44ff4b419d53bc4b905c1fd151f3ba46.ppt

- Количество слайдов: 32

The Talitha Group Beyond the abyss: What did we learn (if anything)? Prof. Luc Nijs Riga Graduate School of Law Founder & Group CEO The Talitha Group Lagos Nigeria, 25 -26 August 2009

Agenda for this session (more or less) How has the world economy changed? What does it mean for emerging markets and EM companies? Are EM’s still more risky? Semi-globalization strategies The Human Capital paradox in EM’s Marketing 3. 0 Non-market strategy - the missing link The Talitha Group

How the world economy has changed? Fin. Eco. crisis has acted as an ignition Underlying current has been in place for many years now Swap in debtorcreditor nations EM’s no longer a super-cyclical play Translation of that process to EM companies Combination of volumedemographics, technology (digitalization) and resources will position EM’s to become a undeniable force in world economy Old (Western) model of economic superiority no longer valid The Talitha Group

How the world economy has changed? Western investors are still not willing to get it right Most portfolio’s still have only 3 -5% EM exposure PPP-adjusted portfolio construction justifies between 40 -50% of EM exposure in a global portfolio World is a slow-learning place Some examples The Talitha Group

How the world economy has changed? Alignment of shareholder interest & compensation models: ◦ In the period 2003 -2007, the 7 largest US investment banks created 41, 8 bio. USD in equity value ◦ In the same period those banks delivered 226, 4 bio USD in compensation ◦ Extremes: Merrill Lynch 21, 5 leverage (compensation/equity) vs. JP Morgan 1, 14 Pure mirroring of how the crisis has unfolded ROI has never been risk adjusted Explains the high ROI in the Financial services industry relative to other industries ◦ Since Q 2 all banks (even those covered by TARP and the pay czar) have returned to pre-crisis practices ◦ Problem is the good old ‘agency conflict’ ◦ Those banks used to be private partnerships where risk-return trade-off was better balanced The Talitha Group

Are EM’s more risky? Often a shallow discussion since most EM risk is non-economic and therefore non-quantifiable risk CDS spreads for BRIC’s are these days lower than for the California state bonds Bubbles in the making: Effect of quantitative easing in West: ◦ Fixed-income ◦ Currencies ◦ Cf. burning your furniture to heat the house ◦ LT effects can/will be disastrous ◦ Strategic effect limited: no direct link with job creation or consumer spending which accounts for 70% of US GDP The Talitha Group

What else didn’t we learn JP Morgan chief economist James Glassman in a report 14/8/2009 ◦ V-shaped recovery is arriving ◦ Pent-up demand will boost economy to 3, 5 % GDP growth for the quarters to come ◦ No jobless recovery ◦ No new normal Versus Nouriel Roubini in April 2009 ◦ W-shaped recovery a potential risk ◦ Especially when commodities rebound too fast ◦ Inflationary pressures The Talitha Group

What else didn’t we learn Versus Luc Nijs October 2008 in a letter to investors: ‘The scope & nature of the crisis forces us to believe that future GDP growth for (at least) the next couple of years in the US will be capped by productivity growth determined by: ◦ ◦ ◦ Deleveraging balance sheets of corporations and households Permanent destruction of certain levels of consumer demand Capital destruction (and therefore job destruction) QE and leveraging of governments (and future tax hikes) Permanent dislocation of real estate valuations’ The Talitha Group

What else didn’t we learn This seems to be the first recession where we didn’t fix anything (rather then destroy wealth) Some are still in denial about what happened Banks back to the old normal Excessive margins on all banking products Limited refocus on relevance EM’s in future economic play Interest rates are a dangerous play: they act as traffic lights in an economy and these days all lights are on green The Talitha Group

What does it mean for EM’s and EM companies? Historically characterized by higher volatility and lower liquidity Causing investors to demand higher risk premiums For EM companies this meant that they learned to live with: ◦ ◦ Higher volatility Institutional and regulatory voids Trade & currency restrictions … BUT… The Talitha Group

What does it mean for EM’s and EM companies? Decoupling is not a yes-or-no phenomenon Decoupling happens in rounds (and the rounds are appearing faster and faster) For now decoupling is limited by immature capital markets in EM’s and weak social structures that will cap consumer spending in EM’s Globalization will always create a certain level of linkage between economies The Talitha Group

What does it mean for EM’s and EM companies? Organizations are ‘build to change’ (not ‘build to last’) More and enhanced agility On average, less leveraged balance sheets Tomorrow’s global giants are not the usual suspects EM to EM transactions are the trade which is improving the most in recent years EM companies are very well positioned to determine global economy going forward But also some issues to sort out… The Talitha Group

What does it mean for EM’s and EM companies? 80% of companies are having success cause they fill a gap in their domestic market Which has been modeled based on a local institutional and regulatory environment Taking that model and being successful abroad needs careful attention: The Talitha Group

Globalization strategies Even large MNC’s fail here on ap ta Expensive when covering many countries Ad • tio n (? ) What advantage to you have over other local players Impact on how to manage a firm: (de)centralized ati eg gr • Regional strategies • Become local Ag • Most important for firms with high fixed cost base • Remodel firm DNA • Adjust to local conditions • Find commonalities among countries • • • Arbitrage • Exploit differences between markets • Needs willingness and ability to change • Needs creative, fearless executives • Some strategies get outdates fe. abor arbitrage The Talitha Group

Semi- globalization strategies Lo G Gl loba ob al l-Act t Ac al- ink ob Gl l ca Th ink Th Think Local-Act Local The Talitha Group

Some other issues we need to cover When do joint ventures with foreign partners work? Building brand equity: you can’t chase money, it needs to chase you When knowledge hampers innovation? Are we at the end of a technology cycle globally? Climate change: impact most probably to be larger than last industrial revolutions The Talitha Group

Talitha Executive no wl d) k (A pp lie HC-related issue not just training Paradigm building rve cu • • ing rn Decay of information Agility build-up a Le • Applicability in new context • ed ge • Firms and its people • Adaptability • Transportability • Firm DNA adjustment • Auto-didactic skill development The Talitha Group

How to behave as a corporate executive during recessions Continuum perpetuum: Engage in opportunities Forego opportunities Risk of going overboard Create permanent competitive disadvantage The Talitha Group

Which organizations have lasted for centuries Those that: 1. 2. 3. 4. Are aware of their identity Are tolerant to new ideas Adapt to their environment Are conservatively financed Only the paranoids survive! The Talitha Group

Effect of globalization Globalization and digitalization is causing a form of permanent turbulence Will make life more difficult for executives Globalization gone wild: everybody is competing with everybody Even more difficult is managing the effect of reversed globalization that we are experiencing these days The Talitha Group

Effect of globalization Globalization is no monotonic linear upward-sloping curve as we would like to believe Distance still matters 3 strategies are only a start (p. 13): ◦ For most companies the question is not which strategy cause all three apply simultaneously but the questions is more to what degree do they need to interact to end up with the best result The Talitha Group

Human Capital in emerging markets Not everybody is like you! Value set might be very different Cash and career visibility not necessarily the backbone Honor, holidays, personal responsibility, facilities for families…. HC paradox Chinese behavior on African continent a good example ◦ Involve local communities ◦ Relevance of expats in firms has declined significantly last decade There is more capital than talent in this world (even after this recession) The Talitha Group

Marketing 3. 0 Marketing 1. 0 (’ 80): convincing arguments ◦ Fe. Buy our products cause it… Marketing 2. 0 (’ 90): target emotions ◦ Fe. Your children will be thankful Marketing 3. 0 (going forward): targets the mind: turn your client into business partners ◦ Fe. Involve them in issues like sustainability, environment, climate change… Be disruptive…you need to be a maverick to be successful Link with non-market strategy essential The Talitha Group

Marketing 3. 0 Case of discussed turbulence: ◦ Link between corporate development and marketing needs to be stronger in order to allow them to pre-early identify investment opportunities Don’t treat marketing as just communication with the market Give them a central position in your firm The Talitha Group

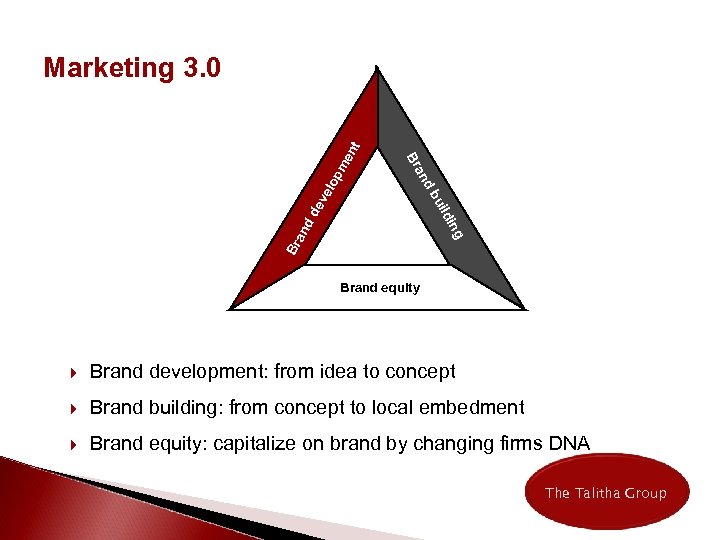

ve lop Br ing an d ild bu de d an Br me nt Marketing 3. 0 Brand equity Brand development: from idea to concept Brand building: from concept to local embedment Brand equity: capitalize on brand by changing firms DNA The Talitha Group

Non-market strategy Determines the interface between business and politics Manages the relationship between firm and government, regulator, NGO’s and the media/society Corporate citizenship Building of competitive advantage in a market strategy: ◦ Relationship to clients, suppliers, competitors, … The Talitha Group

Non-market strategy BUT competitive advantage can be lost or gained outside the market Most companies have given this little thought or don’t consider it part of their level playing field Although it is the place where the biggest difference can be made Most important: how to integrate market and non-market strategies in a consistent way The Talitha Group

Non-market strategy Now more important then ever: ◦ More and more products and services become commoditized ◦ In a globalized world your success in determined by much more than you and your clients; many more actors have an impact on your firm ◦ 24 hour/7 days news cycle: your business is impacted while you sleep Cost/Quality relationship no longer at the center of what you do The Talitha Group

Non-market strategy Which models are available: ◦ Government relations + public policy ◦ Communications ◦ CSR + sustainable development Top-down approach and buy-in of board absolutely necessary It needs an involvement of people who think differently ◦ Not the old model: fe. government relations= public policy + lawyers The Talitha Group

Non-market strategy Tools to build a non-market strategy 4 I‘s ◦ ◦ Issues Interest groups Institutions Information Identify opportunities and threats ◦ Data collection ◦ Strategy formulations The Talitha Group

Non-market strategy Critical is how to make your market and non-market strategy work together Market strategy is about ‘POSITIONING’ Non-market strategy is also about ‘POSITIONING’ Exploitation of opportunities in your firms’ political & social environment The Talitha Group

THANK YOU! To elaborate further on the topic discussed, please contact: Professor Luc Nijs Chair in investment banking E-mail: luc. nijs@rgsl. edu. lv Direct phone: +3214479370 The Talitha Group

44ff4b419d53bc4b905c1fd151f3ba46.ppt