5c7892579a5d1da70c6230a4d446bb5a.ppt

- Количество слайдов: 41

The TSU: Putting banks back at the heart of Trade Services CLACE conference, Panama 5 th June 2007 nicolas. willard@swift. com Slide 1

AGENDA < < < < Setting the scene – How is international trade settled ? – What are the current market trends ? Wh at do corporates need ? How are banks responding ? How is SWIFT helping ? The TSU What’s in it for banks ? Project status TSU interface demo Slide 2

AGENDA < Setting the scene – How is international trade settled ? – What are the current market trends ? < What do corporates need ? < How are banks responding ? < How is SWIFT helping ? The TSU < What’s in it for banks ? < Project status Slide 3

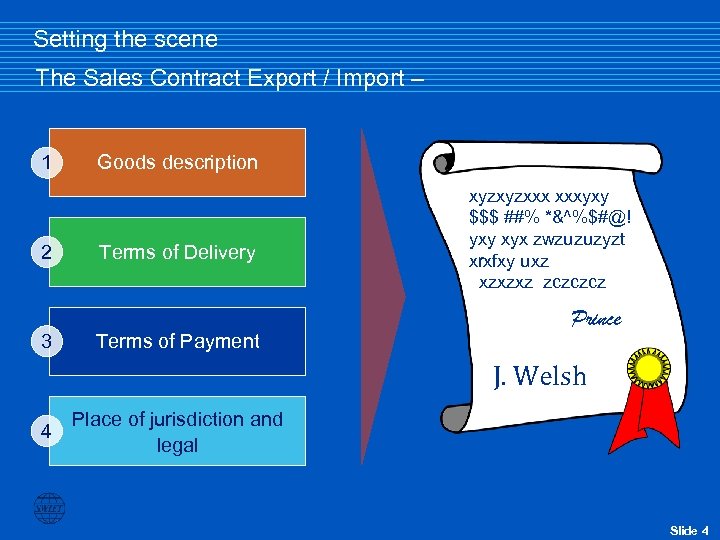

Setting the scene The Sales Contract Export / Import – 1 2 3 Goods description Terms of Delivery Terms of Payment xyzxyzxxx xxxyxy $$$ ##% *&^%$#@! yxy xyx zwzuzuzyzt xrxfxy uxz xzxzxz zczczcz Prince J. Welsh 4 Place of jurisdiction and legal Slide 4

Setting the scene Terms of Payment 1 Goods description 2 Terms of Delivery 3 Terms of Payment 4 Place of jurisdiction and legal < The Payment terms determine – Price – Date of payment – Payment instrument – Discounts – Account details Slide 5

Setting the scene Payment instruments 1 Goods description 2 Terms of Delivery 3 Terms of Payment 4 Place of jurisdiction and legal < Bank intermediation: – – < Documentary Letter of Credit Collections Limited bank intermediation – Payment in advance – Open Account Slide 6

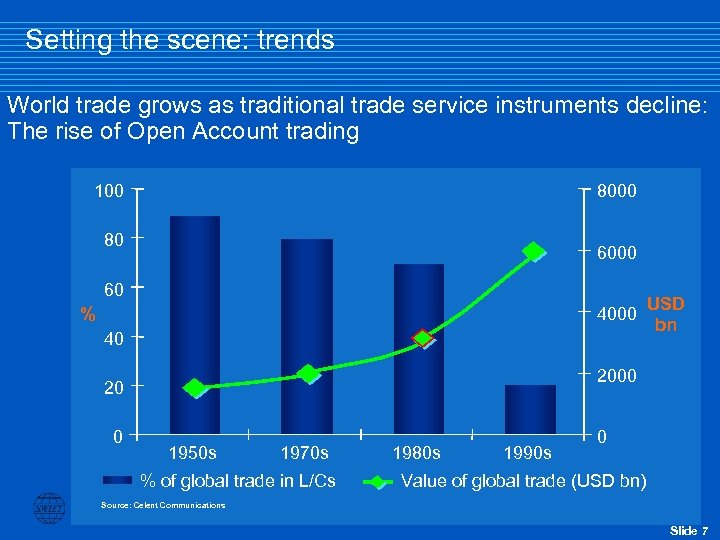

Setting the scene: trends World trade grows as traditional trade service instruments decline: The rise of Open Account trading 100 80 6000 60 4000 % 40 2000 20 0 USD bn 1950 s 1970 s % of global trade in L/Cs 1980 s 1990 s 0 Value of global trade (USD bn) Source: Celent Communications Slide 7

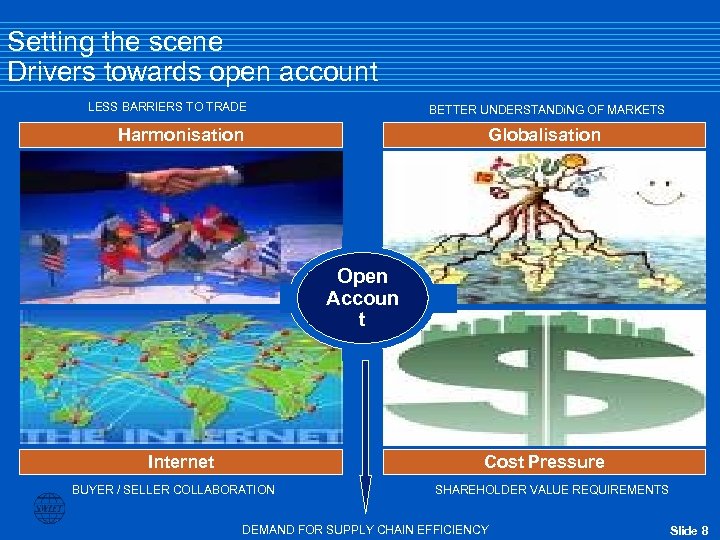

Setting the scene Drivers towards open account LESS BARRIERS TO TRADE BETTER UNDERSTANDi. NG OF MARKETS Harmonisation Globalisation Open Accoun t Internet Cost Pressure BUYER / SELLER COLLABORATION SHAREHOLDER VALUE REQUIREMENTS DEMAND FOR SUPPLY CHAIN EFFICIENCY Slide 8

Setting the scene: trends More international trade on open account 5% 3% 11 % 81 % An estimated 81% of global trade is open account Source: Global Business Intelligence Corp report commissioned by Misys Slide 9

AGENDA < Setting the scene – How is international trade settled ? – What are the current market trends ? < What do corporates need ? < How are banks responding ? < How is SWIFT helping ? The TSU < What’s in it for banks ? < Project status Slide 10

Corporate needs Get paid as early as possible (Exporter) < Get the goods ASAP + pay as late as possible (Importer) < I + E: Optimise working capital – Account payables (importer) – Account receivables (exporter) < I + E: Financing & risk mitigation – Pre-shipment (e. g. working capital financing) – Post-shipment (e. g. invoice discounting) – Currency hedging < Slide 11

AGENDA < Setting the scene – How is international trade settled ? – What are the current market trends ? < Wh at do corporates need ? < How are banks responding ? < How is SWIFT helping ? the TSU < What’s in it for the banks ? < Project status Slide 12

How are banks responding? Global Banks react with integrated supply chain solutions Vendor Finance Working Capital Finance Risk Data Checking & Matching Tracking & Tracing (IT-) Services Others Cash Reporting & Consolidation Finan cing Receivables / Payables Finance Others LC – Issuance & Guarantees FX Hedging & Execution Insurance Broking Others Slide 13

How are banks responding? Challenge for banks with current approach < Issues: – Lack of common standards – Restricted to own community – Difficult to get early access to information Slide 14

AGENDA < Setting the scene – How is international trade settled ? – What are the current market trends ? < What do corporates need ? < How are banks responding ? < How is SWIFT helping ? The TSU < What’s in it for banks ? < Project status Slide 15

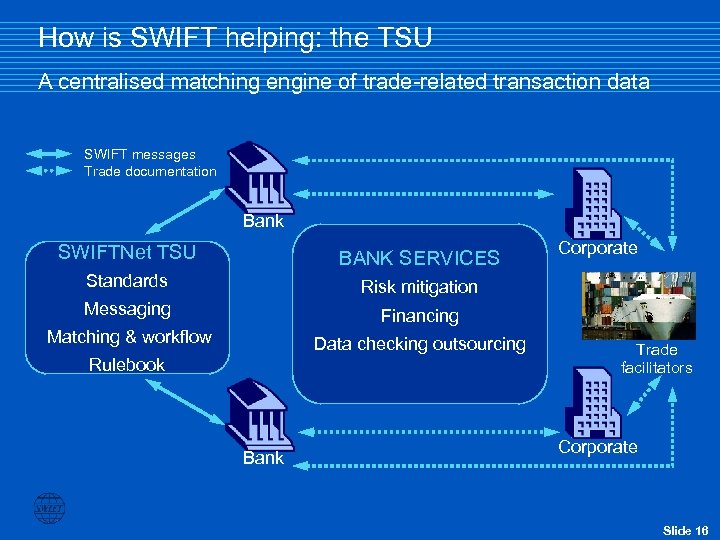

How is SWIFT helping: the TSU A centralised matching engine of trade-related transaction data SWIFT messages Trade documentation Bank SWIFTNet TSU BANK SERVICES Standards Risk mitigation Messaging Financing Matching & workflow Data checking outsourcing Corporate Rulebook Bank Trade facilitators Corporate Slide 16

How is SWIFT helping? : the TSU High Level end-to-end flow Transport document Inv PO Buyer Seller Transport document K data ey SWIFTNet Key data Matc atch M h TSU Bank 17 Slide

AGENDA < Setting the scene – How is international trade settled ? – What are the current market trends ? < What do corporates need ? < How are banks responding ? < How is SWIFT helping ? The TSU < What’s in it for banks ? < Project status Slide 18

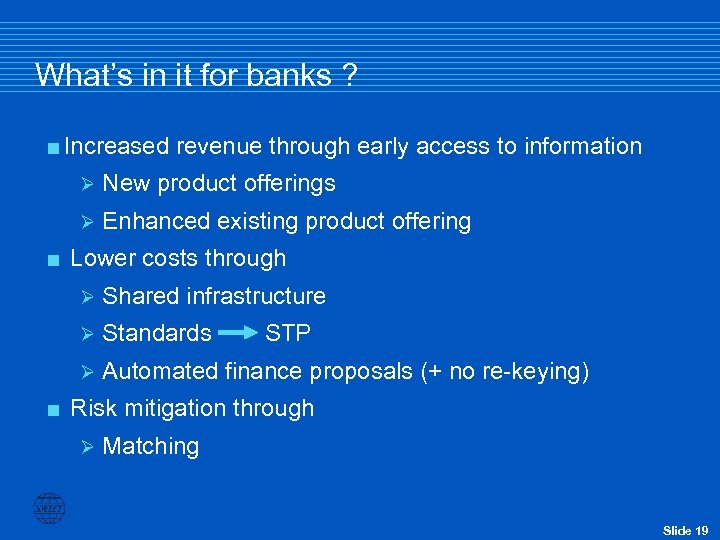

What’s in it for banks ? <Increased revenue through early access to information Ø Ø < New product offerings Enhanced existing product offering Lower costs through Ø Ø Standards Ø < Shared infrastructure Automated finance proposals (+ no re-keying) STP Risk mitigation through Ø Matching Slide 19

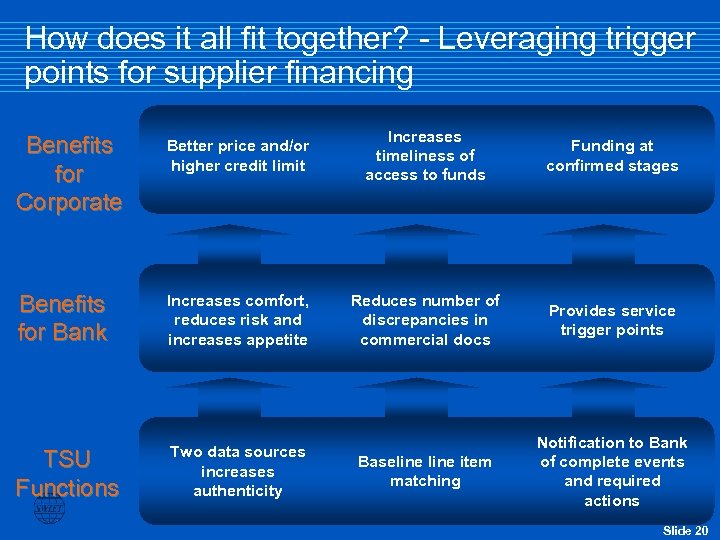

How does it all fit together? - Leveraging trigger points for supplier financing Benefits for Corporate Better price and/or higher credit limit Increases timeliness of access to funds Funding at confirmed stages Benefits for Bank Increases comfort, reduces risk and increases appetite Reduces number of discrepancies in commercial docs Provides service trigger points TSU Functions Two data sources increases authenticity Baseline item matching Notification to Bank of complete events and required actions Slide 20

AGENDA < Setting the scene – How is international trade settled ? – What are the current market trends ? < What do corporates need ? < How are banks responding ? < How is SWIFT helping ? The TSU < What’s in it for banks ? < Project status Slide 21

The TSU Banks Americas EMEA Asia Pacific 33 Trade Banks 17 countries Slide 22

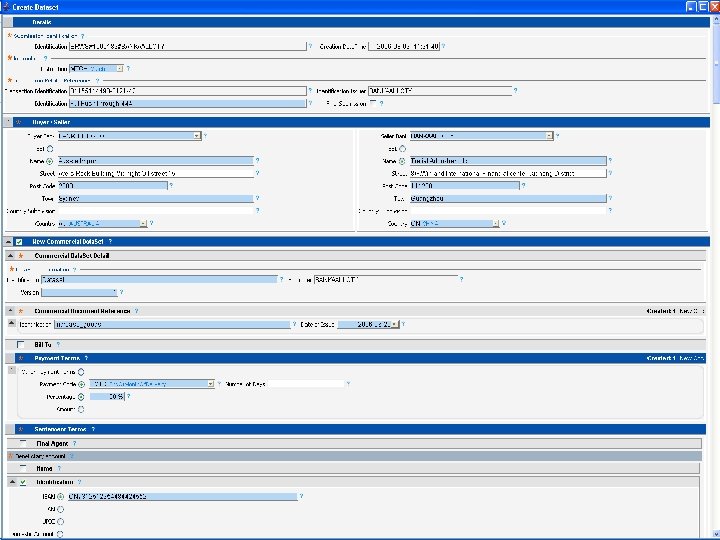

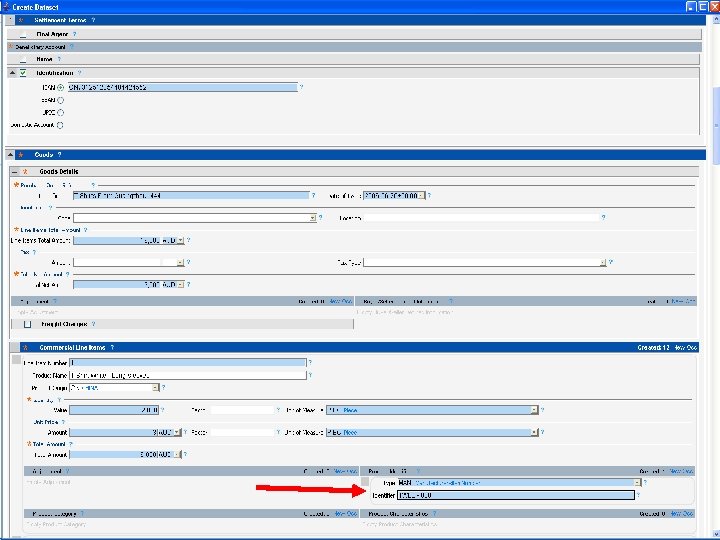

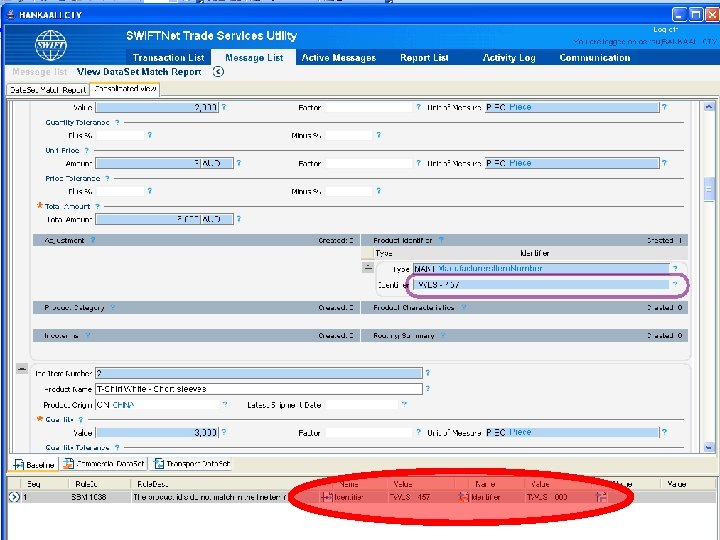

TSU-Interface Demonstration (using screenshots in MS-Powerpoint) Slide 23

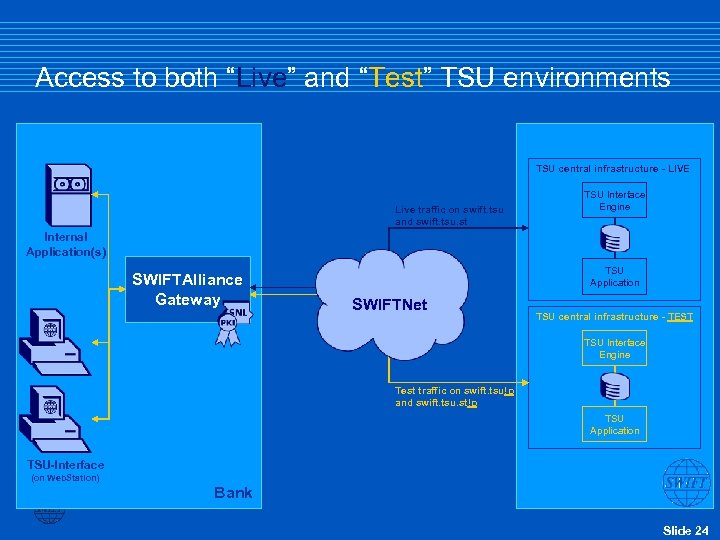

Access to both “Live” and “Test” TSU environments TSU central infrastructure - LIVE Live traffic on swift. tsu and swift. tsu. st TSU Interface Engine Internal Application(s) SWIFTAlliance Gateway TSU Application SWIFTNet TSU central infrastructure - TEST TSU Interface Engine Test traffic on swift. tsu!p and swift. tsu. st!p TSU Application TSU-Interface (on Web. Station) Bank Slide 24

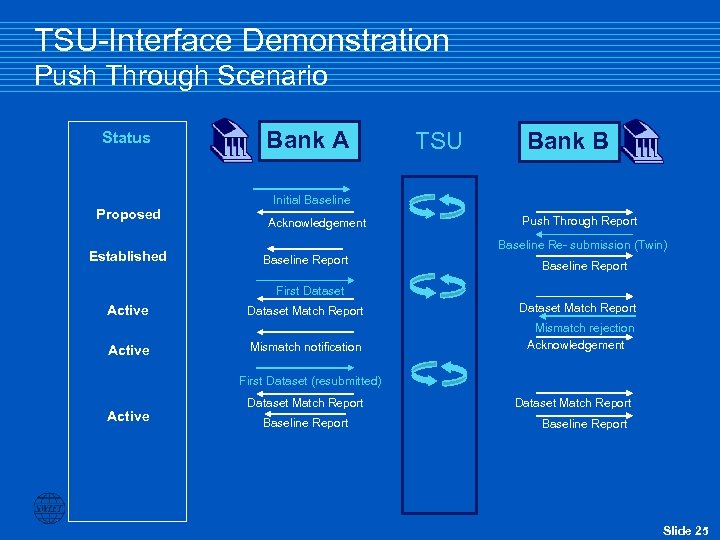

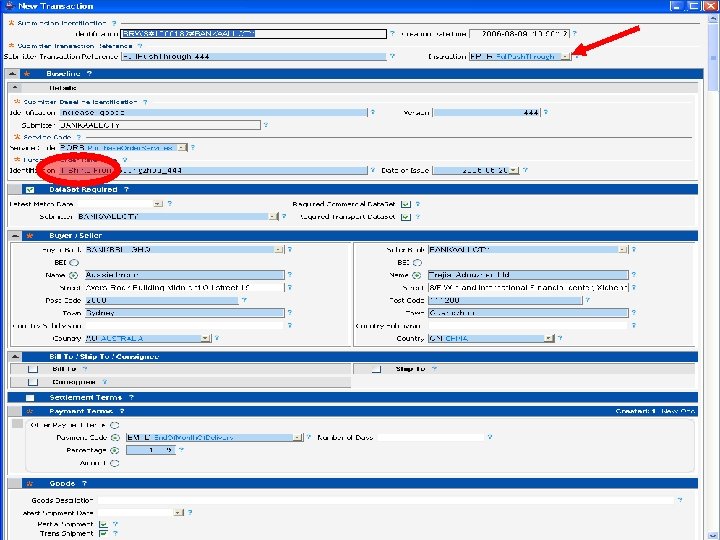

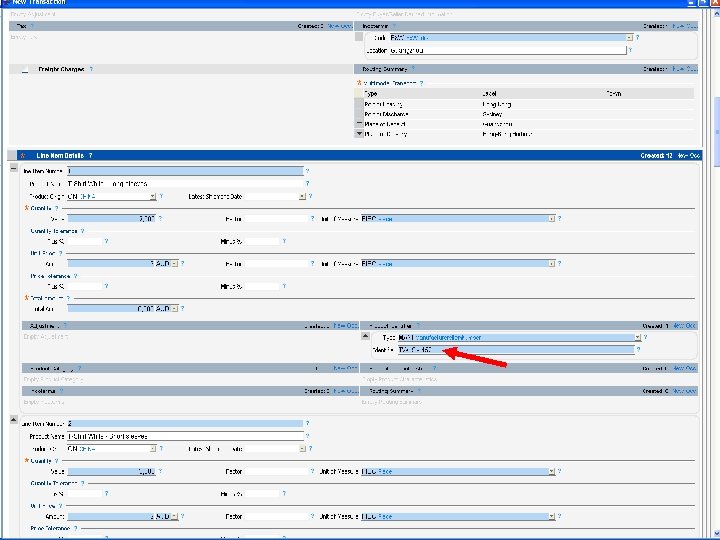

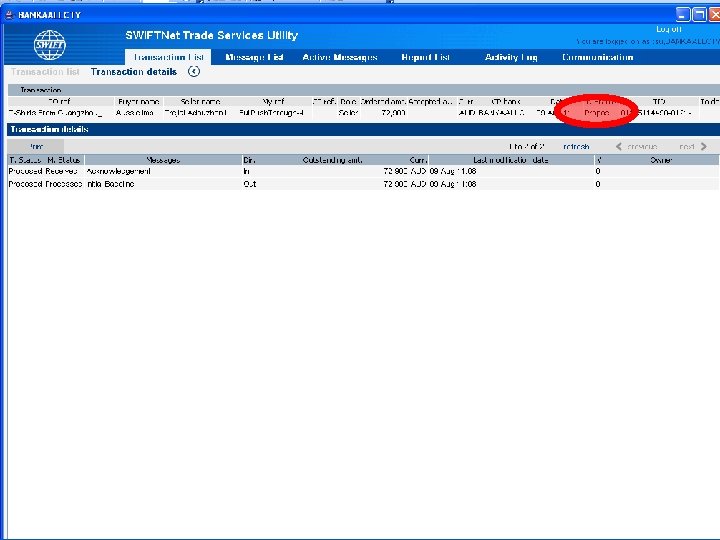

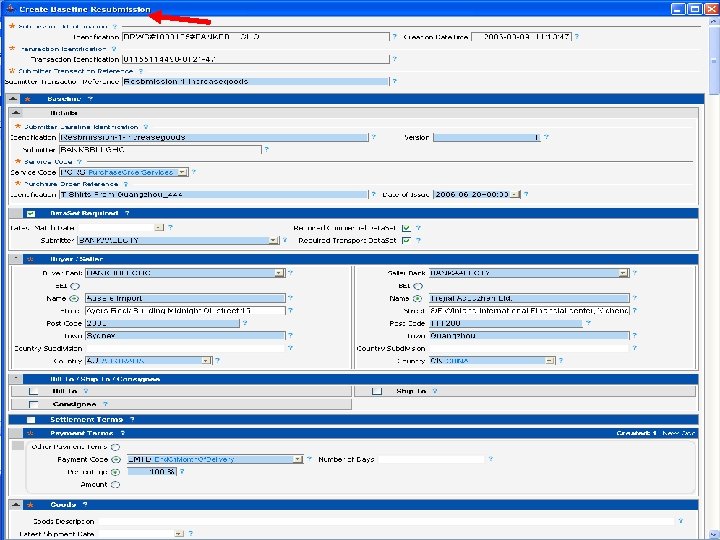

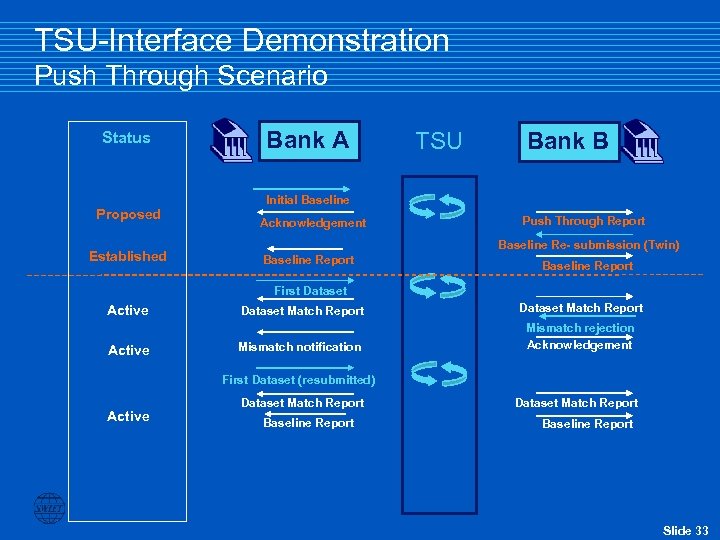

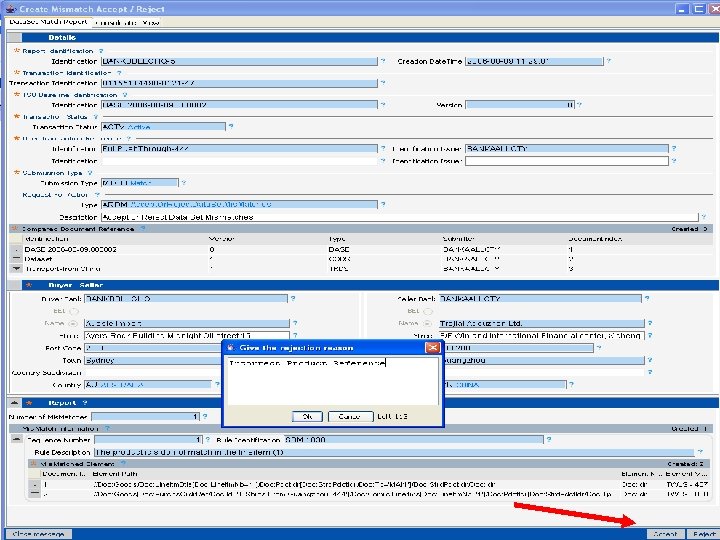

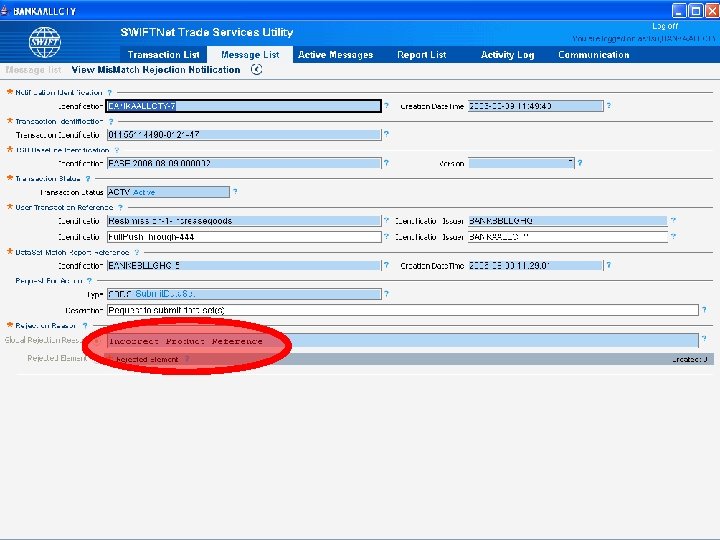

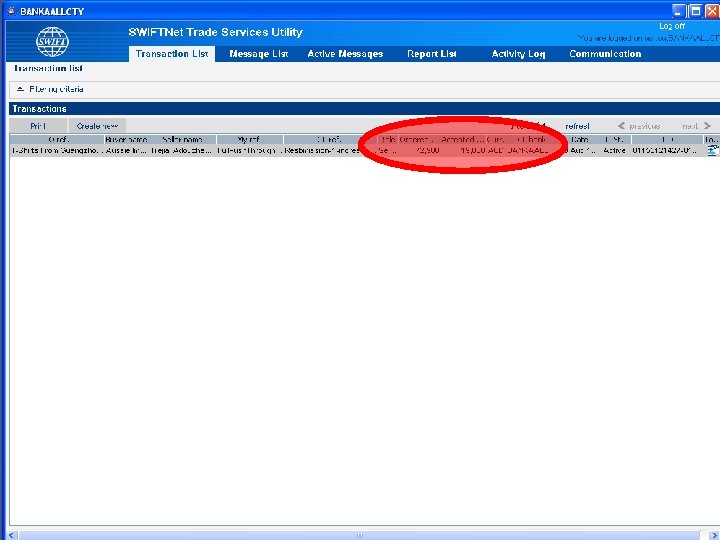

TSU-Interface Demonstration Push Through Scenario Status Proposed Established Bank A TSU Bank B Initial Baseline Acknowledgement Push Through Report Baseline Re- submission (Twin) Baseline Report First Dataset Active Dataset Match Report Mismatch notification Mismatch rejection Acknowledgement First Dataset (resubmitted) Active Dataset Match Report Baseline Report Slide 25

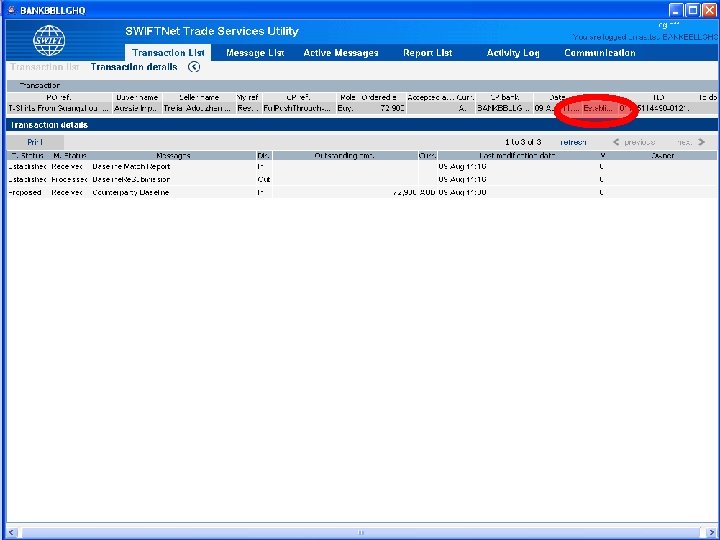

Slide 26

Slide 27

Slide 28

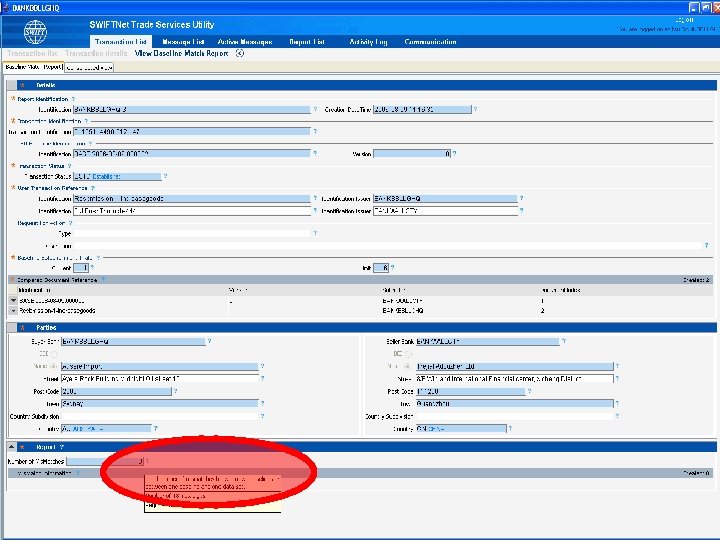

Slide 29

Slide 30

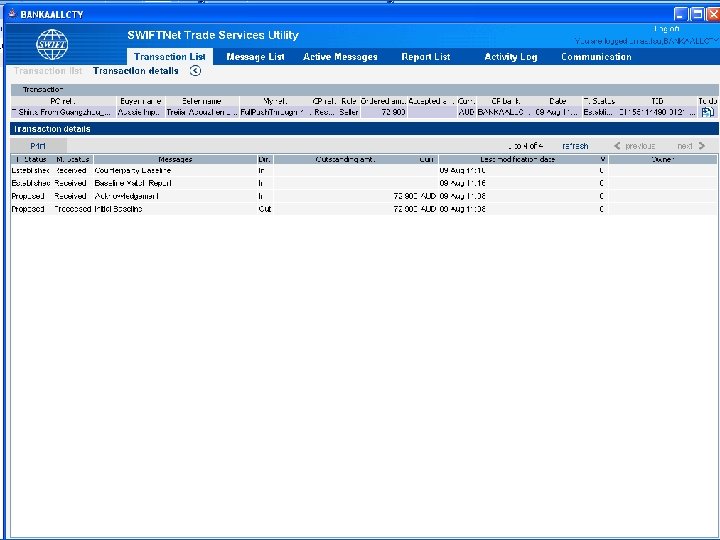

Slide 31

Slide 32

TSU-Interface Demonstration Push Through Scenario Status Proposed Established Bank A TSU Bank B Initial Baseline Acknowledgement Push Through Report Baseline Re- submission (Twin) Baseline Report First Dataset Active Dataset Match Report Mismatch notification Mismatch rejection Acknowledgement First Dataset (resubmitted) Active Dataset Match Report Baseline Report Slide 33

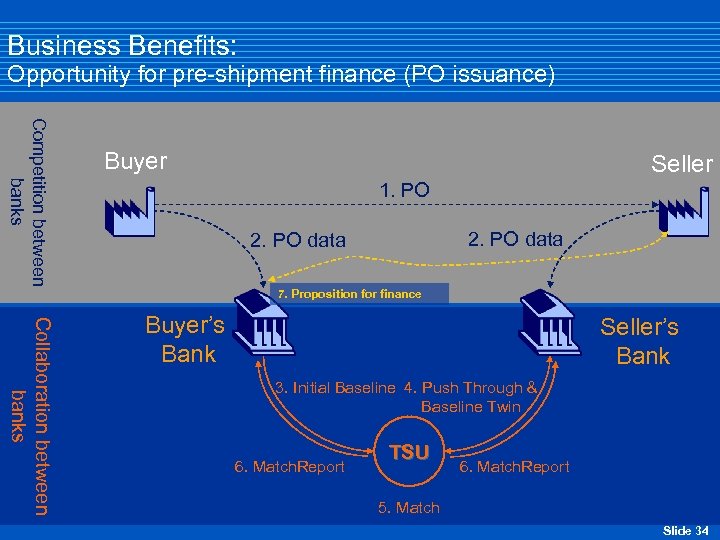

Business Benefits: Opportunity for pre-shipment finance (PO issuance) Competition between banks Buyer Seller 1. PO 2. PO data 7. Proposition for finance Collaboration between banks Buyer’s Bank Seller’s Bank 3. Initial Baseline 4. Push Through & Baseline Twin 6. Match. Report TSU 6. Match. Report 5. Match Slide 34

Slide 35

Slide 36

Slide 37

Slide 38

Slide 39

Slide 40

Thank you Slide 41

5c7892579a5d1da70c6230a4d446bb5a.ppt