1f6426d08cf6f9c2d5e8c5e0e34c739f.ppt

- Количество слайдов: 58

The SBA 504 Loan Program www. seedcorp. com Revised by SEED Corp. 4/2016

What is the SBA 504 Loan Program? Ø It is the Small Business Administration’s “economic development financing program. ” Ø Loans are provided to expanding small businesses to aid in job creation. Ø SBA loans are guaranteed by the Federal Government. 2

Goal of Presentation General understanding of the SBA 504 Loan Program from origination to servicing, and 504 Program Features & Benefits Visit: www. sba. gov/for-lenders Forms, Regulations and Standard Operating Procedure Manuals 3

The Role of SEED Corporation Ø The SBA 504 Program is administered through SBA Certified Development Companies (CDC’s) like SEED Corporation. Ø SEED underwrites, packages, closes and services SBA 504 loans. 4

Selling the 504 Option If the answer to any of the following questions is yes, then give the customer an introduction to SBA 504. Ø Ø Is working capital important to the success of the business? Is a long-term fixed rate important for cash flow? Is a low down payment important? Does the business want protection in the event of a devaluation of real estate? 5

Benefits to the Borrower Ø Up to 90% financing for a fixed asset project. Ø Long-term, fixed rate funds … enhancing cash flow for business. Ø The SEED effective rate as of 4/16 is 4. 31% on a 20 -yr debenture, and 3. 93% on a 10 -yr debenture. Ø Ability to include soft costs, equipment and furniture and fixtures. . . enabling business to minimize out of pocket expenses and preserve cash. Ø Lower down payment conserves working capital. 6

Benefits to the Bank Ø Bank’s maximum loan-to-value is typically 50%, minimizing risk and improving liquidity. Ø Ability to finance projects with as little as 10% injection. Ø Program allows reliance on financial projections for startups and businesses with inadequate historic cash flow. Ø The bank’s first mortgage can be sold in the secondary market for a premium. Ø The CDC is responsible for all of the paperwork! 7

What’s needed for SEED to approve a 504 request? Ø Purchase & sales agreement for project property and cost estimate for construction/renovation projects. Ø Three years of tax returns and financial statements for the business. Ø Information on the borrower’s existing debt. 8

What’s needed for SEED to approve a 504 request? Ø Current personal financial statement and 2 years of personal tax returns for each principal of the business (20% or more ownership). Ø Property appraisal and environmental assessment can be submitted to SEED after approval. No Application Form is required! We essentially use the same underwriting documentation as the bank! 9

Use of Funds Fixed-Asset Acquisition or Expansion: Ø Purchase land & construct new buildings. Ø Purchase and/or renovate existing buildings. Ø Construct an addition to an existing building. Ø Refinance existing eligible fixed asset debt up to 50% of new expansion project; including an existing SBA 504 loan Ø Acquire/install machinery & equipment. Ø Construct or remodel buildings on leased land. Ø Soft costs related to the project (appraisal, environmental assessment, interim interest, and professional fees). 10

Use of Funds (Cont. ) Ineligible use of funds: Ø Ø Ø Debt refinancing (if there is no expansion) Purchase of trucks, autos and airplanes Working Capital Franchise fees Management fees and advertising Incorporation / organization costs Contact SEED at (508) 822 -1020 ~ Ext 315 or 316 11 for Loan Structure!

Project Size Requirements Minimum Amount of 504 Loan: $25, 000* There is no maximum limit to project size. Maximum Amount of 504 Loan: Up to $5 million for most businesses Up to $5. 5 million for manufacturers and projects generating renewable energy or fuels. * SEED Calculates costs and benefits for 504 projects under $300, 000 and may use other program funds. 12

Job Requirements Provide one job for every $65, 000 funded (SBA 504 Portion) Exceptions: Ø Manufacturing businesses provide one job for every $100, 000 funded (SBA 504 portion). Ø Projects that meet any of the SBA Public Policy Goals or Community Development Goals. 13

Public Policy Goals Not Required to Create one job for each $65, 000 Ø Revitalizing a business district of a community (a written revitalization/redevelopment plan). Ø Expanding exports. Ø Expanding minority-owned, woman-owned or veteran-owned businesses. Ø Aiding rural development. Ø Energy-consumption reduction of at least 10% or sustainable design or equipment and process upgrades. 14

Public Policy Goals (Cont. ) Not Required to Create one job for each $65, 000 Ø Increasing productivity and competitiveness (retooling, robotics, modernization, competition with imports). Ø Modernizing or upgrading facilities to meet health, safety, and environmental requirements. Ø Assisting businesses in, or moving to, areas affected by Federal budget reductions (base closings within 10 years). 15

Community Development Goals Not Required to Create one job for each $65, 000 Ø Improving, diversifying or stabilizing the economy of the locality. Ø Stimulating other business development. Ø Bringing new income into the community. Ø Assisting manufacturing firms. Ø Assisting businesses in Labor Surplus Areas as defined by the Department of Labor. 16

Not Eligible for 504 Funding Ø Non Profits Ø Lending institutions Ø Life Insurance companies Ø Private clubs Ø Speculative investment Ø Non-owner occupied building Ø Gambling concerns Ø Businesses engaged in promoting religion Ø Cooperatives (exception for some producer coops) 17

Not Eligible for 504 Funding (Cont. ) Ø Political or lobbying services. Ø Businesses located in a foreign country or owned by a non-resident alien. Ø Businesses selling through pyramid plans. Ø Businesses engaged in sales or services of a prurient sexual nature. Ø Businesses with prior loss to the government. Ø Relocation of a small business causing a net deduction of one third or more of its workforce or a substantial increase in area unemployment. 18

Typical Structure for Established Business 19

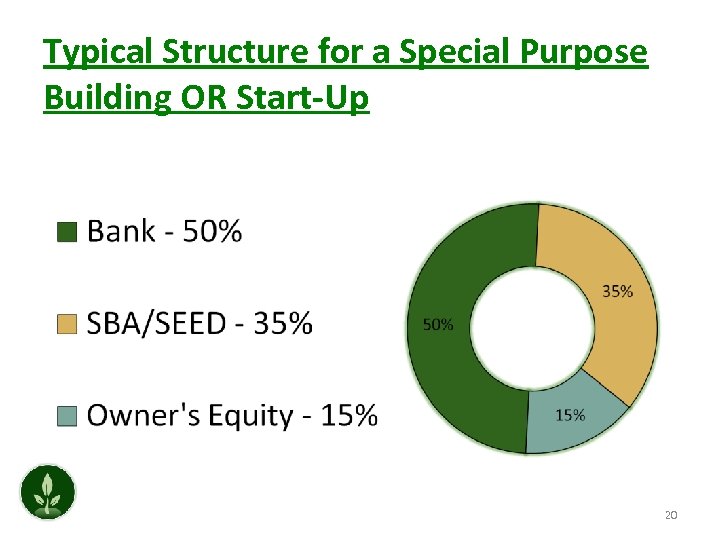

Typical Structure for a Special Purpose Building OR Start-Up 20

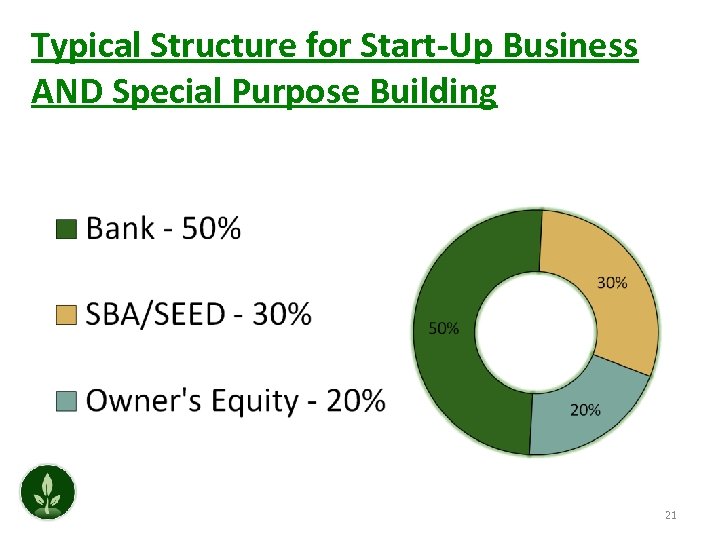

Typical Structure for Start-Up Business AND Special Purpose Building 21

Structure of a Typical $1 Million Project Entity Loan % of Amount Project Security Lender $500, 000 50% 1 st Mortgage SEED/SBA 504 $400, 000* 40% 2 nd Mortgage Borrower $100, 000 10%** TOTAL: $1, 000 100% *Total Debenture: $409, 000 ($400 back to client) (Up front fees include 2. 15% on $400, 000) **Projects that involve a new business and/or special purpose building will require additional 5 -10% from the borrower. 22

Eligible Project Costs: Land Construction Contingency (10%) Site Preparation Machinery/Equipment Furniture/Fixtures Soft Costs ~ Permits Architect/Engineer Appraisal Environmental Report Title Insurance Interim Interest & Fee TOTAL $ 200, 000 60, 000 10, 000 50, 000 20, 000 50% Bank $500, 000 40% CDC $400, 000 10% Owner $100, 000 100% $1, 000 2, 500 25, 000 4, 000 2, 500 1, 000 25, 000 $1, 000 23

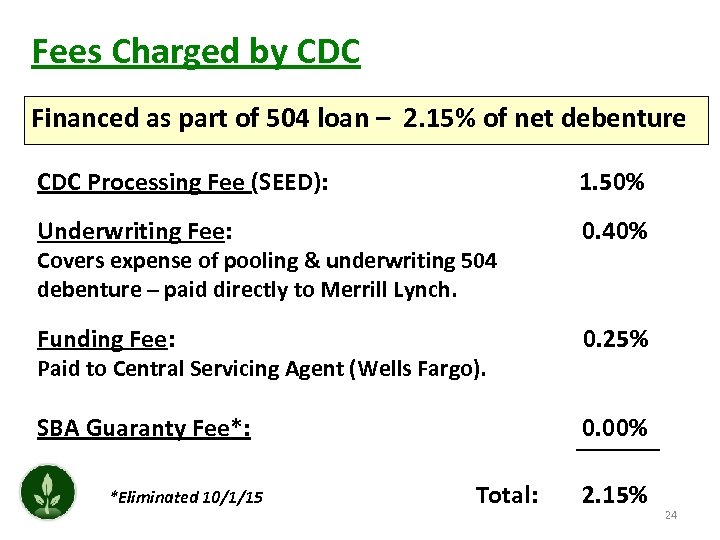

Fees Charged by CDC Financed as part of 504 loan – 2. 15% of net debenture CDC Processing Fee (SEED): 1. 50% Underwriting Fee: 0. 40% Funding Fee: 0. 25% Covers expense of pooling & underwriting 504 debenture – paid directly to Merrill Lynch. Paid to Central Servicing Agent (Wells Fargo). SBA Guaranty Fee*: *Eliminated 10/1/15 0. 00% Total: 2. 15% 24

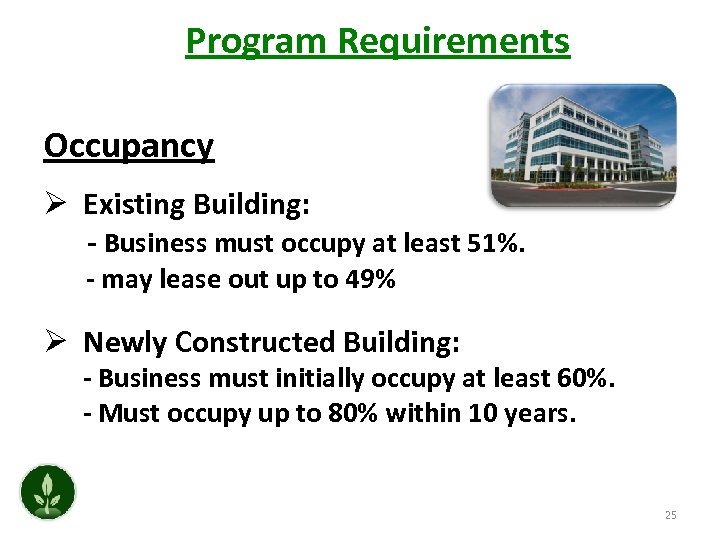

Program Requirements Occupancy Ø Existing Building: - Business must occupy at least 51%. - may lease out up to 49% Ø Newly Constructed Building: - Business must initially occupy at least 60%. - Must occupy up to 80% within 10 years. 25

Ownership of Building Ø By the Operating Company (OC). Ø By an Eligible Passive Company (EPC) Ø Ø Ø Individuals New corporation Partnership Limited liability company Trust Ownership need not be identical 26

Guarantees Ø Required for any principal with 20% ownership or more in Operating Company (OC) or Eligible Passive Company (EPC). 27

Size Standards* Business – when combined with affiliates must: Ø Have less than $15 million in tangible net worth. Ø Have less than $5 million in net income after taxes (average for last 2 yrs) ~ or ~ Use 7 A size standards as an alternative. There is no limitation on annual sales volume * Size standards are increased by 25% in labor surplus areas. 28

Appraisals Ø SBA requires a real estate appraisal if the estimated value of the project is greater than $250, 000; Ø All appraisals must be addressed to both the Bank and the U. S. SBA and be consistent with Uniform Standards of Professional Appraisal Practice (USPAP). Ø Be performed by a state certified or state licensed appraiser and for all loans over $1, 000, the appraiser must be state certified. 29

Appraisals (Cont. ) Ø For new construction or substantial renovations, appraiser must estimate “as complete” value and recertify at completion. Ø CDC must obtain a statement from appraiser indicating the project was built with only minor deviations from plan. Ø If a going concern value is requested due to special purpose nature of the building, appraiser must allocate separate values to the individual components (land, building, equipment and business). Ø When collateral is special purpose, the appraiser must be experienced in the particular industry. 30

Appraisals (Cont. ) ØAn appraisal must be submitted with application if relying on owner’s equity for injection. 31

Environmental Reports Questionnaire Only – Ø If 504 loan amount is up to and including $150, 000. Ø No match to an environmentally sensitive industry. Ø Environmental Questionnaire results in no findings. If findings and over $150, 000 then, at a minimum Environmental Questionnaire & Records Search with Risk Assessment is necessary. 32

Environmental Reports (Cont. ) Environmental Questionnaire & Records Search with Risk Assessment Ø Unlikely there is environmental contamination. Ø Risk Assessment states “Low Risk”. Ø If “Elevated Risk” or “High Risk” ~ Phase I required. 33

Environmental Reports (Cont. ) TSA Required (Transactional Screening Analysis) Ø Environmental Professional must conclude that no further investigation is warranted (Reliance Letter required). Ø If opinion warrants further investigation, a Phase I must be obtained. 34

Phase I Environmental Site Assessment (ESA) Results: Ø If “no further investigation warranted”, Phase I report may be submitted to SBA for approval including the SBA Reliance Letter. Ø If report’s conclusion is “further investigation warranted” the CDC must proceed as recommended by the Environmental Professional. SBA will require compliance with all Environmental Professional recommendations. Ø Phase II ESA or Supplemental Reports Required. 35

Phase II Environmental Site Assessment (ESA) Results: Ø If “no further investigation warranted”, Phase II report may be submitted to SBA for approval including the SBA Reliance Letter. Ø If report’s conclusion reveals contamination, the CDC will need to determine if they will proceed with project. Ø CDC will determine whether disbursement is appropriate according to subparagraph G, Pages 290 -293 of SBA SOP 50 10 5(H). 36

The 504 “Process” Ø Borrower or the bank submits a loan package to SEED. Ø SEED conducts preliminary review and works with bank and client. Ø The loan request is presented to SEED’s Loan Review Committee (meeting or e-mail). Ø A commitment letter is sent to the borrower with a copy to participating bank. Ø Loan is packaged and forwarded to SBA Central Office in Sacramento, California for issuance of the Authorization. 37

The 504 “Process” Ø SEED is an Abridged Submission Method (ASM) lender, and submits required forms to SBA plus: • Purchase & Sale Agreement • Construction Cost Estimates • Bank Commitment Letter Ø SBA approves “ASM” SBA 504 loans within 3 days assuming all eligibility requirements are met, and the paper work has been filled out properly. Ø Potential process delays: Franchise reviews (see additional guidance material); 912 criminal clearances; INS (Immigration) confirmations and gasoline jobber agreement reviews. 38

The 504 “Process” Ø Bank closes on permanent loan and bridge loan. Ø SEED/SBA payoff the bank’s bridge loan in 90 days on turnkey projects or after the project is completed (construction & renovation projects). Ø SBA Authorization (commitment) is valid for four years (48 months). 39

Bank’s Permanent First Mortgage Ø Permanent financing must be for at least 10 years – (on a 20 -year debenture) with no balloon payments during that time. Ø Interest rate on the bank’s mortgage is set by bank, and can be fixed or float. Ø Bank can charge points. Ø The SBA charges a one-time bank participation fee of 0. 5% on the bank’s first mortgage. 40

Interim Loan (Bridge Loan) Ø Used to provide small businesses with financing needed since SBA 504 closing always occurs at least 60 days before the debenture sale. Ø Used to facilitate change of ownership within time frame specified in the P & S Agreement. Ø Used to finance construction and/or improvements to property – if applicable. Ø Bank makes disbursements and supervises construction. 41

Legal Fees Closing costs are financed into the gross debenture & paid to CDC’s closing attorney Legal Fee – Maximum of $2, 500 Other Eligible Closing Costs: Ø Title Insurance Ø Recording fees Ø Flood Insurance Ø Filing fees and title searches Ø Surveys 42

Loan Rates Ø Debenture Rate Ø Note Rate Ø Effective Rate 43

Debenture Rate Negotiated by Underwriters, DCFC & the U. S. Government Ø Based on current market conditions at the time the debenture is sold. Ø Paid to bond investors on semi-annual basis. 44

Note Rate Ø Rate stated on the note between borrower & CDC. Ø Amount used in calculating monthly payments. Ø Slightly higher than debenture rate as it is paid on a monthly basis rather than semi-annually. 45

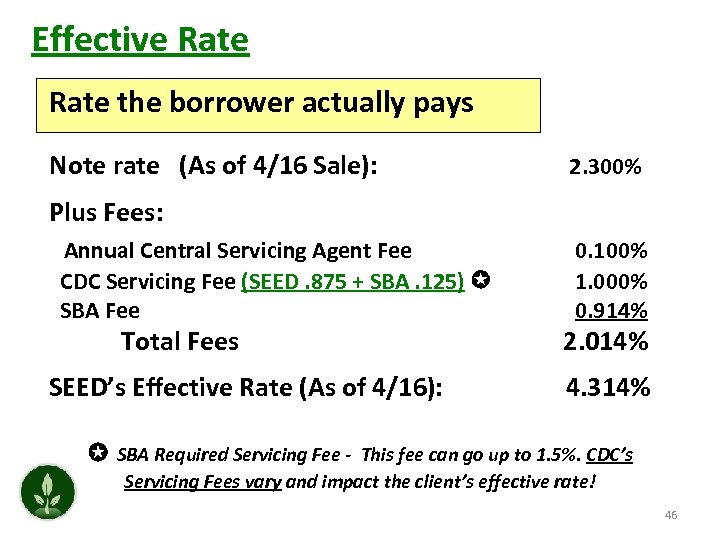

Effective Rate the borrower actually pays Note rate (As of 4/16 Sale): 2. 300% Plus Fees: Annual Central Servicing Agent Fee CDC Servicing Fee (SEED. 875 + SBA. 125) SBA Fee Total Fees SEED’s Effective Rate (As of 4/16): 0. 100% 1. 000% 0. 914% 2. 014% 4. 314% SBA Required Servicing Fee - This fee can go up to 1. 5%. CDC’s Servicing Fees vary and impact the client’s effective rate! 46

Simultaneous SBA 504 Closing with Bank Closing Ø Project is turnkey – does not involve construction or setting up of heavy machinery and equipment. Ø Bank and SBA 504 documents are signed at the same time to simplify process for bank and client. Ø A follow up list of items may be needed prior to funding and bank reimbursement. 47

Funding the 504 Loan When SBA Authorization is received – Ø CDC reviews for changes and/or errors. Ø Copies sent to Borrower & Bank with instructions. Ø Bank orders Appraisal & Environmental Review (if not already completed). Ø CDC orders Preliminary Title & UCC searches (if needed). Ø Work begins on obtaining required documents – corporate resolutions, certificates of good standing, etc. 48

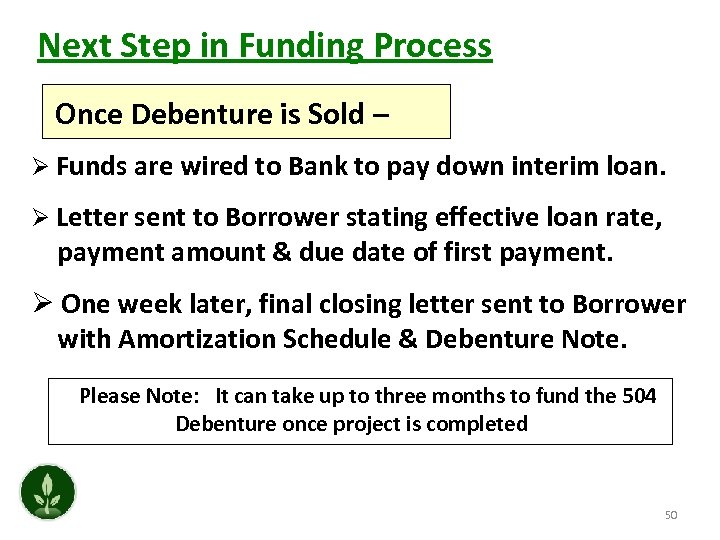

Next Step in Funding Process Before a debenture sale date is set: Ø Title must be taken by new owner. Ø Interim loan must be fully disbursed. Ø Construction or remodeling must be complete. Ø Permanent Certificate of Occupancy or Certificate of Completion must be forwarded to CDC. Ø Borrower’s financial statements must be current within 120 days of targeted funding date. 49

Next Step in Funding Process Once Debenture is Sold – Ø Funds are wired to Bank to pay down interim loan. Ø Letter sent to Borrower stating effective loan rate, payment amount & due date of first payment. Ø One week later, final closing letter sent to Borrower with Amortization Schedule & Debenture Note. Please Note: It can take up to three months to fund the 504 Debenture once project is completed 50

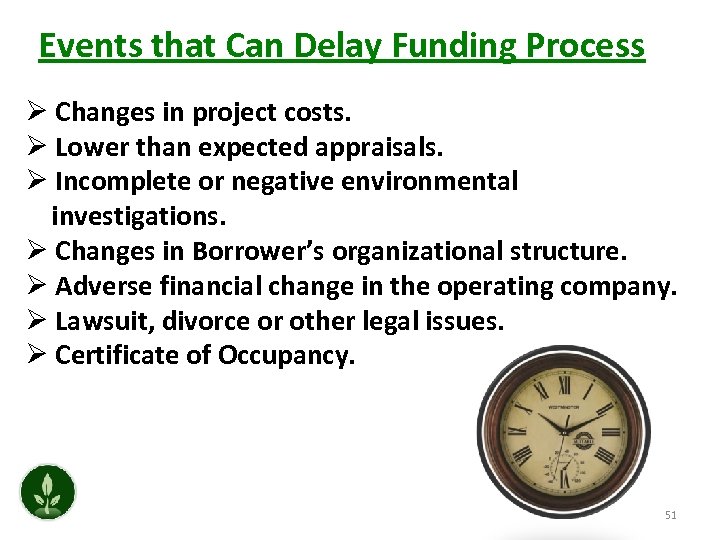

Events that Can Delay Funding Process Ø Changes in project costs. Ø Lower than expected appraisals. Ø Incomplete or negative environmental investigations. Ø Changes in Borrower’s organizational structure. Ø Adverse financial change in the operating company. Ø Lawsuit, divorce or other legal issues. Ø Certificate of Occupancy. 51

Prepayment First Half of 20 year Debenture Prepayment Estimate Based on April 2016 Funding Year 1 2 3 4 5 6 7 8 9 10 After 10 % 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% % of Principal Outstanding 102. 30% 102. 07% 101. 84% 101. 61% 101. 38% 101. 15% 100. 92% 100. 69% 100. 46% 100. 23% 100. 00% Prepayment is based on the negotiated rate plus principal in year one and 10% less each year after. 52

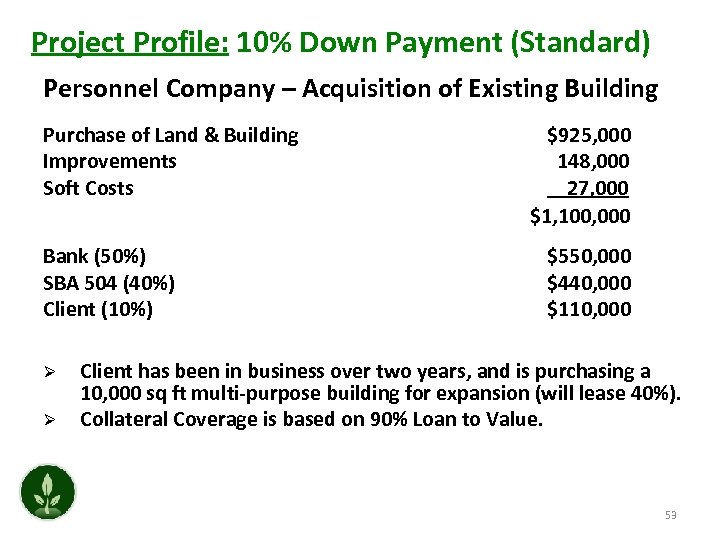

Project Profile: 10% Down Payment (Standard) Personnel Company – Acquisition of Existing Building Purchase of Land & Building Improvements Soft Costs Bank (50%) SBA 504 (40%) Client (10%) Ø Ø $925, 000 148, 000 27, 000 $1, 100, 000 $550, 000 $440, 000 $110, 000 Client has been in business over two years, and is purchasing a 10, 000 sq ft multi-purpose building for expansion (will lease 40%). Collateral Coverage is based on 90% Loan to Value. 53

Project Profile: 15% Down Payment (New Owner) Purchase of Existing Restaurant (New Owner) Considered new operation: Building Purchase Price Bank (50%) SBA 504 (35%) Client (15%) $1, 200, 000 600, 000 420, 000 180, 000 Ø Client has historical restaurant experience. Ø Collateral Coverage is 85% Loan to Value. Ø Building must appraise adequately or additional funds are considered goodwill and must be satisfied outside the 504 transaction. 54

Project Profile: 15% Down Payment (Special Purpose) Acquisition of a Special Purpose Bldg – Gas Station Building Purchase Price Bank (50%) SBA 504 (35%) Client (15%) $675, 000 337, 500 236, 250 101, 250 Ø Client is a three year operator of this leased location and wants to purchase this special purpose facility. Ø Collateral Coverage is 85% Loan to Value on a special-purpose building. 55

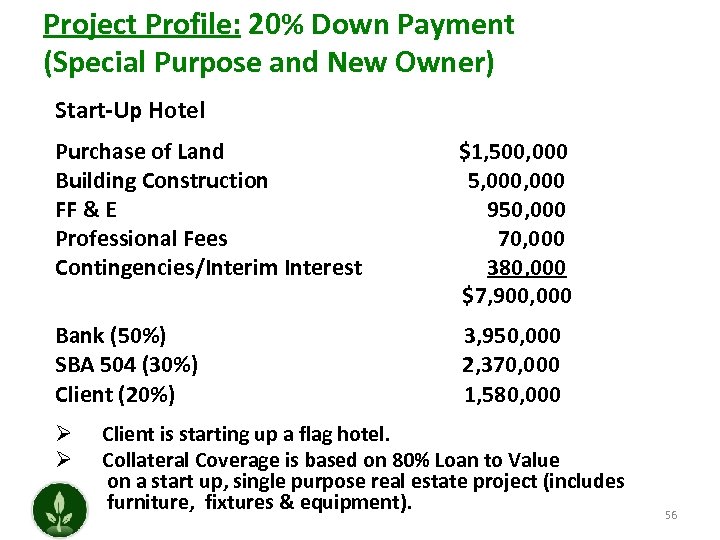

Project Profile: 20% Down Payment (Special Purpose and New Owner) Start-Up Hotel Purchase of Land Building Construction FF & E Professional Fees Contingencies/Interim Interest $1, 500, 000 5, 000 950, 000 70, 000 380, 000 $7, 900, 000 Bank (50%) SBA 504 (30%) Client (20%) 3, 950, 000 2, 370, 000 1, 580, 000 Ø Ø Client is starting up a flag hotel. Collateral Coverage is based on 80% Loan to Value on a start up, single purpose real estate project (includes furniture, fixtures & equipment). 56

504 Refinance is Back! • Reauthorized through the omnibus CREED Act in December 2015, the 504 Refinance Program will be returning in about four (4) to six (6) months! • Originally enacted in 2010 and expired in 2012, the program was responsible for refinancing $5 billion of debt for small business owners. • We will be sure to bring you more good news as the reinstituted program guidelines are rolled out later this Spring!! 57

Why YOU Should Consider a SEED/SBA 504 Loan ü Up to 90% financing for fixed asset project. ü Lower down payment for client. ü Long-term, fixed rates for 10 or 20 years. ü SEED provides quick & efficient turn around (SBA approved for Abridged Submission). ü SEED provides loans up to $200, 000 at 5% fixed to replace the down payment. ü SEED is responsible for all the paperwork. Call (508) 822 -1020 – Lisa x 315 and Laurie x 316 or Visit www. seedcorp. com 58

1f6426d08cf6f9c2d5e8c5e0e34c739f.ppt