The Washington, DC Workforce Housing Land Trust A New Tool Leveraging Funds for Permanent Affordability

The Washington, DC Workforce Housing Land Trust A New Tool Leveraging Funds for Permanent Affordability

The Challenge Mayor’s Comprehensive Housing Strategy Task Force: l “…a growing middle class is the key to the city’s future vitality… l “[The city must] make a major effort to enable middle income working people to find and retain housing they can afford. ”

The Challenge Mayor’s Comprehensive Housing Strategy Task Force: l “…a growing middle class is the key to the city’s future vitality… l “[The city must] make a major effort to enable middle income working people to find and retain housing they can afford. ”

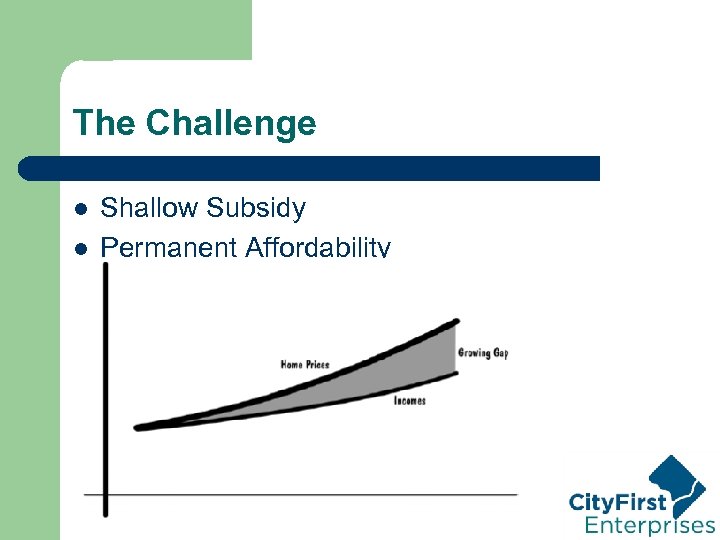

The Challenge l l Shallow Subsidy Permanent Affordability

The Challenge l l Shallow Subsidy Permanent Affordability

An Answer: Leveraging Funds for Permanent Affordability l l l Highly leverage city funds by using NMTCenabled private investment In exchange for subsidy enabling them to buy a home, buyers agree to share the appreciation Use a private, non-profit community land trust with a public mission to oversee and implement permanent affordability

An Answer: Leveraging Funds for Permanent Affordability l l l Highly leverage city funds by using NMTCenabled private investment In exchange for subsidy enabling them to buy a home, buyers agree to share the appreciation Use a private, non-profit community land trust with a public mission to oversee and implement permanent affordability

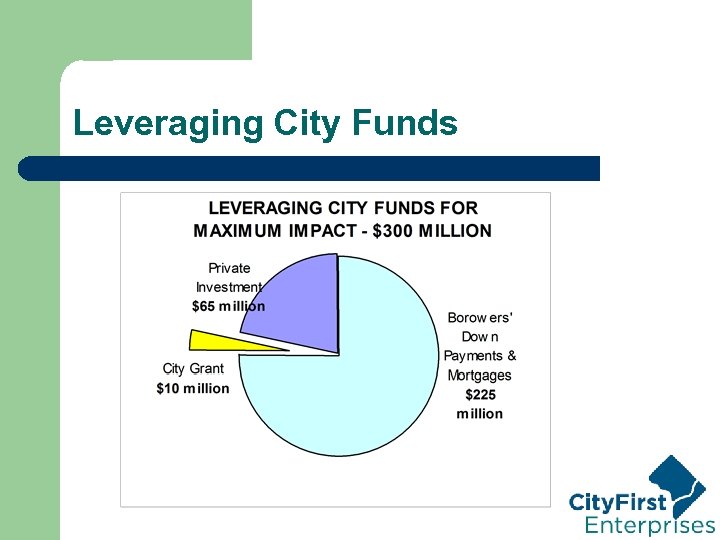

The Mayor’s Plan: Overview l l l $10 MM in City funds leverages: $65 MM in private socially responsive investment Creating a $75 MM financial pool to develop 1, 000 units of permanently affordable workforce housing in the District

The Mayor’s Plan: Overview l l l $10 MM in City funds leverages: $65 MM in private socially responsive investment Creating a $75 MM financial pool to develop 1, 000 units of permanently affordable workforce housing in the District

Leveraging City Funds

Leveraging City Funds

Open Architecture l l l Pool operated by Land Trust which provides $75, 000 per unit in low-interest, nonamortizing subordinate debt Funds made available to non-profit and profit developers Portable: homebuyers may use as a credit towards home purchase

Open Architecture l l l Pool operated by Land Trust which provides $75, 000 per unit in low-interest, nonamortizing subordinate debt Funds made available to non-profit and profit developers Portable: homebuyers may use as a credit towards home purchase

Objectives l l l Efficiently support developers of affordable housing 1, 000 permanently affordable units Achieve 80% AMI or lower portfolio average Disperse housing units across City Support New Communities, Great Streets, AWC, NCRC Prove success and do it again

Objectives l l l Efficiently support developers of affordable housing 1, 000 permanently affordable units Achieve 80% AMI or lower portfolio average Disperse housing units across City Support New Communities, Great Streets, AWC, NCRC Prove success and do it again

Sample Home Purchase l l Land Trust unit with market value of $300, 000 Buys home with: – – – l $9, 000 down payment $75, 000 interest-only, low-rate loan (repaid at resale) $216, 000 mortgage (72% LTV) Unit affordable at 76% AMI

Sample Home Purchase l l Land Trust unit with market value of $300, 000 Buys home with: – – – l $9, 000 down payment $75, 000 interest-only, low-rate loan (repaid at resale) $216, 000 mortgage (72% LTV) Unit affordable at 76% AMI

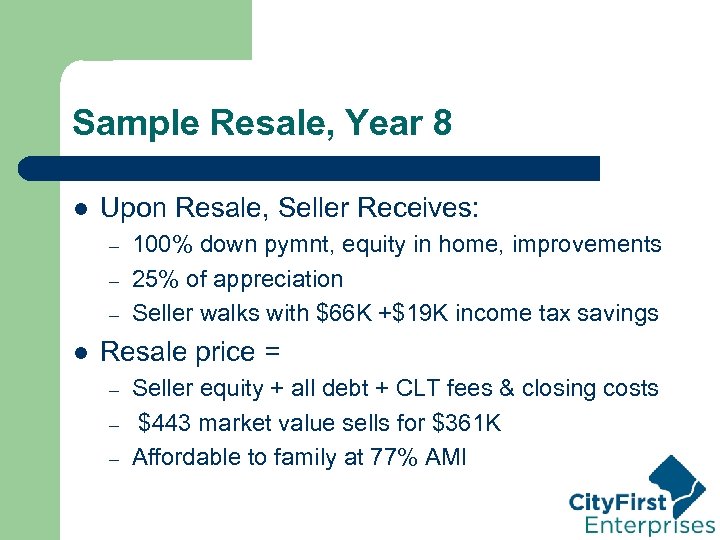

Sample Resale, Year 8 l Upon Resale, Seller Receives: – – – l 100% down pymnt, equity in home, improvements 25% of appreciation Seller walks with $66 K +$19 K income tax savings Resale price = – – – Seller equity + all debt + CLT fees & closing costs $443 market value sells for $361 K Affordable to family at 77% AMI

Sample Resale, Year 8 l Upon Resale, Seller Receives: – – – l 100% down pymnt, equity in home, improvements 25% of appreciation Seller walks with $66 K +$19 K income tax savings Resale price = – – – Seller equity + all debt + CLT fees & closing costs $443 market value sells for $361 K Affordable to family at 77% AMI

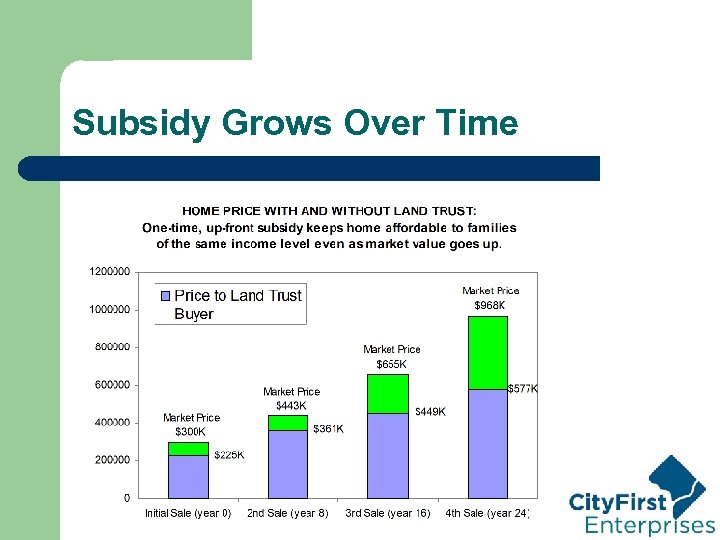

Subsidy Grows Over Time

Subsidy Grows Over Time

The Land Trust is: l Highly Leveraged – bringing in $29 of private funds for every $1 of public support l Highly Efficient – averaging only $10, 000 local public subsidy per unit l Highly Flexible – offering simple terms to any developer preserving or creating affordable housing, as well as individual homebuyers l Easily Layered – works well with HPAP, EAHP and others

The Land Trust is: l Highly Leveraged – bringing in $29 of private funds for every $1 of public support l Highly Efficient – averaging only $10, 000 local public subsidy per unit l Highly Flexible – offering simple terms to any developer preserving or creating affordable housing, as well as individual homebuyers l Easily Layered – works well with HPAP, EAHP and others