50cea8ef9dc9ea42e72e768deaa961ac.ppt

- Количество слайдов: 34

The Ultimate Qualifying, Compliance and Credit Tool In the Industry It’s Quick, Easy & Simple to Understand

The Ultimate Qualifying, Compliance and Credit Tool In the Industry It’s Quick, Easy & Simple to Understand

Our focus and what we are all about § Guaranteed Cost Savings. . . § Trans. Union ~ Experian ~ Equifax ~ Compliance Credit Bureaus – All 3 bureaus on 1 bill. . . Simple, Quick & Easy § Compliance. . Fully Automated Red Flag, OFAC, New Privacy Notice, Adverse Action, Risk-Based Pricing Notice & More § Industry First & Exclusive Credit Tools. . . - Instant Screen. . . first pre-screening product in the auto industry - Credit Pipeline. . . credit turn-downs now become “sales” - Auto Summary. . . make the most inexperienced desk managers into finance pros § Software Solution for the Future. . the Ultimate credit & compliance tool All the flexibility you need. Use one part or use it all!

Our focus and what we are all about § Guaranteed Cost Savings. . . § Trans. Union ~ Experian ~ Equifax ~ Compliance Credit Bureaus – All 3 bureaus on 1 bill. . . Simple, Quick & Easy § Compliance. . Fully Automated Red Flag, OFAC, New Privacy Notice, Adverse Action, Risk-Based Pricing Notice & More § Industry First & Exclusive Credit Tools. . . - Instant Screen. . . first pre-screening product in the auto industry - Credit Pipeline. . . credit turn-downs now become “sales” - Auto Summary. . . make the most inexperienced desk managers into finance pros § Software Solution for the Future. . the Ultimate credit & compliance tool All the flexibility you need. Use one part or use it all!

Credit Bureaus Trans. Union ~ Experian ~ Equifax § Guaranteed Cost $avings § Simple and Easy to use System § Bureaus in Seconds § One Bill for all 3 Bureaus § No Duplicate Bureau Charges § Drop Codes into Dealer. Track & Route. One § Stores Bureaus Forever at no charge § Drivers License Scan ability. . . Speeds Process § ALL THIS. . . Without disrupting your process and making it even stronger!

Credit Bureaus Trans. Union ~ Experian ~ Equifax § Guaranteed Cost $avings § Simple and Easy to use System § Bureaus in Seconds § One Bill for all 3 Bureaus § No Duplicate Bureau Charges § Drop Codes into Dealer. Track & Route. One § Stores Bureaus Forever at no charge § Drivers License Scan ability. . . Speeds Process § ALL THIS. . . Without disrupting your process and making it even stronger!

Compliance & Forms § OFAC (Office of Foreign Assets Control) - at no charge. . . automated § Risk-Based Pricing Notice - at no charge. . . automated § Adverse Action Letters - at no charge. . . automated § Privacy Notice - at no charge. . . automated § Permission to Pull Credit - at no charge. . . automated § Credit App Signature - at no charge. . . automated § Test Drive Agreement - at no charge. . . automated § Guest Information Sheet - at no charge. . . automated § Red Flag -discounted with Instant Screen & Credit Bureaus together automated § Exclusive – “Fail Safe” feature for 100% compliance and peace of mind

Compliance & Forms § OFAC (Office of Foreign Assets Control) - at no charge. . . automated § Risk-Based Pricing Notice - at no charge. . . automated § Adverse Action Letters - at no charge. . . automated § Privacy Notice - at no charge. . . automated § Permission to Pull Credit - at no charge. . . automated § Credit App Signature - at no charge. . . automated § Test Drive Agreement - at no charge. . . automated § Guest Information Sheet - at no charge. . . automated § Red Flag -discounted with Instant Screen & Credit Bureaus together automated § Exclusive – “Fail Safe” feature for 100% compliance and peace of mind

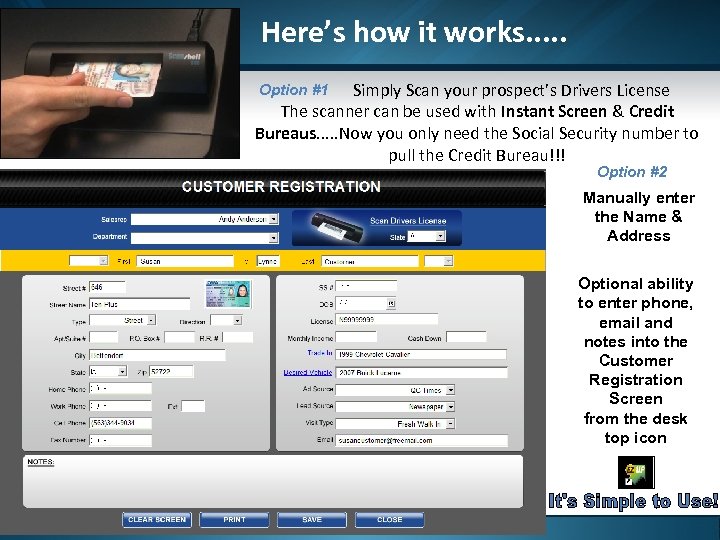

Here’s how it works. . . Simply Scan your prospect’s Drivers License The scanner can be used with Instant Screen & Credit Bureaus. . . Now you only need the Social Security number to pull the Credit Bureau!!! Option #1 Option #2 Manually enter the Name & Address Optional ability to enter phone, email and notes into the Customer Registration Screen from the desk top icon 5

Here’s how it works. . . Simply Scan your prospect’s Drivers License The scanner can be used with Instant Screen & Credit Bureaus. . . Now you only need the Social Security number to pull the Credit Bureau!!! Option #1 Option #2 Manually enter the Name & Address Optional ability to enter phone, email and notes into the Customer Registration Screen from the desk top icon 5

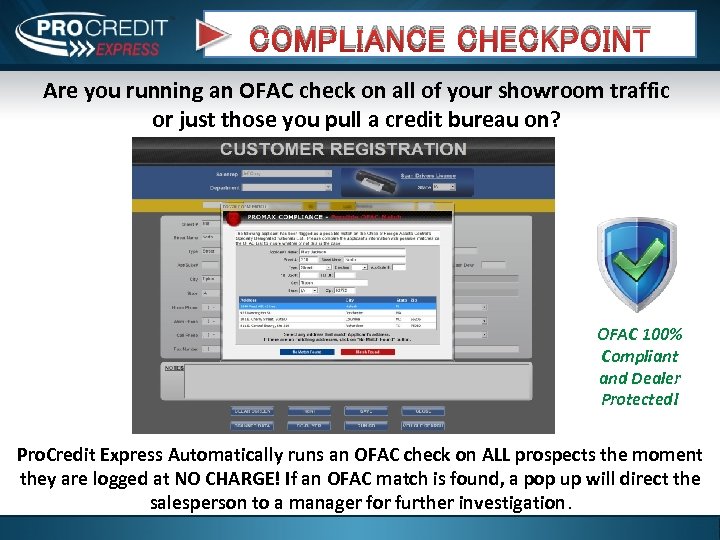

COMPLIANCE CHECKPOINT Are you running an OFAC check on all of your showroom traffic or just those you pull a credit bureau on? OFAC 100% Compliant and Dealer Protected! Pro. Credit Express Automatically runs an OFAC check on ALL prospects the moment they are logged at NO CHARGE! If an OFAC match is found, a pop up will direct the salesperson to a manager for further investigation.

COMPLIANCE CHECKPOINT Are you running an OFAC check on all of your showroom traffic or just those you pull a credit bureau on? OFAC 100% Compliant and Dealer Protected! Pro. Credit Express Automatically runs an OFAC check on ALL prospects the moment they are logged at NO CHARGE! If an OFAC match is found, a pop up will direct the salesperson to a manager for further investigation.

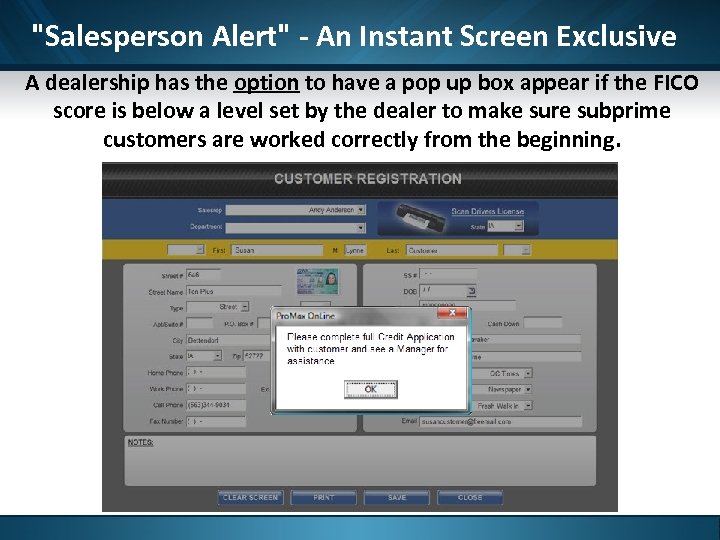

"Salesperson Alert" - An Instant Screen Exclusive A dealership has the option to have a pop up box appear if the FICO score is below a level set by the dealer to make sure subprime customers are worked correctly from the beginning.

"Salesperson Alert" - An Instant Screen Exclusive A dealership has the option to have a pop up box appear if the FICO score is below a level set by the dealer to make sure subprime customers are worked correctly from the beginning.

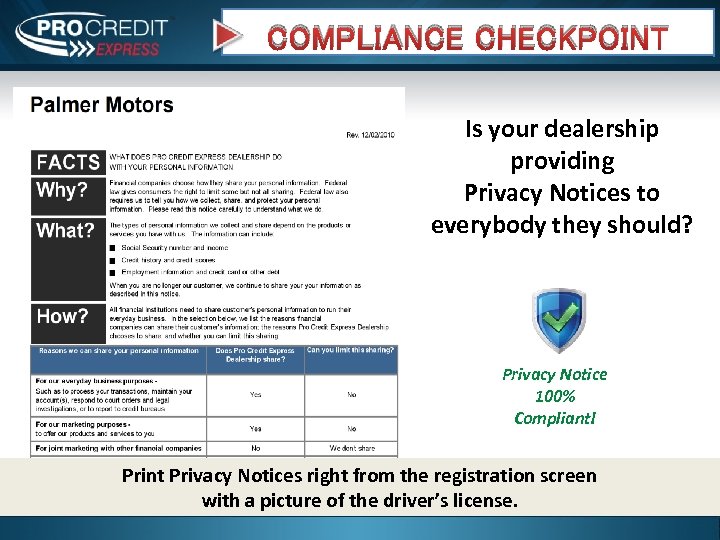

COMPLIANCE CHECKPOINT Is your dealership providing Privacy Notices to everybody they should? Privacy Notice 100% Compliant! Print Privacy Notices right from the registration screen with a picture of the driver’s license.

COMPLIANCE CHECKPOINT Is your dealership providing Privacy Notices to everybody they should? Privacy Notice 100% Compliant! Print Privacy Notices right from the registration screen with a picture of the driver’s license.

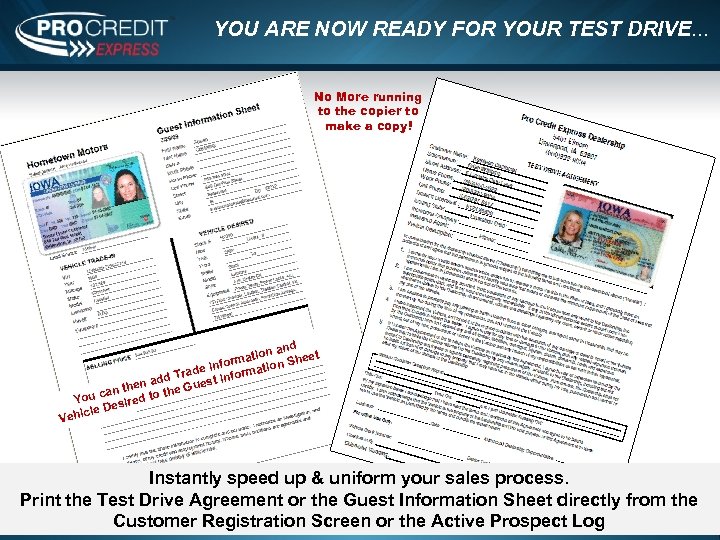

YOU ARE NOW READY FOR YOUR TEST DRIVE. . . No More running to the copier to make a copy! and ation Sheet rm tion e info Trad t informa dd hen a Gues can t d to the You esire cle D Vehi Instantly speed up & uniform your sales process. Print the Test Drive Agreement or the Guest Information Sheet directly from the Customer Registration Screen or the Active Prospect Log

YOU ARE NOW READY FOR YOUR TEST DRIVE. . . No More running to the copier to make a copy! and ation Sheet rm tion e info Trad t informa dd hen a Gues can t d to the You esire cle D Vehi Instantly speed up & uniform your sales process. Print the Test Drive Agreement or the Guest Information Sheet directly from the Customer Registration Screen or the Active Prospect Log

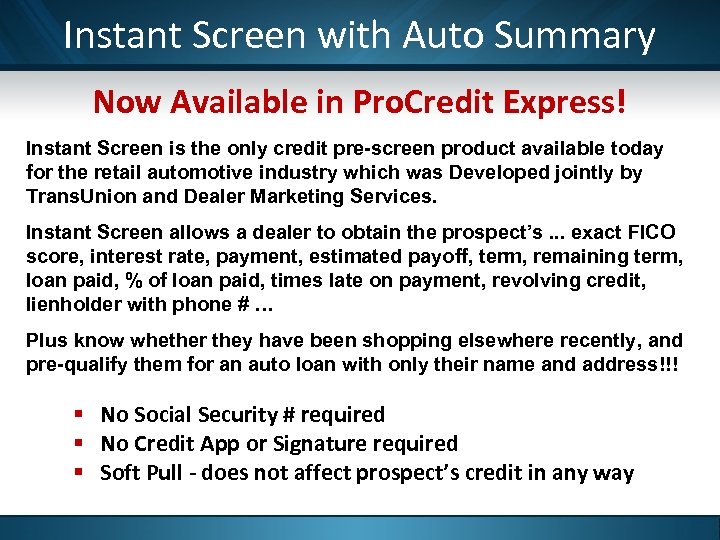

Instant Screen with Auto Summary Now Available in Pro. Credit Express! Instant Screen is the only credit pre-screen product available today for the retail automotive industry which was Developed jointly by Trans. Union and Dealer Marketing Services. Instant Screen allows a dealer to obtain the prospect’s. . . exact FICO score, interest rate, payment, estimated payoff, term, remaining term, loan paid, % of loan paid, times late on payment, revolving credit, lienholder with phone # … Plus know whether they have been shopping elsewhere recently, and pre-qualify them for an auto loan with only their name and address!!! § No Social Security # required § No Credit App or Signature required § Soft Pull - does not affect prospect’s credit in any way

Instant Screen with Auto Summary Now Available in Pro. Credit Express! Instant Screen is the only credit pre-screen product available today for the retail automotive industry which was Developed jointly by Trans. Union and Dealer Marketing Services. Instant Screen allows a dealer to obtain the prospect’s. . . exact FICO score, interest rate, payment, estimated payoff, term, remaining term, loan paid, % of loan paid, times late on payment, revolving credit, lienholder with phone # … Plus know whether they have been shopping elsewhere recently, and pre-qualify them for an auto loan with only their name and address!!! § No Social Security # required § No Credit App or Signature required § Soft Pull - does not affect prospect’s credit in any way

With Instant Screen you will immediately know: If your customer is subprime and should be worked that way from the beginning and put on the right car to get them financed and hold gross. If your customers credit is good enough to qualify for the special low lease payment from the factory they came in for, before having to bump him $30 -$50 a month after he has committed to buy when you run a bureau. If your customer is buried in their trade, or has great credit and a high interest rate on another car loan with equity, work the deal with this incredible information to close and hold gross. If your customer has been shopping at other dealerships in the last 30 days so you know this is a motivated buyer.

With Instant Screen you will immediately know: If your customer is subprime and should be worked that way from the beginning and put on the right car to get them financed and hold gross. If your customers credit is good enough to qualify for the special low lease payment from the factory they came in for, before having to bump him $30 -$50 a month after he has committed to buy when you run a bureau. If your customer is buried in their trade, or has great credit and a high interest rate on another car loan with equity, work the deal with this incredible information to close and hold gross. If your customer has been shopping at other dealerships in the last 30 days so you know this is a motivated buyer.

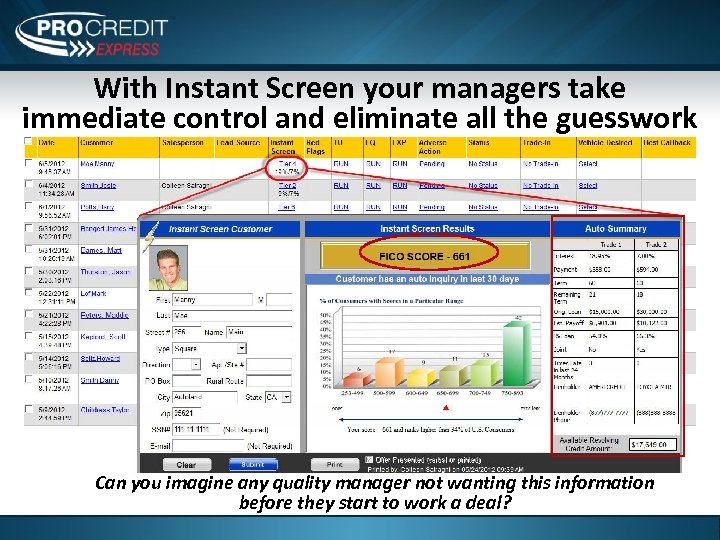

With Instant Screen your managers take immediate control and eliminate all the guesswork Can you imagine any quality manager not wanting this information before they start to work a deal?

With Instant Screen your managers take immediate control and eliminate all the guesswork Can you imagine any quality manager not wanting this information before they start to work a deal?

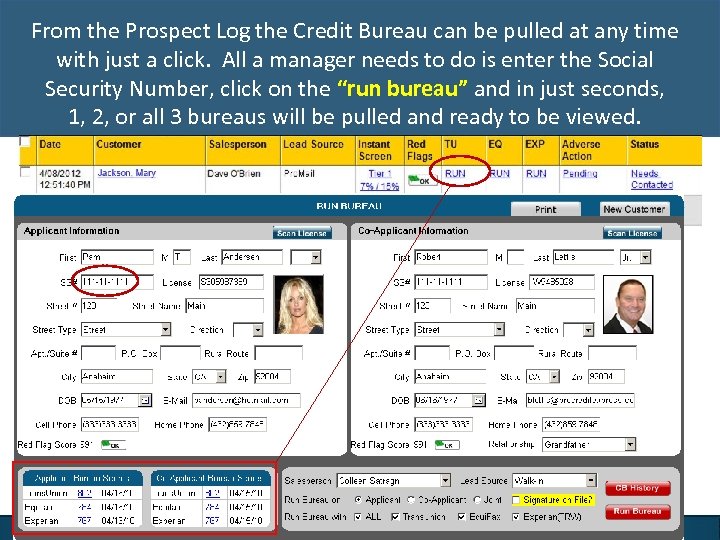

From the Prospect Log the Credit Bureau can be pulled at any time with just a click. All a manager needs to do is enter the Social Security Number, click on the “run bureau” and in just seconds, 1, 2, or all 3 bureaus will be pulled and ready to be viewed.

From the Prospect Log the Credit Bureau can be pulled at any time with just a click. All a manager needs to do is enter the Social Security Number, click on the “run bureau” and in just seconds, 1, 2, or all 3 bureaus will be pulled and ready to be viewed.

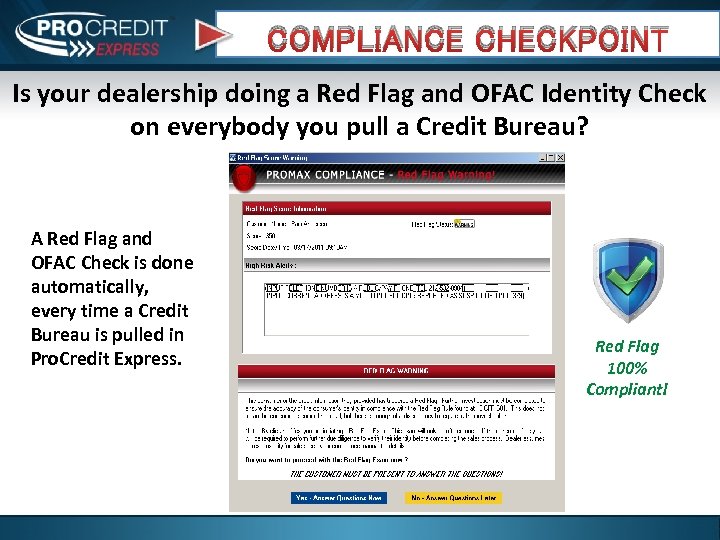

COMPLIANCE CHECKPOINT Is your dealership doing a Red Flag and OFAC Identity Check on everybody you pull a Credit Bureau? A Red Flag and OFAC Check is done automatically, every time a Credit Bureau is pulled in Pro. Credit Express. Red Flag 100% Compliant!

COMPLIANCE CHECKPOINT Is your dealership doing a Red Flag and OFAC Identity Check on everybody you pull a Credit Bureau? A Red Flag and OFAC Check is done automatically, every time a Credit Bureau is pulled in Pro. Credit Express. Red Flag 100% Compliant!

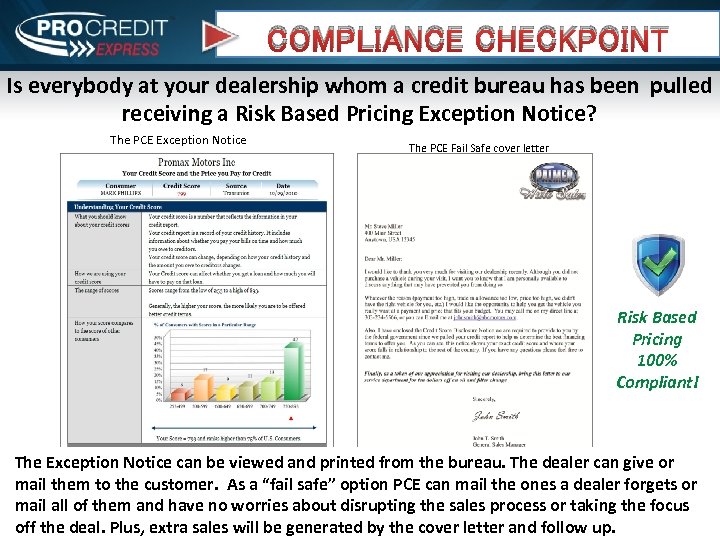

COMPLIANCE CHECKPOINT Is everybody at your dealership whom a credit bureau has been pulled receiving a Risk Based Pricing Exception Notice? The PCE Exception Notice The PCE Fail Safe cover letter Risk Based Pricing 100% Compliant! The Exception Notice can be viewed and printed from the bureau. The dealer can give or mail them to the customer. As a “fail safe” option PCE can mail the ones a dealer forgets or mail all of them and have no worries about disrupting the sales process or taking the focus off the deal. Plus, extra sales will be generated by the cover letter and follow up. !

COMPLIANCE CHECKPOINT Is everybody at your dealership whom a credit bureau has been pulled receiving a Risk Based Pricing Exception Notice? The PCE Exception Notice The PCE Fail Safe cover letter Risk Based Pricing 100% Compliant! The Exception Notice can be viewed and printed from the bureau. The dealer can give or mail them to the customer. As a “fail safe” option PCE can mail the ones a dealer forgets or mail all of them and have no worries about disrupting the sales process or taking the focus off the deal. Plus, extra sales will be generated by the cover letter and follow up. !

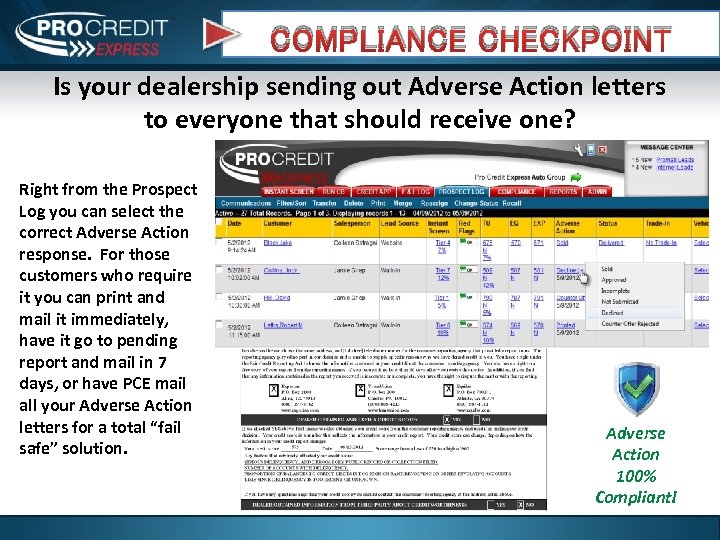

COMPLIANCE CHECKPOINT Is your dealership sending out Adverse Action letters to everyone that should receive one? Right from the Prospect Log you can select the correct Adverse Action response. For those customers who require it you can print and mail it immediately, have it go to pending report and mail in 7 days, or have PCE mail all your Adverse Action letters for a total “fail safe” solution. Adverse Action 100% Compliant!

COMPLIANCE CHECKPOINT Is your dealership sending out Adverse Action letters to everyone that should receive one? Right from the Prospect Log you can select the correct Adverse Action response. For those customers who require it you can print and mail it immediately, have it go to pending report and mail in 7 days, or have PCE mail all your Adverse Action letters for a total “fail safe” solution. Adverse Action 100% Compliant!

Dealers are huge targets in today’s litigious environment Staying compliant with Pro. Credit Express can protect your hard earned profits from an FTC audit and bring accountability, consistency, and profits to your sales process at the same time!

Dealers are huge targets in today’s litigious environment Staying compliant with Pro. Credit Express can protect your hard earned profits from an FTC audit and bring accountability, consistency, and profits to your sales process at the same time!

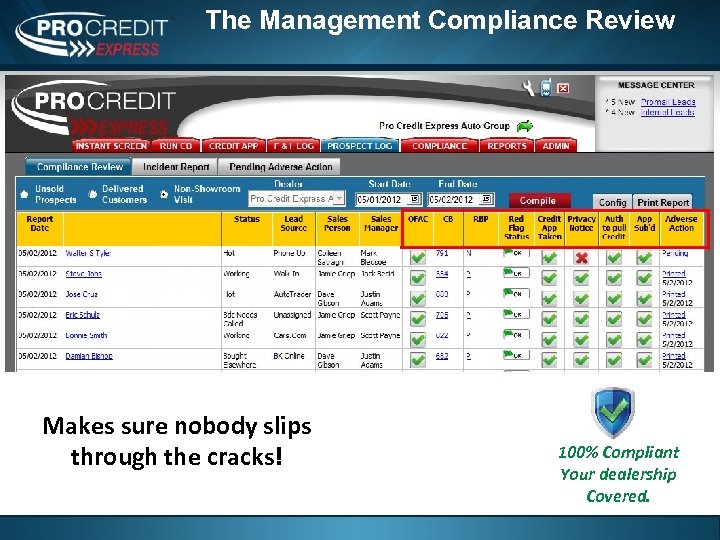

The Management Compliance Review Makes sure nobody slips through the cracks! 100% Compliant Your dealership Covered.

The Management Compliance Review Makes sure nobody slips through the cracks! 100% Compliant Your dealership Covered.

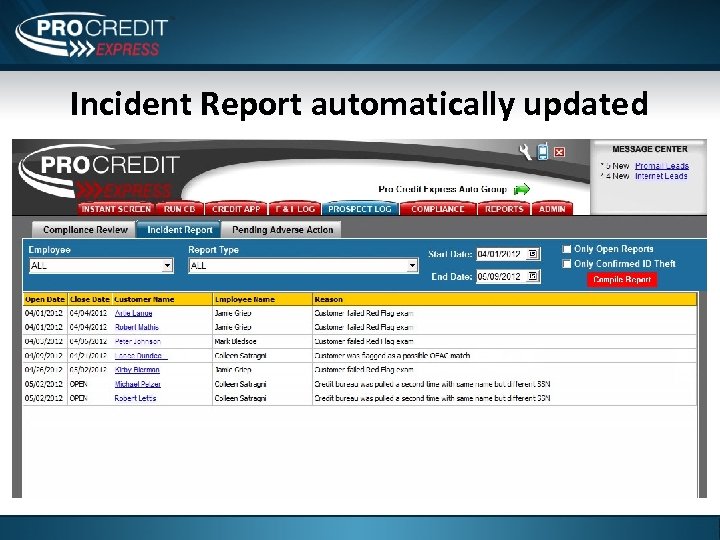

Incident Report automatically updated

Incident Report automatically updated

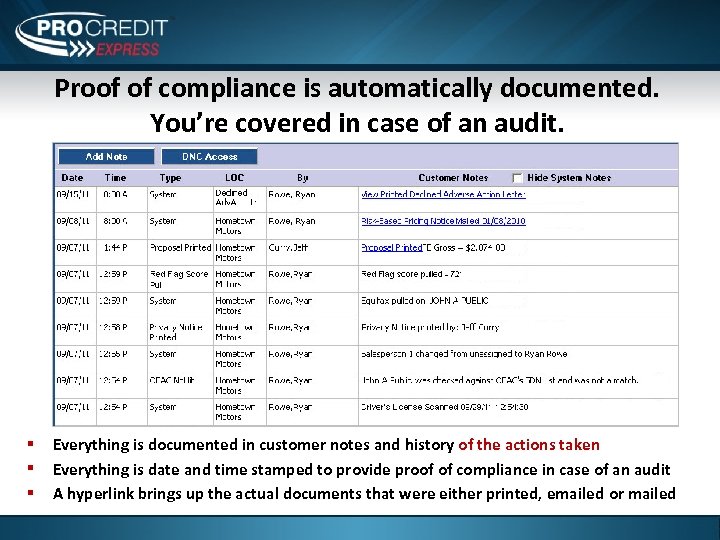

Proof of compliance is automatically documented. You’re covered in case of an audit. § § § Everything is documented in customer notes and history of the actions taken Everything is date and time stamped to provide proof of compliance in case of an audit A hyperlink brings up the actual documents that were either printed, emailed or mailed

Proof of compliance is automatically documented. You’re covered in case of an audit. § § § Everything is documented in customer notes and history of the actions taken Everything is date and time stamped to provide proof of compliance in case of an audit A hyperlink brings up the actual documents that were either printed, emailed or mailed

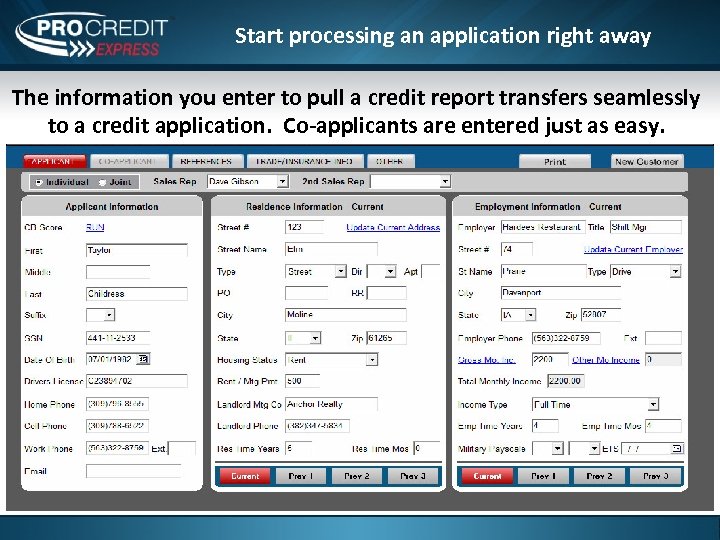

Start processing an application right away The information you enter to pull a credit report transfers seamlessly to a credit application. Co-applicants are entered just as easy.

Start processing an application right away The information you enter to pull a credit report transfers seamlessly to a credit application. Co-applicants are entered just as easy.

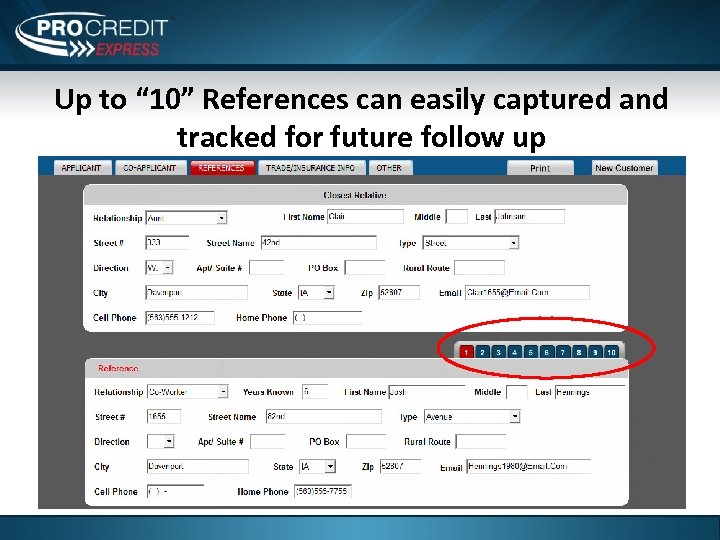

Up to “ 10” References can easily captured and tracked for future follow up

Up to “ 10” References can easily captured and tracked for future follow up

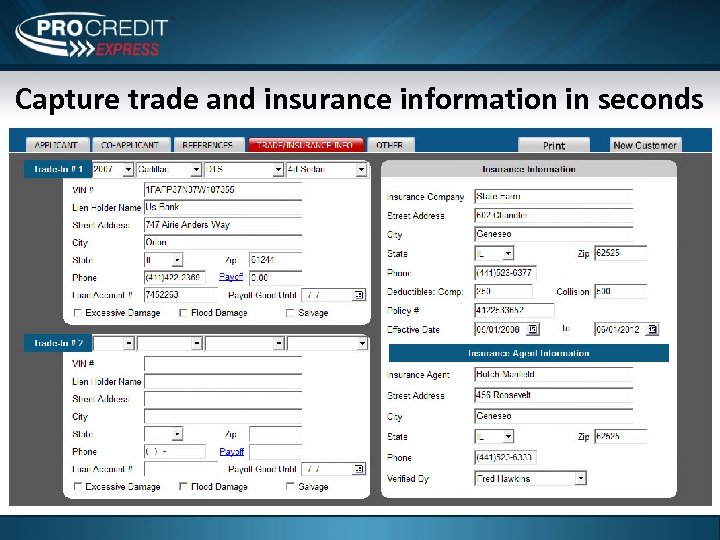

Capture trade and insurance information in seconds

Capture trade and insurance information in seconds

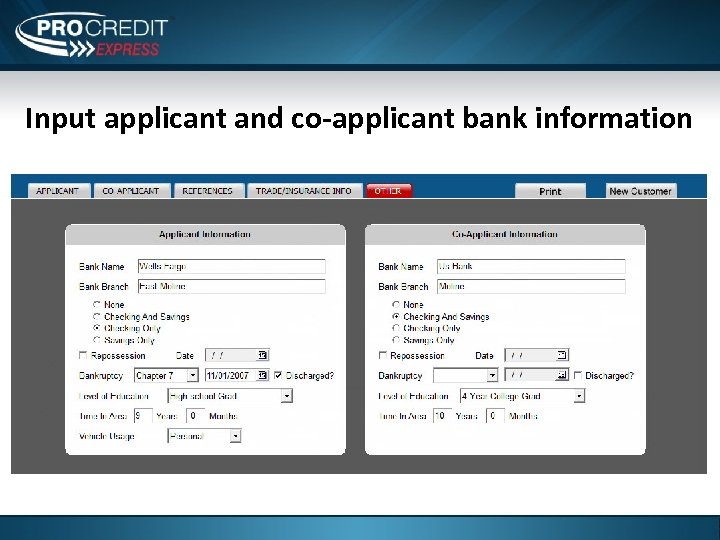

Input applicant and co-applicant bank information

Input applicant and co-applicant bank information

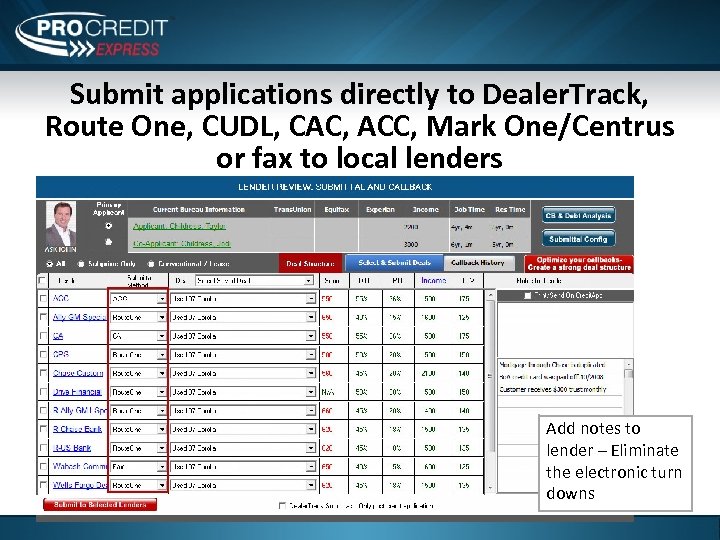

Submit applications directly to Dealer. Track, Route One, CUDL, CAC, ACC, Mark One/Centrus or fax to local lenders Add notes to lender – Eliminate the electronic turn downs

Submit applications directly to Dealer. Track, Route One, CUDL, CAC, ACC, Mark One/Centrus or fax to local lenders Add notes to lender – Eliminate the electronic turn downs

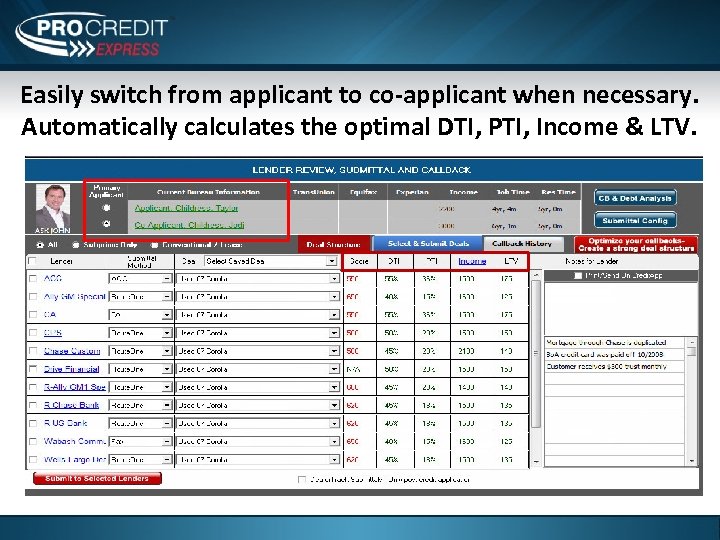

Easily switch from applicant to co-applicant when necessary. Automatically calculates the optimal DTI, PTI, Income & LTV.

Easily switch from applicant to co-applicant when necessary. Automatically calculates the optimal DTI, PTI, Income & LTV.

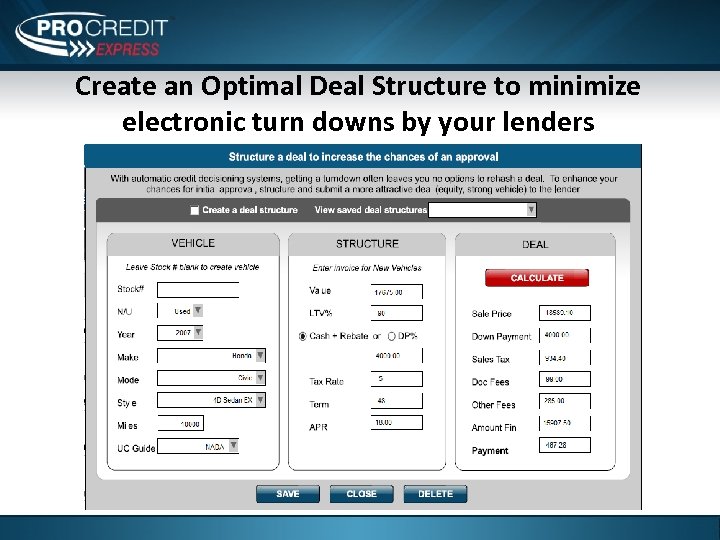

Create an Optimal Deal Structure to minimize electronic turn downs by your lenders

Create an Optimal Deal Structure to minimize electronic turn downs by your lenders

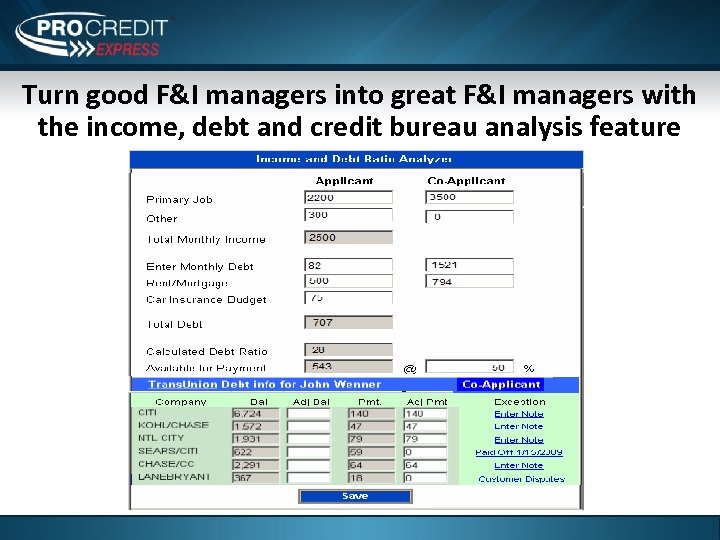

Turn good F&I managers into great F&I managers with the income, debt and credit bureau analysis feature

Turn good F&I managers into great F&I managers with the income, debt and credit bureau analysis feature

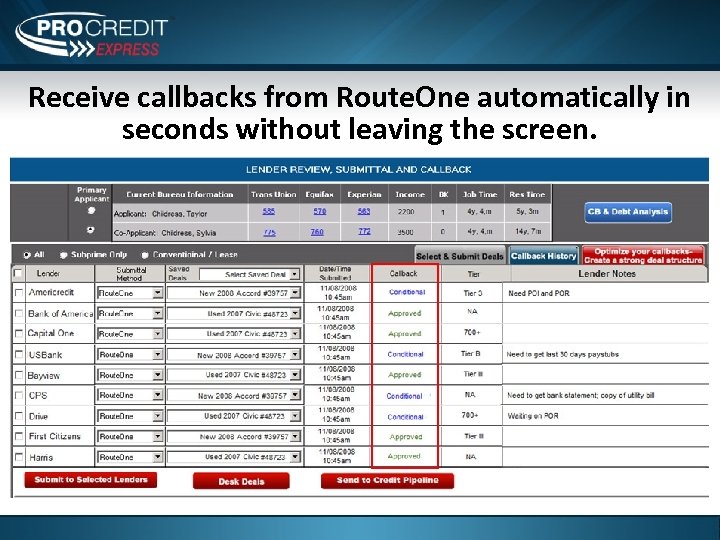

Receive callbacks from Route. One automatically in seconds without leaving the screen.

Receive callbacks from Route. One automatically in seconds without leaving the screen.

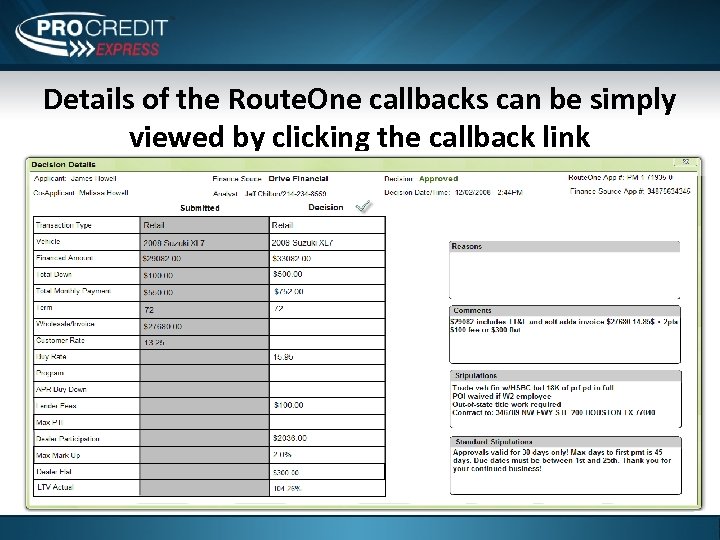

Details of the Route. One callbacks can be simply viewed by clicking the callback link

Details of the Route. One callbacks can be simply viewed by clicking the callback link

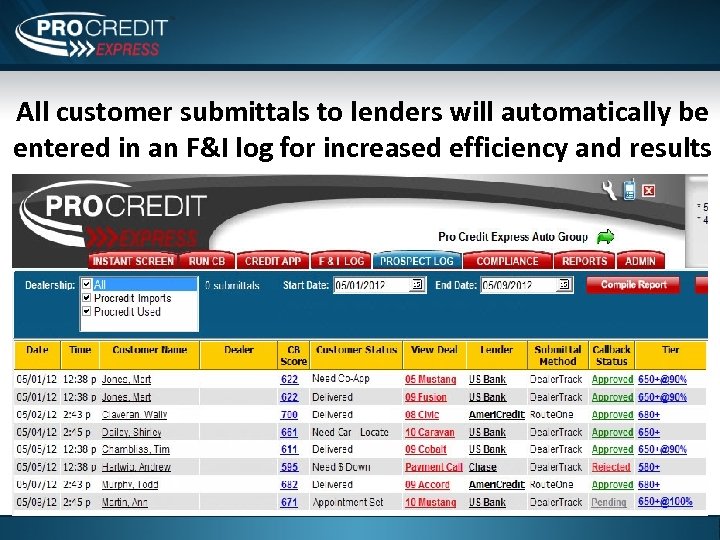

All customer submittals to lenders will automatically be entered in an F&I log for increased efficiency and results

All customer submittals to lenders will automatically be entered in an F&I log for increased efficiency and results

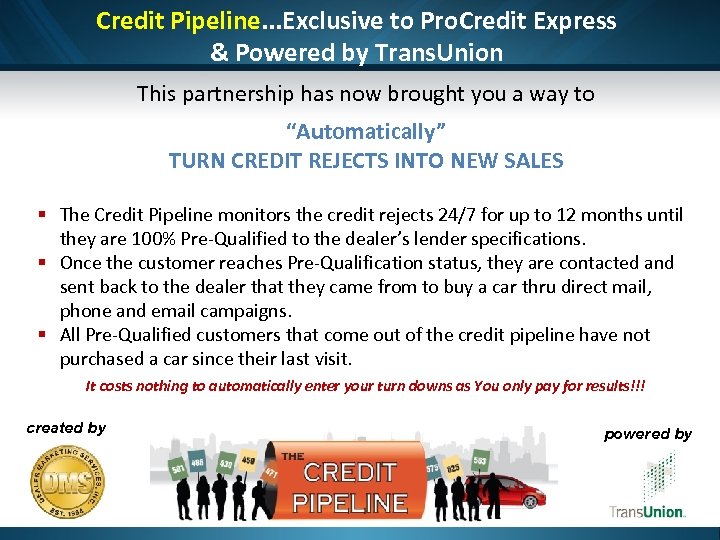

Credit Pipeline. . . Exclusive to Pro. Credit Express & Powered by Trans. Union This partnership has now brought you a way to “Automatically” TURN CREDIT REJECTS INTO NEW SALES § The Credit Pipeline monitors the credit rejects 24/7 for up to 12 months until they are 100% Pre-Qualified to the dealer’s lender specifications. § Once the customer reaches Pre-Qualification status, they are contacted and sent back to the dealer that they came from to buy a car thru direct mail, phone and email campaigns. § All Pre-Qualified customers that come out of the credit pipeline have not purchased a car since their last visit. It costs nothing to automatically enter your turn downs as You only pay for results!!! created by powered by

Credit Pipeline. . . Exclusive to Pro. Credit Express & Powered by Trans. Union This partnership has now brought you a way to “Automatically” TURN CREDIT REJECTS INTO NEW SALES § The Credit Pipeline monitors the credit rejects 24/7 for up to 12 months until they are 100% Pre-Qualified to the dealer’s lender specifications. § Once the customer reaches Pre-Qualification status, they are contacted and sent back to the dealer that they came from to buy a car thru direct mail, phone and email campaigns. § All Pre-Qualified customers that come out of the credit pipeline have not purchased a car since their last visit. It costs nothing to automatically enter your turn downs as You only pay for results!!! created by powered by

We guarantee we will save you money on your Credit Bureaus and Compliance costs and keep your dealership protected!

We guarantee we will save you money on your Credit Bureaus and Compliance costs and keep your dealership protected!

855 -882 -8175 Colleen Satragni csatragni@procreditexpress. com Instant Screen Credit Bureaus Compliance Your dealership Is 100% covered

855 -882 -8175 Colleen Satragni csatragni@procreditexpress. com Instant Screen Credit Bureaus Compliance Your dealership Is 100% covered