5df33ffc8bb5dff0d4a6a7b5647db6ed.ppt

- Количество слайдов: 29

The Yozma Program Success Factors & Policy Presented by: Yigal Erlich the Yozma Group Tel Aviv, Israel

The Yozma Program Success Factors & Policy Presented by: Yigal Erlich the Yozma Group Tel Aviv, Israel

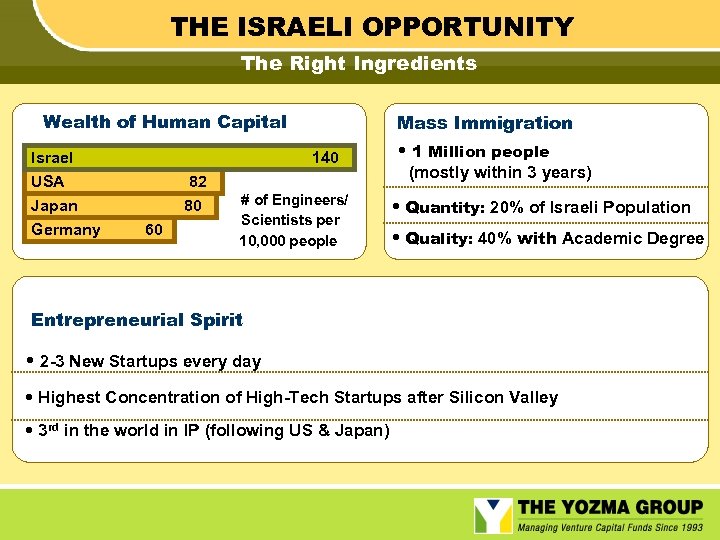

THE ISRAELI OPPORTUNITY The Right Ingredients Wealth of Human Capital Israel USA Japan Germany Mass Immigration 140 82 80 60 # of Engineers/ Scientists per 10, 000 people • 1 Million people (mostly within 3 years) • Quantity: 20% of Israeli Population • Quality: 40% with Academic Degree Entrepreneurial Spirit • 2 -3 New Startups every day • Highest Concentration of High-Tech Startups after Silicon Valley • 3 rd in the world in IP (following US & Japan)

THE ISRAELI OPPORTUNITY The Right Ingredients Wealth of Human Capital Israel USA Japan Germany Mass Immigration 140 82 80 60 # of Engineers/ Scientists per 10, 000 people • 1 Million people (mostly within 3 years) • Quantity: 20% of Israeli Population • Quality: 40% with Academic Degree Entrepreneurial Spirit • 2 -3 New Startups every day • Highest Concentration of High-Tech Startups after Silicon Valley • 3 rd in the world in IP (following US & Japan)

Why Foreign Investors Choose to Invest in Israel • Entrepreneurial Spirit • Human Resources • Reputable Academic Institutes • Government Commitment to R&D • Strong Infrastructure for Entrepreneurs (CS, VCs, Incubators. . . ) • International Activity (R&D centers, VCs, Corporations, Investment Banks) • Deal Flow Sources (Immigrants, Defense, Repatriate Israelis, Spin-offs, etc. ) © Yozma Proprietary

Why Foreign Investors Choose to Invest in Israel • Entrepreneurial Spirit • Human Resources • Reputable Academic Institutes • Government Commitment to R&D • Strong Infrastructure for Entrepreneurs (CS, VCs, Incubators. . . ) • International Activity (R&D centers, VCs, Corporations, Investment Banks) • Deal Flow Sources (Immigrants, Defense, Repatriate Israelis, Spin-offs, etc. ) © Yozma Proprietary

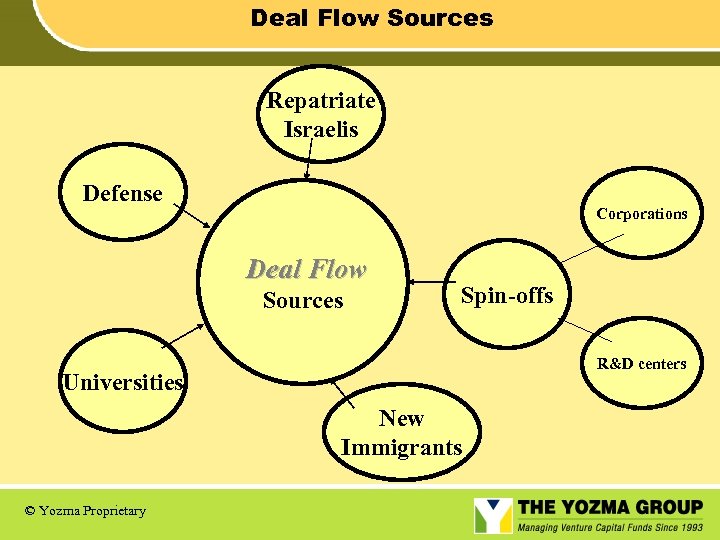

Deal Flow Sources Repatriate Israelis Defense Corporations Deal Flow Sources Spin-offs R&D centers Universities New Immigrants © Yozma Proprietary

Deal Flow Sources Repatriate Israelis Defense Corporations Deal Flow Sources Spin-offs R&D centers Universities New Immigrants © Yozma Proprietary

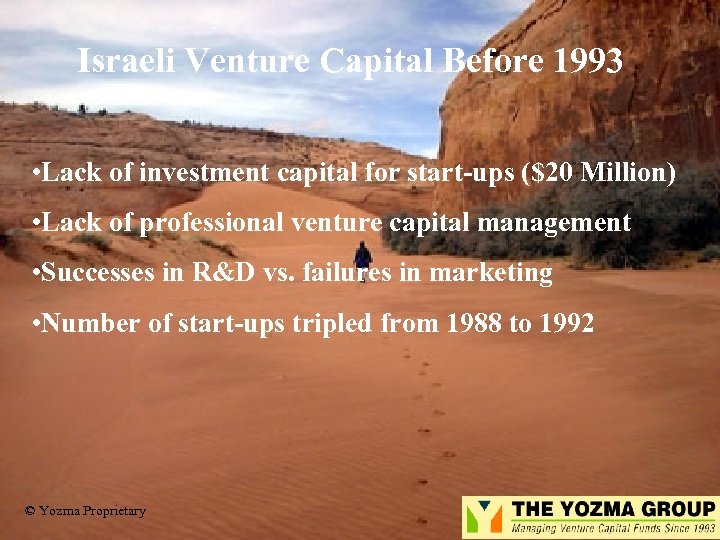

Israeli Venture Capital Before 1993 • Lack of investment capital for start-ups ($20 Million) • Lack of professional venture capital management • Successes in R&D vs. failures in marketing • Number of start-ups tripled from 1988 to 1992 © Yozma Proprietary

Israeli Venture Capital Before 1993 • Lack of investment capital for start-ups ($20 Million) • Lack of professional venture capital management • Successes in R&D vs. failures in marketing • Number of start-ups tripled from 1988 to 1992 © Yozma Proprietary

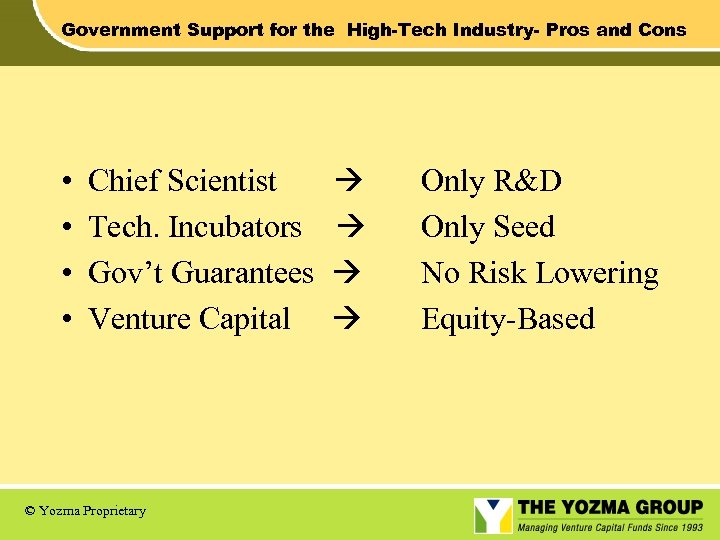

Government Support for the High-Tech Industry- Pros and Cons • • Chief Scientist Tech. Incubators Gov’t Guarantees Venture Capital © Yozma Proprietary Only R&D Only Seed No Risk Lowering Equity-Based

Government Support for the High-Tech Industry- Pros and Cons • • Chief Scientist Tech. Incubators Gov’t Guarantees Venture Capital © Yozma Proprietary Only R&D Only Seed No Risk Lowering Equity-Based

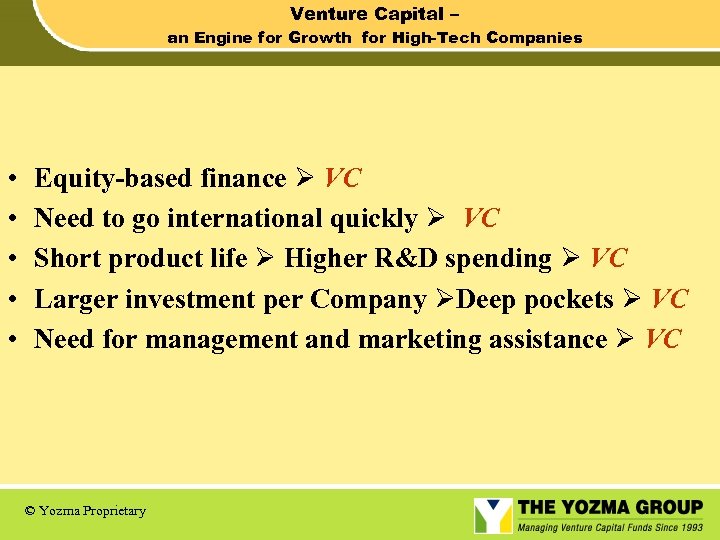

Venture Capital – an Engine for Growth for High-Tech Companies • • • Equity-based finance VC Need to go international quickly VC Short product life Higher R&D spending VC Larger investment per Company Deep pockets VC Need for management and marketing assistance VC © Yozma Proprietary

Venture Capital – an Engine for Growth for High-Tech Companies • • • Equity-based finance VC Need to go international quickly VC Short product life Higher R&D spending VC Larger investment per Company Deep pockets VC Need for management and marketing assistance VC © Yozma Proprietary

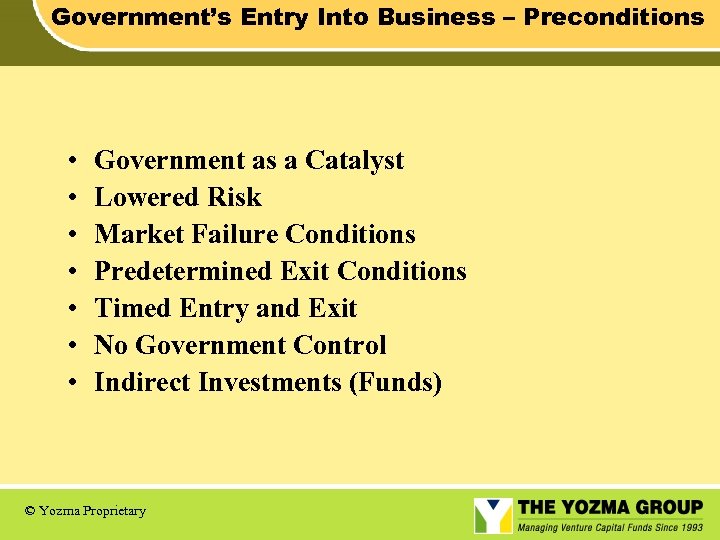

Government’s Entry Into Business – Preconditions • • Government as a Catalyst Lowered Risk Market Failure Conditions Predetermined Exit Conditions Timed Entry and Exit No Government Control Indirect Investments (Funds) © Yozma Proprietary

Government’s Entry Into Business – Preconditions • • Government as a Catalyst Lowered Risk Market Failure Conditions Predetermined Exit Conditions Timed Entry and Exit No Government Control Indirect Investments (Funds) © Yozma Proprietary

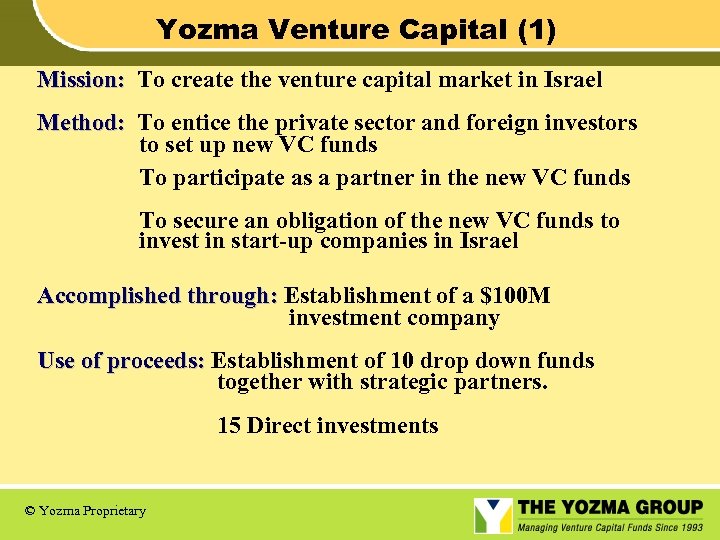

Yozma Venture Capital (1) Mission: To create the venture capital market in Israel Method: To entice the private sector and foreign investors to set up new VC funds To participate as a partner in the new VC funds To secure an obligation of the new VC funds to invest in start-up companies in Israel Accomplished through: Establishment of a $100 M investment company Use of proceeds: Establishment of 10 drop down funds together with strategic partners. 15 Direct investments © Yozma Proprietary

Yozma Venture Capital (1) Mission: To create the venture capital market in Israel Method: To entice the private sector and foreign investors to set up new VC funds To participate as a partner in the new VC funds To secure an obligation of the new VC funds to invest in start-up companies in Israel Accomplished through: Establishment of a $100 M investment company Use of proceeds: Establishment of 10 drop down funds together with strategic partners. 15 Direct investments © Yozma Proprietary

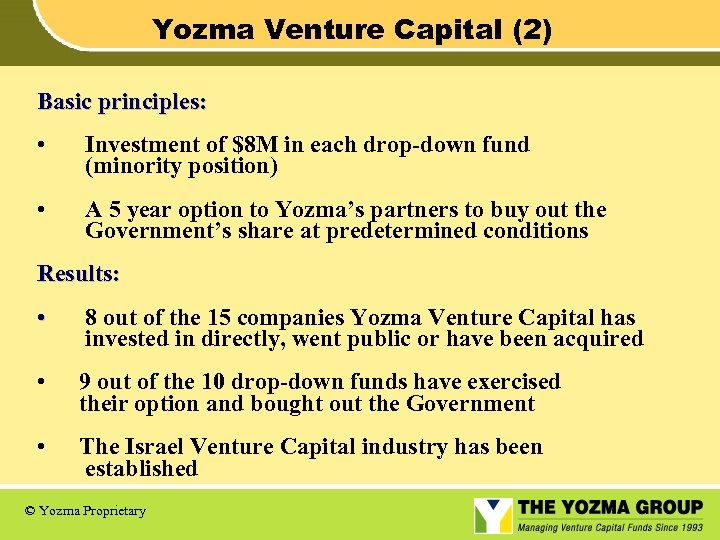

Yozma Venture Capital (2) Basic principles: • Investment of $8 M in each drop-down fund (minority position) • A 5 year option to Yozma’s partners to buy out the Government’s share at predetermined conditions Results: • 8 out of the 15 companies Yozma Venture Capital has invested in directly, went public or have been acquired • 9 out of the 10 drop-down funds have exercised their option and bought out the Government • The Israel Venture Capital industry has been established © Yozma Proprietary

Yozma Venture Capital (2) Basic principles: • Investment of $8 M in each drop-down fund (minority position) • A 5 year option to Yozma’s partners to buy out the Government’s share at predetermined conditions Results: • 8 out of the 15 companies Yozma Venture Capital has invested in directly, went public or have been acquired • 9 out of the 10 drop-down funds have exercised their option and bought out the Government • The Israel Venture Capital industry has been established © Yozma Proprietary

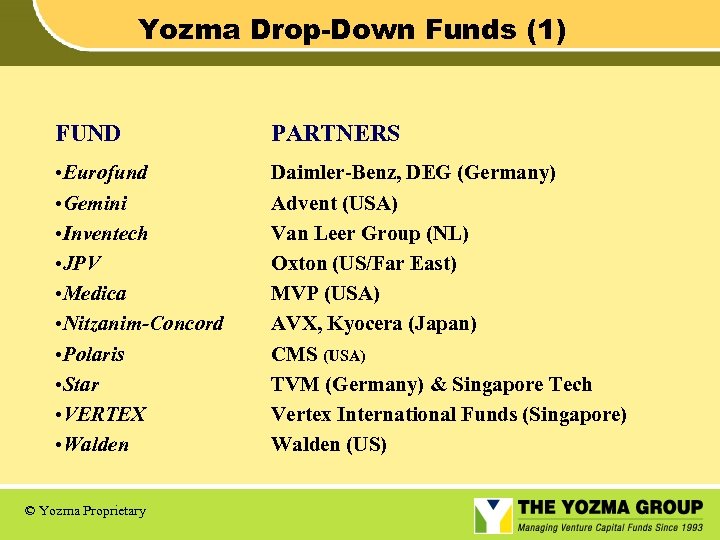

Yozma Drop-Down Funds (1) FUND PARTNERS • Eurofund • Gemini • Inventech • JPV • Medica • Nitzanim-Concord • Polaris • Star • VERTEX • Walden Daimler-Benz, DEG (Germany) Advent (USA) Van Leer Group (NL) Oxton (US/Far East) MVP (USA) AVX, Kyocera (Japan) CMS (USA) TVM (Germany) & Singapore Tech Vertex International Funds (Singapore) Walden (US) © Yozma Proprietary

Yozma Drop-Down Funds (1) FUND PARTNERS • Eurofund • Gemini • Inventech • JPV • Medica • Nitzanim-Concord • Polaris • Star • VERTEX • Walden Daimler-Benz, DEG (Germany) Advent (USA) Van Leer Group (NL) Oxton (US/Far East) MVP (USA) AVX, Kyocera (Japan) CMS (USA) TVM (Germany) & Singapore Tech Vertex International Funds (Singapore) Walden (US) © Yozma Proprietary

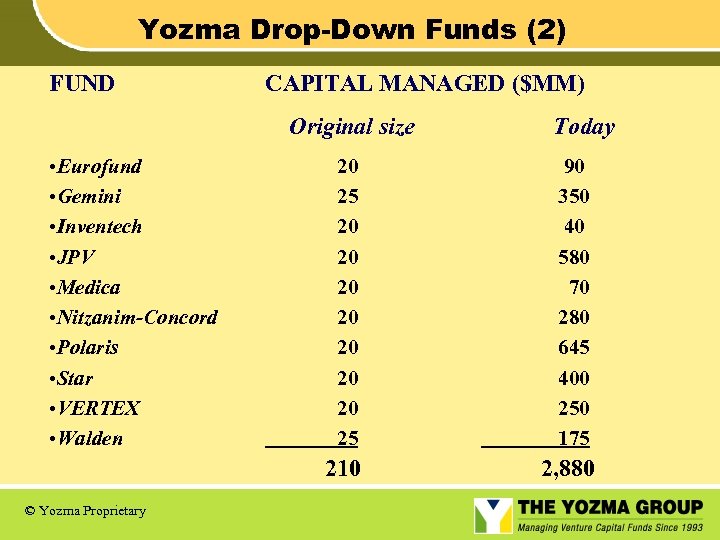

Yozma Drop-Down Funds (2) FUND CAPITAL MANAGED ($MM) Original size • Eurofund • Gemini • Inventech • JPV • Medica • Nitzanim-Concord • Polaris • Star • VERTEX • Walden Today 90 350 40 580 70 280 645 400 250 175 210 © Yozma Proprietary 20 25 20 20 25 2, 880

Yozma Drop-Down Funds (2) FUND CAPITAL MANAGED ($MM) Original size • Eurofund • Gemini • Inventech • JPV • Medica • Nitzanim-Concord • Polaris • Star • VERTEX • Walden Today 90 350 40 580 70 280 645 400 250 175 210 © Yozma Proprietary 20 25 20 20 25 2, 880

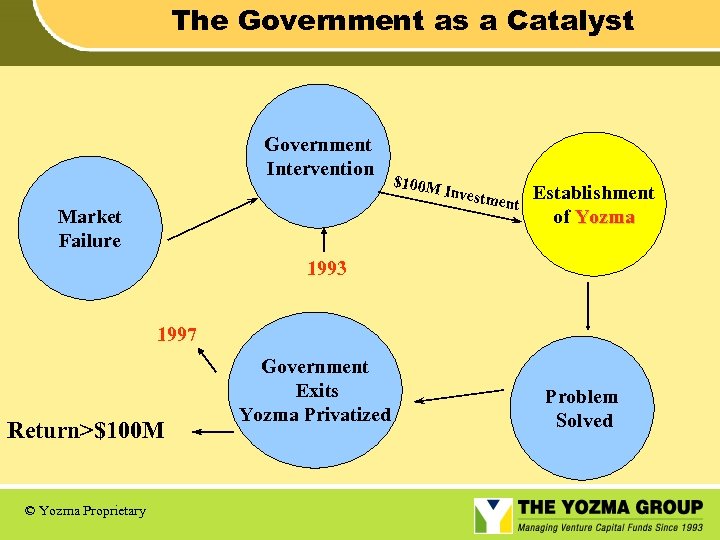

The Government as a Catalyst Government Intervention Market Failure $100 M Investm ent Establishment of Yozma 1993 1997 Return>$100 M © Yozma Proprietary Government Exits Yozma Privatized Problem Solved

The Government as a Catalyst Government Intervention Market Failure $100 M Investm ent Establishment of Yozma 1993 1997 Return>$100 M © Yozma Proprietary Government Exits Yozma Privatized Problem Solved

Countries Following the Yozma Example Czechoslovakia Taiwan Australia Denmark New Zealand Korea South Africa © Yozma Proprietary

Countries Following the Yozma Example Czechoslovakia Taiwan Australia Denmark New Zealand Korea South Africa © Yozma Proprietary

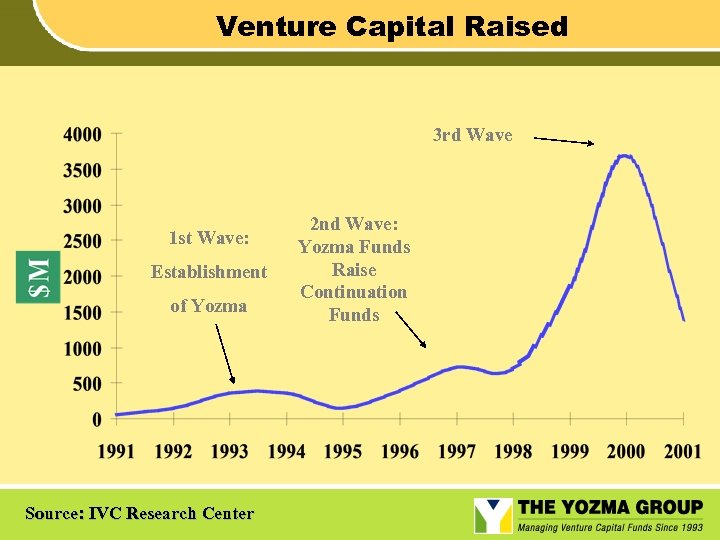

Venture Capital Raised 3 rd Wave 1 st Wave: Establishment of Yozma Source: IVC Research Center 2 nd Wave: Yozma Funds Raise Continuation Funds

Venture Capital Raised 3 rd Wave 1 st Wave: Establishment of Yozma Source: IVC Research Center 2 nd Wave: Yozma Funds Raise Continuation Funds

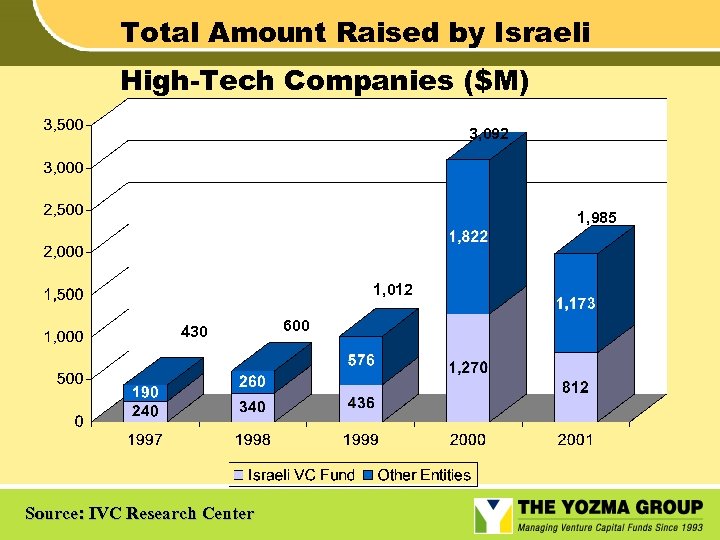

Total Amount Raised by Israeli High-Tech Companies ($M) 3, 092 1, 985 1, 012 430 Source: IVC Research Center 600

Total Amount Raised by Israeli High-Tech Companies ($M) 3, 092 1, 985 1, 012 430 Source: IVC Research Center 600

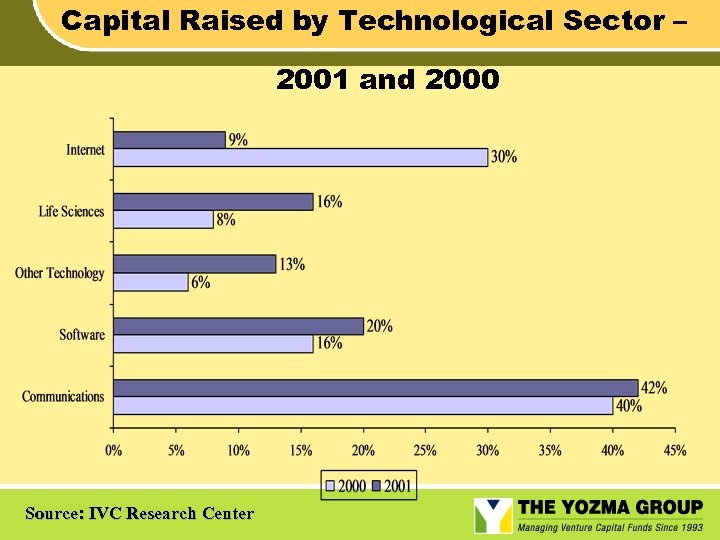

Capital Raised by Technological Sector – 2001 and 2000 Source: IVC Research Center

Capital Raised by Technological Sector – 2001 and 2000 Source: IVC Research Center

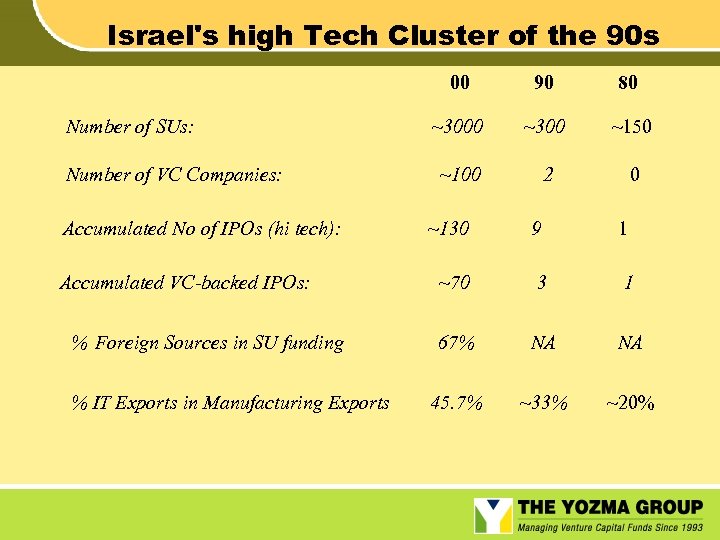

Israel's high Tech Cluster of the 90 s 00 Number of SUs: Number of VC Companies: Accumulated No of IPOs (hi tech): Accumulated VC-backed IPOs: % Foreign Sources in SU funding % IT Exports in Manufacturing Exports 90 80 ~300 ~150 ~100 2 0 ~130 9 1 ~70 3 1 67% NA NA 45. 7% ~33% ~20%

Israel's high Tech Cluster of the 90 s 00 Number of SUs: Number of VC Companies: Accumulated No of IPOs (hi tech): Accumulated VC-backed IPOs: % Foreign Sources in SU funding % IT Exports in Manufacturing Exports 90 80 ~300 ~150 ~100 2 0 ~130 9 1 ~70 3 1 67% NA NA 45. 7% ~33% ~20%

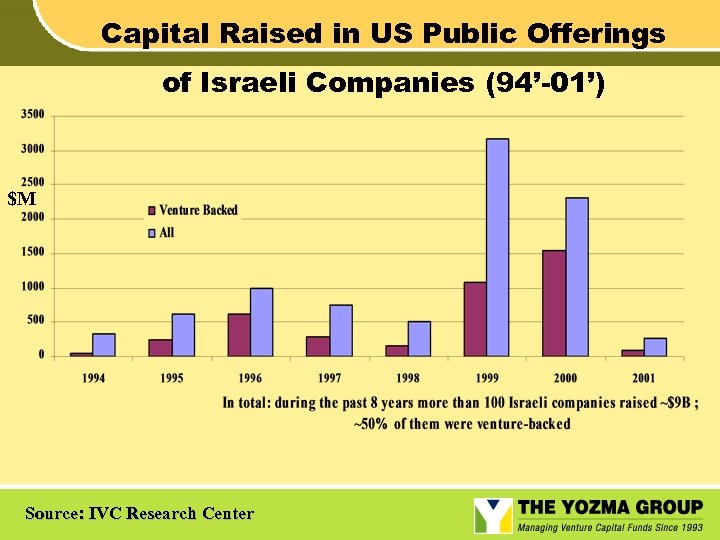

Capital Raised in US Public Offerings of Israeli Companies (94’-01’) $M Source: IVC Research Center

Capital Raised in US Public Offerings of Israeli Companies (94’-01’) $M Source: IVC Research Center

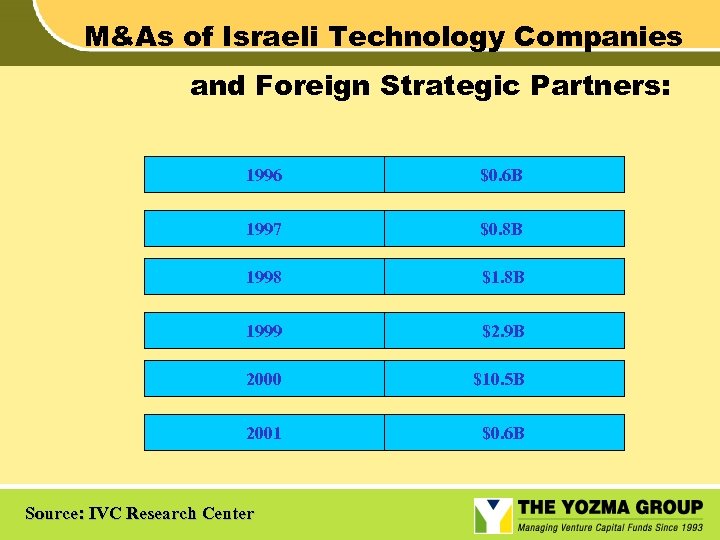

M&As of Israeli Technology Companies and Foreign Strategic Partners: 1996 $0. 6 B 1997 $0. 8 B 1998 $1. 8 B 1999 $2. 9 B 2000 $10. 5 B 2001 $0. 6 B Source: IVC Research Center

M&As of Israeli Technology Companies and Foreign Strategic Partners: 1996 $0. 6 B 1997 $0. 8 B 1998 $1. 8 B 1999 $2. 9 B 2000 $10. 5 B 2001 $0. 6 B Source: IVC Research Center

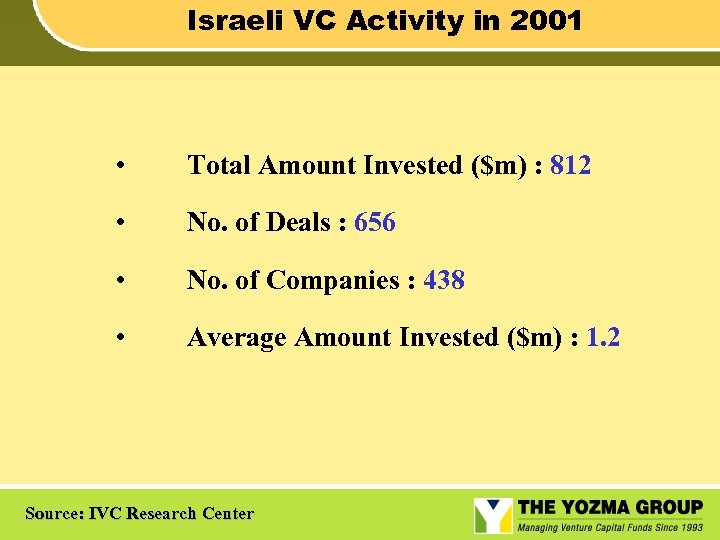

Israeli VC Activity in 2001 • Total Amount Invested ($m) : 812 • No. of Deals : 656 • No. of Companies : 438 • Average Amount Invested ($m) : 1. 2 Source: IVC Research Center

Israeli VC Activity in 2001 • Total Amount Invested ($m) : 812 • No. of Deals : 656 • No. of Companies : 438 • Average Amount Invested ($m) : 1. 2 Source: IVC Research Center

Israel VC Industry - Trends & Challenges • Co-opetition • Volatile Capital Markets • Decrease in International Investments • Maintaining Existing Portfolios • Difficulties in Raising Capital • Focus on Future Technologies • Government Involvement

Israel VC Industry - Trends & Challenges • Co-opetition • Volatile Capital Markets • Decrease in International Investments • Maintaining Existing Portfolios • Difficulties in Raising Capital • Focus on Future Technologies • Government Involvement

Thank You © Yozma Proprietary

Thank You © Yozma Proprietary

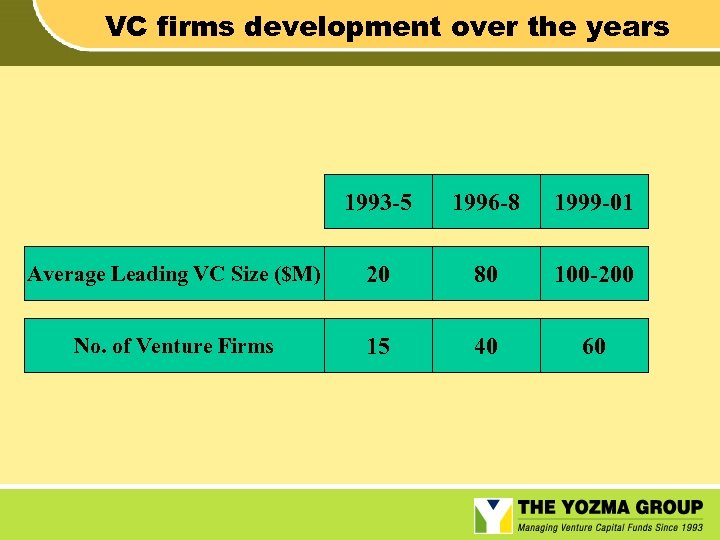

VC firms development over the years 1993 -5 1996 -8 1999 -01 Average Leading VC Size ($M) 20 80 100 -200 No. of Venture Firms 15 40 60

VC firms development over the years 1993 -5 1996 -8 1999 -01 Average Leading VC Size ($M) 20 80 100 -200 No. of Venture Firms 15 40 60

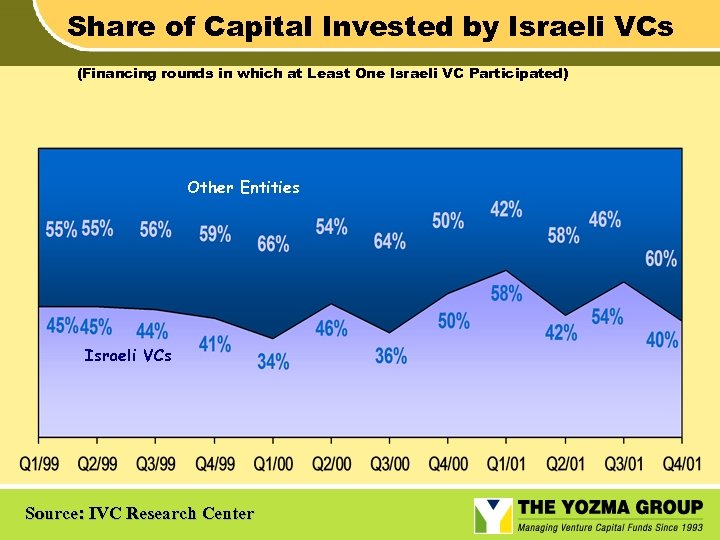

Share of Capital Invested by Israeli VCs (Financing rounds in which at Least One Israeli VC Participated) Other Entities Israeli VCs Source: IVC Research Center

Share of Capital Invested by Israeli VCs (Financing rounds in which at Least One Israeli VC Participated) Other Entities Israeli VCs Source: IVC Research Center

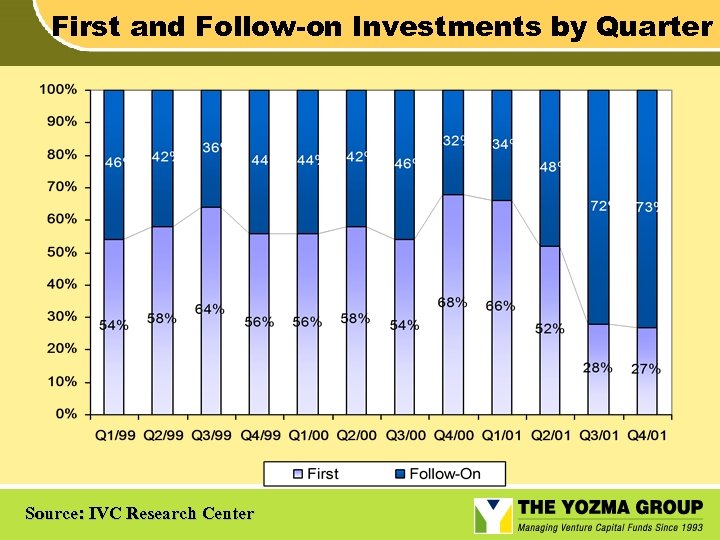

First and Follow-on Investments by Quarter Source: IVC Research Center

First and Follow-on Investments by Quarter Source: IVC Research Center

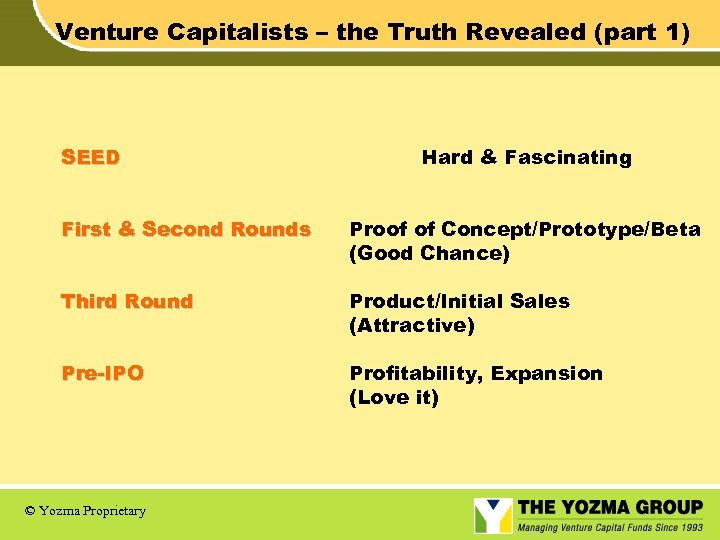

Venture Capitalists – the Truth Revealed (part 1) SEED Hard & Fascinating First & Second Rounds Proof of Concept/Prototype/Beta (Good Chance) Third Round Product/Initial Sales (Attractive) Pre-IPO Profitability, Expansion (Love it) © Yozma Proprietary

Venture Capitalists – the Truth Revealed (part 1) SEED Hard & Fascinating First & Second Rounds Proof of Concept/Prototype/Beta (Good Chance) Third Round Product/Initial Sales (Attractive) Pre-IPO Profitability, Expansion (Love it) © Yozma Proprietary

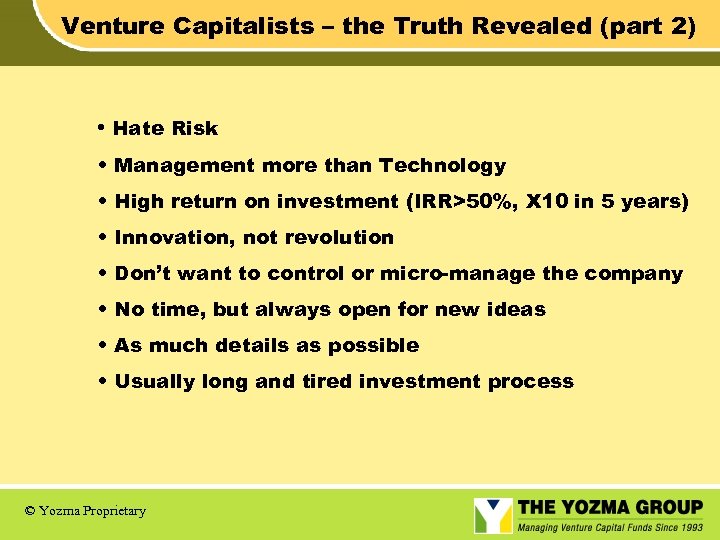

Venture Capitalists – the Truth Revealed (part 2) • Hate Risk • Management more than Technology • High return on investment (IRR>50%, X 10 in 5 years) • Innovation, not revolution • Don’t want to control or micro-manage the company • No time, but always open for new ideas • As much details as possible • Usually long and tired investment process © Yozma Proprietary

Venture Capitalists – the Truth Revealed (part 2) • Hate Risk • Management more than Technology • High return on investment (IRR>50%, X 10 in 5 years) • Innovation, not revolution • Don’t want to control or micro-manage the company • No time, but always open for new ideas • As much details as possible • Usually long and tired investment process © Yozma Proprietary

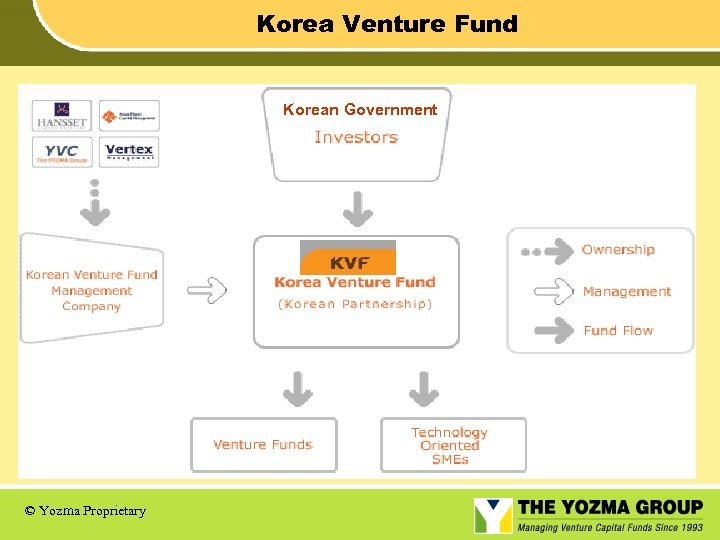

Korea Venture Fund Korean Government © Yozma Proprietary

Korea Venture Fund Korean Government © Yozma Proprietary