а2 Денежный оборот.ppt

- Количество слайдов: 116

Theme 2: "Money turnover and the money supply" 1. 2. 3. 4. The concept of money turnover. Money supply and velocity of money. The law of the money turnover. Mechanism of substitution of money in circulation. 5. Non-cash payments. 1

Theme 2: "Money turnover and the money supply" 1. 2. 3. 4. The concept of money turnover. Money supply and velocity of money. The law of the money turnover. Mechanism of substitution of money in circulation. 5. Non-cash payments. 1

1. The concept of money turnover 2

1. The concept of money turnover 2

Money turnover Continuous movement of money in the process of production, distribution, exchange and consumption of domestic product, which is carried out by non-cash and cash payments. 3

Money turnover Continuous movement of money in the process of production, distribution, exchange and consumption of domestic product, which is carried out by non-cash and cash payments. 3

or money circulation the movement of money capital in the process of expanded social reproduction, directly involving the movement of money in the stages of distribution and exchange. Indirectly serves the processes of production and consumption, and therefore affects all stages of social reproduction. 4

or money circulation the movement of money capital in the process of expanded social reproduction, directly involving the movement of money in the stages of distribution and exchange. Indirectly serves the processes of production and consumption, and therefore affects all stages of social reproduction. 4

By the nature of the cash flow is divided into finance, credit, currency By the form of money the cash flow is divided into cash, non-cash 5

By the nature of the cash flow is divided into finance, credit, currency By the form of money the cash flow is divided into cash, non-cash 5

Money circulation is the process of creating, distributing, collecting and destroying currency. 6

Money circulation is the process of creating, distributing, collecting and destroying currency. 6

The first step in the money circulation process is printing banknotes. Many countries have a specific government department that handles this function; for example, in the United States, the United States Treasury and the FRS are in charge of printing money. 7

The first step in the money circulation process is printing banknotes. Many countries have a specific government department that handles this function; for example, in the United States, the United States Treasury and the FRS are in charge of printing money. 7

Distributing the currency is the next part of the money circulation process. After coins and banknotes are produced, they usually are sent to state and commercial banks. Once currency is held by a bank, it is distributed through ATM and cash offices to customers. From this point the coins and banknotes are used and reused for transactions by the general public. 8

Distributing the currency is the next part of the money circulation process. After coins and banknotes are produced, they usually are sent to state and commercial banks. Once currency is held by a bank, it is distributed through ATM and cash offices to customers. From this point the coins and banknotes are used and reused for transactions by the general public. 8

Life span is next step. The individuals and businesses use the money to buy and sell goods and services and then return it to the local banks in the form of deposits. During the course of these transactions, money wears out, just as any paper product would. 9

Life span is next step. The individuals and businesses use the money to buy and sell goods and services and then return it to the local banks in the form of deposits. During the course of these transactions, money wears out, just as any paper product would. 9

The average life span of a $1 is less than 22 months, according to the Federal Reserve Bank of Atlanta; $5 last about 16 months; $10 last about 18 months; and $20 last approximately two years. Lesser-used banknotes, such as $50 and $100, last much longer, because they don't circulate as much as the smaller denominations. Both $50 and $100 last several years before wearing out. Coins last about 25 years. 10

The average life span of a $1 is less than 22 months, according to the Federal Reserve Bank of Atlanta; $5 last about 16 months; $10 last about 18 months; and $20 last approximately two years. Lesser-used banknotes, such as $50 and $100, last much longer, because they don't circulate as much as the smaller denominations. Both $50 and $100 last several years before wearing out. Coins last about 25 years. 10

After money has been in the hands of the public for a time, it is ready for collection. In money circulation, the most common reason for collection is the mutilation of banknotes and coins. Banks collect currency with rips, tears and graffiti and return the money to the emission bank. This also happens when banks discover or suspect certain currency is counterfeit. 11

After money has been in the hands of the public for a time, it is ready for collection. In money circulation, the most common reason for collection is the mutilation of banknotes and coins. Banks collect currency with rips, tears and graffiti and return the money to the emission bank. This also happens when banks discover or suspect certain currency is counterfeit. 11

Destruction of unusable currency is the final step in money circulation. Older money is replaced by newer currency. The Federal Reserve Bank deems money unfit if there is less than half the banknote or if the banknote is so badly mutilated that there is question as to its value. 12

Destruction of unusable currency is the final step in money circulation. Older money is replaced by newer currency. The Federal Reserve Bank deems money unfit if there is less than half the banknote or if the banknote is so badly mutilated that there is question as to its value. 12

The Federal Reserve runs these bills through authenticity machines that check to make sure they are genuine. If they are genuine but not fit to be circulated again, the Federal Reserve destroys them by sending them to highspeed machines that shred the bills and packages them for disposal. The Federal Reserve sends most of the shredded bills to landfills. 13

The Federal Reserve runs these bills through authenticity machines that check to make sure they are genuine. If they are genuine but not fit to be circulated again, the Federal Reserve destroys them by sending them to highspeed machines that shred the bills and packages them for disposal. The Federal Reserve sends most of the shredded bills to landfills. 13

Subjects of money turnover All natural and legal persons, who are involved in production, distribution, exchange and consumption of domestic product • Firm • Households • State structures • Financial intermediaries 14

Subjects of money turnover All natural and legal persons, who are involved in production, distribution, exchange and consumption of domestic product • Firm • Households • State structures • Financial intermediaries 14

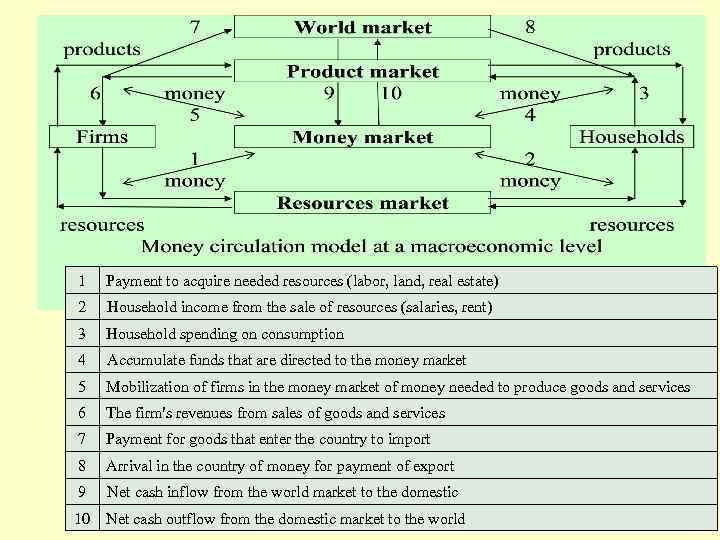

The main markets in the money turnover model • Market of products Ensures the implementation of established firms national product. • Market of resources By buying and selling provide for the redistribution of resources required for production. 15

The main markets in the money turnover model • Market of products Ensures the implementation of established firms national product. • Market of resources By buying and selling provide for the redistribution of resources required for production. 15

• Money market Provides free cash accumulation • World market Communicates with other countries (export-import operations, the outflow-inflow of capital) 16

• Money market Provides free cash accumulation • World market Communicates with other countries (export-import operations, the outflow-inflow of capital) 16

Cash turnover at the microeconomic level Serves circuit of individual capital Money - Commodity -. . . Production. . . - Product `- Money ` 17

Cash turnover at the microeconomic level Serves circuit of individual capital Money - Commodity -. . . Production. . . - Product `- Money ` 17

Cash turnover at the macroeconomic level serves circuit of the all capital in the country 18

Cash turnover at the macroeconomic level serves circuit of the all capital in the country 18

1 Payment to acquire needed resources (labor, land, real estate) 2 Household income from the sale of resources (salaries, rent) 3 Household spending on consumption 4 Accumulate funds that are directed to the money market 5 Mobilization of firms in the money market of money needed to produce goods and services 6 The firm's revenues from sales of goods and services 7 Payment for goods that enter the country to import 8 Arrival in the country of money for payment of export 9 Net cash inflow from the world market to the domestic 10 Net cash outflow from the domestic market to the world 19

1 Payment to acquire needed resources (labor, land, real estate) 2 Household income from the sale of resources (salaries, rent) 3 Household spending on consumption 4 Accumulate funds that are directed to the money market 5 Mobilization of firms in the money market of money needed to produce goods and services 6 The firm's revenues from sales of goods and services 7 Payment for goods that enter the country to import 8 Arrival in the country of money for payment of export 9 Net cash inflow from the world market to the domestic 10 Net cash outflow from the domestic market to the world 19

Сash flow • Collection of payments that are served by a separate step in the process of expanded reproduction. • Cash payments that are carried out by economic units are combined turnover of money. 20

Сash flow • Collection of payments that are served by a separate step in the process of expanded reproduction. • Cash payments that are carried out by economic units are combined turnover of money. 20

The structure of the money turnover on the economic content • Financial and • Monetary credit sector: sector - the - Fiscal and movement of money, serving budgetary turnover; the sphere of - Credit turnover. exchange 21

The structure of the money turnover on the economic content • Financial and • Monetary credit sector: sector - the - Fiscal and movement of money, serving budgetary turnover; the sphere of - Credit turnover. exchange 21

The financial and credit sector Part of the money turnover associated with the process of allocating the cost of GDP, which is not equivalent to the movement of money 22

The financial and credit sector Part of the money turnover associated with the process of allocating the cost of GDP, which is not equivalent to the movement of money 22

The structure of the money turnover in the form of means of payment • Cashless: • Cash: part of the cash flow, in move money which the movement out of banks, can be made in the directly serving form of allocation the relationship amounts on bank of economic accounts or mutual subjects cancellations, i. e. , without cash currency 23

The structure of the money turnover in the form of means of payment • Cashless: • Cash: part of the cash flow, in move money which the movement out of banks, can be made in the directly serving form of allocation the relationship amounts on bank of economic accounts or mutual subjects cancellations, i. e. , without cash currency 23

Cash payments are made between companies and individuals, between enterprises and organizations. By cash payment owners of enterprises pay money income in the form of wages or financial aid. State organizations pay money in cash in form of pensions or grants. Cash transactions between individuals occur in the process of buying and selling goods, providing services. 24

Cash payments are made between companies and individuals, between enterprises and organizations. By cash payment owners of enterprises pay money income in the form of wages or financial aid. State organizations pay money in cash in form of pensions or grants. Cash transactions between individuals occur in the process of buying and selling goods, providing services. 24

A large part (60 -90%) of the total cash flow is non-cash. Cashless payments are a system of payments that are carried out without the participation of cash, that is listed banks a certain amount from the account of the payer to the payee's account or mutual cancellations enterprises and public organizations. 25

A large part (60 -90%) of the total cash flow is non-cash. Cashless payments are a system of payments that are carried out without the participation of cash, that is listed banks a certain amount from the account of the payer to the payee's account or mutual cancellations enterprises and public organizations. 25

The advantages of non-cash turnover • Reducing the cost of production and transportation of cash. • It is easier for National Bank of Ukraine to analyze and regulate the circulation of money. 26

The advantages of non-cash turnover • Reducing the cost of production and transportation of cash. • It is easier for National Bank of Ukraine to analyze and regulate the circulation of money. 26

System of cashless payments is based on • principles of its organization; • forms and methods of payment; • priority of payments; • settlement documents 27

System of cashless payments is based on • principles of its organization; • forms and methods of payment; • priority of payments; • settlement documents 27

Non-cash payments have to be made • after the release of goods and services; • only through the bank and under its control; • only with the consent of the payer; • subject to availability of funds in the account of the payer or the right to receive credit 28

Non-cash payments have to be made • after the release of goods and services; • only through the bank and under its control; • only with the consent of the payer; • subject to availability of funds in the account of the payer or the right to receive credit 28

2. Money supply and the velocity of money 29

2. Money supply and the velocity of money 29

Money supply (mass of money) Collection of money in all its forms, which are available to individuals, enterprises and the state at some point of time 30

Money supply (mass of money) Collection of money in all its forms, which are available to individuals, enterprises and the state at some point of time 30

or Money supply - the total volume of purchasing and payment facilities serving economic circulation and owned by private individuals, businesses and government. 31

or Money supply - the total volume of purchasing and payment facilities serving economic circulation and owned by private individuals, businesses and government. 31

For the analysis of quantitative changes of money at a specified date and for a certain period, and to develop measures to regulate the growth rate of the money supply National Banks use various indicators (monetary aggregates) 32

For the analysis of quantitative changes of money at a specified date and for a certain period, and to develop measures to regulate the growth rate of the money supply National Banks use various indicators (monetary aggregates) 32

Monetary aggregate Specific indicator of money supply, which is characterized by a set of elements according to their liquidity 33

Monetary aggregate Specific indicator of money supply, which is characterized by a set of elements according to their liquidity 33

In the financial statistics of the industrialized countries to determine the money supply is used the following set of key monetary aggregates: M 0 - cash outside banks; M 1 = M 0 + demand deposits; M 2 = M 1 + time deposits; M 3 = M 2 + funds on deposit for trust operations. 34

In the financial statistics of the industrialized countries to determine the money supply is used the following set of key monetary aggregates: M 0 - cash outside banks; M 1 = M 0 + demand deposits; M 2 = M 1 + time deposits; M 3 = M 2 + funds on deposit for trust operations. 34

Monetary aggregates are based on the sectoral balance sheets of the National Bank of Ukraine, and banks, which accords with the methodology of IMF. Monetary aggregates consist of certain liabilities of resident deposit-taking corporations vis-a-vis resident sectors of the economy except general government and other deposit-taking corporations. 35

Monetary aggregates are based on the sectoral balance sheets of the National Bank of Ukraine, and banks, which accords with the methodology of IMF. Monetary aggregates consist of certain liabilities of resident deposit-taking corporations vis-a-vis resident sectors of the economy except general government and other deposit-taking corporations. 35

М 0 includes currency in circulation outside the deposit-taking corporations. М 1 comprises monetary aggregate M 0 and transferable deposits in national currency (M 1–M 0). М 2 comprises monetary aggregate M 1 and transferable deposits in foreign currency and other deposits (M 2–M 1). М 3 comprises monetary aggregate M 2 and securities other than shares (M 3 –M 2). 36

М 0 includes currency in circulation outside the deposit-taking corporations. М 1 comprises monetary aggregate M 0 and transferable deposits in national currency (M 1–M 0). М 2 comprises monetary aggregate M 1 and transferable deposits in foreign currency and other deposits (M 2–M 1). М 3 comprises monetary aggregate M 2 and securities other than shares (M 3 –M 2). 36

There are four aggregates in the U. S. , three - in Switzerland Germany, five - in England, two - in France 37

There are four aggregates in the U. S. , three - in Switzerland Germany, five - in England, two - in France 37

Analysis of the structure and dynamics of the money supply is important in guiding the development of the central banks monetary policy. Money supply in Ukraine is calculated by NBU at 1 st day of each month based on the consolidated balance sheet of the banking system. 38

Analysis of the structure and dynamics of the money supply is important in guiding the development of the central banks monetary policy. Money supply in Ukraine is calculated by NBU at 1 st day of each month based on the consolidated balance sheet of the banking system. 38

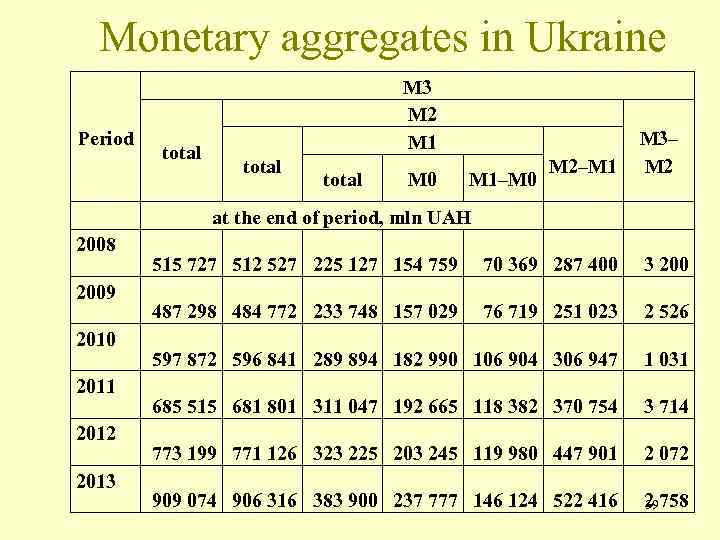

Monetary aggregates in Ukraine Period 2008 2009 2010 2011 2012 2013 total M 3 M 2 M 1 total М 0 at the end of period, mln UAH M 2–M 1 M 1–M 0 M 3– M 2 515 727 512 527 225 127 154 759 70 369 287 400 3 200 487 298 484 772 233 748 157 029 76 719 251 023 2 526 597 872 596 841 289 894 182 990 106 904 306 947 1 031 685 515 681 801 311 047 192 665 118 382 370 754 3 714 773 199 771 126 323 225 203 245 119 980 447 901 2 072 909 074 906 316 383 900 237 777 146 124 522 416 2 758 39

Monetary aggregates in Ukraine Period 2008 2009 2010 2011 2012 2013 total M 3 M 2 M 1 total М 0 at the end of period, mln UAH M 2–M 1 M 1–M 0 M 3– M 2 515 727 512 527 225 127 154 759 70 369 287 400 3 200 487 298 484 772 233 748 157 029 76 719 251 023 2 526 597 872 596 841 289 894 182 990 106 904 306 947 1 031 685 515 681 801 311 047 192 665 118 382 370 754 3 714 773 199 771 126 323 225 203 245 119 980 447 901 2 072 909 074 906 316 383 900 237 777 146 124 522 416 2 758 39

Independent component of the money supply in Ukraine is the monetary base. The change in the money supply may be the result of both an increase of number of money in circulation, and accelerate their turnover. The velocity of circulation of money means the speed of their turnover in servicing deals. 40

Independent component of the money supply in Ukraine is the monetary base. The change in the money supply may be the result of both an increase of number of money in circulation, and accelerate their turnover. The velocity of circulation of money means the speed of their turnover in servicing deals. 40

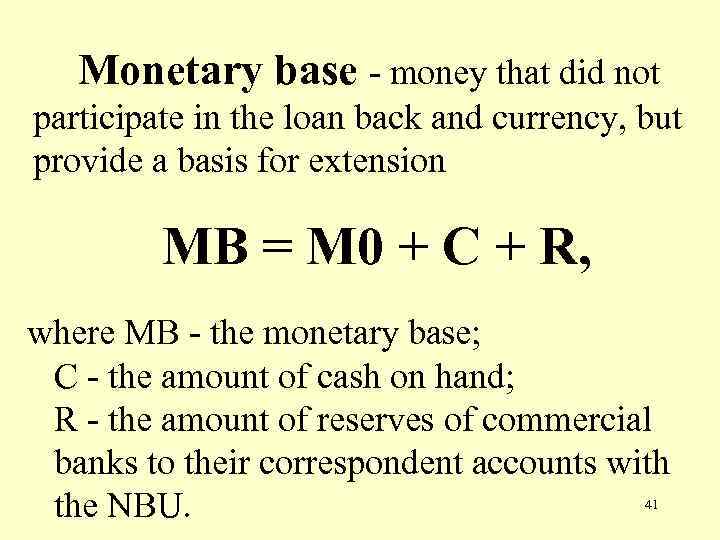

Monetary base - money that did not participate in the loan back and currency, but provide a basis for extension MB = M 0 + C + R, where MB - the monetary base; C - the amount of cash on hand; R - the amount of reserves of commercial banks to their correspondent accounts with the NBU. 41

Monetary base - money that did not participate in the loan back and currency, but provide a basis for extension MB = M 0 + C + R, where MB - the monetary base; C - the amount of cash on hand; R - the amount of reserves of commercial banks to their correspondent accounts with the NBU. 41

Velocity of money frequency of the transition of money from one entity to another monetary relations with servicing the sale of goods and services over time. 42

Velocity of money frequency of the transition of money from one entity to another monetary relations with servicing the sale of goods and services over time. 42

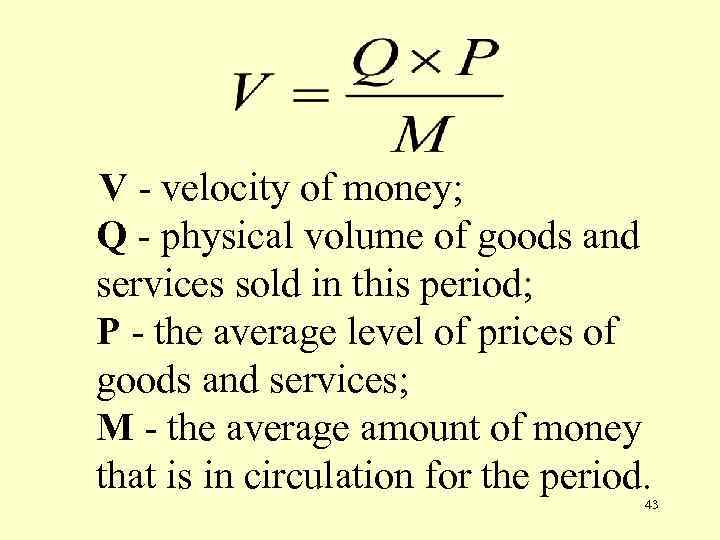

V - velocity of money; Q - physical volume of goods and services sold in this period; P - the average level of prices of goods and services; M - the average amount of money that is in circulation for the period. 43

V - velocity of money; Q - physical volume of goods and services sold in this period; P - the average level of prices of goods and services; M - the average amount of money that is in circulation for the period. 43

Factors affecting the velocity of money • Volume, structure and efficiency of production; • Balance between supply and demand; • Rate of inflation; • Level of marketing development. 44

Factors affecting the velocity of money • Volume, structure and efficiency of production; • Balance between supply and demand; • Rate of inflation; • Level of marketing development. 44

3. Law of money circulation 45

3. Law of money circulation 45

The law of money circulation (by K. Marx): the amount of money required to carry out the functionality of the treatment must be equal to the sum of prices of goods sold, divided by the speed (velocity of circulation) of similar monetary units. Monetary law expresses the economic interdependence between the mass of goods traded, the level of prices and the velocity of money. 46

The law of money circulation (by K. Marx): the amount of money required to carry out the functionality of the treatment must be equal to the sum of prices of goods sold, divided by the speed (velocity of circulation) of similar monetary units. Monetary law expresses the economic interdependence between the mass of goods traded, the level of prices and the velocity of money. 46

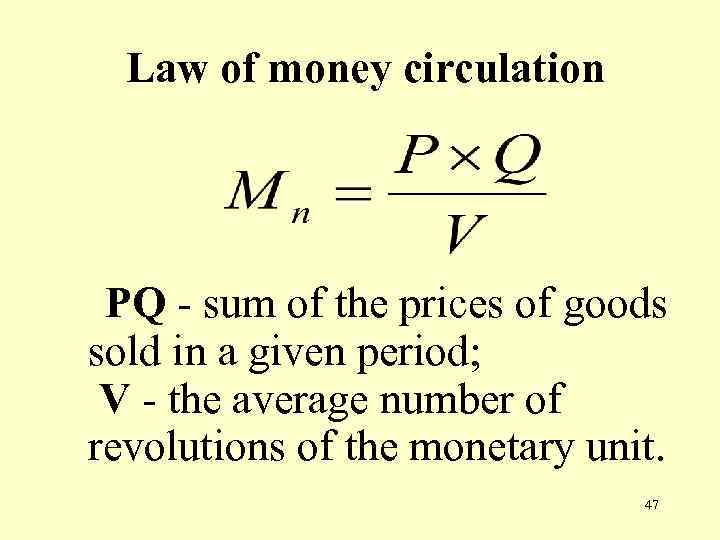

Law of money circulation PQ - sum of the prices of goods sold in a given period; V - the average number of revolutions of the monetary unit. 47

Law of money circulation PQ - sum of the prices of goods sold in a given period; V - the average number of revolutions of the monetary unit. 47

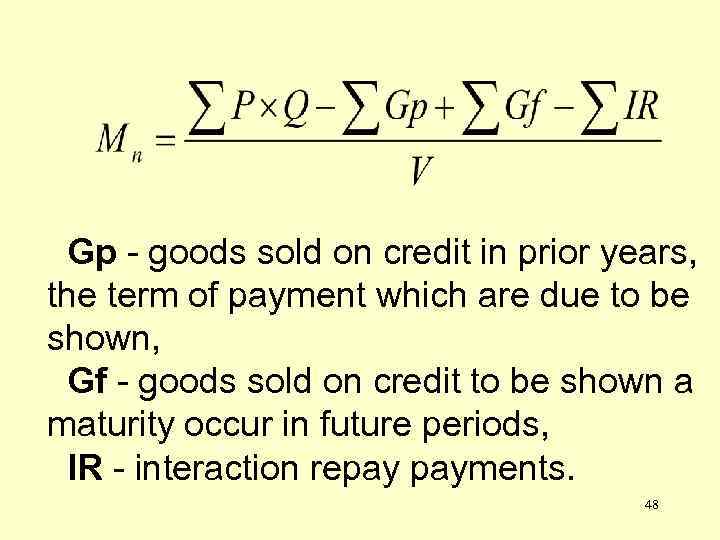

Gp - goods sold on credit in prior years, the term of payment which are due to be shown, Gf - goods sold on credit to be shown a maturity occur in future periods, IR - interaction repay payments. 48

Gp - goods sold on credit in prior years, the term of payment which are due to be shown, Gf - goods sold on credit to be shown a maturity occur in future periods, IR - interaction repay payments. 48

The amount of money which is needed for circulation, is influenced by various factors, which depend on the conditions of production. It is determined by the number of traded goods, the level of prices for goods and services. 49

The amount of money which is needed for circulation, is influenced by various factors, which depend on the conditions of production. It is determined by the number of traded goods, the level of prices for goods and services. 49

Reverse effect on the amount of money is provided by: degree of credit, because as most of the goods are sold on credit, the lower the amount of money required to handle; development of cashless payments; velocity of money. 50

Reverse effect on the amount of money is provided by: degree of credit, because as most of the goods are sold on credit, the lower the amount of money required to handle; development of cashless payments; velocity of money. 50

Conditions of maintain monetary circulation are determined by the interaction of two factors: 1. needs of the economy in the money, 2. actual receipt of money in circulation. If there is more money in circulation than the economy requires, it leads to a depreciation of money, a decrease in the purchasing power of the monetary unit. 51

Conditions of maintain monetary circulation are determined by the interaction of two factors: 1. needs of the economy in the money, 2. actual receipt of money in circulation. If there is more money in circulation than the economy requires, it leads to a depreciation of money, a decrease in the purchasing power of the monetary unit. 51

4. Mechanism of substitution of money in circulation 52

4. Mechanism of substitution of money in circulation 52

Currency issue • Secondary: • Primary: Carry out Central Bank commercial banks carried out in by non-cash and nonmonetary multiplier cash of free reserves and deposits 53

Currency issue • Secondary: • Primary: Carry out Central Bank commercial banks carried out in by non-cash and nonmonetary multiplier cash of free reserves and deposits 53

Monetary multiplier The process of creating bank money in lending by banks to customers on free reserves, which reached the bank from the outside. 54

Monetary multiplier The process of creating bank money in lending by banks to customers on free reserves, which reached the bank from the outside. 54

Free reserve - Collection of funds of commercial banks, which are currently at the disposal of the bank and may be used by him on active operations 55

Free reserve - Collection of funds of commercial banks, which are currently at the disposal of the bank and may be used by him on active operations 55

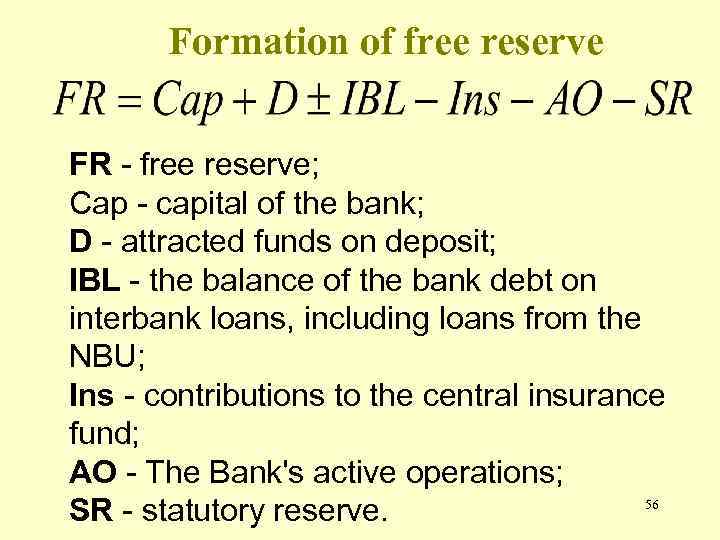

Formation of free reserve FR - free reserve; Cap - capital of the bank; D - attracted funds on deposit; IBL - the balance of the bank debt on interbank loans, including loans from the NBU; Ins - contributions to the central insurance fund; AO - The Bank's active operations; 56 SR - statutory reserve.

Formation of free reserve FR - free reserve; Cap - capital of the bank; D - attracted funds on deposit; IBL - the balance of the bank debt on interbank loans, including loans from the NBU; Ins - contributions to the central insurance fund; AO - The Bank's active operations; 56 SR - statutory reserve.

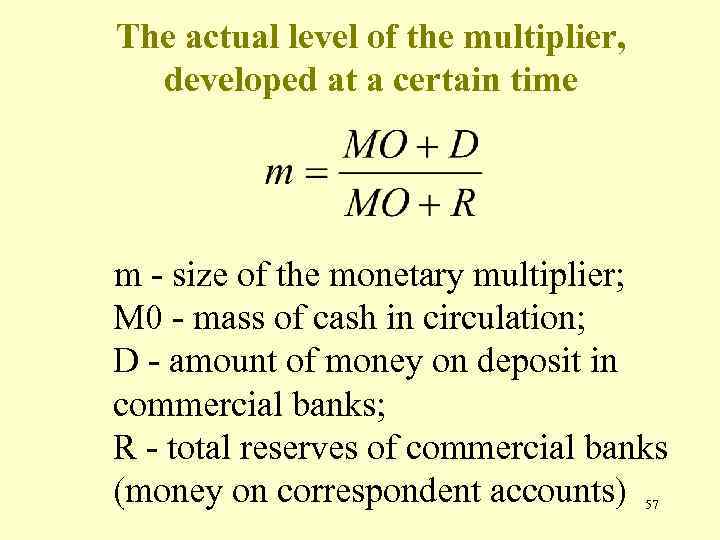

The actual level of the multiplier, developed at a certain time m - size of the monetary multiplier; M 0 - mass of cash in circulation; D - amount of money on deposit in commercial banks; R - total reserves of commercial banks (money on correspondent accounts) 57

The actual level of the multiplier, developed at a certain time m - size of the monetary multiplier; M 0 - mass of cash in circulation; D - amount of money on deposit in commercial banks; R - total reserves of commercial banks (money on correspondent accounts) 57

5. Non-cash payments forms 58

5. Non-cash payments forms 58

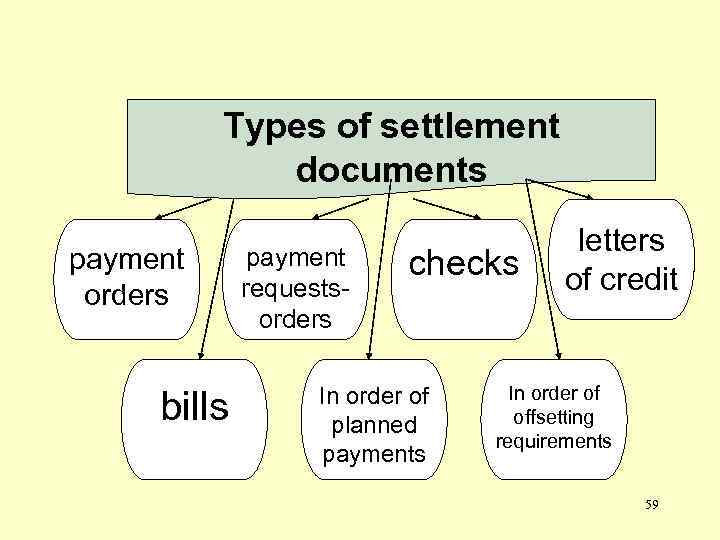

Types of settlement documents payment orders bills payment requestsorders checks In order of planned payments letters of credit In order of offsetting requirements 59

Types of settlement documents payment orders bills payment requestsorders checks In order of planned payments letters of credit In order of offsetting requirements 59

Requisites of payments: • the name of the settlement document; • the number, date, month and year of discharge; • name of the bank of the payer and the payee; • an account of the payer and the payee; • the name of the payer and the recipient; • the purpose of payment (except checks); • payment amount in figures and words; • on the first copy of the settlement document should be signed by the head of the company, chief accountant, printing. 60

Requisites of payments: • the name of the settlement document; • the number, date, month and year of discharge; • name of the bank of the payer and the payee; • an account of the payer and the payee; • the name of the payer and the recipient; • the purpose of payment (except checks); • payment amount in figures and words; • on the first copy of the settlement document should be signed by the head of the company, chief accountant, printing. 60

1. Payment order is the order of company to bank that serves it to transfer a certain amount of money from it’s account to another entity. By payment orders can be made: - Payments for goods received and services rendered; - Advance payments; - Payments for non-goods operations; - Pre-payment for goods and services. A payment order is valid for 10 days. 61

1. Payment order is the order of company to bank that serves it to transfer a certain amount of money from it’s account to another entity. By payment orders can be made: - Payments for goods received and services rendered; - Advance payments; - Payments for non-goods operations; - Pre-payment for goods and services. A payment order is valid for 10 days. 61

Technique of calculations using normal payment orders: the payer's bank writes off the amount specified in the order from the payer's account and credits the funds to the beneficiary. If the recipient is served by another banking institution, the funds are transferred through correspondent accounts. 62

Technique of calculations using normal payment orders: the payer's bank writes off the amount specified in the order from the payer's account and credits the funds to the beneficiary. If the recipient is served by another banking institution, the funds are transferred through correspondent accounts. 62

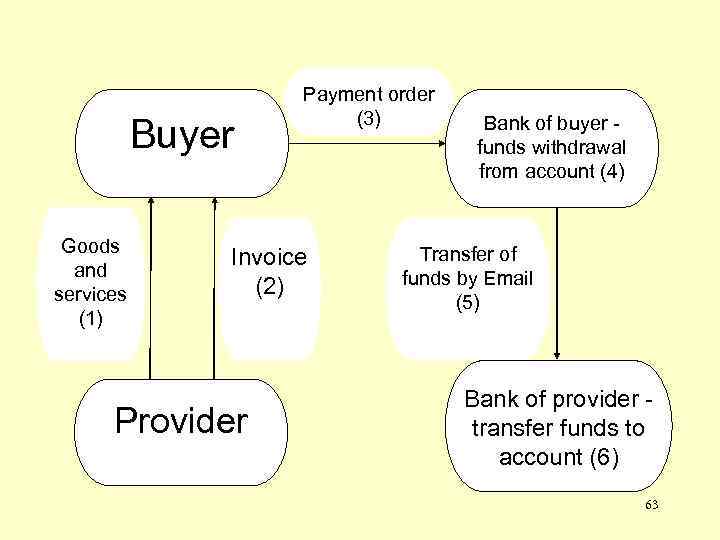

Buyer Goods and services (1) Payment order (3) Invoice (2) Provider Bank of buyer funds withdrawal from account (4) Transfer of funds by Email (5) Bank of provider transfer funds to account (6) 63

Buyer Goods and services (1) Payment order (3) Invoice (2) Provider Bank of buyer funds withdrawal from account (4) Transfer of funds by Email (5) Bank of provider transfer funds to account (6) 63

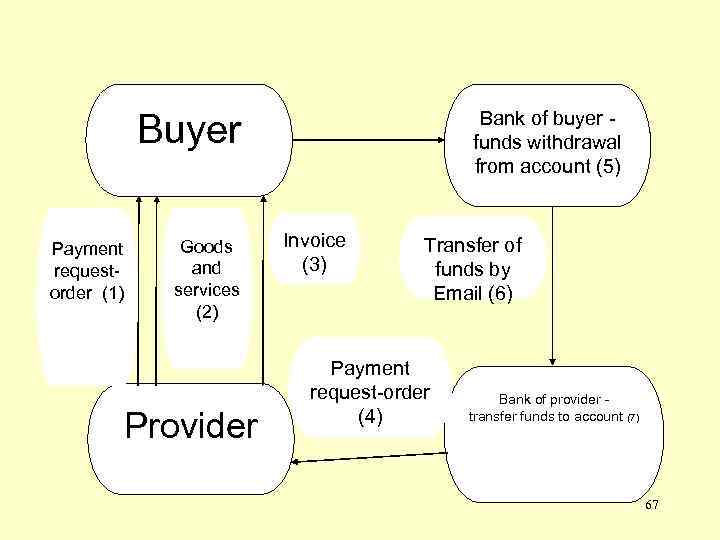

2. Payment request-order - a combined settlement document assembling the request and payment. The document "payment request" fills the recipient, and the second part - "Order" - fills with the consent of the payer to pay. A requirement of the supplier to the buyer to pay based on directed him outside the bank payment and shipping documents supplied under the contract value goods, works and services rendered 64

2. Payment request-order - a combined settlement document assembling the request and payment. The document "payment request" fills the recipient, and the second part - "Order" - fills with the consent of the payer to pay. A requirement of the supplier to the buyer to pay based on directed him outside the bank payment and shipping documents supplied under the contract value goods, works and services rendered 64

Payer, determined to payment requests, orders, delivers it to your bank by filling it with his signature and seal. Deadline demands of instruction to the paying bank is assumed in the contract, but shall not exceed 20 days. The refusal fully or partially pay the payment request authorizing the payer shall notify the supplier immediately in the manner and time stipulated by the contract. 65

Payer, determined to payment requests, orders, delivers it to your bank by filling it with his signature and seal. Deadline demands of instruction to the paying bank is assumed in the contract, but shall not exceed 20 days. The refusal fully or partially pay the payment request authorizing the payer shall notify the supplier immediately in the manner and time stipulated by the contract. 65

Payer may refuse to accept the full amount if: - Provider filed the request for Unreserved not provided the contract goods or services; - Goods not shipped at the proper address or earlier without the consent of the customer; - Before the expiry of the acceptance document established that the goods received, defective, incomplete, custom, lowered grade; - Products previously paid and more. 66

Payer may refuse to accept the full amount if: - Provider filed the request for Unreserved not provided the contract goods or services; - Goods not shipped at the proper address or earlier without the consent of the customer; - Before the expiry of the acceptance document established that the goods received, defective, incomplete, custom, lowered grade; - Products previously paid and more. 66

Buyer Payment requestorder (1) Goods and services (2) Provider Bank of buyer funds withdrawal from account (5) Invoice (3) Transfer of funds by Email (6) Payment request-order (4) Bank of provider transfer funds to account (7) 67

Buyer Payment requestorder (1) Goods and services (2) Provider Bank of buyer funds withdrawal from account (5) Invoice (3) Transfer of funds by Email (6) Payment request-order (4) Bank of provider transfer funds to account (7) 67

Partial rejection of the payment can be made when the above reasons apply only to part of the claim amount as follows: - Along with the ordered products shipped Unreserved provider ; - Admitted arithmetical error in the account; - Part of the products proved defective , and more. 68

Partial rejection of the payment can be made when the above reasons apply only to part of the claim amount as follows: - Along with the ordered products shipped Unreserved provider ; - Admitted arithmetical error in the account; - Part of the products proved defective , and more. 68

In a statement refusing to accept because of poor quality, incompleteness, lowered grade catalog indicate the number and date of the act of acceptance of goods in quality or completeness. One copy shall be acceptance of goods in quality payer is obliged to send to the supplier not later than the date of acceptance of the declaration of refusal. 69

In a statement refusing to accept because of poor quality, incompleteness, lowered grade catalog indicate the number and date of the act of acceptance of goods in quality or completeness. One copy shall be acceptance of goods in quality payer is obliged to send to the supplier not later than the date of acceptance of the declaration of refusal. 69

3. Check in settlement - a document containing instructions of drawer (payer) to the bank to transfer the account to a certain amount of money to the account holder of the check (the recipient) at the time they check in the bank. 70

3. Check in settlement - a document containing instructions of drawer (payer) to the bank to transfer the account to a certain amount of money to the account holder of the check (the recipient) at the time they check in the bank. 70

Checks are divided into two types: - Checks for payments between legal entities; - Checks for payments between individuals and legal entities. Checks are formed in checkbooks of 10, 25 pages. Checkbook is validated for one year. The term of the settlement check issued to an individual to make payments to legal is 3 months. 71

Checks are divided into two types: - Checks for payments between legal entities; - Checks for payments between individuals and legal entities. Checks are formed in checkbooks of 10, 25 pages. Checkbook is validated for one year. The term of the settlement check issued to an individual to make payments to legal is 3 months. 71

Limit of checkbook is the maximum amount by which the taxpayer can write a check (checks) from this book. Bank issues a checkbook to the client based on his application. 72

Limit of checkbook is the maximum amount by which the taxpayer can write a check (checks) from this book. Bank issues a checkbook to the client based on his application. 72

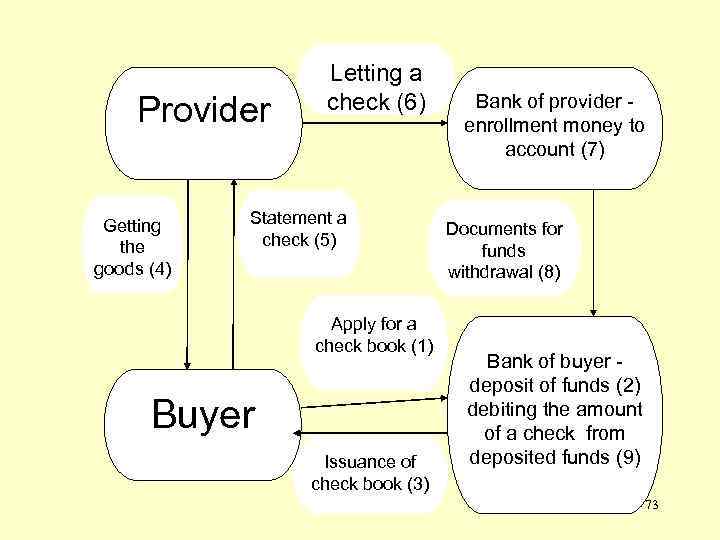

Provider Getting the goods (4) Letting a check (6) Statement a check (5) Apply for a check book (1) Buyer Issuance of check book (3) Bank of provider enrollment money to account (7) Documents for funds withdrawal (8) Bank of buyer deposit of funds (2) debiting the amount of a check from deposited funds (9) 73

Provider Getting the goods (4) Letting a check (6) Statement a check (5) Apply for a check book (1) Buyer Issuance of check book (3) Bank of provider enrollment money to account (7) Documents for funds withdrawal (8) Bank of buyer deposit of funds (2) debiting the amount of a check from deposited funds (9) 73

If in checkbook at the end of its term remaining unused checks, they returned to the bank and repaid it. On request, you can extend your books. If checks from checkbook were used, and the remaining unused limit, the bank can issue a new book by that amount. 74

If in checkbook at the end of its term remaining unused checks, they returned to the bank and repaid it. On request, you can extend your books. If checks from checkbook were used, and the remaining unused limit, the bank can issue a new book by that amount. 74

4. Letter of credit - this settlement document that contains instructions the payer's bank to the beneficiary to pay for goods (services) only if the recipient of the conditions specified in the Credit. A letter of credit is useful in dealing with slow payer. Feature of letter of credit settlement form is that the cash flow is ahead of movement of material values 75

4. Letter of credit - this settlement document that contains instructions the payer's bank to the beneficiary to pay for goods (services) only if the recipient of the conditions specified in the Credit. A letter of credit is useful in dealing with slow payer. Feature of letter of credit settlement form is that the cash flow is ahead of movement of material values 75

Opening (posting) a letter of credit held by the buyer's own funds or bank loans. We may also posting a letter of credit in part from its own funds and bank loans. Each credit is designed to calculate only one supplier and can not be forwarded. 76

Opening (posting) a letter of credit held by the buyer's own funds or bank loans. We may also posting a letter of credit in part from its own funds and bank loans. Each credit is designed to calculate only one supplier and can not be forwarded. 76

Term of the letter of credit is established in the contract between the supplier and the purchaser within 15 days of discovery, not including time passing documents between banks. Due to changes in the conditions of supply and shipping of products may be extended for a period of 10 days. Letters of credit can be opened at the bank of the buyer or vendor. 77

Term of the letter of credit is established in the contract between the supplier and the purchaser within 15 days of discovery, not including time passing documents between banks. Due to changes in the conditions of supply and shipping of products may be extended for a period of 10 days. Letters of credit can be opened at the bank of the buyer or vendor. 77

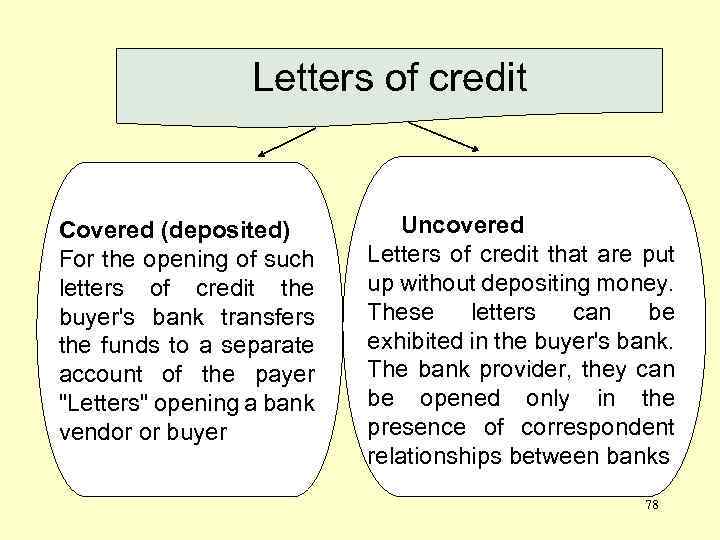

Letters of credit Covered (deposited) For the opening of such letters of credit the buyer's bank transfers the funds to a separate account of the payer "Letters" opening a bank vendor or buyer Uncovered Letters of credit that are put up without depositing money. These letters can be exhibited in the buyer's bank. The bank provider, they can be opened only in the presence of correspondent relationships between banks 78

Letters of credit Covered (deposited) For the opening of such letters of credit the buyer's bank transfers the funds to a separate account of the payer "Letters" opening a bank vendor or buyer Uncovered Letters of credit that are put up without depositing money. These letters can be exhibited in the buyer's bank. The bank provider, they can be opened only in the presence of correspondent relationships between banks 78

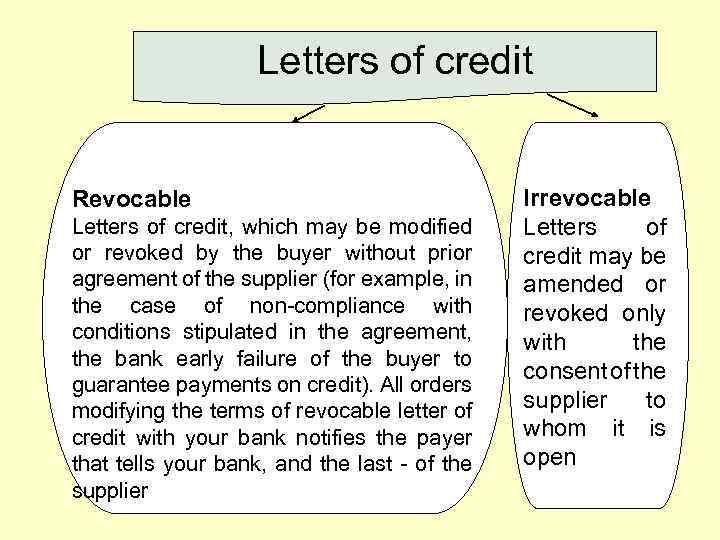

Letters of credit Revocable Letters of credit, which may be modified or revoked by the buyer without prior agreement of the supplier (for example, in the case of non-compliance with conditions stipulated in the agreement, the bank early failure of the buyer to guarantee payments on credit). All orders modifying the terms of revocable letter of credit with your bank notifies the payer that tells your bank, and the last - of the supplier Irrevocable Letters of credit may be amended or revoked only with the consent of the supplier to whom it is open 79

Letters of credit Revocable Letters of credit, which may be modified or revoked by the buyer without prior agreement of the supplier (for example, in the case of non-compliance with conditions stipulated in the agreement, the bank early failure of the buyer to guarantee payments on credit). All orders modifying the terms of revocable letter of credit with your bank notifies the payer that tells your bank, and the last - of the supplier Irrevocable Letters of credit may be amended or revoked only with the consent of the supplier to whom it is open 79

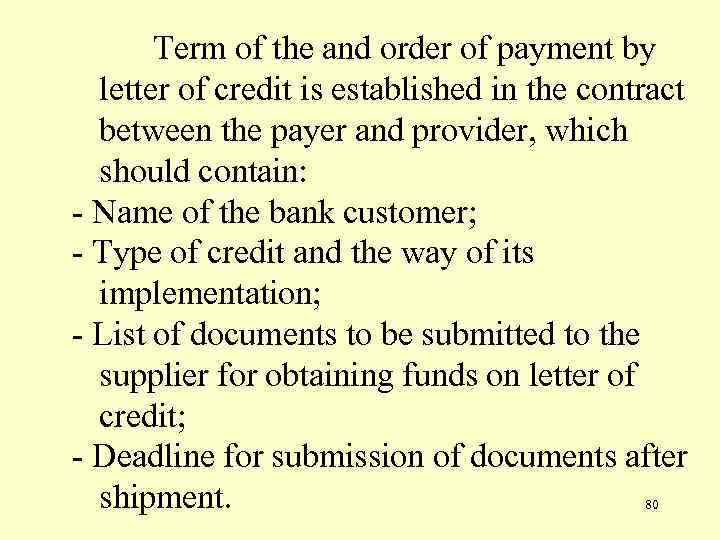

Term of the and order of payment by letter of credit is established in the contract between the payer and provider, which should contain: - Name of the bank customer; - Type of credit and the way of its implementation; - List of documents to be submitted to the supplier for obtaining funds on letter of credit; - Deadline for submission of documents after shipment. 80

Term of the and order of payment by letter of credit is established in the contract between the payer and provider, which should contain: - Name of the bank customer; - Type of credit and the way of its implementation; - List of documents to be submitted to the supplier for obtaining funds on letter of credit; - Deadline for submission of documents after shipment. 80

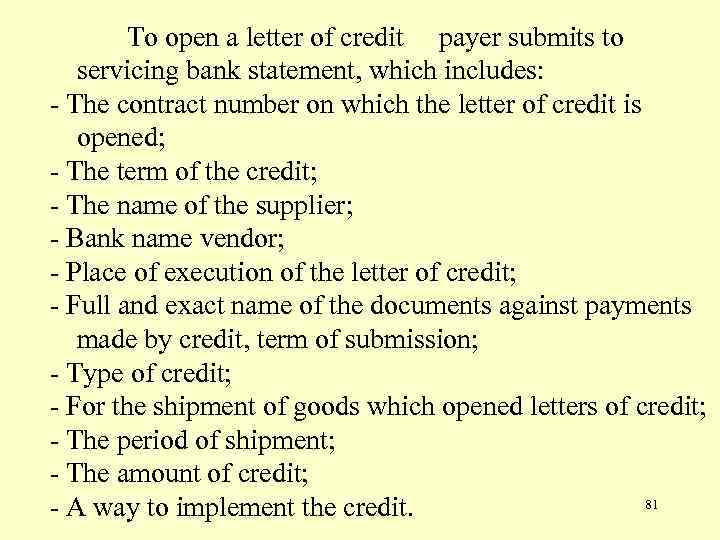

To open a letter of credit payer submits to servicing bank statement, which includes: - The contract number on which the letter of credit is opened; - The term of the credit; - The name of the supplier; - Bank name vendor; - Place of execution of the letter of credit; - Full and exact name of the documents against payments made by credit, term of submission; - Type of credit; - For the shipment of goods which opened letters of credit; - The period of shipment; - The amount of credit; 81 - A way to implement the credit.

To open a letter of credit payer submits to servicing bank statement, which includes: - The contract number on which the letter of credit is opened; - The term of the credit; - The name of the supplier; - Bank name vendor; - Place of execution of the letter of credit; - Full and exact name of the documents against payments made by credit, term of submission; - Type of credit; - For the shipment of goods which opened letters of credit; - The period of shipment; - The amount of credit; 81 - A way to implement the credit.

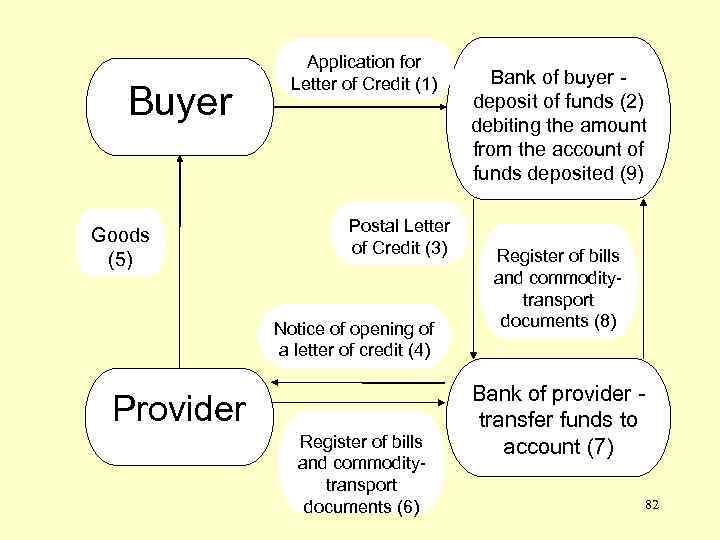

Buyer Goods (5) Application for Letter of Credit (1) Postal Letter of Credit (3) Notice of opening of a letter of credit (4) Provider Register of bills and commoditytransport documents (6) Bank of buyer deposit of funds (2) debiting the amount from the account of funds deposited (9) Register of bills and commoditytransport documents (8) Bank of provider transfer funds to account (7) 82

Buyer Goods (5) Application for Letter of Credit (1) Postal Letter of Credit (3) Notice of opening of a letter of credit (4) Provider Register of bills and commoditytransport documents (6) Bank of buyer deposit of funds (2) debiting the amount from the account of funds deposited (9) Register of bills and commoditytransport documents (8) Bank of provider transfer funds to account (7) 82

5. Operations of commercial banks with promissory notes: - Collection of bills (service provided by a drawer). - Domiciliation of bills (service provided by maker). Collection of bills is a performance of bank orders of holder to collect payment from the debtor. Collection is paid service. By adopting the bill for collection, commercial bank shall promptly forward it to the commercial bank at the place of payment and notify the payer of bill collection. 83

5. Operations of commercial banks with promissory notes: - Collection of bills (service provided by a drawer). - Domiciliation of bills (service provided by maker). Collection of bills is a performance of bank orders of holder to collect payment from the debtor. Collection is paid service. By adopting the bill for collection, commercial bank shall promptly forward it to the commercial bank at the place of payment and notify the payer of bill collection. 83

Having paid bill bank of payer notifies the bank drawer, and the bill payer's hands. If the bill is not paid on the day of maturity, the commercial bank must pass the next day his notary to protest. Bank is responsible for the consequences of failure to present a bill to protest. 84

Having paid bill bank of payer notifies the bank drawer, and the bill payer's hands. If the bill is not paid on the day of maturity, the commercial bank must pass the next day his notary to protest. Bank is responsible for the consequences of failure to present a bill to protest. 84

Unpaid bill with an act of protest is returned by the bank note holder upon request. All costs of mailing, protest, storage drawer bank bills reimbursed over commissions. 85

Unpaid bill with an act of protest is returned by the bank note holder upon request. All costs of mailing, protest, storage drawer bank bills reimbursed over commissions. 85

Domiciliation of bills - is orders paid by the drawer bank bill in due time by advance made to the bank or the amount of a stable balance of money that should be in the account. Its consent to be domicyliat bank expressed on the face of the bill the inscription. 86

Domiciliation of bills - is orders paid by the drawer bank bill in due time by advance made to the bank or the amount of a stable balance of money that should be in the account. Its consent to be domicyliat bank expressed on the face of the bill the inscription. 86

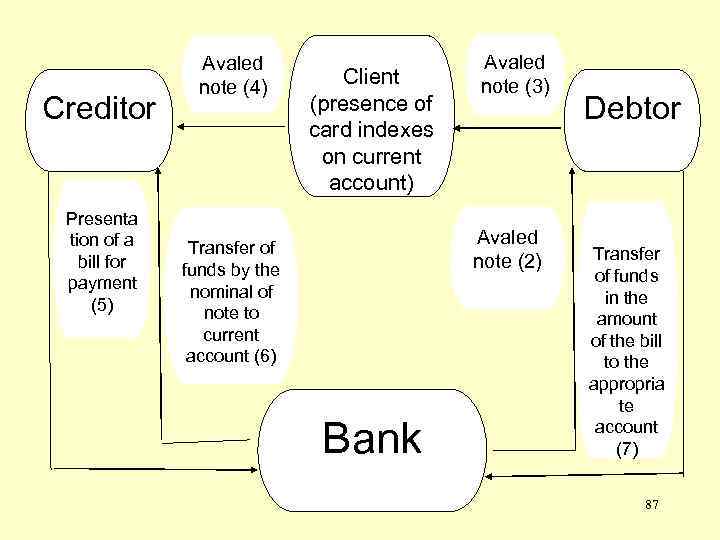

Creditor Presenta tion of a bill for payment (5) Avaled note (4) Client (presence of card indexes on current account) Avaled note (3) Avaled note (2) Transfer of funds by the nominal of note to current account (6) Bank Debtor Transfer of funds in the amount of the bill to the appropria te account (7) 87

Creditor Presenta tion of a bill for payment (5) Avaled note (4) Client (presence of card indexes on current account) Avaled note (3) Avaled note (2) Transfer of funds by the nominal of note to current account (6) Bank Debtor Transfer of funds in the amount of the bill to the appropria te account (7) 87

6. Settlements in order of planned payments. In the case of uniform and constant supply of goods and services provided buyers can pay with suppliers in order of planned payments under which payments are made periodically by agreement of the parties. 88

6. Settlements in order of planned payments. In the case of uniform and constant supply of goods and services provided buyers can pay with suppliers in order of planned payments under which payments are made periodically by agreement of the parties. 88

Transfer of planned payment is made by payment orders. Scheduled payments can be performed daily or periodically within the terms agreed between the supplier and the buyer. Term enlarged scheduled payment is assigned, usually on the middle day of the billing period. 89

Transfer of planned payment is made by payment orders. Scheduled payments can be performed daily or periodically within the terms agreed between the supplier and the buyer. Term enlarged scheduled payment is assigned, usually on the middle day of the billing period. 89

Amount of each scheduled payment shall be fixed by the parties for the next month (quarter), based on the frequency of payments and the amount of supplies or services. At each scheduled payment bank filed a separate document. 90

Amount of each scheduled payment shall be fixed by the parties for the next month (quarter), based on the frequency of payments and the amount of supplies or services. At each scheduled payment bank filed a separate document. 90

7. Settlements based on offsetting mutual claims. In this form of payments each company is both a buyer and supplier of various kinds of goods and services. 91

7. Settlements based on offsetting mutual claims. In this form of payments each company is both a buyer and supplier of various kinds of goods and services. 91

Features of such permanent payments lies in the fact that its members direct settlement documents released by the goods or services are not a bank, and each other. These documents are not subject to immediate payment. At the end of the period specified in the contract, an act of reconciliation payments and in the manner prescribed by the contract, calculations are carried out by the statement of payment orders, requirements, bills. 92

Features of such permanent payments lies in the fact that its members direct settlement documents released by the goods or services are not a bank, and each other. These documents are not subject to immediate payment. At the end of the period specified in the contract, an act of reconciliation payments and in the manner prescribed by the contract, calculations are carried out by the statement of payment orders, requirements, bills. 92

Promissory note is a form of registration of commercial credit given in the form of commodities sellers to buyers in the form of deferred payment of the debt for goods, works, or services provided. Promissory note - a written promissory note, which gives its owner the right to require irrefutable debtor stated therein sum payment after the end of the period 93

Promissory note is a form of registration of commercial credit given in the form of commodities sellers to buyers in the form of deferred payment of the debt for goods, works, or services provided. Promissory note - a written promissory note, which gives its owner the right to require irrefutable debtor stated therein sum payment after the end of the period 93

• Promissory note - "solo" When issuing a promissory note, the maker must pay directly to the note holder a certain amount. In this note holder undertakes to the other party - noteholder to pay a certain amount of money after a specified period of time. • Promissory note - “tratta" A bill is a written proposal of the drawer, addressed to the drawee to pay a certain amount of the note holder. A bill may be sold by endorsement (endorsement). The term of payment is determined by either the date of acceptance, or the date of the protest. 94

• Promissory note - "solo" When issuing a promissory note, the maker must pay directly to the note holder a certain amount. In this note holder undertakes to the other party - noteholder to pay a certain amount of money after a specified period of time. • Promissory note - “tratta" A bill is a written proposal of the drawer, addressed to the drawee to pay a certain amount of the note holder. A bill may be sold by endorsement (endorsement). The term of payment is determined by either the date of acceptance, or the date of the protest. 94

Transactions with notes: - acceptance of bills for collection; - discounting bills; - issuance of bills providing loans 95

Transactions with notes: - acceptance of bills for collection; - discounting bills; - issuance of bills providing loans 95

Bill of exchange (draft) - security, which contains order to holder to pay the payer specified in the bill sum of money to a third person Promissory note - security, which contains simple and unconditional obligation of the drawer to pay a certain sum of money at a certain time and a certain place to holder or by his order 96

Bill of exchange (draft) - security, which contains order to holder to pay the payer specified in the bill sum of money to a third person Promissory note - security, which contains simple and unconditional obligation of the drawer to pay a certain sum of money at a certain time and a certain place to holder or by his order 96

Holder (payee) - a person who owns a bill, presents it to the drawee payment, receives money Drawer (drawer) - a person who writes and gives orders to another person about it pay The bill payer (drawee) - a person who is addressed an order to pay bills 97

Holder (payee) - a person who owns a bill, presents it to the drawee payment, receives money Drawer (drawer) - a person who writes and gives orders to another person about it pay The bill payer (drawee) - a person who is addressed an order to pay bills 97

Acceptation - written accept to a bill Endorsement - t. The transfer signature, which the owner of the bill makes to the other person on the reverse side of the bill Aval - guarantees on the bill from a third person 98

Acceptation - written accept to a bill Endorsement - t. The transfer signature, which the owner of the bill makes to the other person on the reverse side of the bill Aval - guarantees on the bill from a third person 98

Guarantor - backer - has the same responsibility as a person for whom he gave bail, but after paying the bill, he becomes his owner and gets to claim, for whom he gave orders to those persons who are liable for the bill before last. Endorser - owner of promissory note Endorsee - the person in whose favor the bill is given 99

Guarantor - backer - has the same responsibility as a person for whom he gave bail, but after paying the bill, he becomes his owner and gets to claim, for whom he gave orders to those persons who are liable for the bill before last. Endorser - owner of promissory note Endorsee - the person in whose favor the bill is given 99

Friendly bill - statement of bills to each other without real deal Bronze bill - statement of bills for dummies Protest - actions of authorized state organization (notary, bailiff), officially supporting facts, that the law binds occurrence of certain legal consequences. 100

Friendly bill - statement of bills to each other without real deal Bronze bill - statement of bills for dummies Protest - actions of authorized state organization (notary, bailiff), officially supporting facts, that the law binds occurrence of certain legal consequences. 100

Types of endorsements with purpose - endorser of the bill indicates the purpose of transmission to another person. This endorsement has the nature of instruction and the new owner can only endorse a bill for this purpose without turnover - endorser includes text endorsement the words "without recourse", which gives him the right to exclude the possibility of bringing it to the requirements in the event of non-payment of a bill drawer 101

Types of endorsements with purpose - endorser of the bill indicates the purpose of transmission to another person. This endorsement has the nature of instruction and the new owner can only endorse a bill for this purpose without turnover - endorser includes text endorsement the words "without recourse", which gives him the right to exclude the possibility of bringing it to the requirements in the event of non-payment of a bill drawer 101

Types of endorsements nominal - endorser puts on the back of the bill before his signature name of the assignee all rights of a bill blank - endorser puts on the back of the bill only own signature. Bill may be transferred to any person who becomes the owner, with all the rights 102

Types of endorsements nominal - endorser puts on the back of the bill before his signature name of the assignee all rights of a bill blank - endorser puts on the back of the bill only own signature. Bill may be transferred to any person who becomes the owner, with all the rights 102

Operations of the bank with bills Discount - transfer bill to bank by endorsement Rediscount - commercial bank transfers bills, which are taken to discount, to the Central Bank Pawnbrokers operation – credit, which is issued under promissory notes securing 103

Operations of the bank with bills Discount - transfer bill to bank by endorsement Rediscount - commercial bank transfers bills, which are taken to discount, to the Central Bank Pawnbrokers operation – credit, which is issued under promissory notes securing 103

Operations of the bank with bills Collection – operation, which is accompanied with endorsement that is done in the form of an inscription "I instruct to get" or other equivalent in content Domicilation of bills - payer appoints instead of himself the third person as a payer on bill 104

Operations of the bank with bills Collection – operation, which is accompanied with endorsement that is done in the form of an inscription "I instruct to get" or other equivalent in content Domicilation of bills - payer appoints instead of himself the third person as a payer on bill 104

Operations of the bank with bills Acceptance - bank undertakes to pay the bill then, if for any reason can not make the debtor Aval - adoption of the bank of full or partial responsibility for payment 105

Operations of the bank with bills Acceptance - bank undertakes to pay the bill then, if for any reason can not make the debtor Aval - adoption of the bank of full or partial responsibility for payment 105

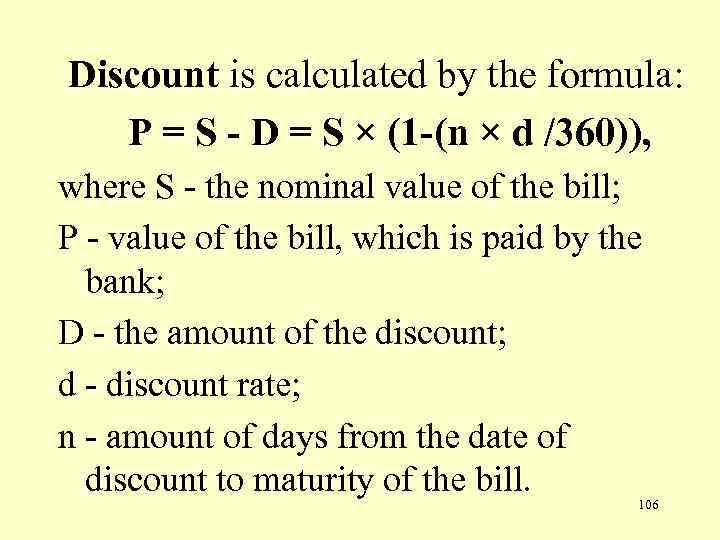

Discount is calculated by the formula: P = S - D = S × (1 -(n × d /360)), where S - the nominal value of the bill; P - value of the bill, which is paid by the bank; D - the amount of the discount; d - discount rate; n - amount of days from the date of discount to maturity of the bill. 106

Discount is calculated by the formula: P = S - D = S × (1 -(n × d /360)), where S - the nominal value of the bill; P - value of the bill, which is paid by the bank; D - the amount of the discount; d - discount rate; n - amount of days from the date of discount to maturity of the bill. 106

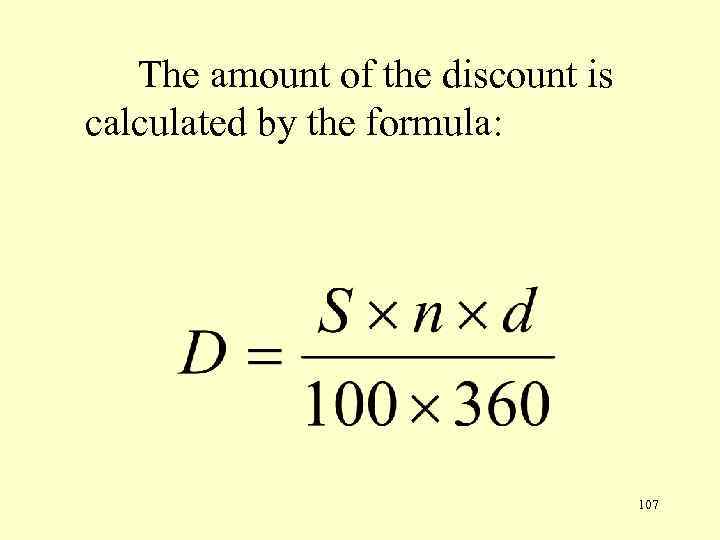

The amount of the discount is calculated by the formula: 107

The amount of the discount is calculated by the formula: 107

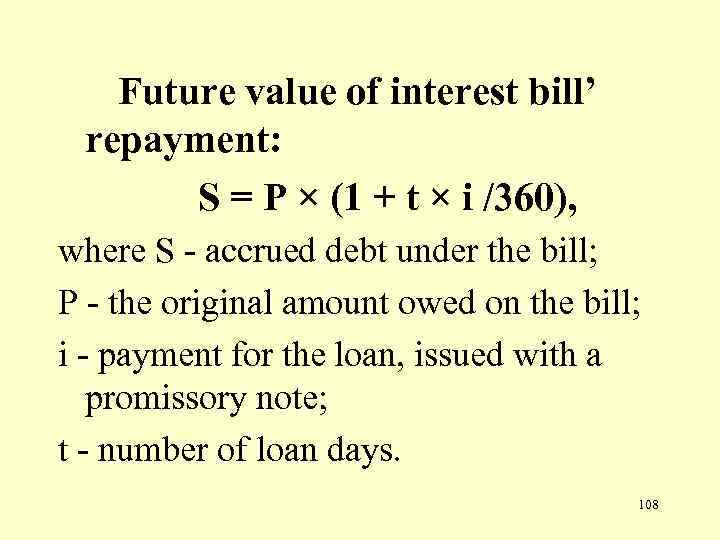

Future value of interest bill’ repayment: S = P × (1 + t × i /360), where S - accrued debt under the bill; P - the original amount owed on the bill; i - payment for the loan, issued with a promissory note; t - number of loan days. 108

Future value of interest bill’ repayment: S = P × (1 + t × i /360), where S - accrued debt under the bill; P - the original amount owed on the bill; i - payment for the loan, issued with a promissory note; t - number of loan days. 108

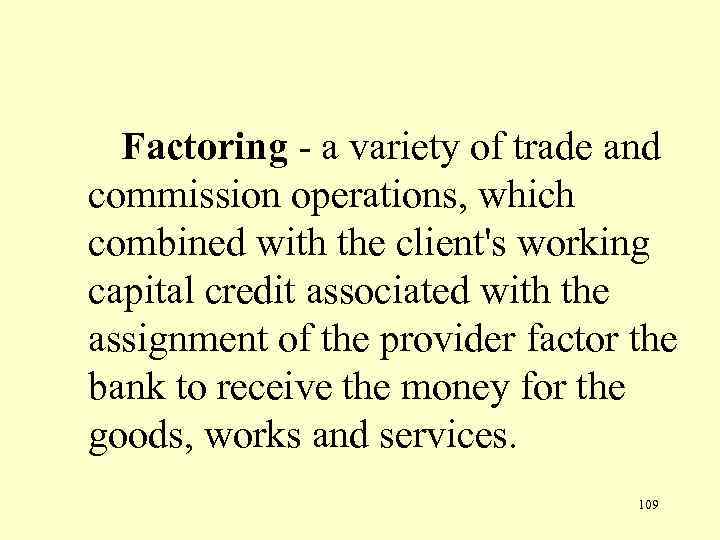

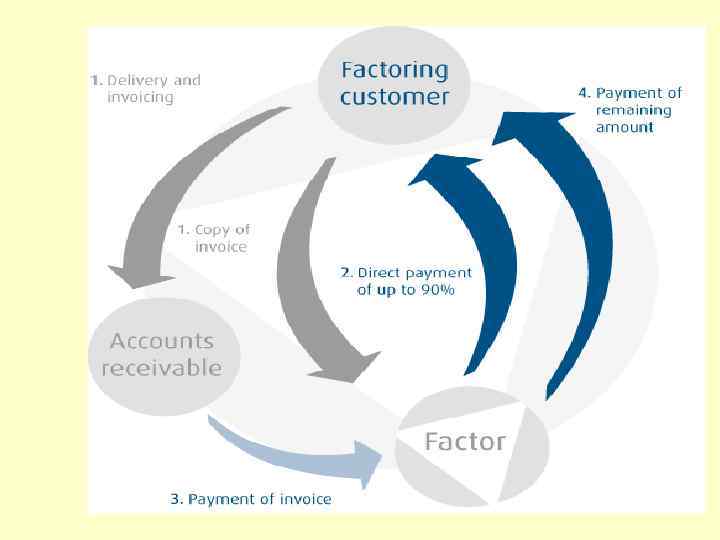

Factoring - a variety of trade and commission operations, which combined with the client's working capital credit associated with the assignment of the provider factor the bank to receive the money for the goods, works and services. 109

Factoring - a variety of trade and commission operations, which combined with the client's working capital credit associated with the assignment of the provider factor the bank to receive the money for the goods, works and services. 109

110

110

Interbank settlements The main types of correspondence relations: - between commercial banks and the central bank of the country; - between commercial banks (including between banks from different countries); - between the central banks of different countries. 111

Interbank settlements The main types of correspondence relations: - between commercial banks and the central bank of the country; - between commercial banks (including between banks from different countries); - between the central banks of different countries. 111

Correspondent account - an account that is affected calculations made by one bank to the account of another bank. 112

Correspondent account - an account that is affected calculations made by one bank to the account of another bank. 112

Correspondent accounts are of two kinds: "Nostro" ("our account in your bank") - when the bank opens an account with the correspondent bank, and "Loro" (your account in our bank) - when in the bank accounts are opened correspondent banks. 113

Correspondent accounts are of two kinds: "Nostro" ("our account in your bank") - when the bank opens an account with the correspondent bank, and "Loro" (your account in our bank) - when in the bank accounts are opened correspondent banks. 113

Aviso - formal notice of settlement operations, directed by one bank to another. 114

Aviso - formal notice of settlement operations, directed by one bank to another. 114

Questions to test the learning material: 1. Explain, please, the nature of money turnover. 2. Please list the main markets in the money turnover model. 3. Please give us a definition of "cash flow". 4. Describe, please, the structure of the money turnover on the economic content. 5. Explain the differences between money supply and monetary base. 115

Questions to test the learning material: 1. Explain, please, the nature of money turnover. 2. Please list the main markets in the money turnover model. 3. Please give us a definition of "cash flow". 4. Describe, please, the structure of the money turnover on the economic content. 5. Explain the differences between money supply and monetary base. 115

Questions to test the learning material: 6. Please give us a definition of "money aggregate". 7. Please calculate the velocity of money. 8. Please calculate the necessary money supply. 9. Please give us a definition of "monetary multiplier". 10. Please list and describe non-cash payments forms. 116

Questions to test the learning material: 6. Please give us a definition of "money aggregate". 7. Please calculate the velocity of money. 8. Please calculate the necessary money supply. 9. Please give us a definition of "monetary multiplier". 10. Please list and describe non-cash payments forms. 116