а4 Денежные системы.ppt

- Количество слайдов: 81

Theme 4 "Monetary Systems" 1. The nature, structure and elements of the monetary system. 2. Types of monetary systems and their evolution. 3. National monetary system of Ukraine. 4. Government regulation of money circulation. 5. Monetary policy, goals, types, tools. 6. Monetization of fiscal deficit to GDP. 1

Theme 4 "Monetary Systems" 1. The nature, structure and elements of the monetary system. 2. Types of monetary systems and their evolution. 3. National monetary system of Ukraine. 4. Government regulation of money circulation. 5. Monetary policy, goals, types, tools. 6. Monetization of fiscal deficit to GDP. 1

1. The nature, structure and elements of the monetary system 2

1. The nature, structure and elements of the monetary system 2

Monetary system State-established form of organization money turnover in the country. 3

Monetary system State-established form of organization money turnover in the country. 3

Objects of the regulatory impact of the monetary system • Cashless settlement system; • System of cash turnover; • Currency system. 4

Objects of the regulatory impact of the monetary system • Cashless settlement system; • System of cash turnover; • Currency system. 4

Structure of the monetary system The state sector • The Central Bank; • • The Treasury; • • The Mint. • The commercial sector Commercial banks; Savings banks; Non-bank financial institutions. 5

Structure of the monetary system The state sector • The Central Bank; • • The Treasury; • • The Mint. • The commercial sector Commercial banks; Savings banks; Non-bank financial institutions. 5

The elements of the monetary system • • • Monetary unit; Scale of prices; Order of ensuring banknotes; Emission mechanism; Structure of the money supply in circulation; Mechanism of monetary control; Procedure for establishing the exchange rate; Cash discipline; Procedure for cashless payments; Order of forecast planning 6

The elements of the monetary system • • • Monetary unit; Scale of prices; Order of ensuring banknotes; Emission mechanism; Structure of the money supply in circulation; Mechanism of monetary control; Procedure for establishing the exchange rate; Cash discipline; Procedure for cashless payments; Order of forecast planning 6

1. Monetary unit as an element of the monetary system is established in law banknote, which serves expression and comparing of all commodities prices. Currency is the legal tender. Name of monetary unit develops historically, but in some cases (for example, in revolutions, political upheavals, divide the country, or vice versa, bringing countries into an economic and political union) state may establish a new monetary unit name. Types of banknotes - are credit bank notes (bills), government paper money (Treasury bills) and small coins, serving legal 7 tender in the country.

1. Monetary unit as an element of the monetary system is established in law banknote, which serves expression and comparing of all commodities prices. Currency is the legal tender. Name of monetary unit develops historically, but in some cases (for example, in revolutions, political upheavals, divide the country, or vice versa, bringing countries into an economic and political union) state may establish a new monetary unit name. Types of banknotes - are credit bank notes (bills), government paper money (Treasury bills) and small coins, serving legal 7 tender in the country.

2. The scale of prices is a way of expressing the value in monetary units, the technical function of money. When the money commodity - metal performed all the functions of money, the price scale is the weight amount of the monetary metal, accepted in the country as a monetary unit or multiple units. State fixed scale of prices in law. 8

2. The scale of prices is a way of expressing the value in monetary units, the technical function of money. When the money commodity - metal performed all the functions of money, the price scale is the weight amount of the monetary metal, accepted in the country as a monetary unit or multiple units. State fixed scale of prices in law. 8

Initially, the weight content of coins coincided with the scale of prices that even reflected in the name of some monetary units (GB pound was a pound of silver). However, in the course of historical development, the scale of prices gradually marginalize the weight content of coins. This was due to the deterioration of coins, their wear and tear, the transition to the coinage of more cheap metals instead of expensive metals (copper instead of silver). 9

Initially, the weight content of coins coincided with the scale of prices that even reflected in the name of some monetary units (GB pound was a pound of silver). However, in the course of historical development, the scale of prices gradually marginalize the weight content of coins. This was due to the deterioration of coins, their wear and tear, the transition to the coinage of more cheap metals instead of expensive metals (copper instead of silver). 9

With the termination of the exchange of lending money on the official gold price scale has lost its economic sense. And finally, as a result of currency reform 19761978 (based on the Jamaican agreement) official price of gold and the gold content of the monetary units were canceled. Currently, the scale of prices formed spontaneously and serves of comparing the values of commodities through price. 10

With the termination of the exchange of lending money on the official gold price scale has lost its economic sense. And finally, as a result of currency reform 19761978 (based on the Jamaican agreement) official price of gold and the gold content of the monetary units were canceled. Currently, the scale of prices formed spontaneously and serves of comparing the values of commodities through price. 10

3. Order of ensuring banknotes is a characteristic of species and the basic rules of their providing. Providing is located in banks' assets, inventory values, gold, freely convertible currency, securities and other debt obligations. 11

3. Order of ensuring banknotes is a characteristic of species and the basic rules of their providing. Providing is located in banks' assets, inventory values, gold, freely convertible currency, securities and other debt obligations. 11

4. Emission mechanism - enshrined in law the procedure for issuance of money in circulation and their withdrawal from circulation. Non-cash money is issued by commercial banks in the process of committing their lending operations. Upon repayment of loans provided by the withdrawal of money from circulation. Issue of cash is made through cash settlement centers of the central bank. Cash withdrawal occurs when depositing cash commercial banks cash settlement centers. 12

4. Emission mechanism - enshrined in law the procedure for issuance of money in circulation and their withdrawal from circulation. Non-cash money is issued by commercial banks in the process of committing their lending operations. Upon repayment of loans provided by the withdrawal of money from circulation. Issue of cash is made through cash settlement centers of the central bank. Cash withdrawal occurs when depositing cash commercial banks cash settlement centers. 12

5. Structure of the money supply in circulation. It is considered in two ways. This is either the ratio between cash and non-monetary mass, or the ratio between money signs different denominations throughout the volume of money supply. 13

5. Structure of the money supply in circulation. It is considered in two ways. This is either the ratio between cash and non-monetary mass, or the ratio between money signs different denominations throughout the volume of money supply. 13

6. Mechanism of monetary control: - set of methods, techniques, tools of government influence on monetary sphere of the economy; includes tasks, objects and institutions of the monetary authorities, rights, duties and responsibilities of its offering. 14

6. Mechanism of monetary control: - set of methods, techniques, tools of government influence on monetary sphere of the economy; includes tasks, objects and institutions of the monetary authorities, rights, duties and responsibilities of its offering. 14

7. The procedure for establishing the exchange rate, which is determined on the basis of quotations. Quote is identification and se of exchange rates of foreign currencies against the national currency. Quote rates to determine the ratio of the two monetary units proposed for exchange. This ratio can not be constant, as changing supply and demand in the foreign exchange market. Quotation spend the central (national) banks and large commercial banks. There are official and free (market) currency quotes. 15

7. The procedure for establishing the exchange rate, which is determined on the basis of quotations. Quote is identification and se of exchange rates of foreign currencies against the national currency. Quote rates to determine the ratio of the two monetary units proposed for exchange. This ratio can not be constant, as changing supply and demand in the foreign exchange market. Quotation spend the central (national) banks and large commercial banks. There are official and free (market) currency quotes. 15

8. Cash discipline is a set of common rules, forms the primary cash instruments, reporting forms, which should guide the enterprises and organizations of all forms of ownership in the organization of cash turnover, passing through their offices. Control over the observance of cash discipline entrusted to commercial banks. 16

8. Cash discipline is a set of common rules, forms the primary cash instruments, reporting forms, which should guide the enterprises and organizations of all forms of ownership in the organization of cash turnover, passing through their offices. Control over the observance of cash discipline entrusted to commercial banks. 16

9. Procedure for cashless payments assumes control accounts, which are made non-cash payments in the economy, forms of settlement and liabilities that arise in noncash payments. 17

9. Procedure for cashless payments assumes control accounts, which are made non-cash payments in the economy, forms of settlement and liabilities that arise in noncash payments. 17

10. Order of forecast planning defines the goals and objectives of the forecast planning, organizations and institutions, planners, system plans themselves predictive of monetary circulation, their compilation methodology and a set of calculated parameters and indicators. 18

10. Order of forecast planning defines the goals and objectives of the forecast planning, organizations and institutions, planners, system plans themselves predictive of monetary circulation, their compilation methodology and a set of calculated parameters and indicators. 18

Principles of construction of the monetary system are reflected in the elements of the monetary system and affect them. Principles of construction of the monetary system of the market type: … 19

Principles of construction of the monetary system are reflected in the elements of the monetary system and affect them. Principles of construction of the monetary system of the market type: … 19

1. Principle of centralized money system management. Management of money systems in a market economy model is characterized by the fact that here more important are economic methods (but no administrative management techniques), when the state through central banks puts on markets such conditions that cause banks, financial institutions and other entities to take the necessary to the state decisions. 20

1. Principle of centralized money system management. Management of money systems in a market economy model is characterized by the fact that here more important are economic methods (but no administrative management techniques), when the state through central banks puts on markets such conditions that cause banks, financial institutions and other entities to take the necessary to the state decisions. 20

2. The principle of predictive planning of money turnover. Plans for the money turnover and its components are not prepared as policy plans that are mandatory for specific bodies, but as projections (targets), to which we should strive. The exception is the state budget, which is in any type of monetary system remains up policy plan, which is responsible for the implementation of the Government and the Ministry of Finance. 21

2. The principle of predictive planning of money turnover. Plans for the money turnover and its components are not prepared as policy plans that are mandatory for specific bodies, but as projections (targets), to which we should strive. The exception is the state budget, which is in any type of monetary system remains up policy plan, which is responsible for the implementation of the Government and the Ministry of Finance. 21

3. The principle of sustainability and resilience of money turnover. The monetary system should be organized so as to prevent inflation and increase money circulation, if the economy needs more cash, and narrow them, if these requirements reduced. 22

3. The principle of sustainability and resilience of money turnover. The monetary system should be organized so as to prevent inflation and increase money circulation, if the economy needs more cash, and narrow them, if these requirements reduced. 22

Under certain conditions (decline in production, the budget deficit, lack of turnover means of payment) the stability of money market can be broken, and there is a payments crisis. Overcoming this crisis is possible through a set of measures, including the development of production, reducing the budget deficit. 23

Under certain conditions (decline in production, the budget deficit, lack of turnover means of payment) the stability of money market can be broken, and there is a payments crisis. Overcoming this crisis is possible through a set of measures, including the development of production, reducing the budget deficit. 23

4. The principle of credit nature of money emission. The emergence of new banknotes (cash and non-cash) in business turnover is only possible as a result of banks lending operations. From other sources, including Treasuries, banknotes in circulation should not come. 24

4. The principle of credit nature of money emission. The emergence of new banknotes (cash and non-cash) in business turnover is only possible as a result of banks lending operations. From other sources, including Treasuries, banknotes in circulation should not come. 24

5. The principle of security of issued banknotes in circulation. In a market economy moneys provided by the banks' assets located in the inventory values, gold, freely convertible currency, securities and other debt obligations. 25

5. The principle of security of issued banknotes in circulation. In a market economy moneys provided by the banks' assets located in the inventory values, gold, freely convertible currency, securities and other debt obligations. 25

6. Principle of disobeying of central bank to the government and the central bank's accountability to parliament of the country. Maintaining the stability of monetary turnover, fighting inflation is a priority task for the central bank. Without this principle, there would be a threat the government to solve it’s tasks will begin to withdraw funds from the central bank, and thus the stability of money circulation will be destroyed. 26

6. Principle of disobeying of central bank to the government and the central bank's accountability to parliament of the country. Maintaining the stability of monetary turnover, fighting inflation is a priority task for the central bank. Without this principle, there would be a threat the government to solve it’s tasks will begin to withdraw funds from the central bank, and thus the stability of money circulation will be destroyed. 26

But the central bank can pursue a policy contrary to the current tasks of the state, so the central bank should regularly report to the Parliament, which is designed to help bridge the differences between the central bank and the government. 27

But the central bank can pursue a policy contrary to the current tasks of the state, so the central bank should regularly report to the Parliament, which is designed to help bridge the differences between the central bank and the government. 27

7. Principle of providing government funds only in lending practices. Usually in the legislations of countries with market economies, there is provision that the central bank should not finance government, and to provide means to it only in order to ensure a certain lending (real estate, commodities and materials owned by the state government securities). 28

7. Principle of providing government funds only in lending practices. Usually in the legislations of countries with market economies, there is provision that the central bank should not finance government, and to provide means to it only in order to ensure a certain lending (real estate, commodities and materials owned by the state government securities). 28

This prevents the use of money to cover the budget deficit and not to give an incentive to the development of the inflationary process. This forces the government to seek other sources of income to the budget to cover government spending. 29

This prevents the use of money to cover the budget deficit and not to give an incentive to the development of the inflationary process. This forces the government to seek other sources of income to the budget to cover government spending. 29

8. The principle of the integrated use of instruments of monetary regulation. The central bank should not be limited to any single instrument of monetary control to maintain the stability of money circulation, and will use a combination of these tools, otherwise the desired effect can not reach. 30

8. The principle of the integrated use of instruments of monetary regulation. The central bank should not be limited to any single instrument of monetary control to maintain the stability of money circulation, and will use a combination of these tools, otherwise the desired effect can not reach. 30

9. The principle of supervision and control of the money in circulation. State through the bank and financial systems and tax authorities should ensure permanent control of both all the money in circulation as a whole and for individual cash flows in the economy. Furthermore, the object of control is compliance of economic subjects major principles of the organization, both in cash and cashless transactions. 31

9. The principle of supervision and control of the money in circulation. State through the bank and financial systems and tax authorities should ensure permanent control of both all the money in circulation as a whole and for individual cash flows in the economy. Furthermore, the object of control is compliance of economic subjects major principles of the organization, both in cash and cashless transactions. 31

10. The principle of operation of an exclusive national currency in the country. The country's legislation provides for payments for goods and services within the country to produce exclusively in the national currency. 32

10. The principle of operation of an exclusive national currency in the country. The country's legislation provides for payments for goods and services within the country to produce exclusively in the national currency. 32

This does not mean, of course, that the population can not in the country freely exchange the national currency to the currencies of other countries, but the use of such currency, resulting in the exchange is allowed for payments abroad, as well as rooms in deposits at banks. 33

This does not mean, of course, that the population can not in the country freely exchange the national currency to the currencies of other countries, but the use of such currency, resulting in the exchange is allowed for payments abroad, as well as rooms in deposits at banks. 33

2. Types of monetary systems and their evolution 34

2. Types of monetary systems and their evolution 34

Type of monetary system Is determined by the content of its elements by their interaction, which determine trends and patterns of functioning of the monetary system 35

Type of monetary system Is determined by the content of its elements by their interaction, which determine trends and patterns of functioning of the monetary system 35

Classification of the types of monetary systems 36

Classification of the types of monetary systems 36

1. Depending on the form in which money operates • Metal system turnover • System of paper and credit turnover 37

1. Depending on the form in which money operates • Metal system turnover • System of paper and credit turnover 37

2. By the nature of the economic system • Market • Nonmarket 38

2. By the nature of the economic system • Market • Nonmarket 38

3. By the nature of regulation of monetary relations • Open • Closed 39

3. By the nature of regulation of monetary relations • Open • Closed 39

The evolution of monetary systems • Self-regulating; • Adjustable. 40

The evolution of monetary systems • Self-regulating; • Adjustable. 40

Self-regulated monetary system • Bimetallism; • Monometallism. 41

Self-regulated monetary system • Bimetallism; • Monometallism. 41

Varieties of bimetallism 1. The system of "parallel" currency the ratio between gold and silver coins is spontaneously installed accordingly to the market value of monetary metals. 42

Varieties of bimetallism 1. The system of "parallel" currency the ratio between gold and silver coins is spontaneously installed accordingly to the market value of monetary metals. 42

2. Dual monetary system The ratio between the two metals traded on an equal basis the state establishes by law. 43

2. Dual monetary system The ratio between the two metals traded on an equal basis the state establishes by law. 43

3. The system of "lame currency" One type of coin has been struck in private 44

3. The system of "lame currency" One type of coin has been struck in private 44

Monometallism • Silver; • Gold. 45

Monometallism • Silver; • Gold. 45

Variety of gold monometallism 1. Gold coin standard Gold performs all the functions of money in circulation were gold coins and banknotes are freely exchanged for gold. 46

Variety of gold monometallism 1. Gold coin standard Gold performs all the functions of money in circulation were gold coins and banknotes are freely exchanged for gold. 46

2. Gold bullion standard In turnover there are no gold coins and banknotes are exchanged for standard gold bullion 47

2. Gold bullion standard In turnover there are no gold coins and banknotes are exchanged for standard gold bullion 47

3. Gold exchange standard In turnover there are no gold coins, and banknotes are exchanged foreign currency, which is exchanged for gold 48

3. Gold exchange standard In turnover there are no gold coins, and banknotes are exchanged foreign currency, which is exchanged for gold 48

3. National monetary system of Ukraine 49

3. National monetary system of Ukraine 49

National monetary system State-established form of organization of money turnover in the country, stated by national legislation. 50

National monetary system State-established form of organization of money turnover in the country, stated by national legislation. 50

National monetary system of Ukraine • Market-based monetary system; • Currency – hryvnia, small change kopeyka; • The scale of prices - a way of expressing the value of goods in terms of money; • Types and denominations of currency - 1, 2, 5, 10, 20, 50, 100, 200, 500 UAH. 1, 2, 5, 10, 25, 50 kopeykas 51

National monetary system of Ukraine • Market-based monetary system; • Currency – hryvnia, small change kopeyka; • The scale of prices - a way of expressing the value of goods in terms of money; • Types and denominations of currency - 1, 2, 5, 10, 20, 50, 100, 200, 500 UAH. 1, 2, 5, 10, 25, 50 kopeykas 51

• Regulation of cash and noncash turnover - NBU; • Exchange rate - the official rate of the hryvnia - NBU; • State institutions in charge of regulation money turnover - NBU 52

• Regulation of cash and noncash turnover - NBU; • Exchange rate - the official rate of the hryvnia - NBU; • State institutions in charge of regulation money turnover - NBU 52

4. State regulation of money turnover 53

4. State regulation of money turnover 53

State economic policies • Structural policy • Fiscal (budget and tax) policy • Monetary policy • Pricing policy • Social policy • Competition state policy 54

State economic policies • Structural policy • Fiscal (budget and tax) policy • Monetary policy • Pricing policy • Social policy • Competition state policy 54

Economic policy is focused influence on socio-economic processes (macro and micro), the establishment and improvement of conditions for economic development, corresponding to a certain social order. 55

Economic policy is focused influence on socio-economic processes (macro and micro), the establishment and improvement of conditions for economic development, corresponding to a certain social order. 55

Structural policy involves the formation of a progressive and effective structure of the national economy. 56

Structural policy involves the formation of a progressive and effective structure of the national economy. 56

Fiscal (budget and tax) policy determines the funding of the state treasury, tax system and the formation of the state budget. 57

Fiscal (budget and tax) policy determines the funding of the state treasury, tax system and the formation of the state budget. 57

Monetary policy is public provision of the necessary amount of money in economy, regulation of money and credit markets. 58

Monetary policy is public provision of the necessary amount of money in economy, regulation of money and credit markets. 58

Pricing policy is the state's influence on prices and pricing in order to influence inflation, promote the upgrading of production, strengthening the competitiveness of domestic products in the world market, the implementation of situational and structural policies, mitigate social tensions. 59

Pricing policy is the state's influence on prices and pricing in order to influence inflation, promote the upgrading of production, strengthening the competitiveness of domestic products in the world market, the implementation of situational and structural policies, mitigate social tensions. 59

Social policy focuses on building effective social and economic conditions of society, the regulation of relations between social groups, the formation of economic incentives to participate in the production, provision of effective employment, social security and creating conditions for improving the well-being of members of society. 60

Social policy focuses on building effective social and economic conditions of society, the regulation of relations between social groups, the formation of economic incentives to participate in the production, provision of effective employment, social security and creating conditions for improving the well-being of members of society. 60

Competition state policy aims to develop methods to create a competitive environment, promote and protect fair competition, fight monopoly. 61

Competition state policy aims to develop methods to create a competitive environment, promote and protect fair competition, fight monopoly. 61

5. Monetary policy, its goals, types, tools 62

5. Monetary policy, its goals, types, tools 62

Monetary policy A set of interrelated and coordinated with defined goals activities for management of money turnover provided by the State through the central bank. 63

Monetary policy A set of interrelated and coordinated with defined goals activities for management of money turnover provided by the State through the central bank. 63

Objects of monetary policy • The money supply; • Interest rate; • The velocity of money; • Exchange Rates. 64

Objects of monetary policy • The money supply; • Interest rate; • The velocity of money; • Exchange Rates. 64

The subjects of the monetary policy • NBU; • Government; • Verkhovna Rada. 65

The subjects of the monetary policy • NBU; • Government; • Verkhovna Rada. 65

Goals of monetary policy 1. Strategic. Promoting the growth of production, full employment, price stability and balance of payments surplus. 66

Goals of monetary policy 1. Strategic. Promoting the growth of production, full employment, price stability and balance of payments surplus. 66

2. Intermediate. recovery or containment of market conditions to achieve strategic goals. 3. Tactical. Change in the money supply and interest rates in a direction that achieves milestones. 67

2. Intermediate. recovery or containment of market conditions to achieve strategic goals. 3. Tactical. Change in the money supply and interest rates in a direction that achieves milestones. 67

Tools of monetary policy Concrete measures and central bank actions aimed at changing the quantity of money and the interest rate. 68

Tools of monetary policy Concrete measures and central bank actions aimed at changing the quantity of money and the interest rate. 68

Policy of open market The change in the purchase and sale of government securities by the central bank 69

Policy of open market The change in the purchase and sale of government securities by the central bank 69

Policy of required reserves The central bank sets the rate for all banks compulsory saving of funds in correspondent accounts without the right to the use and payment of interest on them. 70

Policy of required reserves The central bank sets the rate for all banks compulsory saving of funds in correspondent accounts without the right to the use and payment of interest on them. 70

Discounting policy The central bank sets the interest rate on loans, which it provides to commercial banks in order to refinance. 71

Discounting policy The central bank sets the interest rate on loans, which it provides to commercial banks in order to refinance. 71

6. Monetization of fiscal deficit and GDP 72

6. Monetization of fiscal deficit and GDP 72

Monetization of budget deficit Search for sufficient funds to cover the exceeded budgetary expenditures of budgetary revenues. 73

Monetization of budget deficit Search for sufficient funds to cover the exceeded budgetary expenditures of budgetary revenues. 73

Ways to raise money 1. Increase the taxation of economic agents by raising tax rates, the introduction of new taxes, the abolition of privileges. • Changes in legislation 74

Ways to raise money 1. Increase the taxation of economic agents by raising tax rates, the introduction of new taxes, the abolition of privileges. • Changes in legislation 74

2. Allow the government (Treasury) to issue its own debt in the amount sufficient to cover the budget deficit, and provide them with the status of legal tender. • Seignorage - revenue that the government receives as a result of the monopoly right to print money 75

2. Allow the government (Treasury) to issue its own debt in the amount sufficient to cover the budget deficit, and provide them with the status of legal tender. • Seignorage - revenue that the government receives as a result of the monopoly right to print money 75

3. Allow the government to issue its own securities and sold on the domestic and foreign markets. • The best way, but if the budget deficit is not chronic, and is small 76

3. Allow the government to issue its own securities and sold on the domestic and foreign markets. • The best way, but if the budget deficit is not chronic, and is small 76

4. Allow the Central Bank to lend to the government in the amount of the budget deficit. • NBU may not make direct loans to finance the expenses of the state budget (Article 54 of the Law of Ukraine "On the National Bank"). 77

4. Allow the Central Bank to lend to the government in the amount of the budget deficit. • NBU may not make direct loans to finance the expenses of the state budget (Article 54 of the Law of Ukraine "On the National Bank"). 77

Monetization of GDP • Bringing the quantity of money in circulation to a level sufficient for the success of the entire volume of manufactured goods, services, and debt repayment 78

Monetization of GDP • Bringing the quantity of money in circulation to a level sufficient for the success of the entire volume of manufactured goods, services, and debt repayment 78

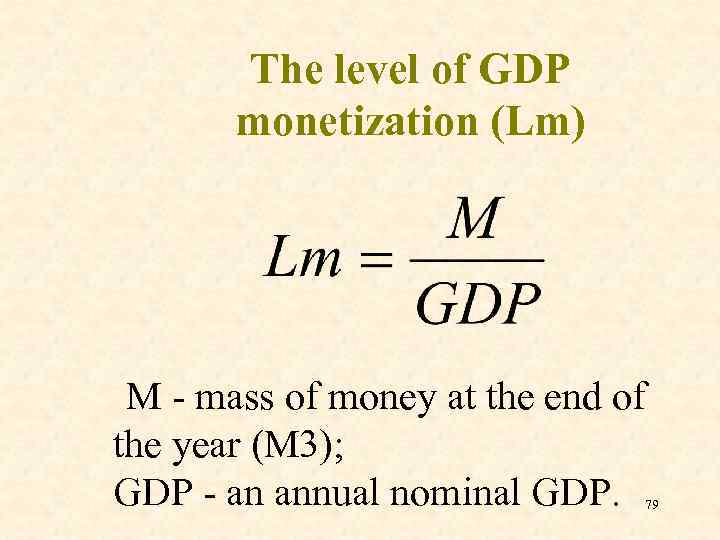

The level of GDP monetization (Lm) M - mass of money at the end of the year (M 3); GDP - an annual nominal GDP. 79

The level of GDP monetization (Lm) M - mass of money at the end of the year (M 3); GDP - an annual nominal GDP. 79

Questions to test the learning material: 1. Explain, please, the essence of monetary system. 2. Describe, please, the structure of monetary system. 3. Please list the elements of the monetary system. 4. Please give us a classification of the types of monetary systems. 5. Please give us a definition of "silver monometallism" and "gold monometallism". 6. Please list the variety of gold monometallism. 80

Questions to test the learning material: 1. Explain, please, the essence of monetary system. 2. Describe, please, the structure of monetary system. 3. Please list the elements of the monetary system. 4. Please give us a classification of the types of monetary systems. 5. Please give us a definition of "silver monometallism" and "gold monometallism". 6. Please list the variety of gold monometallism. 80

Questions to test the learning material: 1. 2. 3. 4. Please give us a definition of "monetary policy". Please list the objectives of monetary policy. Please list the tools of monetary policy. Explain, please, the essence of monetization of budget deficit. 5. Explain, please, the essence of monetization of GDP. 6. Calculate, please, the level of GDP monetization (Lm). 81

Questions to test the learning material: 1. 2. 3. 4. Please give us a definition of "monetary policy". Please list the objectives of monetary policy. Please list the tools of monetary policy. Explain, please, the essence of monetization of budget deficit. 5. Explain, please, the essence of monetization of GDP. 6. Calculate, please, the level of GDP monetization (Lm). 81