06adcc0fbe1dd466264e62e37cd8345a.ppt

- Количество слайдов: 85

The U. S. Personal Computer Industry Abdul-hadi Hamid Dan Liu David Ng Lisa Berladyn Maya Rajani

Agenda l l l Industry Analysis Dell Inc. Apple Computer, Inc. Hewlett-Packard Company Summary

Industry Analysis I

Overview l 1980’s l 1990’s l After the Tech Boom

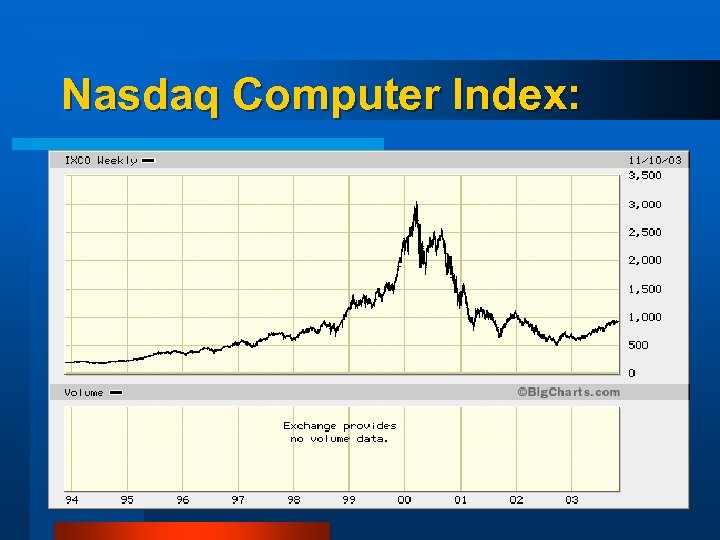

Nasdaq Computer Index:

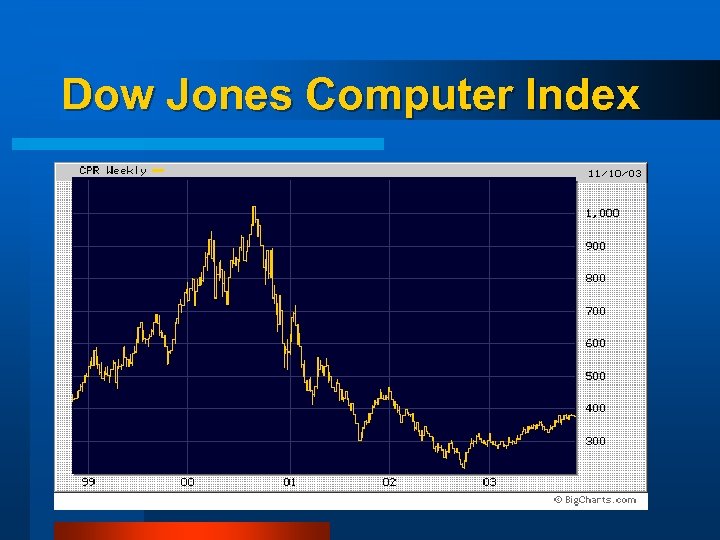

Dow Jones Computer Index

S&P 500 v. s. Computer Industry

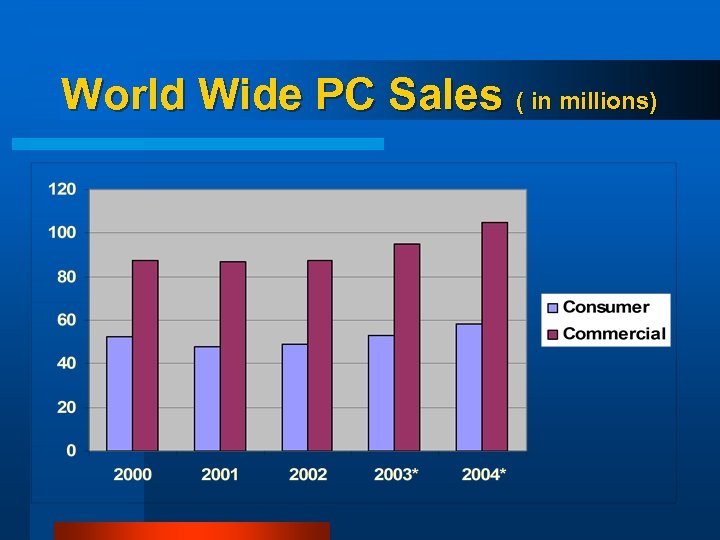

World Wide PC Sales ( in millions)

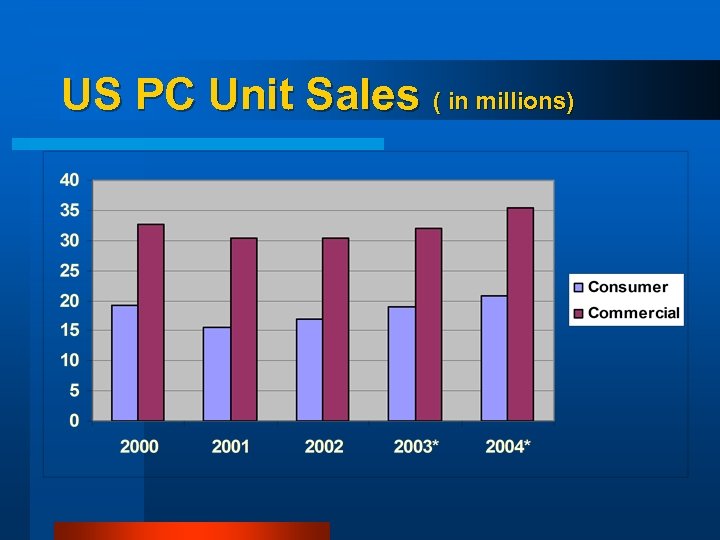

US PC Unit Sales ( in millions)

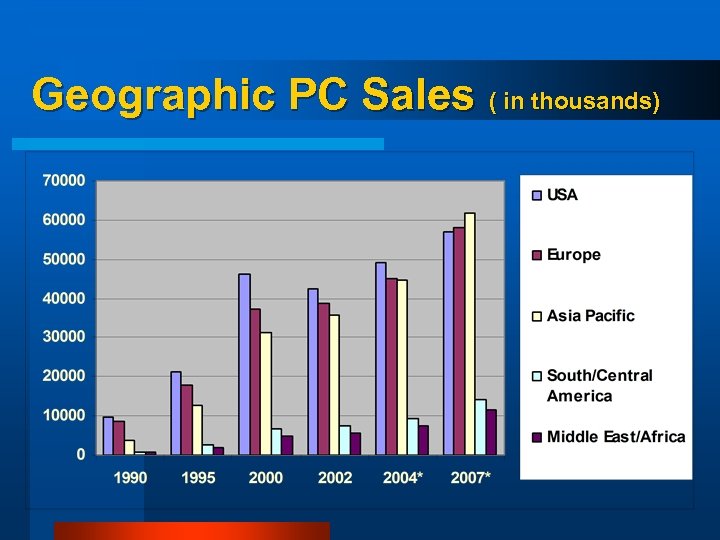

Geographic PC Sales ( in thousands)

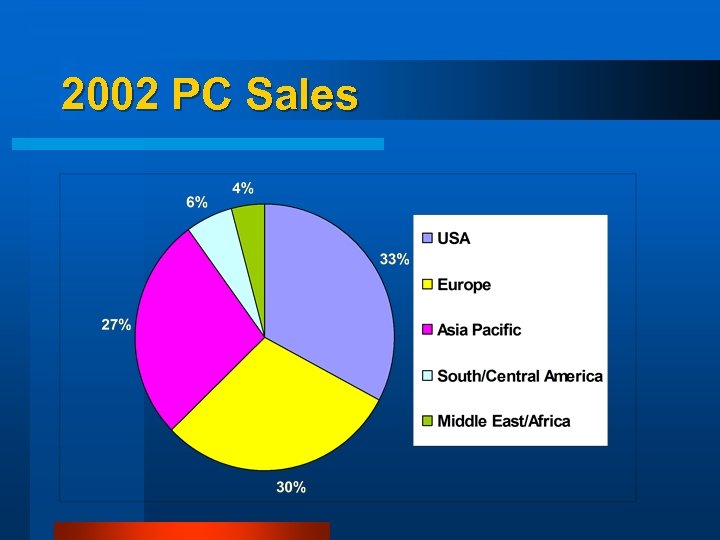

2002 PC Sales

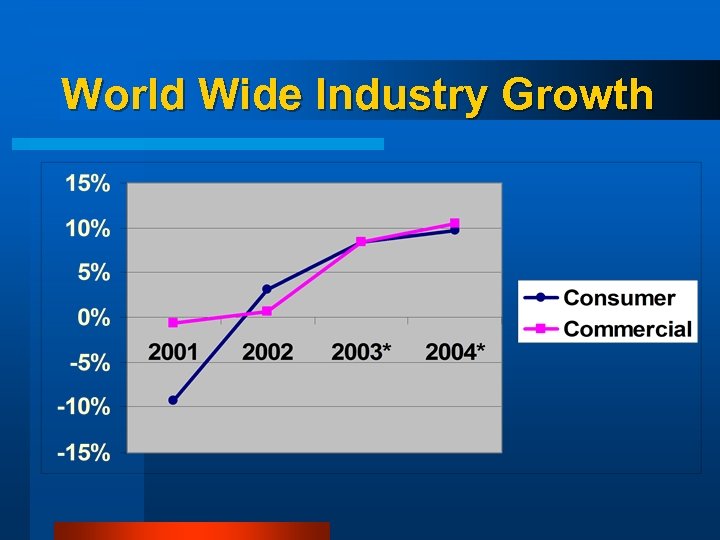

World Wide Industry Growth

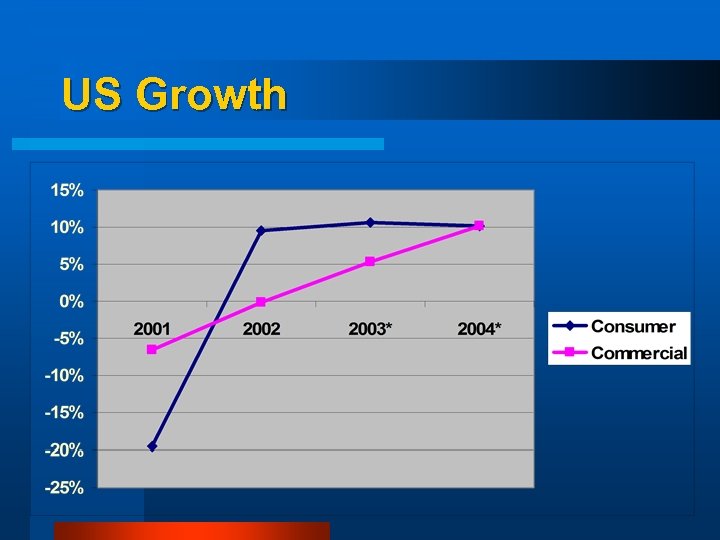

US Growth

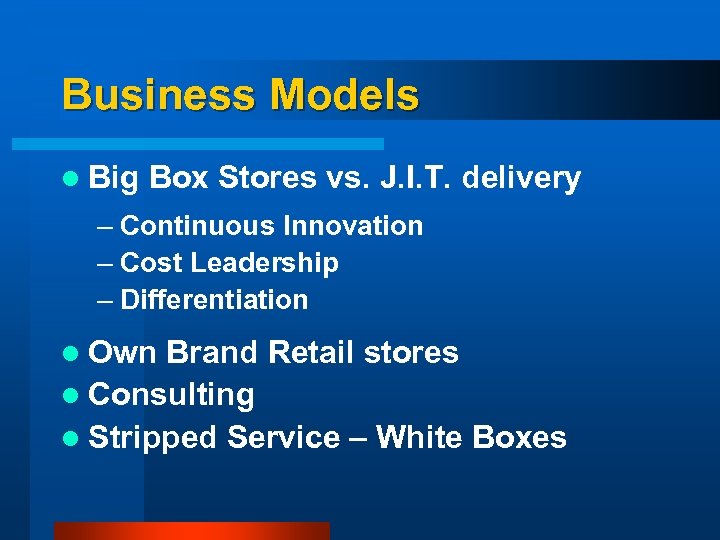

Business Models l Big Box Stores vs. J. I. T. delivery – Continuous Innovation – Cost Leadership – Differentiation l Own Brand Retail stores l Consulting l Stripped Service – White Boxes

Industry Analysis II

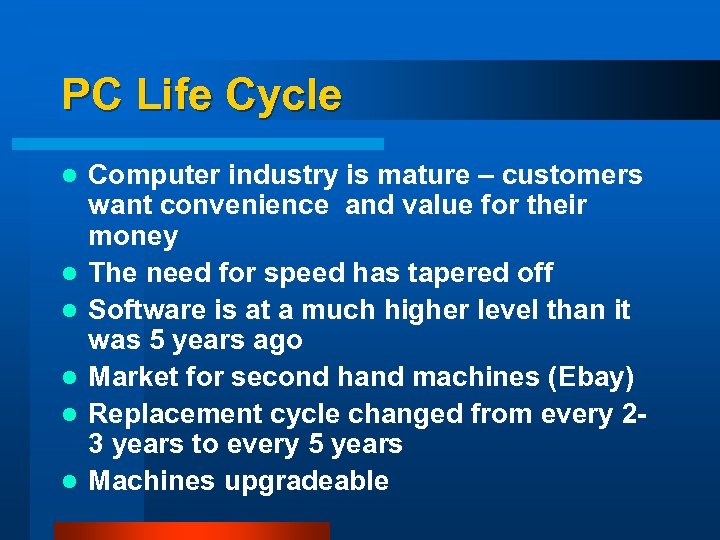

PC Life Cycle l l l Computer industry is mature – customers want convenience and value for their money The need for speed has tapered off Software is at a much higher level than it was 5 years ago Market for second hand machines (Ebay) Replacement cycle changed from every 23 years to every 5 years Machines upgradeable

Market Competition l Transfer in demand drivers for PC components From - Microprocessor - OS - Memory Inventory Risks l Product life cycle l Narrowing price gap l To - Wireless - Mobile Entertainment

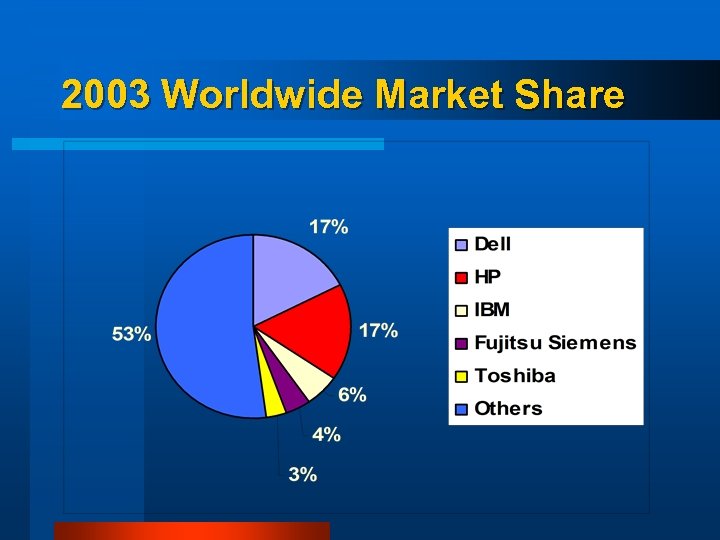

2003 Worldwide Market Share

2003 US Market Share

Key Success Factors l Innovation – scientific research l Operating efficiency across supply chain l After sales service l Reputation, brand name, design l Competitive pricing l Extensive product and service lines

Future Considerations – Threats l Longer replacement cycle l Decline in desktops l Saturated first time buyer market l Decline in average selling price => lower profit margins l Commodity like market

Future Considerations – Growing Trends l Notebook growth – Lower prices, better performance, longer battery life, demand for mobility l Demand for wireless products l Bundling and compatible products l Elimination of intermediaries l Alliances and Mergers

Future Considerations Con’t Diversification into Servers l Consulting l Consumer electronics l – MP 3’s (i. Pod), Online Music (i. Tunes), TV’s, PDA’s

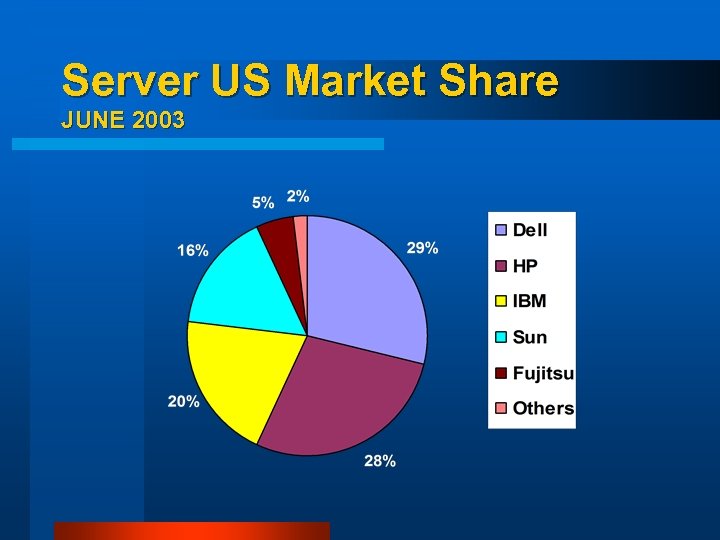

Server US Market Share JUNE 2003

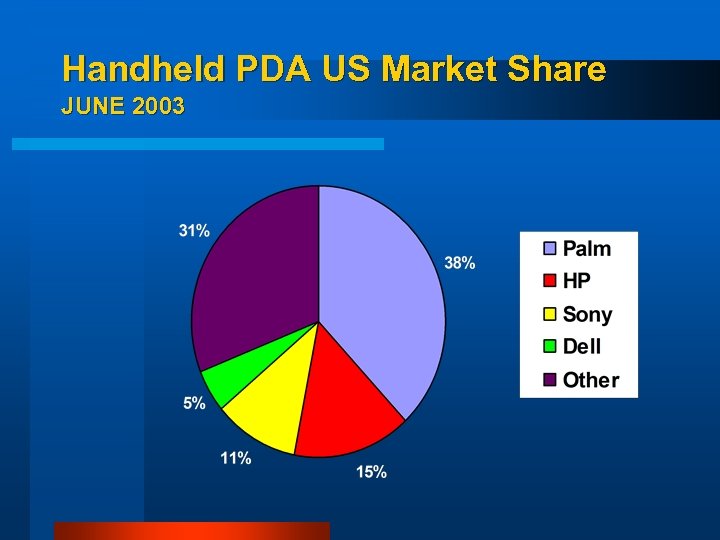

Handheld PDA US Market Share JUNE 2003

Dell Inc.

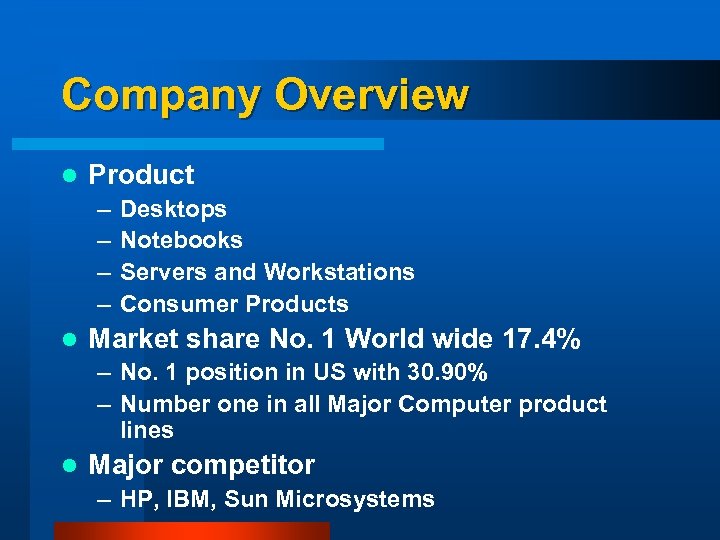

Company Overview l Product – – l Desktops Notebooks Servers and Workstations Consumer Products Market share No. 1 World wide 17. 4% – No. 1 position in US with 30. 90% – Number one in all Major Computer product lines l Major competitor – HP, IBM, Sun Microsystems

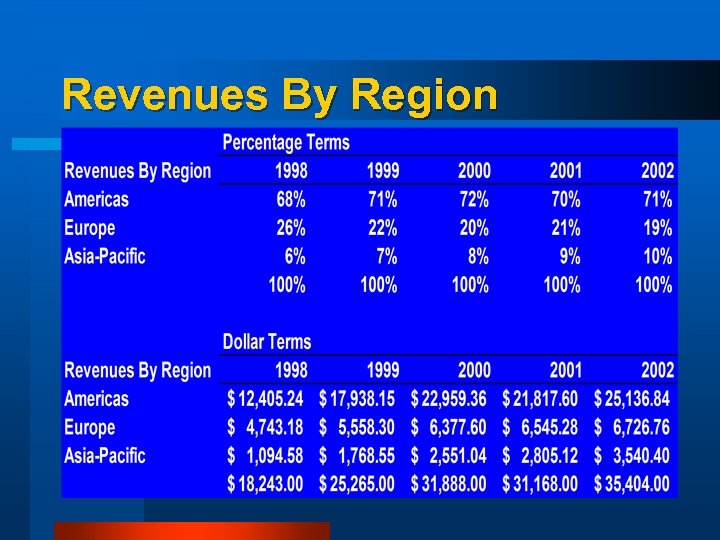

Revenues By Region

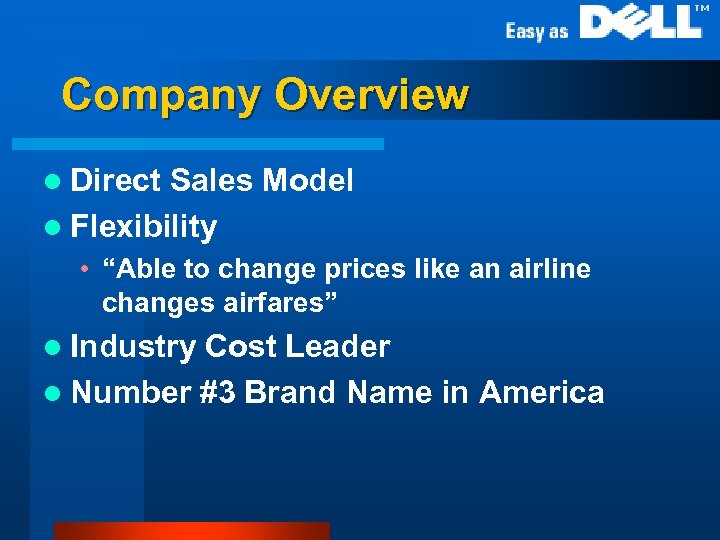

Company Overview l Direct Sales Model l Flexibility • “Able to change prices like an airline changes airfares” l Industry Cost Leader l Number #3 Brand Name in America

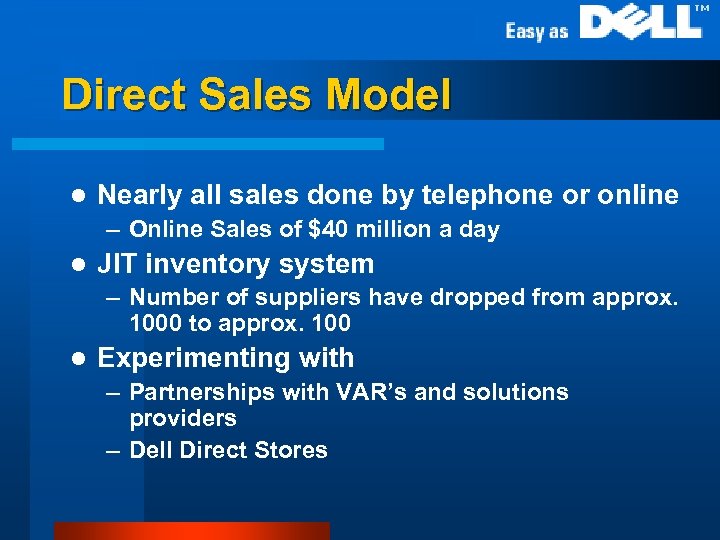

Direct Sales Model l Nearly all sales done by telephone or online – Online Sales of $40 million a day l JIT inventory system – Number of suppliers have dropped from approx. 1000 to approx. 100 l Experimenting with – Partnerships with VAR’s and solutions providers – Dell Direct Stores

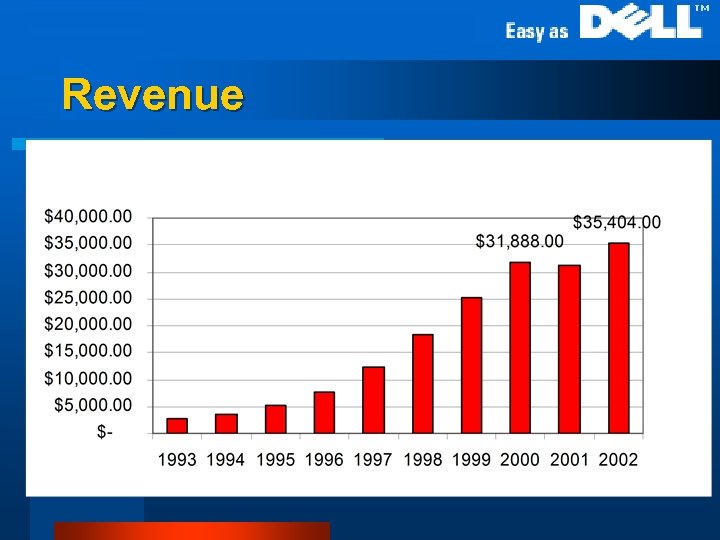

Revenue l revenue

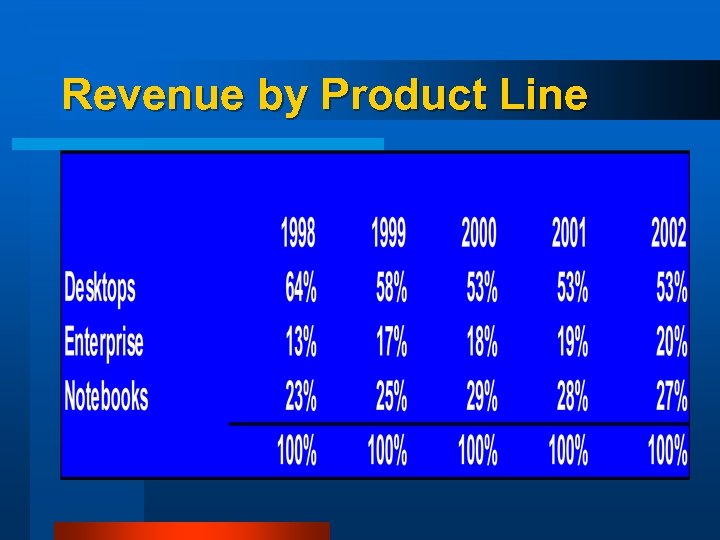

Revenue by Product Line

Where to Grow? l Number One PC maker – Commoditized PC industry l PC sales depend on replacement cycle l Only R&D spends 1. 5% of Revenue on

Attempting Everything l Consumer Products? l Computer Peripherals? l Online Music? l Computing Services? l Expanding too much too fast? ? ?

Current Financials

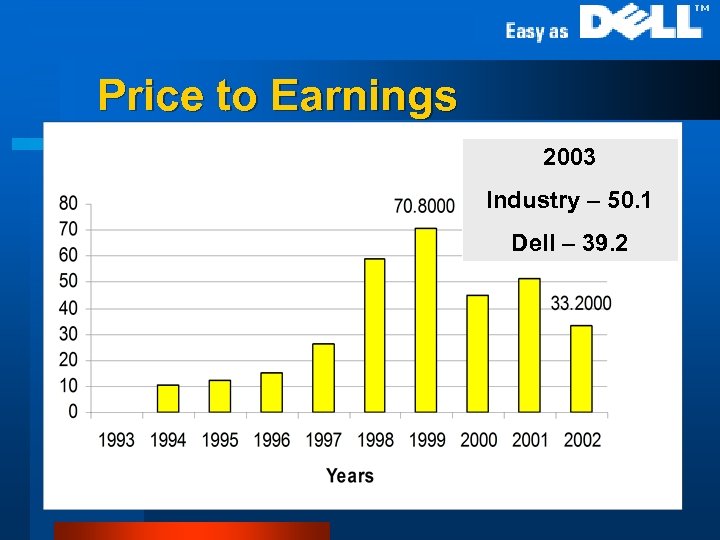

Price to Earnings 2003 Industry – 50. 1 Dell – 39. 2

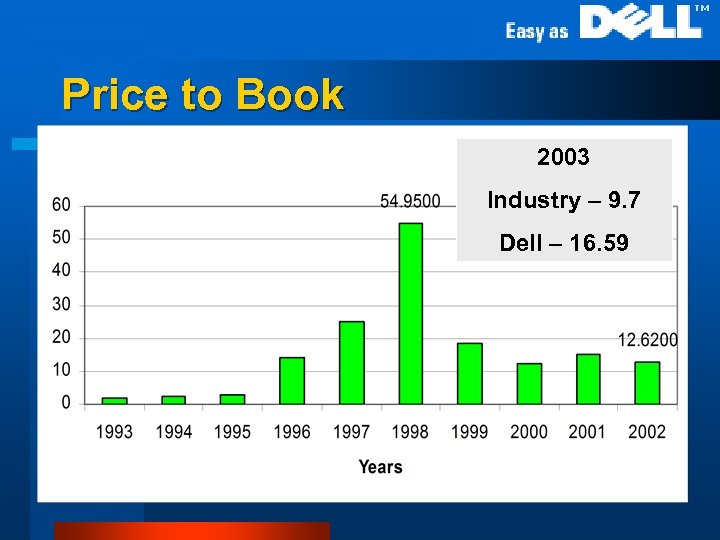

Price to Book 2003 Industry – 9. 7 Dell – 16. 59

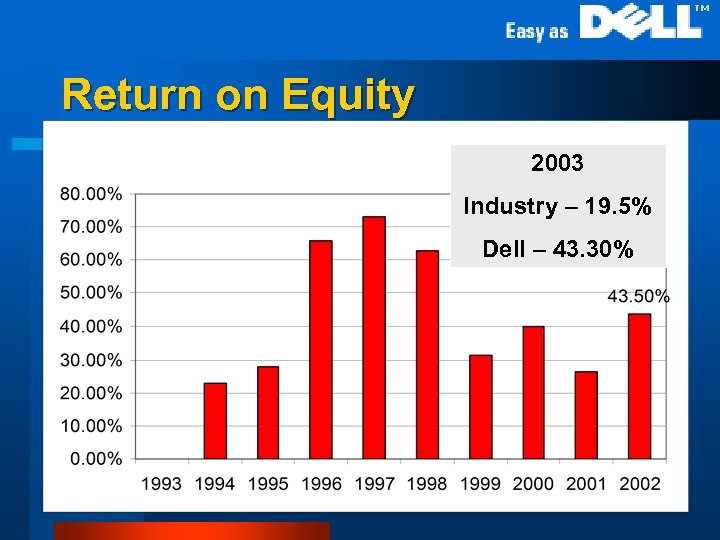

Return on Equity 2003 Industry – 19. 5% Dell – 43. 30%

Earnings per Share

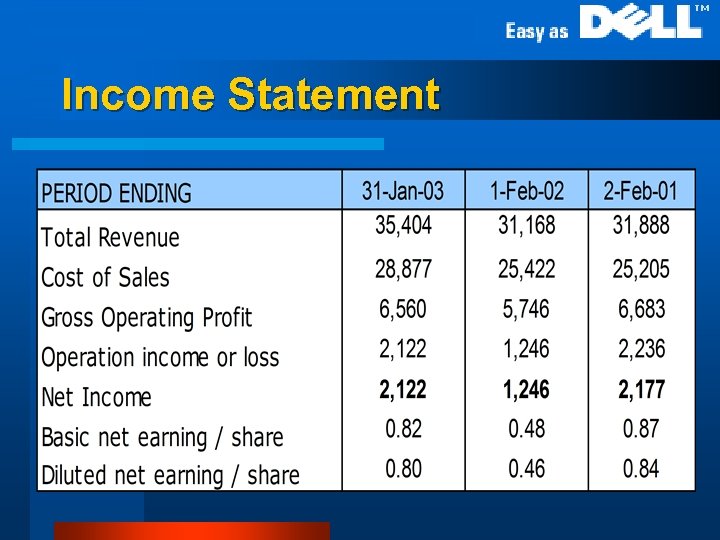

Income Statement l Income Statement (Annual)

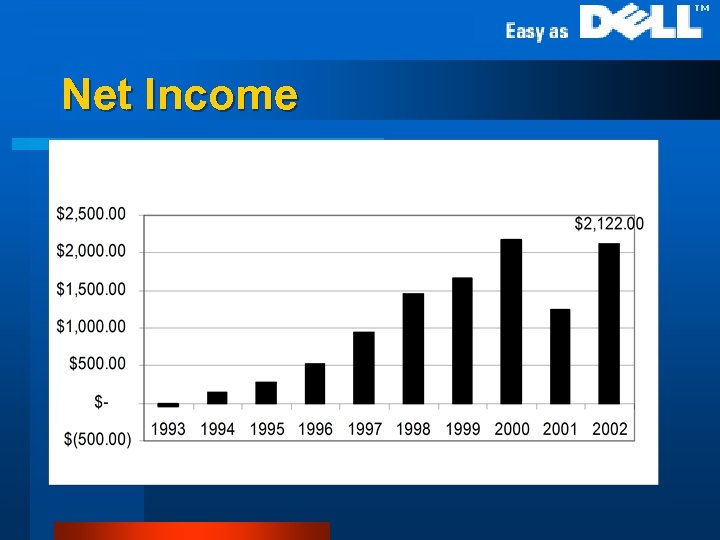

Net Income l Net Income

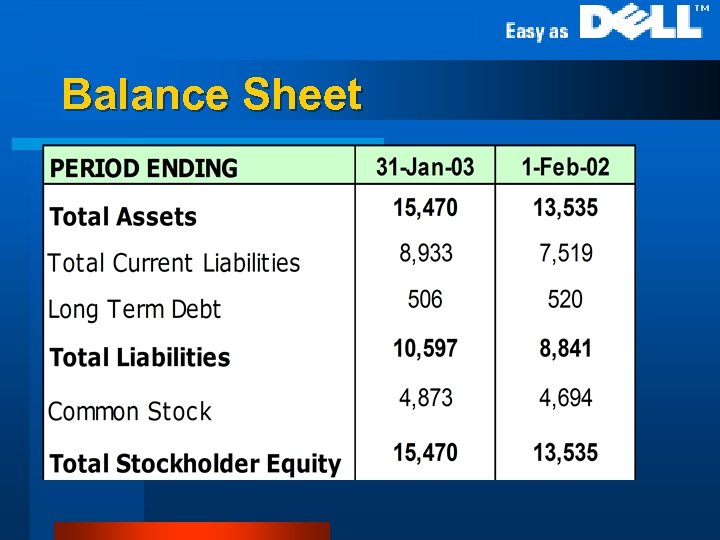

Balance Sheet l Balance Sheet (Annual)

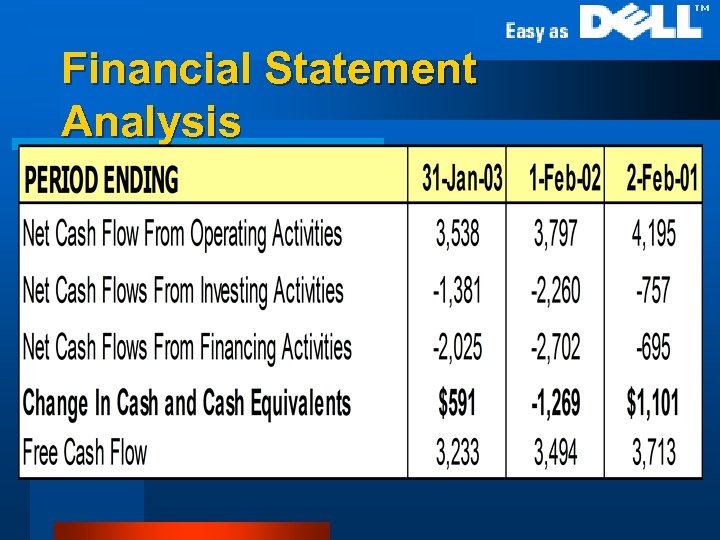

Financial Statement Analysis l Cash Flow Statement (annual)

10 year Price Graph l 10 years stock price chart

1 year Price Graph l 1 year stock price chart

Recommendation l Expensive Stock but… l Market Timer l A head of the Game in Online Sales BUY

Apple Computer, Inc. Think Different.

History ¢ ¢ ¢ Invented low-cost PCs – Apple I Ignited the modern PC industry Financial crisis in 1996/1997

Business Strategy ¢ ¢ ¢ Continuous innovation Pushing towards “Digital Lifestyle” Upscale computing niche Target education, creative, consumer, and business customers Retail Initiative l 74 stores by end of this year

Products ¢ i. Mac, Power Mac, i. Book, Power. Book l ¢ ¢ 72% of revenue in 2003 Software Music: i. Pod and i. Tunes

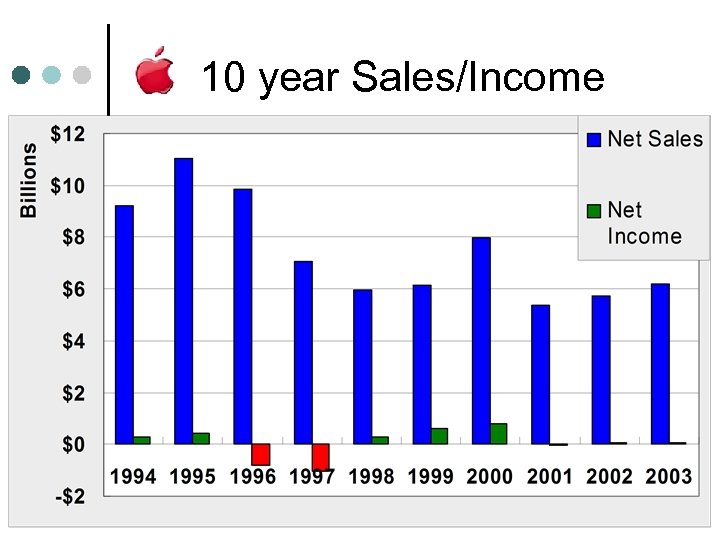

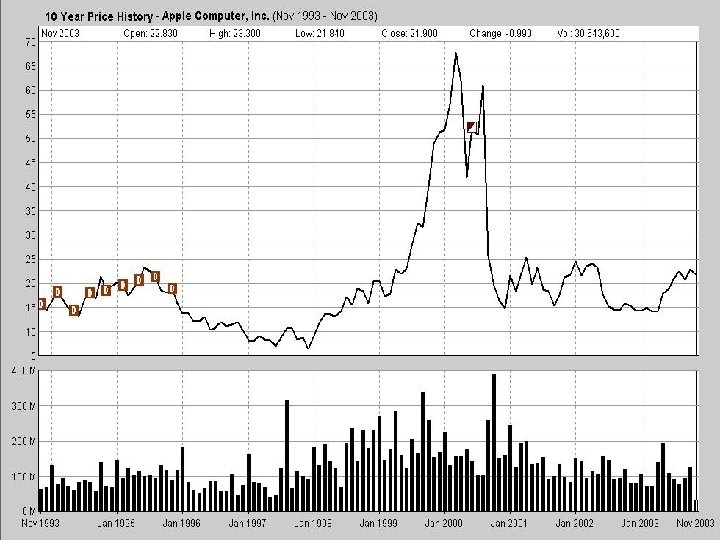

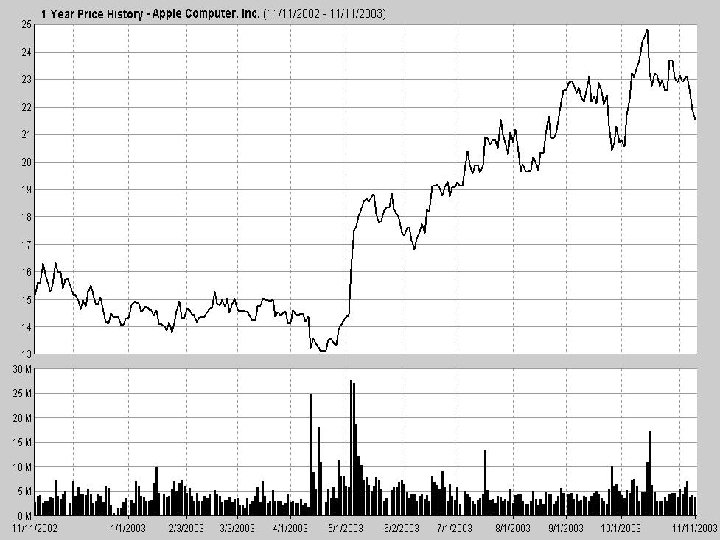

10 year Sales/Income

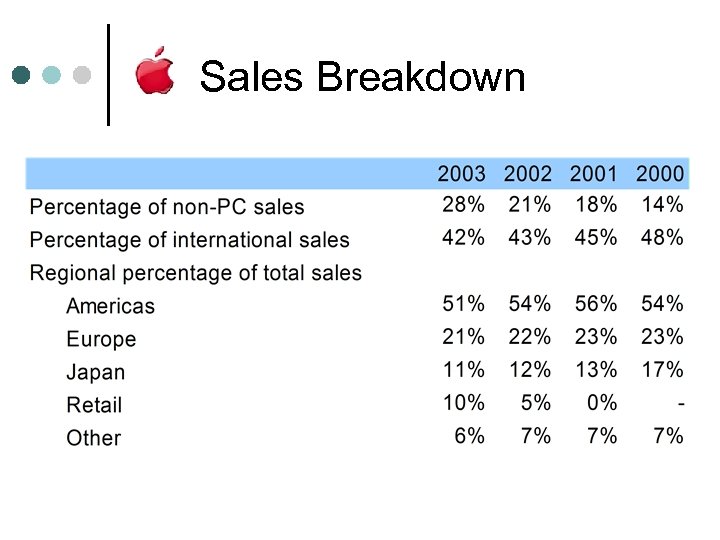

Sales Breakdown

Management ¢ ¢ Major upheaval in management in 1981, 1985, 1990, 1993, and 1997 Internal promotion proved disastrous l Michael Spindler

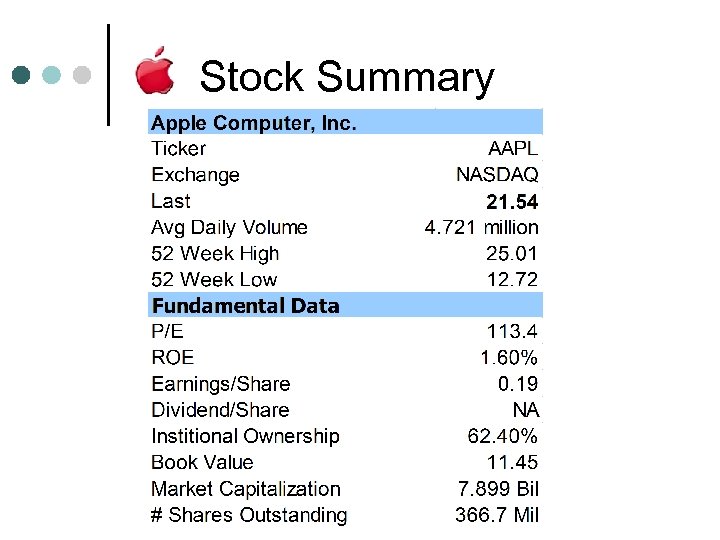

Stock Summary

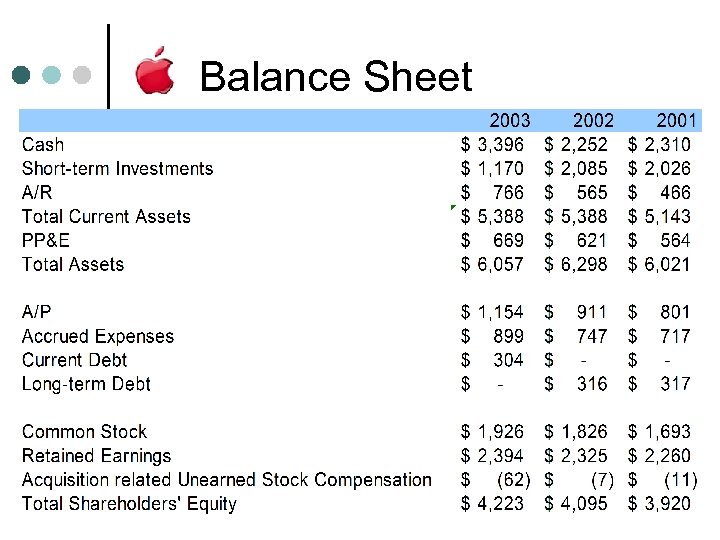

Balance Sheet

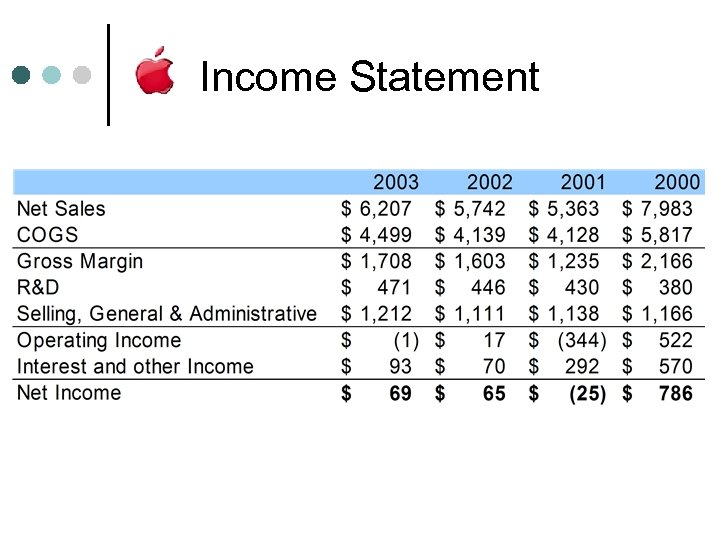

Income Statement

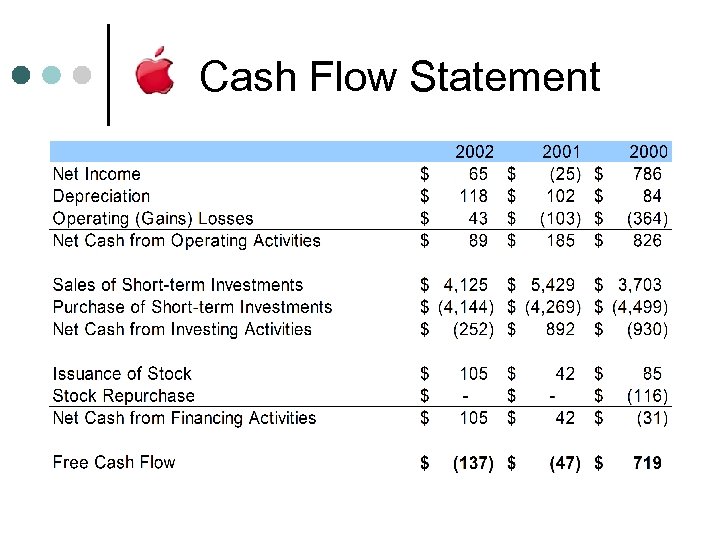

Cash Flow Statement

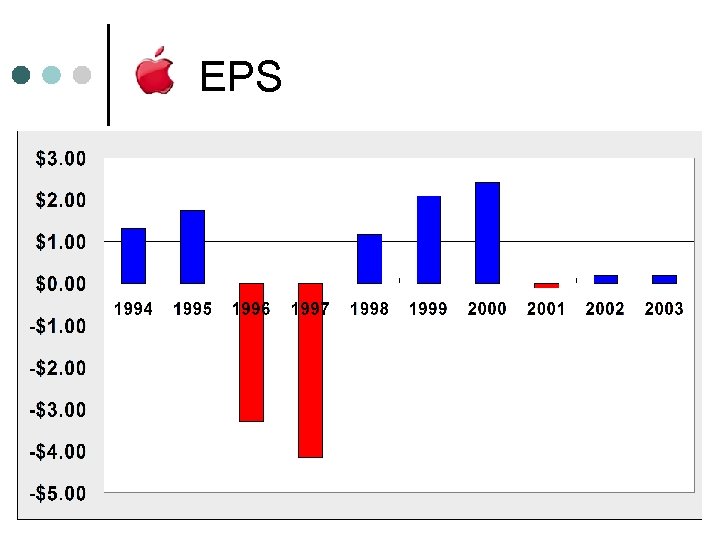

EPS

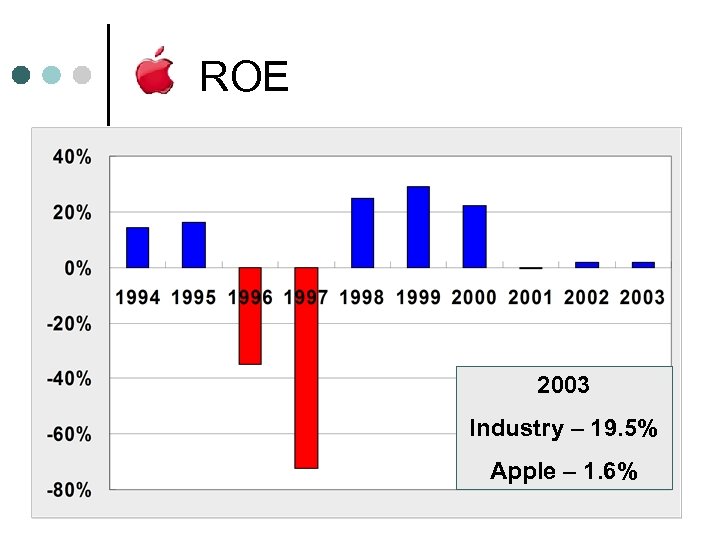

ROE 2003 Industry – 19. 5% Apple – 1. 6%

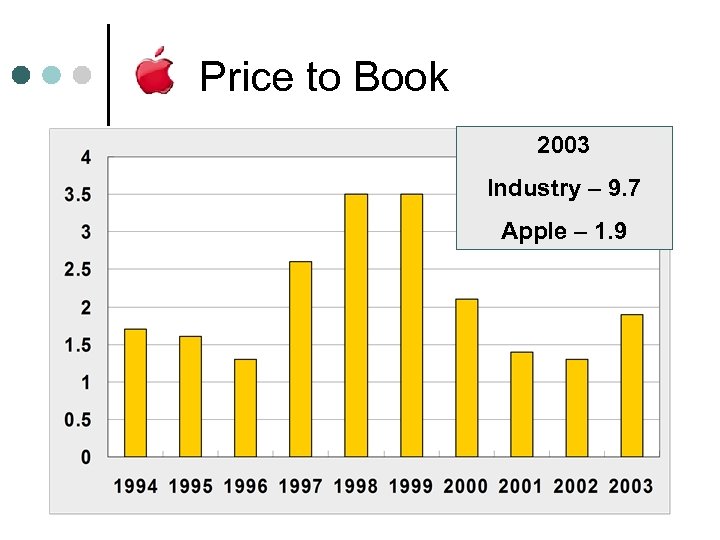

Price to Book 2003 Industry – 9. 7 Apple – 1. 9

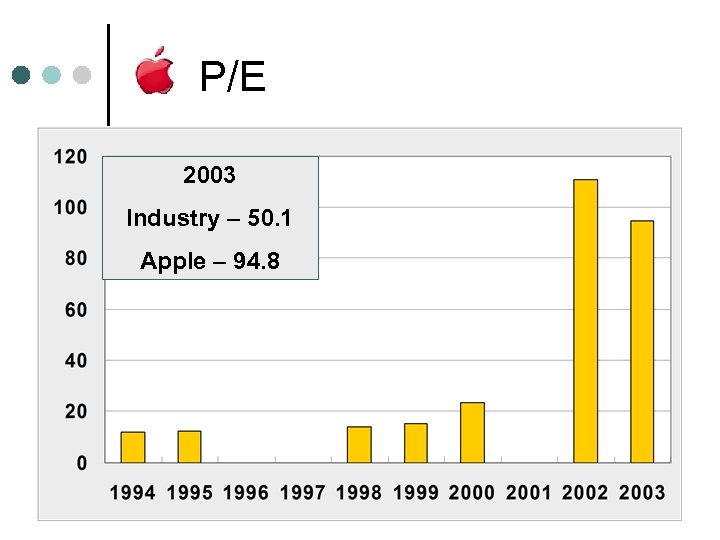

P/E 2003 Industry – 50. 1 Apple – 94. 8

Recommendation ¢ Options l l ¢ ¢ 109 mil outstanding @ $28. 17 57 mil exercisable @ $30. 85 High costs!! High management turnover Supplier dependent Music service will face increased competition Sell

Hewlett-Packard Company © 2003 Hewlett-Packard Development Company, L. P. The information contained herein is subject to change without

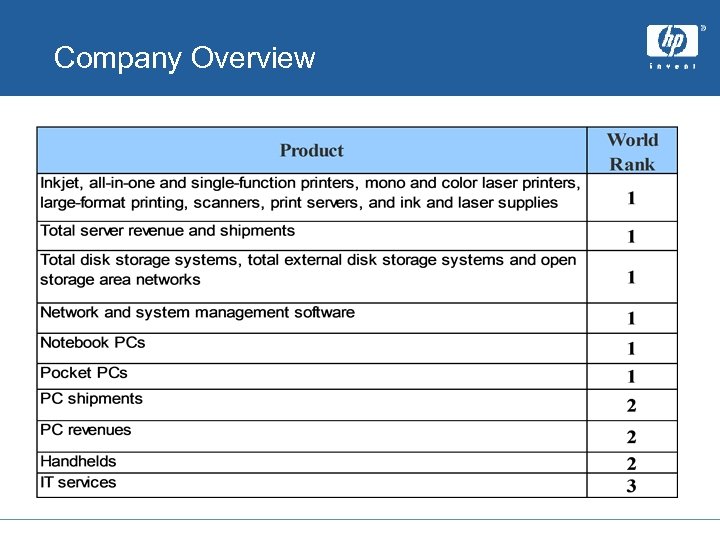

Company Overview • Product IT infrastructure, – Personal computing and access devices, – Imaging and printing solutions – Information technology services – • Market Position No. 1 position in Europe, Middle East, and Asia – Market leader in PCs, servers, storage system, management software, printing and imaging – • Major competitor – IBM, DELL, Sun

Company Overview

HP & Compaq Merger • May 7, 2002 the largest merger in the history of computer industry • Value of the deal at $25 billion • 1 Compaq share = 0. 6325 HP share • The new company after merge HP shareholders own 64% – Compaq shareholders own 36% –

HP & Compaq Merger(cont’) • Reactions – Hostile -- Walter Hewlett (son of Bill Hewlett) – Stock price dive 19% in a massive sell-off (before the actual merge) – Other IT hardware & service companies are happy • Hard to bring the cost down • Too preoccupied with integration

After the Merger – Change ticker symbol from HWP to HPQ – HP Chairwoman & CEO Carly Fiorina holds same position – Compaq Chairman & CEO Michael Capellas is president (left the company later) – Headquarters: Palo Alto (California) – Compaq brand essentially disappear

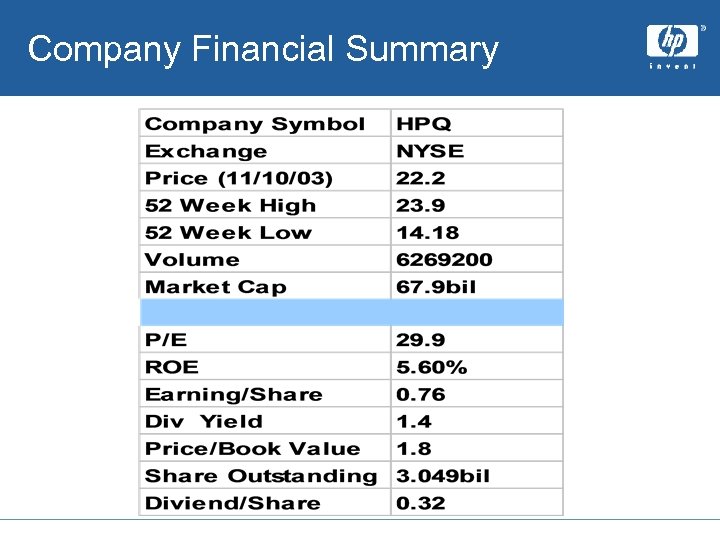

Company Financial Summary

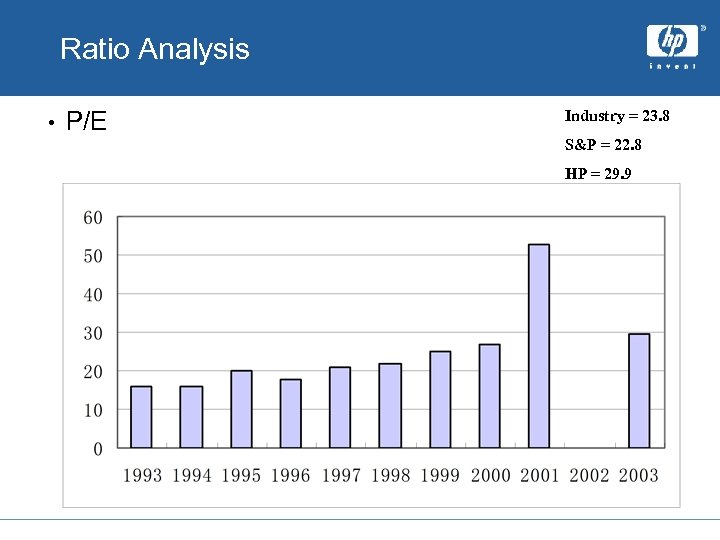

Ratio Analysis • P/E Industry = 23. 8 S&P = 22. 8 HP = 29. 9

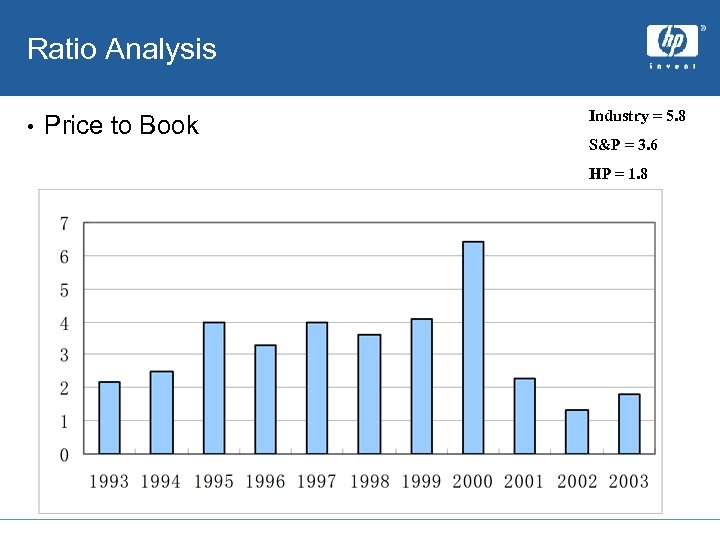

Ratio Analysis • Price to Book Industry = 5. 8 S&P = 3. 6 HP = 1. 8

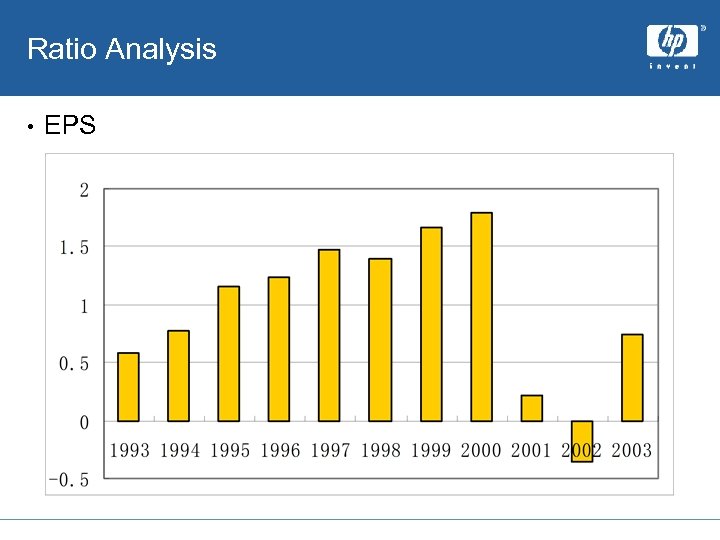

Ratio Analysis • EPS

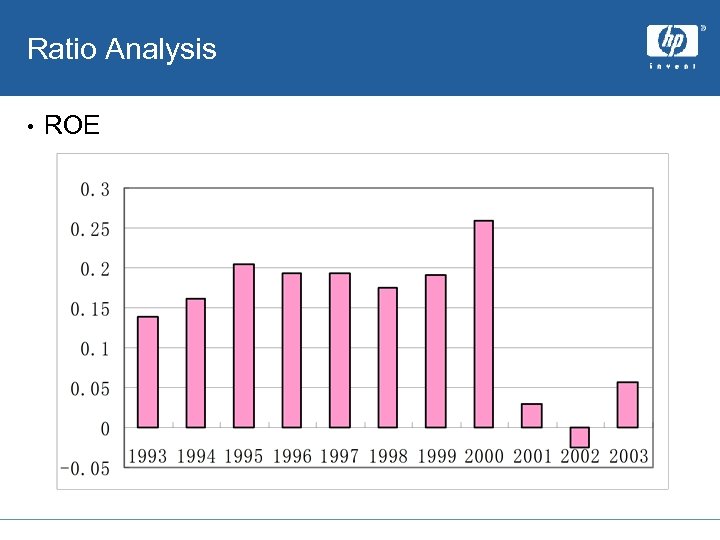

Ratio Analysis • ROE

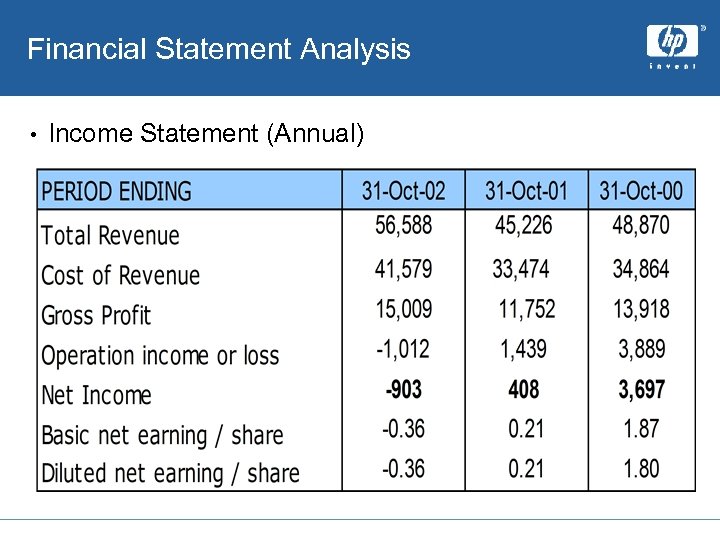

Financial Statement Analysis • Income Statement (Annual)

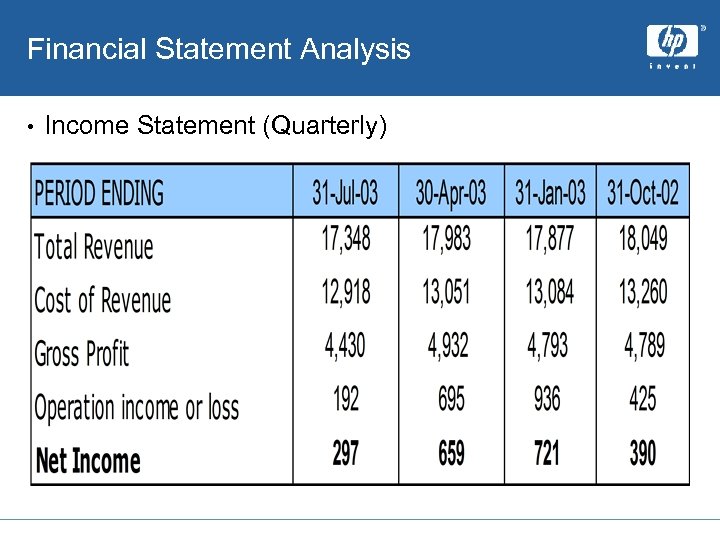

Financial Statement Analysis • Income Statement (Quarterly)

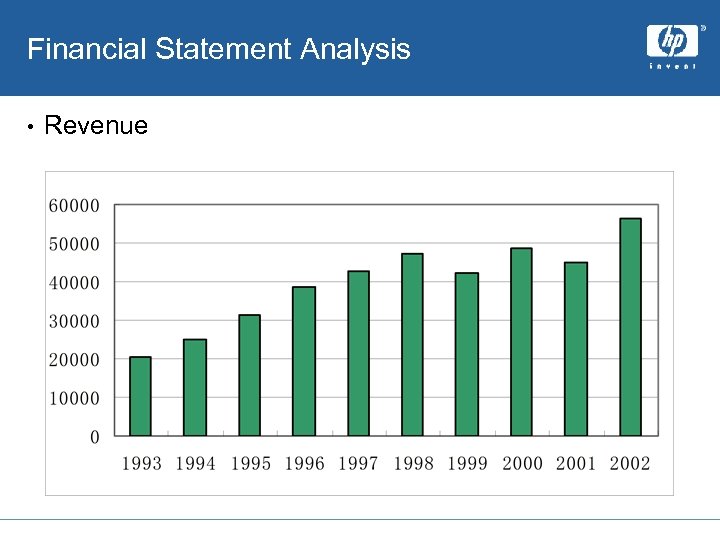

Financial Statement Analysis • Revenue

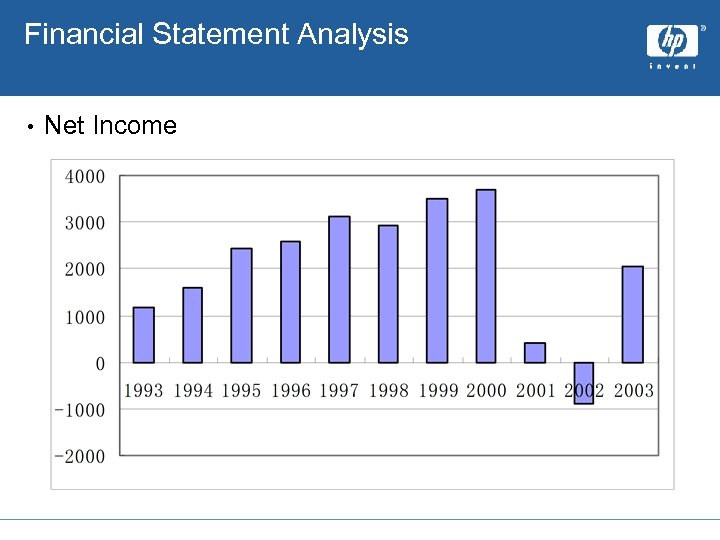

Financial Statement Analysis • Net Income

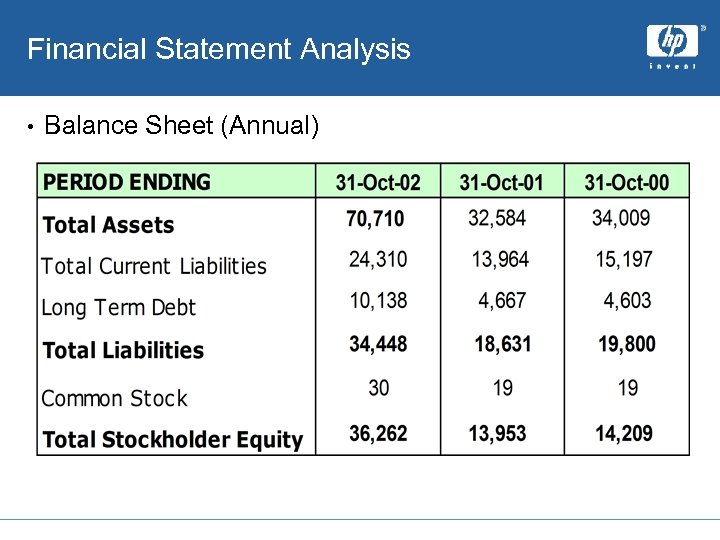

Financial Statement Analysis • Balance Sheet (Annual)

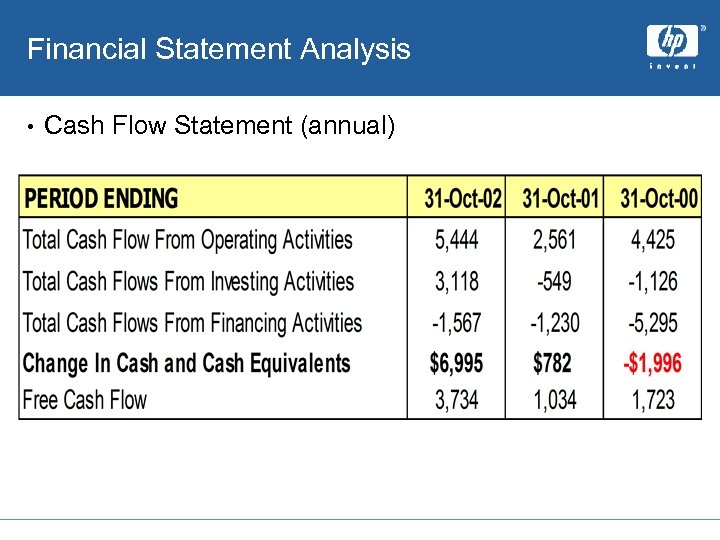

Financial Statement Analysis • Cash Flow Statement (annual)

Price Chart Analysis • 10 years stock price chart

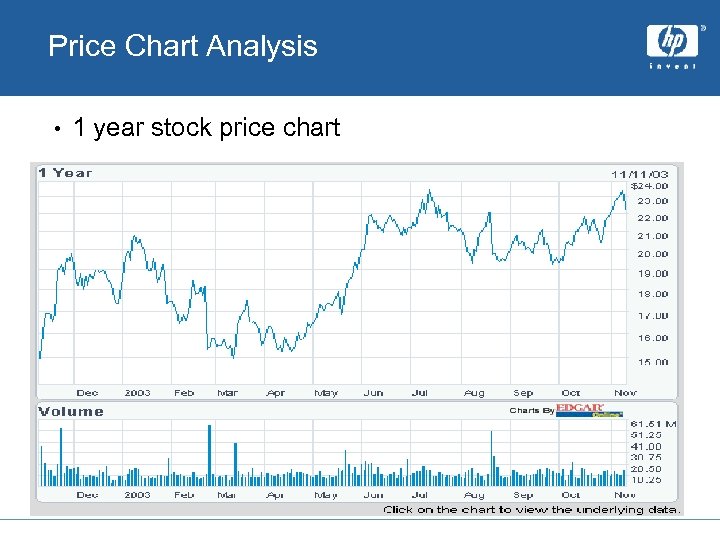

Price Chart Analysis • 1 year stock price chart

Recommendation • • • Earnings growth in the past year has accelerated rapidly compared to earnings growth in the past three years(+) Positive Free cash flow (+) The P/E ratio is higher than the industry average (-) ROE is low (-) The future of the merger is still uncertain (? ) • HOLD

Thank You

06adcc0fbe1dd466264e62e37cd8345a.ppt