681ba786e371fb8cafdac82911c58163.ppt

- Количество слайдов: 10

The Seven Indicators Every Resource Investor Needs to Know Presented by Peter Krauth

The Seven Indicators Every Resource Investor Needs to Know Presented by Peter Krauth

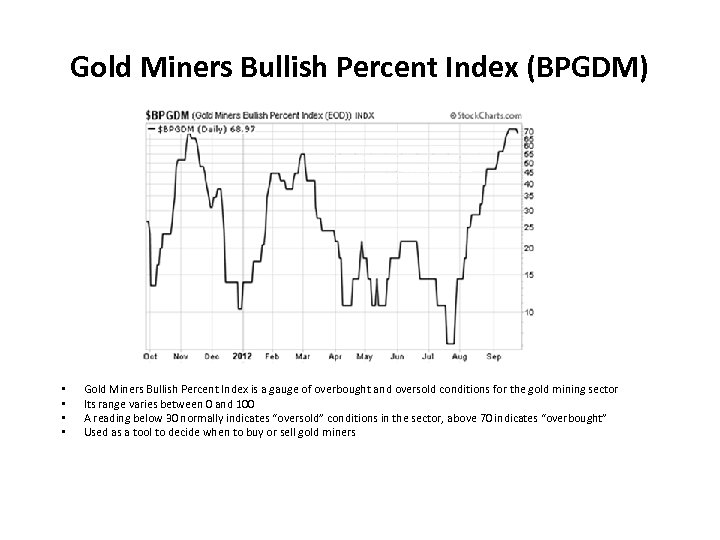

Gold Miners Bullish Percent Index (BPGDM) • • Gold Miners Bullish Percent Index is a gauge of overbought and oversold conditions for the gold mining sector Its range varies between 0 and 100 A reading below 30 normally indicates “oversold” conditions in the sector, above 70 indicates “overbought” Used as a tool to decide when to buy or sell gold miners

Gold Miners Bullish Percent Index (BPGDM) • • Gold Miners Bullish Percent Index is a gauge of overbought and oversold conditions for the gold mining sector Its range varies between 0 and 100 A reading below 30 normally indicates “oversold” conditions in the sector, above 70 indicates “overbought” Used as a tool to decide when to buy or sell gold miners

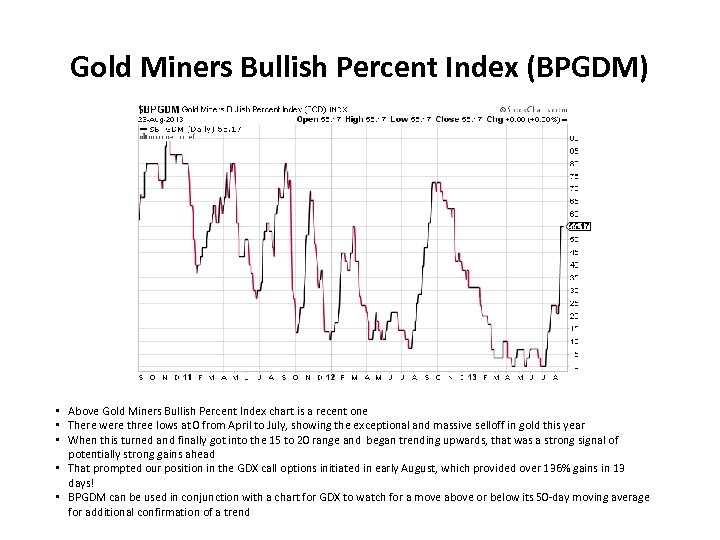

Gold Miners Bullish Percent Index (BPGDM) • Above Gold Miners Bullish Percent Index chart is a recent one • There were three lows at 0 from April to July, showing the exceptional and massive selloff in gold this year • When this turned and finally got into the 15 to 20 range and began trending upwards, that was a strong signal of potentially strong gains ahead • That prompted our position in the GDX call options initiated in early August, which provided over 136% gains in 13 days! • BPGDM can be used in conjunction with a chart for GDX to watch for a move above or below its 50 -day moving average for additional confirmation of a trend

Gold Miners Bullish Percent Index (BPGDM) • Above Gold Miners Bullish Percent Index chart is a recent one • There were three lows at 0 from April to July, showing the exceptional and massive selloff in gold this year • When this turned and finally got into the 15 to 20 range and began trending upwards, that was a strong signal of potentially strong gains ahead • That prompted our position in the GDX call options initiated in early August, which provided over 136% gains in 13 days! • BPGDM can be used in conjunction with a chart for GDX to watch for a move above or below its 50 -day moving average for additional confirmation of a trend

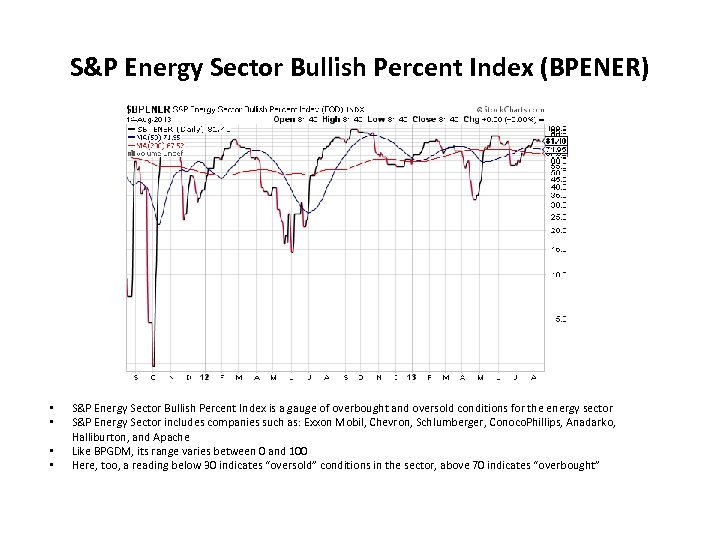

S&P Energy Sector Bullish Percent Index (BPENER) • • S&P Energy Sector Bullish Percent Index is a gauge of overbought and oversold conditions for the energy sector S&P Energy Sector includes companies such as: Exxon Mobil, Chevron, Schlumberger, Conoco. Phillips, Anadarko, Halliburton, and Apache Like BPGDM, its range varies between 0 and 100 Here, too, a reading below 30 indicates “oversold” conditions in the sector, above 70 indicates “overbought”

S&P Energy Sector Bullish Percent Index (BPENER) • • S&P Energy Sector Bullish Percent Index is a gauge of overbought and oversold conditions for the energy sector S&P Energy Sector includes companies such as: Exxon Mobil, Chevron, Schlumberger, Conoco. Phillips, Anadarko, Halliburton, and Apache Like BPGDM, its range varies between 0 and 100 Here, too, a reading below 30 indicates “oversold” conditions in the sector, above 70 indicates “overbought”

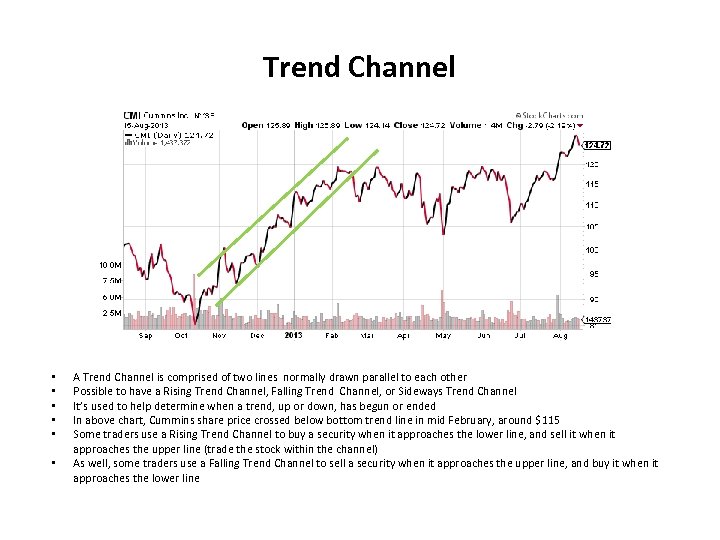

Trend Channel • • • A Trend Channel is comprised of two lines normally drawn parallel to each other Possible to have a Rising Trend Channel, Falling Trend Channel, or Sideways Trend Channel It’s used to help determine when a trend, up or down, has begun or ended In above chart, Cummins share price crossed below bottom trend line in mid February, around $115 Some traders use a Rising Trend Channel to buy a security when it approaches the lower line, and sell it when it approaches the upper line (trade the stock within the channel) As well, some traders use a Falling Trend Channel to sell a security when it approaches the upper line, and buy it when it approaches the lower line

Trend Channel • • • A Trend Channel is comprised of two lines normally drawn parallel to each other Possible to have a Rising Trend Channel, Falling Trend Channel, or Sideways Trend Channel It’s used to help determine when a trend, up or down, has begun or ended In above chart, Cummins share price crossed below bottom trend line in mid February, around $115 Some traders use a Rising Trend Channel to buy a security when it approaches the lower line, and sell it when it approaches the upper line (trade the stock within the channel) As well, some traders use a Falling Trend Channel to sell a security when it approaches the upper line, and buy it when it approaches the lower line

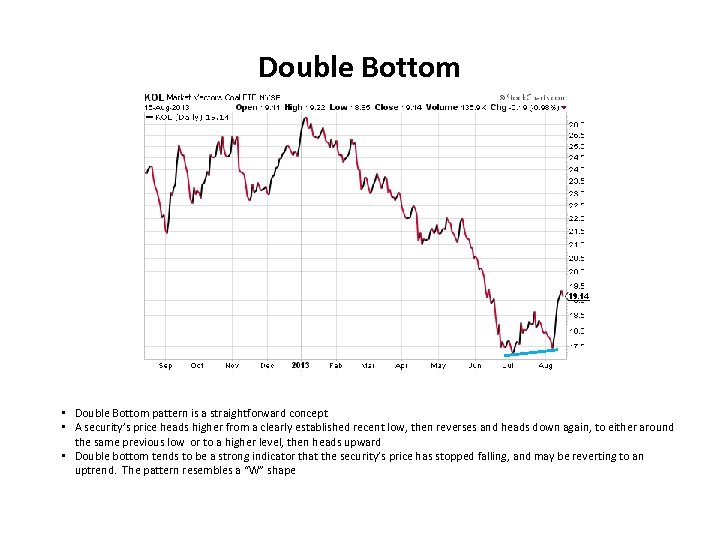

Double Bottom • Double Bottom pattern is a straightforward concept • A security’s price heads higher from a clearly established recent low, then reverses and heads down again, to either around the same previous low or to a higher level, then heads upward • Double bottom tends to be a strong indicator that the security’s price has stopped falling, and may be reverting to an uptrend. The pattern resembles a “W” shape

Double Bottom • Double Bottom pattern is a straightforward concept • A security’s price heads higher from a clearly established recent low, then reverses and heads down again, to either around the same previous low or to a higher level, then heads upward • Double bottom tends to be a strong indicator that the security’s price has stopped falling, and may be reverting to an uptrend. The pattern resembles a “W” shape

Double Top pattern is the same as the Double Bottom, but in reverse The Double Top pattern resembles an “M” shape This pattern can be used as a “trigger point” to initiate a trade Once a second top has been established (when the second top becomes visibly clear), that would be the signal to “short” the security, as it would be expected to head downwards • Some traders prefer to wait for a breakdown below recent support, $14. 50 level orange line for BAC • •

Double Top pattern is the same as the Double Bottom, but in reverse The Double Top pattern resembles an “M” shape This pattern can be used as a “trigger point” to initiate a trade Once a second top has been established (when the second top becomes visibly clear), that would be the signal to “short” the security, as it would be expected to head downwards • Some traders prefer to wait for a breakdown below recent support, $14. 50 level orange line for BAC • •

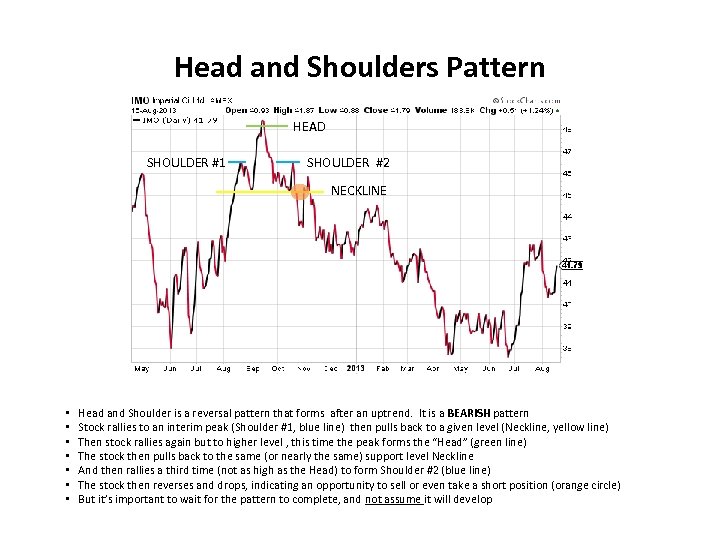

Head and Shoulders Pattern HEAD SHOULDER #1 SHOULDER #2 NECKLINE • • Head and Shoulder is a reversal pattern that forms after an uptrend. It is a BEARISH pattern Stock rallies to an interim peak (Shoulder #1, blue line) then pulls back to a given level (Neckline, yellow line) Then stock rallies again but to higher level , this time the peak forms the “Head” (green line) The stock then pulls back to the same (or nearly the same) support level Neckline And then rallies a third time (not as high as the Head) to form Shoulder #2 (blue line) The stock then reverses and drops, indicating an opportunity to sell or even take a short position (orange circle) But it’s important to wait for the pattern to complete, and not assume it will develop

Head and Shoulders Pattern HEAD SHOULDER #1 SHOULDER #2 NECKLINE • • Head and Shoulder is a reversal pattern that forms after an uptrend. It is a BEARISH pattern Stock rallies to an interim peak (Shoulder #1, blue line) then pulls back to a given level (Neckline, yellow line) Then stock rallies again but to higher level , this time the peak forms the “Head” (green line) The stock then pulls back to the same (or nearly the same) support level Neckline And then rallies a third time (not as high as the Head) to form Shoulder #2 (blue line) The stock then reverses and drops, indicating an opportunity to sell or even take a short position (orange circle) But it’s important to wait for the pattern to complete, and not assume it will develop

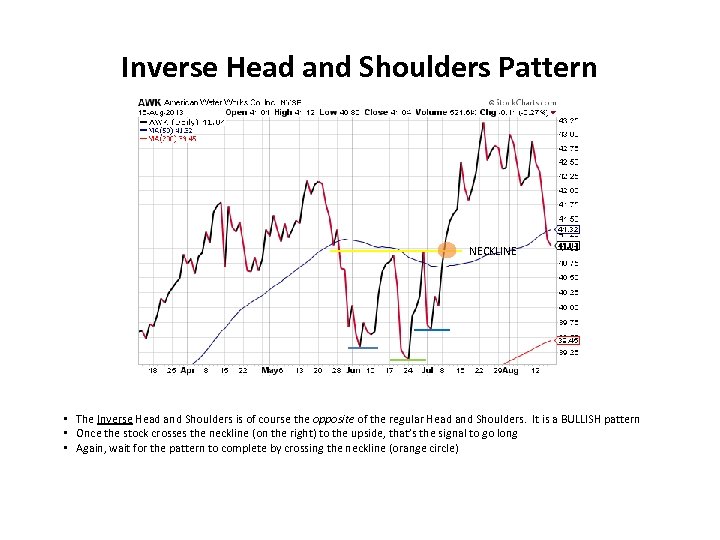

Inverse Head and Shoulders Pattern NECKLINE • The Inverse Head and Shoulders is of course the opposite of the regular Head and Shoulders. It is a BULLISH pattern • Once the stock crosses the neckline (on the right) to the upside, that’s the signal to go long • Again, wait for the pattern to complete by crossing the neckline (orange circle)

Inverse Head and Shoulders Pattern NECKLINE • The Inverse Head and Shoulders is of course the opposite of the regular Head and Shoulders. It is a BULLISH pattern • Once the stock crosses the neckline (on the right) to the upside, that’s the signal to go long • Again, wait for the pattern to complete by crossing the neckline (orange circle)

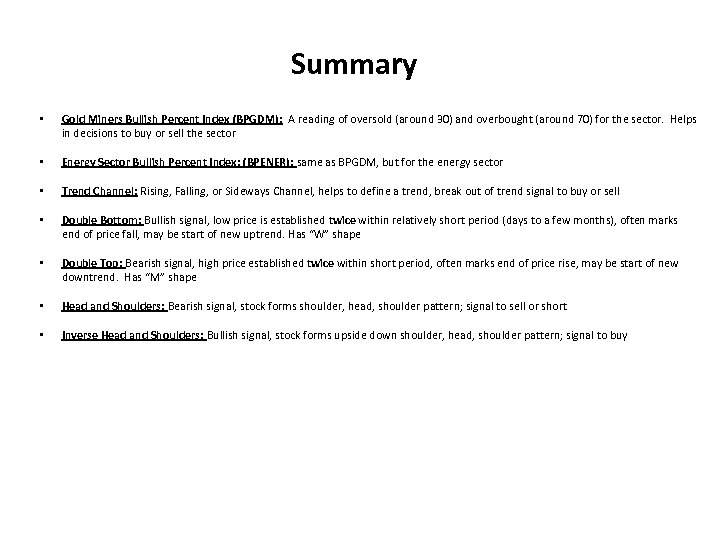

Summary • Gold Miners Bullish Percent Index (BPGDM): A reading of oversold (around 30) and overbought (around 70) for the sector. Helps in decisions to buy or sell the sector • Energy Sector Bullish Percent Index: (BPENER): same as BPGDM, but for the energy sector • Trend Channel: Rising, Falling, or Sideways Channel, helps to define a trend, break out of trend signal to buy or sell • Double Bottom: Bullish signal, low price is established twice within relatively short period (days to a few months), often marks end of price fall, may be start of new uptrend. Has “W” shape • Double Top: Bearish signal, high price established twice within short period, often marks end of price rise, may be start of new downtrend. Has “M” shape • Head and Shoulders: Bearish signal, stock forms shoulder, head, shoulder pattern; signal to sell or short • Inverse Head and Shoulders: Bullish signal, stock forms upside down shoulder, head, shoulder pattern; signal to buy

Summary • Gold Miners Bullish Percent Index (BPGDM): A reading of oversold (around 30) and overbought (around 70) for the sector. Helps in decisions to buy or sell the sector • Energy Sector Bullish Percent Index: (BPENER): same as BPGDM, but for the energy sector • Trend Channel: Rising, Falling, or Sideways Channel, helps to define a trend, break out of trend signal to buy or sell • Double Bottom: Bullish signal, low price is established twice within relatively short period (days to a few months), often marks end of price fall, may be start of new uptrend. Has “W” shape • Double Top: Bearish signal, high price established twice within short period, often marks end of price rise, may be start of new downtrend. Has “M” shape • Head and Shoulders: Bearish signal, stock forms shoulder, head, shoulder pattern; signal to sell or short • Inverse Head and Shoulders: Bullish signal, stock forms upside down shoulder, head, shoulder pattern; signal to buy