9561ee56d1d5a8419036406e5096567e.ppt

- Количество слайдов: 19

The WTO Cotton Case and Doha Round: Implications for U. S. Cotton

The WTO Cotton Case and Doha Round: Implications for U. S. Cotton

The WTO Cotton Case and Doha Round: Implications for U. S. Cotton • U. S. Cotton Marketing/Policy Background • Cotton Initiative & Brazilian Dispute • Impacts and Implications

The WTO Cotton Case and Doha Round: Implications for U. S. Cotton • U. S. Cotton Marketing/Policy Background • Cotton Initiative & Brazilian Dispute • Impacts and Implications

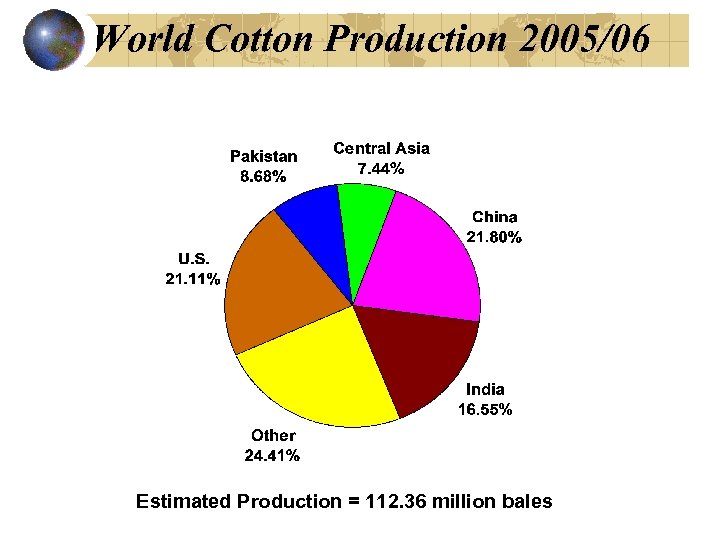

World Cotton Production 2005/06 Estimated Production = 112. 36 million bales

World Cotton Production 2005/06 Estimated Production = 112. 36 million bales

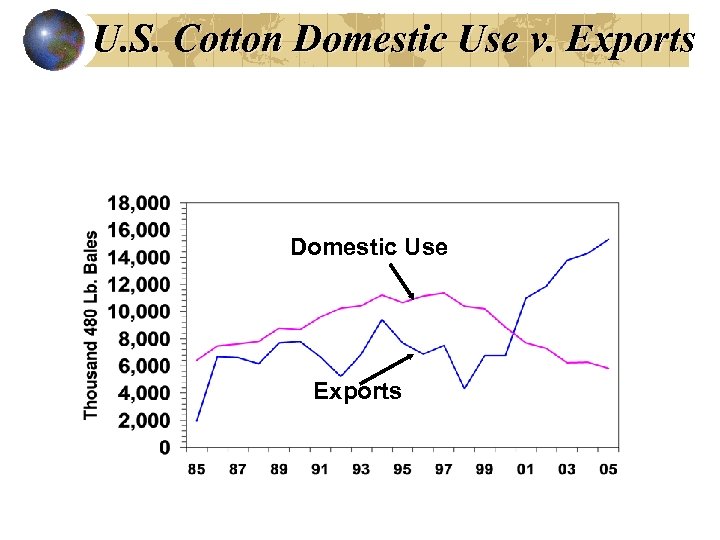

U. S. Cotton Domestic Use v. Exports Domestic Use Exports

U. S. Cotton Domestic Use v. Exports Domestic Use Exports

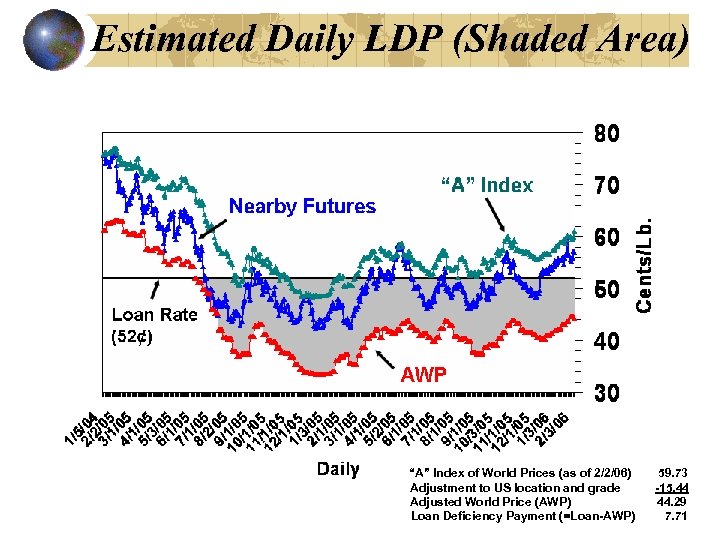

Estimated Daily LDP (Shaded Area) “A” Index of World Prices (as of 2/2/06) Adjustment to US location and grade Adjusted World Price (AWP) Loan Deficiency Payment (=Loan-AWP) 59. 73 -15. 44 44. 29 7. 71

Estimated Daily LDP (Shaded Area) “A” Index of World Prices (as of 2/2/06) Adjustment to US location and grade Adjusted World Price (AWP) Loan Deficiency Payment (=Loan-AWP) 59. 73 -15. 44 44. 29 7. 71

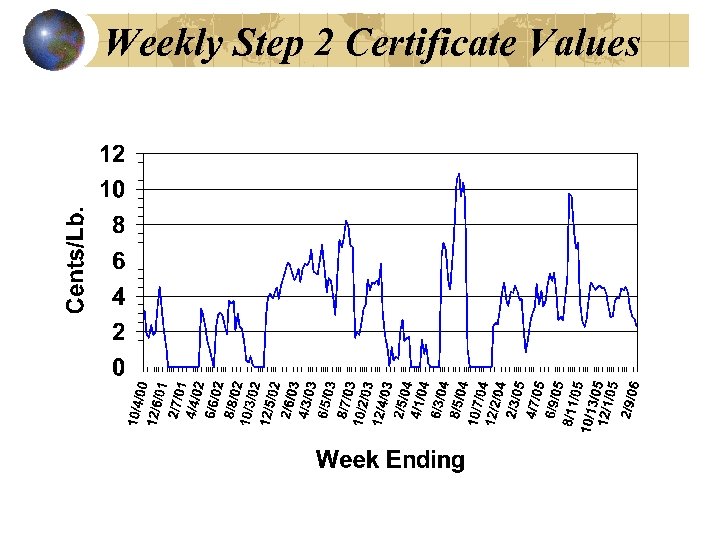

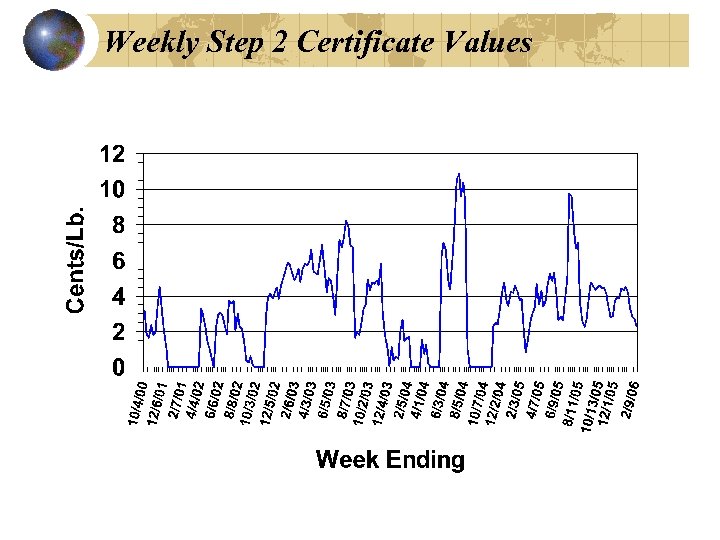

Weekly Step 2 Certificate Values Source: NCC

Weekly Step 2 Certificate Values Source: NCC

U. S. Cotton as the Bad Guy Negative Press trend (NYT, WSJ, Wash. Post, Networks, etc. ) • • • Continuation of anti-farm program lobbying OXFAM Research out of UC Davis WTO Cotton Initiative Brazilian WTO Complaint

U. S. Cotton as the Bad Guy Negative Press trend (NYT, WSJ, Wash. Post, Networks, etc. ) • • • Continuation of anti-farm program lobbying OXFAM Research out of UC Davis WTO Cotton Initiative Brazilian WTO Complaint

The WTO Cotton Initiative Started by Benin, Burkina Faso, Chad and Mali Claim: Rich Country Cotton Subsidies Limit & Damage in Poor Countries Due to Low World Prices Requested Action: Eliminate Subsidies & In Mean Time, Pay Compensation Action to Date: Cotton Sub-Committee formed Under WTO Ag. Committee, November 2004

The WTO Cotton Initiative Started by Benin, Burkina Faso, Chad and Mali Claim: Rich Country Cotton Subsidies Limit & Damage in Poor Countries Due to Low World Prices Requested Action: Eliminate Subsidies & In Mean Time, Pay Compensation Action to Date: Cotton Sub-Committee formed Under WTO Ag. Committee, November 2004

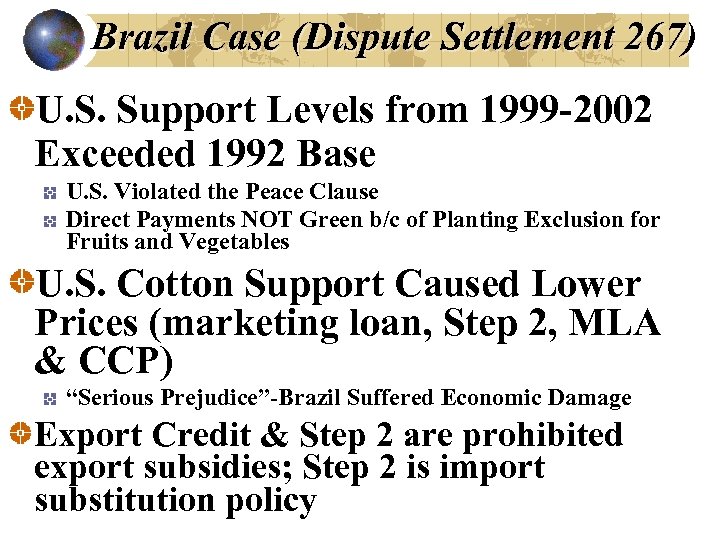

Brazil Case (Dispute Settlement 267) U. S. Support Levels from 1999 -2002 Exceeded 1992 Base U. S. Violated the Peace Clause Direct Payments NOT Green b/c of Planting Exclusion for Fruits and Vegetables U. S. Cotton Support Caused Lower Prices (marketing loan, Step 2, MLA & CCP) “Serious Prejudice”-Brazil Suffered Economic Damage Export Credit & Step 2 are prohibited export subsidies; Step 2 is import substitution policy

Brazil Case (Dispute Settlement 267) U. S. Support Levels from 1999 -2002 Exceeded 1992 Base U. S. Violated the Peace Clause Direct Payments NOT Green b/c of Planting Exclusion for Fruits and Vegetables U. S. Cotton Support Caused Lower Prices (marketing loan, Step 2, MLA & CCP) “Serious Prejudice”-Brazil Suffered Economic Damage Export Credit & Step 2 are prohibited export subsidies; Step 2 is import substitution policy

WTO Domestic Support Classification Green Box: Decoupled, Non-trade Distorting Exple: CRP Amber Box: Trade Distorting Policies Marketing Loan Payments AND Direct Payments Counter-Cyclical Payments Blue Box: Trade Distorting Production Limiting Programs Acreage Set-Asides Used by European Union U. S. currently has no Blue Box programs

WTO Domestic Support Classification Green Box: Decoupled, Non-trade Distorting Exple: CRP Amber Box: Trade Distorting Policies Marketing Loan Payments AND Direct Payments Counter-Cyclical Payments Blue Box: Trade Distorting Production Limiting Programs Acreage Set-Asides Used by European Union U. S. currently has no Blue Box programs

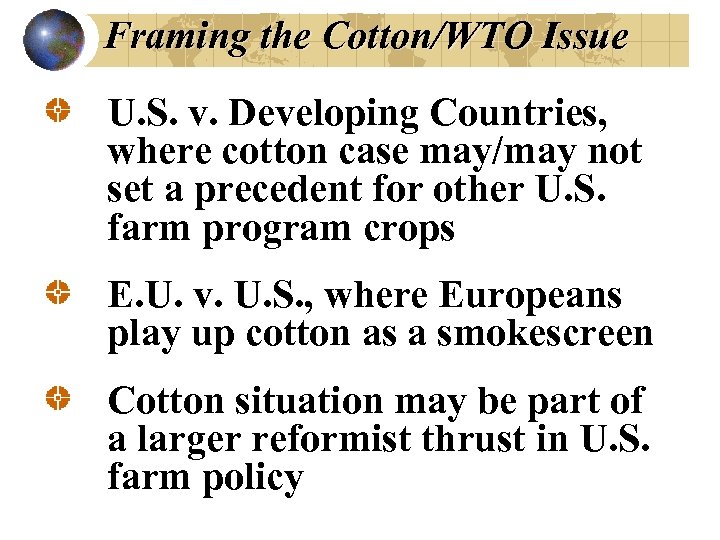

Framing the Cotton/WTO Issue U. S. v. Developing Countries, where cotton case may/may not set a precedent for other U. S. farm program crops E. U. v. U. S. , where Europeans play up cotton as a smokescreen Cotton situation may be part of a larger reformist thrust in U. S. farm policy

Framing the Cotton/WTO Issue U. S. v. Developing Countries, where cotton case may/may not set a precedent for other U. S. farm program crops E. U. v. U. S. , where Europeans play up cotton as a smokescreen Cotton situation may be part of a larger reformist thrust in U. S. farm policy

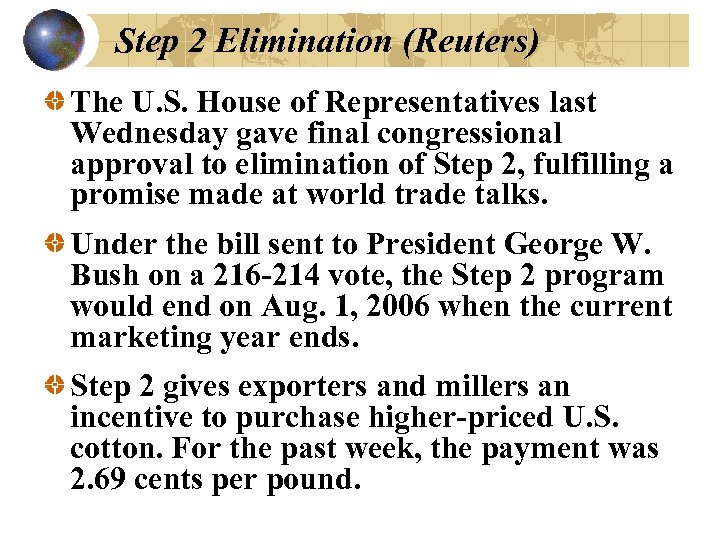

Step 2 Elimination (Reuters) The U. S. House of Representatives last Wednesday gave final congressional approval to elimination of Step 2, fulfilling a promise made at world trade talks. Under the bill sent to President George W. Bush on a 216 -214 vote, the Step 2 program would end on Aug. 1, 2006 when the current marketing year ends. Step 2 gives exporters and millers an incentive to purchase higher-priced U. S. cotton. For the past week, the payment was 2. 69 cents per pound.

Step 2 Elimination (Reuters) The U. S. House of Representatives last Wednesday gave final congressional approval to elimination of Step 2, fulfilling a promise made at world trade talks. Under the bill sent to President George W. Bush on a 216 -214 vote, the Step 2 program would end on Aug. 1, 2006 when the current marketing year ends. Step 2 gives exporters and millers an incentive to purchase higher-priced U. S. cotton. For the past week, the payment was 2. 69 cents per pound.

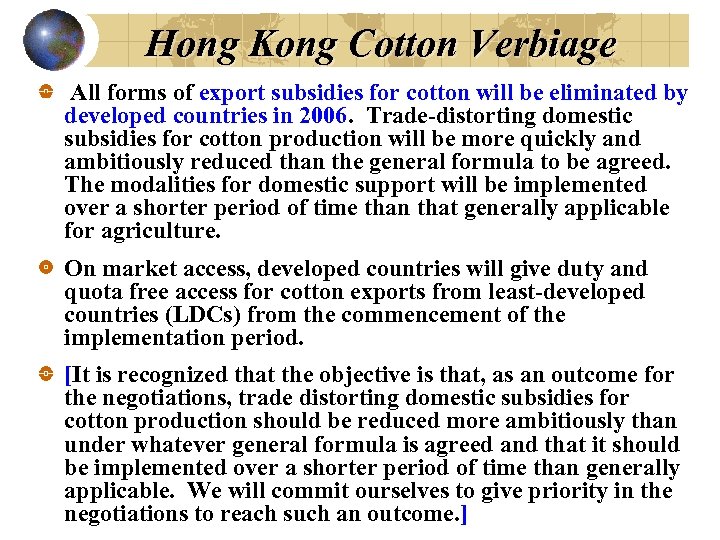

Hong Kong Cotton Verbiage All forms of export subsidies for cotton will be eliminated by developed countries in 2006. Trade-distorting domestic subsidies for cotton production will be more quickly and ambitiously reduced than the general formula to be agreed. The modalities for domestic support will be implemented over a shorter period of time than that generally applicable for agriculture. On market access, developed countries will give duty and quota free access for cotton exports from least-developed countries (LDCs) from the commencement of the implementation period. [It is recognized that the objective is that, as an outcome for the negotiations, trade distorting domestic subsidies for cotton production should be reduced more ambitiously than under whatever general formula is agreed and that it should be implemented over a shorter period of time than generally applicable. We will commit ourselves to give priority in the negotiations to reach such an outcome. ]

Hong Kong Cotton Verbiage All forms of export subsidies for cotton will be eliminated by developed countries in 2006. Trade-distorting domestic subsidies for cotton production will be more quickly and ambitiously reduced than the general formula to be agreed. The modalities for domestic support will be implemented over a shorter period of time than that generally applicable for agriculture. On market access, developed countries will give duty and quota free access for cotton exports from least-developed countries (LDCs) from the commencement of the implementation period. [It is recognized that the objective is that, as an outcome for the negotiations, trade distorting domestic subsidies for cotton production should be reduced more ambitiously than under whatever general formula is agreed and that it should be implemented over a shorter period of time than generally applicable. We will commit ourselves to give priority in the negotiations to reach such an outcome. ]

A Few Assumptions for 2006/07 1) Expected U. S. yield is based on previous five year average -including 813 lb/ac estimate for 2005/06 2) U. S. planted acres is assumed to be roughly the same as previous year, reflecting a small amount of switching to corn and soybeans in some places, offset by more cotton in northern panhandle 3) U. S. abandonment is assumed to be 8% (i. e. , West Texas will have a more normal year) 4) U. S. mill use and exports are assumed to be 2% less from previous year due to trends in U. S. mill use and effect of losing Step 2 5) Foreign production is assumed to be the slightly higher (+2%) due to a relatively profitable world prices (i. e. , A-index >50 cents/lb) inducing at least the same number of foreign acreage, and upward trends in foreign yields 6) Foreign exports are assumed to increase with mill use up 2% compared to previous year from relatively high prices of synthetic fiber and upward trend in foreign cotton use 7) Resolution of U. S. /China textile trade dispute, average production conditions, and no U. S. recession due from energyinduced shocks

A Few Assumptions for 2006/07 1) Expected U. S. yield is based on previous five year average -including 813 lb/ac estimate for 2005/06 2) U. S. planted acres is assumed to be roughly the same as previous year, reflecting a small amount of switching to corn and soybeans in some places, offset by more cotton in northern panhandle 3) U. S. abandonment is assumed to be 8% (i. e. , West Texas will have a more normal year) 4) U. S. mill use and exports are assumed to be 2% less from previous year due to trends in U. S. mill use and effect of losing Step 2 5) Foreign production is assumed to be the slightly higher (+2%) due to a relatively profitable world prices (i. e. , A-index >50 cents/lb) inducing at least the same number of foreign acreage, and upward trends in foreign yields 6) Foreign exports are assumed to increase with mill use up 2% compared to previous year from relatively high prices of synthetic fiber and upward trend in foreign cotton use 7) Resolution of U. S. /China textile trade dispute, average production conditions, and no U. S. recession due from energyinduced shocks

Weekly Step 2 Certificate Values Source: NCC

Weekly Step 2 Certificate Values Source: NCC

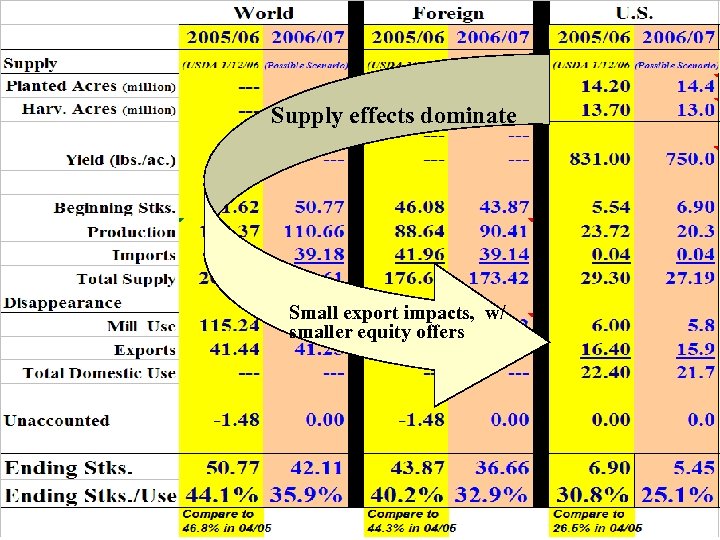

Supply effects dominate Small export impacts, w/ smaller equity offers

Supply effects dominate Small export impacts, w/ smaller equity offers

Step 2 Elimination Impacts ICAC study of shows little correlation between weekly shipments of U. S. raw cotton and the weekly Step 2 payment There were some sporadic exceptions to the economist’s findings, the result of studying data dating back to 1996 -97, when payments became effective on the date of shipment. Extreme spikes in Step 2 payments would cause spikes in shipments in anticipation of steep declines in payments during forthcoming weeks. However, averaged over several months, payments and shipments show no correlation. Study showed significant determinants of U. S. exports were levels of foreign use and excess U. S. supply (of suitable quality fiber)

Step 2 Elimination Impacts ICAC study of shows little correlation between weekly shipments of U. S. raw cotton and the weekly Step 2 payment There were some sporadic exceptions to the economist’s findings, the result of studying data dating back to 1996 -97, when payments became effective on the date of shipment. Extreme spikes in Step 2 payments would cause spikes in shipments in anticipation of steep declines in payments during forthcoming weeks. However, averaged over several months, payments and shipments show no correlation. Study showed significant determinants of U. S. exports were levels of foreign use and excess U. S. supply (of suitable quality fiber)

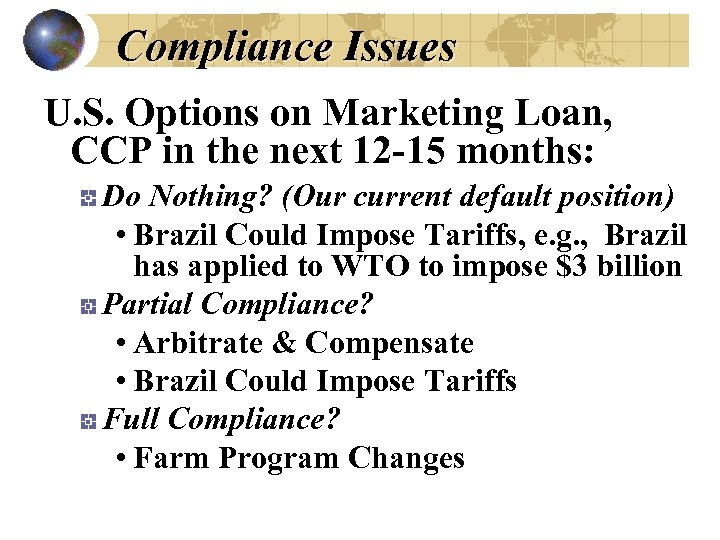

Compliance Issues U. S. Options on Marketing Loan, CCP in the next 12 -15 months: Do Nothing? (Our current default position) • Brazil Could Impose Tariffs, e. g. , Brazil has applied to WTO to impose $3 billion Partial Compliance? • Arbitrate & Compensate • Brazil Could Impose Tariffs Full Compliance? • Farm Program Changes

Compliance Issues U. S. Options on Marketing Loan, CCP in the next 12 -15 months: Do Nothing? (Our current default position) • Brazil Could Impose Tariffs, e. g. , Brazil has applied to WTO to impose $3 billion Partial Compliance? • Arbitrate & Compensate • Brazil Could Impose Tariffs Full Compliance? • Farm Program Changes

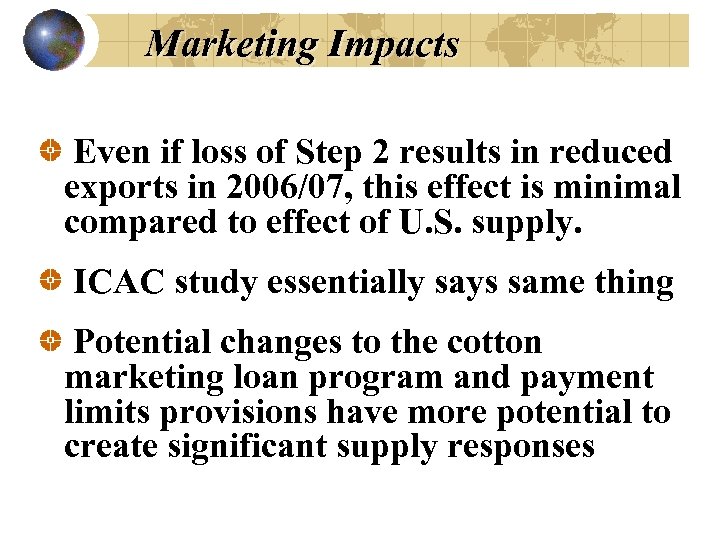

Marketing Impacts Even if loss of Step 2 results in reduced exports in 2006/07, this effect is minimal compared to effect of U. S. supply. ICAC study essentially says same thing Potential changes to the cotton marketing loan program and payment limits provisions have more potential to create significant supply responses

Marketing Impacts Even if loss of Step 2 results in reduced exports in 2006/07, this effect is minimal compared to effect of U. S. supply. ICAC study essentially says same thing Potential changes to the cotton marketing loan program and payment limits provisions have more potential to create significant supply responses