19545e029350598911c0cbd4e327128e.ppt

- Количество слайдов: 44

THE WILLIS ENERGY LOSS DATABASE + CLAIMS REVIEW OF 2011 Presentation to C. T. Bauer College of Business – University of Houston 22 nd March 2012

OVERVIEW • • • 2 Background Property included Database information Purpose of database Types of reports available Information sources Confidentiality Subscriptions & Subscribers Disclaimer

BACKGROUND • Idea conceived in 1994, commercially available from 1997 • Created in recognition of general lack of industry information • Marine and Aviation losses are well reported but not Energy unless they are major and/or involve death or injury • This is a unique facility 3

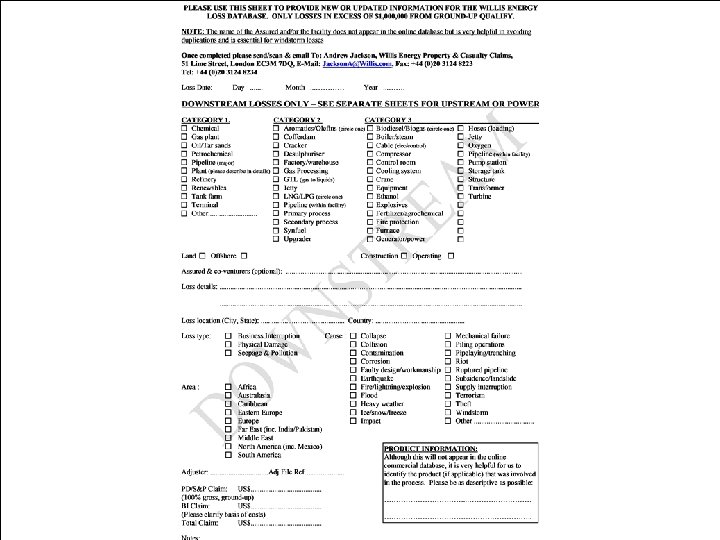

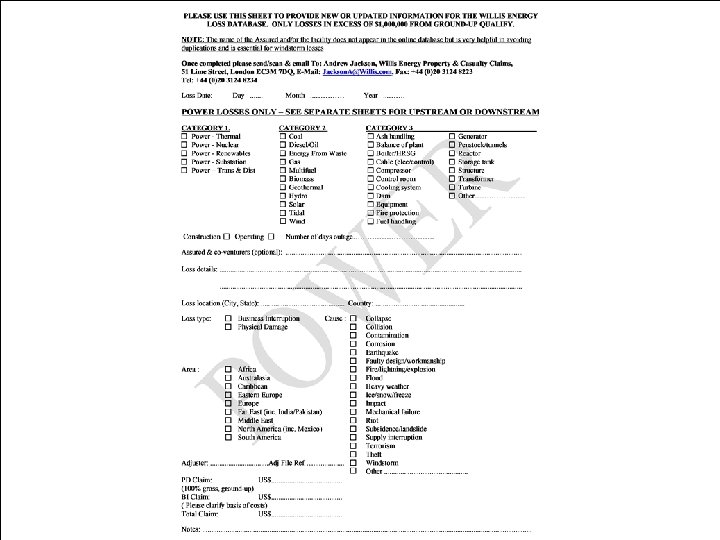

PROPERTY INCLUDED Offshore/Onshore – E&P Upstream - Rigs/FPSOs/FPUs etc - Platforms - Pipelines - Oil sands - Storage & offloading systems Onshore – Midstream/Downstream - Refineries, petrochemical, gas plants etc. - Loading terminals, tank farms - Power Stations, wind farms - Gas plants, transmission stations 4

DATABASE INFORMATION • • • Only for losses of US$1, 000 or more at time of loss Information captured is from 1972 to date All amounts shown in US$ exchanged at date of loss rate of exchange Property related losses – no liability in isolation Amounts relate to PD, OEE (cost of control etc. ) and BI Contains over 9, 400 individual records with an aggregate time of loss value greater than US$158 billion (>US$220 billion indexed) • Except for BI this is a loss database not an insurance database therefore PD, OEE & S&P costs are for 100% interest FGU on the basis of no deductible and no limit – the incident does not have to have been insured but it does have to have been insurable 5

PURPOSE OF DATABASE • To assist in the evaluation and review of current and future insurance strategies – both buying and selling, direct and reinsurance • To help understand the dynamics between losses and pricing • To provide activity profiles and market share analyses for contributing Loss Adjusters • Subscribed to by oil companies, insurers/reinsurers and major brokers • Used by academic establishments – forms part of the “Energy Insurance and Risk Management” course run by the Bauer College of Business at the University of Houston 6

REPORTS AVAILABLE • • 7 Summary: No. of incidents, aggregate & average $ - by year - by geographical area, country or location - by cause - by property type - by cost bandwidths - by well depth - any combination of the above Listings of individual losses sorted by date or value

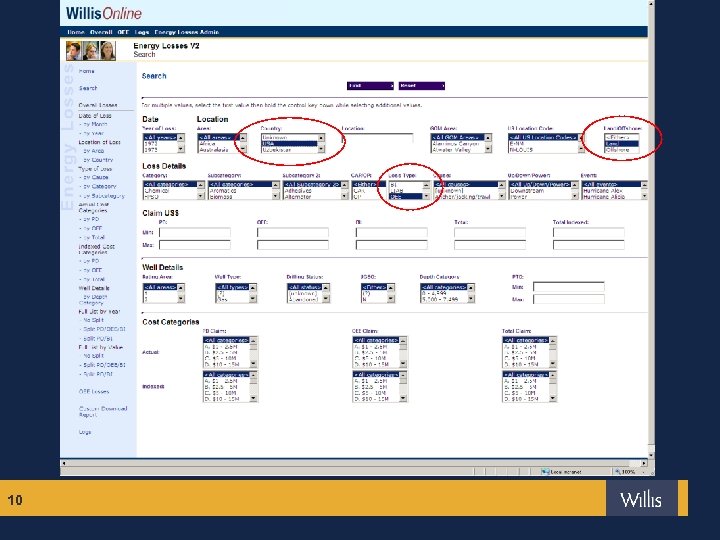

REPORT EXAMPLE 1: An independent oil company operating only onshore USA wishes to review their current OEE limits of $5 M. What can the database tell them about the adequacy of their OEE limit in light of industry experience? Database search criteria: Country = USA, Land/Offshore = Land, Loss Type = OEE 8

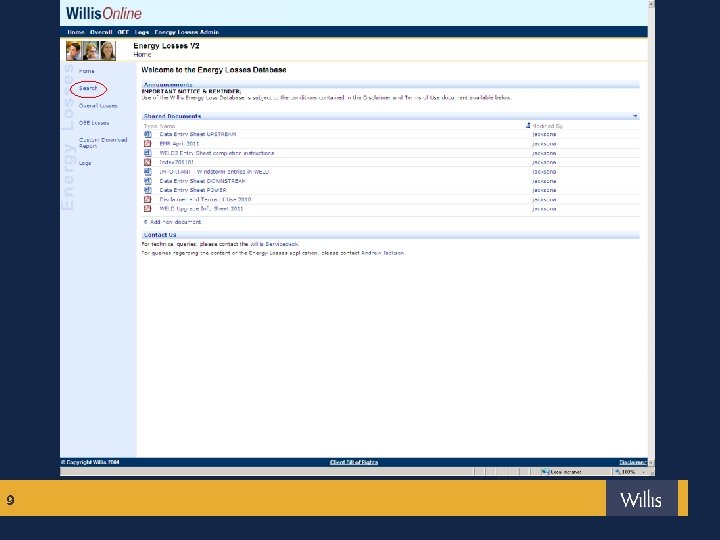

9

10

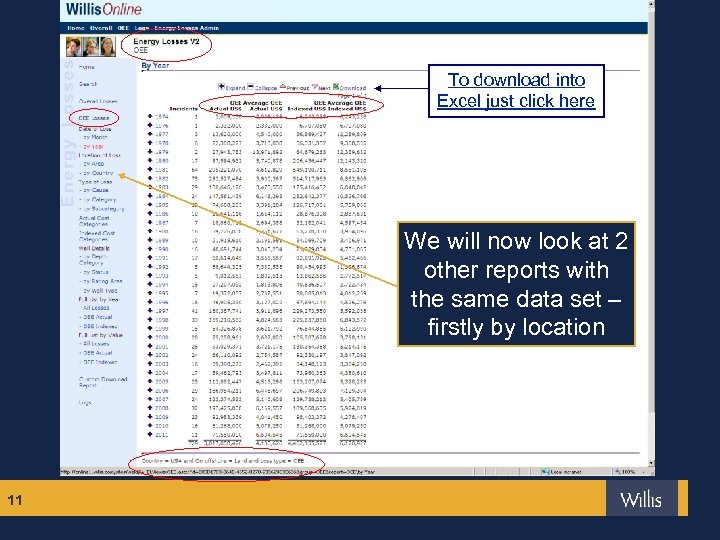

To download into Excel just click here We will now look at 2 other reports with the same data set – firstly by location 11

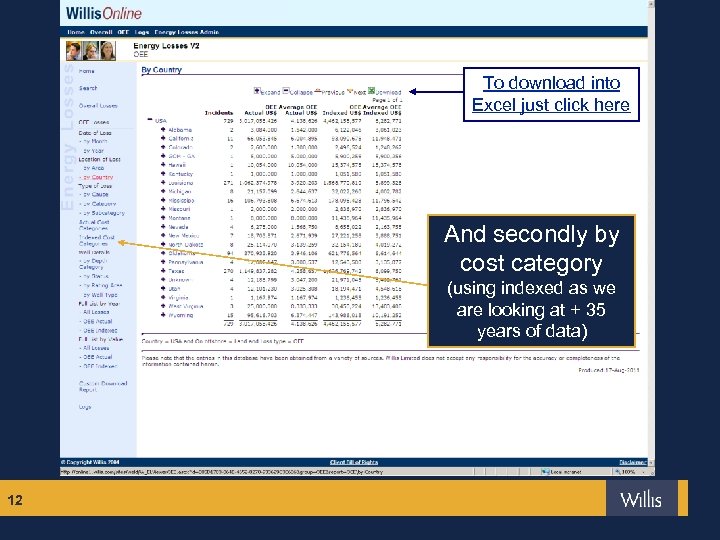

To download into Excel just click here And secondly by cost category (using indexed as we are looking at + 35 years of data) 12

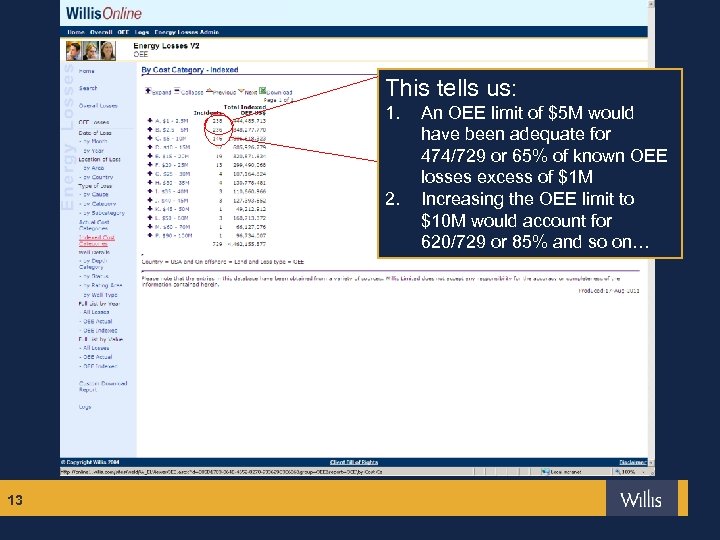

This tells us: 1. 2. 13 An OEE limit of $5 M would have been adequate for 474/729 or 65% of known OEE losses excess of $1 M Increasing the OEE limit to $10 M would account for 620/729 or 85% and so on…

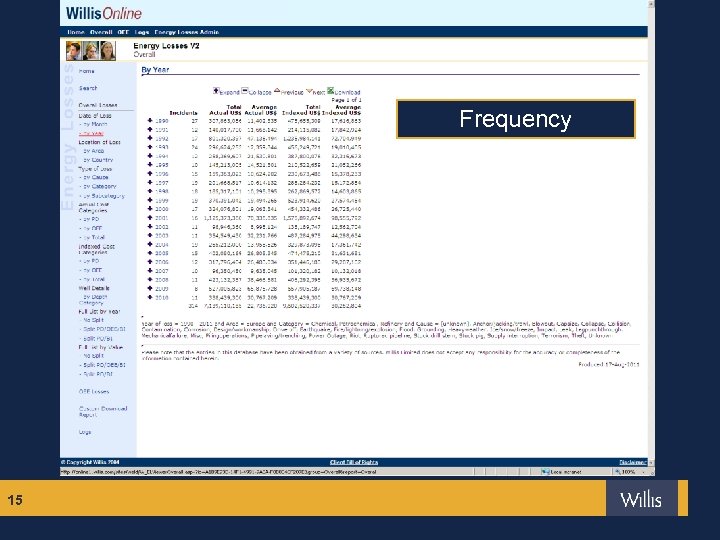

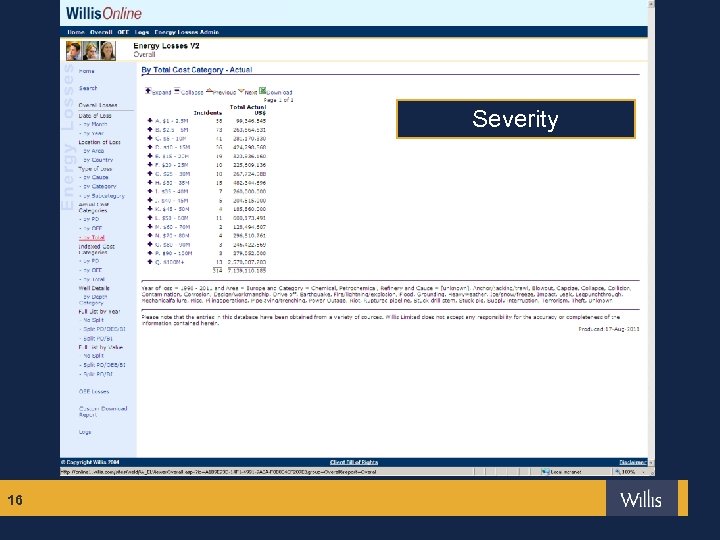

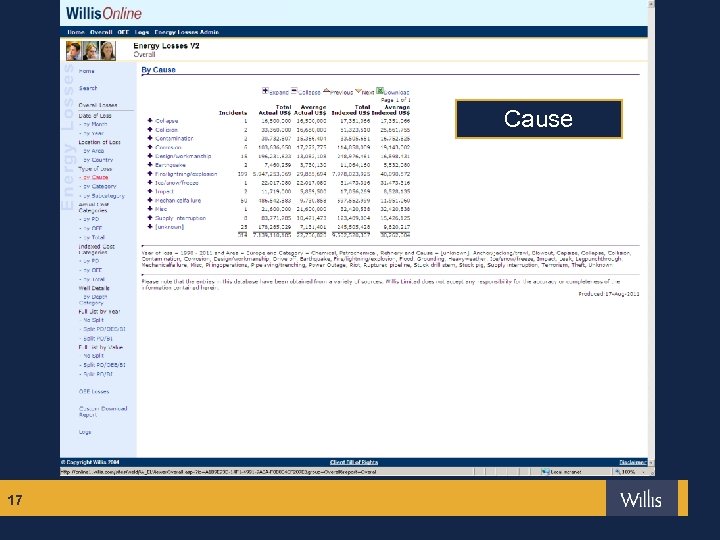

REPORT EXAMPLE 2: Analysis of European chemical/petrochemical/refinery plant losses since 1990 based on frequency and severity excluding the causes of earthquake and subsidence Database search criteria: Year of Loss = 1990 to 2010, Area = Europe, Subcategory = chemical, petrochemical, refinery, Cause = all (excluding earthquake and subsidence/landslide) 14

Frequency 15

Severity 16

Cause 17

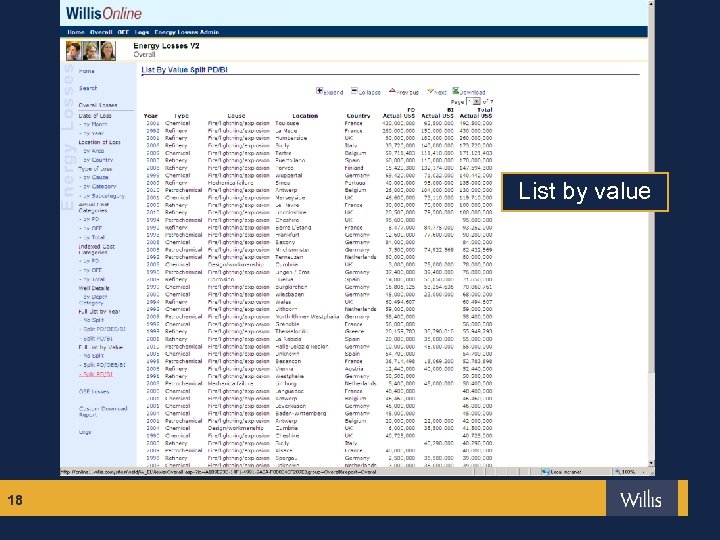

List by value 18

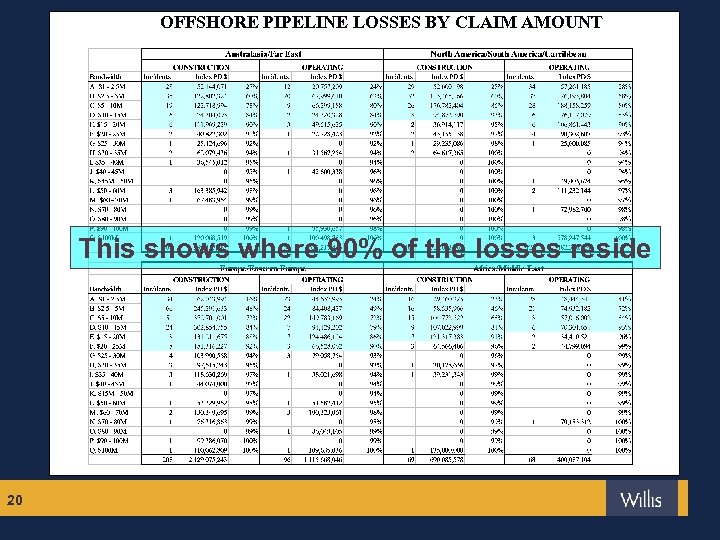

REPORT EXAMPLE 3: A comparison of offshore pipeline losses in both the construction and operating phases in four different areas of the world. As this coverage is usually purchased on a limit rather than value basis, what is the industry experience of loss severity? 19

OFFSHORE PIPELINE LOSSES BY CLAIM AMOUNT This shows where 90% of the losses reside 20

INFORMATION SOURCES: • • • 21 Willis records Willis research team located in Mumbai Loss Adjusters Insurers & Captives Historical data (London Master Energy Line Slip) The press (limited information available)

CONFIDENTIALITY: • Guarantees have been given to information providers that only restricted information will be produced which means that: • Names of Assureds are not revealed • Names of contributors are not revealed • Obvious information to aid identification such as name of facility or precise location are not revealed • Access to the database is strictly controlled 22

SUBSCRIPTIONS: > Price (on application) is for a multi-user annual licence for access via the internet. No additional software is required > Subscriptions go towards maintaining and developing the database > Without sufficient income the facility will be discontinued – it should be regarded as an energy insurance industry tool > Available to all industry interested entities 23

JUST ADDED: • Additional fields showing • Gulf of Mexico Area • US Location Code (OEE only) • Upstream, downstream or power • Subcategory 2 (lower level description of property) • The ability to generate and download custom reports based on up to 12 fields of your choice 24

25

26

27

DISCLAIMER: The entries in the database have been obtained from a variety of sources. Willis Limited does not accept any responsibility for the accuracy or completeness of the information contained therein. 28

THE WILLIS ENERGY LOSS DATABASE 2012 http: //online 1. willis. com/sites/weld/W_ELViewer. aspx

The 17 th Lillehammer Energy Claims Conference 29 th February – 2 nd March 2012 Market Developments - Losses and other updates Andrew Jackson – Willis Limited, 29 th February 2012 30

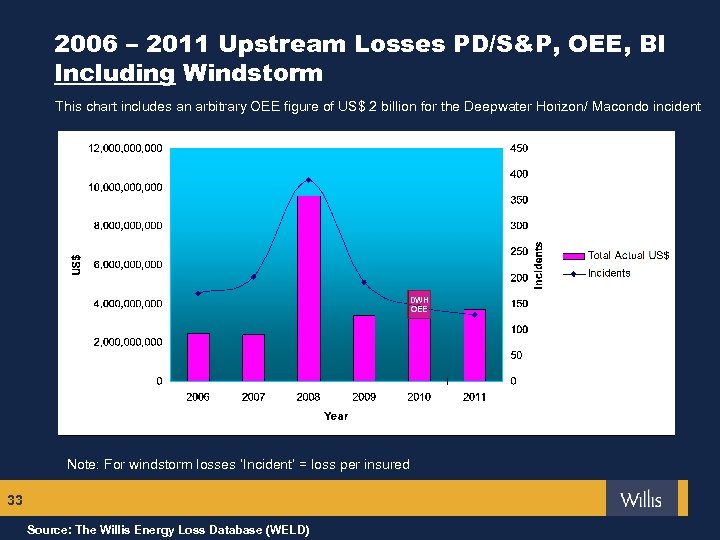

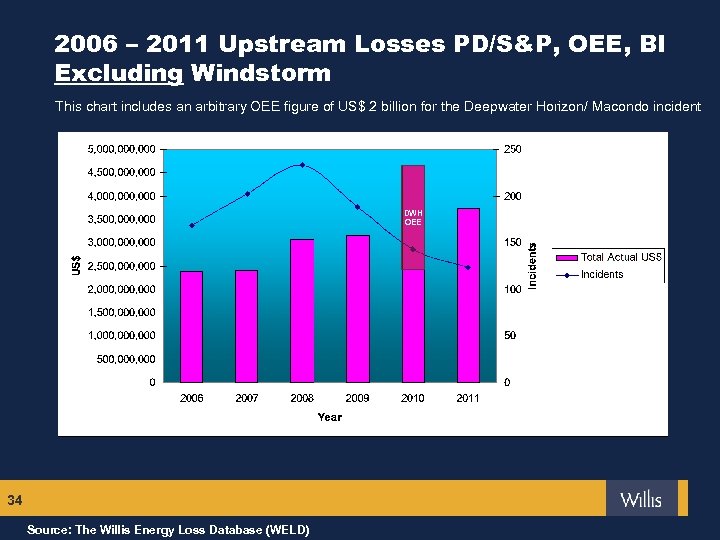

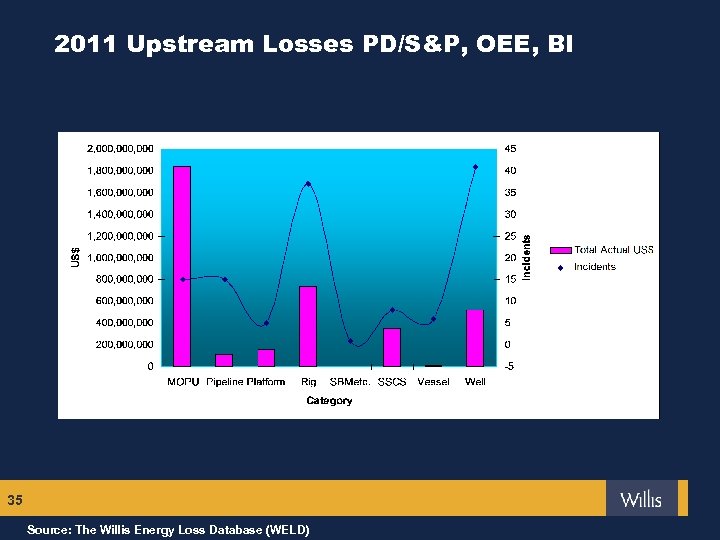

2006 – 2011 OVERVIEW FOR THE CHARTS AND LISTINGS THAT FOLLOW PLEASE NOTE: § § 31 Only losses excess of $ 1, 000 FGU have been included The figures relate to PD/S&P, OEE and BI costs only – no death & injury liability costs are included These are industry figures rather than insured figures which means § Where possible they INCLUDE deductibles and waiting periods § They are not restricted to any policy limits but the costs involved are considered insurable § In other words, if you recognise the loss you may not recognise the amount! It is still too early to have an accurate overview for 2011

2011 Major Upstream Losses (PD/S&P, OEE + BI only no liability, FGU not just insured) February Anchor chains of FPSO broke during heavy weather North Sea, UK Sector $ 984, 000 December Anchor chains of FPSO broke during heavy weather North Sea, UK Sector $ 365, 000 April Sinking of semi-submersible flotel Bay of Campeche, Mexico $ 230, 000 December Leaks in subsea xmas trees Offshore Nigeria $ 230, 000 March Damage to Free Standing Hybrid Riser Gulf of Mexico, USA $ 150, 000 May Developmental well out of control Offshore Israel $ 130, 000 June Oil pollution from wellhead Bohai Bay, China $ 130, 000 July Damage to FPSO mooring system in transit Offshore Nigeria $ 120, 000 February Damage to production guide base on well North Sea, Norwegian Sector $ 104, 000 December Sinking of jackup drilling rig under tow Sea of Okhotsk, Russia $ 100, 000 32 Source: The Willis Energy Loss Database (WELD)

2006 – 2011 Upstream Losses PD/S&P, OEE, BI Including Windstorm This chart includes an arbitrary OEE figure of US$ 2 billion for the Deepwater Horizon/ Macondo incident DWH OEE Note: For windstorm losses ‘Incident’ = loss per insured 33 Source: The Willis Energy Loss Database (WELD)

2006 – 2011 Upstream Losses PD/S&P, OEE, BI Excluding Windstorm This chart includes an arbitrary OEE figure of US$ 2 billion for the Deepwater Horizon/ Macondo incident DWH OEE 34 Source: The Willis Energy Loss Database (WELD)

2011 Upstream Losses PD/S&P, OEE, BI 35 Source: The Willis Energy Loss Database (WELD)

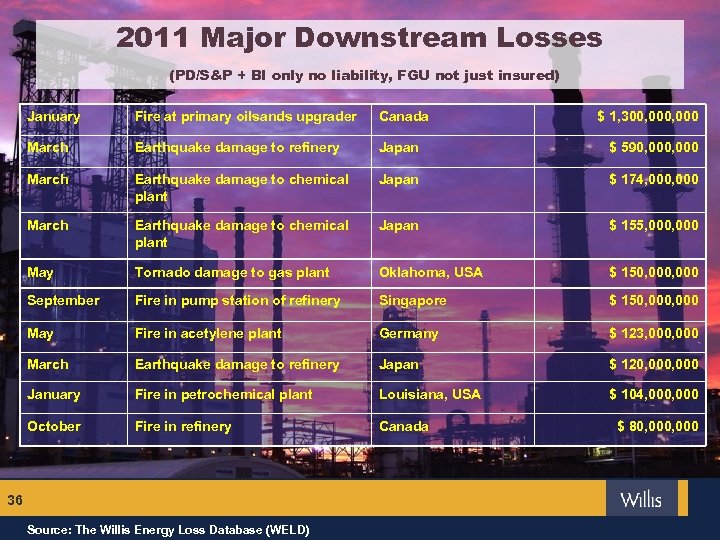

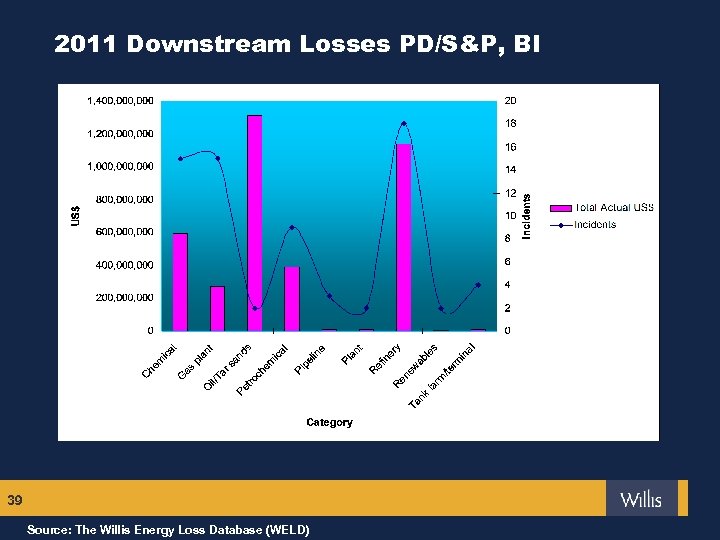

2011 Major Downstream Losses (PD/S&P + BI only no liability, FGU not just insured) January Fire at primary oilsands upgrader Canada March Earthquake damage to refinery Japan $ 590, 000 March Earthquake damage to chemical plant Japan $ 174, 000 March Earthquake damage to chemical plant Japan $ 155, 000 May Tornado damage to gas plant Oklahoma, USA $ 150, 000 September Fire in pump station of refinery Singapore $ 150, 000 May Fire in acetylene plant Germany $ 123, 000 March Earthquake damage to refinery Japan $ 120, 000 January Fire in petrochemical plant Louisiana, USA $ 104, 000 October Fire in refinery Canada 36 Source: The Willis Energy Loss Database (WELD) $ 1, 300, 000 $ 80, 000

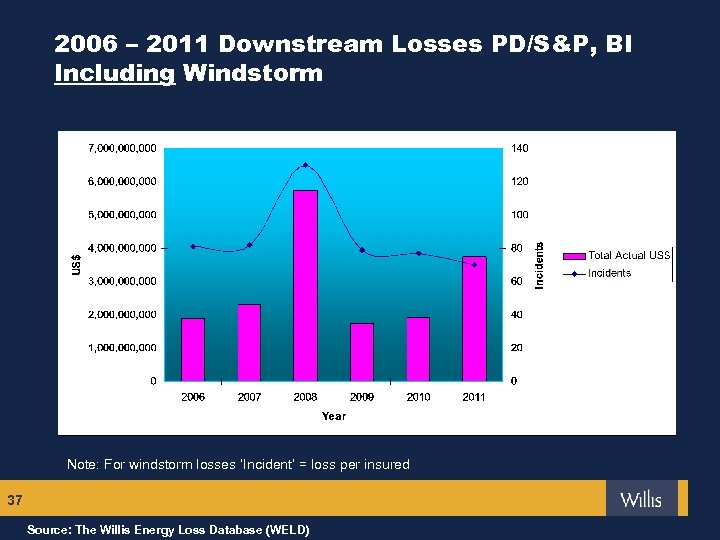

2006 – 2011 Downstream Losses PD/S&P, BI Including Windstorm Note: For windstorm losses ‘Incident’ = loss per insured 37 Source: The Willis Energy Loss Database (WELD)

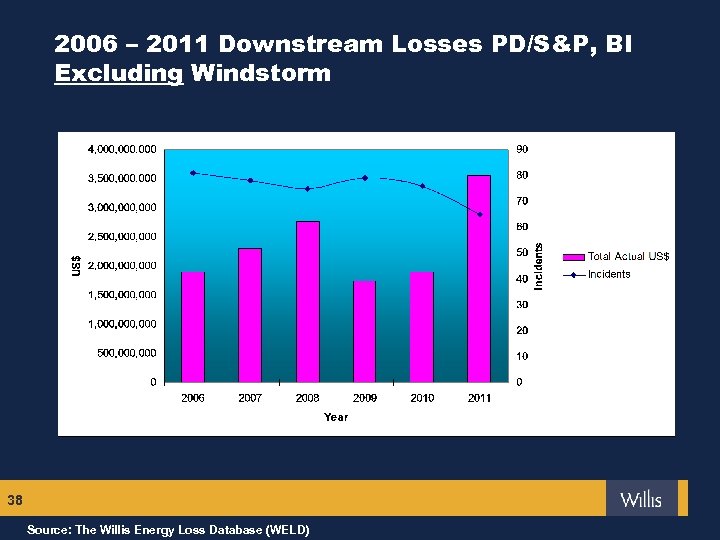

2006 – 2011 Downstream Losses PD/S&P, BI Excluding Windstorm 38 Source: The Willis Energy Loss Database (WELD)

2011 Downstream Losses PD/S&P, BI 39 Source: The Willis Energy Loss Database (WELD)

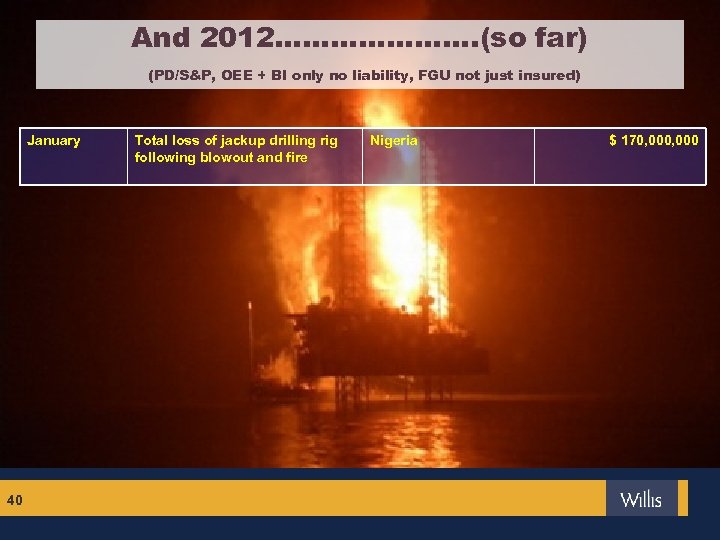

And 2012…………………. (so far) (PD/S&P, OEE + BI only no liability, FGU not just insured) January 40 Total loss of jackup drilling rig following blowout and fire Nigeria $ 170, 000

2011 Natural Catastrophe Activity § § § According to some sources, 2011 considered a record year for insured losses from natural catastrophes with estimates ranging from $ 100 bn to $ 106 bn Previously, 2005 at $ 101 bn was highest due to hurricanes Katrina, Rita & Wilma The February Christchurch earthquake and the March Tohuku earthquake/tsunami contribute almost half of the insured losses at an average estimate of $ 50 bn February March April May July August September November December 41 Christchurch, New Zealand - Earthquake Queensland, Australia - Cyclone Yasi (cat 5) Tohuku, Japan – Earthquake & Tsunami Mississippi, USA – Floods Southern USA – Tornadoes Thailand – Floods Copenhagen – Floods Carribbean & Eastern USA – Hurricane Irene Texas, USA – Wildfires China, Japan, Philippines – Typhoons France – Floods Melbourne, Australia - Hailstorm

Industry and Market News (1) § On 27 th January the Joint Rig Committee (JRC) released the Joint Rig Committee Rig Move Warranty Survey Code of Practice / Scope of Work to: § Outline the criteria for rig Move surveying activities including jacking up / down operations § Clarify the roles of the Marine Warranty Surveyor, the Assured and Underwriters § Define the function of the scopes of work for the different activities § Establish guidelines for communication between the parties § Further information is available from the JRC or Lloyd’s Market Association website 42

Industry and Market News (2) § OIL have raised their policy limit for non-windstorm events from $250 M to US$ 300 M w. e. f. 1 st January 2012 § OIL have also raised their non-windstorm aggregation limit from $750 M to $900 M § Aggregation and per occurrence limits for Designated Named Windstorm losses remain unchanged at $750 M & $150 M 43

Thank you for your attention 44

19545e029350598911c0cbd4e327128e.ppt