loan; 4. Public equity securities in duration are divided into: - Short-term, with a maturity of up to 1 year; - Medium-term, with maturities from 1 to 10 years; -Long-term, with a maturity of over 10 years.

Public equity securities may be issued in certificated and uncertificated form. Government issuing bearer securities can be issued only in paper form. Public equity securities may be issued at face value and the discounted, fixed and floating interest rate.

The forms and methods government credit The main forms of credit are government loans, which are credit relations, in which the state acts as a debtor. Form of government credit is the circulation of balances from deposits of population in the state banks on the formation of the loan fund in order to finance public spending.

Usually it is savings banks, if capital owned by the state, then it is responsible for the risks of deposits use, in the case of state participation in the capital of saving bank (joint) there are problems connected with options of effective use of maintenance margin according to the opinions of the founders (shareholders) of the bank.

The next form of government credit - attraction of means of central emission bank of the country. Given form is accompanied by inflationary depreciation of money in circulation, even if such borrowing is carried out on commercial terms, that is, considering current norms of loan interest : this is due to a significant one-time infusion of money into the economy, and their exemption (if held) can last for long period of time. To this form the government resorts when it is forced by the restriction of the use of other forms of government credit, caused by various negative factors: crisis situations, loss of trust in the government securities emergency situations.

Operations of the government opposite to attraction of monetary funds available to the government, local authorities, are provision of credit from their side to legal and natural persons. This form of loan is called a state (treasury) loans and intended to support companies and organizations in case of an urgent need for cash resources in financial difficulties or lack of resources for development. As a rule, they include household enterprises of social and scientific value and loans are available to them on favorable terms - namely, with longer term of the return and with interest, below the current market. This form of financial support is provided to households during the implementation of housing construction programs, the development of farming, for getting education, etc.

6 loans Legal basis of borrowings and government credits.pptx