ccb16fa3d7695ea59db4a8b377d963ff.ppt

- Количество слайдов: 40

The Seven Year’s War and Financing the War for Independence

The Seven Year’s War and Financing the War for Independence

The Colonial Problem • 17 th & 18 th century world gold & silver coin monetary regime • Colonies have persistent balance of payments deficit • Why? Consequences? • Solutions? – Specie Substitutes – Devalue colonial currency (colonial pounds); Queen Anne’s Proclamation of 1703 – Issue Paper Money, Currency Acts of 1751 and 1764 • The case of NJ

The Colonial Problem • 17 th & 18 th century world gold & silver coin monetary regime • Colonies have persistent balance of payments deficit • Why? Consequences? • Solutions? – Specie Substitutes – Devalue colonial currency (colonial pounds); Queen Anne’s Proclamation of 1703 – Issue Paper Money, Currency Acts of 1751 and 1764 • The case of NJ

Kemmerer (1939): Colonial Loan. Office System in NJ • 1703 ---£ 100 sterling for £ 167 New Jersey pounds • 1709 NJ issues £ 3, 000 bills of credit for war against Canada, NJ pound £ 178. • English order the Governor to stop issues and retire notes. Taxes used to redeem. 1719 NJ £ 145 per £ 100 sterling. • “No money” • Why was there an increase in law suits for debt collection?

Kemmerer (1939): Colonial Loan. Office System in NJ • 1703 ---£ 100 sterling for £ 167 New Jersey pounds • 1709 NJ issues £ 3, 000 bills of credit for war against Canada, NJ pound £ 178. • English order the Governor to stop issues and retire notes. Taxes used to redeem. 1719 NJ £ 145 per £ 100 sterling. • “No money” • Why was there an increase in law suits for debt collection?

NJ Loan Office System • 1723 First NJ loan bank---£ 40, 000 legal tender, one shilling to three pounds denomination. • Loan office in each county. Loans £ 12 to £ 100. Interest 5%. Collateral 2 times value of loan. 12 years maturity---pay 1/12 th and interest annually. • Income to state government. Legislature votes duplicate pay and £ 1000 to governor. Public debt paid off and taxes cut.

NJ Loan Office System • 1723 First NJ loan bank---£ 40, 000 legal tender, one shilling to three pounds denomination. • Loan office in each county. Loans £ 12 to £ 100. Interest 5%. Collateral 2 times value of loan. 12 years maturity---pay 1/12 th and interest annually. • Income to state government. Legislature votes duplicate pay and £ 1000 to governor. Public debt paid off and taxes cut.

NJ Loan Office System • • Second Loan Bank 1732 Third and Last Loan Bank 1735. No more loan banks. French and Indian wars NJ issues £ 347, 000 in bills of credit. • Were the Loan Offices a “success? ” • “The pattern was sufficiently perfect to satisfy a fairly orthodox quantity theorist. ”

NJ Loan Office System • • Second Loan Bank 1732 Third and Last Loan Bank 1735. No more loan banks. French and Indian wars NJ issues £ 347, 000 in bills of credit. • Were the Loan Offices a “success? ” • “The pattern was sufficiently perfect to satisfy a fairly orthodox quantity theorist. ”

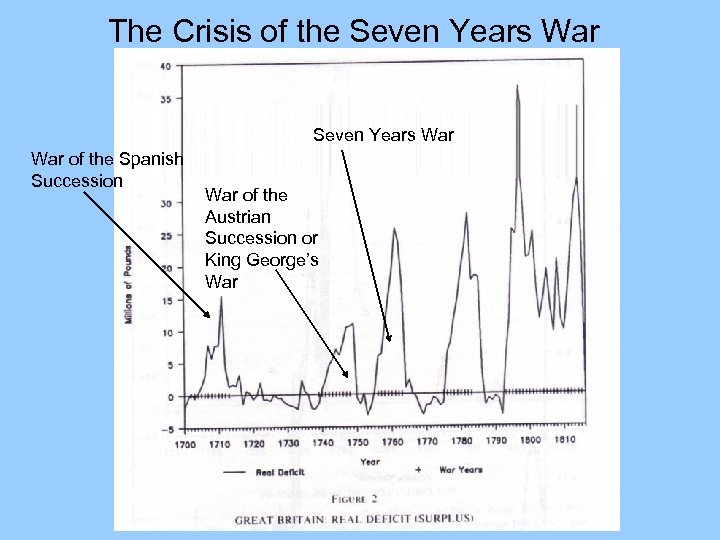

The Crisis of the Seven Years War War of the Spanish Succession War of the Austrian Succession or King George’s War

The Crisis of the Seven Years War War of the Spanish Succession War of the Austrian Succession or King George’s War

Seven Years’ War • British send thousands of troops • British pay salaries and expenses in specie. • Colonies asked to bear a share. They raise local militia, led by officers below rank of general. (Washington was a colonel. ) • Parliament promise to reimburse colonies for part of their costs.

Seven Years’ War • British send thousands of troops • British pay salaries and expenses in specie. • Colonies asked to bear a share. They raise local militia, led by officers below rank of general. (Washington was a colonel. ) • Parliament promise to reimburse colonies for part of their costs.

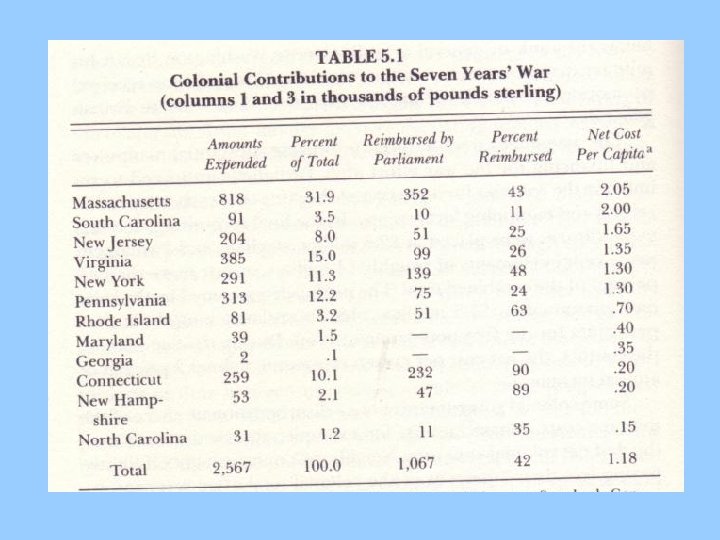

Seven Years War 1756 -1763 • The total war expenditures by colonies were £ 2. 5 million – British Parliament paid £ 1 million or 40%. – The cost = about 3% of GDP • The colonies banned from issuing fiat currency (land banks etc). They financed war largely by issuing bills of credit or debt that was then rapidly retired by high postwar taxes. • Burden disproportionate tensions among debtors & creditors and taxpayers and holders bills of credit

Seven Years War 1756 -1763 • The total war expenditures by colonies were £ 2. 5 million – British Parliament paid £ 1 million or 40%. – The cost = about 3% of GDP • The colonies banned from issuing fiat currency (land banks etc). They financed war largely by issuing bills of credit or debt that was then rapidly retired by high postwar taxes. • Burden disproportionate tensions among debtors & creditors and taxpayers and holders bills of credit

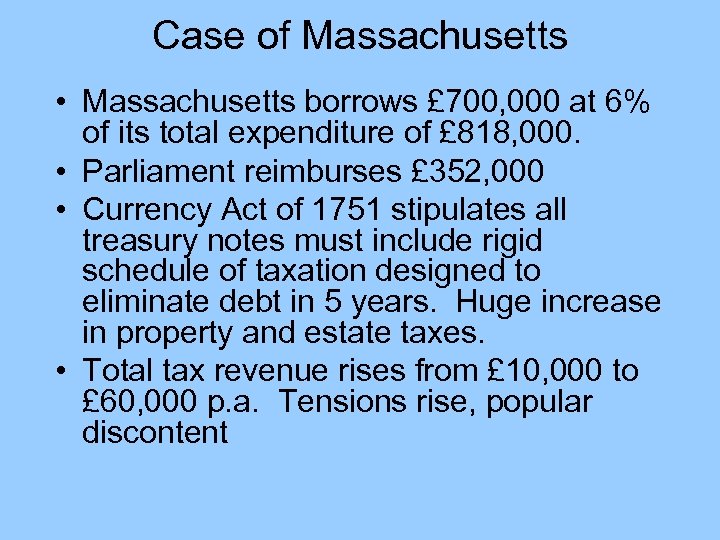

Case of Massachusetts • Massachusetts borrows £ 700, 000 at 6% of its total expenditure of £ 818, 000. • Parliament reimburses £ 352, 000 • Currency Act of 1751 stipulates all treasury notes must include rigid schedule of taxation designed to eliminate debt in 5 years. Huge increase in property and estate taxes. • Total tax revenue rises from £ 10, 000 to £ 60, 000 p. a. Tensions rise, popular discontent

Case of Massachusetts • Massachusetts borrows £ 700, 000 at 6% of its total expenditure of £ 818, 000. • Parliament reimburses £ 352, 000 • Currency Act of 1751 stipulates all treasury notes must include rigid schedule of taxation designed to eliminate debt in 5 years. Huge increase in property and estate taxes. • Total tax revenue rises from £ 10, 000 to £ 60, 000 p. a. Tensions rise, popular discontent

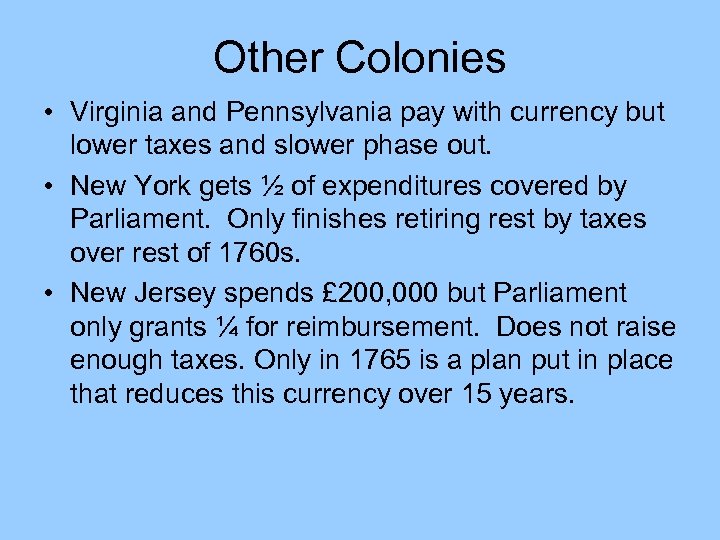

Other Colonies • Virginia and Pennsylvania pay with currency but lower taxes and slower phase out. • New York gets ½ of expenditures covered by Parliament. Only finishes retiring rest by taxes over rest of 1760 s. • New Jersey spends £ 200, 000 but Parliament only grants ¼ for reimbursement. Does not raise enough taxes. Only in 1765 is a plan put in place that reduces this currency over 15 years.

Other Colonies • Virginia and Pennsylvania pay with currency but lower taxes and slower phase out. • New York gets ½ of expenditures covered by Parliament. Only finishes retiring rest by taxes over rest of 1760 s. • New Jersey spends £ 200, 000 but Parliament only grants ¼ for reimbursement. Does not raise enough taxes. Only in 1765 is a plan put in place that reduces this currency over 15 years.

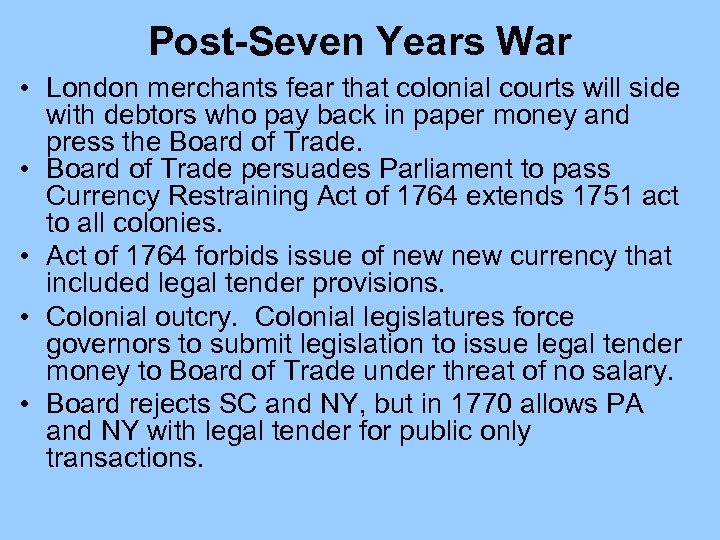

Post-Seven Years War • London merchants fear that colonial courts will side with debtors who pay back in paper money and press the Board of Trade. • Board of Trade persuades Parliament to pass Currency Restraining Act of 1764 extends 1751 act to all colonies. • Act of 1764 forbids issue of new currency that included legal tender provisions. • Colonial outcry. Colonial legislatures force governors to submit legislation to issue legal tender money to Board of Trade under threat of no salary. • Board rejects SC and NY, but in 1770 allows PA and NY with legal tender for public only transactions.

Post-Seven Years War • London merchants fear that colonial courts will side with debtors who pay back in paper money and press the Board of Trade. • Board of Trade persuades Parliament to pass Currency Restraining Act of 1764 extends 1751 act to all colonies. • Act of 1764 forbids issue of new currency that included legal tender provisions. • Colonial outcry. Colonial legislatures force governors to submit legislation to issue legal tender money to Board of Trade under threat of no salary. • Board rejects SC and NY, but in 1770 allows PA and NY with legal tender for public only transactions.

At end of colonial period • 1773 Parliament votes for act to allow currency issue as legal tender at face value for public but not private payments.

At end of colonial period • 1773 Parliament votes for act to allow currency issue as legal tender at face value for public but not private payments.

Background to War • Seven Years’ War (1756 -1763) Expensive. British taxes highest in world. • Postwar, colonists receive military protection at almost no cost---6, 000 , men at £ 350, 000 annually. Lowest taxes in Western world, ¼ of British taxes. • Sugar Act 1764: (1) strict enforcement of tariff (at a lower rate) on sugar from non-British West Indies (protection of British planters from cheaper French sugar) (2) Adds more enumerated articles, (3) new tariff on European imports. • Currency Restraining Act of 1764 extends 1751 act to all colonies. It forbids issue of new currency that included legal tender provisions. Angers debtors & colonial governments • Stamp Act of 1765 Stamp Congress of 1765, boycott of English goods repeal of Act and lowering of duties

Background to War • Seven Years’ War (1756 -1763) Expensive. British taxes highest in world. • Postwar, colonists receive military protection at almost no cost---6, 000 , men at £ 350, 000 annually. Lowest taxes in Western world, ¼ of British taxes. • Sugar Act 1764: (1) strict enforcement of tariff (at a lower rate) on sugar from non-British West Indies (protection of British planters from cheaper French sugar) (2) Adds more enumerated articles, (3) new tariff on European imports. • Currency Restraining Act of 1764 extends 1751 act to all colonies. It forbids issue of new currency that included legal tender provisions. Angers debtors & colonial governments • Stamp Act of 1765 Stamp Congress of 1765, boycott of English goods repeal of Act and lowering of duties

Background to War • Quartering Act of 1765. • Declaratory Act 1766: affirms British right to legislate and tax colonies. • New chancellor of exchequer worried about high property taxes on English landowners: Townshend duties with enforcement by admiralty courts with general search warrants against smuggling • Riots and a new boycott. Decline in British merchants exports. 1770 Townshend duties repealed. • Tea Act of 1773: English East India Company allowed to ship directly to colonies, underselling Dutch smugglers and bypassing American merchants……. Tea Party.

Background to War • Quartering Act of 1765. • Declaratory Act 1766: affirms British right to legislate and tax colonies. • New chancellor of exchequer worried about high property taxes on English landowners: Townshend duties with enforcement by admiralty courts with general search warrants against smuggling • Riots and a new boycott. Decline in British merchants exports. 1770 Townshend duties repealed. • Tea Act of 1773: English East India Company allowed to ship directly to colonies, underselling Dutch smugglers and bypassing American merchants……. Tea Party.

Background to War • Intolerable Acts 1774: (1) Close Port of Boston to all shipping until pay for Tea (2) British officials charged with crimes to be tried in other colonies (3) Revise Massachusetts charter by Crown appointed governor (4) Quarter Troops in Boston. • Boycott and First Continental Congress. • The Interior: Before 1763, British policy encourages rapid westward development against France and Spain. • Proclamation of 1763 ---reserves lands for Indians that are claimed by colonies. Keep out colonists and have land directly sold by Crown. • Quebec Act gives territory claimed by colonies (Ohio, Indiana, Illinois, Michigan and Minnesota) to Quebec. • July 4, 1776

Background to War • Intolerable Acts 1774: (1) Close Port of Boston to all shipping until pay for Tea (2) British officials charged with crimes to be tried in other colonies (3) Revise Massachusetts charter by Crown appointed governor (4) Quarter Troops in Boston. • Boycott and First Continental Congress. • The Interior: Before 1763, British policy encourages rapid westward development against France and Spain. • Proclamation of 1763 ---reserves lands for Indians that are claimed by colonies. Keep out colonists and have land directly sold by Crown. • Quebec Act gives territory claimed by colonies (Ohio, Indiana, Illinois, Michigan and Minnesota) to Quebec. • July 4, 1776

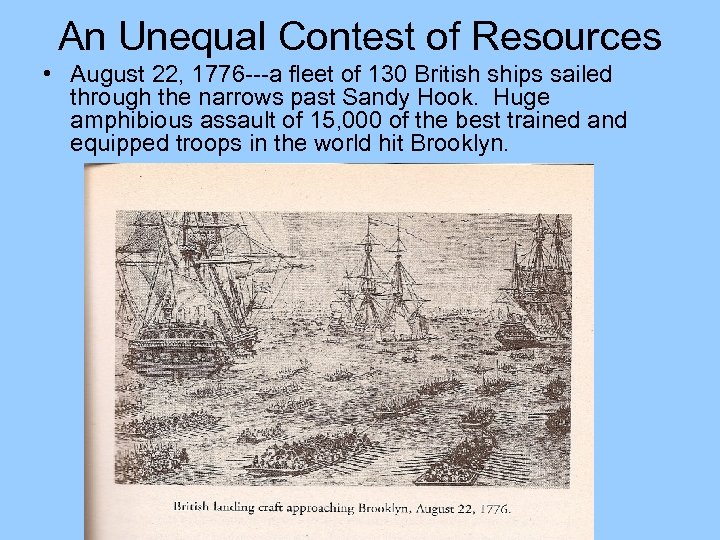

An Unequal Contest of Resources • August 22, 1776 ---a fleet of 130 British ships sailed through the narrows past Sandy Hook. Huge amphibious assault of 15, 000 of the best trained and equipped troops in the world hit Brooklyn.

An Unequal Contest of Resources • August 22, 1776 ---a fleet of 130 British ships sailed through the narrows past Sandy Hook. Huge amphibious assault of 15, 000 of the best trained and equipped troops in the world hit Brooklyn.

An Unequal Contest of Resources • Britain, wealthy, best fleet, superior army, most advanced finances in Europe. Population 10 times colonies. • Idea was to raise a big army and win war quickly before Britain’s European enemies could intervene---especially France. • U. S. regular and militia. Equipment and finances are huge problems.

An Unequal Contest of Resources • Britain, wealthy, best fleet, superior army, most advanced finances in Europe. Population 10 times colonies. • Idea was to raise a big army and win war quickly before Britain’s European enemies could intervene---especially France. • U. S. regular and militia. Equipment and finances are huge problems.

An Unequal Contest of Resources • After initial defeats, American strategy is to avoid “general engagement” as British army formidable when arrayed for a major battle but diluted by holding various cities. British form provincial corps of loyal Tories—irregular warfare. • Once no immediate victory, Britain moves to naval blockade and slower war. • Offer pardons and incentives for patriots to defect. Convinced that if they can maintain their position, hold on to the cities, and keep the rebels in check the mass of the population will come to their senses. • War drags on for 7 years (5 active) • HOW CAN THE COLONIES PAY FOR SUCH A WAR? ? ?

An Unequal Contest of Resources • After initial defeats, American strategy is to avoid “general engagement” as British army formidable when arrayed for a major battle but diluted by holding various cities. British form provincial corps of loyal Tories—irregular warfare. • Once no immediate victory, Britain moves to naval blockade and slower war. • Offer pardons and incentives for patriots to defect. Convinced that if they can maintain their position, hold on to the cities, and keep the rebels in check the mass of the population will come to their senses. • War drags on for 7 years (5 active) • HOW CAN THE COLONIES PAY FOR SUCH A WAR? ? ?

Economic Characteristics of War for Independence • April 1775 -September 1783 • Total military personnel 184, 000 to 250, 000 • Population est. 2, 148, 000, percent mobilized— 8. 5 to 11. 6% • Deaths 4, 004 and wounded 6, 004 or 4% of total mobilized (an underestimate) • Direct cost (1775 specie) $100 -140 million. • Direct Cost/One years GDP=104. 2% (15 -20% per year) • Financing by taxes— 13. 1% and by debt and money 86. 9% • Inflation: Prices rise from outbreak to peak 3 times initial level

Economic Characteristics of War for Independence • April 1775 -September 1783 • Total military personnel 184, 000 to 250, 000 • Population est. 2, 148, 000, percent mobilized— 8. 5 to 11. 6% • Deaths 4, 004 and wounded 6, 004 or 4% of total mobilized (an underestimate) • Direct cost (1775 specie) $100 -140 million. • Direct Cost/One years GDP=104. 2% (15 -20% per year) • Financing by taxes— 13. 1% and by debt and money 86. 9% • Inflation: Prices rise from outbreak to peak 3 times initial level

Two Pennsylvania Shillings

Two Pennsylvania Shillings

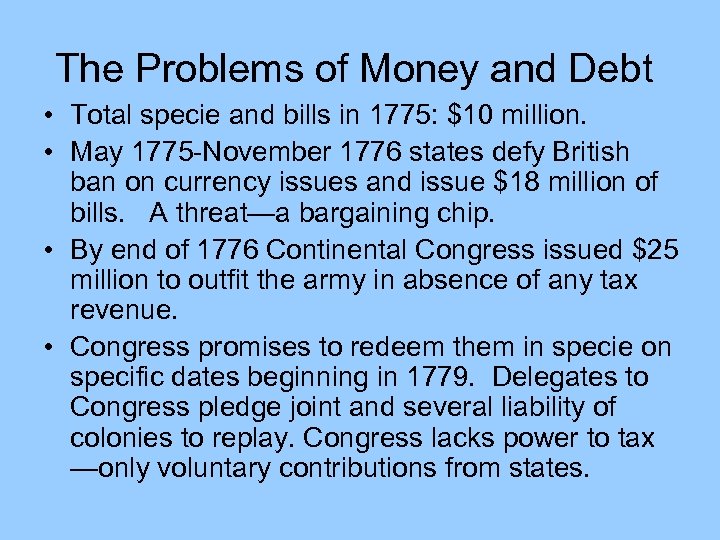

The Problems of Money and Debt • Total specie and bills in 1775: $10 million. • May 1775 -November 1776 states defy British ban on currency issues and issue $18 million of bills. A threat—a bargaining chip. • By end of 1776 Continental Congress issued $25 million to outfit the army in absence of any tax revenue. • Congress promises to redeem them in specie on specific dates beginning in 1779. Delegates to Congress pledge joint and several liability of colonies to replay. Congress lacks power to tax —only voluntary contributions from states.

The Problems of Money and Debt • Total specie and bills in 1775: $10 million. • May 1775 -November 1776 states defy British ban on currency issues and issue $18 million of bills. A threat—a bargaining chip. • By end of 1776 Continental Congress issued $25 million to outfit the army in absence of any tax revenue. • Congress promises to redeem them in specie on specific dates beginning in 1779. Delegates to Congress pledge joint and several liability of colonies to replay. Congress lacks power to tax —only voluntary contributions from states.

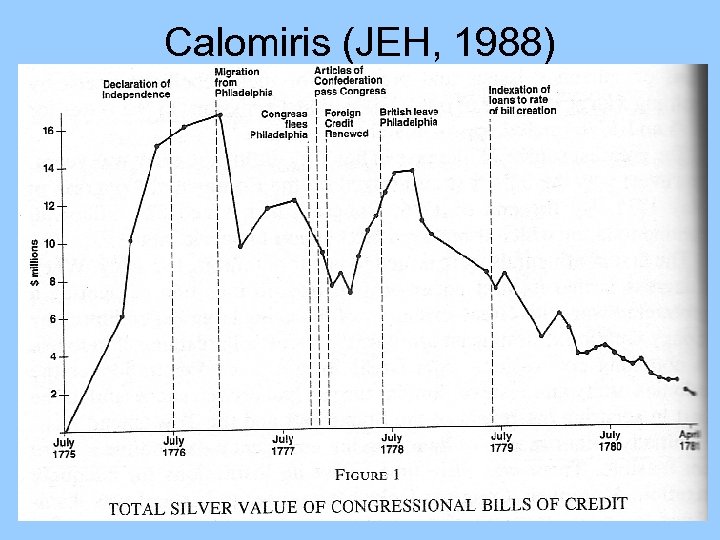

Calomiris (JEH, 1988)

Calomiris (JEH, 1988)

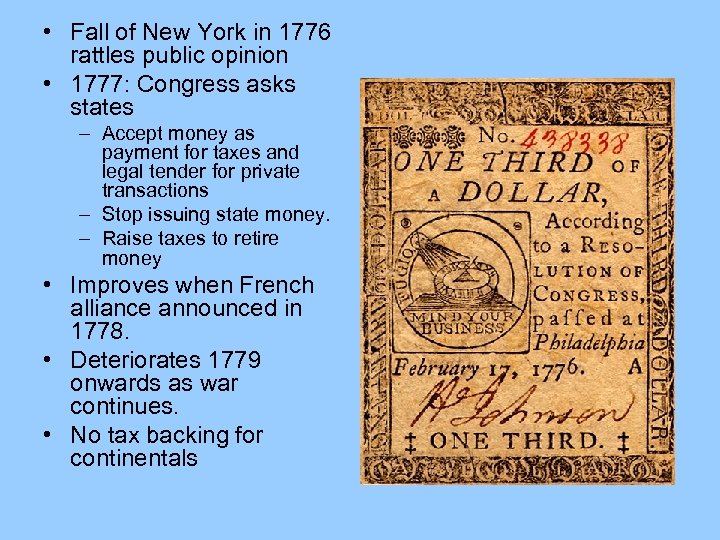

• Fall of New York in 1776 rattles public opinion • 1777: Congress asks states – Accept money as payment for taxes and legal tender for private transactions – Stop issuing state money. – Raise taxes to retire money • Improves when French alliance announced in 1778. • Deteriorates 1779 onwards as war continues. • No tax backing for continentals

• Fall of New York in 1776 rattles public opinion • 1777: Congress asks states – Accept money as payment for taxes and legal tender for private transactions – Stop issuing state money. – Raise taxes to retire money • Improves when French alliance announced in 1778. • Deteriorates 1779 onwards as war continues. • No tax backing for continentals

How does Calomiris explain the reluctance of states to pay taxes? Two reasons

How does Calomiris explain the reluctance of states to pay taxes? Two reasons

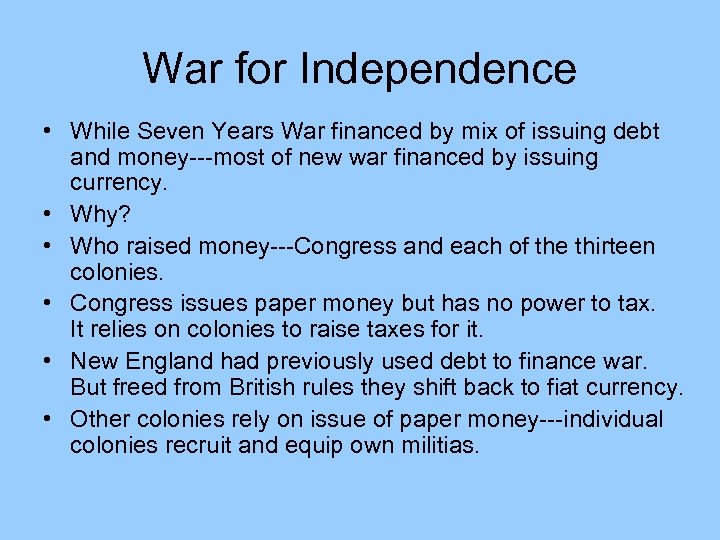

War for Independence • While Seven Years War financed by mix of issuing debt and money---most of new war financed by issuing currency. • Why? • Who raised money---Congress and each of the thirteen colonies. • Congress issues paper money but has no power to tax. It relies on colonies to raise taxes for it. • New England had previously used debt to finance war. But freed from British rules they shift back to fiat currency. • Other colonies rely on issue of paper money---individual colonies recruit and equip own militias.

War for Independence • While Seven Years War financed by mix of issuing debt and money---most of new war financed by issuing currency. • Why? • Who raised money---Congress and each of the thirteen colonies. • Congress issues paper money but has no power to tax. It relies on colonies to raise taxes for it. • New England had previously used debt to finance war. But freed from British rules they shift back to fiat currency. • Other colonies rely on issue of paper money---individual colonies recruit and equip own militias.

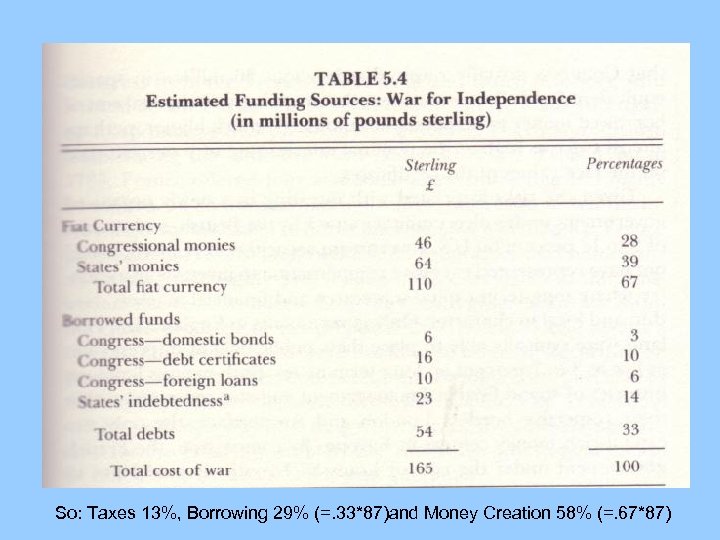

So: Taxes 13%, Borrowing 29% (=. 33*87)and Money Creation 58% (=. 67*87)

So: Taxes 13%, Borrowing 29% (=. 33*87)and Money Creation 58% (=. 67*87)

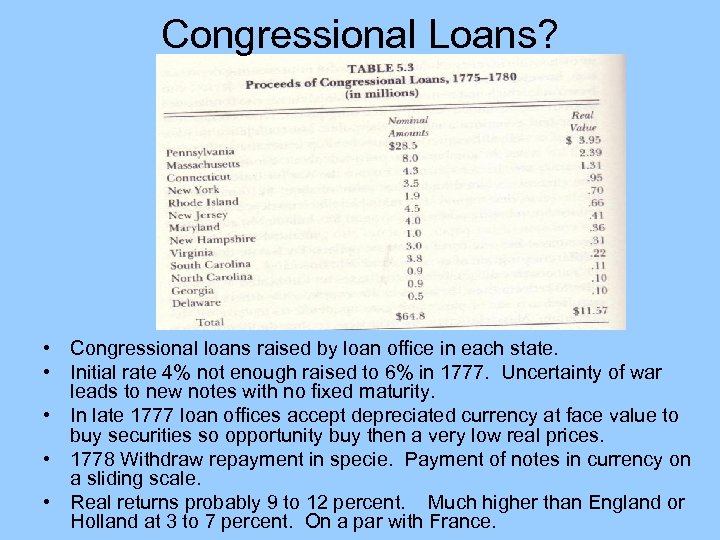

Congressional Loans? • Congressional loans raised by loan office in each state. • Initial rate 4% not enough raised to 6% in 1777. Uncertainty of war leads to new notes with no fixed maturity. • In late 1777 loan offices accept depreciated currency at face value to buy securities so opportunity buy then a very low real prices. • 1778 Withdraw repayment in specie. Payment of notes in currency on a sliding scale. • Real returns probably 9 to 12 percent. Much higher than England or Holland at 3 to 7 percent. On a par with France.

Congressional Loans? • Congressional loans raised by loan office in each state. • Initial rate 4% not enough raised to 6% in 1777. Uncertainty of war leads to new notes with no fixed maturity. • In late 1777 loan offices accept depreciated currency at face value to buy securities so opportunity buy then a very low real prices. • 1778 Withdraw repayment in specie. Payment of notes in currency on a sliding scale. • Real returns probably 9 to 12 percent. Much higher than England or Holland at 3 to 7 percent. On a par with France.

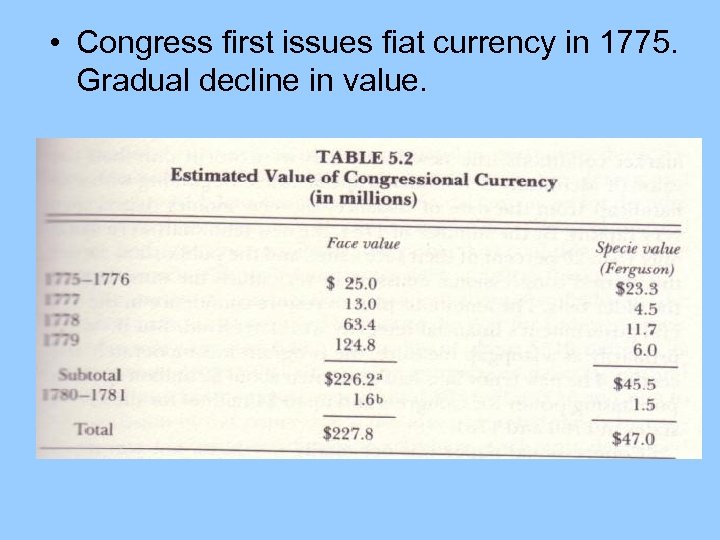

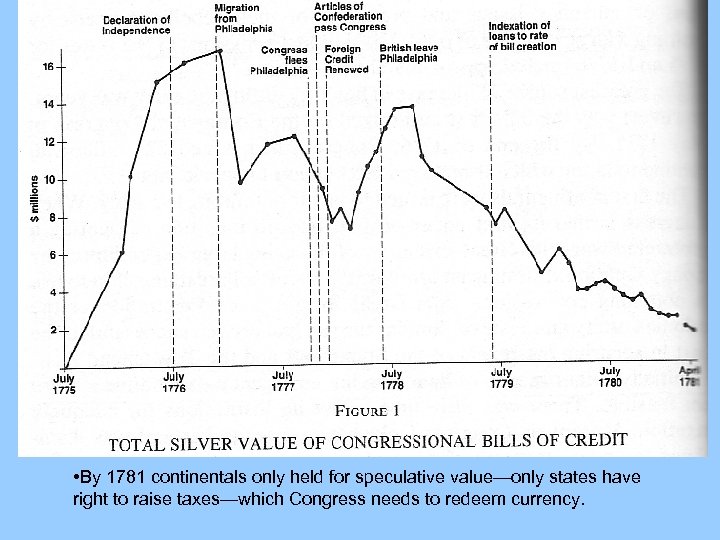

• Congress first issues fiat currency in 1775. Gradual decline in value.

• Congress first issues fiat currency in 1775. Gradual decline in value.

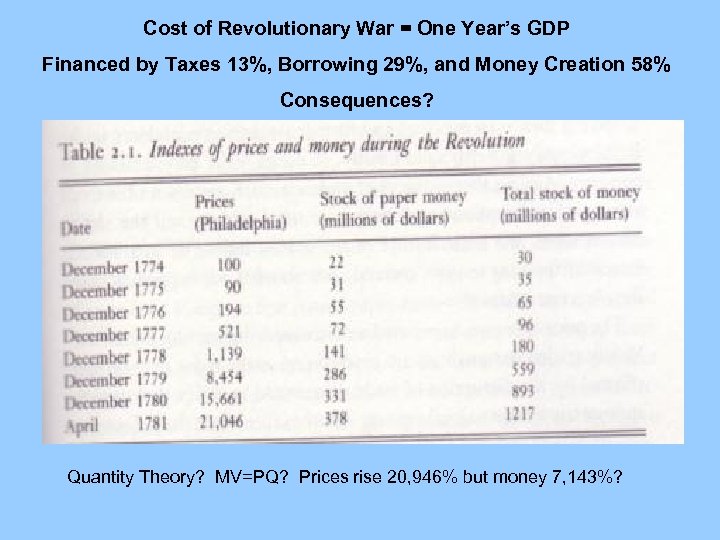

Cost of Revolutionary War = One Year’s GDP Financed by Taxes 13%, Borrowing 29%, and Money Creation 58% Consequences? Quantity Theory? MV=PQ? Prices rise 20, 946% but money 7, 143%?

Cost of Revolutionary War = One Year’s GDP Financed by Taxes 13%, Borrowing 29%, and Money Creation 58% Consequences? Quantity Theory? MV=PQ? Prices rise 20, 946% but money 7, 143%?

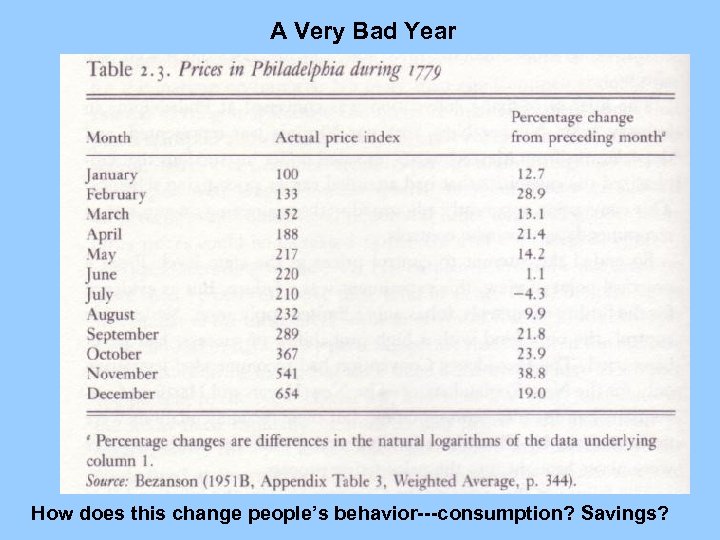

A Very Bad Year How does this change people’s behavior---consumption? Savings?

A Very Bad Year How does this change people’s behavior---consumption? Savings?

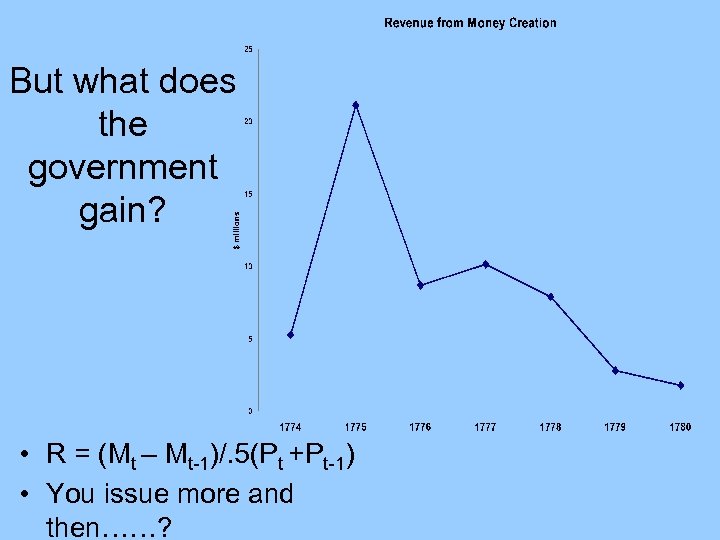

But what does the government gain? • R = (Mt – Mt-1)/. 5(Pt +Pt-1) • You issue more and then……?

But what does the government gain? • R = (Mt – Mt-1)/. 5(Pt +Pt-1) • You issue more and then……?

• By 1781 continentals only held for speculative value—only states have right to raise taxes—which Congress needs to redeem currency.

• By 1781 continentals only held for speculative value—only states have right to raise taxes—which Congress needs to redeem currency.

“Not Worth a Continental” • Public complains but still uses the money. • Why doesn’t public complain more bitterly? • Inflation tax is seen as more equitable, i. e. the rich and the poor pay • Robert Morris: “the depreciation of the paper money, which wiped away not less than 12 millions annually was in effect a tax to that amount. ”

“Not Worth a Continental” • Public complains but still uses the money. • Why doesn’t public complain more bitterly? • Inflation tax is seen as more equitable, i. e. the rich and the poor pay • Robert Morris: “the depreciation of the paper money, which wiped away not less than 12 millions annually was in effect a tax to that amount. ”

Mid-war crisis • Congress’ continental currency pays for much of the war from 1777 to 1780. • Then can’t generate more revenue • In 1781, the Superintendent of the Treasury Robert Morris suspends all payment of wages to soldiers---this lasted for the next two years until army disbanded (Soldiers then paid in securities not specie or fiat money…creating a new problem)

Mid-war crisis • Congress’ continental currency pays for much of the war from 1777 to 1780. • Then can’t generate more revenue • In 1781, the Superintendent of the Treasury Robert Morris suspends all payment of wages to soldiers---this lasted for the next two years until army disbanded (Soldiers then paid in securities not specie or fiat money…creating a new problem)

Foreign Aid--Critical • Important---why? • French pay for their own troops, value is equal to $50 or $60 million • French grants of $2 million, only 1 or 2% but critical and • French Loans 1778 -1783 of $4 million. Dutch and Spanish loans of $100, 000 • After Yorktown 1781 (role of French fleet), John Adams gets a syndicate in Amsterdam to offer $2. 8 million. After battlefield victories but keeps army on field until treaty in 1783. • State governments carry more of the load 17811783. They raise taxes and seize loyalist properties to be sold. Cover 40% of wartime expenditure

Foreign Aid--Critical • Important---why? • French pay for their own troops, value is equal to $50 or $60 million • French grants of $2 million, only 1 or 2% but critical and • French Loans 1778 -1783 of $4 million. Dutch and Spanish loans of $100, 000 • After Yorktown 1781 (role of French fleet), John Adams gets a syndicate in Amsterdam to offer $2. 8 million. After battlefield victories but keeps army on field until treaty in 1783. • State governments carry more of the load 17811783. They raise taxes and seize loyalist properties to be sold. Cover 40% of wartime expenditure

• Trader and financier. “Wealthiest man” in the colonies. • Congress appoints him Superintendent of Finance in 1781. • He succeeds in borrowing funds at home and abroad • Resigns in 1784 in frustration of Congress inability to secure a system of taxation---a national tariff (blocked by one state—Rhode Island). Robert Morris • Also founds Bank of North America 1781—the 1 st bank

• Trader and financier. “Wealthiest man” in the colonies. • Congress appoints him Superintendent of Finance in 1781. • He succeeds in borrowing funds at home and abroad • Resigns in 1784 in frustration of Congress inability to secure a system of taxation---a national tariff (blocked by one state—Rhode Island). Robert Morris • Also founds Bank of North America 1781—the 1 st bank

Default on the Debt • Federal Government has no reliable sources of income. • 1790 Debt – (1) Federal domestic debt $27 million – (2) Federal foreign debt 10. 5 million; – (3) State debts $26 million

Default on the Debt • Federal Government has no reliable sources of income. • 1790 Debt – (1) Federal domestic debt $27 million – (2) Federal foreign debt 10. 5 million; – (3) State debts $26 million

State Finances? • Some states do impose higher taxes, some try to pay for war by the confiscation of loyalist properties. • States have the same plans as during Seven Years War to eventually retire their own notes from circulation. • State tax receipts used then to reduce state currencies. What does Calomiris show? • States reduce stock of bills of credit, producing deflation---levying of taxes causing distress among farmers and other debtors. – Massachusetts policies caused 1787 Shay’s Rebellion – Monetary expansion in Rhode Island helped farmers. • BUT they do not manage to retire debt So that by 1790 large state debts outstanding.

State Finances? • Some states do impose higher taxes, some try to pay for war by the confiscation of loyalist properties. • States have the same plans as during Seven Years War to eventually retire their own notes from circulation. • State tax receipts used then to reduce state currencies. What does Calomiris show? • States reduce stock of bills of credit, producing deflation---levying of taxes causing distress among farmers and other debtors. – Massachusetts policies caused 1787 Shay’s Rebellion – Monetary expansion in Rhode Island helped farmers. • BUT they do not manage to retire debt So that by 1790 large state debts outstanding.

The New Nation is Shaky

The New Nation is Shaky