5996d336ed30df667d078f56ea260341.ppt

- Количество слайдов: 45

The U. S. Market and New Digital Buying and Reading Behaviors Angela Bole Deputy Executive Director Book Industry Study Group EDITECH 2010 | Milano | June 25, 2010 © 2010, the Book Industry Study Group, Inc. 1

Now that e-books are in the mix, are book consumers acquiring more, less or the same number of print books? Does DRM effect a consumers decision to acquire an e-book? How long have print book consumers been reading e-books? What influences a book consumer to switch to e-books? What are the most popular e-book genres? How long are book consumers willing to wait for an e-book by their favorite author? Which e-reading devices do book consumers prefer to use? © 2010, the Book Industry Study Group, Inc. 2

Today’s Agenda (1) High level review of current U. S. book market (2) Deep dive into current U. S. consumer attitudes toward and preferences for e-books and e-readers © 2010, the Book Industry Study Group, Inc. 3

Creating a more informed, empowered and efficient book industry supply chain for both physical and digital products. BISG is committed to the development of effective industrywide standards, best practices, research and events that enhance relationships between trading partners. © 2010, the Book Industry Study Group, Inc.

A small selection of members © 2010, the Book Industry Study Group, Inc.

“Learning is what most adults will do for a living in the 21 st Century. ” S. J. Perelman 6

High level review of the current U. S. book market 7

© April 2010, Bowker Books In Print http: //www. bowker. com/index. php/press-releases/616 -bowker-reports-traditional-us-book-production-flat-in-2009 R. R. Bowker reports traditional U. S. book market flat in 2009. 8

© April 2010, Bowker Books In Print http: //www. bowker. com/index. php/press-releases/616 -bowker-reports-traditional-us-book-production-flat-in-2009 Traditional U. S. title output in 2009 was virtually unchanged. New title/edition output dropped less than half a percent, from 289, 729 in 2008 to a projected 288, 355 in 2009. 9

But, here’s something that might surprise you… 10

© April 2010, Bowker Books In Print http: //www. bowker. com/index. php/press-releases/616 -bowker-reports-traditional-us-book-production-flat-in-2009 POD & reprints (public domain) exploded in 2009. 764, 448 titles were produced in 2009 that fall outside traditional publishing classification definitions, representing 181% increase over 2008 - which, in turn, doubled 2007’s output. 11

© April 2010, Bowker Books In Print http: //www. bowker. com/index. php/press-releases/616 -bowker-reports-traditional-us-book-production-flat-in-2009 Top 10 U. S. POD Publishers Biblio. Bazaar Books LLC Kessinger Publishing, LLC Create. Space General Books, LLC Lulu. com Xlibris Corporation Author. House International Business Publications, USA Publish. America, Inc. 12

© April 2010, Bowker Books In Print http: //www. bowker. com/index. php/press-releases/616 -bowker-reports-traditional-us-book-production-flat-in-2009 Growth categories = Business & Technology (+11%) Science (+9%) Personal Finance (+9%) Cookery (-16%) Language (-16%) Travel (-5%) 13

Surviving the digital transition tipping point © 2010, the Book Industry Study Group, Inc. 14

Current U. S. consumer attitudes toward and preferences for e-books and e-readers 15

Report 3 of 3 JULY 2010 www. bisg. org © 2010, the Book Industry Study Group, Inc. 16

Now that e-books are in the mix, are book consumers acquiring more, less or the same number of print books? Does DRM effect a consumers decision to acquire an e-book? How long have print book consumers been reading e-books? What influences a book consumer to switch to e-books? What are the most popular e-book genres? How long are book consumers willing to wait for an e-book by their favorite author? Which e-reading devices do book consumers prefer to use? © 2010, the Book Industry Study Group, Inc. 17

Pub. Track™ Consumer panel of U. S. book buying men, women and teens Survey pool of ~44 K book consumers at the time of each survey fielding ~1, 500 qualified; ~780 respondents 95% confidence level © 2010, the Book Industry Study Group, Inc. 18

Why study consumers? . . . © 2010, the Book Industry Study Group, Inc. 19

© 2010, the Book Industry Study Group, Inc. 20

Screen shot from EDS commercial You. Tube. com http: //www. youtube. com/watch? v=Pk 7 yql. TMvp 8 © 2010, the Book Industry Study Group, Inc. 21

Proliferation of choice and access to content © 2010, Bowker Pub. Track™ Consumer 22

Living in a 24/7/365 supply chain © 2010, Bowker Pub. Track™ Consumer 23

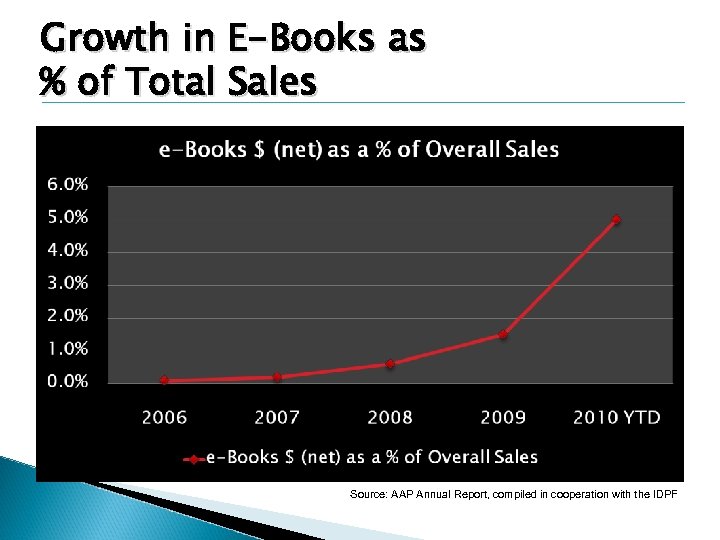

Growth in E-Books as % of Total Sales Source: AAP Annual Report, compiled in cooperation with the IDPF

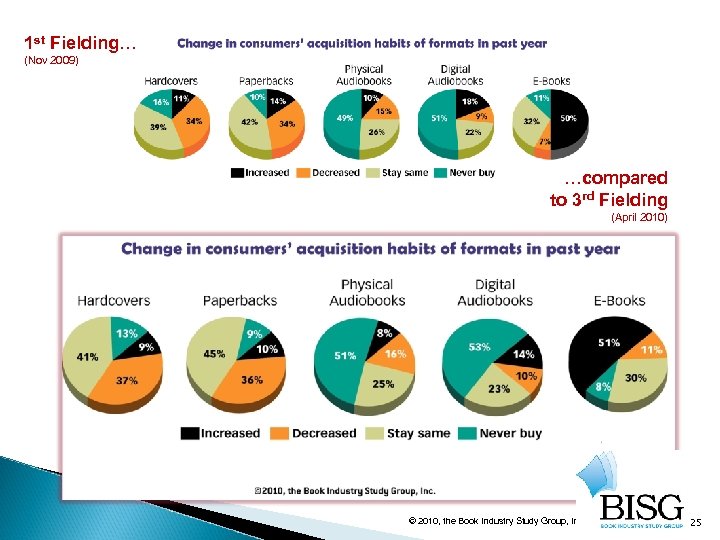

1 st Fielding… (Nov 2009) …compared to 3 rd Fielding (April 2010) © 2010, the Book Industry Study Group, Inc. 25

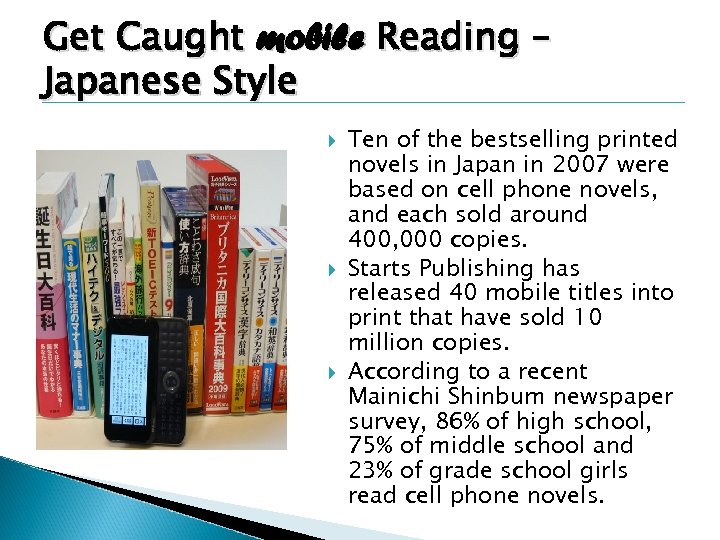

Get Caught mobile Reading – Japanese Style Ten of the bestselling printed novels in Japan in 2007 were based on cell phone novels, and each sold around 400, 000 copies. Starts Publishing has released 40 mobile titles into print that have sold 10 million copies. According to a recent Mainichi Shinbum newspaper survey, 86% of high school, 75% of middle school and 23% of grade school girls read cell phone novels.

Digital Consumers Demographics © 2010, the Book Industry Study Group, Inc. 27

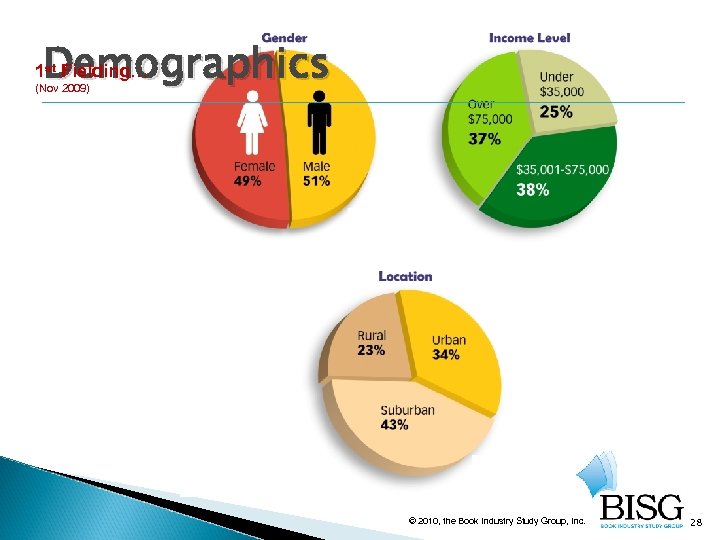

Demographics 1 st Fielding… (Nov 2009) © 2010, the Book Industry Study Group, Inc. 28

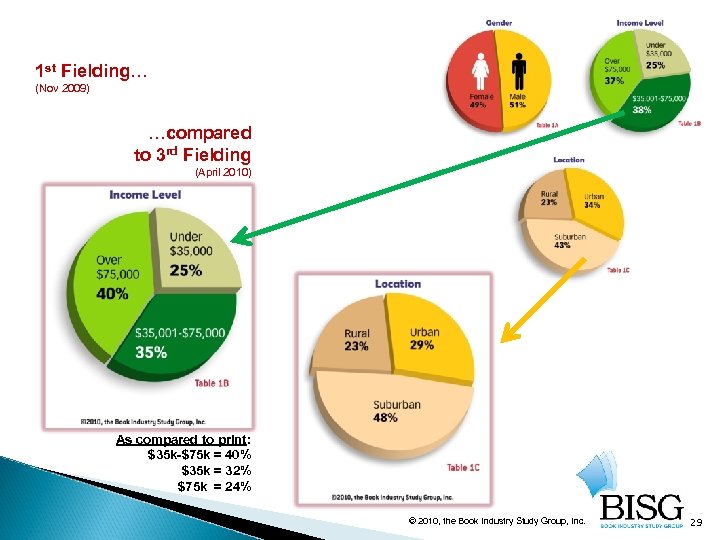

1 st Fielding… (Nov 2009) …compared to 3 rd Fielding (April 2010) As compared to print: $35 k-$75 k = 40% $35 k = 32% $75 k = 24% © 2010, the Book Industry Study Group, Inc. 29

Digital Consumers Purchase Behaviors © 2010, the Book Industry Study Group, Inc. 30

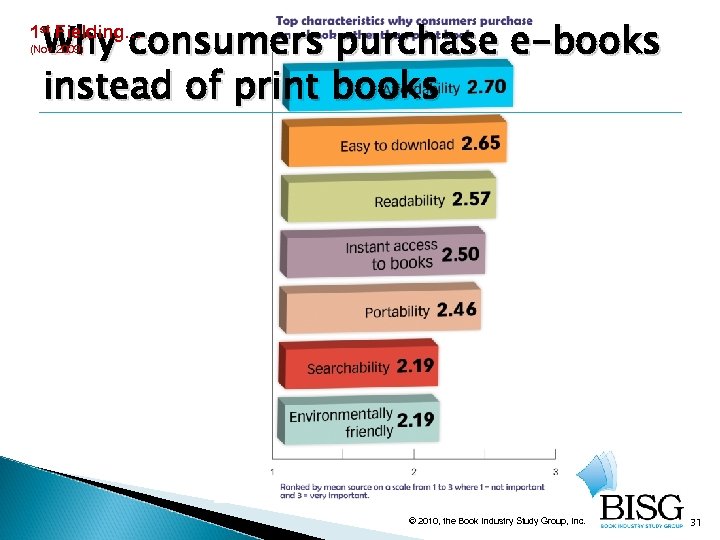

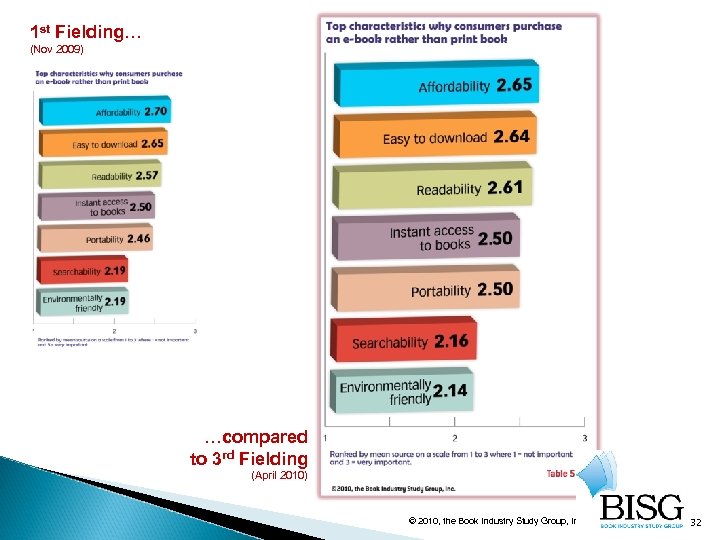

Why consumers purchase e-books instead of print books 1 st Fielding… (Nov 2009) © 2010, the Book Industry Study Group, Inc. 31

1 st Fielding… (Nov 2009) …compared to 3 rd Fielding (April 2010) © 2010, the Book Industry Study Group, Inc. 32

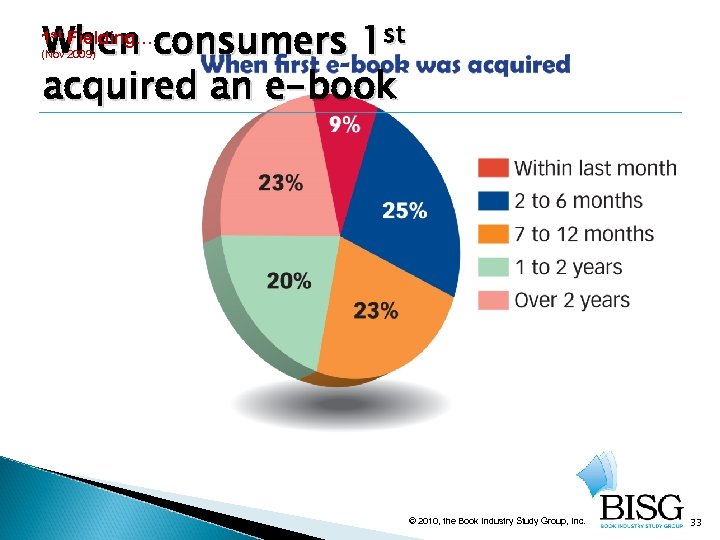

When consumers 1 st acquired an e-book 1 st Fielding… (Nov 2009) © 2010, the Book Industry Study Group, Inc. 33

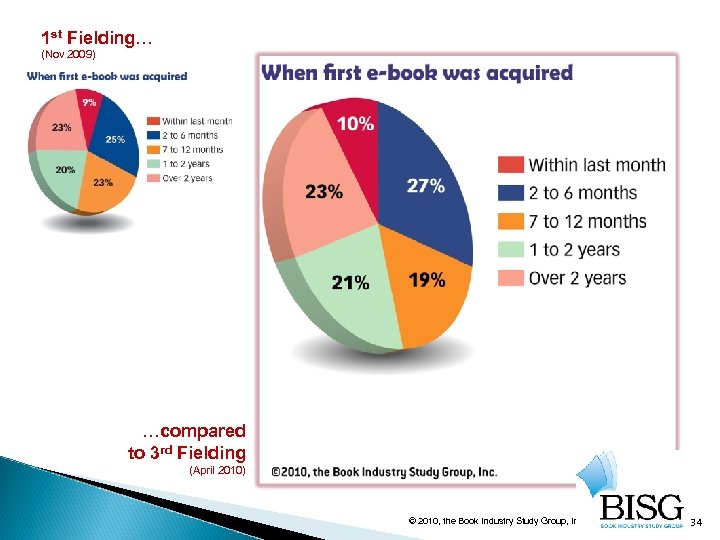

1 st Fielding… (Nov 2009) …compared to 3 rd Fielding (April 2010) © 2010, the Book Industry Study Group, Inc. 34

Digital Consumers Purchase Preferences © 2010, the Book Industry Study Group, Inc. 35

The crowded E-Device market today One Device used most frequently Any Computer 37% - 11% Mobile 4% i-Phone/ i-touch 10% Kindle 32% - 10% B&N Nook 3% - NEW i. Pad 3% - NEW © 2010, Bowker Pub. Track™ Consumer Sony Reader 9% - 4% Netbook/Tablet 2% - NEW 36

This changes everything! © 2010, the Book Industry Study Group, Inc. 37

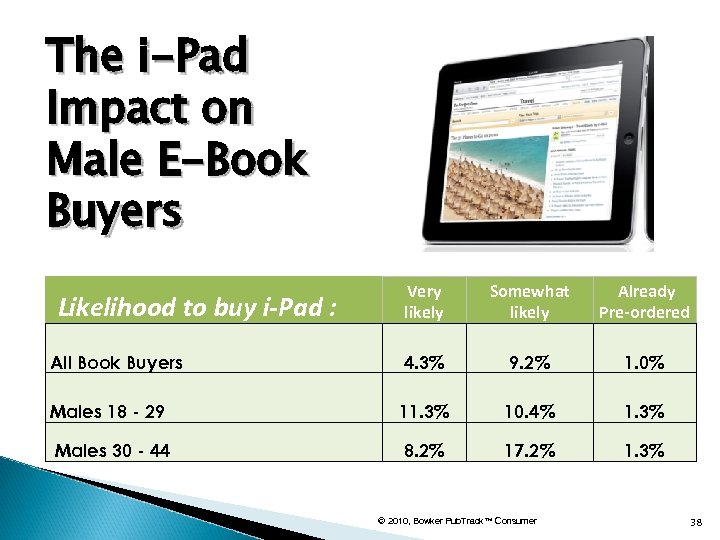

The i-Pad Impact on Male E-Book Buyers Very likely Somewhat likely Already Pre-ordered All Book Buyers 4. 3% 9. 2% 1. 0% Males 18 - 29 11. 3% 10. 4% 1. 3% Males 30 - 44 8. 2% 17. 2% 1. 3% Likelihood to buy i-Pad : © 2010, Bowker Pub. Track™ Consumer 38

Digital Consumers Purchase Perceptions © 2010, the Book Industry Study Group, Inc. 39

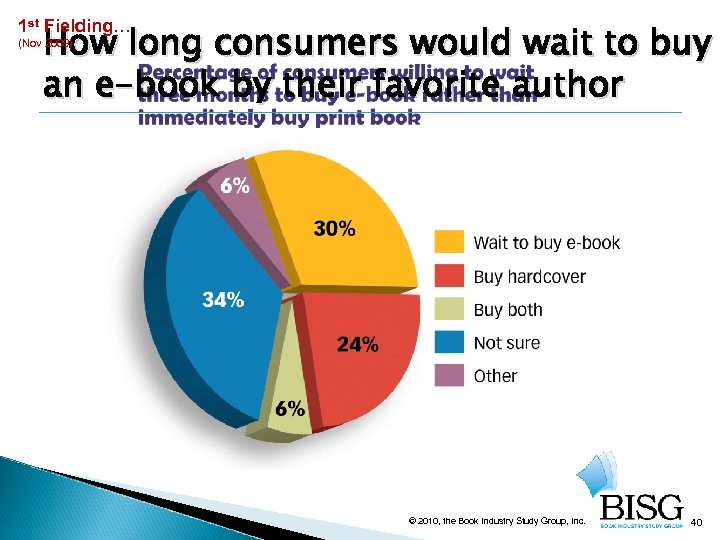

1 st Fielding… How long consumers would wait to buy an e-book by their favorite author (Nov 2009) © 2010, the Book Industry Study Group, Inc. 40

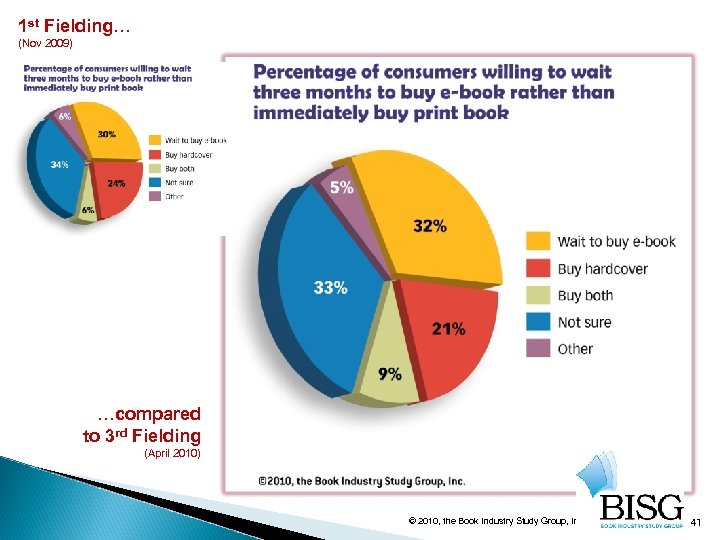

1 st Fielding… (Nov 2009) …compared to 3 rd Fielding (April 2010) © 2010, the Book Industry Study Group, Inc. 41

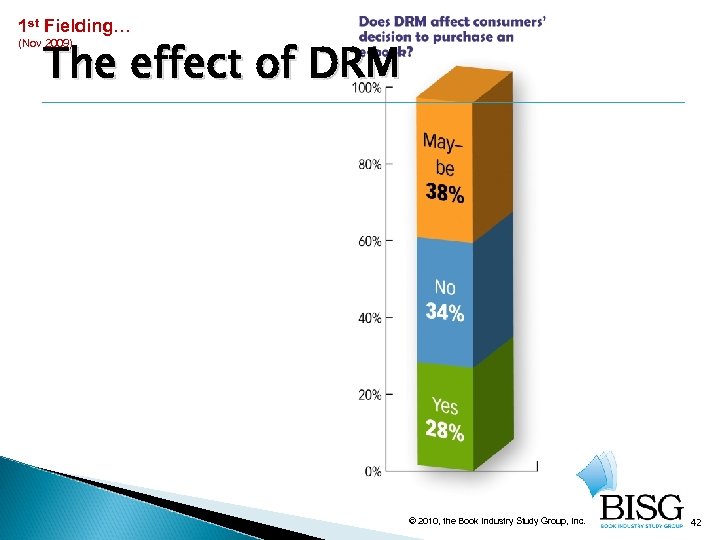

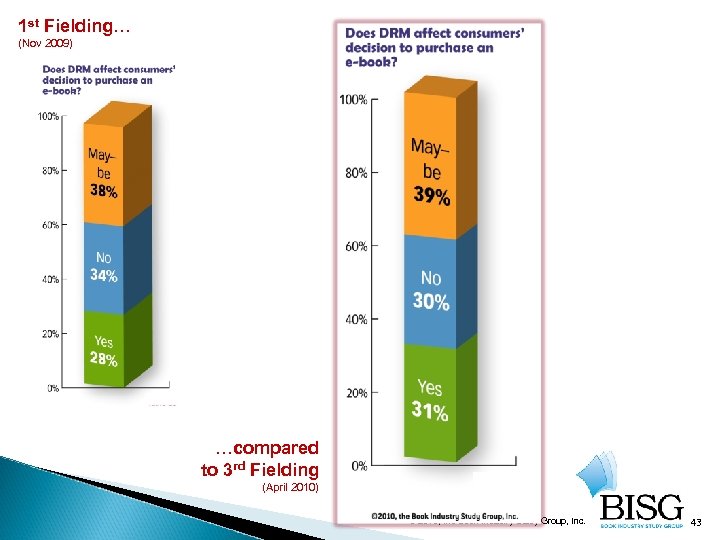

1 st Fielding… The effect of DRM (Nov 2009) © 2010, the Book Industry Study Group, Inc. 42

1 st Fielding… (Nov 2009) …compared to 3 rd Fielding (April 2010) © 2010, the Book Industry Study Group, Inc. 43

Thank you! Do you want more data? … © 2010, the Book Industry Study Group, Inc. 44

Contact Angela Bole Email: angela@bisg. org Website: www. bisg. org Twitter: @bisg © 2010, the Book Industry Study Group, Inc. 45

5996d336ed30df667d078f56ea260341.ppt