cfd3c7440736ffcd5771797b1ec9f8c3.ppt

- Количество слайдов: 47

The U. S. Retirement Market Gregory B. Salsbury, Ph. D. Executive Vice President Jackson National Life Distributors, Inc. 1

The U. S. Retirement Market I. III. The scope of the U. S. retirement savings market The evolution of retirement The need for financial planning and advice 2

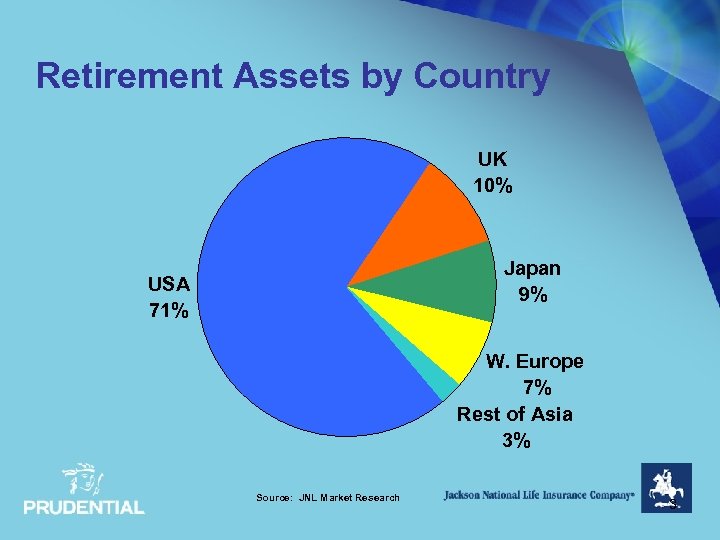

Retirement Assets by Country UK 10% Japan 9% USA 71% W. Europe 7% Rest of Asia 3% Source: JNL Market Research 3

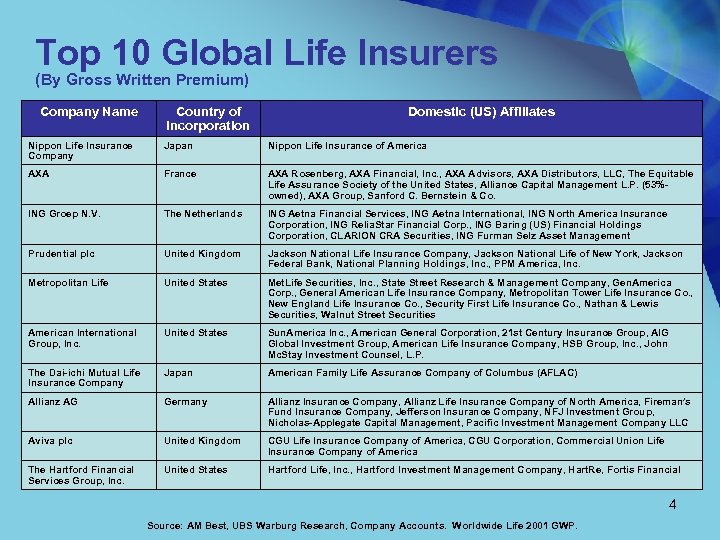

Top 10 Global Life Insurers (By Gross Written Premium) Company Name Country of Incorporation Domestic (US) Affiliates Nippon Life Insurance Company Japan Nippon Life Insurance of America AXA France AXA Rosenberg, AXA Financial, Inc. , AXA Advisors, AXA Distributors, LLC, The Equitable Life Assurance Society of the United States, Alliance Capital Management L. P. (53%owned), AXA Group, Sanford C. Bernstein & Co. ING Groep N. V. The Netherlands ING Aetna Financial Services, ING Aetna International, ING North America Insurance Corporation, ING Relia. Star Financial Corp. , ING Baring (US) Financial Holdings Corporation, CLARION CRA Securities, ING Furman Selz Asset Management Prudential plc United Kingdom Jackson National Life Insurance Company, Jackson National Life of New York, Jackson Federal Bank, National Planning Holdings, Inc. , PPM America, Inc. Metropolitan Life United States Met. Life Securities, Inc. , State Street Research & Management Company, Gen. America Corp. , General American Life Insurance Company, Metropolitan Tower Life Insurance Co. , New England Life Insurance Co. , Security First Life Insurance Co. , Nathan & Lewis Securities, Walnut Street Securities American International Group, Inc. United States Sun. America Inc. , American General Corporation, 21 st Century Insurance Group, AIG Global Investment Group, American Life Insurance Company, HSB Group, Inc. , John Mc. Stay Investment Counsel, L. P. The Dai-ichi Mutual Life Insurance Company Japan American Family Life Assurance Company of Columbus (AFLAC) Allianz AG Germany Allianz Insurance Company, Allianz Life Insurance Company of North America, Fireman’s Fund Insurance Company, Jefferson Insurance Company, NFJ Investment Group, Nicholas-Applegate Capital Management, Pacific Investment Management Company LLC Aviva plc United Kingdom CGU Life Insurance Company of America, CGU Corporation, Commercial Union Life Insurance Company of America The Hartford Financial Services Group, Inc. United States Hartford Life, Inc. , Hartford Investment Management Company, Hart. Re, Fortis Financial 4 Source: AM Best, UBS Warburg Research, Company Accounts. Worldwide Life 2001 GWP.

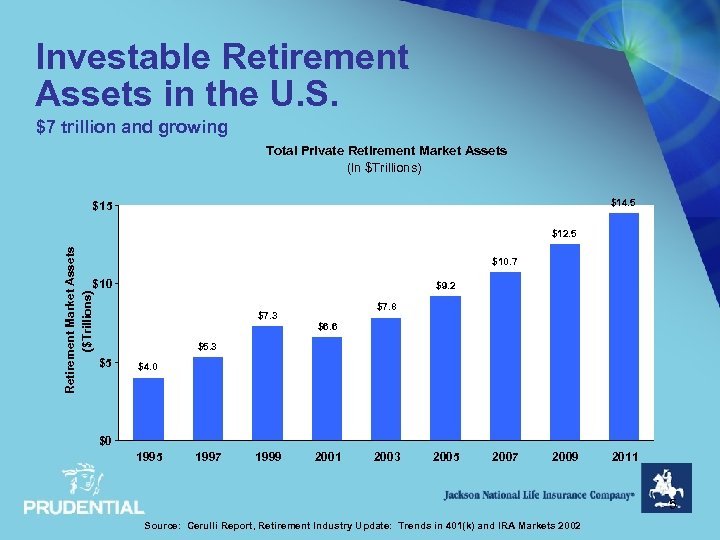

Investable Retirement Assets in the U. S. $7 trillion and growing Total Private Retirement Market Assets (In $Trillions) $14. 5 $15 Retirement Market Assets ($Trillions) $12. 5 $10. 7 $10 $9. 2 $7. 3 $7. 8 $6. 6 $5. 3 $5 $4. 0 $0 1995 1997 1999 2001 2003 2005 2007 2009 2011 5 Source: Cerulli Report, Retirement Industry Update: Trends in 401(k) and IRA Markets 2002

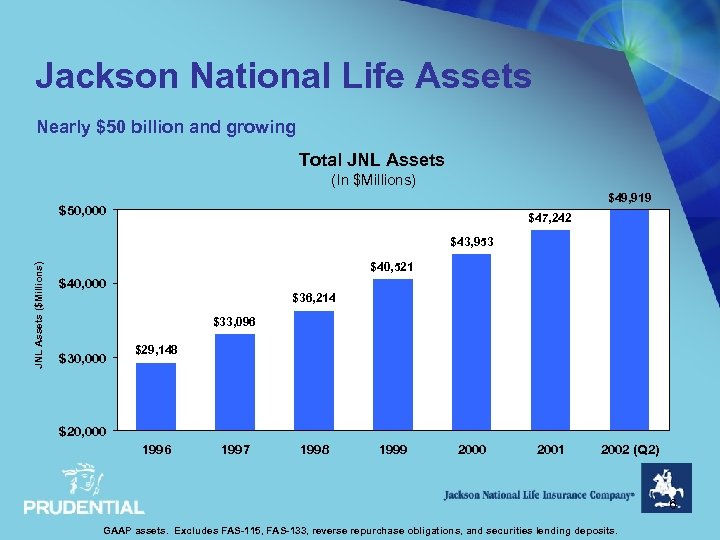

Jackson National Life Assets Nearly $50 billion and growing Total JNL Assets (In $Millions) $49, 919 $50, 000 $47, 242 JNL Assets ($Millions) $43, 953 $40, 521 $40, 000 $36, 214 $33, 096 $30, 000 $29, 148 $20, 000 1996 1997 1998 1999 2000 2001 2002 (Q 2) 6 GAAP assets. Excludes FAS-115, FAS-133, reverse repurchase obligations, and securities lending deposits.

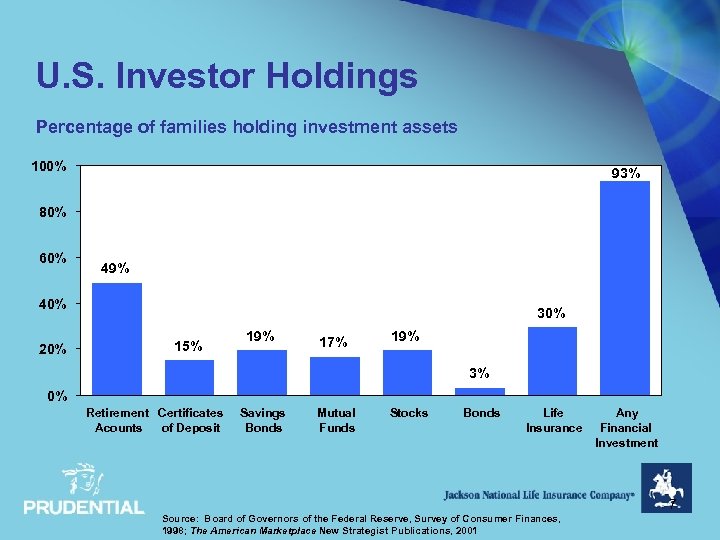

U. S. Investor Holdings Percentage of families holding investment assets 100% 93% 80% 60% 49% 40% 20% 30% 15% 19% 17% 19% 3% 0% Retirement Certificates Acounts of Deposit Savings Bonds Mutual Funds Stocks Bonds Life Insurance Any Financial Investment 7 Source: Board of Governors of the Federal Reserve, Survey of Consumer Finances, 1998; The American Marketplace New Strategist Publications, 2001

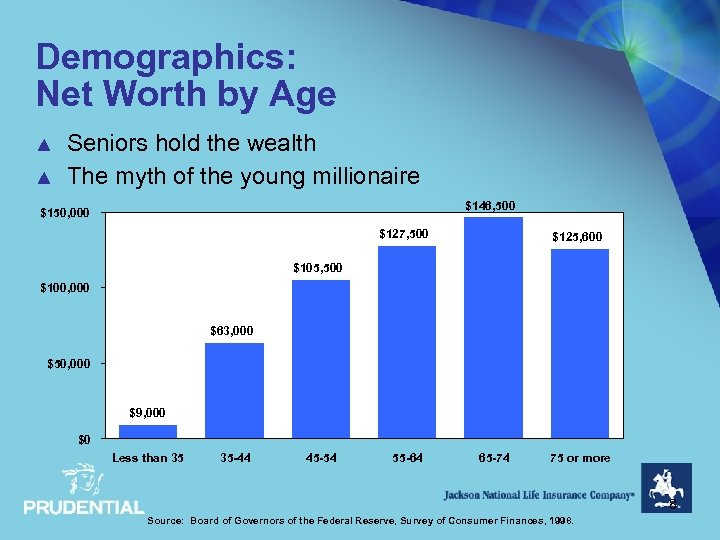

Demographics: Net Worth by Age ▲ ▲ Seniors hold the wealth The myth of the young millionaire $146, 500 $150, 000 $127, 500 $125, 600 $105, 500 $100, 000 $63, 000 $50, 000 $9, 000 $0 Less than 35 35 -44 45 -54 55 -64 65 -74 75 or more 8 Source: Board of Governors of the Federal Reserve, Survey of Consumer Finances, 1998.

The U. S. Retirement Market The scope of the U. S. retirement savings market II. The evolution of retirement III. The need for financial planning and advice I. 9

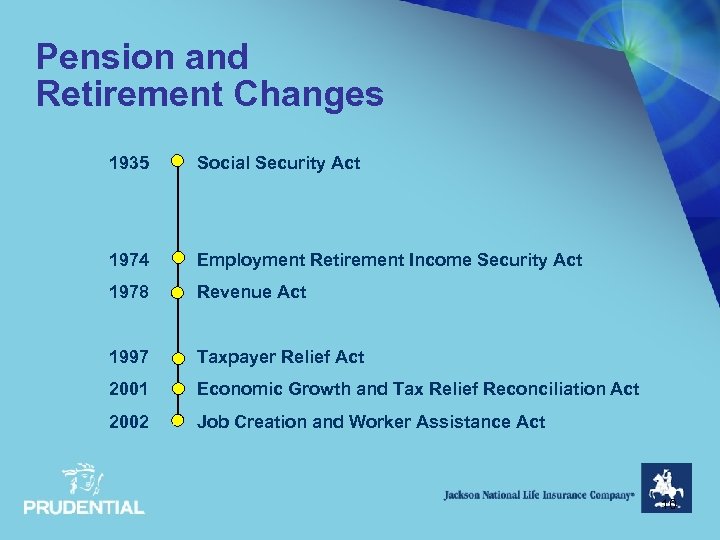

Pension and Retirement Changes 1935 Social Security Act 1974 Employment Retirement Income Security Act 1978 Revenue Act 1997 Taxpayer Relief Act 2001 Economic Growth and Tax Relief Reconciliation Act 2002 Job Creation and Worker Assistance Act 10

Social Security Overburdened ▲ ▲ Social Security doesn’t pay very much Most Americans depend on it The ratio of payees to beneficiaries is shrinking Future retirees will not likely receive Social Security 11 Source: General Accounting Office; Cerulli Associates.

In 15 years or less, Social Security will start paying out more than it takes in. By 2075, it will be $22. 2 trillion in the hole. Source: Barron’s, “Pension Poverty, ” January 28, 2002 Barron’s, Benefits warning! 12

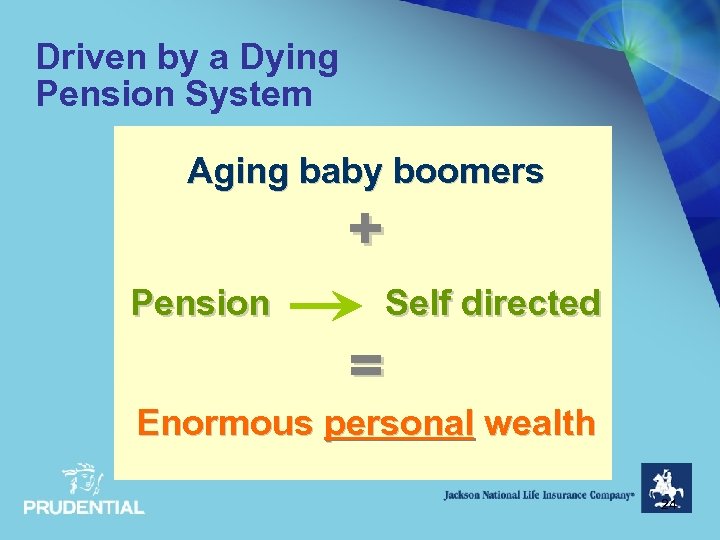

Death of the Company Pension ▲ ▲ ▲ Companies unable to meet pension responsibilities Defined Benefit yields to Defined Contribution The boom in additional retirement plans 13 Source: General Accounting Office; Cerulli Associates.

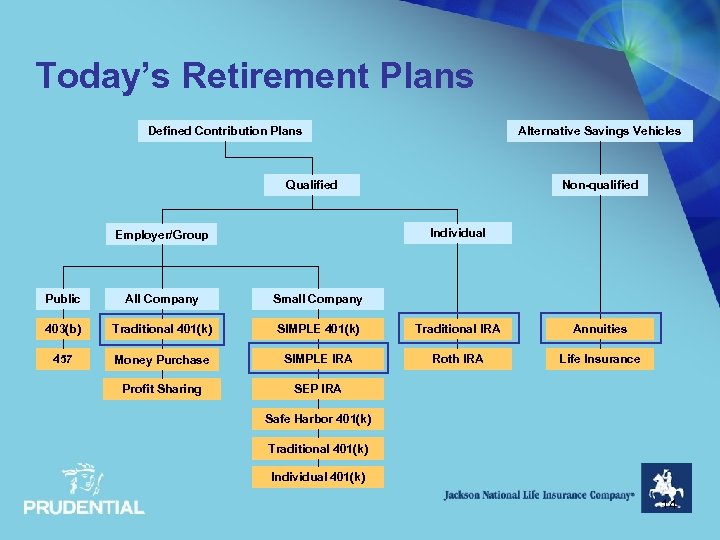

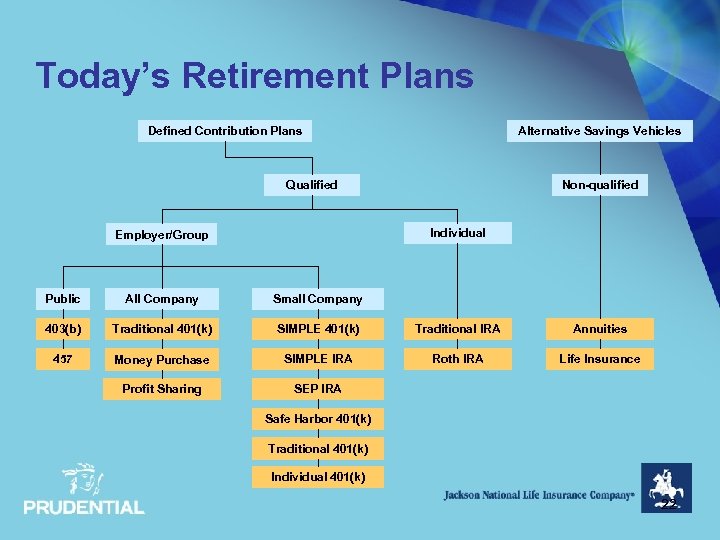

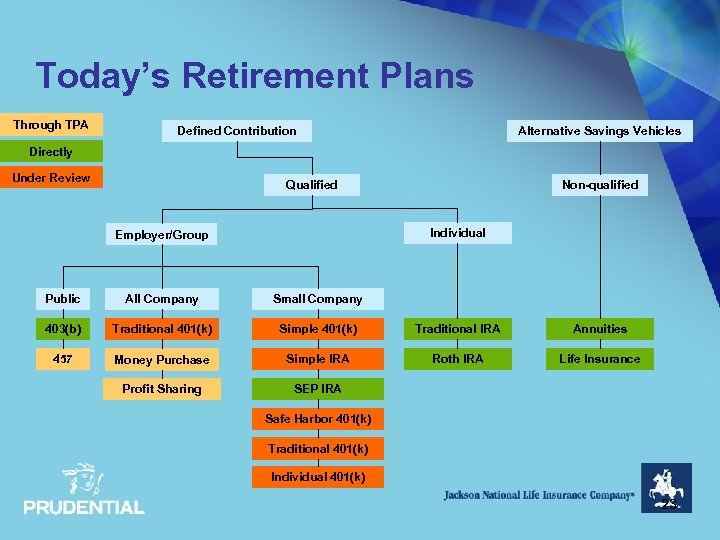

Today’s Retirement Plans Defined Contribution Plans Alternative Savings Vehicles Qualified Non-qualified Individual Employer/Group Public All Company Small Company 403(b) Traditional 401(k) SIMPLE 401(k) Traditional IRA Annuities 457 Money Purchase SIMPLE IRA Roth IRA Life Insurance Profit Sharing SEP IRA Safe Harbor 401(k) Traditional 401(k) Individual 401(k) 14

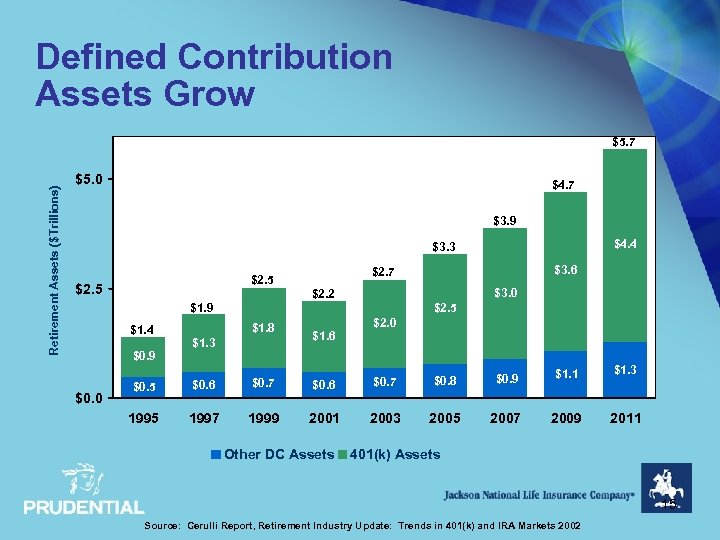

Defined Contribution Assets Grow Retirement Assets ($Trillions) $5. 7 $5. 0 $4. 7 $3. 9 $4. 4 $3. 3 $2. 5 $3. 0 $2. 2 $1. 9 $1. 4 $0. 9 $0. 0 $3. 6 $2. 7 $2. 5 $1. 8 $1. 3 $0. 5 $0. 6 $0. 7 1995 1997 1999 $1. 6 $2. 0 $0. 8 $0. 9 $1. 1 $1. 3 $0. 6 $0. 7 2001 2003 2005 2007 2009 2011 Other DC Assets 401(k) Assets 15 Source: Cerulli Report, Retirement Industry Update: Trends in 401(k) and IRA Markets 2002

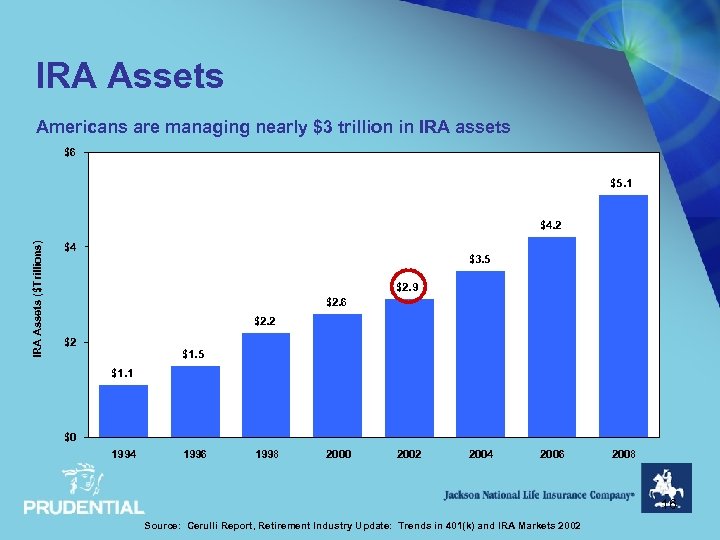

IRA Assets Americans are managing nearly $3 trillion in IRA assets $6 $5. 1 IRA Assets ($Trillions) $4. 2 $4 $3. 5 $2. 9 $2. 6 $2. 2 $2 $1. 5 $1. 1 $0 1994 1996 1998 2000 2002 2004 2006 2008 16 Source: Cerulli Report, Retirement Industry Update: Trends in 401(k) and IRA Markets 2002

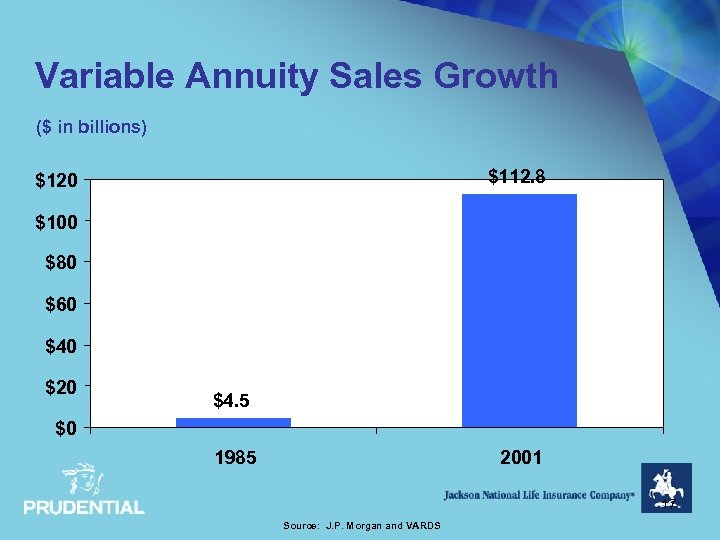

Variable Annuity Sales Growth ($ in billions) $112. 8 $120 $100 $80 $60 $40 $20 $4. 5 $0 1985 2001 17 Source: J. P. Morgan and VARDS

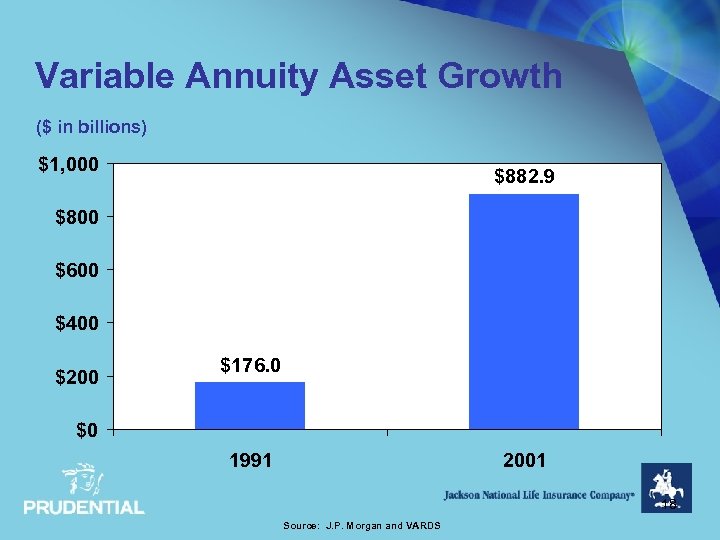

Variable Annuity Asset Growth ($ in billions) $1, 000 $882. 9 $800 $600 $400 $200 $176. 0 $0 1991 2001 18 Source: J. P. Morgan and VARDS

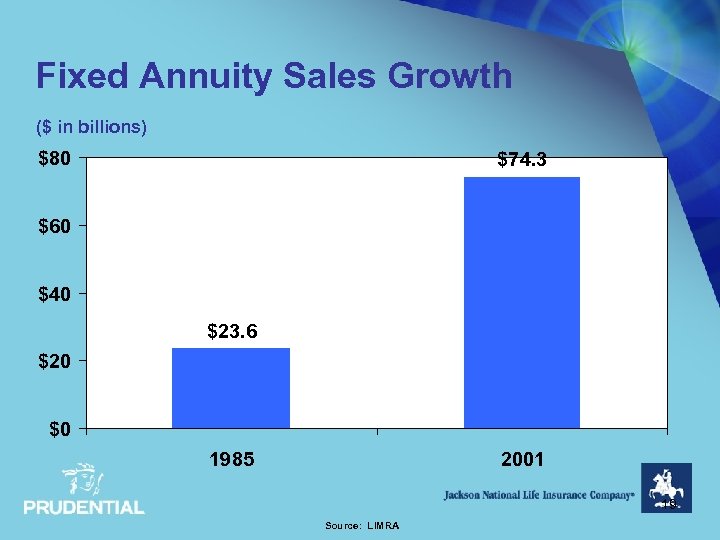

Fixed Annuity Sales Growth ($ in billions) $80 $74. 3 $60 $40 $23. 6 $20 $0 1985 2001 19 Source: LIMRA

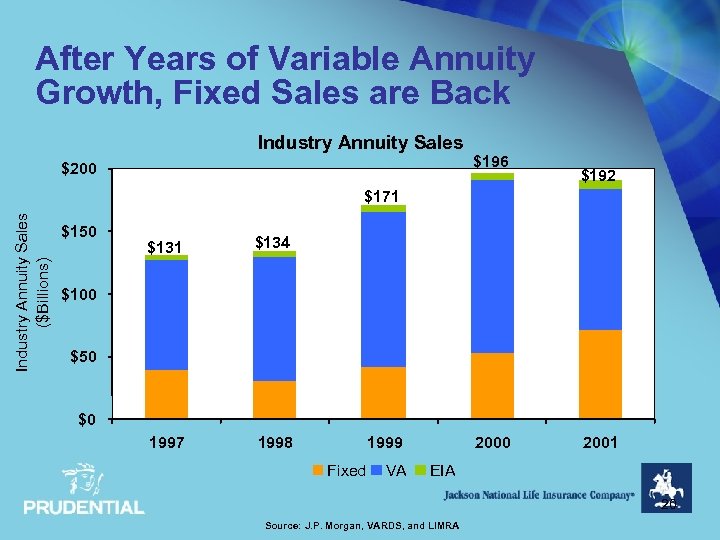

After Years of Variable Annuity Growth, Fixed Sales are Back Industry Annuity Sales $200 $196 $192 Industry Annuity Sales ($Billions) $171 $150 $131 $134 1997 1998 $100 $50 $0 1999 Fixed VA 2000 2001 EIA 20 Source: J. P. Morgan, VARDS, and LIMRA

JNL Retirement Funding Vehicles ▲ Fixed annuities ▲ Variable annuities ▲ Equity-indexed annuities ▲ Life insurance 21

Today’s Retirement Plans Defined Contribution Plans Alternative Savings Vehicles Qualified Non-qualified Individual Employer/Group Public All Company Small Company 403(b) Traditional 401(k) SIMPLE 401(k) Traditional IRA Annuities 457 Money Purchase SIMPLE IRA Roth IRA Life Insurance Profit Sharing SEP IRA Safe Harbor 401(k) Traditional 401(k) Individual 401(k) 22

Today’s Retirement Plans Through TPA Defined Contribution Alternative Savings Vehicles Directly Under Review Qualified Non-qualified Individual Employer/Group Public All Company Small Company 403(b) Traditional 401(k) Simple 401(k) Traditional IRA Annuities 457 Money Purchase Simple IRA Roth IRA Life Insurance Profit Sharing SEP IRA Safe Harbor 401(k) Traditional 401(k) Individual 401(k) 23

Driven by a Dying Pension System Aging baby boomers + Pension Self directed = Enormous personal wealth 24

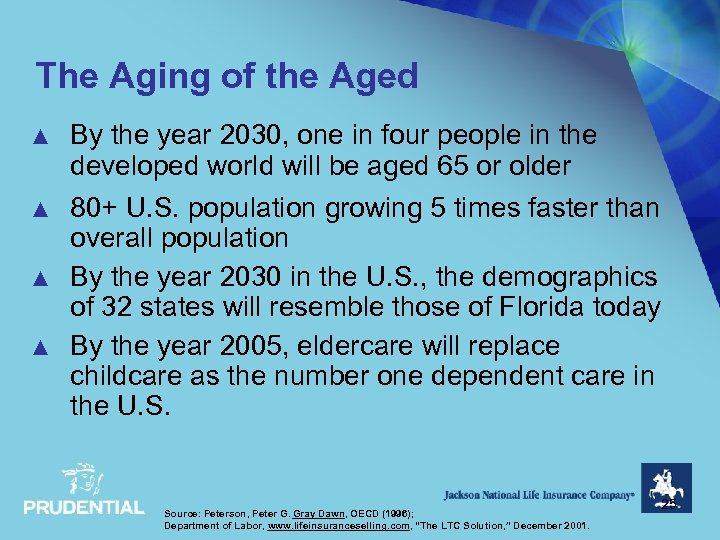

The Aging of the Aged ▲ By the year 2030, one in four people in the developed world will be aged 65 or older ▲ 80+ U. S. population growing 5 times faster than overall population By the year 2030 in the U. S. , the demographics of 32 states will resemble those of Florida today By the year 2005, eldercare will replace childcare as the number one dependent care in the U. S. ▲ ▲ Source: Peterson, Peter G. Gray Dawn, OECD (1996); Department of Labor, www. lifeinsuranceselling. com, “The LTC Solution, ” December 2001. 25

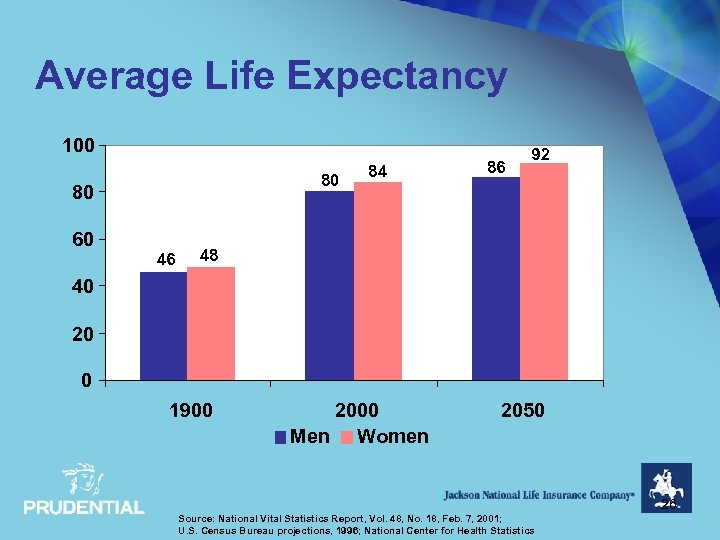

Average Life Expectancy 100 80 80 60 46 84 86 92 48 40 20 0 1900 2000 Men Women 2050 26 Source: National Vital Statistics Report, Vol. 48, No. 18, Feb. 7, 2001; U. S. Census Bureau projections, 1996; National Center for Health Statistics

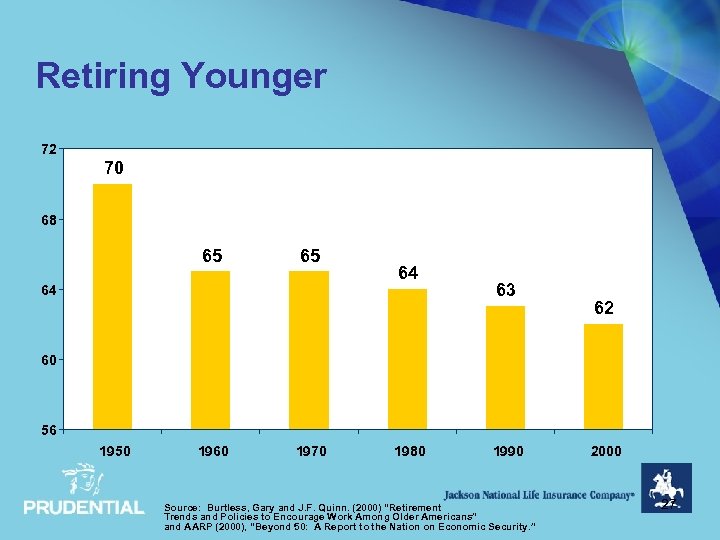

Retiring Younger 72 70 68 65 65 64 64 63 62 60 56 1950 1960 1970 1980 1990 Source: Burtless, Gary and J. F. Quinn. (2000) “Retirement Trends and Policies to Encourage Work Among Older Americans” and AARP (2000), “Beyond 50: A Report to the Nation on Economic Security. ” 2000 27

The Increasing Tax Bite The Tax Foundation has shown that the typical two-earner family now spends more on federal, state, and local taxes than on shelter, food, clothing and transportation combined. Source: “Tax Freedom Day Arrives, ” www. house. gov/dunn/oped/txfree 2. htm Source: Combined federal, state, and local taxes per capita as a percentage of income, 2001. Special Report, No. 104, April 2001, Tax Foundation 28

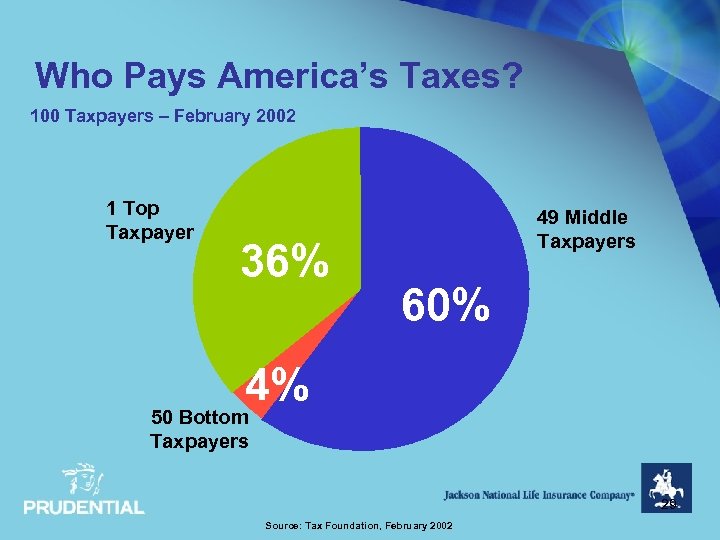

Who Pays America’s Taxes? 100 Taxpayers – February 2002 1 Top Taxpayer 36% 49 Middle Taxpayers 60% 4% 50 Bottom Taxpayers 29 Source: Tax Foundation, February 2002

JNL Provides Answers ▲ Retirement funding vehicles – – – Taxed deferred savings Accumulation and distribution Options for every risk profile 30

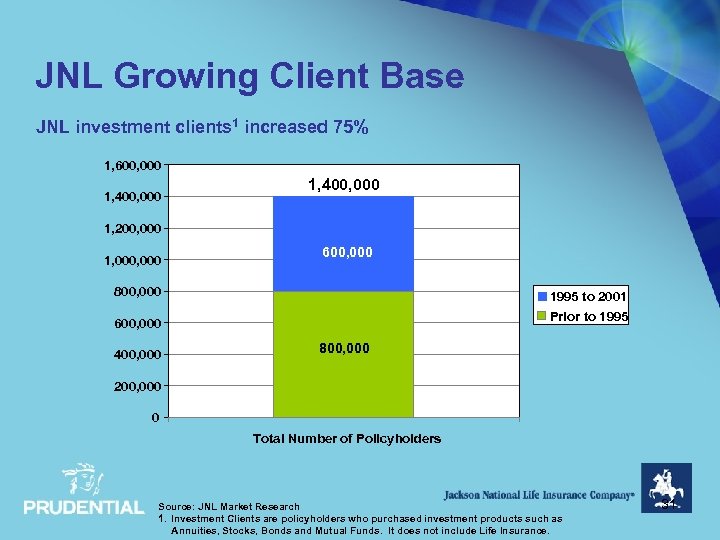

JNL Growing Client Base JNL investment clients 1 increased 75% 1, 600, 000 1, 400, 000 1, 200, 000 1, 000 600, 000 800, 000 1995 to 2001 Prior to 1995 600, 000 400, 000 800, 000 200, 000 0 Total Number of Policyholders Source: JNL Market Research 1. Investment Clients are policyholders who purchased investment products such as Annuities, Stocks, Bonds and Mutual Funds. It does not include Life Insurance. 31

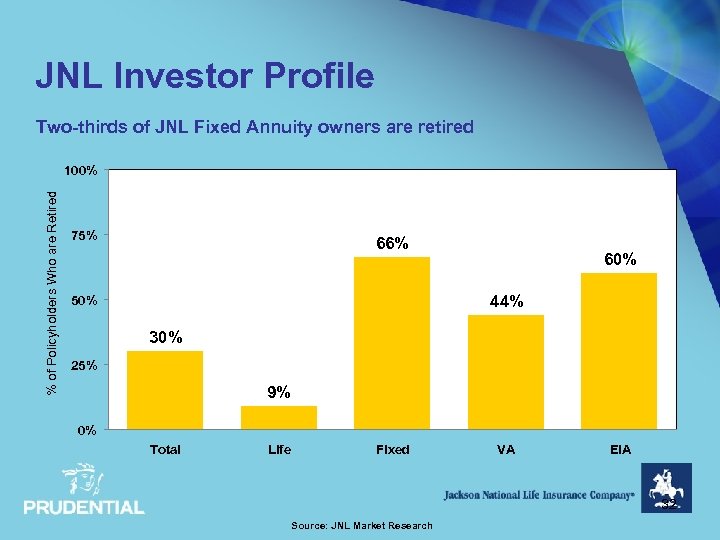

JNL Investor Profile Two-thirds of JNL Fixed Annuity owners are retired % of Policyholders Who are Retired 100% 75% 66% 60% 44% 50% 30% 25% 9% 0% Total Life Fixed VA EIA 32 Source: JNL Market Research

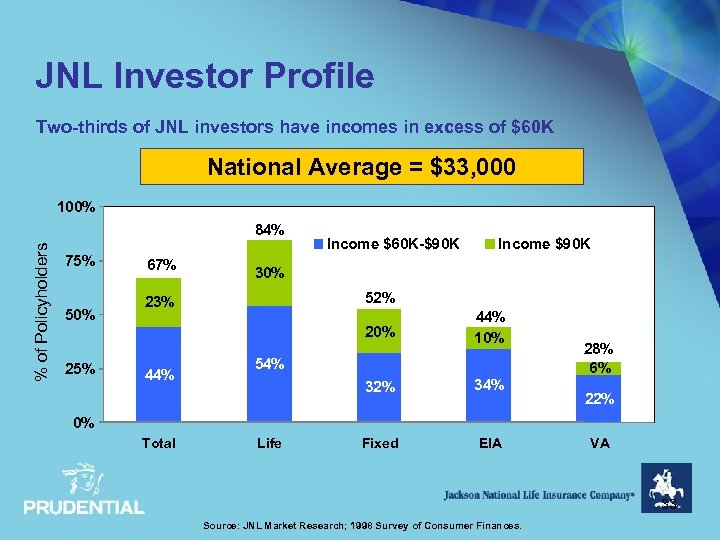

JNL Investor Profile Two-thirds of JNL investors have incomes in excess of $60 K National Average = $33, 000 100% % of Policyholders 84% 75% 50% 67% Income $60 K-$90 K 30% 52% 23% 20% 25% 44% Income $90 K 44% 10% 54% 32% 34% Fixed EIA 28% 6% 22% 0% Total Life VA 33 Source: JNL Market Research; 1998 Survey of Consumer Finances.

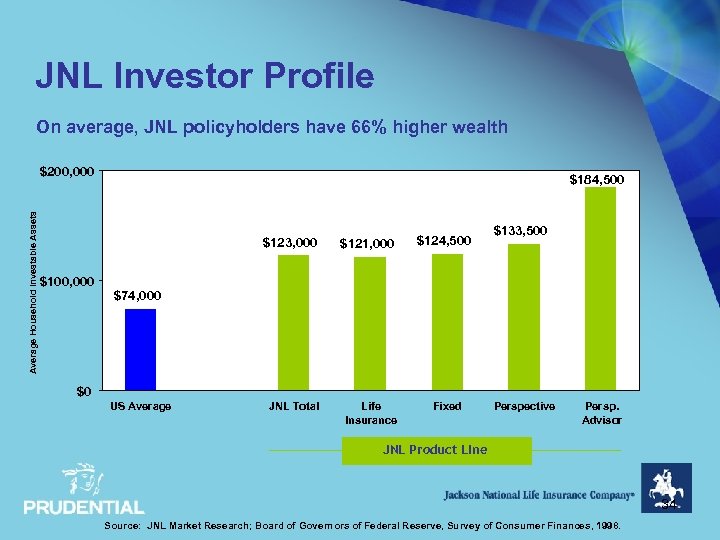

JNL Investor Profile On average, JNL policyholders have 66% higher wealth Average Household Investable Assets $200, 000 $184, 500 $123, 000 $100, 000 $121, 000 JNL Total Life Insurance $124, 500 $133, 500 $74, 000 $0 US Average Fixed Perspective Persp. Advisor JNL Product Line 34 Source: JNL Market Research; Board of Governors of Federal Reserve, Survey of Consumer Finances, 1998.

The U. S. Retirement Market The scope of the U. S. retirement savings market II. The evolution of retirement III. The need for financial planning and advice I. 35

The Impact of the Bull and the Bear on Investors 36

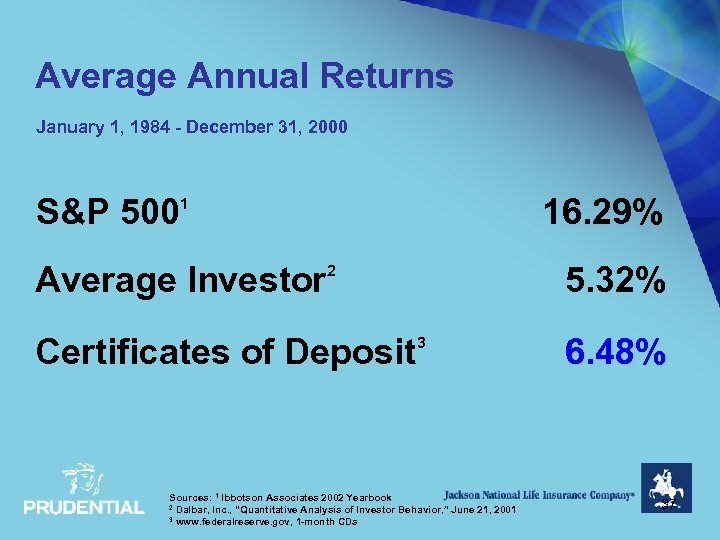

Average Annual Returns January 1, 1984 - December 31, 2000 S&P 500 1 16. 29% Average Investor 2 5. 32% Certificates of Deposit 3 6. 48% Sources: 1 Ibbotson Associates 2002 Yearbook 2 Dalbar, Inc. , “Quantitative Analysis of Investor Behavior, ” June 21, 2001 3 www. federalreserve. gov, 1 -month CDs 37

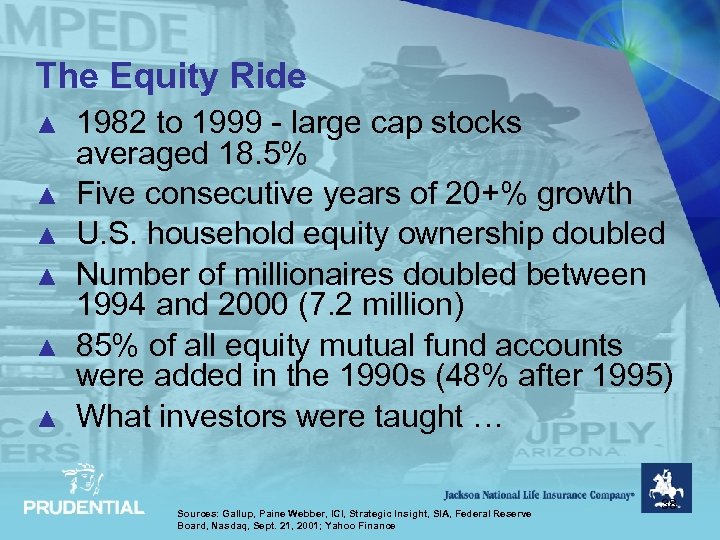

The Equity Ride ▲ ▲ ▲ 1982 to 1999 - large cap stocks averaged 18. 5% Five consecutive years of 20+% growth U. S. household equity ownership doubled Number of millionaires doubled between 1994 and 2000 (7. 2 million) 85% of all equity mutual fund accounts were added in the 1990 s (48% after 1995) What investors were taught … Sources: Gallup, Paine Webber, ICI, Strategic Insight, SIA, Federal Reserve Board, Nasdaq, Sept. 21, 2001; Yahoo Finance 38

39

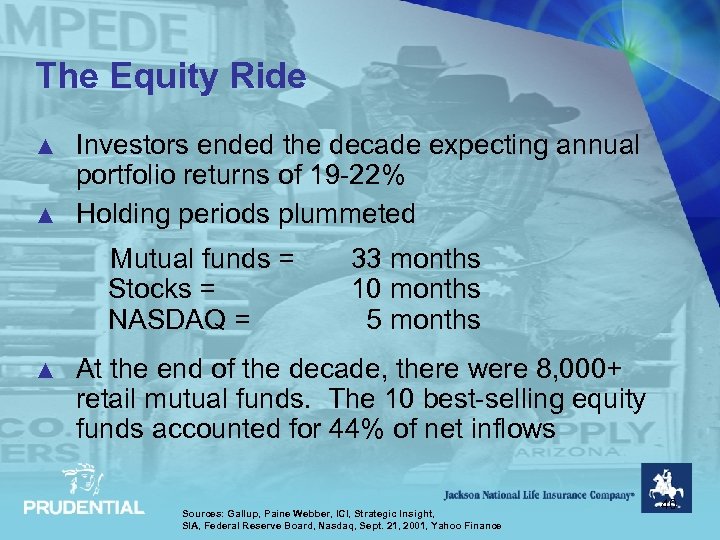

The Equity Ride ▲ ▲ Investors ended the decade expecting annual portfolio returns of 19 -22% Holding periods plummeted Mutual funds = Stocks = NASDAQ = ▲ 33 months 10 months 5 months At the end of the decade, there were 8, 000+ retail mutual funds. The 10 best-selling equity funds accounted for 44% of net inflows Sources: Gallup, Paine Webber, ICI, Strategic Insight, SIA, Federal Reserve Board, Nasdaq, Sept. 21, 2001, Yahoo Finance 40

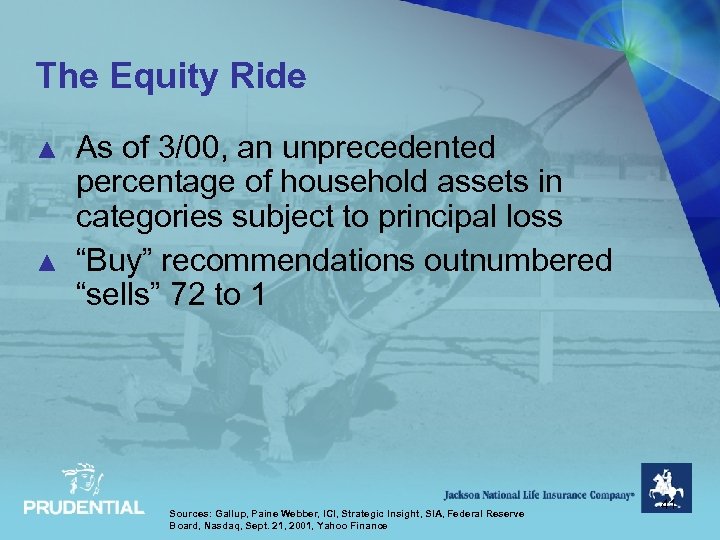

The Equity Ride ▲ ▲ As of 3/00, an unprecedented percentage of household assets in categories subject to principal loss “Buy” recommendations outnumbered “sells” 72 to 1 Sources: Gallup, Paine Webber, ICI, Strategic Insight, SIA, Federal Reserve Board, Nasdaq, Sept. 21, 2001, Yahoo Finance 41

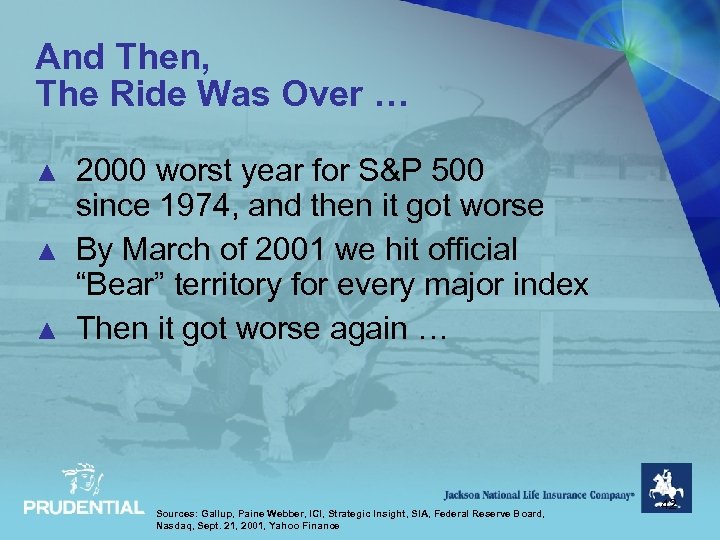

And Then, The Ride Was Over … ▲ ▲ ▲ 2000 worst year for S&P 500 since 1974, and then it got worse By March of 2001 we hit official “Bear” territory for every major index Then it got worse again … Sources: Gallup, Paine Webber, ICI, Strategic Insight, SIA, Federal Reserve Board, Nasdaq, Sept. 21, 2001, Yahoo Finance 42

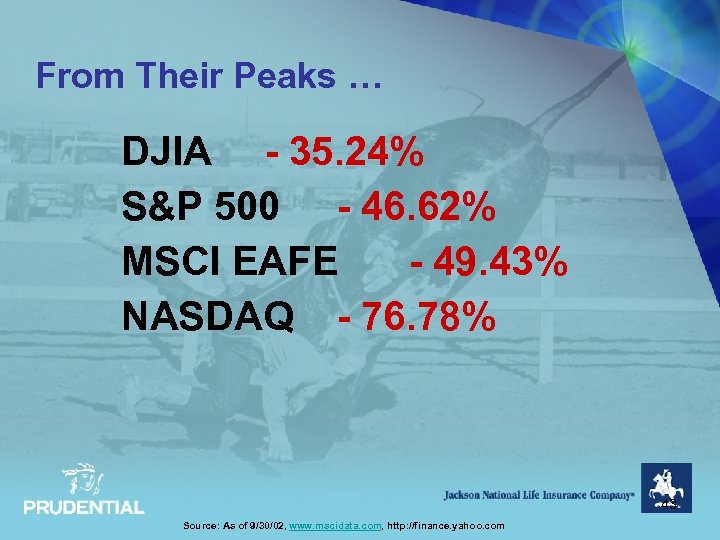

From Their Peaks … DJIA - 35. 24% S&P 500 - 46. 62% MSCI EAFE - 49. 43% NASDAQ - 76. 78% 43 Source: As of 9/30/02, www. mscidata. com, http: //finance. yahoo. com

The Five Stages of Loss I. III. IV. V. Shock Denial Hurt Anger Acceptance 44

Advisor Issues ▲ ▲ ▲ Frightened investors Fee-based pricing Pursuit of the affluent 45

JNL is Well-Positioned ▲ ▲ ▲ Capitalizing on the retirement market Focusing on advisors Understanding investors 46

47

cfd3c7440736ffcd5771797b1ec9f8c3.ppt