c1884c03dac858bb6b0d97617b3420a3.ppt

- Количество слайдов: 29

The Savings Group Information Exchange (SAVIX) Evolution and lessons learned Microfinance Club of the UK, London, 23 May 2012

The Savings Group Information Exchange (SAVIX) Evolution and lessons learned Microfinance Club of the UK, London, 23 May 2012

Myths • Savings groups are a second class type of service that pose unacceptable risks to member savings • Savings groups are unable to meet the needs of their members for useful amounts of investment capital • Savings groups are unlikely to survive when facilitating agencies leave

Myths • Savings groups are a second class type of service that pose unacceptable risks to member savings • Savings groups are unable to meet the needs of their members for useful amounts of investment capital • Savings groups are unlikely to survive when facilitating agencies leave

What are Savings Groups? – The basics • SGs are Accumulating Savings and Credit • • • Associations that mobilise and manage their own savings, provide interest-bearing loans to members and offer a limited form of insurance SG are self-managed and independent Members can save, borrow and reimburse in varying amounts for varying periods of time SGs are usually time-bound – they share out member equity at least once a year in proportion to savings

What are Savings Groups? – The basics • SGs are Accumulating Savings and Credit • • • Associations that mobilise and manage their own savings, provide interest-bearing loans to members and offer a limited form of insurance SG are self-managed and independent Members can save, borrow and reimburse in varying amounts for varying periods of time SGs are usually time-bound – they share out member equity at least once a year in proportion to savings

Here’s one….

Here’s one….

Here’s another….

Here’s another….

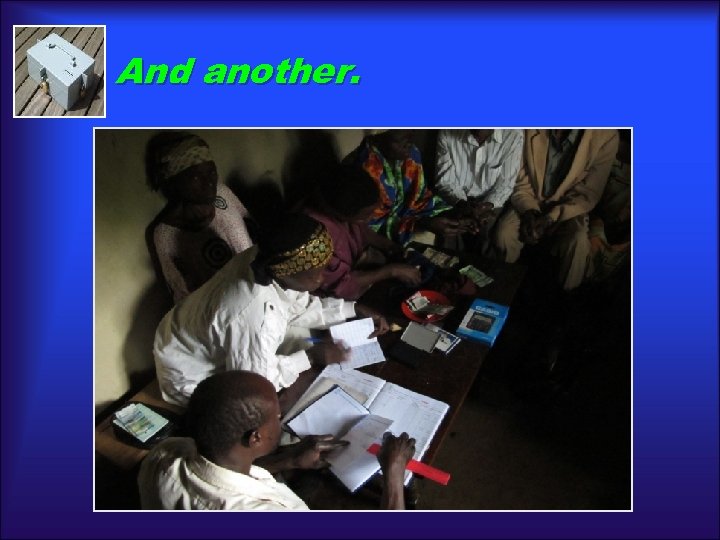

And another.

And another.

What are SGs – Current products and features • Savings: • Regular contributions (weekly, fortnightly, monthly) • Savings or share purchase: 1 -5 at value set by group. May allow withdrawal on demand • Loans: • Loan criteria, loan term and interest rate set by group • Flexible repayments • Insurance/Social fund • Eligibility criteria and benefits set by group • Benefits in the form of grants or zero-interest loans • No transactions take place outside a meeting

What are SGs – Current products and features • Savings: • Regular contributions (weekly, fortnightly, monthly) • Savings or share purchase: 1 -5 at value set by group. May allow withdrawal on demand • Loans: • Loan criteria, loan term and interest rate set by group • Flexible repayments • Insurance/Social fund • Eligibility criteria and benefits set by group • Benefits in the form of grants or zero-interest loans • No transactions take place outside a meeting

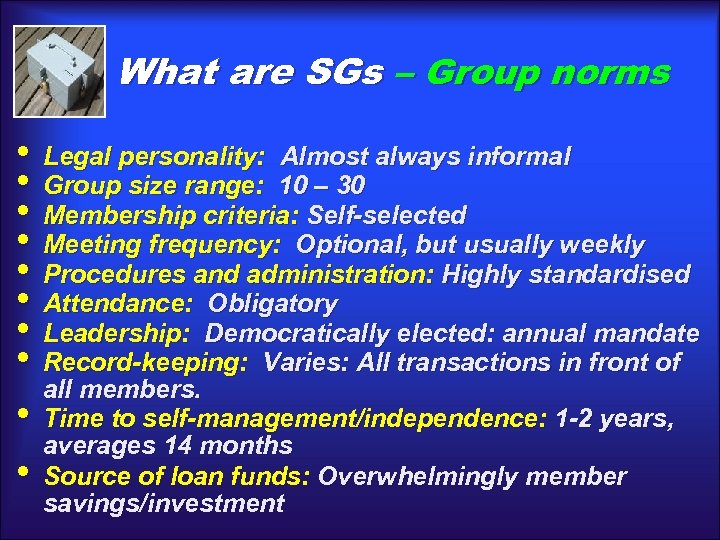

What are SGs – Group norms • Legal personality: Almost always informal • Group size range: 10 – 30 • Membership criteria: Self-selected • Meeting frequency: Optional, but usually weekly • Procedures and administration: Highly standardised • Attendance: Obligatory • Leadership: Democratically elected: annual mandate • Record-keeping: Varies: All transactions in front of all members. • Time to self-management/independence: 1 -2 years, averages 14 months • Source of loan funds: Overwhelmingly member savings/investment

What are SGs – Group norms • Legal personality: Almost always informal • Group size range: 10 – 30 • Membership criteria: Self-selected • Meeting frequency: Optional, but usually weekly • Procedures and administration: Highly standardised • Attendance: Obligatory • Leadership: Democratically elected: annual mandate • Record-keeping: Varies: All transactions in front of all members. • Time to self-management/independence: 1 -2 years, averages 14 months • Source of loan funds: Overwhelmingly member savings/investment

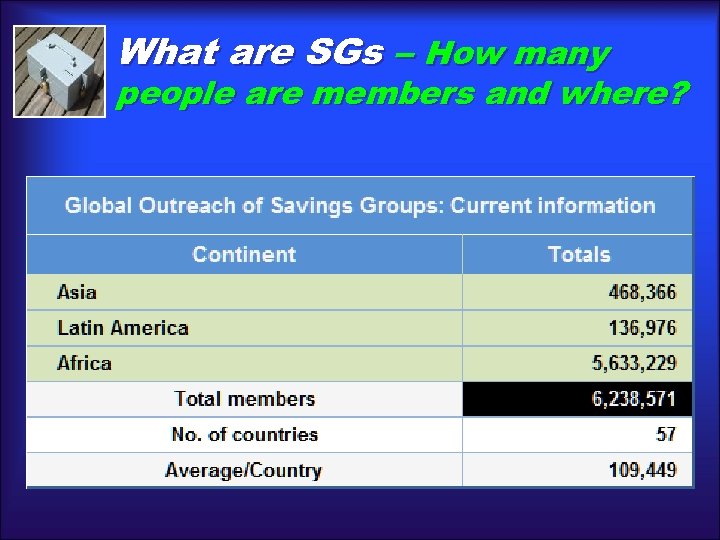

What are SGs – How many people are members and where?

What are SGs – How many people are members and where?

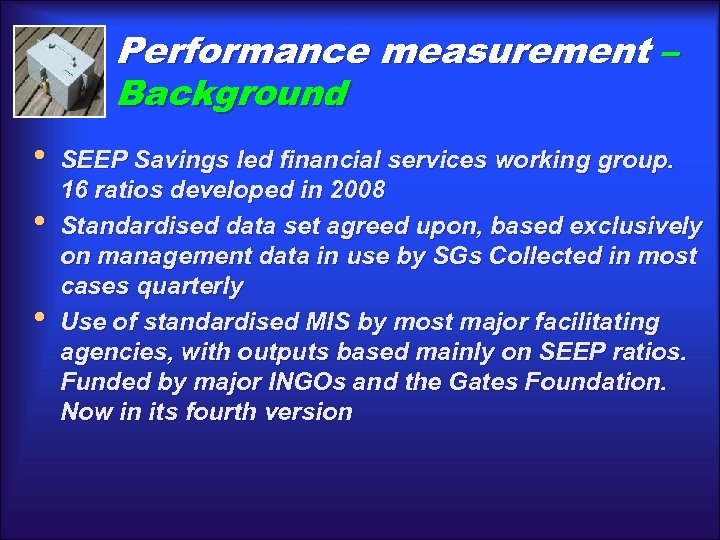

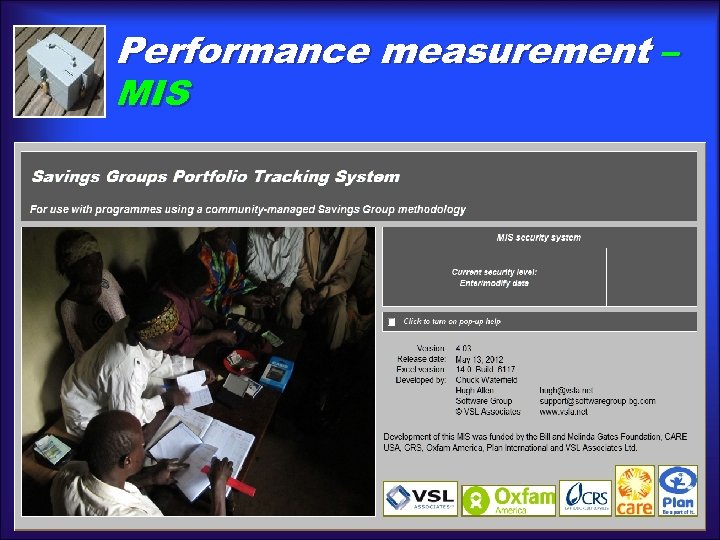

Performance measurement – Background • • • SEEP Savings led financial services working group. 16 ratios developed in 2008 Standardised data set agreed upon, based exclusively on management data in use by SGs Collected in most cases quarterly Use of standardised MIS by most major facilitating agencies, with outputs based mainly on SEEP ratios. Funded by major INGOs and the Gates Foundation. Now in its fourth version

Performance measurement – Background • • • SEEP Savings led financial services working group. 16 ratios developed in 2008 Standardised data set agreed upon, based exclusively on management data in use by SGs Collected in most cases quarterly Use of standardised MIS by most major facilitating agencies, with outputs based mainly on SEEP ratios. Funded by major INGOs and the Gates Foundation. Now in its fourth version

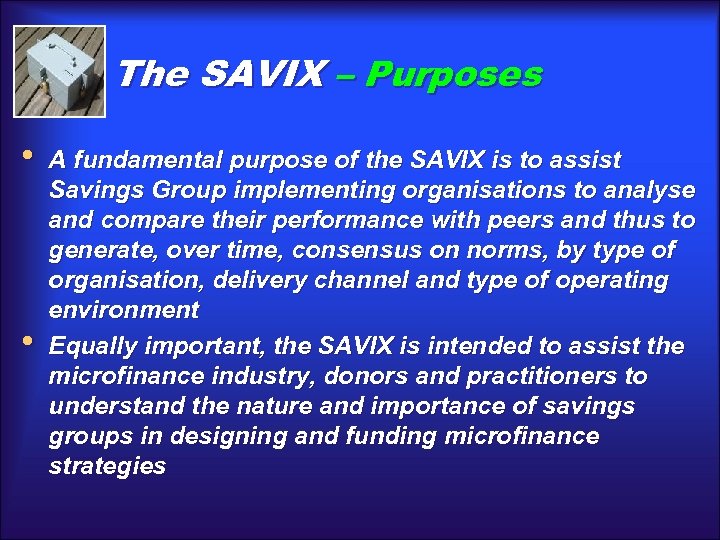

The SAVIX – Purposes • • A fundamental purpose of the SAVIX is to assist Savings Group implementing organisations to analyse and compare their performance with peers and thus to generate, over time, consensus on norms, by type of organisation, delivery channel and type of operating environment Equally important, the SAVIX is intended to assist the microfinance industry, donors and practitioners to understand the nature and importance of savings groups in designing and funding microfinance strategies

The SAVIX – Purposes • • A fundamental purpose of the SAVIX is to assist Savings Group implementing organisations to analyse and compare their performance with peers and thus to generate, over time, consensus on norms, by type of organisation, delivery channel and type of operating environment Equally important, the SAVIX is intended to assist the microfinance industry, donors and practitioners to understand the nature and importance of savings groups in designing and funding microfinance strategies

Performance measurement – MIS

Performance measurement – MIS

The SAVIX – Background • • • Gates Foundation funding of large SG programmes, mainly in Africa. Required centralised monitoring. Revised and expanded list of metrics agreed by CARE, CRS, Oxfam and Plan (now 31) System designed by VSL Associates and built, maintained and administered by Software Group of Sofia and Nairobi. Internet-based relational database Data derived from MIS-generated datafile. Went live in Q 1 2010. Now completing 9 th quarterly posting Initially restricted to Foundation-funded projects but expanded to include any FA project in any country and now includes AKF and Plan

The SAVIX – Background • • • Gates Foundation funding of large SG programmes, mainly in Africa. Required centralised monitoring. Revised and expanded list of metrics agreed by CARE, CRS, Oxfam and Plan (now 31) System designed by VSL Associates and built, maintained and administered by Software Group of Sofia and Nairobi. Internet-based relational database Data derived from MIS-generated datafile. Went live in Q 1 2010. Now completing 9 th quarterly posting Initially restricted to Foundation-funded projects but expanded to include any FA project in any country and now includes AKF and Plan

The SAVIX - Home page: www. thesavix. org

The SAVIX - Home page: www. thesavix. org

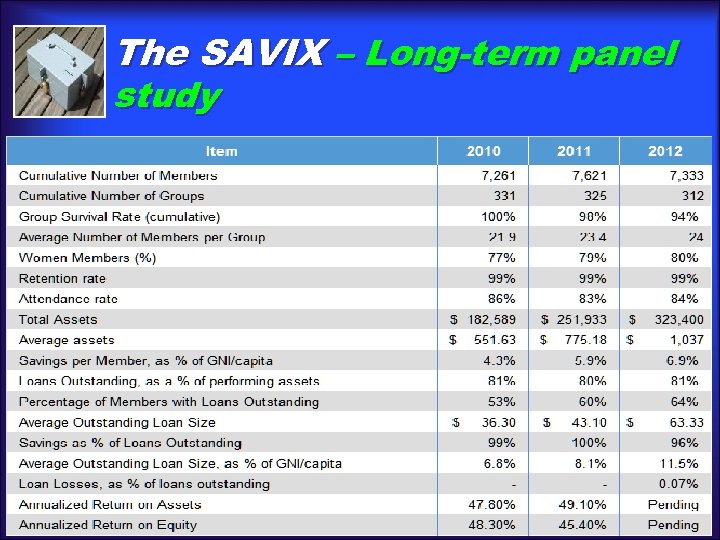

The SAVIX – Elements • • • PROJECTS: Description and analysis of SG project performance using 19 portfolio indicators and 13 on performance. Currently covers 148 projects in 23 countries, covering about 25% of the known sector COMPARISON: Ratio comparison of Facilitating Agencies, Projects, type of trainer, Regions and subregions, countries both in tabular and graphic form RESEARCH: Long-term panel study tracking performance of 332 SGs in 6 countries for 5 years to determine survivale and performance. Uses 17 portfolio and performance indicators

The SAVIX – Elements • • • PROJECTS: Description and analysis of SG project performance using 19 portfolio indicators and 13 on performance. Currently covers 148 projects in 23 countries, covering about 25% of the known sector COMPARISON: Ratio comparison of Facilitating Agencies, Projects, type of trainer, Regions and subregions, countries both in tabular and graphic form RESEARCH: Long-term panel study tracking performance of 332 SGs in 6 countries for 5 years to determine survivale and performance. Uses 17 portfolio and performance indicators

The SAVIX – Global project results • Quarterly reporting covering: • Financial scale • Member satisfaction and programme efficiency • • 1, 693, 366 participants (82. 1% female) 75, 838 groups (project average 478) 148 projects 23 countries in Africa and Asia • $50. 4 million in assets • $37. 8 million in savings • $23. 9 million in loans outstanding • • • Retention rate 98. 9% $23. 5 average cost per member assisted 48. 8% of groups formed by Village Agents

The SAVIX – Global project results • Quarterly reporting covering: • Financial scale • Member satisfaction and programme efficiency • • 1, 693, 366 participants (82. 1% female) 75, 838 groups (project average 478) 148 projects 23 countries in Africa and Asia • $50. 4 million in assets • $37. 8 million in savings • $23. 9 million in loans outstanding • • • Retention rate 98. 9% $23. 5 average cost per member assisted 48. 8% of groups formed by Village Agents

The SAVIX – Global project results • Global financial results: • • • $34. 6 average savings per member per cycle $29. 9 average outstanding loan size 47. 3 % of members with loans outstanding 49. 1% Loans outstanding as % of performing assets 157. 9% ratio of savings to loans outstanding 34. 1% annualised return on total assets: end-of-cycle average of 31% • 0. 2% average group debt/equity ratio

The SAVIX – Global project results • Global financial results: • • • $34. 6 average savings per member per cycle $29. 9 average outstanding loan size 47. 3 % of members with loans outstanding 49. 1% Loans outstanding as % of performing assets 157. 9% ratio of savings to loans outstanding 34. 1% annualised return on total assets: end-of-cycle average of 31% • 0. 2% average group debt/equity ratio

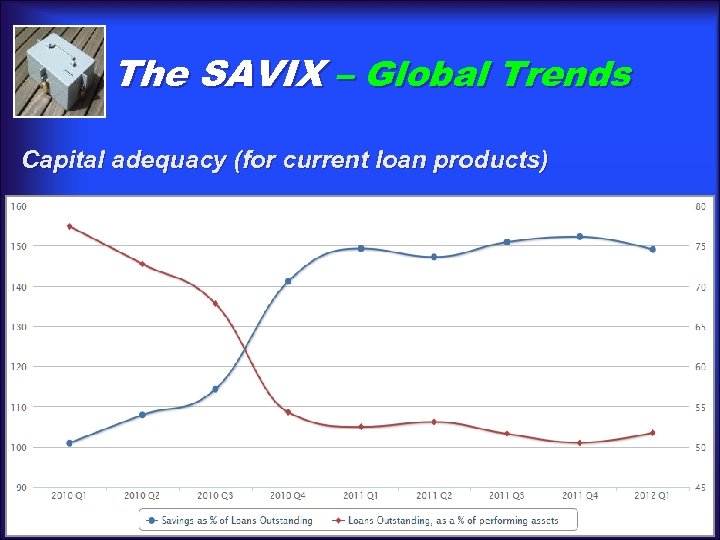

The SAVIX – Global Trends Capital adequacy (for current loan products)

The SAVIX – Global Trends Capital adequacy (for current loan products)

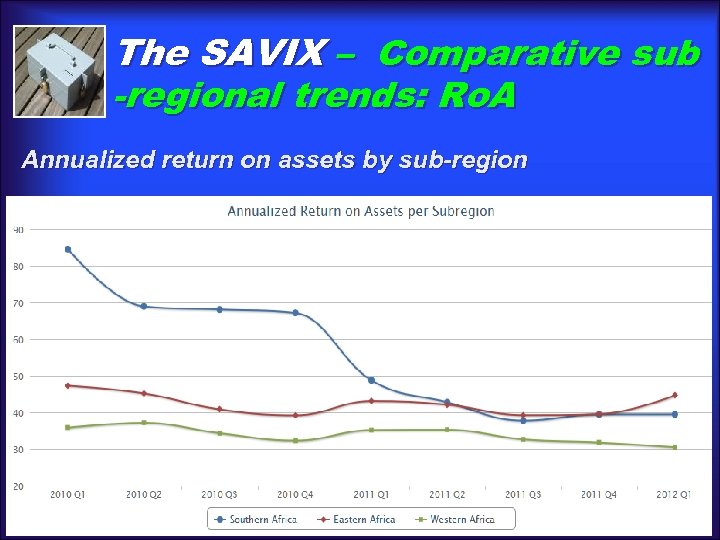

The SAVIX – Comparative sub -regional trends: Ro. A Annualized return on assets by sub-region

The SAVIX – Comparative sub -regional trends: Ro. A Annualized return on assets by sub-region

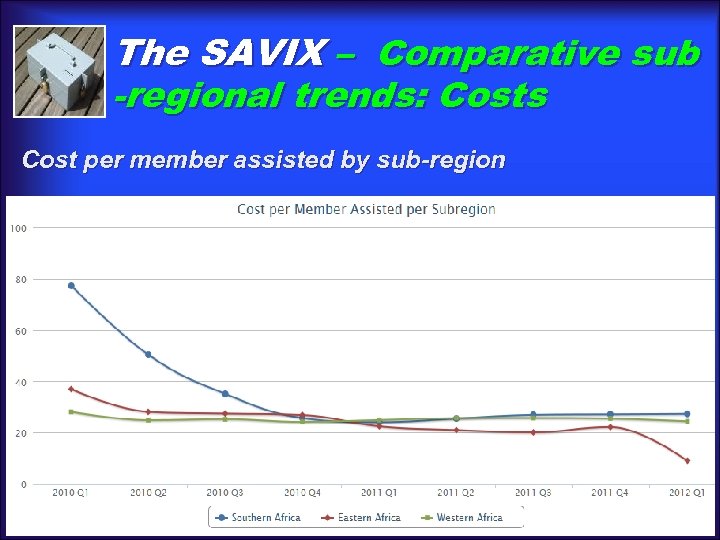

The SAVIX – Comparative sub -regional trends: Costs Cost per member assisted by sub-region

The SAVIX – Comparative sub -regional trends: Costs Cost per member assisted by sub-region

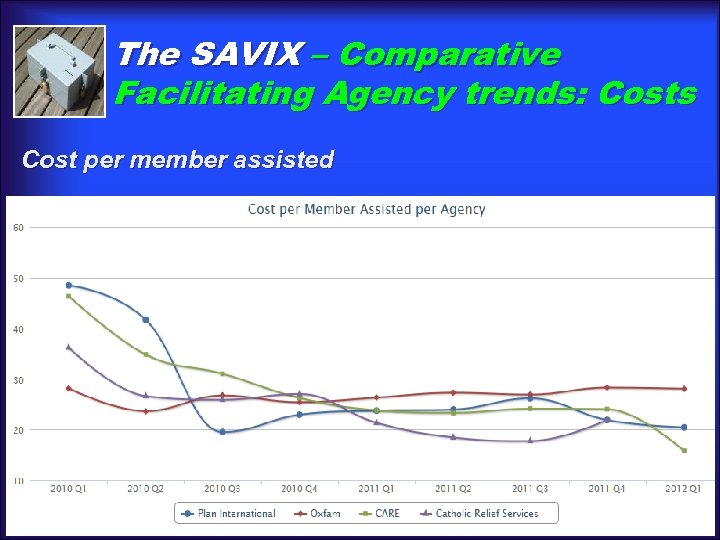

The SAVIX – Comparative Facilitating Agency trends: Costs Cost per member assisted

The SAVIX – Comparative Facilitating Agency trends: Costs Cost per member assisted

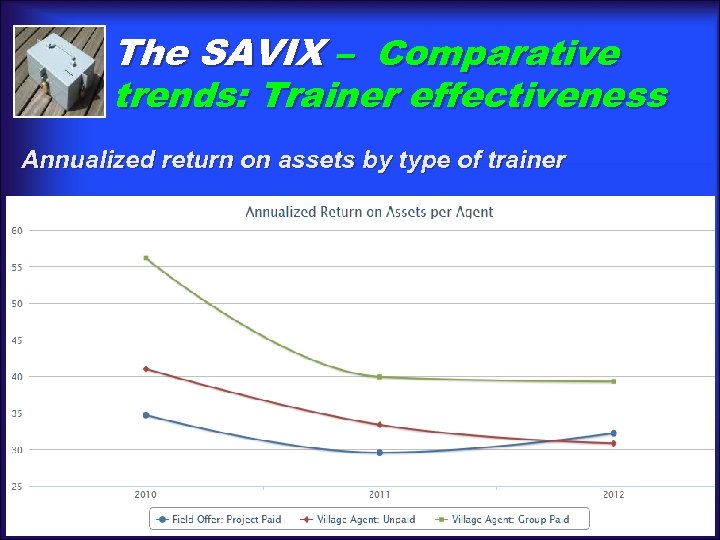

The SAVIX – Comparative trends: Trainer effectiveness Annualized return on assets by type of trainer

The SAVIX – Comparative trends: Trainer effectiveness Annualized return on assets by type of trainer

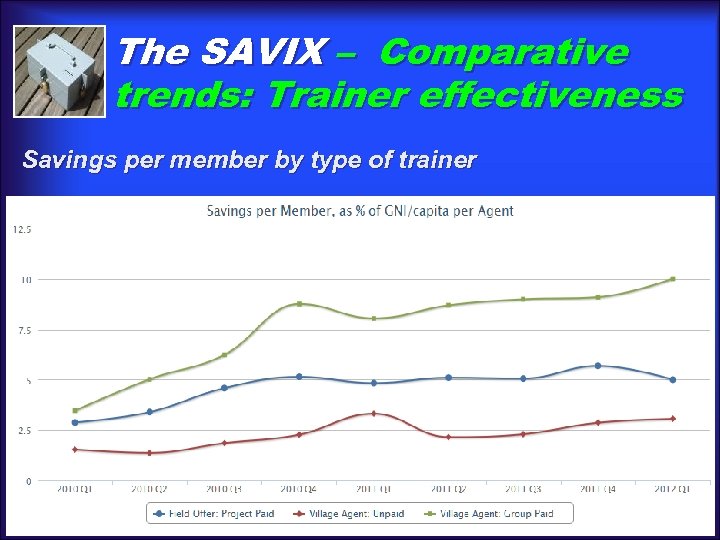

The SAVIX – Comparative trends: Trainer effectiveness Savings per member by type of trainer

The SAVIX – Comparative trends: Trainer effectiveness Savings per member by type of trainer

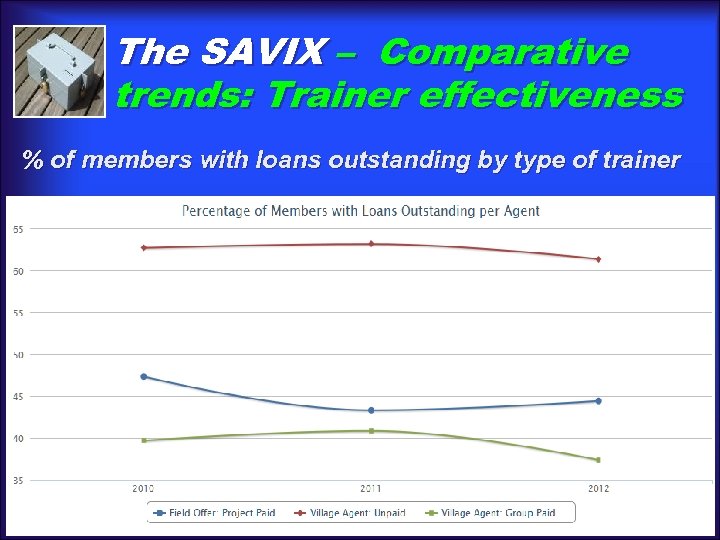

The SAVIX – Comparative trends: Trainer effectiveness % of members with loans outstanding by type of trainer

The SAVIX – Comparative trends: Trainer effectiveness % of members with loans outstanding by type of trainer

The SAVIX – Long-term panel study

The SAVIX – Long-term panel study

The SAVIX – What we don’t yet know • • The effect on performance of linking of SGs to formalsector financial institutions, especially in terms of additional finance capital. The degree to which groups continue to be created through Village Agents post-project and how these groups perform in the long-term The degree to which groups emerge spontaneously, how we learn about them and how they perform in the long-term How the investment behaviour of groups evolve, post -project

The SAVIX – What we don’t yet know • • The effect on performance of linking of SGs to formalsector financial institutions, especially in terms of additional finance capital. The degree to which groups continue to be created through Village Agents post-project and how these groups perform in the long-term The degree to which groups emerge spontaneously, how we learn about them and how they perform in the long-term How the investment behaviour of groups evolve, post -project

The SAVIX – Next steps • Development of web-based V 5. 0 MIS • • • Web-server (cloud) based, low bandwidth. User-acceptrance testing scheduled for July Go-live and stakeholder training workshop in Nairobi in early September 2012 • Maintenance of V 4. 03 for 4 years for use only by FAs

The SAVIX – Next steps • Development of web-based V 5. 0 MIS • • • Web-server (cloud) based, low bandwidth. User-acceptrance testing scheduled for July Go-live and stakeholder training workshop in Nairobi in early September 2012 • Maintenance of V 4. 03 for 4 years for use only by FAs

The SAVIX – Next steps • Integration into the SAVIX. New MIS: • Being web-server based, allows for auomatic updates and software error correction • Stores and accesses historical data • Allows projects (not only FAs) to post results • Allows for other SG methodologies, including SHGs • Allows for project-level database analysis (4. 03 does not) • Permits aggregation, analysis and comparison at VA, FO, Supervisor, Project, Country, Regional & international levels • Allows for creation of unlimited user-defined variables • Allows for creation of private user networks • Permits user discretion on public posting • Allows real-time data update for V 5. 0 • Has API for mobile `phone data entry and download

The SAVIX – Next steps • Integration into the SAVIX. New MIS: • Being web-server based, allows for auomatic updates and software error correction • Stores and accesses historical data • Allows projects (not only FAs) to post results • Allows for other SG methodologies, including SHGs • Allows for project-level database analysis (4. 03 does not) • Permits aggregation, analysis and comparison at VA, FO, Supervisor, Project, Country, Regional & international levels • Allows for creation of unlimited user-defined variables • Allows for creation of private user networks • Permits user discretion on public posting • Allows real-time data update for V 5. 0 • Has API for mobile `phone data entry and download

The SAVIX – Challenges • Roll-out marketing • Long-term support • Re-definition of purpose

The SAVIX – Challenges • Roll-out marketing • Long-term support • Re-definition of purpose