8a0f57be9fe5592244840a185c603500.ppt

- Количество слайдов: 27

THE TEXAS BUSINESS ORGANIZATIONS CODE: THE REVOLUTION IS HERE Prepared and Copyright Reserved By: Sabrina A. Mc. Topy 27 th Annual Advanced Real Estate Law Course San Antonio, Texas

The “WHY” BACKGROUND OF TEXAS BOC Current Entity Statutes Do Not Reflect Modern Practice (Form over Substance) – Recognition of increasingly blurred lines between entity types, driven by commercial desire for increased flexibility – 1996 IRS retreat from formalistic four-factor test for corporations/partnerships Texas Attempting to Promote Itself As a Leader in Entity Laws – Complexity of different entity statutes’ organization and interplay a disincentive to organize in Texas

CHOOSING THE RIGHT ENTITY

QUOTABLE QUOTES “The biggest winners will be small businesses that no longer have to spend a fortune on lawyers’ fees just to file the right form with the Secretary of State. ” “Texas businesses want to play by the rules, but it’s hard to play by the rules when the rules are often incomprehensible. " -Rep. Helen Giddings, TBOC Sponsoring Democrat

The Evolution of “Enabling” vs “Mandatory” Concept of Entities - Partnerships as contracts among parties free to choose their terms. - Corporations as fictitious entities required to comply with mandatory rules and standards.

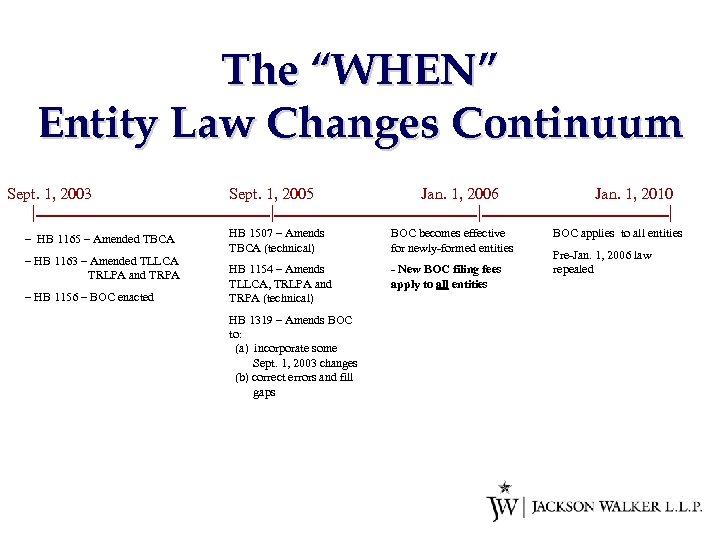

The “WHEN” Entity Law Changes Continuum Sept. 1, 2003 Sept. 2005 Jan. 1, 2006 Jan. 1, 2010 ________1, _______|______| | | – HB 1165 – Amended TBCA – HB 1163 – Amended TLLCA TRLPA and TRPA – HB 1156 – BOC enacted HB 1507 – Amends TBCA (technical) BOC becomes effective for newly-formed entities HB 1154 – Amends TLLCA, TRLPA and TRPA (technical) - New BOC filing fees apply to all entities HB 1319 – Amends BOC to: (a) incorporate some Sept. 1, 2003 changes (b) correct errors and fill gaps BOC applies to all entities Pre-Jan. 1, 2006 law repealed

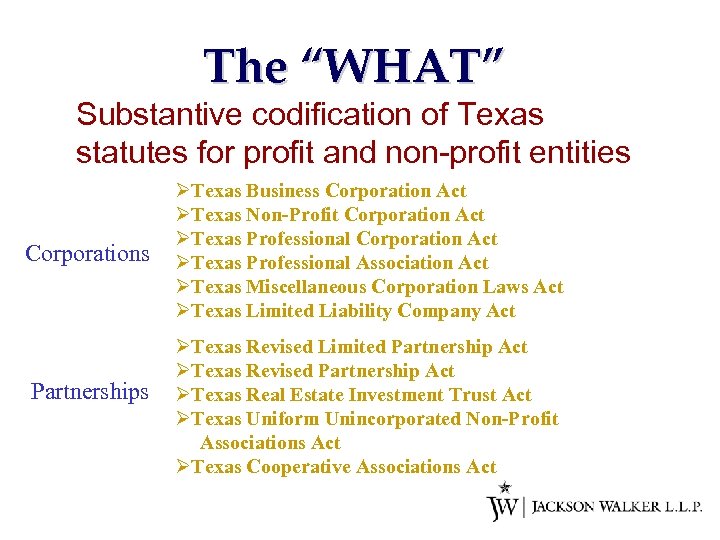

The “WHAT” Substantive codification of Texas statutes for profit and non-profit entities Corporations Partnerships ØTexas Business Corporation Act ØTexas Non-Profit Corporation Act ØTexas Professional Association Act ØTexas Miscellaneous Corporation Laws Act ØTexas Limited Liability Company Act ØTexas Revised Limited Partnership Act ØTexas Revised Partnership Act ØTexas Real Estate Investment Trust Act ØTexas Uniform Unincorporated Non-Profit Associations Act ØTexas Cooperative Associations Act

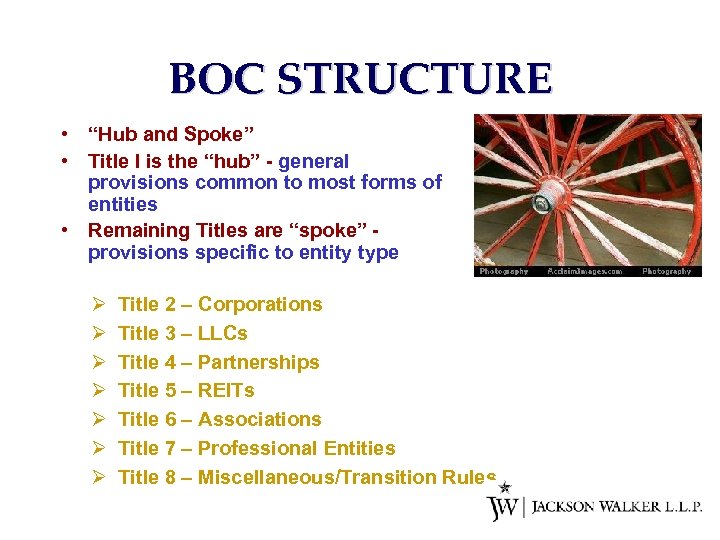

BOC STRUCTURE • “Hub and Spoke” • Title I is the “hub” - general provisions common to most forms of entities • Remaining Titles are “spoke” provisions specific to entity type Ø Ø Ø Ø Title 2 – Corporations Title 3 – LLCs Title 4 – Partnerships Title 5 – REITs Title 6 – Associations Title 7 – Professional Entities Title 8 – Miscellaneous/Transition Rules

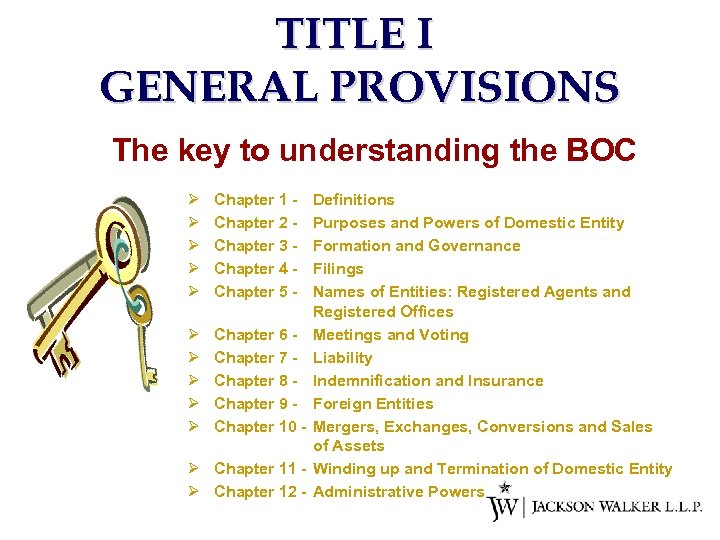

TITLE I GENERAL PROVISIONS The key to understanding the BOC Ø Ø Ø Chapter 1 Chapter 2 Chapter 3 Chapter 4 Chapter 5 - Ø Ø Ø Chapter 6 Chapter 7 Chapter 8 Chapter 9 Chapter 10 - Ø Chapter 11 Ø Chapter 12 - Definitions Purposes and Powers of Domestic Entity Formation and Governance Filings Names of Entities: Registered Agents and Registered Offices Meetings and Voting Liability Indemnification and Insurance Foreign Entities Mergers, Exchanges, Conversions and Sales of Assets Winding up and Termination of Domestic Entity Administrative Powers

UNDERSTANDING THE BOC • • • Refer FIRST to Title I THEN refer to the title for the specific entity type Title I applies unless there is a conflicting provision in the entityspecific title

Title I Definitions Entities have “Owners” or “Members” Ownership Interests For-profit corporations REITs Partnerships Membership Interests Non-profit corporations Unincorporated nonprofit associations LLCs Professional Associations

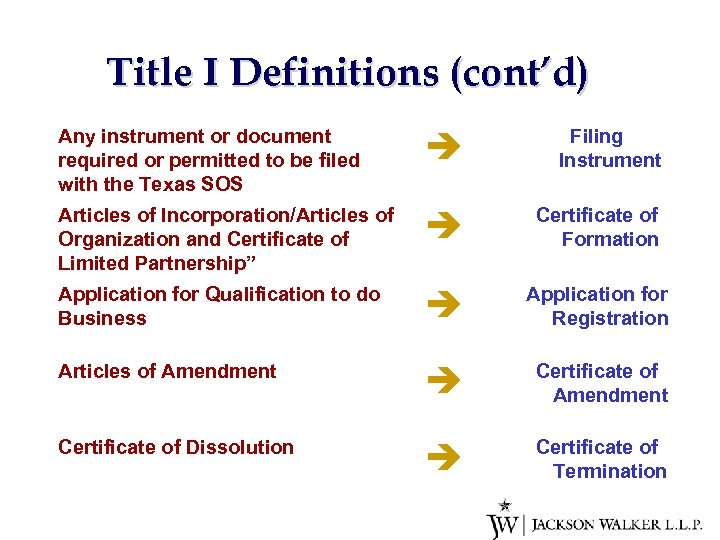

Title I Definitions (cont’d) Any instrument or document required or permitted to be filed with the Texas SOS Articles of Incorporation/Articles of Organization and Certificate of Limited Partnership” Application for Qualification to do Business Articles of Amendment Certificate of Dissolution Filing Instrument Certificate of Formation Application for Registration Certificate of Amendment Certificate of Termination

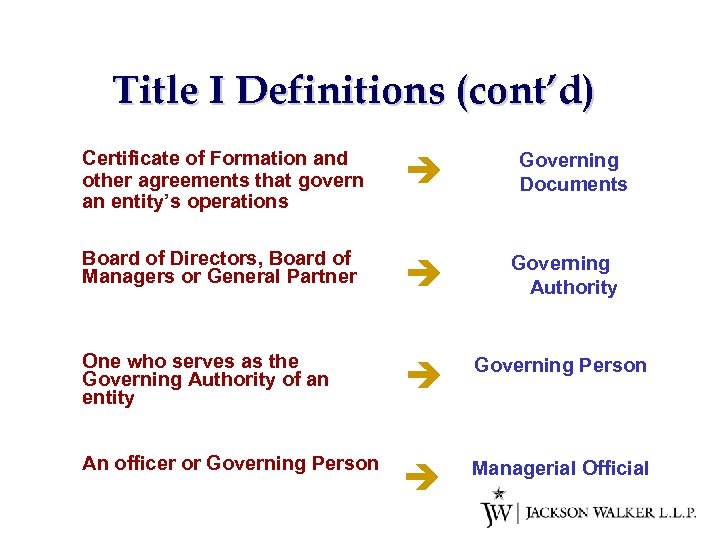

Title I Definitions (cont’d) Certificate of Formation and other agreements that govern an entity’s operations Board of Directors, Board of Managers or General Partner One who serves as the Governing Authority of an entity An officer or Governing Person Governing Documents Governing Authority Governing Person Managerial Official

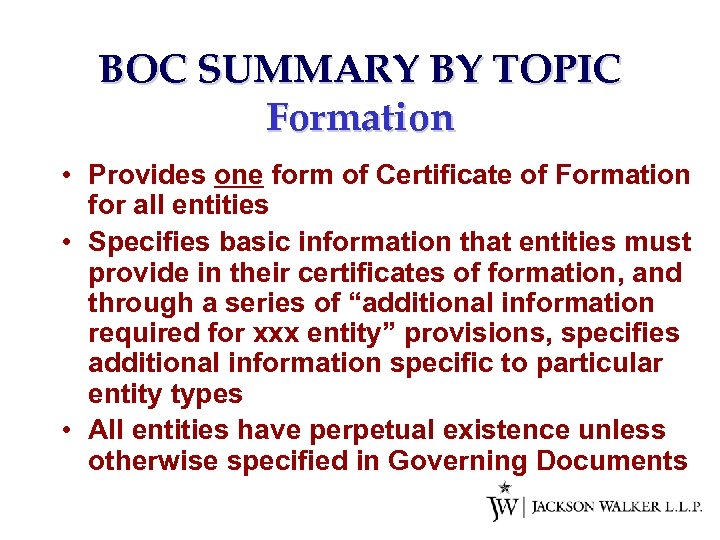

BOC SUMMARY BY TOPIC Formation • Provides one form of Certificate of Formation for all entities • Specifies basic information that entities must provide in their certificates of formation, and through a series of “additional information required for xxx entity” provisions, specifies additional information specific to particular entity types • All entities have perpetual existence unless otherwise specified in Governing Documents

BOC SUMMARY BY TOPIC Formation (cont’d) • “Limited” may be used in corporation name • Permits nonprofit LLCs • Voting trusts and voting agreements for LLCs

BOC SUMMARY BY TOPIC Filings • Consolidates filing procedures in one chapter and standardizes rules for filings • No “certificate of incorporation/formation” issued; Secretary of State (in the case of a REIT, the county clerk) instead issues an acknowledgment of filing (electronic or written) • Retains permissibility of electronic filings and signatures

BOC SUMMARY BY TOPIC Filings (cont’d) • Filings are effective when filed, not when Secretary of State issues a certificate • Entities may abandon any filed instrument before effectiveness • Foreign business trusts and REITs must register in Texas ($750 + $750 late filing fee)

BOC SUMMARY BY TOPIC Filings (cont’d) • Standardizes filing fees by action taken • Eliminates need foreign entity to file certificate of existence with Application For Registration to transact business • Requires amendment to Application for Registration filed within 90 days if foreign entity changes its name or business activity

BOC SUMMARY BY TOPIC Filings (cont’d) • Provides civil remedy (recovery of damages, court costs and reasonable attorneys’ fees) for all entities for false and misleading Filing Instrument • Provides more severe criminal penalty (state jail felony rather than a Class A Misdemeanor) for knowingly filing a materially false Filing Instrument

BOC SUMMARY BY TOPIC Filings (cont’d) • Establishes new or revised civil penalties/late filing fees foreign entities’ failure to register when required • Simplifies filing of Certificate of Merger/ Exchange/Conversion (no need to include plan of merger or to specify actual voting results, and no multiple copy requirement) • Adds to Merger/Conversion Fee a fee for creation of newly-formed entity Ø LLC conversion to LLP = $300 + $750

BOC SUMMARY BY TOPIC Governance • Directors, managers or managing members have right to inspect to books and records • Governing Persons may rely on opinions, reports and statements • Partnerships may adopt in their partnership agreements Code provisions as to meetings and voting • Managers/officers/directors may be removed with or without cause

BOC SUMMARY BY TOPIC Indemnification • Committee of one rather than two disinterested Governing Persons may determine that standard for indemnification has been met • Owners or members may approve by resolution indemnification and advancement of expenses of any officer, employee or agent who is not also a director (only implied in existing law) • Increases (from six to 12 months) maximum time for reporting to limited partners any indemnification or advancement to a general partner

BOC SUMMARY BY TOPIC Mergers • Plan of merger must contain a description of the organizational form of each entity a party created in the merger • Governing Documents of non-BOC organizations that survive or are created by the merger not attached to the plan of merger • Clarifies LLC disposition of assets is not a merger, and purchaser not liable for seller liabilities unless expressly assumed • All surviving entities are secondarily liable for payment to dissenting owners

BOC SUMMARY BY TOPIC Termination • One form of certificate of termination for all entities • Specifies what events require winding up of a domestic entity, the procedure for winding up and application of liquidation proceeds • Secretary of State may involuntarily terminate entity for failure to pay filing fees or maintaining a registered office

BOC SUMMARY BY TOPIC Termination (cont’d) • Secretary of State may reinstate involuntarily terminated filing entity at any time, with retroactive treatment only if reinstated before the 3 rd anniversary of involuntary termination • In case of a retroactively reinstated involuntarily terminated LP, personal liability of Governing Persons is not affected • In certain cases, extends ability to reinstate a voluntarily terminated entity from 120 days to three years after termination (C corps, REITs, LLCs and LPs)

Transition JAN. 1, 2006 – JAN. 1, 2010 • Pre-BOC and BOC Regimes Coexist Ø Changes to Entity Statutes Since Sept. 1, 2003 Minimize Substantive Differences • Existing Entities May Elect BOC Before Jan. 1, 2010 by Amending Certificate of Formation and Stating Election to Adopt

Transition Considerations • Nomenclature, Filing Instrument Forms and Governing Documents Will Differ • Forms and Drafting Eventually Uniform, but Transition Requires Knowing pre-BOC law and BOC Ø Purchase and Sale Agreements v Buyer and Seller Representations v Legal Opinions Ø Financings • TSOS Forms Available Dec. 2005

8a0f57be9fe5592244840a185c603500.ppt