b7593d60e58b7fb9fdea1e37b9bbb463.ppt

- Количество слайдов: 45

The Single European Market (SEM)

The Single European Market (SEM)

Contents • Origins of the Single Market • Expected benefits of the CM • Dynamic Effects of the Single Market • Reassessment of the Single Market • Latest developments

Contents • Origins of the Single Market • Expected benefits of the CM • Dynamic Effects of the Single Market • Reassessment of the Single Market • Latest developments

Origins • Article 3, Treaty of Rome: ‘the elimination, as between member states, of customs duties and quantitative restrictions on the import and export of goods, and all other measures having equivalent effect; the abolition as between member states, of obstacles to freedom of movement for persons, services and capital’

Origins • Article 3, Treaty of Rome: ‘the elimination, as between member states, of customs duties and quantitative restrictions on the import and export of goods, and all other measures having equivalent effect; the abolition as between member states, of obstacles to freedom of movement for persons, services and capital’

Origins… • programme to create a Common Market (CM) • Initial date proposed: 1969 • Free trade but restrictions to capital movements + mobility barriers • Official beginning: 1 st January 1993

Origins… • programme to create a Common Market (CM) • Initial date proposed: 1969 • Free trade but restrictions to capital movements + mobility barriers • Official beginning: 1 st January 1993

Origins… • 1978: the Cassis de Dijon case – The ECJ ruled that Germany could not ban the importing of Cassis de Dijon on the grounds that it did not conform to German rules governing the sale of alcohol – It meant mutual recognition of each other’s rules and regulations • 1979: the introduction of the European Monetary System (EMS)

Origins… • 1978: the Cassis de Dijon case – The ECJ ruled that Germany could not ban the importing of Cassis de Dijon on the grounds that it did not conform to German rules governing the sale of alcohol – It meant mutual recognition of each other’s rules and regulations • 1979: the introduction of the European Monetary System (EMS)

Origins… • 1983 – The European Roundtable of Industrialists (ERT): 46 Industrial leaders propose CM plan including: • Trade facilitation • Opening public procurement • Harmonisation of technical standards • Fiscal harmonisation

Origins… • 1983 – The European Roundtable of Industrialists (ERT): 46 Industrial leaders propose CM plan including: • Trade facilitation • Opening public procurement • Harmonisation of technical standards • Fiscal harmonisation

Origins… • 1983 – Stuttgart Summit • recognised that the failure to establish a CM had resulted in major problems for EC companies. • 1985 – White Paper ‘Completing the Internal Market’ • Objective: The creation of a CM by end of 1992

Origins… • 1983 – Stuttgart Summit • recognised that the failure to establish a CM had resulted in major problems for EC companies. • 1985 – White Paper ‘Completing the Internal Market’ • Objective: The creation of a CM by end of 1992

Origin… • 1987 • The Single European Act – Amended the Treaty of Rome to allow majority voting in issues of the Single Market – Article 13: • ‘The internal market shall comprise an area without internal frontiers in which the free movement of goods, persons, services and capital is ensured in accordance with the provision of this Treaty’

Origin… • 1987 • The Single European Act – Amended the Treaty of Rome to allow majority voting in issues of the Single Market – Article 13: • ‘The internal market shall comprise an area without internal frontiers in which the free movement of goods, persons, services and capital is ensured in accordance with the provision of this Treaty’

Freedoms of movement • Free movement of goods • Free movement of factors: –Capital –Labour • Welfare increase principle the same in all cases

Freedoms of movement • Free movement of goods • Free movement of factors: –Capital –Labour • Welfare increase principle the same in all cases

Free Movement of Labour • Once labour barriers are reduced, labour will move from low to high wage countries. • Wages in the former will tend to rise due to a reduced supply of labour, while in the latter they will tend to fall due to a rising labour supply, i. e. wage equalisation. – But: cultural/language barriers in EU

Free Movement of Labour • Once labour barriers are reduced, labour will move from low to high wage countries. • Wages in the former will tend to rise due to a reduced supply of labour, while in the latter they will tend to fall due to a rising labour supply, i. e. wage equalisation. – But: cultural/language barriers in EU

Free Movement of Capital • If the rate of return on investment is higher in one country than in another, investment funds will tend to move to the latter until the rate is equalised. – But, the capital flows can be influenced by uncertainty and different monetary and exchange rate policies. – The establishment of EMU with fixed exchange and interest rates should remove such a distortion.

Free Movement of Capital • If the rate of return on investment is higher in one country than in another, investment funds will tend to move to the latter until the rate is equalised. – But, the capital flows can be influenced by uncertainty and different monetary and exchange rate policies. – The establishment of EMU with fixed exchange and interest rates should remove such a distortion.

The Single European Act • Programme towards a larger market without frontiers – Economic and social cohesion – Common policy on technological/scientific development – EMS strengthening – European social dimension – Coordinated environment protection

The Single European Act • Programme towards a larger market without frontiers – Economic and social cohesion – Common policy on technological/scientific development – EMS strengthening – European social dimension – Coordinated environment protection

Action focus for SEM The elimination between EC states of: • Physical • Technical • Fiscal barriers New EC approach: • ‘approximation instead of standardization’ • the removal of internal frontiers • a binding timetable

Action focus for SEM The elimination between EC states of: • Physical • Technical • Fiscal barriers New EC approach: • ‘approximation instead of standardization’ • the removal of internal frontiers • a binding timetable

Allocation effects revisited • Real world – perfect competition vs. imperfect competition – understand why gains from customs union not too high –Fact: Intra-EU trade is 70 -80% intraindustry, thus not driven by comparative advantage. –We need models with imperfect competition.

Allocation effects revisited • Real world – perfect competition vs. imperfect competition – understand why gains from customs union not too high –Fact: Intra-EU trade is 70 -80% intraindustry, thus not driven by comparative advantage. –We need models with imperfect competition.

Transaction costs and CMs • Markets influenced by transaction costs of firms • Factors influencing the size of transaction costs: –Legal and regulatory framework –Macroeconomic policy framework –Fragmentation of markets

Transaction costs and CMs • Markets influenced by transaction costs of firms • Factors influencing the size of transaction costs: –Legal and regulatory framework –Macroeconomic policy framework –Fragmentation of markets

Understanding the European market Observation –segmented markets, with prices independent across countries –policies that raise cost of entering specific market (e. g. licensing)

Understanding the European market Observation –segmented markets, with prices independent across countries –policies that raise cost of entering specific market (e. g. licensing)

Understanding the European market Evidence for fragmentation? • Large variation in average prices –for consumer goods 15. 2% around mean –telephone and telegram 50% around mean • Conclusion? –Too little competition, too many firms operating at inefficient level

Understanding the European market Evidence for fragmentation? • Large variation in average prices –for consumer goods 15. 2% around mean –telephone and telegram 50% around mean • Conclusion? –Too little competition, too many firms operating at inefficient level

Effects of market integration • Intensified competition, which • Reduces firms monopoly power • Lower prices • Inefficient firms exiting • Allows for more products to be consumed • Scale reduces costs of production

Effects of market integration • Intensified competition, which • Reduces firms monopoly power • Lower prices • Inefficient firms exiting • Allows for more products to be consumed • Scale reduces costs of production

Effects of market integration… • In sum: Integration may turn previously segmented markets in to a single integrated market

Effects of market integration… • In sum: Integration may turn previously segmented markets in to a single integrated market

Competition effects of SEM Barriers to go by end 1992: • Cost increasing barriers – Fiscal barriers (taxes and subsidies) – Quantitative barriers (quotas on steel) – Different norms and technical regulations – Real costs of trade (border checks, at 1. 7% of value of intra-EU trade)

Competition effects of SEM Barriers to go by end 1992: • Cost increasing barriers – Fiscal barriers (taxes and subsidies) – Quantitative barriers (quotas on steel) – Different norms and technical regulations – Real costs of trade (border checks, at 1. 7% of value of intra-EU trade)

Competition effects of SEM • Market entry restrictions – Protectionist public procurement – Different service regulation (banking; insurance) – Capital controls (still in 8 out of 12 countries) – Different legal frameworks

Competition effects of SEM • Market entry restrictions – Protectionist public procurement – Different service regulation (banking; insurance) – Capital controls (still in 8 out of 12 countries) – Different legal frameworks

The Cecchini Report • Study carried out for the European Commission to estimate result of completion of internal market – A rosy view? Costs of integration?

The Cecchini Report • Study carried out for the European Commission to estimate result of completion of internal market – A rosy view? Costs of integration?

The Cecchini Report • A 4 stage assessment of benefits from: • Removing barriers to trade (e. g. frontier controls) • Removing technical barriers • The creation of scale economies • Reducing X-inefficiency and monopoly power

The Cecchini Report • A 4 stage assessment of benefits from: • Removing barriers to trade (e. g. frontier controls) • Removing technical barriers • The creation of scale economies • Reducing X-inefficiency and monopoly power

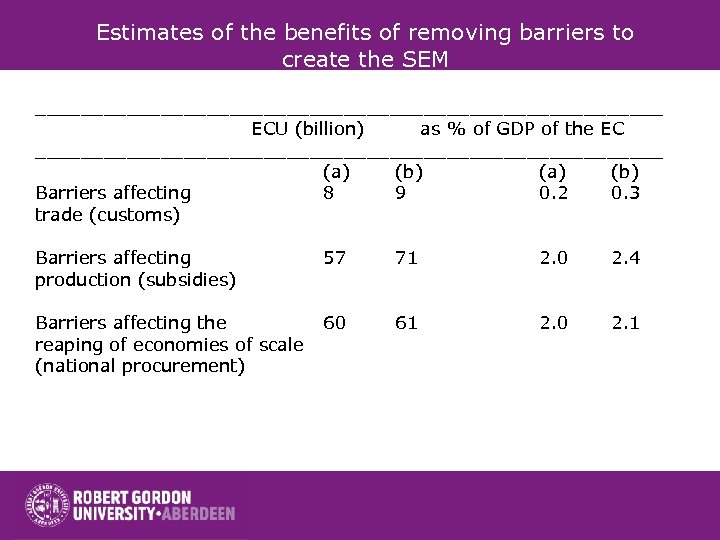

Estimates of the benefits of removing barriers to create the SEM ____________________________ ECU (billion) as % of GDP of the EC ____________________________ (a) (b) Barriers affecting 8 9 0. 2 0. 3 trade (customs) Barriers affecting production (subsidies) 57 71 2. 0 2. 4 Barriers affecting the reaping of economies of scale (national procurement) 60 61 2. 0 2. 1

Estimates of the benefits of removing barriers to create the SEM ____________________________ ECU (billion) as % of GDP of the EC ____________________________ (a) (b) Barriers affecting 8 9 0. 2 0. 3 trade (customs) Barriers affecting production (subsidies) 57 71 2. 0 2. 4 Barriers affecting the reaping of economies of scale (national procurement) 60 61 2. 0 2. 1

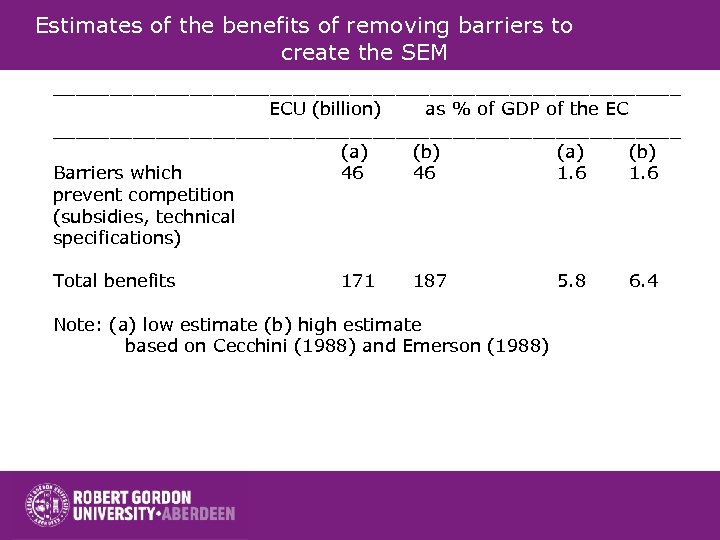

Estimates of the benefits of removing barriers to create the SEM ____________________________ ECU (billion) as % of GDP of the EC ____________________________ (a) (b) Barriers which 46 46 1. 6 prevent competition (subsidies, technical specifications) Total benefits 171 187 Note: (a) low estimate (b) high estimate based on Cecchini (1988) and Emerson (1988) 5. 8 6. 4

Estimates of the benefits of removing barriers to create the SEM ____________________________ ECU (billion) as % of GDP of the EC ____________________________ (a) (b) Barriers which 46 46 1. 6 prevent competition (subsidies, technical specifications) Total benefits 171 187 Note: (a) low estimate (b) high estimate based on Cecchini (1988) and Emerson (1988) 5. 8 6. 4

Benefits revisited • Improved supply-side of the EC economy: – higher aggregate demand by increasing real purchasing power – increased investment – improved competitiveness of EC relative to rest of the world

Benefits revisited • Improved supply-side of the EC economy: – higher aggregate demand by increasing real purchasing power – increased investment – improved competitiveness of EC relative to rest of the world

Benefits • Improvements in public sector budgets: – reduction in cost of public procurement – growth of GDP and tax revenue – more public expenditure and reduced unemployment through restructuring

Benefits • Improvements in public sector budgets: – reduction in cost of public procurement – growth of GDP and tax revenue – more public expenditure and reduced unemployment through restructuring

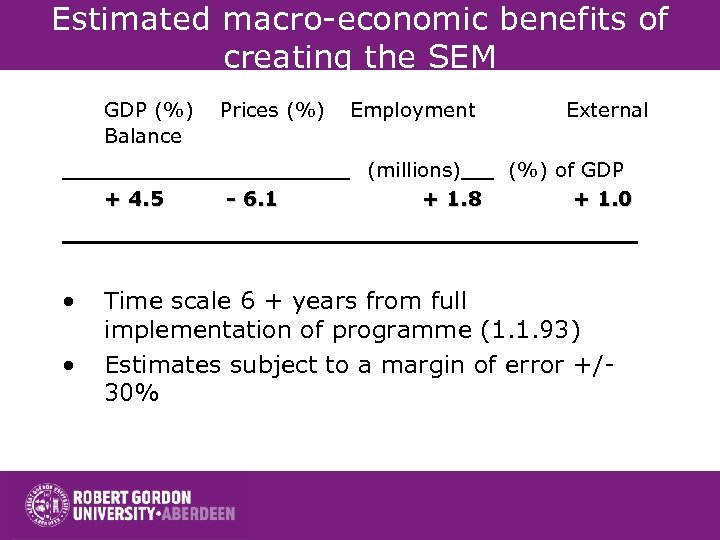

Estimated macro-economic benefits of creating the SEM GDP (%) Balance + 4. 5 • • Prices (%) - 6. 1 Employment (millions) + 1. 8 External (%) of GDP + 1. 0 Time scale 6 + years from full implementation of programme (1. 1. 93) Estimates subject to a margin of error +/30%

Estimated macro-economic benefits of creating the SEM GDP (%) Balance + 4. 5 • • Prices (%) - 6. 1 Employment (millions) + 1. 8 External (%) of GDP + 1. 0 Time scale 6 + years from full implementation of programme (1. 1. 93) Estimates subject to a margin of error +/30%

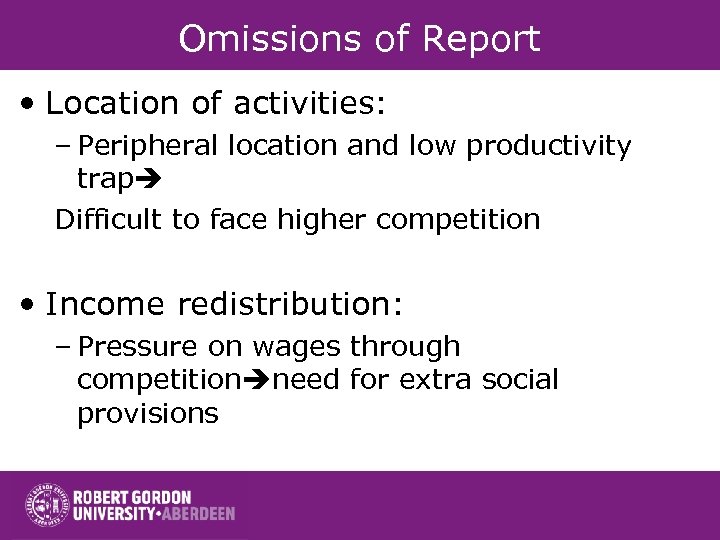

Omissions of Report • Location of activities: – Peripheral location and low productivity trap Difficult to face higher competition • Income redistribution: – Pressure on wages through competition need for extra social provisions

Omissions of Report • Location of activities: – Peripheral location and low productivity trap Difficult to face higher competition • Income redistribution: – Pressure on wages through competition need for extra social provisions

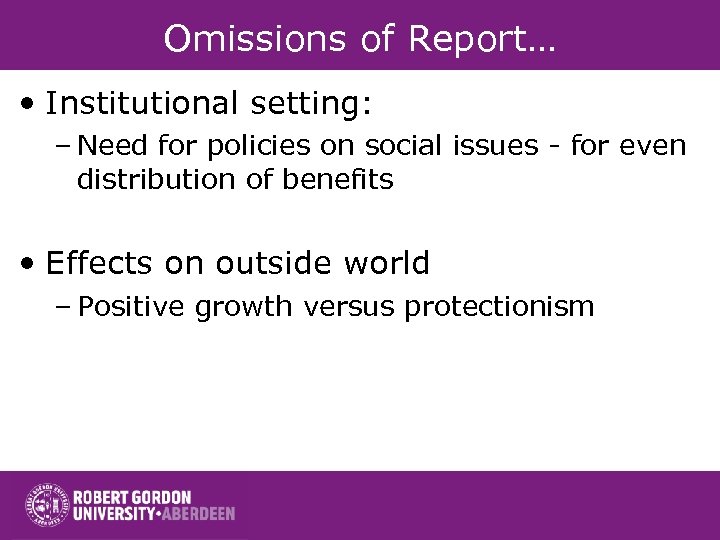

Omissions of Report… • Institutional setting: – Need for policies on social issues - for even distribution of benefits • Effects on outside world – Positive growth versus protectionism

Omissions of Report… • Institutional setting: – Need for policies on social issues - for even distribution of benefits • Effects on outside world – Positive growth versus protectionism

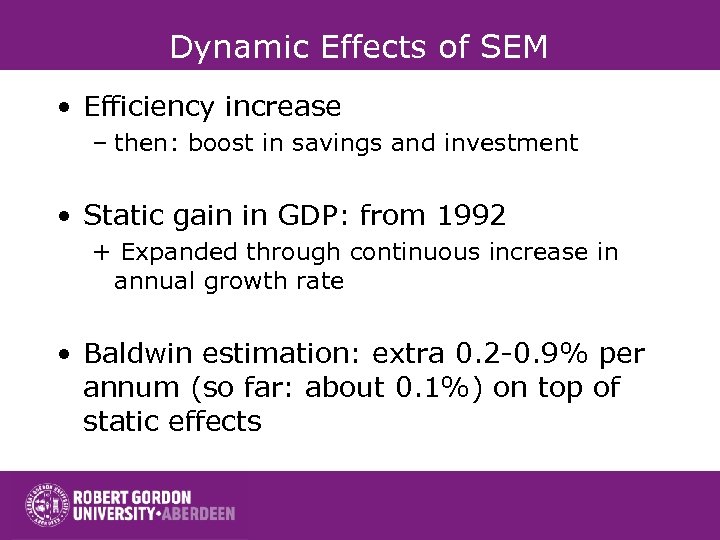

Dynamic Effects of SEM • Efficiency increase – then: boost in savings and investment • Static gain in GDP: from 1992 + Expanded through continuous increase in annual growth rate • Baldwin estimation: extra 0. 2 -0. 9% per annum (so far: about 0. 1%) on top of static effects

Dynamic Effects of SEM • Efficiency increase – then: boost in savings and investment • Static gain in GDP: from 1992 + Expanded through continuous increase in annual growth rate • Baldwin estimation: extra 0. 2 -0. 9% per annum (so far: about 0. 1%) on top of static effects

Dynamic Effects of Single Market • Translation into medium term effect: – Dynamic effects add 30% to 100% to static effect • Reality: – New evaluation needed – Reasons: • Need to distinguish sector effects • The distinction between what happened and what would be without Single Market • Political changes: e. g. German unification • Long term effects!?

Dynamic Effects of Single Market • Translation into medium term effect: – Dynamic effects add 30% to 100% to static effect • Reality: – New evaluation needed – Reasons: • Need to distinguish sector effects • The distinction between what happened and what would be without Single Market • Political changes: e. g. German unification • Long term effects!?

Dynamic Effect of Single European Market • Long term: growth of product per worker is continuing – Increasing returns to reproducible factors (explosive growth) – Constant returns to reproducible factors (ongoing growth) Thus: Integration can have permanent growth effect

Dynamic Effect of Single European Market • Long term: growth of product per worker is continuing – Increasing returns to reproducible factors (explosive growth) – Constant returns to reproducible factors (ongoing growth) Thus: Integration can have permanent growth effect

SEM – A 1996 Review by the Commission • Effect of frontier control removal – need of new taxation system • Technical regulations – slow acceptance of mutual recognition • Public procurement – lack of European standards and…success

SEM – A 1996 Review by the Commission • Effect of frontier control removal – need of new taxation system • Technical regulations – slow acceptance of mutual recognition • Public procurement – lack of European standards and…success

SEM – A 1996 Review by the Commission • Accumulation effect: – Estimated at 1. 1 -1. 5% of GDP – Extra 300, 000 -900, 000 extra jobs • Location effects – Convergence of states But: geography, institutions, quality, technology matter!

SEM – A 1996 Review by the Commission • Accumulation effect: – Estimated at 1. 1 -1. 5% of GDP – Extra 300, 000 -900, 000 extra jobs • Location effects – Convergence of states But: geography, institutions, quality, technology matter!

10 years anniversary of SEM • New Review by Commission in 2002 – Effects of SEM between 1992 -2002: • GDP: 1. 8% higher (164. 5 bn Euro higher) • Employment: 1. 46% higher (2. 5 million extra jobs) • FDI: intra-EU 15 times increase between 1995 and 2000 (from third countries 4 times higher)

10 years anniversary of SEM • New Review by Commission in 2002 – Effects of SEM between 1992 -2002: • GDP: 1. 8% higher (164. 5 bn Euro higher) • Employment: 1. 46% higher (2. 5 million extra jobs) • FDI: intra-EU 15 times increase between 1995 and 2000 (from third countries 4 times higher)

10 years anniversary of SEM… – Effects of SEM between 1992 -2002 (continued): • Downward price convergence (3. 6%) • Productivity immediately after 1992: up 2% • Cross-border procurement: increase from 6% (1987) to 10% (1998) • Export goods price convergence (50% of all in EU)

10 years anniversary of SEM… – Effects of SEM between 1992 -2002 (continued): • Downward price convergence (3. 6%) • Productivity immediately after 1992: up 2% • Cross-border procurement: increase from 6% (1987) to 10% (1998) • Export goods price convergence (50% of all in EU)

10 years anniversary of SEM… – Areas with scope of further integration: • Financial Markets (extra 1% of GDP, and extra 0. 5 million jobs) –Higher liquidity increases companies value added by 0. 74%-0. 92% • Network industries (utilities): lower costs

10 years anniversary of SEM… – Areas with scope of further integration: • Financial Markets (extra 1% of GDP, and extra 0. 5 million jobs) –Higher liquidity increases companies value added by 0. 74%-0. 92% • Network industries (utilities): lower costs

Conference organised by ANO pro Evropu, Prague, 13 October 2006

Conference organised by ANO pro Evropu, Prague, 13 October 2006

Any Problems with SM implementation? See: SOLVIT Also check: Improving the Single Market

Any Problems with SM implementation? See: SOLVIT Also check: Improving the Single Market

Readings • El-Agraa, ch*. 11, ch. 7 • Baldwin, R. E. , 1989. ‘The growth effects of 1992’, in Economic Policy, October. (individual article copy also available in library) • Baldwin and Wyplosz, ch. 6, 7

Readings • El-Agraa, ch*. 11, ch. 7 • Baldwin, R. E. , 1989. ‘The growth effects of 1992’, in Economic Policy, October. (individual article copy also available in library) • Baldwin and Wyplosz, ch. 6, 7

Readings • European Commission, 2003. The Internal Market – Ten years without frontiers. • European Commission, 1996. ‘Economic Evaluation of the Internal Market’, European Economy. Reports and Studies No. 4, Luxembourg: Office for Official Publications of the European Communities. • Checchini, P. , 1988. The European Challenge: 1992. The Benefits of a Single Market, Aldershot: Wildwood House.

Readings • European Commission, 2003. The Internal Market – Ten years without frontiers. • European Commission, 1996. ‘Economic Evaluation of the Internal Market’, European Economy. Reports and Studies No. 4, Luxembourg: Office for Official Publications of the European Communities. • Checchini, P. , 1988. The European Challenge: 1992. The Benefits of a Single Market, Aldershot: Wildwood House.