b65dab5d22303b19daa477a8bb3612ed.ppt

- Количество слайдов: 25

The VAT Return Applicable for Persons Registered under Article 10 VAT Department Malta June 2012

• The words "imports" and "exports" refer only to acquisitions/supplies made from/to a country that is not a member of the European Union. • In the case of goods acquired from/supplied to another member state of the European Union, these are called Intra-Community Acquisitions/Intra-Community Supplies.

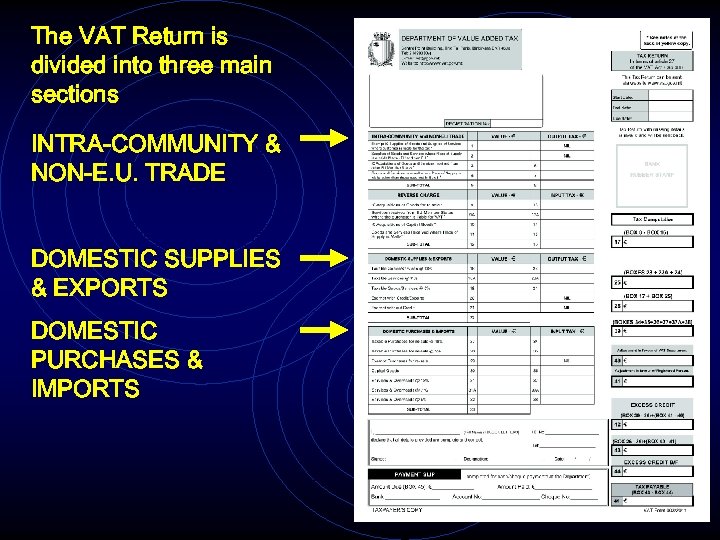

The VAT Return is divided into three main sections INTRA-COMMUNITY & NON-E. U. TRADE DOMESTIC SUPPLIES & EXPORTS DOMESTIC PURCHASES & IMPORTS

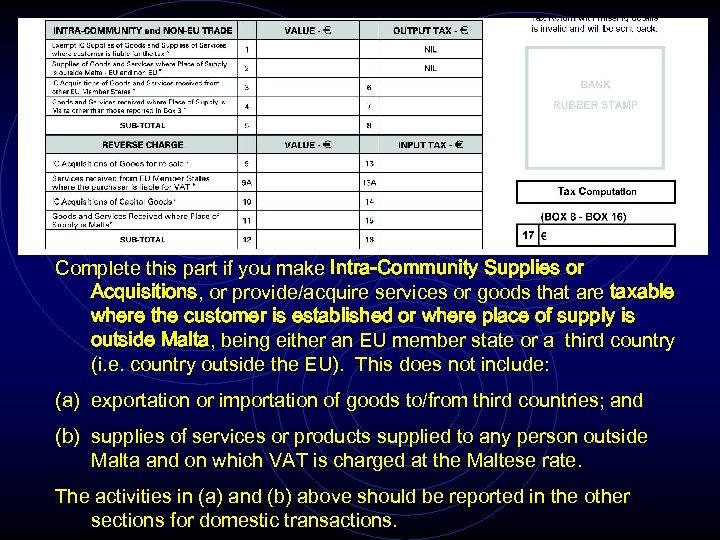

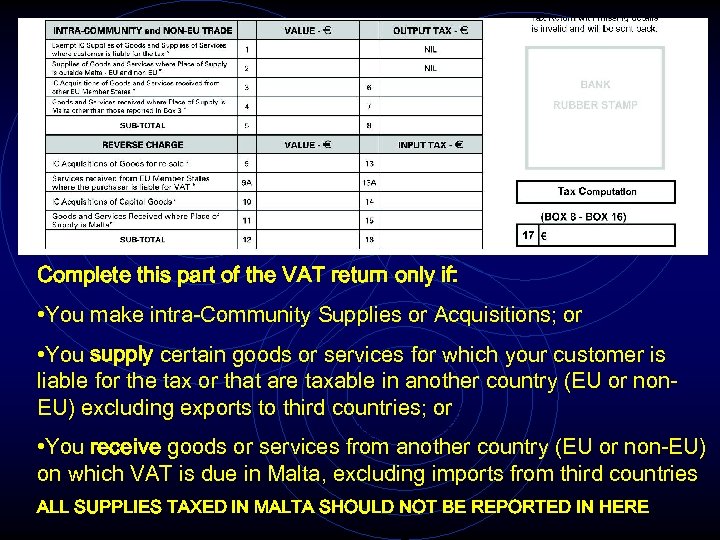

Complete this part if you make Intra-Community Supplies or Acquisitions, or provide/acquire services or goods that are taxable where the customer is established or where place of supply is outside Malta, being either an EU member state or a third country (i. e. country outside the EU). This does not include: (a) exportation or importation of goods to/from third countries; and (b) supplies of services or products supplied to any person outside Malta and on which VAT is charged at the Maltese rate. The activities in (a) and (b) above should be reported in the other sections for domestic transactions.

Complete this part of the VAT return only if: • You make intra-Community Supplies or Acquisitions; or • You supply certain goods or services for which your customer is liable for the tax or that are taxable in another country (EU or non. EU) excluding exports to third countries; or • You receive goods or services from another country (EU or non-EU) on which VAT is due in Malta, excluding imports from third countries ALL SUPPLIES TAXED IN MALTA SHOULD NOT BE REPORTED IN HERE

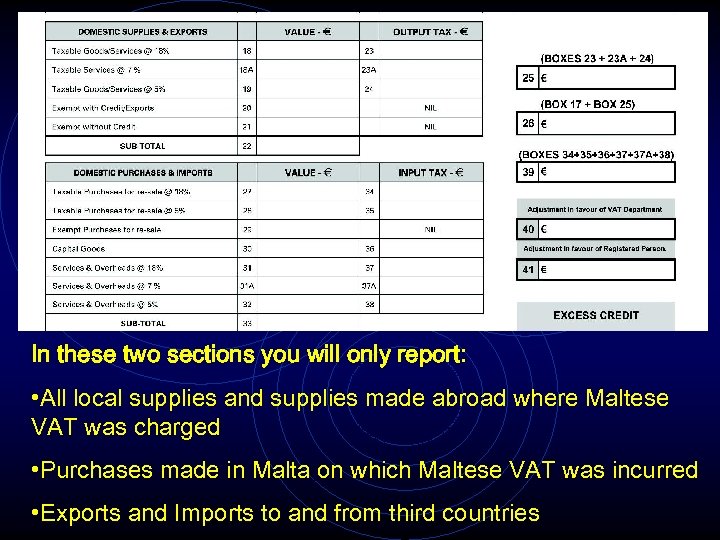

In these two sections you will only report: • All local supplies and supplies made abroad where Maltese VAT was charged • Purchases made in Malta on which Maltese VAT was incurred • Exports and Imports to and from third countries

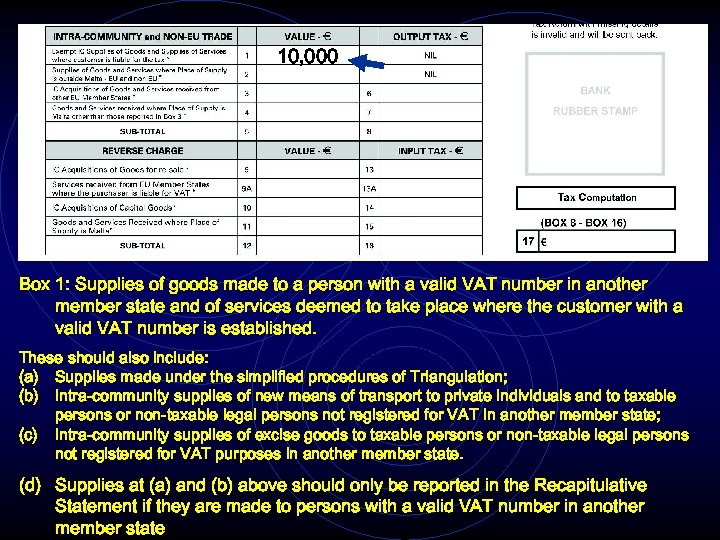

10, 000 Box 1: Supplies of goods made to a person with a valid VAT number in another member state and of services deemed to take place where the customer with a valid VAT number is established. These should also include: (a) Supplies made under the simplified procedures of Triangulation; (b) Intra-community supplies of new means of transport to private individuals and to taxable persons or non-taxable legal persons not registered for VAT in another member state; (c) Intra-community supplies of excise goods to taxable persons or non-taxable legal persons not registered for VAT purposes in another member state. (d) Supplies at (a) and (b) above should only be reported in the Recapitulative Statement if they are made to persons with a valid VAT number in another member state

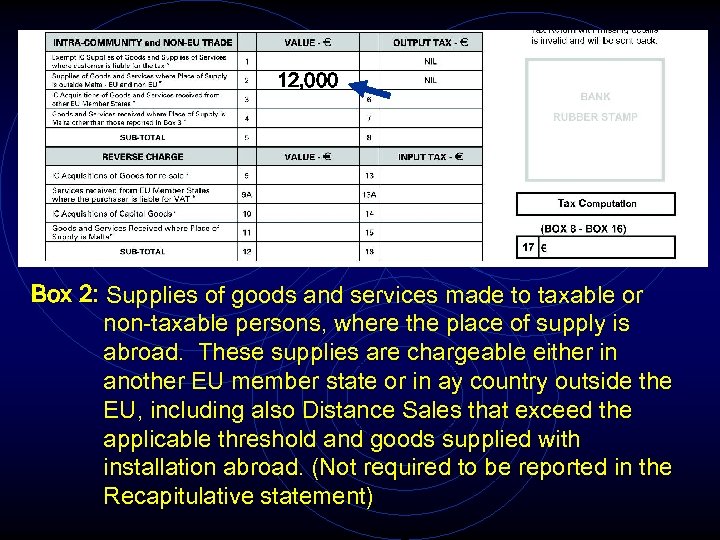

12, 000 Box 2: Supplies of goods and services made to taxable or non-taxable persons, where the place of supply is abroad. These supplies are chargeable either in another EU member state or in ay country outside the EU, including also Distance Sales that exceed the applicable threshold and goods supplied with installation abroad. (Not required to be reported in the Recapitulative statement)

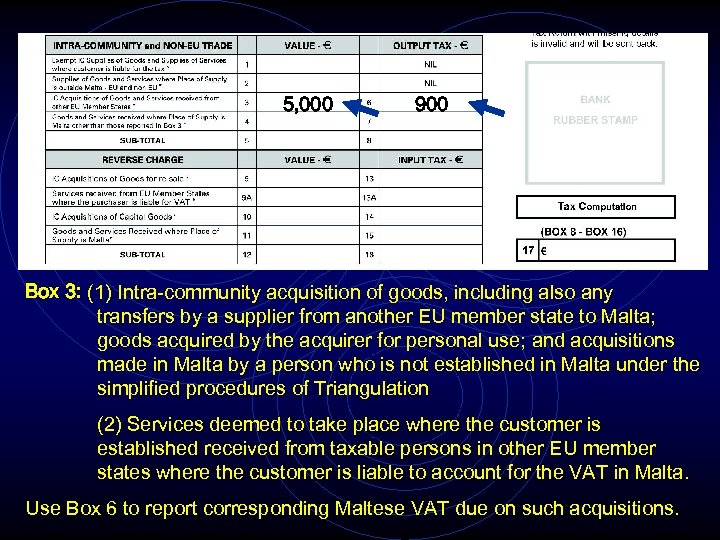

5, 000 900 Box 3: (1) Intra-community acquisition of goods, including also any transfers by a supplier from another EU member state to Malta; goods acquired by the acquirer for personal use; and acquisitions made in Malta by a person who is not established in Malta under the simplified procedures of Triangulation (2) Services deemed to take place where the customer is established received from taxable persons in other EU member states where the customer is liable to account for the VAT in Malta. Use Box 6 to report corresponding Maltese VAT due on such acquisitions.

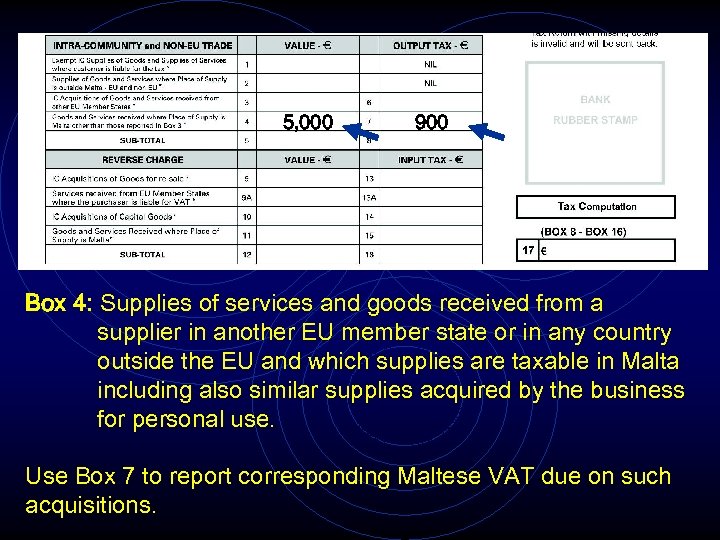

5, 000 900 Box 4: Supplies of services and goods received from a supplier in another EU member state or in any country outside the EU and which supplies are taxable in Malta including also similar supplies acquired by the business for personal use. Use Box 7 to report corresponding Maltese VAT due on such acquisitions.

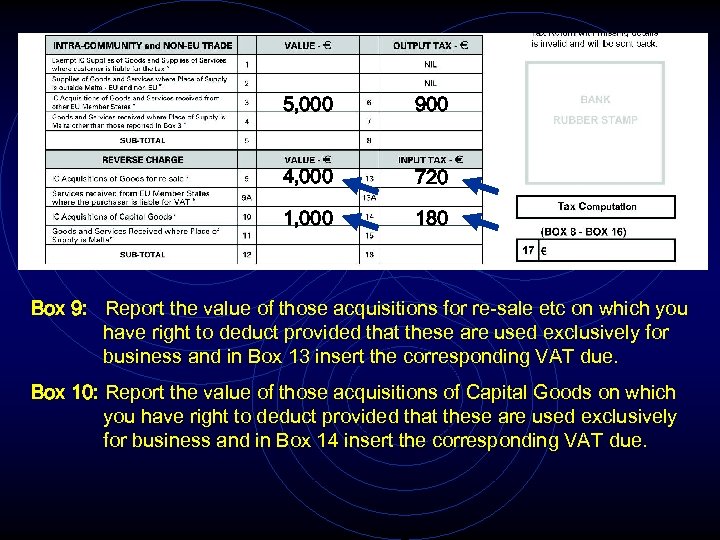

5, 000 900 4, 000 720 1, 000 180 Box 9: Report the value of those acquisitions for re-sale etc on which you have right to deduct provided that these are used exclusively for business and in Box 13 insert the corresponding VAT due. Box 10: Report the value of those acquisitions of Capital Goods on which you have right to deduct provided that these are used exclusively for business and in Box 14 insert the corresponding VAT due.

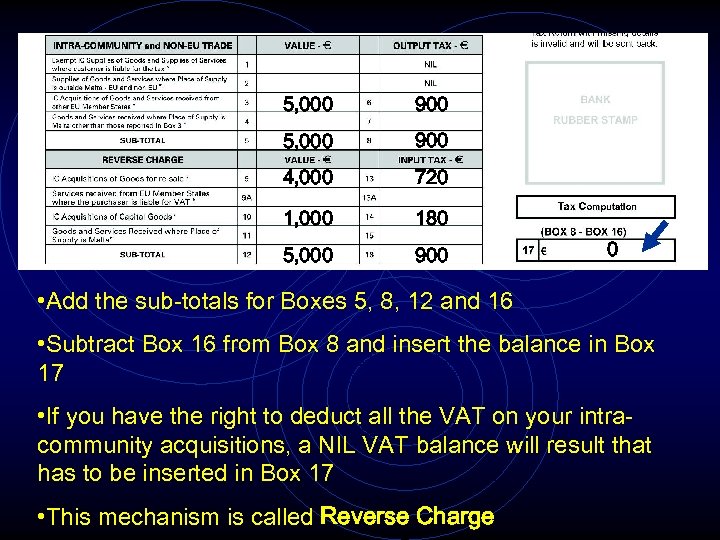

5, 000 900 4, 000 720 1, 000 180 5, 000 900 0 • Add the sub-totals for Boxes 5, 8, 12 and 16 • Subtract Box 16 from Box 8 and insert the balance in Box 17 • If you have the right to deduct all the VAT on your intracommunity acquisitions, a NIL VAT balance will result that has to be inserted in Box 17 • This mechanism is called Reverse Charge

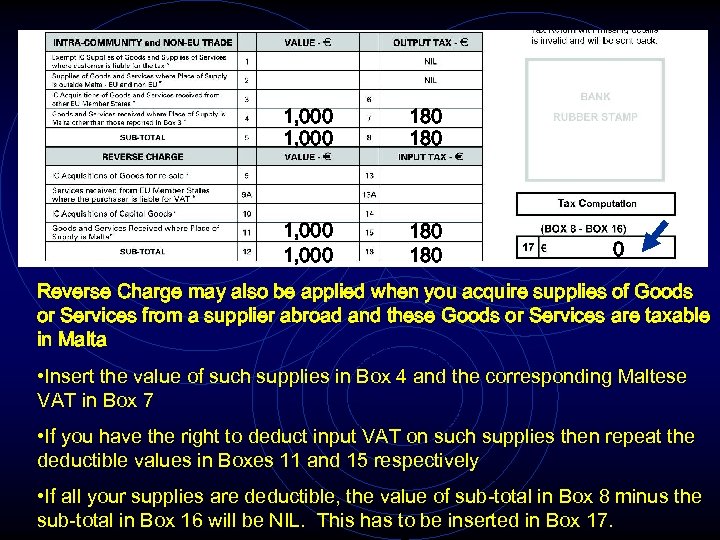

1, 000 180 180 0 Reverse Charge may also be applied when you acquire supplies of Goods or Services from a supplier abroad and these Goods or Services are taxable in Malta • Insert the value of such supplies in Box 4 and the corresponding Maltese VAT in Box 7 • If you have the right to deduct input VAT on such supplies then repeat the deductible values in Boxes 11 and 15 respectively • If all your supplies are deductible, the value of sub-total in Box 8 minus the sub-total in Box 16 will be NIL. This has to be inserted in Box 17.

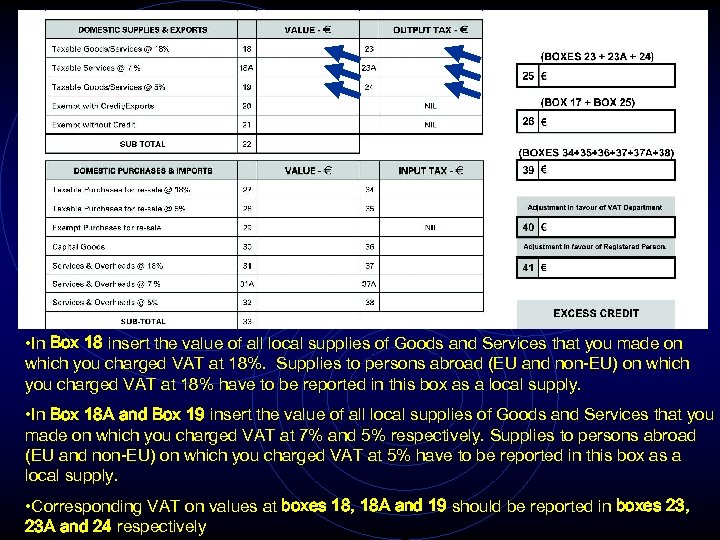

• In Box 18 insert the value of all local supplies of Goods and Services that you made on which you charged VAT at 18%. Supplies to persons abroad (EU and non-EU) on which you charged VAT at 18% have to be reported in this box as a local supply. • In Box 18 A and Box 19 insert the value of all local supplies of Goods and Services that you made on which you charged VAT at 7% and 5% respectively. Supplies to persons abroad (EU and non-EU) on which you charged VAT at 5% have to be reported in this box as a local supply. • Corresponding VAT on values at boxes 18, 18 A and 19 should be reported in boxes 23, 23 A and 24 respectively

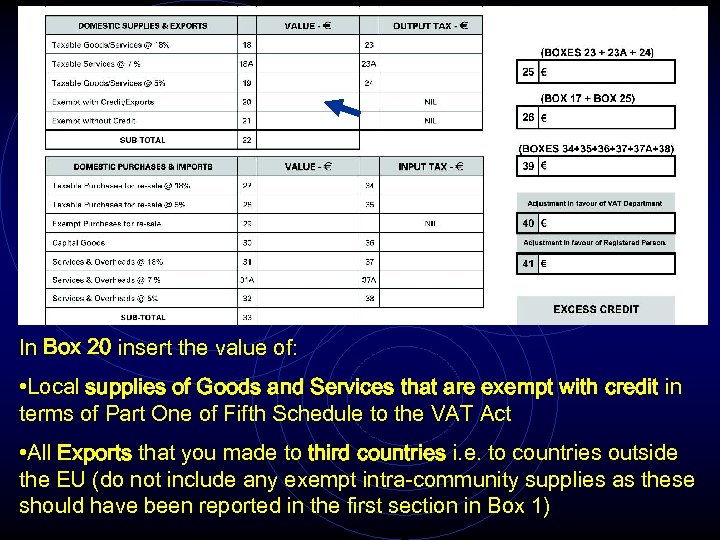

In Box 20 insert the value of: • Local supplies of Goods and Services that are exempt with credit in terms of Part One of Fifth Schedule to the VAT Act • All Exports that you made to third countries i. e. to countries outside the EU (do not include any exempt intra-community supplies as these should have been reported in the first section in Box 1)

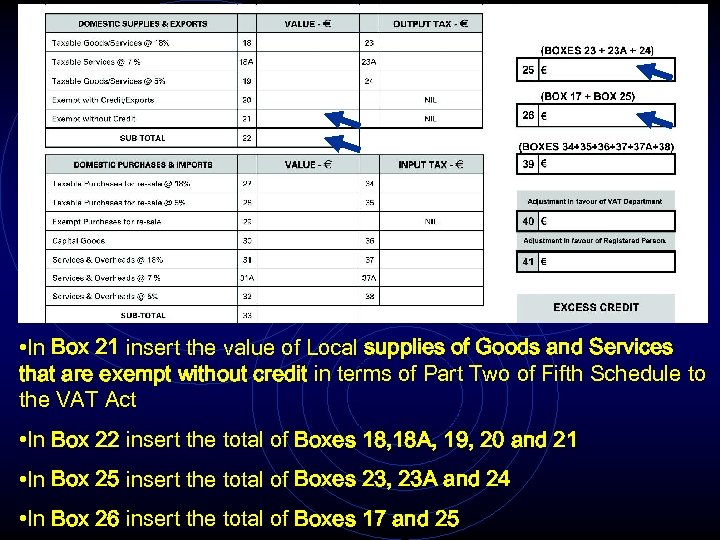

• In Box 21 insert the value of Local supplies of Goods and Services that are exempt without credit in terms of Part Two of Fifth Schedule to the VAT Act • In Box 22 insert the total of Boxes 18, 18 A, 19, 20 and 21 • In Box 25 insert the total of Boxes 23, 23 A and 24 • In Box 26 insert the total of Boxes 17 and 25

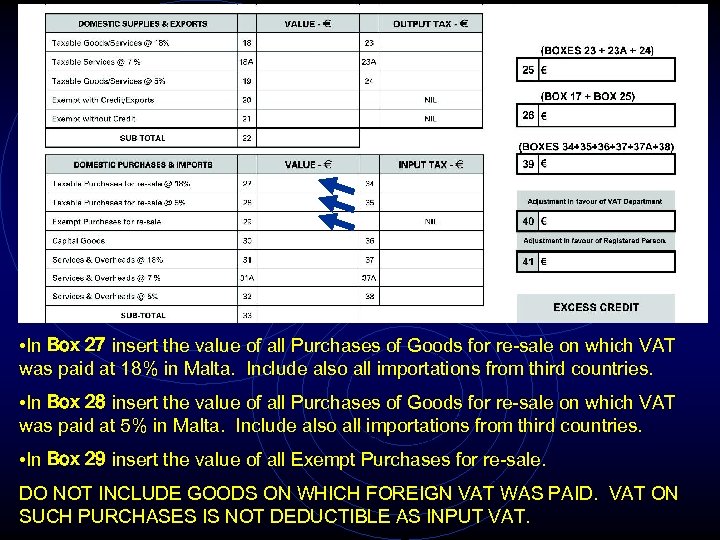

• In Box 27 insert the value of all Purchases of Goods for re-sale on which VAT was paid at 18% in Malta. Include also all importations from third countries. • In Box 28 insert the value of all Purchases of Goods for re-sale on which VAT was paid at 5% in Malta. Include also all importations from third countries. • In Box 29 insert the value of all Exempt Purchases for re-sale. DO NOT INCLUDE GOODS ON WHICH FOREIGN VAT WAS PAID. VAT ON SUCH PURCHASES IS NOT DEDUCTIBLE AS INPUT VAT.

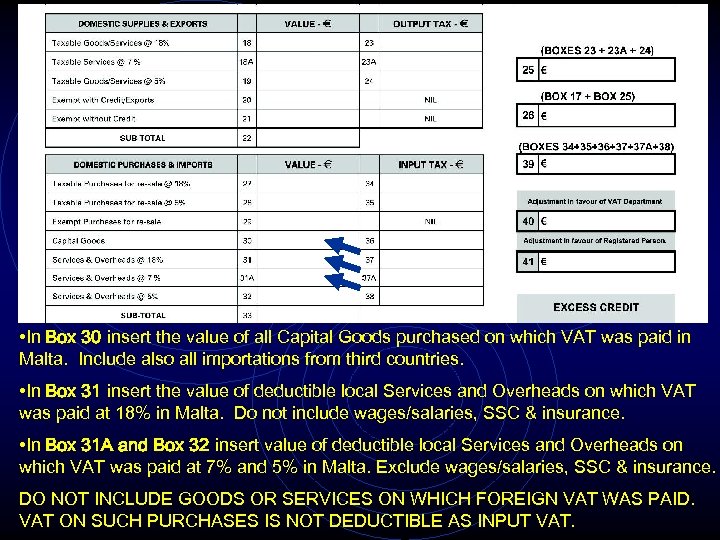

• In Box 30 insert the value of all Capital Goods purchased on which VAT was paid in Malta. Include also all importations from third countries. • In Box 31 insert the value of deductible local Services and Overheads on which VAT was paid at 18% in Malta. Do not include wages/salaries, SSC & insurance. • In Box 31 A and Box 32 insert value of deductible local Services and Overheads on which VAT was paid at 7% and 5% in Malta. Exclude wages/salaries, SSC & insurance. DO NOT INCLUDE GOODS OR SERVICES ON WHICH FOREIGN VAT WAS PAID. VAT ON SUCH PURCHASES IS NOT DEDUCTIBLE AS INPUT VAT.

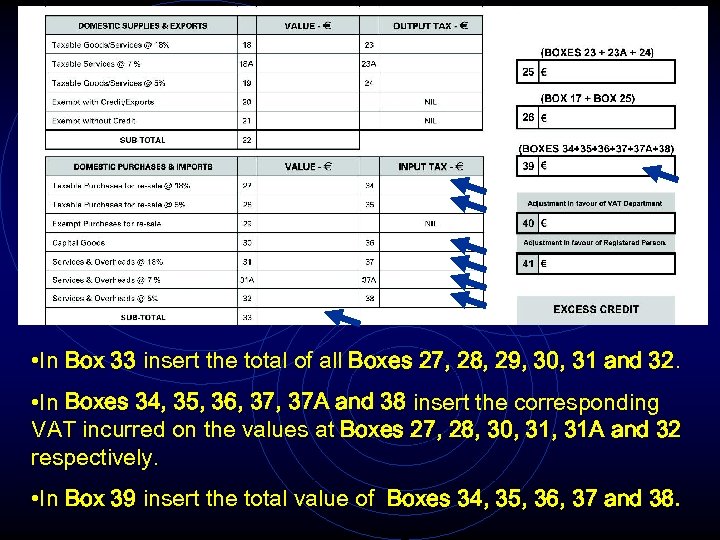

• In Box 33 insert the total of all Boxes 27, 28, 29, 30, 31 and 32. • In Boxes 34, 35, 36, 37 A and 38 insert the corresponding VAT incurred on the values at Boxes 27, 28, 30, 31 A and 32 respectively. • In Box 39 insert the total value of Boxes 34, 35, 36, 37 and 38.

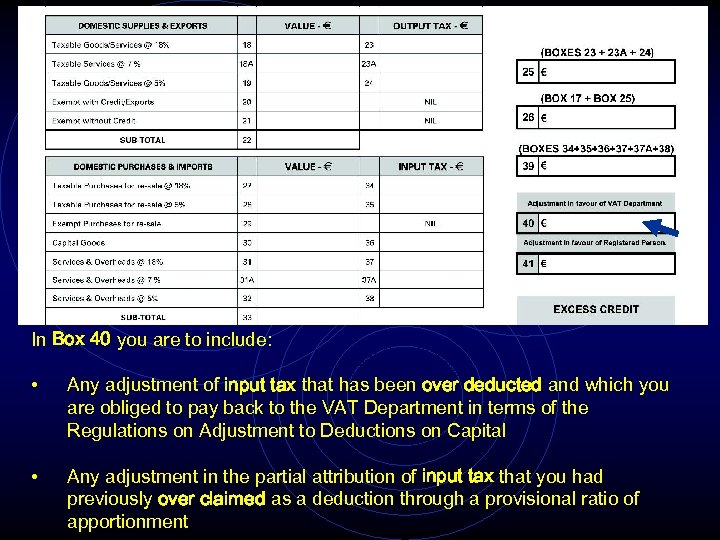

In Box 40 you are to include: • Any adjustment of input tax that has been over deducted and which you are obliged to pay back to the VAT Department in terms of the Regulations on Adjustment to Deductions on Capital • Any adjustment in the partial attribution of input tax that you had previously over claimed as a deduction through a provisional ratio of apportionment

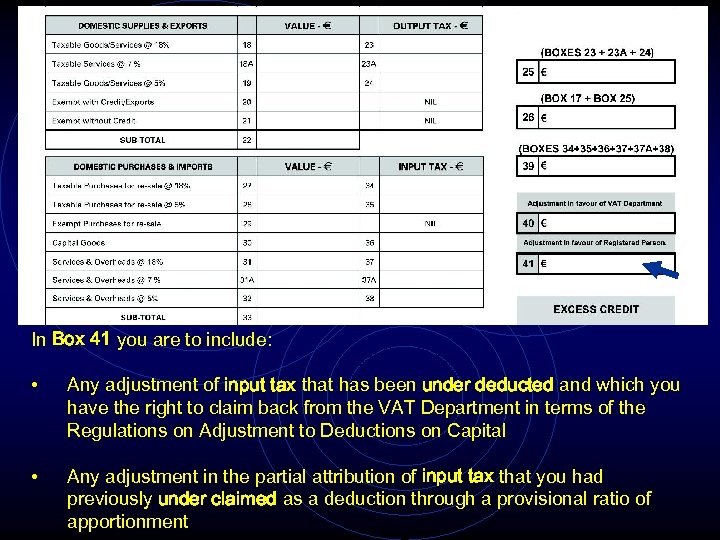

In Box 41 you are to include: • Any adjustment of input tax that has been under deducted and which you have the right to claim back from the VAT Department in terms of the Regulations on Adjustment to Deductions on Capital • Any adjustment in the partial attribution of input tax that you had previously under claimed as a deduction through a provisional ratio of apportionment

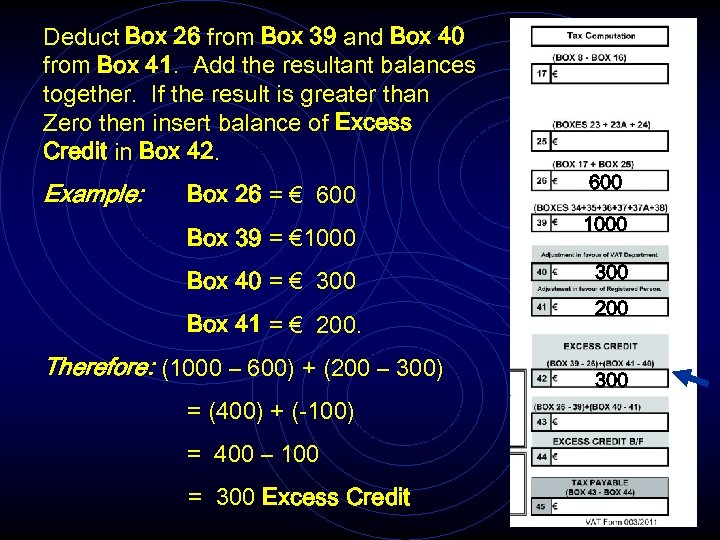

Deduct Box 26 from Box 39 and Box 40 from Box 41. Add the resultant balances together. If the result is greater than Zero then insert balance of Excess Credit in Box 42. Example: Box 26 = € 600 Box 39 = € 1000 Box 40 = € 300 Box 41 = € 200. Therefore: (1000 – 600) + (200 – 300) = (400) + (-100) = 400 – 100 = 300 Excess Credit 600 1000 300 200 300

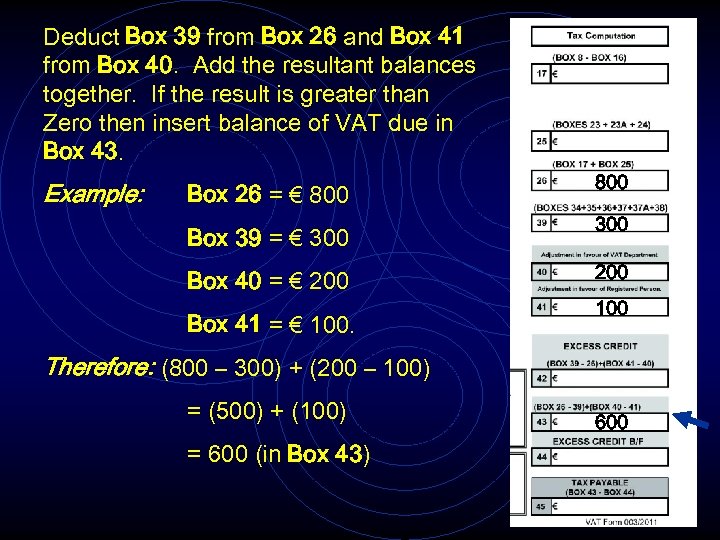

Deduct Box 39 from Box 26 and Box 41 from Box 40. Add the resultant balances together. If the result is greater than Zero then insert balance of VAT due in Box 43. Example: Box 26 = € 800 Box 39 = € 300 Box 40 = € 200 Box 41 = € 100. 800 300 200 100 Therefore: (800 – 300) + (200 – 100) = (500) + (100) = 600 (in Box 43) 600

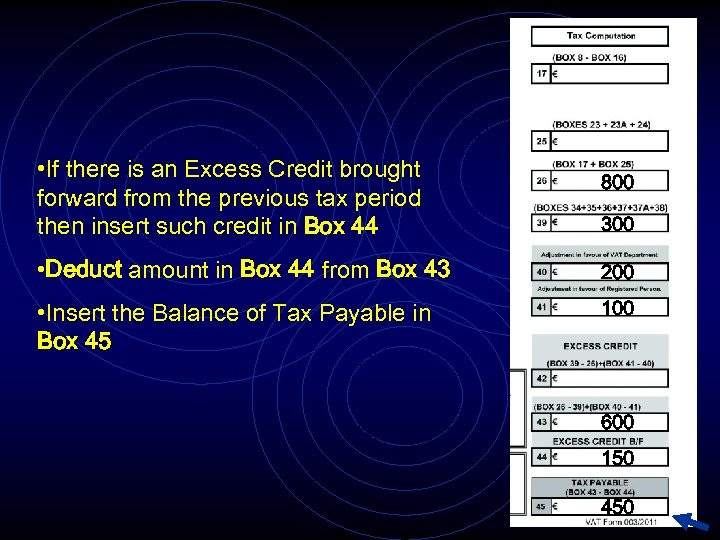

• If there is an Excess Credit brought forward from the previous tax period then insert such credit in Box 44 800 300 • Deduct amount in Box 44 from Box 43 200 • Insert the Balance of Tax Payable in Box 45 100 600 150 450

• Complete the Personal Details section on the Form and don’t forget to sign the form • Send the Return together with payment by not later than the Due Date shown at the top of the Return • Return and payment may also be submitted through the commercial banks

b65dab5d22303b19daa477a8bb3612ed.ppt