f0c8744d265174433d6ac2fd61caf5fd.ppt

- Количество слайдов: 24

The taxation of housing Andrew Leicester Zoë Oldfield

The taxation of housing Andrew Leicester Zoë Oldfield

Background • Recent housing market volatility • Implications for macroeconomic stability? • Miles / Barker reviews to report at Budget • Is housing ‘under-taxed’? • Options for reform? • Could taxes stabilise the market? • Revenue-raising implications?

Background • Recent housing market volatility • Implications for macroeconomic stability? • Miles / Barker reviews to report at Budget • Is housing ‘under-taxed’? • Options for reform? • Could taxes stabilise the market? • Revenue-raising implications?

Is housing under-taxed? “… investment in housing is relatively lightly taxed compared to other investments. ” Fiscal Stabilisation and EMU (2003) • Housing has consumption and investment elements • Economic reasons for lower housing taxes? • UK versus other countries?

Is housing under-taxed? “… investment in housing is relatively lightly taxed compared to other investments. ” Fiscal Stabilisation and EMU (2003) • Housing has consumption and investment elements • Economic reasons for lower housing taxes? • UK versus other countries?

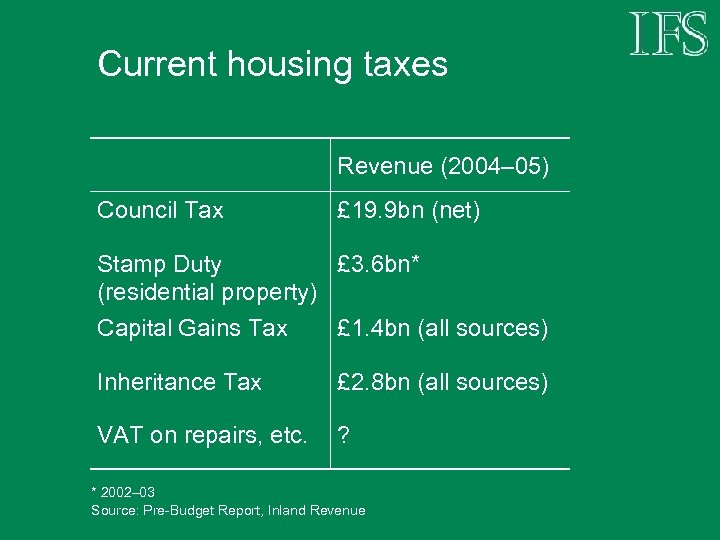

Current housing taxes Revenue (2004– 05) Council Tax £ 19. 9 bn (net) Stamp Duty £ 3. 6 bn* (residential property) Capital Gains Tax £ 1. 4 bn (all sources) Inheritance Tax £ 2. 8 bn (all sources) VAT on repairs, etc. ? * 2002– 03 Source: Pre-Budget Report, Inland Revenue

Current housing taxes Revenue (2004– 05) Council Tax £ 19. 9 bn (net) Stamp Duty £ 3. 6 bn* (residential property) Capital Gains Tax £ 1. 4 bn (all sources) Inheritance Tax £ 2. 8 bn (all sources) VAT on repairs, etc. ? * 2002– 03 Source: Pre-Budget Report, Inland Revenue

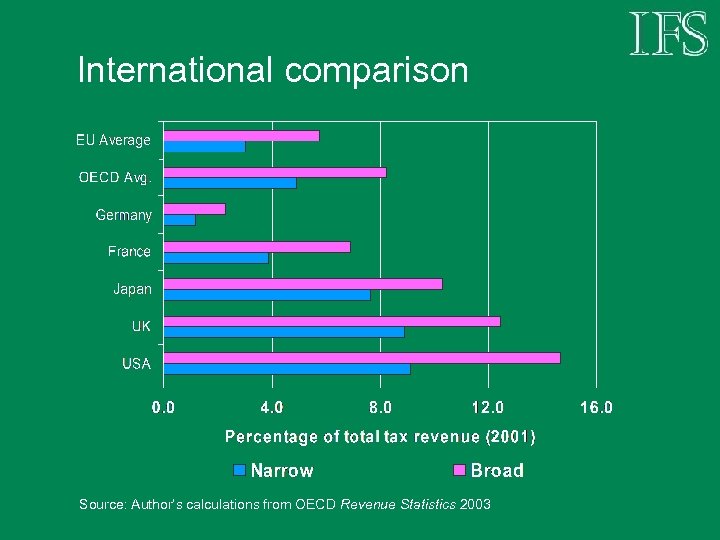

International comparison Source: Author’s calculations from OECD Revenue Statistics 2003

International comparison Source: Author’s calculations from OECD Revenue Statistics 2003

International comparison Source: Author’s calculations from OECD Revenue Statistics 2003

International comparison Source: Author’s calculations from OECD Revenue Statistics 2003

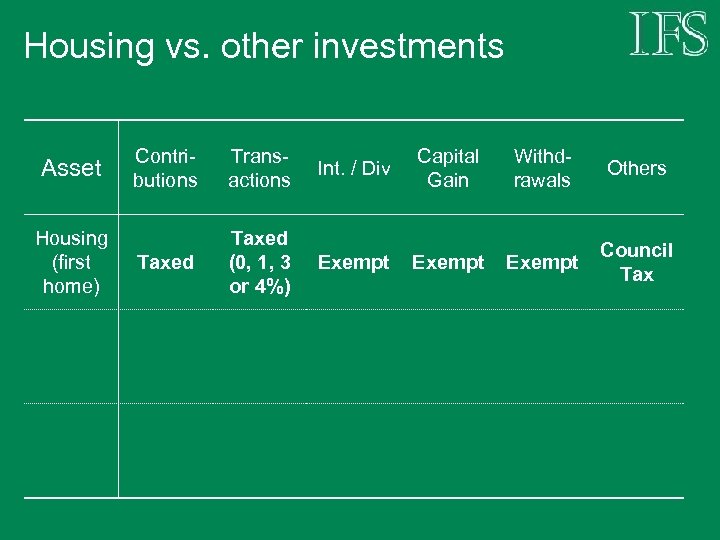

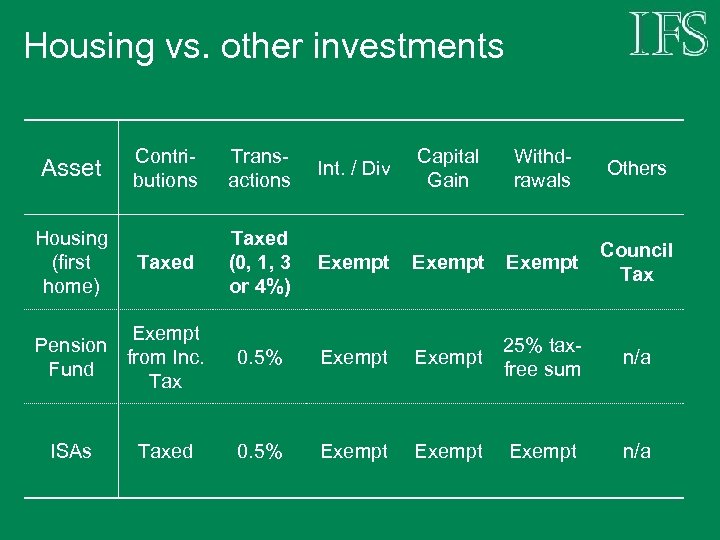

Housing vs. other investments Asset Contributions Transactions Int. / Div Capital Gain Withdrawals Others

Housing vs. other investments Asset Contributions Transactions Int. / Div Capital Gain Withdrawals Others

Housing vs. other investments Asset Housing (first home) Contributions Transactions Int. / Div Capital Gain Withdrawals Others

Housing vs. other investments Asset Housing (first home) Contributions Transactions Int. / Div Capital Gain Withdrawals Others

Housing vs. other investments Asset Housing (first home) Contributions Transactions Int. / Div Capital Gain Withdrawals Others Taxed (0, 1, 3 or 4%) Exempt Council Tax

Housing vs. other investments Asset Housing (first home) Contributions Transactions Int. / Div Capital Gain Withdrawals Others Taxed (0, 1, 3 or 4%) Exempt Council Tax

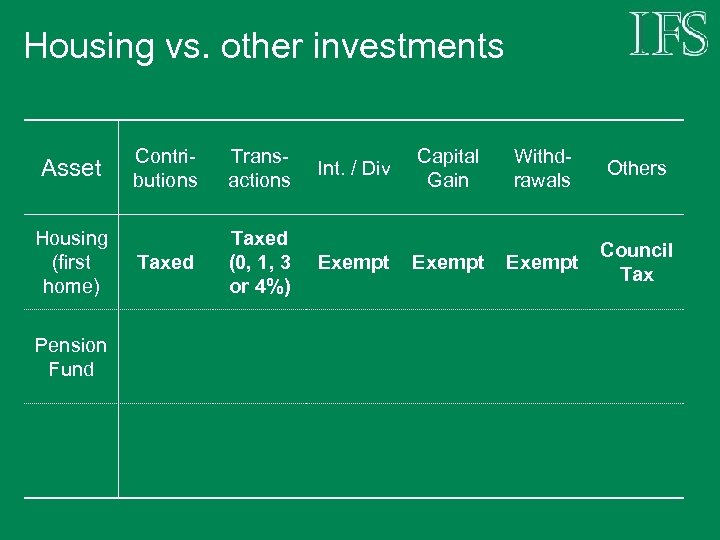

Housing vs. other investments Asset Housing (first home) Pension Fund Contributions Transactions Int. / Div Capital Gain Withdrawals Others Taxed (0, 1, 3 or 4%) Exempt Council Tax

Housing vs. other investments Asset Housing (first home) Pension Fund Contributions Transactions Int. / Div Capital Gain Withdrawals Others Taxed (0, 1, 3 or 4%) Exempt Council Tax

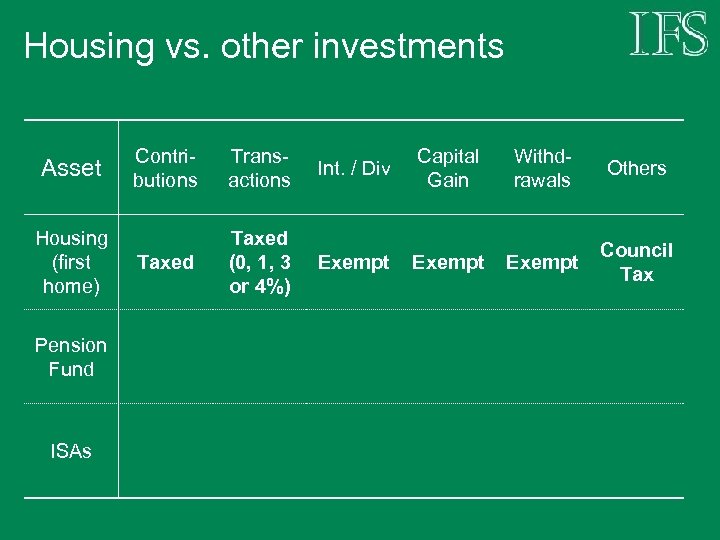

Housing vs. other investments Asset Housing (first home) Pension Fund ISAs Contributions Transactions Int. / Div Capital Gain Withdrawals Others Taxed (0, 1, 3 or 4%) Exempt Council Tax

Housing vs. other investments Asset Housing (first home) Pension Fund ISAs Contributions Transactions Int. / Div Capital Gain Withdrawals Others Taxed (0, 1, 3 or 4%) Exempt Council Tax

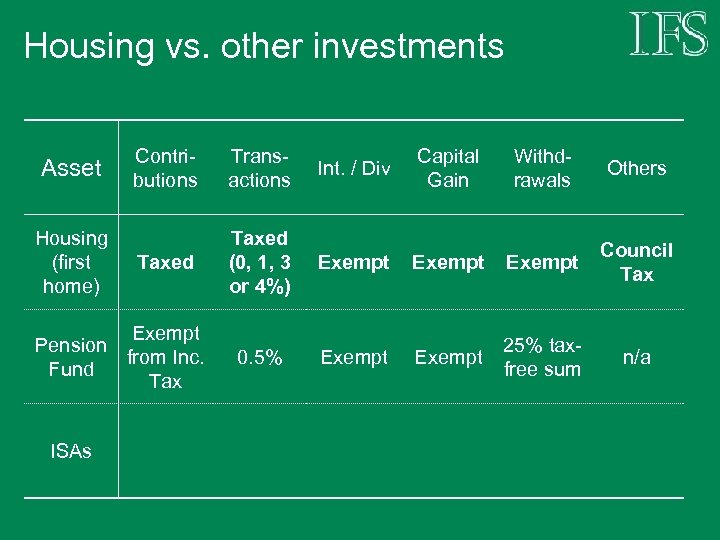

Housing vs. other investments Asset Housing (first home) Contributions Transactions Int. / Div Capital Gain Withdrawals Others Taxed (0, 1, 3 or 4%) Exempt Council Tax 0. 5% Exempt 25% taxfree sum n/a Exempt Pension from Inc. Fund Tax ISAs

Housing vs. other investments Asset Housing (first home) Contributions Transactions Int. / Div Capital Gain Withdrawals Others Taxed (0, 1, 3 or 4%) Exempt Council Tax 0. 5% Exempt 25% taxfree sum n/a Exempt Pension from Inc. Fund Tax ISAs

Housing vs. other investments Asset Housing (first home) Contributions Transactions Int. / Div Capital Gain Withdrawals Others Taxed (0, 1, 3 or 4%) Exempt Council Tax 0. 5% Exempt 25% taxfree sum n/a 0. 5% Exempt n/a Exempt Pension from Inc. Fund Tax ISAs Taxed

Housing vs. other investments Asset Housing (first home) Contributions Transactions Int. / Div Capital Gain Withdrawals Others Taxed (0, 1, 3 or 4%) Exempt Council Tax 0. 5% Exempt 25% taxfree sum n/a 0. 5% Exempt n/a Exempt Pension from Inc. Fund Tax ISAs Taxed

Housing vs. other consumption • • Housing does not attract VAT True for some other consumption goods But not for large durables Council Tax, Stamp Duty etc. make overall comparisons difficult

Housing vs. other consumption • • Housing does not attract VAT True for some other consumption goods But not for large durables Council Tax, Stamp Duty etc. make overall comparisons difficult

Housing ‘under-taxed’? • Hard to argue that housing under-taxed compared to other investments • Compared to other consumption the case is stronger • Effect of Council Tax? • What are the options for reform?

Housing ‘under-taxed’? • Hard to argue that housing under-taxed compared to other investments • Compared to other consumption the case is stronger • Effect of Council Tax? • What are the options for reform?

VAT on housing • No VAT charged on housing • Distort consumption decisions? • Speculation that VAT to be introduced on new houses: • Estimated revenue effect: £ 4. 5 bn (2003 – 04) • Implications for housing supply? • Buy non-new home instead?

VAT on housing • No VAT charged on housing • Distort consumption decisions? • Speculation that VAT to be introduced on new houses: • Estimated revenue effect: £ 4. 5 bn (2003 – 04) • Implications for housing supply? • Buy non-new home instead?

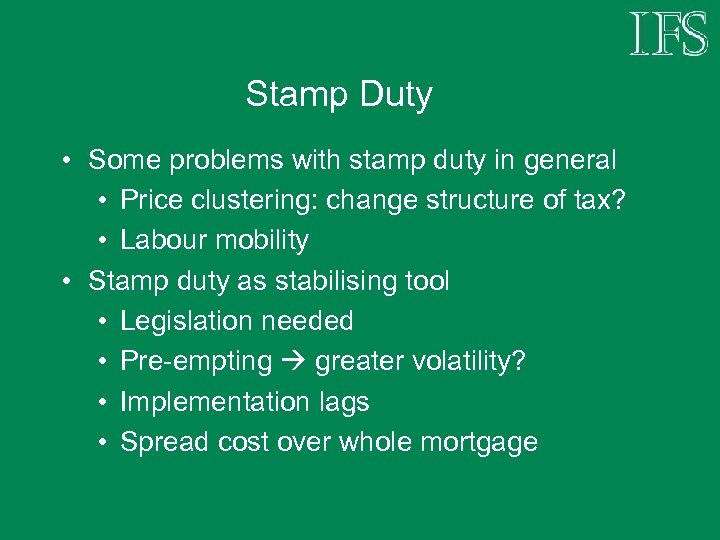

Stamp Duty • Some problems with stamp duty in general • Price clustering: change structure of tax? • Labour mobility • Stamp duty as stabilising tool • Legislation needed • Pre-empting greater volatility? • Implementation lags • Spread cost over whole mortgage

Stamp Duty • Some problems with stamp duty in general • Price clustering: change structure of tax? • Labour mobility • Stamp duty as stabilising tool • Legislation needed • Pre-empting greater volatility? • Implementation lags • Spread cost over whole mortgage

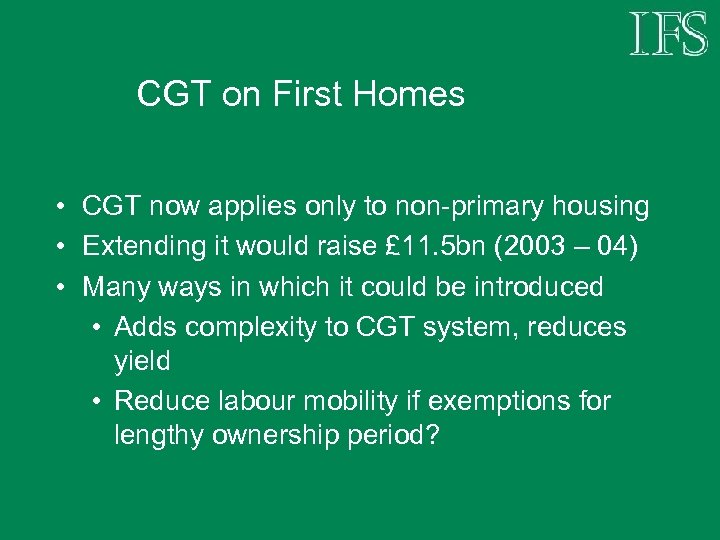

CGT on First Homes • CGT now applies only to non-primary housing • Extending it would raise £ 11. 5 bn (2003 – 04) • Many ways in which it could be introduced • Adds complexity to CGT system, reduces yield • Reduce labour mobility if exemptions for lengthy ownership period?

CGT on First Homes • CGT now applies only to non-primary housing • Extending it would raise £ 11. 5 bn (2003 – 04) • Many ways in which it could be introduced • Adds complexity to CGT system, reduces yield • Reduce labour mobility if exemptions for lengthy ownership period?

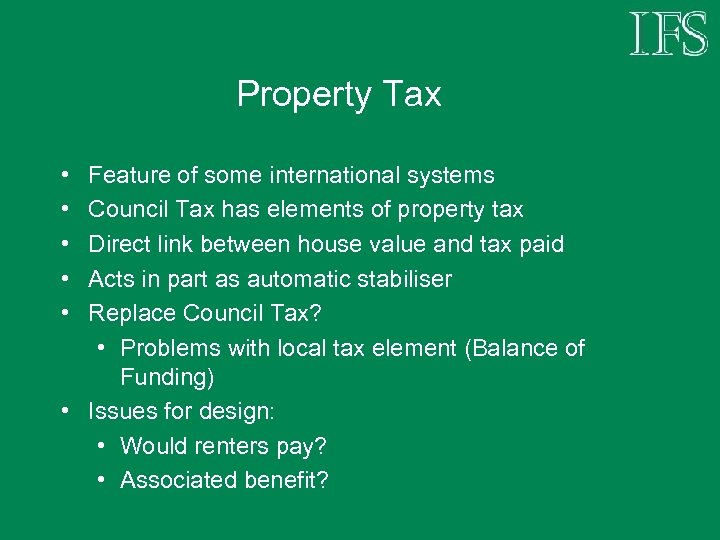

Property Tax • • • Feature of some international systems Council Tax has elements of property tax Direct link between house value and tax paid Acts in part as automatic stabiliser Replace Council Tax? • Problems with local tax element (Balance of Funding) • Issues for design: • Would renters pay? • Associated benefit?

Property Tax • • • Feature of some international systems Council Tax has elements of property tax Direct link between house value and tax paid Acts in part as automatic stabiliser Replace Council Tax? • Problems with local tax element (Balance of Funding) • Issues for design: • Would renters pay? • Associated benefit?

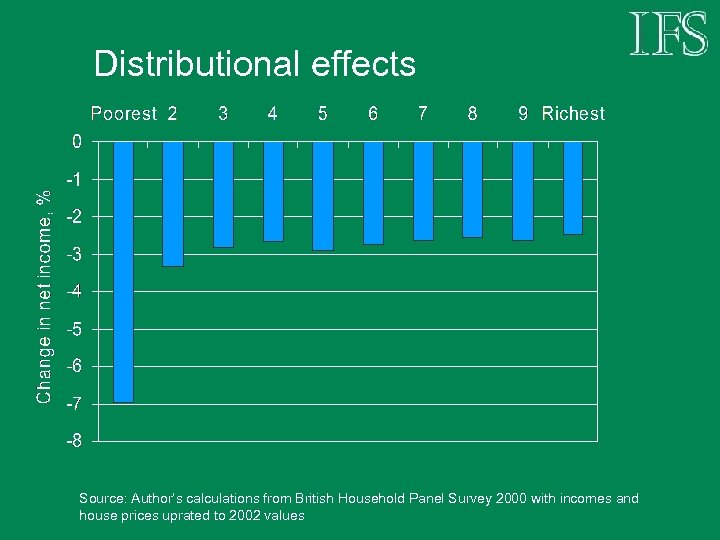

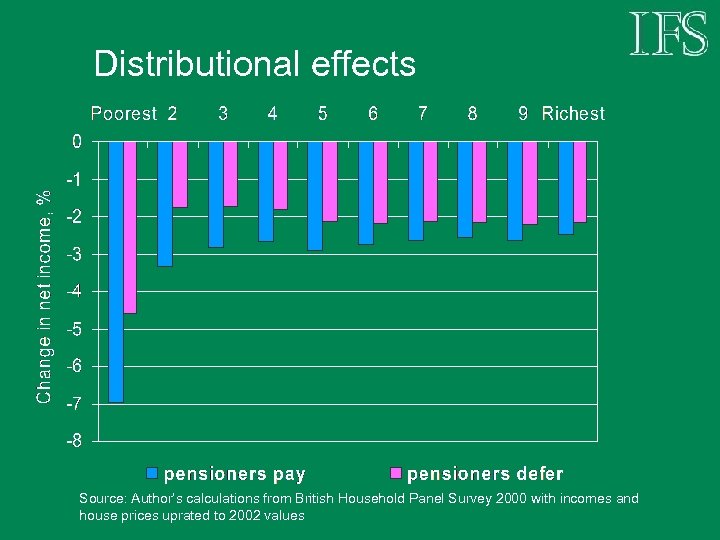

Distributional effects Source: Author’s calculations from British Household Panel Survey 2000 with incomes and house prices uprated to 2002 values

Distributional effects Source: Author’s calculations from British Household Panel Survey 2000 with incomes and house prices uprated to 2002 values

Property Tax • Estimated revenue £ 16 bn (2002) • Larger burden at bottom of distribution • Low income, high housing wealth: are they “poor”? • Includes many pensioners

Property Tax • Estimated revenue £ 16 bn (2002) • Larger burden at bottom of distribution • Low income, high housing wealth: are they “poor”? • Includes many pensioners

Distributional effects Source: Author’s calculations from British Household Panel Survey 2000 with incomes and house prices uprated to 2002 values

Distributional effects Source: Author’s calculations from British Household Panel Survey 2000 with incomes and house prices uprated to 2002 values

Property Tax • Estimated revenue £ 16 bn (2002) • Larger burden at bottom of distribution • Low income, high housing wealth: are they “poor”? • Includes many pensioners • Slightly less regressive than council tax – Revenue similar (for modelled example) • Cost of revaluation?

Property Tax • Estimated revenue £ 16 bn (2002) • Larger burden at bottom of distribution • Low income, high housing wealth: are they “poor”? • Includes many pensioners • Slightly less regressive than council tax – Revenue similar (for modelled example) • Cost of revaluation?

Conclusions • Govt. may need to raise taxes to meet fiscal rules • Housing could provide potential source of significant new revenue • Not easy to justify based on housing being ‘under-taxed’ • Stabilisation another reason for reform • Needs careful consideration and consultation • Would justify reformed rather than higher taxation

Conclusions • Govt. may need to raise taxes to meet fiscal rules • Housing could provide potential source of significant new revenue • Not easy to justify based on housing being ‘under-taxed’ • Stabilisation another reason for reform • Needs careful consideration and consultation • Would justify reformed rather than higher taxation